Exhibit 99.1

Dividend Capital Total Realty Trust Inc.

First Quarter 2008 Financial and Operating Results

DENVER, CO – May 20, 2008: Dividend Capital Total Realty Trust Inc. (“TRT”) today announced additional financial and operating results for the first quarter 2008 that are supplemental to its Report on Form 10-Q filed with the Securities and Exchange Commission (the “Commission”) on May 15, 2008. As of March 31, 2008, the company had invested in a diversified portfolio consisting of 62 properties across 19 markets at a gross investment amount of approximately $1.2 billion. During the first quarter of 2008, TRT acquired one industrial property in Harrisburg, PA, at an acquisition cost of approximately $25.5 million, comprising approximately 500,000 net rentable square feet.

Management Comments

· “We are extremely pleased to have ended the first quarter of 2008 with a broadly diversified real estate portfolio and a company that is well positioned to take advantage of the recent market dislocations that have occurred,” commented Chairman John A. Blumberg. “Going forward, we believe that we have both a strong cash position and a pipeline of potential acquisitions that we are excited about for the balance of 2008 and beyond.”

· Guy M. Arnold, TRT’s President, added, “We have consciously been very patient and selective in our investment approach during the recent period of capital markets turmoil. The Harrisburg property we acquired is a great complement to our existing industrial asset base, as it is 100% leased to a quality tenant on a long term lease in an industrial market with what we believe to be solid fundamentals.”

· Blumberg also noted that, not only are real property acquisition opportunities looking attractive, but that “we are also just now beginning to see significant opportunities to increase our debt investment portfolio by investing in whole loans, B-notes and mezzanine loan positions at what we anticipate to be attractive returns.”

· Chief Financial Officer John E. Biallas reported that he was “very pleased to report solid financial performance in light of a challenging operating environment.” In addition, he said that TRT’s balance sheet continues to be strong and all of its key financial ratios are well within established company guidelines, including leverage, liquidity and REIT and ‘40 Act compliance.

· Subsequent to the end of the quarter, TRT also announced that it had paid down approximately $121.9 million of debt financing it had incurred in conjunction with its 2007 acquisition of a portfolio of properties in New England at a significant discount to par value. Specifically, TRT received a discount of approximately $10.3 million from the lender, which was 91.5% of the cost of the original borrowings. “The transaction was extremely compelling for several reasons,” said Biallas, “including not only the obvious positive effect that this loan paydown will have in effectively lowering our cost basis in the underlying properties, but it also is an effective use of cash on hand in today’s market. In addition, we are now better positioned to build a solid base of unencumbered collateral as we further pursue our long-term financial strategy of lowering our debt cost of capital by eventually seeking an unsecured line of credit.”

Selected Financial Data

The following table presents selected consolidated financial information for TRT as of and during the three month periods ended March 31, 2008 and 2007. The selected financial information presented below has been derived from our unaudited condensed consolidated financial statements. Since the information presented below is only a summary and does not provide all of the information contained in our historical consolidated financial statements, including the related notes thereto, you should read it in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our unaudited consolidated financial statements and notes thereto included in our Form 10-Q filed with the Commission on May 15, 2008. The amounts in the table are in thousands except per share data and footnote information.

| | For the Three Months Ended, | |

| | March 31, 2008 | | March 31, 2007 | |

Operating Data: | | | | | | | |

Total revenue | | $ | 35,188 | | $ | 10,878 | |

Total operating expense | | 23,540 | | 7,536 | |

Interest expense | | 12,998 | | 2,883 | |

Interest income | | 3,186 | | 2,538 | |

Impairment of available-for-sale securities | | 25,202 | | — | |

Minority interests | | 803 | | (12 | ) |

Net income (loss) | | (22,563 | ) | 2,985 | |

| | | | | |

Common Stock Distributions: | | | | | |

Common stock distributions declared | | $ | 18,393 | | $ | 8,059 | |

Common stock distributions declared per share | | 0.15 | | 0.15 | |

| | | | | |

Per Share Data: | | | | | |

Basic net income (loss) per common share | | $ | (0.19 | ) | $ | 0.06 | |

Diluted net income (loss) per common share | | (0.19 | ) | 0.06 | |

| | | | | |

Other Information: | | | | | |

Weighted average shares outstanding - basic | | 120,893 | | 53,746 | |

Weighted average shares outstanding - diluted | | 122,663 | | 53,766 | |

| | | | | |

Balance Sheet Data: | | | | | |

Total assets | | $ | 1,907,851 | | $ | 904,951 | |

Debt | | 800,594 | | 203,453 | |

Total liabilities | | 907,854 | | 245,411 | |

| | | | | |

Cash Flow Data: | | | | | |

Net cash provided by operating activities | | $ | 14,589 | | $ | 5,155 | |

Net cash used in investing activities | | (27,833 | ) | (370,256 | ) |

Net cash provided by financing activities | | 109,828 | | 464,057 | |

Funds from Operations (FFO)

The following table presents the calculation of TRT’s FFO reconciled from net income for the three months ended March 31, 2008 and 2007 (amounts in thousands, except per share information):

| | Three months ended

March 31, | |

| | 2008 | | 2007 | |

| | | | | |

Reconciliation of net income (loss) to FFO: | | | | | |

| | | | | |

Net income (loss) attributable to common shares | | $ | (22,563 | ) | $ | 2,985 | |

| | | | | |

Add (deduct) NAREIT defined adjustments: | | | | | |

Depreciation and amortization | | 12,745 | | 3,418 | |

Minority interests share of funds from operations | | (992 | ) | (285 | ) |

Subtotals-NAREIT defined FFO | | (10,810 | ) | 6,118 | |

| | | | | |

Add (deduct) our defined adjustments: | | | | | |

Impairment of available for sale securities, net of minority interests | | 24,733 | | — | |

FFO attributable to common shares-basic | | 13,923 | | 6,118 | |

FFO attributable to dilutive OP units | | 264 | | 2 | |

FFO attributable to common shares-diluted | | 14,187 | | 6,120 | |

| | | | | |

FFO per share - basic | | $ | 0.12 | | $ | 0.11 | |

FFO per share - diluted | | $ | 0.12 | | $ | 0.11 | |

FFO Definitions, Adjustments and Limitations

We believe that FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), is a meaningful supplemental measure of our operating performance because historical cost accounting for real estate assets in accordance with Generally Accepted Accounting Principles (“GAAP”) implicitly assumes that the value of real estate assets diminishes predictably over time, as reflected through depreciation and amortization expenses. However, since real estate values have historically risen or fallen with market and other conditions, many industry investors and analysts have considered presentation of operating results for real estate companies that use historical cost accounting to be insufficient. Thus, NAREIT created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost depreciation and amortization, among other items, from net income, as defined by GAAP.

FFO as defined by NAREIT consists of net income, calculated in accordance with GAAP, plus real estate related depreciation and amortization, less gains (or losses) from dispositions of real estate held for investment purposes. Importantly, as part of its guidance concerning FFO, NAREIT has stated that the “management of each of its member companies has the responsibility and authority to publish financial information that it regards as useful to the financial community.” As a result, modifications to the NAREIT calculation of FFO are common among REITs as companies seek to provide financial measures that meaningfully reflect the specific characteristics of their businesses. We believe potential investors and stockholders who review our operating results are best served by a defined FFO measure that makes certain adjustments to net income computed under GAAP in addition to those included in the NAREIT defined measure of FFO because we believe such additional adjustments create a better measure of our operating performance.

Our definition of FFO is generally consistent with NAREIT. However, NAREIT does not specifically address how other-than-temporary impairment of available-for-sale preferred equity securities should be treated from an FFO standpoint. All of TRT’s preferred equity securities investments are perpetual in nature and, while these securities are generally subject to issuer call provisions, none of them has an explicit maturity date. TRT currently has both the ability and the intention to hold its preferred securities investments for the long term, although we may, from time to time, sell any of these investments as part

of our overall management of our portfolio. Accordingly, TRT classifies these investments as available-for-sale, and therefore they are reported at estimated fair value based upon market prices in TRT’s financial statements prepared in accordance with GAAP. For purposes of calculating net income computed under GAAP for the three months ended March 31, 2008, primarily due to the amount and duration of the decline in the fair value of these assets, we have classified in our statement of operations a portion of our preferred securities investments as being impaired on an other-than-temporary basis.

The preferred securities impairment charge included in net income is primarily a function of market pricing, which may be subject to significant fluctuations and volatility from period to period that may result in potentially inconsistent and unpredictable effects on our GAAP financial statements. Importantly, the accounting treatment underlying the preferred securities asset class is not the primary driver in management’s decision-making process and capital investment decisions for these types of investments. Period to period fluctuations in the impairment line item can be caused by the accounting treatment for short-term factors that may not be relevant to our long-term investment strategy, long-term capital structures or long-term tax planning. Accordingly, we believe investors are best served if the FFO information that is made available to them excludes items such as this impairment charge and therefore allows them to align their analysis and evaluation of our operating results along the same lines that our management uses in planning and executing our business strategy.

FFO is presented herein as a supplemental financial measure and has inherent limitations. We do not use FFO as, nor should it be considered to be, an alternative to net income computed under GAAP as an indicator of our operating performance, or as an alternative to cash from operating activities computed under GAAP. We use FFO as an indication of TRT’s operating performance and as a guide to making decisions about both our existing and future investments. Our FFO calculation is not meant to represent a comprehensive system of financial reporting and does not present, nor do we intend it to present, a complete picture of TRT’s financial condition and operating performance. In addition, other REITs may choose to treat impairment charges and potentially other accounting line items in a manner different from ours due to specific differences in investment strategy or for other reasons. Our FFO calculation is limited by its exclusion of impairments related to our preferred equity securities, but we continuously evaluate our preferred equity securities portfolio and the usefulness of the FFO measure in relation thereto. We believe net income computed under GAAP remains the primary measure of performance and that FFO is only meaningful when it is used in conjunction with net income computed under GAAP. Further, we believe our consolidated financial statements, prepared in accordance with GAAP, provide the most meaningful picture of our financial condition and our operating performance.

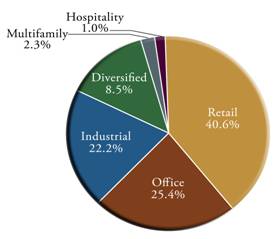

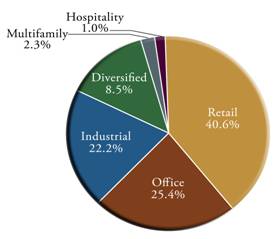

Selected Operating Data

As of March 31, 2008, TRT had total investments of approximately $1.5 billion, which were generally diversified across major property sectors as follows:

Total Investments: $1.5 billion

Dividends on Common Stock

TRT’s Board of Directors has declared a quarterly cash dividend of $0.15 per common share for the quarter ended June 30, 2008. The dividend represents an annualized yield of $0.60 per common share.

Earnings Conference Call

Dividend Capital Total Realty Trust also announced that it will be hosting a public conference call on May 20, 2008 to review first quarter financial and operating results. John Blumberg, Chairman, Guy Arnold, President, and John Biallas, Chief Financial Officer, will present performance data and provide management commentary. The conference call will take place at 2:15 p.m. MST and can be accessed by dialing 877.313.6462 and referencing “Dividend Capital ID 39997322.”

Contact Information

Dividend Capital Total Realty Trust, Inc.

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

Telephone: (303) 228-2200

Fax: (303) 228-2201

Attn: Guy M. Arnold, President

####

Certain items in this document may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expect(s)” and similar expressions are intended to identify such forward-looking statements. As used herein, “the Company,” “we,” “us” and “ours” refer to Dividend Capital Total Realty Trust Inc. and its consolidated subsidiaries and partnerships except where the context otherwise requires. These statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results materially different from those described in the forward-looking statements. Dividend Capital Total Realty Trust can give no assurance that its expectations will be attained. Factors that could cause actual results to differ materially from Dividend Capital Total Realty Trust’s expectations include, but are not limited to, the uncertainty of the sources for funding Dividend Capital Total Realty Trust’s future capital needs, delays in the acquisition, development and construction of real properties, changes in economic conditions generally and the real estate and securities markets specifically and the other risks detailed from time to time in Dividend Capital Total Realty Trust’s SEC reports. Such forward-looking statements speak only as of the date of this press release. Dividend Capital Total Realty Trust expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.