UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2014

DIVIDEND CAPITAL DIVERSIFIED PROPERTY FUND INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| Maryland | | 000-52596 | | 30-0309068 |

(State or other jurisdiction of incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | |

| 518 Seventeenth Street, 17th Floor, Denver CO | | 80202 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (303) 228-2200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On January 22, 2014, Dividend Capital Diversified Property Fund Inc. (referred to herein as the “Company,” “we,” “our,” or “us”) sold a portfolio of 12 industrial properties comprising 3.4 million net rentable square feet to an unrelated third party. The following information provides a summary snapshot of our real property portfolio as of January 31, 2014.

As of January 31, 2014, we held the majority ownership in 70 operating properties located in 25 geographic markets in the United States, aggregating approximately 11.9 million square feet. As of January 31, 2013, our real property portfolio was approximately 91.4% leased to approximately 400 tenants. As of January 31, 2013, these properties had an estimated fair value of approximately $2.4 billion (calculated in accordance with our valuation policies), comprising:

| | • | | 26 office properties located in 16 geographic markets, aggregating approximately 5.1 million net rentable square feet, with an aggregate fair value amount of approximately $1.4 billion. Of these 26 properties, nine are considered “multi-tenant” properties and aggregate approximately 1.9 million net rentable square feet, with an aggregate fair value amount of approximately $611.1 million, and 17 are considered “single-tenant” properties and aggregate approximately 3.2 million net rentable square feet, with an aggregate fair value amount of approximately $763.4 million; and |

| | • | | 31 retail properties located in seven geographic markets, aggregating approximately 3.1 million net rentable square feet, with an aggregate fair value amount of approximately $718.2 million; and |

| | • | | 13 industrial properties located in 9 geographic markets, aggregating approximately 3.7 million net rentable square feet, with an aggregate fair value amount of approximately $260.9 million. |

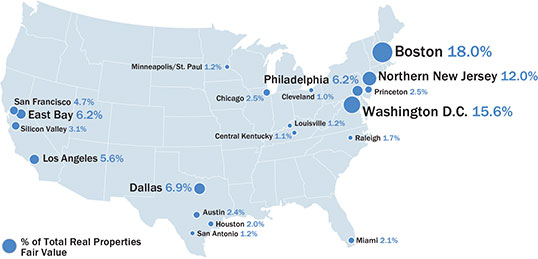

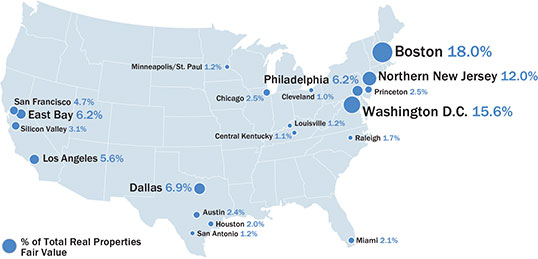

The chart below shows the current allocations of our real property investments across geographic markets. Percentages in the chart correspond to our fair value as of January 31, 2014.

In addition, we own real property investments in the following markets, though the fair value of the investments in each market account for less than 1% of the total fair value of our real property investments: Denver, CO, Fayetteville, AR, Jacksonville, FL, Little Rock, AR, and Pittsburgh, PA.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| | | | Dividend Capital Diversified Property Fund Inc. |

February 5, 2014 | | | | |

| | | |

| | | | By: | | /S/ M. KIRK SCOTT |

| | | | | | M. Kirk Scott |

| | | | | | Chief Financial Officer |

3