CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Statements included in this portfolio performance and review package that are not historical facts (including any statements concerning investment objectives, other plans and objectives of management for future operations or economic performance or assumptions or forecasts related thereto) are forward looking statements. These statements are only predictions. We caution that forward looking statements are not guarantees. Actual events or our investments and results of operations could differ materially from those expressed or implied in the forward looking statements. Forward looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology.

The forward looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: the continuing impact of high unemployment and the slow economic recovery, which is having and may continue to have a negative effect on the following, among other things, the fundamentals of our business, including overall market demand and occupancy, tenant space utilization, and rental rates; the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); our ability to effectively raise and deploy proceeds from our equity offerings; risks associated with the availability and terms of debt and equity financing and refinancing and the use of debt to fund acquisitions and developments, including the risk associated with interest rates impacting the cost and/or availability of financing and refinancing; the business opportunities that may be presented to and pursued by us; changes in laws or regulations (including changes to laws governing the taxation of real estate investment trusts); changes in accounting principles, policies and guidelines applicable to real estate investment trusts; environmental, regulatory and/or safety requirements; and the availability and cost of comprehensive insurance, including coverage for terrorist acts and earthquakes. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward looking statements after the date of this supplemental package, whether as a result of new information, future events, changed circumstances or any other reason. You should review the risk factors contained in Part I, Item 1A of our 2016 Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 3, 2017, and in our subsequent quarterly reports.

Please see the section titled “Definitions” at the end of this portfolio performance and review package for definitions of terms used herein.

Dividend Capital Diversified Property Fund Inc. is a daily NAV-based REIT and has invested in a diverse portfolio of real property and real estate related investments. As used herein, “the Portfolio,” “we,” “our” and “us” refer to Dividend Capital Diversified Property Fund Inc. and its consolidated subsidiaries and partnerships except where the context otherwise requires.

Quarter Highlights

| |

| • | Total return of 2.46% for the quarter; 6.35% for the last 12 months. |

| |

| • | Repaid two senior mortgage notes for $44.2 million with a weighted average interest rate of 5.5% and amended our credit facility to increase our term loan borrowing capacity by $125.0 million. |

| |

| • | Sold one building from a multi-building grocery-anchored retail property located in the Greater Boston area for $6.2 million. |

| |

| • | Percentage leased of 91.2% as of December 31, 2016 (if weighted by the fair value of each segment, our portfolio was 93.9% leased as of December 31, 2016). |

| |

| • | Paid weighted-average distribution of $0.0892/share. |

|

| | | | | | | | | |

| Shareholder Returns (before class specific expenses) | | Key Statistics |

| | Q4 2016 | Year-to-Date | 1-Year | 3-Year | Since Inception (9/30/12) - Annualized(5) | | | As of December 31, 2016 |

|

| | | Fair Value(1) of Investments | $2,282.2 million |

|

| | | Number of Real Properties | 55 |

|

| | | Number of Real Property Markets | 20 |

|

| | | Total Square Feet | 9.0 million |

|

Distribution returns(3)(4) | 1.21% | 4.98% | 4.98% | 5.12% | 5.19% | | Number of Tenants | approximately 520 |

|

Net change in NAV, per share(4) | 1.25% | 1.37% | 1.37% | 2.98% | 3.13% | | Percentage Leased | 91.2 | % |

Total return(4)(5) | 2.46% | 6.35% | 6.35% | 8.10% | 8.32% | | Debt to Fair Value of Investments | 45.9 | % |

| |

| (1) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2016 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of "fair value" of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled "Definitions" beginning on page 25. For a description of key assumptions used in calculating the value of our real properties as of December 31, 2016, please refer to “Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" in Part II, Item 5 of our 2016 Annual Report on Form 10-K. |

| |

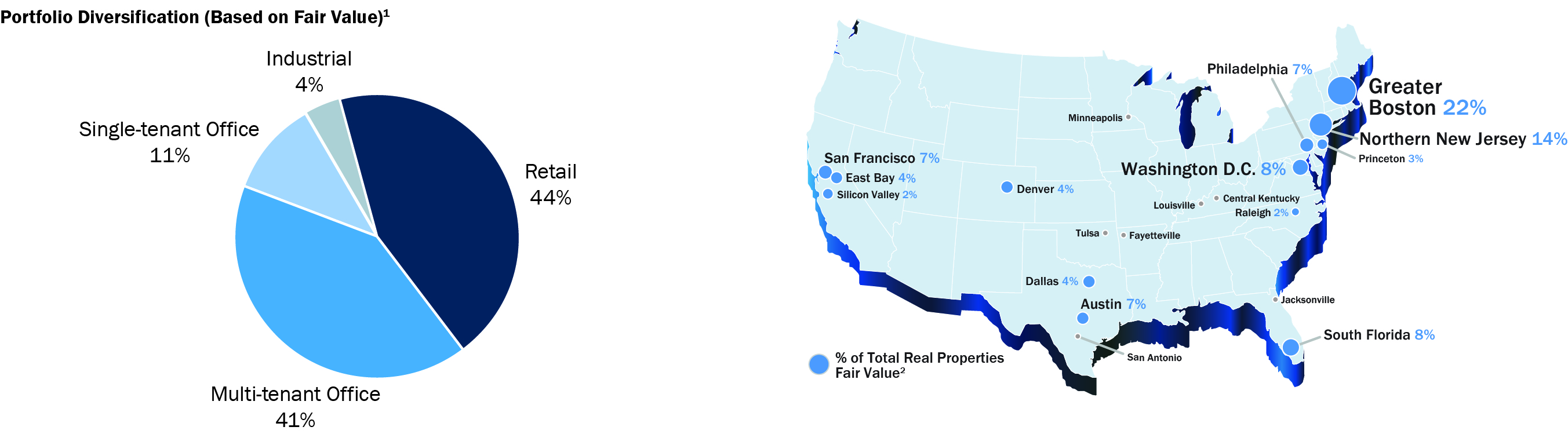

| (2) | Any market for which we do not show a corresponding percentage of our total fair value comprises 1% or less of the total fair value of our real property portfolio. |

| |

| (3) | Represents the compounded return realized from reinvested distributions before class specific expenses. We pay our dealer manager (1) a dealer manager fee equal to 1/365th of 0.60% of our NAV per share for Class A shares and Class W shares for each day, (2) a dealer manager fee equal to 1/365th of 0.10% of our NAV per share for Class I shares for each day and (3) for Class A shares only, a distribution fee equal to 1/365th of 0.50% of our NAV per share for Class A shares for each day. |

| |

| (4) | Excludes the impact of up-front commissions paid with respect to certain Class A shares. We pay selling commissions on Class A shares sold in the primary offering of up to 3.0% of the public offering price per share, which may be higher or lower due to rounding. Selling commissions may be reduced or eliminated to or for the account of certain categories of purchasers. |

| |

| (5) | Total return represents the compound annual rate of return assuming reinvestment of all dividend distributions. Past performance is not a guarantee of future results. Q4 2012 represents the first full quarter for which we have complete NAV return data. As such, we use 9/30/12 as “inception” for the purpose of calculating cumulative returns since inception. |

Amounts in thousands, except per share information and percentages.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of or For the Three Months Ended | | As of or For Year Ended |

Selected Operating Data (as adjusted) (1) | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| Total revenues | $ | 53,956 |

| | $ | 53,493 |

| | $ | 52,939 |

| | $ | 55,782 |

| | $ | 56,298 |

| | $ | 216,170 |

| | $ | 225,200 |

|

| Gain on sale of real property | 2,165 |

| | 2,095 |

| | — |

| | 41,400 |

| | 984 |

| | 45,660 |

| | 134,218 |

|

| Net income | 3,357 |

| | 3,318 |

| | 135 |

| | 48,238 |

| | 776 |

| | 55,048 |

| | 131,659 |

|

| Net income per share | $ | 0.02 |

| | $ | 0.02 |

| | $ | 0.00 |

| | $ | 0.27 |

| | $ | 0.00 |

| | $ | 0.31 |

| | $ | 0.70 |

|

| Weighted average number of common shares outstanding - basic | 154,807 |

| | 158,688 |

| | 161,209 |

| | 163,954 |

| | 166,352 |

| | 159,648 |

| | 175,938 |

|

| Weighted average number of common shares outstanding - diluted | 166,942 |

| | 170,952 |

| | 173,669 |

| | 176,690 |

| | 179,203 |

| | 172,046 |

| | 188,789 |

|

| Portfolio Statistics | | | | | | | | | | | | | |

| Operating properties | 55 |

| | 55 |

| | 58 |

| | 57 |

| | 60 |

| | 55 |

| | 60 |

|

| Square feet | 8,971 |

| | 8,988 |

| | 9,333 |

| | 9,253 |

| | 10,133 |

| | 8,971 |

| | 10,133 |

|

| Percentage leased at end of period | 91.2 | % | | 91.5 | % | | 90.2 | % | | 90.2 | % | | 90.1 | % | | 91.2 | % | | 90.1 | % |

| Non-GAAP Supplemental Financial Measures | | | | | | | | | | | | | |

Real property net operating income ("NOI") (2) | 36,523 |

| | 36,821 |

| | 37,070 |

| | 39,226 |

| | 38,793 |

| | 149,640 |

| | 158,688 |

|

Funds from Operations ("FFO") per share (3) | $ | 0.13 |

| | $ | 0.14 |

| | $ | 0.12 |

| | $ | 0.15 |

| | $ | 0.12 |

| | $ | 0.53 |

| | $ | 0.47 |

|

Company-defined FFO per share (3) | $ | 0.13 |

| | $ | 0.14 |

| | $ | 0.12 |

| | $ | 0.12 |

| | $ | 0.13 |

| | $ | 0.51 |

| | $ | 0.49 |

|

Net Asset Value ("NAV") (4) | | | | | | | | | | | | | |

| NAV per share at the end of period | $ | 7.57 |

| | $ | 7.48 |

| | $ | 7.37 |

| | $ | 7.36 |

| | $ | 7.47 |

| | $ | 7.57 |

| | $ | 7.47 |

|

| Weighted average distributions per share | $ | 0.0892 |

| | $ | 0.0892 |

| | $ | 0.0893 |

| | $ | 0.0894 |

| | $ | 0.0894 |

| | $ | 0.3571 |

| | $ | 0.3582 |

|

| Weighted average closing dividend yield - annualized | 4.71 | % | | 4.77 | % | | 4.84 | % | | 4.86 | % | | 4.79 | % | | 4.72 | % | | 4.80 | % |

| Weighted average total return for the period | 2.45 | % | | 2.59 | % | | 1.44 | % | | (0.25 | )% | | 1.90 | % | | 6.31 | % | | 9.37 | % |

| Aggregate fund NAV at end of period | $ | 1,229,300 |

| | $ | 1,232,985 |

| | $ | 1,264,858 |

| | $ | 1,276,263 |

| | $ | 1,317,839 |

| | $ | 1,229,300 |

| | $ | 1,317,839 |

|

| Consolidated Debt | | | | | | | | | | | | | |

Leverage (5) | 45.9 | % | | 45.9 | % | | 44.4 | % | | 42.2 | % | | 45.4 | % | | 45.9 | % | | 45.4 | % |

| Weighted average stated interest rate of total borrowings | 3.4 | % | | 3.2 | % | | 3.6 | % | | 4.2 | % | | 4.1 | % | | 3.4 | % | | 4.1 | % |

| Secured borrowings | $ | 343,470 |

| | $ | 388,070 |

| | $ | 465,292 |

| | $ | 513,053 |

| | $ | 588,849 |

| | $ | 343,470 |

| | $ | 588,849 |

|

| Secured borrowings as % of total borrowings | 33 | % | | 37 | % | | 45 | % | | 54 | % | | 53 | % | | 33 | % | | 53 | % |

| Unsecured borrowings | $ | 711,000 |

| | $ | 668,000 |

| | $ | 561,000 |

| | $ | 432,000 |

| | $ | 517,000 |

| | $ | 711,000 |

| | $ | 517,000 |

|

| Unsecured borrowings as % of total borrowings | 67 | % | | 63 | % | | 55 | % | | 46 | % | | 47 | % | | 67 | % | | 47 | % |

Fixed rate borrowings (6) | $ | 653,093 |

| | $ | 697,785 |

| | $ | 835,580 |

| | $ | 913,053 |

| | $ | 956,394 |

| | $ | 653,093 |

| | $ | 956,394 |

|

| Fixed rate borrowings as % of total borrowings | 62 | % | | 66 | % | | 81 | % | | 97 | % | | 86 | % | | 62 | % | | 86 | % |

| Floating rate borrowings | $ | 401,377 |

| | $ | 358,285 |

| | $ | 190,712 |

| | $ | 32,000 |

| | $ | 149,455 |

| | $ | 401,377 |

| | $ | 149,455 |

|

| Floating rate borrowings as % of total borrowings | 38 | % | | 34 | % | | 19 | % | | 3 | % | | 14 | % | | 38 | % | | 14 | % |

| Total borrowings | $ | 1,054,470 |

| | $ | 1,056,070 |

| | $ | 1,026,292 |

| | $ | 945,053 |

| | $ | 1,105,849 |

| | $ | 1,054,470 |

| | $ | 1,105,849 |

|

Net GAAP adjustments (7) | $ | (5,669 | ) | | $ | (5,360 | ) | | $ | (5,173 | ) | | $ | (5,039 | ) | | $ | (8,080 | ) | | $ | (5,669 | ) | | $ | (8,080 | ) |

| Total borrowings (GAAP Basis) | $ | 1,048,801 |

| | $ | 1,050,710 |

| | $ | 1,021,119 |

| | $ | 940,014 |

| | $ | 1,097,769 |

| | $ | 1,048,801 |

| | $ | 1,097,769 |

|

| |

| (1) | Certain asset and liability amounts in this table and throughout this document are presented inclusive of amounts relating to real properties that have been classified as held for sale in our GAAP financial statements. |

| |

| (2) | NOI is a non-GAAP measure. For a reconciliation of NOI to GAAP net income, see the section titled "Results From Operations" beginning on page 12. |

| |

| (3) | FFO and Company-defined FFO are non-GAAP measures. For a reconciliation of FFO and Company-Defined FFO to GAAP net income, see the section titled “Funds From Operations” beginning on page 10. |

| |

| (4) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2016 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of "fair value" of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled "Definitions" beginning on page 25. For a description of key assumptions used in calculating the value of our real properties as of December 31, 2016, please refer to “Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" in Part II, Item 5 of our 2016 Annual Report on Form 10-K. |

| |

| (5) | Leverage presented represents the total principal outstanding under our total borrowings divided by the fair value of our real property and debt investments. |

| |

| (6) | Fixed rate borrowings presented includes floating rate borrowings that are effectively fixed by a derivative instrument such as a swap through maturity or substantially through maturity. |

| |

| (7) | Net GAAP adjustments include net deferred issuance costs, mark-to-market adjustments on assumed debt, and principal amortization on restructured debt. These items are included in mortgage notes and other secured borrowings and unsecured borrowings in our condensed consolidated balance sheets in accordance with GAAP. |

The following table sets forth the components of NAV for the Portfolio as of the end of each of the five quarters ending December 31, 2016, as determined in accordance with our valuation procedures. For information about the valuation procedures and key assumptions used in these calculations, please refer to our Annual Report on Form 10-K or Quarterly Report on Form 10-Q for the applicable period. As used below, “Fund Interests” means our Class E shares, Class A shares, Class W shares, and Class I shares, along with the OP Units held by third parties, and “Aggregate Fund NAV” means the NAV of all of the Fund Interests (amounts in thousands except per share information).

|

| | | | | | | | | | | | | | | | | | | |

| | As of |

| | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 |

| Real properties: | | | | | | | | | |

| Office | $ | 1,187,600 |

| | $ | 1,185,850 |

| | $ | 1,192,700 |

| | $ | 1,184,385 |

| | $ | 1,378,635 |

|

| Industrial | 81,750 |

| | 80,850 |

| | 85,550 |

| | 85,650 |

| | 90,250 |

|

| Retail | 1,012,850 |

| | 1,020,750 |

| | 1,020,050 |

| | 951,700 |

| | 950,925 |

|

| Total real properties | 2,282,200 |

| | 2,287,450 |

| | 2,298,300 |

| | 2,221,735 |

| | 2,419,810 |

|

| Debt-related investments | 15,209 |

| | 15,340 |

| | 15,469 |

| | 15,596 |

| | 15,722 |

|

| Total investments | 2,297,409 |

| | 2,302,790 |

| | 2,313,769 |

| | 2,237,331 |

| | 2,435,532 |

|

| Cash and other assets, net of other liabilities | (10,051 | ) | | (10,109 | ) | | (19,238 | ) | | (12,695 | ) | | (14,069 | ) |

| Debt obligations | (1,054,470 | ) | | (1,056,070 | ) | | (1,026,292 | ) | | (945,053 | ) | | (1,098,853 | ) |

| Outside investors' interests | (3,588 | ) | | (3,626 | ) | | (3,381 | ) | | (3,320 | ) | | (4,771 | ) |

| Aggregate Fund NAV | $ | 1,229,300 |

| | $ | 1,232,985 |

| | $ | 1,264,858 |

| | $ | 1,276,263 |

| | $ | 1,317,839 |

|

| Total Fund Interests outstanding | 162,396 |

| | 164,930 |

| | 171,525 |

| | 173,445 |

| | 176,490 |

|

| NAV per Fund Interest | $ | 7.57 |

| | $ | 7.48 |

| | $ | 7.37 |

| | $ | 7.36 |

| | $ | 7.47 |

|

|

|

| NET ASSET VALUE (continued) |

The following table sets forth the quarterly changes to the components of NAV for the Portfolio, for each of the most recent four quarters, for the years ended December 31, 2016 and 2015 (amounts in thousands, except per share information):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2016 | | December 31, 2015 |

| NAV as of beginning of period | $ | 1,232,985 |

| | $ | 1,264,858 |

| | $ | 1,276,263 |

| | $ | 1,317,839 |

| | $ | 1,317,839 |

| | $ | 1,365,090 |

|

| Fund level changes to NAV | | | | | | | | | | | |

| Realized/unrealized gains (losses) on net assets | 12,163 |

| | 13,206 |

| | (3,990 | ) | | (25,662 | ) | | (4,283 | ) | | 44,096 |

|

| Income accrual | 22,407 |

| | 23,078 |

| | 26,083 |

| | 26,372 |

| | 97,940 |

| | 98,976 |

|

| Dividend accrual | (14,901 | ) | | (15,275 | ) | | (15,525 | ) | | (15,802 | ) | | (61,503 | ) | | (67,525 | ) |

| Advisory fee | (3,624 | ) | | (3,665 | ) | | (3,657 | ) | | (3,758 | ) | | (14,704 | ) | | (15,772 | ) |

| Performance based fee | (94 | ) | | — |

| | — |

| | — |

| | (94 | ) | | (1,245 | ) |

| Class specific changes to NAV | | | | | | | | | | | |

| Dealer Manager fee | (107 | ) | | (99 | ) | | (89 | ) | | (85 | ) | | (380 | ) | | (256 | ) |

| Distribution fee | (18 | ) | | (18 | ) | | (17 | ) | | (17 | ) | | (70 | ) | | (51 | ) |

| NAV as of end of period before share/unit sale/redemption activity | $ | 1,248,811 |

| | $ | 1,282,085 |

| | $ | 1,279,068 |

| | $ | 1,298,887 |

| | $ | 1,334,745 |

| | $ | 1,423,313 |

|

| Share/unit sale/redemption activity | | | | | | | | | | | |

| Shares/units sold | 44,371 |

| | 7,850 |

| | 46,228 |

| | 14,008 |

| | 112,457 |

| | 112,855 |

|

| Shares/units redeemed | (63,882 | ) | | (56,950 | ) | | (60,438 | ) | | (36,632 | ) | | (217,902 | ) | | (218,329 | ) |

| NAV as of end of period | $ | 1,229,300 |

| | $ | 1,232,985 |

| | $ | 1,264,858 |

| | $ | 1,276,263 |

| | $ | 1,229,300 |

| | $ | 1,317,839 |

|

| Shares/units outstanding beginning of period | 164,930 |

| | 171,525 |

| | 173,445 |

| | 176,490 |

| | 176,490 |

| | 190,547 |

|

| Shares/units sold | 5,925 |

| | 1,061 |

| | 6,265 |

| | 1,886 |

| | 15,137 |

| | 15,459 |

|

| Shares/units redeemed | (8,459 | ) | | (7,656 | ) | | (8,185 | ) | | (4,931 | ) | | (29,231 | ) | | (29,516 | ) |

| Shares/units outstanding end of period | 162,396 |

| | 164,930 |

| | 171,525 |

| | 173,445 |

| | 162,396 |

| | 176,490 |

|

| NAV per share as of beginning of period | $ | 7.48 |

| | $ | 7.37 |

| | $ | 7.36 |

| | $ | 7.47 |

| | $ | 7.47 |

| | $ | 7.16 |

|

| Change in NAV per share | 0.09 |

| | 0.11 |

| | 0.01 |

| | (0.11 | ) | | 0.10 |

| | 0.31 |

|

| NAV per share as of end of period | $ | 7.57 |

| | $ | 7.48 |

| | $ | 7.37 |

| | $ | 7.36 |

| | $ | 7.57 |

| | $ | 7.47 |

|

As of December 31, 2016, our real property investments were geographically diversified across 20 markets throughout the United States. The following table presents information about the operating results and fair value of our real property portfolio as of or for the three months and trailing twelve months ended December 31, 2016 (dollar and square footage amount in thousands).

|

| | | | | | | | | | | | | | | | |

| | | Office | | Industrial | | Retail | | Total |

| As of December 31, 2016: | | | | | | | | |

| Number of investments | | 16 |

| | 5 |

| | 34 |

| | 55 |

|

| Square footage | | 3,400 |

| | 1,782 |

| | 3,789 |

| | 8,971 |

|

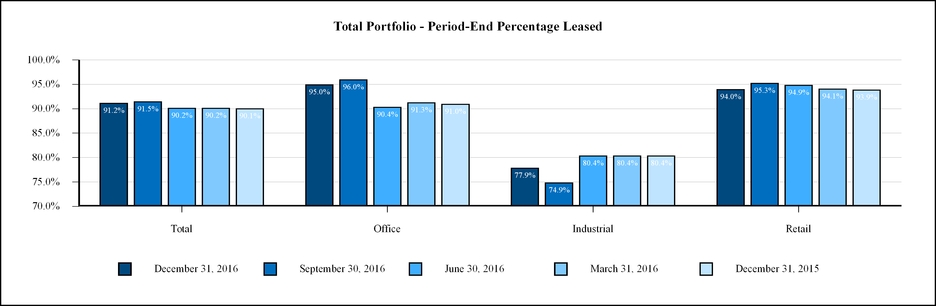

| Percentage leased at period end | | 95.0 | % | | 77.9 | % | | 94.0 | % | | 91.2 | % |

Fair value (1) | | $ | 1,187,600 |

| | $ | 81,750 |

| | $ | 1,012,850 |

| | $ | 2,282,200 |

|

| % of total Fair Value | | 52.0 | % | | 3.6 | % | | 44.4 | % | | 100.0 | % |

| For the three months ended December 31, 2016: | | | | | | | | |

| Revenue | | $ | 30,747 |

| | $ | 1,379 |

| | $ | 21,597 |

| | $ | 53,723 |

|

Net operating income ("NOI") (2) | | 19,515 |

| | 977 |

| | 16,031 |

| | 36,523 |

|

| % of total NOI | | 53.4 | % | | 2.7 | % | | 43.9 | % | | 100.0 | % |

NOI - cash basis (3) | | $ | 21,025 |

| | $ | 1,006 |

| | $ | 15,164 |

| | $ | 37,195 |

|

| For the trailing twelve months ended December 31, 2016: | | | | | | | | |

| Revenue | | $ | 126,782 |

| | $ | 6,073 |

| | $ | 82,372 |

| | $ | 215,227 |

|

NOI (2) | | 84,300 |

| | 4,323 |

| | 61,017 |

| | 149,640 |

|

| % of total NOI | | 56.3 | % | | 2.9 | % | | 40.8 | % | | 100.0 | % |

NOI - cash basis (3) | | $ | 88,479 |

| | $ | 4,442 |

| | $ | 57,470 |

| | $ | 150,391 |

|

| |

| (1) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2016 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of "fair value" of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled "Definitions" beginning on page 25. For a description of key assumptions used in calculating the value of our real properties as of December 31, 2016, please refer to “Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" in Part II, Item 5 of our 2016 Annual Report on Form 10-K. |

| |

| (2) | NOI is a non-GAAP measure. For a reconciliation of NOI to GAAP net income, see the section titled "Results From Operations" beginning on page 12. |

| |

| (3) | NOI - cash basis is a non-GAAP measure. For a reconciliation of NOI - Cash Basis to NOI and to GAAP net income, see the section titled “Results From Operations” beginning on page 12. |

The following table presents our consolidated balance sheets, as adjusted, as of the end of each of the five quarters ended December 31, 2016 (dollar amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | |

| | | As of |

| | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 |

| ASSETS | | | | | | | | | | |

| Investments in real property | | $ | 2,204,322 |

| | $ | 2,201,127 |

| | $ | 2,240,520 |

| | $ | 2,164,290 |

| | $ | 2,380,174 |

|

| Accumulated depreciation and amortization | | (492,911 | ) | | (473,211 | ) | | (469,341 | ) | | (448,994 | ) | | (505,957 | ) |

| Total net investments in real property | | 1,711,411 |

| | 1,727,916 |

| | 1,771,179 |

| | 1,715,296 |

| | 1,874,217 |

|

| Debt related investments, net | | 15,209 |

| | 15,340 |

| | 15,469 |

| | 15,596 |

| | 15,722 |

|

| Total net investments | | 1,726,620 |

| | 1,743,256 |

| | 1,786,648 |

| | 1,730,892 |

| | 1,889,939 |

|

| Cash and cash equivalents | | 13,864 |

| | 34,403 |

| | 17,088 |

| | 11,675 |

| | 15,769 |

|

| Restricted cash | | 7,282 |

| | 7,836 |

| | 17,219 |

| | 16,281 |

| | 18,394 |

|

| Other assets, net | | 35,962 |

| | 36,166 |

| | 33,344 |

| | 35,625 |

| | 36,789 |

|

| Total Assets | | $ | 1,783,728 |

| | $ | 1,821,661 |

| | $ | 1,854,299 |

| | $ | 1,794,473 |

| | $ | 1,960,891 |

|

| LIABILITIES AND EQUITY | | | | | | | | | | |

| Liabilities: | | | | | | | | | | |

| Mortgage notes | | $ | 342,247 |

| | $ | 386,861 |

| | $ | 464,564 |

| | $ | 512,753 |

| | $ | 585,864 |

|

| Unsecured borrowings | | 706,554 |

| | 663,849 |

| | 556,555 |

| | 427,261 |

| | 511,905 |

|

| Intangible lease liabilities, net | | 59,545 |

| | 61,357 |

| | 62,909 |

| | 62,339 |

| | 63,874 |

|

| Other liabilities | | 67,291 |

| | 81,968 |

| | 85,371 |

| | 67,247 |

| | 73,297 |

|

| Total Liabilities | | 1,175,637 |

| | 1,194,035 |

| | 1,169,399 |

| | 1,069,600 |

| | 1,234,940 |

|

| Equity: | | | | | | | | | | |

| Stockholders' equity: | | | | | | | | | | |

| Common stock | | 1,506 |

| | 1,531 |

| | 1,595 |

| | 1,613 |

| | 1,641 |

|

| Additional paid-in capital | | 1,361,638 |

| | 1,383,191 |

| | 1,430,673 |

| | 1,449,364 |

| | 1,470,859 |

|

| Distributions in excess of earnings | | (839,896 | ) | | (829,162 | ) | | (817,920 | ) | | (803,594 | ) | | (832,681 | ) |

| Accumulated other comprehensive loss | | (6,905 | ) | | (20,166 | ) | | (22,848 | ) | | (19,429 | ) | | (11,014 | ) |

| Total stockholders' equity | | 516,343 |

| | 535,394 |

| | 591,500 |

| | 627,954 |

| | 628,805 |

|

| Noncontrolling interests | | 91,748 |

| | 92,232 |

| | 93,400 |

| | 96,919 |

| | 97,146 |

|

| Total Equity | | 608,091 |

| | 627,626 |

| | 684,900 |

| | 724,873 |

| | 725,951 |

|

| Total Liabilities and Equity | | $ | 1,783,728 |

| | $ | 1,821,661 |

| | $ | 1,854,299 |

| | $ | 1,794,473 |

| | $ | 1,960,891 |

|

The following table presents our condensed consolidated statements of operations, as adjusted, for each of the five quarters ended December 31, 2016, and for the years ended December 31, 2016 and 2015 (amounts in thousands, except per share data):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| REVENUE: | | | | | | | | | | | | | | |

| Rental revenue | | $ | 53,723 |

| | $ | 53,258 |

| | $ | 52,702 |

| | $ | 55,544 |

| | $ | 54,970 |

| | $ | 215,227 |

| | $ | 218,278 |

|

| Debt related income | | 233 |

| | 235 |

| | 237 |

| | 238 |

| | 1,328 |

| | 943 |

| | 6,922 |

|

| Total Revenue | | 53,956 |

| | 53,493 |

| | 52,939 |

| | 55,782 |

| | 56,298 |

| | 216,170 |

| | 225,200 |

|

| EXPENSES: | | | | | | | | | | | | | | |

| Rental expense | | 17,200 |

| | 16,437 |

| | 15,632 |

| | 16,318 |

| | 16,177 |

| | 65,587 |

| | 59,590 |

|

| Real estate depreciation and amortization expense | | 20,083 |

| | 19,989 |

| | 20,198 |

| | 19,835 |

| | 21,710 |

| | 80,105 |

| | 83,114 |

|

| General and administrative expenses | | 2,257 |

| | 2,234 |

| | 2,338 |

| | 2,621 |

| | 2,564 |

| | 9,450 |

| | 10,720 |

|

| Advisory fees, related party | | 3,740 |

| | 3,681 |

| | 3,671 |

| | 3,765 |

| | 4,062 |

| | 14,857 |

| | 17,083 |

|

| Acquisition-related expenses | | 6 |

| | 136 |

| | 474 |

| | 51 |

| | 1,385 |

| | 667 |

| | 2,644 |

|

| Impairment of real estate property | | — |

| | 2,090 |

| | — |

| | 587 |

| | — |

| | 2,677 |

| | 8,124 |

|

| Total Operating Expenses | | 43,286 |

| | 44,567 |

| | 42,313 |

| | 43,177 |

| | 45,898 |

| | 173,343 |

| | 181,275 |

|

| Other Income (Expenses): | | | | | | | | | | | | | | |

| Interest and other income | | (90 | ) | | 2,308 |

| | (69 | ) | | 58 |

| | 693 |

| | 2,207 |

| | 2,192 |

|

| Interest expense | | (9,388 | ) | | (10,011 | ) | | (10,422 | ) | | (10,961 | ) | | (11,301 | ) | | (40,782 | ) | | (47,508 | ) |

| Gain (loss) on extinguishment of debt and financing commitments | | — |

| | — |

| | — |

| | 5,136 |

| | — |

| | 5,136 |

| | (1,168 | ) |

| Gain on sale of real property | | 2,165 |

| | 2,095 |

| | — |

| | 41,400 |

| | 984 |

| | 45,660 |

| | 134,218 |

|

| Net income | | 3,357 |

| | 3,318 |

| | 135 |

| | 48,238 |

| | 776 |

| | 55,048 |

| | 131,659 |

|

| Net income attributable to noncontrolling interests | | (245 | ) | | (353 | ) | | (18 | ) | | (4,456 | ) | | (46 | ) | | (5,072 | ) | | (7,404 | ) |

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | | $ | 3,112 |

| | $ | 2,965 |

| | $ | 117 |

| | $ | 43,782 |

| | $ | 730 |

| | $ | 49,976 |

| | $ | 124,255 |

|

| NET INCOME PER BASIC AND DILUTED COMMON SHARE | | $ | 0.02 |

| | $ | 0.02 |

| | $ | 0.00 |

| | $ | 0.27 |

| | $ | 0.00 |

| | $ | 0.31 |

| | $ | 0.70 |

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING | | | | | | | | | | | | | | |

| Basic | | 154,807 |

| | 158,688 |

| | 161,209 |

| | 163,954 |

| | 166,352 |

| | 159,648 |

| | 175,938 |

|

| Diluted | | 166,942 |

| | 170,952 |

| | 173,669 |

| | 176,690 |

| | 179,203 |

| | 172,046 |

| | 188,789 |

|

| Weighted average distributions declared per common share | | $ | 0.0892 |

| | $ | 0.0892 |

| | $ | 0.0893 |

| | $ | 0.0894 |

| | $ | 0.0894 |

| | $ | 0.3571 |

| | $ | 0.3582 |

|

NAREIT-Defined Funds From Operations (“FFO”) and Company-defined FFO are non-GAAP measures. The following tables present a reconciliation of FFO and Company-defined FFO to GAAP net income attributable to common stockholders for each of the five quarters ended December 31, 2016, and for the years ended December 31, 2016 and 2015 (amounts in thousands except for per share amounts and percentages):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31,

2016 | | September 30,

2016 | | June 30,

2016 | | March 31,

2016 | | December 31,

2015 | | December 31,

2016 | | December 31,

2015 |

| Reconciliation of net earnings to FFO: | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 3,112 |

| | $ | 2,965 |

| | $ | 117 |

| | $ | 43,782 |

| | $ | 730 |

| | $ | 49,976 |

| | $ | 124,255 |

|

| Add (deduct) NAREIT-defined adjustments: | | | | | | | | | | | | | | |

| Depreciation and amortization expense | | 20,083 |

| | 19,989 |

| | 20,198 |

| | 19,835 |

| | 21,710 |

| | 80,105 |

| | 83,114 |

|

| Gain on disposition of real property | | (2,165 | ) | | (2,095 | ) | | — |

| | (41,400 | ) | | (984 | ) | | (45,660 | ) | | (134,218 | ) |

| Impairment of real property | | — |

| | 2,090 |

| | — |

| | 587 |

| | — |

| | 2,677 |

| | 8,124 |

|

| Noncontrolling interests' share of adjustments | | (1,331 | ) | | (1,366 | ) | | (1,481 | ) | | 1,376 |

| | (1,588 | ) | | (2,802 | ) | | 895 |

|

| FFO attributable to common shares-basic | | 19,699 |

| | 21,583 |

| | 18,834 |

| | 24,180 |

| | 19,868 |

| | 84,296 |

| | 82,170 |

|

| FFO attributable to dilutive OP units | | 1,544 |

| | 1,668 |

| | 1,456 |

| | 1,878 |

| | 1,535 |

| | 6,546 |

| | 6,001 |

|

| FFO attributable to common shares-diluted | | $ | 21,243 |

| | $ | 23,251 |

| | $ | 20,290 |

| | $ | 26,058 |

| | $ | 21,403 |

| | $ | 90,842 |

| | $ | 88,171 |

|

| FFO per share-basic and diluted | | $ | 0.13 |

| | $ | 0.14 |

| | $ | 0.12 |

| | $ | 0.15 |

| | $ | 0.12 |

| | $ | 0.53 |

| | $ | 0.47 |

|

| FFO payout ratio | | 70 | % | | 66 | % | | 76 | % | | 61 | % | | 75 | % | | 68 | % | | 77 | % |

| | | | | | | | | | | | | | | |

| Reconciliation of FFO to Company-Defined FFO: | | | | | | | | | | | | | | |

| FFO attributable to common shares-basic | | $ | 19,699 |

| | $ | 21,583 |

| | $ | 18,834 |

| | $ | 24,180 |

| | $ | 19,868 |

| | $ | 84,296 |

| | $ | 82,170 |

|

| Add (deduct) our adjustments: | | | | | | | | | | | | | | |

| Acquisition-related expenses | | 6 |

| | 136 |

| | 474 |

| | 51 |

| | 1,385 |

| | 667 |

| | 2,644 |

|

| (Gain) loss on extinguishment of debt and financing commitments | | — |

| | — |

| | — |

| | (5,136 | ) | | — |

| | (5,136 | ) | | 1,168 |

|

| Noncontrolling interests' share of our adjustments | | (1 | ) | | (10 | ) | | (34 | ) | | 1,326 |

| | (99 | ) | | 1,281 |

| | (260 | ) |

| Company-Defined FFO attributable to common shares-basic | | 19,704 |

| | 21,709 |

| | 19,274 |

| | 20,421 |

| | 21,154 |

| | 81,108 |

| | 85,722 |

|

| Company-Defined FFO attributable to dilutive OP units | | 1,545 |

| | 1,678 |

| | 1,490 |

| | 1,586 |

| | 1,634 |

| | 6,299 |

| | 6,261 |

|

| Company-Defined FFO attributable to common shares-diluted | | $ | 21,249 |

| | $ | 23,387 |

| | $ | 20,764 |

| | $ | 22,007 |

| | $ | 22,788 |

| | $ | 87,407 |

| | $ | 91,983 |

|

| Company-Defined FFO per share-basic and diluted | | $ | 0.13 |

| | $ | 0.14 |

| | $ | 0.12 |

| | $ | 0.12 |

| | $ | 0.13 |

| | $ | 0.51 |

| | $ | 0.49 |

|

| Weighted average number of shares outstanding | | | | | | | | | | | | | | |

| Basic | | 154,807 |

| | 158,688 |

| | 161,209 |

| | 163,954 |

| | 166,352 |

| | 159,648 |

| | 175,938 |

|

| Diluted | | 166,942 |

| | 170,952 |

| | 173,669 |

| | 176,690 |

| | 179,203 |

| | 172,046 |

| | 188,789 |

|

|

|

| FUNDS FROM OPERATIONS (continued) |

The following table presents certain other supplemental information for each of the five quarters ended December 31, 2016, and for the years ended December 31, 2016 and 2015 (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31,

2016 | | September 30,

2016 | | June 30,

2016 | | March 31,

2016 | | December 31,

2015 | | December 31,

2016 | | December 31,

2015 |

| Other Supplemental Information | | | | | | | | | | | | | | |

| Capital expenditures summary: | | | | | | | | | | | | | | |

Recurring capital expenditures (1) | | $ | 8,039 |

| | $ | 4,165 |

| | $ | 8,212 |

| | $ | 6,280 |

| | $ | 3,152 |

| | $ | 26,696 |

| | $ | 12,294 |

|

| Non-recurring capital expenditures | | 1,078 |

| | 748 |

| | 694 |

| | 988 |

| | 1,167 |

| | 3,508 |

| | 1,994 |

|

| Total capital expenditures | | 9,117 |

| | 4,913 |

| | 8,906 |

| | 7,268 |

| | 4,319 |

| | 30,204 |

| | 14,288 |

|

| Other non-cash adjustments: | | | | | | | | | | | | | | |

| Straight-line rent decrease to rental revenue | | 522 |

| | 296 |

| | 205 |

| | 240 |

| | 291 |

| | 1,263 |

| | 976 |

|

| Amortization of above- and below- market rent decrease (increase) to rental revenue | | 143 |

| | (127 | ) | | (283 | ) | | (268 | ) | | (197 | ) | | (535 | ) | | (813 | ) |

| Amortization of loan costs and hedges - increase to interest expense | | 873 |

| | 909 |

| | 910 |

| | 1,058 |

| | 983 |

| | 3,750 |

| | 4,101 |

|

| Amortization of mark-to-market adjustments on borrowings - (decrease) to interest expense | | (33 | ) | | (32 | ) | | (32 | ) | | (581 | ) | | (608 | ) | | (678 | ) | | (1,604 | ) |

| Total other non-cash adjustments | | $ | 1,505 |

| | $ | 1,046 |

| | $ | 800 |

| | $ | 449 |

| | $ | 469 |

| | $ | 3,800 |

| | $ | 2,660 |

|

| |

| (1) | Recurring capital expenditures include lease incentives. Unlike other capital expenditures, we record lease incentives as other assets in our balance sheet and we classify payments for lease incentives as cash used in operating activities in our statement of cash flows. |

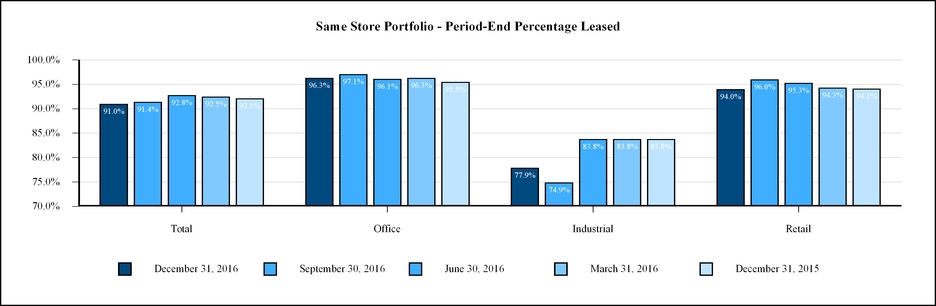

Net operating income (“NOI”) and NOI - cash basis are non-GAAP measures. See page 13 for a reconciliation of GAAP net income attributable to common stockholders to NOI and NOI - cash basis. The following tables present revenue and NOI of our three operating segments for each of the five quarters ending December 31, 2016, and for the years ended December 31, 2016 and 2015. Our same store portfolio includes all operating properties owned for the entirety of all periods presented and totals 46 properties, comprising approximately 7.5 million square feet or 83.7% of our total portfolio when measured by square feet (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| Revenue: | | | | | | | | | | | | | | |

| Same store real property: | | | | | | | | | | | | | | |

| Office | | $ | 24,246 |

| | $ | 25,094 |

| | $ | 24,651 |

| | $ | 24,292 |

| | $ | 24,059 |

| | $ | 98,283 |

| | $ | 97,703 |

|

| Industrial | | 1,391 |

| | 1,417 |

| | 1,487 |

| | 1,662 |

| | 1,478 |

| | 5,957 |

| | 5,790 |

|

| Retail | | 16,239 |

| | 16,012 |

| | 15,951 |

| | 16,037 |

| | 15,844 |

| | 64,239 |

| | 65,491 |

|

| Total same store real property revenue | | 41,876 |

| | 42,523 |

| | 42,089 |

| | 41,991 |

| | 41,381 |

| | 168,479 |

| | 168,984 |

|

| 2015/2016 Acquisitions/Dispositions | | 11,847 |

| | 10,735 |

| | 10,613 |

| | 13,553 |

| | 13,589 |

| | 46,748 |

| | 49,294 |

|

| Total real property revenue | | $ | 53,723 |

| | $ | 53,258 |

| | $ | 52,702 |

| | $ | 55,544 |

| | $ | 54,970 |

| | $ | 215,227 |

| | $ | 218,278 |

|

| NOI: | | | | | | | | | | | | | | |

| Same store real property: | | | | | | | | | | | | | | |

| Office | | $ | 15,697 |

| | $ | 17,119 |

| | $ | 17,113 |

| | $ | 16,827 |

| | $ | 16,243 |

| | $ | 66,756 |

| | $ | 67,489 |

|

| Industrial | | 991 |

| | 953 |

| | 1,101 |

| | 1,260 |

| | 1,084 |

| | 4,305 |

| | 4,107 |

|

| Retail | | 12,363 |

| | 12,094 |

| | 12,139 |

| | 12,201 |

| | 12,115 |

| | 48,797 |

| | 49,577 |

|

| Total same store real property NOI | | 29,051 |

| | 30,166 |

| | 30,353 |

| | 30,288 |

| | 29,442 |

| | 119,858 |

| | 121,173 |

|

| 2015/2016 Acquisitions/Dispositions | | 7,472 |

| | 6,655 |

| | 6,717 |

| | 8,938 |

| | 9,351 |

| | 29,782 |

| | 37,515 |

|

| Total NOI | | $ | 36,523 |

| | $ | 36,821 |

| | $ | 37,070 |

| | $ | 39,226 |

| | $ | 38,793 |

| | $ | 149,640 |

| | $ | 158,688 |

|

| NOI - cash basis: | | | | | | | | | | | | | | |

| Same store real property: | | | | | | | | | | | | | | |

| Office | | $ | 17,422 |

| | $ | 18,541 |

| | $ | 18,357 |

| | $ | 17,904 |

| | $ | 17,286 |

| | $ | 72,224 |

| | $ | 71,063 |

|

| Industrial | | 1,019 |

| | 1,030 |

| | 1,111 |

| | 1,264 |

| | 1,019 |

| | 4,424 |

| | 3,922 |

|

| Retail | | 11,854 |

| | 11,515 |

| | 11,547 |

| | 11,699 |

| | 11,589 |

| | 46,615 |

| | 47,391 |

|

| Total same store real property NOI - cash basis | | 30,295 |

| | 31,086 |

| | 31,015 |

| | 30,867 |

| | 29,894 |

| | 123,263 |

| | 122,376 |

|

| 2015/2016 Acquisitions/Dispositions | | 6,900 |

| | 5,909 |

| | 5,982 |

| | 8,337 |

| | 9,003 |

| | 27,128 |

| | 36,446 |

|

| Total NOI - cash basis | | $ | 37,195 |

| | $ | 36,995 |

| | $ | 36,997 |

| | $ | 39,204 |

| | $ | 38,897 |

| | $ | 150,391 |

| | $ | 158,822 |

|

|

|

| RESULTS FROM OPERATIONS (continued) |

The following tables present a reconciliation of GAAP net income attributable to common stockholders to NOI and NOI - cash basis of our three operating segments for each of the five quarters ending December 31, 2016, and for the years ended December 31, 2016 and 2015 (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| Net income attributable to common stockholders | | $ | 3,112 |

| | $ | 2,965 |

| | $ | 117 |

| | $ | 43,782 |

| | $ | 730 |

| | $ | 49,976 |

| | $ | 124,255 |

|

| Debt related income | | (233 | ) | | (235 | ) | | (237 | ) | | (238 | ) | | (1,328 | ) | | (943 | ) | | (6,922 | ) |

| Real estate depreciation and amortization expense | | 20,083 |

| | 19,989 |

| | 20,198 |

| | 19,835 |

| | 21,710 |

| | 80,105 |

| | 83,114 |

|

| General and administrative expenses | | 2,257 |

| | 2,234 |

| | 2,338 |

| | 2,621 |

| | 2,564 |

| | 9,450 |

| | 10,720 |

|

| Advisory fees, related party | | 3,740 |

| | 3,681 |

| | 3,671 |

| | 3,765 |

| | 4,062 |

| | 14,857 |

| | 17,083 |

|

| Acquisition-related expenses | | 6 |

| | 136 |

| | 474 |

| | 51 |

| | 1,385 |

| | 667 |

| | 2,644 |

|

| Impairment of real estate property | | — |

| | 2,090 |

| | — |

| | 587 |

| | — |

| | 2,677 |

| | 8,124 |

|

| Interest and other expense (income) | | 90 |

| | (2,308 | ) | | 69 |

| | (58 | ) | | (693 | ) | | (2,207 | ) | | (2,192 | ) |

| Interest expense | | 9,388 |

| | 10,011 |

| | 10,422 |

| | 10,961 |

| | 11,301 |

| | 40,782 |

| | 47,508 |

|

| (Gain) loss on extinguishment of debt and financing commitments | | — |

| | — |

| | — |

| | (5,136 | ) | | — |

| | (5,136 | ) | | 1,168 |

|

| Gain on sale of real property | | (2,165 | ) | | (2,095 | ) | | — |

| | (41,400 | ) | | (984 | ) | | (45,660 | ) | | (134,218 | ) |

| Net income attributable to noncontrolling interests | | 245 |

| | 353 |

| | 18 |

| | 4,456 |

| | 46 |

| | 5,072 |

| | 7,404 |

|

| NOI | | $ | 36,523 |

| | $ | 36,821 |

| | $ | 37,070 |

| | $ | 39,226 |

| | $ | 38,793 |

| | $ | 149,640 |

| | $ | 158,688 |

|

| Net amortization of above- and below-market lease assets and liabilities, and other non-cash adjustments to rental revenue | | 150 |

| | (122 | ) | | (278 | ) | | (262 | ) | | (187 | ) | | (512 | ) | | (842 | ) |

| Straight line rent | | 522 |

| | 296 |

| | 205 |

| | 240 |

| | 291 |

| | 1,263 |

| | 976 |

|

| NOI - cash basis | | $ | 37,195 |

| | $ | 36,995 |

| | $ | 36,997 |

| | $ | 39,204 |

| | $ | 38,897 |

| | $ | 150,391 |

| | $ | 158,822 |

|

The following tables present details regarding our capital expenditures for each of the five quarters ending December 31, 2016, and for the years ended December 31, 2016 and 2015 (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 | | December 31, 2016 | | December 31, 2015 |

| Recurring capital expenditures: | | | | | | | | | | | | | | |

| Land and building improvements | | $ | 5,740 |

| | $ | 1,949 |

| | $ | 1,729 |

| | $ | 1,294 |

| | $ | 1,425 |

| | $ | 10,712 |

| | $ | 5,158 |

|

| Tenant improvements | | 1,267 |

| | 1,680 |

| | 1,459 |

| | 4,100 |

| | 1,178 |

| | 8,506 |

| | 4,788 |

|

Leasing costs (1) | | 1,032 |

| | 536 |

| | 5,024 |

| | 886 |

| | 549 |

| | 7,478 |

| | 2,348 |

|

| Total recurring capital expenditures | | $ | 8,039 |

| | $ | 4,165 |

| | $ | 8,212 |

| | $ | 6,280 |

| | $ | 3,152 |

| | $ | 26,696 |

| | $ | 12,294 |

|

| Non-recurring capital expenditures: | | | | | | | | | | | | | | |

| Land and building improvements | | $ | 782 |

| | $ | 553 |

| | $ | 374 |

| | $ | 304 |

| | $ | 665 |

| | $ | 2,013 |

| | $ | 759 |

|

| Tenant improvements | | 165 |

| | 111 |

| | 256 |

| | 529 |

| | 320 |

| | 1,061 |

| | 786 |

|

| Leasing costs | | 131 |

| | 84 |

| | 64 |

| | 155 |

| | 182 |

| | 434 |

| | 449 |

|

| Total non-recurring capital expenditures | | $ | 1,078 |

| | $ | 748 |

| | $ | 694 |

| | $ | 988 |

| | $ | 1,167 |

| | $ | 3,508 |

| | $ | 1,994 |

|

| |

| (1) | Recurring leasing costs include lease incentives. Unlike other capital expenditures, we record lease incentives as other assets in our balance sheet and we classify payments for lease incentives as cash used in operating activities in our statement of cash flows. |

The following table describes certain information about our capital structure. Amounts reported as financing capital represent the total principal outstanding under our total borrowings. Amounts reported as equity capital are presented based on the NAV as of December 31, 2016 (shares and dollar amounts other than price per share / unit in thousands).

|

| | | | | | | | | |

| FINANCING: | | | | | | | As of December 31, 2016 |

| Mortgage notes | | | | | | | $ | 343,470 |

|

| Unsecured line of credit | | | | | | | 236,000 |

|

| Unsecured term loans | | | | | | | 475,000 |

|

Total Financing (1) | | | | | | | $ | 1,054,470 |

|

|

| | | | | | | | | | | | | |

| EQUITY: | Shares / Units | | Percentage of Aggregate Shares and Units Outstanding | | NAV Per Share / Unit | | Value |

| Class E Common Stock | 112,325 |

| | 69.2 | % | | $ | 7.57 |

| | $ | 850,278 |

|

| Class A Common Stock | 2,001 |

| | 1.2 | % | | 7.57 |

| | 15,142 |

|

| Class W Common Stock | 2,271 |

| | 1.4 | % | | 7.57 |

| | 17,194 |

|

Class I Common Stock (2) | 33,751 |

| | 20.8 | % | | 7.57 |

| | 255,489 |

|

| Class E OP Units | 12,048 |

| | 7.4 | % | | 7.57 |

| | 91,197 |

|

| Total/Weighted Average | 162,396 |

| | 100.0 | % | | $ | 7.57 |

| | $ | 1,229,300 |

|

| Joint venture partners' noncontrolling interests | | | | | | | 3,588 |

|

| Total Equity | | | | | | | 1,232,888 |

|

| TOTAL CAPITALIZATION | | | | | | | $ | 2,287,358 |

|

| |

| (1) | For a reconciliation of the total outstanding principal balance under our total borrowings to total borrowings on a GAAP basis see p.15. |

| |

| (2) | Amounts reported do not include approximately 288,000 restricted stock units granted to the Advisor that remain unvested as of December 31, 2016. |

|

|

| FINANCE & CAPITAL (continued) |

The following table presents a summary of our borrowings as of December 31, 2016 (dollar amounts in thousands):

|

| | | | | | | | | |

| | Outstanding Principal Balance | Weighted Average Stated Interest Rate | Fair Value of Real Properties Securing Borrowings (1) |

Fixed-rate mortgages (2) | $ | 290,970 |

| | 4.9% | | $ | 946,650 |

|

Floating-rate mortgages (3) | 52,500 |

| | 2.3% | | 80,600 |

|

| Total mortgage notes | 343,470 |

| | 4.5% | | 1,027,250 |

|

Line of credit (4) | 236,000 |

| | 2.3% | | N/A |

|

Term loans (4) | 475,000 |

| | 3.2% | | N/A |

|

| Total unsecured borrowings | 711,000 |

| | 2.9% | | N/A |

|

| Total borrowings | $ | 1,054,470 |

| | 3.4% | | N/A |

|

| Less: net debt issuance costs | (6,295 | ) | | | | |

| Add: mark-to-market adjustment on assumed debt | 626 |

| | | | |

|

| Total borrowings (net basis) | $ | 1,048,801 |

| | | | |

| |

| (1) | Fair value of real properties was determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2016 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of "fair value" of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled "Definitions" beginning on page 25. For a description of key assumptions used in calculating the value of our real properties as of December 31, 2016, please refer to “Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" in Part II, Item 5 of our 2016 Annual Report on Form 10-K. |

| |

| (2) | As of December 31, 2016, fixed-rate mortgages included one floating-rate mortgage subject to an interest rate spread of 1.60% over one-month LIBOR, which we have effectively fixed using an interest rate swap at 3.051% for the term of the borrowing. |

| |

| (3) | As of December 31, 2016, our floating-rate mortgage note was subject to an interest rate spread of 1.65% over one-month LIBOR. However, we entered into interest rate swaps which will effectively fix the interest rate of the borrowing at 2.852% from July 1, 2018 to July 1, 2021. |

| |

| (4) | $362.1 million of our unsecured floating rate borrowings are effectively fixed by the use of fixed-for-floating swap instruments as of December 31, 2016. The stated interest rate disclosed above includes the impact of these swaps. |

The following table presents a summary of our covenants and our actual results for each of the five quarters ended December 31, 2016, calculated in accordance with the terms of our credit facilities:

|

| | | | | | | | | | | | | | | | | |

| Portfolio-Level Covenants: | | Covenant | | December 31, 2016 | | September 30, 2016 | | June 30, 2016 | | March 31, 2016 | | December 31, 2015 |

| Leverage | | < 60% | | 47.5 | % | | 46.5 | % | | 44.8 | % | | 42.9 | % | | 45.1 | % |

| Fixed Charge Coverage | | > 1.50 | | 3.3 |

| | 3.0 |

| | 2.7 |

| | 2.6 |

| | 2.6 |

|

| Secured Indebtedness | | < 55% | | 15.5 | % | | 17.0 | % | | 20.2 | % | | 23.2 | % | | 24.0 | % |

| | | | | | | | | | | | | |

| Unencumbered Pool Covenants: | | | | | | | | | | | | |

| Leverage | | < 60% | | 45.5 | % | | 41.4 | % | | 38.8 | % | | 34.2 | % | | 38.4 | % |

| Unsecured Interest Coverage | | >2.0 | | 6.8 |

| | 7.8 |

| | 6.9 |

| | 6.2 |

| | 7.7 |

|

|

|

| FINANCE & CAPITAL (continued) |

The following table presents a detailed analysis of our borrowings outstanding as of December 31, 2016 (dollar amounts in thousands):

|

| | | | | | | | | | | | | | | | | | |

| Borrowings | | Principal Balance | | Secured / Unsecured | | Maturity Date | | Extension Options | | % of Total Borrowings | | Fixed or Floating Interest Rate | | Interest Rate |

Eastern Retail Portfolio (1) | | $ | 110,000 |

| | Secured | | 6/11/2017 | | None | | 10.4 | % | | Fixed | | 5.51 | % |

| Wareham | | 24,400 |

| | Secured | | 8/8/2017 | | None | | 2.3 | % | | Fixed | | 6.13 | % |

| Kingston | | 10,574 |

| | Secured | | 11/1/2017 | | None | | 1.0 | % | | Fixed | | 6.33 | % |

| Sandwich | | 15,825 |

| | Secured | | 11/1/2017 | | None | | 1.5 | % | | Fixed | | 6.33 | % |

| Total 2017 | | 160,799 |

| | | | | | | | 15.2 | % | | | | 5.74 | % |

Bank of America Term Loan (2) | | 275,000 |

| | Unsecured | | 1/31/2018 | | 2 - 1 Year | | 26.1 | % | | Floating | | 2.73 | % |

Line of Credit (2) | | 236,000 |

| | Unsecured | | 1/31/2019 | | 1 - 1 Year | | 22.4 | % | | Floating | | 2.28 | % |

| Shenandoah | | 10,524 |

| | Secured | | 9/1/2021 | | None | | 1.0 | % | | Fixed | | 4.84 | % |

Wells Fargo Term Loan (2) | | 200,000 |

| | Unsecured | | 2/27/2022 | | None | | 19.0 | % | | Fixed | | 3.79 | % |

| Norwell | | 4,392 |

| | Secured | | 10/1/2022 | | None | | 0.4 | % | | Fixed | | 6.76 | % |

Preston Sherry Plaza (3) | | 33,000 |

| | Secured | | 3/1/2023 | | None | | 3.1 | % | | Fixed | | 3.05 | % |

1300 Connecticut (4) | | 52,500 |

| | Secured | | 8/5/2023 | | None | | 5.0 | % | | Floating | | 2.27 | % |

| Greater DC Retail Center | | 70,000 |

| | Secured | | 12/1/2025 | | None | | 6.6 | % | | Fixed | | 3.80 | % |

| Harwich | | 5,034 |

| | Secured | | 9/1/2028 | | None | | 0.5 | % | | Fixed | | 5.24 | % |

| New Bedford | | 7,221 |

| | Secured | | 12/1/2029 | | None | | 0.7 | % | | Fixed | | 5.91 | % |

| Total 2018 - 2029 | | 893,671 |

| | | | | | | | 84.8 | % | | | | 3.00 | % |

| Total borrowings | | $ | 1,054,470 |

| | | | | | | | 100.0 | % | | | | 3.42 | % |

| Add: mark-to-market adjustment on assumed debt | | 626 |

| | | | | | | | | | | | |

| Less: net debt issuance costs | | (6,295 | ) | | | | | | | | | | | | |

| Total Borrowings (GAAP basis) | | $ | 1,048,801 |

| | | | | | | | | | | | |

| |

| (1) | The Eastern Retail Portfolio was fully repaid on January 10, 2017. |

| |

| (2) | $362.1 million of our term loan and line of credit borrowings are effectively fixed by the use of fixed-for-floating rate swap instruments as of December 31, 2016. The stated interest rates disclosed above include the impact of these swaps. |

| |

| (3) | The Preston Sherry Plaza term loan was subject to an interest rate spread of 1.60% over one-month LIBOR. However, we have effectively fixed the interest rate of the borrowing using an interest rate swap at 3.051% for the term of the borrowing as of December 31, 2016. |

| |

| (4) | As of December 31, 2016, the 1300 Connecticut term loan was subject to an interest rate spread of 1.65% over one-month LIBOR. However, we entered into interest rate swaps which will effectively fix the interest rate of the borrowing at 2.852% from July 1, 2018 to July 1, 2021. |

The following table describes our operating property portfolio as of December 31, 2016 (dollar and square feet amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | |

| Market | | Number of Properties | | Gross

Investment Amount | | % of Gross Investment Amount | | Net Rentable Square Feet | | % of Total Net Rentable Square Feet | | % Leased (1) | | Secured Indebtedness (2) |

| Office Properties: | | | | | | | | | | | | | | |

| Northern New Jersey | | 1 | | $ | 231,029 |

| | 10.6 | % | | 594 |

| | 6.6 | % | | 100.0 | % | | $ | — |

|

| Austin, TX | | 3 | | 155,270 |

| | 7.1 | % | | 585 |

| | 6.5 | % | | 97.5 | % | | — |

|

| East Bay, CA | | 1 | | 145,376 |

| | 6.6 | % | | 405 |

| | 4.5 | % | | 100.0 | % | | — |

|

| San Francisco, CA | | 1 | | 121,827 |

| | 5.5 | % | | 263 |

| | 2.9 | % | | 93.5 | % | | — |

|

| Denver, CO | | 1 | | 83,160 |

| | 3.8 | % | | 257 |

| | 2.9 | % | | 79.0 | % | | — |

|

| South Florida | | 2 | | 82,141 |

| | 3.7 | % | | 363 |

| | 4.0 | % | | 83.9 | % | | — |

|

| Washington, DC | | 1 | | 70,485 |

| | 3.2 | % | | 126 |

| | 1.4 | % | | 99.1 | % | | 52,500 |

|

| Princeton, NJ | | 1 | | 51,324 |

| | 2.3 | % | | 167 |

| | 1.9 | % | | 100.0 | % | | — |

|

| Philadelphia, PA | | 1 | | 46,908 |

| | 2.1 | % | | 174 |

| | 1.9 | % | | 93.2 | % | | — |

|

| Silicon Valley, CA | | 1 | | 42,685 |

| | 1.9 | % | | 143 |

| | 1.6 | % | | 100.0 | % | | — |

|

| Dallas, TX | | 1 | | 37,763 |

| | 1.7 | % | | 155 |

| | 1.7 | % | | 92.3 | % | | 33,000 |

|

| Minneapolis/St Paul, MN | | 1 | | 29,515 |

| | 1.3 | % | | 107 |

| | 1.2 | % | | 100.0 | % | | — |

|

| Fayetteville, AR | | 1 | | 11,695 |

| | 0.5 | % | | 61 |

| | 0.7 | % | | 100.0 | % | | — |

|

| Total/Weighted Average Office: 13 markets with average annual rent of $32.94 per sq. ft. | | 16 | | 1,109,178 |

| | 50.3 | % | | 3,400 |

| | 37.8 | % | | 95.0 | % | | 85,500 |

|

| Industrial Properties: | | | | | | | | | | | | | | |

| Dallas, TX | | 1 | | 35,928 |

| | 1.6 | % | | 446 |

| | 5.0 | % | | 35.1 | % | | — |

|

| Central Kentucky | | 1 | | 30,840 |

| | 1.4 | % | | 727 |

| | 8.1 | % | | 100.0 | % | | — |

|

| Louisville, KY | | 3 | | 22,360 |

| | 1.0 | % | | 609 |

| | 6.8 | % | | 82.8 | % | | — |

|

| Total/Weighted Average Industrial: three markets with average annual rent of $3.64 per sq. ft. | | 5 | | 89,128 |

| | 4.0 | % | | 1,782 |

| | 19.9 | % | | 77.9 | % | | — |

|

| Retail Properties: | | | | | | | | | | | | | | |

| Greater Boston | | 25 | | 540,872 |

| | 24.5 | % | | 2,223 |

| | 24.8 | % | | 95.2 | % | | 83,447 |

|

| South Florida | | 2 | | 106,629 |

| | 4.8 | % | | 206 |

| | 2.3 | % | | 96.8 | % | | 10,523 |

|

| Philadelphia, PA | | 1 | | 105,308 |

| | 4.8 | % | | 426 |

| | 4.8 | % | | 90.3 | % | | 67,800 |

|

| Washington, DC | | 1 | | 62,867 |

| | 2.9 | % | | 233 |

| | 2.6 | % | | 100.0 | % | | 70,000 |

|

| Northern New Jersey | | 1 | | 58,959 |

| | 2.7 | % | | 223 |

| | 2.5 | % | | 93.8 | % | | — |

|

| Raleigh, NC | | 1 | | 45,714 |

| | 2.1 | % | | 143 |

| | 1.6 | % | | 97.8 | % | | 26,200 |

|

| Tulsa, OK | | 1 | | 34,038 |

| | 1.5 | % | | 101 |

| | 1.1 | % | | 97.7 | % | | — |

|

| San Antonio, TX | | 1 | | 32,072 |

| | 1.5 | % | | 161 |

| | 1.8 | % | | 89.6 | % | | — |

|

| Jacksonville, FL | | 1 | | 19,557 |

| | 0.9 | % | | 73 |

| | 0.8 | % | | 48.0 | % | | — |

|

| Total/Weighted Average Retail: nine markets with average annual rent of $17.58 per sq. ft. | | 34 | | 1,006,016 |

| | 45.7 | % | | 3,789 |

| | 42.3 | % | | 94.0 | % | | 257,970 |

|

| Grand Total/Weighted Average | | 55 | | $ | 2,204,322 |

| | 100.0 | % | | 8,971 |

| | 100.0 | % | | 91.2 | % | | $ | 343,470 |

|

| |

| (1) | Based on executed leases as of December 31, 2016. If weighted by the fair value of each segment, our portfolio was 93.9% leased as of December 31, 2016. |

| |

| (2) | Secured indebtedness represents the principal balance outstanding and does not include our mark-to-market adjustment on debt or net debt issuance costs. |

The following graphs highlight our total portfolio and same store portfolio percentage leased at the end of each of the five quarters ended December 31, 2016, by segment and in total:

|

|

| LEASING ACTIVITY (continued) |

As of December 31, 2016, the weighted average remaining term of our leases was approximately 4.7 years, based on annualized base rent, and 4.5 years, based on leased square footage. The following table presents our lease expirations, by segment and in total, as of December 31, 2016 (dollars and square feet in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | Office | | Industrial | | Retail |

| Year | | Number of Leases Expiring | | Annualized Base Rent | | % of Total Annualized Base Rent | | Square

Feet | | Number of Leases Expiring | | Annualized Base Rent | | Square

Feet | | Number of Leases Expiring | | Annualized Base Rent | | Square

Feet | | Number of Leases Expiring | | Annualized Base Rent | | Square

Feet |

2017 (1) | | 92 |

| | $ | 37,199 |

| | 21.9 | % | | 1,112 |

| | 43 | | $ | 33,708 |

| | 840 |

| | 2 | | $ | 372 |

| | 104 |

| | 47 | | $ | 3,119 |

| | 168 |

|

| 2018 | | 117 |

| | 13,288 |

| | 7.8 | % | | 591 |

| | 62 | | 8,437 |

| | 337 |

| | — | | — |

| | — |

| | 55 | | 4,851 |

| | 254 |

|

| 2019 | | 105 |

| | 24,625 |

| | 14.5 | % | | 1,168 |

| | 51 | | 14,417 |

| | 458 |

| | 2 | | 1,313 |

| | 212 |

| | 52 | | 8,895 |

| | 498 |

|

| 2020 | | 114 |

| | 24,155 |

| | 14.2 | % | | 1,120 |

| | 41 | | 9,914 |

| | 398 |

| | — | | — |

| | — |

| | 73 | | 14,241 |

| | 722 |

|

| 2021 | | 64 |

| | 17,214 |

| | 10.2 | % | | 1,552 |

| | 23 | | 8,029 |

| | 260 |

| | 3 | | 3,192 |

| | 1,021 |

| | 38 | | 5,993 |

| | 271 |

|

| 2022 | | 46 |

| | 10,400 |

| | 6.1 | % | | 612 |

| | 19 | | 5,203 |

| | 192 |

| | — | | — |

| | — |

| | 27 | | 5,197 |

| | 420 |

|

| 2023 | | 36 |

| | 16,194 |

| | 9.5 | % | | 647 |

| | 18 | | 11,844 |

| | 389 |

| | — | | — |

| | — |

| | 18 | | 4,350 |

| | 258 |

|

| 2024 | | 25 |

| | 5,249 |

| | 3.1 | % | | 336 |

| | 7 | | 2,145 |

| | 105 |

| | — | | — |

| | — |

| | 18 | | 3,104 |

| | 231 |

|

| 2025 | | 19 |

| | 4,230 |

| | 2.5 | % | | 210 |

| | 7 | | 2,362 |

| | 81 |

| | 1 | | 182 |

| | 51 |

| | 11 | | 1,686 |

| | 78 |

|

| 2026 | | 17 |

| | 3,217 |

| | 1.9 | % | | 182 |

| | 6 | | 1,179 |

| | 31 |

| | — | | — |

| | — |

| | 11 | | 2,038 |

| | 151 |

|

| Thereafter | | 32 |

| | 14,111 |

| | 8.3 | % | | 643 |

| | 5 | | 4,993 |

| | 134 |

| | — | | — |

| | — |

| | 27 | | 9,118 |

| | 509 |

|

| Total | | 667 |

| | $ | 169,882 |

| | 100.0 | % | | 8,173 |

| | 282 | | $ | 102,231 |

| | 3,225 |

| | 8 | | $ | 5,059 |

| | 1,388 |

| | 377 | | $ | 62,592 |

| | 3,560 |

|

| |

| (1) | Includes 10 leases with combined annualized base rent of approximately $330,000 that are on a month-to-month basis. |

|

|

| LEASING ACTIVITY (continued) |

The following table presents our top 10 tenants by annualized base rent and their related industry sector, as of December 31, 2016 (dollars and square feet in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| | Tenant | | Locations | | Industry Sector | | Annualized Base Rent(1) | | % of Total Annualized Base Rent | | Square

Feet | | % of Occupied Square Feet |

| 1 |

| Charles Schwab & Co, Inc. (2) | | 2 | | Securities, Commodities, Fin. Inv./Rel. Activities | | $ | 23,645 |

| | 13.9 | % | | 602 |

| | 7.4 | % |

| 2 |

| Sybase (3) | | 1 | | Publishing Information (except Internet) | | 18,692 |

| | 11.0 | % | | 405 |

| | 5.0 | % |

| 3 |

| Stop & Shop | | 14 | | Food and Beverage Stores | | 14,125 |

| | 8.3 | % | | 853 |

| | 10.4 | % |

| 4 |

| Novo Nordisk | | 1 | | Chemical Manufacturing | | 4,627 |

| | 2.7 | % | | 167 |

| | 2.0 | % |

| 5 |

| Seton Health Care | | 1 | | Hospitals | | 4,339 |

| | 2.6 | % | | 156 |

| | 1.9 | % |

| 6 |

| Shaw's Supermarket | | 4 | | Food and Beverage Stores | | 3,944 |

| | 2.3 | % | | 240 |

| | 2.9 | % |

| 7 |

| I.A.M. National Pension Fund | | 1 | | Funds, Trusts and Other Financial Vehicles | | 3,114 |

| | 1.8 | % | | 63 |

| | 0.8 | % |

| 8 |

| TJX Companies | | 7 | | Clothing and Clothing Accessories Stores | | 2,998 |

| | 1.8 | % | | 299 |

| | 3.7 | % |

| 9 |

| Home Depot | | 1 | | Building Material and Garden Equipment and Supplies Dealers | | 2,469 |

| | 1.5 | % | | 102 |

| | 1.3 | % |

| 10 |

| Alliant Techsystems Inc. | | 1 | | Fabricated Metal Product Manufacturing | | 2,450 |

| | 1.4 | % | | 107 |

| | 1.3 | % |

| | Total | | 33 | | | | $ | 80,403 |

| | 47.3 | % | | 2,994 |

| | 36.7 | % |

| |

| (1) | Annualized base rent represents the annualized monthly base rent of executed leases as of December 31, 2016. |

| |

| (2) | The amount presented for Charles Schwab reflects the total annualized base rent for our two leases in place with Charles Schwab as of December 31, 2016. One of these leases, which expires in September 2017, entails the lease of all 594,000 square feet of our 3 Second Street (formerly known as Harborside) office property and accounts for $23.5 million or 13.8% of our annualized base rent as of December 31, 2016. We do not expect Charles Schwab to renew this lease. Charles Schwab has subleased 100% of 3 Second Street to 27 sub-tenants through September 2017. We have executed leases directly with nine of these subtenants that comprise 352,000 square feet or 59% of 3 Second Street that effectively extend their leases beyond the Schwab lease expiration. These direct leases will expire between September 2020 and September 2032. |

| |

| (3) | The Sybase lease was terminated on January 31, 2017. |

|

|

| LEASING ACTIVITY (continued) |

The top two tenants in the table on the previous page comprise 24.9% of annualized base rent as of December 31, 2016. However, due to the expiration of the Sybase lease and the near-term expiration of the Schwab lease at 3 Second Street, these two tenants are no longer in the top three tenants based on future minimum rental revenue, together comprising less than 3% of our total future minimum rental revenue as of December 31, 2016. The following table presents our top 10 tenants by future minimum rental revenue and their related industry sector, as of as of December 31, 2016 (dollars and square feet in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| | Tenant | | Locations | | Industry Sector | | Future Minimum Rental Revenue | | % of Total Future Minimum Rental Revenue | | Square

Feet | | % of Total Portfolio Leased Square Feet |

| 1 |

| Stop & Shop | | 14 | | Food and Beverages | | $ | 74,864 |

| | 9.9 | % | | 853 |

| | 10.4 | % |

| 2 |

| Mizuho Bank Ltd. | | 1 | | Credit Intermediation and Related Activities | | 65,322 |

| | 8.6 | % | | 107 |

| | 1.3 | % |

| 3 |

| Shaw's Supermarket | | 4 | | Food and Beverages | | 44,261 |

| | 5.8 | % | | 240 |

| | 2.9 | % |

| 4 |

| Novo Nordisk | | 1 | | Chemical Manufacturing | | 31,714 |

| | 4.2 | % | | 167 |

| | 2.0 | % |

| 5 |

| Charles Schwab & Co., Inc. | | 2 | | Securities, Commodities, Fin. Inv./Rel. Activities | | 17,916 |

| | 2.4 | % | | 602 |

| | 7.4 | % |

| 6 |

| Alliant Techsystems Inc | | 1 | | Fabricated Metal Product Manufacturing | | 16,716 |

| | 2.2 | % | | 107 |

| | 1.3 | % |

| 7 |

| CVS | | 8 | | Ambulatory Health Care Services | | 15,709 |

| | 2.1 | % | | 73 |

| | 0.9 | % |

| 8 |

| Citco Fund Services | | 1 | | Funds, Trusts and Other Financial Vehicles | | 15,021 |

| | 2.0 | % | | 104 |

| | 1.3 | % |

| 9 |

| Seton Health Care | | 1 | | Hospitals | | 13,686 |

| | 1.8 | % | | 156 |

| | 1.9 | % |

| 10 |

| Walgreens | | 2 | | Health and Personal Care Services | | 13,292 |

| | 1.8 | % | | 31 |

| | 0.4 | % |

| | Total | | 35 | | | | $ | 308,501 |

| | 40.8 | % | | 2,440 |

| | 29.8 | % |

|

|

| LEASING ACTIVITY (continued) |

The following series of tables details leasing activity during the four quarters ended December 31, 2016:

|

| | | | | | | | | | | | | | | | | | | | |

| Quarter | | Number of Leases Signed | | Gross Leasable Area ("GLA") Signed | | Weighted Average

Rent Per Sq. Ft. | | Weighted Average Growth / Straight Line Rent | | Weighted Average Lease Term (mos) | | Tenant Improvements & Incentives Per Sq. Ft. | | Average Free Rent (mos) |

Office Comparable (1) | | | | | | | | | | | | | | |

| Q4 2016 | | 14 | | 52,455 |

| | $ | 29.81 |

| | 45.0 | % | | 72 | | $ | 23.17 |

| | 1.4 |

| Q3 2016 | | 11 | | 71,204 |

| | 32.76 |

| | 22.1 | % | | 86 | | 13.75 |

| | 0.8 |

| Q2 2016 | | 7 | | 13,009 |

| | 38.09 |

| | 38.5 | % | | 87 | | 32.14 |

| | 2.9 |

| Q1 2016 | | 12 | | 33,241 |

| | 34.82 |

| | 52.4 | % | | 63 | | 36.24 |

| | 1.8 |

| Total - twelve months | | 44 | | 169,909 |

| | $ | 32.66 |

| | 36.4 | % | | 77 | | $ | 22.46 |

| | 1.4 |

Industrial Comparable (1) | | | | | | | | | | | | | | |

| Q4 2016 | | — | | — |

| | $ | — |

| | — | % | | — | | $ | — |

| | — |

| Q3 2016 | | — | | — |

| | — |

| | — | % | | — | | — |

| | — |

| Q2 2016 | | — | | — |

| | — |

| | — | % | | — | | — |

| | — |

| Q1 2016 | | — | | — |

| | — |

| | — | % | | — | | — |

| | — |

| Total - twelve months | | — | | — |

| | $ | — |

| | — | % | | — | | $ | — |

| | — |

Retail Comparable (1) | | | | | | | | | | | | | | |

| Q4 2016 | | 14 | | 87,871 |

| | $ | 20.48 |

| | 15.8 | % | | 56 | | $ | 0.73 |

| | — |

| Q3 2016 | | 17 | | 133,140 |

| | 12.33 |

| | 15.4 | % | | 78 | | 2.33 |

| | 0.1 |

| Q2 2016 | | 7 | | 130,120 |

| | 16.22 |

| | 11.5 | % | | 97 | | 0.33 |

| | — |

| Q1 2016 | | 6 | | 17,004 |

| | 22.99 |

| | 17.3 | % | | 56 | | 1.18 |

| | — |

| Total - twelve months | | 44 | | 368,135 |

| | $ | 16.14 |

| | 14.2 | % | | 78 | | $ | 1.19 |

| | — |

Total Comparable Leasing (1) | | | | | | | | | | | | | | |

| Q4 2016 | | 28 | | 140,326 |

| | $ | 23.97 |

| | 28.2 | % | | 62 | | $ | 9.12 |

| | 0.5 |

| Q3 2016 | | 28 | | 204,344 |

| | 19.45 |

| | 16.2 | % | | 80 | | 6.31 |

| | 0.3 |

| Q2 2016 | | 14 | | 143,129 |

| | 18.21 |

| | 15.4 | % | | 96 | | 3.23 |

| | 0.3 |

| Q1 2016 | | 18 | | 50,245 |

| | 30.82 |

| | 41.7 | % | | 60 | | 24.37 |

| | 1.2 |

| Total - twelve months | | 88 | | 538,044 |

| | $ | 21.36 |

| | 21.5 | % | | 78 | | $ | 7.91 |

| | 0.4 |

| Total Leasing | | | | | | | | | | | | | | |

| Q4 2016 | | 36 | | 235,614 |

| | $ | 18.25 |

| | | | 53 | | $ | 10.73 |

| | 0.5 |

| Q3 2016 | | 41 | | 336,374 |

| | 17.94 |

| | | | 67 | | 11.14 |

| | 1.0 |

| Q2 2016 | | 25 | | 297,843 |

| | 26.57 |

| | | | 124 | | 36.49 |

| | 3.7 |

| Q1 2016 | | 30 | | 75,656 |

| | 27.34 |

| | | | 54 | | 25.34 |

| | 1.2 |

| Total - twelve months | | 132 | | 945,487 |

| | $ | 21.49 |

| | | | 80 | | $ | 20.16 |

| | 1.8 |

| |

| (1) | Comparable leases comprise leases for which prior leases were in place for the same suite within 12 months of executing a new lease. Comparable leases must have terms of at least six months and the square footage of the suite occupied by the new tenant cannot deviate by more than 50% from the size of the old lease’s suite. |

The following tables describe changes in our portfolio from December 31, 2014 through December 31, 2016 (dollars and square feet in thousands):

|

| | | | | | | | | | | | | | |

| | | | | Square Feet |

| Properties and Square Feet Activity | | Number of Properties | | Total | | Office | | Industrial | | Retail |

| Properties owned as of | | | | | | | | | | |

| December 31, 2014 | | 68 | | 11,871 |

| | 5,094 |

| | 3,492 |

| | 3,285 |

|

| 2015 Acquisitions | | 8 | | 1,383 |

| | 792 |

| | — |

| | 591 |

|

| 2015 Dispositions | | (17) | | (3,124 | ) | | (1,427 | ) | | (1,583 | ) | | (114 | ) |

Building remeasurement and other (1) | | 1 | | 3 |

| | 2 |

| | — |

| | 1 |

|

| December 31, 2015 | | 60 | | 10,133 |

| | 4,461 |

| | 1,909 |

| | 3,763 |

|

| 2016 Acquisitions | | 1 | | 82 |

| | — |

| | — |

| | 82 |

|

| 2016 Dispositions | | (7) | | (1,236 | ) | | (1,058 | ) | | (126 | ) | | (52 | ) |

Building remeasurement and other (1) | | 1 | | (8 | ) | | (3 | ) | | (1 | ) | | (4 | ) |

| December 31, 2016 | | 55 | | 8,971 |

| | 3,400 |

| | 1,782 |

| | 3,789 |

|

| |