UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

| x | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Dividend Capital Diversified Property Fund Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

Dividend Capital Diversified Property Fund Inc.

Date of Record: May 17, 2017

Vote Cut-off Date: July 25, 2017

Additional Items:

Item 1. Financial advisor presentation

1 For Broker / Dealer Use Only — Not for Use with the Public June 2017 Proposed Fund Changes 1300 CONNECTICUT

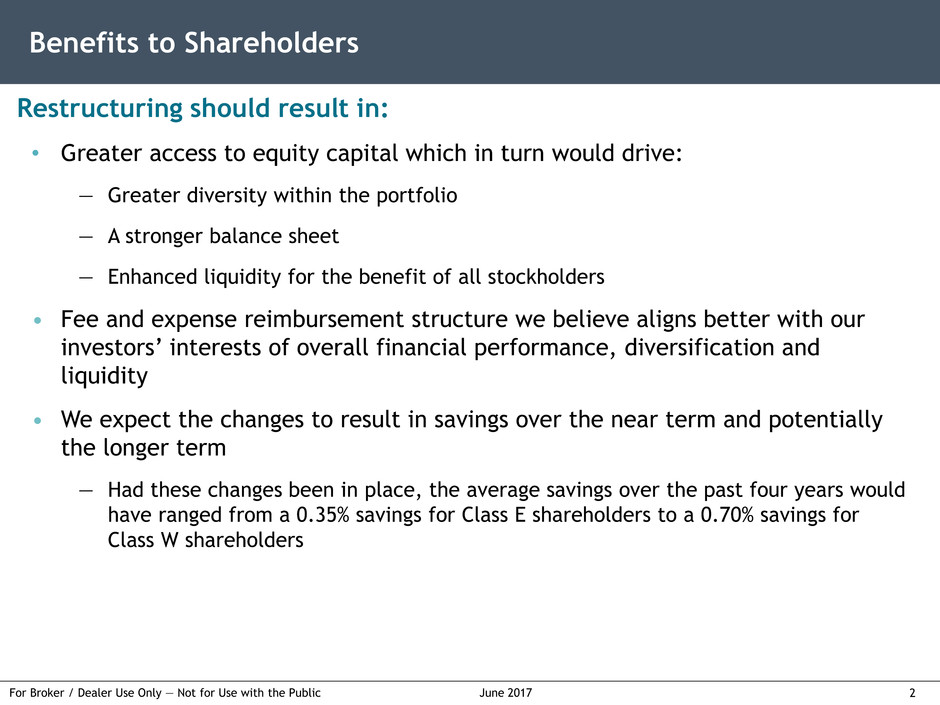

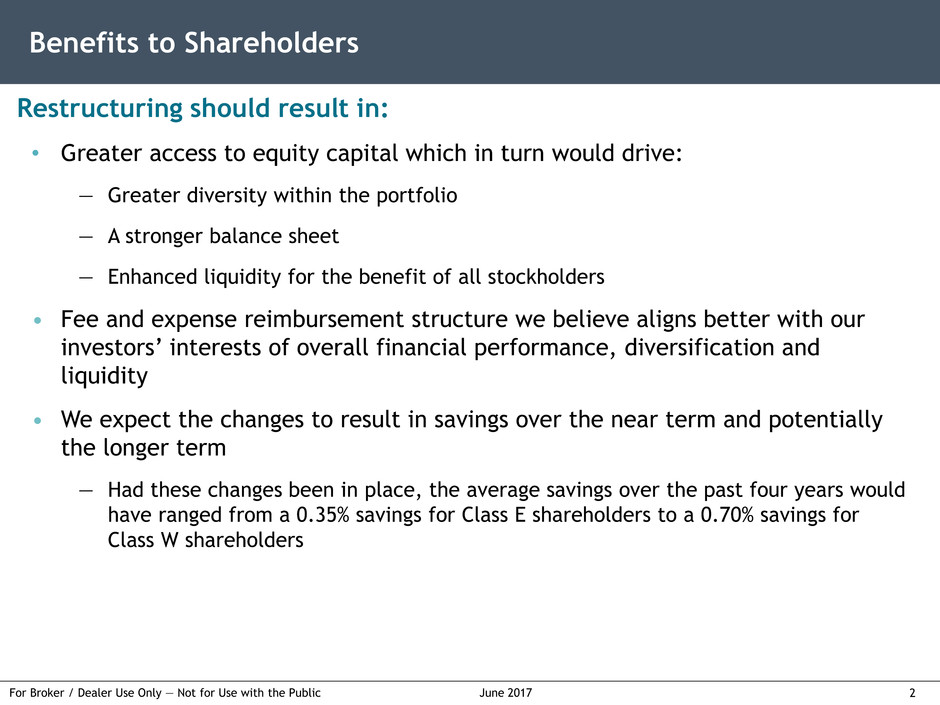

2 For Broker / Dealer Use Only — Not for Use with the Public June 2017 • Greater access to equity capital which in turn would drive: — Greater diversity within the portfolio — A stronger balance sheet — Enhanced liquidity for the benefit of all stockholders • Fee and expense reimbursement structure we believe aligns better with our investors’ interests of overall financial performance, diversification and liquidity • We expect the changes to result in savings over the near term and potentially the longer term — Had these changes been in place, the average savings over the past four years would have ranged from a 0.35% savings for Class E shareholders to a 0.70% savings for Class W shareholders Benefits to Shareholders Restructuring should result in:

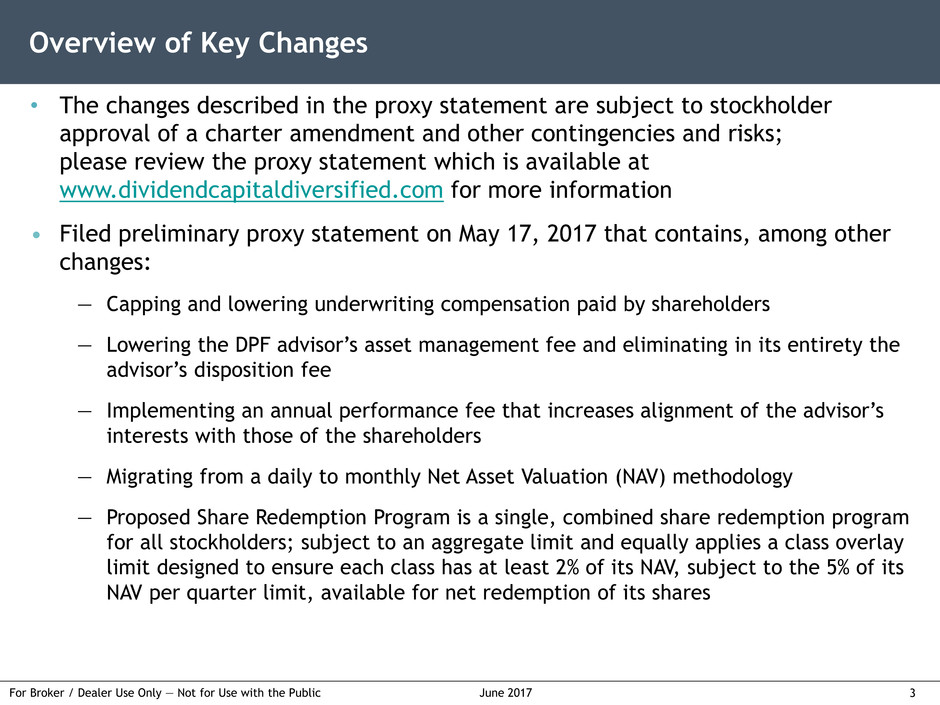

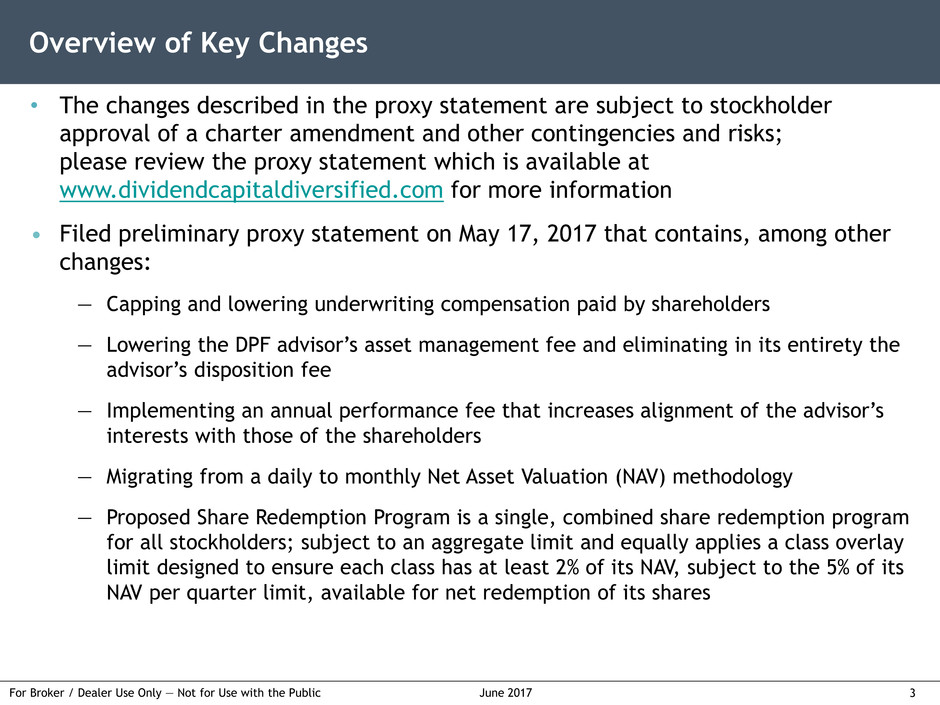

3 For Broker / Dealer Use Only — Not for Use with the Public June 2017 • The changes described in the proxy statement are subject to stockholder approval of a charter amendment and other contingencies and risks; please review the proxy statement which is available at www.dividendcapitaldiversified.com for more information • Filed preliminary proxy statement on May 17, 2017 that contains, among other changes: — Capping and lowering underwriting compensation paid by shareholders — Lowering the DPF advisor’s asset management fee and eliminating in its entirety the advisor’s disposition fee — Implementing an annual performance fee that increases alignment of the advisor’s interests with those of the shareholders — Migrating from a daily to monthly Net Asset Valuation (NAV) methodology — Proposed Share Redemption Program is a single, combined share redemption program for all stockholders; subject to an aggregate limit and equally applies a class overlay limit designed to ensure each class has at least 2% of its NAV, subject to the 5% of its NAV per quarter limit, available for net redemption of its shares Overview of Key Changes

4 For Broker / Dealer Use Only — Not for Use with the Public June 2017 Questions? PRESTON SHERRY PLAZA

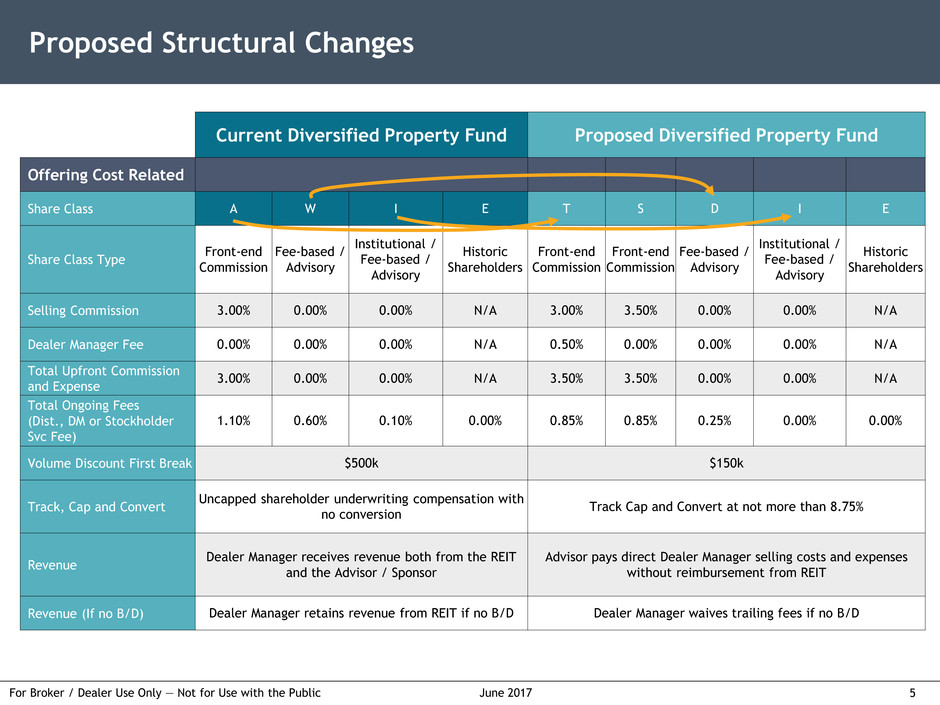

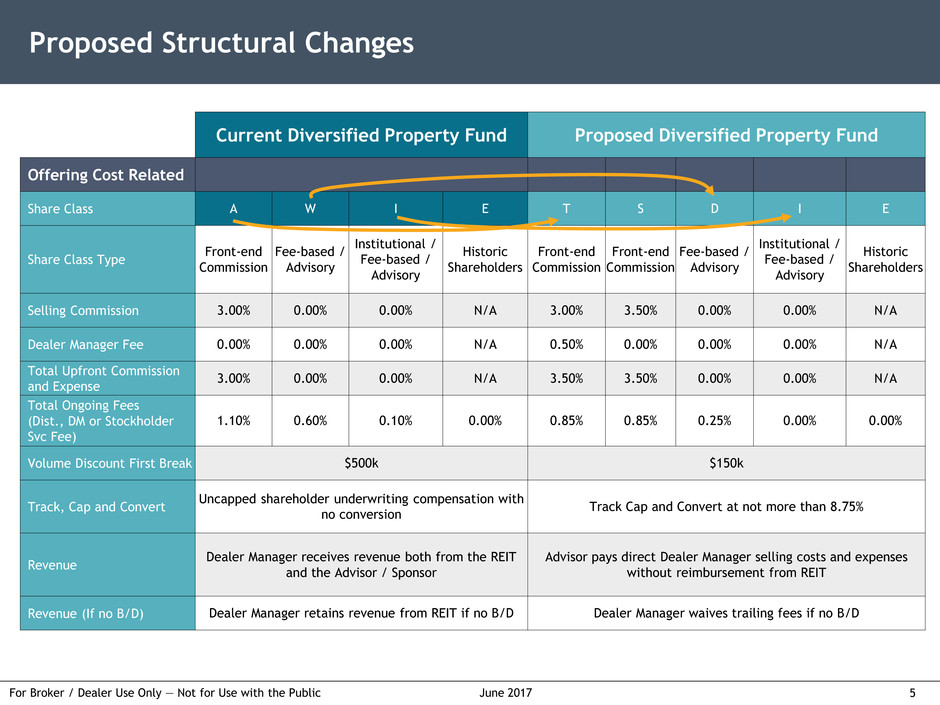

5 For Broker / Dealer Use Only — Not for Use with the Public June 2017 Current Diversified Property Fund Proposed Diversified Property Fund Offering Cost Related Share Class A W I E T S D I E Share Class Type Front-end Commission Fee-based / Advisory Institutional / Fee-based / Advisory Historic Shareholders Front-end Commission Front-end Commission Fee-based / Advisory Institutional / Fee-based / Advisory Historic Shareholders Selling Commission 3.00% 0.00% 0.00% N/A 3.00% 3.50% 0.00% 0.00% N/A Dealer Manager Fee 0.00% 0.00% 0.00% N/A 0.50% 0.00% 0.00% 0.00% N/A Total Upfront Commission and Expense 3.00% 0.00% 0.00% N/A 3.50% 3.50% 0.00% 0.00% N/A Total Ongoing Fees (Dist., DM or Stockholder Svc Fee) 1.10% 0.60% 0.10% 0.00% 0.85% 0.85% 0.25% 0.00% 0.00% Volume Discount First Break $500k $150k Track, Cap and Convert Uncapped shareholder underwriting compensation with no conversion Track Cap and Convert at not more than 8.75% Revenue Dealer Manager receives revenue both from the REIT and the Advisor / Sponsor Advisor pays direct Dealer Manager selling costs and expenses without reimbursement from REIT Revenue (If no B/D) Dealer Manager retains revenue from REIT if no B/D Dealer Manager waives trailing fees if no B/D Proposed Structural Changes

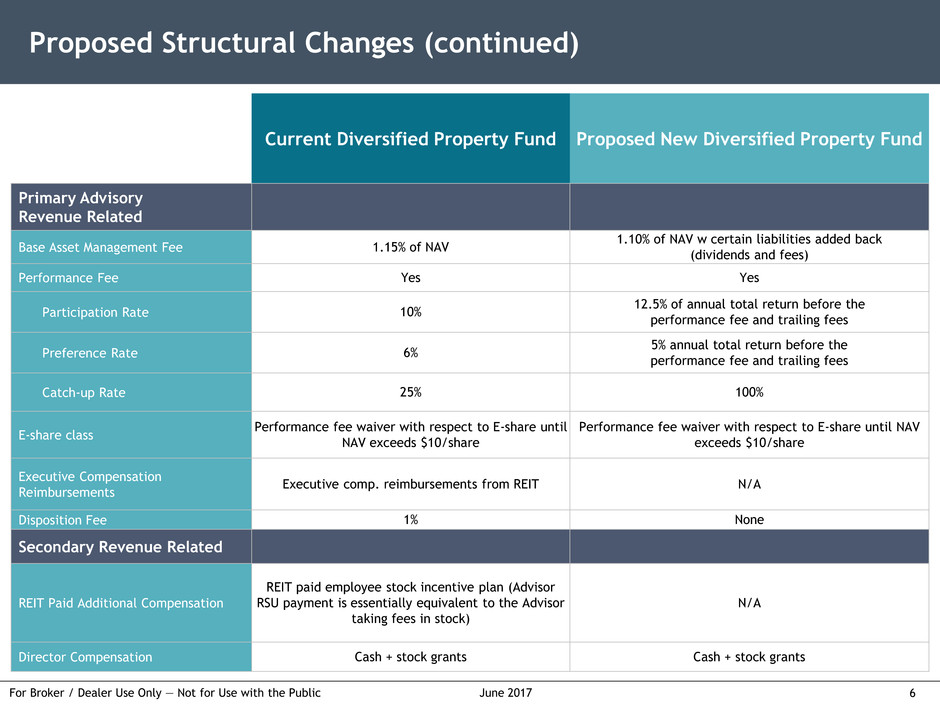

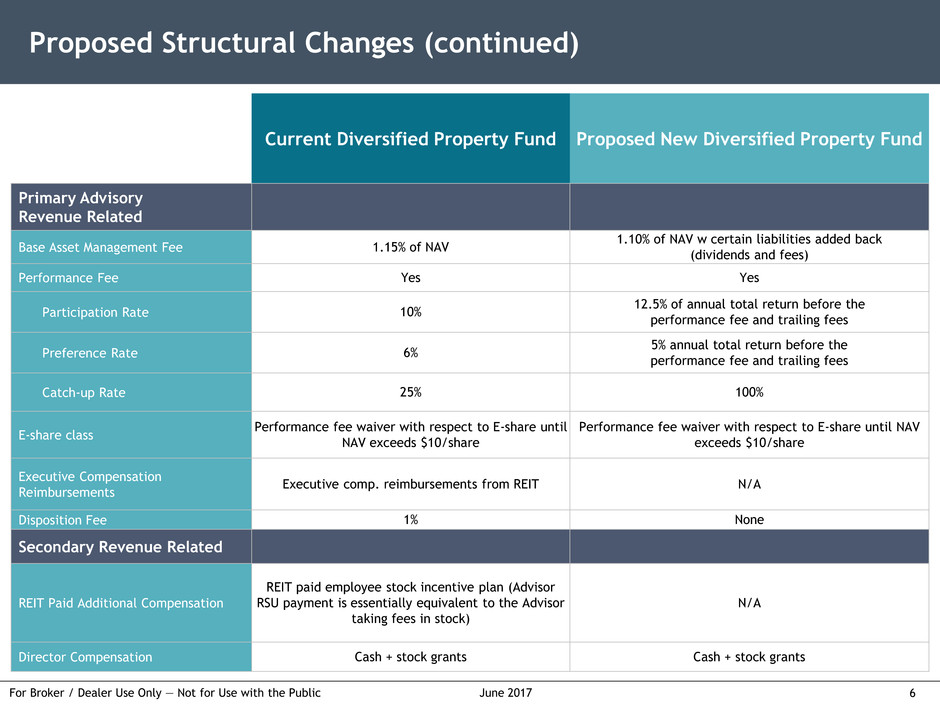

6 For Broker / Dealer Use Only — Not for Use with the Public June 2017 Current Diversified Property Fund Proposed New Diversified Property Fund Primary Advisory Revenue Related Base Asset Management Fee 1.15% of NAV 1.10% of NAV w certain liabilities added back (dividends and fees) Performance Fee Yes Yes Participation Rate 10% 12.5% of annual total return before the performance fee and trailing fees Preference Rate 6% 5% annual total return before the performance fee and trailing fees Catch-up Rate 25% 100% E-share class Performance fee waiver with respect to E-share until NAV exceeds $10/share Performance fee waiver with respect to E-share until NAV exceeds $10/share Executive Compensation Reimbursements Executive comp. reimbursements from REIT N/A Disposition Fee 1% None Secondary Revenue Related REIT Paid Additional Compensation REIT paid employee stock incentive plan (Advisor RSU payment is essentially equivalent to the Advisor taking fees in stock) N/A Director Compensation Cash + stock grants Cash + stock grants Proposed Structural Changes (continued)

7 For Broker / Dealer Use Only — Not for Use with the Public June 2017 Current Diversified Property Fund Proposed Diversified Property Fund Other Primary Structural Components Valuation Frequency Daily Monthly Mark to Market Hedges Debt and hedges Purchase Frequency Daily Monthly at prior month transaction price Redemption Frequency Daily Monthly at prior month transaction price Share Redemption Program Net 5% per quarter Net 2% per month; 5% per quarter Other Secondary Structural Components Short-Term Trading Penalty 2% 5% Distribution Reinvestment Plan NAV Day of DRP Prior month transaction price Distribution Reinvestment Plan Enrollment Active Automatic Proposed Structural Changes (continued)