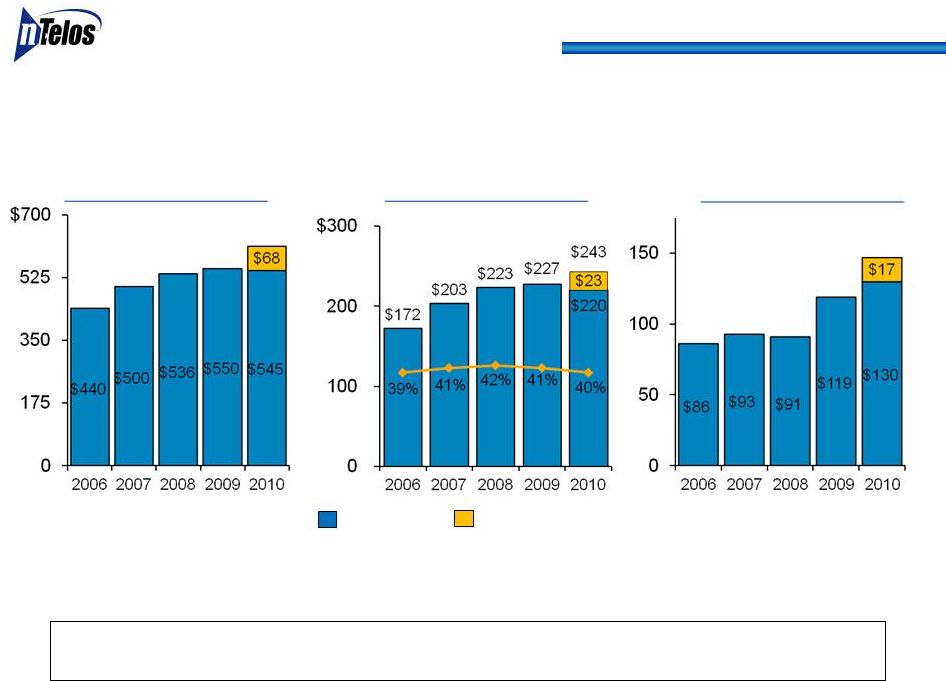

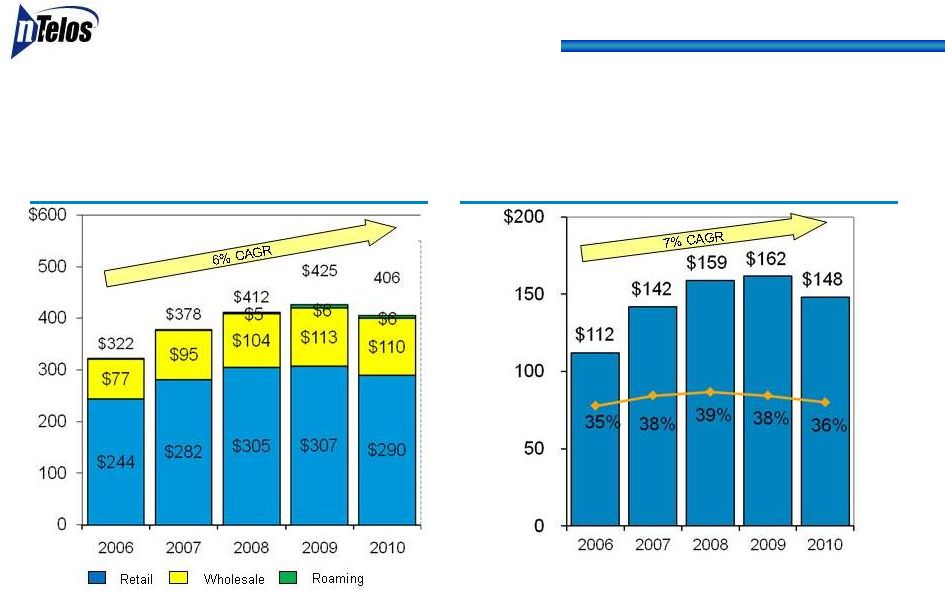

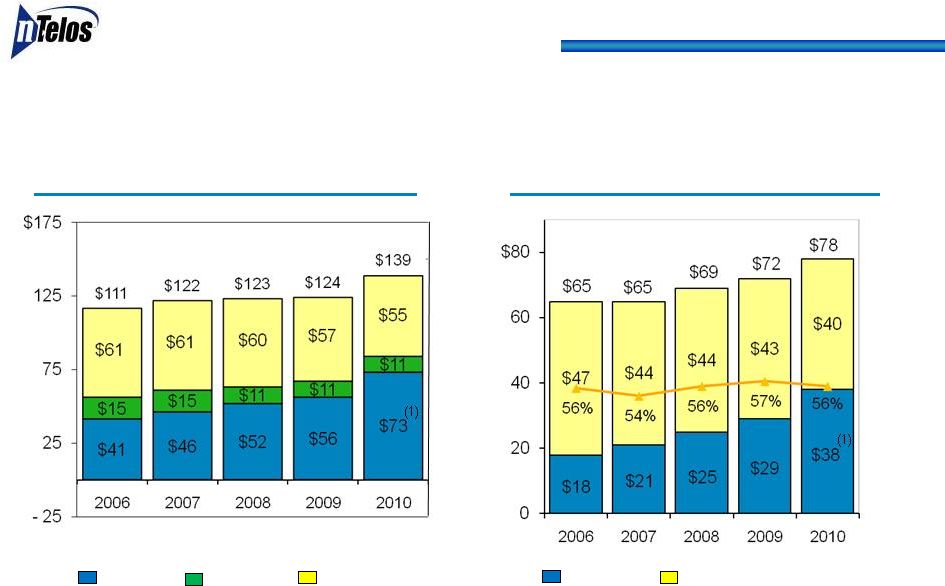

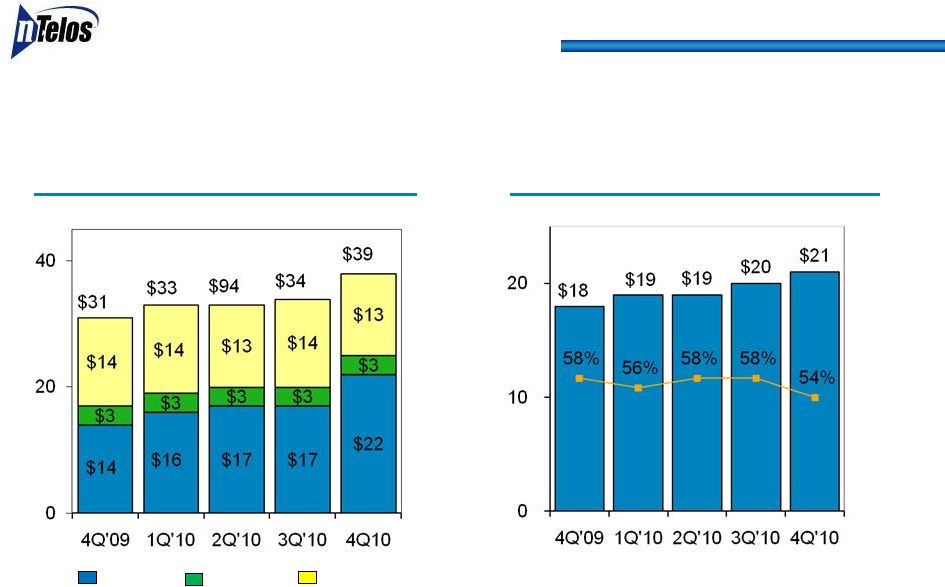

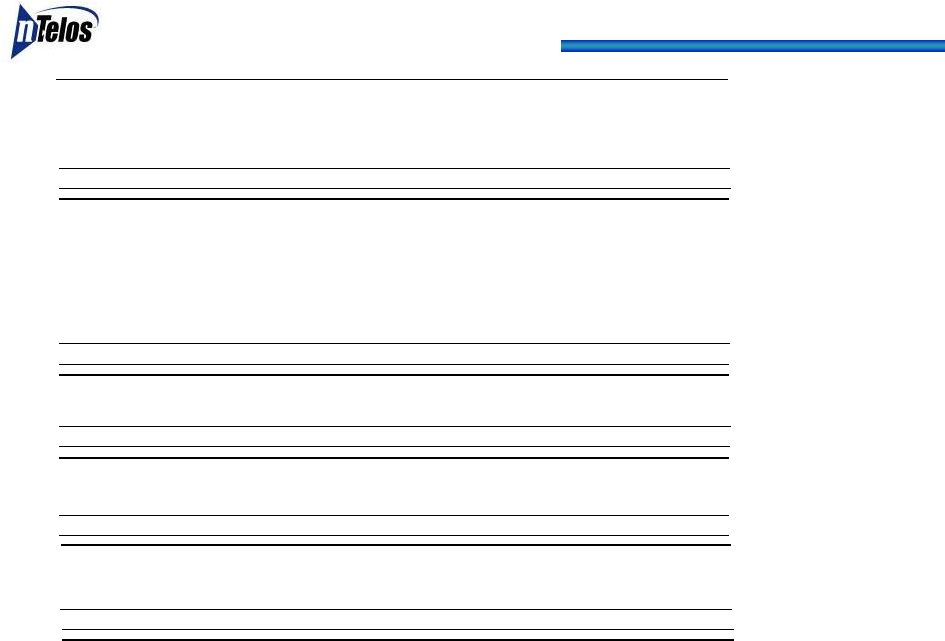

32 Summary of Operating Results ($ in thousands) Year Ended: Three Months Ended: (1) First quarter 2010 includes a $0.9 million charge related to severance benefits pursuant to an executive employment agreement. Please see Form 8-K filed with the SEC on March 12, 2010 for additional information. First quarter 2009 includes a one-time cash payment of $1.0 million to James A. Hyde, NTELOS' then newly hired president and COO. December 31, 2009 December 31, 2010 December 31, 2009 December 31, 2010 Operating Revenues Wireless PCS Operations 102,388 $ 102,376 $ 424,678 $ 406,396 $ Subscriber Revenues 67,754 66,273 280,191 266,193 Wholesale/Roaming Revenues, net 28,396 30,559 118,266 115,619 Equipment Revenues 5,887 5,177 24,832 23,126 Other Revenues 351 367 1,389 1,458 Wireline Operations RLEC 13,761 13,276 57,304 54,871 Competitive Wireline 17,083 25,737 67,237 83,885 Wireline Total 30,844 39,013 124,541 138,756 Other 117 155 481 532 133,349 $ 141,544 $ 549,700 $ 545,684 $ Operating Expenses Wireless PCS Operations 66,523 $ 67,270 $ 262,886 $ 258,360 $ Cost of Sales and Services Cost ofSales - Equipment 8,118 8,043 35,440 29,665 Cost ofSales - Access& Other 10,575 8,749 43,804 37,032 Maintenance and Support 15,079 16,399 59,084 62,665 Customer Operations 27,435 28,301 102,451 104,818 Corporate Operations 5,316 5,778 22,107 24,180 Wireline Operations RLEC 3,611 3,488 14,403 14,516 Competitive Wireline 9,416 14,269 38,545 45,938 Wireline Total 13,027 17,757 52,948 60,454 Other (1) 1,685 1,200 6,726 6,474 81,235 $ 86,227 $ 322,560 $ 325,288 $ Adjusted EBITDA (a non-GAAP Measure) (1) Wireless PCS Operations 37.5% 35,865 $ 35.0% 35,106 $ 34.3% 161,792 $ 38.1% 148,036 $ Wireline Operations RLEC 76.9% 10,150 73.8% 9,788 73.7% 42,901 74.9% 40,355 Competitive Wireline 44.3% 7,667 44.9% 11,468 44.6% 28,692 42.7% 37,948 Wireline Total 59.2% 17,817 57.8% 21,256 54.5% 71,593 57.5% 78,303 Other (1) (1,568) (1,045) (6,245) (5,943) 41.7% 52,114 $ 39.1% 55,317 $ 39.1% 227,140 $ 41.3% 220,396 $ Capital Expenditures Wireless PCS Operations 8,369 $ 9,433 $ 50,747 $ 39,187 $ Wireline Operations RLEC 819 4,616 11,316 12,522 Competitive Wireline 4,754 5,802 26,023 28,230 Wireline Total 5,573 10,418 37,339 40,752 Other 2,943 3,311 19,805 10,754 16,885 $ 23,162 $ 107,891 $ 90,693 $ Wireless PCS Operations 27,496 $ 25,673 $ 111,045 $ 108,849 $ Wireline Operations RLEC 9,331 5,172 31,585 27,833 Competitive Wireline 2,913 5,666 2,669 9,718 Wireline Total 12,244 10,838 34,254 37,551 Other (1) (4,511) (4,356) (26,050) (16,697) 35,229 $ 32,155 $ 119,249 $ 129,703 $ (before depreciation & amortization, asset impairment charges, accretion of asset retirement obligations, equity based compensation, acquisition related charges, charges from voluntary early retirement and workforce reduction plans and costs related to the planned separation of the wireless and wireline companies, a non-GAAP Measure of operating expenses) Adjusted EBITDA less Capital Expenditures (a non-GAAP measure) |