1Q15 Earnings Presentation May 1, 2015 NASDAQ: NTLS NASDAQ: NTLS

Presentation of Financial and Other Important Information USE OF NON-GAAP FINANCIAL MEASURES Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles (“GAAP”). These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because NTELOS believes they provide relevant and useful information to investors. NTELOS utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, and to fund continued growth. NTELOS also uses these financial performance measures to evaluate the performance of its business, for budget planning purposes and as factors in its employee compensation programs. Adjusted EBITDA is defined as net income attributable to NTELOS Holdings Corp. before interest, income taxes, depreciation and amortization, accretion of asset retirement obligations, transaction related costs, restructuring and asset impairment charges, gain/loss on sale or disposal of assets and derivatives, net income attributable to noncontrolling interests, other expenses/income, equity-based compensation charges, separation charges, secondary offering costs and adjustments for impact of recognizing a portion of the billed SNA contract revenues on a straight line basis. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS Any statements contained in this presentation that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. The words "anticipates," "believes," "expects," "intends," "plans," "estimates," "targets," "projects," "should," "may," "will" and similar words and expressions are intended to identify forward-looking statements. Such forward-looking statements reflect, among other things, our current expectations, plans and strategies, and anticipated financial results, all of which are subject to known and unknown risks, uncertainties and factors that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise. Important factors with respect to any such forward-looking statements, including certain risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, include, but are not limited to: our ability to attract and retain retail subscribers to our services; our dependence on our strategic relationship with Sprint Corporation ("Sprint"); our ability to realize the expected proceeds, cost savings and other benefits from the wind down of our Eastern Markets; a potential increase in roaming rates and wireless handset subsidy costs; rapid development and intense competition in the telecommunications industry; our ability to finance, design, construct and realize the benefits of any planned network technology upgrade; our ability to acquire or gain access to additional spectrum in the future; the potential to experience a high rate of customer turnover; the potential for competitors to build networks in our markets; cash and capital requirements; operating and financial restrictions imposed by our credit agreement; adverse economic conditions; federal and state regulatory fees, requirements and developments; loss of ability to use our current cell sites; our continued reliance on indirect channels of retail distribution; our reliance on certain suppliers and vendors; and other unforeseen difficulties that may occur. These risks and uncertainties are not intended to represent a complete list of all risks and uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk factors included in our SEC filings, including our most recent Annual Report filed on Form 10-K and Quarterly Reports filed on Form 10-Q. 2

Agenda 3 3 Rod Dir, Chief Executive Officer Steb Chandor, Chief Financial Officer Michael Huber, Chairman of the Board (Q&A Session) Craig Highland, SVP Finance & Corporate Development (Q&A Session) • Opening Remarks • Financial & Operational Results • Q&A Session

Strategic Trajectory 4 Leverage our strategic relationship with Sprint to enhance nTelos’s operations Strengthen our retail performance Improve our processes and become more efficient Increase the strategic relevance of our assets Strategic Objectives Monetizing non-core and underutilized assets – tower portfolio and Eastern spectrum Focusing our investment and operations solely on our Western Markets Significantly reducing capital requirements by exiting Eastern Markets Reducing costs through corporate restructuring and improving operational efficiencies Initiatives

Strategic Refocus Activities 5 Western Markets 4G LTE roll out continues Strong Equipment Installment Plan (EIP) take rates Expanded device offerings Eastern Markets Spectrum sale completed Markets wind down on track Subscriber migrations on schedule Corporate Completed owned towers sale Increased operational efficiencies Realigned sales and marketing effort Announced corporate action plan to reduce expenses

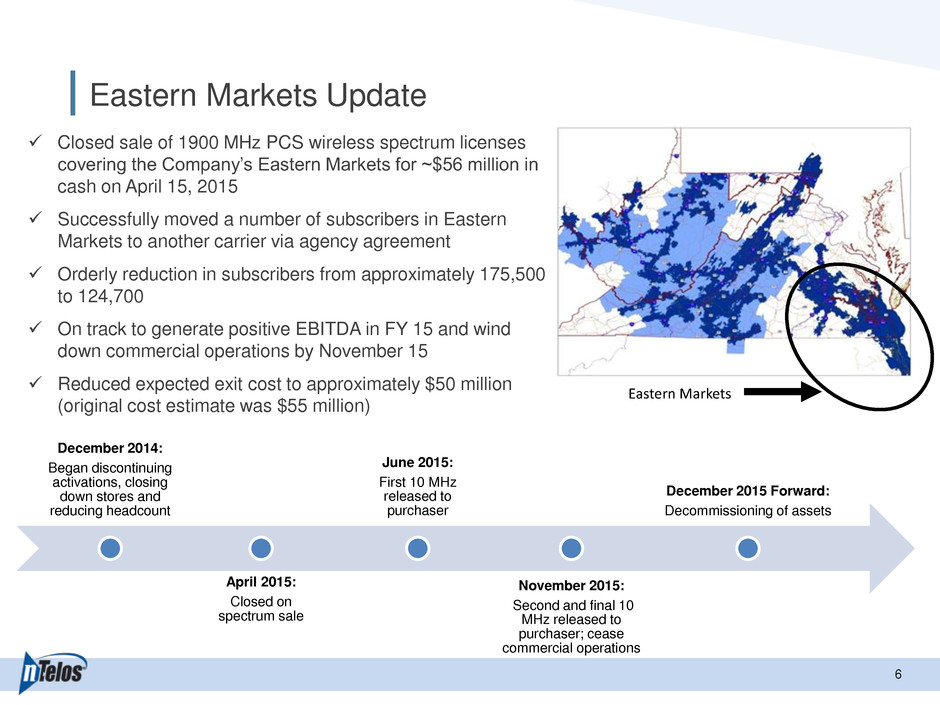

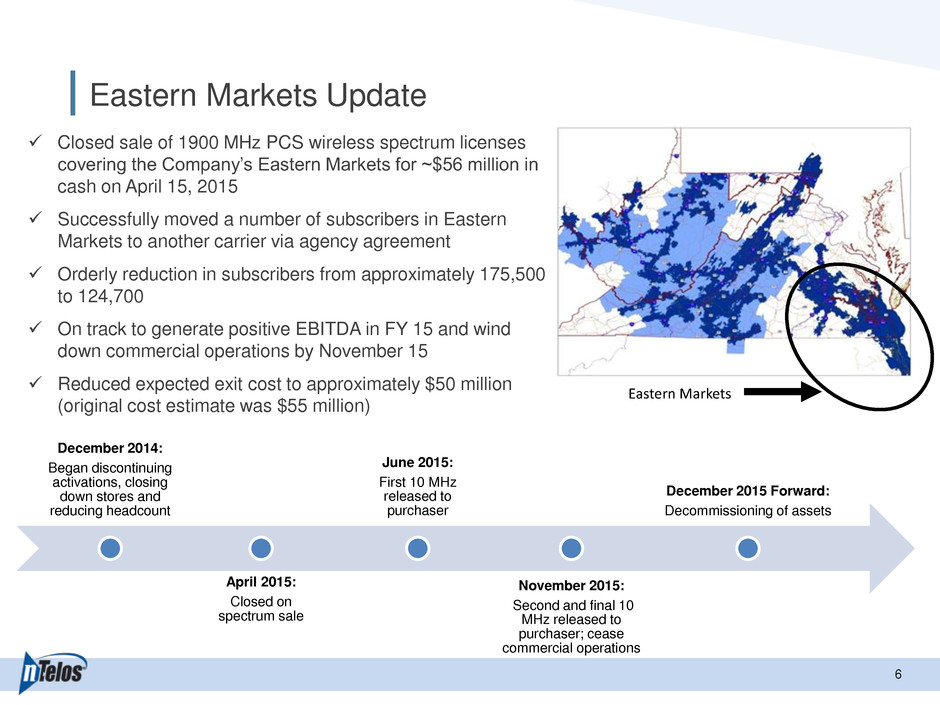

Eastern Markets Update 6 Closed sale of 1900 MHz PCS wireless spectrum licenses covering the Company’s Eastern Markets for ~$56 million in cash on April 15, 2015 Successfully moved a number of subscribers in Eastern Markets to another carrier via agency agreement Orderly reduction in subscribers from approximately 175,500 to 124,700 On track to generate positive EBITDA in FY 15 and wind down commercial operations by November 15 Reduced expected exit cost to approximately $50 million (original cost estimate was $55 million) December 2014: Began discontinuing activations, closing down stores and reducing headcount April 2015: Closed on spectrum sale June 2015: First 10 MHz released to purchaser November 2015: Second and final 10 MHz released to purchaser; cease commercial operations December 2015 Forward: Decommissioning of assets Eastern Markets

Retail Highlights (Western Markets) 7 Increased 1Q revenues 7% year-over- year Subscriber base grew 5% over prior year benefitting from strong gross adds and a 30 bps reduction in churn Expanded 4G LTE coverage to 44% of Covered POPs Grew EIP to approximately 20% of postpay customer base Launched iPad with expanded handset/tablet line up on the way Generated 10% increase in year-over- year gross adds driven by improved productivity

Key Subscriber Metrics (Western Markets) Metric 1Q15 1Q14 Change % Change 8 Ending Subscribers 290,100 277,100 13,000 5% Postpay Gross Adds 15,700 14,600 1,100 8% Total Gross Adds 27,500 25,000 2,500 10% Postpay Net Adds 4,600 1,700 2,900 171% Total Net Adds 8,000 3,500 4,500 129% Postpay Churn 1.7% 2.0% (30) bps (15)% Blended Churn 2.3% 2.6% (30) bps (12)% 210,300 212,400 215,500 220,100 224,700 66,800 61,600 61,600 62,000 65,400 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 1Q14 2Q14 3Q14 4Q14 1Q15 Total Subscribers Postpay Prepay Postpay/ Total Subs 78%

Key Financial Metrics (Western Markets) 9 Metric ($ millions) 1Q15 1Q14 Change % Change Revenues $95.3 $89.2 $6.1 7% Adjusted EBITDA $27.3 $33.3 $(6.0) (18)% $89 $86 $88 $97 $95 $33 $33 $33 $30 $27 $0 $20 $40 $60 $80 $100 $120 1Q14 2Q14 3Q14 4Q14 1Q15 Revenues Adjusted EBITDA • EBITDA change driven by: • Absorption of Virginia East overhead of approximately $3.5 million, net • Contractual reduction in SNA billed revenue of $2.7 million

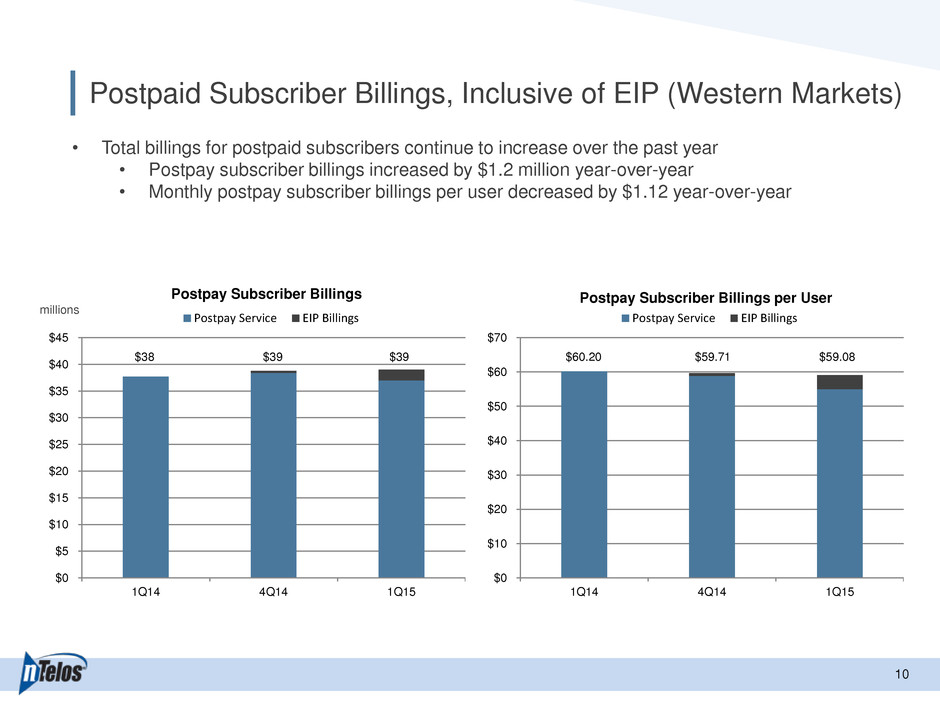

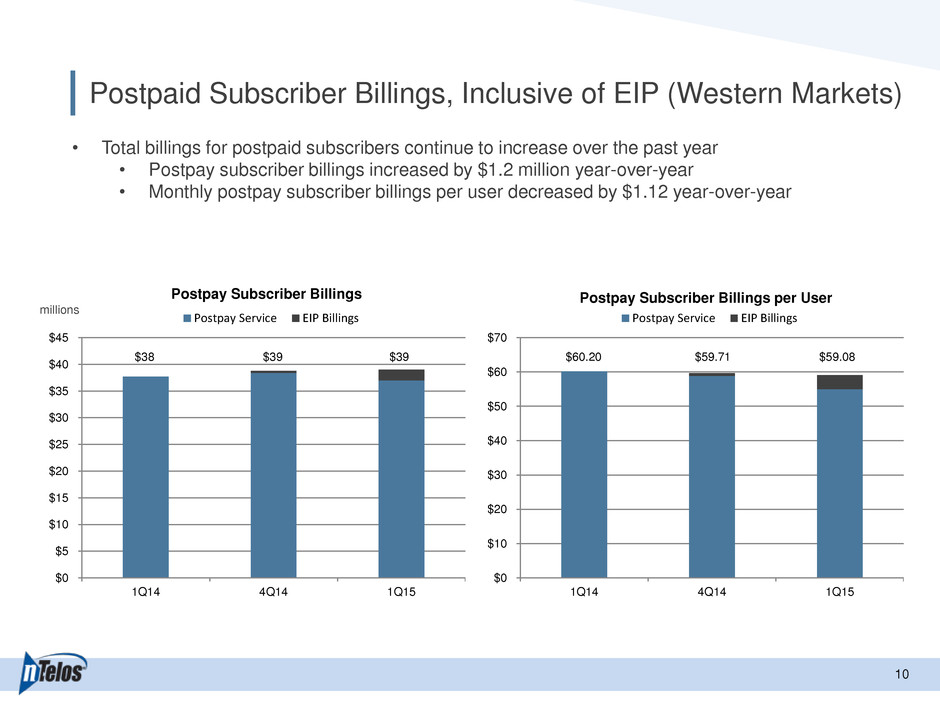

Postpaid Subscriber Billings, Inclusive of EIP (Western Markets) 10 millions • Total billings for postpaid subscribers continue to increase over the past year • Postpay subscriber billings increased by $1.2 million year-over-year • Monthly postpay subscriber billings per user decreased by $1.12 year-over-year $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 1Q14 4Q14 1Q15 Postpay Subscriber Billings Postpay Service EIP Billings $0 $10 $20 $30 $40 $50 $60 $70 1Q14 4Q14 1Q15 Postpay Subscriber Billings per User Postpay Service EIP Billings $38 $39 $39 $60.20 $59.71 $59.08

Wholesale/Other Revenue Impacted By Amended SNA Agreement 11 1 • 1Q15 billed SNA revenue was $36.6 million, tied to a contractual decrease in rates $39 $38 $38 $38 $37 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 1Q14 2Q14 3Q14 4Q14 1Q15 SNA Billed Revenue1 millions 1SNA Billed Revenue excludes GAAP adjustments to S/L the fixed component of the contract and for the non-cash value of leased spectrum. See earnings release for reconciliation.

Capital Investment 12 12 Catalysts: • 2013-2014 Start of LTE deployment • 2015-2017 Completion of LTE deployment Current Status: • Rolling out tri-band network in Western Markets: • 1.9 GHz, 800 MHz and 2.5 GHz being deployed • 44% of covered POPs have 4G LTE coverage (as of March 31, 2015) $53 $68 $83 $0 $20 $40 $60 $80 $100 $120 FY 2012 FY 2013 FY 2014 FY 2015 (G) Western Markets CapEx millions $95-$105

Capitalization Overview (as of March 31, 2015) ($ millions) Cash1 $105.6 Total Debt $524.2 Net Debt $418.6 LTM Adjusted EBITDA2 $123.7 Secured Term Loan $522.3 Net Debt Leverage 3.4x Note: Excludes ~$56 million in cash proceeds from spectrum sale in April 13 1Includes $2.2 million in restricted cash. 2Please see Western Markets Adjusted EBITDA reconciliation in the Appendix. $105.6 $5.4 $5.4 $5.4 $0 $20 $40 $60 $80 $100 $120 1Q15 FY 2015 FY 2016 FY 2017 Cash Term Loan B Maturities(millions) Scheduled Maturities

FY 2015 Guidance (as of May 1, 2015) 14 14 For the year ended December 31, 2015 (unchanged from February 26, 2015): Adjusted EBITDA of $100 - $108 million • Includes approximately $140 - $144 million of SNA billed revenue • Includes $9 - $12 million of cost savings realized from corporate overhead previously allocated to Eastern Markets in FY 2015 • Excludes any benefit from the wind-down of the Eastern Markets, restructuring costs and impairment charges CapEx expected to be approximately $95 - $105 million

Strategic Objectives 1 5 5 Leverage our strategic relationships to enhance nTelos’s operations Strengthen our retail performance Improve our processes and become more efficient Increase the strategic relevance of our assets

Questions & Answers

Appendix

FY 2014 - FY 2015 Guidance 18 18 2014 Adjusted EBITDA $132 million Eastern Markets Pre-Corp. O/H EBITDA Elimination ($24) million Eastern Markets-Related Corp. O/H Elimination $9-$12 million1 Western Markets Post-Corp. O/H EBITDA $108 million 2015 SNA Billed Revenue ($10-$14) million 2015 Adjusted EBITDA Outlook $100-$108 million 2016 O/H Elimination $8-$11 million1 $60 $70 $80 $90 $100 $110 $120 $130 $140 1Of the approximately $20 million of corporate overhead allocation otherwise absorbed by the remaining company in 2015, the Company expects to eliminate $9-$12 million during 2015. 2015 guidance driven by: Wind down in East Contracted SNA rate reset

Select Financial Metrics 1 9 9 (In thousands) 1Q15 4Q14 3Q14 2Q14 1Q14 Western Markets Revenue 95,311$ 96,652$ 88,191$ 86,125$ 89,166$ Operating Expenses 75,453 86,175 73,041 70,554 71,217 Operating Income 19,858 10,477 15,150 15,571 17,949 Adjusted EBITDA 2 27,340 30,197 32,878 33,307 33,348 Capital Expenditures 22,701 35,664 21,141 24,992 824 Consolidated Revenue 120,206$ 128,319$ 119,638$ 117,795$ 122,082$ Operating Expenses 1 86,989 211,659 109,315 107,891 110,219 Operating Income 33,217 (83,340) 10,323 9,904 11,863 Adjusted EBITDA 2 37,380 31,371 32,778 34,363 33,923 Capital Expenditures 22,941 39,289 23,867 29,883 13,961 Eastern Markets Revenue 24,895$ 31,667$ 31,447$ 31,670$ 32,916$ Operating Expenses 1 11,536 125,484 36,274 37,338 39,001 Operating Income 13,359 (93,817) (4,827) (5,667) (6,086) Adjusted EBITDA 10,040 1,174 (100) 1,056 575 Capital Expenditures 240 3,625 2,726 4,891 13,137 Note: Western Markets is defined as Consolidated Financial Measures less Eastern Market Financial Measures. 1 4Q14 operating expenses include $87.9 million of impairments and other charges and $3.7 million of restructuring charges. 2 Includes gain on sale of tow ers of $15.9 million for Consolidated and $11.0 million for Western Markets.

Consolidated

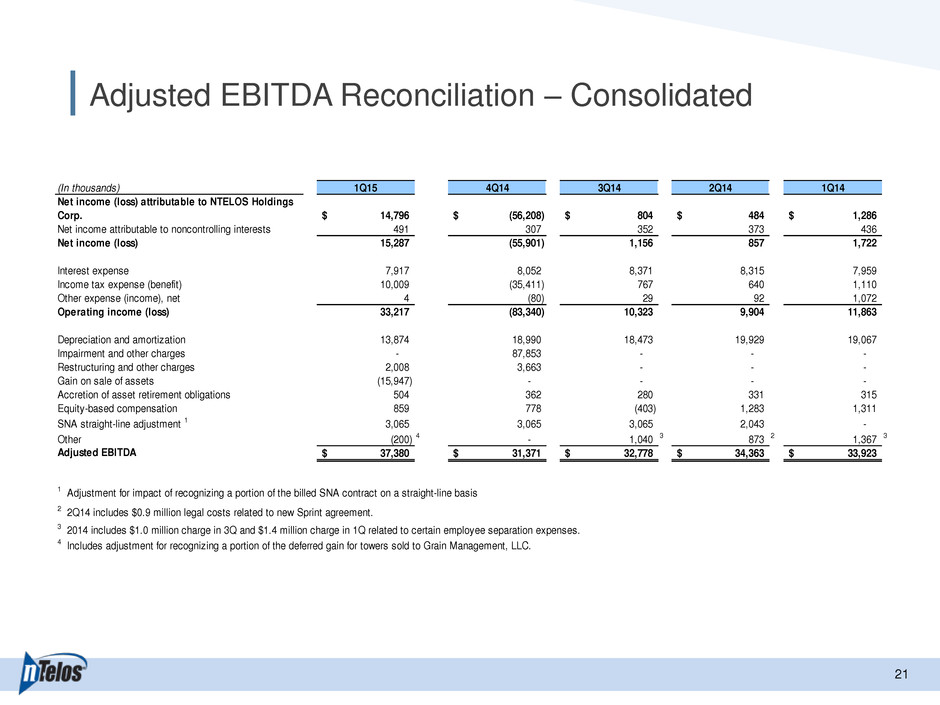

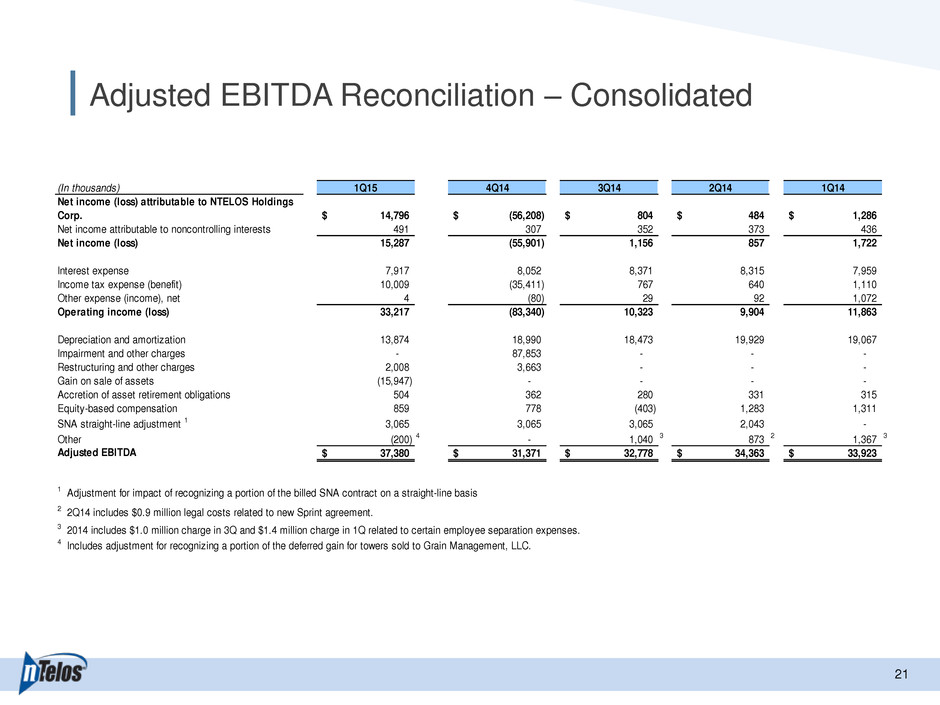

Adjusted EBITDA Reconciliation – Consolidated 2 1 1 (In thousands) 1Q15 4Q14 3Q14 2Q14 1Q14 Net income (loss) attributable to NTELOS Holdings Corp. 14,796$ (56,208)$ 804$ 484$ 1,286$ Net income attributable to noncontrolling interests 491 307 352 373 436 Net income (loss) 15,287 (55,901) 1,156 857 1,722 Interest expense 7,917 8,052 8,371 8,315 7,959 Income tax expense (benefit) 10,009 (35,411) 767 640 1,110 Other expense (income), net 4 (80) 29 92 1,072 Operating income (loss) 33,217 (83,340) 10,323 9,904 11,863 Depreciation and amortization 13,874 18,990 18,473 19,929 19,067 Impairment and other charges - 87,853 - - - Restructuring and other charges 2,008 3,663 - - - Gain on sale of assets (15,947) - - - - Accretion of asset retirement obligations 504 362 280 331 315 Equity-based compensation 859 778 (403) 1,283 1,311 SNA straight-line adjustment 1 3,065 3,065 3,065 2,043 - Other (200) 4 - 1,040 3 873 2 1,367 3 Adjusted EBITDA 37,380$ 31,371$ 32,778$ 34,363$ 33,923$ 4 Includes adjustment for recognizing a portion of the deferred gain for towers sold to Grain Management, LLC. 3 2014 includes $1.0 million charge in 3Q and $1.4 million charge in 1Q related to certain employee separation expenses. 1 Adjustment for impact of recognizing a portion of the billed SNA contract on a straight-line basis 2 2Q14 includes $0.9 million legal costs related to new Sprint agreement.

Western Markets

Statement of Operating Income – Western Markets 2 3 3 Western Markets¹ Condensed Consolidated Statements of Operating Income (In thousands, except per share amounts) March 31, 2015 December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 Operating Revenues 95,311$ 96,652$ 88,191$ 86,125$ 89,166$ Operating Expenses Cost of sales and services 43,819 45,486 38,585 34,602 34,551 Customer operations 19,552 18,296 15,169 14,996 16,021 Corporate operations 8,625 6,710 5,629 7,238 7,723 Restructuring 1,605 982 - - - Depreciation and amortization 12,861 14,701 13,658 13,718 12,922 Gain on sale of assets (11,009) - - - - 75,453 86,175 73,041 70,554 71,217 Operating Income 19,858$ 10,477$ 15,150$ 15,571$ 17,949$ ¹ Western Markets is defined as Holdings less Eastern Markets. Three Months Ended (Unaudited)

Adjusted EBITDA Reconciliation – Western Markets 2 4 4 (In thousands) 1Q15 4Q14 3Q14 2Q14 1Q14 Net income (Loss) attributable to NTELOS Holdings Corp. 14,796$ (56,208)$ 804$ 483$ 1,286$ Net income attributable to noncontrolling interests 491 307 352 373 436 Net income (loss) 15,287$ (55,901)$ 1,156$ 856$ 1,722$ Operating loss attributable to Eastern Markets (13,359) 93,817 4,827 5,668 6,086 Interest expense 7,917 8,052 8,371 8,315 7,959 Income tax expense (benefit) 10,009 (35,411) 767 640 1,110 Other expense (income), net 4 (80) 29 92 1,072 Operating income 19,858$ 10,477$ 15,150$ 15,571$ 17,949$ Depreciation and amortization 12,861 14,701 13,658 13,718 12,922 Restructuring 1 1,605 982 - - - Gain on sale of assets (11,009) - - - - Accretion of asset retirement obligations 300 241 179 235 223 Equity-based compensation 860 731 (212) 866 887 SNA straight-line adjustment 2 3,065 3,065 3,065 2,043 - Other 3 (200) - 1,038 874 1,367 Adjusted EBITDA 27,340$ 30,197$ 32,878$ 33,307$ 33,348$ Note: Western Markets is defined as Holdings less Eastern Markets. 1 Restructuring costs attributable to Corporate and Western Markets. 2 Adjustment for impact of recognizing a portion of the billed SNA contract revenues on a straight-line basis. 3 Other includes legal and advisory fees related to Amended and Restated Sprint agreement, certain employee separation charges and adjustment for recognizing a portion of the deferred gain for towers sold to Grain Management, LLC in 2015.

1Q15 Earnings Presentation May 1, 2015 NASDAQ: NTLS NASDAQ: NTLS