In addition to the description below, please refer to Note 3 to the financial statements for further discussion of our accounting policies.

The functional currency of the Trust is the euro in accordance with ASC 830, Foreign Currency Translation.

Results of Operations

As of October 31, 2017, the number of euro owned by the Trust was 337,862,948, resulting in a redeemable capital share value of $393,375,323. During the nine months ended July 31, 2018, an additional 4,250,000 Shares were created in exchange for 409,014,266 euro and 5,350,000 Shares were redeemed in exchange for 514,911,692 euro. In addition, 1,661,536 euro were withdrawn to pay the portion of the Sponsor’s fee that exceeded the interest earned. As of July 31, 2018, the number of euro owned by the Trust was 230,303,986, resulting in a redeemable capital Share value of $269,281,953.

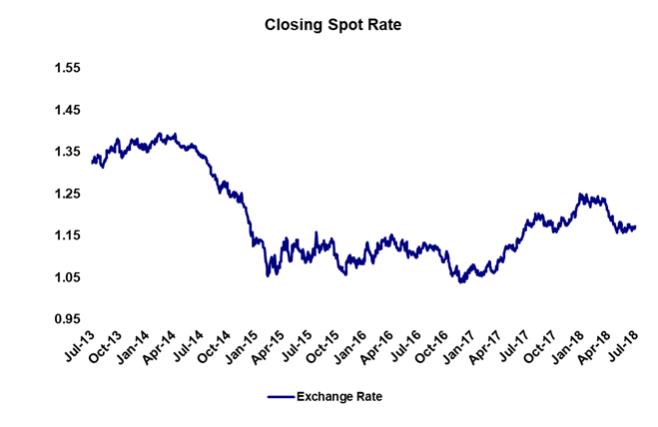

A decrease in the Trust’s redeemable capital Share value from $393,375,323 at October 31, 2017 to $269,281,953 at July 31, 2018, was primarily the result of a decrease in the number of Shares outstanding from 3,500,000 at October 31, 2017 to 2,400,000 at July 31, 2018. This decrease was partially offset by an increase in the Closing Spot Rate from 1.1650 at October 31, 2017 to 1.1701 at July 31, 2018.

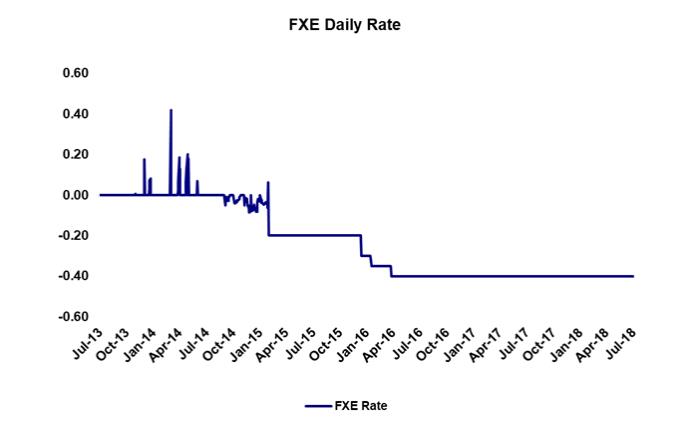

No interest income was earned during the three months ended July 31, 2017, the three months ended July 31, 2018, the nine months ended July 31, 2017 and the nine months ended July 31, 2018, due to an annual nominal interest rate which remained at or below 0.00% through those periods, as set forth in the chart above.

The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the euro in the Trust. Due primarily to a decrease in the weighted-average euro in the Trust, the Sponsor’s fee decreased from $309,874 for the three months ended July 31, 2017 to $308,043 for the three months ended July 31, 2018. Due primarily to an increase in the weighted-average euro in the Trust, the Sponsor’s fee increased from $741,646 for the nine months ended July 31, 2017 to $965,410 for the nine months ended July 31, 2018. Because the annual interest rate paid by the depository remained below 0.00%, the Trust incurred interest expense. Due primarily to a decrease in the weighted-average euro in the Trust, interest expense decreased from $320,533 for the three months ended July 31, 2017 to $315,380 for the three months ended July 31, 2018. Due primarily to an increase in the weighted-average euro in the Trust, interest expense increased from $761,507 for the nine months ended July 31, 2017 to $993,491 for the nine months ended July 31, 2018. The only expenses of the Trust during the three months and nine months ended July 31, 2018 were the Sponsor’s fee and interest expense.

The Trust’s net loss for the three months ended July 31, 2018 was $623,423 due to the Sponsor’s fee of $308,043 and interest expense of $315,380 exceeding interest income of $0. The Trust’s net loss for the nine months ended July 31, 2018 was $1,958,901 due to the Sponsor’s fee of $965,410 and interest expense of $993,491 exceeding interest income of $0.

Cash dividends were not paid by the Trust for the three months ended July 31, 2017, the three months ended July 31, 2018, the nine months ended July 31, 2017 and the nine months ended July 31, 2018 as the Trust’s interest income did not exceed the Trust’s expenses during those periods.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Except as described above with respect to fluctuations in the euro/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on euro held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative products.

Item 4. Controls and Procedures

The Trust maintains disclosure controls and procedures (as defined in Rules13a-15(e) and15d-15(e) under the Securities Exchange Act of 1934) designed to ensure that material information relating to the Trust is recorded, processed and disclosed on a timely basis. The Trust’s disclosure controls and procedures are designed by or under the supervision of the Sponsor’s principal executive officer and principal financial officer, who exercise oversight over the Trust as the Trust has no officers. The principal executive officer and principal financial officer of the Sponsor have evaluated the effectiveness of the Trust’s disclosure controls and procedures as of July 31, 2018. Based on that evaluation, the principal executive officer and principal financial officer of the Sponsor have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this report.

14