Use of Proceeds

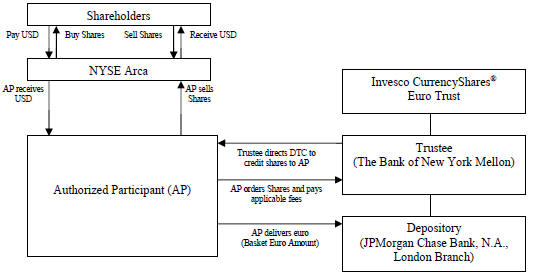

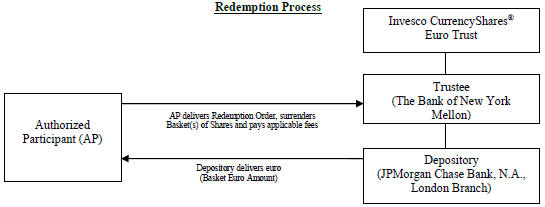

The proceeds received by the Trust from the issuance and sale of Baskets are euro. Such proceeds are deposited into the Deposit Accounts. In accordance with the Depositary Trust Agreement, during the life of the Trust these proceeds will only be (1) owned by the Trust and held by the Depository, (2) disbursed or sold as needed to pay the Trust’s expenses, and (3) distributed to Authorized Participants upon the redemption of Baskets.

Overview of the Foreign Exchange Industry

There are three major kinds of transactions in the traditional foreign exchange markets: spot transactions, outright forwards and foreign exchange swaps. “Spot” trades are foreign exchange transactions that settle typically within two business days with the counterparty to the trade. “Forward” trades are transactions that settle on a date beyond spot and “swap” transactions are transactions in which two parties exchange two currencies on one or more specified dates over an agreed period and exchange them again when the period ends. There also are transactions in currency options, which trade bothover-the-counter and, in the U.S., on the Philadelphia Stock Exchange. Currency futures are transactions in which an institution buys or sells a standardized amount of foreign currency on an organized exchange for delivery on one of several specified dates. Currency futures are traded in a number of regulated markets, including the International Monetary Market division of the Chicago Mercantile Exchange, the Singapore Exchange Derivatives Trading Limited (formerly the Singapore International Monetary Exchange, or SIMEX) and the London International Financial Futures Exchange (LIFFE).

Participants in the foreign exchange market have various reasons for participating. Multinational corporations and importers need foreign currency to acquire materials or goods from abroad. Banks and multinational corporations sometimes require specific wholesale funding for their commercial loan or other foreign investment portfolios. Some participants hedge open currency exposure throughoff-balance-sheet products.

The primary market participants in foreign exchange are banks (including government-controlled central banks), investment banks, money managers, multinational corporations and institutional investors. The most significant participants are the major international commercial banks that act both as brokers and as dealers. In their dealer role, these banks maintain long or short positions in a currency and seek to profit from changes in exchange rates. In their broker role, the banks handle buy and sell orders from commercial customers, such as multinational corporations. The banks earn commissions when acting as agent. They profit from the spread between the rates at which they buy and sell currency for customers when they act as principal.

Much of the foregoing information is taken fromA Foreign Exchange Primer by Shani Shamah (John Wiley & Sons Ltd., 2003) andTrading in the Global Currency Markets by Cornelius Luca (New York Institute of Finance, 2d ed., 2000).

The Euro

In 1998, the European Central Bank in Frankfurt was organized by Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain to establish a common currency — the euro. In 2001, Greece joined as the twelfth country adopting the euro as its national currency. Unlike the U.S. Federal Reserve System, the Bank of Japan and other comparable central banks, the European Central Bank is a central authority that conducts monetary policy for an economic area consisting of many otherwise largely autonomous states.

At its inception on January 1, 1999, the euro was launched as an electronic currency used by banks, foreign exchange dealers and stock markets. Since that time, the euro has been the second most widely held international reserve currency after the US dollar. The euro inherited this status from the German mark, and since its introduction, it has increased its standing, mostly at the expense of the dollar.

In 2002, the euro became cash currency for approximately 300 million citizens of 12 European countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain). On May 1, 2004, ten additional countries joined the European Union. By January 1, 2015, seven of those ten countries, Slovakia, Slovenia, Cyprus, Estonia, Malta, Latvia, and Lithuania, had adopted the Euro. The euro has been adopted by 19 of the European Union’s 28 member states.

Although the European countries that have adopted the euro are members of the European Union, the United Kingdom, Denmark and Sweden, as well as several other European Union members, are European Union members that have not adopted the euro as their national currency. The United Kingdom, however, has begun the process of leaving the European Union, and therefore will no longer be eligible to adopt the euro.

13