SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-51471

Bronco Drilling Company, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-2902156 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| |

| 14313 North May Avenue, Suite 100 | | 73134 |

| (Address of Registrant’s Principal Executive Offices) | | (Zip Code) |

(405) 242-4444

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

| Common Stock, par value $.01 per share |

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

| | | | |

Large Accelerated Filer ¨ | | Accelerated Filer ¨ | | Non-Accelerated Filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the most recently completed second fiscal quarter (June 30, 2005), based on the price at which the common equity was last sold on such date: $0.

As of February 28, 2006, 23,237,939 shares of common stock were outstanding.

Documents Incorporated By Reference

Certain information called for by Part III is incorporated by reference to certain sections of the Proxy Statement for the 2006 Annual Meeting of our stockholders which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2005.

BRONCO DRILLING COMPANY, INC.

INDEX

Cautionary Note Regarding Forward-Looking Statements

Our disclosure and analysis in this Form 10-K may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All statements other than statements of historical facts included in this Form 10-K that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements.

These forward-looking statements are largely based on our expectations and beliefs concerning future events, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control.

Although we believe our estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this Form 10-K are not guarantees of future performance, and we cannot assure any reader that those statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to the factors listed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and elsewhere in this Form 10-K. All forward-looking statements speak only as of the date of this Form 10-K. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as required by law. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

PART I

Item 1. Business

Our Company

We provide contract land drilling services to oil and natural gas exploration and production companies. We currently own a fleet of 64 land drilling rigs, of which 41 are currently operating, four are in the process of being refurbished and 19 are held in inventory. We expect to put all four of the rigs currently being refurbished into service by the end of the second quarter of 2006. We plan on refurbishing seven additional rigs from our current inventory during 2006 at estimated costs (including drill pipe) ranging from $1.8 million to $6.5 million per rig. We continue to focus our refurbishment program on our more powerful rigs, with 1,000 to 2,000 horsepower, which are capable of drilling to depths between 15,000 and 25,000 feet. We also own a fleet of 60 trucks used to transport our rigs.

We commenced operations in 2001 with the purchase of one stacked 650-horsepower rig that we refurbished and deployed. We subsequently made selective acquisitions of both operational and inventoried rigs, as well as ancillary equipment. Our most recent acquisition was completed in January 2006 when we purchased six land drilling rigs and certain other assets, including heavy haul trucks and excess equipment, from Big A Drilling Company, L.C. for $16.3 million in cash and 72,571 shares of our common stock. See “— Our Acquisitions” below for additional information regarding this acquisition.In October 2005, we purchased 12 land drilling rigs from Eagle Drilling, L.L.C. for approximately $50.0 million, and 13 land drilling rigs from Thomas Drilling Co. for approximately $68.0 million. These transactions not only increased the size of our rig fleet, but

1

also expanded our operations to the Barnett Shale trend in North Texas and Palo Duro Basin in West Texas. In July 2005, we completed a transaction with Strata Drilling, L.L.C. and Strata Property, L.L.C. in which we acquired, among other assets, three land drilling rigs and a 16 acre storage and refurbishment yard for $20.0 million.

Our management team has significant experience not only with acquiring rigs, but also with refurbishing and deploying inventoried rigs. We have successfully refurbished and brought into operation 12 inventoried drilling rigs since November 2003. Upon completion of refurbishment, the rigs either met or exceeded our operating expectations. In addition, we have a 41,000 square foot machine shop in Oklahoma City, which allows us to refurbish and repair our rigs and equipment in-house. This facility, which complements our four rig refurbishment yards, significantly reduces our reliance on outside machine shops and the attendant risk of third-party delays in our rig refurbishment program.

We currently operate in Oklahoma, Kansas, the Barnett Shale and Cotton Valley trends and Palo Duro Basin in Texas, the Williston Basin in North Dakota and the Piceance Basin in Colorado. A majority of the wells we have drilled for our customers have been drilled in search of natural gas reserves. Natural gas is often found in deep and complex geologic formations that generally require higher horsepower, premium rigs and experienced crews to reach targeted depths. Our current fleet of 64 rigs includes 31 rigs ranging from 950 to 2,500 horsepower. Accordingly, such rigs can, or in the case of inventoried rigs upon refurbishment will be able to, reach the depths required to explore for deep natural gas reserves. Our higher horsepower rigs can also drill horizontal wells, which are increasing as a percentage of total wells drilled in North America. We believe our premium rig fleet, rig inventory and experienced crews position us to benefit from the strong natural gas drilling activity in our core operating areas.

Our Acquisitions

On January 18, 2006, we completed the acquisition of six land drilling rigs and certain other assets, including heavy haul trucks and excess rig equipment and inventory, from Big A Drilling. The purchase price for the assets consisted of $16.3 million in cash and 72,571 shares of our common stock. At closing, we also entered into a lease agreement with an affiliate of Big A Drilling under which we leased a rig refurbishment yard located in Woodward, Oklahoma. The lease has an initial term of six months, and we have the option to extend the term of the lease for a period of three years following the expiration of the initial term. We also have the option to purchase the leased premises at any time during the term of the lease for $200,000. For additional information regarding this transaction, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and “Item 2. Properties.”

The following table summarizes completed acquisitions in which we acquired rigs and rig related equipment since June 2001:

| | | | | | | |

Date | | Acquisition | | Purchase

Price | | Number of Rigs

Acquired |

June 2001 | | Ram Petroleum | | $ | 1,250,000 | | 1 |

May 2002 | | Bison Drilling and Four Aces Drilling | | $ | 12,500,000 | | 7 |

August 2003 | | Elk Hill Drilling and U.S. Rig & Equipment | | $ | 49,000,000 | | 22 |

July 2005 | | Strata Drilling and Strata Property | | $ | 20,000,000 | | 3 |

October 2005 | | Eagle Drilling | | $ | 50,000,000 | | 12 |

October 2005 | | Thomas Drilling | | $ | 68,000,000 | | 13 |

January 2006 | | Big A Drilling | | $ | 18,150,000 | | 6 |

In May 2002, we purchased seven drilling rigs ranging in size from 400 to 950 horsepower, associated spare parts and equipment, drill pipe, haul trucks and vehicles from Bison Drilling L.L.C. and Four Aces Drilling L.L.C. After accepting delivery of the rigs, we spent approximately $97,000 upgrading the rigs before placing six

2

of them into service. In August 2003, we purchased all of the outstanding stock of Elk Hill Drilling, Inc. and certain drilling rig structures and components from U.S. Rig & Equipment, Inc., an affiliate of Elk Hill. In these transactions, we acquired drilling rigs and inventoried structures and components which, with refurbishment and upgrades, could be used to assemble 22 drilling rigs. At the date of its acquisition, Elk Hill was an inactive corporation with no customers, employees, operations or operational drilling rigs. We began refurbishing the acquired rigs and have deployed an average of approximately one rig per quarter since November 2003. In July 2005, we acquired all of the membership interests of Strata Drilling, L.L.C. and Strata Property, L.L.C. Included in the Strata acquisitions were two operating rigs, one rig that was refurbished, related structures, equipment and components and a 16 acre yard in Oklahoma City, Oklahoma used for equipment storage and refurbishment of inventoried rigs. In September 2005, we acquired 18 trucks and related equipment through our acquisition of Hays Trucking, Inc. for a purchase price consisting of $3.0 million in cash, which included the repayment of $1.9 million of debt owed by Hays Trucking, and 65,368 shares of our common stock. In October 2005, we purchased 12 land drilling rigs from Eagle Drilling, L.L.C. for approximately $50.0 million plus approximately $500,000 of related transaction costs, and 13 land drilling rigs from Thomas Drilling Co. for approximately $68.0 million plus approximately $2.6 million of related transaction costs. In connection with the Thomas acquisition, we leased an additional rig refurbishment yard for a six month term, with the right to extend the term for an additional three years. We also obtained an option to purchase the yard at any time during the term for $175,000. In January 2006, we completed the Big A Drilling acquisition as described above.

Our Industry

The United States contract land drilling services industry is highly cyclical. Volatility in oil and natural gas prices can produce wide swings in the levels of overall drilling activity in the markets we serve and affect the demand for our drilling services and the dayrates we can charge for our rigs. The availability of financing sources, past trends in oil and natural gas prices and the outlook for future oil and natural gas prices strongly influence the number of wells oil and natural gas exploration and production companies decide to drill. Nevertheless, we believe that the following trends in our industry should benefit our operations:

| | • | | Need for increased natural gas drilling activity as U.S. demand growth outpaces U.S. supply growth. From 1994 to 2003, demand for natural gas in the United States grew at an annual rate of 0.6% while the U.S. domestic supply grew at an annual rate of 0.2%. The Energy Information Administration, or EIA, recently estimated that U.S. domestic consumption of natural gas exceeded domestic production by 17% in 2004, a gap that the EIA forecasts will expand to 24% in 2010. |

3

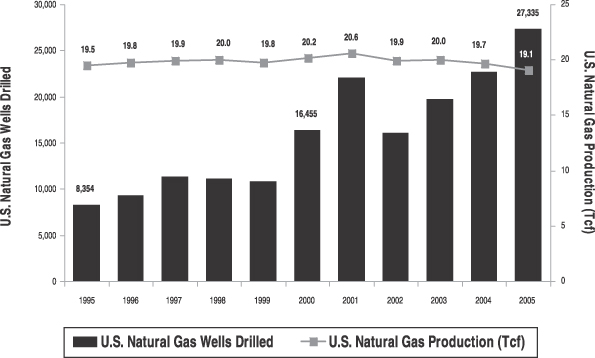

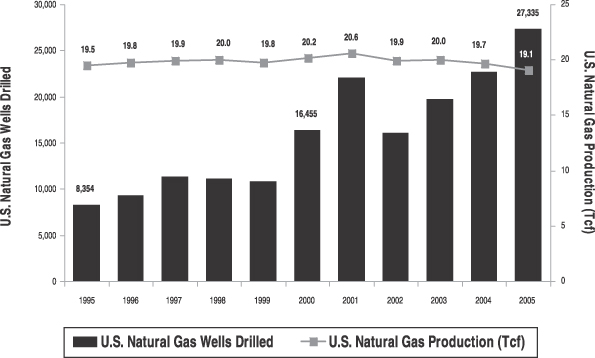

U.S. Natural Gas Wells Drilled & Production

| | • | | Increased decline rates in natural gas basins in the U.S. As the chart above shows, even though the number of U.S. natural gas wells drilled has increased significantly, a corresponding increase in production has not been realized. We believe that a significant reason for the limited supply response, even as drilling activities have increased, is the accelerating decline rates of production from new natural gas wells drilled. A study published by the National Petroleum Council in September 2003 concluded, from analysis of production data over the preceding ten years, that as a result of domestic natural gas decline rates of 25% to 30% per year, 80% of natural gas production in ten years will be from wells that have not yet been drilled. We believe that this tends to support a sustained higher natural gas price environment, which should create incentives for oil and natural gas exploration and production companies to increase drilling activities in the U.S. |

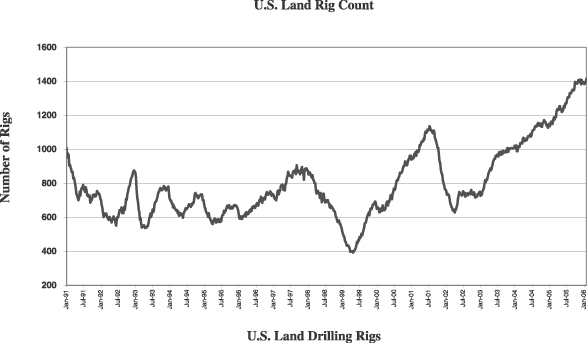

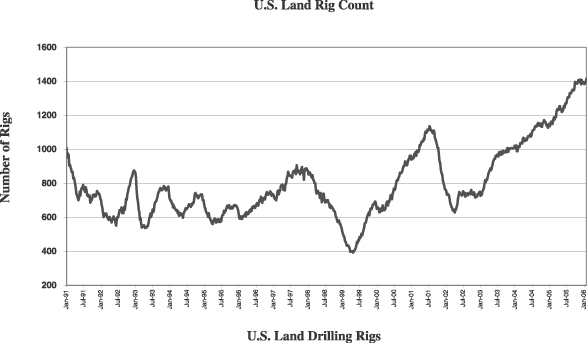

| | • | | Trend towards drilling and developing unconventional natural gas resources. As a result of improvements in extraction technologies along with general increases in natural gas prices, oil and natural gas companies increasingly are exploring for and developing “unconventional” natural gas resources, such as natural gas from tight sands, shales and coalbed methane. This type of drilling activity is frequently done on tighter acreage spacing, and requires that more wells be drilled. It also requires higher horsepower rigs for techniques such as horizontal drilling. The chart below shows the U.S. land rig count is significantly higher than it has been in recent years. |

4

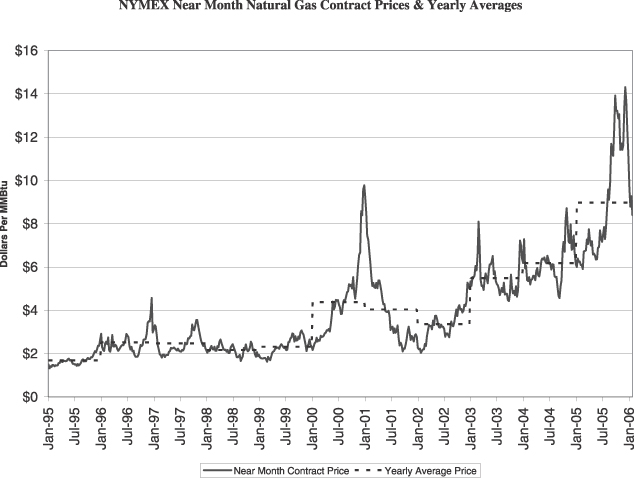

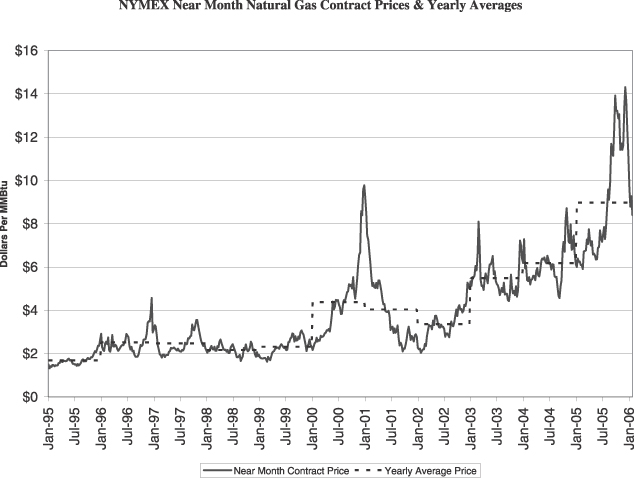

| | • | | High natural gas prices. While U.S. natural gas prices are volatile, 2005 marked the third consecutive year of increases in the yearly average NYMEX near month natural gas contract prices, as shown on the chart below. We believe that high natural gas prices in the U.S., if sustained, should result in more exploration and development drilling activity, and thus higher utilization and dayrates for drilling companies like us. |

5

| | • | | Increases in dayrates and operating margins for land drilling. The increase in the price of natural gas, coupled with accelerating decline rates and an increase in the number of natural gas wells being drilled, have resulted in increases in rig utilization, and consequently improved dayrates and gross margins. |

Our Strengths

Our competitive strengths include:

| | • | | Premium rig fleet. We currently operate a fleet of 41 rigs, 20 of which have been refurbished since November 2003 by us or the parties from which the rigs were purchased. Natural gas reserves are often found in deep and complex geological formations that require higher horsepower or premium rigs to drill. In addition, the recovery of unconventional natural gas resources often involves horizontal drilling techniques that also require premium rigs with approximately 1,000 or more horsepower. We believe that our operating history and high-quality rig fleet position us to benefit from this type of drilling activity. |

| | • | | Inventory of drilling rigs and ancillary equipment. In addition to our four rigs currently being refurbished, our 19 drilling rigs held in inventory for refurbishment will allow us to add capacity in response to the currently strong land drilling market. We also have an inventory of excess drawworks, hooks, blow-out preventors and other rig-related equipment. Our inventoried rigs as well as many of the parts we have in inventory would have long delivery lead times if ordered new. |

6

| | • | | Ability to refurbish inventoried rigs. Our management team has demonstrated the ability to refurbish rigs from our inventory. Since November 2003, we have successfully refurbished and placed into service 12 inventoried drilling rigs at costs ranging from $2.2 million to $6.6 million per rig. We are currently refurbishing four additional rigs, all of which range from 450 to 1,400 horsepower. We expect to put all four of the rigs currently being refurbished into service by the end of the second quarter of 2006. In connection with each of the Thomas and Big A Drilling acquisitions, we leased an additional refurbishment yard for a six month term, with the right to extend the term of the lease for an additional three years. We also obtained options to purchase both of these yards at any time during the term for $175,000 and $200,000, respectively. |

| | • | | Ability to attract and retain qualified rig crews. We believe that our premium rig fleet and experienced management team allow us to successfully attract and retain qualified rig crews relative to some larger, more diversified land drilling companies. As a result, we believe we have been able to refurbish rigs from our inventory and put them into operation without sacrificing our operating quality. |

Our Strategy

Our strategy is to continue to expand our contract land drilling services. Specifically, we intend to:

| | • | | Refurbish and deploy rigs from our inventory. We intend to continue the refurbishment and deployment of our inventoried rigs. We expect to put all four of the rigs currently being refurbished into service by the end of the second quarter of 2006. We plan on refurbishing seven additional rigs from our current inventory during 2006, at estimated costs (including drill pipe) ranging from $1.8 million to $6.5 million per rig. We continue to focus our refurbishment program on our higher horsepower rigs. As a result of the Thomas and Big A Drilling acquisitions, we added the use of two additional rig refurbishment yards, bringing the total number of yards in use for refurbishment to four, and also added experienced refurbishing crews that complemented the experienced crews we had in place. Our five rig-up supervisors have an average of 31 years of experience in the drilling industry. Following our Big A Drilling acquisition, the management and crews from Big A Drilling joined our team. |

| | • | | Expand our rig fleet and geographic focus. We intend to continue to expand our rig fleet and geographic areas of operation by making selected acquisitions and mobilizing rigs to other regions. We are currently operating in Oklahoma, Kansas, the Barnett Shale and Cotton Valley trends and Palo Duro Basin in Texas, the Williston Basin in North Dakota and the Piceance Basin in Colorado. We began operations in the Barnett Shale with seven rigs through our Eagle and Thomas acquisitions. We regularly evaluate potential acquisitions of rigs and ancillary operations in both our existing and new regions. |

| | • | | Maintain a balanced portfolio of spot and term contracts. We manage our rig fleet as a portfolio, committing some of our rigs to longer-term contracts that meet our targeted returns on invested capital, and leveraging spot market rates with other rigs. As we expand our geographic focus, we initially plan on favoring longer-term contracts in our new markets until we gain operating maturity in those markets. |

| | • | | Maintain a conservative capital structure and disciplined approach to capital spending. We believe that our conservative balance sheet will allow us to pursue opportunities to grow our business. We will continue to evaluate investment opportunities, including potential acquisitions and additional rig refurbishments, that meet our targeted returns on invested capital. |

Drilling Equipment

General

A drilling rig consists of engines, a hoisting system, a rotating system, pumps and related equipment to circulate drilling fluid, blowout preventors and related equipment.

Diesel or gas engines are typically the main power sources for a drilling rig. Power requirements for drilling jobs may vary considerably, but most drilling rigs employ two or more engines to generate between 500 and

7

2,000 horsepower, depending on well depth and rig design. Most drilling rigs capable of drilling in deep formations, involving depths greater than 15,000 feet, use diesel-electric power units to generate and deliver electric current through cables to electrical switch gears, then to direct-current electric motors attached to the equipment in the hoisting, rotating and circulating systems.

Drilling rigs use long strings of drill pipe and drill collars to drill wells. Drilling rigs are also used to set heavy strings of large-diameter pipe, or casing, inside the borehole. Because the total weight of the drill string and the casing can exceed 500,000 pounds, drilling rigs require significant hoisting and braking capacities. Generally, a drilling rig’s hoisting system is made up of a mast, or derrick, a drilling line, a traveling block and hook assembly and ancillary equipment that attaches to the rotating system, a mechanism known as the drawworks. The drawworks mechanism consists of a revolving drum, around which the drilling line is wound, and a series of shafts, clutches and chain and gear drives for generating speed changes and reverse motion. The drawworks also houses the main brake, which has the capacity to stop and sustain the weights used in the drilling process. When heavy loads are being lowered, a hydromatic or electric auxiliary brake assists the main brake to absorb the great amount of energy developed by the mass of the traveling block, hook assembly, drill pipe, drill collars and drill bit or casing being lowered into the well.

The rotating equipment from top to bottom consists of a swivel, the kelly bushing, the kelly, the rotary table, drill pipe, drill collars and the drill bit. We refer to the equipment between the swivel and the drill bit as the drill stem. The swivel assembly sustains the weight of the drill stem, permits its rotation and affords a rotating pressure seal and passageway for circulating drilling fluid into the top of the drill string. The swivel also has a large handle that fits inside the hook assembly at the bottom of the traveling block. Drilling fluid enters the drill stem through a hose, called the rotary hose, attached to the side of the swivel. The kelly is a triangular, square or hexagonal piece of pipe, usually 40 feet long, that transmits torque from the rotary table to the drill stem and permits its vertical movement as it is lowered into the hole. The bottom end of the kelly fits inside a corresponding triangular, square or hexagonal opening in a device called the kelly bushing. The kelly bushing, in turn, fits into a part of the rotary table called the master bushing. As the master bushing rotates, the kelly bushing also rotates, turning the kelly, which rotates the drill pipe and thus the drill bit. Drilling fluid is pumped through the kelly on its way to the bottom. The rotary table, equipped with its master bushing and kelly bushing, supplies the necessary torque to turn the drill stem. The drill pipe and drill collars are both steel tubes through which drilling fluid can be pumped. Drill pipe, sometimes called drill string, comes in 30-foot sections, or joints, with threaded sections on each end. Drill collars are heavier than drill pipe and are also threaded on the ends. Collars are used on the bottom of the drill stem to apply weight to the drilling bit. At the end of the drill stem is the bit, which chews up the formation rock and dislodges it so that drilling fluid can circulate the fragmented material back up to the surface where the circulating system filters it out of the fluid.

Drilling fluid, often called mud, is a mixture of clays, chemicals and water or oil, which is carefully formulated for the particular well being drilled. Bulk storage of drilling fluid materials, the pumps and the mud-mixing equipment are placed at the start of the circulating system. Working mud pits and reserve storage are at the other end of the system. Between these two points the circulating system includes auxiliary equipment for drilling fluid maintenance and equipment for well pressure control. Within the system, the drilling mud is typically routed from the mud pits to the mud pump and from the mud pump through a standpipe and the rotary hose to the drill stem. The drilling mud travels down the drill stem to the bit, up the annular space between the drill stem and the borehole and through the blowout preventer stack to the return flow line. It then travels to a shale shaker for removal of rock cuttings, and then back to the mud pits, which are usually steel tanks. The reserve pits, usually one or two fairly shallow excavations, are used for waste material and excess water around the location.

There are numerous factors that differentiate drilling rigs, including their power generation systems and their drilling depth capabilities. The actual drilling depth capability of a rig may be less than or more than its rated depth capability due to numerous factors, including the size, weight and amount of the drill pipe on the rig. The intended well depth and the drill site conditions determine the amount of drill pipe and other equipment needed to drill a well. Generally, land rigs operate with crews of five to six persons.

8

Our Fleet of Drilling Rigs

Our rig fleet consists of 64 drilling rigs, of which 41 are currently operating, four are in the process of being refurbished and 19 are held in inventory. We expect to put the four rigs that are currently being refurbished into service by the end of the second quarter of 2006. We plan on refurbishing seven additional rigs from our current inventory during 2006. We own all the rigs in our fleet. The following table sets forth information regarding utilization for our fleet of operating drilling rigs:

| | | | | | | | | |

| | | For The Year Ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Average number of operating rigs | | 17 | | | 9 | | | 7 | |

Average utilization rate | | 95 | % | | 81 | % | | 76 | % |

The following table sets forth information regarding our drilling fleet as of March 3, 2006:

| | | | | | | | |

Rig | | Design | | Approximate

Drilling Depth (ft) | | Type | | Horsepower |

Working Rigs | | | | | | |

19 | | Mid Continent U-1220 EB | | 25,000 | | Electric | | 2,500 |

18 | | Gardner Denver 1500E | | 25,000 | | Electric | | 2,000 |

17 | | Skytop Brewster NE-95 | | 20,000 | | Electric | | 1,700 |

12 | | Gardner Denver 1100E | | 18,000 | | Electric | | 1,500 |

16 | | Oilwell 840E | | 18,000 | | Electric | | 1,400 |

15 | | Mid Continent U-712-EA | | 16,000 | | Electric | | 1,200 |

14 | | Mid Continent U-712-EA | | 16,000 | | Electric | | 1,200 |

77 | | Ideco 711 | | 16,000 | | Mechanical | | 1,200 |

78 | | Seaco 1200 | | 12,000 | | Mechanical | | 1,200 |

56 | | BDW 800 MI | | 16,500 | | Mechanical | | 1,100 |

60 | | Skytop Brewster N46 | | 14,000 | | Mechanical | | 1,100 |

57 | | Continental Emsco GB800 | | 16,500 | | Mechanical | | 1,100 |

11 | | Gardner Denver 800E | | 15,000 | | Electric | | 1,000 |

10 | | Gardner Denver 800E | | 15,000 | | Electric | | 1,000 |

43 | | National 80B | | 15,000 | | Mechanical | | 1,000 |

8 | | National 80-UE | | 15,000 | | Electric | | 1,000 |

3 | | Cabot 900 | | 10,000 | | Mechanical | | 950 |

4 | | Skytop Brewster N46 | | 14,000 | | Mechanical | | 950 |

51 | | Skytop Brewster N42 | | 12,000 | | Mechanical | | 850 |

52 | | Continental Emsco G-500 | | 11,000 | | Mechanical | | 850 |

53 | | Skytop Brewster N42 | | 12,000 | | Mechanical | | 850 |

54 | | Skytop Brewster N46 | | 13,000 | | Mechanical | | 850 |

55 | | National 50-A | | 12,000 | | Mechanical | | 850 |

59 | | Skytop Brewster N46 | | 13,000 | | Mechanical | | 850 |

61 | | National 50-A | | 11,500 | | Mechanical | | 850 |

41 | | Skytop-Brewster N-46 | | 13,500 | | Mechanical | | 800 |

72 | | Skytop Brewster N45 | | 10,000 | | Mechanical | | 750 |

75 | | Ideco 750 | | 14,000 | | Mechanical | | 750 |

76 | | National N55 | | 12,000 | | Mechanical | | 700 |

42 | | Gardner Denver 500 | | 12,000 | | Mechanical | | 650 |

94 | | Skytop Brewster N45 | | 9,000 | | Mechanical | | 650 |

95 | | Unit U-15 | | 8,000 | | Mechanical | | 650 |

9 | | Gardner Denver 500 | | 11,000 | | Mechanical | | 650 |

7 | | Mid Con U36A | | 12,000 | | Mechanical | | 650 |

9

| | | | | | | | |

Rig | | Design | | Approximate

Drilling Depth (ft) | | Type | | Horsepower |

6 | | Mid Con U36A | | 12,000 | | Mechanical | | 650 |

5 | | Mid Con U36A | | 12,000 | | Mechanical | | 650 |

92 | | Weiss 45 | | 8,000 | | Mechanical | | 650 |

2 | | Cardwell L-350 | | 6,000 | | Mechanical | | 400 |

91 | | Ideco H-35 | | 8,000 | | Mechanical | | 400 |

96 | | Ideco H-35 | | 8,000 | | Mechanical | | 400 |

93 | | Ideco H-30 | | 8,000 | | Mechanical | | 350 |

| | | |

Rigs Being Refurbished | | | | | | |

20 | | Mid Continent U-914-EC | | 18,000 | | Electric | | 1,400 |

23 | | Continental Emsco D-3 | | 15,000 | | Electric | | 1,000 |

58 | | Unit U-15 | | 10,200 | | Mechanical | | 800 |

70 | | National T32 | | 6,000 | | Mechanical | | 450 |

| | | |

Rigs in Inventory | | | | | | |

24 | | Skytop Brewster N-12 | | 25,000 | | Electric | | 2,000 |

25 | | National 1320-UE | | 18,000 | | Electric | | 2,000 |

27 | | National 1320-UE | | 18,000 | | Electric | | 2,000 |

73 | | Brewster N95 | | 18,000 | | Mechanical | | 1,700 |

74 | | Mid Con 914 | | 16,000 | | Mechanical | | 1,400 |

79 | | Mid Con 914 | | 16,000 | | Mechanical | | 1,400 |

21 | | Mid Continent U-914-EC | | 18,000 | | Electric | | 1,400 |

22 | | Continental Emsco D-3 | | 15,000 | | Electric | | 1,000 |

26 | | National 80-UE | | 15,000 | | Electric | | 1,000 |

28 | | Ideco 1200E | | 15,000 | | Electric | | 1,000 |

80 | | Skytop Brewster N45 | | 10,000 | | Mechanical | | 750 |

31 | | Oilwell 660 | | 12,000 | | Mechanical | | 700 |

71 | | National N55 | | 12,000 | | Mechanical | | 700 |

62 | | Schaffer SOS 6000 | | 8,000 | | Mechanical | | 650 |

30 | | Skytop Brewster N42 | | 10,000 | | Mechanical | | 600 |

32 | | Schaffer 6000S | | 10,000 | | Mechanical | | 600 |

81 | | National T32 | | 6,000 | | Mechanical | | 450 |

1 | | Cardwell L-350 | | 5,000 | | Mechanical | | 400 |

64 | | National T-32 | | 6,000 | | Mechanical | | 325 |

| | | |

Excess Rig Inventory | | | | | | |

33 | | Oilwell 500 | | 10,000 | | Mechanical | | 500 |

34 | | Mac 400 | | 6,000 | | Mechanical | | 400 |

35 | | Mid Continent U34B | | 6,000 | | Mechanical | | 400 |

36 | | Ideco H-35 Hydrair | | 6,000 | | Mechanical | | 400 |

Working Rigs

We currently have 41 operating rigs. Eighteen of the rigs are currently operating on term contracts ranging from one to two years and twenty-three of the rigs are operating on a well-to-well basis. Twenty of the 41 rigs we currently operate have undergone significant refurbishment since November 2003 by us or the parties from which the rigs were purchased.

Rig 19. This Mid-Continent U-1220 EB rig was acquired as part of the Elk Hill acquisition. We refurbished this rig from inventory at a cost of approximately $6.6 million and deployed it in July 2005. It is currently working in Caddo County, Oklahoma under a two-year term contract that expires in August 2007.

10

Rig 18. This Gardner Denver 1500E rig was acquired in the Elk Hill acquisition. We refurbished this rig from inventory at a cost of approximately $4.8 million and deployed it in December 2004. It has been working for the same operator since it was refurbished. It is currently working in Latimer County, Oklahoma on a well-to-well basis.

Rig 17. This Skytop Brewster NE-95 was acquired as part of the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of $6.5 million and deployed it in January 2006. It is currently working in Roger Mills County, Oklahoma under a two-year term contract that expires January 2008.

Rig 12. This Gardner Denver 1100E rig was acquired in the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $2.3 million and deployed it in March 2004. It is currently working in Caddo County, Oklahoma under a two-year term contract that expires in April 2007.

Rig 16. This Oilwell 840E rig was acquired in the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $2.2 million and deployed it in October 2003. It is currently working in Grady County, Oklahoma on a well-to-well basis.

Rig 15. This Mid-Continent U-712-EA was acquired as part of the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of $6.1 million and deployed it in January 2006. It is currently working in Smith County, Texas under a two-year term contract that expires January 2008.

Rig 14. This Mid-Continent U-712-EA rig was acquired in the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $4.8 million and deployed it in March 2005. It is currently working on a one-year term contract in Eastern Oklahoma that expires in July 2006.

Rig 77. This Ideco 711 rig was acquired as part of the Eagle acquisition. It is currently working in Pittsburg County, Oklahoma under a one-year term contract that expires in November 2006.

Rig 78. This Seaco 1200 rig was acquired as part of the Eagle acquisition. It is currently working in Johnson County, Texas on a one-year term contract that expires in August 2006.

Rig 56. This BDW 800 MI was acquired as part of the Thomas acquisition. It is currently operating in Parker County, Texas on a well-to-well basis.

Rig 60. This Skytop Brewster N46 was acquired as part of the Thomas acquisition. It is currently operating in Tarrant County, Texas under a one-year contract that expires in February 2007.

Rig 57. This Continental Emsco GB800 was acquired as part of the Thomas acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $2.3 million and deployed it in March 2006. It is currently drilling its first well in Grady County, Oklahoma. Subsequent to completion of this well it will begin working in Eastern Oklahoma under a two-year term contract that expires in March 2008.

Rig 11. This Gardner Denver 800E rig was acquired in the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $2.7 million and deployed it in May 2004. It is currently working in Garvin County, Oklahoma on a well-to-well basis.

Rig 10. This Gardner Denver 800E rig was acquired in the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of approximately $3.2 million and deployed it in August 2004. It is currently working in Caddo County, Oklahoma on a well-to-well basis.

Rig 43. This National 80B was acquired as part of the Strata acquisition. The refurbishment of this rig was completed pursuant to a $7.0 million seller’s note and deployed in January 2006. It is currently working in Harrison County, Texas under a two-year term contract that expires in January 2008.

11

Rig 8. This National 80-UE was acquired as part of the Elk Hill acquisition. We completed the refurbishment of this rig from inventory at a cost of $6.0 million and deployed it in November 2005. It is currently working in Billings County, North Dakota under a two-year term contract that expires November 2007.

Rig 3. This Cabot 900 was acquired in the Bison Drilling acquisition. This rig is currently working in Pottawatomie County, Oklahoma under a two-year contract that expires in January 2008.

Rig 4. This Skytop Brewster N46 rig was acquired as part of the Bison acquisition. We completed refurbishment of this rig in August 2005. It is currently working in the Piceance Basin in Colorado under a seventeen-month term contract that expires in September 2006.

Rig 51. This Skytop Brewster N42 was acquired as part of the Thomas acquisition. It is currently operating in Caddo County, Oklahoma on a well-to-well basis.

Rig 52. This Continental Emsco G-500 was acquired as part of the Thomas acquisition. It is currently operating in Dewey County, Oklahoma on a well-to-well basis.

Rig 53. This Skytop Brewster N42 was acquired as part of the Thomas acquisition. It is currently operating in McClain County, Oklahoma on a well-to-well basis.

Rig 54. This Skytop Brewster N46 was acquired as part of the Thomas acquisition. It is currently operating in Murray County, Oklahoma on a well-to-well basis.

Rig 55. This National 50-A was acquired as part of the Thomas acquisition. It is currently operating in Denton County, Texas on a well-to-well basis.

Rig 59. This Skytop Brewster N46 was acquired as part of the Thomas acquisition. It is currently operating in Coal County, Oklahoma under a one-year contract that expires in January 2007.

Rig 61. This National 50-A was acquired as part of the Thomas acquisition. It is currently operating in Parker County, Texas on a well-to-well basis.

Rig 41. This Skytop Brewster N-46 rig was acquired as part of the Strata acquisitions. It has been working for the same operator for the last three years in Central and Western Oklahoma. This rig is currently working in McClain County, Oklahoma on a well-to-well basis.

Rig 72. This Skytop Brewster N45 rig was acquired as part of the Eagle acquisition. It is currently working in Johnson County, Texas on a well-to-well basis.

Rig 75. This Ideco 750 rig was acquired as part of the Eagle acquisition. It is currently working in Murray County, Oklahoma on a well-to-well basis.

Rig 76. This National N55 rig was acquired as part of the Eagle acquisition. It is currently working in Johnson County, Texas under a one-year term contract that expires in November 2006.

Rig 42. This Gardner Denver 500 rig was acquired as a part of the Strata acquisitions. It has been working for the same operator for the last three years in Central and Western Oklahoma. This rig is currently working in Major County, Oklahoma on a well-to-well basis.

Rig 94. This Skytop Brewster N45 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Texas County, Oklahoma on a well-to-well basis.

12

Rig 95. This Unit U-15 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Roberts County, Texas on a well-to-well basis.

Rig 9. This Gardner Denver 500 was acquired in the Ram acquisition. This rig is currently working in Oklahoma County, Oklahoma under a two-year contract that expires in January 2008.

Rig 7. This Mid-Continent U36A was acquired in the Bison Drilling acquisition. It is drilling a well in Coal County, Oklahoma under a one-year term contract that expires November 2006.

Rig 6. This Mid-Continent U36A was acquired in the Bison Drilling acquisition. This rig is currently working in Major County, Oklahoma under a one-year contract that expires in February 2007.

Rig 5. This Mid-Continent U36A was acquired in the Bison Drilling acquisition. It is drilling in Grady County, Oklahoma on a well-to-well basis.

Rig 92. This Weiss 45 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Texas County, Oklahoma on a well-to-well basis.

Rig 2. This Cardwell L-350 was acquired in the Bison Drilling acquisition. It works primarily in the Arkoma Basin in Eastern Oklahoma. This rig is currently working in Hughes County, Oklahoma on a well-to-well basis.

Rig 91. This Ideco H-35 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Beaver County, Oklahoma on a well-to-well basis.

Rig 96. This Ideco H-35 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Clark County, Kansas on a well-to-well basis.

Rig 93. This Ideco H-30 rig was acquired as part of the Big A Drilling acquisition. It is currently working in Cimarron County, Oklahoma on a well-to-well basis.

Rigs Being Refurbished

We are currently in the process of refurbishing four rigs, all of which we anticipate will be completed by the end of the second quarter of 2006.

Rig 20. This Mid-Continent U-914-EC rig was acquired as part of the Elk Hill acquisition. We started its refurbishment in October 2005 and believe it can be delivered in the first quarter of 2006.

Rig 23. This Continental Emsco D-3 rig was acquired as part of the Elk Hill acquisition. We intend to start its refurbishment in March 2006 and believe it can be delivered in the second quarter of 2006. We have ordered drill pipe, derrick and substructure power packages and SCR house which are scheduled for delivery beginning in the first quarter of 2006.

Rig 58. This Unit U-15 was acquired as part of the Thomas acquisition. We started its refurbishment in October 2005 and anticipate that it will be complete and drill ready by the end of the first quarter 2006.

Rig 70. This National T32 was acquired as part of the Eagle acquisition. We started its refurbishment in February 2006 and believe it can be delivered by the end of the second quarter of 2006.

Rigs in Inventory

We currently have 19 rigs held in inventory in our rig yards in Oklahoma. We define an inventoried rig as a rig that is included in our refurbishment plan and has been assigned a start and delivery date. The seven

13

additional rigs that we intend to refurbish during 2006 are described below. We intend to refurbish and deploy our remaining rigs held in inventory on a periodic basis, with such refurbishment currently scheduled for completion by the end of the second quarter of 2008.

Rig 24. This Skytop Brewster NE-12 rig was acquired as part of the Elk Hill acquisition. We intend to start its refurbishment in April 2006 and believe it can be delivered in the third quarter of 2006. We have ordered drill pipe, power packages and SCR house which are scheduled for delivery beginning in the first quarter of 2006.

Rig 25. This National 1320-UE rig was acquired as part of the Elk Hill acquisition. We intend to start its refurbishment in May 2006 and believe it can be delivered by the end of 2006. We have ordered drill pipe, power packages and SCR house which are scheduled for delivery beginning in the first quarter of 2006.

Rig 73. This Skytop Brewster N95 was acquired as part of the Eagle acquisition. We intend to start its refurbishment in April 2006 and believe it can be delivered in the third quarter of 2006.

Rig 74. This Mid-Continent 914 was acquired as part of the Eagle acquisition. We intend to start its refurbishment in July 2006 and believe it can be delivered in the fourth quarter of 2006.

Rig 21. This Mid-Continent U-914-EC rig was acquired as part of the Elk Hill acquisition. We started its refurbishment in October 2005 and believe it can be delivered in the third quarter of 2006.

Rig 22. This Continental Emsco D-3 rig was acquired as part of the Elk Hill acquisition. We started its refurbishment in October 2005 and believe it can be delivered in the fourth quarter of 2006.

Rig 81. This National T32 was acquired as part of the Eagle acquisition. We intend to start its refurbishment in May 2006 and believe it can be delivered in the fourth quarter of 2006.

Excess Rig Inventory

We currently have four rigs that we believe can be refurbished, but are not currently part of our refurbishment plan. We periodically review the market, our financial condition and our refurbishment yard capacity to determine if we will add additional rigs to our refurbishment plan.

Excess Equipment

As of February 28, 2006, we had an inventory of excess rig equipment that includes 42 drawworks (30 of which are 1,000 horsepower or higher), 84 blocks, 69 blow out preventors, 14 electric brakes, 52 hydromatic brakes, 59 rotary tables and 33 swivels. This inventoried equipment could be used with newly ordered or purchased parts to build additional rigs.

As of February 28, 2006, we owned a fleet of 60 trucks and related transportation equipment that we use to transport our drilling rigs to and from drilling sites. By owning our own trucks, we reduce the cost of rig moves and reduce downtime between rig moves.

We believe that our operating drilling rigs and other related equipment are in good operating condition. Our employees perform periodic maintenance and minor repair work on our drilling rigs. Historically, we have relied on various oilfield service companies for major repair work and overhaul of our drilling equipment. In April 2005, we opened a 41,000 square foot machine shop in Oklahoma City, which allows us to refurbish and repair our rigs and equipment in-house. In the event of major breakdowns or mechanical problems, our rigs could be subject to significant idle time and a resulting loss of revenue if the necessary repair services are not immediately available.

14

Drilling Contracts

As a provider of contract land drilling services, our business and the profitability of our operations depend on the level of drilling activity by oil and natural gas exploration and production companies operating in the geographic markets where we operate. Our business has generally not been affected by seasonal fluctuations. The oil and natural gas exploration and production industry is a historically cyclical industry characterized by significant changes in the levels of exploration and development activities. During periods of lower levels of drilling activity, price competition tends to increase and results in decreases in the profitability of daywork contracts. In this lower level drilling activity and competitive price environment, we may be more inclined to enter into footage contracts that expose us to greater risk of loss without commensurate increases in potential contract profitability.

We obtain our contracts for drilling oil and natural gas wells either through competitive bidding or through direct negotiations with customers. Our drilling contracts generally provide for compensation on either a daywork or footage basis. The contract terms we offer generally depend on the complexity and risk of operations, the on-site drilling conditions, the type of equipment used and the anticipated duration of the work to be performed. Generally, our contracts provide for the drilling of a single well and typically permit the customer to terminate on short notice, usually on payment of an agreed fee.

The following table presents, by type of contract, information about the total number of wells we completed for our customers during the years ended December 31, 2005, 2004, and 2003.

| | | | | | |

| | | Year Ended December 31, |

| | | 2005 | | 2004 | | 2003 |

Daywork | | 148 | | 80 | | 41 |

Footage | | 5 | | 11 | | 28 |

Turnkey | | — | | — | | — |

| | | | | | |

Total | | 153 | | 91 | | 69 |

| | | | | | |

Daywork Contracts. Under daywork drilling contracts, we provide a drilling rig with required personnel to our customer who supervises the drilling of the well. We are paid based on a negotiated fixed rate per day while the rig is used. Daywork drilling contracts specify the equipment to be used, the size of the hole and the depth of the well. Under a daywork drilling contract, the customer bears a large portion of the out-of-pocket drilling costs and we generally bear no part of the usual risks associated with drilling, such as time delays and unanticipated costs.

Footage Contracts. Under footage contracts, we are paid a fixed amount for each foot drilled, regardless of the time required or the problems encountered in drilling the well. We typically pay more of the out-of-pocket costs associated with footage contracts as compared to daywork contracts. The risks to us on a footage contract are greater because we assume most of the risks associated with drilling operations generally assumed by the operator in a daywork contract, including the risk of blowout, loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalation and personnel. We manage this additional risk through the use of engineering expertise and bid the footage contracts accordingly, and we maintain insurance coverage against some, but not all, drilling hazards. However, the occurrence of uninsured or under-insured losses or operating cost overruns on our footage jobs could have a negative impact on our profitability.

Turnkey Contracts. Turnkey contracts typically provide for a drilling company to drill a well for a customer to a specified depth and under specified conditions for a fixed price, regardless of the time required or the problems encountered in drilling the well. The drilling company would provide technical expertise and engineering services, as well as most of the equipment and drilling supplies required to drill the well. The drilling

15

company may subcontract for related services, such as the provision of casing crews, cementing and well logging. Under typical turnkey drilling arrangements, a drilling company would not receive progress payments and would be paid by its customer only after it had performed the terms of the drilling contract in full.

Although we have not historically entered into any turnkey contracts, we may decide to enter into such arrangements in the future. The risks to a drilling company under a turnkey contract are substantially greater than on a well drilled on a daywork basis. This is primarily because under a turnkey contract the drilling company assumes most of the risks associated with drilling operations generally assumed by the operator in a daywork contract, including the risk of blowout, loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalations and personnel.

Customers and Marketing

We market our rigs to a number of customers. In 2005, we drilled wells for 52 different customers, compared to 29 customers in 2004 and 34 customers in 2003. The following table shows our customers that accounted for more than 5% of our total contract drilling revenue for each of our last three years.

| | | |

Customer | | Total Contract Drilling Revenue Percentage | |

| 2005 | | | |

New Dominion, L.L.C. | | 10 | % |

Chesapeake Energy Corporation | | 9 | % |

Carl E. Gungoll Exploration, L.L.C. | | 6 | % |

Western Oil and Gas Development Co. | | 6 | % |

XTO Energy | | 5 | % |

| |

2004 | | | |

Carl E. Gungoll Exploration, L.L.C. | | 11 | % |

Western Oil and Gas Development Co. | | 9 | % |

New Dominion, L.L.C. | | 9 | % |

Chesapeake Energy Corporation. | | 7 | % |

XTO Energy | | 7 | % |

Triad Energy | | 6 | % |

Ward Petroleum Corp. | | 6 | % |

| |

2003 | | | |

Carl E. Gungoll Exploration, L.L.C. | | 13 | % |

Zinke and Trumbo, Inc. | | 11 | % |

Questar Exploration & Production | | 8 | % |

Medicine Bow Operating Co. | | 8 | % |

Apache Corporation | | 7 | % |

We primarily market our drilling rigs through employee marketing representatives. These marketing representatives use personal contacts and industry periodicals and publications to determine which operators are planning to drill oil and natural gas wells in the near future in our market areas. Once we have been placed on the “bid list” for an operator, we will typically be given the opportunity to bid on most future wells for that operator in the areas in which we operate. Our rigs are typically contracted on a well-by-well basis.

From time to time we also enter into informal, nonbinding commitments with our customers to provide drilling rigs for future periods at specified rates plus fuel and mobilization charges, if applicable, and escalation provisions. This practice is customary in the contract land drilling services business during times of tightening rig supply.

16

Competition

We encounter substantial competition from other drilling contractors. Our primary market area is highly fragmented and competitive. The fact that drilling rigs are mobile and can be moved from one market to another in response to market conditions heightens the competition in the industry.

The drilling contracts we compete for are usually awarded on the basis of competitive bids. Our principal competitors are Nabors Industries, Inc., Patterson-UTI Energy, Inc., Unit Corp. and Helmerich & Payne, Inc. We believe pricing and rig availability are the primary factors our potential customers consider in determining which drilling contractor to select. In addition, we believe the following factors are also important:

| | • | | the type and condition of each of the competing drilling rigs; |

| | • | | the mobility and efficiency of the rigs; |

| | • | | the quality of service and experience of the rig crews; |

| | • | | the offering of ancillary services; and |

| | • | | the ability to provide drilling equipment adaptable to, and personnel familiar with, new technologies and drilling techniques. |

While we must be competitive in our pricing, our competitive strategy generally emphasizes the quality of our equipment and the experience of our rig crews to differentiate us from our competitors. This strategy is less effective as lower demand for drilling services or an oversupply of rigs usually results in increased price competition and makes it more difficult for us to compete on the basis of factors other than price. In all of the markets in which we compete, an oversupply of rigs can cause greater price competition.

Contract drilling companies compete primarily on a regional basis, and the intensity of competition may vary significantly from region to region at any particular time. If demand for drilling services improves in a region where we operate, our competitors might respond by moving in suitable rigs from other regions. An influx of rigs from other regions could rapidly intensify competition and reduce profitability.

Many of our competitors have greater financial, technical and other resources than we do. Their greater capabilities in these areas may enable them to:

| | • | | better withstand industry downturns; |

| | • | | compete more effectively on the basis of price and technology; |

| | • | | better retain skilled rig personnel; and |

| | • | | build new rigs or acquire and refurbish existing rigs so as to be able to place rigs into service more quickly than us in periods of high drilling demand. |

Raw Materials

The materials and supplies we use in our drilling operations include fuels to operate our drilling equipment, drilling mud, drill pipe, drill collars, drill bits and cement. We do not rely on a single source of supply for any of these items. While we are not currently experiencing any shortages, from time to time there have been shortages of drilling equipment and supplies during periods of high demand.

Shortages could result in increased prices for drilling equipment or supplies that we may be unable to pass on to customers. In addition, during periods of shortages, the delivery times for equipment and supplies can be substantially longer. Any significant delays in our obtaining drilling equipment or supplies could limit drilling operations and jeopardize our relations with customers. In addition, shortages of drilling equipment or supplies could delay and adversely affect our ability to obtain new contracts for our rigs, which could have a material adverse effect on our financial condition and results of operations.

17

Operating Risks and Insurance

Our operations are subject to the many hazards inherent in the contract land drilling business, including the risks of:

| | • | | collapse of the borehole; |

| | • | | lost or stuck drill strings; and |

| | • | | damage or loss from natural disasters. |

Any of these hazards can result in substantial liabilities or losses to us from, among other things:

| | • | | suspension of drilling operations; |

| | • | | damage to, or destruction of, our property and equipment and that of others; |

| | • | | personal injury and loss of life; |

| | • | | damage to producing or potentially productive oil and natural gas formations through which we drill; and |

We seek to protect ourselves from some but not all operating hazards through insurance coverage. However, some risks are either not insurable or insurance is available only at rates that we consider uneconomical. Those risks include pollution liability in excess of relatively low limits. Depending on competitive conditions and other factors, we attempt to obtain contractual protection against uninsured operating risks from our customers. However, customers who provide contractual indemnification protection may not in all cases have sufficient financial resources or maintain adequate insurance to support their indemnification obligations. We can offer no assurance that our insurance or indemnification arrangements will adequately protect us against liability or loss from all the hazards of our operations. The occurrence of a significant event that we have not fully insured or indemnified against or the failure of a customer to meet its indemnification obligations to us could materially and adversely affect our results of operations and financial condition. Furthermore, we may not be able to maintain adequate insurance in the future at rates we consider reasonable.

Our insurance coverage includes property insurance on our rigs, drilling equipment and real property. Our insurance coverage for property damage to our rigs and to our drilling equipment is based on a third party estimate of the appraised value of the rigs and drilling equipment. The policy provides for a deductible on rigs of $1.0 million per occurrence and a $40.0 million aggregate stop loss. Our umbrella liability insurance coverage is $25.0 million per occurrence and in the aggregate, with a deductible of $10,000 per occurrence. We believe that we are adequately insured for public liability and property damage to others with respect to our operations. However, such insurance may not be sufficient to protect us against liability for all consequences of well disasters, extensive fire damage or damage to the environment.

Employees

As of February 28, 2006, we had approximately 1,400 employees. Approximately 145 of these employees are salaried administrative or supervisory employees. The rest of our employees are hourly employees who operate or maintain our drilling rigs and rig-hauling trucks. The number of hourly employees fluctuates depending on the number of drilling projects we are engaged in at any particular time. None of our employees are subject to collective bargaining arrangements.

18

Our operations require the services of employees having the technical training and experience necessary to obtain the proper operational results. As a result, our operations depend, to a considerable extent, on the continuing availability of such personnel. Although we have not encountered material difficulty in hiring and retaining qualified rig crews, shortages of qualified personnel are occurring in our industry. If we should suffer any material loss of personnel to competitors or be unable to employ additional or replacement personnel with the requisite level of training and experience to adequately operate our equipment, our operations could be materially and adversely affected. While we believe our wage rates are competitive and our relationships with our employees are satisfactory, a significant increase in the wages paid by other employers could result in a reduction in our workforce, increases in wage rates, or both. The occurrence of either of these events for a significant period of time could have a material and adverse effect on our financial condition and results of operations.

Governmental Regulation

Our operations are subject to stringent federal, state and local laws and regulations governing the protection of the environment and human health and safety. Several such laws and regulations relate to the disposal of hazardous oilfield waste and restrict the types, quantities and concentrations of such regulated substances that can be released into the environment. Several such laws also require removal and remedial action and other cleanup under certain circumstances, commonly regardless of fault. Planning, implementation and maintenance of protective measures are required to prevent accidental discharges. Spills of oil, natural gas liquids, drilling fluids and other substances may subject us to penalties and cleanup requirements. Handling, storage and disposal of both hazardous and non-hazardous wastes are also subject to these regulatory requirements. In addition, our operations are often conducted in or near ecologically sensitive areas, which are subject to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, natural gas, drilling fluids, contaminated water or other substances or for noncompliance with other aspects of applicable laws and regulations. Historically, we have not been required to obtain environmental or other permits prior to drilling a well. Instead, the operator of the oil and gas property has been obligated to obtain the necessary permits at its own expense.

The federal Clean Water Act, as amended by the Oil Pollution Act, the federal Clean Air Act, the federal Resource Conservation and Recovery Act, CERCLA, the Safe Drinking Water Act, OSHA and their state counterparts and similar statutes are the primary vehicles for imposition of such requirements and for civil, criminal and administrative penalties and other sanctions for violation of their requirements. The OSHA hazard communication standard, the Environmental Protection Agency “community right-to-know” regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require us to organize and report information about the hazardous materials we use in our operations to employees, state and local government authorities and local citizens. In addition, CERCLA, also known as the “Superfund” law, and similar state statutes impose strict liability, without regard to fault or the legality of the original conduct, on certain classes of persons who are considered responsible for the release or threatened release of hazardous substances into the environment. These persons include the current owner or operator of a facility where a release has occurred, the owner or operator of a facility at the time a release occurred and companies that disposed of or arranged for the disposal of hazardous substances found at a particular site. This liability may be joint and several. Such liability, which may be imposed for the conduct of others and for conditions others have caused, includes the cost of removal and remedial action as well as damages to natural resources. Few defenses exist to the liability imposed by environmental laws and regulations. It is also not uncommon for third parties to file claims for personal injury and property damage caused by substances released into the environment.

Environmental laws and regulations are complex and subject to frequent changes. Failure to comply with governmental requirements or inadequate cooperation with governmental authorities could subject a responsible party to administrative, civil or criminal action. We may also be exposed to environmental or other liabilities originating from businesses and assets that we acquired from others. We are in substantial compliance with applicable environmental laws and regulations and, to date, such compliance has not materially affected our

19

capital expenditures, earnings or competitive position. We do not expect to incur material capital expenditures in our next fiscal year in order to comply with current or reasonably anticipated environment control requirements. However, our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of regulatory noncompliance or contamination may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

In addition, our business depends on the demand for land drilling services from the oil and natural gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and natural gas industry generally, by changes in those laws and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers or otherwise directly or indirectly affect our operations.

Item 1A. Risk Factors

Risks Relating to the Oil and Natural Gas Industry

We derive all our revenues from companies in the oil and natural gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices.

We derive all our revenues from companies in the oil and natural gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. Any prolonged reduction in the overall level of exploration and development activities, whether resulting from changes in oil and natural gas prices or otherwise, can adversely impact us in many ways by negatively affecting:

| | • | | our revenues, cash flows and profitability; |

| | • | | our ability to maintain or increase our borrowing capacity; |

| | • | | our ability to obtain additional capital to finance our business and make acquisitions, and the cost of that capital; |

| | • | | our ability to retain skilled rig personnel whom we would need in the event of an upturn in the demand for our services; and |

| | • | | the fair market value of our rig fleet. |

Worldwide political, economic and military events have contributed to oil and natural gas price volatility and are likely to continue to do so in the future. Depending on the market prices of oil and natural gas, oil and natural gas exploration and production companies may cancel or curtail their drilling programs, thereby reducing demand for our services. Oil and natural gas prices have been volatile historically and, we believe, will continue to be so in the future. Many factors beyond our control affect oil and natural gas prices, including:

| | • | | the cost of exploring for, producing and delivering oil and natural gas; |

| | • | | the discovery rate of new oil and natural gas reserves; |

| | • | | the rate of decline of existing and new oil and natural gas reserves; |

| | • | | available pipeline and other oil and natural gas transportation capacity; |

| | • | | the ability of oil and natural gas companies to raise capital; |

| | • | | actions by OPEC, the Organization of Petroleum Exporting Countries; |

| | • | | political instability in the Middle East and other major oil and natural gas producing regions; |

| | • | | economic conditions in the United States and elsewhere; |

20

| | • | | governmental regulations, both domestic and foreign; |

| | • | | domestic and foreign tax policy; |

| | • | | weather conditions in the United States and elsewhere; |

| | • | | the pace adopted by foreign governments for the exploration, development and production of their national reserves; |

| | • | | the price of foreign imports of oil and natural gas; and |

| | • | | the overall supply and demand for oil and natural gas. |

Risks Relating to Our Business

Our acquisition strategy exposes us to various risks, including those relating to difficulties in identifying suitable acquisition opportunities and integrating businesses, assets and personnel, as well as difficulties in obtaining financing for targeted acquisitions and the potential for increased leverage or debt service requirements.

As a component of our business strategy, we have pursued and intend to continue to pursue selected acquisitions of complementary assets and businesses. In May 2002, we purchased seven drilling rigs, associated spare parts and equipment, drill pipe, haul trucks and vehicles. In August 2003, we acquired drilling rigs and inventoried structures and components which, with refurbishment and upgrades, could be used to assemble 22 drilling rigs. In July 2005, we acquired three additional rigs and related inventory, equipment, components and rig yard. On October 3, 2005, we acquired five operating rigs, seven inventoried rigs and rig equipment and parts. On October 14, 2005, we acquired nine operating rigs, two rigs undergoing refurbishment, two inventoried rigs and rig equipment and parts. On January 18, 2006, we acquired six operating land drilling rigs and certain other assets, including heavy haul trucks and excess rig equipment. Acquisitions, including those described above, involve numerous risks, including:

| | • | | unanticipated costs and assumption of liabilities and exposure to unforeseen liabilities of acquired companies, including but not limited to environmental liabilities; |

| | • | | difficulty in integrating the operations and assets of the acquired business and the acquired personnel and distinct cultures; |

| | • | | our ability to properly access and maintain an effective internal control environment over an acquired company, in order to comply with the recently adopted public reporting requirements; |

| | • | | potential loss of key employees and customers of the acquired companies; |

| | • | | risk of entering markets in which we have limited prior experience; and |

| | • | | an increase in our expenses and working capital requirements. |

The process of integrating an acquired business may involve unforeseen costs and delays or other operational, technical and financial difficulties and may require a disproportionate amount of management attention and financial and other resources. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations.

In addition, we may not have sufficient capital resources to complete additional acquisitions. Historically, we have funded the acquisition of rigs and the refurbishment of our rig fleet through a combination of debt and equity financing. We may incur substantial additional indebtedness to finance future acquisitions and also may issue equity, debt or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity or convertible securities could be dilutive to our existing stockholders. Furthermore, we may not be able to

21

obtain additional financing on satisfactory terms. Even if we have access to the necessary capital, we may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms or successfully acquire identified targets.

Increases in the supply of rigs could decrease dayrates and utilization rates.

An increase in the supply of land rigs, whether through new construction or refurbishment, could decrease dayrates and utilization rates, which would adversely affect our revenues and profitability. In addition, such adverse affect on our revenue and profitability caused by such increased competition and lower dayrates and utilization rates could be further aggravated by any downturn in oil and natural gas prices.

A material reduction in the levels of exploration and development activities in Oklahoma or Texas or an increase in the number of rigs mobilized to Oklahoma or Texas could negatively impact our dayrates and utilization rates.

We currently conduct a substantial portion of our operations in Oklahoma and Texas. A material reduction in the levels of exploration and development activities in Oklahoma or Texas due to a variety of oil and natural gas industry risks described above or an increase in the number of rigs mobilized to Oklahoma or Texas could negatively impact our dayrates and utilization rates, which could adversely affect our revenues and profitability.

Our revenues and profitability could be negatively impacted if we are unable to successfully complete the refurbishment of our inventoried rigs on schedule and within budget and use those and the other rigs in our fleet at profitable levels.

We expect to put all four of the rigs currently being refurbished into service by the end of the second quarter of 2006. We plan on refurbishing seven additional rigs from our current inventory during 2006, at estimated costs (including drill pipe) ranging from $1.8 million to $6.5 million per rig. Our revenues and profitability could be negatively impacted if we are unable to successfully complete the refurbishment of our inventoried rigs on schedule and within budget and operate those and the other rigs in our fleet at profitable levels. Our refurbishment projects are subject to the risks of delay and cost overruns inherent in any large construction project, including shortages of equipment, unforeseen engineering problems, work stoppages, weather interference, unanticipated cost increases, inability to obtain necessary certifications and approvals and shortages of materials or skilled labor. Significant delays could negatively impact our anticipated contract commitments with respect to rigs being refurbished, while significant cost overruns or delays in general could adversely affect our financial condition and results of operations. Moreover, customer demand for rigs currently being refurbished may not be as strong as we presently anticipate, and our inability to obtain contracts on anticipated terms or at all may negatively impact our revenues and profitability.

We have a history of losses and may experience losses in the future.

Although we reported net income of $5.1 million for the year ended December 31, 2005, we have a history of losses. We incurred net losses of $2.8 million, $1.6 million and $1.9 million for the years ended December 31, 2004, 2003 and 2002, respectively. Our profitability in the future will depend on many factors, but largely on utilization rates and dayrates for our drilling rigs. Our current utilization rates and dayrates may decline and we may experience losses in the future.

We operate in a highly competitive, fragmented industry in which price competition could reduce our profitability.

We operate in a highly competitive, fragmented industry in which price competition could reduce our profitability. The fact that drilling rigs are mobile and can be moved from one market to another in response to market conditions heightens the competition in the industry.

22