Exhibit (a)(5)(F)

CJ -11- 2687 Owens

DANIEL L. OWENS

IN THE DISTRICT COURT OF OKLAHOMA COUNTY

STATE OF OKLAHOMA

| DEBRA KUSHNER, Individually and on | ) | Case No. | ||

| Behalf of All Others Similarly Situated, | ) | |||

| ) | CLASS ACTION | |||

| Plaintiff, | ) | |||

vs. | ) | |||

| ) | CJ – 2011 – 2687 | |||

| BRONCO DRILLING COMPANY, INC., D. | ) | |||

| FRANK HARRISON, RICHARD B. | ) | |||

| HEFNER, DAVID W. HOUSE, GARY C. | ) | |||

| HILL and WILLIAM R. SNIPES, | ) | |||

| ) | ||||

| Defendants. | ) | |||

| ) | DEMAND FOR JURY TRIAL |

PETITION FOR BREACH OF FIDUCIARY DUTY

Plaintiff Debra Kushner, individually and on behalf of all others similarly situated, files this action against defendants for breach of fiduciary duty and hereby shows the following:

SUMMARY OF THE ACTION

1. This is a stockholder class action brought by plaintiff on behalf of the holders of Bronco Drilling Company, Inc. (“Bronco” or the “Company”) common stock against the Company’s Board of Directors (the “Board”), arising out of their agreement to sell the Company to Chesapeake Energy Corporation (“Chesapeake”) pursuant to an unfair process and at an unfair price. Pursuant to an Agreement and Plan of Merger (“Merger Agreement”) between Bronco and Chesapeake, Chesapeake is set to acquire all of Bronco’s outstanding shares for just $11.00 per share (the “Proposed Acquisition”).

- 1 -

2. Founded in 2001 and headquartered in Edmund, Oklahoma, Bronco provides contract land drilling and workover services to the oil and natural gas exploration and production companies in the United States. It also provides well services, including maintenance, new well completion, and plugging and abandonment services, as well as engages in the installation and removal of downhole equipment and elimination of obstructions in the well bore to facilitate the flow of oil and gas. The Company operates drilling rigs in Oklahoma, Texas, Pennsylvania, West Virginia, North Dakota, Utah and Louisiana. As of February 28, 2010, Bronco owned a fleet of 37 marketed land drilling rigs and 61 workover rigs, as well as 60 trucks used to transport its rigs.

3. On April 15, 2011, Bronco announced that it had entered into the Merger Agreement, whereby Chesapeake will commence a cash tender offer to acquire all outstanding shares of Bronco’s common stock at a price of $11.00 per share, or approximately $315 million in the aggregate (the “Announcement”). Under the Merger Agreement, a wholly owned subsidiary of Chesapeake will make a cash tender offer for all outstanding shares of Bronco common stock at $11.00 per share. In the second step, the tender offer will be followed by a merger in which the holders of the outstanding shares of Bronco common stock not purchased in the tender offer will receive the same per share price paid in the tender offer, in cash, without interest. If the Proposed Acquisition is completed, Bronco will then become an indirect wholly owned subsidiary of Chesapeake and its public shareholders will lose all equity interest in the Company.

4. The Announcement came as a shock to Bronco’s shareholders, as the Company had experienced significant growth during the past year, along with a dramatically increasing stock price. According to analysts, Bronco has benefited from rising oil prices and from its strategy of selling off rigs that use older technology, reducing debt and readying new rigs with more modem design. While Bronco’s stock price suffered in late 2008 and 2009 along with the rest of the economy, it increased from $3.40 per share on July 2, 2010 to a high of $11.63 per share on March 31, 2011, representing an increase of 242%. Just two weeks later, however, defendants agreed to sell the Company for just $11.00 per share. That price amounts to a 5.4%discount to its stock price at the end of March 2011. Notably, one analyst at Houston-based investment bank Simmons and Co. described the almost non-existent premium as “paltry.”

- 2 -

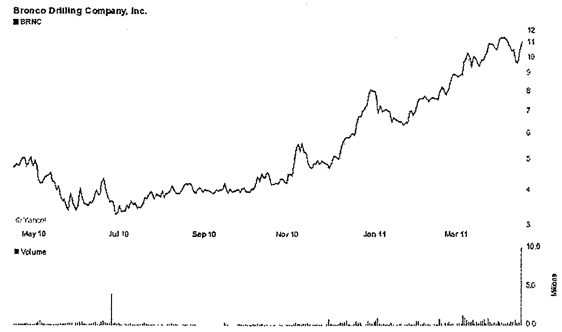

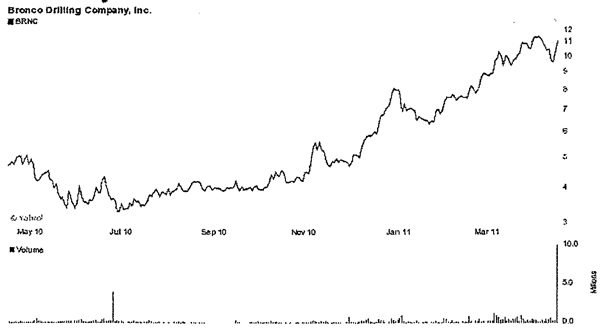

5. The market also expected the Company’s stock price to increase well above the paltry offer of $11.00 per share, as one analyst had set an expected price target of $13.50 per share for the Company’s stock. In fact, since June 29, 2010, Bronco’s stock price had performed better than any of its 14 industry peers, according to data compiled byBloomberg. This rise in Bronco’s stock is captured by the following chart:

6. The lowball $11.00 per share price also fails to take into account the synergies that Chesapeake stands to gain as a result of the Proposed Acquisition. For example, Chesapeake stated in the Announcement that the Proposed Acquisition will enable Chesapeake to further its goal of owning approximately two-thirds of the rigs that it operates in its drilling program, which Chesapeake calls a “key aspect of its vertical integration strategy.” As Chesapeake stated in the Announcement, “[t]he acquisition of Bronco is a great additional step in our vertical integration strategy and increases confidence in our plan to ramp up drilling activities in highly lucrative, liquids-rich unconventional resource plays.”

- 3 -

7. The Proposed Acquisition was pushed through at the behest of the Company’s largest shareholders, Third Avenue Management LLC (“Third Avenue”) and Inmobilaria Carso, S.A. de C.V. (“Inmobilaria”), who were seeking to lock in recent gains and sell their large and illiquid blocks of Bronco shares. This interest is not shared by and, indeed is at odds with, the interests of the rest of the Company’s public shareholders. Third Avenue and Inmobilaria own a combined 32% of the Company and have entered into agreements binding them to tender all their shares into the lowball Chesapeake offer. Moreover, Inmobilaria, which is controlled by Mexican billionaire Carlos Slim, also owns 5.44 million warrants to buy Bronco shares at just $7 per share, which could boost Inmobilaria’s stake to at least 20% before the Proposed Acquisition closes. And Third Avenue already owns nearly 20% of the Company In other words, Third Avenue and Inmobilaria could control nearly 40% of the Company’s outstanding shares by the time a stockholder vote on the Proposed Acquisition takes place. These voting agreements, along with the combined 5.46% ownership interest of Company insiders, render the Proposed Acquisition a virtualfait accompli, absent judicial intervention.

8. The Company’s insiders also pushed through the Proposed Acquisition in an attempt to lock in their gains as well. For example, defendant D. Frank Harrison (“Harrison”), Bronco’s Board Chairman and Chief Executive Officer (“CEO”), sold more than 77,000 shares between February 25, 2011 and March 25, 2011, after an award of nearly 106,000 restricted shares in January. And Executive Vice President Zachary Graves (“Graves”) sold 127,000 shares since January 12, 2011, after an award of 103,000 restricted shares in January. Through the Proposed Acquisition, these Company insiders are attempting to complete their personal stock sale and achieve immediate vesting of otherwise long-term illiquid restricted shares. Additionally, management stands to gain extremely lucrative “change of control payments” just for negotiating the Proposed Acquisition and selling out the Company’s public shareholders. Harrison is set to receive an over$3 million windfall in change of control benefits. This amount existsin addition to the approximate $6 million that Harrison will receive for his illiquid block of shares and stock options in Bronco. These benefits of “change of control” payments and immediate vesting of restricted shares are not shared by the Company’s non-insider public stockholders.

- 4 -

9. In sum, defendants face serious conflicts of interest in connection with the Proposed Acquisition. Thus, defendants have breached and will continue to breach their fiduciary duties of loyalty, due care, independence, candor, good faith and fair dealing to the Company’s public shareholders.

10. Because defendants dominate and control the business and corporate affairs of Bronco and are in possession of private corporate information concerning the Company’s assets, business and future prospects, there exists an imbalance and disparity of knowledge and economic power between them and the public shareholders of Bronco, which makes it inherently unfair for them to favor their own personal interests to the exclusion of maximizing stockholder value.

11. Plaintiff seeks injunctive relief to prevent defendants from favoring their own personal interests and failing to maximize shareholder value unless and until they remedy their breaches of fiduciary duty.

JURISDICTION AND VENUE

12. This Court has jurisdiction over each defendant named herein because each defendant is either a corporation or an individual who has sufficient minimum contacts with Oklahoma so as to render the exercise of jurisdiction by the Oklahoma courts permissible under traditional notions of fair play and substantial justice.

13. Venue is proper in this Court because one or more of the defendants resides in this County.

PARTIES

14. Plaintiff Debra Kushner is and has been a shareholder of Bronco at all relevant times.

- 5 -

15. Defendant Bronco is incorporated under the laws of the State of Delaware and its principal executive offices are located at 16217 North May Avenue, Edmond, Oklahoma 73013.

16. Defendant Harrison has served as Bronco’s CEO and has maintained a Board seat since May 2005. Harrison is also the Board Chairman.

17. Defendant Richard B. Hefner has been a director of Bronco at all relevant times.

18. Defendant David W. House has been a director of Bronco since September 2008.

19. Defendant Gary C. Hill has been a director of Bronco since August 2006.

20. Defendant William R. Snipes has been a director of Bronco since February 2006.

21. The defendants named ¶¶16-20 are referred to herein as “Individual Defendants.”

DEFENDANTS’ FIDUCIARY DUTIES

22. Under Delaware law, directors have an affirmative fiduciary obligation to obtain the highest value reasonably available for the corporation’s shareholders, including a significant premium. To diligently comply with these duties, neither the directors nor the officers may take any action that:

(a) adversely affects the value provided to the corporation’s shareholders;

(b) will discourage, inhibit, or deter alternative offers to purchase control of the corporation or its assets;

(c) contractually prohibits them from complying with their fiduciary duties;

(d) will otherwise adversely affect their duty to secure the best value reasonably available under the circumstances for the corporation’s shareholders; and/or

(e) will provide the directors and/or officers with preferential treatment at the expense of, or separate from, the public shareholders.

23. In accordance with their duties of loyalty and good faith, the Individual Defendants, as directors and/or officers of Bronco, are obligated under Delaware law to refrain from:

(a) participating in any transaction where the directors’ or officers’ loyalties are divided;

- 6 -

(b) participating in any transaction where the directors or officers receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the corporation; and/or

(c) unjustly enriching themselves at the expense or to the detriment of the public shareholders.

SUBSTANTIVE ALLEGATIONS

24. Founded in 2001 and headquartered in Edmund, Oklahoma, Bronco provides contract land drilling and workover services to the oil and natural gas exploration and production companies in the United States. It also provides well services, including maintenance, new well completion, and plugging and abandonment services, as well as engages in the installation and removal of downhole equipment and elimination of obstructions in the well bore to facilitate the flow of oil and gas. The Company operates drilling rigs in Oklahoma, Texas, Pennsylvania, West Virginia, North Dakota, Utah and Louisiana. As of February 28, 2010, Bronco owned a fleet of 37 marketed land drilling rigs and 61 workover rigs, as well as 60 trucks used to transport its rigs.

25. On April 15,2011, Bronco announced that it had entered into the Merger Agreement, whereby Chesapeake will commence a cash tender offer to acquire all outstanding shares of Bronco’s common stock at a price of $11.00 per share, or approximately $315 million in the aggregate. Under the Merger Agreement, a wholly owned subsidiary of Chesapeake will make a cash tender offer for all outstanding shares of Bronco common stock at $11.00 per share. In the second step, the tender offer will be followed by a merger in which the holders of the outstanding shares of Bronco common stock not purchased in the tender offer will receive the same per share price paid in the tender offer, in cash, without interest. If the Proposed Acquisition is completed, Bronco will then become an indirect wholly owned subsidiary of Chesapeake and its public shareholders will lose all equity interest in the Company.

- 7 -

26. The Announcement came as a shock to Bronco’s shareholders, as the Company had experienced significant growth during the past year, along with a dramatically increasing stock price. According to analysts, Bronco has benefited from rising oil prices and from its strategy of selling off rigs that use older technology, reducing debt and readying new rigs with more modem design. While Bronco’s stock price suffered in late 2008 and 2009 along with the rest of the economy, it increased from $3.40 per share on July 2, 2010 to a high of $11.63 per share on March 31, 2011, representing an increase of 242%. Just two weeks later, however, defendants agreed to sell the Company for just $11.00 per share. That price amounts to a 5.4%discountto its stockprice at the end of March 2011. Notably, one analyst at Houston-based investment bank Simmons and Co. described the almost non-existent premium as“paltry.” The Announcement reads as follows:

Chesapeake Energy Corporation to Acquire Bronco Drilling Company, Inc.

Bronco’s Shareholders to Receive $11.00 Per Share in Cash

Chesapeake Will Add 22 Drilling Rigs to Assist in Ramp-up of

Company’s Liquids-Focused Drilling Programs

. . . Chesapeake Energy Corporation and Bronco Drilling Company, Inc. today announced that they have entered into a definitive agreement for Chesapeake to acquire Bronco for approximately $315 million, including debt, net working capital and outstanding warrants.

Under the agreement, Chesapeake will make a cash tender offer to acquire all outstanding shares of Bronco’s common stock at a price of $11.00 per share. The $11.00 per share purchase price represents premiums of 6% and 24% over the closing price of Bronco’s common stock on the NASDAQ on April 14, 2011 (the date of signing of the definitive agreement) and the average closing price for the 90- calendar day period ending on April 14, 2011, respectively.

The transaction has been unanimously approved by the Boards of Directors of both companies. The Board of Directors of Bronco unanimously recommends that Bronco’s shareholders accept the Chesapeake offer. Third Avenue Management LLC, on behalf of its investment advisory clients, and Inmobiliaria Carso, S.A. de C.V., which are Bronco’s largest shareholders and collectively own or have dispositive authority over approximately 32% of Bronco’s outstanding common stock, have committed to tender all their shares into the Chesapeake offer.

- 8 -

The acquisition will enable Chesapeake to further its goal of owning approximately two-thirds of the rigs that it operates in its drilling program – a key aspect of its vertical integration strategy – at an attractive price per rig. Bronco currently owns 22 high-quality drilling rigs primarily operating in the Williston and Anadarko basins, including three that are under contract with Chesapeake. Chesapeake is currently Bronco’s second largest customer.

Following the closing of the transaction, Chesapeake will integrate Bronco’s 22 rigs into Chesapeake’s wholly owned subsidiary, Nomac Drilling, L.L.C., which currently owns 95 drilling rigs available for service, of which 90 are currently drilling under contract for Chesapeake. The company is currently operating a total of 160 drilling rigs and plans to end 2012 utilizing approximately 200 drilling rigs. Chesapeake believes that the acquisition of Bronco should satisfy the vast majority of Chesapeake’s anticipated rig investment needs through 2012.

Aubrey K. McClendon, Chesapeake’s CEO, stated, “We have known and admired Bronco’s management team and assets for years and we are especially pleased to announce this transaction today. The acquisition of Bronco is a great additional step in our vertical integration strategy and increases confidence in our plan to ramp up drilling activities in highly lucrative, liquids-rich unconventional resource plays. We look forward to working with Bronco’s management team to quickly complete this transaction and integrate operations.”

D. Frank Harrison, Bronco’s Chairman and CEO, stated, “We are excited about this transaction with Chesapeake, one of the premiere and most innovative energy companies in the world. Chesapeake’s visionary and people-centric approach is highly admired. We view this as a great opportunity and in the best interests of Bronco, our shareholders and our employees.”

The definitive agreement entered into by Chesapeake and Bronco provides for Chesapeake to acquire Bronco in a two-step transaction. The first step will consist of a cash tender offer to be made by a wholly owned subsidiary of Chesapeake for all outstanding shares of Bronco common stock at a price of $11.00 per share in cash. In the second step, the tender offer will be followed by a merger in which the holders of the outstanding shares of Bronco common stock not purchased in the tender offer will receive the same per share price paid in the tender offer, in cash, without interest. Upon completion of the transaction, Bronco will become an indirect wholly owned subsidiary of Chesapeake. The tender offer will be conditioned upon a majority of the outstanding shares of Bronco common stock being tendered into the offer and will also be subject to regulatory clearances and other customary terms and conditions.

Chesapeake is expected to launch the tender offer shortly and the transaction is expected to close in the second quarter of 2011, subject to customary closing conditions. The transaction is not subject to or conditioned upon financing arrangements.

- 9 -

27. The market also expected the Company’s stock price to increase well above the paltry offer of $11.00 per share, as one analyst had set an expected price target of $13.50 per share for the Company’s stock. In fact, since June 29, 2010, Bronco’s stockprice had performed better than any of its 14 industry peers, according to data compiled byBloomberg. This rise in Bronco’s stock is captured by the following chart:

28. The lowball $11.00 per share price also fails to take into account the synergies that Chesapeake stands to gain as a result of the Proposed Acquisition. For example, Chesapeake stated in the Announcement that the Proposed Acquisition will enable Chesapeake to further its goal of owning approximately two-thirds of the rigs that it operates in its drilling program, which Chesapeake calls a “key aspect of its vertical integration strategy.” As Chesapeake stated in the Announcement, “[t]he acquisition of Bronco is a great additional step in our vertical integration strategy and increases confidence in our plan to ramp up drilling activities in highly lucrative, liquids-rich unconventional resource plays.”

- 10 -

29. The Proposed Acquisition was pushed through at the behest of the Company’s largest shareholders, Third Avenue and Inmobilaria, who were seeking to lock in recent gains and sell their large and illiquid blocks of Bronco shares. This interest is not shared by and, indeed is at odds with, the interests of the rest of the Company’s public shareholders. Third Avenue and Inmobilaria own a combined 32% of the Company and have entered into agreements binding them to tender all their shares into the lowball Chesapeake offer. Moreover, Inmobilaria, which is controlled by Mexican billionaire Carlos Slim, also owns 5.44 million warrants to buy Bronco shares at just $7 per share, which could boost Inmobilaria’s stake to at least 20% before the Proposed Acquisition closes. And Third Avenue already owns nearly 20% of the Company. In other words, Third Avenue and Inmobilaria could control nearly 40% of the Company’s outstanding shares by the time a stockholder vote on the Proposed Acquisition takes place. These voting agreements, along with the combined 5.46% ownership interest of Company insiders, render the Proposed Acquisition a virtualfait accompli, absent judicial intervention. Inmobilaria’s gains were articulated by the following article, issued just before the Announcement:

Mexico tycoon triples money in Bronco Drilling investment

Carlos Slim’s investment in an Edmond-based oil driller has more than tripled in value during the past nine months, giving the Mexican billionaire a boost as he adds to his energy investments.

Shares of Bronco Drilling Co. dipped 4 cents Wednesday on the Nasdaq Stock Market, closing at $10.86. That’s more than triple its price on June 29, giving it the best performance since then among 14 industry peers, according to data compiled by Bloomberg.

Slim, who has a joint venture with Bronco in Mexico, is entering Colombia’s oil market through a separate $23.3 million acquisition. He has a 15 percent stake in Bronco, making him the second-largest shareholder after Third Avenue Management LLC, plus warrants that could boost his stake to 20 percent.

Bronco has benefited from rising oil prices and from its own strategy of selling off rigs that use older technology, reducing debt and readying new rigs with more modem design, said Brian Uhlmer, an analyst at Global Hunter Securities LLC in Houston who recommends buying the shares.

“People started paying attention to it,” Uhlmer said in a phone interview. “They figured out that management had transformed the company from a bunch of non-performing assets.”

- 11 -

Slim’s stake in Bronco is worth about $46 million, or more than 60 of his public holdings of $73.8 billion, according to data compiled by Bloomberg.

His Colombian investment, a stake in Geoprocesados SA’s Tabasco Oil Co., is held through publicly traded Grupo Carso SAB, whose construction unit also provides drilling services to Petroleos Mexicanos.

Slim said in a February interview that he’s betting on commodities because of the surge in demand he expects from developing countries such as India and China. Crude oil prices have climbed about 30 percent in the past year.

Slim’s Inmobiliaria Carso fund disclosed a stake of 2.2 million shares in Bronco in October 2008, when the stock was trading above $6. He bought an additional 2 million shares through March 2009 as the stock fell further. He has warrants to buy 5.44 million Bronco shares for at least $7 apiece.

Bronco insiders have also benefited from the company’s share gains. Chairman and CEO Frank Harrison has sold more than 77,000 shares since Feb. 25 after an award of almost 106,000 restricted shares in January. Executive Vice President Zachary Graves sold 127,000 shares since Jan. 12 after an award of 103,000 restricted shares in January.

30. In addition, in a proxy statement issued in November 2010, the Company described Inmobilaria’s ownership interest as follows:

Based solely upon information obtained from Schedule 13D/A filed with the SEC on March 8, 2010 by Inmobiliaria Carso, S.A. de C.V., or lnmobiliaria, and Carso lnfraestructura y Construccion, S.A.B. de. C.V., or CICSA. Pursuant to the Schedule 13D/A, Inmobiliaria beneficially owns directly 4,200,000 shares of our common stock as of March 8, 2010. CICSA directly owns a warrant, which represents the right, subject to certain terms, conditions and limitations, to purchase up to 5,440,770 shares of our common stock. As of March 8, 2010, the number of shares of our common stock issuable upon exercise of the warrant after giving effect to the limitations set forth in the warrant is 1,554,360 shares of our common stock. Mr. Carlos Slim Helú, Mr. Carlos Slim Domit, Mr. Marco Antonio Slim Domit, Mr. Patrick Slim Domit, Ms. Maria Soumaya Slim Domit, Ms. Vanessa Paola Slim Domit and Ms. Johanna Monique Slim Domit indirectly beneficially own a majority of the issued and outstanding voting and equity securities of each of Inmobiliaria and CICSA and therefore may be deemed to share beneficial ownership of all of the company shares beneficially owned by Inmobiliaria and CICSA. Due to the relationship among Inmobiliaria, CICSA and each of the individuals listed above, these reporting persons may be deemed to constitute a “group”, and therefore each reporting person may be deemed to beneficially own all of the company shares beneficially owned by lnmobiliaria and CICSA. Each of Inmobiliaria and CICSA disclaims beneficial ownership of all of the shares of our common stock that may be deemed to be beneficially owned by it except with respect to any shares of our common stock directly owned by such reporting person.

- 12 -

31. The Company’s insiders also pushed through the Proposed Acquisition in an attempt to lock in their gains as well. For example, defendant Harrison, Bronco’s Board Chairman and CEO, sold more than 77,000 shares between February 25, 2011 and March 25, 2011, after an award of nearly 106,000 restricted shares in January. And Executive Vice President Graves sold 127,000 shares since January 12, 2011, after an award of 103,000 restricted shares in January.

32. Through the Proposed Acquisition, these Company insiders are attempting to complete their personal stock sale and achieve immediate vesting of otherwise long-term illiquid restricted shares. Additionally, management stands to gain extremely lucrative “change of control payments” just for negotiating the Proposed Acquisition and selling out the Company’s public shareholders. Harrison is set to receive an over$3 million windfall in change of control benefits. This amount existsin addition to the approximate $6 million that Harrison will receive for his illiquid block of shares and stock options in Bronco. These benefits of “change of control” payments and immediate vesting of restricted shares are not shared by the Company’s non-insider public stockholders.

33. Through the Proposed Acquisition, these Company insiders are attempting to complete their personal stock sale and achieve immediate vesting of otherwise long-term illiquid restricted shares. Again, this benefit of immediate vesting of restricted shares is not shared by the Company’s non-insider public stockholders.

34. In sum, defendants face serious conflicts of interest in connection with the Proposed Acquisition. Thus, defendants have breached and will continue to breach their fiduciary duties of loyalty, due care, independence, candor, good faith and fair dealing to the Company’s public shareholders.

35. Because defendants dominate arid control the business and corporate affairs of Bronco and are in possession of private corporate information concerning the Company’s assets, business and future prospects, there exists an imbalance and disparity of knowledge and economic power between them and the public shareholders of Bronco, which makes it inherently unfair for them to favor their own personal interests to the exclusion of maximizing stockholder value.

- 13 -

36. Plaintiff seeks injunctive relief to prevent defendants from favoring their own personal interests and failing to maximize shareholder value unless and until they remedy their breaches of fiduciary duty.

CLASS ACTION ALLEGATIONS

37. Plaintiff brings this action individually and as a class action on behalf of all holders of Bronco common stock who are being and will be harmed by defendants’ actions described herein (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendants.

38. This action is properly maintainable as a class action.

39. The Class is so numerous that joinder of all members is impracticable. According to the Company’s U.S. Securities Exchange Commission filings, as of February 28, 2011, there were over 28 million shares of Bronco common stock outstanding.

40. There are questions of law and fact which are common to the Class and which predominate over questions affecting any individual Class member. The common questions include,inter alia, the following:

(a) whether the Individual Defendants have breached their fiduciary duties of undivided loyalty, independence, or due care with respect to plaintiff and the other members of the Class in connection with the Proposed Acquisition;

(b) whether the Individual Defendants are engaging in self-dealing in connection with the Proposed Acquisition;

- 14 -

(c) whether the Individual Defendants have breached their fiduciary duty to secure and obtain the best price reasonable under the circumstances for the benefit of plaintiff and the other members of the Class in connection with the Proposed Acquisition;

(d) whether the Individual Defendants are unjustly enriching themselves and other insiders or affiliates of Bronco and Chesapeake;

(e) whether the Individual Defendants have breached any of their other fiduciary duties to plaintiff and the other members of the Class in connection with the Proposed Acquisition, including the duties of good faith, diligence, honesty and fair dealing;

(f) whether the Individual Defendants have breached their fiduciary duties of candor to plaintiff and the other members of the Class in connection with the Proposed Acquisition;

(g) whether the Individual Defendants, in bad faith and for improper motives, have impeded or erected barriers to discourage other offers for the Company or its assets; and

(h) whether plaintiff and the other members of the Class would be irreparably harmed as a result of defendants’ conduct.

41. Plaintiff’s claims are typical of the claims of the other members of the Class and plaintiff does not have any interests adverse to the Class.

42. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

43. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class which would establish incompatible standards of conduct for the party opposing the Class.

- 15 -

44. Plaintiff anticipates that there will be no difficulty in the management of this litigation. A class action is superior to other available methods for the fair and efficient adjudication of this controversy.

45. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

FIRST CAUSE OF ACTION

Breach of Fiduciary

Against the Individual Defendants

46. Plaintiff incorporates by reference ¶¶l-45 as if fully set forth herein.

47. The Individual Defendants have violated the fiduciary duties of care, loyalty, candor, good faith, and independence owed to the public shareholders of Bronco and have acted to put their personal interests ahead of the interests of the Company’s shareholders.

48. By the acts, transactions and courses of conduct alleged herein, defendants, individually and acting as a part of a common plan, are attempting to unfairly deprive plaintiff and other members of the Class of the true value inherent in and arising from Bronco.

49. As demonstrated by the allegations above, the Individual Defendants failed to exercise the care required, and breached their duties of loyalty, good faith, candor and independence owed to the shareholders of Bronco because, among other reasons:

(a) they failed to take steps to maximize the value of Bronco to its public shareholders; and

(b) they ignored and did not protect against the numerous conflicts of interest resulting from the directors’ own interrelationships in connection with the Proposed Acquisition.

50. Because the Individual Defendants dominate and control the business and corporate affairs of Bronco, and are in possession of private corporate information concerning the Company’s assets, business and future prospects, there exists an imbalance and disparity of knowledge and economic power between them and the public shareholders of Bronco which makes it inherently unfair for them to pursue a course of conduct that will benefit them to the exclusion of maximizing stockholder value.

- 16 -

51. By reason of the foregoing acts, practices and course of conduct, the Individual Defendants have failed to exercise ordinary care and diligence in the exercise of their fiduciary obligations toward plaintiff and the other members of the Class.

52. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to plaintiff and the Class, all to the irreparable harm of the Class.

53. The Individual Defendants are engaging in self-dealing, are not acting in good faith toward plaintiff and the other members of the Class, and have breached and are breaching their fiduciary duties to the members of the Class. Plaintiff and the members of the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can plaintiff and the Class be fully protected from the immediate and irreparable injury which defendants’ actions threaten to inflict.

SECOND CAUSE OF ACTION

Aiding and Abetting the Individual Defendants’

Breaches of Fiduciary Duty Against Bronco

54. Plaintiff incorporates by reference ¶¶l-53 as if fully set forth herein.

55. Defendant Bronco knowingly assisted the Individual Defendants’ breaches of fiduciary duty in connection with the Proposed Acquisition, which, without such aid, would not have occurred.

56. As a result of this conduct, plaintiff and the other members of the Class have been and will be damaged in that they have and will be prevented from obtaining a fair price for their shares.

57. Plaintiff and the members of the Class have no adequate remedy at law.

- 17 -

PRAYER FOR RELIEF

WHEREFORE, plaintiff demands injunctive relief, in her favor and in favor of the Class and against defendants as follows:

A. Declaring that this action is properly maintainable as a class action;

B. Enjoining defendants, their agents, counsel, employees, and all persons acting in concert with them from placing their own interests ahead of those of plaintiff and the Class, unless and until defendants adopt and implement a procedure or process to maximize shareholder value;

C. Directing the Individual Defendants to exercise their fiduciary duties to act in a manner that maximizes shareholder value;

D. Rescinding, to the extent already implemented, any barriers to the maximization of shareholder value;

E. Awarding plaintiff the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff hereby demands trial by jury.

| DATED: April 20, 2011 | Respectfully Submitted, | |||

| ||||

| DARREN B. DERRYBERRY, OBA No. 14542 | ||||

| DERRYBERRY & NAIFEH, LLP | ||||

| 4800 N. Lincoln Blvd. | ||||

| Oklahoma City, OK 73105 | ||||

| Telephone: 405/528-6569 | ||||

| 405/528-6462 (fax) | ||||

- 18 -

ROBBINS GELLER RUDMAN & DOWD LLP |

RANDALL J. BARON |

A. RICK ATWOOD, JR. |

DAVID T. WISSBROECKER |

655 West Broadway, Suite 1900 |

San Diego, CA 92101 |

Telephone: 619/231-1058 |

619/231-7423 (fax) |

THE BRISCOE LAW FIRM, PLLC |

WILLIE C. BRISCOE |

8117 Preston Road, Suite 300 |

Dallas, TX 75225 |

Telephone: 214/706-9314 |

214/706-9315 (fax) |

POWERS TAYLOR LLP |

PATRICK W. POWERS |

Campbell Centre II |

8150 North Central Expressway, Suite 1575 |

Dallas, TX 75206 |

Telephone: 214/239-8900 |

214/239-8901 (fax) |

Attorneys for Plaintiff |

- 19 -