Exhibit 99.1

APRIL 2013

| | |

| |

AFFINIA INFORMATION MEMORANDUM |

| | |

CONFIDENTIAL

Exhibit 4.1

Key credit highlights

| | |

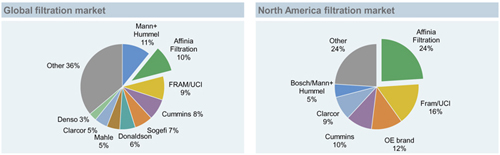

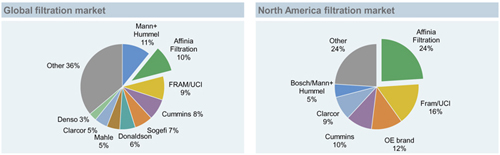

| Diverse revenue base with leading market positions and a breadth of world-class products | | • One of the largest global suppliers of aftermarket products with leading market positions in all primary categories |

| | • Based on management estimates, Affinia holds the #1 market position in North America and Eastern Europe aftermarket filtration and the #2 market position in Brazilian aftermarket parts distribution, North American chassis products and global aftermarket filtration |

Portfolio of highly regarded aftermarket Brands | | • Affinia has one of the broadest aftermarket product offerings in the world |

| | • Well-known portfolio of product brands, including WIX®, ecoLAST®, Filtron®, Raybestos®, McQuay- Norris® and Nakata®, along with its leading South American distribution brand, Pellegrino® |

| | • Through its WIX®, ecoLAST® and Filtron® brands, Affinia has one of the broadest filter product offerings in the global aftermarket |

Long-standing customer relationships and world-class award recognition | | • Significant customer loyalty as the Company’s top ten customers have relationships averaging approximately 23 years |

| | • Affinia has supplied its largest customer, NAPA, with products for more than 46 years |

| | • The Company is well-known for its fast turnaround times and typically ships orders within 24 to 48 hours of receipt |

| | • Successfully maintains a market-leading on-time delivery rate of nearly 100% and an order fill rate of approximately 95% across the three business units |

| | • Affinia and its products and brands have been widely recognized by customers and consumers for unparalleled quality and service |

Global low-cost manufacturing and distribution footprint | | • As part of the Company’s broader restructuring, management has focused on shifting select manufacturing operations to low cost countries |

| | • Affinia has closed or sold 74 facilities globally and has built or acquired several facilities in lower cost countries, such as China, Mexico and Ukraine |

Unmatched quality assurance and control | | • World Smart™ Quality Management System ensures that every product in any country follows the same production standards and can be sold at market prices globally |

Exposure to favorable aftermarket trends | | • The Company benefits from the attractive long-term industry trends of the global aftermarket, and Affinia’s global footprint capitalizes on trends in emerging markets |

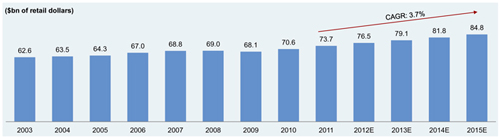

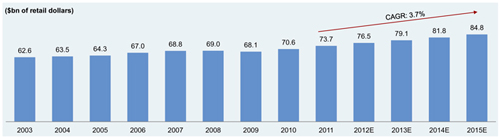

| | • Since 1991, the US automotive aftermarket has only declined in one year (1.3% in 2009) |

| | • According to the latest Automotive Aftermarket Industry Association (“AAIA”) forecast, in 2013 aftermarket sales are expected to grow 3.5% |

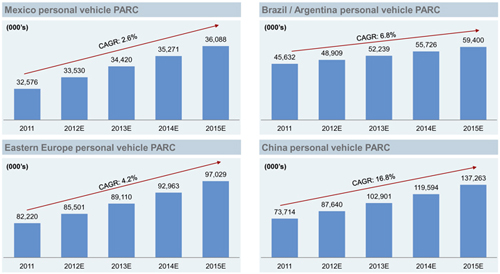

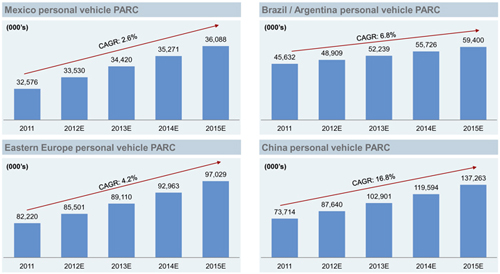

| | • Vehicle population of Brazil, Argentina, China and Eastern Europe are estimated to grow by a CAGR of 9.9% from 2011 to 2014 |

| | • Affinia’s primary markets, the maintenance and wear replacement markets, are expected to outpace the overall aftermarket as these markets are not impacted by the increasing durability of vehicles |

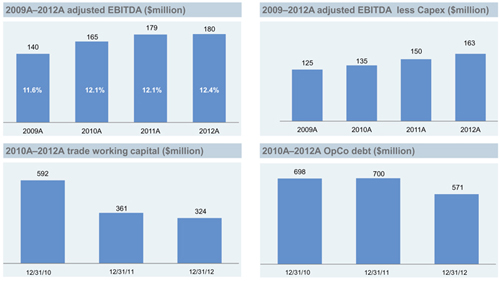

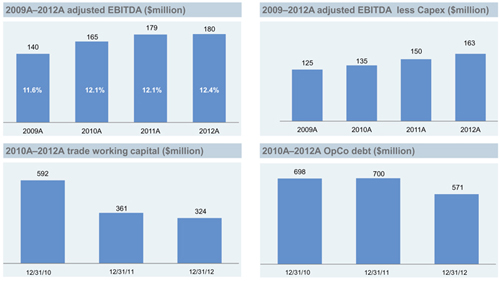

Strong operating efficiency and cash flow generation | | • Affinia’s focus on operating cost savings and achieving a high return on assets, combined with relatively low CapEx requirements, will allow the Company to continue generating significant free cash flow in the future |

| | • The Company increased its operating margins from 6.9% in 2005 to 9.0% in 2012 |

| | • Affinia has reduced its net trade working capital from $592 million at 12/31/10 to $324 million at 12/31/12 |

| | • Affinia has demonstrated a commitment to de-levering, having reduced its operating company debt from $698 million at 12/31/10 to $571 million at 12/31/12 |

Accomplished and experienced management team | | • Affinia’s operations are led by an experienced management team that has successfully transformed the business over the past eight years |

| | • Seasoned management team with extensive track record in achieving organic and inorganic growth opportunities |

| | • The Company’s top ten executives have an average of more than 25 years in the automotive aftermarket and industrial sectors |

12

CONFIDENTIAL

Diverse revenue base with leading market positions and a breadth of world-class products

Affinia is a global leader in the on- and off-highway vehicle replacement products and services industry through its extensive aftermarket product offering that consists principally of branded and private label filtration and chassis products. The Company has the broadest product coverage and highest quality reputation, coupled with the best speed-to-market, customer service, fill rates and on-time delivery records in the aftermarket industry. Affinia’s product portfolio and quality standards ensure that it can quickly supply service professionals with the appropriate replacement part to repair a vehicle in the shortest time with the lowest chances of malfunction. The Company’s World Smart™ Quality Management System outlines the basic premise that no matter where in the world the product is manufactured, the product meets all required design and performance specifications.

The Company has the unique capability to add new SKUs more quickly than its competitors, which enables Affinia to keep pace with the introduction of new vehicle models. Affinia can design new products and bring them to market in as little as four months after a new vehicle is introduced. The Company has developed and accumulated more than 128,000 SKUs covering nearly every vehicle in the market today. Affinia’s product coverage and market-leading customer satisfaction have entrenched long-standing customer relationships that provide a substantial competitive advantage.

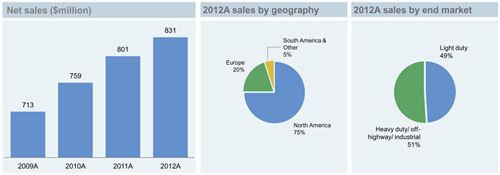

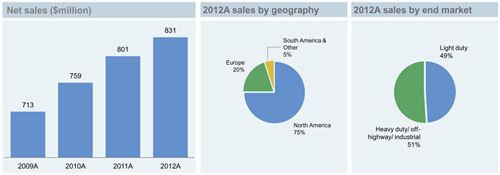

The Company is one of the largest global manufacturers of aftermarket filters for heavy-duty applications.Approximately 51% of global Filtration net sales are for heavy-duty and off-highway applications (i.e., residential construction, non-residential construction, mining, forestry, marine and agricultural). Operators of commercial vehicles depend on high-quality products and short delivery times to minimize costly equipment downtime. Heavy-duty and off-highway filtration products also require technologies that are more complex. As a result, these products are priced at three to four times the price of filters used in light vehicles, which supports higher margins.

Exhibit 4.2

Market position by product category

| | | | |

Product category | | Region | | Market position |

Aftermarket Filtration | | Global | | #2 |

Aftermarket Filtration | | North America | | #1 |

Aftermarket Filtration | | Poland | | #1 |

Aftermarket Filtration | | Europe | | #4 |

Aftermarket Chassis | | North America | | #2 |

Aftermarket Parts Distribution | | Brazil | | #2 |

Aftermarket Parts Manufacturing | | South America | | #4 |

Source: Management estimates and NPD data

13

CONFIDENTIAL

Exhibit 4.3

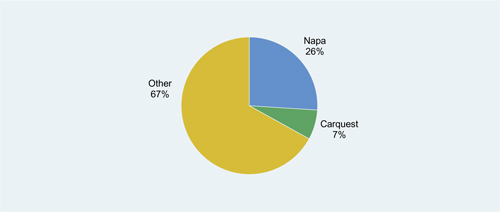

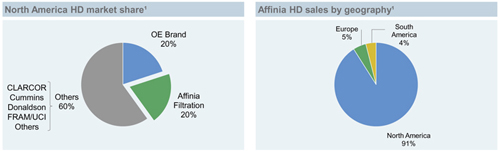

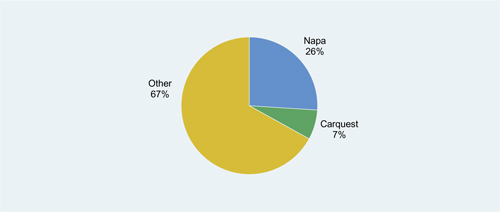

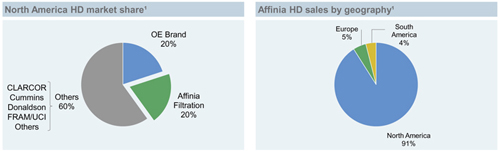

Market share overview

Source: Frost & Sullivan; McKay Brand Preference; Management estimates

Note: Market shares as of 2011

Portfolio of highly regarded aftermarket brands

Affinia’s brands have a reputation for form, fit, function and quality, and these attributes are highly sought after by professional installers and technicians, the most common purchasers of products in the aftermarket. The Company’s well-known portfolio of brands includes WIX®, ecoLAST®, Filtron®, Raybestos®, McQuay-Norris® and Nakata®, and the company also supplies parts for reputable private label brands such as NAPA, CARQUEST and ACDelco. The Company competes primarily in the higher-end, premium portion of the market, which supports higher prices due to stricter quality standards and superior product performance. Professional installers recognize the superior quality and reputation associated with Affinia’s brands, and prefer the Company’s premium products over competitors’ alternative economy products in order to avoid “come backs”.

Within the Company’s ASA business unit, Pellegrino® distribution operates extensively in the Brazilian territory and is one of the largest and most recognized parts distributors covering the light vehicle and heavy-duty sectors. Management believes that in 2012, Pellegrino® distribution held the #2 market position in Brazilian aftermarket parts distribution and Affinia Automotiva held the #4 position in aftermarket parts manufacturing in South America.

Exhibit 4.4

Highly regarded brands/entities

14

CONFIDENTIAL

Long-standing customer relationships and world-class award recognition

Exhibit 4.5

Long-standing customer relationships

Exhibit 4.6

2012A Revenue by customer

15

CONFIDENTIAL

Affinia has supplied the automotive aftermarket parts industry for over 70 years, and during this time, the Company has fostered deep, long-standing relationships with leading commercial vehicle and automotive parts retailers and wholesale distributors. The Company’s successful customer partnerships have resulted in significant customer loyalty based on shared values of product quality, responsive service and integrity. Each of Affinia’s top customers has a tenure with the Company of more than 23 years.

As a result of the Company’s efficient supply chain management, Affinia successfully maintains a market-leading on-time delivery rate of nearly 100% and an order fill rate of approximately 95% across the three business units. These are key factors for the Company’s blue-chip customer base given the critical nature of its aftermarket products to the safety and performance of vehicles.

Affinia has been continually recognized by its North American customers as the premier aftermarket company, receiving awards including theO’Reilly Sales and Service Award, Auto Value Outstanding Parts Master Vendor Award, Aftermarket Auto Parts Alliance Supplier of the Year and theAutomotive Distribution Network Exceptional Sales Teamrecognitions. Importantly, Affinia has also been recognized by its largest customer, NAPA, with theSpirit of NAPA Award an unprecedented 15 times out of 36 years. Global Filtration has won theSpirit of NAPA Award an unprecedented nine times, including most recently in 2012. In 2011, Filtration became one of the laureates of the European Business Awards in the category ofInternational Growth Strategy of the Year, having demonstrated exceptional financial returns, strong growth and innovative strategies.

In South America, Affinia has been awardedSupplier of the Year by its largest customer, Mayor Beval, four times since 2007. In 2012, Nakata®-branded products won the Vehicle Reparation Union’s silver award (Prêmio Sindirepa) for its suspension components. And in 2010 and 2012, Brazil’sNovo Meio magazine rated Pellegrino® distribution the best overall automotive parts distributor after a survey of 500 jobbers, including the top rating in several categories that included service speed, customer support, commercial / returns policy, warranties and product quality.

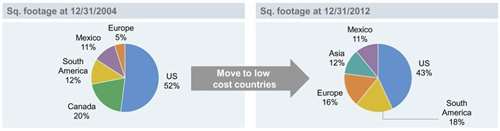

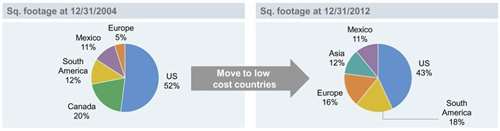

Global low-cost manufacturing and distribution footprint

As a result of a management initiative to focus on efficient operations and maximization of profitability, Affinia succeeded in consolidating domestic manufacturing facilities and transitioning to lower cost countries, as well as divesting non-core assets with higher capital expenditure needs.

Since Affinia was founded in late 2004, the Company has shifted a significant portion of its manufacturing and distribution base to low cost countries. In the last eight years, the Company has closed or sold 74 facilities globally and has built or acquired several facilities in lower labor-cost countries, such as China, Mexico and Ukraine.

16

CONFIDENTIAL

Exhibit 4.7

Transformation of Affinia, 2004 - 2012

Manufacturing footprint by sq. ft.

Global manufacturing Facilities (‘05 vs. ‘12)

World-class quality assurance and control

Affinia demonstrates its commitment to excellence and product quality across all business lines through its quality assurance program. The Company’s guiding principle is its World Smart™ Quality Management System, which establishes unparalleled quality standards and ensures that no matter where in the world the product is manufactured, the product meets design and performance specifications required by the Company. Quality assurance and control is a core value for Affinia and each business unit is dedicated to ensuring that every product meets the Company’s stringent quality expectations.

17

CONFIDENTIAL

| | |

The program focuses on customers, supplier relationships, continual improvement and involved personnel. The Company tracks customer order fill, packing accuracy, shipping accuracy, customer returns / rejects and scrap to continuously address and improve customer satisfaction. In an effort to maximize and optimize supplier relationships, Affinia keeps supplier scorecards and tracks supplier PPM, on-time deliveries and other supplier metrics. Affinia tracks its employee productivity through a number of metrics. Further, nearly all of the Company’s facilities are TS-16949, ISO-9001 and ISO-14001 registered and it employs a number of measures to ensure continual improvement to processes and operations. |

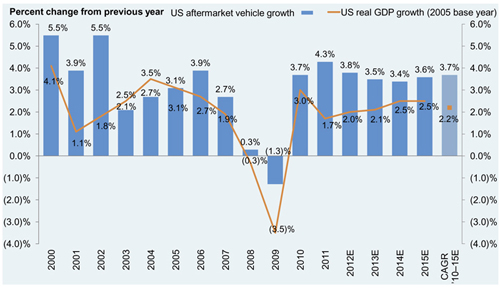

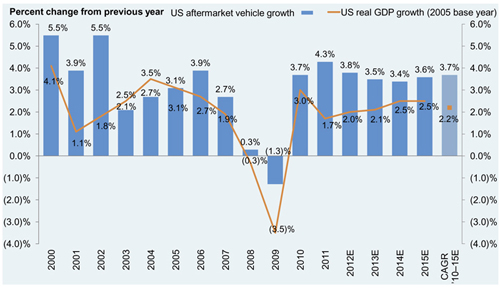

Affinia has developed an annual self-audit to ensure commitment to quality and compliance with Affinia Global Quality and Design standards. The self-audit is designed around universal quality standards and must be reviewed and endorsed by each facility’s Quality Manager, along with the Plant Manager and Business Unit President. The audit is reviewed by the quality committee, which includes members from various global locations. If a facility meets the quality standards, it receives a plaque, flag and banner in recognition of its quality achievements. To maintain certification, the facility must pass an annual review by the Affinia Internal Auditing team. Exposure to favorable aftermarket trends Compared to the overall automotive and industrial markets, revenues in the automotive aftermarket are very stable. Since 1991, sales in the US automotive aftermarket have only declined once (1.3% in 2009). | |

|

According to the latest U.S. Census data and AAIA forecasts, end user sales in the US automotive aftermarket increased by 4.3% from 2010 to 2011 and were expected to grow by 3.8% in 2012. In 2013-2015, aftermarket sales are expected to grow by ~3.5% annually. |

18

CONFIDENTIAL

Exhibit 4.8

Growth rate of the US motor vehicle aftermarket and US real GDP growth

Source: Aftermarket Vehicle: AAIA Channel Forecast Model; GDP Projections: Business Monitor International

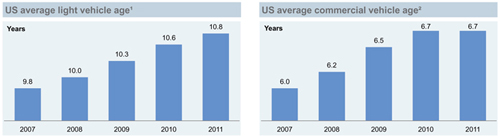

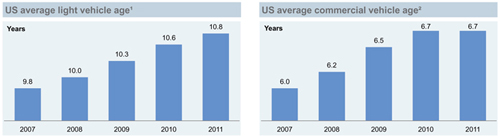

The recent realignment of original equipment manufacturers (“OEM”) and auto dealerships, which has resulted in the closure of more than 3,000 auto dealerships in the U.S. since 2008, has created new product and service opportunities for the independent aftermarket. The recent economic crisis also resulted in a significant decline in new vehicle sales which has led to an increase in the average vehicle age and created additional demand for out-of-warranty (i.e., independent repair shop) servicing and repair. The Company and the aftermarket are expected to directly benefit from these industry dynamics.

Exhibit 4.9

US vehicle age

| 2 | ACT Research Co., LLC, based on class 8 vehicles |

19

CONFIDENTIAL

A global increase in the base of consumers capable of purchasing a vehicle and a steadily increasing population of age-eligible drivers is creating greater demand for vehicles. These industry characteristics, particularly when combined with an aging vehicle fleet and increased total miles driven, support strong long-term demand for aftermarket replacement products.

Exhibit 4.10

Vehicle PARC growth in select markets

Source: Polk total world wide vehicle PARC

The Company derived approximately 51% of its 2012 Filtration revenues and approximately 28% of its 2012 ASA revenues from the premium heavy-duty equipment market, which includes on-highway trucks, residential and non-residential construction equipment, agricultural equipment, industrial equipment, marine applications and severe service vehicles. The premium filtration category has experienced growth rates and margins in excess of the traditional aftermarket and economy level products, primarily as a result of the increased focus on emissions, the growing importance of fuel efficiency and the high costs operators incur as a result of commercial vehicle down-time.

Exhibit 4.11

Medium and heavy-duty aftermarket sales

Source: AAIA

20

CONFIDENTIAL

Strong operating efficiency and cash flow generation

Since 2005, Affinia has consolidated domestic manufacturing facilities and transitioned to lower cost countries, which has successfully lowered its manufacturing and distribution costs, thereby improving margin performance, total return on assets and free cash flow generation.

During this same period, Affinia’s sales increased from approximately $1.0 billion in 2005 to nearly $1.5 billion in 2012, and the Company increased its operating margins from 6.9% in 2005 to 9.0% in 2012. Affinia has demonstrated strong capital management abilities by reducing its net trade working capital from $592 million at 12/31/10 to $324 million at 12/31/12 and has demonstrated a commitment to de-levering by reduced its operating company debt from $698 million at 12/31/10 to $571 million at 12/31/12. Affinia’s focus on operating cost savings, relatively low capital expenditure requirements, and strong capital management practices position the Company to maximize profitability and generate significant free cash flow going forward.

Exhibit 4.12

Operating metrics

Note: Excludes discontinued operations

21

CONFIDENTIAL

Accomplished and experienced management team

Affinia’s strong financial performance and operations are led by an experienced management team that has successfully transformed the business over the past eight years. Led by Chief Executive Officer Terry McCormack, the Company’s senior management team has an average of more than 23 years of experience in the aftermarket and industrial sectors. These executives have been instrumental to the Company’s efforts to shift the manufacturing footprint to lower labor-cost countries and penetrate high growth emerging markets. Management has focused on maintaining, growing and enhancing the Company’s customer relationships, entering into new markets and positioning Affinia to capitalize on many significant growth opportunities.

Exhibit 4.13

Affinia management team

| | | | | | | | | | |

Name | | Title | | Years with

company | | | Years in

industry | |

| Terry McCormack | | Chief Executive Officer and President | | | 40 | | | | 40 | |

| Keith Wilson | | President, Global Filtration | | | 29 | | | | 29 | |

| Jorge Schertel | | President, South America | | | 42 | | | | 42 | |

| Rick Pizarek | | President, Global Chassis | | | 17 | | | | 17 | |

| Thomas Madden | | Senior Vice President and Chief Financial Officer | | | 39 | | | | 39 | |

| Steven Keller | | Senior Vice President, General Counsel and Secretary | | | 20 | | | | 20 | |

| Patrick Manning | | Vice President, Business Development | | | 18 | | | | 18 | |

| Timothy Zorn | | Vice President, Human Resources | | | 38 | | | | 38 | |

| Sam Quick | | Chief Information Officer | | | 6 | | | | 8 | |

| Tom Kaczynski | | Vice President, Treasurer | | | 8 | | | | 21 | |

22

CONFIDENTIAL

| 5. | Affinia Filtration overview |

History

Jack Wicks and Paul G. Crawshaw founded WIX® Filters in Gastonia, North Carolina in 1939. With the patented creation of the revolutionary “spin-on” filter in 1954, a design similar to what is still used in most filters today, WIX® Filters experienced significant growth by offering a superior alternative to competitor filters which needed to be housed in a compartment mounted on the engine block. After more than a half-century of growth and innovation, in December 2004 WIX® Filters joined the Affinia Group and has since continued to solidify its position as the global leader in heavy-duty, automotive and light truck filtration.

Business overview

Affinia Filtration is the world’s leading designer, manufacturer, marketer and distributor of a broad range of filtration products for the aftermarket, and is one of only a few aftermarket suppliers of both heavy-duty and off-highway / industrial filters and automotive and light truck filters. Affinia Filtration benefits from industry leading brands, long-standing customer relationships and a global low-cost manufacturing and distribution footprint, along with an all-makes / all-models product line of oil, air, fuel, cabin air, coolant, hydraulic and other filters. Affinia Filtration’s products are used in light, medium and heavy-duty on- and off-highway vehicles, in addition to various industrial and marine applications. The numerous strengths of Filtration have led to a #1 market position in the North America filtration aftermarket and a leading market position in Europe. Filtration is Affinia’s largest business unit, having contributed approximately 57% of global revenues and 72% of total adjusted EBITDA from 2009 to 2012 (excluding discontinued operations).

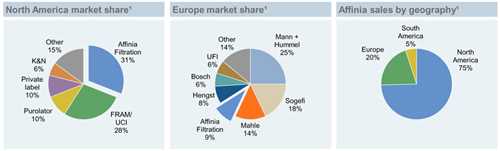

Exhibit 5.1

Affinia filtration market share

Source: McKay Brand Preference, NPD and Company management

Note: Market shares as of 2011

23

CONFIDENTIAL

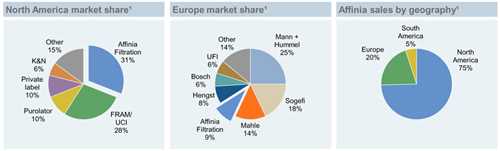

Exhibit 5.2

Affinia Filtration overview

Source: Company management

Heavy-duty filtration – 51% of 2012A filtration sales

Affinia Filtration is among the leading global manufacturers and distributors of aftermarket filters for heavy-duty and off-highway applications, including on-highway trucks, residential and non-residential construction equipment, agricultural, mining, forestry and industrial equipment, severe service vehicles, medium-duty vehicles and marine applications. With over 70 years of experience, Filtration’s heavy-duty filters are designed to withstand harsh elements and provide for optimal filtration and engine protection in less-than-optimal work environments.

Filtration’s full line of heavy-duty products is a key differentiator versus automotive and light truck filtration competitors. In contrast to most automotive and light truck competitors, Affinia is able to provide customers with a full suite of filtration options. Customers, particularly distributors, derive value from having a one-stop-shop supplier that is capable of providing products for a diverse range of end markets. Furthermore, heavy-duty filtration products are generally more technologically advanced and are thus typically priced three to four times higher than similar automotive and light truck products, allowing them to carry higher margins.

Exhibit 5.3

Heavy-duty filtration overview

Source: McKay Brand Preference and Company management

24

CONFIDENTIAL

Exhibit 5.4

Select end markets

Automotive and light truck filtration – 49% of 2012A filtration sales

Affinia Filtration’s automotive and light truck products are at the forefront of filter technology and performance. The portfolio of premium line and value line products are designed to exceed performance demands for a variety of applications, including passenger vehicles, sport utility vehicles, motorcycles and ATVs.

Filtration’s #1 market position in automotive and light truck filtration in North America and leading position in Europe is supported by an unparalleled reputation among distributors and professional installers, an extensive patent portfolio, comprehensive all-makes / all-models vehicle coverage of greater than 99% and the ability to bring new SKUs to market rapidly after a new vehicle’s introduction.

Exhibit 5.5

Automotive and light truck filtration overview

Source: NPD and management

Exhibit 5.6

Select end markets

25

CONFIDENTIAL

While Affinia Filtration’s automotive and light truck reputation was built on its premium line products, in order to serve the broader market and meet its key customers’ needs, Filtration also produces value line products at a lower price point. The primary performance differences between premium and value line products are filter capacity, expected life and efficiency. For a given product, Affinia Filtration typically designs a premium aftermarket filter initially and adds a value option as the targeted vehicle’s age and the addressable market develops.

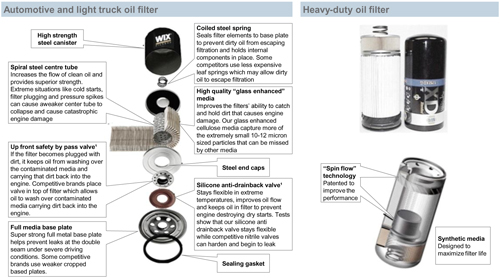

Products

Affinia Filtration’s products include oil, air, fuel, cabin air, coolant, hydraulic and other filters for many types of vehicles and machinery. The products are sold under well-known brands, such as WIX® and Filtron®, and private label brands including NAPA and CARQUEST. All products follow the World Smart™ quality approach, ensuring exact fit, form and function throughout for the approximately 200 million filters produced annually by Affinia Filtration.

The total product portfolio consists of approximately 16,350 filter designs, including 12,650 for heavy duty, 9,500 of which are industrial specific, and 3,700 for automotive and light truck. These products make up over 48,000 unique SKUs to serve Affinia Filtration’s broad customer base.

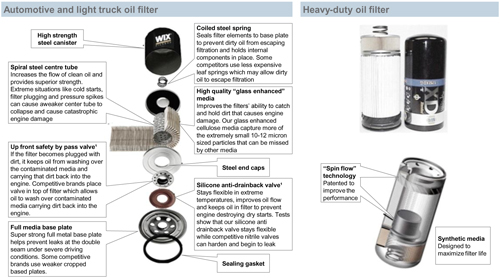

Exhibit 5.7

Affinia Filtration product example

| 1 | Some filters may or may not have these specific features due to OE requirements or other manufacturing processes. Refer to individual part numbers for specific details |

26

CONFIDENTIAL

Exhibit 5.8

Affinia Filtration product overview

| 2 | Includes cabin air, industrial, hydraulic, coolant, small engine, test kits, gaskets, AquaChek and spare products |

Brands

Affinia Filtration markets its products under a variety of well-known brands to automotive aftermarket distributors, heavy-duty distributors and automotive aftermarket retailers.

Exhibit 5.9

Key Affinia Filtration brands

WIX®: The WIX® brand has been a mainstay at the forefront of filter technology and performance for passenger cars, light trucks, heavy trucks, buses and off-highway vehicles. WIX® oil filters hold up to 45% more dirt than its primary competitor. There are six individual filter brands under the WIX® family of products, including:

| | • | | ecoLAST®: A revolutionary new heavy-duty oil filter made by WIX® that reduces equipment downtime and extends useful oil life up to two times. ecoLAST® filters are also environmentally friendly as they can double oil drain intervals and assist in green fleet certification by reducing emissions. Affinia Filtration has an exclusive licensing agreement for the technology used to neutralize engine oil particles in ecoLAST® filters. |

| | • | | WIX® Racing: Used by more than half the teams in NASCAR, WIX® Racing is a trusted brand in high performance racing engines. This line of filters features a special filtration media and element design with a heavy-duty can and cover, as well as a steel, fully perforated spiral center tube that has the highest collapse strength in the industry. The racetrack provides an ideal testing ground for focusing on scenarios such as high temperatures, wide fluctuations in pressures and flows and rapid breakdown of engine oil. |

27

CONFIDENTIAL

| | • | | WIX® XD: A two-stage oil filter for heavy-duty applications. WIX® XD consists of a full flow section and a bypass, part flow section. The filter is designed for applications that produce significant soot and sludge, helping to extend the drain period and mitigate potential contaminants in demanding environments. |

| | • | | WIX® XE:A heavy-duty oil filter that uses 100% synthetic wire back media. The filter is used in engines that need extra fine filtration, including applications in the coal, cement and mining industries. |

| | • | | WIX® XP:A premium filter line for use with synthetic oils. WIX® XP incorporates technology used in racing and off-highway applications, and features wire-backed synthetic media, a silicone anti-drainback valve and an upgraded sealing gasket material for the passenger car and light truck market. |

| | • | | Pro-Tec:WIX®’s value line offering for automotive and light truck applications. Pro-Tec filters are used by most customers as the lower-priced product line. |

Filtron®:A leader in the European filtration aftermarket, Filtron® is a producer and distributor of filters for various automotive and industrial applications. Founded in 1982, Filtron® enjoys leading market share in Poland and a firmly established presence throughout the rest of Europe.

AquaChek:Affinia Filtration set the new standard for compressed air moisture control with the introduction of the polymer technology air drying filter. Specifically designed to address system- wide and point-of-use compressed air moisture control through a non-mechanical spin-on filter solution, each filter can trap water up to 28 times the weight of the filter media itself.

Lee Martin:A leading low-cost filter brand in the Venezuelan aftermarket, Lee Martin services automotive and light truck oil and air applications. Lee Martin has been in the market for over 30 years and has approximately 7% market share.

Customers

Filtration has a very strong customer base that is supported by many relationships that are several decades long, including a relationship with its largest customer, NAPA, that exceeds 46 years. Similarly, Filtration has supplied filter products to its second largest customer, CARQUEST, for over 23 years.

Affinia Filtration provides its customers with the industry’s most extensive range of products and services which has built customer loyalty and generates repeat business. Filtration provides its customers with an unmatched breadth of products, allowing them to source nearly all of their filtration needs from Affinia Filtration, regardless of price point or targeted end market.

Filtration’s customers include automotive aftermarket distributors, heavy-duty distributors and automotive aftermarket retailers.

28

CONFIDENTIAL

Exhibit 5.10

Other customer relationships

Awards

Affinia Filtration has been continually recognized by its customers as the premiere aftermarket filtration company, especially by its key customers in North America, including NAPA, CARQUEST, O’Reilly and the Alliance.

NAPA Awards:Due to NAPA’s powerful position in the aftermarket space, the highly covetedSpirit of NAPA Awardis arguably the most prestigious automotive aftermarket award. The award is voted on by the NAPA Distribution Center management teams and based on extensive criteria, including line leadership, shipping performance, product quality and local sales support. Affinia Filtration has received the award a record nine times, along with being the first supplier to win the award three times in a row (2004–2006). Most recently, Filtration won theSpirit of NAPA Awardin 2010 and 2011.

CARQUEST Awards:Since supplying filters to CARQUEST in 1989, Filtration has won severalSupplier of the Yearawards.

O’Reilly Auto Parts Awards:Affinia Filtration won theO’Reilly Exceptional Sales and Service Awardin 2010 and 2011. In addition, Filtration was awarded special recognition for Acquisition Support in 2010 for outstanding performance during the O’Reilly acquisition of CSK and the ensuing changeover of product lines to Filtration.

Aftermarket Auto Parts Alliance Awards:Since 2000, Affinia Filtration has won a major award from the Alliance in nearly every year, highlighted by six consecutiveSupplier of the Yearawards during the period.

In addition to numerous customer accolades in North America, Affinia Filtration has also been recognized globally as an industry leader. In 2011, Filtration became one of the laureates of the European Business Awards in the category ofInternational Growth Strategy of the Year. This award went to the top ten companies that demonstrated exceptional financial returns, strong growth and innovation strategies and market leadership in their respective sectors. In South America, Affinia Filtration has been awardedSupplier of the Yearby its largest customer, Mayor Beval, four times since 2007, beating out approximately 120 different suppliers.

29

CONFIDENTIAL

Key private labels

Filtration provides private label products to large aftermarket distributors and retailers, including NAPA and CARQUEST.

NAPA:The leading parts distributor in the world, NAPA has over 6,000 stores in the US with 64 strategically located distribution centers. NAPA has the most extensive inventory in the industry with over 400,000 quality parts and accessories for automotive and industrial applications. NAPA also has a unique applications identification system, called NAPA “Pro-link”, that helps the jobber / installer determine the specific part that is needed for each job. A majority of NAPA’s filters are supplied by Affinia Filtration.

CARQUEST:The second largest distributor in the US, CARQUEST is a premier supplier of replacement products, accessories, supplies and equipment for virtually all makes of automobiles, as well as light and heavy-duty trucks, off-road equipment, buses, recreational vehicles and agricultural equipment. CARQUEST has over 3,000 auto part stores throughout North America. In addition, CARQUEST has a sophisticated network of distribution centers and automated inventory and delivery management technology driven by its 18,000 employees. A majority of CARQUEST’s filters are supplied by Affinia Filtration.

Other key private labels include:

| | • | | Auto Extra:A private label value line for automotive and light truck applications that Affinia Filtration sells to Uni-Select, the leading network of independently owned automotive parts dealers in Canada with a growing presence in the US. Auto Extra filters are used by most customers as a value line. |

| | • | | Fleetrite:A maintenance and repair arm of Navistar. This private label includes select heavy- duty filters for Navistar and International Trucks. Launched in January of 2012, this is a new business win for Filtration in Mexico with tremendous upside potential, as indicated by year- to-date growth. |

| | • | | Ingersoll-Rand:Engages in the design, manufacture, sale and service of a diverse portfolio of industrial and commercial products internationally. Affinia Filtration provides Ingersoll-Rand with select private label heavy-duty filters and systems for OEM and OES applications. |

| | • | | Kohler:Kohler engines are supplied to equipment manufacturers worldwide in the lawn and garden, commercial, industrial, agricultural and construction markets. Through two divisions, which manufacture gasoline and diesel engines, respectively, Kohler provides a line of highly engineered performance service parts designed to meet Kohler engine systems’ needs. |

| | • | | LTH:A division of Enertec that is owned by Johnson Controls, LTH is the leading battery supplier for the Latin American market. LTH also supplies filters to their distributors throughout Mexico. |

| | • | | Mopar:The automotive parts arm of Chrysler, Mopar supports all-makes and OES products for Chrysler. This private label is focused on the Canadian market. |

| | • | | NORAUTO:A pioneer with the car care concept, NORAUTO combines each self-service store with a garage that provides repair services for all vehicles. NORAUTO provides a wide range of branded products and operates in seven countries. |

| | • | | Parts Master:A private label value line for automotive and light truck applications that Filtration sells to the Alliance, a network of over 50 independent automotive parts dealers in North America and Europe. Parts Master filters are used by most customers as a lower-priced line |

| | • | | Unipart:The UK’s largest independent supplier of car parts and workshop consumables with distribution centers throughout the region, Unipart provides automotive and commercial vehicle products throughout the European aftermarket. |

| | • | | Volkswagen: Provides a line of quality-tested service parts designed for optimum fit. Volkswagen technicians use these parts to ensure optimal vehicle performance. Affinia Filtration supplies air and fuel filters for first fit and service parts. |

30

CONFIDENTIAL

| 6. | Affinia Chassis overview |

History

Affinia Chassis (“Chassis”) is a manufacturer of heavy-duty and automotive and light truck chassis components that originated from the combination of several businesses, including Krizman Corporation, Jamco and Barmatic. Chassis became a part of the Affinia Group in December 2004. Over the past eight years, Chassis has focused on optimizing its global footprint and manufacturing base, including transitions to lower-cost suppliers and consolidation of facilities. In December 2010, Affinia purchased North American Parts Distributors (“NAPD”) a supplier of lower-volume suspension and steering products which, at the time of the acquisition, generated approximately $40 million in annual revenue (50% of which was sales to Affinia). The acquisition provided access to several new customers and foreign nameplate (“FnP”) applications.

Business overview

Chassis offers the industry’s broadest range of products, including tie rods, ball joints, sway bar bushings and other suspension/drive-line components. Chassis currently holds the #2 market position in North America aftermarket chassis components due to its unmatched commitment to quality and its long-standing customer relationships. Chassis manufactures and supplies products that meet or exceed OEM quality standards under the well-recognized Raybestos® and McQuay-Norris® brands as well as reputable private label brands including NAPA, CARQUEST and ACDelco.

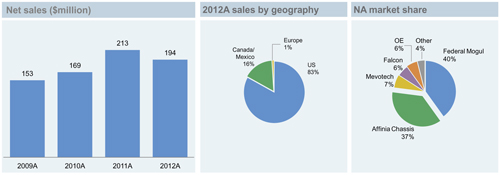

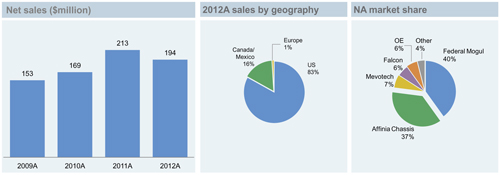

The division has experienced significant growth over the past two years after significant business wins in premium product lines in early 2011. Revenues have increased from $169 million in 2010 to $194 million in 2012, accounting for 13% of Affinia’s global revenue. The Company has offices and manufacturing and distribution facilities in Oklahoma, New Jersey, Indiana and Illinois. Additionally, the Chassis division maintains a minority joint venture with QH-Talbros in India.

Exhibit 6.1

Affinia Chassis overview

Source: Company filings

Note: Market shares as of 2011

Products

Chassis offers the broadest product coverage in the industry with over 13,000 designs and over 43,000 SKUs, including approximately 4,500 FnP designs and approximately 8,500 designs for domestic nameplates (GM, Ford and Chrysler vehicles). Chassis aims to be the first to market

31

CONFIDENTIAL

with new products, to provide quality equal to or better than original equipment (“OE”) and to differentiate its products with its Advanced Technology® premium designs. The Company’s Chassis products are renowned in the industry for high quality and ease of installation, which provides a distinct value proposition to professional installers and has resulted in long-standing customer relationships.

Exhibit 6.2

Affinia Chassis overview

Brands

Affinia’s well-known portfolio of Chassis brands includes Raybestos® and McQuay-Norris®. Chassis also provides products for reputable private labels including NAPA, CARQUEST and ACDelco. Raybestos® NAPA, ACDelco and CARQUEST comprise four out of the top five selling brands of chassis products.

Exhibit 6.3

Chassis brands

Customers

Chassis supplies products to large aftermarket distributors, including NAPA, CARQUEST and ACDelco, as well as independent warehouse distributors. NAPA, with over 6,000 outlets, is Chassis’ largest customer, and Affinia supplies nearly all of its chassis products. Large distributors sell to professional installers, who are the primary decision-makers in the aftermarket industry. The reputation of Affinia brands and products for form, fit, function and quality has promoted significant demand for its products throughout the aftermarket supply chain.

32

CONFIDENTIAL

Exhibit 6.4

Key customer relationships

Chassis has received numerous awards for its outstanding commitment to quality, performance and service. Chassis was awarded theSpirit of Napa Award in 2003, thePolk Inventory Efficiency Award in 2006, theUndercar Digest Top 10 Products Award in 2010 (awarded for NAPA-branded Precision Engineered Ball Joints) and theBest Business-to-Consumer Brochure Automotive Communications Award in 2011. The division’s leading catalog management system has received twenty awards in the past ten years from the National Catalog Managers Association, including theBest In Class, Platinumand Most Improved awards.

33

CONFIDENTIAL

| 7. | Affinia South America overview |

History

Affinia South America (“ASA”) and its legacy businesses have a long history as leading manufacturers and distributors of automotive aftermarket products in the South American market. Pellegrino® was established in 1941 as an importer and distributor of automotive products in São Paulo and operated independently until 1977, when Dana Corporation purchased the Company from the Pellegrino family to gain access to the Brazilian aftermarket. In 2004, Cypress, OMERS and others acquired Dana’s aftermarket business operations, which included Pellegrino® distribution, a manufacturing arm in Brazil that subsequently became Affinia Automotiva and distribution operations in Argentina, Uruguay and Venezuela. These businesses were combined to form Affinia South America.

Business overview

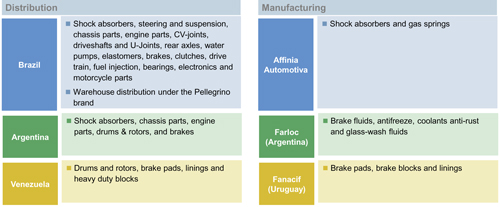

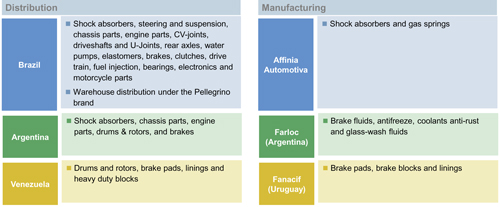

ASA is a market leader in the distribution and manufacturing of automotive aftermarket products throughout South America. Since 2004, ASA has focused on distributing and manufacturing brake, suspension, driveshaft and U-joint components, water and fuel pumps, filters, engine products and other critical aftermarket components through its operations in Argentina, Brazil, Uruguay and Venezuela. ASA distributes more than 37,000 SKUs across South America and various countries in North America, Europe, Asia and Africa. Several of the products are marketed under Affinia brands, including Nakata©, Raybestos© and Power Engine©.

ASA has operations in four countries: Brazil, Argentina, Uruguay and Venezuela. In Brazil, ASA’s operations are conducted through Affinia Automotiva, an aftermarket parts manufacturer and master distributor, and Pellegrino®, a warehouse distributor. Automotiva manufactures Nakata® brand shock absorbers and distributes those and other third party products to warehouse distributors, including Pellegrino® distribution. Automotiva assembles, brands and packages many of the third party products that it distributes, including steering, transmission and engine products. In Argentina, Farloc, ASA’s subsidiary, bottles brake fluids and sells its products to local warehouse distributors through its master distributor. The Uruguayan operation, Fanacif, is focused on the production and export of brake pads, blocks and linings, while the Venezuela operation sells a wide portfolio of brake components to local warehouse distributors. The operations share middle and back office activities such as accounts payable and receivable, HR, Tax and IT at the Company’s headquarters in Săo Paulo, Brazil. ASA’s revenues are concentrated in Brazil, the largest market in Latin America, which represented 88% of its 2012 revenues.

ASA is a market leader across a range of products and services. Pellegrino® distribution is the #2 warehouse distributor in Brazil by sales. Automotiva is the #1 player in chassis components in Brazil and the #3 player in shock absorbers across light, medium and heavy-duty users in Brazil, driven largely by its well-known Nakata® brand. Affinia Automotiva held the #4 position in aftermarket parts manufacturing in South America.

34

CONFIDENTIAL

Exhibit 7.1

ASA business overview

Exhibit 7.2

Affinia ASA overview

Source: Company filings and Company management

Pellegrino® Distribution

ASA participates in the warehouse distribution market through its subsidiary Pellegrino®, operating extensively throughout the northeastern, mid-western and southern regions of Brazil as the second largest and most recognized warehouse distributor with 20 facilities totaling over 360,000 square feet of warehouse space.

Pellegrino® sells approximately 65% of its products to retailers and jobber stores, with the balance sold to parties such as auto centers, diesel injection centers, motorcycle retailers, heavy-duty fleets and engine rebuilders. With the exception of certain custom and specialty products which are ordered directly by installers, Pellegrino® does not distribute to installers or end-consumers. Pellegrino® employs a highly experienced sales force that serves a broad base of over 19,000 customers in 2,400 cities.

35

CONFIDENTIAL

The Pellegrino® product portfolio is highly diversified across nine groups, including powertrain, engine, brake, electrical and suspension components. Pellegrino® offers products from many highly-regarded brands, including TRW, Bosch, Spicer, Nakata®, Philips and Mahle. In 2009, Pellegrino® entered the fast-growing motorcycle products market, distributing batteries, transmission kits, horns, brake pads and engine components. In 2010, Pellegrino® entered the high-margin electronics and accessories segment, offering multimedia, GPS and speakers as part of its portfolio.

Pellegrino® distribution has a reputation for exceptional customer satisfaction. It makes over 99% of its deliveries in 24 hours or less and makes products available for 96% of its on-site pick-up orders in 20 minutes or less. According to the Brazilian jobber magazine Novo Varejo, Pellegrino® distribution has maintained the #1 position in customer satisfaction for drive-train components over the last four years. Novo Meio magazine rated Pellegrino® distribution the best overall automotive parts distributor in a survey of 500 jobbers based on several categories that included service speed, customer support, commercial / returns policy, warranties and product quality. Additionally, employee satisfaction is high, with Exame magazine ranking Pellegrino® distribution as one of the top 150 places to work in Brazil every year since 2001.

Affinia Automotiva

Affinia Automotiva is the fourth largest aftermarket products manufacturer in South America through its shock absorber manufacturing arm. Automotiva’s manufacturing operations produce over two million Nakata® brand shock absorbers per year at an 80,000 square foot facility located in Diadema, São Paulo, Brazil.

In addition to direct manufacturing, Automotiva is a leader in the supply of chassis components and driveshaft products, assembling, packaging and branding various components from third party manufacturers. Automotiva’s master distribution operations are located in a new 105,000 square foot distribution center that is strategically located in the central city of Extrema, in the state of Minas Gerais. The center receives Automotiva’s manufactured and outsourced products, which it then ships to warehouse distributors both nationally and internationally. Pellegrino® is Automotiva’s largest customer, representing approximately 15% of revenues. In addition, Automotiva exports to ASA’s operations in Argentina and to 27 other countries around the world.

According to a 2012 study by auto parts market research group Cinau, Automotiva’s Nakata® brand is the most recognized chassis parts brand and the second most recognized shock absorber brand in Brazil. The brand is known for high quality and availability, and has won several awards including Jornauto Magazine’s Top Suspension Component and Sindirepa’s Suspension System Silver Medal, both in 2012.

Fanacif, Farloc and Venezuelan operations

Fanacif operates in Uruguay and produces brake pads, linings and brake blocks in an 82,000 square foot facility. The products are mostly exported, with over 80% of production supplying the Argentinean, Brazilian and Venezuelan markets through Affinia’s master distributors in those countries.

Farloc is a joint venture 76.1%-owned by ASA that operates in Argentina. Farloc bottles brake fluids, antifreeze and coolant, anti-rust fluids and glass wash under several brand names at a 100,000 square foot manufacturing facility. As part of its path-to-market, Affinia operates a master distributor which sells to local warehouse distributors. Approximately 70% revenues are generated by Affinia-manufactured products, including those made by Farloc, Fanacif and Automotiva, with the remaining 30% sourced from third-party manufacturers.

36

CONFIDENTIAL

In Venezuela, ASA operates a distribution facility that sources brake components from Fanacif and third party suppliers, which it sells to warehouse distributors under a variety of top brands such as Raybestos®.

37