UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A (Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Under § 240.14a-12 |

TECHPRECISION CORPORATION

(Name of Registrant as Specified in Its Charter)

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P. I

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P.

WYNNEFIELD SMALL CAP VALUE OFFSHORE FUND, LTD.

WYNNEFIELD CAPITAL, INC. PROFIT SHARING PLAN

WYNNEFIELD CAPITAL MANAGEMENT, LLC

WYNNEFIELD CAPITAL, INC.

NELSON OBUS

JOSHUA H. LANDES

ROBERT D. STRAUS

GENERAL VICTOR E. RENUART JR. (RETIRED)

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Wynnefield Partners Small Cap Value, L.P. I and its affiliates (“Wynnefield”), and Robert D. Straus (together, with Wynnefield, the “Group”) have filed a definitive proxy statement and accompanying BLUE proxy card with the Securities and Exchange Commission to be used to solicit votes for the Group’s director nominees for election to the Board of Directors (the “Board”) of TechPrecision Corporation (the “Company”) at the Company’s upcoming 2024 Annual Meeting of Stockholders scheduled to be held on December 19, 2024.

Item 1: On November 25, 2024, the Group sent the following letter to stockholders of the Company:

WYNNEFIELD SEEKS TO REBUILD TECHPRECISION CREDIBILITY FOR ALL STOCKHOLDERS

ENCOURAGES STOCKHOLDERS TO VOTE FOR WYNNEFIELD’S NEW, INDEPENDENT DIRECTOR CANDIDATES WHO IT BELIEVES WILL ADDRESS TECHPRECISION’S DISMAL STOCKHOLDER RETURNS, RECENT M&A DEBACLES, LACK OF TRANSPARENCY AND POOR GOVERNANCE

Sign-Up for Further Updates at our Campaign Website at www.rebuildTPCScredibility.com

November 22, 2024

Dear Fellow TechPrecision Stockholders:

Wynnefield Partners Small Cap Value, L.P. I and its affiliates (“Wynnefield”), and Robert D. Straus (together, with Wynnefield, the “Group”), who collectively own approximately 7.0% of TechPrecision Corporation’s (“TechPrecision” or the “Company”) outstanding common stock, are writing to you as the largest collective stockholders of TechPrecision. The Company’s upcoming 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”), is scheduled for December 19, 2024.

As you well know, TechPrecision’s performance over the last several years has been terrible, destroying tens of millions of dollars in stockholder value.1 During this time, the Company has significantly underperformed relevant indices, with its share price declining by more than 50% over the last year.2 We believe that TechPrecision’s credibility within the investment community and its relationship with stockholders has been significantly tarnished – yet it can be repaired and the Company’s true potential realized. That is why we have nominated and seek to elect four-star General Victor Eugene “Gene” Renuart, Jr., U.S. Air Force (Ret.) and Robert D. Straus as members of the Company’s Board of Directors (the “Board”) at the 2024 Annual Meeting. The Group believes that General Renuart and Mr. Straus have the necessary expertise and background to help reverse years of chronic underperformance by the Company, as evidenced by their biographies as set forth at the end of this letter.

WYNNEFIELD URGES TECHPRECISION STOCKHOLDERS TO VOTE FOR OUR TWO

HIGHLY QUALIFIED NOMINEES ON THE ENCLOSED BLUE VOTING FORM

While we have lost confidence in the entire Board, the Group intends to vote our shares FOR the election of four-star General Renuart and Mr. Straus and to WITHHOLD on the election of the two (2) opposed Company nominees, Mr. Richard McGowan – Current Chair of the Board, and Mr. Robert Crisafulli – Current Chair of the Audit Committee. The Group will also WITHHOLD on each of the four (4) other Company nominees.

1 Per the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, filed with the SEC on September 13, 2024 (the “2024 10-K”) and the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on June 15, 2023 (the “2023 10-K”).

2 Bloomberg. One year date range is from July 3, 2023, to July 2, 2024, the date of the Group’s 13D filing with its Nomination Letter.

The Group strongly urges all stockholders to vote FOR the election of General Renuart and Mr. Robert Straus and to WITHHOLD on the election of the two (2) opposed Company nominees. We make no recommendation with respect to your votes on the election of the four (4) other Company nominees on the BLUE proxy card or BLUE voting instruction form.

.

We urge stockholders to please refer to page 7 of the Group’s definitive proxy statement to review Wynnefield’s detailed “Reasons for Solicitation.”

Major Reasons Why Incumbent Directors Must Be Held Accountable

The Group holds Mr. Richard McGowan, Chair of the Board, accountable for his poor leadership and oversight, which we believe has resulted in the Company’s financial underperformance resulting in a going concern, absent investor relations strategy and lack of transparency. We hold Mr. Robert Crisafulli, Chair of the Audit Committee, accountable for consistently late and inaccurate SEC filings, lack of oversight of internal controls and the Company’s going concern.

As discussed in more detail in the Group’s definitive proxy statement, the Group’s reasons for its solicitation of the election of General Renuart and Mr. Straus and belief that the incumbent directors should be held accountable include:

| Ø | Unfavorable total stockholder returns in absolute and relative terms, |

| Ø | Deteriorated financial performance over the last three years, |

| Ø | M&A debacles that resulted in significant stockholder dilution and a weaker financial position, |

| Ø | Substantial doubt about the Company’s ability to continue as a going concern, |

| Ø | Ineffective internal controls, |

| Ø | Lack of transparency to stockholders, |

| Ø | No comprehensive investor relations strategy to communicate with stockholders and maximize stockholder value, |

| Ø | Alarming absence of Governance Committee and Compensation Committee meetings over the last two fiscal years, and |

| Ø | No majority voting standard in uncontested director elections. |

We believe NEW INDEPENDENT VOICES are needed on TechPrecision’s Board as we seek BETTER TRANSPARENCY and DISCIPLINED BUSINESS JUDGEMENT.

| Ø | NEW INDEPENDENT VOICES on the Board to give stockholders the ability to express concerns and objectives, and to effectuate change. |

| Ø | BETTER TRANSPARENCY to allow stockholders the opportunity to assess the Company’s investment risks and the Board’s performance. |

| Ø | DISCIPLINED BUSINESS JUDGEMENT to avoid poorly conceived and costly strategies like the recently failed acquisition of Votaw Precision Technologies, Inc. (“Votaw”), and to enhance stockholder value. |

| Ø | DIRECTORS THAT ARE CAPABLE AND FOCUSED on enhancing stockholder value. |

The Group believes the Board has failed its stockholders, and their decisions have resulted in the Company significantly underperforming the market over the past five years.

| Ø | TechPrecision’s Total Stockholder Returns are Unfavorable in Absolute and Relative Terms: |

| | | | Russell | Relative |

| Metric | Time Period3 | TPCS | Micro Index | Performance |

| Proposed Votaw Acquisition | 11/29/23 to 07/02/24 | -47.1% | 13.1% | -60.2% |

| STADCO Acquisition | 08/25/21 to 07/02/24 | -41.5% | -19.0% | -22.5% |

| 2024 Performance | 12/29/23 to 07/02/24 | -33.6% | -2.0% | -31.6% |

| 1-Year | 07/03/23 to 07/02/24 | -53.2% | 4.0% | -57.2% |

| 3-Year | 07/03/21 to 07/02/24 | -31.2% | -22.2% | -9.0% |

| 5-Year | 07/03/19 to 07/02/24 | -37.7% | 30.1% | -67.8% |

Source: Bloomberg

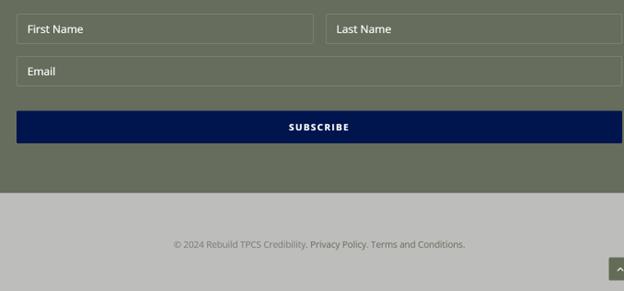

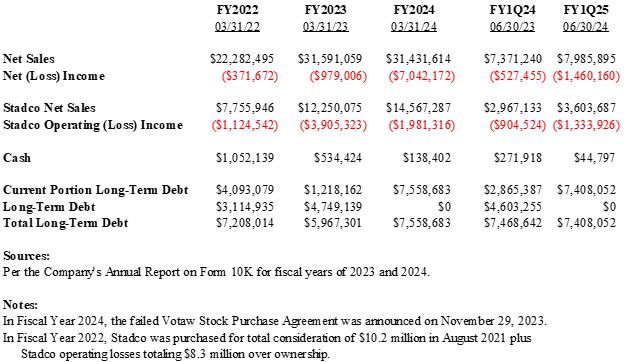

| Ø | Financial Performance has Materially Deteriorated Over the Past Three Years |

| Ø | M&A Debacles Resulted in Significant Stockholder Dilution Totaling Approximately 19%.4 |

3 The Group filed its statement on Schedule 13D with the SEC and delivered its notice of nomination of General Renuart and Mr. Straus to the Company on July 2, 2024.

4 Per the Company’s Current Report on Form 8-K filed with the SEC on April 8, 2024, and the Company’s Current Report on Form 8-K filed with the SEC on July 10, 2024.

| o | FAILED Votaw acquisition that we believe represented poor oversight by the current Board and a lack of business judgement that resulted in significant stockholder dilution. The Company paid a share-based M&A break-up fee to Doerfer Corporation, Votaw’s parent company. The Company also paid M&A advisory fees with borrowings from its revolver, necessitating the Company to then raise additional capital in order to repay such loans through the sale of shares and warrants at $3.45 per share.5 |

| o | AGREED TO PURCHASE Votaw without an assured financing commitment in place violating fundamental M&A practices and basic process tenets. The current Board decided to continue to pursue the Votaw acquisition past the 45-day walkaway deadline, even though there was no public disclosure on how the Company intended to fund this transaction. |

| o | Committed to the now failed Votaw purchase but independent directors were NOT committed to communicating the details to stockholders. The current Board and Company management never even held a public conference call to explain this transaction’s strategic reasoning or answer stockholders’ concerns or inquiries. |

| o | LAGGING STADCO acquisition is still not fully integrated and remains an underperformer after over three years of ownership, according to Company SEC filings. In August 2021, the STADCO acquisition was funded by an equity capital raise at $4.40 per-share, which is 22% higher than the most recent raise.6 TechPrecision paid $10.2 million for Stadco, which never turned a profit and generated operating losses totaling $8.3 million since the purchase.7 |

| Ø | Transparency & Governance. |

| o | “SUBSTANTIAL DOUBT about the Company’s ability to continue as a going concern” per Marcum LLP, the Company’s auditor, as stated in the Company’s annual report filed on September 13, 2024. |

| o | INEFFECTIVE internal controls over the Company’s financial reporting and consistent FAILURE to timely file annual and quarterly reports with the SEC are a substantial risk to stockholders and indicate a significant failure by the Audit Committee to provide effective oversight. |

| o | LACK OF transparency prevents stockholders from reasonably valuing the Company’s investment risks. |

| o | Plurality voting standard used for uncontested director elections, where there are no alternatives, allow directors to be elected by just one vote. Instead, a majority voting requirement in uncontested elections is generally considered the best accepted corporate governance practice amongst leading proxy advisory firms. |

| o | ALARMING that the Nominating and Corporate Governance Committee and the Compensation Committee – two of three committees of the Board – potentially failed to meet at all during fiscal 2023 and 2024, especially given the significant oversight responsibilities of these committees on vital aspects of the Company’s business. |

5 Per the 2024 10-K.

6 Per the 2023 10-K.

7 Per the 2024 10-K, 2023 10-K and the 10Q for the reporting period ending June 30, 2024.

| o | CRITICAL MISS due to no comprehensive investor relations strategy to communicate with stockholders and maximize stockholder value. The Company has no sell-side analyst research coverage, even after two recent capital raises. To our knowledge, Company management does not attend Wall Street-related or industry conferences to meet with existing stockholders or prospective investors in order to increase awareness and broaden the Company’s stockholder base. We believe that the Company’s website, Techprecision.com, is outdated, unsophisticated and misses several opportunities to be more informative. |

Biographies

General Victor Eugene “Gene” Renuart, Jr., U.S. Air Force (Ret.) is a retired four-star general of the U.S. Air Force with over 39 years of service and extensive experience in military leadership, national defense, and aerospace operations. The Group believes that General Renuart’s proven military, governmental and corporate leadership record, provide him with unique skills, insights and qualifications to serve as a member of the Board and any of its committees. General Renuart would bring extensive experience in multi-national strategic and operational planning, fiscal oversight of large organizations with annual multi-billion-dollar budgets as well as his public company and private company board experience

Robert D. Straus is an institutional portfolio manager with 25 years of proven experience investing in and serving as an advisor to C-suite executives of public and private companies. His expertise includes evaluating business and capital allocation strategies as well as advising on executive compensation structure, strategic initiative analysis and corporate governance best practices. The Group believes that Mr. Straus’ extensive investment, financial, capital allocation and strategic initiative analysis expertise, as well as his significant corporate governance experience serving as a director and board committee member of publicly traded companies, provide him with unique skills, insights and qualifications to serve as a member of the Board and any of its committees.

You may stay abreast of information about our director nominees and the Group’s campaign by visiting our campaign website at www.rebuildTPCScredibility.com.

Respectfully yours,

| Nelson J. Obus | Robert D. Straus |

| Founder | Portfolio Manager |

IF YOU HAVE ANY QUESTIONS OR NEED ASSISTANCE IN VOTING, PLEASE CALL SARATOGA:

(888) 368-0379 OR (212) 257-1311: OR BY EMAIL AT INFO@SARATOGAPROXY.COM

Item 2: Also on November 25, 2024, the Group issued the following press release:

WYNNEFIELD GROUP SENDS DEFINITIVE PROXY MATERIALS TO TECHPRECISION STOCKHOLDERS, INCLUDING A BLUE PROXY CARD AND A LETTER SEEKING TO HOLD MEMBERS OF THE BOARD ACCOUNTABLE FOR YEARS OF POOR OPERATING RESULTS, POOR PERFORMANCE AND A SERIES OF COSTLY STRATEGIC MISSTEPS

Wynnefield Group also Releases Detailed Investor Presentation that Has Been Posted to www.RebuildTPCSCredibility.com

Urges ALL TechPrecision Stockholders to Take Immediate Action by Voting Each and Every BLUE Proxy Card and BLUE Voting Instruction Form You Will Receive

NEW YORK, November 25, 2024 /PRNewswire/ -- Wynnefield Partners Small Cap Value, L.P. I and its affiliates ("Wynnefield"), and Robert D. Straus (together, with Wynnefield, the "Wynnefield Group"), who collectively own more shares of TechPrecision Corporation (the "Company" and/or “TechPrecision”) (NASDAQ: TPCS) than any other common stockholder, collectively owning approximately 7% of the Company's outstanding common stock according to Bloomberg, announced today the filing with the Securities and Exchange Commission (“SEC”) and mailing to stockholders of a definitive proxy statement and a letter to stockholders together with a BLUE proxy card and/or BLUE voting instruction form seeking to elect it’s two highly qualified and exceptional director nominees to the Company’s Board.

The Wynnefield Group also released a detailed investor presentation highlighting the many reasons why the TechPrecision Board should be held accountable and why the election of both of the Wynnefield Group’s highly qualified and exceptional director nominees is so important for TechPrecision stockholders.

Following the Company’s Friday afternoon disclosure of its failure to comply with a critical Nasdaq Listing Rule due to the late filing of its Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, the Wynnefield Group is raising serious concerns. TechPrecision has consistently missed SEC filing deadlines for years, signaling a systemic issue that continues to jeopardize stockholders. Adding to this troubling pattern, the Company has disclosed substantial doubt about its ability to continue as a going concern—a warning that demands immediate action and accountability. For these reasons and the reasons outlined in our proxy statement, our letter to stockholders and our investor presentation, TechPrecision stockholders should vote the BLUE proxy card or BLUE voting instruction form to elect our two highly-qualified and exceptional Director nominees, General Victor Eugene “Gene” Renuart, Jr. and Mr. Robert Straus.

Note to the many stockholders who own TechPrecision shares in more than one account, please vote each and every BLUE voting form sent to you to ensure all of your shares are voted.

If you have any questions or need assistance voting your shares, please contact Saratoga Proxy Consulting LLC at (212) 257-1311 or (888) 368-0379 or info@saratogaproxy.com.

Remember you can sign up for updates at www.RebuildTPCSCredibility.com.

Item 3: Also on November 25, 2024, the Group posted the following materials to www.rebuildTPCScredibility.com: