UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended:December 31, 2015 |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: _____

For the transition period from _____ to _____

Commission file number 001-36723

AMEC FOSTER WHEELER PLC

(Exact name of Registrant as specified in its charter)

England and Wales

(Jurisdiction of incorporation or organization)

Amec Foster Wheeler plc, Old Change House, 128 Queen Victoria Street

London EC4V 4BJ, United Kingdom

(Address of principal executive offices)

Alison Yapp

General Counsel & Company Secretary

Amec Foster Wheeler plc, 4th Floor, Old Change House, 128 Queen Victoria Street

London EC4V 4BJ, United Kingdom

Tel +44 (0) 20 7429 7500

Fax +44 (0) 20 7429 7550

(Name, Telephone, E-mail and/or Facsimilie number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered |

American Depositary Shares evidenced by American Depositary Receipts,

each American Depositary Share representing one ordinary share of Amec

Foster Wheeler plc | New York Stock Exchange, Inc. |

| | |

| Ordinary shares, nominal value £0.50 per share* | New York Stock Exchange, Inc.* |

*Not for trading, but only in connection with the listing of the American Depositary Shares on the New York Stock Exchange, Inc.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Ordinary shares | 393,131,813 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

þ Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes þ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 of 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

þ Yeso No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filerþ | Accelerated filer | o | Non-accelerated filero |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | o | International Financial Reporting Standards as issued by the International Accounting Standards Board | þ | Other | o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes þ No

Amec Foster Wheeler plc

Annual report and accounts 2015

Welcome to Amec Foster Wheeler

Our vision is to be the most trusted partner for our customers by consistently delivering excellence – bringing together the knowledge, expertise and skills of our people from across our global network.

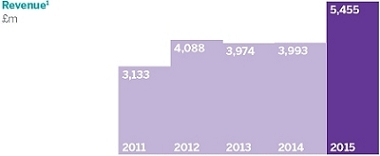

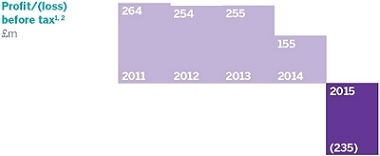

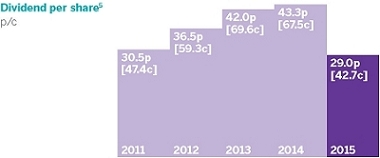

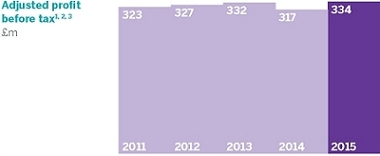

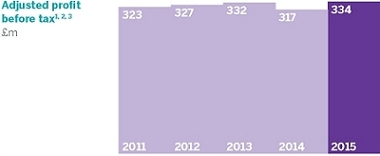

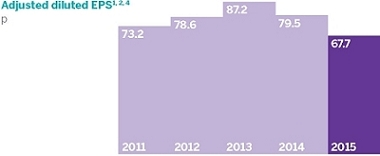

Performance highlights

2015 was a year of contrasting forces.

Key performance indicators

We use a variety of other key performance indicators to track our progress towards our goals. These relate to the elements of our business model and can be found in the strategic report on pages 12 and 13.

Adjusted performance measures used by the Group are explained and reconciled to the equivalent IFRS measures in the section entitled Performance measures on pages 172 to 174.

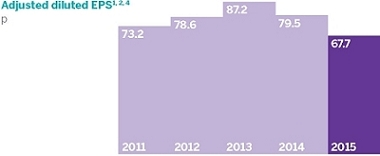

| 2 | Figures for 2012 and 2011 have been restated to reflect the reclassification in 2013 of the UK conventional power business as a discontinued operation and the adoption of IAS 19 (Revised 2011) ‘Employee Benefits’. |

| 3 | Adjusted profit before tax represents profit before tax before exceptional items, the amortisation and impairment of intangible assets, asbestos-related costs and interest expense (net of insurance recoveries), and the Group’s share of tax on the results of joint ventures. |

| 4 | Adjusted diluted earnings per share represents profit for the year before exceptional items, the amortisation and impairment of intangible assets, asbestos-related costs and interest expense (net of insurance recoveries), and the tax effect of those items, divided by the diluted number of ordinary shares. |

| 5 | The dividend values disclosed in cents were calculated at the following year end exchange rates: |

| | This represents an estimate and no representation can be made that the dividend could have been converted into US dollars at this rate, and as a result these figures have been included in square brackets in the table above. |

Amec Foster Wheeler Annual report and accounts 2015 | 01 |

Amec Foster Wheeler at a glance

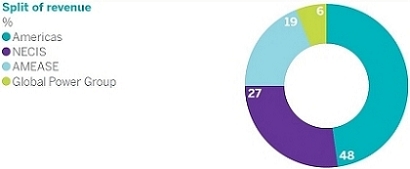

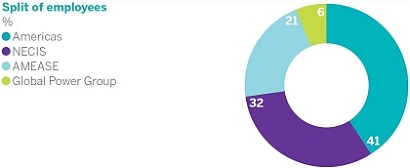

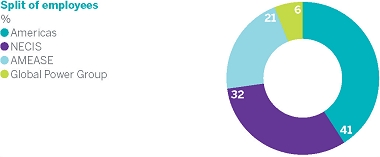

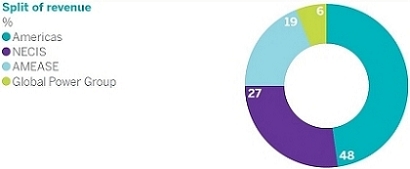

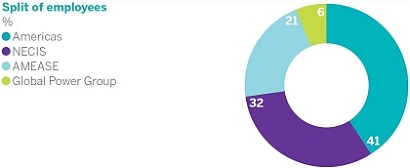

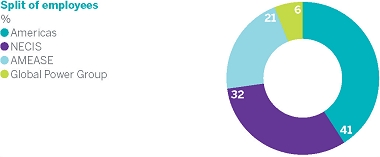

| Amec Foster Wheeler operates across the whole of the oil & gas value chain – from production to refining, processing and distribution of derivative products – in mining, clean energy and the environment & infrastructure markets, employing around 40,000 people in more than 55 countries. | |  |

| | Total revenue 2015 | |

| | £5.5bn | |

| | Employees 2015 40k | |

| 02 | Amec Foster Wheeler

Annual report and accounts 2015 |

Our operations Our operations are structured into four business units – three with geographic remits and one with a global remit (see overviews below). This structure has been designed to further enable collaboration and promote greater growth opportunities. |  |

Americas The largest of our business units, with around 16,000 employees and approximately 150 offices in 10 countries, across North and South America. The business is balanced across our markets. In oil & gas, we are delivering world scale projects across a portfolio of upstream, midstream and downstream business, with a leadership position in the oil sands of Canada, a strong US position onshore and in the Gulf of Mexico and a growing presence in Mexico. We provide a full-service solution in the mining market from our leading position in consulting, project delivery and remediation. In clean energy, we have a strong renewables business supporting the development of solar and wind projects, a robust nuclear position and a growing development of gas power. Throughout our geographies we are a leading environmental consultancy. | | Northern Europe & CIS (NECIS) Northern Europe & the Commonwealth of Independent States has around 12,500 employees operating in more than 120 locations across 20 countries, with its expertise extending into many more. The unit has broad-based customer reach across three of our markets: in environment & infrastructure; clean energy – notably in the nuclear industry, including asset support, decommissioning and new-build programmes; and oil & gas – across the value chain and lifecycle for projects onshore and offshore, from pre-feasibility consulting to late-life management and decommissioning. | | Asia, Middle East, Africa and Southern Europe (AMEASE) The Asia, Middle East, Africa & Southern Europe (AMEASE) unit has over 8,000 employees, spread across more than 40 locations, with strong capabilities and customer reach across each of our oil & gas, environment & infrastructure and mining markets. In addition to our regional locations, we also have our E&I and clean energy group which works across all markets and is focused on delivering major construction projects and specialty consulting services across key geographies throughout AMEASE and beyond. | | Global Power Group Operating three manufacturing facilities, two cogeneration plants, 10 engineering and service centres in seven countries and employing around 2,500 employees, this business unit designs, supplies and erects steam generating, auxiliary and air pollution control equipment, as well as a wide range of aftermarket products and services. Delivering projects and services virtually anywhere in the world, we enable utilities, independent power producers and industrial customers to achieve their power, process steam and environmental goals. |

Amec Foster Wheeler

Annual report and accounts 2015 | 03 |

Amec Foster Wheeler at a glance continued

| Our customers include | | |

| BP | | KOC |

| ConocoPhilips | | Kuwait National Petroleum Co |

| Duke Energy | | Louisville Gas & Electric Co |

| EDF | | Newmont |

| Enterprise Products Operating LLC | | Owens Corning |

| Equistar Chemicals LP | | PEMEX |

| ExxonMobil | | Sempra |

| Georgia Pacific | | Shell |

| Georgia Power | | Talisman Sinopec |

| K&S Potash Canada | | Zadco |

Our four markets

Our diversified approach with operations across four markets balances risk and maximises opportunity over the long term. We provide similar services across our markets (see pages 24 to 25), winning work through strong customer relationships and our proven ability to deliver projects successfully. Many of the skills and services we provide to our customers are transferable across markets.

Oil & Gas

We are involved in every part of the project delivery phase across the oil & gas value chain, but we specifically do not operate in early cycle exploration or drilling.

Clean Energy

In renewables we provide a full-service engineering, procurement and construction solution on wind, solar, biomass and biofuels projects. We also support the full lifecycle of nuclear energy and are a respected leader in the design and supply of combustion and steam generation equipment.

Mining

We offer mining consultancy (including ore resource estimation, mine planning and feasibility studies), design, project and construction management services.

Environment & Infrastructure (E&I)

We are a leading consulting, engineering and project management firm with strong market positions, especially in the water, transportation and infrastructure, government services and industrial sectors.

| 04 | Amec Foster Wheeler

Annual report and accounts 2015 |

| Our sectors | | | | |

| | | | | |

Upstream Full lifecycle for the upstream

oil & gas industry – offshore

and onshore |  | |

Midstream Providing transportation

for the midstream oil & gas industry |  |

| | | | | |

Downstream Executing downstream projects in refining, chemicals and petrochemicals |  | |

Mining Expertise and delivery

from concept to closure |  |

| | | | | |

Nuclear Expertise spanning the entire lifecycle of complex nuclear assets |  | |

Renewables/Bioprocess

A century of experience

supporting today’s

renewable energy |  |

| | | | | |

Conventional Power High-value services, equipment and technology for power plants |  | |

Transmission & Distribution

Innovative and high-value

added solutions |  |

| | | | | |

Water Global expertise in every aspect of water, from source to ocean |  | |

Government

Comprehensive

environmental, engineering

services and design |  |

| | | | | |

Industrial/Pharmaceutical Offering a whole world of technical expertise and full lifecycle services |  | |

Transportation & Infrastructure

Innovative solutions for

complex transportation needs |  |

Amec Foster Wheeler Annual report and accounts 2015 | 05 |

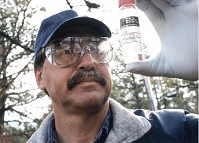

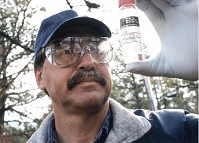

Chairman’s statement

John Connolly

Chairman

The last year has been one of significant challenge and change in your company.

Having completed the acquisition of Foster Wheeler at the end of 2014, the group tackled the task of integrating the two companies to create the new Amec Foster Wheeler. This took place during a year when the significant oil price decline and consequent actions across the oil & gas sector produced extremely turbulent and challenging markets for our business. Whilst we will continue for some time to operate in these harsh markets, your board remains confident that the strategic rationale for the Amec Foster Wheeler combination remains sound.

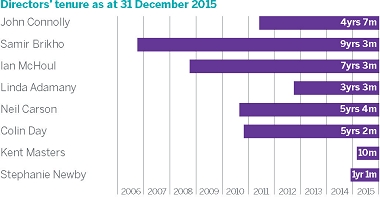

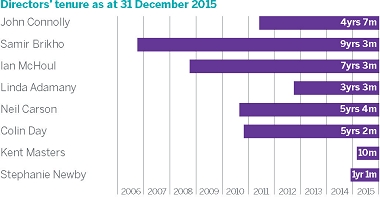

As we announced, Samir Brikho stepped down from the Chief Executive role on 17 January and left the company, with Ian McHoul appointed interim CEO from that date. Samir was Chief Executive for nine years and made a significant contribution to the development of the group during that period and, on behalf of the board, I want to thank him for his commitment and contribution during his tenure. I also want to thank Ian McHoul for stepping into this role to steer the company forward in the period ahead. The board has progressed the search for a new CEO, supported by Korn Ferry, and we anticipate making an announcement on this in due course.

In the Chief Executive’s statement on page 7, Ian McHoul reports on progress and our near term priorities. As already announced your board concluded that an appropriate action in these markets is to lower the dividend (see below). A priority was to execute a refinancing and in March 2016 we announced that the new financing for the company’s medium term was in place, with total facilities of £1.7 billion, which gives us substantial headroom and marks another important step towards further strengthening our balance sheet. The executive team continue to execute a clear strategic plan to optimise the group’s performance during these challenging market conditions.

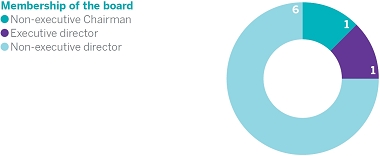

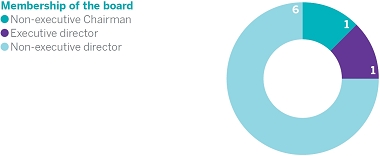

Your board

There have been a number changes to your board since the start of 2015:

| ► | Kent Masters, formerly the Chief Executive Officer at Foster Wheeler AG, was appointed a non-executive director on 13 February 2015 for an initial term of three years, which will end at the 2018 AGM |

| ► | Neil Carson was appointed Senior Independent Director and Chairman of our Remuneration Committee on 14 May 2015 following the previously-announced retirement from the board of Simon Thompson at the close of the annual general meeting, having served two three-year terms as a Director |

| ► | Roy Franklin, currently Chairman of Keller Group plc, deputy chairman of Statoil ASA and a non-executive director of Santos Ltd, was appointed an independent non-executive director and member of the nominations committee, with effect from 1 January 2016 |

| ► | As reported above, Samir Brikho stepped down from his position as Chief Executive on 17 January 2016. Ian McHoul was appointed interim CEO, in addition to his role as Chief Financial Officer with effect from 17 January 2016 |

Full biographical details of your board can be seen on pages 41 to 43.

Diversity remains another key area of focus for your board and your company has made great strides in this area – not just the diversity of human capital (individual characteristics, skills and gender) but also, as I have mentioned previously, in thought diversity. Collaboration, teamwork and respect for each other, combined with an assiduous attention to health, safety, security and the environment will ensure that we remain at the top of our game, despite competitive pressures and market conditions. And here again we see further benefits from the merged operating practices following our acquisition of Foster Wheeler where we have created a best of both approach.

I also want to comment on health and safety, which remains an absolute priority throughout the organisation. The Chief Executive reports to the board on this at every meeting and our Health, Safety, Security, Environmental & Ethics Committee (see page 63) has an increasingly key role to ensure we protect our people, our customers and everyone associated with our projects. Your company will benefit from our best-in-class approach, which is clearly understood and upheld throughout the group.

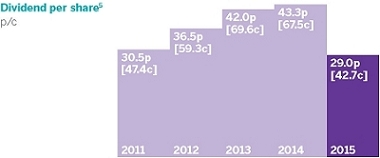

Your Company’s performance

The tough market conditions will continue for longer than originally expected and these have been reflected in the performances of your company across our four markets – oil & gas, mining & metals, clean energy and environment & infrastructure (more details can be seen on pages 24 to 25). Our 2015 trading profit1was £374m and our proposed final dividend is 14.2p per share, making a total of 29.0p per share for the year. If approved at your Company’s annual general meeting on 27 April 2016, it will be paid on 4 July 2016 to those shareholders on the register at close of business on 27 May 2016.

Conclusion

My fellow directors and I remain strongly convinced of Amec Foster Wheeler’s potential. We believe that your company’s strategy, strength & depth of customer relationships and breadth of skills & capabilities will enable us to optimise our performance in these down markets and position your company to take advantage of better markets when they return.

Difficult times call for strong leadership and I would like to thank our leadership team and everyone in Amec Foster Wheeler for their valued contribution to date and their commitment to delivering our future potential.

John Connolly

Chairman

10 March 2016

1 Non-IFRS measure (see Performance measures on pages 172 to 174)

| 06 | Amec Foster Wheeler Annual report and accounts 2015 |

Chief Executive’s statement

Ian McHoul Chief Financial Officer and interim CEO |  | | Dividend per share for the year 29.0p | Adjusted diluted EPS for 2015 67.7p |

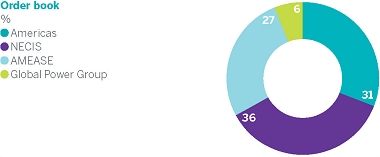

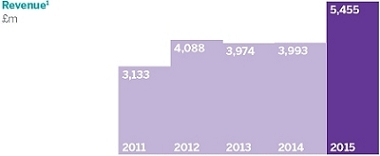

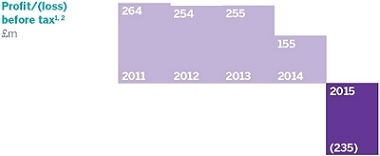

Following a board meeting on 17 January, the Company announced the departure of Samir Brikho on 18 January 2016, since when I have fulfilled the dual roles of Chief Financial Officer and interim CEO. My finance report can be found on page 28 and I would, for the record, like to wish Samir all the best for the future. 2015 was a year of contrasting forces. We successfully launched our new operating model on 1 January, so creating the platform from which to develop and grow our business. However, market conditions and commodity prices continue to dictate the flow of multiple projects on which we have been working. Despite the market downturn and the industry-wide mantra about the conditions being ‘tougher for even longer’, we have achieved notable successes in helping our customers achieve greater efficiencies – and we have continued to win projects and contracts across all of our four business units. In November, in recognition of the harsh environment and future outlook, we announced our intention to reduce our future dividend payments – thereby bringing them back in line with our existing policy of around two times earnings cover. Tough times call for tough actions and we continue to reduce costs – raising our synergy targets, streamlining our business, focusing our offering, creating greater efficiencies through innovation and partnership and being more flexible to even better support the needs of our customers. The Group Leadership Team and I are working on creating the most efficient platform for growth in both the current and hopefully more positive market conditions in the mid- to near term future. 2015 results The challenging backdrop of economic uncertainty continued into 2015 and was exacerbated by the continuing price decline in many of our core commodities. We have delivered a trading profit1of £374m, on reduced revenues of £5,455m and proposed a final dividend of 14.2p per share – in line with our November 2015 guidance. Our cash conversion rate1was 104% and adjusted earnings per share1of 67.7p. As I am also Chief Financial Officer, I will give more depth and insight into our financial performance in the Financial Review on pages 28 to 37. We have continued to win interesting and exciting projects in each of our four key markets and across our four business units, resulting from increased collaboration, skills transfer and knowledge sharing. | | Order book £6.6bn

|

Amec Foster Wheeler Annual report and accounts 2015 | 07 |

Chief Executive’s statement continued

Delivering on promises

We operate throughout the oil & gas value chain, from production and transportation, through processes that go beyond simple separation and dehydration, to refining or processing crude oil into finished fuel products. This remains the major part of our business, accounting for 54% of our revenues and so the low price of crude oil has had a dramatic impact on our business.

In 2015 we have concentrated on developing innovative ways of working and providing more cost-efficient solutions for our customers, who are also feeling the pain. Our More4Less initiative, which established more momentum during the year, is just one example of how our lean and scalable engineering processes and integrated delivery approach has been proven to deliver notable savings.

During 2015, we won more than 1,000 new projects with a mix of new and existing customers; however, the start dates of a number of these contracts have been delayed by market conditions. Our order book, at £6.6bn, is up on 2014, but does not take into account work won with no confirmed start date.

Our employees continue to work on many of the more interesting and ground-breaking work in our chosen markets, as befits the talent and skills we have. More detail can be found on pages 24 to 25.

In oil & gas we have strengthened our relationship with BP, winning North Sea contracts, have won work in Texas, US with D’Arcinoff, and been awarded projects with SKS, Orpic and the Government of Timor-Leste in Malaysia, Oman and Timor-Leste respectively.

Our clean energy business has seen us win a range of contracts from steam generating and air pollution control to nuclear assessment and solar generation. We have been recognised as a key supplier and strategic player for Mexico’s growing heat recovery steam generator market, with four project wins during 2015; and have won nuclear projects in Canada, France, Japan, UK and USA.

We have seen notable innovation in our environment & infrastructure markets, winning further work for the US Air Force with the Contract Augmentation Program IV in the US and for the design and construction of special facilities in Guam.

Our mining business has been impacted by commodity prices, but notable wins included providing front-end engineering services for the expansion of the Çöpler Gold Mine in Turkey and an engineering procurement and construction contract with Petra Diamonds for its Cullinan Mill Extension Project in South Africa.

| Tough environments provide opportunities for diverse thought leaders. | Challenges create a platform from which to showcase our best work. |

| 08 | Amec Foster Wheeler

Annual report and accounts 2015 |

Developing full potential We have blended the skills within our organisation to benefit the needs of our customers and created a platform for long-term growth which, while the slings and arrows of commodity prices may temporarily hurt us, is the right approach for our business in the long term. Our company has been delivering ground-breaking, energy-related projects and improving the lives of billions of people since 1848. Operating in over 55 countries, our approach is to forge strong working partnerships with our customers – which include governments, multi-national businesses and communities – to create some of the world’s leading industrial projects. Our 40,000-strong, skilled workforce ranges from archaeologists to zoologists and almost every profession in between. And we are good at what we do – designing, delivering and maintaining strategic and complex assets to time and budget. For example, despite the challenging conditions, our Danjing 4 biomass power plant project in South Korea reached commercial operation two weeks ahead of schedule. We have embedded the concept of using our specifically resourced offices in India as further support for the businesses and we have added greater risk management protocols through our Identify, Acquire, Deliver process. We deliberately maintain our strong and established positions in mining, clean energy, power generation, environment & infrastructure alongside the oil & gas market to develop complementary skills and services as well as to provide revenue diversification and a form of hedging against market trends. Diversity is also evident in our approach to life, in the methodology we apply to solving our customers’ problems and in our business strategy. We have to empower our employees and maintain their career paths and excitement about our future and, as a part of the integration process, we have introduced new systems to further harness our combined potential in living our values and creating a culture of safety, honesty and collaboration – with customer needs at the heart of everything we do. The Academy, which provides our people with development opportunities towards reaching their full potential, also shifted towards delivering more free and accessible solutions globally, supporting the business need for improved efficiency. Doing the right thing Without ethical or safe behaviour we would be just another company, so we aspire to be the best at both. During the year we introduced our new Code of Business Conduct by which we operate and accompanying online programmes for Code of Business Conduct and anti-bribery and corruption training. Both are mandatory for all staff to ensure that all our employees, and those working on our behalf, are aware of the laws applicable to us and act in accordance with those laws. | | Safety is at the heart of all that we do and we successfully launched our Beyond Zero initiative – meaning zero harm every minute of every day, whatever we do at work or at home. It includes the tools to enable all our employees to help us achieve a world-class Health, Safety, Security and Environmental performance and includes preparing the ground for a new programme for 2016. Designed to enable our safety leaders to effectively identify hazard and intervene when they consider safety is being compromised, we call it HEART (for Harm Elimination and Recognition Training). HEART will equip our safety leaders at supervisory and management levels of our organisation with the confidence and skills to use the technique. Outlook Current thinking indicates that low commodity prices will continue to be the largest disruptive factor in our markets for the immediate future – especially in our oil & gas and mining operating units – so we see another tough year ahead in some markets. However, I have taken great heart from the way our people have buckled down to the challenges set across our business, as the ‘tougher for even longer’ mantra continues to have a major impact on customer decision-making, capital expenditure and project implementation. In particular, I believe the benefits of our diverse model are already differentiating us, with good opportunities in down stream oil & gas, renewables, government work and UK T&D. We have almost sixty years’ experience in decommissioning highly complex nuclear assets and the expertise we have can be used to benefit other areas such as retiring UK North Sea oil and gas platforms. We will continue to partner with our customers to deliver the most innovative, efficient and effective results possible and are looking to put our global resources, people and thinking to work even harder to achieve this. Our business platform is in place, our operating model is embedded, we are reviewing underperforming assets, we plan to halve our debt by mid 2017 and we are looking to build our business by doing the right thing, delivering on promises and delivering full potential.  Ian McHoul Chief Financial Officer and interim CEO 10 March 2016 1 Non-IFRS measure (see Performance measures on pages 172 to 174) |

Amec Foster Wheeler Annual report and accounts 2015 | 09 |

Long-term client relationships help to safeguard the future of our business. Our work with EDF Energy, under a lifetime enterprise agreement, provides technical support and expertise for EDF Energy Generation’s current UK nuclear reactor fleet. EDF Energy operates 15 reactors at eight nuclear power plants across the UK. Amec Foster Wheeler was chosen to provide services because of our unique range of skills and capabilities in nuclear engineering, combined with a long-standing relationship between the two organisations. The services we provide will enable EDF Energy to continue delivering the secure, reliable, low-carbon electricity the UK needs now and into the future. | | |

10

| | Jo Skelton, Section Lead

– Remote Operations, fits

a cowl in the gap between

fuel guide tubes on Amec

Foster Wheeler’s Hot Box

Dome rig at Birchwood,

Warrington, UK. The Hot

Box Dome project is one

of the projects within EDF’s

fleet-critical programme. |

11

Our business model

We convert the talents of our people and their customer relationships into a low-risk business.

To succeed we need to deliver excellence to our customers.

| Delivering excellence | | What this means |

| | | |

People are our principal asset Read more on page 14 | | Our employees are clever people. Their skills are a scarce resource. Our highly skilled engineers, project managers, consultants and scientists deliver for our customers, creating long-term customer relationships and a strong reputation for excellence. We are investing in our High-Value Execution Centres (HVECs) to increase our capability and capacity to take on work cost effectively. |

| | | |

We are customer focused Read more on page 15 | | We have a wide range of customers around the world. They include some of the largest international oil companies such as ExxonMobil and BP, chemical companies such as Dow, miners such as Rio Tinto, utility companies such as EDF and government bodies such as US DoD. |

| | | |

Customers rely on our services and solutions Read more on page 16 | | We provide high-value services – consulting, engineering, project and construction management, and supply chain management. These skills are critical to the successful development and operation of our customers’ assets – right across their lifecycle. We have a particularly strong reputation for delivering engineering solutions for complex projects. |

| | | |

We have a flexible and low-risk business model Read more on page 17 | | The majority of our contracts reimburse us for our people’s time. We often also get additional payments by achieving pre-agreed performance measures. Many of these are long-term contracts. In selected circumstances we take on fixed-price work. The breadth of our market and customer exposure gives us great growth opportunities, and reduces the impact during lower levels of activity in one market. |

| 12 | Amec Foster Wheeler Annual report and accounts 2015 |

| | Our values | |

| |  | ► We listen, understand and respond ►We agree on clear expectations ►We aspire to consistent excellence ►We invest in our people ►We embrace diversity and inclusion ►We connect globally as one team ►We put safety first ►We act ethically and with integrity ►We care about our communities |

| Managing the challenges | | How we measure success |

| | | |

Our future success relies on attracting, developing and retaining the best people. We need to be flexible, using our people as cost effectively and efficiently as possible. We maintain the highest standards of safety and ethics. We are committed to encouraging and providing mechanisms for employees to become shareholders in Amec Foster Wheeler and our SAYE share option schemes (Sharesave) allow employees to participate in Amec Foster Wheeler’s share price growth. Sharesave is open to employees in all major countries of operation who meet a minimum service qualification. Offers to participate are currently being made on a regular basis. | | We look at the utilisation rate of employees, gender diversity and employee-instigated turnover. We measure the engagement of our people and the development activity that has taken place and a number of safety measures. Read more on page 14 |

| | | |

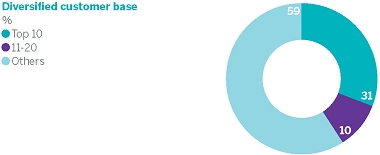

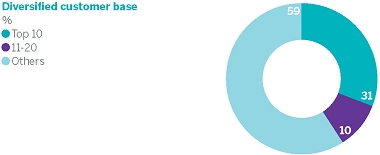

We win business because of our reputation for delivery and the strength of our long-term customer relationships. Our diversified customer base limits our dependence on any one customer. | | We track levels of customer satisfaction and look to improve our win-to-bid ratio. Read more on page 15 |

| | | |

We are adaptable to ensure we offer our customers the right services when and where they need them. We must be able to deliver these services in a cost-effective way. We work across a range of cyclical markets, which can impact demand for our services. | | We track our revenue growth and our margin progression. We also look at the mix of services we provide and where they sit in the lifecycle of our customers’ assets. Read more on page 16 |

| | | |

Our reputation for delivery is very important to our continued success. We take fixed-price work when we know the customer and the project well. We have a good track record predicting earnings from each project and contract. | | Our profit margin and cash conversion reflect the quality of project delivery. We also have a range of non-financial measures, including greenhouse gas emissions and completion of project and peer reviews. Read more on page 17 |

Amec Foster Wheeler Annual report and accounts 2015 | 13 |

Delivering excellence

People are our principal asset |

Our success depends upon our people delivering projects successfully for our customers.

To foster the right culture in which our people can succeed,our values (see page 13) are entrenched throughout our business.

We perpetuate the very highest standards of safety, mutual respect and ethical behaviour that we can and this, combined with caring for the environment in which we operate, underpins our approach to being a sustainable people business (read more about our commitment to sustainability on page 22 and on our dedicated sustainability microsite on amecfw.com).

Operating model

On 1 January 2015, we introduced our new operating model.

Key principles include global standards for execution of projects, creating centres of excellence and multi-office delivery.

Investing in talent

We have developed both technical and leadership training to ensure we maintain a pipeline of skilled talent to meet our growth aspirations.

Group-wide training is led by the Academy, our in-house development programme.

Adapting to dynamic markets

Delivering a project for our customers requires us to put together teams of people to match the needs of the project and the customer.

During 2015 we recruited approximately 12,000 people, the vast majority into project teams. Of these new hires, more than 90% were recruited directly. We have also seen a similar number of people leave as projects finish, or their roles change. Together this means that our utilisation rates remain very high.

Diversity and inclusion

The business case is clear. An organisation that enjoys diversity enjoys a richness of ideas that leads to better solutions for the customer.

Gender is just one part of this. Of our directly employed workforce, 23% (or 8,247 people) is made up of women and 77% (or 27,610) is made up of men; of our executive grade employees, 10% (41) are women and 90% (369) are men; of our Group Leadership Team one person (10%) is a woman and nine people (90%) are men; and of our board 25% (two people) are women and 75% (six people) are men.

Age, gender and ethnicity are all important and assessed, but diversity of thought, for instance, cannot be measured as accurately. Our approach is to survey our employees, to ask how they feel and feed the findings into the Group Leadership Team.

We are committed to providing a safe and secure workplace, where people are free from harassment and where diversity and inclusion are the norm, with equal opportunities for progression and development for all.

Our Code of Business Conduct highlights our commitment to human rights and we respect those of any individual, or community, with whom we are involved and we support the elimination of child labour.

Participation

We are committed to encouraging and providing mechanisms for employees to become shareholders in Amec Foster Wheeler and our savings-related share option schemes (Sharesave) allow employees to participate in Amec Foster Wheeler share price growth. Sharesave is open to all employees in all major countries of operation who meet a minimum service qualification. Offers to participate are currently being made on a regular basis.

Priorities for 2016

As usual, the most important priority remains that our people are safe at work and that we continue to attract, develop and retain skilled employees.

| 14 | Amec Foster Wheeler

Annual report and accounts 2015 |

We have a wide range of customers and work for some of the world’s largest corporations and government bodies, designing and maintaining critical assets. Our customers expect us to deliver excellence every day. We are very proud of the high proportion of repeat business we generate.

Our customers include some of the largest international oil companies such as ExxonMobil and BP, chemical companies such as Dow, miners such as Rio Tinto, utility companies such as EDF, and government bodies, such as the US Department of Defense.

Our top 10 customers accounted for approximately 31% of revenue.

Strategic customer management

Developing long-term and worldwide relationships with key customers is a priority.

With additional service offerings and new customers across a broader geographic footprint, there are much greater opportunities to cross-sell and a strategic approach to managing our customer relationships is no longer a nice-to-have – it is a necessity. We now have three tiers of customer relationship: global, regional and local.

Global accounts are managed centrally by the business development team. We expect to expand this over the coming years.

By utilising strategic account management and global accounts, we are ‘upping our game’ to expand and deepen our relationships with our most significant customers.

Our goal is to get closer to our customers and be their trusted partner. Regional and local account management will remain an important component.

Achievements in 2015

Despite the challenging conditions in our end markets, we are pleased that the customer satisfaction scores have remained high.

During 2015, work has continued on a number of significant projects for customers such as BP, ExxonMobil, K+S, Sempra, EDF and Honeywell.

We have also begun new projects for customers such as:

| ► | Maersk Oil in the UK North Sea – where our cost-effective approach (More4Less) was key in winning a new contract |

| | |

| ► | Yuhuang Chemicals in Louisiana – where we are utilising the breadth of our US-based engineering and construction capabilities, combined with a strong relationship with Air Liquide to win a major contract to build a new methanol plant |

| | |

| ► | Petra Diamonds in South Africa – where we have begun work at the Cullinan diamond mine mill extension |

| | |

| ► | UK Power Networks – where we have begun a 12-year partnership to upgrade electricity infrastructure in the UK |

Priorities for 2016

The development of long-term and worldwide customer relationships will continue to be our key priority.

Integrating the former AMEC and Foster Wheeler relationships will provide us with significant new opportunities, particularly in the mid- and downstream oil & gas market.

For example, we can offer enhanced project delivery to our combined upstream and downstream customers across new-build and brownfield projects. We are now offering environmental services to former Foster Wheeler customers for the first time too.

We are also planning to expand the geographic reach of our services, for instance by offering brownfield services in new countries.

Amec Foster Wheeler

Annual report and accounts 2015 | 15 |

Delivering excellence continued

Customers rely on our services and solutions |

In each market or sector, the range of services provided to our customers is similar.

We are experts in designing, delivering and maintaining strategic and complex assets, offering total life of asset support from feasibility planning right through to decommissioning.

Our diversified service offering partially offsets the cyclical nature of our customers’ capital expenditure plans, and reduces our dependence on any one part of the energy mix.

Core services

Our core services include: engineering, project management, construction and construction management, hook-up and commissioning, decommissioning, and related consultancy work.

We have a reputation for delivering engineering solutions for complex projects and operating in remote and harsh locations.

Our clean energy offering also includes Circulating Fluidised Bed (CFB) and heat recovery steam generators, condensers and emission control equipment for improved environmental performance.

Working through the lifecycle

We provide high-value services across the lifecycle of our customers’ assets and the range of services we are able to provide is similar in each of our four markets.

Many of our services are provided through long-term contracts, giving us the opportunity to provide critical services in partnership with our customers. For instance, we have been supporting the current fleet of UK nuclear reactors for more than 50 years. Some of these contracts have been renewed several times.

Project delivery team

Our operating model has an enhanced project delivery function with responsibility for ensuring the identification and management of project risks, driving the use of common systems and tools, supporting the development and mobilisation of our teams and ultimately helping us to deliver excellence on all our projects.

Achievements in 2015

Contract wins announced in 2015 include:

| ► | Algeria: Consultancy project to de-bottleneck Hassi R’Mei gas field (Sonatrach) |

| | |

| ► | Belgium: Detailed engineering for Zeebrugge LNG terminal expansion (Felguera) |

| | |

| ► | Canada: Remediation work at Port Granby long-term waste management facility (Canadian Nuclear Laboratories) |

| | |

| ► | China: Three-year project management contract at a coal-chemical complex (Shenhua Ningxia Coal) |

| | |

| ► | Guam: Design and construction of specialist facilities (U.S. Air Force) |

| | |

| ► | Malaysia: Consultancy services to a new refinery and pet-chem complex in Kedah (SKS) |

| | |

| ► | Oman: Three-year technical services contract for refinery and polypropylene facilities (Orpic) |

| | |

| ► | Philippines: Design and supply two 150MW CFB boilers in Cebu (Hyundai) |

| | |

| ► | Poland: Design, supply, construction and commissioning of 220MW CFB boiler in Zabrze (Fortum Zabrze) |

| | |

| ► | Turkey: Initial phase reimbursable EPC for the Çöpler Gold Mine (Anagold Madencilik) |

| | |

| ► | UAE: Three-year extension to project management consultancy (PMC) services contract on Upper Zakum project (Zadco) |

| | |

| ► | UK: Five-year integrated services contract in the UK North Sea (Maersk) |

| | |

| ► | UK: Three-year contract to supply regulatory, technical and training services to MoD nuclear safety authority (UK MoD) |

| | |

| ► | USA: Engineering and logistics support worldwide AFCAP IV (U.S. Air Force) |

| | |

| ► | USA: Early stage EPC for new methanol plant in Louisiana (Yuhuang Chemicals) |

| | |

| ► | Vietnam: Front-end engineering design (FEED) for Dun Quat refinery upgrade (Vietnam National Oil and Gas Group) |

Priorities in 2016

Our main priority is to continue to adapt our services so that customers choose us to deliver and maintain their projects –safely and cost effectively.

| 16 | Amec Foster Wheeler

Annual report and accounts 2015 |

We have a flexible and low-risk business model |

We have a flexible and low-risk business model; the majority of our contracts are on a cost-plus basis.

When we agree fixed-price work we take the time to get to know the customer and the project first.

By using common systems we can deliver work consistently and share work across offices and time zones.

We are also able to adapt the type of work we do as our customers’ plans change – offering a mix of engineering, project management and full-scope project delivery packages.

As a result, our business is more flexible and sustainable, and our financial performance less volatile than others’.

In the majority of our contracts, our customers reimburse us for our people’s time and any materials we consume. We often arrange to get additional payments if we achieve pre-agreed performance measures.

In selected circumstances we take on fixed-price work. Typically, we will do this where we know the customer and the project well.

Where this is not possible, we may look to partner with others to gain access to projects which would otherwise be unavailable to us.

Each year we do work on numerous contracts – some of which are multi-year, this, together with the breadth of our market and customer exposure, reduces the impact of lower levels of activity in any one area of our business.

Flexibility

The Global Power Group has a different business model to our engineering and project management business.

In addition to engineering and project delivery, it includes fabrication in its typical scope of activities.

Enhanced risk management

This plays a vital role in ensuring that we win projects with the greatest possible opportunity for success: maximising the value we get for our resources and addressing risks that are part of contracting in our industry.

We use a detailed workflow system which addresses the risks associated with tenders (for both lump sum and reimbursable contracts) in areas such as technical challenges, financial and pricing terms, joint venture/partner risks; as well as a full range of governance issues, such as human rights, safety and environmental risks.

Achievements in 2015

Our order book finished 2015 at £6.6bn and we have successfully adapted to lower levels of upstream oil & gas work by increasing our exposure to downstream and clean energy projects.

In April we announced the completion of Copper Mountain solar 3 project in Nevada, where we provided EPC services for one of the largest photovoltaic (PV) solar plants in the US, ahead of schedule and under budget.

In December we entered into a joint venture with Khan Offshore to deliver commissioning services for facilities as they are being constructed in South Korean yards – creating an opportunity to expand the addressable market for commissioning services which has been growing well since we acquired Qedi in 2011.

Priorities for 2016

Despite some tough market conditions, we want to win new contracts which will maintain our low-risk and flexible business model.

We will continue to increase collaboration across the Group –between teams from different sectors and countries, as well as substantially increasing the share of work carried out through multi-office delivery.

Amec Foster Wheeler

Annual report and accounts 2015 | 17 |

Principal risks and uncertainties

Amec Foster Wheeler operates in more than 55 countries, serving a broad range of markets and customers. As such, the Group is subject to certain general and industry specific risks. Where practicable, the Group seeks to mitigate exposure to all forms of risk through effective risk management and risk transfer practices.

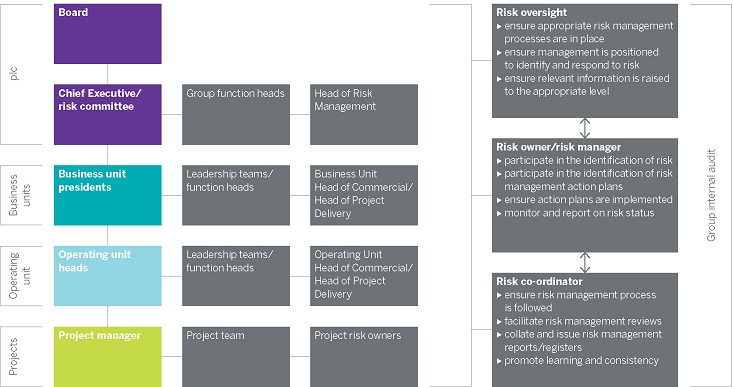

The board has overall responsibility for risk management, for determining the risk appetite in relation to the principal risks, for implementation of the risk management policy and for reviewing the effectiveness of the risk management systems.

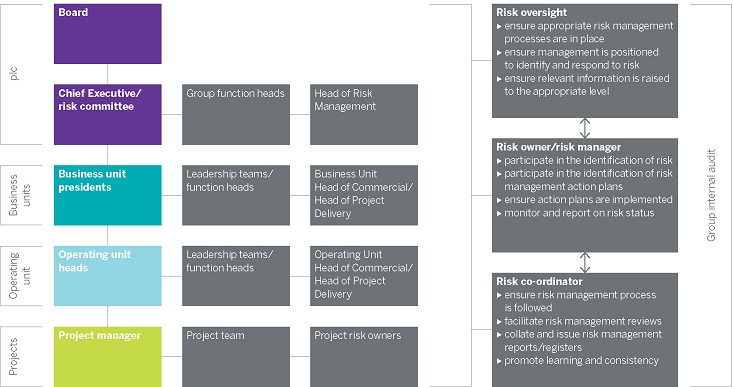

Risk management process

A global mandatory procedure detailing the risk management process is used at project, operating unit, business unit and group levels to identify the key risks that could have a significant impact on Amec Foster Wheeler’s ability to achieve its objectives. These are recorded in risk registers and evaluated to determine the likely impact and probability of occurring.

Control actions are developed to mitigate or eliminate risks that are considered unacceptable. Risk owners are identified and given responsibility for ensuring actions are implemented with appropriate review dates.

The risk registers are reviewed and updated at least quarterly with the relevant risk owners.

Reporting and monitoring

The risk committee is chaired by the Chief Executive and meets at least twice each year to:

| ► | review and advise the board on Amec Foster Wheeler’s risk appetite in relation to the principal strategic risks, taking account of the current and prospective macro-economic, financial, political, business and sector environments |

| | |

| ► | review and approve the risk management strategy, policies, procedures and processes |

| | |

| ► | review and report to the board on the effectiveness of the risk management systems |

| | |

| ► | review the Amec Foster Wheeler plc risk register and make recommendations as appropriate |

| | |

| ► | review any new or emerging risks and any potential impact they may have on risk appetite and the ability of Amec Foster Wheeler to manage such risks |

| | |

| ► | review any issues raised by other committees of the board that impact on the risk profile of Amec Foster Wheeler |

| | |

| ► | review and consider reports on key risk issues such as new business and geographical locations for operations or projects |

| | |

| ► | consider any internal or external risk trends and concentrations |

The terms of reference of the risk committee have been amended to reflect the requirements of the UK Corporate Governance Code 2014.

Roles and responsibilities

| 18 | Amec Foster Wheeler

Annual report and accounts 2015 |

Principal business and strategic risks

The table below shows Amec Foster Wheeler’s principal business and strategic risks. Each is specific to the Group and could have a material impact on it. Actions have been taken to mitigate these risks and these are also shown.

Other financial risks that may impact the Group are shown on pages 136 to 141 – note 19 Capital and financial risk management.

| Risk | | Mitigation |

Geopolitical and economic conditions Amec Foster Wheeler expects to derive the majority of its revenues from Europe, the US and Canada and is therefore particularly affected by political and economic conditions in those markets. Changes in general economic conditions may influence customers’ decisions on capital investment and/or asset maintenance, which could lead to volatility in the development of Amec Foster Wheeler’s order intake. These may also lead to change in the customer base, competition and in the way customers procure the services we provide. An increase in competition for new contracts may lead to different, less favourable contract terms and conditions. Continuing and escalating unrest and insurgency activity in the Middle East may have a negative impact on existing and future opportunities in the region. | | Amec Foster Wheeler seeks to maintain a balanced geographic presence and, through acquisitions and organic growth, will continue to increase its exposure to other attractive regions of the world. The risk associated with economic conditions resulting in a downturn and affecting the demand for Amec Foster Wheeler’s services has been addressed, as far as practicable, by seeking to maintain a balanced business portfolio in terms of geographies, markets, clients and service offering/ business model. In light of continuing global economic uncertainties, steps have been taken to assess and monitor any potential impact on Amec Foster Wheeler’s business opportunities and address potential increased supply chain and, more broadly, counterparty risk. The strategy and business development function is focused on realising the synergies across our customers, markets, geographies, service offerings and relationships. |

Changes in commodity prices A sustained and significant reduction in oil & gas or commodity prices would have an adverse impact on the level of customer spending in Amec Foster Wheeler’s markets and consequently represents a risk to organic growth. The fall in oil prices has had an impact on the investment behaviour of Amec Foster Wheeler customers in this sector, with pressure on capital expenditure leading to a greater focus on smaller projects and operating expenditure and an increase in competition for new contracts. | | This risk is mitigated by maintaining a balanced business portfolio of geographies, markets, clients and service offerings. Improved efficiencies through increased workflow between offices and the effective use of centres of excellence and HVEC. |

Project delivery Failing to maintain discipline and meet customer expectations on project delivery could result in damage to reputation, loss of repeat business and potentially lead to litigation and/or claims against Amec Foster Wheeler. | | The project delivery function provides assurance, drives project execution and supports the development, training and mobilisation of personnel to enhance execution competencies. In addition the system of globally applied policies and procedures, combined with comprehensive management oversight, the risk management process, project reviews, internal audit, peer reviews and customer feedback, mitigate the risk to successful project delivery. |

Lump sum contracts Lump sum contracts carry different risks than reimbursable contracts, with the contractor agreeing the contract price at the start of the contract and accepting the risk of cost overruns in completing the project. | | This risk is mitigated by having skills and competencies fully aligned with the project scope. It is further mitigated by having a clear, delegated authority structure in place, combined with the formal global mandatory procedures relating to contracting principles and the tender review process. In addition, the project delivery function, referred to in the project delivery risk above, performs reviews, provides assurance and drives project execution. |

Staff recruitment and retention An inability to attract and retain sufficient high-calibre employees could become a barrier to the continued success and growth of Amec Foster Wheeler. Senior management departures or prolonged absences could also adversely affect our ability to implement our strategy and manage our operations efficiently. | | This risk is mitigated with a clear HR strategy, which is aligned to the business strategy and focused on attracting, developing and retaining the best people for the Group with succession planning as appropriate. It is underpinned by an employee framework which describes how we manage our people consistently. In addition, there is a continual review of compensation and benefits to ensure sector and geographic competitiveness and there are localised recruitment teams capable of recruiting large numbers into Amec Foster Wheeler. Amec Foster Wheeler Academy delivers development activities to enhance delivery and prepare employees for more advanced roles. |

Amec Foster Wheeler

Annual report and accounts 2015 | 19 |

Principal risks and uncertainties continued

| Risk | | Mitigation |

Health, safety, security and environment Amec Foster Wheeler is involved in activities and environments that have the potential to cause serious injury to personnel or damage to property or the environment and damage to our reputation. These activities may involve operations such as design, construction, commissioning and decommissioning, which have potential to cause serious environmental damage, pollution and habitat destruction. | | In order to control risk and prevent harm, Amec Foster Wheeler is focused on achieving the highest standards of health, safety and security management. This is achieved through setting of an effective policy and putting in place clear standards which underpin our health, safety, security and environmental management systems. We have put in place processes to assure that our systems work effectively throughout the organisation and health and safety performance is regularly reviewed against agreed targets to facilitate continual improvement. Amec Foster Wheeler employs environmental and engineering specialists to support projects in implementing comprehensive project management planning at all stages of a project. These processes are governed by appropriate quality management systems and are supported by risk identification tools aimed at identifying and managing all aspects of project environmental risk. |

Environmental licences Amec Foster Wheeler’s build/own/operate facilities and fabrication/ manufacturing sites rely on maintaining environmental licences to operate, which includes protecting the environment and achieving legally enforceable operating parameters. Failure to maintain these standards may result in the revocation of all or part of the licence and the suspension of operation, resulting in criminal or civil action and/or financial risk to the business. Failure to maintain assets and/or pollution abatement equipment may result in a failure to meet legally binding objectives and targets for the operation. | | Environmental management systems are in place to monitor and mitigate this risk. Planned preventative maintenance schedules are in place to further mitigate this risk. |

Information technology (IT) Amec Foster Wheeler is exposed to the risk that the IT systems on which it relies fail and/or that sensitive data held by the Group is lost due to ineffective data governance or as a result of unauthorised access to Amec Foster Wheeler systems or malware attacks. | | Appropriate controls are in place to mitigate the risk of systems failure and data loss, including systems back-up procedures, data security breach response plan, disaster recovery plans and globally distributed data centres providing a secure and reliable environment for hosting critical applications. There is also appropriate virus protection, malware detection and remediation, network security controls and penetration testing and encryption of mobile devices. |

Ethical breach A substantive ethical breach and/or non-compliance with laws or regulations could potentially lead to damage to Amec Foster Wheeler’s reputation, fines, litigation and claims for compensation. | | Amec Foster Wheeler has a number of measures in place to mitigate the risk of a substantive ethical breach and/or non-compliance with laws or regulations, including: ► embedded policies and procedures ► Code of Business Conduct ► segregation of duties ► management oversight ► financial and operational controls ► independent whistle-blowing mechanism ► appointment of ethics and compliance officers ► anti-fraud and other internal audits ► legal team advice ► training programmes supporting the Code of Business Conduct and anti-bribery and corruption ► oversight by the ethics committee of the board (now the HSSEE committee – see pages 63 and 64) |

Pensions Amec Foster Wheeler operates a number of defined benefit pension schemes, where careful judgement is required in determining the assumptions for future salary and pension increases, discount rate, inflation, investment returns and member longevity. There is a risk of underestimating this liability. | | This risk to Amec Foster Wheeler’s pension schemes is mitigated by: ► maintaining a relatively strong funding position over time ► taking advice from independent qualified actuaries and other professional advisers ► agreeing appropriate investment policies with the trustees ► close monitoring of changes in the funding position, with reparatory action agreed with the trustees in the event that a sustained deficit emerges See note 14 on page 128 for further details on our pension schemes. |

| 20 | Amec Foster Wheeler

Annual report and accounts 2015 |

| Risk | | Mitigation |

Legacy risks Litigation and business claims from divested and non-core businesses remain a risk to Amec Foster Wheeler. Managing non-core legacy assets until divestment may require skills that are not common to the rest of the Company. Ground contaminants remain at some former Amec Foster Wheeler operational localities where the pollutant may have been as a result of the Company’s operations, or the Company is responsible for its clean-up. There is a risk that pollution may result in a risk to human health or the environment. There is potential for civil and/or criminal action against the Company for such pollutants. | | The established legacy team manages these claims with internal and external legal advice. The aim is to seek cost-effective management of litigation and promote commercially sensible settlements where appropriate. Amec Foster Wheeler has made provisions for the legacy issues that are believed to be adequate and is not aware of any other current issues relating to disposed businesses which are likely to have a material impact. Specialist teams with the appropriate knowledge are brought in as required. In the case of any known contaminated land, strategies have been developed to minimise the risk posed by such contaminated land, including asset management and land remediation projects and they remain under continuing review. |

Asbestos liability The legacy Foster Wheeler business is exposed to significant numbers of claims relating to alleged exposure to asbestos. The quantum of these claims is actuarially forecast each year and provisions are held against these loss projections. However there is a risk that these loss projections will be exceeded and the provisions could be inadequate to meet the liabilities. | | There is a dedicated in-house finance and legal resource including a team of specialist asbestos lawyers who manage the claims, assisted by National Co-ordinating Counsel (NCC) and local counsel. A claims strategy has been developed with the NCC and regular reviews are undertaken. The team monitors legal developments in these claims and the strategy to deal with them on a regular basis. The quantum of these claims is actuarially forecast each year and provisions are held against the ultimate loss projections. |

Viability statement

In accordance with provision C.2.2 of The UK Corporate Governance Code (September 2014 revision) the directors have performed a robust assessment of the principal risks detailed on pages 19 to 21 for the next three years and have concluded that they have a reasonable expectation that Amec Foster Wheeler will be able to continue in operation and meet its liabilities as they fall due over this three-year period.

The directors have selected a three-year period for this assessment, in line with the three-year business planning process and this also reflects the average duration of the larger customer contracts entered into by the Company.

In making this assessment the directors have taken into account the Company’s current trading performance and prospects, the stated strategy concerning the review of underperforming assets and the board’s appetite for risk. The Company refinanced its banking facilities in early March 2016 and the assessment confirms that we are compliant with the covenants and undertakings contained within these new facilities over the three-year period.

The approach adopted for this assessment was a detailed review of the principal risks by a senior management team with representatives from finance, commercial, legal, tax and treasury, strategy, internal audit and risk to consider which of these risks might threaten the Group’s viability. The assessment of these risks included modelling them in severe but plausible scenarios taking account of:

| ► | varying impacts of specific risks across business units or market sectors as appropriate |

| | |

| ► | any potential risk interdependencies |

| | |

| ► | the risk mitigation measures currently in place |

| | |

| The analysis of the principal risks has been weighted towards downside risk and a sensitivity analysis has been used to stress test the risk events most likely to negatively impact the company. Specific scenarios have been tested and include: |

| |

| ► | a further fall in oil prices, increasing pressure on customer spending and impacting prospects for future projects |

| | |

| ► | project delivery failure resulting in delayed payments, settlement payments, reputational damage and reduced future work |

| | |

| ► | risk of cost overruns on lump sum contracts |

| | |

| ► | a substantive ethics breach and/or non-compliance with laws or regulation which could result in reputational damage, fines, litigation and claims for compensation |

| | |

| ► | a serious environmental incident causing third party damage and/or injury and reputational damage |

Amec Foster Wheeler

Annual report and accounts 2015 | 21 |

Sustainability

Sustainable development is shaping our business every day. It is at the heart of our values.

| Greenhouse gas emissions | | | | |

| Year ended 31 October | 2015

CO2e

emissions in

tonnes | | 2014

CO2e

emissions in

tonnes | |

| Combustion of fuel and operation of facilities | 838,073 | | 24,355 | |

| Electricity, heat, steam and cooling purchased for own use | 59,682 | | 35,434 | |

| Per employee | 22.83 | | 2.17 | |

| Per £1m revenue* | 164.57 | | 15.74 | * |

*Based on AMEC revenue only for 2014.

The figures show scope one and two emissions from our global business where we have operational control.

The 12-month period to 30 September (the carbon reporting year), rather than the calendar year, has been used. This ensures actual data can be reported, even for those regions where energy/fuel usage is more difficult to access. By reducing reliance on estimation, a more accurate footprint can be provided in a timely manner.

We have use accepted methods of calculation based on the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (revised edition). We have used national conversion factor guidelines (eg Environmental Protection Agency, Environment Canada) where appropriate.

Our 2015 footprint is markedly different from previous year due to the inclusion of emissions from two power generation facilities which came as part of the Foster Wheeler acquisition. Our 2014 data represents the AMEC business only. The 2015 footprint represents the Amec Foster Wheeler business (with Foster Wheeler data being incorporated into the carbon report from 1 January 2015).

Our approach to sustainable business

Our growth aspirations will only be achieved by focusing on our customers and how we deliver our projects safely and sustainably.

In 2015 we developed and launched our sustainability strategy for Amec Foster Wheeler – Resilient World, where natural resources are cleaner and more efficient, and we work in partnership with others to respond to changing demands for a stable and secure supply of natural resources. Our strategy focuses on the opportunities to work with others to help solve these challenges, as well as manage our risks, to deliver value to Amec Foster Wheeler and its customers. Our strategy focuses on three key areas:

People

Investing for tomorrow by developing a diverse, inclusive and talented workforce which exhibits our values and behaviours to drive sustainability.

Growth in demand drives the competition for skills and expertise within the industry that we need to deliver a resilient world. We will resource for a diverse and inclusive workforce, introducing new people (both experienced and new entrants) to the resource pools in order to create a business with genuine diversity of thought.

Innovation

Delivering innovative technologies, solutions and services that add business value for our customers whilst minimising environmental impacts.

We will drive long-term growth for Amec Foster Wheeler by developing and encouraging a growing portfolio of innovative environmental technologies, solutions and services which add value to our customers and our business.

Delivery

Being a trusted partner by embedding a consistent sustainability standard across our projects.

Our customers demand high standards, and sustainability is a fundamental part of this. We will ensure a consistent approach to inherently embedding sustainability into the core of our projects, and implement a value-add sustainability framework to be used for those clients with advanced sustainability objectives.

We want to ensure that sustainability is integrated into the very core of our business and within our decision-making processes. We want to be acknowledged as a leader in sustainable business practice, continually validating our social licence to operate by ensuring employees’ behaviours and actions are in line with our values. Further details on our approach and our strategy can be found on our dedicated sustainability site at www.amecfw.com/sustainability

Additionally we:

| ► | developed and launched our Resilient World sustainability strategy |

| | |

| ► | launched an online interactive sustainability report on our new sustainability website |

| | |

| ► | re-committed to the UN Global Compact principles as Amec Foster Wheeler |

| | |

| ► | continue to support SOS Children as our global strategic charity – in 2015 we raised just over £140,000 for them, reaching 5,568 beneficiaries. We also developed a new memorandum of understanding with the International Federation of Red Cross and Red Crescent Societies (IFRC), to support them in designing transitional shelters to be used in disaster situations |

| | |

| ► | collated and reported a new carbon footprint baseline for the Amec Foster Wheeler business from which future reduction targets will be set |

| | |

| ► | became a partner of 100 Resilient Cities (100RC) – pioneered by the Rockefeller Foundation to give urban centres across the world access to ground-breaking tools allowing them to better plan for potentially destructive weather events |

| | |

| ► | convened a working group to address the due diligence and operational processes required to address the Modern Slavery Act |

| 22 | Amec Foster Wheeler

Annual report and accounts 2015 |

Global market trends

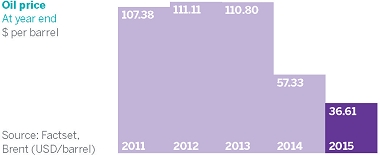

With nearly $400bn of projects in the oil & gas industry cancelled in the past 12 months, we are facing an unprecedented upheaval in our largest market.

The fundamentals for energy consumption and infrastructure investment remain positive in the long term.

In the short term we will need to continue to adapt to customers’ needs.

Our asset-light business model and mix of end markets and services has provided us with some protection from commodity market volatility.

Short-term challenges

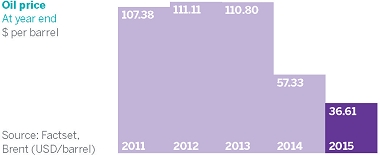

At the time of writing, in early 2016, the oil price has fallen to $40, and has recently been below $30. At this price research shows that more than 10% of current production cannot cover its operating costs.

We have also seen hundreds of new projects cancelled or deferred as our clients cut costs and capital commitments.

Despite this, the global oil market remains over-supplied and stocks have continued to grow.

This situation looks set to continue for a while yet – with forecasts for the market to re-balance in 2017 at the earliest.

During 2016 we also expect to see Iran begin exporting more oil as international sanctions are lifted. Estimates vary from 250,000 to 500,000 extra barrels of oil entering the market during the first few months. While this may increase the over-supply of oil in the short term, the opening up of Iran is also an opportunity for us. In September 2015 we joined a British government delegation in Tehran to meet with potential Iranian customers.

Long-term outlook

Despite the current weakness, long-term forecasts for global energy demand and supply have not changed significantly over the past year. The International Energy Agency (IEA) World Energy Outlook 2015 predicts a 37% increase by 2040.

Long-term oil demand is expected to increase more than 20% from just over 90 to 110 million barrels of oil per day by 2035.

Changing hydrocarbon production mix

A change from today’s production mix is still expected, with crude oil falling and a greater share being taken by natural gas liquids and unconventional sources.

In recent years the rapid increase in tight oil production – mainly from the oil sands in Canada and shale oil in the US – together with huge investments in liquefied natural gas projects has changed the nature of the energy market, and created regional trade imbalances.

In 2005 the US imported more than 12 million barrels of oil per day, and it is now forecast to be self-sufficient during the 2030s. Over the same period, China is expected to import more than 13 million barrels per day, and to become the largest importer.

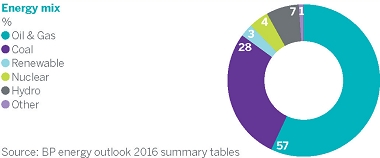

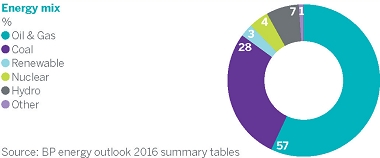

Changing energy mix

Concerns around resource depletion, dangerous emissions, stricter regulation and consumer preference are driving renewable forms of energy, including nuclear, to increase their share of total energy production. Amongst fossil fuels, gas is expected to grow its share, with oil and coal reducing.

The nuclear industry remains a fragmented market with a consequence that our opportunities vary significantly. We expect to see new build in the UK, Eastern Europe and in some countries in Asia; reactor life extensions in the UK, Europe and North America; and decommissioning work in the UK, Europe and North America. Overall, the IEA forecasts nuclear will be used to generate around 12% of electricity in 2035, slightly above today’s level.

Emissions controls and the need for greater efficiency are also driving change. Today, many renewable technologies benefit from local and regional subsidies, which is currently supporting their growth.

World leaders gathered in Paris at the end of 2015 to agree on a pact to cut carbon emissions. We remain well placed to benefit from these developments – with our increased exposure to gas and LNG since the acquisition of Foster Wheeler, and our long-standing market positions in renewable and nuclear energy markets.

Strong resource fundamentals remain

More than 1.5bn people in emerging markets are expected to become urbanised in the period to 2035, a key underlying driver of long-term growth for the mining industry.

However, lower commodity prices and general economic uncertainty have caused the postponement or cancellation of some projects in the near term.

In addition, a number of major mining companies have announced delays to projects and cost reduction programmes.

Amec Foster Wheeler

Annual report and accounts 2015 | 23 |

Our markets

We operate in more than 55 countries, focusing on four markets: ► Oil & Gas ► Clean Energy ► Mining ► Environment & Infrastructure |

We provide similar services in each of our markets.

We win work through strong customer relationships and our proven ability to deliver projects successfully.

Many of our services are transferable across markets.

We have benefited from our ability to operate across many markets – focusing our efforts on retaining a diverse, adaptable and scalable business model.

We have also shifted resources between markets – for instance offsetting the weakness in upstream with significant growth in downstream oil & gas.

In the UK we have transferred some senior project management staff from the oil & gas market into nuclear – allowing us to expand our role on a nine-year contract with EDF.

In the US we have created a combined project delivery team – which can work across the oil and gas and clean energy markets to ensure we execute to the highest standards possible every time.

Business review

In November 2015 we announced a review of our market positions. Our aim is to identify a path to improved performance, or to sell businesses if this is not likely. We are making good progress on this plan, and expect to update shareholders later in 2016.

Competitive environment

There is no one competitor operating in all the same markets, with the same geographic footprint and with a similar approach to risk as Amec Foster Wheeler.

Oil & Gas