UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 13, 2009

FREZER, INC.

(Exact name of Registrant as specified in charter)

| Nevada | | 0-51336 | | 02-2777600 |

| (State of Incorporation) | | (Commission File No.) | | (IRS Employer |

| | | | | Identification Number) |

No. 90-1 Hongji Street

Xigang District Dalian City

Liaoning Province, PRC, 116011

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (011)-86-411-83678755

190 Lakeview Way, Vero Beach, Florida

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| o | Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

TABLE OF CONTENTS

| Item No. | Description of Item | Page No. |

| Item 1.01 | Entry Into a Material Definitive Agreement | 3 |

| Item 2.01 | Completion of Acquisition or Disposition of Assets | 5 |

| Item 3.02 | Unregistered Sales of Equity Securities | 47 |

| Item 5.01 | Changes in Control of Registrant | 47 |

| Item 5.02 | Departure of Directors or Principal Officers,Election of Directors; Appointment of Principal Officer | 47 |

| Item 5.06 | Change in Shell Company Status | 48 |

| Item 9.01 | Financial Statements and Exhibits | 48 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Current Report on Form 8-K contains forward-looking statements. Certain of the matters discussed concerning our operations, cash flows, financial position, economic performance and financial condition, including, in particular, future sales, product demand, the market for our products in the People’s Republic of China and elsewhere, competition, exchange rate fluctuations and the effect of economic conditions include forward-looking statements.

Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as "expects," "anticipates," "intends," "plans," "believes," "estimates" and similar expressions are forward-looking statements. Although we believe that these statements are based upon reasonable assumptions, including projections of orders, sales, operating margins, earnings, cash flow, research and development costs, working capital, capital expenditures and other projections, they are subject to several risks and uncertainties and therefore, we can give no assurance that these statements will be achieved.

Investors are cautioned that our forward-looking statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed in the forward-looking statements.

As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections which may be better or worse than projected. Given these uncertainties, you should not place any reliance on these forward-looking statements. These forward-looking statements also represent our estimates and assumptions only as of the date that they were made.

We expressly disclaim a duty to provide updates to these forward-looking statements, and the estimates and assumptions associated with them, after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events. You are advised, however, to consult any additional disclosures we make in our reports on Form 10-K, Form 10-Q, Form 8-K, or their successors.

Information regarding market and industry statistics contained in this Current Report is included based on information available to us which we believe is accurate. We have not reviewed or included data from all sources, and cannot assure stockholders of the accuracy or completeness of the data included in this Current Report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). According to the currency exchange website www.xe.com, on March 13, 2009, U.S.$1.00 was equivalent to 6.8392 yuan.

Explanatory Note

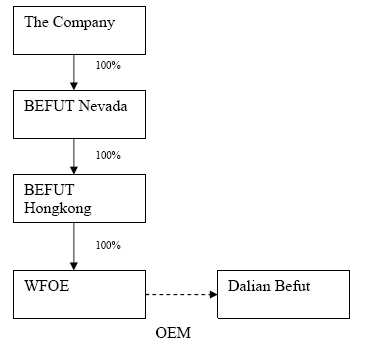

This current report on Form 8-K is being filed by Frezer, Inc. in connection with a series of transactions, all of which closed on March 13, 2009, through which (i) we acquired the ownership of Befut Electric (Dalian), Co., Ltd. (the “WFOE”) and control over its captive manufacturing company, Dalian Befut Wire & Cable Manufacturing Co., Ltd. (“Dalian Befut”) in China and (ii) raised funds through a private placement of notes and warrants. We refer to the transactions through which we acquired the ownership of the WFOE as the “Reverse Merger.” We refer to the transaction through which we raised funds as the “Private Placement”.

This report describes those transactions, the agreements through which they were executed, the nature of the business we now conduct through WFOE and Dalian Befut, and other important features of the Company.

Through the Reverse Merger, we ceased to be a shell company as that term is defined in Rule 12b-2 under the Securities Exchange Act of 1934 (the “Exchange Act”) and are now in the business of wire and cable manufacture and distribution in northeastern China.

Unless the context indicates otherwise, as used in this report, the words "Company”, "we,” "us,” and "our,” each refer to (i) Frezer, Inc., (ii) BEFUT Corporation, a corporation incorporated in the State of Nevada (“Befut Nevada”); (ii) Hongkong BEFUT Co., Ltd. (“Befut Hongkong”), a wholly-owned subsidiary of Befut Nevada incorporated under the laws of Hong Kong; (iii) WFOE, a corporation organized under the laws of the People’s Republic of China (the “PRC”) that is wholly owned by Befut Hongkong; and (vi) Dalian Befut, a corporation organized under the laws of the PRC which is the captive manufacturing company to WFOE and (vii) Dalian Marine Cable Co., Ltd., a corporation that is 86.6% owned by Dalian Befut.

Item 1.01. Entry into a Material Definitive Agreement.

On March 13, 2009 (the “Closing Date”), we entered into and consummated a series of transactions whereby (a) the Company acquired 100% of the outstanding shares of common stock of Befut Nevada, constituting all of the capital stock of Befut Nevada, from Befut International Co. Limited, a British Virgin Islands company (“Befut BVI”) in exchange for the issuance to Befut BVI of a net number of 117,768,300 shares of the Company’s common stock and the cancellation of an aggregate of 2,176,170 shares of the Company’s common stock and (b) the Company raised $500,000 in gross proceeds from the sale to four investors of convertible promissory notes of the Company in the principal amount of $500,000 and warrants to purchase an aggregate of 720,076 shares of the Company’s common stock.

As more fully discussed below, as a result of the transactions, Befut Nevada became a wholly owned subsidiary of the Company. Befut Nevada, through its wholly owned subsidiary, Hongkong Befut wholly owns WFOE, which company has entered into a series of agreements with Dalian Befut pursuant to which WFOE has established control over Dalian Befut, its captive manufacturing company. Dalian Befut is one of the largest developers, manufacturers and distributors of wire and cable products in Northeastern China.

The following sets forth the material agreements that the Company entered into in connection with the above-described transactions and the material terms of these agreements:

1. Share Exchange Agreement

On March 13, 2009, the Company, Befut Nevada and Befut BVI entered into and consummated a Share Exchange Agreement (the “Exchange Agreement”) pursuant to which Befut BVI transferred to the Company all of the outstanding shares of common stock of Befut Nevada, constituting all of the outstanding capital stock and equity interests in such company in exchange for (a) the issuance to Befut BVI of an aggregate of 117,768,300 or 98.3% of the outstanding shares of common stock of the Company, and (b) the cancellation of an aggregate of 2,176,170 shares of the Company’s common stock then owned by Befut Nevada. Befut Nevada had acquired such shares from three persons for an aggregate purchase price of $370,000 pursuant to the terms of a Stock Purchase Agreement dated as of March 2, 2009 (the “Share Exchange”).

The Exchange Agreement contains representations and warranties by the Company on one hand and Befut Nevada and Befut BVI, on the other hand, which are customary for transactions of this type.

2. Securities Purchase Agreement

Simultaneously with the Share Exchange, the Company entered into and consummated a Securities Purchase Agreement with four individuals, Yong Li, Yuming Ning, Chunying Diao and Yining Xia, pursuant to which the Company sold to such persons for a gross purchase price of $500,000: (a) 15% Convertible Notes of the Company in the aggregate principal amount of $500,000 (the “Notes”) and warrants to purchase an aggregate of 720,076 shares of the Company’s common stock at an initial exercise price of $.1916 per share, which exercise price is subject to adjustment upon the occurrence of certain events (the “Warrants”).

The offer and sale of the Notes and Warrants was exempt from the registration provisions of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to Section 4(2) of the Securities Act and/or Regulation S.

The entire unpaid principal amount of the Notes is due on March 12, 2010. The outstanding principal amount of the Notes bears interest at the rate of 15% per annum. After a default, the interest rate would be 20% per annum.

The Notes may not be voluntarily prepaid by the Company. The outstanding principal amount of the Notes (but not accrued interest) is convertible at any time at the option of the holder of the Notes into common stock of the Company at the initial rate of one share of common stock for each $.1597 of principal converted. The conversion rate is subject to adjustment in the case of stock dividends, subdivisions and combinations of the Company’s common stock. Under the terms of each Note, an Event of Default occurs: (i) if interest on such Note is not paid within 10 days following the maturity date, the entire outstanding principal is not paid on the maturity date, (ii) the Company defaults in any of its obligations under the Securities Purchase Agreement and such default continues for more than 10 business days after notice is given to the Company by the holder of the Note, (iii) upon the occurrence of certain events relating to the bankruptcy of the Company or (iv) if the Company’s common stock ceases to be quoted on the OTC Bulletin Board or listed on a stock exchange within 12 months after the date of the Note.

The Warrants are exercisable in whole or in part at any time from the date of issuance until the earlier of (a) March 13, 2014 or (b) thirty days after delivery to the holder of audited financial statements of the Company for a particular fiscal year that shows that the consolidated net income of the Company and its subsidiaries exceeded $20 million for such fiscal year and consolidated net income of the Company and its subsidiaries per share on a fully diluted basis exceeded $.26 per share (which amount is subject to proportional downward adjustment in the case of the issuance of additional fully diluted shares of the Company). The Warrants may also be exercised on a net or cashless basis, if, after September 13, 2009 there is no effective registration statement covering the resale of the shares of the Company’s common stock which may be issued upon exercise of the Warrants. The exercise price of the Warrants is subject to adjustment in certain events, such as the payment of stock dividends, or subdivisions or combinations of the Company’s Common Stock. In the event the Company consolidates or merges with another entity in a transaction in which the Company is not the surviving corporation, the Company transfers all or substantially all of its assets or properties to another entity or the Company effects a capital reorganization or reclassification of its Common Stock, adjustment is to be made to the exercise price and number of shares issuable upon exercise of the Warrants so that the holders will be entitled upon exercise of the Warrants to the securities, cash and property to which the holders would have been entitled upon consummation of such event if such holders had exercised the Warrant immediately prior thereto.

Each of the investors listed below (“Investors”) purchased the securities indicated below under the Securities Purchase Agreement:

| Name | Purchase Price | Principal Amount of Note | Warrants to Purchase Number of Shares of the Company’s Common Stock |

| Yong Li | $100,000 | $100,000 | 144,015 |

| Yuming Ning | $100,000 | $100,000 | 144,015 |

| Chunying Diao | $130,000 | $130,000 | 187,220 |

| Yining Xia | $170,000 | $170,000 | 244,826 |

Representations; Warranties; Indemnification: The Securities Purchase Agreement contains representations and warranties by the Company and the Investors which are customary for transactions of this type. The Securities Purchase Agreement also (i) obligates us to indemnify the Investors for any losses arising out of any breach of the agreement or failure by the Company to perform with respect to the representations, warranties or covenants in the agreement and (ii) obligates the Investors to indemnify the Company for any losses (up to the purchase price for the Notes and Warrants) incurred by the Company as a result of any inaccuracy in or breach of the representations, warranties or covenants made by such Investors in the agreement.

Covenants: The Securities Purchase Agreement contains certain covenants on the Company’s part, including the following: (i) to notify the Securities and Exchange Commission of the transaction, including filing of a Form D and (ii) to comply with the reporting and filing obligations applicable to the Company under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and (iii)to effect a 1 for 4.07 reverse stock split as a result of which the conversion rate of the Notes shall be adjusted to be 1 share of common stock for each $.65 of principal converted.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Item 1.01 is incorporated herein by reference. The Exchange Agreement was consummated on March 13, 2009. As a result, Befut Nevada became a wholly owned subsidiary of the Company. Befut Nevada, through its wholly owned subsidiary, Hongkong Befut wholly owns WFOE, which company has entered into a series of agreements with Dalian Befut giving it control of Dalian Befut and pursuant to which Dalian Befut manufactures products solely for WFOE. Dalian Befut is one of the largest developers, manufacturers and distributors of wire and cable products in Northeastern China.

BUSINESS

Our History

Organizational History of Frezer, Inc.

Frezer, Inc. (“we”, “us”, “our”, or the “Company”) was incorporated in the State of Nevada on May 2, 2005. The Company was previously a wholly owned subsidiary of BMXP Holdings, Inc., then known as Bio-Matrix Scientific Group, Inc. (“BMXG”), a Delaware corporation engaged primarily in the development of medical devices. The board of directors of BMXG voted to distribute all shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), held by BMXG to holders of BMXG common stock of record as of May 31, 2005. On June 15, 2005, these stockholders received one share of the Company’s Common Stock for each share of BMXG common stock.

On June 1, 2005, the Company filed a registration statement on Form 10-SB with the Securities and Exchange Commission (the “SEC”). Upon effectiveness of such registration statement, the Company has been subject to the reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

From inception to July 11, 2006 the Company’s objective was to operate in the field of stem cell banking and regenerative medicine. However, on July 11, 2006, the Company’s board of directors (the “Board of Directors”) unanimously approved resolutions to abandon all plans to develop a stem cell banking facility and market that facility's services.

On February 22, 2007, the Company experienced a change in control as a result of purchase of the aggregate of 3,500,000 shares of Common Stock by KI Equity Partners IV, LLC ("KI Equity"), a Delaware limited liability company. Following such change in control, the Company became a shell company with nominal assets, no employees and no active business operations.

On January 10, 2008, the Company's Board of Directors adopted, and holders of a majority of our issued and outstanding shares of Common Stock approved, by written consent, a 1-for-20 reverse stock split of the Company's common stock outstanding, with special treatment for certain of the Company's stockholders to preserve round lot stockholders.

On March 13, 2009, the Company experienced another change in control as a result of Befut Nevada’s purchase of 2,176,170 shares of the Company’s Common Stock, or 51% of the then outstanding shares from three shareholders of the Company. Immediately after such change in control, the Company acquired Befut Nevada, as discussed in Item 2.01 of this report and cancelled the 2,176,170 shares issued to Befut Nevada. On the same day, the Company consummated the Private Placement as described in Item 1.01 of this report.

Organizational History of Dalian Befut Wire & Cable Manufacturing Co., Ltd.

Dalian Befut was incorporated on June 13, 2002 under the laws of the People’s Republic of China (the “PRC”). It is currently owned by eight individuals in the PRC, among whom, Mr. Hongbo Cao and Mr. Tingmin Li are the largest shareholders having an aggregate of 90% of its equity interests. Pursuant to a series of agreements, Dalian Befut is controlled by WFOE and is a captive manufacturer to it as Dalian Befut is contractually precluded form engaging in business with any other person or entity.

On April 14, 2006, Dalian Marine Cable Co., Ltd. (“Dalian Marine Co.”) was incorporated by Dalian Befut. Its current shareholders are Dalian Befut (having 86.6% of the equity interest) and three individual shareholders, namely, Mr. Tingmin Li (having 6% of the equity interest), Mr. Hongbo Cao (having 4% of the equity interest) and Mr. Qingye Meng (3.4% of the equity interest). The three individuals are also shareholders of Dalian Befut. We plan to have Dalian Marine Co. conduct all of our marketing and production of marine cables.

Organizational History of Befut Electric (Dalian) Co., Ltd.

WFOE was incorporated on February 13, 2009 by Hongkong BEFUT Co., Ltd. under the laws of the PRC.

On February 16, 2009, WFOE entered into a series of agreements, the purpose of which was to restructure Dalian Befut in accordance with PRC law such that it could seek capital and grow its business (the “Restructuring”). First, WFOE entered into an Original Manufacturer Agreement (the “OEM Agreement”) with Dalian Befut with the following material provisions: (i) Dalian Befut may not manufacture products for any person or entity other than WFOE without its written consent; (ii) WFOE is to provide all raw materials and advance related costs to Dalian Befut, as well as provide design requirements for products to be manufactured; (iii) WFOE is responsible for marketing and distributing the products manufactured by Dalian Befut and its keeps all related profits and revenues; and (iv) WFOE has an exclusive right to purchase whole or part of the assets and/or equity of Dalian Befut to the extent permitted by the PRC law at the sole discretion of WFOE and at the mutually agreed price.

In addition, on February 16, 2009, WFOE entered into two ancillary agreements with Dalian Befut: (i) Intellectual Property Rights License Agreement, pursuant to which WFOE shall be permitted to use the intellectual property rights such as trademarks, patents and know-how for the marketing and sale of the products manufactured by Dalian Befut; and (ii) Non-competition Agreement, pursuant to which Dalian Befut shall not compete against WFOE.

Organizational History of Hongkong BEFUT Co., Ltd.

Befut Hongkong was incorporated on September 10, 2008 under the laws of Hong Kong. As of the date of this report, Befut Nevada owns 100% of the shares of Befut Hongkong. Befut Hongkong is a holding company having all of the equity interests of WFOE.

Organizational History of BEFUT International Co. Limited

Befut BVI was incorporated on September 1, 2008 under the laws of British Virgin Islands. As of the date of this report, Befut BVI is owned by the six individuals, among whom, each of Mr. Hongbo Cao and Mr. Tingmin Li own 43.48% of Befut BVI. Befut BVI has an aggregate of 117,768,300 shares, or 98.3% of the total outstanding shares of the Company’s Common Stock, as a result of the Share Exchange described under Item 1.01 of this report.

Organizational History of BEFUT Corporation

Befut Nevada was incorporated on January 14, 2009 under the laws of the state of Nevada, United States. Befut Nevada is a wholly owned subsidiary of the Company as a result of the Share Exchange as described under Item 1.01 of this report. It owns all of the outstanding shares of Hongkong BEFUT.

Immediately after the Share Exchange, as of the date of this report, our corporate structure is as follows:

Overview of the Business

We are one of the largest developers, manufacturers and distributors of wire and cable products in Northeastern China (namely, Helongjiang, Jilin and Liaoning provinces in China). We are headquartered in Dalian, which is situated at the tip of China’s Liaodong Peninsula. Dalian is a trading and financial center in Northeastern Asia. Dalian Befut has branch offices at Beijing and Representative Offices at several cities in Northeastern China such as Shenyang, Anshan, Harbin and Jilin.

We are engaged in the production of traditional cables, including metallurgy, coal and electric power system cables and specialty cables, including marine cable, mine specialty cable, nuclear cable, and petrochemical cable. Dalian Befut has the technical capability for the production of large-scale marine cable, a segment with significantly higher profit margins which we intend to pursue.

In 2006, we commenced the construction of our project in the industry zone on Changxing Island, Dalian to dedicate in marine cable production. We plan to have specialty cable such as marine cable as our main business in the next five years.

The following table shows our historical composition of our products in percentages:

| Products | Percentages for the Fiscal Years Ended June 30, | Percentages for the six months ended December 31, 2008 |

| 2007 | 2008 |

| Traditional Cable | | 60.5% | | 57.6% | | 50.0% |

| Marine Cable | 13.2% | 14.5% | 36.4% |

| Mine Special Cable | 11.01% | 12.4% | 4.5% |

| Petrochemical Cable | 11.01% | 10.3% | 4.5% |

| Nuclear Cable | 0 | 0 | 4.5% |

| Other Cable | 4.28% | 5.2% | 0.1% |

| Total | 100% | 100% | 100% |

Our Products

We produce the following principal products –

| Products | Feature | Application |

| Traditional Cable (Mainly “Electric Cable”) | It has an outstanding thermo-mechanical property, excellent electrical and anti-corrosion properties. | Used in telecommunication industry, auto industry, metal refining, electrical and petrochemical industry transportation industry including electrified railway and urban rail transportation, and construction industry |

| Marine Cable | It has strong physical features such as stronger anti-erosion, anti-stretch and long use life. | Applicable to all the ship building standard categories such as construction of ships, on-water oil platform, coastal marine project, and also capable of meeting all needs on a ship including power transmission, signal transmission of lighting and information processing equipment, and control system |

| Nuclear Cable | High-temperature resistant, corrosion protection low-temperature resistant, hard-wear, rusty-resistant, acid-bases resistant, age-resistant, long-life | Used in nuclear power plants |

| Mine Special Cable | temperature resistant, corrosion protection, soft, low-temperature resistant | Used by mining corporations |

| Petrochemical Cable | corrosion protection, long-life, high stretch resistance feature | Applied on the petrochemical enterprise, and the offshore building |

| Other Specialty Cable | high-temperature resistant, low-temperature resistant, hard-wear, acid-bases resistant, age-resistant, long-life | Applied in Steelwork, ore yard |

We plan to develop marine cables such as submerged cables used to transfer data and telecommunications and marine cable used in shipbuilding. We anticipate that the initial phase of the marine cable project will cost approximately $7.3 million. It includes the purchase land use rights for 30,000 square meters of land and the purchase of imported production lines. There is no assurance that we can obtain the necessary bank or other funding for this project.

We believe the specialty cable sector is the most profitable sector in wire and cable industry with significantly higher gross margins of up to 60%. Specialty cables typically are produced specifically for certain uses in harsh conditions unsuitable for other typical cables.

The following lateral section images show the general structure of our traditional cables and marine cables:

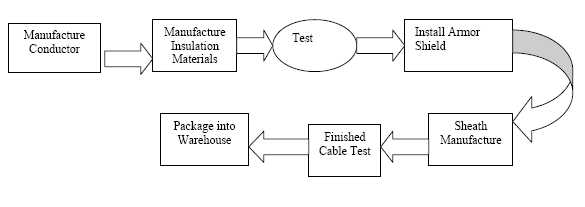

Manufacturing Process:

The following illustration shows the manufacturing process for our cable products:

Raw Materials and Suppliers

The primary raw materials we use are copper, insulation materials and protective materials. The following is a list of the top suppliers in the fiscal years of 2007 and 2008:

| Raw Materials | Suppliers | Percentages as to our total purchase from the suppliers in the Fiscal Year Ended June 30, 2008 |

| Copper Wire | Tianjin Huabei Wire & Cable Manufacturing | 30.41% |

| Copper Wire | Shenyang Tailida Copper Industry Co., Ltd | 14.68% |

| Copper Wire | Kaiyuan Aiming Copper Industry Co., Ltd | 11.64% |

| Insulation Material | Hebei Shunping Town Longchang Plastic | 0.48% |

| Insulation Material | Shenyang Meijia Wire & Cable Material Factory | 0.26% |

| Sheath | Shenyang Xiangrui Adhesive Tape Manufacturing Co., Ltd | 0.46% |

| Sheath | Shenyang Xinqite Wire & Cable Co., Ltd | 0.17% |

| Cross-link | Samat Chemicals Co., Ltd | 0.23% |

| Cross-link | Tianjin Tianli Special Wire & Cable Co., Ltd | 0.27% |

| Total | | 58.60% |

| Raw Materials | Suppliers | Percentages as to our total purchase from the suppliers in the Fiscal Year Ended June 30, 2007 |

| Copper Wire | Tianjin Huabei Wire & Cable Manufacturing | 57.32% |

| Copper Wire | Dashiqiao Yongsheng Copper Industry Co., Ltd | 8.07% |

| Copper Wire | Shenyang Metal Co., Ltd | 5.87% |

| Insulation Material | Shunchang Longchang Plastic Co., Ltd | 1.18% |

| Insulation Material | Shenyang Meijia Wire & Cable Material Factory | 0.90% |

| Sheath | Shenyang Xiangrui Adhesive Tape Manufacturing Co., Ltd | 1.54% |

| Sheath | Shenyang Xinxin Flame-retarded Cable Material Co., Ltd | 0.36% |

| Cross-link | Tianjin Tianli Special Wire & Cable Co., Ltd | 0.52% |

| Cross-link | Samat Chemicals Co., Ltd | 0.40% |

| Total | | 76.16% |

Our principal raw materials are generally available in the market and we have not experienced any raw material shortages in the past. Because of the general availability of these raw materials, we do not believe that we will experience any raw material shortages in the future; however, changes in the prices of copper, which has an established history of volatility, directly affect the prices of our products and may influence the demand for our products.

Distribution, Sales Network and Customers

We sell our products through a network of twenty-four sales persons located in Dalian and sales branches in six cities, such as Beijing, Shenyang, An’shan, Jilin and Benxi to facilitate the sales in those cities. A total of twelve persons cover those branches. In addition, we contracted three distributors. Normally, the contracts with distributors are for one year.

We have a total of approximately 500 customers located in Northeastern China and other provinces in China.

Our ten largest customers in the fiscal year ended June 30, 2008 generated approximately 25% of the total sales that year.

| Customers | For the fiscal year ended June 30, 2008 Percent as to the total sales (%) |

| CCEED Industrial Equipment Installation Co., Ltd. | 5.9 |

| Dalian Huasheng Electric Installation Co., Ltd. | 3.86 |

| Dalian Huarui Joint Stock Company | 3.4 |

| Dalian COSCO SHIPYARD | 2.27 |

| Dalian Juzheng Electric Power Source Co., Ltd | 2.04 |

| Hebei Provance Shougang Qian’an Steel Co., Ltd. | 1.86 |

| Lvshun Tongyuan Goods & Materials Distribution | 1.59 |

| Jiangsu Provincial Industrial Equipment Installation Co., Ltd | 1.36 |

| Inner Mongolia Baogang Ganglian Joint Stock Company | 1.36 |

| Sunny 100 House Purchasing (Liaoning) Co., Ltd | 1.36 |

| Ten Largest Customers in Total | 25 |

Our ten largest customers in the fiscal year ended June 30, 2007 generated a total of approximately 45.0% of the total sales that year.

| Customers | For the fiscal year ended June 30, 2007 Percent as to the total sales (%) |

| Ningxia Meili Paper Industry Joint Stock Company | 7.4 |

| Dalian Yifeng Industry Co.,Ltd | 6.66 |

| Dalian Huarui Joint Stock Company | 5.46 |

Dalian Hongqi Electric Field Engineering Co., Ltd | 5 |

| Jiangsu Provincial Industrial Equipment Installation Co., Ltd | 4.8 |

| Dalian Juzheng Electric Power Source Co., Ltd | 4 |

| Sunny 100 House Purchasing (Liaoning) Co., Ltd | 3.33 |

| Qianhao Group Co., Ltd | 3 |

Shenyang Wire & Cable Co., Ltd Rubber & Plastic Manufacturing Branch Company | 2.66 |

| Baogang Ganglian Joint Stock Company | 2.66 |

| Ten Largest Customers in Total | 44.97 |

Research and Development

In the fiscal years of 2008 and 2007, we spent $6,903 and $6,405 on research and development, respectively. We maintain an internal Research and Development Department composed of eleven full-time employees to improve our current product features and develop new devices and technologies.

Intellectual Property

Trademark

Dalian Befut is the registered trademark holder of the following trademark, which was registered with the Trademark Office of the State Administration for Industry and Commerce in PRC ("SAIC").

The registered scope of use includes wire products such as wire cable, electric wire, power materials (electric wire and wire cable), and electric resister for copper wire. The registered term of the trademark is from September 7, 2001 to September 6, 2011. Under the PRC Trademark Law, which was adopted in 1982 and revised in 2001, registered trademarks are granted a term of ten years’ protection, renewable for further terms. Each renewal is limited to ten year terms and the registrant must continue to use the trademark and apply for a renewal within six months prior to the expiration of the current term.

In 2008, the trademark was recognized as a Famous Trademark in China through a judicial procedure, one of the two procedures in the PRC to grant a trademark such title (the other procedure is through administrative procedure) pursuant to Rules on Famous Trademark Recognition and Protection promulgated by the PRC National Industrial and Commercial Bureau and implemented from June 1, 2003. A Famous Trademark in China is entitled to a stronger protection comparing to a general trademark in China. For example, it can prevent others using the same or similar trademark not only on the same or similar products but also on certain products in other industry as long as the use of such trademark by others would cause confusion and misleading to a reasonable customer. In addition, in a trademark dispute adjudication, being a Famous Trademark itself provides self evidence of influence on consumers. There are approximately ten Famous Trademarks owned by companies located in city of Dalian.

Patent

Dalian Befut has the following two patents:

| Name of Patent | Type of Patent | Patent No. | Inventor’s Name | Date of Application | Date of Publication and Term |

| Intelligent reactive power compensation for automatic screen | Utility model | ZL200720184912.4 | Dalian Befut Wire & Cable Manufacturing Co., Ltd | 12/14/2007 | 10/15/2008; Term: 10 years from 10/15/2008 to 10/14/2018 |

| Automatic Protection Ni-mh Battery Screen | Utility model | ZL200720184913.9 | | 12/14/2007 | 01/07/2009 Term: 10 years from 01/07/2009 to 01/06/2019 |

Dalian Befut is in the process of applying for the following five patents with the Patent Office of the National Intellectual Property Office of the PRC:

| Name of Patent | Type of Patent | Patent No. | Inventor’s Name | Date of Application | Date of Acceptance of the Application by the PRC IP Office | Status of Application |

| New tide-proof power cable | Utility model | 200820015254.0 | Guoxiang Liu, | 08/27/2008 | 08/29/2008 | Patent Pending |

| Sonar watertight cable | Utility model | 200820015255.5 | Hongming Wu and | 08/27/2008 | 08/29/2008 | Patent Pending |

| Environmentally friendly wire & cable of low-smoke, halogen-free, fire-retardant insulation | Utility model | 200820015256.X | Ying Zhao | 08/27/2008 | 08/29/2008 | Patent Pending |

| High-temperature plastic extrusion die-tool | Utility model | 200820015331.2 | | 08/29/2008 | 09/01/2008 | Patent Pending |

| Mine fire-retardant rubber branch of the pre-cable | Utility model | 200820015332.7 | | 08/29/2008 | 09/01/2008 | Patent Pending |

The PRC Patent Law was adopted by the National People's Congress, the parliament in PRC, in 1984 and was subsequently amended in 1992 and 2000. The Patent Law aims to protect and encourage invention, foster applications of invention and promote the development of science and technology. To be patentable, invention or unity models must meet three conditions: novelty, inventiveness and practical applicability. The Patent Office of the National Intellectual Property Office of the PRC under the State Council is responsible for receiving, examining and approving patent applications. A patent is valid for a term of twenty years in the case of an invention and a term of ten years in the case of utility models and designs. Our pending patents are all utility models and will subject to the ten years' protection. Any use of patent without consent or a proper license from the patent owner constitutes an infringement of patent rights. We cannot assure you that any patent applications filed by us will be approved in the future.

Competition

Currently, there are approximately 7,000 manufacturers in China producing a variety of types of cables and wires, most of which produce traditional electric cables and wires only. Among all of those manufacturers, 2,000 manufacturers can undertake specialty cable production, such as marine cables and mine cables. Furthermore, among the 7,000 manufacturers, only 40 are eligible for producing nuclear cables and 20 can produce marine cables.

Our competitors include the manufacturers having the ability to conduct comprehensive cable and wire production like us, such as Far East Cable Co., Limited, Shangshang Cable and the manufacturers which can produce specialty cable such as Yangzhou Marine Cable Manufacturing Factory.

Far East Cable Co., Ltd. (“Far East”) in Jiangsu Province in China is our largest competitor in the sector of traditional electric cable and wires. It is in the leading position in terms of market share. Our competitive advantage to Far East is in specialty cable production, in which we have more qualification certificates and market share than that of Far East.

In terms of specialty cables such as marine cables, Yangzhou Marine Cable Factory is our major competitor. It entered into this market earlier than us and has strong competitive advantage on qualifications and market share. However, their market is mostly in the adjacent provinces such as Jiangsu and Zhejiang, which are not where we are located.

We have the following competitive advantages –

| n | We have a strong research and development team including the top personnel in this industry such as the advanced technology staff from Shenyang Electric Cable Factory, which was the largest cable company in Northeastern China owned by the state but was dissolved. Our team also includes the experts from Dalian Science and Technology University. |

| n | We have obtained qualifications in specialty cable production. We are nationally-designated enterprise for coal mine and mechanical products and have passed National Confidential Certification. We obtained Classification Society certifications from the PRC, US, Germany, Italy, Japan and South Korea for our marine cables, first-grade supply network certificate for China National Petroleum Corporation (CNPC), and MIL-Spec Quality Management System certification. |

| n | We have entered into a contract to expand our production facilities in the Industrial Zone by harbor on Changxing Island in Dalian to develop our marine cable production. We believe such expansion may provide us dominant advantages in terms of production scale and capacity in Northeastern China. |

In order to expand our production and sustain our growth, we will need additional working capital. There is no assurance such capital will be available to us, or that if available, that it will be on the terms that are acceptable to us.

Environmental Compliance

We are subject to environmental regulations that are generally applicable to manufacturing companies in the PRC. For example, Dalian Befut obtained necessary approval for its new manufacturing facilities. We are also subject to periodic inspection by environmental regulators and must follow specific procedures in some of our processes. We have not violated environmental regulations or approved practices.

Employees

We currently have 200 employees in total, of whom 179 are full time and 21 are part time.

Government Regulations

We are subject to the recent PRC State Administration of Foreign Exchange (“SAFE”) regulations regarding offshore financing activities by PRC residents. SAFE issued a public notice in October 2005 requiring PRC domestic residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” All of our PRC resident shareholders have complied with the registration procedure with local SAFE.

Dalian Befut’s production facilities maintain an ISO 9001 Quality Management System.

According to The Rule Regarding the Administration on Compulsory Products Certification promulgated by General Administration of Quality Supervision, Inspection and Quarantine of the PRC on December 3, 2001 and effective from May 1, 2002, products that impact health and safety of human beings, life and health of animals and plants and environmental protection and public safety that are listed in the Index of the PRC Compulsory Production Certification (the “Index”) are subject to the universally applicable national standards, technical rules and implementation procedures. China Compulsory Certification (“CCC”) is a mandatory requirement for the production, distribution and exportation of any of the products that are listed in the Index. Certain of our cable and wire products are subject to such certification and we have maintained effective CCC status on those products accordingly.

We received Classification Society certifications for our marine cable products from classification societies such as China Classification Society, American Bureau of Shipping, Germanischer Lloyd, Italy, Nippon Kaiji Kyokai and Korean Register of Shipping. A classification society is a non-governmental organization in the shipping industry, often referred to as “Class”. It establishes and maintains standards for the construction and classification of ships and offshore structures, supervises that construction is according to these standards and carries out regular surveys of ships in service to ensure these comply with these standards.

In addition, we are a nationally-designated enterprise for coal mine and mechanical products, first-grade supply network certificate for China National Petroleum Corporation (CNPC), and MIL-Spec Quality Management System certification.

We obtained a license for importing and exporting products in 2006.

Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. However, we are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse affect on our business, financial condition or operating results.

Description of Properties

Under PRC law, all land in the PRC is owned by either the state (“State Land”) or by rural collectives (“Collective Land”), which grant a "land use right" to an individual or entity after a purchase price for such "land use right" is paid to the government. The "land use right" grants the holder the right to use the land for a specified long-term period of time and other rights that are incidental to the ownership of the land, except for the right to ownership. Land and buildings are regarded as two separate properties in China. Land users may use the land and own the buildings and improvements on it, but the sovereignty of the land are retained by the State or rural collectives.

We lease a piece of land and the buildings on that land from Dalian Wanbao Industrial Co. Ltd. (the “Lessor”). Set forth in the following table is the information of such lease:

| Location | Qipanzi County, Gezhenbao Town of Ganjingzi District, Dalian, |

| Certificate of Land Use Right No. | Ganjiyong (2001) Zi Di 0316004 |

| Registered Owner of Land | Qipan Village (Rural Collective) |

| Lessor | Dalian Wanbao Industrial Co. Ltd. |

| Usage | Industrial Use |

Size ( in Square Meters) | 14,040 |

| Term and Expiration Date of the Lease | For 50 years, from Oct.1 2001 through Oct. 1, 2051 |

| Rent | RMB2,500,000 (approximately $365,540) for 50 years |

| Other | The right to transfer and to allocate security interest on the land shall be subject to the Lessor’s consent. |

We own three factory buildings that are built upon the leased land referenced immediately above. Set forth in the following table is the information of the factory buildings:

| Registered Owner of Land Use Right | Location | Certificate of House Ownership Number | Size (in Square Meters) | Usage | Encumbrance |

| Dalian Befut Wire & Cable Manufacturing Co., Ltd | Qipanzi County, Gezhenbao Town of Ganjingzi District, Dalian | Dagan Cun Fang Zi Di 205010073 | 661.5 | Industrial use, Factory | None |

| Dagan Cun Fang Zi Di 205010074 | 1531.05 |

| Dagan Cun Fang Zi Di 205010075 | 4014.72 |

In addition, we are currently undertaking a construction project of factory facilities, located in Xingang County, Lingang Industrial District of Changxing Island (“Changxing Island Property”). Such project is expected to be completed in June 2009, and WFOE shall be then entitled to: (i) the use right to the land which Changxing Island Property covers; and (ii) the ownership of the buildings and factories built upon Changxing Island Property, upon the completion of the project. Changxing Island Property has an area of 120,953 square meters, and the construction area totals 73,177 square meters, with 54,257 square meters of factory facility and 18,920 square meters of affiliated buildings. However, there can be no assurance that WFOE may obtain such land use right and building ownership as we anticipated.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Current Report on Form 8-K. This discussion and analysis contains forward-looking statements that involve significant risks and uncertainties.

As a result of many factors, such as the competition in the cable industry and the impact of such competition on pricing, revenues and margins, the economic conditions affecting our customers, the cost of attracting and retaining highly skilled personnel, the prospects for future acquisitions, and other factors set forth elsewhere in this report, our actual results may differ materially from those anticipated in these forward-looking statements.

Unless the context indicates otherwise, as used in the following discussion, the words "Company”, "we,” "us,” and "our,” each refer to (i) Frezer, Inc., (ii) BEFUT Corporation, a corporation incorporated in the State of Nevada (Befut Nevada); (ii) Hongkong BEFUT Co., Ltd. (“Befut Hongkong”), a wholly-owned subsidiary of Befut Nevada incorporated under the laws of Hong Kong; (iii) Befut Electric (Dalian) Co., Ltd. (“WFOE”), a corporation organized under the laws of the People’s Republic of China (the “PRC”); and (vi) Dalian Befut Wire and Cable Manufactuing Co., Ltd. (“Dalian Befut”), a corporation incorporated under the laws of the PRC with a series of contracts establishing their exclusive business relationship; and (vii) Dalian Marine Cable Co., Ltd., a corporation that is 86.6% owned by Dalian Befut.

Overview

Headquartered in Dalian, PRC, we are one of the largest wire and cable manufacturers in northeastern China. Because the city of Dalian has become a center for ship manufacturing and nuclear power plant construction in China, we have changed our business strategy from being a traditional cable manufacturer to a specialty cable supplier. By focusing on manufacturing high yield and high profit margin marine and other specialty cables, we believe that we have achieved competitive advantages and are growing rapidly.

We seek to quickly respond to market demand of the shipbuilding, steel, coal, nuclear power and offshore oil industries and can manufacture tailor-made cables for special purposes and special conditions to meet customers’ demands.

Recent Developments

We have invested 60 million RMB (approximately $8,754,000) to construct and develop a 150,000 square meter Industrial Park on Changxing Island, the third largest island in the PRC where Dalian Marine Equipment Manufacturing Park is based. Changxing Island is 120 kilometers from Dalian.

Financial Results for the Quarterly Period Ended December 31, 2008 and 2007

Results of Operations for Three Months ended December 31, 2008 and 2007

The following table shows the operating results of the Company for the three months ended December 31, 2008 and 2007:

| | | For the Three months ended | |

| | | December 31 | |

| | | 2008 | | | 2007 | |

| Sales | | $ | 5,597,320 | | | $ | 5,789,673 | |

| Cost of Good Sold | | | 4,297,581 | | | | 5,378,206 | |

| Gross Profit | | | 1,299,739 | | | | 411,467 | |

| Operating Expenses | | | | | | | | |

| Selling, general and administrative | | | 346,285 | | | | 363,349 | |

| Income from Operations | | | 953,454 | | | | 48,118 | |

| Other Income (Expenses) | | | | | | | | |

| Other income | | | | | | | | |

| Interest expense | | | (122,030 | ) | | | (115,189 | ) |

| Other expense | | | 55,751 | | | | 141,140 | |

| Government subsidy income | | | 100,833 | | | | 380,021 | |

| Total Other Income (Expenses) | | $ | 34,554 | | | $ | 405,972 | |

| Income before Provision for Income Tax | | | 988,008 | | | | 454,090 | |

| Provision for Income Tax | | | 29,684 | | | | 26,828 | |

| Net Income before Minority Interest | | | 958,324 | | | | 427,262 | |

| Minority Interest | | | (724 | ) | | | (1,559 | ) |

| Net Income | | | 959,048 | | | | 428,821 | |

| Other Comprehensive Income | | | | | | | | |

| Foreign currency translation adjustment | | | 45,570 | | | | 490,472 | |

| Comprehensive Income | | $ | 1,004,618 | | | $ | 919,293 | |

Sales

Our sales for the three months ended December 31, 2008 were $5,597,320, a decrease of $192,353, or 3.32%, from our sales of $5,789,673 for the three months ended December 31, 2007. Such decrease is due to the decrease in the price of the final products arising from the decrease in our major raw material, copper. Our output and sales volume of for the three months ended December 31, 2008, however, was higher than that of the three months ended December 31, 2007.

Cost of Goods Sold

Our cost of goods sold for the three months ended December 31, 2008 was $4,297,581, a decrease of $1,080,625 or 20.09%, as compared to $5,378,206 for the quarter ended December 31, 2007. Cost of goods sold is primarily comprised of the cost of our raw materials and direct labor, manufacturing overhead expenses. Our principal raw material is copper, the price for which can affect our operating results..

The unit price of copper decreased to RMB35,200 (approximately $5,157) per ton in the three months ended December 31, 2008 from RMB54,900 (approximately $7,515) per ton from the comparable period in prior year, a decrease of 35.9% (or 31.3% if considering the appreciation of the RMB). (Currency Exchange Rate: 1RMB=$0.1465 on December 31, 2008, 1RMB=$0.1369 on December 31, 2007) In addition, we increased our production of specialty cable and marine wire, which has a lower cost as to profit as compared to such ratio of traditional cable and wire.

Gross Profit

Our gross profit is equal to the difference between sales and cost of goods sold. Our gross profit for the fiscal year ended December 31, 2008 was $1,299,739, an increase of $888,272, or 215.88%, from $411,467 in gross profit for the fiscal year ended December 31, 2007. The increase in gross profit was attributable to the decrease of cost of sales. Gross profit as a percentage of net sales was 23.22% for the fiscal year ended December 31, 2008, as compared to 7.11% for the fiscal year ended December 31, 2007. The gross profit margin increased by 16.11 percentage points.

Selling Expenses, general and administration

Our selling expenses consist primarily of salaries of sales personnel, advertising and promotion expenses, freight charges and related compensation. Selling and general administration expenses were $346,285 for the quarter ended December 31, 2008 as compared to $363,349 for the quarter ended December 31, 2007, a slight decrease of $17,064 or approximately 4.70%. Such decrease is mainly due to our strict internal control on general and administration fees which offset the increase in selling expenses.

Operating Income

Our operating income was $953,454 for the three months ended December 31, 2008, as compared to $48,118 for the same period ended December 31, 2007, an increase of $905,336 or 1881.5%. The Sharp increase in our operating income was mainly attributable to the decrease in the cost of our products and the increased production in special cable and marine wire with a higher profit margin.

Government Subsidy

We received subsidy from Chinese local government for the three months ended December 31, 2008 at the amount of $100,833 while we received $380,021 for the three months ended December 31, 2007.

The local government has a favorable policy to encourage new investments in Changxing Island where our new facilities are located. However, such subsidy is on a year by year basis and has its uncertainty.

Income Taxes

Our business operations were solely conducted by Dalian Befut and its subsidiary Befut Marine which were incorporated in the PRC. They were governed by the PRC Enterprise Income Tax Laws. In accordance with the Income Tax Laws, a PRC domestic company is subject to the following taxes, including but not limited to: (i) enterprise income tax rate has been adjusted from 33% to 25% effective from January 1 2008, when the new PRC Enterprise Income Tax Laws became effective; and (ii) value added tax at the rate of 17% for most of the goods sold.

Our income tax was $29,684 for the quarter ended December 31, 2008, comparing to $26,828 for the same quarter ended December 31, 2007, an increase of $2,856 or 10.65%. Such increase is due to the increased income from operations.

Net Income

Net income for the three months ended December 31, 2008 was $959,048, an increase of $530,227 from $428,821, or 123.65%, compared with that of the three months ended December 31, 2007. The increase was attributable to the lower cost of the raw materials in our products in general and the increase in our production of special cable and marine wire which has a higher profit margin.

Results of Operations for the Six Months ended December 31, 2008 and 2007

The following table shows the operating results of Dalian Befut and its subsidiary, Dalian Marine for the six months ended December 31, 2008 and 2007:

| | | For the Six Months Ended | |

| | | December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Sales: | | $ | 10,883,540 | | | $ | 11,075,538 | |

| Cost of goods sold: | | | 8,261,547 | | | | 8,606,265 | |

| Gross profit: | | | 2,621,993 | | | | 2,469,273 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | | 580,723 | | | | 612,511 | |

| Income from operations: | | | 2,041,270 | | | | 1,856,762 | |

| Other income (expenses): | | | | | | | | |

| Interest expense | | | (280,162 | ) | | | (192,504 | ) |

| Other income (expense) | | | 34,330 | | | | 141,140 | |

| Government subsidy income | | | 159,903 | | | | 433,841 | |

| Total other income (expenses): | | | (85,929 | ) | | | 382,477 | |

| Income before provision for income tax: | | | 1,955,341 | | | | 2,239,239 | |

| Provision for income tax: | | | 102,407 | | | | 60,030 | |

| Net income before minority interest: | | | 1,852,934 | | | | 2,179,209 | |

| Minority interest: | | | (804 | ) | | | (2,420 | ) |

| Net income: | | | 1,853,738 | | | | 2,181,629 | |

| Other comprehensive income: | | | | | | | | |

| Foreign currency translation adjustment | | | 166,597 | | | | 517,478 | |

| Comprehensive income: | | $ | 2,020,335 | | | $ | 2,699,107 | |

Sales

Our net sales for the six months ended December 31, 2008 were $10,883,540, a decrease of $191,998 or 1.73%, from $11,075,538 for the six months ended December 31, 2007. The reason for such decrease is the decrease in the price of the final products arising from the decrease in our major raw material, copper.The Company maintains an increase on its output and sales volume, comparing the six months ended December 31, 2008 with that of the same period of fiscal year 2007.

Cost of Goods Sold

Cost of goods sold is primarily comprised of the cost of our raw materials and direct labor, manufacturing overhead expenses. Our cost of goods sold for the six months ended December 31, 2008 was $8,261,547, a decrease of $344,718 or 4.01%, as compared to $8,606,265 for its corresponding period in 2007. Our principal raw materialis copper, the price for which can affecting our operating results. As we described in the three months comparison analysis above, the unit price of copper, our main material, decreased by approximately one third in the six months ended December 31, 2008 as compared to the same period of the prior year. In addition, we increased our production of specialty cable and marine wire, which has a lower cost as to profit as compared to such ratio of traditional cable and wire.

Gross Profit

Our gross profit is the difference between net sales and cost of goods sold. Our gross profit for the six months ended December 31, 2008 was $2,621,993, an increase of $152,720, or 6.18%, compared to $2,469,273 for the corresponding period of year 2007. Gross profit as a percentage of net sales was 24.09% for the fiscal year in the six month ended December 31, 2008, as compared to 22.29% for that of 2007.

The decrease of our net sales is offset by the sharper drop of the cost of goods sold in the six months period ended December 31, 2008. And the downward trend of the prices of our raw materials, mainly consisting of copper, contributes to the decrease of the cost of goods sold. Therefore, we achieved a greater gross profit during the six months ended December 31, 2008 than that of 2007.

Selling Expenses,general and administration

Our selling expenses consist primarily of salaries of sales personnel, advertising and promotion expenses, freight charges and related compensation. Selling and general administration expenses were $580,723 for the six months ended December 31, 2008 as compared to $612,511 for the corresponding period in 2007, a decrease of $31,788 or approximately 5.19%. Such decrease is mainly due to our strict internal control on general and administration fees which offset the increase in selling expenses.

Operating Income

Our operating income was $2,041,270 for the six months ended December 31, 2008, as compared to $1,856,762 for the six months ended December 31, 2007, an increase of $184,508 or approximately 9.94%, primarily a result of the decrease in raw materials.

Government Subsidy

We received subsidy from Chinese local government for the six months ended December 31, 2008 at the amount of $159,903, while we received $433,841 for the six months ended December 31, 2007. As we analyzed in the three months comparison, the local government’s subsidy has its uncertainty.

Income Taxes

Our business operations were solely conducted by our subsidiaries incorporated in the PRC and we were governed by the PRC Enterprise Income Tax Laws. PRC enterprise income tax is calculated based on taxable income determined under PRC GAAP. In accordance with the Income Tax Laws, a PRC domestic company is subject to the following taxes, including but not limited to: (i) enterprise income tax rate has decreased from 33% to 25% with effect from January 1 2008, when new Chinese tax law became effective; and (ii) value added tax at the rate of 17% for most of the goods sold.

A valuation allowance is provided to reduce the carrying amount of deferred tax assets if it is considered more likely than not that some portion, or all, of the deferred tax assets will not be realized. No differences were noted between the book and tax bases of the Company’s assets and liabilities, respectively.

Income taxation provision was $102,407 for the six months ended December 31, 2008 and $60,030 for the same period in 2007, representing an increase of $42,377 or 70.59%. Such increase is due to the increased income from operations.

Net Income

Net income for the six months ended December 31, 2008 was $1,853,738, a decrease of $ 327,891 from $2,181,629, or 15.03%, compared with that of the six months ended December 31, 2007. The decrease was due to a variety of reasons such as the lower sales, the less government subsidy which were not offset by a lower cost than the same period of the prior year.

Liquidity and Capital Resources

As of December 31, 2008, we had cash and cash equivalents of $1,384,598. Our current assets were $16,641,814 and our current liabilities were $8,658,783 as of December 31, 2008, which resulted in a current ratio of approximately 1.92: 1. The total stockholders' equity then was $17,107,162.

The following table sets forth a summary of our cash flows for the periods indicated:

| | | For the Six Months Ended December 31 | |

| | | 2008 | | | 2007 | |

| Net cash provided by / (used in) operating activities | | | (677,998 | ) | | | 9,514,879 | |

| Net cash used in investing activities | | | (2,328,242 | ) | | | (8,971,376 | ) |

| Net cash provided by financing activities | | | 4,034,216 | | | | (814,187 | ) |

| Effect of exchange rate change on cash and cash equivalents | | | 3,831 | | | | 59,532 | |

| Net increase in cash and cash equivalents | | | 1,031,807 | | | | (211,152 | ) |

| Cash and cash equivalents, beginning balance | | | 352,791 | | | | 331,618 | |

| Cash and cash equivalents, ending balance | | $ | 1,384,598 | | | $ | 120,466 | |

We have historically financed our operations and capital expenditures principally through bank loans, and cash provided by operations. Our management believes that the Company has sufficient cash, along with projected cash to be generated by the business of the Company to support its current operations for the next twelve months. However, we have a plan to expand our operation on Changxing Island which requires approximately RMB50 million or $7.3 million capital. There can be no assurance that any additional financing will be available on acceptable terms, if at all.

Operating Activities

Net cash used in operating activities was $677,998 for the six months period ended December 31, 2008, compared to $9,514,879 of net cash generated by operating activities for the same period in 2007. The reason for the difference of $10,192,877 of cash provision in operating activities is due to the increase in other receivables under which we recorded the payment for the new facilities located on Changxing Island.

Investing Activities

During the six months ended December 31, 2008, $2,328,242 of cash was used in investing activities, which decreased by $6,643,134, compared with $8,971,376 spent in the corresponding period of 2007. We spent approximately $8,875,567 in the construction of new factory building on Changxing Island in the six months ended December 31, 2007 while there were no such spending in the six months ended December 31, 2008.

Financing Activities

Net cash provided by financing activities for the six months ended December 31, 2008 totaled $4,034,216, as compared to $814,187 that was used in financing activities for the same period ended of 2007. Such difference of cash flows in financing activities of $4,848,403 was mainly attributable the proceeds from short-term bank loans and issuance of trade notes payable.

During the six months ended December 31, 2008, we received loans of a total of $3,441,105 from Chinese local banks, and we repaid certain long-term bank loan for $316,289.

As of December 31, 2008, our outstanding loans were as follows:

| Creditors | Loan Amount | Interest Rate | Term | Expiration Date |

| Agricultural Bank of China | $220,050 | 10.1085% | 1 year | 08/20/2009 |

| Bank of Dalian | $2,934,000 | 10.458% | 1 year | 08/27/2009 |

| Bank of Dalian | $440,100 | 9.711% | 1 year | 04/24/2009 |

| Guangdong Development Bank | $586,800 | 9.98% | 1 year | 07/31/2009 |

| Shanghai Pudong Development Bank | $1,467,000 | 8.019% | 1 year | 12/28/2009 |

| Construction Bank of China | $5,477,778 | To be adjusted every 12 months | 5 year | 11/2011 |

Total | $11,125,728 | | | |

None of our officers or shareholders has made any commitments to the Company for financing in the form of advances, loans or credit lines.

Accounts Receivable

We had $6,868,308 accounts receivable, net of allowance for doubtful accounts of $20,250 as of December 31, 2008, compared to $5,902,124, net of allowance for doubtful account of $25,263 as of June 30, 2008, an increase of $966,184, mainly due to certain state-owned companies as our clients began to require to retain from 5% to 10% of the revenues we generated from them as quality guarantee deposit for a term of one year. Such quality guarantee deposit can be released to us if there are no quality issues of the products we provide at the expiration of such one-year term.

Inventories

Inventories consisted of the following as of December 31 and June 30, 2008, respectively:

| | | Dec. 31, 2008 | | | June 30, 2008 | |

| | | | | | | |

| Raw materials | | $ | 632,421 | | | $ | 194,273 | |

| Work-in-progress | | | 91,302 | | | | 111,756 | |

| Finished goods | | | 1,542,937 | | | | 1,337,914 | |

| | | | | | | | | |

| Total Inventories | | $ | 2,266,660 | | | $ | 1,643,943 | |

We had an inventory of $2,266,660 as of December 31, 2008 as compare to $1,643,943 as of June 30, 2008, an increase of $622,717. The increase is primarily due to the increase in raw materials of $438,148 for the purposes of storing copper while its price is relatively low.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Financial Results for the Fiscal Years Ended June 30, 2008 and 2007

Results of Operations

The following table shows our operating results on a consolidated basis for the fiscal years ended June 30, 2008 and June 30, 2007.

| | | For the Years Ended June 30, | |

| | | 2008 | | | 2007 | |

| SALES | | $ | 20,012,975 | | | $ | 17,483,967 | |

| COST OF GOODS SOLD | | | 15,141,308 | | | | 14,034,451 | |

| GROSS PROFIT | | | 4,871,667 | | | | 3,449,516 | |

| OPERATING EXPENSES | | | | | | | | |

| Selling, general and administrative | | | 939,793 | | | | 854,931 | |

| INCOME FROM OPERATIONS | | | 3,931,874 | | | | 2,594,585 | |

| OTHER INCOME (EXPENSES) | | | | | | | | |

| Other income | | | 215,155 | | | | 77,072 | |

| Interest expense | | | -338,267 | | | | -486,373 | |

| Other expense | | | -4,420 | | | | 352 | |

| Government subsidy income | | | 492,294 | | | | 239,545 | |

| Total Other Income (Expenses) | | | 364,762 | | | | (169,404 | ) |

| INCOME BEFORE PROVISION FOR INCOME TAX | | | 4,296,636 | | | | 2,425,181 | |

| PROVISION FOR INCOME TAX | | | 71,058 | | | | 130,546 | |

| NET INCOME BEFORE MINORITY INTEREST | | | 4,225,578 | | | | 2,294,635 | |

| MINORITY INTEREST | | | -4,410 | | | | -439 | |

| NET INCOME | | | 4,229,988 | | | | 2,295,074 | |

| OTHER COMPREHENSIVE INCOME | | | | | | | | |

| Foreign currency translation adjustment | | | 1,303,694 | | | | 405,217 | |

| COMPREHENSIVE INCOME | | $ | 5,533,682 | | | $ | 2,700,291 | |

Sales

Our net sales for the fiscal year ended June 30, 2008 were $20,012,975, an increase of $2,529,008, or 14.46%, from our net sales of $17,483,967 for the fiscal year ended June 30, 2007, due to the increase in our clients especially in specialty cable area.

Cost of Goods Sold

Cost of goods sold is primarily comprised of the cost of our raw materials and direct labor and manufacturing overhead expenses. Our cost of goods sold for the fiscal year ended June 30, 2008 was $15,141,308, an increase of $1,106,857 or 7.89%, as compared to $14,034,451 for the fiscal year ended June 30, 2007. Cost of goods sold as a percentage of net sales was 75.66% and 80.27% for the fiscal years ended on June 30, 2008 and 2007, respectively. The increase in cost of goods sold was primarily due to the increase in our sales volume, as the cost of goods sold as a percentage of net sales for the fiscal year ended June 30, 2008 remained relatively steady and we were generally able to pass on to our customers the price increases in raw materials used in the manufacturing process.

Gross Profit

Our gross profit is equal to the difference between net sales and cost of goods sold. Our gross profit for the fiscal year ended June 30, 2008 was $4,871,667, an increase of $1,422,151, or 41.23%, compared to $3,449,516 in gross profit for the fiscal year ended June 30, 2007. The increase in gross profit was attributable to the increase in our net sales and decrease of cost of sales and selling expenses as a percentage of net sales. Gross profit as a percentage of net sales was 24.34% for the fiscal year ended June 30, 2008, as compared to 19.73% for the fiscal year ended June 30, 2007.

Selling Expenses, general and administration

Our selling expenses consist primarily of salaries of sales personnel, advertising and promotion expenses, freight charges and related compensation. Selling and general administration expenses were $939,793 for the fiscal year ended June 30, 2008 as compared to $854,931 for the fiscal year ended June 30, 2007, an increase of $84,862 or approximately 9.93% which percentage increase was lower than the 14.46% growth in our revenue during the same period. The increase in selling expenses was primarily attributable to increases in our market promotion activities, salaries of sales personnel and freight charges. China’s consumer price index, the main gauge of inflation, increased approximately 7.7% in May 2008 from the same month in the prior year. This led to higher costs for marketing and salaries.

Operating Income

Our operating income was $3,931,874 for the fiscal year ended June 30, 2008, as compared to $2,594,585 for the fiscal ended June 30, 2007, an increase of $1,337,289 or approximately 51.54%. The increase was attributable to revenue growth and our ability to limit increases in our expenses.

Other Income

Other income mainly comes from recycling of used materials. Our other income was $215,155 for the fiscal year ended June 30, 2008, as compared to $77,072 for the fiscal ended June 30, 2007, an increase of $138,083, or approximately 179.16%.

Government subsidy

In the fiscal year ended June 30, 2008 we received a subsidy from the Dalian government of $492,294 as compared to $ 239,545 for the fiscal ended June 30, 2007, an increase of $252,749 or approximately105.51%. This subsidy is for encouraging investment in Changxing Island where our new facility is located.

Income Taxes

We were subject to a tax rate of 33% for the year ended December 31, 2007 and 25% for the year ended December 31, 2008. Our provision for income taxes was $ 71,058 for the for the fiscal year ended June 30, 2008 and $130,546 for the fiscal year ended June 30, 2007, representing a decrease of $59,488 or 45.57 %. The decrease was due to the decreased tax rate.

Net Income

Net income for the fiscal year ended June 30, 2008 was $4,229,988, an increase of $1,934,914 or 84.31% as compared to our net income of $2,295,074 for the fiscal year ended June 30, 2007. The increase was attributable to the increase in net sales, better control of costs and the tax rate cut as discussed above.

Liquidity and Capital Resources

As of June 30, 2008, we had cash and cash equivalents of $352,791. Our current assets were $10,493,780 and our current liabilities were$4,573,472 as of June 30, 2008, which resulted in a current ratio of approximately 2.29:1. Total stockholders' equity as of June 30, 2008 was $15,086,827.

The following table sets forth a summary of our cash flows for the periods indicated:

| | | Fiscal Year Ended June 30 | |

| | | 2008 | | | 2007 | |

| Net cash provided by / (used in) operating activities | | | 12,177,545 | | | | (1,056,560 | ) |

| Net cash used in investing activities | | | (10,013,578 | ) | | | (2,807,910 | ) |

| Net cash provided by (used in) financing activities | | | (2,178,256 | ) | | | 1,461,222 | |

| Effect of exchange rate change on cash and cash equivalents | | | 35,462 | | | | 69,422 | |

| Net increase in cash and cash equivalents | | | 21,173 | | | | (2,333,827 | ) |

| Cash and cash equivalents, beginning balance | | | 331,618 | | | | 2,665,445 | |

| Cash and cash equivalents, ending balance | | | 352,791 | | | | 331,618 | |

We have historically financed our operations and capital expenditures principally through bank loans, and cash provided by operations. Our management believes that the Company has sufficient cash, along with projected cash to be generated by the business of the Company to support its current operations for the next twelve months. However, we have a plan to expand our operation on Changxing Island which requires approximately RMB50 million or $7.3 million capital. There can be no assurance that any additional financing will be available on acceptable terms, if at all.

Operating Activities

Net cash provided by operating activities was $12,177,545 for the fiscal year ended June 30, 2008, an increase of $13,234,105 from net cash of $1,056,560 that was used in operating activities for the fiscal year ended June 30, 2007 primarily as a result of our increased net income and the increase of advance payments made by our clients.

Investing Activities

Net cash used in investing activities in the fiscal year ended June 30, 2008 was $10,013,578, which was an increase of $7,205,668 from $2,807,910 for the fiscal year ended June 30, 2007, due to advances made in 2008 for equipment in the new production facility located in Changxin Island.

Financing Activities

Net cash outflow in financing activities in the fiscal year ended June 30, 2008 totaled $2,178,256 as compared to an inflow of $1,461,222 provided by financing activities for the corresponding period ended June 30, 2007. The decrease of $3,639,478 of cash provided by financing activities was mainly attributable to repayment of a short-term loan.

As of June 30, 2008, our outstanding loans were as following:

| Creditors | Loan Amount | Annual Interest Rate | Term | Expiration Date |

Commercial Bank of Dalian | $437,700 | 9.711% | 1 year | 04/24/2009 |

| Agricultural Bank of China Dalian Branch | $291,800 | 9.576% | 1 year | 07/15/2008 |

| Shanghai Pudong Development Bank | $1,459,000 | 8.019% | 1 year | 12/27/2008 |

| Construction Bank of China | $5,763,050 | 8.6897% and 7.50312% for the first two years and the interest rates of the following years are to be adjusted every 12 months | 5 year | 11/2011 |

Total | $7,951,550 | | | |

None of our officers or shareholders has made commitments to the Company for financing in the form of advances, loans or credit lines.

Accounts Receivable

We had $5,902,124 of accounts receivable as of June 30, 2008, compared to $5,680,556 as of June 30, 2007, an increase of $221,568 which was due to the increased sales in 2008.

Our allowance for doubtful accounts was $25,263 as of June 30, 2008 compared with $91,393 as of June 30, 2007, a decrease of $66,130 due to the successful efforts we have made to collect accounts receivables.

Inventories

We had an inventory of $1,643,943 as of June 30, 2008 as compared to $1,117,504, an increase of $526,439. The increase was for the store up of the certain special raw materials in preparation of our increased production of specialty cables.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies and Estimates

Management's discussion and analysis of its financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles. Our financial statements reflect the selection and application of accounting policies which require management to make significant estimates and judgments. See Note 2 to our consolidated financial statements, “Basis of Presentation and Summary of Significant Accounting Policies.” We believe that the following paragraphs reflect the more critical accounting policies that currently affect our financial condition and results of operations:

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those estimates.

Revenue recognition

Sales revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectibility is reasonably assured. The cost of the sold goods or products can be determined or calculated. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

Cash and cash equivalents

For statement of cash flows purposes, the Company considers all cash on hand and in banks, certificates of deposit and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents.

Accounts receivable