Use these links to rapidly review the document

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on September 1, 2005

Registration No. 333-125524

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Texas Genco Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 4911

(Primary Standard Industrial

Classification Code Number) | | 20-2886772

(I.R.S. Employer

Identification Number) |

1301 McKinney

Suite 2300

Houston, Texas 77010

(713) 795-6000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) |

Thad Miller, Esq.

Executive Vice President, Chief Legal Officer

Texas Genco Inc.

1301 McKinney

Suite 2300

Houston, Texas 77010

(713) 795-6000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to: |

Joshua Ford Bonnie, Esq.

Edward P. Tolley III, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

Tel: (212) 455-2000

Fax: (212) 455-2502 | | Marc D. Jaffe, Esq.

Latham & Watkins LLP

885 Third Avenue

New York, New York 10022-4834

Tel: (212) 906-1200

Fax: (212) 751-4864 |

Approximate date of commencement of the proposed sale of the securities to the public:As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Proposed Maximum

Aggregate Offering Price(1)

| | Amount of Registration Fee

|

|---|

|

| Class A Common Stock, par value $0.01 per share(2) | | $600,000,000 | | $70,620(3) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee under Rule 457(o) of the Securities Act of 1933, as amended.

- (2)

- Includes shares of Class A common stock that the underwriters have the option to purchase to cover over-allotments, if any.

- (3)

- Previously paid.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated August 31, 2005.

Shares

Texas Genco Inc.

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Texas Genco Inc. Texas Genco Inc. is offering all of the shares to be sold in the offering.

Immediately following this offering, stockholders that purchase shares in this offering will own % of the equity in our business, or % if the underwriters exercise their option to purchase additional shares in full. Our existing equityholders, consisting of investment funds affiliated with The Blackstone Group, Hellman & Friedman LLC, Kohlberg Kravis Roberts & Co. L.P. and Texas Pacific Group and certain members of our management, will beneficially own all of the remaining equity in our business and will have % of the voting power in Texas Genco Inc., or % if the underwriters exercise their option to purchase additional shares in full.

We intend to use all of the net proceeds from this offering to pay special distributions to our existing equityholders.

Prior to this offering, there has been no public market for the Class A common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . Texas Genco Inc. intends to list the Class A common stock on the NASDAQ National Market under the symbol "POWR".

See "Risk Factors" on page 13 to read about factors you should consider before buying shares of the Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share

| | Total

|

|---|

| Initial public offering price | | $ | | | $ | |

| Underwriting discount | | $ | | | $ | |

| Proceeds, before expenses, to Texas Genco Inc. | | $ | | | $ | |

To the extent that the underwriters sell more than shares of Class A common stock, the underwriters have an option to purchase up to an additional shares from Texas Genco Inc. at the initial public offering price less the underwriting discount. We intend to use the net proceeds from any shares sold pursuant to the underwriters' option to purchase additional shares to pay an additional special distribution to our existing equityholders.

The underwriters expect to deliver the shares against payment in New York, New York on , 2005.

Goldman, Sachs & Co.

Prospectus dated , 2005.

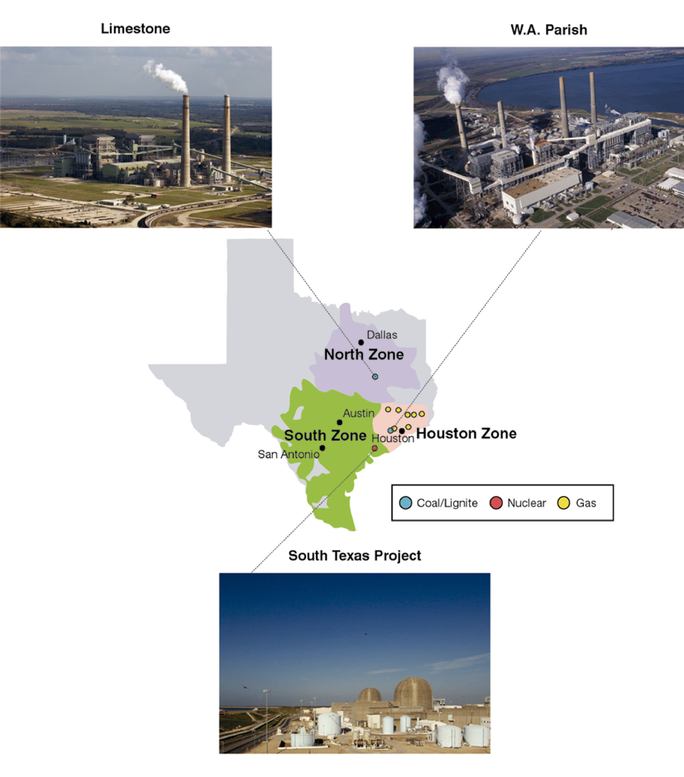

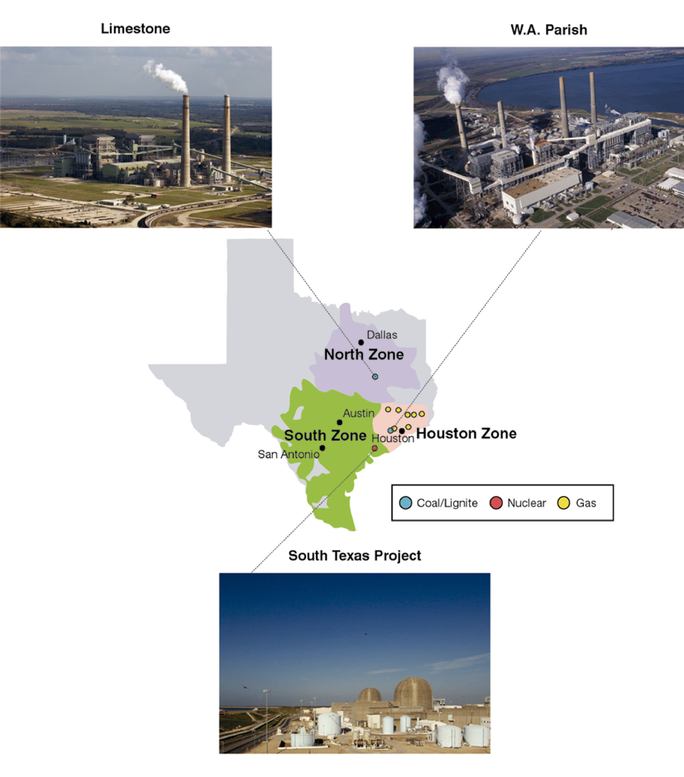

Generation Sites

| | Net

Generation

Capacity

(MW)

| | Number

of Units

| | Dates of First

Commercial

Operation

|

|---|

| Solid-Fuel Baseload Plants: | | | | | | |

| W. A. Parish | | 2,464 | | 4 | | 1977-1982 |

| Limestone | | 1,629 | | 2 | | 1985-1986 |

| South Texas Project | | 1,127 | | 2 | | 1988-1989 |

| | |

| |

| | |

| | Total Solid-Fuel Baseload | | 5,220 | | 8 | | |

| | |

| |

| | |

| Natural Gas-Fired Plants: | | | | | | |

| Cedar Bayou | | 1,492 | | 2 | | 1970-1972 |

| T. H. Wharton | | 1,090 | | 17 | | 1967-1974 |

| W. A. Parish (natural gas) | | 1,086 | | 5 | | 1958-1968 |

| San Jacinto | | 162 | | 2 | | 1995 |

| S. R. Bertron | | 784 | | 6 | | 1956-1967 |

| Greens Bayou | | 715 | | 7 | | 1973-1976 |

| P. H. Robinson | | 390 | | 1 | | 1967 |

| | |

| |

| | |

| | Total Operating Natural Gas-Fired | | 5,719 | | 40 | | |

| | |

| |

| | |

| | Total Operating | | 10,939 | | 48 | | |

| | |

| |

| | |

SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the section entitled "Risk Factors" and the historical financial statements and the notes to those statements, before making an investment decision.

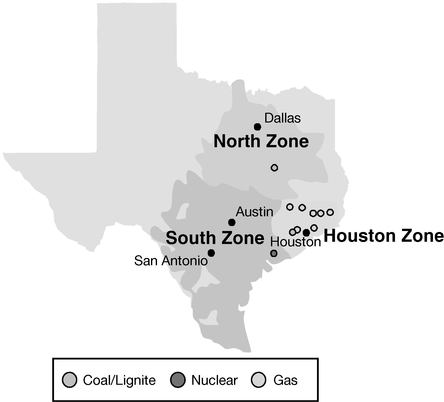

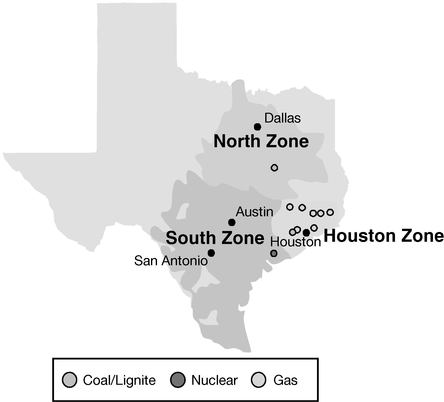

Texas Genco

We are a wholesale electric power generation company engaged in the ownership and operation of a diverse portfolio of power plants in the state of Texas. According to the Electric Reliability Council of Texas, the independent system operator for the electric market that services 85% of the electric demand in Texas, we are the second-largest generation company within that market and the largest owner of power plants in the Houston zone of that market based on total generation capacity. We sell power and related products to wholesale purchasers such as retail electric providers, power trading organizations, municipal utilities, electric power co-operatives and other power generation companies.

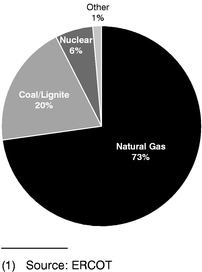

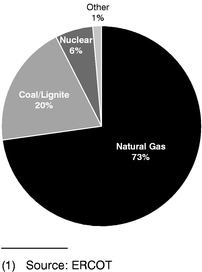

We currently own 48 operating generation units at nine power generation plants, including an undivided 44.0% interest in two nuclear generation units at South Texas Project Electric Generating Station. Our generation plants are diversified across fuel sources, technology and geographic regions within the Electric Reliability Council of Texas market. The substantial majority of our revenues and cash flows are realized from the sale of power from eight units at our three solid fuel (coal, lignite and uranium) power plants — W. A. Parish, Limestone and South Texas Project Electric Generating Station. Because generation units are generally dispatched in order of lowest cost and approximately 73% of the net generation capacity in our market is from higher-cost natural gas-fired units, we expect these eight baseload units to operate nearly 100% of the time they are available.

Our management team has implemented a strategy of creating a stable base of operating cash flows through a combination of forward fixed price power sales, natural gas price swap agreements (which have the effect of hedging the price we would receive for additional future power sales and therefore our revenues), and forward solid fuel and fuel transportation purchases. As of August 19, 2005, we had hedged the price we will receive for approximately 82% of the power that we expect to generate at our solid-fuel baseload units from 2005 through 2009—including 74% under fixed price power sales contracts and 8% using natural gas price swap agreements. These forward power sales and natural gas price swap agreements, combined with sales and price swaps in 2010, represent approximately $7.5 billion in total future revenues. In addition, we had contracted to purchase at future dates under fixed price contracts (with contractually-specified price adjustments) enough solid fuel to provide for approximately 83% of our expected generation from our solid-fuel baseload plants from 2005 through 2009.

We believe that the stable cash flows generated by this combination of forward power sales and natural gas price swap agreements and forward solid fuel and fuel transportation purchases create a strong platform for growth in our equity value, initially through reducing the level of debt in our capital structure and ultimately through additions to our generation business in Texas and expansion into other attractive markets. In addition, our portfolio of natural gas-fired units that serve the Houston market provides opportunities for us to capture additional revenues through offering capacity or similar products to retail electric providers and others, selling power at prevailing market prices during periods of peak demand and providing ancillary services in support of system reliability.

As of June 30, 2005, the aggregate net generation capacity of our portfolio of operating assets was 10,939 MW, of which 5,220 MW represented the generation capacity of our solid-fuel baseload plants. Our three low-cost and efficient solid-fuel baseload plants produced 84% of our total megawatt hours sold for the twelve months ended June 30, 2005, giving pro forma effect to the acquisitions of our generation plants (including our acquisition of an additional 13.2% undivided

1

interest in South Texas Project Electric Generating Station) and generated a substantial majority of our revenues and cash flow. See "Business—Our Generation Plants" for more information about our portfolio of generation plants. For the twelve months ended June 30, 2005, giving pro forma effect to the acquisitions of our generation plants (other than our acquisition of an additional 13.2% undivided interest in South Texas Project Electric Generating Station, which is accounted for as an asset acquisition and therefore is not included in the pro forma statement of operations) and the related financings, and to the corporate reorganization we will undertake in connection with this offering as if these transactions had occurred on July 1, 2004, we had revenues of $2,347.8 million, income before minority interest of $ and net income of $ . See "The Formation Transactions," "Reorganization and Holding Company Structure" and "Unaudited Pro Forma Financial Information."

Recent Initiatives

Since we signed definitive documentation in July 2004 to acquire Texas Genco Holdings, Inc. from CenterPoint Energy, Inc. our new management team has undertaken a variety of initiatives to materially enhance the value of our business, including:

- •

- executing new forward power sales and natural gas price swap agreements at attractive prices that we expect will generate an additional $6.1 billion of revenues through 2010;

- •

- implementing initiatives that we expect will reduce annual operation and maintenance expenses after fiscal 2005 by approximately $130 million as compared to our pro forma operation and maintenance expenses of $529 million, which includes approximately $30 million of annual expenses for our additional 13.2% ownership interest in the South Texas Project Electric Generating Station acquired May 19, 2005, for the twelve months ended June 30, 2005, through a reduction in the workforce, the assumption of services previously provided by CenterPoint Energy, Inc. and Reliant Energy, Inc., the elimination of one-time restructuring costs and the suspension of operations of uneconomic natural gas-fired units;

- •

- effecting the acquisition, funded from cash on the balance sheet, of an additional 338 MW of ownership interest in South Texas Project Electric Generating Station; and

- •

- selling non-core assets.

Our Competitive Strengths

High Quality, Low-Cost, Solid-Fuel Baseload Power Plants. Our solid-fuel baseload power plants are well-built and well-maintained, representing 5,220 MW of net generation capacity. W. A. Parish and Limestone were available to operate 85% and 88% of the time, respectively, over the five years ended December 31, 2003, compared to the five-year industry average availability for coal and lignite power plants of 84% and 85%, respectively, based on information published by the North American Electric Reliability Council. For the year ended December 31, 2004, W.A. Parish and Limestone were available to operate 92% and 94% of the time, respectively. South Texas Project Electric Generating Station is one of the newest nuclear-powered generation plants in the United States according to information published by the U.S. Department of Energy and, for the year ended December 31, 2004, was both available and in operation greater than 95% of the time. We believe we have made all investments necessary to meet applicable air emissions requirements for all of our solid-fuel baseload plants.

Favorable Dynamics for Baseload Power Plants in Our Market. The Electric Reliability Council of Texas market represents approximately 85% of the demand for power in Texas and is one of the nation's largest and fastest growing power markets according to information published by the Electric Reliability Council of Texas. Because electricity demand almost always exceeds supply available from solid-fuel baseload power plants in our market, higher marginal cost natural gas-fired

2

power plants currently set the market price of wholesale power in our market more than 90% of the time. This pricing environment allows our low-cost solid-fuel baseload power plants to earn attractive operating margins compared to natural gas-fired power plants.

Experienced Management Team. We are led by a management team with substantial experience in the energy industry and strong operating, commercial, regulatory, financial and strategic capabilities. Our Chief Executive Officer, Jack Fusco, founded Orion Power Holdings, Inc. in 1998 and, in less than five years, he and his team built Orion Power into a profitable and diversified generation company with 85 power plants representing over 5,600 MW of generation capacity across four different states. Many of Mr. Fusco's former colleagues have also joined our management team.

Significant Cash Flow Generation and a Strong Base for Disciplined Expansion. The current pricing environment allows us to generate significant operating cash flow after deducting capital expenditures, and we actively seek to secure this cash flow through a combination of fixed price forward power sales and natural gas price swap agreements coupled with forward solid fuel and fuel transportation arrangements. We believe that this strategy, together with our relatively low capital expenditure requirements going forward, should allow us to generate significant cash flow to, among other things, repay indebtedness and pay dividends to stockholders. We also believe our management's experience in operating, acquiring and integrating domestic generation assets and the substantial cash flow generation capability of our plants in Texas provide us with the capability to grow our generating business in Texas through expansion of our existing generation capacity and expand into other domestic markets should attractive opportunities arise. In addition, since December 2004, we have implemented initiatives designed to reduce our costs and improve our operating performance.

Our Strategy

Our goal is to become the premier independent power producer in North America while maximizing value for our stockholders. We intend to pursue our goal by:

- •

- attracting and retaining talented, entrepreneurial employees;

- •

- improving the operating performance and lowering the operating costs of our power plants;

- •

- optimizing our asset base to match market conditions and demands;

- •

- opportunistically expanding our existing solid-fuel baseload power plants; and

- •

- evaluating and executing a disciplined growth program into other attractive domestic markets.

In addition, we have implemented a risk management strategy to reduce our exposure to fluctuations in the market prices of power and fuel, reduce our operating risk and increase the certainty of our cash flows. The focus of this strategy is to secure gross margins for our baseload generation capacity while maintaining sufficient generation capacity reserves to mitigate plant outage risks. Our risk management strategy includes the following key attributes:

- •

- no speculative commodity trading;

- •

- targeting selling on a firm basis up to 80% of future available baseload capacity for a rolling three-year period or longer depending on market conditions and our credit

capacity, selling the balance on a short-term and/or non-firm basis, so that, together with our portfolio of natural gas-fired units, we will have available substantial reserve generation capacity and using the financial markets to hedge power price risk where appropriate, subject to the above parameters;

- •

- coordinating our forward power sales with our forward purchases of solid fuel and fuel transportation for comparable time periods and quantities, to the extent practicable; and

3

- •

- limiting future demands on our liquidity by capping, to the extent practicable, the amount of cash and letter of credit collateral provided or committed to our counterparties.

The following table summarizes our forward power sales and natural gas price swap agreements transacted through August 19, 2005. Approximately 80% of our forward power sales and natural gas price swap agreements are with investment grade rated counterparties, and we expect this percentage to increase over time as current contracts with below investment grade rated counterparties are fulfilled. See "Business—Our Competitive Strengths" for more information about our forward power sales and natural gas price swap agreements.

| | 2005(1)

| | 2006

| | 2007

| | 2008

| | 2009

| | Annual

Average

for

2005-2009

| | 2010

| |

|---|

| Baseload Capacity (MW) | | | 5,220 | | | 5,366 | | | 5,382 | | | 5,382 | | | 5,382 | | | 5,346 | | | 5,382 | |

| Available Baseload Capacity (MW) | | | 4,793 | | | 4,946 | | | 5,133 | | | 5,120 | | | 5,127 | | | 5,024 | | | 5,124 | |

| Forward Firm Sales Obligations (MW) | | | 3,869 | | | 3,279 | | | 4,071 | | | 3,650 | | | 2,275 | | | 3,429 | | | 500 | |

| Forward Natural Gas Price Swap Agreements (MW)(2) | | | — | | | 530 | | | — | | | 346 | | | 1,136 | | | 402 | | | 866 | |

| Forward Non-Firm Sales Obligations (MW) | | | 602 | | | 450 | | | 200 | | | 150 | | | — | | | 280 | | | — | |

| Available Baseload Capacity Sold Forward-Firm(3) | | | 81 | % | | 77 | % | | 79 | % | | 78 | % | | 67 | % | | 76 | % | | 27 | % |

| Total Available Baseload Capacity Sold Forward(2) | | | 93 | % | | 86 | % | | 83 | % | | 81 | % | | 67 | % | | 82 | % | | 27 | % |

| Weighted Average Forward Price ($ per MWh) | | $ | 43 | | $ | 44 | | $ | 39 | | $ | 41 | | $ | 48 | | $ | 43 | | $ | 53 | |

| Total Revenue Sold Forward ($ in millions)(2)(3) | | $ | 1,670 | | $ | 1,654 | | $ | 1,445 | | $ | 1,510 | | $ | 1,448 | | $ | 1,545 | | $ | 628 | |

- (1)

- Reflects amounts for the full year ended December 31, 2005, which include $823 million of revenues for the six months ended June 30, 2005.

- (2)

- The Forward Natural Gas Swap quantities reflected in equivalent MW are derived by first dividing the quantity of MMBtu of natural gas hedged by the forward market heat rate (in MMBtu/MWh, mid-point of the bid and offer as quoted by brokers in the market of the relevant Electric Reliability Council of Texas zones as of August 19, 2005) to arrive at the equivalent MWh hedged which is then divided by 8,760 to arrive at MW hedged. Revenues sold forward include revenues assumed to be associated with the natural gas price swap agreements. The natural gas price swap agreements are entered into as a hedge against fluctuations in the gas price component of future power sales and therefore the revenues associated with natural gas price swap agreements in the Total Revenue Sold Forward represent the assumed revenues of future power sales. The revenues of these future power sales are estimated by multiplying the fixed swap gas price we receive in the natural gas price swap agreements by the relevant forward market heat rate of the relevant ERCOT zone as of August 19, 2005.

- (3)

- Includes amounts under fixed price power sales contracts and amounts financially hedged under natural gas price swap agreements.

Risks Related to Our Business

We are subject to a variety of risks related to our competitive position and business strategies. Some of the more significant challenges and risks include those associated with the operation of our power generation plants, volatility in power prices and fuel costs, our leveraged capital structure and extensive governmental regulation. See "Risk Factors" beginning on page 13 for a discussion of the factors you should consider before investing in our securities.

Texas Genco Inc.'s principal executive offices are located at 1301 McKinney, Suite 2300, Houston, Texas 77010. Our telephone number is (713) 795-6000.

4

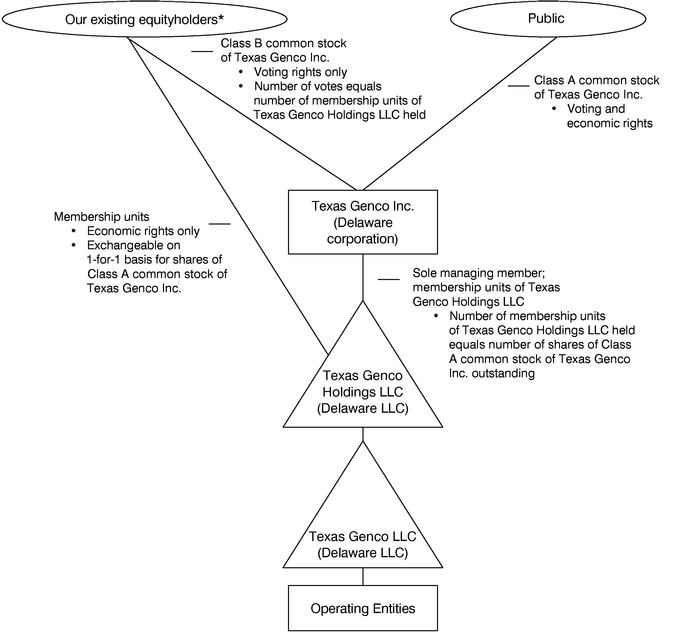

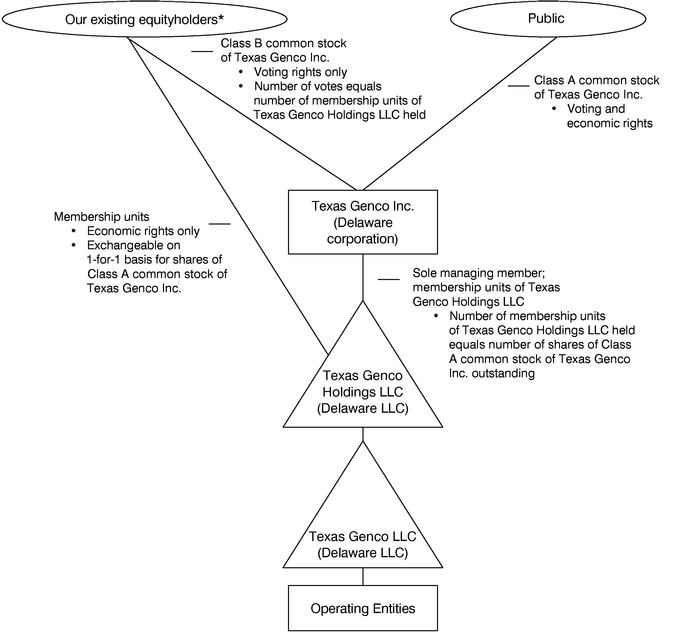

Reorganization and Holding Company Structure

Prior to the Class A common stock offering we will effect a reorganization described in greater detail in "Reorganization and Holding Company Structure." Following the reorganization and the Class A common stock offering, Texas Genco Inc. will be a holding company and its sole asset will be an equity interest in Texas Genco Holdings LLC. As the sole managing member of Texas Genco Holdings LLC, Texas Genco Inc. will operate and control all of the business and affairs of Texas Genco Holdings LLC and, through Texas Genco Holdings LLC and its subsidiaries, continue to conduct the business now conducted by these subsidiaries. Texas Genco Inc. will consolidate the financial results of Texas Genco Holdings LLC and its subsidiaries and the ownership interest of our existing equityholders in Texas Genco Holdings LLC will be reflected as a minority interest in Texas Genco Inc.'s consolidated financial statements.

The diagram below depicts our organizational structure immediately after the consummation of the reorganization, including the Class A common stock offering:

- *

- Investment funds affiliated with The Blackstone Group, Hellman & Friedman LLC, Kohlberg Kravis Roberts & Co. L.P. and Texas Pacific Group and certain members of our management team. The investment funds hold their interests in the membership units of Texas Genco Holdings LLC and in the Class B common stock of Texas Genco Inc. indirectly through Texas Genco Sponsor LLC.

Immediately following this offering, stockholders that purchase shares in this offering will own % of the equity in our business, or % if the underwriters exercise their option to purchase additional shares in full. Our existing equityholders will beneficially own all of the remaining equity in our business and will have % of the voting power in Texas Genco Inc., or % if the underwriters exercise their option to purchase additional shares in full.

5

The Offering

| Class A common stock offered by Texas Genco Inc. | | shares. |

Class A common stock outstanding after this offering |

|

shares (or shares if our existing equityholders exchanged all of their membership units in Texas Genco Holdings LLC, including membership units that will be distributed to these holders to the extent the underwriters do not exercise their option to purchase additional shares, for newly issued shares of Class A common stock on a one-for-one basis). |

Use of proceeds |

|

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full. |

|

|

Texas Genco Inc. will use the proceeds from this offering to purchase newly issued membership units from Texas Genco Holdings LLC, or membership units if the underwriters exercise their option to purchase additional shares in full. We intend to use all of these net proceeds to pay special distributions to our existing equityholders. |

Voting rights |

|

Each share of our Class A common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally. |

|

|

Each holder of membership units in Texas Genco Holdings LLC will be issued one or more shares of our Class B common stock that will entitle the holder (other than Texas Genco Inc.), without regard to the number of shares of Class B common stock held, to a number of votes in Texas Genco Inc. that is equal to the aggregate number of membership units in Texas Genco Holdings LLC held by such holder. |

|

|

Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. |

Dividend policy |

|

Upon completion of this offering, our board of directors currently intends to adopt a policy of declaring, subject to legally available funds, a quarterly cash dividend on our Class A common stock at an annual rate initially equal to approximately $ per share, unless our board of directors, in its sole discretion, determines otherwise, commencing with the quarter of 2005. However, sufficient cash may not be available to pay such dividends. |

| | | |

6

|

|

We are a holding company and, as such, our ability to pay dividends is subject to the ability of our subsidiaries to provide cash to us. The declaration and payment of future dividends by us will be at the discretion of our board of directors and will depend on, among other things, general economic and business conditions, our strategic plans, our financial results and condition, contractual, legal and regulatory restrictions on the payment of dividends by us and our subsidiaries, and such other factors as our board of directors considers to be relevant. |

|

|

In addition, as described under "Use of Proceeds," we intend to distribute all of our net proceeds from this offering, including any net proceeds received upon the exercise by the underwriters of their option to purchase additional shares, to our existing equityholders. |

|

|

We also intend to distribute up to membership units of Texas Genco Holdings LLC to our existing equityholders, shortly after the expiration of the underwriters' option to purchase additional shares (to the extent that the option is not exercised in full). The aggregate number of membership units so distributed will equal (x) the number of additional shares the underwriters have an option to purchaseminus (y) the actual number of shares the underwriters purchase from us pursuant to that option. |

|

|

See "Dividend Policy" and "Description of Indebtedness." |

Risk factors |

|

An investment in our Class A common stock involves significant risks. You should carefully consider all of the information in this prospectus prior to investing in our Class A common stock. In particular, for a discussion of specific factors that you should consider in evaluating an investment in the Class A common stock, see "Risk Factors" beginning on page 13. |

Proposed trading symbol |

|

POWR. |

Unless we specifically state otherwise, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares. In addition, shares outstanding and the other information based thereon do not reflect:

- •

- shares of Class A common stock issuable pursuant to outstanding options, of which options relating to shares of our Class A common stock have vested; and

- •

- shares of Class A common stock reserved for issuance under our stock incentive plan.

See "Management — Equity Benefit Plans."

7

Summary Financial and Other Data

The following table sets forth summary consolidated financial information and other data for Texas Genco LLC and its subsidiaries and for Texas Genco Holdings, Inc., Texas Genco LLC's predecessor for financial reporting purposes, and its subsidiaries. Because Texas Genco LLC acquired Texas Genco Holdings, Inc. as part of a multi-step transaction in which the Initial Acquisition (as defined under "The Formation Transactions") was consummated on December 15, 2004 and the Nuclear Acquisition (as defined under "The Formation Transactions") was consummated on April 13, 2005, information is presented for Texas Genco Holdings, Inc. as of and for the years ended December 31, 2002, 2003 and 2004 and as of and for the six months ended June 30, 2004 and for the period from January 1, 2005 through April 13, 2005.

The consolidated financial position and consolidated results of operations for Texas Genco LLC as of December 31, 2004 and for the period from July 19, 2004 ("Inception") through December 31, 2004 were derived from our audited consolidated financial statements. The consolidated financial position and consolidated results of operations for Texas Genco LLC as of and for the six months ended June 30, 2005 were derived from our unaudited financial statements, which have been prepared on a similar basis to that used in the preparation of our audited financial statements. Texas Genco LLC did not exist prior to Inception; therefore, no consolidated financial and other data has been presented in the following table for Texas Genco LLC for any other period.

The consolidated financial position and consolidated results of operations for Texas Genco Holdings, Inc. as of and for the years ended December 31, 2002, 2003 and 2004 were derived from Texas Genco Holdings, Inc.'s audited financial statements. The consolidated financial position and consolidated results of operations for Texas Genco Holdings, Inc. as of and for the six months ended June 30, 2004 and for the period from January 1, 2005 through April 13, 2005 were derived from Texas Genco Holdings, Inc.'s unaudited financial statements which have been prepared on a similar basis to that used in the preparation of Texas Genco Holdings, Inc.'s audited financial statements. The financial information for Texas Genco Holdings, Inc. reflects ownership of the Non-Nuclear Assets (as defined under "The Formation Transactions") for periods prior to December 15, 2004 and of an undivided 30.8% interest in South Texas Project Electric Generating Station for all periods presented, and is therefore not comparable to the historical financial information for Texas Genco LLC, which reflects ownership of the Non-Nuclear Assets only for periods subsequent to December 15, 2004, the Nuclear Acquisition only for periods subsequent to April 13, 2005 and the ROFR (as defined under "The Formation Transactions") only for periods subsequent to May 18, 2005.

The summary pro forma balance sheet data of Texas Genco Inc. as of June 30, 2005 give pro forma effect to the Reorganization (as defined under "The Reorganization and Holding Company Structure"), as if it had been consummated on that date. The summary pro forma results of operations of Texas Genco Inc. for the twelve months ended June 30, 2005 give pro forma effect to all of the Formation Transactions (as defined under "The Formation Transactions") and to the Reorganization as if they had been consummated on January 1, 2004. The summary pro forma financial data for Texas Genco Inc. reflect, among other things, significant minority interest and therefore are not comparable to the historical financial information for Texas Genco Holdings, Inc. or Texas Genco LLC. The ROFR is considered to be an asset acquisition and accordingly, pursuant to the accounting guidance applicable to the preparation of pro forma financial statements, the pro forma effects of that transaction are not presented in the pro forma results of operations.

The summary pro forma financial data are for informational purposes only and should not be considered indicative of actual results that would have been achieved had these events actually been consummated on the dates indicated and do not purport to indicate results of operations as of any future date or for any future period.

8

Historical results are not indicative of future performance. The following tables should be read in conjunction with "The Formation Transactions," "Unaudited Pro Forma Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical financial statements and the notes to those statements appearing elsewhere in this prospectus.

| | Texas Genco Holdings, Inc. — Predecessor

| | Texas Genco LLC

| | Texas Genco Inc.

| |

|---|

| |

| |

| |

| |

| |

| |

| |

| | For the twelve

months ended

June 30, 2005

| | For the twelve

months ended

June 30, 2005

| |

|---|

| |

| |

| |

| |

| | Period from January 1, 2005 through April 13, 2005

| |

| |

| |

| | Pro forma

for the

Formation

Transactions

and the

Reorganization(2)

| |

|---|

| | For the years ended December 31,

| | For the six months

ended June 30,

| | Period

from July 19, 2004

through

December 31,

2004

| |

| |

| |

|---|

| |

| | Pro forma

for the

Formation

Transactions

| |

|---|

| | For the six months ended June 30,

2005

| |

|---|

| | 2002(1)

| | 2003

| | 2004

| | 2004

| |

|---|

| | ($ in millions, except per unit data)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues(3) | | $ | 1,541 | | $ | 2,002 | | $ | 2,054 | | $ | 992 | | $ | 61 | | $ | 96 | | $ | 1,123 | | $ | 2,348 | | $ | 2,348 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fuel and purchased power expense(4) | | | 1,083 | | | 1,171 | | | 1,021 | | | 477 | | | 6 | | | 45 | | | 479 | | | 971 | | | 971 | |

| | Operation and maintenance(5) | | | 391 | | | 411 | | | 415 | | | 200 | | | 35 | | | 24 | | | 229 | | | 509 | | | 499 | |

| | Depreciation and amortization | | | 157 | | | 159 | | | 89 | | | 81 | | | 5 | | | 13 | | | 159 | | | 333 | | | 333 | |

| | Write-down of assets(6) | | | — | | | — | | | 763 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Taxes other than income taxes | | | 43 | | | 39 | | | 41 | | | 24 | | | 3 | | | — | | | 21 | | | 40 | | | 40 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | Total | | | 1,674 | | | 1,780 | | | 2,329 | | | 782 | | | 49 | | | 82 | | | 888 | | | 1,853 | | | 1,843 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income/(loss) | | | (133 | ) | | 222 | | | (275 | ) | | 210 | | | 12 | | | 14 | | | 235 | | | 495 | | | 505 | |

| Other income | | | 3 | | | 2 | | | 5 | | | 2 | | | 1 | | | — | | | 2 | | | 7 | | | 7 | |

| Interest income (expense), net(7) | | | (26 | ) | | (2 | ) | | — | | | — | | | — | | | (34 | ) | | (85 | ) | | (186 | ) | | (186 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | | (156 | ) | | 222 | | | (270 | ) | | 212 | | | 13 | | | (20 | ) | | 152 | | | 316 | | | 326 | |

| Income tax expense (benefit)(8) | | | (63 | ) | | 71 | | | (171 | ) | | 71 | | | 4 | | | — | | | 7 | | | 31 | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before cumulative effect of accounting change | | | (93 | ) | | 151 | | | (99 | ) | | 141 | | | 9 | | | (20 | ) | | 145 | | | 285 | | | | |

| Cumulative effect of accounting change, net of tax(9) | | | — | | | 99 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Income before minority interest | | | (93 | ) | | 250 | | | (99 | ) | | 141 | | | 9 | | | (20 | ) | | 145 | | | 285 | | | | |

| Minority interest(10) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Net income/(loss) | | $ | (93 | ) | $ | 250 | | $ | (99 | ) | $ | 141 | | $ | 9 | | $ | (20 | ) | $ | 145 | | $ | 285 | | $ | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Pro Forma Earnings Per Share Data(11): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share before cumulative effect of accounting change — basic and diluted |

|

$ |

(1.16 |

) |

$ |

3.13 |

|

$ |

(1.25 |

) |

$ |

1.76 |

|

$ |

0.13 |

|

$ |

(0.13 |

) |

$ |

0.87 |

|

$ |

1.58 |

|

$ |

|

|

| Net income (loss) per share — basic and diluted | | | (1.16 | ) | | 3.13 | | | (1.25 | ) | | 1.76 | | | 0.13 | | | (0.13 | ) | | 0.86 | | | 1.58 | | | | |

| Weighted average shares outstanding — basic (in millions) | | | 80.0 | | | 80.0 | | | 79.4 | | | 80.0 | | | 67.8 | | | 156.5 | | | 166.8 | | | 180.0 | | | | |

| Weighted average shares outstanding — diluted (in millions) | | | 80.0 | | | 80.0 | | | 79.4 | | | 80.0 | | | 67.8 | | | 156.5 | | | 168.4 | | | 180.9 | | | | |

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA(12) |

|

$ |

52 |

|

$ |

406 |

|

$ |

(151 |

) |

$ |

308 |

|

$ |

22 |

|

$ |

27 |

|

$ |

404 |

|

$ |

854 |

|

$ |

|

|

| Capital expenditures | | | 258 | | | 157 | | | 73 | | | 36 | | | 9 | | | 6 | | | 41 | | | 93 | | | 93 | |

Selected Operating Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total power generation capacity (MW)(13)(14) |

|

|

14,175 |

|

|

14,153 |

|

|

14,153 |

|

|

14,153 |

|

|

788 |

|

|

13,375 |

|

|

14,317 |

|

|

14,317 |

|

|

14,317 |

|

| Total baseload capacity(MW)(14) | | | 4,852 | | | 4,834 | | | 4,834 | | | 4,834 | | | 788 | | | 4,159 | | | 5,220 | | | 5,220 | | | 5,220 | |

| Total sales (GWh) | | | 51,463 | | | 47,375 | | | 47,308 | | | 22,683 | | | 1,500 | | | N/A | | | 21,849 | | | 47,974 | | | 47,974 | |

| Total baseload generation (GWh) | | | 35,396 | | | 34,305 | | | 37,583 | | | 18,561 | | | 1,500 | | | N/A | | | 14,434 | | | 34,956 | | | 34,956 | |

| Average power price (per MWh)(15) | | $ | 29.94 | | $ | 42.27 | | $ | 45.02 | | $ | 43.73 | | $ | 41.06 | | $ | N/A | | $ | 46.23 | | $ | 46.06 | | $ | 46.06 | |

| Average baseload power price (per MWh)(16) | | $ | 25.48 | | $ | 33.76 | | $ | 38.85 | | $ | 37.91 | | $ | 41.06 | | $ | N/A | | $ | 42.83 | | $ | 41.27 | | $ | 41.27 | |

| Average fuel cost (per MWh)(17) | | $ | 20.75 | | $ | 24.38 | | $ | 21.81 | | $ | 20.76 | | $ | 3.77 | | $ | N/A | | $ | 20.53 | | $ | 21.16 | | $ | 21.16 | |

| Average baseload fuel cost (per MWh)(18) | | $ | 14.90 | | $ | 13.40 | | $ | 13.15 | | $ | 13.34 | | $ | 3.77 | | $ | N/A | | $ | 13.55 | | $ | 12.23 | | $ | 12.23 | |

9

| | Texas Genco Holdings, Inc. — Predecessor

| | Texas Genco LLC

| | Texas Genco Inc.

|

|---|

| |

| |

| |

| |

| |

| | As of June 30, 2005

|

|---|

| | As of December 31,

| |

| |

| |

|

|---|

| | As of

December 31,

2004

| | As of

June 30,

2005

| | Pro forma

for the

Reorganization(2)

|

|---|

| | 2002(1)

| | 2003

| | 2004

|

|---|

Balance Sheet Data (at period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

$ |

4,096 |

|

$ |

4,126 |

|

$ |

474 |

|

$ |

2,440 |

|

$ |

3,583 |

|

$ |

3,583 |

| Total assets(19) | | | 4,508 | | | 4,640 | | | 1,395 | | | 4,588 | | | 6,091 | | | |

| Total debt | | | — | | | — | | | — | | | 2,280 | | | 2,747 | | | 2,747 |

| Minority interest(10) | | | — | | | — | | | — | | | — | | | — | | | |

| Shareholders' equity | | | 2,824 | | | 3,033 | | | 454 | | | — | | | — | | | |

| Members' equity(19)(20) | | | — | | | — | | | — | | | 772 | | | 917 | | | — |

- (1)

- Upon the restructuring of Reliant Energy Incorporated pursuant to its business separation plan, effective August 31, 2002, Texas Genco Holdings, Inc.'s equity structure was changed to reflect the contribution of Reliant Energy Incorporated's electric generating facilities to Texas Genco Holdings, Inc.

- (2)

- The ROFR is considered to be an asset acquisition and accordingly, pursuant to the accounting guidance applicable to the preparation of pro forma financial statements, the pro forma effects of that transaction are not presented in the pro forma results of operations. Therefore, only the pro forma selected operating information give pro forma effect to consummation of the ROFR. Giving effect to the consummation of the ROFR would have increased pro forma revenues by $91.0 million to $2,438.8 million, increased pro forma net income by $ million to $ million, increased pro forma EBITDA by $54.8 million to $908.3 million and increased pro forma capital expenditures by $11.2 million to $104.2 million for the twelve months ended June 30, 2005. See footnote 6 to the unaudited pro forma financial data of Texas Genco Inc.

- (3)

- Revenues for Texas Genco LLC include amortization of the liability related to below-market power sales contracts recorded in connection with the Initial Acquisition and the effect of other non-trading derivatives, which increased revenues by $12.3 million and decreased revenues by $3.6 million, respectively, for the period from Inception through December 31, 2004. For the six months ended June 30, 2005, amortization of the liability related to below-market power sales contracts increased revenues for Texas Genco LLC by $125.1 million and the effect of other non-trading derivatives decreased revenues for Texas Genco LLC by $12.6 million. On a pro forma basis for the twelve months ended June 30, 2005, amortization of the liability related to below-market power sales contracts increased revenues by $215.6 million and the effect of other non-trading derivatives decreased revenues by $16.2 million. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Assumed Contracts."

- (4)

- Fuel and purchased power expense for Texas Genco LLC includes fuel-related depreciation and amortization — amortization of nuclear fuel — and the amortization of the liability related to above-market coal purchase contracts (which obligations we expect to fulfill in 2010) recorded in connection with the Initial Acquisition. Fuel-related depreciation and amortization had no effect on fuel expense for the period of Inception through December 31, 2004 and increased fuel expense by $7.8 million for the six months ended June 30, 2005. The amortization of the liability related to above-market coal purchase contracts decreased fuel and purchased power expense for Texas Genco LLC by $1.5 million for the period from Inception through December 31, 2004 and $23.7 million for the six months ended June 30, 2005. On a pro forma basis, fuel-related depreciation and amortization increased fuel expense by $18.6 million and the amortization of the liability related to above-market coal purchase contracts decreased fuel and purchased power expense by $52.2 million, in each case for the twelve months ended June 30, 2005. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Assumed Contracts."

- (5)

- Operation and maintenance for Texas Genco Holdings, Inc. includes allocations of overhead costs from CenterPoint Energy, Inc. Operations and maintenance for Texas Genco LLC includes payments to CenterPoint Energy, Inc. and Reliant Energy, Inc. for transition services. Operations and maintenance for Texas Genco LLC for the six months ended June 30, 2005 includes a charge of $36.9 million related to our workforce optimization plan and a payment of $5.0 million of monitoring fees paid to affiliates of The Blackstone Group, Hellman & Friedman LLC, Kohlberg Kravis Roberts & Co. L.P. and Texas Pacific Group, which fees will terminate upon consummation of the offering of Class A common stock.

- (6)

- For the year ended December 31, 2004, Texas Genco Holdings, Inc. recorded an asset impairment of $763.0 million ($426.0 million net of tax) to reflect the net realizable value for the assets to be sold in the Initial Acquisition. Texas Genco Holdings, Inc. ceased depreciation on its coal, lignite and natural gas-fired generation plants at the time these assets were considered "held for sale." This resulted in a decrease in depreciation expense of $69.0 million for the year ended December 31, 2004 as compared to the same period in 2003.

- (7)

- Interest income (expense), net for Texas Genco LLC includes amortization of deferred financing fees of $(1.0) million for the period from Inception through December 31, 2004 and $(6.6) million for the six months ended June 30, 2005. On a pro forma basis, interest income (expense), net includes amortization of deferred financing fees of $(13.5) million for the twelve months ended June 30, 2005.

- (8)

- Texas Genco LLC is a limited liability company that is treated as a partnership for U.S. federal income tax purposes and is, therefore, not itself subject to federal income taxation. Profits or losses are subject to taxation at the member interest level.

10

Texas Genco Holdings, Inc., our subsidiary that holds our 44.0% undivided interest in South Texas Project Generating Station, is a corporation that is subject to U.S. federal income taxation on its income.

- (9)

- Cumulative effect of an accounting change resulting from the allocation of Statement of Financial Accounting Standards No. 143, "Accounting for Asset Retirement Obligations."

- (10)

- Pro forma minority interest reflects an adjustment to record the % minority interest ownership of our existing equityholders in Texas Genco Holdings LLC, assuming shares of Class A common stock are issued in connection with this offering. Membership units of Texas Genco Holdings LLC are exchangeable into shares of Class A common stock of Texas Genco Inc. on a one-for-one basis.

- (11)

- Earnings per share are calculated by dividing net earnings by the weighted average shares outstanding. Unaudited pro forma basic and diluted earnings per share have been calculated in accordance with the SEC rules for initial public offerings. Pro forma weighted average shares for purposes of the unaudited pro forma basic net income (loss) per share calculation is based on shares outstanding as of June 30, 2005 and has been adjusted to reflect (1) the Reorganization, including the issuance of the shares of Class A common stock offered hereby and (2) the distribution of membership units of Texas Genco Holdings LLC to our existing equityholders that will be made shortly after the expiration of the underwriters' option to purchase additional shares assuming no exercise of that option.

- (12)

- EBITDA represents net income (loss) before interest expense, income tax, depreciation and amortization. Management uses EBITDA as an additional tool to assess our operating performance. Management considers EBITDA to be a useful measure in highlighting trends in our business and in analyzing the profitability of similar enterprises because EBITDA typically eliminates the effects of financing decisions. As a result, management believes that EBITDA is more effective than net income in evaluating asset performance and differentiating efficient operators in the industry. EBITDA (as calculated with contractually specified adjustments) is also one of the key measures used in calculating compliance with covenants in our senior secured credit facilities and our senior notes. Non-compliance with financial covenants could prevent us from engaging in certain activities or result in a default under our senior secured credit facilities or our senior notes.

- EBITDA has limitations as an analytical tool. For example, the use of EBITDA is limited as a measure to assess the performance of our business because it excludes certain material costs. EBITDA is not a measurement of operating performance calculated in accordance with accounting principles generally accepted in the United States ("GAAP") and should not be considered as a substitute for net income, operating income, net profit after tax or cash flows from operating activities, as determined in accordance with GAAP, or as a measure of profitability or liquidity. In addition, since EBITDA is not defined by GAAP, it may not be calculated on the same basis as other similarly titled measures of other companies within our industry.

- Management compensates for the limitations of using EBITDA by using it only to supplement our GAAP results to provide a more complete understanding of the factors and trends affecting our business.

- Management believes that EBITDA provides useful information to potential investors and analysts because it provides insights into management's evaluation of our results of operations.

| | Texas Genco Holdings, Inc. — Predecessor

| | Texas Genco LLC

| | Texas Genco Inc.

|

|---|

| |

| |

| |

| |

| |

| |

| |

| | For the twelve

months ended

June 30, 2005

| | For the twelve

months ended

June 30, 2005

|

|---|

| |

| |

| |

| |

| | Period from January 1, 2005 through April 13, 2005

| |

| |

| |

| | Pro forma

for the

Formation

Transactions

and the

Reorganization(c)

|

|---|

| | For the years ended December 31,

| | For the six

months

ended

June 30,

2004

| | Period

from July 19, 2004

through

December 31,

2004

| | For the six

months

ended

June 30,

2005

| |

|

|---|

| | Pro forma

for the

Formation

Transactions

|

|---|

| | 2002(1)

| | 2003

| | 2004

|

|---|

| | (in millions)

|

|---|

| Net income (loss) | | $ | (93 | ) | $ | 250 | | $ | (99 | ) | $ | 141 | | $ | 9 | | $ | (20 | ) | 145 | | $ | 285 | | |

| Depreciation and amortization(a) | | | 157 | | | 159 | | | 89 | | | 81 | | | 5 | | | 13 | | 159 | | | 333 | | 333 |

| Fuel-related depreciation and amortization(b) | | | 25 | | | 23 | | | 30 | | | 15 | | | 4 | | | — | | 8 | | | 19 | | 19 |

| Interest expense (income) | | | 26 | | | 2 | | | — | | | — | | | — | | | 34 | | 85 | | | 186 | | 186 |

| Income taxes | | | (63 | ) | | 71 | | | (171 | ) | | 71 | | | 4 | | | — | | 7 | | | 31 | | |

| Cumulative effect of accounting change | | | — | | | (99 | ) | | — | | | — | | | — | | | — | | — | | | — | | — |

| Minority interest | | | — | | | — | | | — | | | — | | | — | | | — | | — | | | — | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | |

| EBITDA(d) | | | 52 | | | 406 | | | (151 | ) | | 308 | | | 22 | | | 27 | | 404 | | | 854 | | |

- (a)

- Depreciation and amortization excludes fuel-related depreciation and amortization and amortization of the liabilities related to above-market coal purchase contracts and below-market sales contracts.

- (b)

- Fuel-related depreciation and amortization includes the amortization of nuclear fuel, but excludes amortization of the liability related to above-market coal purchase contracts.

11

- (c)

- The ROFR is considered to be an asset acquisition and accordingly, pursuant to the accounting guidance applicable to the preparation of pro forma financial statements, the pro forma effects of that transaction are not presented in the pro forma results of operations. Therefore, only the pro forma selected operating information give pro forma effect to consummation of the ROFR. Giving effect to the consummation of the ROFR, our EBITDA on a pro forma basis would have increased by $54.8 million to $908.3 million for the twelve months ended June 30, 2005.

- (d)

- EBITDA for Texas Genco Holdings, Inc. presented for the year ended December 31, 2003 represents adjusted EBITDA after giving effect to the cumulative effect of accounting change.

Net income and EBITDA include the effect of the amortization of the liability related to the below-market sales contracts, the effect of other non-trading derivatives and the payment to the Investors of the management fee or the termination fee, as the case may be. The definition of EBITDA in our senior secured credit facilities excludes these items for purposes of determining covenant compliance. Net income and EBITDA also include the effect of the amortization of the liability related to the above-market coal contract. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Assumed Contracts."

- (13)

- We have placed four units into mothball status for more than 180 days and intend to retire one unit and sell nine units, together representing approximately 3,378 MW of available capacity. We intend to place one additional unit representing approximately 390 MW of availability capacity, which is currently operating pursuant to a "reliability must run" contract with the Electric Reliability Council of Texas, into mothball status for more than 180 days when the contract terminates on October 29, 2005.

- (14)

- Figures for net generation capacity as of June 30, 2005 are demonstrated capability based on tests performed by us and reported to ERCOT as of June 30, 2005. Actual capacity can vary depending on weather conditions, operational conditions and other factors. ERCOT requires periodic demonstration of capability, and the capacity may vary individually and in the aggregate from time to time.

- (15)

- Average power price (per MWh) is total revenues, excluding revenues from amortization of below-market sales contracts and the effect of other non-trading derivatives, divided by megawatt hours sold.

- (16)

- Average baseload power price (per MWh) is total revenues from our solid-fuel baseload power plants, excluding revenues from amortization of below-market sales contracts and the effect of other non-trading derivatives, divided by baseload megawatt hours generated.

- (17)

- Average fuel cost (per MWh) is total fuel and purchased power expense, excluding the amortization of above-market coal purchase contracts, but including the amortization of nuclear fuel, railcar depreciation and depreciation of other fuel related assets, divided by megawatt hours sold.

- (18)

- Average baseload fuel cost (per MWh) is total fuel expense with respect to our solid-fuel baseload power plants, excluding the amortization of above-market coal purchase contracts, but including the amortization of nuclear fuel, railcar depreciation and depreciation of other fuel related assets, divided by baseload megawatt hours generated.

- (19)

- Total assets and members' equity as of June 30, 2005 does not reflect distributions to members of an aggregate of $85.8 million from July 1, 2005 through August 15, 2005, representing preliminary distributions of net proceeds relating to certain asset sales.

- (20)

- Members' equity includes capital contributions from our existing equityholders of $899.5 million, of which $892.2 million was contributed by the investment funds affiliated with The Blackstone Group, Hellman & Friedman LLC, Kohlberg Kravis Roberts & Co. L.P. and Texas Pacific Group Investors and $7.3 million was contributed by certain members of our management team.

12

RISK FACTORS

An investment in our securities involves risks. You should carefully consider the following information about these risks, together with the other information contained in this prospectus, before investing in our securities.

RISKS RELATED TO OUR BUSINESS

The operation of power generation plants involves significant risks that could result in unplanned power outages or reduced output, which would adversely affect our results of operations, financial condition or cash flows.

We are subject to significant risks associated with operating power generation plants, any of which could adversely affect our revenues, costs, results of operations, financial condition or cash flows. These risks include:

- •

- operating performance below expected levels of output or efficiency;

- •

- failure of equipment or processes, operator or maintenance errors or other events resulting in power outages or reduced output;

- •

- availability of fuel and fuel transportation;

- •

- disruptions in the transmission or distribution of power;

- •

- availability or cost of ash disposal from our coal plants; and

- •

- catastrophic events such as fires, hurricanes, explosions, floods, terrorist attacks or other similar occurrences to our facilities or to facilities upon which we depend.

Unplanned outages of generating units, including extensions of scheduled outages, due to mechanical failures or other problems occur from time to time and are an inherent risk of our business. For example, after the scheduled refueling outage at Unit 2 at South Texas Project Electric Generating Station in the fourth quarter of 2002, mechanical failures relating to the low pressure turbine blades prevented the unit from being restored to full capacity until March 2003. In July 2003, a steam line ruptured at our W. A. Parish plant, damaging one of the plant's generating units and temporarily taking another unit offline. The damaged unit was returned to service in September 2003. In 2003, the Unit 1 reactor at South Texas Project Electric Generating Station also experienced an unplanned outage extension. During a routine refueling and maintenance outage in early April 2003, engineers found a small quantity of residue from reactor cooling water in the Unit 1 reactor containment building. Upon discovery of the residue, officials of South Texas Project Electric Generating Station Nuclear Operating Company ("STPNOC") immediately reported their findings to the NRC. STPNOC staff subsequently completed repairs on the Unit 1 reactor and the unit was returned to operation in August 2003 following NRC approval. Unplanned outages typically increase our operation and maintenance expenses. In addition, an unplanned outage may reduce our revenues as a result of selling fewer MWh or require us to incur significant costs as a result of running one of our higher cost units or obtaining replacement power from third parties in the open market to satisfy our firm power sales obligations. We expect to satisfy these obligations primarily with production from our three solid-fuel baseload plants, which together represent 5,220 MW of net generation capacity and 84% of our total megawatt hours sold for the twelve months ended June 30, 2005 on a pro forma basis giving effect to the Formation Transactions. If any one plant were to experience an unexpected failure or unplanned outage, it may have a material adverse effect on our revenues from operations or our costs of operations.

A significant number of our generation units were constructed many years ago. Older generation equipment, even if maintained in accordance with good engineering practices, may

13

require major maintenance or significant capital expenditures to keep it operating at high reliability and efficiency and to meet regulatory and environmental requirements. This equipment is also likely to require periodic upgrading and improvement. Any unexpected failure to produce power, including failure caused by breakdown or forced outage, could result in reduced revenues or increased costs of operations.

The cost of repairing damage to our plants due to storms, natural disasters, wars, terrorist acts and other catastrophic events may adversely affect our results of operations, financial condition or cash flows. These events could also result in adverse changes in the insurance markets, increased security or other operating costs and disruptions of power and fuel markets. In addition, our power generation plants, fuel supply and transmission capability could be directly or indirectly harmed by future terrorist activity. The occurrence or risk of occurrence of future terrorist attacks or related acts of war could also adversely affect the United States economy or otherwise impact our results of operations and financial condition in unpredictable ways.

Our revenues and results of operations from the sale of electric power and generation capacity may be impacted by market risks that are beyond our control.

We sell electric power, generation capacity and ancillary services in the Electric Reliability Council of Texas, or ERCOT, market. Under the Texas electric restructuring law, we and other power generators in Texas are not subject to traditional cost-based regulation and therefore sell electric generation capacity, power and ancillary services to wholesale purchasers at prices determined by the market. As a result, we are not guaranteed any rate of return on our capital investments through mandated rates, and our revenues and results of operations depend upon current and forward market prices for power in the ERCOT market. Market prices for power, generation capacity and ancillary services may fluctuate substantially. Unlike most other commodities, electricity cannot be stored and therefore must be produced concurrently with its use. As a result, wholesale power markets are subject to significant price fluctuations over relatively short periods of time and can be unpredictable.

Our revenues are primarily derived from the sale of power and capacity associated with our large solid-fuel baseload generation units: our Limestone and W. A. Parish plants and our undivided interest in South Texas Project Electric Generating Station. In the ERCOT market, higher cost natural gas-fired generation plants set the market price of power almost all of the time. As a result, the market price of power generally rises and falls with natural gas prices. Our solid-fuel baseload plants are currently benefiting from higher market prices in the ERCOT market as a result of natural gas prices at or near historical highs. A decrease in natural gas prices would be expected to result in a corresponding decrease in the market price of power but would generally not affect the cost of the solid fuel we use, which could have a material adverse effect on our revenues and results of operations.

Power prices may also fluctuate substantially due to other factors, such as:

- •

- oversupply or undersupply of generation capacity;

- •

- changes in power transmission or fuel transportation capacity constraints or inefficiencies;

- •

- electric supply disruptions, including plant outages and transmission disruptions;

- •

- seasonality;

- •

- demand changes due to changes in the macro-economic environment;

- •

- weather conditions;

14

- •

- availability and market prices for natural gas, crude oil and refined products, coal, lignite, enriched uranium and uranium fuels;

- •

- changes in power usage;

- •

- additional supplies of power from existing competitors or new market entrants as a result of the development of new generation plants, expansion of existing plants or additional transmission capacity;

- •

- illiquidity in the ERCOT market;

- •

- changes in the structure of the ERCOT market;

- •

- availability of competitively priced alternative power sources;

- •

- natural disasters, wars, embargoes, terrorist attacks and other catastrophic events; and

- •

- federal and state power market and environmental regulation and legislation.

Our costs, results of operations, financial condition or cash flows could be adversely impacted by an increase in prices and disruption of our fuel supplies.

We rely primarily on coal, lignite, nuclear fuel derived from uranium and natural gas to fuel our generation plants. The fuel mix used to produce the megawatt hours we generated for the six months ended June 30, 2005 on a pro forma basis giving effect to the Formation Transactions was approximately 72% coal and lignite, 16% nuclear and 12% natural gas. As of June 30, 2005, the fuel mix of our generation portfolio based on installed capacity was approximately 37% coal and lignite, 10% nuclear and 52% natural gas. We purchase our fuel from a number of different suppliers under long-term contracts and on the spot market. On a pro forma basis giving effect to the Formation Transactions, our solid-fuel baseload fuel costs were approximately $12.23 per MWh for the twelve months ended June 30, 2005. As discussed above, an important part of our strategy is contracting to sell a substantial part of our solid-fuel baseload power at future dates to lock in favorable pricing. The contracts under which this power is sold do not generally allow us to pass through changes in fuel costs or discharge our power sale obligations in the case of a disruption in fuel supply due to force majeure events or the default of a fuel supplier or transporter. Therefore, any disruption in the delivery of fuel could prevent us from operating our plants to meet our forward power sales, which could adversely affect our results of operations, financial condition or cash flows.

In 2004, 20% of our low-sulfur Powder River Basin ("PRB") coal requirements were sourced from shorter term contracts with market pricing and, in the third quarter of 2005, we began to purchase coal and petroleum coke in the spot market as a result of temporarily reduced deliveries of PRB coal under our long-term contracts. Any increase in market prices for fuel could adversely affect our earnings. In addition, we purchase natural gas under long-term contracts and on the spot market. Our long-term natural gas contracts contain pricing provisions based on fluctuating spot market prices. Delivery of natural gas to each of our natural gas-fired plants typically depends on the natural gas pipelines or distributors for that location. As a result, we are subject to increased risks of disruptions or curtailments if a natural gas pipeline or distributor is unable to deliver natural gas to us or delivers less natural gas than we require. These disruptions or curtailments could adversely affect our ability to operate our natural gas-fired generation plants.

The owners of South Texas Project Electric Generating Station satisfy fuel supply requirements for South Texas Project Electric Generating Station by acquiring uranium concentrates and contracting to convert uranium concentrates into uranium hexafluoride, enrich uranium hexafluoride and fabricate nuclear fuel assemblies. These contracts have varying expiration dates, and most are short to medium term. Supply and delivery of uranium for South Texas Project Electric Generating

15

Station through 2010 and 50% of STP's requirements for 2011 are secured under fixed price constant dollar contracts (with increases tied to inflation). However, we are subject to fluctuations in the price of procuring uranium after our existing agreement expires. STPNOC, on behalf of the co-owners, has entered into "life of license" contracts for enrichment services and nuclear fuel assembly fabrication. A disruption in uranium supplies, or in conversion, enrichment or fabrication services, could adversely affect operations at South Texas Project Electric Generating Station or increase the fuel costs associated with operations.

A significant portion of our fuel supplies are purchased or delivered under a few long-term contracts, and a default by any one of these suppliers could adversely affect our costs, results of operations, financial condition or cash flows.

Our W. A. Parish plant is fueled with low-sulfur PRB coal, and our Limestone plant is currently fueled primarily with lignite and to a lesser extent PRB coal. In 2004, we purchased 60% of our PRB coal requirements under a fixed-quantity, firm priced (with contractually specified price adjustments) supply contract that expires in about 2010. We purchased an additional 20% under a fixed supply contract that expires in 2011 at a firm price to be reset at market prices in 2008 for the last three years of the contract. In the event one of the mines associated with our long-term coal supply contracts experiences a force majeure event, we could experience a disruption of supply, which could result in a curtailment or shutdown of our W. A. Parish and Limestone plants, or could require us to acquire the supply at high spot market prices.

Our Limestone facility is able to burn both lignite and PRB coal. We currently procure lignite from a mine located adjacent to our facility, which supplies approximately 70% of the fuel consumed by the power plant, with the balance fueled by PRB coal. The contract under which the lignite is supplied expires in 2015, and has been the subject of past litigation over pricing and other matters, which generally resulted in settlements. The contract currently requires the parties to periodically renegotiate both the price and volume of lignite provided, with the current pricing and volumes in effect through 2007. The mine operator, Texas Westmoreland Coal Co., which is a single-purpose wholly-owned subsidiary of Westmoreland Coal Company, has indicated that the current fixed price is not sufficient to meet its costs and has requested early renegotiation of the price and volume terms. Westmoreland Coal Company has not guaranteed performance of its subsidiary. We have agreed to interim surcharges to fund operations and certain capital expenditures required for expansion into a new area of the mine through September 10, 2005. If we are unable to renegotiate the terms of the agreement and the counterparty otherwise fails to perform, or if the mine is unable to yield sufficient quantities of lignite, we could experience a disruption of supply, which could result in a curtailment or shutdown of our Limestone plant, or could require us to acquire the supply at higher spot market prices.

We have long-term rail transportation contracts with two rail transportation companies to transport coal to our W. A. Parish facility. We have only one exclusive transportation contract for the delivery of coal to our Limestone facility. In the event that one of our transporters fails to deliver or underperforms, there can be no assurances that we could simultaneously or within a short period of time have in place substitute transportation arrangements, which may result in a shut down or curtailment of the facility. There can be no assurance that any substitute arrangements will be on terms similar to those of our long-term contracts. Any extended disruption in our coal supply, including those caused by rail strikes, damage to or shortages in transportation equipment, transportation disruptions, adverse weather conditions, labor relations or environmental regulations affecting our coal or rail suppliers, could adversely affect our ability to operate our coal-fired plants. For example, in May and June of 2005, we received notices pursuant to our rail transportation contracts of a force majeure event due to adverse weather conditions in the Powder River Basin and Wyoming causing deteriorated rail track beds, resulting in train derailments and other

16

operational problems and therefore the delay of rail deliveries. Subsequent to the derailments, the railroads have begun major repairs to the affected tracks. These events reduced deliveries since May 2005, and we expect future deliveries will be reduced by about 15% through the end of 2005 when the track repairs are expected to be completed. This has had an adverse effect on the level of coal inventory we are able to maintain and our level of inventory may decline further.

As a result of any of these events, our results of operations, financial condition and cash flows could be adversely affected.

There may be periods when we will not able to meet our commitments under our Forward Sales Obligations at a reasonable cost or at all.