SCHULTE ROTH & ZABELLLP

919 Third Avenue

New York, NY 10022

(212) 756-2000

fax (212) 593-5955

www.srz.com

| | |

| Writer’s Direct Number | | Writer’s E-mail Address |

| (212) 756-2565 | | neil.rifkind@srz.com |

June 14, 2006

VIA EDGAR

Melissa Duru, Esq.

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| | |

| Re: | | Newpage Holding Corporation |

| | Amendment No. 2 to Registration Statement on |

| | Form S-1, File No. 333-133367 |

Dear Ms. Duru:

On behalf of NewPage Holding Corporation, Inc. (the“Registrant”), we have filed simultaneously by EDGAR, Amendment No. 2 to the above-referenced Registration Statement (“ Amendment No. 2”) addressing comments contained in the Comment Letter (as defined below).

This letter is in response to the comments of the Staff set forth in its letter dated June 8, 2006, concerning the above-referenced Registration Statement (the“Comment Letter”). For the convenience of the Staff, we have repeated each of the Staff’s commentsin italicsimmediately above our response to the corresponding comment. Capitalized terms used herein and not otherwise defined herein have the meanings set forth in Amendment No. 2.

General

| | 1. | Please confirm that you will either withdraw the S-4 registration statement or amend the S-4 registration statement and submit the balance of your reply to our prior comment letter once you have resolved the uncertainty regarding whether you will be able to fully redeem the PIK notes with proceeds raised from the initial public offering. |

Melissa Duru, Esq.

Securities and Exchange Commission

June 14, 2006

The Registrant will fully redeem the PIK notes with proceeds raised from the initial public offering. Upon effectiveness of the Registration Statement, the Registrant confirms it will withdraw the Form S-4 registration statement. If the initial public offering is not consummated, the Registrant will amend the Form S-4 registration statement and submit the balance of the Registrant’s reply to the Staff’s May 10, 2006 comment letter.

| | 2. | You indicate in your response to prior comment 4 that certain of the studies referenced in the prospectus are not available free of charge or for a de minimis amount to investors. Consequently, please remove all statements referencing the studies cited for which objective support is not easily available to the public. Alternatively, please adopt any such statements as your own. |

The revisions requested by the Staff have been made.

| | 3. | We note your response to prior comment 4. Please provide supplemental support for the additional statements made in the disclosure, for example, on pages 62-63. Further, we note that prior supplemental materials provided in response to similar comments on the S-4 disclosure, were not filed as correspondence on EDGAR. Unless subject to a Rule 83 request, all materials provided to the Staff should be filed as correspondence. Please ensure that the prior materials and any additional materials provided are so filed. |

After reviewing the additional statements made in the disclosure, the Registrant has decided to delete those statements from the Registration Statement. The period to period changes in demand were not significant. Accordingly, the Registrant does not believe that the inclusion of such information enhances a reader’s understanding of the Registrant’s industry or business.

Melissa Duru, Esq.

Securities and Exchange Commission

June 14, 2006

Page 3

All materials provided to the Staff supplementally that have not been previously filed were filed today as correspondence on EDGAR. Unless subject to a Rule 83 request, the Registrant will file all additional materials provided to the Staff supplementally as correspondence on EDGAR.

| | 4. | We remind you of prior comment 34. Ensure that you file a revised preliminary prospectus inclusive of such information prior to circulation of the preliminary prospectus in connection with the initial public offering. |

The Registrant will respond to this comment in a future amendment to the Form S-1 after the information has been determined prior to circulation of the preliminary prospectus in connection with the initial public offering.

Cover Page

| | 5. | Remove the reference to Goldman Sachs & Co. and UBS Investment Bank serving as joint bookrunning lead mangers. |

The revision requested by the Staff has been made.

Prospectus Summary, page 1

| | 6. | Include a summary of the acquisition and related transactions leading to the formation of the company. We refer you to the summary provided on page 2 of the S-4 registration statement. |

The revision requested by the Staff has been made.

Summary Historical and Pro Forma Combined Financial Data, page 9

| | 7. | We note that you disclose EBITDA and adjusted EBITDA because they are a primary component of certain covenants under your senior secured creditfacilities. On page 102 and 103, you appear to list those covenants. Given your stated rationale for including the measure, it appears that you should also include a table showing the computation of the relevant pro forma covenant ratios, compared to the covenant requirements for the period, and include a discussion addressing the extent to which you would have complied with your debt covenants. For additional information please refer to the FAQ on non-GAAP measures which can be found on our website at the following address: |

http://www.sec.gov/divisions/corpfin/faqs/nongaapfaq.htm

The revision requested by the Staff has been made.

Melissa Duru, Esq.

Securities and Exchange Commission

June 14, 2006

Page 4

The Offering, page 7

| | 8. | As done on page 27, revise to indicate the total amount of the PIK notes to be redeemed. Further, given that net proceeds expected are only $277 million, clarify further in this section and in the Use of Proceeds whether you intend to use alternate sources in order to effectuate the redemption in full of the PIK notes and the other series of NewPage Corp notes. |

The revision requested by the Staff has been made.

Use of Proceeds, page 27

| | 9. | Also clarify the impact of the IPO on the vesting of common percentage interests held by certain directors and officers by providing a cross reference in footnote 7 to the disclosure regarding the Management Restricted Interests that appears on page 90 of the prospectus. |

The revision requested by the Staff has been made.

Selected Financial Information and Other Data, page 42

| | 10. | You disclose that you have derived the historical combined financial data as of December 31, 2002 and 2003 from the audited combined financial statements included elsewhere in the prospectus. As such audited financial statements are not included in the prospectus, revise your disclosures accordingly. |

The revision requested by the Staff has been made.

Business Strategy, page 66

“Enhance scale through opportunistic...,” page 67

| | 11. | Supplement the disclosure in this section to specify that your business strategy is subject to the limitations on the types of acquisitions delineated in your response to our prior comment 19. |

Melissa Duru, Esq.

Securities and Exchange Commission

June 14, 2006

Page 5

The revision requested by the Staff has been made.

Management Restricted Interests, page 90

| | 12. | Similar to your response to prior comment 27, revise to indicate that there are no limits on the amounts of new series of common percentage interests that may be established as deemed appropriate by the majority of the board of directors of Maple Timber Acquisition LLC. Specify the impact to holders of common stock in the company resulting from such future issuances. |

The revision requested by the Staff has been made.

Financial Statements—NewPage Holding Corporation and Subsidiaries

Note R. Recently Issued Accounting Standards, page F-26

| | 13. | The potential impact that recently issued accounting standards are expected to have on your financial statements when adopted, such as SFAS 123(R), should ordinarily be disclosed to comply with the guidance in SAB Topic 11:M. |

The Registrant has considered the requirements of SAB Topic 11:M and determined that the only disclosure necessary as of December 31, 2005 was related to EITF 04-5. With respect to SFAS 123R, the Registrant adopted SFAS 123R as of May 2, 2005 and notes that this is disclosed in the Summary of Significant Accounting Policies in its consolidated financial statements for the eight months ended December 31, 2005.

Condensed Consolidated Statement of Cash Flows, page F-31

| | 14. | We note you present the increase in cash and cash equivalents from the initial consolidation of Rumford Cogeneration below the subtotals of cash from operating, investing and financing activities, adding this amount to your measure of unrestricted cash and cash equivalents, while also including disclosure on page F-33 indicating that such amounts are not available to you. The guidance in FRC Section 203.02 generally requires cash that is subject to restriction to be separately reported on the balance sheet, and accordingly, apart from the totals on the cash flow statements. |

Taking into account the guidance in FRC Section 203.02, the Registrant believes that, because there are no compensating balance arrangements or legal restrictions on the cash and cash equivalents of the limited partnership, it is appropriately classified as cash and cash equivalents in the consolidated financial statements. However, substantially all consolidated cash and cash equivalents reported is the property of the limited partnership, and is not available for use by the Registrant and its wholly-owned subsidiaries until distributed by the limited partnership to its partners. The Registrant has clarified its disclosure.

* * * * *

Melissa Duru, Esq.

Securities and Exchange Commission

June 14, 2006

Page 6

Your prompt review of Amendment No. 2 to the Registration Statement is greatly appreciated. Any questions relating to this submission may be directed to the undersigned at 212-756-2565 or Michael R. Littenberg of this firm at 212-756-2524.

|

| Very truly yours, |

|

/s/ Neil C. Rifkind |

| Neil C. Rifkind |

NewPage Holding Corporation

Chief Financial Officer and Vice President

Douglas K. Cooper

NewPage Holding Corporation

Vice President, General Counsel and Secretary

Michael R. Littenberg, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, NY 10022

(212) 756-2000

fax (212) 593-5955

www.srz.com

| | |

Writer’s Direct Number (212) 756-2043 | | Writer’s E-mail Address brett.director@srz.com |

December 20, 2005

VIA FEDERAL EXPRESS

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Melissa Duru

| | Re: | NewPage Holding Corporation |

| | | Registration Statement on Form S-4 (the “Registration Statement”) |

Dear Ms. Duru:

On behalf of NewPage Holding Corporation (the“Registrant”), we sent a letter dated the date hereof (the“Response Letter”) in response to the comments of the Staff set forth in its letter dated December 1, 2005, concerning the Registration Statement (the“Comment Letter”). The Response Letter indicated that certain supplemental information would be provided under separate cover. In accordance with Rule 418(b) of the Securities Act of 1933, as amended, attached is the objective support for subjective/comparative statements, and assertions regarding our market share or position in response to comment 11 of the Comment Letter. For the convenience of the Staff, we have repeated each of the subjective/comparative statementsin italicsimmediately above our responses.

| | 1. | Based on RISI data, we are the largest coated paper manufacturer in North America, based on production capacity, with approximately 18% of the coated paper manufacturing capacity in North America during 2004. (Pages 4, 5, 83 and 84) |

According to the RISI North American Graphic Paper Capacity Report, in 2004, the Registrant had the largest production capacity with an annual production capacity of 2,010 thousand tons out of 11,511 thousand tons total coated paper manufacturing

capacity in North America (or approximately 18%). Please see Tab 1 for an excerpt from this report.

| | 2. | According to Paperloop, and based on certain assumptions set forth in “Business—Manufacturing,” during the third quarter of 2005, the mills at which we produce our coated paper were in the top 20% of efficiency of all coated paper mills in North America, Europe and Asia based on the cash cost of delivery to Chicago. (Pages 1, 5, 84 and 88) |

According to Paperloop’s 3rd quarter 2005 Cash Cost chart, all of the Registrant’s paper mills were in the top 49 of the 276 coated paper mills (or in the top 20%) operating in North America, Europe and Asia based on the cash cost of delivery of a ton of paper to Chicago, Illinois. The highlighted items on the chart represent the Registrant’s paper mills. The other items on the chart represent all other coated paper mills throughout North America, Europe and Asia. The fourth column labeled “Cash Cost USD/ST” represents, with respect to each mill, the average cost per ton to produce each mill’s representative grade of coated paper (as determined by the mill to accurately reflect their product mix), as applicable, plus the average cost of shipping such paper to Chicago, Illinois. The exchange rate used for the various mills is provided in the Exchange Rate chart included in Tab 2. Please see Tab 2 for a copy of this chart.

| | 3. | Within the overall coated paper market, according to RISI, we represented approximately 22% of 2004 U.S. coated freesheet production capacity and approximately 13% of U.S. coated groundwood production capacity. (Pages 5 and 84) |

According to the RISI North American Graphic Paper Capacity Report, the Registrant represented 1,185 thousand tons of the 5,323 thousand tons (or approximately 22.3%) of the North American coated freesheet production capacity and 825 thousand tons of the 6,188 thousand tons (or approximately 13.3%) of the North American coated groundwood production capacity. Please see Tab 1 for an excerpt from this report.

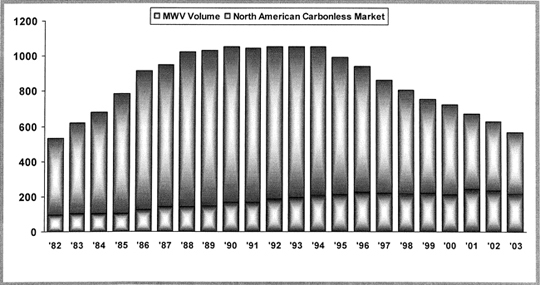

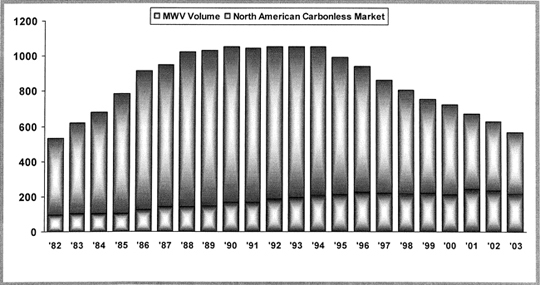

| | 4. | We are a significant producer of carbonless paper. (Pages 6 and 85) |

Please see Tab 3 which illustrates the Registrant’s carbonless paper volume relative to the North American carbonless paper market.

Pursuant to Rule 418(b), we respectfully request that the supplemental information attached to this letter be returned to the Registrant upon completion of its review.

|

Very truly yours, |

|

/s/ Brett S. Director |

Brett S. Director |

| | |

cc: | | Matthew L. Jesch NewPage Holding Corporation Chief Financial Officer, Vice President and Secretary |

| |

| | John E. Kurila NewPage Holding Corporation Controller |

| |

| | Gregory A. Hoffbauer NewPage Holding Corporation Assistant Controller |

| |

| | Michael R. Littenberg, Esq. Schulte Roth & Zabel LLP |

TAB

1

From 2000 RISI North American Graphic Paper Capacity Report

| | | | | | | | | |

| | | 2000 | |

| | | CFS | | CGW | | Total | | | |

International Paper | | 1,376 | | 1,240 | | 2,616 | | 21.1 | % |

Stora Enso | | 773 | | 1,113 | | 1,886 | | 36.3 | % |

Mead | | 770 | | 600 | | 1,370 | | 47.3 | % |

Sappi | | 1,055 | | | | 1,055 | | 55.8 | % |

Westvaco | | 882 | | | | 882 | | 62.9 | % |

United Paper Mills | | | | 520 | | 520 | | 67.1 | % |

Repap | | | | 495 | | 495 | | 71.1 | % |

Potlatch | | 440 | | | | 440 | | 74.7 | % |

Bowater | | | | 416 | | 416 | | 78.0 | % |

Domtar | | 414 | | | | 414 | | 81.4 | % |

Belgravia | | 346 | | | | 346 | | 84.2 | % |

Crown Vantage | | | | 310 | | 310 | | 86.7 | % |

Appleton | | 245 | | | | 245 | | 88.6 | % |

Weyerhaeuser | | | | 205 | | 205 | | 90.3 | % |

Pacifica | | | | 180 | | 180 | | 91.7 | % |

Kruger | | | | 175 | | 175 | | 93.1 | % |

Plainwell | | 160 | | | | 160 | | 94.4 | % |

Inexcon | | | | 130 | | 130 | | 95.5 | % |

Others | | 258 | | 303 | | 561 | | 100.0 | % |

| | 6,719 | | 5,687 | | 12,406 | | | |

| |

| | | 2004 | |

| | | CFS | | CGW | | Total | | | |

MeadWestvaco | | 1,185 | | 825 | | 2,010 | | 17.5 | % |

International Paper | | 700 | | 1,193 | | 1,893 | | 33.9 | % |

Stora Enso | | 882 | | 989 | | 1,871 | | 50.2 | % |

Sappi | | 1,372 | | | | 1,372 | | 62.1 | % |

UPM | | | | 875 | | 875 | | 69.7 | % |

Bowater | | 30 | | 780 | | 810 | | 76.7 | % |

Kruger | | | | 382 | | 382 | | 80.0 | % |

Belgravia | | 380 | | | | 380 | | 83.3 | % |

Tembec | | | | 354 | | 354 | | 86.4 | % |

Domtar | | 345 | | | | 345 | | 89.4 | % |

Appleton | | 240 | | | | 240 | | 91.5 | % |

Weyerhaeuser | | | | 240 | | 240 | | 93.6 | % |

United Paper Mills | | | | | | — | | 93.6 | % |

Potlatch | | | | | | — | | 93.6 | % |

Crown Vantage | | | | | | — | | 93.6 | % |

Pacifica | | | | | | — | | 93.6 | % |

Plainwell | | | | | | — | | 93.6 | % |

Inexcon | | | | | | — | | 93.6 | % |

Others | | 189 | | 550 | | 739 | | 100.0 | % |

| | 5,323 | | 6,188 | | 11,511 | | | |

TAB

2

| | | | | | | | |

Capacity (Millions of STPY) (Width of Bars) | | Grades | | NewPage/NA/Europe/Asia (Color of Bars) | | Cash Cost USD/ST (Height of Bars) | | % Capacity |

| 25,347 | | cfs | | North America | | $528.27 | | 0.1% |

| 487,440 | | cgw | | North America | | $542.80 | | 1.3% |

| 239,904 | | cfs | | North America | | $551.81 | | 1.8% |

| 302,736 | | cfs | | North America | | $556.87 | | 2.6% |

| 4,641 | | cfs | | North America | | $566.16 | | 2.6% |

| 139,680 | | cgw | | North America | | $567.52 | | 2.9% |

| 179,928 | | cfs | | NewPage | | $575.72 | | 3.4% |

| 142,086 | | cfs | | North America | | $583.04 | | 3.7% |

| 316,080 | | cgw | | NewPage | | $585.79 | | 4.5% |

| 214,200 | | cfs | | North America | | $586.71 | | 5.0% |

| 32,130 | | cfs | | North America | | $587.07 | | 5.1% |

| 96,390 | | cfs | | NewPage | | $589.53 | | 5.4% |

| 239,400 | | cgw | | North America | | $591.73 | | 5.9% |

| 108,885 | | cfs | | NewPage | | $594.47 | | 6.2% |

| 43,200 | | cgw | | North America | | $596.52 | | 6.3% |

| 114,240 | | cfs | | North America | | $597.49 | | 6.6% |

| 268,560 | | cgw | | NewPage | | $598.58 | | 7.3% |

| 36,000 | | cgw | | North America | | $603.66 | | 7.3% |

| 245,616 | | cfs | | North America | | $605.99 | | 8.0% |

| 126,000 | | cgw | | North America | | $607.29 | | 8.3% |

| 299,880 | | cfs | | North America | | $609.87 | | 9.0% |

| 163,800 | | cgw | | North America | | $609.94 | | 9.4% |

| 134,946 | | cfs | | NewPage | | $611.13 | | 9.7% |

| 113,400 | | cgw | | North America | | $612.13 | | 10.0% |

| 60,690 | | cfs | | North America | | $613.68 | | 10.2% |

| 44,982 | | cfs | | NewPage | | $615.40 | | 10.3% |

| 116,025 | | cfs | | North America | | $615.91 | | 10.6% |

| 34,200 | | cgw | | North America | | $617.18 | | 10.6% |

| 39,270 | | cfs | | North America | | $619.08 | | 10.7% |

| 79,200 | | cgw | | North America | | $619.31 | | 10.9% |

| 66,600 | | cgw | | North America | | $619.76 | | 11.1% |

| 46,410 | | cfs | | North America | | $624.86 | | 11.2% |

| 255,612 | | cfs | | North America | | $627.44 | | 11.8% |

| 284,400 | | cgw | | North America | | $627.78 | | 12.5% |

| 78,540 | | cfs | | North America | | $628.59 | | 12.7% |

| 28,935 | | wcc | | Europe | | $633.92 | | 12.8% |

| 274,890 | | cfs | | NewPage | | $634.48 | | 13.5% |

| 366,512 | | wcc | | Europe | | $636.30 | | 14.4% |

| 119,599 | | wcc | | Europe | | $642.12 | | 14.7% |

| 54,012 | | wcc | | Europe | | $643.07 | | 14.8% |

| 280,602 | | cfs | | North America | | $643.52 | | 15.5% |

| 48,225 | | wcc | | Europe | | $643.59 | | 15.6% |

| 59,976 | | cfs | | NewPage | | $647.90 | | 15.8% |

| 78,704 | | wcc | | Europe | | $649.43 | | 16.0% |

| 201,705 | | cfs | | NewPage | | $651.07 | | 16.4% |

| 430,170 | | wcc | | Europe | | $653.47 | | 17.5% |

| 323,085 | | cfs | | NewPage | | $655.43 | | 18.3% |

| 358,796 | | wcc | | Europe | | $656.20 | | 19.2% |

| 115,200 | | cgw | | North America | | $657.03 | | 19.5% |

| 119,048 | | wfc | | Europe | | $657.20 | | 19.8% |

| 64,800 | | cgw | | North America | | $657.45 | | 19.9% |

| 83,351 | | cgw | | North America | | $658.46 | | 20.1% |

| 187,114 | | wcc | | Europe | | $659.19 | | 20.6% |

| 187,200 | | cgw | | North America | | $659.72 | | 21.0% |

| 331,349 | | wfc | | Europe | | $661.34 | | 21.9% |

| | | | | | | | |

| 23,148 | | wcc | | Europe | | $661.78 | | 21.9% |

| 64,537 | | acp | | Asia | | $662.28 | | 22.1% |

| 30,600 | | cgw | | North America | | $665.50 | | 22.1% |

| 145,800 | | cgw | | North America | | $667.12 | | 22.5% |

| 453,318 | | wcc | | Europe | | $667.26 | | 23.6% |

| 106,096 | | wcc | | Europe | | $667.61 | | 23.9% |

| 400,602 | | wcc | | Europe | | $667.62 | | 24.9% |

| 10,800 | | cgw | | North America | | $668.97 | | 24.9% |

| 59,524 | | wfc | | Europe | | $669.21 | | 25.0% |

| 275,849 | | wcc | | Europe | | $669.32 | | 25.7% |

| 118,800 | | cgw | | North America | | $670.41 | | 26.0% |

| 168,120 | | cgw | | North America | | $672.09 | | 26.4% |

| 236,111 | | wfc | | Europe | | $672.12 | | 27.0% |

| 19,841 | | wfc | | Europe | | $675.73 | | 27.0% |

| 144,875 | | cgw | | North America | | $677.08 | | 27.4% |

| 440,476 | | wfc | | Europe | | $679.96 | | 28.5% |

| 66,600 | | cgw | | North America | | $680.46 | | 28.6% |

| 15,741 | | acp | | Asia | | $686.33 | | 28.7% |

| 428,241 | | wcc | | Europe | | $691.18 | | 29.7% |

| 148,810 | | wfc | | Europe | | $692.66 | | 30.1% |

| 182,540 | | wfc | | Europe | | $695.87 | | 30.6% |

| 126,000 | | cgw | | North America | | $696.58 | | 30.9% |

| 167,400 | | cgw | | North America | | $697.50 | | 31.3% |

| 87,302 | | wfc | | Europe | | $700.49 | | 31.5% |

| 18,000 | | cgw | | North America | | $703.13 | | 31.5% |

| 205,200 | | cgw | | North America | | $703.97 | | 32.0% |

| 156,600 | | cgw | | North America | | $704.89 | | 32.4% |

| 289,352 | | wcc | | Europe | | $706.55 | | 33.1% |

| 65,586 | | wcc | | Europe | | $710.20 | | 33.3% |

| 198,688 | | wcc | | Europe | | $710.31 | | 33.8% |

| 138,600 | | cgw | | North America | | $711.51 | | 34.1% |

| 767,747 | | wcc | | Europe | | $712.89 | | 36.0% |

| 85,317 | | wfc | | Europe | | $713.54 | | 36.2% |

| 341,280 | | cgw | | North America | | $714.74 | | 37.1% |

| 121,528 | | wcc | | Europe | | $714.88 | | 37.4% |

| 173,611 | | wcc | | Europe | | $716.39 | | 37.8% |

| 61,728 | | wcc | | Europe | | $718.80 | | 37.9% |

| 106,096 | | wcc | | Europe | | $719.60 | | 38.2% |

| 109,954 | | wcc | | Europe | | $722.45 | | 38.5% |

| 43,651 | | wfc | | Europe | | $723.62 | | 38.6% |

| 279,707 | | wcc | | Europe | | $723.98 | | 39.3% |

| 494,048 | | wfc | | Europe | | $725.69 | | 40.5% |

| 154,321 | | wcc | | Europe | | $726.75 | | 40.9% |

| 119,048 | | wfc | | Europe | | $726.83 | | 41.1% |

| 77,160 | | wcc | | Europe | | $726.84 | | 41.3% |

| 279,707 | | wcc | | Europe | | $727.30 | | 42.0% |

| 459,105 | | wcc | | Europe | | $728.18 | | 43.2% |

| 170,635 | | wfc | | Europe | | $730.28 | | 43.6% |

| 68,400 | | cgw | | North America | | $730.85 | | 43.7% |

| 287,423 | | wcc | | Europe | | $732.27 | | 44.4% |

| 100,309 | | wcc | | Europe | | $732.92 | | 44.7% |

| 66,600 | | cgw | | North America | | $740.20 | | 44.9% |

| 270,062 | | wcc | | Europe | | $741.25 | | 45.5% |

| 67,460 | | wfc | | Europe | | $741.66 | | 45.7% |

| 198,688 | | wcc | | Europe | | $742.72 | | 46.2% |

| 561,343 | | wcc | | Europe | | $744.53 | | 47.6% |

| 66,358 | | wcc | | Europe | | $749.78 | | 47.7% |

| | | | | | | | |

| 140,818 | | wcc | | Europe | | $756.79 | | 48.1% |

| 142,747 | | wcc | | Europe | | $760.16 | | 48.4% |

| 396,825 | | wfc | | Europe | | $761.74 | | 49.4% |

| 109,599 | | cfs | | North America | | $768.35 | | 49.7% |

| 198,333 | | acp | | Asia | | $769.35 | | 50.1% |

| 225,000 | | cgw | | North America | | $769.86 | | 50.7% |

| 444,444 | | wfc | | Europe | | $774.56 | | 51.8% |

| 115,741 | | wcc | | Europe | | $776.68 | | 52.1% |

| 334,509 | | cfs | | North America | | $777.83 | | 52.9% |

| 30,345 | | cfs | | North America | | $777.87 | | 53.0% |

| 132,222 | | acp | | Asia | | $778.03 | | 53.3% |

| 127,800 | | cgw | | North America | | $781.36 | | 53.6% |

| 15,432 | | wcc | | Europe | | $782.50 | | 53.6% |

| 43,287 | | acp | | Asia | | $789.23 | | 53.8% |

| 59,799 | | wcc | | Europe | | $790.63 | | 53.9% |

| 146,605 | | wcc | | Europe | | $791.91 | | 54.3% |

| 200,397 | | wfc | | Europe | | $794.75 | | 54.8% |

| 61,782 | | acp | | Asia | | $798.05 | | 54.9% |

| 226,190 | | wfc | | Europe | | $798.65 | | 55.5% |

| 231,349 | | wfc | | Europe | | $799.50 | | 56.0% |

| 253,571 | | wfc | | Europe | | $799.55 | | 56.7% |

| 107,143 | | wfc | | Europe | | $802.41 | | 56.9% |

| 111,883 | | wcc | | Europe | | $802.97 | | 57.2% |

| 110,317 | | wfc | | Europe | | $806.07 | | 57.5% |

| 177,469 | | wcc | | Europe | | $806.32 | | 57.9% |

| 73,800 | | cgw | | North America | | $807.45 | | 58.1% |

| 21,420 | | cfs | | North America | | $807.89 | | 58.1% |

| 99,960 | | cfs | | North America | | $808.01 | | 58.4% |

| 55,692 | | cfs | | North America | | $808.68 | | 58.5% |

| 347,222 | | wcc | | Europe | | $810.90 | | 59.4% |

| 148,810 | | wfc | | Europe | | $810.95 | | 59.7% |

| 202,662 | | acp | | Asia | | $811.17 | | 60.2% |

| 39,683 | | wfc | | Europe | | $811.62 | | 60.3% |

| 124,950 | | cfs | | North America | | $813.00 | | 60.6% |

| 200,617 | | wcc | | Europe | | $814.23 | | 61.1% |

| 291,281 | | wcc | | Europe | | $816.04 | | 61.8% |

| 304,784 | | wcc | | Europe | | $820.09 | | 62.6% |

| 57,540 | | wfc | | Europe | | $821.25 | | 62.7% |

| 145,800 | | cgw | | North America | | $821.75 | | 63.1% |

| 23,218 | | cfs | | North America | | $823.56 | | 63.2% |

| 220,635 | | wfc | | Europe | | $825.13 | | 63.7% |

| 489,537 | | acp | | Asia | | $825.76 | | 64.9% |

| 142,747 | | wcc | | Europe | | $826.68 | | 65.2% |

| 164,097 | | acp | | Asia | | $828.30 | | 65.7% |

| 71,400 | | cfs | | North America | | $829.34 | | 65.8% |

| 81,349 | | wfc | | Europe | | $830.69 | | 66.0% |

| 111,600 | | cgw | | North America | | $831.59 | | 66.3% |

| 143,254 | | wfc | | Europe | | $832.70 | | 66.7% |

| 37,485 | | cfs | | North America | | $833.32 | | 66.7% |

| 95,238 | | wfc | | Europe | | $834.07 | | 67.0% |

| 132,937 | | wfc | | Europe | | $836.56 | | 67.3% |

| 31,746 | | wfc | | Europe | | $836.73 | | 67.4% |

| 36,651 | | wcc | | Europe | | $837.25 | | 67.5% |

| 111,883 | | wcc | | Europe | | $837.35 | | 67.7% |

| 99,206 | | wfc | | Europe | | $839.00 | | 68.0% |

| 59,524 | | wfc | | Europe | | $839.05 | | 68.1% |

| 57,870 | | wcc | | Europe | | $839.60 | | 68.3% |

| | | | | | | | |

| 146,605 | | wcc | | Europe | | $840.15 | | 68.6% |

| 218,254 | | wfc | | Europe | | $845.47 | | 69.2% |

| 245,949 | | acp | | Asia | | $845.96 | | 69.8% |

| 301,587 | | wfc | | Europe | | $846.15 | | 70.5% |

| 59,524 | | wfc | | Europe | | $847.14 | | 70.7% |

| 77,381 | | wfc | | Europe | | $847.23 | | 70.9% |

| 51,944 | | acp | | Asia | | $849.74 | | 71.0% |

| 46,767 | | cfs | | North America | | $850.60 | | 71.1% |

| 106,250 | | acp | | Asia | | $851.71 | | 71.4% |

| 99,206 | | wfc | | Europe | | $852.61 | | 71.6% |

| 220,238 | | wfc | | Europe | | $852.67 | | 72.1% |

| 115,741 | | wcc | | Europe | | $852.82 | | 72.4% |

| 450,579 | | acp | | Asia | | $856.49 | | 73.5% |

| 65,476 | | wfc | | Europe | | $856.81 | | 73.7% |

| 71,429 | | wfc | | Europe | | $857.10 | | 73.9% |

| 41,319 | | acp | | Asia | | $858.28 | | 74.0% |

| 190,476 | | wfc | | Europe | | $858.46 | | 74.4% |

| 73,413 | | wfc | | Europe | | $859.61 | | 74.6% |

| 59,524 | | wfc | | Europe | | $860.10 | | 74.8% |

| 361,111 | | wfc | | Europe | | $862.93 | | 75.7% |

| 118,524 | | cfs | | North America | | $863.81 | | 76.0% |

| 108,025 | | wcc | | Europe | | $866.07 | | 76.2% |

| 55,556 | | wfc | | Europe | | $867.41 | | 76.4% |

| 99,206 | | wfc | | Europe | | $868.73 | | 76.6% |

| 107,100 | | cfs | | North America | | $868.87 | | 76.9% |

| 26,759 | | acp | | Asia | | $869.52 | | 76.9% |

| 259,722 | | acp | | Asia | | $869.69 | | 77.6% |

| 119,048 | | wfc | | Europe | | $870.46 | | 77.9% |

| 39,683 | | wfc | | Europe | | $873.73 | | 78.0% |

| 39,683 | | wfc | | Europe | | $873.98 | | 78.1% |

| 165,476 | | wfc | | Europe | | $876.16 | | 78.5% |

| 39,352 | | acp | | Asia | | $876.60 | | 78.6% |

| 198,413 | | wfc | | Europe | | $878.83 | | 79.0% |

| 52,381 | | wfc | | Europe | | $880.20 | | 79.2% |

| 31,746 | | wfc | | Europe | | $881.93 | | 79.2% |

| 177,083 | | acp | | Asia | | $882.00 | | 79.7% |

| 17,857 | | wfc | | Europe | | $882.65 | | 79.7% |

| 131,173 | | wcc | | Europe | | $883.32 | | 80.1% |

| 69,972 | | cfs | | North America | | $883.93 | | 80.2% |

| 89,286 | | wfc | | Europe | | $885.61 | | 80.4% |

| 165,476 | | wfc | | Europe | | $885.74 | | 80.8% |

| 43,651 | | wfc | | Europe | | $887.55 | | 81.0% |

| 369,907 | | acp | | Asia | | $888.18 | | 81.9% |

| 98,175 | | cfs | | North America | | $889.48 | | 82.1% |

| 110,317 | | wfc | | Europe | | $889.85 | | 82.4% |

| 77,381 | | wfc | | Europe | | $890.80 | | 82.6% |

| 41,713 | | acp | | Asia | | $893.88 | | 82.7% |

| 130,952 | | wfc | | Europe | | $895.54 | | 83.0% |

| 128,968 | | wfc | | Europe | | $895.64 | | 83.3% |

| 71,429 | | wfc | | Europe | | $896.11 | | 83.5% |

| 54,000 | | cgw | | North America | | $897.85 | | 83.6% |

| 109,127 | | wfc | | Europe | | $898.07 | | 83.9% |

| 295,139 | | acp | | Asia | | $901.85 | | 84.6% |

| 19,676 | | acp | | Asia | | $902.35 | | 84.7% |

| 336,458 | | acp | | Asia | | $902.86 | | 85.5% |

| 263,889 | | wfc | | Europe | | $902.89 | | 86.1% |

| 23,611 | | acp | | Asia | | $903.40 | | 86.2% |

| | | | | | | | |

| 36,000 | | cgw | | North America | | $ 905.13 | | 86.3% |

| 157,407 | | acp | | Asia | | $906.27 | | 86.7% |

| 64,683 | | wfc | | Europe | | $909.64 | | 86.8% |

| 27,546 | | acp | | Asia | | $911.09 | | 86.9% |

| 159,936 | | cfs | | North America | | $918.49 | | 87.3% |

| 98,380 | | acp | | Asia | | $918.97 | | 87.5% |

| 133,875 | | cfs | | North America | | $922.72 | | 87.9% |

| 21,644 | | acp | | Asia | | $922.81 | | 87.9% |

| 59,028 | | acp | | Asia | | $926.77 | | 88.1% |

| 14,994 | | cfs | | North America | | $928.92 | | 88.1% |

| 574,537 | | acp | | Asia | | $933.75 | | 89.5% |

| 69,444 | | wfc | | Europe | | $933.86 | | 89.7% |

| 140,880 | | acp | | Asia | | $934.20 | | 90.0% |

| 29,762 | | wfc | | Europe | | $935.28 | | 90.1% |

| 641,435 | | acp | | Asia | | $939.07 | | 91.7% |

| 347,477 | | acp | | Asia | | $940.70 | | 92.5% |

| 55,556 | | wfc | | Europe | | $942.98 | | 92.7% |

| 541,088 | | acp | | Asia | | $946.02 | | 94.0% |

| 49,603 | | wfc | | Europe | | $946.99 | | 94.1% |

| 65,331 | | cfs | | North America | | $947.29 | | 94.3% |

| 119,048 | | wfc | | Europe | | $949.50 | | 94.6% |

| 222,338 | | acp | | Asia | | $951.05 | | 95.1% |

| 67,460 | | wfc | | Europe | | $956.48 | | 95.3% |

| 35,417 | | acp | | Asia | | $956.49 | | 95.4% |

| 35,714 | | wfc | | Europe | | $959.61 | | 95.5% |

| 28,333 | | acp | | Asia | | $961.29 | | 95.5% |

| 29,762 | | wfc | | Europe | | $961.61 | | 95.6% |

| 79,365 | | wfc | | Europe | | $962.50 | | 95.8% |

| 39,352 | | acp | | Asia | | $963.17 | | 95.9% |

| 49,190 | | acp | | Asia | | $966.00 | | 96.0% |

| 47,222 | | acp | | Asia | | $967.83 | | 96.1% |

| 13,773 | | acp | | Asia | | $974.19 | | 96.2% |

| 203,843 | | acp | | Asia | | $977.08 | | 96.7% |

| 143,634 | | acp | | Asia | | $977.59 | | 97.0% |

| 21,420 | | cfs | | North America | | $978.97 | | 97.1% |

| 55,556 | | wfc | | Europe | | $981.45 | | 97.2% |

| 60,690 | | cfs | | North America | | $983.74 | | 97.4% |

| 71,620 | | acp | | Asia | | $991.20 | | 97.5% |

| 23,810 | | wfc | | Europe | | $994.26 | | 97.6% |

| 604,051 | | acp | | Asia | | $997.20 | | 99.1% |

| 27,778 | | wfc | | Europe | | $997.97 | | 99.1% |

| 57,060 | | acp | | Asia | | $999.28 | | 99.3% |

| 61,389 | | acp | | Asia | | $1,000.23 | | 99.4% |

| 19,841 | | wfc | | Europe | | $1,008.57 | | 99.5% |

| 33,449 | | acp | | Asia | | $1,012.28 | | 99.6% |

| 23,611 | | acp | | Asia | | $1,014.96 | | 99.6% |

| 21,825 | | wfc | | Europe | | $1,016.39 | | 99.7% |

| 77,381 | | wfc | | Europe | | $1,043.11 | | 99.9% |

| 11,905 | | wfc | | Europe | | $1,071.15 | | 99.9% |

| 44,625 | | cfs | | North America | | $1,077.35 | | 100.0% |

Source: Paperloop, Global Coated Production.

Note: Based on cash cost by facility, deliverd to Chicago for all coated grades in 3Q of 2005. Assumes Euro 1.22

TAB

3

Michael Todasco 8 Mar 2005 16:38 1/1

(Source: Arlington Analytical, Industry Consultant and AF&PA)

1

919 Third Avenue

New York, NY 10022

(212) 756-2000

fax (212) 593-5955

www.srz.com

| | |

| Writer’s Direct Number | | Writer’s E-mail Address |

| |

| (212) 756-2565 | | neil.rifkind@srz.com |

May 22, 2006

BY HAND

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attention: Melissa Duru

| | Re: | NewPage Holding Corporation |

| | | Registration Statement on Form S-l |

| | | File No. 333-133367 (the “Registration Statement”) |

Dear Ms. Duru:

On behalf of NewPage Holding Corporation (the“Registrant”),we sent a letter dated the date hereof (the“Response Letter”)in response to the comments of the Staff set forth in its letter dated May 10, 2006, concerning the Registration Statement. The Response Letter indicated that in response to comment 25, that the Registrant would supplementally provide the repurchase agreement (the“Repurchase Agreement”),dated April 5, 2006, by and between Peter Vogel and Maple Timber Acquisition LLC. Accordingly, in accordance with Rule 418(b) of the Securities Act of 1933, as amended, attached is the Repurchase Agreement.

* * * * *

Pursuant to Rule 418(b), we respectfully request that the supplemental information enclosed with this letter be returned to the Registrant upon completion of its review.

Please contact the undersigned at (212) 756-2565 or Michael Littenberg at (212) 756-2524 with any questions regarding this submission.

|

Very truly yours, |

|

/s/ Neil C. Rifkind |

Neil C. Rifkind |

Securities and Exchange Commission

May 22, 2006

Page 2

| | |

cc: | | Matthew L. Jesch NewPage Holding Corporation Chief Financial Officer |

| |

| | Douglas K. Cooper NewPage Holding Corporation Vice President, General Counsel and Secretary |

| |

| | John E. Kurila NewPage Holding Corporation Controller |

| |

| | Gregory A. Hoffbauer NewPage Holding Corporation Assistant Controller |

| |

| | Michael R. Littenberg, Esq. Schulte Roth & Zabel LLP |

REPURCHASE AGREEMENT

THIS REPURCHASE AGREEMENT (the “Agreement”) is made and entered into as of April 5, 2006, by and between Peter Vogel (the “Executive”) and Maple Timber Acquisition LLC (the “Company”),

WHEREAS, the Executive desires to sell to the Company and the Company desires to repurchase from the Executive the Executive’s 3% Paper Class A Common Percentage Interests and 26.1502% Paper Class B Common Percentage Interests (together, the “Repurchased Interests”).

WHEREAS, all terms not otherwise defined herein shall have the same meanings as in the Executive Purchase Agreement.

NOW, THEREFORE, in consideration of the mutual covenants herein set forth, the parties hereby agree as follows:

SECTION 1.Sale And Purchase.

(a)Sale and Purchase. On the terms and subject to the conditions of this Agreement, on the Closing Date (as defined in Section 2(a)), the Executive will sell to the Company, and the Company will purchase from the Executive, the Repurchased Interests. The Company acknowledges and agrees that the Executive shall continue to have all rights that he currently has with respect to the Repurchased Interests until the sale of such Repurchased Interests occurs. It is acknowledged by the Company that it shall report the repurchase of Executive’s Repurchased Interest as a capital transaction and that it will not make any filing with any taxing authority indicating that all or a portion of the Repurchase Price is earned income or otherwise take a position which contradicts the repurchase of the Repurchased Interests as a capital transaction.

(b)Purchase Price. On the terms and subject to the conditions of this Agreement, the Company shall cause a payment in cash to be made of $7,000,000 as the aggregate purchase price for such Repurchased Interests, less all applicable withholding taxes required by applicable law (the “Repurchase Price”), and the Company shall record the transfer of the Repurchased Interests from the Executive to the Company on the books and records of the Company.

SECTION 2.The Closing.

(a)Time of Closing. On the terms and subject to the conditions contained in this Agreement, the closing of the repurchase of the Repurchased Interests shall take place on May 16, 2006 (the “Closing Date”). On the Closing Date there shall have been delivered to the Company the acknowledgement required to be delivered hereunder.

(b)Delivery and Payment. On the Closing Date, the Executive shall deliver to the Company an executed written acknowledgement in the form attached hereto as Annex A that, as of the Closing Date, the Executive has no further right, title or interest in the Repurchased Interests (the “Acknowledgement”). Upon receipt of the Acknowledgment, the

Company shall pay the Repurchase Price by wire transfer of immediately available funds to such bank account as the Executive shall designate in writing to the Company.

SECTION 3.Representations And Warranties of the Executive.

The Executive represents and warrants to the Company, as follows:

(a) The Executive is the legal, beneficial and record owner of and has the power and authority to convey, the Repurchased Interests, free and clear of any lien, pledge, option, security interest, claim, charge, third party right or any other restriction or encumbrance of any nature whatsoever (each an “Encumbrance”), and will transfer to the Company good and marketable title to the Interests, free and clear of any Encumbrance.

(b) This Agreement has been duly executed and delivered by the Executive and constitutes a legal, valid and binding obligation of the Executive enforceable against the Executive in accordance with its terms, except as the enforcement may be limited by bankruptcy, insolvency, or other similar laws affecting the enforcement of creditors’ rights in general or by general principles of equity.

SECTION 4.Conditions To Company’s Obligations.

The obligation of the Company to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, or the waiver by the Company, on or prior to the Closing Date, of the following conditions:

(a)Representations and Warranties True at the Closing Date. The representations and warranties of the Executive contained in this Agreement shall be deemed to have been made on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date and shall then be true and correct in all respects.

(b)Delivery of Acknowledgement. The Executive shall have delivered to the Company the Acknowledgement in accordance with Section 2(b) of this Agreement.

SECTION 5.General.

(a)Amendments and Waivers. The provisions of this Agreement may not be amended, modified, supplemented or terminated, and waivers or consents to departures from the provisions hereof may not be given, without the written consent of the Executive and the Company.

(b)Counterparts. This Agreement may be executed in two or more counterparts, each of which, when so executed and delivered, shall be deemed to be an original, but all of which counterparts, taken together, shall constitute one and the same instrument.

(c)Descriptive Headings, Etc. The headings in this Agreement are for convenience of reference only and shall not limit or otherwise affect the meaning of terms contained herein.

- 2 -

(d)Governing Law, This Agreement shall be governed by and construed in accordance with the internal laws of the State of New York (without reference to its choice of law rules).

(e)Entire Agreement. This Agreement is intended by the parties as a final expression of their agreement and intended to be a complete and exclusive statement of the agreement and understanding of the parties hereto in respect of the subject matter contained herein. There are no restrictions, promises, representations, warranties, covenants or undertakings relating to such subject matter, other than those set forth or referred to herein. This Agreement supersedes all prior agreements and understandings between the Executive and the Company with respect to such subject matter.

(f)Survival. The representations and warranties given or made in this Agreement shall survive the consummation of the transactions contemplated hereby.

(g)Successors and Assigns. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, successors and permitted assigns. The Executive may not assign any of its rights or obligations under this Agreement without the prior written consent of the Company.

(h)Further Assurances. Each party hereto shall do and perform or cause to be done and performed all such further acts and things and shall execute and deliver all such other agreements, certificates, instruments and documents as any other party hereto reasonably may request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank. Signature page follows.]

- 3 -

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement the day and year first above written.

| | |

| MAPLE TIMBER ACQUISITION LLC |

| |

| By: | | /s/ Mark A. Suwyn |

| | Name: Mark A. Suwyn |

| | Title: Chairman & CEO |

|

| EXECUTIVE |

|

/s/ Peter Vogel |

Peter Vogel |

- 4 -

ANNEX A

ACKNOWLEDGEMENT

I, Peter Vogel, hereby acknowledge that as of May 16, 2006, in consideration for payment by Maple Timber Acquisition LLC (the “Company”) to me of the Repurchase Price, as defined in the Repurchase Agreement by and between the Company and me, dated as of April 5, 2006 (the “Repurchase Agreement”), pursuant to Section l(b) of the Repurchase Agreement, I have no further right, title, or interest in the Repurchased Interests (as defined in the Purchase Agreement).