AS OF DECEMBER 31, 2010 AND 2011 (CONTINUED)

| | | | | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | December 31, | | December 31, |

| | Note | | | 2010 | | | 2011 | | 2011 |

LIABILITIES AND EQUITY | | | | | | | | | | |

Current liabilities | | | | | | | | | | |

Trade payables | | | | ¥ | 6,763,668 | | ¥ | 12,500,602 | $ | 1,986,146 |

Other payables | 8 | | | 11,236,527 | | | 12,525,300 | | 1,990,070 |

Accrued expenses | | 9 | | | 16,000,966 | | | 14,464,113 | | 2,298,116 |

Taxes payable | | | | | 6,508,039 | | | 4,205,734 | | 668,224 |

Advances from customers | | | | | 42,688,878 | | | 49,653,714 | | 7,889,180 |

Deferred tax liabilities, current portion | 15 | | | 995,104 | | | 623,600 | | 99,080 |

Liabilities of discontinued operations | | 3 | | | 18,182,475 | | | - | | - |

Total current liabilities | | | | | 102,375,657 | | | 93,973,063 | | 14,930,816 |

Long-term liabilities | | | | | | | | | | |

10% ¥6,600,000 and nil convertible notes payable, net of ¥6,552,850 and nil of unamortized discount, respectively | 16 | | | 47,150 | | | - | | - |

Derivative liabilities | | 16 | | | 354,420 | | | 3,168 | | 503 |

Deferred tax liabilities | | 15 | | | 2,733,107 | | | 413,130 | | 65,640 |

Total long-term liabilities | | | | | 3,134,677 | | | 416,298 | | 66,143 |

| | | | | | | | | | |

Commitments and contingencies | | 18 | | | | | | | | |

| | | | | | | | | | |

Equity | | | | | | | | | | |

Ordinary shares, $0.0756 U.S. dollars par value; 6,613,756 shares authorized; 3,599,536 shares and 3,977,221 shares issued and outstanding, respectively | 10 | | | 2,161,766 | | | 2,353,068 | | 373,865 |

Additional paid-in capital | | 10 | | | 220,293,916 | | | 225,411,222 | | 35,814,236 |

Statutory reserves | | | | | 3,084,020 | | | 3,305,527 | | 525,195 |

Accumulated deficits | | | | | (86,011,313) | | | (105,063,689) | | (16,692,938) |

Total eFuture Information Technology Inc. Shareholders' Equity | | | | 139,528,389 | | | 126,006,128 | | 20,020,358 |

Non-controlling interest | | 12 | | | (3,206,568) | | | - | | - |

Total equity | | | | | 136,321,821 | | | 126,006,128 | | 20,020,358 |

Total liabilities and equity | | | | ¥ | 241,832,155 | | ¥ | 220,395,489 | $ | 35,017,317 |

See the accompanying notes to consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011

| | | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | | For the |

| | | | | Year Ended |

| | | For the Years Ended December 31, | | December 31, |

| Note | | 2009 | | | 2010 | | | 2011 | | 2011 |

Revenues | | | | | | | | | | | |

Software revenue | | ¥ | 54,187,769 | | ¥ | 63,887,988 | | ¥ | 52,599,132 | $ | 8,357,160 |

Hardware revenue | | | 21,518,084 | | | 35,805,127 | | | 38,838,235 | | 6,170,774 |

Service fee revenue | | | 33,130,034 | | | 52,209,569 | | | 83,011,113 | | 13,189,138 |

Total Revenues | | | 108,835,887 | | | 151,902,684 | | | 174,448,480 | | 27,717,072 |

| | | | | | | | | | | |

Cost of revenues | | | | | | | | | | | |

Cost of software revenue | | | (13,805,682) | | | (11,952,426) | | | (12,658,868) | | (2,011,292) |

Cost of hardware revenue | | | (17,294,931) | | | (31,282,457) | | | (32,412,956) | | (5,149,900) |

Cost of service fee revenue | | | (22,067,175) | | | (30,748,994) | | | (57,885,408) | | (9,197,065) |

Amortization of acquired technology | | | (11,513,910) | | | (10,353,492) | | | (7,838,965) | | (1,245,486) |

Amortization of software costs | | | (4,280,233) | | | (4,734,364) | | | (3,319,857) | | (527,472) |

Impairment loss of intangible assets | 7 | | - | | | (2,401,502) | | | (4,135,194) | | (657,016) |

Total Cost of Revenues | | | (68,961,931) | | | (91,473,235) | | | (118,251,248) | | (18,788,231) |

| | | | | | | | | | | |

Gross Profit | | | 39,873,956 | | | 60,429,449 | | | 56,197,232 | | 8,928,841 |

| | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | |

Research and development expenses | | | (3,165,788) | | | (8,152,923) | | | (4,666,122) | | (741,372) |

General and administrative expenses | | | (33,620,855) | | | (39,253,368) | | | (46,231,355) | | (7,345,423) |

Selling and distribution expenses | | | (27,519,934) | | | (34,755,979) | | | (24,845,248) | | (3,947,512) |

Total Operating Expenses | | | (64,306,577) | | | (82,162,270) | | | (75,742,725) | | (12,034,307) |

| | | | | | | | | | | |

Loss from operations | | | (24,432,621) | | | (21,732,821) | | | (19,545,493) | | (3,105,466) |

| | | | | | | | | | | |

Other income (expenses) | | | | | | | | | | | |

Interest income | | | 589,508 | | | 588,600 | | | 534,203 | | 84,876 |

Interest expenses | | | (450,817) | | | (636,050) | | | (550,338) | | (87,440) |

Interest expenses - amortization of discount on convertible notes payable | | | (13,316) | | | (13,712) | | | (6,431,872) | | (1,021,922) |

Interest expenses - amortization of deferred loan costs | | | (350,996) | | | (369,516) | | | (474,399) | | (75,374) |

Finance cost - exchange warrants | 10 | | - | | | (1,443,888) | | | - | | - |

Loss on investments | | | - | | | (54,192) | | | (240,000) | | (38,132) |

Gains on derivative liabilities | 16 | | 1,290,329 | | | 3,429,479 | | | 347,565 | | 55,223 |

Other income | | | - | | | - | | | 873,697 | | 138,816 |

Foreign currency exchange loss | | | (133,087) | | | (530,939) | | | (36,864) | | (5,857) |

Loss from continuing operations before income tax | | | (23,501,000) | | | (20,763,039) | | | (25,523,501) | | (4,055,276) |

Less: Income tax benefit | 15 | | (1,513,216) | | | (1,770,001) | | | (571,857) | | (90,859) |

Loss from continuing operations | | | (21,987,784) | | | (18,993,038) | | | (24,951,644) | | (3,964,417) |

Less: Net loss attributable to the non-controlling interest | 12 | | (2,099,874) | | | (1,606,146) | | | (511,423) | | (81,257) |

Net loss from continuing operations attributable to eFuture Information Technology Inc. | | | (19,887,910) | | | (17,386,892) | | | (24,440,221) | | (3,883,160) |

Discontinued operations | | | | | | | | | | | |

Gain (Loss) from discontinued operations (including gain on disposal of nil, ¥3,427,236 and ¥6,701,170($1,064,709), respectively) | 3 | | (5,260,675) | | | 63,471 | | | 5,609,352 | | 891,236 |

Less: Income tax expenses | | | 116,912 | | | - | | | - | | - |

Gain (Loss) from discontinued operations | | | (5,377,587) | | | 63,471 | | | 5,609,352 | | 891,236 |

Net loss | | ¥ | (25,265,497) | | ¥ | (17,323,421) | | ¥ | (18,830,869) | $ | (2,991,924) |

Earnings (Loss) per ordinary share | 17 | | | | | | | | | | |

Basic | | ¥ | (7.51) | | ¥ | (4.53) | | ¥ | (4.56) | $ | (0.72) |

- Continuing operations | | | (5.91) | | | (4.55) | | | (5.92) | | (0.94) |

- Discontinued operations | | | (1.60) | | | 0.02 | | | 1.36 | | 0.22 |

Diluted | | ¥ | (7.51) | | ¥ | (4.53) | | ¥ | (4.56) | $ | (0.72) |

- Continuing operations | | | (5.91) | | | (4.55) | | | (5.92) | | (0.94) |

- Discontinued operations | | | (1.60) | | | 0.02 | | | 1.36 | | 0.22 |

Basic Weighted-average Shares Outstanding | | 3,362,986 | | | 3,822,386 | | | 4,130,221 | | 4,130,221 |

Fully-Diluted Weighted-average Shares Outstanding | | 3,396,881 | | | 3,831,803 | | | 4,130,221 | | 4,130,221 |

See the accompanying notes to consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011

| Chinese Yuan (Renminbi) |

| Ordinary Shares | | Additional | | | | | | Non- | | |

| Shares | | Amount | | Paid-in

Capital | | Statutory

Reserves | | Accumulated

Deficits | | controlling

Interest | | Total |

Balance as of January 1, 2009 | 3,362,241 | ¥ | 2,039,196 | ¥ | 173,054,651 | ¥ | 3,084,020 | ¥ | (43,422,395) | ¥ | 204,414 | ¥ | 134,959,886 |

Issuance of ordinary shares in Health Field acquisition | 6,183 | | 3,188 | | 591,195 | | - | | - | | - | | 594,383 |

Compensation expenses for options granted to employees | - | | - | | 4,464,698 | | - | | - | | - | | 4,464,698 |

Compensation expenses for restricted shares awarded to

directors and senior managements | - | | - | | 1,711,356 | | - | | - | | - | | 1,711,356 |

Net loss | - | | - | | - | | - | | (25,265,497) | | (2,099,874) | | (27,365,371) |

Balance as of December 31, 2009 | 3,368,424 | ¥ | 2,042,384 | ¥ | 179,821,900 | ¥ | 3,084,020 | ¥ | (68,687,892) | ¥ | (1,895,460) | ¥ | 114,364,952 |

Issuance of ordinary shares in Royalstone acquisition | 60,405 | | 31,202 | | 6,395,268 | | - | | - | | - | | 6,426,470 |

Issuance of ordinary shares in Proadvancer acquisition | 169,584 | | 87,600 | | 14,912,400 | | - | | - | | - | | 15,000,000 |

Issuance of ordinary shares to certain managements | - | | - | | 12,158,096 | | - | | - | | - | | 12,158,096 |

Issuance of ordinary shares to warrants holders | - | | - | | 1,443,888 | | - | | - | | - | | 1,443,888 |

Exercise of options by employees | 1,123 | | 580 | | 35,489 | | - | | - | | - | | 36,069 |

Compensation expenses for options granted to employees | - | | - | | 3,930,160 | | - | | - | | - | | 3,930,160 |

Compensation expenses for restricted shares awarded to

directors and senior managements | - | | - | | 1,596,715 | | - | | - | | - | | 1,596,715 |

Disposal of Biaoshang | - | | - | | - | | - | | - | | 295,038 | | 295,038 |

Net loss | - | | - | | - | | - | | (17,323,421) | | (1,606,146) | | (18,929,567) |

Balance as of December 31, 2010 | 3,599,536 | ¥ | 2,161,766 | ¥ | 220,293,916 | ¥ | 3,084,020 | ¥ | (86,011,313) | ¥ | (3,206,568) | ¥ | 136,321,821 |

Issuance of ordinary shares to certain managements | 337,685 | | 171,042 | | (171,042) | | - | | - | | - | | - |

Issuance of ordinary shares to warrants holders | 40,000 | | 20,260 | | (20,260) | | - | | - | | - | | - |

Compensation expenses for options granted to employees | - | | - | | 3,937,919 | | - | | - | | - | | 3,937,919 |

Compensation expenses for restricted shares awarded to

directors and senior managements | - | | - | | 1,370,689 | | - | | - | | - | | 1,370,689 |

Disposal of Wangku | - | | - | | - | | - | | - | | 3,717,991 | | 3,717,991 |

Appropriation to statutory reserves of eFuture Beijing | - | | - | | - | | 221,507 | | (221,507) | | - | | - |

Net loss | - | | - | | - | | - | | (18,830,869) | | (511,423) | | (19,342,292) |

Balance as of December 31, 2011 | 3,977,221 | ¥ | 2,353,068 | ¥ | 225,411,222 | ¥ | 3,305,527 | ¥ | (105,063,689) | ¥ | - | ¥ | 126,006,128 |

| U.S. Dollars |

| Ordinary

Shares | | Additional | | | | | | Non- | | |

| Shares | | Amount | | Paid-in

Capital | | Statutory

Reserves | | Accumulated Deficits | | controlling

Interest | | Total |

Balance as of January 1, 2011 | 3,599,536 | $ | 343,470 | $ | 35,001,178 | $ | 490,001 | $ | (13,665,820) | $ | (509,473) | $ | 21,659,356 |

Issuance of ordinary shares to certain managements | 337,685 | | 27,176 | | (27,176) | | - | | - | | - | | - |

Issuance of ordinary shares to warrants holders | 40,000 | | 3,219 | | (3,219) | | - | | - | | - | | - |

Compensation expenses for options granted to employees | - | | - | | 625,672 | | - | | - | | - | | 625,672 |

Compensation expenses for restricted shares awarded to

directors and senior managements | - | | - | | 217,781 | | - | | - | | - | | 217,781 |

Disposal of Wangku | - | | - | | - | | - | | - | | 590,729 | | 590,729 |

Appropriation to statutory reserves of eFuture Beijing | - | | - | | - | | 35,194 | | (35,194) | | - | | - |

Net loss | - | | - | | - | | - | | (2,991,924) | | (81,256) | | (3,073,180) |

Balance as of December 31, 2011 | 3,977,221 | $ | 373,865 | $ | 35,814,236 | $ | 525,195 | $ | (16,692,938) | $ | - | $ | 20,020,358 |

See the accompanying notes to consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | For the |

| | | | Year Ended |

| | For the Years Ended December 31, | | December 31, |

| | 2009 | | | 2010 | | | 2011 | | 2011 |

Cash flows from operating activities: | | | | | | | | | | |

Net loss | ¥ | (25,265,497) | | ¥ | (17,323,421) | | ¥ | (18,830,869) | $ | (2,991,924) |

Adjustments to reconcile net loss to net cash flows provided by (used in) operating activities: | | | | | | | | | | |

Depreciation of property and equipment | | 1,371,421 | | | 2,009,702 | | | 1,996,264 | | 317,174 |

Amortization of intangible assets | | 16,263,531 | | | 15,408,168 | | | 11,206,919 | | 1,780,600 |

Impairment of goodwill | | 762,000 | | | - | | | - | | - |

Impairment of intangible assets | | - | | | 2,401,502 | | | 4,135,194 | | 657,016 |

Amortization of discount on convertible notes payable | | 13,316 | | | 13,712 | | | 6,431,872 | | 1,021,922 |

Amortization of deferred loan costs | | 350,996 | | | 369,516 | | | 474,399 | | 75,374 |

Gain on extinguishment of debt | | - | | | - | | | (382,889) | | (60,835) |

Gains on derivative liabilities | | (1,290,329) | | | (3,429,479) | | | (347,565) | | (55,223) |

Finance cost - exchange warrants | | - | | | 1,443,888 | | | - | | - |

Investment income | | - | | | (3,373,044) | | | (6,461,170) | | (1,026,577) |

Loss on disposal of property and equipment | | 49,900 | | | 48,832 | | | 88,148 | | 14,005 |

Allowance for doubtful accounts | | 4,044,232 | | | 5,482,636 | | | 2,832,646 | | 450,062 |

Provision for loss in inventory and work in process | | 1,103,382 | | | 3,138,266 | | | 4,184,469 | | 664,845 |

Compensation expenses for options granted to employees | | 4,464,698 | | | 3,930,160 | | | 3,937,919 | | 625,672 |

Compensation expenses for restricted shares awarded to directors and senior management | | 1,711,356 | | | 1,596,715 | | | 1,370,689 | | 217,781 |

Deferred income taxes | | (1,513,216) | | | (1,770,001) | | | (2,691,481) | | (427,633) |

Foreign exchange gain (loss) | | (134,451) | | | 295,552 | | | (141,638) | | (22,504) |

Non-controlling interest | | (2,099,874) | | | (1,606,146) | | | (511,423) | | (81,257) |

Changes in assets and liabilities: | | | | | | | | | | |

Trade receivables | | 2,898,851 | | | (3,357,770) | | | (9,051,744) | | (1,438,178) |

Refundable value added tax | | 155,403 | | | (55,367) | | | (4,295,257) | | (682,448) |

Advances to employees | | 1,593,262 | | | (1,886,714) | | | 720,142 | | 114,419 |

Advances to suppliers | | (98,852) | | | (1,939,238) | | | 1,703,355 | | 270,636 |

Other receivables | | (3,077,188) | | | (321,291) | | | 3,163,605 | | 502,646 |

Prepaid expenses | | (744,422) | | | 757,414 | | | (794,600) | | (126,249) |

Inventory and work in process | | (3,771,348) | | | (13,226,638) | | | (16,554,487) | | (2,630,243) |

Trade payables | | 3,434,690 | | | (2,108,399) | | | 6,036,907 | | 959,168 |

Other payables | | 4,770,671 | | | 2,533,262 | | | 1,533,607 | | 243,666 |

Accrued expenses | | 3,184,765 | | | 6,094,865 | | | (1,392,446) | | (221,237) |

Taxes payable | | (948,478) | | | (677,294) | | | (2,345,297) | | (372,630) |

Advances from customers | | 3,346,161 | | | 26,218,042 | | | 7,465,494 | | 1,186,148 |

Net cash provided by (used in) operating activities | ¥ | 10,574,980 | | ¥ | 20,667,430 | | ¥ | (6,519,237) | $ | (1,035,804) |

| | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | |

Purchases of property and equipment | | (3,024,457) | | | (2,835,284) | | | (1,425,678) | | (226,517) |

Payments for intangible assets | | (9,226,066) | | | (2,455,360) | | | (8,220,522) | | (1,306,109) |

Long-term investment | | - | | | (240,000) | | | - | | - |

Acquisition of Proadvancer | | - | | | (15,000,000) | | | - | | - |

Cash received from disposal of property and equipment | | - | | | - | | | 3,000 | | 477 |

Disposal of investments | | - | | | 2,633,092 | | | 5,895,999 | | 936,780 |

Net cash used in investing activities | ¥ | (12,250,523) | | ¥ | (17,897,552) | | ¥ | (3,747,201) | $ | (595,369) |

See the accompanying notes to consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2009, 2010 AND 2011 (CONTINUED)

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | For the |

| | | | Year Ended |

| | For the Years Ended December 31, | | December 31, |

| | 2009 | | | 2010 | | | 2011 | | 2011 |

Cash flows from financing activities: | | | | | | | | | | |

Issuance of ordinary shares for cash, net of offering costs paid | ¥ | - | | ¥ | 12,158,095 | | ¥ | - | $ | - |

Proceeds from exercise of options | | - | | | 36,068 | | | - | | - |

Cash paid for the redemption of convertible notes | | - | | | - | | | (6,329,300) | | (1,005,624) |

Net cash provided by (used in) financing activities | ¥ | - | | ¥ | 12,194,163 | | ¥ | (6,329,300) | $ | (1,005,624) |

Effect of exchange rate changes on cash and cash equivalents | | 2,685 | | | (311,739) | | | (14,362) | | (2,282) |

Net increase (decrease) in cash and cash equivalents | | (1,672,858) | | | 14,652,302 | | | (16,610,100) | | (2,639,079) |

Cash and cash equivalents at beginning of year | | 60,787,734 | | | 59,114,876 | | | 73,767,178 | | 11,720,424 |

Cash and cash equivalents at end of year | ¥ | 59,114,876 | | ¥ | 73,767,178 | | ¥ | 57,157,078 | $ | 9,081,345 |

| | | | | | | | | | |

Supplemental cash flow information | | | | | | | | | | |

Interest paid | ¥ | 450,826 | | ¥ | 660,000 | | ¥ | 482,048 | $ | 76,590 |

Income tax paid | ¥ | - | | ¥ | 230,961 | | ¥ | 3,758,088 | $ | 597,100 |

| | | | | | | | | | |

Non-cash Investing and Financing Activities | | | | | | | | | | |

Issuance of ordinary shares in Health Field acquisition | ¥ | 594,383 | | ¥ | - | | ¥ | - | $ | - |

Issuance of ordinary shares in Royalstone acquisition | ¥ | - | | ¥ | 6,426,470 | | ¥ | - | $ | - |

Issuance of ordinary shares in Proadvancer acquisition | ¥ | - | | ¥ | 15,000,000 | | ¥ | - | $ | - |

See the accompanying notes to consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. ORGANIZATION AND NATURE OF OPERATIONS

Organization

eFuture Information Technology Inc. (the "Company") is a Cayman Islands Corporation. Its wholly owned subsidiary eFuture (Beijing) Tornado Information Technology Inc. is located in Beijing, the People's Republic of China (the "PRC"). In August 2007, eFuture (Beijing) Tornado Information Technology Inc. was renamed as eFuture (Beijing) Royalstone Information Technology Inc. ("eFuture Beijing"). The Company is a holding company with no operations of its own. All of its operations are conducted through eFuture Beijing.

On November 6, 2007, the Company acquired 51% majority equity interests in Beijing Fuji Biaoshang Information Technology Co., Ltd. ("Biaoshang") through certain nominee pursuant to an equity transfer agreement between the certain nominee and the original shareholders. On May 14, 2008, the Company acquired 51% majority equity interests in Beijing Wangku Hutong Information Technology Co., Ltd. ("Wangku") through certain nominee pursuant to an equity transfer agreement between the certain nominee and the original shareholders. Biaoshang and Wangku were treated as variable interest entities ("VIEs") before disposal (see note 13).

On July 16, 2010 and March 13, 2011, the Company disposed all its equity interest in Biaoshang and Wangku, respectively. For the years ended December 31, 2009, 2010 and 2011, the operating results of Biaoshang and Wangku were reported as discontinued operations in the consolidated statements of operations (see note 3).

The Company acquired control over a 100% equity interests in Beijing Changshengtiandi Ecommerce Co., Ltd. ("Changshengtiandi") through certain nominees on January 18, 2011. Changshengtiandi was treated as a variable interest entity ("VIE") for the period from January 18, 2011 to December 31, 2011 (see note 13).

The Company, its subsidiary and VIEs are collectively referred to as the "Group".

Nature of Operations

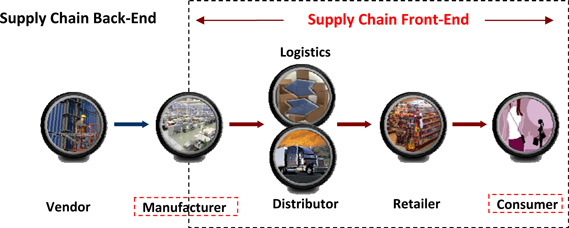

The Group is mainly engaged in developing and selling Enterprise Resource Planning (ERP) software and providing ONE-STOP solutions for distribution, retail and logistics businesses focused on the supply chain front market for manufacturers, retailers, distributors and third party logistics, and in providing the related system integration service and technical training services. Systems integration services involve system design and system implementation through the application of the software as well as ongoing technical supporting services. Revenues are generated solely from sales to customers in China.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("US GAAP"). Significant accounting policies followed by the Group in the preparation of its accompanying consolidated financial statements are summarized below.

Principles of Consolidation

The consolidated financial statements include the financial statements of the Company, its subsidiary and VIEs for which the Company is the primary beneficiary. All significant transactions and balances among the Company, its subsidiary and VIEs have been eliminated upon consolidation.

A subsidiary is an entity in which the Company, directly or indirectly, controls more than one half of the voting power; has the power to appoint or remove the majority of the members of the board of directors; to cast majority of votes at the meeting of the board of directors or to govern the financial and operating policies of the investee under a statute or agreement among the shareholders or equity holders.

The Company applies guidance that requires certain VIEs to be consolidated by the primary beneficiary of the entity if the equity investors in the entity do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties.

Accounting Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, including trade receivables, inventory and work in process, property and equipment, intangible assets, goodwill and derivative liabilities, and the disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Management bases the estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results could materially differ from these estimates.

Foreign Currency Translation

The Group's reporting and functional currency is the Renminbi ("RMB"), the official currency in the PRC. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates quoted by the People's Bank of China (the "PBOC") prevailing at the dates of the transactions. Gains and losses resulting from foreign currency transactions are included in the consolidated statements of operations. Monetary assets and liabilities denominated in foreign currencies are translated into RMB using the applicable exchange rates quoted by the PBOC at the applicable balance sheet dates. All such exchange gains or losses are included in foreign currency exchange gain (loss) in the consolidated statements of operations. Non-monetary assets denominated in foreign currencies have been remeasured at historical rates.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Convenience Translation

The consolidated financial statements as of and for the year ended December 31, 2011 have been translated into U.S. dollars ("US$" or "$") solely for the convenience of the reader. Translations of amounts from RMB into US$ have been calculated at the exchange rate of RMB6.2939 per US$1.00, as published on the website of the Federal Reserve Bank of New York as at December 31, 2011. These translated U.S. dollar amounts should not be construed as representing Chinese Yuan amounts or that the Chinese Yuan amounts have been or could be converted, realized or settled into U.S. dollars at that rate on December 31, 2011, or at any other rate.

Fair Values of Financial Instruments

The Group records certain of its financial assets and liabilities at fair value on a recurring basis. Fair value reflects the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Group considers the principal or most advantageous market in which it would transact and considers assumptions that market participants would use when pricing the asset or liability.

The Group applies a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument's categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. There are three levels of inputs that may be used to measure fair value:

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices included within Level 1 that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The carrying amount of cash and cash equivalents, trade receivables, other receivables, other receivables due from previously consolidated entities, advances to suppliers, refundable value added tax, advances to employees, prepaid expenses, trade payables, taxes payable, other payables, accrued liabilities and advances from customers approximates fair value due to their immediate or short-term nature. The single compound embedded derivative within convertible notes we issued was recorded at fair value at the date of issuance, which was measured by using unobservable (Level 3) inputs.

Cash and Cash Equivalents

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Cash and cash equivalents are comprised of cash on hand and demand deposits with original maturities of no more than three months. As of December 31, 2011 and 2010, RMB57.2 million (US$9.1 million) and RMB73.3 million of the Group's cash and cash equivalents were not maintained in US banks or financial institutions, which are not protected by FDIC insurance or other insurance.

Trade and Other receivables, net

Trade receivables, net are stated at the amount management expects to collect from outstanding balances. An estimate for doubtful accounts is made when the collection is doubtful and a loss is probable and estimable. The Group maintains an allowance for potentially uncollectible trade receivables based on its assessment of the collectability of trade receivables. In evaluating the collectability of individual receivable balances, the Group considers many factors, including the age of the balance, the customer's past payment history, its current credit-worthiness and current economic trends.

As of December 31, 2011, no customer individually accounted for more than 10% of total trade receivables.

Other receivables consist of miscellaneous items arising from transactions with non-trade customers.

The Group writes off receivables when they are deemed uncollectible, and payments subsequently received on the receivables for which doubtful accounts was specifically provided are recognized as other income in the consolidated financial statements.

Inventory and Work in Process

Inventory is comprised of purchased hardware and software available for resale and other consumable materials. Labor and overhead costs are allocated to each contract based on actual labor hours incurred. Work in process consists of labor and overhead costs and outsourced service fees incurred on services contracts that have not been completed. Inventory and work in process are stated at the lower of cost or net realizable value.

Provisions are made for excess, slow moving and obsolete purchased hardware and software held for resale, as well as for inventories and work in process with carrying values in excess of net realizable value. The Group uses the future selling price less the estimated taxes and future expenditure as the estimates of net realizable value on contract basis.

Deferred Offering Costs

The Group capitalizes direct and incremental costs associated with the acquisition of equity financing, which will be netted against the actual equity proceeds. If the equity offering is abandoned, the deferred offering costs will be charged to expense.

Long-term Investments

The Group accounts for an equity investment over which it has significant influence but does not own a majority equity interest or otherwise control using the equity method. For equity investments over which the Group does not have significant influence, cost method accounting is used.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

On March 15, 2010, the Company acquired 15% of the equity interest of cFuture with total cash consideration of RMB240,000. The Company is required to perform an impairment assessment of its investments whenever events or changes in business circumstances indicate that the carrying value of the investment may not be fully recoverable. As of December 31, 2011, the Company determined that such events and changes occurred and were other-than-temporary. Thus, impairment of RMB240,000 was made to write down the asset to its fair value and take the corresponding charge to the consolidated statements of operations.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is computed on a straight-line basis over the estimated useful lives of the assets as follows:

Motor vehicles | | 5 Years |

Leasehold improvements | | shorter of 3 Years or Lease Term |

Office equipment | | 4 Years |

Communication equipment | | 4 Years |

Software | | 4 Years |

The cost of maintenance and repairs is charged to expense as incurred and major improvements are capitalized. Gains or losses on sales or retirements are included in the operation results in the year of disposition.

Intangible Assets - Computer Software Costs and Research and Development

The Group charges all development costs to research and development expenses which include salaries, contractor fees, utilities, administrative expenses and other allocated expenses until technological feasibility has been established. Technological feasibility is established when a detail program design or working model is completed. After reaching technological feasibility, additional software costs are capitalized until the software is available for general release to customers. The capitalized software development expenditures is subject to amortization on a straight-line basis over its estimated useful lives, which is the shorter of four years or the estimated period of realization of revenue from the related software. The subsequent expenditure in connection with major upgrade for the developed intangible assets is capitalized as incurred.

Business Combination and Goodwill

The Group accounts for business combination using the purchase method of accounting. This method requires that the acquisition cost to be allocated to the assets, including separately identifiable intangible assets, and the liabilities that the Group acquires based on their estimated fair values. The Group makes estimates and judgments in determining the fair value of the acquired assets and liabilities based on its experience with similar assets and liabilities in similar industries. If different judgments or assumptions were used, the amounts assigned to the individual acquired assets or liabilities could be materially different.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Goodwill represents the excess of the purchase price over the fair value of the identifiable assets and liabilities of the acquired business. In a business acquisition, any acquired intangible assets that do not meet separate recognition criteria are recognized as goodwill.

No amortization is recorded for goodwill. The Group tests goodwill on an annual basis or more frequently if an event occurs or circumstances change that could more likely than not reduce the fair value of the goodwill below its carrying amount. The impairment of goodwill is determined by estimating the fair value based upon the present value of future cash flows. In estimating the future cash flows, the Group takes into consideration the overall and industry economic conditions and trends, market risk of the Group and historical information.

Impairment of Long-lived Assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that carrying amount of an asset may not be recoverable. The Group may recognize impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to these assets. If impairment exists, the impairment amount is recognized for the difference between the fair value of the asset and its carrying value.

Revenue Recognition

The Group recognizes revenue when (1) it has persuasive evidence of an arrangement, (2) delivery has occurred, (3) the sales price is fixed or determinable, and (4) collectability is reasonably assured. Delivery does not occur until products have been shipped or services have been rendered to the client and the client has signed a completion and acceptance report, risk of loss has transferred to the client, client acceptance provisions have lapsed, or the Group has objective evidence that the criteria specified in client acceptance provisions have been satisfied. The sales price is not considered to be fixed or determinable until all contingencies related to the sale have been resolved.

The Group's policy requires the customers to make payments before delivery has occurred or service has rendered. Such unearned amounts billed to customers are recorded as advances from customers in the Group's consolidated financial statements, until the above criteria have been met.

Revenue from software and hardware sales represents the invoiced value of products sold, net of a value-added tax ("VAT"). All of the Group's software and hardware that are sold in the PRC are subject to a Chinese VAT at a rate of 17% of the gross sales price or at a rate approved by the Chinese local government. This VAT may be offset by VAT paid by the Group on externally purchased software and hardware from suppliers. The VAT amounts paid and available for offset are maintained in current liabilities.

In respect of revenues on self-developed software sales, a VAT refund at a rate of 14% of the gross sales price is approved by the Chinese local government. The VAT subjected to the refund is recorded as refundable value added tax in the Group's consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The Group provides the following products and services: self-developed software, purchased software, purchased hardware, system design and integration, and professional services, including post contract maintenance and technical support.

Software

The Group sells self-developed software and software purchased from other vendors.

For software sales, the Group recognizes revenues in accordance with ASC 985-605, Software Revenue Recognition. Revenue from perpetual (one-time charge) licensed software is recognized at the inception of the license term. Revenue from term (monthly license charge) arrangements is recognized on a subscription basis over the period that the customer is using the license. The Group does not provide any rights of return or warranties on its software.

Revenues applicable to multiple-element fee arrangements are bifurcated among the elements such as software, hardware and post-contract service using vendor-specific objective evidence of fair value. Such evidence consists of pricing of multiple elements when those same elements are sold as separate products or arrangements. Software maintenance for the first year and initial training are included in the purchase price of the software. Initial training is provided at the time of installation and is recognized as income as part of the price of the software since it is minimal in value. Maintenance is valued based on the fee schedule used by the Group for providing the regular level of maintenance service as sold to customers when renewing their maintenance contracts on a stand alone basis.

Software revenues include VAT refund received from the Chinese local government on the sales of certain software. Such refund is granted to the Group as part of the PRC government's policy to encourage software development in the PRC, and is recorded as a component of revenue when the relevant compliance requirements are met, there are no further obligations, and are not subject to future returns or reimbursements.

Hardware

Revenue from hardware sales is recognized when the product is shipped to the customer and there are no unfulfilled obligations that affect the customer's final acceptance of the arrangement. If hardware deliverable is one of the elements in a multiple-elements arrangement, the Group recognizes revenues in accordance with ASC subtopic 605-25 ("ASC 605-25"), Revenue recognition: Multiple-Element Arrangements. Because generally the hardware is a standalone sale and the software components are not essential to the functionality of hardware. Revenue of hardware is carved out from the total consideration based on best estimated selling price which is cost plus a reasonable margin. The software components is within the scope of ASC985-605, which should applied the same method as software deliverables. By the adoption of ASU 2009-13 and ASU 2009-14 in 2011, there was no material impact on the consolidated financial statements.

Services

Professional service

The Group provides system integration which involves the design and development of complex IT systems to the customer's specifications. These services are provided on a fixed-price contract and the contract terms are generally short-term. Revenue is recognized on the completed contract method when delivery and acceptance is determined by a completion report signed by the customer.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The Group offers telephone and minimal on-site support to its customers. Revenue from maintenance services and technical support is recognized over the period of the agreement.

For those contracts containing multiple-delivery elements of software, customization, training and 1 year maintenance service, residual method under ASC 985-605 is adopted. Vendor-specific objective evidence is only established for maintenance service by the renewal contract quoted at certain percentage of original contract price. There was no vendor-specific objective evidence established for other deliverables. If contract only contains a completion date, then upon the date obtained the "Final Acceptance Report" from customer, part of contract amount is recognised as revenue on completion method; the remaining part will be recognised evenly over the free maintenance service period.

Cost of Revenues

Costs associated with contracts are deferred and recognized as inventory and work in process until the services are rendered, the products and software are installed and delivered to and accepted by the customer. When the criteria for revenue recognition have been met, costs incurred are recognized as cost of revenues. Cost of revenues include labor costs, materials, overhead expenses, business taxes related to certain services revenues and other expenses associated with the development of IT systems to customers' specifications, the cost of purchased hardware and software, and costs related to technical support services. Amortization of capitalized software costs and costs of acquired technology are included in the cost of revenues.

Advertising Costs

Advertising costs are expensed when incurred. Total advertising expense were RMB133,247, RMB136,500, and RMB283,710 (US$45,077) for the years ended December 31, 2009, 2010 and 2011, respectively.

Income Taxes

The Group recognizes deferred income taxes under the asset and liability method. Deferred income taxes are recognized for differences between the financial statement carrying amounts and tax bases of assets and liabilities at enacted tax rates in effect for the years in which the differences are expected to reverse. A valuation allowance is recorded against deferred tax assets if management does not believe the Group has met the "more likely than not" standard imposed by ASC subtopic 740-10.

The Group adopted the provisions of ASC subtopic 740-10 ("ASC 740-10"), Income Taxes: Overall, on January 1, 2008. ASC 740-10 clarified the accounting for uncertainty in income taxes by prescribing the recognition threshold a tax position is required to meet before being recognized in the financial statements. The Group did not incur a cumulative effect adjustment upon adoption of ASC 740-10 nor did the standard have a material impact on the Group's financial statements for the years ended December 31, 2009, 2010 and 2011.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

In general, the PRC tax authorities have up to five years to conduct examinations of the Group's tax filings. Accordingly, the PRC subsidiaries' tax years 2007-2011 remain open to examination by the respective taxing jurisdictions.

Statutory Reserves

eFuture Beijing, as a wholly foreign owned enterprise incorporated in the PRC, is required on an annual basis to make appropriations of net profits, after the recovery of accumulated deficit, to a general reserve fund and a staff bonus and welfare fund. These reserve funds are set at certain percentage of after-tax profit determined in accordance with PRC accounting standards and regulations (the "PRC GAAP"). The percentage of the appropriation for general reserve fund is at least 10%, and the percentage of the appropriation for staff bonus and welfare fund is at the discretion of its boards of directors.

Wangku, Biaoshang and Changshengtiandi, as domestic enterprises incorporated in the PRC, are required on an annual basis to make an appropriation of net profits, after the recovery of accumulated deficit, to a statutory reserve fund. The statutory reserve fund is set at the percentage of not lower than 10% of the after-tax profit determined in accordance with the PRC GAAP.

Once the level of the general reserve fund and the statutory reserve fund reach 50% of the registered capital of the underlying entities, further appropriations to these funds are discretionary. The Group's statutory reserves can only be used for specific purposes of enterprises expansion and staff bonus and welfare, and are not distributable to the shareholders except in the event of liquidation. Appropriations to these funds are accounted for as transfers from retained earnings to the statutory reserves.

For the years ended December 31, 2009 and 2010, respectively, no appropriation was made to the above statutory reserves. For the year ended December 31, 2011, RMB221,507 was made to statutory reserves of eFuture Beijing. As of December 31, 2010 and 2011, the amount comprising the general reserve fund of RMB3,084,020 and RMB3,305,527, respectively.

Dividends

Dividends are recorded when declared. No dividends were declared for the years ended December 31, 2009, 2010 and 2011, respectively.

PRC regulations currently permit payment of dividends only out of accumulated profits as determined in accordance with PRC GAAP. The Company's PRC subsidiaries can only distribute dividends after they have met the PRC requirements for appropriation to statutory reserves (see note 2, Statutory Reserves).

Convertible Debt and Embedded Derivatives

The Group applies ASC subtopic 470-20 ("ASC 470-20"), Debt with Conversion Options — Recognition. The Group identifies any embedded derivative instruments that may be contained within its convertible debt instruments in accordance with the provisions of ASC subtopic 815-10 ("ASC 815-10"), Derivatives and Hedging — Overall and records the fair value of such derivatives separately from the value of the host instrument. Changes in the fair value of the derivative instruments are recorded in the consolidated statements of operations for each reporting period. The fair value of the embedded derivative is bifurcated from the host contract at inception and is recorded as a discount to the face value of the convertible debt. The discount is amortized as additional finance cost over the period of the debt. Refer to note 16 for more detail.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Net Earnings (Loss) per share of Ordinary shares

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income (loss) attributable to ordinary shareholders as adjusted for the effect of dilutive ordinary equivalent shares, if any, by the weighted average number of ordinary and dilutive potential ordinary equivalents shares outstanding during the period. Potential ordinary shares equivalents consist of shares issuable upon the conversion of preferred stock, convertible notes, the exercise of stock options and warrants and restricted shares subject to cancellation.

Share-Based Compensation

The Company accounts for share-based compensation in accordance with ASC subtopic 718-10 ("ASC 718-10"), Compensation-Stock Compensation: Overall. Under the provisions of ASC 718-10, share-based compensation cost is estimated at the grant date based on the award's fair value as calculated by the Black-Scholes-Merton (BSM) option-pricing model and is recognized as expense net of a forfeiture rate over the requisite service period. The BSM model requires various highly judgmental assumptions including volatility and expected option life. Volatility is measured using historical daily price changes of ordinary shares over the respective expected life of the option. Expected option life is the number of years that the Company estimates, based on the vesting and contractual terms and employee demographics. The estimate of forfeitures will be adjusted over the requisite service period to the extent that actual forfeitures differ, or are expected to differ, from such estimates. Changes in estimated forfeitures will be recognized through a cumulative catch-up adjustment in the period of change. If any of the assumptions used in the BSM model change significantly, share-based compensation expenses may differ materially in the future from that recorded in the current period.

Recently Enacted Accounting Standards

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income: Presentation of Comprehensive Income, which requires an entity to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. The guidance eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders' equity. The guidance does not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income. The guidance should be applied retrospectively. For public entities, the guidance is effective for fiscal years and interim periods within those years, beginning after December 15, 2011. Early adoption is permitted. In December 2011, the FASB issued ASU No. 2011-12, Comprehensive Income: Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05. This guidance allows the FASB to redeliberate whether to present on the face of the financial statements the effects of reclassifications out of accumulated other comprehensive income on the components of net income and other comprehensive income for all periods presented. While the FASB is considering the operational concerns about the presentation requirements for reclassification adjustments and the needs of financial statement users for additional information about reclassification adjustments, entities should continue to report reclassifications out of accumulated other comprehensive income consistent with the presentation requirements in effect before update the pronouncement issued in June 2011. The Company does not expect the adoption of this guidance to have a significant effect on its consolidated financial statements.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

In September 2011, the FASB issued ASU No. 2011-08, Intangibles-Goodwill and Other: Testing Goodwill for Impairment. The guidance is intended to simplify how entities, both public and nonpublic, test goodwill for impairment. The guidance permits an entity to first assess qualitative factors to determine whether it is "more likely than not" that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the two-step goodwill impairment test. The guidance is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption is permitted, including for annual and interim goodwill impairment tests performed as of a date before September 15, 2011, if a public entity's financial statements for the most recent annual or interim period have not yet been issued. The Group is now assessing the impact on its financial condition or results of operations for adoption of this accounting pronouncement.

In December 2011, the FASB has issued ASU No. 2011-11, Balance Sheet: Disclosures about Offsetting Assets and Liabilities. The guidance requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. An entity is required to apply the amendments for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. An entity should provide the disclosures required by those amendments retrospectively for all comparative periods presented. The Company is in the process of evaluating the effect of adoption of this guidance on its consolidated financial statements.

NOTE 3. Disposition and Discontinued Operations

On July 16, 2010, the Company sold its 51% ownership stake in Biaoshang to Mr. Peter Jiang, Biaoshang's founder and Chief Executive Officer, for cash consideration of RMB3,468,000. The Company will not have any continuing involvement in the operations of Biaoshang.

On March 13, 2011, the Company sold its 51% ownership stake in Wangku to Mr. Wang Haibo, Wangku's founder and Chief Executive Officer, for cash consideration of RMB6,000,000 (US$953,304). The Company will not have any continuing involvement in the operations of Wangku.

After disposal of Biaoshang and Wangku, they were no longer related parties of the Company.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The financial results of the discontinued operations for the years ended December 31, 2009, 2010 and 2011 were as follows:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | For the |

| | | | Year Ended |

| | For the Years Ended December 31, | | December 31, |

| | 2009 | | | 2010 | | | 2011 | | 2011 |

Revenues | | | | | | | | | | |

Service fee revenue | ¥ | 13,431,755 | | ¥ | 9,235,836 | | ¥ | 1,740,799 | $ | 276,585 |

Total Revenues | | 13,431,755 | | | 9,235,836 | | | 1,740,799 | | 276,585 |

| | | | | | | | | | |

Cost of revenues | | | | | | | | | | |

Cost of service fee revenue | | (1,412,821) | | | (1,026,319) | | | (192,320) | | (30,557) |

Amortization of acquired technology | | (469,389) | | | (320,312) | | | (48,097) | | (7,641) |

Total Cost of Revenues | | (1,882,210) | | | (1,346,631) | | | (240,417) | | (38,198) |

| | | | | | | | | | |

Gross Profit | | 11,549,545 | | | 7,889,205 | | | 1,500,382 | | 238,387 |

| | | | | | | | | | |

Operating Expenses | | | | | | | | | | |

General and administrative expenses | | (9,116,300) | | | (7,513,153) | | | (1,560,645) | | (247,962) |

Selling and distribution expenses | | (6,764,473) | | | (3,699,450) | | | (1,025,957) | | (163,008) |

Impairment loss of goodwill | | (762,000) | | | - | | | - | | - |

Total Operating Expenses | | (16,642,773) | | | (11,212,603) | | | (2,586,602) | | (410,970) |

| | | | | | | | | | |

Loss from operations | | (5,093,228) | | | (3,323,398) | | | (1,086,220) | | (172,583) |

| | | | | | | | | | |

Other income (expenses) | | | | | | | | | | |

Interest income | | 4,805 | | | 1,683 | | | 2 | | - |

Interest expenses | | (172,252) | | | (276,447) | | | (5,600) | | (890) |

Gain on extinguishment of debt | | - | | | 234,397 | | | - | | - |

Income on investments | | - | | | 3,427,236 | | | 6,701,170 | | 1,064,709 |

Gain (Loss) before income tax | | (5,260,675) | | | 63,471 | | | 5,609,352 | | 891,236 |

Less: Income tax expenses | | 116,912 | | | - | | | - | | - |

Gain (Loss) from discontinued operations | ¥ | (5,377,587) | | ¥ | 63,471 | | ¥ | 5,609,352 | $ | 891,236 |

The assets and liabilities of the discontinued operations as of December 31, 2010 and 2011 were as follow:

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

| | | | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | | | December 31, | | December 31, |

| | | | | 2010 | | | 2011 | | 2011 |

Current assets of discontinued operations | | | | | | | | | | |

Cash and cash equivalents | | | | ¥ | 516,322 | | ¥ | - | $ | - |

Trade receivables, net of allowance for doubtful accounts of ¥5,074,647 and nil, respectively | | | | 750,334 | | | - | | - |

Other current assets | | | | | 326,357 | | | - | | - |

Total current assets of discontinued operations | | | | ¥ | 1,593,013 | | ¥ | - | $ | - |

Non-current assets of discontinued operations | | | | | | | | | | |

Property and equipment, net of accumulated depreciation of ¥1,312,801 and nil, respectively | | | ¥ | 891,334 | | ¥ | - | $ | - |

Intangible assets, net of accumulated amortization of ¥596,405 and nil, respectively | | | | 2,866,595 | | | - | | - |

Goodwill | | | | | 9,504,191 | | | - | | - |

Total non-current assets of discontinued operations | | | | ¥ | 13,262,120 | | ¥ | - | $ | - |

| | | | | | | | | | |

Liabilities of discontinued operations | | | | | | | | | | |

Trade and other payables | | | | ¥ | 7,566,523 | | ¥ | - | $ | - |

Other payables due to eFuture Beijing | | | | | 3,095,000 | | | - | | - |

Advances from customers | | | | | 7,382,624 | | | - | | - |

Other current liabilities | | | | | 138,328 | | | - | | - |

Total liabilities of discontinued operations | | | | ¥ | 18,182,475 | | ¥ | - | $ | - |

The other payables due to eFuture Beijing were entrusted loans from eFuture Beijing to Biaoshang and Wangku, which was previously eliminated when the Biaoshang and Wangku had not been treated as discontinued operations. They were also presented as other receivables due from previously consolidated entities in the consolidated balance sheets.

As of December 31, 2011, the Company made a bad debt provision of RMB1,200,000 for other receivables due from previously consolidated entities, as certain circumstance indicated that the collectability of it could not be reasonably assured.

NOTE 4. TRADE RECEIVABLES

The trade receivables amount included in the consolidated balance sheets as of December 31, 2010 and 2011 were as follows:

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Trade receivables | | ¥ | 17,564,984 | | ¥ | 23,463,849 | | $ | 3,728,030 |

Less : Allowance for doubtful accounts | | | (2,987,733) | | | (3,559,207) | | | (565,501) |

Trade receivables, net | | ¥ | 14,577,251 | | ¥ | 19,904,642 | | $ | 3,162,529 |

The movement of the allowance for doubtful accounts during the years was as follows:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Balance at the beginning of the year | | ¥ | 2,088,870 | | ¥ | 2,987,733 | | $ | 474,703 |

Provision for the year | | | 2,416,346 | | | 4,118,618 | | | 654,382 |

Write-offs | | | (1,517,483) | | | (3,547,144) | | | (563,584) |

Balance at the end of the year | | ¥ | 2,987,733 | | ¥ | 3,559,207 | | $ | 565,501 |

NOTE 5. INVENTORY AND WORK IN PROCESS

The inventory amounts included in the consolidated balance sheets as of December 31, 2010 and 2011 comprised of:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Work in process | | ¥ | 15,665,108 | | ¥ | 23,687,248 | | $ | 3,763,525 |

Purchased hardware and software held for resale | | | 3,098,844 | | | 8,822,088 | | | 1,401,689 |

Less: Inventory provision | | | (3,138,266) | | | (4,507,846) | | | (716,225) |

Total inventories, net | | ¥ | 15,625,686 | | ¥ | 28,001,490 | | $ | 4,448,989 |

The movement of inventory provision related to loss making contracts during the years was as follows:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Balance at the beginning of the year | | ¥ | 1,103,382 | | ¥ | 3,138,266 | | $ | 498,620 |

Add: Current year additions | | | 3,138,266 | | | 4,184,469 | | | 664,845 |

Less: Current year reversal | | | (1,103,382) | | | (2,814,889) | | | (447,240) |

Balance at the end of the year | | ¥ | 3,138,266 | | ¥ | 4,507,846 | | $ | 716,225 |

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

NOTE 6. PROPERTY AND EQUIPMENT, NET

Property and equipment included in the consolidated balance sheets as of December 31, 2010 and 2011 comprised of:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Motor vehicles | | ¥ | 1,303,570 | | ¥ | 1,243,443 | | $ | 197,563 |

Leasehold improvements | | | 2,316,999 | | | 2,477,265 | | | 393,598 |

Office equipment | | | 4,929,463 | | | 4,994,735 | | | 793,585 |

Communication equipment | | | 61,963 | | | 61,871 | | | 9,830 |

Software | | | 647,622 | | | 902,188 | | | 143,343 |

Total | | | 9,259,617 | | | 9,679,502 | | | 1,537,919 |

Less: Accumulated depreciation | | | (4,641,786) | | | (5,748,528) | | | (913,349) |

Property and equipment, net | | ¥ | 4,617,831 | | ¥ | 3,930,974 | | $ | 624,570 |

Depreciation expense was RMB1.0 million, RMB1.7 million and RMB2.0 million (US$0.3 million) for the years ended December 31, 2009, 2010, and 2011, respectively.

NOTE 7. GOODWILL AND INTANGIBLE ASSETS, NET

The carrying amount of goodwill included in the consolidated balance sheets as of December 31, 2010 and 2011 were RMB80,625,667 (US$12,810,128). The balance represents the goodwill arising from the Group's acquisition of Royalstone, Health Field and Proadvancer.

The Group completed its annual impairment test of goodwill using a discounted cash flow method and determined that the carrying value of the reporting unit exceeded its fair value. The value of the reporting unit implied by the test was based on management's assessment of the Group's business strategy and the related expected future cash flows based on working capital requirements. The Group has not recognized any impairment loss on goodwill.

The Group completed its annual impairment test of goodwill as of December 31, 2009 arising from its acquisition of 51% equity interest in Wangku using the same method mentioned above and determined that the carrying value of the reporting unit exceeded the fair value of the reporting unit. The value of the reporting unit implied by the test was based on management's current assessment of the time frame for recovery of the retail and consumer goods industries and the related expected future cash flows based on working capital requirements. In addition, the lack of success in implementing new sales capabilities and practices at Wangku to convert more prospects into actual deals due to general economic conditions and competition from existing competitors also attributed to reductions in expected future cash flows. The Group recorded a goodwill impairment loss of RMB762,000, nil and nil for the years ended December 31, 2009, 2010 and 2011, respectively.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Intangible assets included in the consolidated balance sheets as of December 31, 2011 and 2010 comprised of:

| | | Weighted Average Amortization Period | | Gross Carrying Amount | | Accumulated Amortization | | | | Net Book Value |

Customer relationship | | | 4.48 years | | ¥ | 36,270,003 | | ¥ | 32,970,671 | | | ¥ | 3,299,332 | | $ | 524,211 |

Software | | | 5 years | | | 6,588,516 | | | 5,327,401 | | | | 1,261,115 | | | 200,371 |

Internally generated software | | | 4 years | | | 39,803,101 | | | 27,548,572 | | | | 12,254,529 | | | 1,947,049 |

Trademark | | | Indefinite | | | 376,000 | | | - | | | | 376,000 | | | 59,740 |

Balance at December 31, 2011 | | | | ¥ | 83,037,620 | | ¥ | 65,846,644 | | | ¥ | 17,190,976 | | $ | 2,731,371 |

| | Weighted Average Amortization Period | | Gross Carrying Amount | | Accumulated Amortization | | | Net Book Value |

Customer relationship | | 4.48 years | | ¥ | 36,270,003 | | ¥ | 26,426,893 | | ¥ | 9,843,110 |

Software | | 5 years | | | 6,573,943 | | | 4,019,688 | | | 2,554,255 |

Internally generated software | | 4 years | | | 33,658,347 | | | 24,241,241 | | | 9,417,106 |

Trademark | | Indefinite | | | 2,450,000 | | | - | | | 2,450,000 |

Balance at of December 31, 2010 | | | | | ¥ | 78,952,293 | | ¥ | 54,687,822 | | ¥ | 24,264,471 |

Amortization expense for the years ended December 31, 2009, 2010 and 2011 was RMB15.8 million, RMB15.1 million and RMB11.2 million (US$1.8 million), respectively. Unamortized capitalized software costs as of December 31, 2010 and 2011 was RMB3.7 million and RMB8.1 million (US$1.3 million), respectively.

The Group determined the fair value of intangible assets based on the expected future cash flows generated by them. The Group recorded an impairment loss of RMB2.4 million and RMB2.06 million (US$0.33 million) for the years ended December 31, 2010 and 2011, respectively for certain internally generated software which had or were not expected to generate future revenue, or be sellable to a third party, and did not fit the Company's development strategy going forward. In addition, the Group recorded an impairment loss of nil and RMB2.07 million (US$0.33 million) for the years ended December 31, 2010 and 2011, respectively for a trade name acquired during the business combination in 2007 which was not expected to generate sufficient future cashflow as the market is inclined to pursue more advanced technical platform than that under this trade name.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

Estimated aggregate amortization related to the existing intangible assets with definite lives for the each of succeeding five years is as follows:

| | | Chinese Yuan | | | |

| | | (Renminbi) | | | U.S. Dollars |

For the years ending December 31, | | | | |

2012 | | ¥ | 6,514,204 | | $ | 1,035,003 |

2013 | | | 3,297,631 | | | 523,941 |

2014 | | | 2,839,931 | | | 451,220 |

2015 | | | 2,495,640 | | | 396,517 |

2016 | | | 1,496,324 | | | 237,742 |

Thereafter | | | 171,246 | | | 27,207 |

NOTE 8. OTHER PAYABLES

Other payables included in the consolidated balance as of December 31, 2010 and 2011 comprised of:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Social welfare accrual | | ¥ | 7,653,491 | | ¥ | 9,469,618 | | $ | 1,504,571 |

Expenses payable to employees | | | 1,558,915 | | | 1,463,057 | | | 232,456 |

Individual income tax payable | | | 1,426,367 | | | 1,411,652 | | | 224,289 |

Miscellaneous payable | | | 597,754 | | | 180,973 | | | 28,754 |

Total other payables | | ¥ | 11,236,527 | | ¥ | 12,525,300 | | $ | 1,990,070 |

NOTE 9. ACCRUED EXPENSES

Accrued expenses included in the consolidated balance sheets as of December 31, 2010 and 2011 comprised of:

| | Chinese Yuan (Renminbi) | | U.S. Dollars |

| | December 31, | | December 31, |

| | | 2010 | | | 2011 | | 2011 |

Accrued payroll | | ¥ | 13,414,129 | | ¥ | 11,327,859 | | $ | 1,799,815 |

Accrued rental fee | | | - | | | 1,069,196 | | | 169,878 |

Accrued audit fee | | | 1,016,400 | | | 905,175 | | | 143,818 |

Other accruals | | | 1,570,437 | | | 1,161,883 | | | 184,605 |

Total accrued expenses | | ¥ | 16,000,966 | | ¥ | 14,464,113 | | $ | 2,298,116 |

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

NOTE 10. STOCKHOLDERS' EQUITY

Preferred stock

The Company's Articles of Association allows for the issuance of convertible preferred stock in the amount of 10,000,000 shares at a par value of $0.0756 per share with the rights as described in those articles. Holders of the preferred stock have the same voting rights as holders of ordinary stock. All other material rights are to be determined by special resolution of the Company. No shares of convertible preferred stock have been issued as of December 31, 2010 and 2011.

Ordinary shares

During October 2006 the Company closed its initial public offering of 1,133,500 ordinary shares at RMB47.27 per share under the terms of the offering and realized gross proceeds of RMB53,581,679 before cash offering costs of RMB8,738,655. In addition, the Company issued the placement agents warrants to purchase 113,350 ordinary shares at RMB56.19 per share for a period of five years. The Company accounted for the warrants as an additional offering cost. On December 21, 2007, warrants to purchase 20,000 ordinary shares were exercised. The Company received RMB1,060,992 proceeds and recorded RMB1,049,852 additional paid-in capital. On October 3, 2007, $5,000,000 of convertible notes was converted into 200,080 ordinary shares at a conversion price of $24.99 per share; the Company recorded RMB47,305,512 additional paid-in capital for this conversion. In connection with the Royalstone acquisition, the Company issued 71,122 ordinary shares on December 31, 2007 as part of the satisfaction of the purchase obligation.

On January 3, January 7, March 19 and May 5 of 2008, warrants to purchase 20,000, 16,675, 16,675 and, 17,500 ordinary shares were exercised by the placement agents of the initial public offering, respectively. The Company received RMB3,657,908 proceeds and recorded RMB3,619,526 additional paid-in capital. In July and August of 2008, US$4,000,000 of convertible notes was converted into 210,526 ordinary shares at a conversion price of $19 per share; the Company recorded RMB14,834,371 additional paid-in capital for this conversion. In connection with the Royalstone acquisition, the Company issued 66,035 ordinary shares on September 1, 2008 as part of the satisfaction of the purchase obligation, and finally, the Company issued 83,944 and 6,184 ordinary shares on September 1, 2008 and November 25, 2008 to the Proadvancer and Healthfield acquisition, respectively.

On November 18, 2009, in connection with the Healthfield acquisition, the Company issued 6,183 ordinary shares as the final satisfaction of the purchase obligation.

On December 11, 2009, the Company adopted a share incentive plan (the "2009 Plan"), which reserved 332,000 ordinary shares for issuance. Under 2009 Plan, 84,000 and 69,000 restricted shares are granted to members of the board of directors and senior management, respectively. The Company recorded RMB1,711,356 additional paid-in capital for this award. Restricted shares vested over a three year period with the first 25% vested on the grant day. No restricted shares were issued or registered as of December 31, 2011.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

On February 11 and February 12, 2010, in connection with Royalstone acquisition and Proadvancer acquisition, the Company issued 169,584 and 60,405 ordinary shares as the final satisfaction of the purchase obligations, respectively.

On March 29 and April 15, 2010, options to purchase 793 and 330 ordinary shares were exercised by two employees, respectively.

On September 23, 2010, the Company signed a Share Purchase Agreement ("September Agreement") to sell 337,685 ordinary shares to 13 purchasers including board members, management and key employees of the Company for total cash consideration of RMB12.2 million (US$1.8 million). The price of the shares is equal to US$5.37 per share, the average closing price of the Company's ordinary shares for the 20 consecutive trading days ending on, and including, September 23, 2010. 152,604 of the shares was purchased by eFuture Inc., a Cayman Islands holding company controlled by the Company's chairman and Chief Executive Officer, Adam Yan. The remaining 185,081 shares were sold to 12 individuals including a board member (other than independent directors), management and key employees of the Company. The net proceeds from the sale of ordinary shares is used for general corporate purposes. The shares are restricted within 180-day lockup periods. The issuance or register of such shares was completed on January 6, 2011.

Subsequent to the issuance in September Agreement, the Company was contacted by both Capital Ventures International ("Capital Ventures") and Hudson Bay Master Fund Ltd. ("Hudson Bay"), each of which holds Series A Warrants in connection with a financing transaction completed on March 13, 2007. Each of Capital Ventures and Hudson Bay claimed that the September Agreement constituted a dilutive issuance under their outstanding Series A Warrants. While the Company disagreed at the time with this analysis, it recognized that an adverse judicial determination could result in substantial dilution to existing shareholders if the anti-dilution features of the warrants were triggered. Specifically, the investors currently hold 184,077 warrants in the aggregate, exercisable at $28.25 per warrant. If a court determined that the anti-dilution provision was triggered, then these warrants would be exchanged for 968,376 warrants at an exercise price of $5.37 per share.

In order to settle the disagreement with the warrant holders, the Company agreed with each of Capital Ventures and Hudson Bay to exchange the existing Series A Warrants for an equal number of new Series A Warrants and an additional 20,000 ordinary shares. On November 29, 2010, the Company entered into two separate exchange agreements (the "November Agreements") with Capital Ventures and Hudson Bay, whereby the Company exchanged the outstanding Series A Warrants held by each of Capital Ventures and Hudson Bay for a new Series A Warrants to purchase the same number of ordinary shares and under exactly the same terms prescribed by the Series A Warrants and an additional 20,000 ordinary shares of the Company which were restricted and could not be offered for sale, sold, transferred or assigned prior to May 28, 2011, respectively. The issuance or register of such shares was completed on January 6, 2011.

EFUTURE INFORMATION TECHNOLOGY INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The fair value of the ordinary shares of RMB1.4 million was recorded as additional paid-in capital and finance cost in the consolidated financial statements for the year ended December 31, 2010.

NOTE 11. SHARE-BASED AWARDS PLAN

On April 18, 2001, the Company adopted the 2001 Option Plan (the "2001 Plan"), under which 59,063 stock options were granted to key employees, each with an exercise price of $4.71, a contractual life of 11 years and evenly vest over a five-year period.

Under the 2001 Plan, the Company's board of directors may amend or terminate the Plan at any time if required under the Plan, subject to shareholders' approval.

On January 31, 2007, the Company adopted the 2005 Option Plan Set One (the "2005 Plan I"), under which 65,875 stock options were granted to key employees (including directors and senior management who are key employees), each with an exercise price of $25.42, a contractual life of 10 years and evenly vest over a five-year period.

On September 17, 2007, the Company adopted the 2005 Option Plan Set Two (the "2005 Plan II"), under which 65,800 stock options were granted to key employees, each with an exercise price of $11.71, a contractual life of 10 years and evenly vest over a five-year period.

Under the 2005 Plan I and Plan II, the Company's board of directors may amend or terminate the Plan at any time if required under the Plan, subject to shareholders' approval.

On December 11, 2009, the Company adopted a share incentive plan (the "2009 Plan"), which provided for the granting of share incentives, including Incentive Stock Option (ISO) and restricted shares to the key employees. Under the 2009 Plan, 175,000 stock options were granted to the key employees with an exercise price of $6.55 and a contractual life of 10 years, 84,000 and 69,000 restricted shares are granted to members of the board of directors and senior management, receptively, with no cash consideration. Pursuant to the 2009 Plan, options and restricted shares evenly vest over a three-year period with the first 25% vested on the grant day.

The 2009 Plan is administered by the Company's Nominee and Compensation Committee. The Nominee and Compensation Committee has the authority to determine the individuals who will receive grants, the type of grant, the number of shares subject to the grant, the terms of the grant, the time the grants will be made, the duration of any exercise or restriction period, and to deal with any other matters arising under the Plan. The Company's board of directors may amend or terminate the Plan at any time if required under the Plan, subject to shareholders' approval.