As filed with the Securities and Exchange Commission on November 19, 2009

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEWPAGE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2621 | | 05-0616156 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

NewPage Corporation

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(877) 855-7243

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Co-Registrants

See next page

c/o NewPage Corporation

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(877) 855-7243

(Address, including zip code, and telephone number, including area code, of co-registrant’s principal executive offices)

Douglas K. Cooper, Esq.

General Counsel

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(877) 855-7243

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael R. Littenberg, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, NY 10022

Ph: (212) 756-2000

Fax: (212) 593-5955

Approximate Date of Commencement of Proposed Offer to the Public:

As soon as practicable after this registration statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer x (Do not check if a small reporting company) | | Small reporting company ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

| Title of Securities to be Registered | | Amount to be

Registered | | Proposed Maximum

Offering Price Per

Unit(1) | | Proposed Maximum

Aggregate Offering

Price(1) | | Amount of

Registration Fee(2) |

11.375% Senior Secured Notes due 2014 | | $1,700,000,000 | | 100% | | $1,700,000,000 | | $94,860 |

Guarantees related to the 11.375% Senior Secured Notes due 2014(3) | | n/a | | n/a | | n/a | | n/a |

| |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 of the Securities Act. |

| (2) | Calculated pursuant to Rule 457(f) under the Securities Act. |

| (3) | Pursuant to Rule 457(n) of the Securities Act, no additional fee is required |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Co-Registrants

| | | | | | |

Exact Name of Co-Registrant as specified in Its Charter | | State or Other

Jurisdiction of

Incorporation or

Organization | | Primary

Standard

Industrial

Classification

Code Number | | I.R.S. Employer

Identification

Number |

Chillicothe Paper Inc. (Guarantor) | | Delaware | | 2621 | | 05-0616154 |

Escanaba Paper Company (Guarantor) | | Michigan | | 2621 | | 31-0735598 |

Luke Paper Company (Guarantor) | | Delaware | | 2621 | | 11-3666265 |

NewPage Canadian Sales LLC (Guarantor) | | Delaware | | 2621 | | 27-0015384 |

NewPage Consolidated Papers Inc. (Guarantor) | | Delaware | | 2621 | | 16-1708330 |

NewPage Energy Services LLC (Guarantor) | | Delaware | | 4991 | | 30-0261838 |

NewPage Port Hawkesbury Corp. (Guarantor) | | Nova Scotia, Canada | | 2621 | | 98-0400070 |

NewPage Port Hawkesbury Holding LLC (Guarantor) | | Delaware | | 2621 | | 16-1708330 |

NewPage Wisconsin System Inc. (Guarantor) | | Wisconsin | | 2621 | | 39-2003332 |

Rumford Cogeneration, Inc. (Guarantor) | | Delaware | | 4991 | | 82-0378864 |

Rumford Paper Company (Guarantor) | | Delaware | | 2621 | | 31-1480427 |

Upland Resources, Inc. (Guarantor) | | West Virginia | | 4991 | | 22-2092996 |

Wickliffe Paper Company LLC (Guarantor) | | Delaware | | 2621 | | 81-0668293 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 19, 2009

PRELIMINARY PROSPECTUS

NEWPAGE CORPORATION

$1,700,000,000

OFFER TO EXCHANGE

$1,700,000,000 in Aggregate Principal Amount of 11.375% Senior Secured Notes due 2014, Series B

for all outstanding

$1,700,000,000 in Aggregate Principal Amount of 11.375% Senior Secured Notes due 2014, Series A

The exchange offer will expire at 12:00 midnight, New York City time,

on , 2010, which is 20 business days after the commencement of the exchange offer, unless extended.

The Offering:

Offered securities: the securities offered by this prospectus are 11.375% senior secured notes due 2014, Series B, or the New Notes, which are being issued in exchange for 11.375% senior secured notes due 2014, Series A, or the Original Notes, sold by us in our private placement that we consummated on September 30, 2009. The New Notes are substantially identical to the Original Notes and are governed by the same indenture governing the Original Notes. Unless indicated otherwise, the New Notes and the Original Notes are collectively referred to as the “notes.”

Expiration of offering: the exchange offer expires at 12:00 midnight, New York City time, on , 2010, which is 20 business days after the commencement of the exchange offer, unless extended.

The New Notes:

Maturity: The New Notes will mature on the earlier of (i) December 31, 2014 or (ii) the date that is 31 days prior to the maturity date of (a) any NewPage Corporation floating-rate senior secured notes due 2012 (the “Floating Rate Notes”) or NewPage Corporation 10% senior secured notes due 2012 (the “10% Notes” and, together with the Floating Rate Notes, the “Second Lien Notes”) then outstanding; (b) any NewPage Corporation 12% senior subordinated notes due 2013 (the “12% Senior Subordinated Notes”) or NewPage Holding Corporation floating rate senior unsecured notes (the “NewPage Holding PIK Notes” and, together with the 12% Senior Subordinated Notes, the “Subordinated Notes”) then outstanding; or (c) any refinancing of any indebtedness included in items (a) or (b) of this clause (ii) then outstanding.

Redemption: we can redeem all or a portion of the notes at any time on or after March 31, 2012 at the redemption prices set forth in this prospectus. In addition, on or before March 31, 2012, we may redeem up to 35% of the aggregate principal amount of the notes with the net proceeds of certain equity offerings at the redemption prices set forth in this prospectus. Prior to March 31, 2012, we may also redeem some or all of the notes at a price equal to 100% of the principal amount of the notes plus a “make-whole” premium and may, but not more than once in any twelve-month period, redeem up to 10% of the original aggregate principal amount of the notes at a redemption price of 103%, plus accrued and unpaid interest and special interest, if any, to the redemption date, subject to certain rights of holders of the notes. In addition, we are required to offer to repurchase the notes under some circumstances involving changes of control events.

Ranking and Subordination: The New Notes will be secured on a first-priority basis by substantially all of our, our domestic restricted subsidiaries’ and NewPage Port Hawkesbury Corp.’s (“NewPage Port Hawkesbury”) present and future property and assets, other than cash, deposit accounts, accounts receivables, inventory, the capital stock of our subsidiaries and intercompany debt, if any, and will be secured on a second-priority basis by substantially all of our, our domestic restricted subsidiaries’ and NewPage Port Hawkesbury’s present and future cash, deposit accounts, accounts receivables and inventory. The New Notes will bepari passu, secured equally and ratably with, our existing and future first-priority obligations (other than with respect to any capital stock of our subsidiaries and intercompany debt that may secure other first priority obligations).

See “Risk Factors,” beginning on page 14, for a discussion of some factors that should be considered by holders in connection with a decision to tender original notes in the exchange offer.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2009.

TABLE OF CONTENTS

i

INFORMATION ABOUT THE TRANSACTION

THIS PROSPECTUS INCORPORATES IMPORTANT INFORMATION ABOUT US THAT IS NOT INCLUDED IN OR DELIVERED WITH THIS PROSPECTUS. SUCH INFORMATION IS AVAILABLE WITHOUT CHARGE TO THE HOLDERS OF OUR ORIGINAL NOTES BY CONTACTING US AT OUR ADDRESS, WHICH IS 8540 GANDER CREEK DRIVE, MIAMISBURG, OHIO 45342, OR BY CALLING US AT (877) 855-7243. TO OBTAIN TIMELY DELIVERY OF THIS INFORMATION, YOU MUST REQUEST THIS INFORMATION NO LATER THAN FIVE BUSINESS DAYS BEFORE , 2010, WHICH IS 20 BUSINESS DAYS AFTER THE COMMENCEMENT OF THE EXCHANGE OFFER, UNLESS EXTENDED. ALSO SEE “AVAILABLE INFORMATION.”

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that is important to you. We urge you to read this entire prospectus, including the “Risk Factors” section and the financial statements and related notes included elsewhere in this prospectus.

In this prospectus, unless otherwise noted or the context otherwise requires, (i) the terms “we,” “our,” “ours,” “us,” “NewPage” and “Company” refer collectively to NewPage Corporation and its consolidated subsidiaries; (ii) the term “NewPage Holding” refers to NewPage Holding Corporation, our direct parent; (iii) the term “NewPage Group” refers to NewPage Group Inc., the direct parent of NewPage Holding; (iv) the term “predecessor” refers to the printing and writing papers business of MeadWestvaco Corporation prior to its acquisition by NewPage Corporation and (v) the term “SENA” refers to Stora Enso North America Inc. All references to the “Acquisition” refer to the acquisition of SENA by us on December 21, 2007. Following the Acquisition, SENA changed its name to NewPage Consolidated Papers Inc., or “NPCP.” References to each of SENA and NPCP are to the acquired business.

Our Company

We believe that we are the largest coated paper manufacturer in North America, based on production capacity. Coated paper is used primarily in media and marketing applications, such as high-end advertising brochures, direct mail advertising, coated labels, magazines, magazine covers and inserts, catalogs and textbooks. We currently operate 20 paper machines at ten paper mills located in Kentucky, Maine, Maryland, Michigan, Minnesota, Wisconsin and Nova Scotia, Canada. These mills, along with our distribution centers, are strategically located near major print markets, such as New York, Chicago, Minneapolis and Atlanta.

Acquisition of SENA

On December 21, 2007, NewPage acquired all of the issued and outstanding common stock of SENA from Stora Enso Oyj, or “SEO.” We acquired SENA in order to expand our business platform, serve our customers more efficiently and capture significant synergies between the two businesses. In connection with the Acquisition, SEO acquired approximately 20% of the equity in NewPage Group.

During 2008, we announced actions being taken to integrate the existing NewPage operations and the former SENA facilities and services that included the shutdown in 2008 and early 2009 of six of our less efficient, higher cash cost paper machines, as well as selected headcount reductions, all of which have been completed. We anticipate generating annualized synergies as a result of the Acquisition of approximately $265 million. We completed our integration activities during the third quarter of 2009, at which time we had achieved approximately $200 million of annual synergies. Full realization of the synergies from anticipated incremental available capacity has been delayed in part by the recent industry-wide slowdown in both demand and volume. The remaining synergies are expected to be realized when our paper machines return to running at historical operating patterns with a beneficial grade mix. For further information concerning the actions taken to integrate the SENA operations with the existing NewPage business, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview—Restructuring.”

1

Our Strategy

The key elements of our strategy include the following:

| | • | | Maintain core focus on coated paper business. |

| | • | | Continue to reduce costs through synergies and further productivity improvements. |

| | • | | Enhance product mix to improve margins and earnings. |

| | • | | Further improve cash flow and return on capital. |

Our Strengths

We believe that our core strengths include the following:

| | • | | Largest North American manufacturer of coated paper products. |

| | • | | Well positioned to benefit from up-turn in the industry cycle. |

| | • | | Significant, well-invested asset base. |

| | • | | Attractive cost position coupled with further profit improvement initiatives. |

| | • | | Strong relationships with key customers. |

| | • | | Efficient and integrated supply chain. |

| | • | | Experienced management team with proven track record. |

2

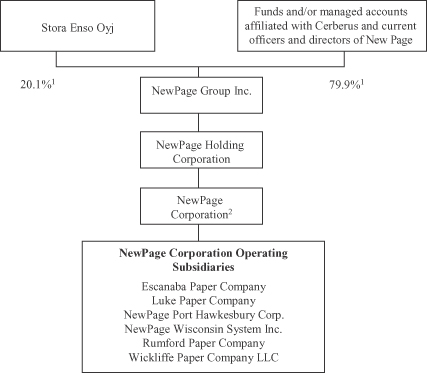

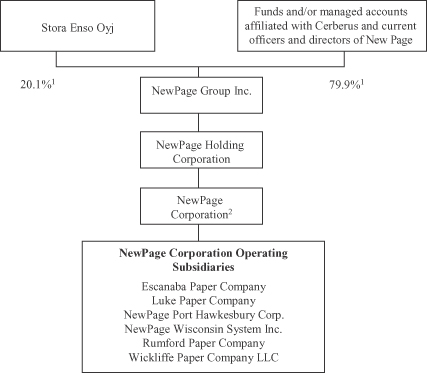

Organizational Chart

The following chart shows our organizational structure as of the date of this prospectus. All entities are 100% directly or indirectly owned unless otherwise indicated and all of the subsidiaries of NewPage Corporation shown below will be guarantors of the New Notes.

| (1) | Excludes NewPage Group common stock that may be issued upon exercise of options outstanding or that may be granted under the NewPage Group Inc. 2008 Incentive Plan, or “NewPage Group Equity Incentive Plan.” |

| (2) | Issuer of the Original Notes and the New Notes. |

3

Our Sponsor

Established in 1992, Cerberus Capital Management, L.P., along with its affiliates, which we collectively refer to as “Cerberus,” is one of the world’s leading private investment firms. Cerberus currently holds controlling or significant minority investments in companies around the world. Cerberus invests in divestitures, turnarounds, recapitalizations, financial restructurings, public-to-privates and management buyouts in a variety of sectors. Cerberus formed NewPage in 2005 to effect the acquisition of the coated paper operations of MeadWestvaco Corporation.

Our Corporate Information

NewPage Corporation is a Delaware corporation. Our principal executive offices are located at 8540 Gander Creek Drive, Miamisburg, Ohio 45342, and our telephone number at those offices is (877) 855-7243.

4

THE EXCHANGE OFFER

Expiration Date | 12:00 midnight, New York City time, on , 2010, which is 20 business days after the commencement of the exchange offer, unless we extend the exchange offer. |

Exchange and Registration Rights | In an exchange and registration rights agreements dated September 30, 2009, the holders of our $1.7 billion of 11.375% senior secured notes due 2014, series A, or the Original Notes, were granted exchange and registration rights. This exchange offer is intended to satisfy these rights. You have the right to exchange the Original Notes that you hold for our 11.375% senior secured notes due 2014, Series B, or the New Notes, with substantially identical terms. Once the exchange offer is complete, you will no longer be entitled to any exchange rights with respect to your Original Notes. |

Accrued Interest on the New Notes and Original Notes | The New Notes will bear interest from December 31, 2009. Holders of Original Notes which are accepted for exchange will be deemed to have waived the right to receive any payment in respect of interest on those Original Notes accrued to the date of issuance of the New Notes. |

Conditions to the Exchange Offer | The exchange offer is conditioned upon some customary conditions, which we may waive. All conditions to which the exchange offer is subject must be satisfied or waived on or before the expiration of this offer. |

Procedures for Tendering Original Notes | Each holder of Original Notes wishing to accept the exchange offer must: |

| | • | | complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal; or |

| | • | | arrange for DTC to transmit required information in accordance with DTC’s procedures for transfer to the exchange agent in connection with a book-entry transfer. |

You must mail or otherwise deliver this documentation together with the Original Notes to the exchange agent. Original Notes tendered in the exchange offer must be in denominations of principal amount of $2,000 and integral multiples of $1,000 in excess of $2,000.

Special Procedures for Beneficial Holders | If you beneficially own Original Notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your Original Notes in the exchange offer, you should contact the registered holder promptly and instruct them to tender on your behalf. If you wish to tender on your own behalf, you must, before completing and executing the letter of transmittal for the |

5

| | exchange offer and delivering your Original Notes, either arrange to have your Original Notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

Guaranteed Delivery Procedures | You must comply with the applicable procedures for tendering if you wish to tender your Original Notes and: |

| | • | | time will not permit your required documents to reach the exchange agent by the expiration date of the exchange offer; or |

| | • | | you cannot complete the procedure for book-entry transfer on time; or |

| | • | | your Original Notes are not immediately available. |

Withdrawal Rights | You may withdraw your tender of Original Notes at any time on or prior to 12:00 midnight, New York City time, on the expiration date, unless previously accepted for exchange. |

Failure to Exchange Will Affect You Adversely | If you are eligible to participate in the exchange offer and you do not tender your Original Notes, you will not have further exchange rights and you will continue to be restricted from transferring your Original Notes. Accordingly, the liquidity of the Original Notes will be adversely affected. |

Federal Tax Considerations | We believe that the exchange of the Original Notes for the New Notes pursuant to the exchange offer will not be a taxable event for United States federal income tax purposes. A holder’s holding period for New Notes will include the holding period for Original Notes, and the adjusted tax basis of the New Notes will be the same as the adjusted tax basis of the Original Notes exchanged. See “Certain Material U.S. Federal Income Tax Considerations.” |

Exchange Agent | The Bank of New York Mellon, trustee under the indenture under which the New Notes will be issued, is serving as exchange agent. |

Use of Proceeds | We will not receive any proceeds from the exchange offer. |

6

SUMMARY TERMS OF NEW NOTES

The summary below describes the principal terms of the New Notes. Some of the terms and conditions described below are subject to important limitations and exceptions. See “Description of New Notes” for a more detailed description of the terms and conditions of the New Notes.

Issuer | NewPage Corporation. |

Securities | The form and terms of the New Notes will be the same as the form and terms of the Original Notes except that: |

| | • | | the New Notes will bear a different CUSIP number from the Original Notes; |

| | • | | the New Notes will have been registered under the Securities Act of 1933, or the Securities Act, and, therefore, will not bear legends restricting their transfer; and |

| | • | | you will not be entitled to any exchange or registration rights with respect to the New Notes. |

The New Notes will evidence the same debt as the Original Notes. They will be entitled to the benefits of the indenture governing the Original Notes and will be treated under the indenture as a single class with the Original Notes.

Interest Rate | The New Notes will bear interest at a rate of 11.375% per annum. Interest will be computed on the basis of a 360-day year composed of twelve 30-day months. |

Maturity Date | The earlier of (i) December 31, 2014 or (ii) the date that is 31 days prior to the maturity date of (a) any Second Lien Notes then outstanding; (b) any Subordinated Notes then outstanding or (c) any refinancing of any indebtedness included in items (a) or (b) of this clause (ii) then outstanding. See “Description of New Notes—Principal, Maturity and Interest.” |

Interest Payment Dates | December 31 and June 30 of each year, commencing on June 30, 2010. Interest payments will be paid to the holders of record on the December 15 and June 15 immediately preceding the applicable interest payment date. |

Original Issue Discount | The Original Notes were issued with original issue discount (that is, the difference between the stated principal amount at maturity and the issue price of the Original Notes) for federal income tax purposes. The New Notes should be treated as a continuation of the Original Notes for federal income tax purposes. Thus, original issue discount will accrue on Original Notes and New Notes from the issue date of the Original Notes and be included as interest income periodically in a holder’s gross income for federal income tax purposes in advance of receipt of the cash payments to which the income is attributable. See “Certain Material U.S. Federal Income Tax Considerations.” |

7

Guarantees | The New Notes will be unconditionally guaranteed by all of our domestic restricted subsidiaries and NewPage Port Hawkesbury, a Canadian entity. |

Ranking and Security | The New Notes and the related guarantees will be senior secured obligations: |

| | • | | secured on a first-priority basis by substantially all of our assets and those of our guarantors (other than cash, deposit accounts, accounts receivables, inventory, the capital stock of our subsidiaries and intercompany debt); see “Description of New Notes—Security;” |

| | • | | secured on a second-priority basis by our and our guarantors’ cash, deposit accounts, accounts receivables and inventory; see “Description of New Notes—Security;” |

| | • | | secured equally and ratably with, all existing and future first-priority obligations (other than with respect to any capital stock of our subsidiaries and intercompany debt that may secure other first-priority obligations); |

| | • | | effectively subordinated to any permitted liens other than liens securing second-priority obligations, to the extent of the value of our assets and those of our guarantors subject to those permitted liens; |

| | • | | effectively senior to all existing and future second-priority obligations, including our Second Lien Notes and any unsecured obligations, to the extent of the value of substantially all of our assets and those of our guarantors (other than cash, deposit accounts, accounts receivables, inventory, the capital stock of our subsidiaries and intercompany debt, if any); |

| | • | | junior to our revolving credit facility (the “Revolver”) to the extent of the value of our cash, deposit accounts, accounts receivables, inventory and intercompany debt, which secure the Revolver on a first lien basis; and |

| | • | | senior in right of payment to any of our future subordinated indebtedness or that of our guarantors, including guarantees of the 12% Senior Subordinated Notes. |

As of September 30, 2009:

| | • | | we had $84 million of senior secured indebtedness outstanding under our Revolver; this excludes up to a maximum of $323 million of additional borrowings (after deducting for $93 million in outstanding letters of credit and not taking into account any borrowing base limitations) that would be available under the Revolver; the Revolver is secured by our cash, deposit accounts, accounts receivables and inventory; |

| | • | | we had $1,700 million of senior secured indebtedness outstanding under the Original Notes; |

8

| | • | | we had $1,031 million of senior secured indebtedness outstanding under the Second Lien Notes; the Second Lien Notes are secured by a second lien on substantially all of our and our domestic restricted subsidiaries’ present and future property and assets (other than cash, deposit accounts, accounts receivables, inventory, the capital stock of our subsidiaries and intercompany debt, if any); |

| | • | | we had $200 million of senior subordinated indebtedness, consisting solely of the 12% Senior Subordinated Notes; and |

| | • | | we had $146 million of capital lease obligations outstanding. |

Optional Redemption | At any time on or after March 31, 2012, we may redeem some or all of the New Notes at the applicable redemption prices described under “Description of New Notes—Optional Redemption,” plus accrued and unpaid interest and special interest, if any, to the redemption date. |

In addition, at any time prior to March 31, 2012, we may, on one or more occasions, redeem some or all of the New Notes at any time at a redemption price equal to 100% of the principal amount of the notes redeemed, plus a “make-whole” premium as of, and accrued and unpaid interest and special interest, if any, to, the applicable redemption date.

Optional Redemption after Equity Offerings | At any time, on one or more occasions before March 31, 2012, we can choose to redeem up to 35% of the outstanding aggregate principal amount of the New Notes with the net cash proceeds of any one or more qualified public equity offerings by the Company or a contribution to the Company’s equity from NewPage Holding or NewPage Group from one or more qualified public equity offerings, at 111.375% of the principal amount of the New Notes plus accrued and unpaid interest and special interest, if any, to the redemption date. See “Description of New Notes—Optional Redemption.” |

Additional Optional Redemption | At any time prior to March 31, 2012, but not more than once in any twelve-month period, we may redeem up to 10% of the original aggregate principal amount of the New Notes at a redemption price of 103%, plus accrued and unpaid interest and special interest, if any, to the redemption date, subject to certain rights of holders of the New Notes. See “Description of New Notes—Optional Redemption.” |

Mandatory Offer to Repurchase | If we sell certain assets without applying the proceeds in a specified manner, or experience certain change of control events, each holder of New Notes may require us to repurchase all or a portion of its New Notes at the purchase prices set forth in this prospectus, plus accrued and unpaid interest and special interest, if any, to the repurchase date. See “Description of New Notes—Repurchase of New Notes at the Option of Holders.” Our Revolver may restrict us from repurchasing any of the New Notes, including any repurchase we may be required to make as a result of a change of control or certain asset sales. See “Risk Factors—Risks Relating to the New Notes and our |

9

| | Indebtedness—We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture governing the New Notes.” |

Covenants | The indenture governing the New Notes will contain covenants that will impose significant restrictions on our business. The restrictions that these covenants place on us and our restricted subsidiaries include limitations on our ability and the ability of our restricted subsidiaries to, among other things: |

| | • | | incur additional indebtedness or issue disqualified stock or preferred stock; |

| | • | | pay dividends or make other sorts of restricted payments; |

| | • | | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| | • | | enter into transactions with our affiliates; and |

| | • | | designate our subsidiaries as unrestricted subsidiaries. |

These covenants are subject to a number of important exceptions and qualifications, which are described under “Description of New Notes.”

Exchange Offer; Registration Rights | You have the right to exchange the Original Notes for New Notes with substantially identical terms. This exchange offer is intended to satisfy that right. The New Notes will not provide you with any further exchange or registration rights. |

Resales Without Further Registration | We believe that the New Notes issued in the exchange offer in exchange for Original Notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, if: |

| | • | | you are acquiring the New Notes issued in the exchange offer in the ordinary course of your business; |

| | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in the distribution of the New Notes issued to you in the exchange offer; and |

| | • | | you are not our “affiliate,” as defined under Rule 405 of the Securities Act. |

Each of the participating broker-dealers that receives New Notes for its own account in exchange for Original Notes that were acquired by it as a result of market-making or other activities must acknowledge that it will deliver a prospectus in connection with the resale of the New Notes. We do not intend to list the New Notes on any securities exchange.

10

Summary Historical Consolidated Financial Data

The following tables, as indicated below, set forth historical consolidated financial data for NewPage and its subsidiaries for the years ended December 31, 2006, 2007 and 2008, and the nine months ended September 30, 2008 and 2009. We have derived the historical consolidated financial data for the years ended December 31, 2006, 2007 and 2008 from the audited consolidated financial statements of NewPage and its subsidiaries included elsewhere in this prospectus. We have derived the historical consolidated financial data for the nine months ended September 30, 2008 and 2009 from the unaudited financial statements of NewPage and its subsidiaries included elsewhere in this prospectus.

The following summary historical consolidated financial data should be read in conjunction with “Historical Selected Financial Information and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, and the accompanying notes thereto, included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2007 | | | Year Ended

December 31,

2008 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

| | | (dollars in millions, except volume and price per ton) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 2,038 | | | $ | 2,168 | | | $ | 4,356 | | | $ | 3,379 | | | $ | 2,249 | |

Cost of sales | | | 1,825 | | | | 1,895 | | | | 3,979 | | | | 3,066 | | | | 2,261 | |

Selling, general and administrative expenses | | | 112 | | | | 124 | | | | 217 | | | | 179 | | | | 142 | |

Interest expense(1) | | | 146 | | | | 154 | | | | 277 | | | | 208 | | | | 328 | |

Other (income) expense net | | | (25 | ) | | | (2 | ) | | | (3 | ) | | | (5 | ) | | | (218 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before income taxes | | | (20 | ) | | | (3 | ) | | | (114 | ) | | | (69 | ) | | | (264 | ) |

Income tax (benefit) | | | (4 | ) | | | 4 | | | | — | | | | 4 | | | | (15 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (16 | ) | | | (7 | ) | | | (114 | ) | | | (73 | ) | | | (249 | ) |

Income (loss) from discontinued operations | | | (16 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (32 | ) | | | (7 | ) | | | (114 | ) | | | (73 | ) | | | (249 | ) |

Net income (loss)—noncontrolling interests | | | — | | | | 1 | | | | 3 | | | | 2 | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to the company | | $ | (32 | ) | | $ | (8 | ) | | $ | (117 | ) | | $ | (75 | ) | | $ | (253 | ) |

| | | | | | | | | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

EBITDA(2) | | $ | 262 | | | $ | 284 | | | $ | 477 | | | $ | 357 | | | $ | 268 | |

Capital expenditures | | | 88 | | | | 102 | | | | 165 | | | | 114 | | | | 45 | |

| | | | | |

Selected Operating Data: | | | | | | | | | | | | | | | | | | | | |

Weighted average coated paper price per ton | | $ | 893 | | | $ | 886 | | | $ | 983 | | | $ | 980 | | | $ | 930 | |

Coated paper volume sold (in thousands of short tons) | | | 2,116 | | | | 2,261 | | | | 3,564 | | | | 2,805 | | | | 1,897 | |

11

| | | |

| | | As of September 30, 2009 |

| | | (dollars in millions) |

Balance Sheet Data: | | | |

Working capital(3) | | $ | 516 |

Property, plant and equipment, net | | | 3,014 |

Total assets | | | 4,145 |

Long-term debt, less current portion | | | 3,056 |

Total debt | | | 3,056 |

Total equity | | | 15 |

| (1) | Includes a loss on extinguishment of debt of $85 million and a reclassification adjustment of $48 million of unrealized losses on our interest rate swaps from accumulated other comprehensive income (loss) as the hedged forecasted cash flows are no longer probable of occurring as a result of the refinancing in 2009. |

| (2) | EBITDA is defined as net income (loss) attributable to the company before interest expense, income taxes (benefit), including amount in discontinued operations, depreciation and amortization. EBITDA is not a measure of our performance under GAAP and is not intended to represent net income (loss) attributable to the company, as defined under GAAP, and should not be used as an alternative to net income (loss) attributable to the company as an indicator of performance. EBITDA is included in this prospectus because it is a primary component of certain covenants under our Revolver and is a basis upon which our management assesses performance. For a more detailed discussion of the covenants, see “Description of Certain Indebtedness.” In addition, our management believes EBITDA is useful to investors because it and similar measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies with substantial financial leverage. |

The use of EBITDA instead of net income (loss) attributable to the company has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| | • | | EBITDA does not reflect our current cash expenditure requirements, or future requirements, for capital expenditures or contractual commitments; |

| | • | | EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| | • | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized often will have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and |

| | • | | our measure of EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation. |

Because of these limitations, EBITDA should not be considered as discretionary cash available to us to reinvest in the growth of our business.

12

The following table presents a reconciliation of our net income (loss) attributable to the company to our EBITDA:

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2007 | | | Year Ended

December 31

2008 | | | Nine Months

Ended

September 30,

2008 | | | Nine Months

Ended

September 30,

2009 | |

| | | (dollars in millions) | |

Net income (loss) attributable to the company | | $ | (32 | ) | | $ | (8 | ) | | $ | (117 | ) | | $ | (75 | ) | | $ | (253 | ) |

Income tax provision (benefit) | | | (4 | ) | | | 4 | | | | — | | | | 4 | | | | (15 | ) |

Interest expense | | | 146 | | | | 154 | | | | 277 | | | | 208 | | | | 328 | |

Depreciation and amortization | | | 152 | | | | 134 | | | | 317 | | | | 220 | | | | 208 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 262 | | | $ | 284 | | | $ | 477 | | | $ | 357 | | | $ | 268 | |

| | | | | | | | | | | | | | | | | | | | |

| (3) | “Working Capital” is defined as current assets net of current liabilities. |

13

RISK FACTORS

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding whether to tender the Original Notes in exchange for the New Notes. The risks described below are what we believe to be the risks which could materially and adversely affect our business, financial condition or results of operations. If that occurs, the value of the New Notes may decline and you may lose all or part of your investment.

Risks Related to the New Notes and our Indebtedness

Our substantial level of indebtedness could adversely affect our business, financial condition or results of operations and prevent us from fulfilling our obligations under the New Notes.

We have substantial indebtedness. As of September 30, 2009, we had approximately $3,161 million of total indebtedness, of which $84 million consisted of borrowings under our Revolver (excluding letters of credit), and we have up to $323 million available for borrowing under our Revolver (after deducting for $93 million in outstanding letters of credit and not taking into account any borrowing base limitations). All of the borrowings under our Revolver would effectively rank senior to the New Notes and the guarantees to the extent of the value of our cash, deposit accounts, accounts receivable, inventory, intercompany debt, if any and certain other assets, which secure our Revolver on a first lien basis (the “ABL Collateral”). In addition, subject to restrictions in our existing debt instruments, we may incur additional indebtedness. If additional debt is added to our and our subsidiaries’ current debt levels, the related risks that we now face could intensify. For the nine months ended September 30, 2009, earnings were insufficient to meet fixed charges by $269 million.

Our substantial indebtedness could have important consequences to you, including the following:

| | • | | it may be more difficult for us to satisfy our obligations with respect to the New Notes; |

| | • | | our ability to obtain additional financing for working capital, debt service requirements, general corporate or other purposes may be impaired; |

| | • | | we must use a substantial portion of our cash flow to pay interest and principal on the New Notes and our other indebtedness, which will reduce the funds available to us for other purposes; |

| | • | | we are more vulnerable to economic downturns and adverse industry conditions; |

| | • | | our ability to capitalize on business opportunities and to react to competitive pressures and changes in our industry as compared to our competitors may be compromised due to our high level of indebtedness; and |

| | • | | our ability to refinance our indebtedness, including the New Notes, may be limited. |

In addition, prior to the repayment of the New Notes, we will be required to repay or refinance our Revolver. We cannot assure you that we or NewPage Holding will be able to refinance any of our debt on commercially reasonable terms or at all. If we were unable to make payments on or refinance our debt or obtain new financing under these circumstances, we would have to consider other options, such as:

| | • | | negotiations with our lenders to restructure the applicable debt; |

| | • | | cash equity contributions from our controlling equity owner or others; and/or |

| | • | | commencement of voluntary bankruptcy proceedings. |

14

Our and NewPage Holding’s debt instruments may restrict, or market or business conditions may limit, our ability to use some of our options.

A significant portion of our debt bears interest at variable rates. If market interest rates increase, it could adversely affect our cash flow, compliance with our debt covenants or the amount of our cash interest payments.

As of September 30, 2009, we had approximately $309 million of indebtedness consisting of borrowings that bear interest at variable rates, representing approximately 10% of our total indebtedness. If market interest rates increase, variable-rate debt will create higher debt service requirements, which could adversely affect our cash flow and compliance with our debt covenants. As of September 30, 2009, weighted-average interest rates were (i) 6.7% on the Floating Rate Notes and (ii) 5.8% on borrowings under the Revolver. Each one-eighth percentage-point change in LIBOR would result in a $0.3 million change in annual interest expense on the Floating Rate Notes and, assuming the entire Revolver were drawn, a $0.6 million change in interest expense on the Revolver, in each case, without taking into account any interest rate derivative agreements. While we may from time-to-time enter into agreements limiting our exposure to higher market interest rates, these agreements may not offer complete protection from this risk.

Servicing our indebtedness will require a significant amount of cash. Our ability to generate sufficient cash depends on numerous factors beyond our control, and we may be unable to generate sufficient cash flow to service our debt obligations.

Our ability to make payments on and to refinance our indebtedness will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, political, financial, competitive, legislative, regulatory and other factors that are beyond our control.

During 2008, we expended approximately $267 million to service our indebtedness as compared to approximately $202 million during 2007 (without giving effect to the repayment of $450 million under our pre-Acquisition credit facility at the closing of the Acquisition). For the nine months ended September 30, 2009, our interest expense was $328 million (including a loss on extinguishment of debt of $85 million and a reclassification adjustment of $48 million of unrealized losses on our interest rate swaps from accumulated other comprehensive income (loss)), compared to $208 million for the nine months ended September 30, 2008. We cannot assure you that our business will generate sufficient cash flow from operations, or that future borrowings will be available to us under the Revolver, in an amount sufficient to enable us to pay our indebtedness or to fund our other liquidity needs. If our cash flows and capital resources are insufficient to allow us to make scheduled payments on our indebtedness, we may need to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance all or a portion of our indebtedness on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, or that we will be able to refinance on commercially reasonable terms or that these measures would satisfy our scheduled debt service obligations. If we are unable to generate sufficient cash flow or refinance our debt on favorable terms it could have a material adverse effect on our financial condition, the value of the outstanding debt and our ability to make any required cash payments under our indebtedness.

Our debt instruments impose significant operating and financial restrictions on us. If we default under any of these debt instruments, we may not be able to make payments on the New Notes.

The indentures and other agreements governing our debt instruments impose significant operating and financial restrictions on us. These restrictions limit our ability to, among other things:

| | • | | incur additional indebtedness or guarantee obligations; |

| | • | | repay indebtedness (including the New Notes) prior to stated maturities; |

15

| | • | | pay dividends or make certain other restricted payments; |

| | • | | make investments or acquisitions; |

| | • | | create liens or other encumbrances; |

| | • | | transfer or sell certain assets or merge or consolidate with another entity; |

| | • | | engage in transactions with affiliates; and |

| | • | | engage in certain business activities. |

In addition to the covenants listed above, our Revolver requires the maintenance of at least $50 million of Revolver borrowing availability through the date of the delivery of the compliance certificate with respect to the fiscal quarter ending March 31, 2011 and limits our ability to make capital expenditures. Subsequent to March 31, 2011, we would have to comply with various other specified financial ratios and tests, including minimum interest and fixed charge coverage ratios and total and senior leverage ratios to the extent that NewPage’s unused borrowing availability under the revolving credit facility is below $50 million for 10 consecutive business days or $25 million for three consecutive business days.

Our ability to comply with these covenants may be affected by events beyond our control, and an adverse development affecting our business could require us to seek waivers or amendments of covenants, alternative or additional sources of financing or reductions in expenditures. We cannot assure you that such waivers, amendments or alternative or additional financings could be obtained on acceptable terms or at all. In addition, the holders of the New Notes will have no control over any waivers or amendments with respect to any debt outstanding other than the New Notes. Therefore, we cannot assure you that even if the holders of the New Notes agree to waive or amend the covenants contained in the indenture relating to the New Notes, the holders of our other debt will agree to do the same with respect to their debt instruments.

A breach of any of the covenants or restrictions contained in any of our existing or future financing agreements, including our inability to comply with the required financial covenants in our Revolver, could result in an event of default under those agreements. Such a default could allow the lenders under our financing agreements, if the agreements so provide, to discontinue lending, to accelerate the related debt as well as any other debt to which a cross acceleration or cross default provision applies, and to declare all borrowings outstanding thereunder to be due and payable. In addition, the lenders could terminate any commitments they had made to supply us with further funds. If the lenders require immediate repayments, we will not be able to repay them and also repay the New Notes in full.

We cannot assure you that the Company will be in compliance with these covenants in the periods required or that the Company will be able to refinance the Revolver in the event it cannot comply with the applicable covenants.

The New Notes are not secured by all of our assets, the collateral securing the New Notes may be diluted under certain circumstances and the liens on the collateral may be subject to limitations.

Our obligation to make payments on the New Notes will be secured only by the Shared Collateral and the ABL Collateral on the basis and as described in this prospectus under the headings “Description of New Notes— Collateral Trust Agreement—Shared Collateral” and “Description of New Notes—Collateral Trust Agreement—ABL Collateral.” In particular, stock of our subsidiaries and intercompany debt, if any, will not constitute collateral for the New Notes. In addition, ABL Collateral (other than intercompany debt, if any) will constitute collateral for the New Notes on a second-priority basis.

The indenture governing the New Notes and our Revolver and our other security documents will permit the incurrence of additional secured indebtedness, including additional debt that shares equally and ratably in the lien in favor of the collateral trustee that secures the New Notes. Any additional debt could consist of additional loans

16

under the Revolver, notes issued under a new indenture or additional notes issued under the indenture governing the New Notes and would be guaranteed by the same guarantors and could have security interests, with the same priority, in all of the assets that secure the New Notes. As a result, the collateral securing the New Notes would be shared by any such additional debt we may issue under the indenture, and an issuance of such additional debt would dilute the value of the collateral compared to the aggregate principal amount of notes issued. We also may acquire additional assets that do not constitute collateral for the New Notes. In addition, certain permitted liens on the collateral securing the New Notes may allow the holder of such lien to exercise rights and remedies with respect to the collateral subject to such lien that could adversely affect the value of such collateral and the ability of the collateral trustee or the holders of the New Notes to realize or foreclose upon such collateral. See “Description of New Notes—Certain Covenants—Liens.”

The lien priority provisions in the Intercreditor Agreement (as defined below) will limit the ability of holders of New Notes to exercise rights and remedies with respect to the ABL Collateral.

The rights of the holders of New Notes with respect to the ABL Collateral will be junior to the rights of the holders of obligations under our Revolver and will be substantially limited by the terms of the lien priority provisions in the Intercreditor Agreement, dated as of May 2, 2005, by and among NewPage, NewPage Holding, certain subsidiaries of NewPage, JPMorgan Chase Bank. N.A., as revolving loan collateral agent and The Bank of New York Mellon, as collateral trustee (the “Intercreditor Agreement”). Under the terms of the Intercreditor Agreement, at any time that any obligations under our Revolver are outstanding, almost any action in respect of the ABL Collateral, including the exercise of rights or remedies or objection to actions taken with respect thereto, may only be taken by the collateral agent under our Revolver or the holders of the obligations under our Revolver. The collateral trustee, on behalf of the holders of obligations with junior liens on the ABL Collateral (including the holders of New Notes), will not have the ability to institute or contest such actions, even if the rights of such holders are or would be adversely affected; provided that the collateral trustee may take certain actions to create, perfect, preserve or protect (but not enforce) its junior lien in the ABL Collateral and may also take certain actions that would be available to a holder of an unsecured claim.

In addition, the Intercreditor Agreement contains certain provisions benefiting holders of obligations under our Revolver that prevent the collateral trustee from objecting to a number of important matters regarding the ABL Collateral following the filing of a bankruptcy. After such filing, the value of the ABL Collateral could materially deteriorate and the holders of New Notes would be unable to raise an objection. See “Description of New Notes—Intercreditor Agreement.”

Security over certain collateral may not be in place by closing or may not be perfected by closing.

Certain security interests, including, without limitation, modifications of bank account control agreements, mortgages and deeds of trust, modifications of mortgages and/or deeds of trust, easement agreements and subordination and non-disturbance agreements on or affecting certain of our real properties, may not be in place by the closing date of this offering or may not be perfected on the closing date of this offering. To the extent any security interest in the collateral securing the New Notes cannot be perfected on or prior to the closing date, we will be required to have all such security interests perfected, to the extent required by the indenture governing the New Notes and the security documents, promptly following the closing date or as otherwise agreed pursuant to the terms of the indenture or security documents. To the extent a security interest in certain collateral is perfected following the closing date, that security interest would remain at risk of having been granted within 90 days of a bankruptcy filing (in which case it might be voided as a preferential transfer by a trustee in bankruptcy) even after the security interests perfected on the closing date were no longer subject to such risk.

Governmental approvals are required for proposed mortgage modifications for certain properties.

In connection with proposed mortgages and/or mortgage modification agreements with respect to certain of our real property in Nova Scotia, Canada, we will need to successfully obtain the necessary provincial governmental approvals in order to permit the registration, creation and/or continuation of the security interests

17

contemplated by the mortgages and/or mortgage modifications in such Nova Scotia real property. We will be required to have all mortgages and/or mortgage modification agreements in place as soon as practically permitted under the laws of the Province of Nova Scotia. We cannot assure that all such necessary governmental approvals will in fact be obtained.

Proceeds from any sale of the collateral securing the New Notes upon foreclosure or liquidation may not be sufficient to repay the New Notes in full.

We have not conducted appraisals of any of our assets to determine if the value of the collateral securing the New Notes equals or exceeds the amount of the New Notes and the value of the collateral upon foreclosure or liquidation will depend on market and economic conditions, the availability of buyers and other factors upon foreclosure or liquidation. Accordingly, we cannot assure you that the proceeds from the sale of the collateral would be sufficient to repay holders of the New Notes all amounts owed under the New Notes.

In the event of a foreclosure or liquidation of the collateral securing the New Notes, the value realized on the collateral will depend on market conditions, the availability of buyers and other factors. The collateral is by its nature illiquid, and we can therefore not assure you that the collateral can be sold in a short period of time or at all. A significant portion of the collateral, including the real property portion thereof, includes assets that may only be usable as part of the existing operating business. Accordingly, any such sale of the collateral, including the real property portion thereof, separate from the sale of NewPage as a whole, may not be feasible or of any value. We therefore cannot assure you that the proceeds from the sale of the collateral (after payment of expenses of the sale and repayment of other liens on the collateral which might under applicable law or by contract rank prior to or equally and ratably with the lien on the collateral in favor of the collateral trustee under the indenture) would be sufficient to repay holders of the New Notes all amounts owed under the New Notes.

To the extent that the proceeds of the collateral were not sufficient to repay amounts owed under the New Notes, then holders of the New Notes would have a general unsecured claim against our remaining assets, which claim would be effectively subordinated to debt secured by other assets of ours to the extent of the value of the collateral securing such other secured debt.

As of September 30, 2009, the aggregate amount of our indebtedness was $3,161 million, $84 million of which was pursuant to our Revolver, $1,700 million of which was pursuant to the Original Notes, $1,031 million of which was pursuant to our Second Lien Notes, $200 million of which was pursuant to the 12% Senior Subordinated Notes and $146 million of which was pursuant to our capital lease obligations.

The ability of the collateral trustee to foreclose on the collateral may be limited.

U.S. and Canadian bankruptcy and insolvency laws could prevent the collateral trustee from enforcing its security interest in the collateral upon the occurrence of an event of default if bankruptcy or insolvency proceedings are commenced by or against us before the collateral trustee has foreclosed, disposed of or appointed a receiver or otherwise enforced its security over the collateral. Under bankruptcy and insolvency laws, secured creditors such as the holders of the New Notes are prohibited from taking steps to enforce their security interest in the assets of a debtor in bankruptcy or insolvency proceeding without court approval. Moreover, in certain bankruptcy and insolvency proceedings debtors are permitted to continue to retain and to use the collateral (and the proceeds, products, rents or profits of such collateral). In U.S. proceedings, the secured creditor must be given “adequate protection.” The meaning of the term “adequate protection” may vary according to circumstances, but it is intended in general to protect the value of the secured creditor’s interest in the collateral. The court may find “adequate protection” if the debtor pays cash or grants additional security for any diminution in the value of the collateral as a result of the stay or repossession or disposition or any use of the collateral during the pendency of the bankruptcy case. In Canadian proceedings, the secured creditor would have to convince the court that the prejudice to the secured creditor by allowing the debtor to continue to retain and use the collateral outweighs the benefit to the debtor and all of its stakeholders by allowing the debtor to do so.

18

In addition, the collateral trustee may need to evaluate the impact of the potential liabilities before determining whether to enforce its security interest in the collateral because lenders and noteholders that hold a security interest in real property may be held liable under environmental laws and regulations for the costs of remediating or preventing any release or threatened release of hazardous substances at the secured property. Similarly, lenders who enforce their security interest by appointment of a receiver in Canada may be liable under employment and labor laws for employment-related costs and expenses. In this regard, the collateral trustee may decline to enforce its security interest in the collateral or exercise remedies available if it does not receive indemnification to its satisfaction from the holders of the New Notes. Finally, the collateral trustee’s ability to foreclose on the collateral on your behalf may be subject to lack of perfection, the consent of third parties, other liens and practical problems associated with the enforcement of the collateral trustee’s security interest in the collateral.

The value of the collateral securing the New Notes may not be sufficient to secure post-petition interest.

In the event of a bankruptcy, liquidation, dissolution, reorganization or similar proceeding against us, holders of the New Notes will only be entitled to post-petition interest under the bankruptcy code to the extent that the value of their security interest in the collateral is greater than their pre-bankruptcy claim. Holders of the New Notes that have a security interest in collateral with a value equal or less than their pre-bankruptcy claim will not be entitled to post-petition interest under the bankruptcy code. We have not conducted appraisals of any of our assets in connection with this offering and cannot assure you that the value of the noteholders’ interest in their collateral equals or exceeds the principal amount of the New Notes.

The waivers in the Intercreditor Agreement and the Collateral Trust Agreement (as defined below) of rights of marshalling may adversely affect the recovery rates of holders of the New Notes in a bankruptcy or foreclosure scenario.

The New Notes and the related guarantees are secured on a second-priority basis by the ABL Collateral that secures our Revolver, and are not secured by the stock of our subsidiaries or intercompany debt, if any. The Intercreditor Agreement and the Collateral Trust Agreement dated as of May 2, 2005 among NewPage, the Pledgors from time to time party thereto, Goldman Sachs Credit Partners L.P., HSBC Bank USA, National Association, and The Bank of New York Mellon (the “Collateral Trust Agreement”) provide that, the holders of the New Notes, the trustee under the indenture governing the New Notes and the collateral trustee may not assert or enforce any right of marshalling accorded to a junior lienholder, as against the holders of priority liens. Without this waiver of the right of marshalling, holders of prior liens on the collateral securing the New Notes, such as the collateral agent under our Revolver, could be required to liquidate collateral on which the New Notes did not have a lien prior to liquidating collateral on which the New Notes have a second lien, thereby maximizing the proceeds of the collateral that would be available to repay our obligations under the New Notes. As a result of this waiver, the proceeds of sales of the collateral securing the New Notes could be applied to repay priority lien obligations before applying proceeds of other collateral securing such priority lien obligations, and the holders of the New Notes may recover less than they would have if such proceeds were applied in the order most favorable to the holders of the New Notes.

Future priority lien indebtedness may be secured by certain assets that do not secure the New Notes.

The New Notes and the guarantees will be secured by security interests in all of our and our domestic restricted subsidiaries’ and NewPage Port Hawkesbury’s assets, except for debt and equity securities, including intercompany debt, issued by us and our domestic restricted subsidiaries and NewPage Port Hawkesbury (also referred to as the “Separate Collateral”). See “Description of New Notes—Collateral Trust Agreement—Separate Collateral” for additional information. The New Notes will, however, be guaranteed by the issuers of the excluded securities and will be secured, equally and ratably with all other priority lien obligations, by all collateral owned by each such issuer of excluded securities except the Separate Collateral. However, future indebtedness that is secured equally and ratably with the New Notes could also be secured by liens on the

19

Separate Collateral. The value of the Separate Collateral could be significant, and the New Notes will effectively rank junior to indebtedness secured by liens on, and to the extent of, the Separate Collateral. While the Collateral Trust Agreement provides for an adjustment in the ratable sharing of the proceeds from any shared collateral to compensate for the prior or simultaneous delivery of the proceeds of Separate Collateral to other holders of priority lien obligations, such adjustment will not provide any adjustment for subsequent delivery of the proceeds from the Separate Collateral to such other holders and, in certain instances, holders of the New Notes may receive less, comparatively, than such other holders.

Any future pledge of collateral might be avoidable by a trustee in bankruptcy.

Any future pledge of collateral in favor of the collateral trustee, including pursuant to security documents delivered after the date of the indenture governing the New Notes, might be avoidable by the pledgor (as debtor in possession) or by its trustee in bankruptcy if certain events or circumstances exist or occur, including, among others, if the pledgor is insolvent at the time of the pledge, the pledge permits the holders of the New Notes to receive a greater recovery than if the pledge had not been given and a bankruptcy proceeding in respect of the pledgor is commenced within 90 days following the pledge, or, in certain circumstances, a longer period.

Despite our current indebtedness level, we may still be able to incur substantially more debt, which could increase the risks associated with our substantial leverage.

As of September 30, 2009, we had $3,161 million of total indebtedness. The terms of the indenture governing the New Notes will not restrict NewPage Holding’s ability to incur additional indebtedness and will permit us and NewPage Holding to incur substantial additional indebtedness in the future, including secured indebtedness. See “Description of New Notes.” Any additional debt incurred by us which is secured equally and ratably with the Revolver would be secured on a first-priority basis by the ABL Collateral, which is senior to the lien securing the New Notes. Any additional priority lien debt incurred by us would be secured equally and ratably with the New Notes. If we incur any additional indebtedness that ranks equal to the New Notes, the holders of that debt will be entitled to share equally and ratably with you in any proceeds of sales of the collateral securing the New Notes distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of us. If new debt is added to our, NewPage Holding’s or our subsidiaries’ current debt levels, the related risks that we now face could intensify. See “Description of Certain Indebtedness.”

Your right to receive payment on the New Notes will be effectively subordinated to the liabilities of our non-guarantor subsidiaries, including our existing unrestricted subsidiaries.

Our unrestricted subsidiaries and foreign subsidiaries will not be required to be guarantors of the New Notes, although NewPage Port Hawkesbury will be a guarantor of the New Notes. Creditors of our non-guarantor subsidiaries will generally be entitled to payment from the assets of those subsidiaries before those assets can be distributed to us. As a result, the New Notes will effectively be subordinated to the prior payment of all of the debts of our non-guarantor subsidiaries. In the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, holders of their indebtedness will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to us. We have designated Consolidated Water Power Company as an unrestricted subsidiary. As of September 30, 2009, the aggregate total assets of this subsidiary were $44 million, or 1% of our total assets. For the nine months ended September 30, 2009, $6 million, or less than 0.5%, of our net sales was attributable to this subsidiary.

The collateral is subject to casualty risks.

The indenture governing the New Notes will require, and the Revolver, the indentures governing the existing secured notes and the related security documents require, us and the guarantors to maintain adequate insurance or otherwise insure against risks to the extent customary with companies in the same or similar business operating in the same or similar locations. There are, however, certain losses, including losses resulting

20

from terrorist acts, that may be either uninsurable or not economically insurable, in whole or in part. As a result, we cannot assure you that the insurance proceeds will compensate us fully for our losses. If there is a total or partial loss of any of the collateral securing the New Notes, we cannot assure you that any insurance proceeds received by us will be sufficient to satisfy all the secured obligations, including the New Notes.

In the event of a total or partial loss to any of the mortgaged facilities, certain items of equipment and inventory may not be easily replaced. Accordingly, even though there may be insurance coverage, the extended period needed to manufacture replacement units or inventory could cause significant delays.

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture governing the New Notes.

Upon the occurrence of a “change of control,” as defined in the indenture governing the New Notes, we must offer to buy back the New Notes at a price equal to 101% of the principal amount, together with any accrued and unpaid interest, if any, to the date of the repurchase. Our failure to purchase, or give notice of purchase of, the New Notes would be a default under the indenture governing the New Notes, which would also be a default under our Revolver and our other existing series of notes. See “Description of New Notes—Repurchase of Notes at the Option of Holders—Change of Control.”

If a change of control occurs, it is possible that we may not have sufficient assets at the time of the change of control to make the required repurchase of New Notes or to satisfy all obligations under our other debt instruments. In order to satisfy our obligations, we could seek to refinance our indebtedness or obtain a waiver from the other lenders or you as a holder of the New Notes. We cannot assure you that we would be able to obtain a waiver or refinance our indebtedness on terms acceptable to us, if at all.

Our controlling equity holder may take actions that conflict with your interests.

A substantial portion of the voting power of the equity of our indirect parent is held by affiliates of Cerberus. Accordingly, Cerberus indirectly controls the power to elect our directors and officers, to appoint new management and to approve all actions requiring the approval of the holders of our equity (subject to certain specified consent rights of SEO under the securityholders agreement between NewPage Group and SEO), including adopting amendments to our constituent documents and approving mergers, acquisitions or sales of all or substantially all of our assets. The directors have the authority, subject to the terms of our debt, to issue additional indebtedness or equity, implement equity repurchase programs, declare dividends and make other such decisions about our equity.

In addition, the interests of our controlling equity holder could conflict with your interests if, for example, we encounter financial difficulties or are unable to pay our debts as they mature. Our controlling equity holder also may have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in its judgment, could enhance its equity investment, even though these transactions might involve risks to you, as holders of the New Notes.

Federal and state laws permit courts to void guarantees under certain circumstances.

The New Notes will be guaranteed by all of our material U.S. and Canadian restricted subsidiaries. The guarantees may be subject to review under U.S. federal bankruptcy law and comparable provisions of state fraudulent conveyance laws and Canadian federal insolvency and corporate laws and provisions of provincial preference, fraudulent conveyance and corporate laws, if a bankruptcy or insolvency proceeding or a lawsuit is commenced by or on behalf of us or one of our guarantors or by our unpaid creditors or the unpaid creditors of one of our guarantors. Under these laws, a court could void the obligations under the guarantee, subordinate the guarantee of the New Notes to that guarantor’s other debt or take other action detrimental to holders of the New

21

Notes and the guarantees of the New Notes, if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

| | • | | issued the guarantee to delay, hinder or defraud present or future creditors; |

| | • | | received less than reasonably equivalent value or fair consideration for issuing the guarantee at the time it issued the guarantee; |

| | • | | was insolvent or rendered insolvent by reason of issuing the guarantee; |

| | • | | was engaged, or about to engage, in a business or transaction for which its remaining assets constituted unreasonably small capital to carry on its business; |

| | • | | intended to incur, or believed that it would incur, debts beyond its ability to pay as they mature; or |

| | • | | with respect to Canadian companies in issuing the guarantee, acted in a manner that was oppressive, unfairly prejudicial to or unfairly disregarded the interests of any shareholder, creditor, director, officer or other interested party. |

In those cases where our solvency or the solvency of one of our guarantors is a relevant factor, the measures of insolvency will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a party would be considered insolvent if:

| | • | | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; |

| | • | | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing indebtedness, including contingent liabilities, as they become absolute and mature; or |

| | • | | it could not pay its indebtedness as it becomes due. |

We cannot be sure as to the standard that a court would use to determine whether or not a party was solvent at the relevant time, or, regardless of the standard that the court uses, that the issuance of the guarantees would not be voided or the guarantees would not be subordinated to the guarantors’ other debt. If such a case were to occur, the guarantee could also be subject to the claim that, since the guarantee was incurred for our benefit and only indirectly for the benefit of the guarantor, the obligations of the applicable guarantor were incurred for less than fair consideration.

An active public market may not develop for the New Notes, which may hinder your ability to liquidate your investment.

The New Notes are a new issue of securities with no active trading market, and we do not intend to apply for the New Notes to be listed on any securities exchange or to arrange for any quotation on any automated dealer quotation systems. The initial purchasers of the Original Notes are not obligated to make a market in the New Notes and, if they do so, they may cease their market-making in the New Notes at any time. In addition, the liquidity of the trading market in the New Notes, and the market price quoted for the New Notes, may be adversely affected by changes in the overall market for fixed income securities, and by changes in our financial performance or prospects, or in the prospects for companies in our industry in general. As a result, an active trading market for the New Notes may not develop. If no active trading market develops, you may not be able to resell your New Notes at their fair market value, or at all.

The market price for the New Notes may be volatile.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused volatility in prices of securities similar to the New Notes. The market for the New Notes, if any, may be subject to similar disruptions. Any disruptions may have a negative effect on noteholders, regardless of our prospects and financial performance.

22

The Original Notes were issued with original issue discount for U.S. federal income tax purposes.