Exhibit 99.2

January 12, 2015

RE: Proposed Merger of the Federal Home Loan Banks of Des Moines and Seattle

Dear Seattle Bank Members,

The Federal Housing Finance Agency’s (FHFA’s) recent approval of the merger application submitted by the Federal Home Loan Bank of Des Moines (Des Moines Bank) and the Federal Home Loan Bank of Seattle (Seattle Bank) represents another significant step in the FHLBank merger process. The next step is the ratification of the Agreement and Plan of Merger, dated September 25, 2014 (merger agreement), by the members of both banks.

Des Moines and Seattle bank members will vote on the ratification in separate, simultaneous voting processes. The voting process begins with your receipt of the enclosed materials and will close on February 23, 2015. The merger agreement will be ratified if a majority of the votes cast by the members of each bank are in favor of ratifying the merger agreement.

If the agreement is ratified, the banks would target completion of the merger for May 31, 2015.

The enclosed materials are provided to support your knowledge and understanding of the potential merger’s impact on your cooperative and your institution and to facilitate your voting process. They include:

| | • | | An overview of the benefits the Seattle Bank’s Board of Directors believes would be achieved through the merger |

| | • | | A preliminary impact statement describing the effect of the merger on your institution’s capital stock requirements, credit line, and collateral position with the combined bank, based on September 30, 2014, data |

| | • | | The Joint Merger Disclosure Statement describing the specific terms of the merger and including, among other things, the merger agreement, historical and pro forma financial data, stock conversion plan, accounting treatment and tax consequences of the merger, a comparison of stockholders’ rights, and a discussion of risk factors |

| | • | | A voting packet with instructions and materials needed to cast your institution’s vote |

We encourage you to read these materials thoroughly. We also appreciate that you will have questions about the merger process and its impact on your cooperative. To answer your questions, the Seattle Bank will host member meetings in each of the eight states in its district prior to the close of the voting process. Seattle Bank President and CEO Mike Wilson, the member director representing your state, and members of the Seattle Bank executive and relationship management teams will be on hand to answer your questions.

The meeting schedule and registration form are available on the Seattle Bank’s website at www.fhlbsea.com/merger, along with electronic copies of the benefits overview and disclosure statement. Your Seattle Bank Board of Directors firmly believes that a merger with the Des Moines Bank is in the best interests of our members—as customers and stockholders—and our decision to enter into an agreement to merge the two banks was unanimous.

On behalf of your Board of Directors, we encourage you to vote “yes” in this effort to ensure the long-term viability and value of your cooperative.

Thank you for your support of your FHLBank cooperative.

Sincerely,

| | | | |

| |  | | |

| William V. Humphreys, Chairman | | Gordon Zimmerman, Vice Chair | | |

| Federal Home Loan Bank of Seattle | | Federal Home Loan Bank of Seattle | | |

| Enclosures: | Merger Benefits Summary |

Preliminary Impact Statement

Joint Merger Disclosure Statement

Merger Voting Packet

| cc: | Federal Home Loan Bank of Seattle Board of Directors |

Your Cooperative Positioned for the Future In a cooperative, every member is a customer and a stockholder. As a customer, you rely on your Federal Home Loan Bank (FHLBank) for credit products, community investment programs, and financial strategies and services to help you manage your balance sheet, grow your business, and strengthen the communities you serve. As stockholders, you expect that the value of your investment in the cooperative will be preserved and earn a market rate of return. Over the past several years, the FHLBank of Seattle (Seattle Bank) has overcome many challenges. Our efforts have resulted in a return to profitability, retained earnings growth, and our ability, with regulatory approval, to repurchase and redeem and pay dividends on your capital stock. At the same time, our industry is facing new challenges and undergoing structural changes which, for our institution, have manifested themselves in low levels of advance demand and increasing operational expenses. Many of these challenges are not short term in nature and limit our future ability to prosper as a stand-alone FHLBank without relying on investments as a source of income. The Seattle Bank’s Board of Directors and management believe that a merger with the FHLBank of Des Moines (Des Moines Bank) offers a strategic opportunity to create a combined FHLBank that is well-positioned to meet your needs as customers and to ensure the value and liquidity of your capital stock investment for years to come. If the merger is completed, the members of both FHLBanks will benefit from a cooperative with greater economies of scale, greater diversification of risks, and an enhanced suite of products and services. In addition, as current Seattle Bank members, you will benefit from an initial repurchase of your institution’s excess capital stock, the routine repurchase of your excess activity-based stock, and the opportunity to earn a higher dividend on your FHLBank investment. The Seattle Bank’s Board of Directors unanimously supports a merger with the Des Moines Bank because of the many benefits it offers Seattle Bank members—as customers and stockholders. The board encourages you to vote in favor of ratifying the merger agreement.

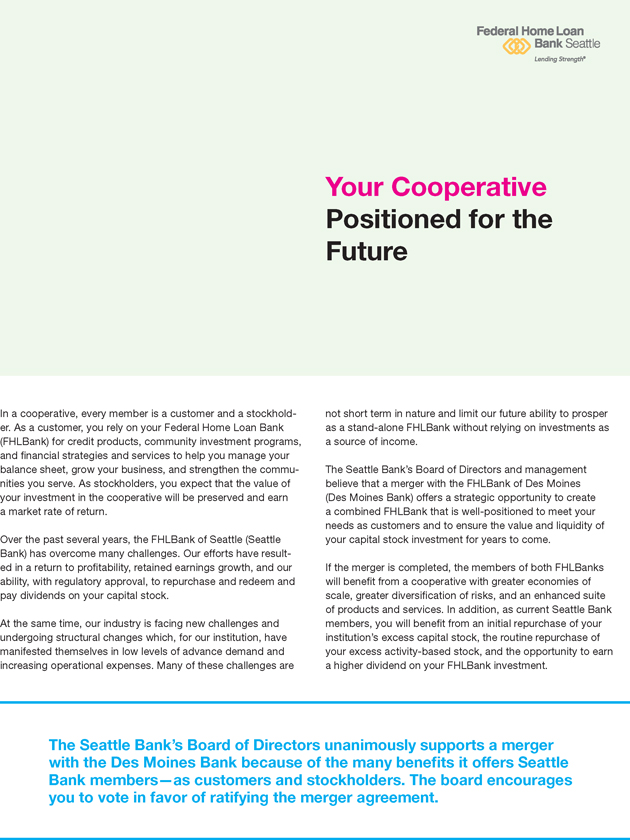

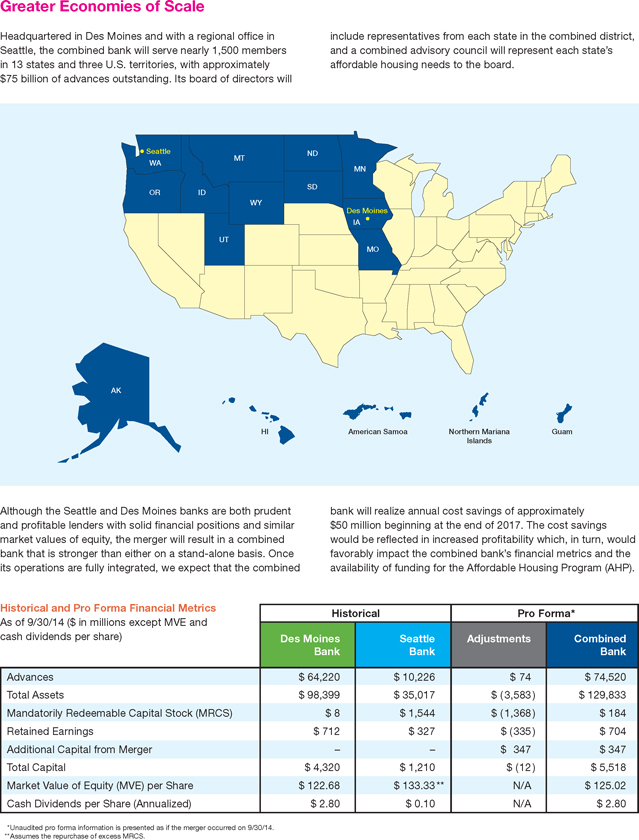

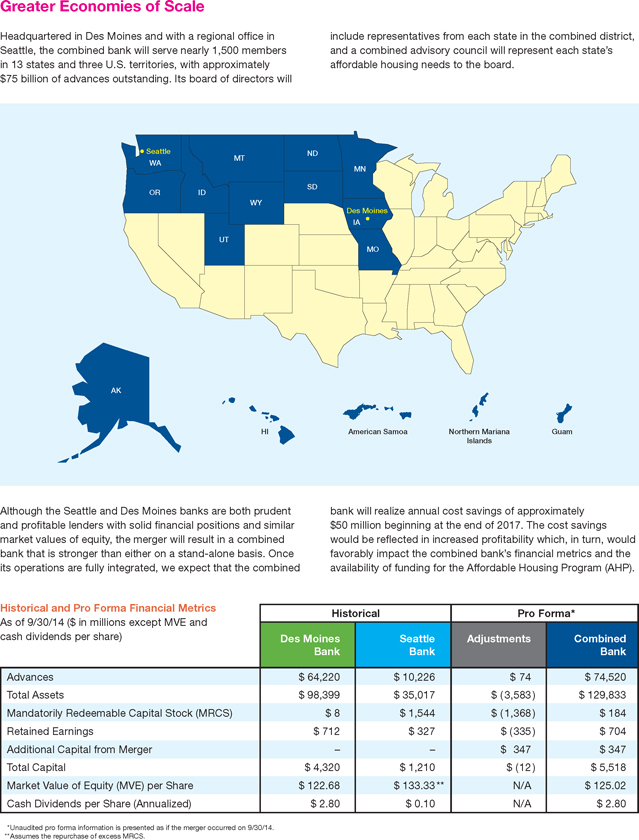

Greater Economies of Scale Headquartered in Des Moines and with a regional office in Seattle, the combined bank will serve nearly 1,500 members in 13 states and three U.S. territories, with approximately $75 billion of advances outstanding. Its board of directors will include representatives from each state in the combined district, and a combined advisory council will represent each state’s affordable housing needs to the board. Although the Seattle and Des Moines banks are both prudent and profitable lenders with solid financial positions and similar market values of equity, the merger will result in a combined bank that is stronger than either on a stand-alone basis. Once its operations are fully integrated, we expect that the combined bank will realize annual cost savings of approximately $50 million beginning at the end of 2017. The cost savings would be reflected in increased profitability which, in turn, would favorably impact the combined bank’s financial metrics and the availability of funding for the Affordable Housing Program (AHP). Historical and Pro Forma Financial Metrics As of 9/30/14 ($ in millions except MVE and cash dividends per share) Historical Pro Forma* Des Moines Seattle Adjustments Combined Bank Bank Bank Advances $ 64,220 $ 10,226 $ 74 $ 74,520 Total Assets $ 98,399 $ 35,017 $ ( 3,583 ) $ 129,833 Mandatorily Redeemable Capital Stock (MRCS) $ 8 $ 1,544 $ ( 1,368 ) $ 184 Retained Earnings $ 712 $ 327 $ (335 ) $ 704 Additional Capital from Merger – – $ 347 $ 347 Total Capital $ 4,320 $ 1,210 $ ( 12 ) $ 5,518 Market Value of Equity (MVE) per Share $ 122.68 $ 133.33** N/A $ 125.02 Cash Dividends per Share (Annualized) $ 2.80 $ 0.10 N/A $ 2.80 *Unaudited pro forma information is presented as if the merger occurred on 9/30/14. **Assumes the repurchase of excess MRCS.

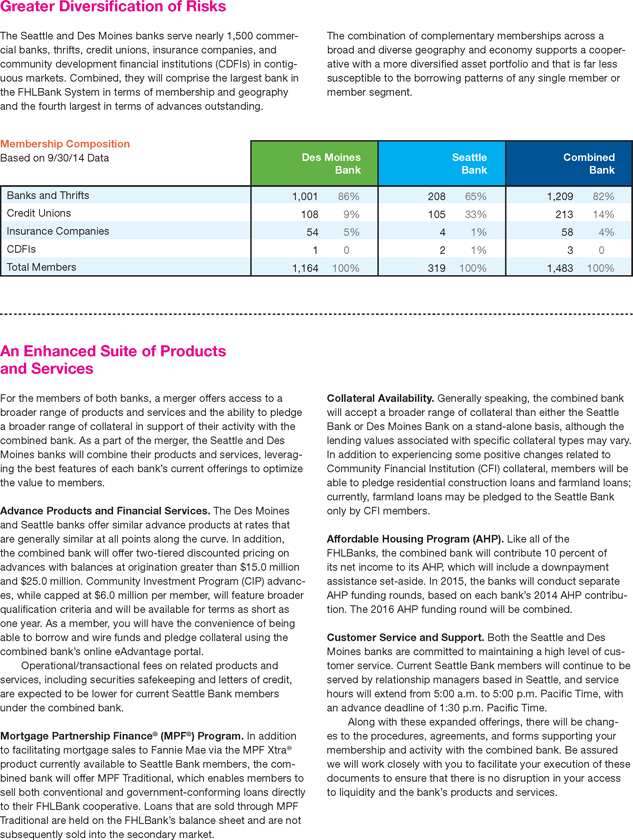

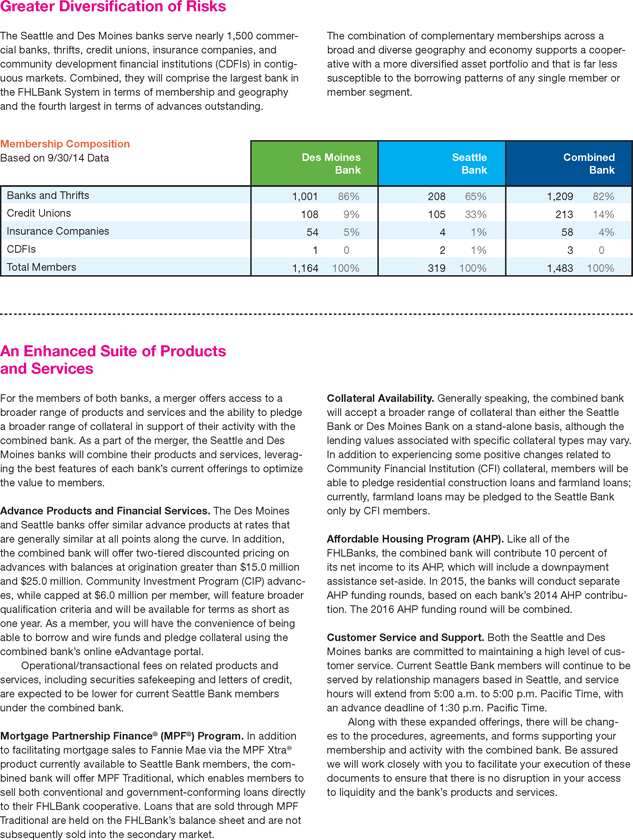

Greater Diversification of Risks The Seattle and Des Moines banks serve nearly 1,500 commercial banks, thrifts, credit unions, insurance companies, and community development financial institutions (CDFIs) in contiguous markets. Combined, they will comprise the largest bank in the FHLBank System in terms of membership and geography and the fourth largest in terms of advances outstanding. The combination of complementary memberships across a broad and diverse geography and economy supports a cooperative with a more diversified asset portfolio and that is far less susceptible to the borrowing patterns of any single member or member segment. Membership Composition Based on 9/30/14 Data Des Moines Seattle Combined Bank Bank Bank Banks and Thrifts 1,001 86% 208 65% 1,209 82% Credit Unions 108 9% 105 33% 213 14% Insurance Companies 54 5% 4 1% 58 4% CDFIs 1 0% 2 1% 3 0% Total Members 1,164 100% 319 100% 1,483 100% An Enhanced Suite of Products and Services For the members of both banks, a merger offers access to a broader range of products and services and the ability to pledge a broader range of collateral in support of their activity with the combined bank. As a part of the merger, the Seattle and Des Moines banks will combine their products and services, leveraging the best features of each bank’s current offerings to optimize the value to members. Advance Products and Financial Services. The Des Moines and Seattle banks offer similar advance products at rates that are generally similar at all points along the curve. In addition, the combined bank will offer two-tiered discounted pricing on advances with balances at origination greater than $15.0 million and $25.0 million. Community Investment Program (CIP) advances, while capped at $6.0 million per member, will feature broader qualification criteria and will be available for terms as short as one year. As a member, you will have the convenience of being able to borrow and wire funds and pledge collateral using the combined bank’s online eAdvantage portal. Operational/transactional fees on related products and services, including securities safekeeping and letters of credit, are expected to be lower for current Seattle Bank members under the combined bank. Mortgage Partnership Finance® (MPF®) Program. In addition to facilitating mortgage sales to Fannie Mae via the MPF Xtra® product currently available to Seattle Bank members, the combined bank will offer MPF Traditional, which enables members to sell both conventional and government-conforming loans directly to their FHLBank cooperative. Loans that are sold through MPF Traditional are held on the FHLBank’s balance sheet and are not subsequently sold into the secondary market. Collateral Availability. Generally speaking, the combined bank will accept a broader range of collateral than either the Seattle Bank or Des Moines Bank on a stand-alone basis, although the lending values associated with specific collateral types may vary. In addition to experiencing some positive changes related to Community Financial Institution (CFI) collateral, members will be able to pledge residential construction loans and farmland loans; currently, farmland loans may be pledged to the Seattle Bank only by CFI members. Affordable Housing Program (AHP). Like all of the FHLBanks, the combined bank will contribute 10 percent of its net income to its AHP, which will include a downpayment assistance set-aside. In 2015, the banks will conduct separate AHP funding rounds, based on each bank’s 2014 AHP contribution. The 2016 AHP funding round will be combined. Customer Service and Support. Both the Seattle and Des Moines banks are committed to maintaining a high level of customer service. Current Seattle Bank members will continue to be served by relationship managers based in Seattle, and service hours will extend from 5:00 a.m. to 5:00 p.m. Pacific Time, with an advance deadline of 1:30 p.m. Pacific Time. Along with these expanded offerings, there will be changes to the procedures, agreements, and forms supporting your membership and activity with the combined bank. Be assured we will work closely with you to facilitate your execution of these documents to ensure that there is no disruption in your access to liquidity and the bank’s products and services.

Capital Stock and Dividends: A Return to Normal Operations Among the most significant benefits for current Seattle Bank members is that the merger will accelerate a return to normal FHLBank operations, which include the ability to repurchase, redeem, and pay dividends on capital stock, commensurate with the combined bank’s financial performance. Subject to Federal Housing Finance Agency approval and prior to the merger, the Seattle Bank will repurchase, at a minimum, all of its members’ past-due MRCS and excess Class A stock. Upon completion of the stock conversion, we expect each member of the combined bank will hold only the number of shares required to support its membership and activity with the combined bank. Following the merger, the combined bank intends to repurchase excess activity-based stock on at least a monthly basis. With the merger, the combined bank will adopt the Des Moines Bank’s current two-tier dividend structure, paying different rates on membership and activity-based stock. In 2014, Des Moines Bank members received a 50 basis-points per annum dividend on membership stock and a 350 basis-points per annum dividend on activity-based stock, a significantly higher return than the 10 basis-points per annum dividend paid to Seattle Bank members in 2014. Dividends will be paid on a quarterly basis, based on the previous quarter’s net income and average outstanding capital stock. This statement of benefits includes forward-looking statements. It should be read in conjunction with the Disclosure Statement Regarding the Merger of Federal Home Loan Bank of Des Moines and Federal Home Loan Bank of Seattle (“Disclosure Statement”), including the Cautionary Statement Regarding Forward-Looking Statements included in the Disclosure Statement. 1001 Fourth Avenue, Suite 2600 Seattle, WA 98154 www.fhlbsea.com