Federal Home Loan Bank of Seattle 2012 Earnings Call Michael L. Wilson, President and CEO March 28, 2013

2012 Earnings Call This member presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including expectations regarding operations of the Federal Home Loan Bank of Seattle (Seattle Bank). Forward-looking statements are subject to known and unknown risks and uncertainties. Actual financial performance and condition and actions may differ materially from that expected or implied in forward-looking statements due to many factors. Such factors may include, but are not limited to: significant and sustained reductions in members’ advance demand; loss of members and repayment of advances made to those members; regulatory requirements or restrictions relating to the Consent Arrangement; adverse economic changes or other factors affecting our financial instruments, including our private-label mortgage-backed securities; government actions or inactions, including government- sponsored enterprise (GSE) reform, affecting the Federal Home Loan Bank (FHLBank) System, centralized derivatives clearing, the capital and credit markets, or demand for our advances; changes in global, national, or local economic conditions that could impact the financial and credit markets; significant or rapid changes in market conditions or our failure to effectively manage the effects of these changes on our assets; our ability to attract new members and our existing members’ willingness to purchase new or additional capital stock or to transact business with us; rating agency actions affecting the Seattle Bank, the FHLBank System, or U.S. debt issuances. Additional factors are discussed in the Seattle Bank's 2012 annual report on Form 10-K filed with the SEC. The Seattle Bank does not undertake to update any forward-looking statements made in this member presentation. Forward Looking Statements 2

2012 Earnings Call 2012 Financial Results Risk Management Update Economic Overview Member-Focused Initiatives 2013 Strategic Priorities Agenda 3

2012 Earnings Call The Seattle Bank exists to provide members with funding and liquidity. • Advances are our core business. Reliability is crucial. • We must be available at all points in an economic cycle and during a member’s lifecycle. We want to be innovative to help members thrive in a challenging environment. • We work to anticipate member needs, and value our members’ input. We have an obligation to safeguard the capital our members have entrusted to us. • We must be able to redeem/repurchase stock at par. Any dividend must be reasonable. • We are not a profit maximizing entity. A Vision for the Seattle Bank 4

2012 Earnings Call • Continue to work with the Finance Agency to return the bank to health, using the Consent Arrangement as a framework, not as the Seattle Bank’s long-term strategic plan. • Reduce short-term unsecured investments in favor of variable-rate, longer-term, secured investments, while retaining our ability to meet our members’ funding needs. • Encourage our members’ use of advances through the introduction of new advance structures, the possible acceptance of municipal securities as collateral, and the possible reintroduction of an excess stock pool. • Strive to repurchase some amount of excess stock in 2012. • Continue our efforts to expand our membership. • Collaborate with other FHLBanks to reduce operating expenses. • Continue to pursue lawsuits against issuers of private-label mortgage-backed securities (MBS), but not to build the bank’s future on that outcome. How We Will Achieve Our Vision 5

2012 Earnings Call Developed a long-term strategic plan Significantly improved our balance sheet Reduced our operational and financial risks Deemed adequately capitalized and repurchased excess stock: • September – $24.1 million • December – $24.2 million Obtained Finance Agency approval to: • Accept municipal securities as collateral • Provide access to the Excess Stock Pool • Implement a cap on our membership stock requirement • Resume lending to insurance company members Earned $70.8 million in net income and committed $7.9 million to the 2013 Affordable Housing Program Continued to provide value to our members Our Progress in 2012 6

2012 Earnings Call 2012 Financial Results 7

For the Years Ended December 31, 2012 2011 Net interest income after benefit (provision) for credit losses $ 125,894 $ 96,988 (Benefit)/Provision for credit losses (2,893) 3,924 Other-than-temporary impairment credit loss (11,089) (91,176) Gain on sale of mortgage loans -- 73,925 Other non-interest income (1) 35,330 80,889 Total other expense 71,471 67,246 Total assessments (AHP) 7,866 9,338 Net Income 70,798 84,042 2012 Earnings Call ($ thousands) Selected Statements of Income Data 8 (1) Depending upon activity within the period, may include the following: gain on derivatives and hedging activities, gain on sale of available-for-sale securities, gain on sale of held-to-maturity securities, gain (loss) on financial instruments held under fair value option, loss on early extinguishments of consolidated obligations, service fees, and other non- interest income.

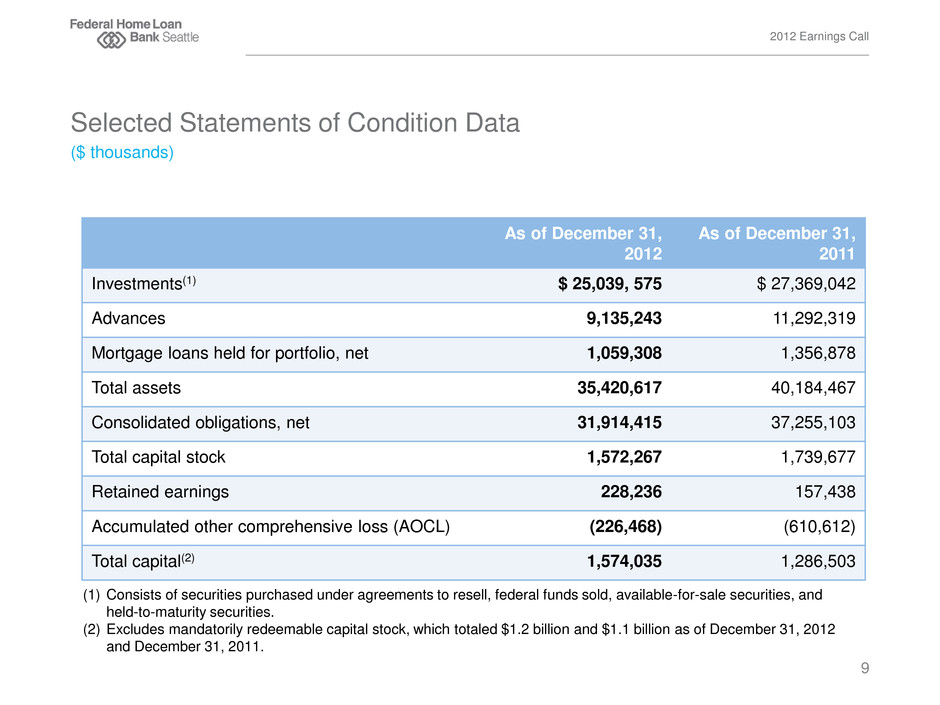

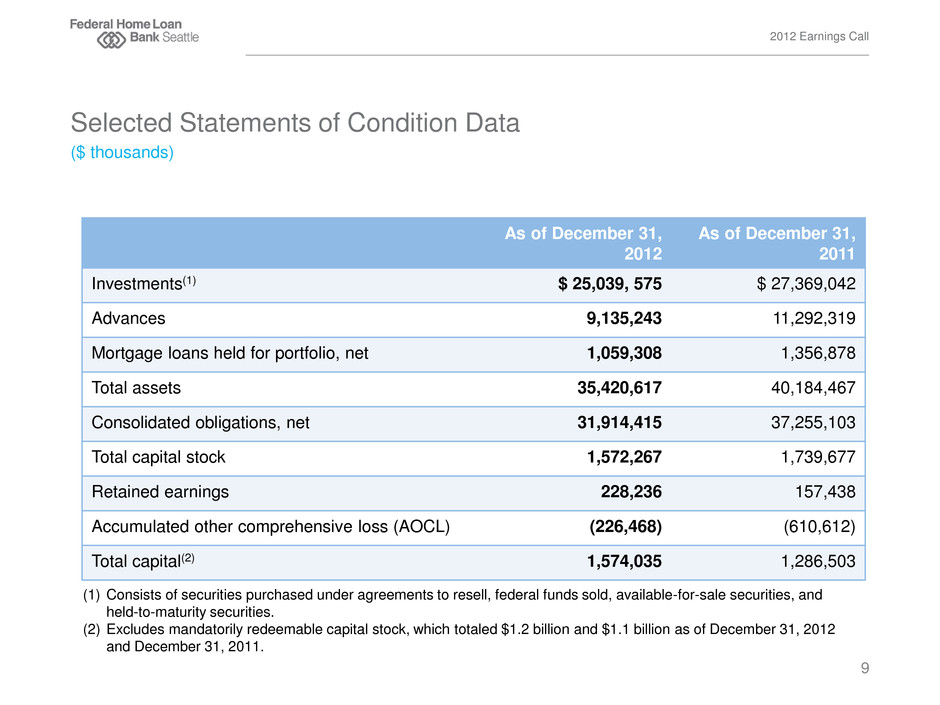

2012 Earnings Call ($ thousands) Selected Statements of Condition Data 9 As of December 31, 2012 As of December 31, 2011 Investments(1) $ 25,039, 575 $ 27,369,042 Advances 9,135,243 11,292,319 Mortgage loans held for portfolio, net 1,059,308 1,356,878 Total assets 35,420,617 40,184,467 Consolidated obligations, net 31,914,415 37,255,103 Total capital stock 1,572,267 1,739,677 Retained earnings 228,236 157,438 Accumulated other comprehensive loss (AOCL) (226,468) (610,612) Total capital(2) 1,574,035 1,286,503 (1) Consists of securities purchased under agreements to resell, federal funds sold, available-for-sale securities, and held-to-maturity securities. (2) Excludes mandatorily redeemable capital stock, which totaled $1.2 billion and $1.1 billion as of December 31, 2012 and December 31, 2011.

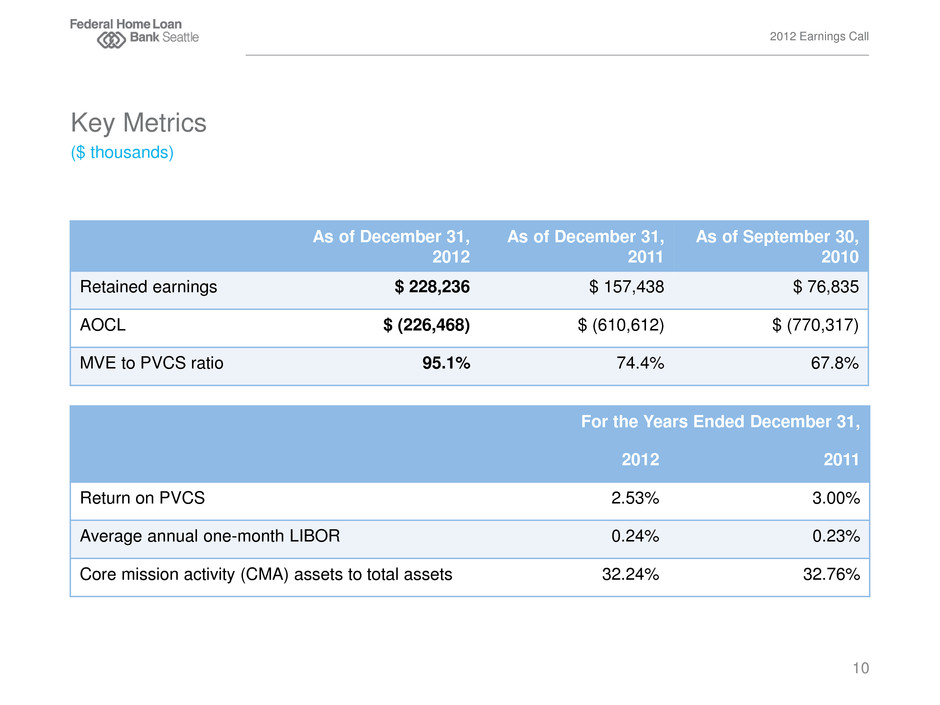

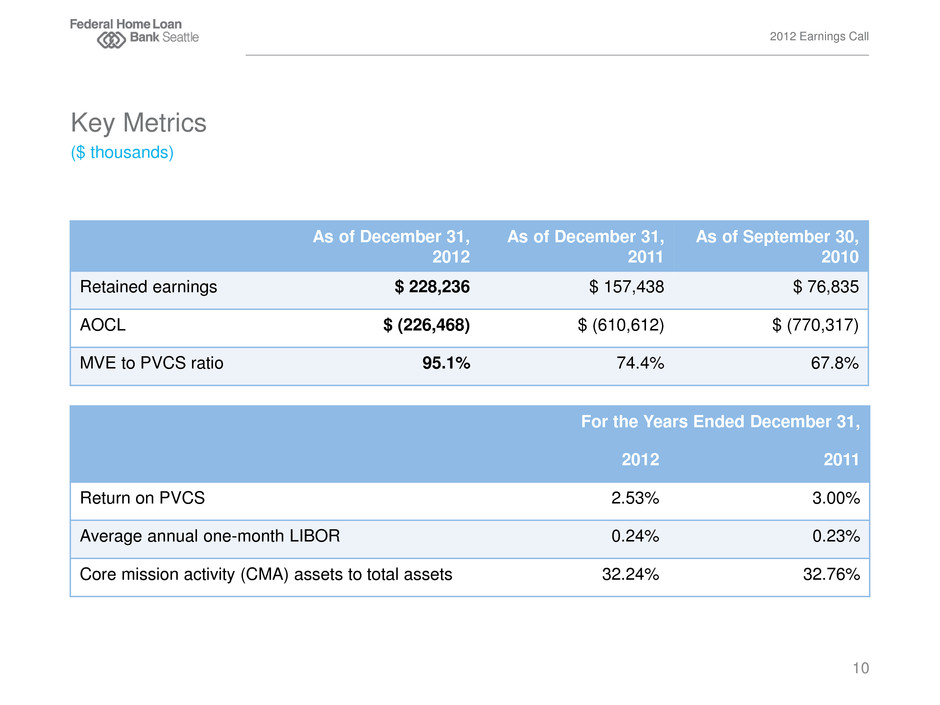

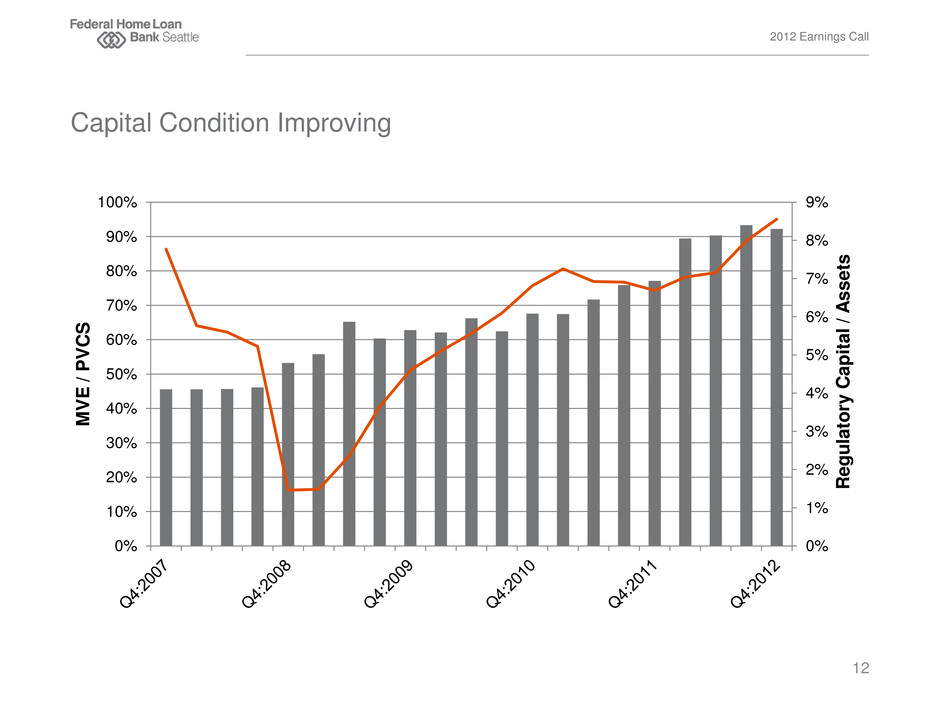

2012 Earnings Call ($ thousands) Key Metrics 10 As of December 31, 2012 As of December 31, 2011 As of September 30, 2010 Retained earnings $ 228,236 $ 157,438 $ 76,835 AOCL $ (226,468) $ (610,612) $ (770,317) MVE to PVCS ratio 95.1% 74.4% 67.8% For the Years Ended December 31, 2012 2011 Return on PVCS 2.53% 3.00% Average annual one-month LIBOR 0.24% 0.23% Core mission activity (CMA) assets to total assets 32.24% 32.76%

2012 Earnings Call Risk Management Update 11

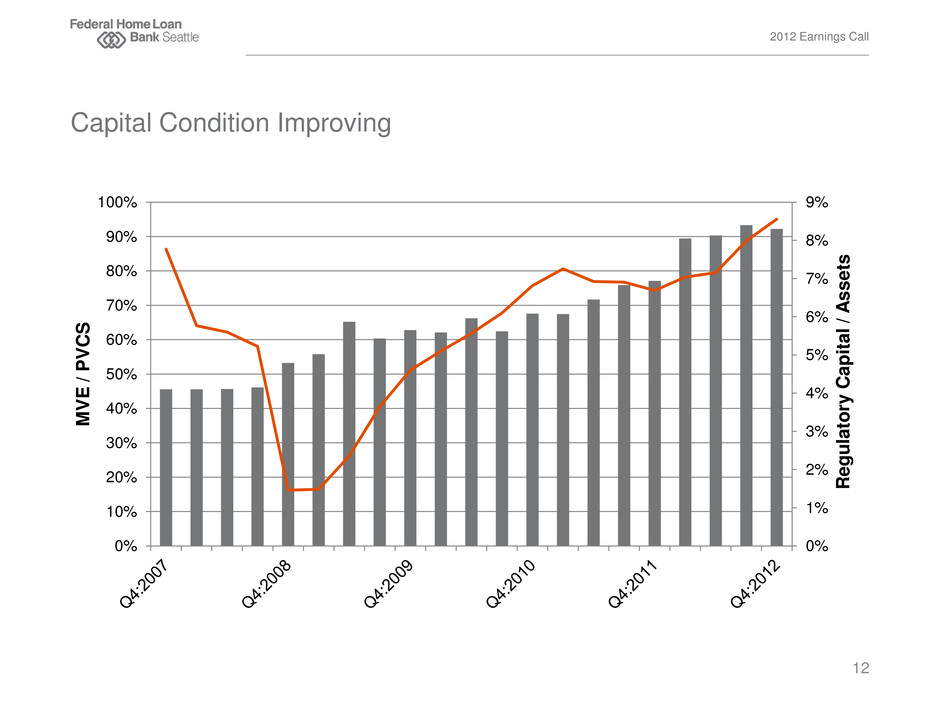

2012 Earnings Call Capital Condition Improving 12 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% R e g u lat o ry C a p ita l / A sset s M VE / PV C S

($ millions) 2012 Earnings Call Retained Earnings Improving -100 -50 0 50 100 150 200 250 Q4:2007 Q4:2008 Q4:2009 Q4:2010 Q4:2011 Q4:2012 13

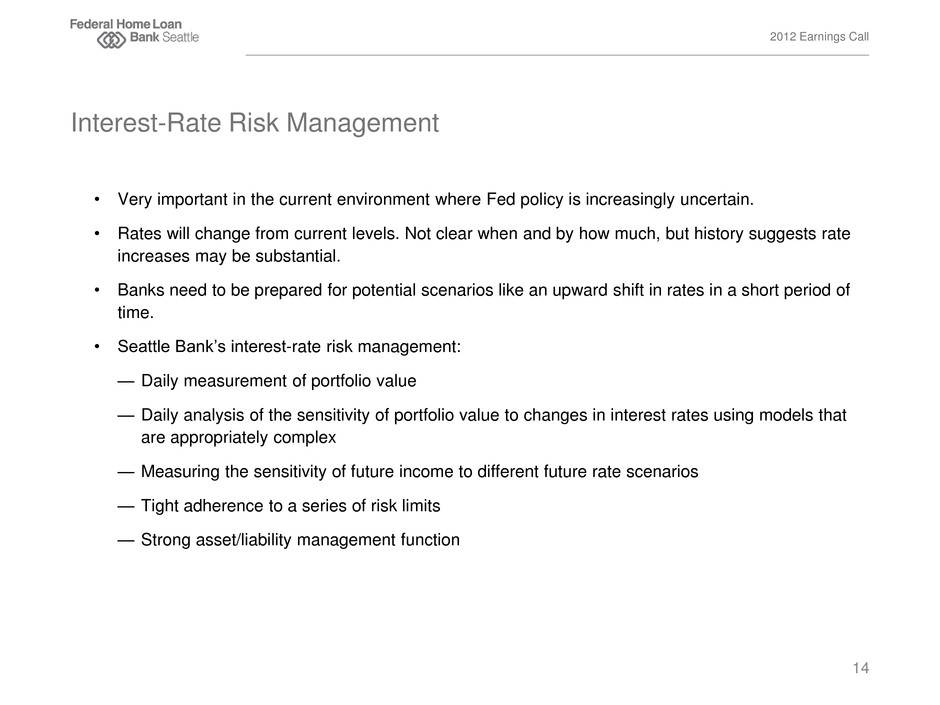

2012 Earnings Call • Very important in the current environment where Fed policy is increasingly uncertain. • Rates will change from current levels. Not clear when and by how much, but history suggests rate increases may be substantial. • Banks need to be prepared for potential scenarios like an upward shift in rates in a short period of time. • Seattle Bank’s interest-rate risk management: — Daily measurement of portfolio value — Daily analysis of the sensitivity of portfolio value to changes in interest rates using models that are appropriately complex — Measuring the sensitivity of future income to different future rate scenarios — Tight adherence to a series of risk limits — Strong asset/liability management function Interest-Rate Risk Management 14

2012 Earnings Call CoreLogic U.S. Housing Price Index 15 120 130 140 150 160 170 180 190 200 Housing Price Index

2012 Earnings Call Economic Overview 16

2012 Earnings Call Real Annualized GDP Growth 17

2012 Earnings Call Total Debt Balance and Composition 18

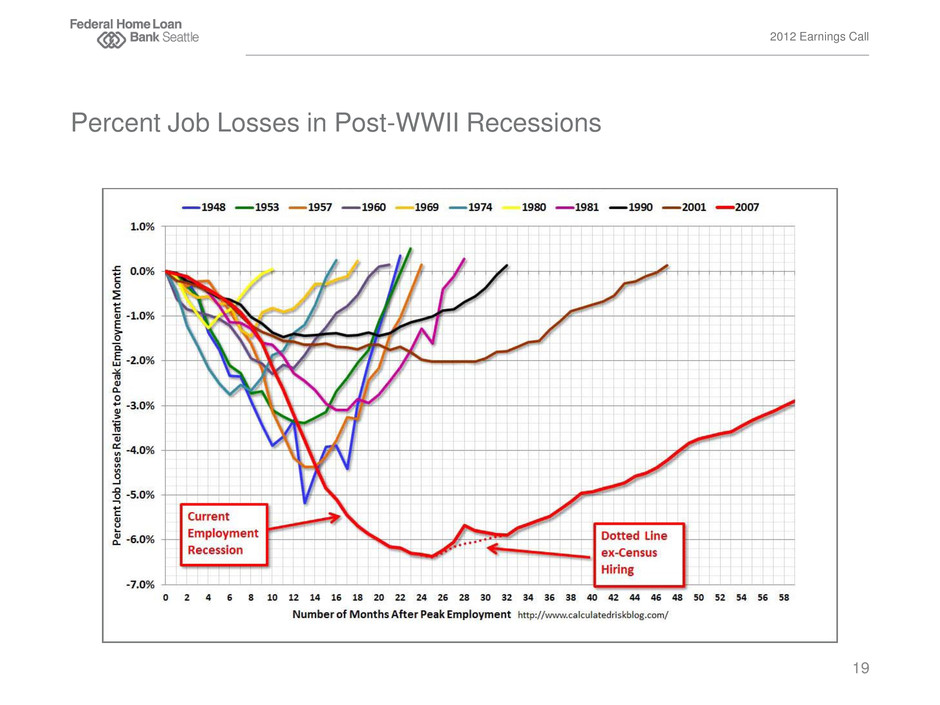

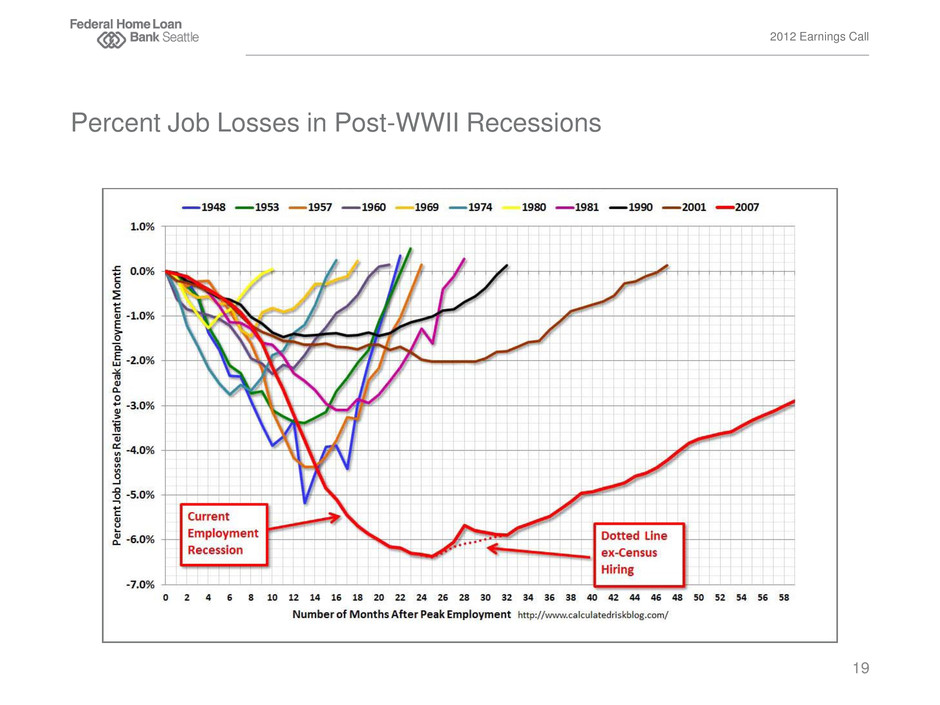

2012 Earnings Call Percent Job Losses in Post-WWII Recessions 19

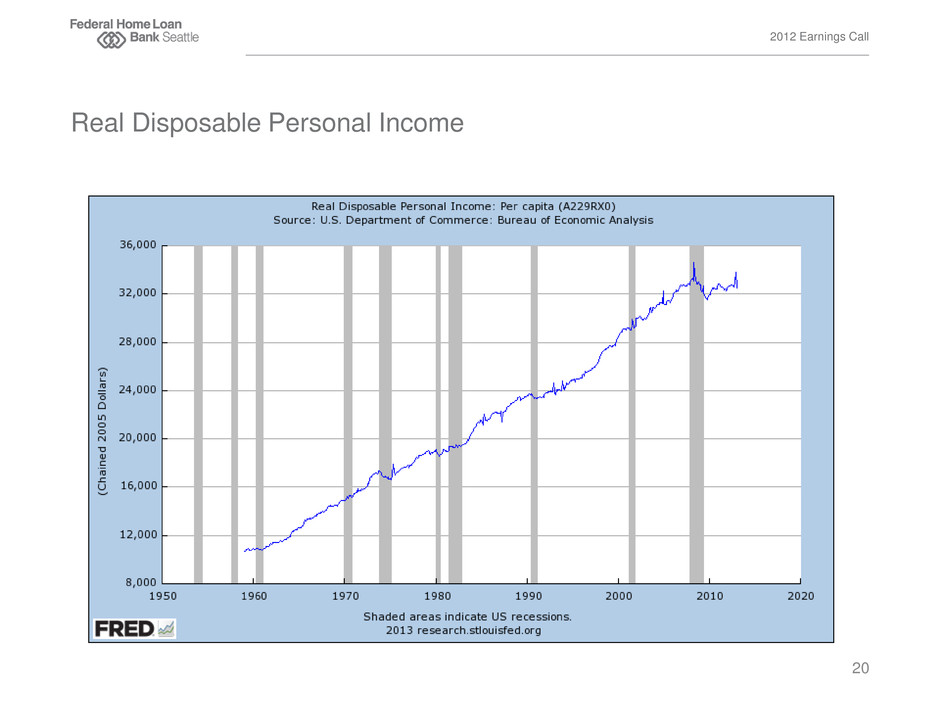

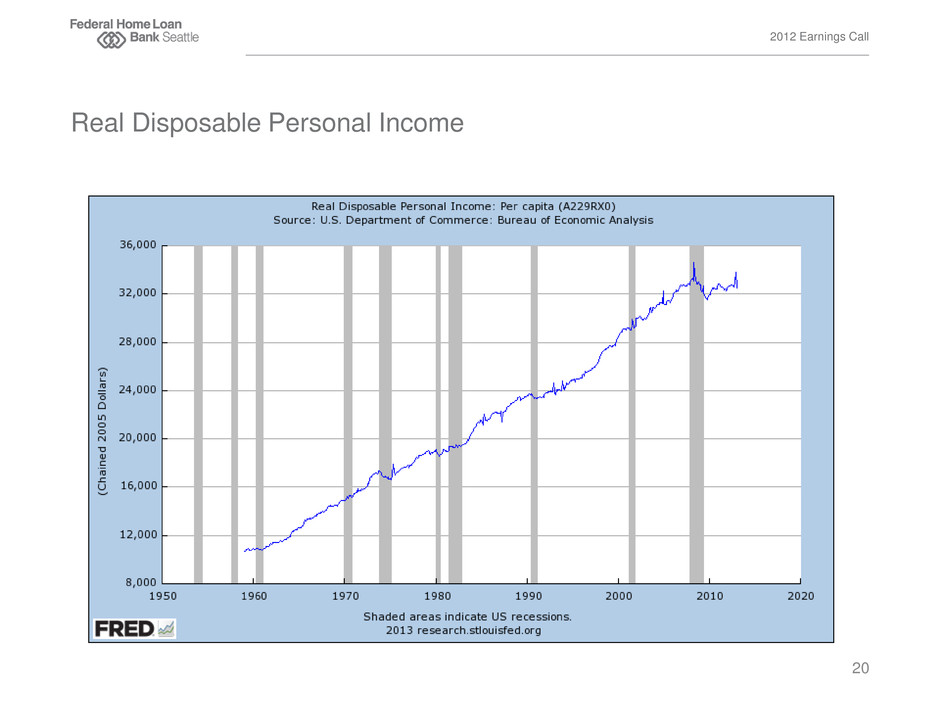

2012 Earnings Call Real Disposable Personal Income 20

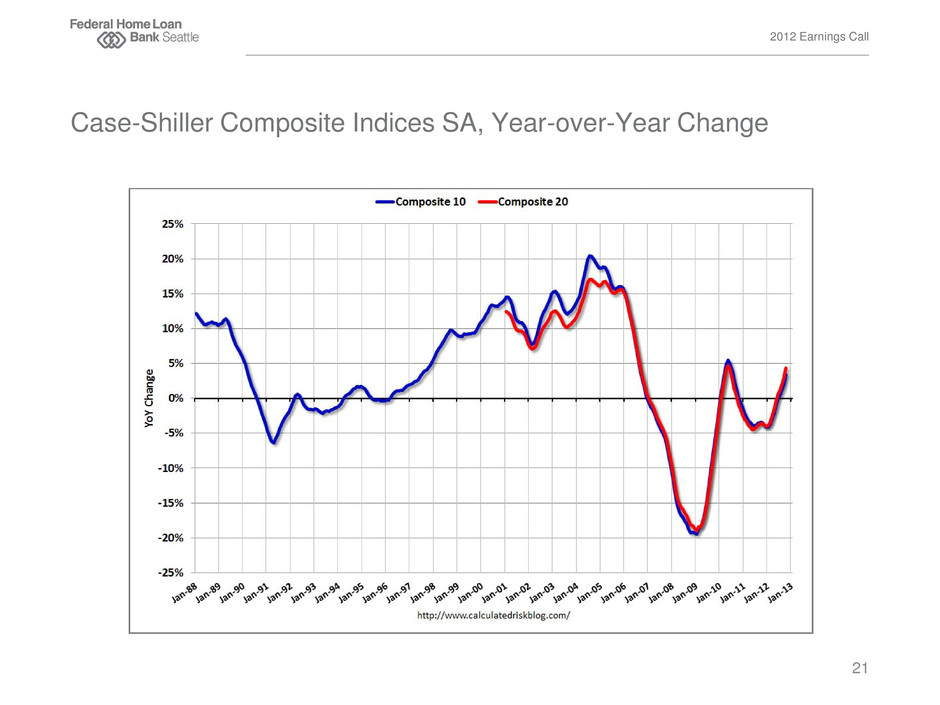

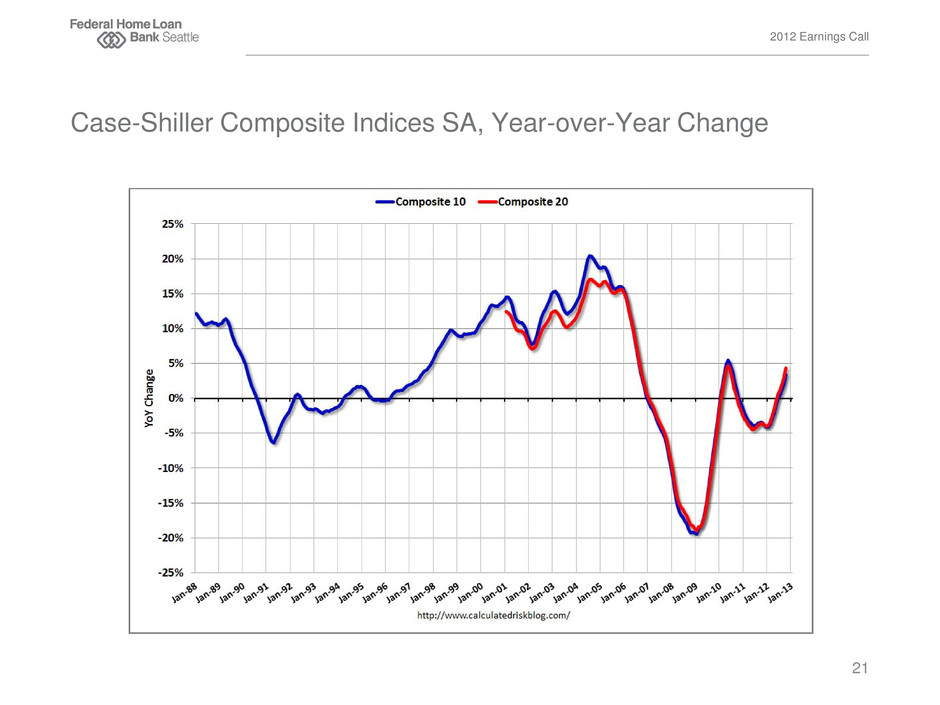

2012 Earnings Call Case-Shiller Composite Indices SA, Year-over-Year Change 21

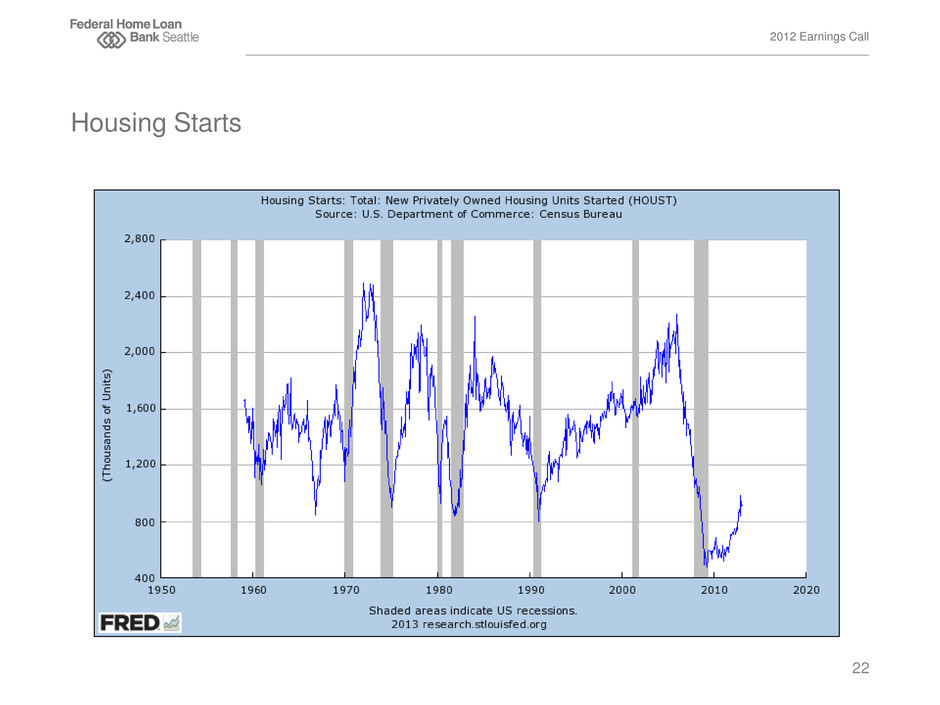

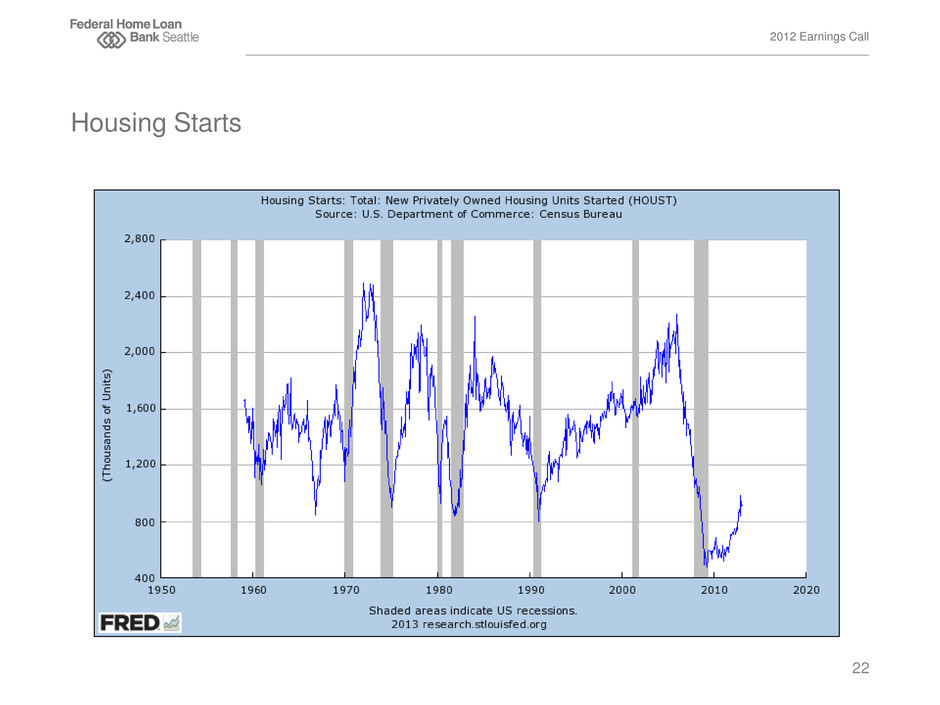

2012 Earnings Call Housing Starts 22

2012 Earnings Call Monetary stimulus continues… 23

2012 Earnings Call …but with muted effect. 24

2012 Earnings Call Member-Focused Initiatives 25

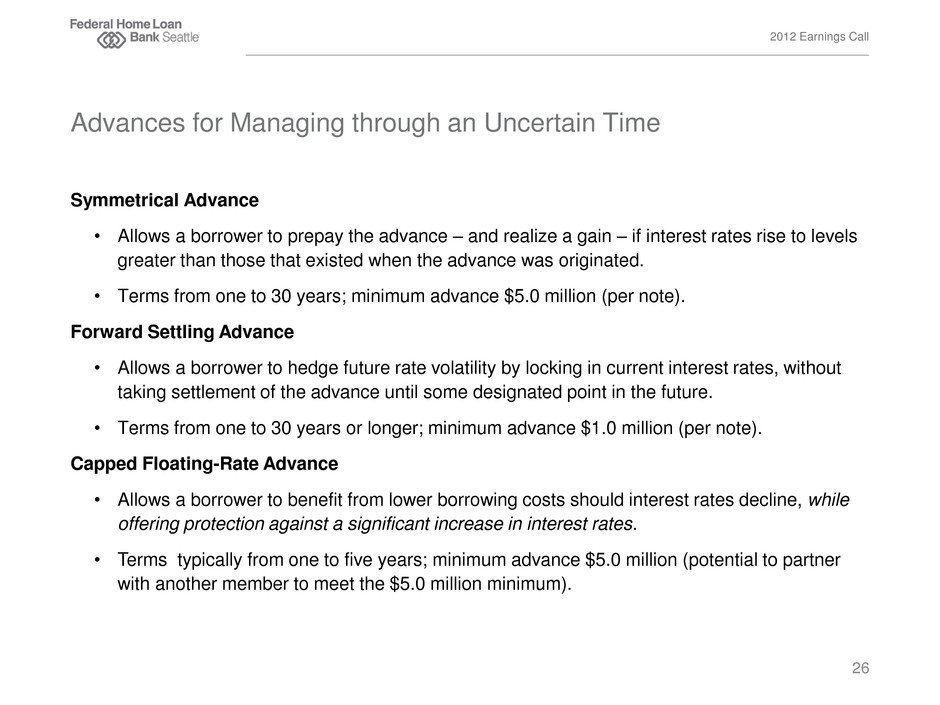

2012 Earnings Call Symmetrical Advance • Allows a borrower to prepay the advance – and realize a gain – if interest rates rise to levels greater than those that existed when the advance was originated. • Terms from one to 30 years; minimum advance $5.0 million (per note). Forward Settling Advance • Allows a borrower to hedge future rate volatility by locking in current interest rates, without taking settlement of the advance until some designated point in the future. • Terms from one to 30 years or longer; minimum advance $1.0 million (per note). Capped Floating-Rate Advance • Allows a borrower to benefit from lower borrowing costs should interest rates decline, while offering protection against a significant increase in interest rates. • Terms typically from one to five years; minimum advance $5.0 million (potential to partner with another member to meet the $5.0 million minimum). Advances for Managing through an Uncertain Time 26

2012 Earnings Call Economic Update Financial Tools • Marginal Cost of Funds Analytics • Blended Funding Model Community Investment Products • 2013 Home$tart Program begins April 1 — $2.0 million of downpayment assistance available for qualifying households up to 80 percent of area median income, on a first-come, first-served basis — First-time homebuyers until 1/3 of pool is allocated; all qualifying homebuyers thereafter Educational Programs • April 10: Finding Value in Municipal Securities through Smart Credit Analysis • Other 2013 topics: Investment strategies for a flat yield curve environment, maintaining credit and rate-risk disciplines, scenarios for the next state of loan demand, portfolio strategies, and building a high-performance financial services culture Other Seattle Bank Tools and Resources 27

2012 Earnings Call We will always seek to maximize the value of your investment in your cooperative, via: • Efficient collateral valuations • Convenient and low cost products and services • Education • Reliable and convenient access to liquidity and long-term funding Let us know what we can do for you! • Relationship Managers • Funding Desk Working to Address Your Business Needs 28

2012 Earnings Call 2013 Strategic Initiatives 29

2012 Earnings Call 1. Member Focus: Fulfill the Seattle Bank’s mission by addressing the needs of its members. 2. Financial Strength: Maintain the financial viability and improve the risk profile of the Seattle Bank while gradually transitioning it to a desired “end-state” business model focused on advances and other core mission assets. 3. Quality Operations: Improve the Seattle Bank’s infrastructure to increase operational efficiency and effectiveness. 4. Engaged People: Devise and implement a plan to more fully engage employees at all levels to attract, retain, and develop a high-performance workforce. 5. Community Relationships: Support the Seattle Bank’s business initiatives and goals by developing and strengthening relationships with banking and housing industry stakeholders and encouraging their advocacy on behalf of the Seattle Bank cooperative and the FHLBank System. 2013 – 2017 Strategic Initiatives 30

2012 Earnings Call • Preserve the FHLBanks’ role in supporting housing finance, community and economic development, and our community financial institutions. • Recognize that the FHLBanks fulfill their mission through lending to financial institutions and investing in assets that help to sustain housing, jobs, and economic development. • Ensure equal access to funding for all FHLBank members. • Maintain the regional FHLBank structure. • Preserve the FHLBanks’ role in meeting affordable housing needs. Public Policy Priorities 31

2012 Earnings Call As a cooperative, our mission is to serve as a reliable source of liquidity and funding for our members. Our members’ use of the cooperative – as active borrowers – is key to our long-term viability. Thank you for your continued support and use of the Federal Home Loan Bank of Seattle. Our Mission 32