Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-126464

333-126464-01

EXCHANGE OFFER PROSPECTUS

Offer to Exchange All Outstanding Unregistered

10.75% Dollar-Denominated Senior Secured Notes due 2014

and

11.75% Sterling-Denominated Senior Secured Notes due 2014

of

GLOBAL CROSSING (UK) FINANCE PLC

The issuer is offering to exchange all of its outstanding unregistered 10.75% dollar-denominated Senior Secured Notes due 2014 and 11.75% sterling-denominated Senior Secured Notes due 2014 for new registered 10.75% dollar-denominated Senior Secured Notes due 2014 and 11.75% sterling-denominated Senior Secured Notes due 2014. In this prospectus, the registered notes offered in exchange for outstanding unregistered notes will be called “exchange notes,” unless otherwise indicated.

Terms of the exchange offer:

The exchange offer will expire at 5:00 p.m., London time, on September 1, 2005, unless extended.

The issuer will exchange all outstanding unregistered notes that are validly tendered and not withdrawn before the exchange offer expires.

You may withdraw tenders of unregistered notes at any time before the exchange offer expires.

The exchange offer is subject to customary conditions, which we may waive.

We believe that the exchange of unregistered notes for exchange notes will not be a taxable exchange for US federal income tax purposes. You should consult your tax advisor for the particular tax consequences to you of holding and disposing of exchange notes.

We will not receive any proceeds from the exchange offer.

The terms of the exchange notes are substantially identical to the unregistered notes, except that the exchange notes have been registered under the US Securities Act of 1933, as amended, and transfer restrictions and registration rights relating to the unregistered notes do not apply to the exchange notes.

The issuer currently intends to list the exchange notes on the Irish Stock Exchange.

See “Risk Factors” beginning on page 20 to read about important factors that you should consider before participating in the exchange offer.

Neither the US Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense in the United States.

The date of this prospectus is August 3, 2005.

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or a solicitation of an offer to buy any of these securities to any person in any jurisdiction where it is unlawful to make this type of an offer or solicitation.

This prospectus incorporates business and financial information about us and the issuer that is not included in or delivered with the prospectus. This information is available without charge to you upon written or oral request toWilliam Ginn,Chief Financial Officer, Centennium House, 100 Lower Thames Street, London EC3R 6DL, telephone number 44 (0) 845 000 1000.In order to obtain timely delivery, you must request the information not later than five business days before the exchange offer expires.

This prospectus is being distributed only (i) in the United Kingdom to persons who have professional experience in matters relating to investments falling within Articles 19(1) and 19(5) of the Financial Services Markets Act 2000 (Financial Promotions) Order 2001 and (ii) to persons to whom it is legal to distribute it. This prospectus is directed only at these people and must not be acted on or relied on by persons who are not these people. Any investment or investment activity to which this prospectus relates is available only to relevant persons and will be engaged in only with these people. This prospectus and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other person.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

SELLING RESTRICTIONS

United Kingdom

The exchange notes are being issued under an exemption from the UK Banking Act 1987. We are not an institution authorized either under the UK Banking Act 1987 or the UK Building Societies Act 1986 or a European-authorized institution (as defined in the regulations implementing the second Banking Coordination Directive). The exchange notes will not be guaranteed by an authorized institution. The exchange notes will be long-term debt securities issued under regulations made under Section 4 to the UK Banking Act 1987.

THE ISSUER HAS NOT AUTHORIZED ANY OFFER OF THE EXCHANGE NOTES TO THE PUBLIC IN THE UNITED KINGDOM WITHIN THE MEANING OF THE PUBLIC OFFERS OF SECURITIES REGULATIONS 1995. THE EXCHANGE NOTES MAY NOT BE OFFERED OR SOLD TO PERSONS IN THE UNITED KINGDOM EXCEPT IN CIRCUMSTANCES WHICH DO NOT CONSTITUTE AN OFFER TO

i

THE PUBLIC WITHIN THE MEANING OF SUCH REGULATIONS. ALL APPLICABLE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 200 MUST BE COMPLIED WITH IN RESPECT OF ANYTHING DONE IN RELATION TO THE EXCHANGE NOTES IN, FROM OR OTHERWISE INVOLVING THE UNITED KINGDOM.

Within the United Kingdom, this prospectus is directed only at persons who have professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001, or relevant persons. The investment or investment activity to which this prospectus relates is only available to and will only be engaged in with relevant persons and persons who receive this prospectus who are not relevant persons should not rely or act upon it.

Ireland

The exchange notes may be offered and sold in Ireland only in accordance with the European Communities (Transferable Securities and Stock Exchange) Regulations 1992 of Ireland, if applicable, the Investment Intermediaries Act 1995 of Ireland, as amended, the Companies Acts 1963 to 2003 of Ireland and all other applicable Irish laws and regulations.

France

In France, the exchange notes may not be directly or indirectly offered or sold to the public, and offers and sales of the exchange notes will only be made in France to qualified investors or to a closed circle of investors acting for their own accounts, in accordance with Article L.411 2 of the Code Monétaire et Financier (formerly Article 6-II of Ordinance no. 67-833 dated September 28, 1967), as amended, and Decree no. 98-880 dated October 1, 1998. Accordingly, this prospectus has not been submitted to the Commission des Opérations de Bourse. Neither this prospectus nor any other offering material may be distributed to the public in France.

Les titres ne pourront pas être offerts ou vendus directement ou indirectement au public en France et ne pourront l’être qu’à des investisseurs qualifiés ou à un cercle restreint d’investisseurs au sens de l’Article L.411 2 du Code Monétaire et Financier (anciennement article 6-II de l’Ordonnance no. 67-833 du 28 Septembre 1967), telle que modifiée et du Décret no. 98-880 du 1er Octobre 1998. Par conséquent, ce prospectus n’a pas été soumis au visa de la Commission des Opérations de Bourse. Ni ce prospectus ni aucun autre document promotionnel ne pourrant être communiqués au public en France.

Germany

The offering of the exchange notes is not a public offering in the Federal Republic of Germany. The exchange notes may be offered and sold in the Federal Republic of Germany only in accordance with the provisions of the Securities Sales Prospectus Act (Wertpapier-Verkaufsprospektgesetz) of the Federal Republic of Germany, as amended, and any other applicable German law. No application has been made under German law to publicly market the exchange notes in or out of the Federal Republic of Germany. The exchange notes are not registered or authorized for distribution under the Securities Sales Prospectus Act and accordingly may not be, and are not being, offered or advertised publicly or by public promotion. Therefore, this prospectus is strictly for private use and the offer is only being made to recipients to whom the document is personally addressed and does not constitute an offer or advertisement to the public. Consequently, in Germany, the exchange notes will only be available to persons who, by profession, trade or business, buy or sell notes for their own or a third party’s account.

Spain

The exchange notes may not be offered within the Kingdom of Spain by means of advertising activities which might infringe in any way the regulations currently in force on public offerings and issues of securities

ii

and, in particular, this prospectus has not been registered with the Spanish Securities and Exchange Commission and neither this prospectus nor any other material information relating to the exchange notes may be distributed to Spanish investors except in compliance with Spanish securities regulations. Private placement of the exchange notes can be made pursuant to The Spanish Securities Markets Law (Ley 24/1988 de julio, del Mercado de Valores, as amended by Act 37/1998 of November 16) and the Royal Decree 291/1992 on Issues and Public Offering of Securities (Real Decreto 291/1992 de 27 de Marzo, sobre Emisiones y Ofertas Públicas de Venta de Valores), as amended or restated by the Royal Decree 2590/1988 of December 7, 1998 and subsequent legislation.

This prospectus is neither verified nor registered in the administrative registries of theComisión Nacional del Mercado de Valores, and therefore a public offer for the subscription of the exchange notes will not be carried out in Spain. Notwithstanding that and in accordance with Article 7 of the Royal Decree 291/1992, a private placement of the notes addressed exclusively to institutional investors (as defined in Article 7.1(a) of the Royal Decree 291/1992) may be carried out.

Luxembourg

The exchange notes may not be offered in the Grand Duchy of Luxembourg except in circumstances where the requirements of Luxembourg law concerning public offerings of securities have been met.

ENFORCEMENT OF FOREIGN JUDGMENTS AND SERVICE OF PROCESS

The issuer is a public limited company organized under the laws of England and Wales. The guarantor is a private limited company organized under the laws of England and Wales. The majority of each of the issuer’s and the guarantor’s officers and members of the board of directors are not residents of the United States, and all of the assets of each of the issuer, the guarantor and these persons are located outside the United States. As a result, it may not be possible for holders or beneficial owners of notes to effect service of process within the United States upon the necessary people, or to enforce against them in the US courts judgments obtained in US courts, whether or not predicated upon the civil liability provisions of the US federal securities or other laws of the United States or any US state. We have been advised by Weil, Gotshal & Manges, our English and US counsel, that if an original action is brought in the United Kingdom, predicated solely upon US federal securities laws, UK courts may not have the requisite jurisdiction to grant the remedies sought.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements,” as such term is defined in Section 21E of the US Securities Exchange Act of 1934, or the Exchange Act. These statements set forth anticipated results based on our management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public as well as in oral forward-looking statements. These forward-looking statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify these forward-looking statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance or strategies.

We do not undertake to update forward-looking statements, whether as a result of new information, future events or otherwise. You should, however, consult any future disclosures we make on related subjects. Also note that we provide a discussion of risks and uncertainties related to our businesses. See “Risk Factors.” These are factors that we believe, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. You should understand that it is not possible to predict or identify all these factors. Therefore, you should not consider the “Risk Factors” section to be a complete discussion of all potential

iii

risks or uncertainties. As described in this prospectus, these risks, uncertainties and other important factors include, among others:

| | • | | deficiencies we have identified in our internal controls, processes and procedures; |

| | • | | our parent’s chapter 11 reorganization, financial restatement and other matters; |

| | • | | the potential adverse effect on us of a change in financial reporting in accordance with international financial reporting standards, or IFRS; |

| | • | | our reliance on the services of our key personnel; |

| | • | | periodic reviews of our financial condition by certain of our governmental customers; |

| | • | | the level of competition in the marketplace; |

| | • | | surplus industry capacity and other factors that might decrease the price of our products and services; |

| | • | | weakness in the telecommunications industry; |

| | • | | the fact that our turnover is concentrated in a limited number of customers; |

| | • | | a substantial portion of our network is subject to a finance lease with Network Rail; |

| | • | | insolvency could lead to termination of certain of our contracts; |

| | • | | a change of control could lead to the termination of many of our government contracts; |

| | • | | the absence of firm commitments to purchase minimum levels of turnover or services in our commercial customer contracts; |

| | • | | our ability to avoid and mitigate any disruptions in the availability or quality of our service; |

| | • | | risks relating to the rating of our notes; |

| | • | | increases in industry competition due to rapid technological changes; |

| | • | | limitations on our ability to control our costs while maintaining and improving our service levels; |

| | • | | the UK Office of Fair Trading is investigating concerns as to certain allegations of collusive behavior; |

| | • | | changes in government regulation of telecommunications services; |

| | • | | our reliance on third parties for the timely supply of equipment and services; |

| | • | | limitations on our ability to continue to develop effective business support systems; |

| | • | | the influence of our parent and actions our parent takes, or actions we are obliged to take as a result of our parent’s action, may conflict with our interests; |

| | • | | the sharing of corporate and operational services with our parent; |

iv

| | • | | our directors’ potential conflicts of interest due to ownership of, or options to purchase, our parent’s stock; |

| | • | | limitations on our ability to develop and market new or existing commercial services successfully; |

| | • | | the return of assets to our parent if fraudulent conveyances to us by our parent occur; |

| | • | | major rail accidents or significant acts of vandalism; |

| | • | | terrorist attacks or other acts of violence; and |

| | • | | increased scrutiny of financial disclosure and the possibility of litigation. |

We cannot guarantee that any forward-looking statement will be realized. Our achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions. If known or unknown risks or uncertainties materialize, or if underlying assumptions prove inaccurate, our actual results could vary materially from past results and from those anticipated, estimated or projected. You should bear this in mind as you read the forward-looking statements.

PRESENTATION OF INFORMATION

Corporate Organization

All references in this prospectus to:

| | • | | “we,” “us,” “our,” the “company,” the “guarantor,” and “GCUK” refer to Global Crossing (UK) Telecommunications Limited and its consolidated subsidiaries, including the issuer, except where expressly stated otherwise or the context otherwise requires; |

| | • | | the “issuer” refer to Global Crossing (UK) Finance Plc, a company organized under the laws of England and Wales, and our direct, wholly owned finance subsidiary that is the issuer of the 10.75% dollar-denominated senior secured notes and the 11.75% sterling-denominated senior secured notes guaranteed by us and which has had no trading activity, except where expressly stated otherwise or the context otherwise requires; |

| | • | | “GCL,” “Global Crossing,” “our parent” and “our parent company” refer to Global Crossing Limited, a company organized under the laws of Bermuda and our indirect parent company by which we are indirectly wholly owned; |

| | • | | “old parent company” or “old parent” refer to Global Crossing Ltd., a company formed under the laws of Bermuda and our parent company’s predecessor; |

| | • | | “BidCo,” “our immediate parent” and “our immediate parent company” refer to Global Crossing BidCo Limited, a company organized under the laws of England and Wales and our direct parent company by which we are directly wholly owned and which is indirectly wholly owned by GCL; |

| | • | | “group companies” refers to the group of companies owned directly or indirectly by GCL, including us; and |

| | • | | “Racal” refer to the network services arm of Racal Telecommunications Limited, our predecessor. |

v

Financial and Other Information

All references in this prospectus to:

| | • | | the “UK” refer to the United Kingdom; |

| | • | | “pounds sterling,” “sterling,” “£” or “pence” refer to the lawful currency of the United Kingdom; |

| | • | | the “United States” or the “US” refer to the United States of America; |

| | • | | “US$,” “US Dollars,” “dollars” or “$” refer to the lawful currency of the United States; |

| | • | | the “EU” refer to the European Union; |

| | • | | “euro” or “€” refer to the lawful currency of the European Union; and |

| | • | | the “notes” refer to the 10.75% dollar-denominated senior secured notes and the 11.75% sterling-denominated senior secured notes issued by the issuer on December 23, 2004 and to the exchange notes that the issuer proposes to issue in the registered exchange offer. |

The financial statements and the related notes in this prospectus have been prepared in accordance with applicable UK accounting standards, or UK GAAP. UK GAAP differs in some material respects from accounting principles generally accepted in the US, or US GAAP. For a discussion of the differences between UK GAAP and US GAAP as they apply to us, see note 26 to the audited financial statements included elsewhere in this prospectus. Unless otherwise indicated, financial information in this prospectus has been prepared in accordance with UK GAAP.

Some numbers in the financial information has been rounded and, as a result, the numbers shown as totals in this prospectus may vary slightly from the exact arithmetic aggregation of figures that precede them.

In this prospectus, we refer to “EBITDA,” by which we mean profit/(loss) before finance charges, taxes, depreciation and amortization. Although EBITDA is not a measure of operating profit/(loss), operating performance or liquidity under UK GAAP and US GAAP, we have presented EBITDA because we use EBITDA as a measure of our performance without regard to depreciation and amortization and we believe that some of our investors use this measurement in a consistent manner and to determine our ability to service our indebtedness and fund ongoing capital expenditures. See “Selected Financial Data” footnote 6, for further information. Although EBITDA is not a measure of operating profit/(loss), operating performance or liquidity under UK GAAP or US GAAP, we have presented EBITDA because we believe that some of our investors use this measurement to determine our ability to service our indebtedness and fund ongoing capital expenditures, and because some of the covenants in our debt agreements require the calculation of similar measures. You should not, however, construe EBITDA in isolation or as a substitute for operating income as determined by UK GAAP or US GAAP, or as an indicator of our operating performance or of our cash flows from operating activities as determined in accordance with UK GAAP or US GAAP. You should not use this non-GAAP measure as a substitute for the analysis provided in our profit and loss accounts or in our cash flow statements.

vi

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The following table sets forth, for the periods indicated, certain information concerning the noon buying rate in the City of New York for cable transfers in pounds sterling as announced by the Federal Reserve Bank of New York for customs purposes, or the “noon buying rate,” for pounds sterling expressed in dollars per £1.00. As of July 5, 2005, the noon buying rate for pounds sterling expressed in dollars per £1.00 was 1.757.

| | | | | | | | | | | | |

| | | Dollars per £1.00

|

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

(through

July 5)

|

Exchange rate at end of period (Year ended December 31, except 2005) | | 1.496 | | 1.454 | | 1.609 | | 1.784 | | 1.916 | | 1.757 |

Average exchange rate during period* | | 1.513 | | 1.438 | | 1.508 | | 1.645 | | 1.836 | | 1.855 |

Highest exchange rate during period | | 1.654 | | 1.503 | | 1.610 | | 1.784 | | 1.948 | | 1.929 |

Lowest exchange rate during period | | 1.400 | | 1.373 | | 1.407 | | 1.550 | | 1.754 | | 1.757 |

| * | The average of the noon buying rates for cable transfer in pound sterling as certified for customs purposes by the Federal Reserve Bank of New York on the last business day of each month during the applicable period (through July 5 in the case of 2005). |

| | | | |

Month

| | Highest exchange

rate during the month

| | Lowest exchange

rate during the month

|

January 2005 | | 1.906 | | 1.865 |

February 2005 | | 1.925 | | 1.857 |

March 2005 | | 1.929 | | 1.866 |

April 2005 | | 1.920 | | 1.873 |

May 2005 | | 1.905 | | 1.820 |

June 2005 | | 1.837 | | 1.794 |

July 2005 (through July 5) | | 1.771 | | 1.757 |

MARKET AND INDUSTRY DATA

In this prospectus, we rely on and refer to information and statistics on our industry. We obtained these market data from independent industry publications or other publicly available information. Although we believe that these sources are reliable, we have not independently verified and do not guarantee the accuracy and completeness of this information.

WHERE YOU CAN OBTAIN MORE INFORMATION

The issuer and we have filed a registration statement on Form F-4 under the US Securities Act of 1933 or, the Securities Act, with the SEC for our offering of the exchange notes. This prospectus does not contain all of the information in the registration statement. You will find additional information about us and the exchange notes in the registration statement. For more information about statements in this prospectus about legal documents, we refer you to copies of the documents that are filed as exhibits to the registration statement.

We file some reports and other information with the SEC, and furnish some reports and other information to the SEC. You may read and copy the registration statement, the exhibits to the registration statement and the reports and other information filed by us in accordance with the U.S. Exchange Act, at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC maintains an internet site athttp://www.sec.gov that contains reports, proxy and information statements and other information on issuers.

vii

However, we are not and, prior to the effectiveness under the Securities Act of a registration statement for an exchange offer for the unregistered notes, are not expected to be, required to file reports with the SEC for the unregistered notes or to deliver an annual report to holders of the unregistered notes under the Exchange Act. However, we will be subject to the disclosure obligations described in “Description of the Notes—Certain Covenants—Reports to Holders.” Under these obligations, as long as the notes are outstanding, we will furnish you with certain annual and quarterly financial information and, for as long as the notes are “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act, we will furnish you, or any prospective purchaser of the exchange notes you designate, with the information required to be delivered by Rule 144A(d)(4) under the Securities Act when we receive a written request to do so from you. Written requests for the information should be addressed to William Ginn, Global Crossing (UK) Finance plc, Centennium House, 100 Lower Thames Street, London EC3R 6DL. Our telephone number is +44 (0) 845 000 1000.

viii

SUMMARY

The following summary highlights certain key information contained elsewhere in this prospectus. This summary includes significant information that you should consider before participating in the exchange offer. You should read this entire prospectus, including the financial data and related notes, before making an investment decision. You should also carefully consider the information set forth under the heading “Risk Factors.”

Overview

We are one of the leading UK providers of managed network communications services. We are an indirect, wholly owned subsidiary, and the principal UK telecommunications business, of Global Crossing. Our predecessor, the network services arm of Racal, began operations in fixed line communications in 1988 when the UK government awarded it the contract to establish and maintain the Government Data Network providing managed services and other communications offerings to numerous departments of the UK government. In December 1995, our predecessor acquired the company that owned the rights and assets related to the fiber optic network originally created for the UK national railway, together with associated contracts. Our old parent company subsequently acquired this business in November 1999.

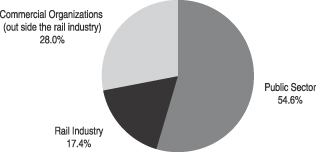

We have a strong and established commercial customer base, including over 100 UK government departments, as well as information technology systems integrators, rail sector customers and major corporate clients. We provide our commercial customers with a range of services generally tailored to their specific requirements. Turnover from commercial customers with which we have a multi-year contractual relationship represented 76.9% of our turnover in 2004 and 83.8% of our turnover for the quarter ended March 31, 2005. In total, commercial customers generated 87.2% of our turnover in 2004. We also provide carrier services to national and international communications service providers.

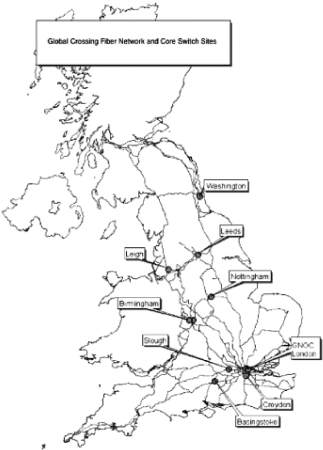

We operate the most extensive fiber optic network in the UK after BT (formerly British Telecommunications) and Cable and Wireless, reaching within two kilometers of 64% of UK central business delivery addresses tracked by Royal Mail. Because of our network’s reach and capacity, we believe we are well positioned to take advantage of new business opportunities with modest incremental capital expenditure.

Despite an economic downturn and a challenging telecommunications spending environment, we have achieved financial stability through our significant contract-based recurring turnover stream, strong service suite, customer relationships and disciplined cost control. Our financial results for the year ended December 31, 2004 included turnover of £269.9 million, EBITDA of £86.5 million (amounting to an EBITDA margin of 32.1%) and net cash flow from operating activities less capital expenditure of £51.1 million.

Services Offered

We provide a wide range of telecommunications services, including voice, data and Internet Protocol, or IP, services to government and other public sector organizations, major corporations and other communications companies. We market these services through two channels: commercial services and carrier services.

We provide UK government departments and other commercial customers with a range of complex managed and network services that we typically tailor to specific customer requirements. The voice and data communications services we provide to our customers include:

| | • | | high-speed managed connectivity through access to our asynchronous transfer mode, or ATM, and frame relay networks; |

1

| | • | | leased lines and international private leased lines; |

| | • | | direct dial voice services; and |

| | • | | IP-based virtual private networks, or IP VPNs. |

In addition, we expect by the end of the first half of 2005 to offer our commercial customers voice connectivity over our IP network, a service known as voice over IP, or VoIP, as well as video over IP.

We also sell wholesale data capacity on our network and provide voice and data services to other communications service providers. These carrier services consist of structured capacity, sales of dark fiber and empty ducts, IP transit, carrier voice service on a wholesale basis, carrier pre-selection and other services.

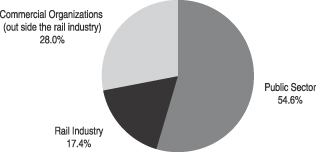

Customers

We have two types of customers: commercial customers and carrier customers (including mobile customers), most of whom purchase capacity on a wholesale basis. Our primary strategy is to provide communications services to commercial customers in the UK and globally via the worldwide network of Global Crossing and others. Turnover from commercial customers represented 81.9% of our total turnover in 2003 and 87.2% of our total turnover in 2004. Certain of our principal customer relationships in 2004 included:

| | |

Commercial Customers

| | Initial Contract

Length/Term(1)

|

Camelot (National Lottery) | | 7 years |

EDS (Her Majesty’s Prisons)(3) | | 12 years |

Foreign & Commonwealth Office | | 10 years |

Fujitsu (Her Majesty’s Customs and Excise)(3) | | 10 years |

Fujitsu (Magistrates Courts/Libra)(3)(5) | | 3 years |

Lockheed Martin(4) | | 7 years,

3 months |

Network Rail | | 5 years |

OGCbuying.solutions (Managed Telecom Service)(2) | | 12 years |

Train Operating Companies | | Various |

| (1) | This table measures the term of our key commercial contracts from the signing of each contract, the earliest of which was signed by our predecessor on March 23, 1989. Therefore, the remaining life of these contracts may be significantly shorter than the initial contract length/term reflected in this table. |

| (2) | This framework contract contains a clause that permits end-users (the government agencies and departments that agree to purchase our services under this framework contract) to terminate after a three-year period. The framework contract has a term of 12 years. |

| (3) | We provide these services to systems integrators, which large organizations typically use to coordinate and manage the outsourcing of, among other things, their telecommunications services. For these contracts, we act as a subcontractor to the systems integrator who holds the contract with the entity noted in parentheses. |

| (4) | In February 2005, this contract was extended until March 31, 2011. |

| (5) | The Magistrate Courts/Libra contract was for an initial term of three years from November 2000. It has been extended until March 2007. |

The table below sets forth information regarding our commercial turnover. These amounts represent turnover for the periods indicated.

| | | | | | | | | |

| | | Year ended

December 31,

| | 2004

|

| | | 2002

| | 2003

| |

| | | (in millions) |

Commercial Turnover from Top 20 Customers(1) | | £ | 161.0 | | £ | 178.6 | | £ | 187.7 |

Other Commercial Turnover(1) | | | 54.9 | | | 57.2 | | | 47.6 |

| | |

|

| |

|

| |

|

|

Total Commercial Turnover(1) | | £ | 215.9 | | £ | 235.8 | | £ | 235.3 |

| | |

|

| |

|

| |

|

|

| (1) | This turnover is based on historical information and does not necessarily indicate future turnover-generating capability. Few of our contracts provide for a minimum or threshold turnover stream or usage base and, it is not therefore possible to predict future turnover that will be generated from our contracts. Turnover shown above excludes carrier figures which constituted £44.5 million, £50.9 million and £34.0 million for the years ended December 31, 2002, 2003 and 2004, respectively. |

2

Examples of the customized network services that we provide to our commercial customers include:

| | • | | A managed voice and data network linking all of the UK Foreign & Commonwealth Office’s 256 locations in 148 countries.The connectivity established under this contract enables critical applications such as instantly connecting UK diplomats around the world and providing for secure information transfer among diplomatic sites. |

| | • | | A managed voice network that we offer through OGCbuying.solutions (a procurement arm of the UK government). This network provides service to approximately 122,000 telephone handsets servicing voice communications needs for upwards of 80 major UK government departments. We believe this is one of the largest private European managed voice networks. We are currently migrating this network from a traditional switched-based service to IP technology. |

| | • | | An integrated services digital network, or ISDN, linking around 27,000 retail outlets for Camelot, the UK’s national lottery operator. The actual maximum call rate that has hit the live network is around 40,000 calls per minute, with much greater capacity available. |

| | • | | A voice VPN for all of the UK’s train operating companies, or TOCs, for all internal and external voice communications nationwide, including their customer sales and support activities. We also provide managed data services to several TOCs on which they run their ticketing systems and fulfill other data communications needs. |

In 2004, we entered into 668 new commercial customer contracts and added 114 new commercial customers. Examples of these new customers include Taylor Woodrow, for which we are providing a nationwide IP VPN, and the UK’s Immigration & Nationality Directorate, or IND, for which we are supplying managed voice services through our Managed Telecommunications Services framework contract, or the MTS framework agreement. In addition, we expanded certain existing contracts, including, in May 2004, the MTS framework agreement for migrating existing customers to IP-converged services. During the first quarter of 2005, we entered into 54 new commercial contracts and have added six new commercial customers.

We provide our managed voice and data services largely via multi-year contracts that provide a recurring turnover stream. Turnover from commercial customers with which we have a multi-year contractual relationship represented 76.9% of our turnover in 2004. Our strong customer relationships, our service capabilities, and the complexity and highly integrated nature of the services we provide to our customers contribute to the stability of our customer base and turnover stream. We believe that in many cases, our customers would incur significant expense and logistical challenges if they were to move to an alternative provider. As a result, we have not experienced significant customer churn in recent years.

We also provide wholesale services to carrier customers on a selective basis. We rigorously analyze these incremental turnover streams and their associated costs and overheads to ensure that these customer opportunities generate sufficient returns. Our carrier customers accounted for 12.6% of our 2004 turnover. Our carrier customers include Fibrenet, Energis, Hutchison Network Systems, NTL and BT.

3

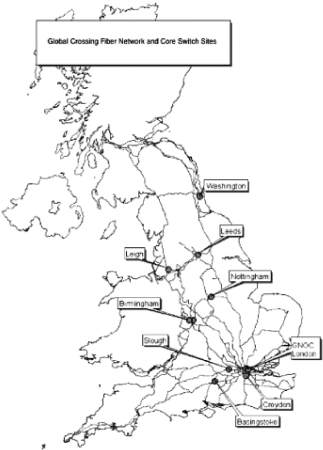

Network

Our network consists of both leased assets and owned assets. We operate a high-capacity and resilient optical transport network, which consists of approximately 13,200 route kilometers of optical fiber cable, most of which runs in troughs along the UK rail network. Our network runs directly into 150 towns and cities, reaching within two kilometers of 64% of UK central business delivery addresses tracked by Royal Mail. Our core optical fiber network interconnects to local network providers at 158 points of presence, or PoPs, and 36 main switching units.

Our entire nationwide fiber optic network footprint currently contains lit fiber and has significant dark fiber availability to serve increased capacity needs. Accordingly, we believe that our existing network reach and capacity are sufficient to support a substantially increased turnover stream and customer base with modest incremental capital expenditure.

Business Strategies

Our strategy is to capitalize on the expected growth in demand for complex, managed telecommunications services and capacity while maintaining our recurring turnover stream and stable margins:

| | • | | Focus on managed services to commercial customers. Our primary focus is on further developing our managed service business by maintaining and growing turnover from our existing commercial customer base and adding new customers, which we believe will allow us to preserve a recurring turnover stream and stable margins. The delivery of complex and tailored managed services under long-term contracts allows us to become an integrated and embedded component of our customers’ telecommunications requirements. Our strategy is to maintain turnover from commercial customers at over 80% of total turnover. |

| | • | | Leverage embedded infrastructure and existing customer relationships. We intend to increase our turnover from existing customers. For a number of our customers, we have invested in developing customer-specific service offerings and have also upgraded customer premises equipment, including routers, switches and handsets. We believe this investment and the depth of our involvement in our customers’ business reduces churn and provides the basis for offering additional services at lower incremental costs and, we believe, improved margins. |

| | • | | Migrate technology to IP-based services. We have commenced, and intend over the next three years to complete, the migration of our entire customer base from legacy voice and data services to IP-based services, which will allow us to provide converged voice and data services. We are currently developing a platform that integrates voice, data and video services on a fully converged basis. We anticipate that these initiatives will increase our total turnover and enable us to realize network and operating efficiencies by allowing us to introduce new data and voice services, and provide those services to our customers at lower unit costs than they currently pay for legacy services. |

| | • | | Build cooperative sales efforts with systems integrators and others. We deliver new products and enhance our sales penetration through cooperative approaches with systems integrators, network suppliers, equipment manufacturers and other parties. These parties assist us in pursuing new customers and allow us to bundle our services with their equipment or applications. |

| | • | | Continue to reduce cost of access and control operating expenses. We intend to continue to reduce our cost of access by taking advantage of regulatory developments and we actively participate in their further development. We are focused on improving network optimization. We have reduced our cost of access from 48.8% of turnover for the year ended December 31, 2001, to 37.9% of turnover for the year ended December 31, 2003, and to 32.8% of turnover for the year ended December 31, 2004 and see further opportunities to continue to do so. |

4

Relationship with our Parent Company

We have a number of operating relationships with our parent and its affiliates. For example, we assist our parent and its affiliates in terminating voice traffic within the United Kingdom while they assist us with terminating voice traffic outside the United Kingdom. We benefit from a broad range of corporate functions that our parent company and its affiliates conduct, including senior management activities, human resources, corporate development, and other functions and services. We also share with our parent and its affiliates portions of our network and some personnel who may have functional responsibilities for both our business and our parent’s European and global businesses.

We have not historically operated on a stand-alone basis. In connection with the offering of the unregistered notes which we are offering to exchange, we entered into a series of agreements formalizing our operating relationship with our parent company and its affiliates. These agreements include the:

| | • | | corporate service agreement; |

| | • | | shared resources agreement; |

| | • | | voice termination agreement; |

| | • | | asset transfer agreement; and |

| | • | | insurance proceeds agreement. |

These inter-company agreements contain terms that are similar to those that have informally governed the relationship between our parent company, its affiliates and us. See “Certain Relationships and Related Party Transactions—Inter-company Agreements” and “ Operating and Financial Review and Prospects—Overview—Relationship with our Parent Company and its Affiliates.”

While Global Crossing Ltd., our parent company’s predecessor, began proceedings under chapter 11 of the US Bankruptcy Code in January 2002, and GCL, our existing parent company, emerged from those proceedings in December 2003, we were not part of those proceedings and continued to fulfill our financial obligations in the normal course of business. In December 2004, we amended our articles of association to provide that our members will not pass a resolution to wind up our company voluntarily as a result of the existence of insolvency or bankruptcy proceedings affecting other GCL group members incorporated outside the United Kingdom, including any proceedings under chapter 11 of the US Bankruptcy Code.

In order to enhance our independence, in June 2005, we increased the board of directors from five to seven members by the addition of two independent directors. These independent board directors constitute a majority on the newly formed three-person audit committee.

Our Parent Company’s Recapitalization and the Restructuring Agreement

The discussion below sets forth the background to our original offering of the unregistered notes.

On December 9, 2003, when our parent company emerged from bankruptcy, Global Crossing North American Holdings, Inc., or GCNAH, a subsidiary of our parent company, issued $200.0 million aggregate principal amount of 11.0% senior secured notes due 2006 to an affiliate of Singapore Technologies Telemedia Pte Ltd, or STT. We refer to these notes as the pre-existing STT notes. The pre-existing STT notes benefited

5

from, among other things, a guarantee of that debt by us, a first priority security interest over some of our assets, and a first priority pledge of the shares of our capital stock by our immediate parent company, BidCo.

On May 18, 2004, we, GCL and another affiliate of STT entered into a bridge loan facility that permitted us to borrow up to $100.0 million. We refer to this agreement as the STT bridge facility. The STT bridge facility benefited from, among other things, a second priority security interest over some of our assets and a second priority pledge of the shares of our capital stock by BidCo. On October 1, 2004, we drew down the remainder of the $100.0 million then available under this facility. We were the direct obligor on all amounts drawn under the STT bridge facility.

On October 8, 2004, GCL announced that it reached an agreement with some affiliates of STT to restructure the debt outstanding under the existing STT notes and the STT bridge facility and to provide additional short-term liquidity to GCL. We refer to this agreement as the restructuring agreement. Under the terms of the restructuring agreement, the STT affiliates agreed with us, GCL and some of its other affiliates to:

| | • | | increase the availability under the STT bridge facility by an additional $25.0 million to a maximum amount of $125.0 million; and |

| | • | | refinance the existing STT notes and the STT bridge facility as follows: |

| | • | | we would complete a debt financing (which was consummated by the offering of the unregistered notes); |

| | • | | GCNAH would use $75.0 million of the proceeds of our debt financing (plus an amount for accrued and unpaid interest) to repay $75.0 million in principal amount of the $200.0 million outstanding principal plus all of the accrued interest under the pre-existing STT notes; |

| | • | | GCL would issue to specific STT affiliates $250.0 million aggregate principal amount of new senior mandatory convertible notes, convertible into shares of our parent company, which we refer to as the mandatory convertible notes, in exchange for the acquisition by GCL of the existing STT notes and the STT bridge facility (after the cash repayment described above); |

| | • | | the STT bridge facility would be settled by GCUK (after the acquisition of the STT bridge facility by GCL described above); |

| | • | | GCNAH would repurchase the existing STT notes from GCL by issuing non-voting stock with an aggregate fair market value of $125.0 million; |

| | • | | our guarantee in respect of the existing STT notes would be cancelled; |

| | • | | the first priority security interest over our assets for the pre-existing STT notes and the second priority security interest over our assets in respect of the STT bridge facility would be released; and |

| | • | | neither we nor the issuer would guarantee or provide a security interest in respect of the mandatory convertible notes. |

On November 2, 2004, we entered into the agreement increasing availability under the STT bridge facility and on November 5, 2004, drew down the additional $25.0 million. The STT affiliate that was the lender under the STT bridge facility agreed to defer the interest payment due on December 31, 2004 under that facility and also agreed to defer the final maturity date of the facility from December 31, 2004 until the earlier of the completion of the offering of the unregistered notes and January 15, 2005.

All of the agreements that relate to the restructuring of the existing STT notes and the STT bridge facility were conditioned upon and closed concurrently with the offering of the unregistered notes.

6

The effect of these transactions was that neither we nor the issuer owe any direct obligations to STT or its affiliates or to GCL or its affiliates, with the exception of certain inter-company trading balances that arise in the ordinary course of business and that we intend to settle on a quarterly basis. Our shares remain pledged by our immediate parent company in favor of the holders of the mandatory convertible notes.

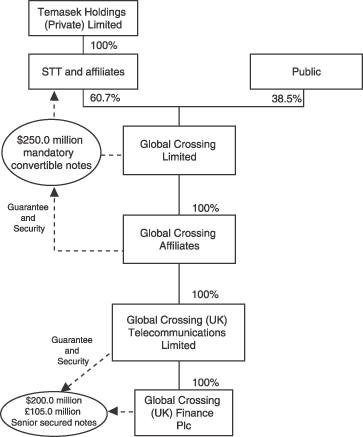

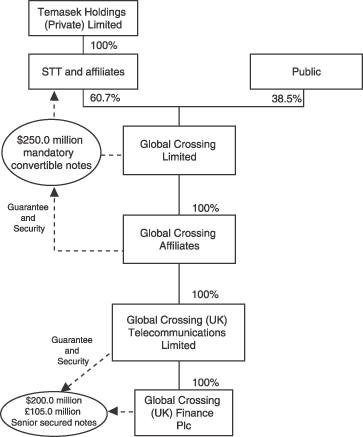

Our Organizational Structure and Certain Obligations under Indebtedness

We set forth in the diagram below a simplified corporate organizational chart for us, the issuer, our parent company and its shareholders. We also reflect in this diagram certain of our existing debt obligations.

The terms of a security arrangement agreement govern the relationship between the holders of the mandatory convertible notes and the holders of the unregistered notes. It will continue to govern the relationship between the holders of the mandatory convertible notes and the exchange notes offered in this exchange offer. See “Description of the Notes—Security Arrangement Agreement.”

The issuer, a finance subsidiary that has no trading activity, is a public limited company and we are a private limited company, each organized under the laws of England and Wales. The issuer’s and our principal executive offices are located at Centennium House, 100 Lower Thames Street, London EC3R 6DL, England, and the issuer’s and our telephone number at that address is +44 (0) 845 000 1000. Information on our parent company can be found at www.globalcrossing.com. The information on that website is not part of this prospectus.

STT is in the business of media and telecommunications services, investment holdings and management services.

7

The Exchange Offer

On December 23, 2004, Global Crossing (UK) Finance plc issued $200,000,000 aggregate principal amount of 10.75% dollar-denominated senior secured notes due 2014 and £105,000,000 aggregate principal amount of 11.75% sterling-denominated senior secured notes due 2014 in a transaction that was exempt from registration under the Securities Act. The dollar-denominated senior secured notes and the sterling-denominated senior secured notes issued on December 23, 2004 are together referred to as the “unregistered notes.” As a condition to the purchase of the unregistered notes, we agreed to use our best efforts to commence an exchange offer for the unregistered notes by August 19, 2005. Unregistered notes that remain outstanding after the completion of the exchange offer, together with the exchange notes, will be treated as a single class of securities under the indenture. As used in this prospectus, the term “notes” or “outstanding notes” refers to all of our outstanding senior secured notes due 2014.

Securities Offered | We are offering up to $200,000,000 aggregate principal amount of new 10.75% senior secured notes due 2014 and up to £105,000,000 aggregate principal amount of new 11.75% senior secured notes due 2014, all of which have been registered under the Securities Act. The terms of the exchange notes are substantially identical to the those of the unregistered notes, except that transfer restrictions and registration rights relating to the unregistered notes do not apply to the exchange notes. |

The Exchange Offer | We are offering to issue the exchange notes in exchange for a like principal amount of the unregistered notes. The unregistered notes were not registered under the Securities Act. We are offering to issue the exchange notes to satisfy our obligations contained in the registration rights agreement entered into when the unregistered notes were sold under Rule 144A and Regulation S of the Securities Act. |

Expiration Date | The exchange offer will expire at 5.00 p.m., London time on September 1, 2005. |

Procedures for Tendering Unregistered Notes | If you wish to participate in the exchange offer, you must transmit a properly completed and signed letter of transmittal, and all other documents required by the letter of transmittal, to the exchange agent at the relevant address set forth in the letter of transmittal or transmit an agent’s message via the relevant book-entry transfer facility on or prior to the expiration date. You must also comply with the procedures described under “The Exchange Offer—Procedures for Tendering.” |

The letter of transmittal must also contain, or the agent’s message must state that you are making, the representations you must make to us as described under “The Exchange Offer—Procedures for Tendering.”

Special Procedures for Beneficial Owners | If you are a beneficial owner of unregistered notes that are held through a broker, dealer, commercial bank, trust company or other nominee and you wish to tender such unregistered notes, you should contact the registered holder promptly and instruct them to tender your unregistered notes on your behalf. |

8

Guaranteed Delivery Procedures for Unregistered Notes | If you cannot meet the expiration deadline, or you cannot deliver your unregistered notes, the letter of transmittal or any other required documentation, or comply with DTC’s, Euroclear’s or Clearstream’s standard operating procedures for electronic tenders on time, you may tender your unregistered notes according to the guaranteed delivery procedures set forth under “The Exchange Offer—Procedures for Tendering—Guaranteed Delivery Procedures.” |

Withdrawal Rights | You may withdraw the tender of your unregistered notes at any time before 5:00 p.m., London time on the expiration date by sending a notice of withdrawal that complies with the procedures of DTC, Euroclear or Clearstream, as applicable, to the exchange agent. You must also follow the withdrawal procedures as described under the heading “The Exchange Offer—Procedures for Tendering—Withdrawal Rights.” |

Acceptance of Tenders | If we decide for any reason not to accept an unregistered note for exchange, the unregistered note will be returned without expense to you promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. Please read “The Exchange Offer—Conditions to the Exchange Offer” for more information. |

U.S. Federal Income Tax Consequences | We believe that your exchange of unregistered notes for exchange notes in the exchange offer will not result in any gain or loss to you for US federal income tax purposes. Please read “Tax Considerations – United States Federal Income Tax Considerations” for a further discussion of tax issues. |

Resale of Exchange Notes | If you decide to exchange your unregistered notes for exchange notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the exchange notes. If you are a broker-dealer and you are receiving the exchange notes for unregistered notes that you acquired as a result of market-making or trading activities, you must deliver a prospectus when you resell exchange notes. |

Use of Proceeds | We will receive no proceeds from the exchange offer. |

Exchange Agent | The Bank of New York is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are given under “The Exchange Offer—Exchange Agent.” |

9

Consequences of Not Exchanging Unregistered Notes

If you do not exchange your unregistered notes in the exchange offer, the transfer of unregistered notes will continue to be restricted. In general, you may offer or sell your unregistered notes only if:

| | • | | they are registered under the Securities Act and applicable state securities laws; |

| | • | | they are offered or sold under an exemption from the Securities Act and applicable state securities laws; or |

| | • | | they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not currently intend to register the unregistered notes under the Securities Act. However, holders of unregistered notes who are not permitted to participate in the exchange offer or who may not freely resell exchange notes received in the exchange offer may under some circumstances require us to file a shelf registration statement to cover resale of unregistered notes by them.

10

The Exchange Notes

The terms of the exchange notes and the unregistered notes are substantially identical in all material respects, except that the exchange notes do not contain terms for transfer restrictions and the payment of additional interest.

Issuer | Global Crossing (UK) Finance Plc. |

Guarantor | Global Crossing (UK) Telecommunications Limited. |

Notes Offered | $200,000,000 aggregate principal amount of 10.75% senior secured notes due December 15, 2014. |

£105,000,000 aggregate principal amount of 11.75% senior secured notes due December 15, 2014.

In this prospectus, we refer to the dollar-denominated exchange notes and the sterling-denominated exchange notes collectively as the exchange notes. The exchange notes are being offered as additional debt securities under the indenture under which we issued the unregistered notes. Unregistered notes that remain outstanding at the completion of the exchange offer, together with the exchange notes will be treated as a single class of securities under the indenture.

Maturity Date | The exchange notes will mature on December 15, 2014. |

Interest Payment Dates | The exchange notes will accrue interest from their date of issuance. The issuer will pay interest on the exchange notes in cash semi-annually in arrears on June 15 and December 15 of each year, beginning on June 15, 2005. |

Ranking and Guarantee | The exchange notes will be senior obligations of the issuer and will rank equal in right of payment with all of the issuer’s future senior debt. The exchange notes will effectively rank senior in right of payment to all future obligations of the issuer that are unsecured or secured by liens junior to those securing the exchange notes, to the extent of the value, priority and validity of the liens on the collateral securing the notes. The exchange notes will rank senior to any of the issuer’s future debt that is expressly subordinated to the notes. |

The guarantor will guarantee the exchange notes. The guarantee will be our senior obligation and will rank equal in right of payment with all of our existing and future senior debt. The guarantee will effectively rank senior in right of payment to all of our existing and future obligations that are unsecured or that are secured by liens junior to those securing the guarantee, to the extent of the value, priority and validity of the liens on the collateral securing the guarantee. The guarantee will rank senior to any of our future debt that is expressly subordinated to the guarantee. The guarantee will effectively rank junior to any of our other obligations that are secured by liens on property that does not secure the guarantee, to the extent of the value, priority and validity of those liens.

11

A significant portion of the guarantor’s assets will not serve as collateral for the exchange notes and there are restrictions on the exercise of remedies relating to the security interest. See “Description of the Notes—Security” and “—Sufficiency of Collateral.”

Collateral | The exchange notes will be secured by certain assets of the guarantor and the issuer, including the capital stock of the issuer, but a significant portion of the guarantor’s assets will not serve as collateral for the exchange notes. |

In particular, the guarantor will not pledge:

| | • | | certain parts of the network leased by us, including any telecommunications cables and other equipment under a finance lease with Network Rail under which we lease approximately 23% of our lit fiber (calculated by fiber kilometers); |

| | • | | any rights, title, interest or obligations under certain specified excluded contracts, including (i) any contracts in which our counterparty is a UK governmental entity and (ii) any contract in which our counterparty is a contractor or subcontractor to a UK governmental entity; |

| | • | | any equipment or assets owned by us located on the premises of the parties to excluded contracts and any equipment or assets used exclusively by us for the provision of services and the performance of obligations under those contracts; |

| | • | | property that we have pledged to Camelot in connection to our relationship with them and any equipment subject to our contract relating to Freenet; or |

| | • | | any contract or agreement (or rights or interests thereunder) which, if charged, would be a breach or default or result in the invalidation or unenforceability of any rights, title or interest of the chargor under that contract or agreement. |

Your rights in enforcing the collateral are more limited than they would be if we were pledging all or substantially all of our assets. See “Risk Factors—Risks Related to the Notes and the Structure—A significant portion of our assets will not be pledged in favor of the notes and the collateral securing the notes and the guarantee may be reduced or diluted under certain circumstances. The value of the collateral securing the notes and the guarantee may not be sufficient to satisfy obligations to you” and “—English insolvency laws may limit your ability to recover amounts due on the notes and the guarantee.”

The exchange notes will be secured by a security assignment of the inter-company loan from the issuer to the guarantor of the proceeds of the offering of the unregistered notes.

12

The issuer and the guarantor may incur liens on the collateral under the indenture’s terms, and these permitted liens will have priority over the liens in favor of the notes and the guarantee.

We entered into a five-year cross-currency interest rate swap transaction with an affiliate of Goldman, Sachs & Co. to minimize exposure of any dollar/sterling currency fluctuations on interest payments on the US dollar-denominated senior secured notes. The swap transaction converts the US dollar currency rate on interest payments to a specified pounds sterling amount. As of December 31, 2004, there was an unrecognized loss of £2.4 million on the swap. The interest payments on the US dollar-denominated exchange notes will also be governed by the swap agreement. The affiliate of Goldman, Sachs & Co. was granted a security interest in the collateral securing the exchange notes ranking equally with the security interest of holders of the exchange notes. Any proceeds resulting from the exercise of security interests in the collateral are to be shared pro rata among those financial institutions and holders of the exchange notes. See “Description of the Notes—Intercreditor Agreement.”

Restriction on Exercise of Remedies | The terms of a security arrangement agreement will govern the exercise of rights in the collateral pledged in favor of the exchange notes and the guarantee. The terms of the security arrangement agreement significantly limit the exercise of remedies associated with the security documents. These restrictions limit the ability of the trustee and the holders to realize value from the collateral. See “Description of the Notes—Security Arrangement Agreement” and “Risk Factors—Risks Related to the Notes and the Structure —Holders of the mandatory convertible notes have certain rights relating to and affecting the notes that the issuer is offering.” |

Specifically, the security arrangement agreement provides that none of our assets or the issuer’s assets may be sold or disposed of in an enforcement action begun under the security documents by or on behalf of the trustee or the holders, unless:

| | • | | all of our assets or all of the issuer’s assets, as the case may be, are sold; |

| | • | | the sale is for cash payable at the closing of the transaction; |

| | • | | all claims of the holders are unconditionally released and discharged concurrently with that sale and all liens for the benefit of the holders are unconditionally released and discharged; and |

| | • | | the sale is made in a public auction or for fair market value (taking into account the circumstances giving rise to the sale) as certified by an independent, internationally recognized investment bank selected by the holders of the mandatory convertible notes. |

13

The security arrangement agreement expressly states that these provisions shall not alter any rights or remedies of the trustee or holders as unsecured creditors under the indenture, the exchange notes or the guarantee.

Optional Redemption | The issuer may redeem either or both series of exchange notes, in whole or in part, at any time on or after December 15, 2009 at the redemption prices set forth under “—Redemption—Optional Redemption.” At any time before December 15, 2009, the issuer may redeem either or both series of exchange notes, in whole or in part, by paying a “make-whole” premium. The issuer may also redeem up to 35% of the principal amount of either series of exchange notes before December 15, 2007 using the proceeds of certain equity offerings. The issuer may also redeem either or both series of exchange notes, in whole but not in part, upon certain changes in tax laws and regulations. |

Excess Cash Flow Offer | Within 120 days after the end of the period beginning on the date of the indenture and ending December 31, 2005 and for each 12-month period thereafter, we must offer to purchase a portion of the exchange notes at a purchase price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, to the purchase date, with 50% of our excess operating cash flow from that period. |

Change of Control | If we experience a change of control, you will have the right to require the issuer to purchase some or all of your exchange notes at a purchase price equal to 101% of their principal amount plus accrued and unpaid interest, if any, and additional amounts, if any, to the date of repurchase. |

Buy-Out Right | If there is a payment default on or an acceleration of the exchange notes or in the case of certain enforcement events, STT Communications Ltd (or one of its affiliates) for so long as it together with its affiliates owns not less than 50% in aggregate principal amount of our parent’s mandatory convertible notes may, but are not required to, purchase the exchange notes from you at a price equal to 100% of the principal amount of the exchange notes plus accrued and unpaid interest. |

Certain Covenants | The issuer will issue the exchange notes under an indenture among the issuer, the guarantor and the trustee. The indenture governing the exchange notes, among other things, limits our ability to: |

| | • | | incur or guarantee additional indebtedness; |

| | • | | pay dividends or make other distributions or repurchase or redeem our stock; |

| | • | | make investments or other restricted payments; |

| | • | | enter into certain transactions with affiliates; |

14

| | • | | enter into agreements that restrict our restricted subsidiaries’ ability to pay dividends; and |

| | • | | consolidate, merge or sell all or most of our assets. |

All of these limitations will be subject to a number of important qualifications and exceptions that are described under “Description of the Notes—Certain Covenants.”

Additional Notes | The issuer may issue additional notes from time to time under the indenture and these additional notes will benefit from the security and pledge described above under “Description of the Notes—Security” and “—Sufficiency of Collateral.” |

Listing | The unregistered notes are listed on the Irish Stock Exchange. The issuer intends to list the exchange notes on the Official List of the Irish Stock Exchange. |

Governing Law for the Exchange

Notes and Indenture | New York. |

15

Summary Financial Data

You should read the following summary financial data together with the section entitled “Operating and Financial Review and Prospects” and our financial statements and the accompanying notes thereto included elsewhere in this prospectus.

The summary financial data at December 31, 2000 and for the period from November 25, 1999 (inception) to December 31, 2000 were derived from our unaudited consolidated financial statements which are not included in this prospectus. The summary financial data at December 31, 2001 and 2002 and for the year ended December 31, 2001 were derived from our financial statements which are not included in this prospectus. The summary financial data at December 31, 2003 and 2004 and for each of the three years ended December 31, 2004 have been derived from our audited financial statements and related notes thereto included elsewhere in this prospectus.

Unless otherwise indicated, the historical financial data have been prepared in accordance with UK GAAP. UK GAAP differs in certain significant respects from US GAAP. For a discussion of the differences between UK GAAP and US GAAP as they apply to us, see note 26 to our audited financial statements included elsewhere in this prospectus.

| | | | | | | | | | | | | | | |

| | | Period from Inception to December 31, 2000(1)

| | Years ended December 31,

|

| | | | 2001

| | 2002

| | 2003

| | 2004

|

| | | (unaudited) | | (in thousands, except ratios) |

Profit and Loss Account Data: | | | | | | | | | | | | | | | |

Turnover(2) | | £ | 251,412 | | £ | 292,887 | | £ | 262,279 | | £ | 288,020 | | £ | 269,889 |

Cost of sales | | | (273,982) | | | (233,735) | | | (219,835) | | | (199,124) | | | (177,283) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Gross profit | | | (22,570) | | | 59,152 | | | 42,444 | | | 88,896 | | | 92,606 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Operating expenses: | | | | | | | | | | | | | | | |

Distribution costs | | | (21,463) | | | (22,073) | | | (12,276) | | | (9,647) | | | (10,128) |

Administrative expenses | | | (97,196) | | | (129,874) | | | (74,531) | | | (54,424) | | | (36,973) |

Exceptional fixed asset impairment | | | (95,107) | | | (66,374) | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | (213,766) | | | (218,321) | | | (86,807) | | | (64,071) | | | (47,101) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Operating profit/(loss)(2) | | | (236,336) | | | (159,169) | | | (44,363) | | | 24,825 | | | 45,505 |

Finance charges, net | | | (5,559) | | | (1,789) | | | (1,406) | | | (3,753) | | | (4,787) |

Tax on profit/(loss) on ordinary activities | | | — | | | — | | | — | | | — | | | 5,064 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Profit/(loss) | | £ | (241,895) | | £ | (160,958) | | £ | (45,769) | | £ | 21,072 | | £ | 45,782 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | |

Cash at bank and in hand | | £ | 6,534 | | £ | 3,231 | | £ | 4,565 | | £ | 15,403 | | £ | 466 |

Debtors, net(3) | | | 127,348 | | | 160,363 | | | 152,442 | | | 128,712 | | | 83,560 |

Working capital/(deficit)(4) | | | (353,517) | | | (526,515) | | | (523,545) | | | (326,675) | | | (7,630) |

Tangible assets, net | | | 223,770 | | | 220,052 | | | 197,728 | | | 185,981 | | | 186,477 |

Total assets | | | 357,655 | | | 383,650 | | | 391,739 | | | 365,100 | | | 291,234 |

Total debt(5) | | | 374,561 | | | 497,068 | | | 512,719 | | | 371,867 | | | 234,950 |

Total shareholder’s deficit | | | (243,807) | | | (421,647) | | | (467,416) | | | (308,845) | | | (159,167) |

Financial Ratios and Other Data: | | | | | | | | | | | | | | | |

EBITDA(6) | | £ | (78,562) | | £ | (108,505) | | £ | (1,210) | | £ | 66,554 | | £ | 86,538 |

Depreciation and amortization | | | 62,667 | | | 50,664 | | | 43,153 | | | 41,729 | | | 41,033 |

Capital expenditures | | | 110,875 | | | 98,739 | | | 55,059 | | | 28,239 | | | 7,811 |

Ratio of earnings to fixed charges(7) | | | (7) | | | (7) | | | (7) | | | 2.5x | | | 3.6x |

16

| | | | | | | | | | | | | | | | | | |

| | | Period from Inception to December 31, 2000

| | | Years ended December 31,

| |

| | | 2001

| | | 2002

| | | 2003

| | | 2004

| |

| | | (unaudited) | | | (in thousands, except ratios) | |

US GAAP Data(8) | | | | | | | | | | | | | | | | | | |

Profit and Loss Account Data: | | | | | | | | | | | | | | | | | | |

Revenue | | (10 | ) | | (10 | ) | | £ | 265,663 | | | £ | 290,922 | | | £ | 263,776 | |

Operating profit/(loss) | | (10 | ) | | (10 | ) | | | (43,512 | ) | | | 23,633 | | | | 53,712 | |

Income/(loss) from continuing activities(9) | | (10 | ) | | (10 | ) | | | (17,271 | ) | | | 330,062 | | | | 39,846 | |

Net income/(loss) | | (10 | ) | | (10 | ) | | | (18,607 | ) | | | 330,062 | | | | 39,846 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | (10 | ) | | (10 | ) | | £ | 41,565 | | | £ | 50,403 | | | £ | 21,193 | |

Fixed assets | | (10 | ) | | (10 | ) | | | 202,602 | | | | 112,404 | | | | 132,407 | |

Total assets | | (10 | ) | | (10 | ) | | | 385,134 | | | | 293,823 | | | | 235,577 | |

Total debt | | (10 | ) | | (10 | ) | | | 512,719 | | | | 371,867 | | | | 245,415 | |

Total shareholder’s deficit | | (10 | ) | | (10 | ) | | | (477,790 | ) | | | (307,289 | ) | | | (146,672 | ) |

Financial Ratios and Other Data | | | | | | | | | | | | | | | | | | |

EBITDA(11) | | (10 | ) | | (10 | ) | | £ | 17,547 | | | £ | 377,786 | | | £ | 84,782 | |

Depreciation and amortization | | (10 | ) | | (10 | ) | | | 46,336 | | | | 43,613 | | | | 23,915 | |

Ratio of earnings to fixed charges(12) | | (10 | ) | | (10 | ) | | | (12 | ) | | | 25.3 | x | | | 4.7 | x |

| | (1) | Includes the results of operations and cash flows from November 25, 1999, the date of our acquisition from Racal Electronics plc, through December 31, 2000. This summary financial data is not presented for the year ended December 31, 2000 as such information is not reasonably obtainable at other than onerous expense. |

| | (2) | Our results for the years ended December 31, 2000, 2001 and 2002 include our cellular business, which was discontinued in 2001. This includes turnover of £7.6 million and £7.0 million for the years ended December 31, 2000 and 2001 and net operating loss of £0.1 million, £0.8 million and £1.3 million for the years ended December 31, 2000, 2001 and 2002, respectively. |

| | (3) | Net debtors include operating and non-operating debtors from other group companies. Excluding the debtors from other group companies, net debtors are £119.9 million, £152.1 million, £94.3 million, £85.7 million and £79.8 million at December 31, 2000, 2001, 2002, 2003 and 2004, respectively. |

| | (4) | Working capital consists of current assets (excluding debtors due in more than one year) less creditors falling due within one year. Working capital includes operating and non-operating debtors and creditors from other group companies. Excluding all debtors and creditors from other group companies, working capital/(deficit) is £17.0 million, £(17.3) million, £(0.6) million, £26.3 million and (£5.7) million at December 31, 2000, 2001, 2002, 2003 and 2004, respectively. |

| | (5) | Total debt represents obligations under finance leases and hire purchase contracts, third-party indebtedness and loans owed to group companies. |

| | (6) | UK GAAP EBITDA consists of profit/(loss) for the period before taxation, finance charges, depreciation expense and the amortization of connection costs. Although EBITDA is not a measure of operating profit/(loss), operating performance or liquidity under UK GAAP, we have presented EBITDA because we use EBITDA as a measure of our performance without regard to depreciation and amortization and we believe that some of our investors use this measurement in a consistent manner and to determine our ability to service our indebtedness and fund ongoing capital expenditures. You should not, however, construe EBITDA in isolation or as a substitute for operating income as determined by UK GAAP, or as an indicator of our operating performance or of our cash flows from operating activities as determined in accordance with UK GAAP. You should not use this non-GAAP measure as a substitute for the analysis provided in our profit and loss accounts or in our cash flow statements. |

| | | | | | | | | | | | | | | |

| | | Period from Inception to December 31, 2000

| | Year ended December 31,

|

| | | | 2001

| | 2002

| | 2003

| | 2004

|

| | | unaudited | | (in thousands) |

Profit/(loss) | | £ | (241,895) | | £ | (160,958) | | £ | (45,769) | | £ | 21,072 | | £ | 45,782 |

Finance charges, net | | | 5,559 | | | 1,789 | | | 1,406 | | | 3,753 | | | 4,787 |

Taxes | | | — | | | — | | | — | | | — | | | (5,064) |

Depreciation | | | 62,667 | | | 49,412 | | | 36,537 | | | 35,831 | | | 34,433 |

Amortization | | | | | | 1,252 | | | 6,616 | | | 5,898 | | | 6,600 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

EBITDA | | £ | (173,669) | | £ | (108,505) | | £ | (1,210) | | £ | 66,554 | | £ | 86,538 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

17