Filed Pursuant to Rule 424(b)(4)

Registration No. 333-193197

PROSPECTUS

5,781,126 Shares

Common Stock

This prospectus relates to the initial public offering of Square 1 Financial’s Class A common stock. We are offering 3,125,000 shares of our Class A common stock. The selling shareholders identified in this prospectus are offering 2,206,126 shares of our Class A common stock and 450,000 shares of our Class B common stock, which will convert into 450,000 shares of Class A common stock upon sale in this offering. We will not receive any proceeds from sales by the selling shareholders. References in this prospectus to “common stock” refer to Square 1 Financial’s Class A common stock unless we state otherwise or the context otherwise requires.

Prior to this offering, there has been no established public market for our common stock. Our common stock has been approved for listing on the Nasdaq Global Select Market under the symbol “SQBK.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements.

See “Risk Factors,” beginning on page 14, for a discussion of certain risks that you should consider before making an investment decision to purchase our common stock.

| | | | | | | | |

| | | Per Share | | | Total | |

Initial public offering price | | $ | 18.00 | | | $ | 104,060,268 | |

Underwriting discounts(1) | | | 1.17 | | | | 6,763,917 | |

Proceeds to us before expenses | | | 16.83 | | | | 52,593,150 | |

Proceeds to selling shareholders, before expenses | | | 16.83 | | | | 44,702,601 | |

| (1) | See“Underwriting” for additional information regarding the underwriting discount and certain expenses payable to the underwriters by us. |

The underwriters have an option to purchase up to an additional 867,167 shares of our common stock at the initial public offering price less the underwriting discount, within 30 days from the date of this prospectus. Of the 867,167 shares subject to the underwriters’ option, 468,750 shares will be offered by us and 398,417 shares will be offered by the selling shareholders (67,500 of which are shares of our Class B common stock that convert into 67,500 shares of our Class A common stock upon sale in this offering).

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The shares of our common stock that you purchase in this offering will not be savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The underwriters expect to deliver the shares to purchasers on or about March 31, 2014, subject to customary closing conditions.

| | |

SANDLER O’NEILL + PARTNERS,L.P. | |

|

| |

Prospectus dated March 26, 2014

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in or incorporated by reference in this prospectus or in any free writing prospectus that we may authorize to be delivered and made available to you. We, the selling shareholders and the underwriters have not authorized anyone to provide you with additional or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We and the selling shareholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where those offers and sales are permitted.

This prospectus describes the specific details regarding this offering and the terms and conditions of the common stock being offered hereby and the risks of investing in our common stock. You should read this prospectus, any free writing prospectus and the additional information about us described in the section entitled “Where You Can Find Additional Information” before making your investment decision.

Neither we, nor any of our officers, directors, agents or representatives or any of the selling shareholders or underwriters, make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company,

| | • | | we may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this initial public offering prospectus; |

| | • | | we are exempt from the requirement to obtain an attestation from our auditors on management’s assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002; |

| | • | | we are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| | • | | we are not required to present to our shareholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have elected in this prospectus to take advantage of scaled disclosure relating only to executive compensation arrangements. We do not intend to take advantage of any other scaled disclosure or relief during the time that we qualify as an emerging growth company, although the JOBS Act would permit us to do so.

In addition to scaled disclosure and the other relief described above, the JOBS Act permits us an extended transition period for complying with new or revised accounting standards affecting public companies. However, we have elected not to take advantage of this extended transition period, which means that the financial statements included in this prospectus, as well as any financial statements that we file in the future, will be subject to all new or revised accounting standards generally applicable to public companies. Our election not to take advantage of the extended transition period is irrevocable.

i

PROSPECTUS SUMMARY

This summary highlights selected information contained in this prospectus and may not contain all of the information that you need to consider in making your investment decision. To understand this offering fully, you should carefully read this summary together with the more detailed information contained in this prospectus. You should carefully consider the section titled “Risk Factors” in this prospectus and our consolidated financial statements. Unless we state otherwise or the context otherwise requires, references in this prospectus to “Square 1,” “we,” “our,” and “us” refer to Square 1 Financial, Inc., a Delaware corporation, and its consolidated subsidiaries. References in this prospectus to “the Bank” means Square 1 Bank, the wholly-owned banking subsidiary of Square 1 Financial.

Overview

About us. We are a financial services company headquartered in the greater Research Triangle Park area of North Carolina and became the bank holding company for Square 1 Bank, ade novo North Carolina commercial bank, in August 2005 upon the commencement of Square 1 Bank’s operations. Through Square 1 Bank, which was formed by experienced venture bankers, commercial bankers and entrepreneurs, we focus our banking activities almost exclusively on venture capital firms and private equity firms (which we collectively refer to as “venture firms”) and the portfolio companies funded by such firms. Square 1 Bank provides a broad range of financial services nationwide to these investors and their portfolio companies, including, among others, term commercial loans, revolving lines of credit, asset-based loans, deposit products and fee-based banking services, including credit cards, foreign exchange, cash management and letters of credit. We refer to the market in which we operate as the “venture banking market” and our bankers as “venture bankers.” Among entrepreneurial companies, our primary focus is on venture-backed technology and life sciences companies, nationwide. Our strong relationships and extensive experience in the entrepreneurial community have allowed us to follow these and other companies across their stages of development, resulting in a diversified borrower and depositor customer base. We marked our eight year anniversary in August 2013 and, shortly thereafter, exceeded $1.0 billion in loans outstanding. As of December 31, 2013, we had total assets of $2.3 billion, total loans outstanding of $1.1 billion, total deposits of $2.1 billion, and shareholders’ equity of $189.1 million.

Venture firms are a key referral source for new entrepreneurial company relationships for Square 1 Bank. However, we have no arrangements or understandings with any venture firm relating to lending money to their portfolio companies. We target our business development and marketing strategy primarily on entrepreneurs, venture-backed entrepreneurial companies and venture firms. The terms of the credit facilities we provide to our clients vary by type of loan product, loan size and growth stage of the client and underlying collateral. We provide commercial term loans and lines of credit to venture-backed companies primarily in the technology and life sciences sectors, with loan terms of between 12 and 48 months. These loans are typically made to companies in all stages of a typical start-up company’s lifecycle. Loans originated by our asset-based lending group are typically structured as revolving lines of credit and advances are based on a formula tied to accounts receivable or other assets of the borrowers. Our asset-based loans are typically made to expansion and late stage companies. The primary source of repayment for asset-based loans is typically operating cash flow of the client. We also provide real estate secured, government-guaranteed loans through the Small Business Administration (“SBA”) and U.S. Department of Agriculture (“USDA”) programs, with maturities of 20 years or more, and construction loans, which convert into real estate SBA and USDA loans upon completion of construction, the terms of which are generally 12 months or less. In certain cases, we sell the guaranteed portion of SBA loans originated by us on the secondary SBA market, which serves to reduce the amount of our outstanding loan balances and results in a gain on sale as well as fee income for us.

We provide senior debt facilities to our borrowers that are secured by substantially all of the assets of the borrower client. In some instances, we also obtain the guarantee of the venture firm that provided venture capital to our borrower client or, in the case of a borrower that has not received venture capital funding, a guarantee of individuals associated with the borrower. For early stage companies, the primary source of repayment is typically cash collateral held in accounts with us. At December 31, 2013, with the exception of several credit card loans, all of the loans in our portfolio were secured loans.

In connection with the negotiation of credit facilities with our portfolio company borrowers, we often receive warrants to acquire stock of the borrower, primarily those that are privately-held, venture-backed companies in the life sciences and technology industries, but do not otherwise make equity investments in our portfolio company clients.

1

Our market. According to the PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report (“MoneyTree™ Report”), in 2013 venture capital investment in the U.S. totaled approximately $29.4 billion invested across 3,995 venture investment rounds. In the past four years, in a given quarter, based on theMoneyTree™ Report, there are generally as few as approximately 675 and as many as approximately 1,075 venture investment rounds completed, totaling between $5.0 billion to $8.0 billion across the U.S. While approximately one-third of these investments will be first-time financings for companies, overall these investments span the life stages of a company from angel/seed to late stage of the company, at which point the venture capital backer typically exits its investment through an acquisition or the sale of its investment in connection with an initial public offering of the company. This cycle of venture investment and company maturation results in these companies needing tailored venture banking products and services for many years. This market and the short-term nature of our loan facilities provide a steady flow of banking needs, since we work very closely with both the entrepreneurial company and its venture firm investors to provide debt financing and cash management solutions for each stage of the company’s growth.

Balance Sheet Strength

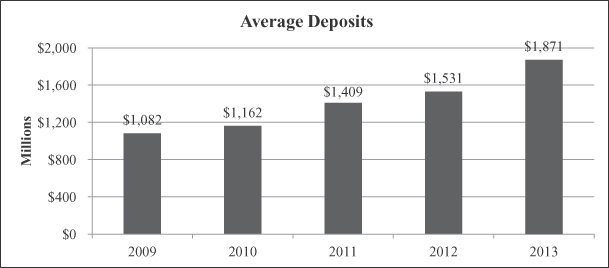

Banking the venture capital community provides a steady stream of funding, including low-cost deposits. In addition, venture-backed companies, as well as venture firms, typically have large fluctuations in cash flow. We have developed a mix of on- and off-balance sheet client funds and cash management products to accommodate their financial needs, while prudently managing our capital. Venture-backed companies tend to receive large cash infusions from each round of equity financing, which they must hold in a liquid vehicle that allows them to access funds for operating purposes as they implement their business models. As a result, many of our customers hold large cash balances in deposit accounts and off-balance sheet cash management products with us. At December 31, 2013, 65.6% of our client funds came from our borrower clients. Client funds consist of on-balance sheet deposits and off-balance sheet client investment funds. Venture firms also often have excess cash after a capital call or sale of a portfolio company, and require access to a short-term, liquid investment vehicle for these funds. These firms need liquidity for these funds as well as desire to earn a yield, so they often utilize a combination of demand deposits, money market accounts and certain other short-term, highly liquid products we offer. Our average cost of deposits for the year ended December 31, 2013 was 0.04% on an average balance of deposits of $1.9 billion. These low-cost deposits are our primary source of funding and provide us with a significant competitive advantage. They also provide us with more than sufficient funds to satisfy the lending needs of our clients. This funding leverage can be seen in our relatively low loan-to-deposit ratio, which was 49.1% for the year ended December 31, 2013 as well as off-balance sheet deposits, which were $557.9 million at December 31, 2013.

In addition to our funding advantages from our low-cost deposits, 92.7% of our loan portfolio is comprised of floating-rate loans, which provides us with automatic re-pricing of those loans as the interest rate environment changes.

A Specialized Market Demands Specialized Capabilities

Lending to a venture-backed company, particularly in the early and expansion stages of its corporate life cycle, presents challenges to a typical commercial bank lender. For example, early stage clients are in the process of developing their products and often lack revenue and operating cash flow. Expansion stage clients have begun to commercialize their products and generate revenue, but may not have achieved profitability. At December 31, 2013, 13.4% of our loans outstanding were represented by loans to early stage companies, 54.3% to expansion stage companies, and 13.2% to late stage companies. The remainder of our loan portfolio at that date was comprised of loans to venture firms, credit cards and SBA/USDA loans. Lending to companies without revenue or established products requires frequent monitoring as well as knowledgeable and experienced venture bankers who can assist our borrowers. Managing these risks, therefore, requires specialized expertise and controls that cannot be acquired with a simple addition to staff. Our controls include, among other things, the review of monthly financial statements and close monitoring of non-traditional measures such as investor reserves, the company’s cash burn rate, and its performance against non-financial business metrics and milestones. We perform frequent company updates with management and engage venture firms quarterly or more frequently on each portfolio company’s performance and its next anticipated equity event. Our team of experienced bankers and risk managers who are knowledgeable about the industry, and our organizational structure, are dedicated to evaluating and monitoring entrepreneurial companies and their venture capital backers. As a result, we believe the controls and procedures we have in place have enabled us to manage this risk effectively.

2

We believe that entrepreneurial companies and venture firms welcome choice when selecting a banking partner. Despite the attractiveness of this market, the need for experienced bankers who specialize in lending to venture-backed companies has limited the number of financial institutions and specialty lending companies serving this market. From inception, we have believed there is a significant market opportunity for a high-quality and nimble alternative to Silicon Valley Bank, the only other commercial bank that focuses primarily on, and has the largest share of, the venture banking market on which we focus. Given the industry in which we operate, we believe this market is generally underserved and, therefore, it provides us with an opportunity to continue our strong growth and profitability. While there are other banks that will provide deposit and lending services to entrepreneurial companies, most of these banks do not specialize in lending and deposit/cash services tailored to the specific needs of these types of entrepreneurial companies. There are also specialty venture debt funds that provide loans to such companies, but do not accept deposits or provide other traditional fee-based banking services to such companies. We are still a young company, having only been in existence since August 2005, but believe that we have penetrated the venture banking market in all of the key entrepreneurial hubs in the United States. We have continued to add venture bankers and client managers in key markets, particularly during the last three years, adding over 15 bankers and client managers in Silicon Valley, Boston, New York and the West Coast. These key hires have allowed us to further penetrate markets in which we believe there is significant opportunity for us to grow, and they complement our consistently strong presence in other markets such as the mid-Atlantic, Southeast, Texas and Colorado. We, therefore, believe that our position as the only other “pure play” commercial bank serving the venture banking market provides substantial opportunity for us to continue our successful growth.

Our History and Growth

Square 1 Bank was founded in 2005 by a group of venture and commercial bankers, led by Richard Casey and Susan Casey. The founding team collectively had many decades of experience in banking entrepreneurial companies and venture firms. Since inception, Square 1 Bank has experienced significant success across the following areas:

Capital-Raising:

| | • | | August 2005—Chartered with an initial capitalization of $105.0 million raised through a private placement of common stock to the management team and Board of Directors of Square 1 Bank, members of the venture community and institutional investors. |

| | • | | September and December 2008—$7.4 million raised through a private placement of trust preferred securities to members of management, the Board of Directors and other existing shareholders and an additional $5.0 million raised through a private placement of preferred stock to a private equity fund. |

| | • | | May 2010—$48.5 million raised through a private placement of common stock primarily to institutional investors to support growth and bolster capital. |

| | • | | October—December 2012 – $23.2 million raised through a private placement of common stock to continue Square 1 Bank’s focus on organic growth and it strategic initiatives. |

3

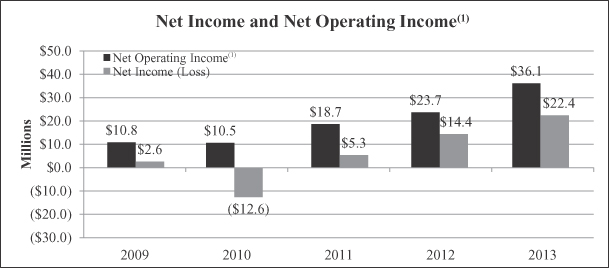

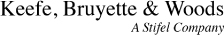

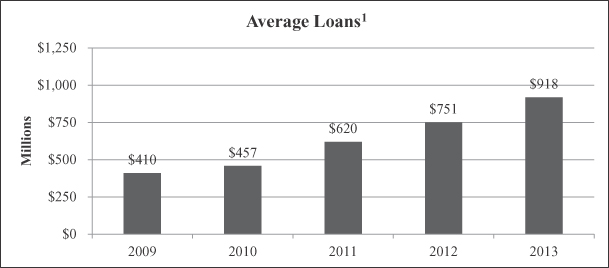

Net Income and Net Operating Income(1)

| | • | | As shown in the chart below, our net operating income has grown steadily, particularly in the last three years. We incurred a loss in 2010 resulting from the sale and impairment of non-agency mortgage-backed securities held in our investment portfolio. |

| (1) | Net Operating Income is a non-GAAP financial measure. See“Selected Historical Consolidated Financial Information—Non-GAAP Financial Measures.” |

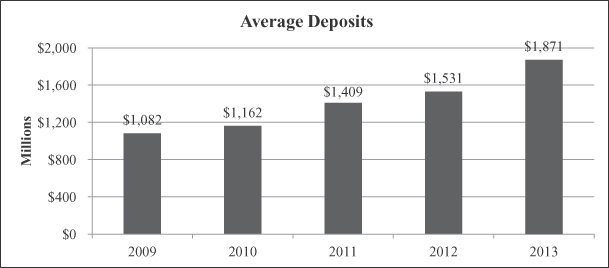

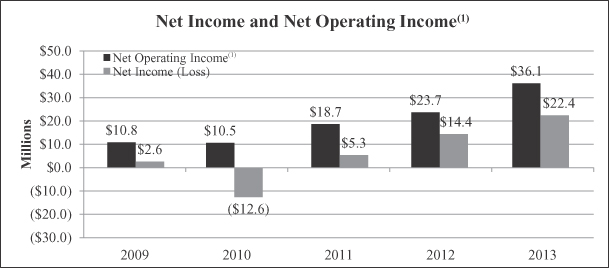

Deposit Growth

| | • | | We exceeded approximately $1.0 billion in deposits at Square 1 Bank in July 2008, (amounting to $1.1 billion as of July 31, 2008), solely through organic growth. Low-cost deposits have been, and we expect will continue to be, our primary source of funding. |

| | • | | 65.5% of our deposits were held in noninterest-bearing demand deposit accounts as of December 31, 2013. Our average cost of deposits for the year ended December 31, 2013 was 0.04%. This deposit mix may shift over time as interest rates move up or down. |

4

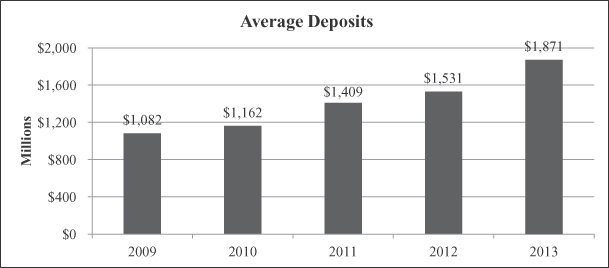

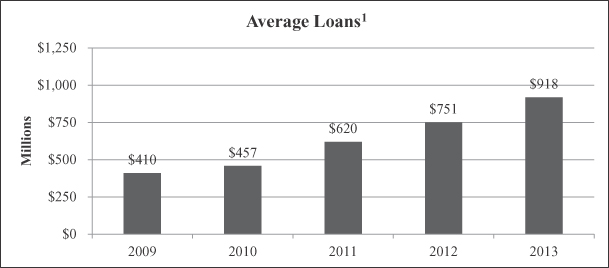

Loan Growth

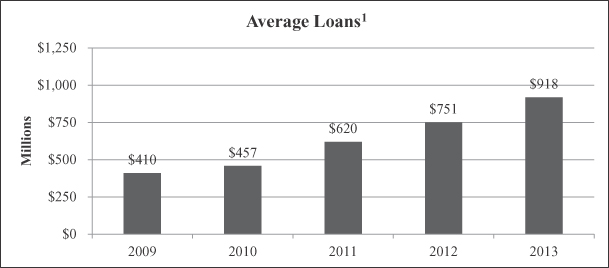

The chart below sets forth the average balance of loans outstanding for each period presented.

| | • | | At December 31, 2013 we had $1.1 billion in loans outstanding, with $977.3 million in outstanding unfunded loan commitments. |

| (1) | Net of unearned income. |

Our Strengths

We believe that we are well-positioned to create value for our shareholders, particularly as a result of the following strengths:

Experienced and knowledgeable entrepreneurs serving entrepreneurs

Our banking team and culture. Square 1 Bank was founded by a group of venture bankers, with collectively, decades of experience in lending to entrepreneurial companies and venture firms. From the outset, we sought to operate in a manner different from larger banks, and recruited experienced bankers who are driven by an entrepreneur’s motivation to serve our market in a manner that is quick and responsive, flexible, accessible and provides “high touch,” personalized service. These founding goals, coupled with a very strong credit culture, have resulted today in a team of over 60 venture bankers and client managers with extensive relationships throughout the entrepreneurial and venture capital community and dedicated to the industry we serve.

Our executive management team. Douglas H. Bowers, President and Chief Executive Officer, has more than 30 years of commercial banking experience. Judith Erwin, our Executive Vice President, Venture Capital Services and Global Treasury Management, and Christopher Woolley, our Executive Vice President, Banking West, are both founders of Square 1 Bank. Sam Bhaumik is our Executive Vice President, Banking Silicon Valley. Each of these three executive officers has an average of more than 25 years of experience working with entrepreneurs and the venture capital community. Ms. Erwin and Mr. Woolley previously worked together in venture banking at the former Imperial Bank and its successor, Comerica Bank. Mr. Bhaumik brings decades of experience in our market having served in a senior position at a specialty finance company focused on venture-backed technology companies and prior to that in senior positions at Imperial Bank, its successor Comerica Bank, and Silicon Valley Bank. Our Chief Credit Officer, Diane Earle, has more than 27 years of experience in commercial lending and risk management. Ms. Earle spent several years at a venture debt fund, as well as at GE Commercial Finance where she served in senior leadership roles in the credit risk management area, focused on the technology and life sciences industries.

5

Our Board of Directors. Our Board of Directors includes former venture bankers and commercial bankers, representatives of private equity funds and venture capital firms, and a former banking regulator. Several of our founders who serve on our Board of Directors previously worked together in various high-level executive positions at Imperial Bank, and collectively bring decades of experience in lending to the entrepreneurial and venture capital community and in senior management and/or Boards of Directors roles in this market.

Our relationships. A key component of our strategy is to leverage our strong relationships with venture and private equity firms that invest in, and support, our borrowing clients. From these relationships we gain deep insight into the operations and performance of our clients. These venture firms provide experienced institutional oversight over the portfolio companies to which we lend and are a significant driver in our decision to provide banking services to those companies. The ongoing support provided by these firms to the portfolio companies is also a significant factor in our underwriting decisions with respect to our borrowing clients.

Risk Management

Loan portfolio. We understand the risk profile of entrepreneurial companies and have many years of experience lending to the entrepreneurial and venture capital communities. Credit quality is very important to our business and is a key focus of Square 1 Bank. We have four risk managers and a team of portfolio analysts dedicated to evaluating and continually monitoring our borrowers’ financial and operational progress, which positions us to act quickly and proactively manage our exposure to our borrowers. Our bankers and client managers actively partner with our risk management personnel to manage credit issues which may arise in our loan portfolio. Our lending activities are diversified nationwide over a variety of industry sectors (with a focus on technology and life sciences) and with companies in different stages of development. We have developed an extensive credit risk management system which provides for, among other things, frequent contact with our borrowers and we are in the process of upgrading our credit process capabilities to create additional efficiencies for more scalable risk management practices as we grow.

As a result of this credit focus, we have maintained a track record of sound credit quality from inception. Our highest annual rate of net loan charge-offs to average loans over the past five years, 2009 through 2013, was 1.94%. At December 31, 2013, our ratio of nonperforming loans to total loans was 1.34%. Our 2013 net loan charge-offs were 0.95% of average outstanding loans.

Investment portfolio. As a result of the significant low-cost deposits generated by this business model, we have funds in excess of those we lend to our borrowing clients. As a result, we maintain a significant securities portfolio, which totaled $1.1 billion as of December 31, 2013. This securities portfolio provides us with additional sources of income and liquidity. Our investment portfolio is managed by a team of highly-experienced officers and employees. Prior to 2009, management of our investment portfolio was outsourced to a third-party investment firm. At that time, our investment securities portfolio was highly concentrated in non-agency mortgage-backed securities which at the time of purchase were investment grade securities. Following the financial crisis in 2008, a majority of these securities were downgraded to noninvestment grade securities. We incurred significant losses in 2008, 2010 and 2011 on our investment portfolio due primarily to our investment in these pre-2008 non-agency mortgage-backed securities. We terminated our outsourcing relationship in 2008 and began managing our securities investments internally at that time. The remaining non-agency mortgage-backed securities carry a fair value of $20.9 million, less than 2.0%, of the investment portfolio as of December 31, 2013. These remaining non-agency mortgage-backed securities have been written down $7.0 million to address any future losses. We consider the earnings stream on this remaining balance to be of greater value than the risk of additional losses.

We believe that our active management of this portfolio has helped minimize our losses and positioned us to use our large securities portfolio to meet the sometimes unpredictable liquidity needs of our clients and to optimize yields.

Strong brand and reputation in the entrepreneurial and venture capital community. We believe that we have developed a strong brand and market reputation within the entrepreneurial community and have strong relationships with more than 125 venture firms nationwide who are both clients and a source of referrals for entrepreneurial company clients. By capitalizing on the business and personal relationships of our senior management team in the entrepreneurial and venture communities, we believe that we are positioned to continue to grow our business and our client base.

6

Our Operating Strategy

Our strategic focus is on continuing to build market share and strong revenues complemented by operational efficiencies. We expect to accomplish this by continuing to attract new venture firm and portfolio company relationships while continuing to strengthen existing relationships with entrepreneurs and venture firms.

We intend to pursue the following core strategies to achieve those goals:

Building our presence within the entrepreneurial and venture community in our existing and target markets by:

| | • | | leveraging the strong relationships and reputations of our experienced venture bankers to grow our market share in key entrepreneurial and venture markets nationwide; |

| | • | | growing our loan portfolio, including asset-based loans, and continuing to enhance our product offerings to expansion and late stage companies; |

| | • | | expanding our suite of deposit and investment products, which is important to support the growth of our venture firm and portfolio company clients; and |

| | • | | deploying the capital from this offering to support our lending and deposit growth. |

Maintaining excellent credit quality by:

| | • | | continuing to aggressively monitor the performance of our borrowers, which allows us to proactively manage credit exposure; and |

| | • | | upgrading our systems to more effectively and efficiently monitor asset quality as we grow. |

Expanding and growing our noninterest income and relationship profitability by:

| | • | | growing the assets under management of Square 1 Asset Management, a registered investment adviser, that was launched in April 2013 to provide a critical cash management tool for our clients and which provides us with income-generating off-balance sheet alternatives to manage the large and sometimes volatile fund flows typical of our clients; |

| | • | | growing our foreign exchange and letter of credit fee income; |

| | • | | growing our service charges and fees as we grow our lending and deposit relationships; and |

| | • | | continuing our practice of taking warrants for equity positions in the companies we serve. |

Growing our core deposits, and prudently and expertly managing strong deposit inflows by:

| | • | | continuing to grow deposits organically; |

| | • | | managing our investment portfolio in a conservative manner consistent with our liquidity needs and asset/liability management strategies including to optimize yields; and |

| | • | | continuing to develop alternative cash management solutions for our clients that allow us to move client funds on and off balance sheet. |

There are no assurances that we will be able to successfully implement our business strategy or that we will achieve our strategic goals or our projected growth.

Our Market Opportunity

The venture banking market in the U.S. includes companies in industries with high potential for innovation and growth, such as technology and life sciences. These entrepreneurial companies can be located anywhere, but venture activity tends to be concentrated in key markets which are hubs for academia and innovation. As a result, in addition to our home office in the greater Research Triangle Park area, we maintain offices in Silicon Valley, San Diego, Campbell, Orange County and Los Angeles, CA, Boston, Austin, the Washington, DC metropolitan area, Denver, New York City and Seattle. We also recently

7

hired key personnel in Chicago and plan to open loan production offices in San Francisco and Chicago in 2014, as these markets continue to evolve as focal points for the development of venture capital-backed early through late stage companies.

Our market opportunity is driven in large part by the number and amount of venture capital investments because, as entrepreneurial companies receive venture capital investments, they require banking services beyond what they may have obtained when they were formed.

The peak year for venture capital investment in the U.S. was in 2000, a period in which approximately 8,041 companies received a total of nearly $105.2 billion in equity investment as reported in theMoneyTree™ Report. However, as reported in theMoneyTree™ Report, in a more typical year, an average of 3,774 companies receive venture capital investments for aggregate average annual equity investments of approximately $20.0 billion to $30.0 billion.

The following data from theMoneyTree™ Reportshows venture capital investment by stage of emerging companies in 2013:

| | | | | | | | |

Stage of Development | | Number of Deals | | | Investment

(in 000’s) | |

Seed | | | 218 | | | $ | 942,953 | |

Early Stage | | | 2,003 | | | | 9,758,813 | |

Expansion | | | 984 | | | | 9,838,458 | |

Later Stage | | | 790 | | | | 8,824,734 | |

| | | | | | | | |

Total | | | 3,995 | | | $ | 29,364,958 | |

| | | | | | | | |

We believe that the market data demonstrates the robust opportunities for growth in our core market. Our deposit and loan portfolio includes entrepreneurial companies at all stages of their life cycles as well as the venture firms. These venture-backed companies need specialized banking services and we are well-positioned, as one of only two commercial banks almost exclusively focused on this market, to capitalize on these opportunities consistent with our past successes.

Corporate Information

Our principal executive office is located at 406 Blackwell Street, Suite 240, Durham, North Carolina 27701, and our telephone number is (866) 355-0468. Our website address is www.square1financial.com. The information contained on our website is not a part of, or incorporated by reference into, this prospectus.

8

THE OFFERING

Class A common stock offered by us | 3,125,000 shares |

| | 3,593,750 shares if the underwriters’ option is exercised in full. |

Class A common stock and Class B common stock offered by the selling shareholders | 2,206,126 shares of Class A and 450,000 shares of Class B(1) |

| | 2,537,043 shares of Class A and 517,500 shares of Class B if the underwriters’ option is exercised in full. |

Common shares outstanding after completion of the offering(2) | 27,200,336 shares |

| | 27,669,086 shares of common stock if the underwriters’ option is exercised in full. |

Common shares outstanding after completion of the offering assuming all outstanding convertible/exercisable securities are converted/exercised into Class A common shares | 29,602,096 shares |

| | 30,070,846 shares if the underwriters’ option is exercised in full |

Use of proceeds | We estimate that the net proceeds to us from the sale of shares of common stock being offered by us in this offering will be $51.4 million (or $59.3 million if the underwriters exercise in full their purchase option), after deducting estimated underwriting discounts and offering expenses. We will not receive any proceeds from the sale of our common stock by the selling shareholders. We expect to downstream approximately 90% of the net proceeds of the offering to Square 1 Bank. |

| (1) | Purchasers in this offering will be deemed to have exercised their option to convert Class B shares to Class A shares as a condition to participating in the offering such that all purchasers will receive Class A shares. |

| (2) | References in this section to the number of shares of our common stock outstanding after this offering are based on 23,696,336 shares of our common stock (including Class A and Class B shares) issued and outstanding as of January 31, 2014. Unless otherwise noted, these references exclude: |

| | • | | 1,319,550 shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $6.11 per share (of which options to purchase 719,260 shares have vested); |

| | • | | 522,870 shares of common stock issuable upon the vesting of outstanding restricted stock awards; |

| | • | | 612,715 shares of common stock reserved for issuance in connection with restricted stock awards and stock options that remain available for issuance under our equity incentive plan; |

| | • | | 500,000 shares of our common stock reserved for issuance in connection with outstanding Series A preferred stock and 366,500 shares of our common stock reserved for issuance in connection with outstanding trust preferred securities, which are convertible at the option of the holder, and are expected to be converted, in large part, into shares of common stock following completion of the offering; |

| | • | | 66,000 shares of common stock issuable upon the exercise of warrants issued to the organizers of the Bank at an exercise price of $10.00 per share; and |

| | • | | 750,000 shares of common stock issuable upon the exercise of warrants issued to Patriot Financial Partners, L.P. and Patriot Financial Partners Parallel, L.P. at an exercise price of $5.15 per share in connection with a private placement of our common stock in 2010. |

9

| | We intend to use the net proceeds generated by this offering to support our long-term growth by enhancing our capital ratios in light of Basel III, and for general working capital and other corporate purposes. We intend, as a secondary purpose of the offering, to use the net proceeds to redeem, at the first quarterly redemption date following the offering, any Series A preferred stock and to retire any indebtedness relating to Square 1 Financial’s trust preferred securities that remain outstanding following the completion of this offering. Our trust preferred securities and Series A preferred stock are currently redeemable by the Company, at its option, on any quarterly dividend payment date. No premium is attached to such redemption. As our preferred stock and our trust preferred securities are currently convertible, at the option of the holder, into common stock at a conversion price of $10.00 per share, we expect that a significant portion of the $7.4 million in principal outstanding trust preferred securities and the $5.0 million in outstanding Series A preferred stock will be converted into common stock prior to the redemption date. There was no accrued interest payable with respect to our trust preferred securities at December 31, 2013. Although we may, from time to time in the ordinary course of business, evaluate potential acquisition and business line expansion opportunities that we believe are complementary to our business and provide attractive risk-adjusted returns, we do not have any immediate plans, arrangements or understandings relating to any material acquisition. |

| | Selling shareholders will receive the proceeds from the sale of their shares in the offering, which are estimated to be, before expenses, approximately $44.7 million in the aggregate, or approximately $51.4 million in the aggregate if the underwriters exercise in full their purchase option. |

| | For additional information, see“Use of Proceeds.” |

Dividend policy | We do not expect to pay cash dividends on our common stock in the foreseeable future. Instead, we anticipate that all of our future earnings will be retained to support our operations and finance the growth and development of our business. Any future determination to pay dividends on our common stock will be made by our Board of Directors and will depend upon our results of operations, financial condition, capital requirements, regulatory and contractual restrictions, our business strategy and other factors that the Board deems relevant. For additional information, see“Dividend Policy.” |

Rank | Our common stock is subordinate to our Series A preferred stock and trust preferred securities, with respect to the payment of dividends and the distribution of assets upon liquidation. In addition, our common stock will be subordinate to any debt that we may issue in the future and may be subordinate to any new series of preferred stock that we may issue in the future. |

Listing | Our common stock has been approved for listing on the Nasdaq Global Select Market under the trading symbol “SQBK.” |

Determination of offering price | Prior to this offering, there has been no public market for our common stock. The initial public offering price will be negotiated between the representative of the underwriters, the selling shareholders and us. In determining the initial public offering price of our common stock, the representative will consider: |

| | • | | the history and prospects for the industry in which we compete; |

| | • | | our financial information; |

| | • | | our earnings prospects; |

| | • | | the prevailing securities markets at the time of this offering; and |

| | • | | the recent market prices of and the demand for publicly traded stock of comparable companies. |

Risk factors | Investing in our common stock involves risks. See“Risk Factors,” beginning on page 14, for a discussion of certain factors that you should carefully consider before making an investment decision. |

10

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The summary financial information presented below is derived in part from our consolidated financial statements. The following is only a summary and you should read it in conjunction with the consolidated financial statements and the related notes beginning on page F-1. The information at December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011 is derived in part from the audited consolidated financial statements that appear in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | At or For the Years Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (Dollars in thousands) | |

Financial Condition Data: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,326,427 | | | $ | 1,803,281 | | | $ | 1,648,287 | | | $ | 1,583,871 | | | $ | 1,095,836 | |

Cash and cash equivalents | | | 105,730 | | | | 48,971 | | | | 194,240 | | | | 201,279 | | | | 94,489 | |

Investment securities—available- for-sale | | | 924,229 | | | | 776,160 | | | | 679,553 | | | | 820,048 | | | | 460,833 | |

Investment securities—held-to- maturity | | | 154,255 | | | | 67,022 | | | | 28,817 | | | | 16,964 | | | | 19,390 | |

Loans(1) | | | 1,082,536 | | | | 863,081 | | | | 710,904 | | | | 490,636 | | | | 456,551 | |

Off-balance sheet unfunded loan commitments | | | 977,262 | | | | 741,232 | | | | 714,185 | | | | 576,632 | | | | 433,582 | |

Deposits | | | 2,106,727 | | | | 1,519,329 | | | | 1,508,829 | | | | 1,461,913 | | | | 1,017,437 | |

Off-balance sheet client investment funds | | | 557,883 | | | | 377,932 | | | | 458,464 | | | | 263,325 | | | | 348,968 | |

Borrowings | | | 6,207 | | | | 96,204 | | | | 6,193 | | | | 6,183 | | | | 6,193 | |

Repurchase agreements | | | 12,737 | | | | — | | | | — | | | | 928 | | | | 1,256 | |

Total shareholders’ equity | | | 189,149 | | | | 176,726 | | | | 124,379 | | | | 107,004 | | | | 66,412 | |

| | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 77,662 | | | $ | 67,676 | | | $ | 60,827 | | | $ | 52,854 | | | $ | 46,992 | |

Interest expense | | | 1,328 | | | | 1,142 | | | | 1,502 | | | | 1,880 | | | | 2,982 | |

Net interest income | | | 76,334 | | | | 66,534 | | | | 59,325 | | | | 50,974 | | | | 44,009 | |

Provision for loan losses | | | 13,300 | | | | 9,371 | | | | 7,300 | | | | 5,050 | | | | 9,273 | |

Net interest income after provision for loan losses | | | 63,034 | | | | 57,163 | | | | 52,025 | | | | 45,924 | | | | 34,737 | |

Noninterest income (loss) | | | 25,308 | | | | 15,560 | | | | 6,857 | | | | (22,724 | ) | | | 10,320 | |

Noninterest expense | | | 55,921 | | | | 51,148 | | | | 49,163 | | | | 43,091 | | | | 37,705 | |

Income before income tax expense (benefit) | | | 32,421 | | | | 21,575 | | | | 9,719 | | | | (19,892 | ) | | | 7,350 | |

Income tax expense (benefit) | | | 10,038 | | | | 7,203 | | | | 4,372 | | | | (7,271 | ) | | | 4,738 | |

Preferred stock dividends and discount accretion | | | 250 | | | | 250 | | | | 250 | | | | 250 | | | | 256 | |

Net income (loss) available to common shareholders | | | 22,133 | | | | 14,122 | | | | 5,097 | | | | (12,871 | ) | | | 2,356 | |

| (1) | Net of unearned income of $4.5 million, $4.0 million, $4.1 million, $2.1 million and $1.6 million at December 31, 2013, 2012, 2011, 2010 and 2009, respectively. Unearned loan fees, the discount on SBA loans and the unearned initial warrant value are included in unearned income. |

11

| | | | | | | | | | | | | | | | | | | | |

| | | At or For the Years Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (Dollars in thousands, except per share data) | |

Performance Ratios: | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 1.06 | % | | | 0.83 | % | | | 0.33 | % | | | (1.01 | )% | | | 0.20 | % |

Return on average common equity | | | 12.44 | | | | 10.11 | | | | 4.59 | | | | (14.00 | ) | | | 3.21 | |

Net interest margin(1) | |

| 3.91

|

| | | 4.14 | | | | 4.02 | | | | 4.22 | | | | 3.92 | |

Efficiency ratio(2) | | | 53.10 | | | | 60.74 | | | | 65.43 | | | | 73.46 | | | | 65.28 | |

Average equity to average assets | | | 8.75 | | | | 8.48 | | | | 7.52 | | | | 7.58 | | | | 6.66 | |

| | | | | |

Capital Ratios (consolidated): | | | | | | | | | | | | | | | | | | | | |

Tier 1 leverage capital | | | 8.34 | | | | 9.53 | | | | 8.69 | | | | 8.88 | | | | 8.03 | |

Tier 1 risk-based capital | | | 12.08 | | | | 14.28 | | | | 14.05 | | | | 15.59 | | | | 10.29 | |

Total risk-based capital | | | 13.24 | | | | 15.42 | | | | 15.25 | | | | 16.72 | | | | 11.36 | |

Total shareholders’ equity to assets | | | 8.13 | | | | 9.80 | | | | 7.55 | | | | 6.76 | | | | 6.06 | |

Tangible common equity to tangible assets(3) | | | 7.89 | | | | 9.53 | | | | 7.25 | | | | 6.44 | | | | 5.61 | |

| | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses as a percent of total loans | | | 1.70 | | | | 1.60 | | | | 1.64 | | | | 1.87 | | | | 2.05 | |

Allowance for loan losses as a percent of nonperforming loans | |

| 127.05

|

| | | 95.25 | | | | 164.69 | | | | 166.47 | | | | 139.04 | |

Net charge-offs to average outstanding loans during the period | | | 0.95 | | | | 0.95 | | | | 0.79 | | | | 1.14 | | | | 1.94 | |

Nonperforming loans as a percent of total loans | | | 1.34 | | | | 1.68 | | | | 0.99 | | | | 1.13 | | | | 1.47 | |

Nonperforming assets as a percent of total assets | | | 0.63 | | | | 0.81 | | | | 0.50 | | | | 0.55 | | | | 0.65 | |

| | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Basic income (loss) per common share | | $ | 0.94 | | | $ | 0.67 | | | $ | 0.25 | | | $ | (0.78 | ) | | $ | 0.22 | |

Diluted income (loss) per common share | | $ | 0.93 | | | $ | 0.67 | | | $ | 0.25 | | | $ | (0.78 | ) | | $ | 0.22 | |

Book value per common share | | $ | 7.80 | | | $ | 7.31 | | | $ | 5.94 | | | $ | 5.08 | | | $ | 5.76 | |

Tangible book value per common share | | $ | 7.77 | | | $ | 7.31 | | | $ | 5.94 | | | $ | 5.08 | | | $ | 5.76 | |

Weighted average common shares outstanding—basic | | | 23,508,254 | | | | 20,925,764 | | | | 20,093,977 | | | | 16,455,993 | | | | 10,676,500 | |

Weighted average common shares outstanding—diluted | | | 23,859,448 | | | | 21,136,770 | | | | 20,200,227 | | | | 16,514,246 | | | | 10,676,500 | |

| (1) | Represents net interest income as a percent of average interest-earning assets. |

| (2) | Represents noninterest expense divided by the sum of net interest income and other income, excluding gains or losses on the impairment and sale of securities. Efficiency ratio, as calculated, is a non-GAAP financial measure. See“Selected Historical Consolidated Financial Information—Non-GAAP Financial Measures.” |

| (3) | Tangible common equity to tangible assets is a non-GAAP financial measure. Tangible common equity is computed as total shareholders’ equity, excluding preferred stock, less intangible assets. Tangible assets are calculated as total assets less intangible assets. We believe that the most directly comparable GAAP financial measure is total shareholders’ equity to assets. See“Selected Historical Consolidated Financial Information—Non-GAAP Financial Measures.” |

12

Non-GAAP Financial Measures

The information set forth above contains certain financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures are “efficiency ratio,” “tangible common equity to tangible assets” and “net operating income.” Although we believe these non-GAAP financial measures provide a greater understanding of our business, these measures are not necessarily comparable to similar measures that may be presented by other companies.

The information provided below reconciles each non-GAAP measure to its most comparable GAAP measure.

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (Dollars in thousands) | |

Efficiency Ratio | | | | | | | | | | | | | | | | | | | | |

Noninterest expense | | $ | 55,921 | | | $ | 51,148 | | | $ | 49,163 | | | $ | 43,091 | | | $ | 37,705 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest taxable equivalent income | | | 79,404 | | | | 67,950 | | | | 59,325 | | | | 50,974 | | | | 44,009 | |

Noninterest taxable equivalent income (loss) | | | 25,886 | | | | 15,900 | | | | 6,858 | | | | (22,724 | ) | | | 10,319 | |

Less loss on sale of securities and impairment | | | (24 | ) | | | (358 | ) | | | (8,956 | ) | | | (30,410 | ) | | | (3,433 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjusted operating revenue | | $ | 105,314 | | | $ | 84,208 | | | $ | 75,139 | | | $ | 58,660 | | | $ | 57,761 | |

| | | | | | | | | | | | | | | | | | | | |

Efficiency ratio | | | 53.10 | % | | | 60.74 | % | | | 65.43 | % | | | 73.46 | % | | | 65.28 | % |

| | | | | |

Tangible Common Equity/Tangible Assets | | | | | | | | | | | | | | | | | | | | |

Total equity | | $ | 189,149 | | | $ | 176,726 | | | $ | 124,379 | | | $ | 107,004 | | | $ | 66,412 | |

Less: preferred stock | | | 4,950 | | | | 4,950 | | | | 4,950 | | | | 4,950 | | | | 4,950 | |

Intangible assets(1) | | | 800 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Tangible common equity | | $ | 183,399 | | | $ | 171,776 | | | $ | 119,429 | | | $ | 102,054 | | | $ | 61,462 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,326,427 | | | $ | 1,803,281 | | | $ | 1,648,287 | | | $ | 1,583,871 | | | $ | 1,095,836 | |

Less: intangible assets(1) | | | 800 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Tangible assets | | | 2,325,627 | | | | 1,803,281 | | | | 1,648,287 | | | | 1,583,871 | | | | 1,095,836 | |

| | | | | | | | | | | | | | | | | | | | |

Tangible common equity/tangible assets | | | 7.89 | % | | | 9.53 | % | | | 7.25 | % | | | 6.44 | % | | | 5.61 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Operating Income | | | | | | | | | | | | | | | | | | | | |

GAAP income before taxes | | $ | 32,421 | | | $ | 21,575 | | | $ | 9,719 | | | $ | (19,892 | ) | | $ | 7,350 | |

Less loss on sale of securities and impairment | | | (24 | ) | | | (358 | ) | | | (8,956 | ) | | | (30,410 | ) | | | (3,433 | ) |

Add: tax equivalent adjustment | | | 3,647 | | | | 1,755 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Non-GAAP net operating income before taxes | | $ | 36,092 | | | $ | 23,688 | | | $ | 18,675 | | | $ | 10,518 | | | $ | 10,783 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Does not include a loan servicing asset of $1.3 million at December 31, 2013. |

13

RISK FACTORS

An investment in our common stock involves various risks. Before making an investment decision, you should carefully read and consider the risk factors described below as well as the other information included in this prospectus. Any of these risks, if they are realized, could materially and adversely affect our business, financial condition, and results of operations. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect us. In any such case, you could lose all or a portion of your original investment.

Risks Relating to Our Business

We are dependent upon the services of key executives and we could be harmed by the loss of their services.

Our performance depends largely on the experience and client relationships of our management team and bankers. Most of these individuals have been involved in venture banking for much of their professional careers, primarily in providing lending or other financing services to emerging growth technology companies, life sciences companies and venture firms and have strong relationships with individuals and institutions in the markets we serve. The implementation of our business and growth strategies also depends upon our ability to continue to attract and retain additional qualified management and banking personnel. Our bankers may terminate their employment with us at any time, and we could have difficulty replacing such officers with persons who are experienced in the specialized aspects of our business or who have ties to the communities within our market areas. If we are unable to retain any of these key employees, our growth and results of operations could be adversely affected. See“Management.”

Because of the credit profile of our loan portfolio, our levels of nonperforming assets and charge-offs can be volatile. We may need to make material provisions for loan losses in any period, which could reduce net income and/or increase net losses in that period.

Our loan portfolio has a credit profile different from that of most other banking companies. The credit profile of our clients varies across our loan portfolio, based on the nature of the lending we do for different market segments. In our portfolios for early, expansion and late stage companies, many of our loans are made to companies with modest or negative cash flows and no established record of profitable operations. Repayment of these loans may be dependent upon receipt by borrowers of additional equity financing from venture firms or others, or in some cases, a successful sale to a third party, public offering or other form of liquidity event. Due to the overall weakening of the economic environment in 2008, venture capital financing activity, as well as mergers and acquisitions and initial public offerings – activities on which venture firms rely to “exit” investments to realize returns – slowed in a meaningful manner. While there has been some improvement in overall economic conditions since then, particularly during the past few years, if economic conditions worsen or do not continue to improve, such activities may slow down further, which may impact the financial health of our client companies. Venture firms may continue to provide financing in a more selective manner, at lower levels, and/or on less favorable terms, any of which may have an adverse effect on our borrowers that are otherwise dependent on such financing to repay their loans to us. Moreover, collateral for many of our loans often includes intellectual property, which is difficult to value and may not be readily salable in the case of default. Because of the intense competition and rapid technological change that characterizes the companies in the technology and life science industry sectors, a borrower’s financial position can deteriorate rapidly.

We continue to increase our efforts to lend to larger clients, as well as to make larger loans. Our ability to make larger loans will increase with the additional capital resulting from this offering. These larger loans include loans equal to or greater than $7.5 million to individual clients, which have over time represented an increasingly larger proportion of our total loan portfolio. Increasing our loan commitments, especially for larger loans, could increase the impact on us of any single borrower default.

We may enter into financing arrangements with our clients, the repayment of which may be dependent on third parties’ financial condition or ability to meet their payment obligations. We make loans secured by letters of credit issued by other third party banks, the repayment of which may be dependent on the reimbursement by third party banks. These third parties may not meet their financial obligations to our clients or to us, which could have an adverse impact on us. We also intend to maintain an emphasis on asset-based lending by providing our clients with lines of credit secured by accounts receivable and inventory. These types of loans generally expose us to additional risks since they are made on the basis of the borrower’s ability to make payments from the cash flows of the borrower’s business and are secured by collateral that may depreciate over time.

14

In our portfolio of venture capital clients, many of our clients have lines of credit, the repayment of which is dependent on the payment of capital calls or management fees by the underlying limited partner investors in the funds managed by these firms. These limited partner investors may face liquidity issues or have difficulties meeting their financial commitments, especially during unstable economic times, which may lead to our clients’ inability to meet their repayment obligations to us.

Based on the credit profile of our overall loan portfolio, our level of nonperforming loans, loan charge-offs and allowance for loan losses can be volatile and can vary materially from period to period. Although our average nonperforming loans and loan charge-offs have been relatively low historically, due to the credit profile of our loan portfolio and the nature of our borrowers, we may have quarterly or interim periods where nonperforming loans and charge-offs significantly exceed our historical averages. Increases in our level of nonperforming loans or loan charge-offs may require us to increase our provision for loan losses in any period, which could reduce our net income or cause net losses in that period. Additionally, such increases in our level of nonperforming loans or loan charge-offs may also have an adverse effect on our capital ratios and market perceptions of us.

If we conclude that the decline in value of any of our investment securities is other than temporary, we are required to write down the value of that security through a charge to earnings.

We review our investment securities portfolio at each quarter-end reporting period to determine whether securities need to be impaired due to changes in value associated with credit quality. When our other than temporary impairment (“OTTI”) methodology shows that an investment security has declined below its carrying value, we are required to assess whether the decline is other than temporary. If we conclude through our impairment methodology that the decline is other than temporary, we are required to write down the value of that security through a charge to earnings. Factors beyond our control can significantly influence the fair value of securities in our portfolio and can cause potential adverse changes to the fair value of these securities. For example, fixed-rate securities are generally subject to decreases in market value when market interest rates rise. Additional factors include, but are not limited to, rating agency downgrades of the securities, defaults by the issuer or individual borrowers with respect to the underlying securities, and continued instability in the credit markets. The process for determining whether impairment is other than temporary usually requires difficult, subjective judgments about the future financial performance of the issue and any collateral underlying the security in order to assess the probability of receiving all contractual principal on the security. Changes in the expected cash flows of these securities may result in our concluding in future periods that the impairment of these securities is other than temporary, which would require a charge to earnings to write down these securities.

The valuation risk associated with our investment portfolio could have a material adverse impact on our book equity.

As part of managing our overall inherent risk position, our investment portfolio is typically weighted towards fixed-rate securities. If interest rates increase (decrease) the fair value of our investment portfolio will conversely decrease (increase). The decline in value is an unrealized loss that will decrease the fair value of our securities and the Other Comprehensive Income component of our shareholders’ equity. Due to the relatively large size of the investment portfolio, this can have a material adverse impact to our shareholders’ equity. The potential loss in book value could be quite large depending on how quickly and how materially market interest rates change. While the loss is not permanent, it could have a material impact on our book value for any particular reporting period. In addition to regular interest rate risk analysis, we also conduct ongoing analysis to test Square 1 Bank’s exposure to various rising rate scenarios in order to better manage this risk.

Public equity offerings and mergers and acquisitions involving our clients or a slowdown in venture capital investment levels may reduce the market for venture capital investment and the borrowing needs of our current and potential clients, which could adversely affect our ability to grow and our financial performance.

Our core strategy is focused on providing banking products and services to companies, including in particular early- and expansion-stage companies that receive financial support from sophisticated investors, including venture capital or private equity firms, “angels,” and corporate investors. We derive a meaningful share of our deposits from these companies and provide them with loans as well as other banking products and services. In many cases, our credit decisions are based on our analysis of the likelihood that our venture capital-backed client will receive additional rounds of equity capital from investors. If the amount of capital available to such companies decreases, it is likely that the number of new clients and investor financial support to our existing borrowers could decrease, which could have an adverse effect on our business, profitability and growth prospects.

15

While an active market for public equity offerings and mergers and acquisitions generally has positive implications for our business, one negative consequence is that our clients may pay off or reduce their loans with us if they complete a public equity offering, are acquired by or merge with another entity or otherwise receive a significant equity investment. Moreover, our capital call lines of credit are typically utilized by our venture capital fund clients to make investments prior to receipt of capital called from their respective limited partners. A slowdown in overall venture capital investment levels may reduce the need for our clients to borrow from our capital call lines of credit. Any significant reduction in the outstanding amounts of our loans or under our lines of credit could have a material adverse effect on our business, results of operations and financial condition.

The borrowing needs of our clients may be unpredictable, especially during a challenging economic environment. We may not be able to meet our unfunded credit commitments, or adequately reserve for losses associated with our unfunded credit commitments, which could have a material effect on our business, financial condition, results of operations and reputation.

A commitment to extend credit is a formal agreement to lend funds to a client as long as there is no violation of any condition established under the agreement. The actual borrowing needs of our clients under these credit commitments have historically been lower than the contractual amount of the commitments. A significant portion of these commitments expire without being drawn upon. Because of the credit profile of our clients, we typically have a substantial amount of total unfunded credit commitments, which is reflected off our balance sheet. Actual borrowing needs of our clients may exceed our expected funding requirements, especially during a challenging economic environment when our client companies may be more dependent on our credit commitments due to the lack of available credit elsewhere, the increasing costs of credit, or the limited availability of financings from venture firms. In addition, limited partner investors of our venture capital clients may fail to meet their underlying investment commitments due to liquidity or other financing issues, which may increase our clients’ borrowing needs. Any failure to meet our unfunded credit commitments in accordance with the actual borrowing needs of our clients may have a material adverse effect on our business, financial condition, results of operations and reputation.

Additionally, we establish a reserve for losses associated with our unfunded credit commitments. The level of the reserve for unfunded credit commitments is determined by following a methodology similar to that used to establish our allowance for loan losses in our funded loan portfolio. The reserve is based on credit commitments outstanding, credit quality of the loan commitments, and management’s estimates and judgment, and is susceptible to significant changes. There can be no assurance that our reserve for unfunded credit commitments will be adequate to provide for actual losses associated with our unfunded credit commitments. An increase in the reserve for unfunded credit commitments in any period may result in a charge to our earnings, which could reduce our net income or increase net losses in that period.

Concentration of risk increases the potential for significant losses.

Concentration of risk increases the potential for significant losses in our business. While there may exist a great deal of diversity within each industry, our clients are concentrated by these general industry niches: technology, life science and venture capital. Many of our client companies are concentrated by certain stages within their life cycles, such as early-stage or expansion-stage, and many of these companies are venture capital-backed. Our loan concentrations are derived from our borrowers engaging in similar activities or types of loans extended to a diverse group of borrowers that could cause those borrowers to be similarly impacted by economic or other conditions. In addition, we are continuing to increase our efforts to lend to larger clients and/or to make larger loans, which may increase our concentration risk. Any adverse effect on any of our areas of concentration could have a material impact on our business, results of operations and financial condition. Due to our concentrations, we may suffer losses even when economic and market conditions are generally favorable for our competitors.

We face competitive pressures that could adversely affect our business, results of operations, financial condition and future growth.

We compete with other banks and specialty and diversified financial services companies and venture debt funds, many of which are larger than us. While there are a limited number of direct competitors in the venture banking market. Some of our competitors have long-standing relationships with venture firms and the companies that are funded by such firms. As such, the market we target is extremely competitive and several of our competitors have significantly greater resources, established customer bases, more locations and longer operating histories. Our competitors sometimes undercut the pricing

16

and/or credit terms we are able to offer in order to increase their market share. Our pricing and credit terms could deteriorate if we act to meet these competitive challenges, which could adversely affect our business, results of operations and financial condition and future growth. If we are not able to successfully compete for customers and grow our business, our earnings could be adversely affected.

A return of recessionary conditions could result in increases in our level of nonperforming loans and/or reduce demand for our products and services, which could have an adverse effect on our results of operations.

Although the U.S. economy has emerged from the severe recession that occurred in 2008 and 2009, economic growth has been slow and uneven, and unemployment levels remain high. Recovery by many businesses has been impaired by lower consumer spending. A return to prolonged deteriorating economic conditions and/or continued negative developments in the domestic and international credit markets could significantly affect the ability of our client companies to operate, the markets in which we do business, the value of our loans and investments, and our ongoing operations, costs and profitability. These events may cause us to incur losses and may adversely affect our financial condition and results of operations.

Our allowance for loan losses is determined based upon both objective and subjective factors, and may be inadequate or subject to increase by our regulators, which could hurt our earnings.

When borrowers default and do not repay the loans that we make to them, we may lose money. The allowance for loan losses is the amount estimated by management as necessary to cover probable losses in the loan portfolio at the statement of financial condition date. The allowance is established through the provision for loan losses, which is charged to income. Determining the amount of the allowance for loan losses necessarily involves a high degree of judgment. Among the material estimates required to establish the allowance are loss exposure at default, the amount and timing of future cash flows on impacted loans, value of collateral, and determination of the loss factors to be applied to the various elements of the portfolio. If our estimates and judgments regarding such matters prove to be incorrect, our allowance for loan losses might not be sufficient, and additional loan loss provisions might need to be made. Depending on the amount of such loan loss provisions, the adverse impact on our earnings could be material. In addition, we may increase the allowance because of changing economic conditions or other qualitative factors. There may be a significant increase in the number of borrowers who are unable or unwilling to repay their loans, resulting in our charging off more loans and increasing our allowance.

In addition, bank regulators may require us to make a provision for loan losses or otherwise recognize further loan charge-offs following their periodic review of our loan portfolio, our underwriting procedures, and our loan loss allowance. Any increase in our allowance for loan losses or loan charge-offs as required by such regulatory authorities could have a material adverse effect on our financial condition and results of operations. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Allowance for Loan Losses” for a discussion of the procedures we follow in establishing our loan loss allowance.

Our current level of interest rate spread may decline in the future. Any material reduction in our interest rate spread, or a continuation of the sustained period of low market interest rates, could have a material effect on our business, results of operations or financial condition.

A major portion of our net income comes from our interest rate spread, which is the difference between the interest rates paid by us on amounts used to fund assets and the interest rates and fees we receive on our interest-earning assets. We fund assets using deposits and other borrowings. While we offer interest-bearing deposit products, a majority of our deposit balances consist of noninterest-bearing products. Our interest-earning assets include outstanding loans extended to our clients and securities held in our investment portfolio. Overall, the interest rates we pay on our interest-bearing liabilities and receive on our interest-earning assets, and our level of interest rate spread, could be affected by a variety of factors, including changes in market interest rates, competition, regulatory requirements (such as the repeal of the interest payment restrictions under Federal Reserve Regulation Q), and a change over time in the mix of the types of loans, investment securities, deposits and other liabilities on our balance sheet.

Changes in market interest rates, such as the Federal Funds rate, generally impact our interest rate spread. While changes in interest rates do not produce equivalent changes in the revenues earned from our interest-earning assets and the expenses associated with our interest-bearing liabilities, increases in market interest rates will nevertheless likely cause our interest rate spread to increase. Conversely, if interest rates decline, our interest rate spread will likely decline. Sustained low levels of market interest rates could continue to place downward pressure on our net income levels. Unexpected or further

17

interest rate changes may adversely affect our business forecasts and expectations. Interest rates are highly sensitive to many factors beyond our control, such as inflation, recession, global economic disruptions, unemployment and the fiscal and monetary policies of the federal government and its agencies. Any material reduction in our interest rate spread or the continuation of sustained low levels of market interest rates could have a material adverse effect on our business, results of operations and financial condition. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Interest Rate Risk—Interest Rate Risk Management.”

We anticipate that we will have increased operating expenses in 2014 which could adversely impact our earnings.

As we continue to grow our business and add employees to support our growth, we will incur additional personnel and benefits expenses related to this growth. In addition, our occupancy expenses will increase in 2014 due to our assumption of the leases for the Sand Hill Finance LLC offices, our anticipated addition of new loan production offices in San Francisco and Chicago and an increase in our lease expenses for one of our existing loan production offices. Square 1 Bank is also in the process of updating its online banking system and its platform for lending and credit operations and such updates will result in increased expenses in 2014. We anticipate that the aggregate of these increased expenses will result in approximately a 20% increase in our operating expenses for 2014 compared to 2013. Such increased operating expenses could adversely impact our net income for fiscal year 2014.

Liquidity risk could impair our ability to fund operations and jeopardize our financial condition.