UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-51397

Federal Home Loan Bank of New York

(Exact name of registrant as specified in its charter)

| Federally chartered corporation | | 13-6400946 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

| 101 Park Avenue, New York, New York | | 10178 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 681-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Class B Stock, putable, par value $100

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yesx No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | | Accelerated filer ¨ |

| | | |

| Non-accelerated filer x | | Smaller reporting company¨ |

| | | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Registrant’s stock is not publicly traded and is only issued to members of the registrant. Such stock is issued and redeemed at par value, $100 per share, subject to certain regulatory and statutory limits. At June 30, 2019, the aggregate par value of the common stock held by members of the registrant was approximately $5,841,246,900. At February 29, 2020, 54,526,185 shares of common stock were outstanding.

FEDERAL HOME LOAN BANK OF NEW YORK

2019 Annual Report on Form 10-K

Table of Contents

PART I

General

The Federal Home Loan Bank of New York (“we,” “us,” “our,” “the Bank” or the “FHLBNY”) is a federally chartered corporation exempt from federal, state and local taxes except local real property taxes. It is one of eleven district Federal Home Loan Banks (FHLBanks). The FHLBanks are U.S. government-sponsored enterprises (GSEs), organized under the authority of the Federal Home Loan Bank Act of 1932, as amended (FHLBank Act). Each FHLBank is a cooperative owned by member institutions located within a defined geographic district. The members purchase capital stock in the FHLBank and generally receive dividends on their capital stock investment. Our defined geographic district is New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands. We provide a readily available, low-cost source of funds for our member institutions.

The FHLBNY is managed to deliver balanced value to members, rather than to maximize profitability or advance volume through low pricing. Our members must purchase FHLBNY stock according to regulatory requirements as a condition of membership. For more information, see financial statements, Note 14. Capital Stock, Mandatorily Redeemable Capital Stock and Restricted Retained Earnings. The business of the cooperative is to provide liquidity for our members (primarily in the form of loans referred to as “advances”) and to provide a return on members’ investment in FHLBNY stock in the form of a dividend. Since members are both stockholders and customers, our management operates the Bank such that there is a trade-off between providing value to them via low pricing for advances with a relatively lower dividend versus higher advances pricing with a relatively higher dividend.

All federally insured depository institutions, federally insured credit unions and insurance companies engaged in residential housing finance can apply for membership in the FHLBank in their district. Community development financial institutions (CDFIs) that have been certified by the CDFI Fund of the U.S. Treasury Department, including community development loan funds, community development venture capital funds, and state-chartered credit unions without federal insurance, are also eligible to become members of a FHLBank. Five CDFIs were members of the FHLBNY at December 31, 2019.

A member of another FHLBank or a financial institution that is not a member of any FHLBank may also hold FHLBNY stock as a result of having acquired one of our members. Because we operate as a cooperative, we conduct business with related parties in the normal course of business and consider all members and non-member stockholders as related parties in addition to the other FHLBanks. For more information, see financial statements, Note 20. Related Party Transactions, and also Item 13. Certain Relationships and Related Transactions, and Director Independence in this Form 10-K.

Our primary business is making collateralized loans or advances to members and is also the principal factor that impacts our financial condition. We also serve the public through our mortgage programs, which enable our members to liquefy certain mortgage loans by selling them to the Bank. We also provide members with such correspondent services as safekeeping, wire transfers, depository and settlement services. Non-members that have acquired members have access to these services up to the time that their advances outstanding prepay or mature.

We obtain our funds from several sources. A primary source is the issuance of FHLBank debt instruments, called Consolidated obligations, to the public. The issuance and servicing of Consolidated obligations are performed by the Office of Finance, the fiscal agent for the issuance and servicing of Consolidated obligations on behalf of the 11 FHLBanks. These debt instruments represent the joint and several obligations of all the FHLBanks. Because the FHLBanks’ Consolidated obligations are rated Aaa/P-1 with a stable outlook by Moody’s Investors Service (Moody’s) and AA+/A-1+ with a stable outlook by Standard & Poor’s Rating Services (S&P or Standard & Poor’s) and because of the FHLBanks’ GSE status, the FHLBanks are generally able to raise funds at rates that are typically at a small to moderate spread above U.S. Treasury security yields. Additional sources of funding are member deposits, other borrowings, and the issuance of capital stock. Deposits may be accepted from member financial institutions and federal instrumentalities.

We combine private capital and public sponsorship as a GSE to provide our member financial institutions with a reliable flow of credit and other services for housing and community development, and our cooperative ownership structure allows us to pass along the benefit of these low funding rates to our members. By supplying additional liquidity to our members, we enhance the availability of residential mortgages and community investment credit. Members also benefit from our affordable housing and economic development programs, which provide grants and below-market-rate loans that support members’ involvement in creating affordable housing and revitalizing communities.

We do not have any wholly or partially owned subsidiaries, nor do we have an equity position in any partnerships, corporations, or off-balance sheet special purpose entities. We own a grantor trust to fund certain non-qualified employee retirement programs, more fully described in financial statements Note 16. Employee Retirement Plans and Note 6. Equity Investments.

A Joint Capital Enhancement Agreement (Capital Agreement) among the 11 FHLBanks requires each FHLBank to enhance its capital position, and each FHLBank will contribute 20% of its Net income each quarter to its own restricted retained earnings account at the FHLBank until the balance of that account equals at least one percent of that FHLBank’s average balance of outstanding Consolidated obligations for the previous quarter. These restricted retained earnings will not be available to pay dividends.

The FHLBNY is supervised by the Federal Housing Finance Agency (FHFA or the Finance Agency), the independent Federal regulator of the FHLBanks, the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae). The FHFA’s stated mission with respect to the FHLBanks is to provide effective supervision, regulation and housing mission oversight of the FHLBanks to promote their safety and soundness, support housing finance and affordable housing, and support a stable and liquid mortgage market.

Each FHLBank carries out its statutory mission only through activities that are authorized under and consistent with the Safety and Soundness Act and the FHLBank Act; and the activities of each FHLBank and the manner in which they are operated is consistent with the public interest. The Finance Agency also ensures that the FHLBNY carries out its housing and community development mission, remains adequately capitalized and able to raise funds in the capital markets. However, while the Finance Agency establishes regulations governing the operations of the FHLBanks, the Bank functions as a separate entity with its own management, employees and board of directors.

Our website is www.fhlbny.com. We have adopted, and posted on our website, a Code of Business Conduct and Ethics applicable to all employees and directors.

Market Area

Our market area is the same as the membership district — New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands. Institutions that are members of the FHLBNY must have their charter or principal places of business within this market area but may also operate elsewhere. We had 328 members at December 31, 2019 and December 31, 2018.

Due to the penetrated market, there are few opportunities to gain members. However, we continue to engage the member prospects who are eligible to join. In addition, foreign banks with charters based in our membership district are another potential pool of prospects. This is not a new trend as we currently have members who have parent companies outside the United States.

An appropriate candidate for membership is an institution that is likely to transact advance business with us within a reasonable period of time, so that the capital stock of the potential member will likely be required to purchase under membership provisions will not dilute the dividend on the existing members’ capital stock. Characteristics that identify attractive candidates include institutions with assets “of size”, an established practice of wholesale funding, a high loan-to-deposit ratio, strong asset growth, sufficient eligible collateral, and management that might have had experience with the FHLBanks during previous employment.

We actively market membership through a series of targeted, on-going sales and marketing initiatives. We compete for business by offering competitively priced products, services and programs that provide financial flexibility to the membership. The dominant reason institutions join the FHLBNY is access to a reliable source of liquidity. While liquidity is provided in a variety of ways, advances are one of the most attractive sources of liquidity because they permit members to pledge relatively illiquid assets, such as 1-4 family, multifamily, home equity, and commercial real estate mortgages held in portfolio, to create liquidity. Advances are attractively priced because of our access to capital markets as a GSE and our strategy of providing balanced value to members.

The following table summarizes our members by type of institution:

| | | | | | | | | | | | | | | Community | | | | |

| | | | | | | | | | | | | | | Development | | | | |

| | | Commercial | | | Thrift | | | Credit | | | Insurance | | | Financial | | | | |

| | | Banks | | | Institutions | | | Unions | | | Companies | | | Institution | | | Total | |

| December 31, 2019 | | | 121 | | | | 71 | | | | 100 | | | | 31 | | | | 5 | | | | 328 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2018 | | | 129 | | | | 74 | | | | 95 | | | | 26 | | | | 4 | | | | 328 | |

Business Segments

We manage our operations as a single business segment. Management and our Board of Directors review enterprise-wide financial information in order to make operating decisions and assess performance.

Our cooperative structure permits us to expand and contract with demand for advances and changes in membership. When advances are paid down, because the member no longer needs the funds or because the member has been acquired by a non-member and the former member decides to prepay advances, the stock associated with the advances is immediately redeemed. When advances are paid before maturity, we collect fees that make us financially indifferent to the prepayment. Our operating expenses are low. Dividend capacity, which is a function of net income and the amount of stock outstanding, is largely unaffected by the prepayment since future stock and future income are reduced more or less proportionately. We believe that we will be able to meet our financial obligations and continue to deliver balanced value to members, even if advance demand contracts or if membership declines.

Products and Services

Introduction— Advances to members are the primary focus of our operations, and are also the principal factor that impacts our financial condition. Revenues from advances to members are the largest and the most significant element in our operating results. Providing advances to members, supporting the products and associated collateral and credit operations, and funding and swapping the funds are the focus of our operations.

We offer our members several correspondent banking services as well as safekeeping services. The fee income that is generated from these services is not significant. We also issue standby letters of credit on behalf of members for a fee. The total income derived from all such sources, and other incidental income and expenses were not material in the periods in this report.

We provide our members with an alternative to originating and selling long-term, fixed-rate mortgages in the secondary market. We accomplish this by purchasing eligible conforming fixed-rate mortgages originated or purchased by our members. Purchases are at negotiated market rates. For more information, see Acquired Member Assets Programs below and in the financial statements, Note 10. Mortgage Loans Held-for-Portfolio. We do not expect the program to become a significant factor in our operations. The interest revenues derived from this program were $101.2 million in 2019, $97.5 million in 2018 and $94.3 million in 2017. Relative to interest income from advances, revenues from mortgage loans have not been a significant source of interest income.

Advances

We offer a wide range of credit products to help members meet local credit needs, manage interest rate and liquidity risk and serve their communities. Our primary business is making secured loans, called advances, to members. These advances are available as short- and long-term loans with adjustable, variable and fixed-rate features (including option-embedded and amortizing advances).

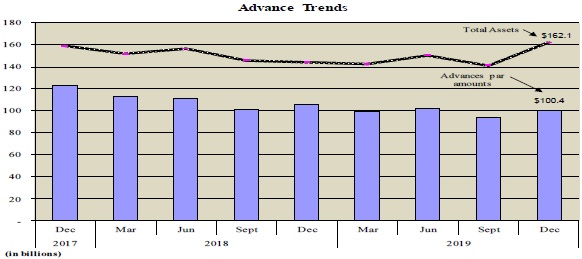

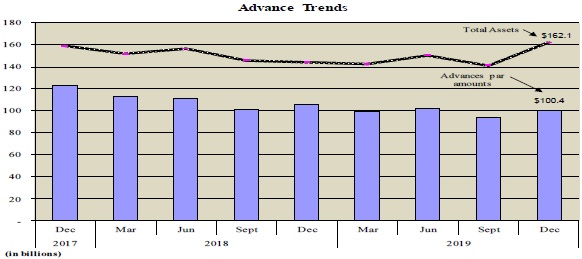

Advances to members, including former members, constituted 62.1% and 72.8% of our total assets of $162.1 billion and $144.4 billion at December 31, 2019 and 2018. In terms of revenues, interest income derived from advances were $2.5 billion, $2.5 billion and $1.6 billion, representing 66.8%, 70.3%, and 69.7% of total interest income in 2019, 2018 and 2017. Most of our critical functions are directed at supporting the borrowing needs of our members and monitoring the members’ associated collateral positions. For more information about advances, including our underwriting standards, see financial statements, Note 9. Advances; also see Tables 3.1 to 3.8 and the accompanying discussions in this MD&A.

Members use advances as a source of funding to supplement their deposit gathering activities. Advances borrowed by members have generally increased over the last decade because many members have not been able to increase their deposits in their local markets as quickly as they have increased their assets. To close this funding gap, members have preferred to obtain reasonably priced advances rather than increasing their deposits by offering higher rates or foregoing asset growth. Because of the wide range of advance types, terms, and structures available to them, members have also used advances to enhance their asset/liability management. As a cooperative, we price advances at minimal net spreads above the cost of our funding in order to deliver more value to members.

Letters of Credit

We may issue standby financial letters of credit on behalf of members to facilitate members’ residential and community lending, provide members with liquidity, or assist members with asset/liability management. Where permitted by law, members may utilize FHLBNY letters of credit to collateralize deposits made by units of state and local governments. Our underwriting and collateral requirements for securing letters of credit are the same as our requirements for securing advances.

Derivatives

To assist members in managing their interest rate and basis risks in both rising and falling interest-rate environments, we will act as an intermediary between the member and derivatives counterparty. We do not act as a dealer and view this as an additional service to our members. Participating members must comply with our documentation requirements and meet our underwriting and collateral requirements. Volume of such requests has been insignificant.

Acquired Member Assets Programs

Utilizing a risk-sharing structure, the FHLBanks are permitted to acquire certain assets from or through their members. These initiatives are referred to as Acquired Member Assets (AMA) programs. At the FHLBNY, the Acquired Member Assets initiative is the Mortgage Partnership Finance (MPF®) Program, which provides members with an alternative to originating and selling long-term, fixed-rate mortgages in the secondary market. In the MPF Program, we purchase conforming fixed-rate mortgages originated or purchased by our members. Members are then paid a fee for assuming a portion of the credit risk of the mortgages that we acquired. Members assume credit risk by providing a credit enhancement to us or providing and paying for a supplemental mortgage insurance policy insuring us for some portion of the credit risk involved. Prior to June 1, 2017, the mortgage loans acquired were credit enhanced to a double-A equivalent level of creditworthiness.For loans acquired after June 1, 2017, the credit enhancement is computed to a “Single A” credit risk. The amount of this credit enhancement is fully collateralized by the member. We assume the remainder of the credit risk along with the interest rate risk of holding the mortgages in the MPF loan portfolio.

The Acquired Member Assets Regulation does not specifically address the disposition of Acquired Member Assets. The main intent of that regulation is the purchase of assets for investment rather than for trading purposes. However, the FHLBanks have the legal authority to sell Mortgage Partnership Finance loans pursuant to the granting of incidental powers in Section 12 of the FHLBank Act. Section 12(a) of the FHLBank Act specifically provides that each FHLBank shall have all such incidental powers, not inconsistent with the provisions of this chapter, as are customary and usual in corporations generally. General corporate law principles permit the sale of investments.

For additional discussion on our mortgage loans and their related credit risk, see financial statements, Note 10. Mortgage Loans Held-for-Portfolio. Also see Tables 5.1 to 5.3 and accompanying discussions in this MD&A.

Correspondent Banking Services

We offer our members an array of correspondent banking services, including depository services, wire transfers, settlement services, and safekeeping services. Depository services include processing of customer transactions in “Overnight Investment Accounts,” the interest-bearing demand deposit account each customer has with us. All customer-related transactions (e.g. deposits, Federal Reserve Bank settlements, advances, securities transactions, and wires) are posted to these accounts each business day. Wire transfers include processing of incoming and outgoing domestic wire transfers, including third-party transfers. Settlement services include automated clearinghouse and other transactions received through our accounts at the Federal Reserve Bank as correspondent for members and passed through to our customers’ Overnight Investment Accounts with us. Through a third party, we offer customers a range of securities custodial services, such as settlement of book entry (electronically held) and physical securities. We encourage members to access these products through 1Linksm, an Internet-based delivery system we developed as a proprietary service. Members access the 1Link system to obtain account activity information or process wire transfers, book transfers, security safekeeping and advance transactions.

Affordable Housing Program and Other Mission Related Programs

Federal Housing Finance Agency regulation 12 CFR Part 1292.5 (Community Investment Cash Advance Programs) states in general that each FHLBank shall establish an Affordable Housing Program (AHP) in accordance with Part 1291, and a Community Investment Program. The 11 FHLBanks together must annually allocate for the AHP the greater of $100 million or 10 percent of regulatory defined net earnings. The FHLBank may also offer a Rural Development Advance program, an Urban Development Advance program, and other Community Investment Cash Advance programs.

| · | Affordable Housing Program (AHP). We meet this requirement by allocating 10 percent of regulatory defined net income to our AHP to support the creation and preservation of housing for lower income families and individuals through the Affordable Housing Program (AHP). The program is offered primarily in two forms. A competitive program and a homeownership program. In the competitive program, AHP funds are awarded through a competitive process to members who submit applications on behalf of project sponsors who are planning to purchase, rehabilitate, or construct affordable homes or apartments. In the homeownership program, we require households to have income at or below 80% of the area median income, and we may set aside annually, in aggregate, up to the greater of $4.5 million or 35% of the Bank’s annual required AHP contributions. The Homebuyer Dream Program® (HDP) was established in 2019 to replace the First Home Clubsm (FHC), which is expected to sunset in 2021. The homeownership programs are to assist first time homebuyers with closing costs and/or down payment assistance. The HDP provides grant assistance up to $14,500 to eligible households through an annual round on a first come, first served basis. New homebuyers are eligible under the program to receive up to $500 to defray the cost of counseling provided by a nonprofit housing agency. |

See financial statements, Note 13. Affordable Housing Program for assessments allocated from earnings for the periods in this report.

| · | Other Mission — Related Activities. The Bank offers three distinct Community Lending Programs (CLP) that support our member’s community-oriented mortgage lending, which was established under the Community Investment Cash Advance Programs. The Bank provides reduced interest rate advances to members for lending activity that meet the CLP requirements, under the following individual programs: Community Investment Program (CIP), Rural Development Advance (RDA), and Urban Development Advance (UDA). The CLP provides additional support to members in their affordable housing and economic development lending activities within low- and moderate-income neighborhoods as well as other activities that benefit low- and moderate-income households. The Bank also provides letters of credit in support of projects that meet the CLP program requirements and are offered at reduced fees. Providing CLP Advances and Letters of Credit at advantaged pricing that is discounted from our market interest rates and fees represents an additional allocation of our income in support of the Bank’s affordable housing and community economic development mission. In addition, overhead costs and administrative expenses associated with the implementation of our Affordable Housing and CLP are absorbed as general operating expenses and are not charged back to the AHP allocation set aside. The foregone interest and fee income, as well as the administrative and operating costs, are above and beyond the annual income contribution to the AHP Loans offered under these programs. |

Investments

We maintain portfolios of investments to provide additional earnings and for liquidity purposes. Investment income also bolsters our capacity to fund Affordable Housing Program projects, and to cover operating expenditures. To help ensure the availability of funds to meet member credit needs, we maintain a portfolio of short-term investments issued by highly-rated, high credit quality financial institutions. The investments may include overnight Federal funds, term Federal funds, securities purchased under agreements to resell, and we are a major lender in this market, particularly in the overnight market. We further enhance our interest income by holding long-term investments classified as either held-to-maturity or as available-for-sale. These portfolios primarily consist of mortgage-backed securities issued by government-sponsored mortgage enterprises. Our long-term investments also include a small portfolio of privately issued mortgage-backed and residential asset-backed securities that were primarily acquired prior to 2006, bonds issued by housing finance agencies, and Grantor Trust owned by the FHLBNY that invests in mutual funds. We have a liquidity trading portfolio invested primarily in highly-liquid U.S. Treasury securities to enhance our short-term liquidity positions. The trading portfolio is not for speculative purposes.

For more information, see financial statements, Note 4. Federal Funds Sold and Securities Purchased Under Agreements to Resell, Note 5. Trading Securities, Note 6. Equity Investments, Note 7. Available-for-Sale Securities, and Note 8. Held-To-Maturity Securities. Also see Tables 4.1 through 4.9 and accompanying discussions in this MD&A.

Debt Financing — Consolidated Obligations

Our primary source of funds is the sale of debt securities, known as Consolidated obligations, in the U.S. and global capital markets. Consolidated obligations are the joint and several obligations of the FHLBanks, backed only by the financial resources of the 11 FHLBanks. Consolidated obligations are not obligations of the United States, and the United States does not guarantee them. The issuance and servicing of Consolidated obligations debt are performed by the Office of Finance, a joint office of the FHLBanks established by the Finance Agency. The Office of Finance (or the “OF”) has authority to issue joint and several debt on behalf of the FHLBanks. At December 31, 2019 and 2018, the par amounts of Consolidated obligations outstanding, bonds and discount notes for all 11 FHLBanks was $1.0 trillion, including $152.2 billion and $134.6 billion issued for the FHLBNY and outstanding at those dates.

For more information, see financial statements, Note 12. Consolidated Obligations. Also see Tables 6.1 to 6.10 and accompanying discussions in this MD&A.

Finance Agency regulations state that the FHLBanks must maintain, free from any lien or pledge, qualifying assets at least equal to the face amount of Consolidated obligations outstanding. Qualifying assets are defined as cash; secured advances; assets with an assessment or rating at least equivalent to the current assessment or rating of the Consolidated obligations; obligations of or fully guaranteed by the United States, obligations, participations, or other instruments of or issued by Federal National Mortgage Association (Fannie Mae) or the Government National Mortgage Association (Ginnie Mae); mortgages, obligations, or other securities which are or ever have been sold by

the Federal Home Loan Mortgage Corporation (Freddie Mac) under the FHLBank Act; and such securities as fiduciary and trust funds may invest in under the laws of the state in which the FHLBank is located. Any assets subject to a lien or pledge for the benefit of holders of any issue of Consolidated obligations are treated as if they were free from lien or pledge for purposes of compliance with these regulations.

Consolidated obligations are distributed through dealers selected by the Office of Finance using various methods including competitive auction and negotiations with individual or syndicates of underwriters. Some debt issuance is in response to specific inquiries from underwriters. Many Consolidated obligations are issued with the FHLBank concurrently entering into derivatives agreements, such as interest rate swaps. To facilitate issuance, the Office of Finance may coordinate communication between underwriters, individual FHLBanks, and financial institutions executing derivative agreements with the FHLBanks. Issuance volume is not concentrated with any particular underwriter.

The Office of Finance is mandated by the Finance Agency to ensure that Consolidated obligations are issued efficiently and at the lowest all-in cost of funds over time. If the Office of Finance determines that its action is consistent with its Finance Agency’s mandated policies, it may reject our issuance request, and the requests of other FHLBanks, to raise funds through the issuance of Consolidated obligations on particular terms and conditions. We have never been denied access under this policy for all periods reported. The Office of Finance serves as a source of information for the FHLBanks on capital market developments, and manages the FHLBanks’ relationship with the rating agencies with respect to the Consolidated obligations.

Consolidated Obligation Liabilities

Each FHLBank independently determines its participation in each issuance of Consolidated obligations based on (among other factors) its own funding and operating requirements, maturities, interest rates, and other terms available for Consolidated obligations in the market place. The FHLBanks have emphasized diversification of funding sources and channels as the need for funding from the capital markets has grown.

Consolidated Obligations Bonds. Consolidated bonds are issued primarily to raise intermediate- and long-term funds for the FHLBanks. They can be issued and distributed through negotiated or competitive bidding transactions with approved underwriters or bidding group members. Consolidated bonds (COs or CO bonds) generally carry fixed- or variable-rate payment terms and have maturities ranging from one month to 30 years.

| · | The Global Debt Program — The FHLBanks issue global bullet Consolidated bonds. The FHLBanks and the Office of Finance maintain a debt issuance process for scheduled issuance of global bullet Consolidated bonds. As part of this process, management from each FHLBank will determine and communicate a firm commitment to the Office of Finance for an amount of scheduled global bullet debt to be issued on its behalf. If the FHLBanks’ orders do not meet the minimum debt issue size, each FHLBank receives an allocation of proceeds equal to either the larger of the FHLBank’s commitment or the ratio of the individual FHLBank’s regulatory capital to total regulatory capital of all of the FHLBanks. If the FHLBanks’ commitments exceed the minimum debt issue size, then the proceeds are allocated based on relative regulatory capital of the FHLBanks, with the allocation limited to either the lesser of the allocation amount or the actual commitment amount. The FHLBanks can, however, pass on any scheduled calendar slot and decline to issue any global bullet Consolidated bonds upon agreement of at least eight of the FHLBanks. |

| · | TAP Issue Program — The FHLBanks use the TAP Issue Program to issue fixed-rate, non-callable (bullet) bonds. This program uses specific maturities that may be reopened daily through competitive auctions. The goal of the TAP Issue Program is to aggregate frequent smaller fixed-rate funding needs into a larger bond issue that may have greater market liquidity. |

Consolidated Obligation Discount Notes. Discount notes may be offered into the market though the “discount note window”, or through regularly scheduled competitive auctions. These CO discount notes have a maturity range of one day to one year, are generally issued at or below par, and mature at par.

| · | Discount notes issued through the discount note window are priced daily and distributed through FHLBank authorized dealers. FHLBanks may request that specific amounts of Consolidated discount notes (CO discount notes or discount notes) with specific maturity dates be offered by the Office of Finance for sale through authorized securities dealers. The Office of Finance commits to issue CO discount notes on behalf of the |

| | requesting FHLBanks after dealers submit orders for the specific CO discount notes offered for sale. The FHLBanks receive funding based on the time of their request, the rate requested for issuance, the trade date, the settlement date, and the maturity date. However, a FHLBank may receive less than requested (or may not receive any funding) because of investor demand and competing FHLBank requests for the particular funding that the FHLBank is requesting. |

| · | Twice weekly, one or more of the FHLBanks may also request that specific amounts of CO discount notes with fixed maturities of 4, 8, 13, and 26 weeks be offered by the Office of Finance through single-price (Dutch) auctions conducted with securities dealers in the discount note selling group. Issuance is contingent on FHLBank demand for funding with these terms. Auction sizes and maturity categories are announced to dealers during the auction process on Reuters and other major wire services. The discount notes offered for sale through Dutch auctions are not subject to a limit on the maximum costs the FHLBanks are willing to pay. Bids will be accepted from the lowest bid rate until the auction size is met, and all winning bids will be awarded at the highest bid rate accepted, so that the FHLBanks receive funding based on their requests at the highest bid rate accepted. If the bids submitted are less than the total of the FHLBanks’ requests, the FHLBank receives funding based on that FHLBank’s regulatory capital relative to the regulatory capital of other FHLBanks offering CO discount notes. |

Deposits

The FHLBank Act allows us to accept deposits from its members, other FHLBanks and government instrumentalities. For us, member deposits are also a source of funding, but we do not rely on member deposits to meet our funding requirements. For members, deposits are a low-risk earning asset that may satisfy their regulatory liquidity requirements. We offer several types of deposit programs to our members, including demand and term deposits.

Capital

From its enactment in 1932, the FHLBank Act provided for a subscription-based capital structure for the FHLBanks. The amount of capital stock that each FHLBank issued was determined by a statutory formula establishing how much FHLBank capital stock each member was required to purchase. With the enactment of the Gramm-Leach-Bliley Act of 1999, Congress replaced the statutory subscription-based member capital stock purchase formula with requirements for total capital, leverage capital, and risk-based capital for the FHLBanks and required the FHLBanks to develop new capital plans to replace the previous statutory structure.

The FHLBNY’s capital plan bases the stock purchase requirement on the level of activity a member has with the Bank, subject to a minimum membership requirement that is intended to reflect the value to the member of having access to the Bank as a funding source. With the approval of the Board of Directors, we may adjust these requirements from time to time within the ranges established in the capital plan. Any changes to our capital plan must be approved by our Board of Directors and the Finance Agency.

Bank capital stock cannot be publicly traded, and under the capital plan, may be issued, transferred, redeemed, and repurchased only at its par value of $100 per share, subject to certain regulatory and statutory limits. Under the capital plan, a member’s capital stock will be redeemed by the Bank upon five years notice from the member, subject to certain conditions. In addition, we have the discretion to repurchase excess capital stock from members. Our current practice is to acquire excess activity based capital stock daily.

For more information, see Table 7.1 Stockholders’ Capital in this MD&A, and Note 14. Capital Stock, Mandatorily Redeemable Capital Stock and Restricted Retained Earnings in the notes to the audited financial statements.

Retained Earnings and Dividends

The Bank’s Retained Earnings and Dividends policy (the “Policy”) is a Board approved policy, the objectives of which are to preserve the value of our members’ investment with us, and to provide members with a reasonable dividend. The Policy also states that we want to provide returns on the investment in the Bank’s stock that are sufficient to attract and retain members, and that do not discourage member borrowing. The Bank’s minimum level of retained earning provides management with a high degree of confidence that estimable losses under simulated

stressful conditions and scenarios will not impair paid-in capital, thereby preserving the par value of the stock. Additionally, Unrestricted Retained Earnings should be available to supplement dividends when earnings are low or losses occur. Our ability to pay dividends and any other distributions may be affected by standards under the Policy.

The Policy establishes (1) a minimum level of Retained Earnings equal to the Bank’s “Retained Earnings Sufficiency”, which is the FHLBNY’s measure of estimating the Bank’s risk exposures; it is estimated under simulated stressful conditions and scenarios, within a defined confidence interval, on market, credit and operational risks, as well as GAAP accounting exposures related to the fair values of certain financial instruments; (2) the priority of contributions to retained earnings relative to other distributions of income; (3) the target level of Retained Earnings, based on the Retained Earnings Sufficiency level, and (4) a timeline to achieve the targets and to ensure maintenance of appropriate levels of Retained Earnings.

The Bank may pay dividends from Unrestricted Retained Earnings and current net income. Per Finance Agency regulations, our Board of Directors may declare and pay dividends in either cash or capital stock; our practice has been to pay dividends in cash. Our dividends and our dividend policy are subject to Federal Housing Finance Agency regulations and policies. Any dividend payments declared by our Board are a function of these policies, and our financial condition and performance.

To achieve the Bank’s strategic plans and business objectives within the Bank’s risk appetite, the Board-approved Retained Earnings target was $1,760 million for 2019 (including $656 million of Restricted retained earnings (RRE) allocated to Risk Bearing Capacity) and $1,505 million for 2018. For more information about Restricted retained earnings, see Table 7.1 Stockholder’s Capital in this MD&A.

Unrestricted Retained Earnings was $1,115.2 million and $1,102.8 million at December 31, 2019 and 2018. Restricted Retained Earnings was $685.8 million and $591.3 million at the two dates. The balance in Accumulated Other Comprehensive Income (AOCI), a component of stockholder’s equity, were losses of $47.8 million and $13.3 million at December 31, 2019 and 2018. At December 31, 2019 and 2018, our actual retained earning balances exceeded the required Bank’s Retained Earnings Sufficiency level and was in compliance with the Retained Earnings and Dividend Policy.

The following table summarizes the impact of dividends on our retained earnings for the years ended December 31, 2019, 2018 and 2017 (in thousands):

| | | December 31, | |

| | | 2019 | | | 2018 | | | 2017 | |

| Retained earnings, beginning of year | | $ | 1,694,082 | | | $ | 1,546,282 | | | $ | 1,411,965 | |

| Adjustments to opening balance(a) | | | - | | | | 4,924 | | | | - | |

| Net Income for the year | | | 472,588 | | | | 560,478 | | | | 479,469 | |

| | | | 2,166,670 | | | | 2,111,684 | | | | 1,891,434 | |

| Dividends paid in the year(b) | | | (365,636 | ) | | | (417,602 | ) | | | (345,152 | ) |

| | | | | | | | | | | | | |

| Retained earnings, end of year | | $ | 1,801,034 | | | $ | 1,694,082 | | | $ | 1,546,282 | |

| (a) | Cumulative catch-up adjustment upon adoption of ASU 2016-01 relating to change in the designation of funds in the grantor trust from AFS to Equity Investments. |

| | |

| (b) | Dividends are paid quarterly in arrears in the second month after quarter-end. Dividends are not accrued at quarter-end. |

Competition

Demand for advances is affected by the availability and cost to members of alternate sources of liquidity, including retail deposits and wholesale funding options such as brokered deposits, repurchase agreements, Federal Funds lines of credit, wholesale CD programs, and deposits thru listing service. Historically, members have grown their assets at a faster pace than retail deposits and capital resulting in the creation of a funding gap. We compete with both secured and unsecured suppliers of wholesale funding to fill these potential funding gaps. Such other suppliers of funding may include Wall Street dealers, commercial banks, regional broker-dealers and firms capitalizing on

wholesale funding platforms. Of these wholesale funding sources, the brokered CD market is our main threat as members continue to increase their usage and counterparties extend available maturities.

An emerging competitor is Deposits thru Listing Services, which are financial institutions that charge a subscription fee to help banks gather deposits. We have seen a gradual uptick in the use of these wholesale deposits using this vehicle. Repo and Federal Funds usage has been stable, though demand for certain members has both increased and decreased as a result of the various changes in the regulatory liquidity requirements and we expect this trend to extend as advances and brokered CDs continue to take market share. Our larger members may also have access to the national and global credit markets. The availability of alternative funding sources can vary as a result of market conditions, member creditworthiness, availability of collateral and suppliers’ appetite for the business, as well as other factors. However, we believe the competitive landscape will continue and will be reflected in the balances and market share.

In the debt markets, we compete for funds in the national and global debt markets. Competitors include corporations, sovereigns, the U.S. Treasury, supranational entities and Government Sponsored Enterprises including Fannie Mae, Freddie Mac and the Federal Farm Credit Banks (FFCB). Increases in the supply of competing debt products could, in the absence of increases in demand, result in higher debt costs or lesser amounts of debt issued at the same cost than would otherwise be the case. In addition, the availability and cost of funds can be adversely affected by regulatory initiatives that could reduce demand for Federal Home Loan Bank System debt. Although the available supply of funds has historically kept pace with the liquidity needs of our members, there can be no assurance this will continue to be the case.

In certain market conditions, there is considerable competition among high credit quality issuers in the markets for callable debt. The issuance of callable debt and the simultaneous execution of callable derivatives that mirror the debt have been, when available, a valuable source of competitively priced funding for the FHLBNY. However, since Money Market Fund Reform, the dominant System issuance has been in simple floating-rate debt as money market funds migrated assets from Prime to Government Funds; thereby creating demand for eligible assets such as FHLB debt. Floaters have been one of the main determinants of our relative cost of funds. There can be no assurance that the current breadth and depth of these markets will be sustained as it is heavily influenced by investor sentiment concerning rates and yields, LIBOR cessation and availability of alternative investments, particularly in the Repo sector.

Since November 2018, the FHLB System has been a major participant in the issuance of floaters using the proposed LIBOR replacement index, the Secured Overnight Financing Rate (SOFR). SOFR-floaters are potentially a major source of funding for the System as issuance grows and a broader derivative market develops in anticipation of a cessation of LIBOR. See LIBOR replacement discussions in Item 1A. Risk Factors.

We compete for the purchase of mortgage loans held-for-sale. For single-family products, competition is primarily with Fannie Mae and Freddie Mac, principally on the basis of price, products, structures, and services offered.

Competition for certain aspects of the FHLBank business model among the 11 FHLBanks is limited, although a bank holding company with multiple banking charters may operate in more than one FHLBank’s district. If the member has a centralized treasury function, it is possible that there could be competition for advances. A limited number of our member institutions are subsidiaries of financial holding companies with multiple charters and FHLBank memberships. The amount of advances borrowed by these entities and the amount of capital stock held, could be material to the business. Certain large member financial institutions operating in our district may borrow unsecured Federal funds or source deposits from other FHLBanks. We are permitted by regulation to purchase short-term investments from our members, though we choose to not permit members to borrow unsecured funds from us.

Oversight, Audits, and Examinations

The Federal Housing Finance Agency (Finance Agency or FHFA), an independent agency in the executive branch of the U.S. government, supervises and regulates the FHLBanks. The Housing Act created the FHFA with regulatory authority over FHLBank matters such as: board of director composition, executive compensation, risk-based capital standards and prompt corrective action enforcement provisions, membership eligibility, and low-income housing goals. The FHFA’s mission, with respect to the FHLBanks, is to ensure that the FHLBanks operate in a safe and sound manner so that the FHLBanks serve as a reliable source of liquidity and funding for housing finance and community investment.

We carry out our statutory mission only through activities that comply with the rules, regulations, guidelines, and orders issued under the Federal Housing Enterprises Financial Safety and Soundness Act, the Housing Act and the FHLBank Act.

Our shares of Class B stock are registered with the SEC under the Exchange Act, and we are subject to the information, disclosure, insider trading restrictions and other requirements under the Exchange Act. We are not subject to the provisions of the Securities Act.

The Government Corporation Control Act provides that, before a government corporation may issue and offer obligations to the public, the Secretary of the Treasury shall prescribe the form, denomination, maturity, interest rate and conditions of the obligations; the way and time issued; and the selling price. The U.S. Department of the Treasury receives the Finance Agency’s annual report to Congress, monthly reports reflecting securities transactions of the FHLBanks, and other reports reflecting the operations of the FHLBanks. The FHLBNY has an internal audit department, and our Board of Directors has an Audit Committee. An independent registered public accounting firm audits our annual financial statements. The independent registered public accounting firm conducts these audits following auditing standards established by the Public Company Accounting Oversight Board (PCAOB). The FHLBanks, the Finance Agency, and Congress all receive the audit reports. We must also submit annual management reports to Congress, the President, the Office of Management and Budget, and the Comptroller General. These reports include: Statements of financial condition, operations, and cash flows; a Statement of internal accounting and administrative control systems; and the Report of the independent registered public accounting firm on the financial statements and internal controls over financial reporting.

The Comptroller General has authority under the FHLBank Act to audit or examine the Finance Agency and the FHLBanks, including the FHLBNY, and to decide the extent to which they fairly and effectively fulfill the purpose of the FHLBank Act. Furthermore, the Government Corporation Control Act provides that the Comptroller General may review any audit of our financial statements conducted by a registered independent public accounting firm. If the Comptroller General conducts such a review, then he or she must report the results and provide his or her recommendations to Congress, the Office of Management and Budget and the Bank. The Comptroller General may also conduct his or her own audit of any of our financial statements.

Personnel

As of December 31, 2019, we had 342 full-time and no part-time employees. As of December 31, 2018, we had 314 full-time and no part-time employees. The employees are not represented by a collective bargaining unit, and we consider our relationship with employees to be good.

Tax Status

The FHLBanks, including the FHLBNY, are exempt from ordinary federal, state, and local taxation except for real property taxes.

Assessments

Affordable Housing Program (AHP) Assessments. — Section 10(j) of the FHLBank Act requires each FHLBank to establish an Affordable Housing Program. Each FHLBank provides subsidies in the form of direct grants and below-market interest rate advances to members who use the funds to assist in the purchase, construction, or rehabilitation of housing for very low-, low-, and moderate-income households. Annually, the FHLBanks must allocate for the AHP the greater of $100 million or 10% of regulatory net income. Regulatory net income is defined as GAAP net income before interest expense related to mandatorily redeemable capital stock and the assessment for Affordable Housing Program. The exclusion of interest expense related to mandatorily redeemable capital stock is a regulatory interpretation of the Finance Agency. We accrue the AHP expense monthly.

We charge the amount allocated for the Affordable Housing Program to income and recognize the amounts allocated as a liability. We relieve the AHP liability as members use subsidies. In periods where our regulatory income before Affordable Housing Program is zero or less, the amount of AHP liability is equal to zero. If the result of the aggregate 10% calculation described above is less than $100 million for all 11 FHLBanks, then the Act requires the shortfall to be allocated among the FHLBanks based on the ratio of each FHLBank’s income before Affordable Housing Program to the sum of the income before Affordable Housing Program of the 11 FHLBanks. There were no shortfalls in 2019, 2018 and 2017.

Available Information

The Federal Home Loan Bank of New York maintains a website located at www.fhlbny.com where we make available our annual report on Form 10-K and quarterly reports on Form 10-Q as filed with the Securities and Exchange Commission (the SEC), and other information regarding us and our products free of charge. We are required to file with the SEC an annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. The SEC maintains a website that contains these reports and other information regarding our electronic filings located at www.sec.gov. Information on these websites, or that can be accessed through these websites, does not constitute a part of this annual report.

The following discussion sets forth the material risk factors that could affect the FHLBNY’s financial condition and results of operations. Readers should not consider any descriptions of such factors to be a complete set of all potential risks that could affect the FHLBNY.

Market and Economic Risks

Changes to and replacement of the London Interbank Offered Rate (LIBOR) benchmark interest rate could adversely affect FHLBNY’s business, financial condition, and results of operations. In July 2017, the United Kingdom's Financial Conduct Authority, which regulates LIBOR, announced that after 2021 it will no longer persuade or compel banks to submit rates for the calculation of LIBOR. The announcement indicates that the continuation of LIBOR on the current basis cannot and will not be guaranteed after 2021. It is impossible to predict whether and to what extent banks will continue to provide LIBOR submissions to the administrator of LIBOR, whether LIBOR rates will cease to be published or supported before or after 2021, or whether any additional reforms to LIBOR may be enacted in the United Kingdom or elsewhere. There is no assurance that LIBOR will continue to be accepted or used by the markets generally or by any issuers, investors, or counterparties at any time, even if LIBOR continues to be available.

In September 2019, the FHFA issued a supervisory letter (the Supervisory Letter) to the FHLBank and the Office of Finance relating to their planning for the LIBOR phase-out. Under the Supervisory Letter, with limited exceptions, FHLBanks, including the FHLBNY, should, by December 31, 2019, stop purchasing investments that reference LIBOR and mature after December 31, 2021, and should, by March 31, 2020, no longer enter into any other new financial assets, liabilities, and derivatives that reference LIBOR and mature after December 31, 2021 (The March 31, 2020 date has now been extended to June 30, 2020). As we align our business strategies to the Supervisory Letter, we may experience less flexibility in our access to funding, higher funding costs, or lower overall demand or increased costs for our advances, which may, in turn, negatively affect the future composition of our balance sheet, capital stock levels, core mission asset ratios, and net income. In addition, as we are generally not permitted to continue to use instruments that reference LIBOR for hedging and risk-mitigating purposes, we will have to alter our hedging and interest-rate risk management strategies, which may have a negative effect on our financial condition and results of operations.

In the United States, the Federal Reserve Board and the Federal Reserve Bank of New York convened the Alternative Reference Rates Committee to identify a set of alternative reference interest rates for possible use as market benchmarks. This committee has proposed the Secured Overnight Financing Rate (SOFR) as its recommended alternative to U.S. dollar LIBOR, and the Federal Reserve Bank of New York began publishing SOFR rates in the second quarter of 2018. SOFR is based on a broad segment of the overnight Treasury repurchase market and is intended to be a measure of the cost of borrowing cash overnight collateralized by Treasury securities. Since 2018, market activity in SOFR-linked financial instruments has continued to develop. The FHLBanks, including the FHLBNY, have offered SOFR-linked consolidated obligations on an ongoing basis and have started offering SOFR-linked advances.

As many of our assets, liabilities, and derivatives are indexed to LIBOR, the FHLBanks, including the FHLBNY and the Office of Finance have developed a LIBOR transition plan, which addresses considerations such as LIBOR exposure, fallback language, operational preparedness, and balance sheet management. However, the market transition away from LIBOR and towards SOFR or another alternate reference rate is expected to be complicated, including the development of term and credit adjustments to accommodate differences between LIBOR and SOFR or any other alternate reference rate. During the market transition away from LIBOR, LIBOR may experience increased volatility or become less representative. In addition, the overnight Treasury repurchase market underlying SOFR has experienced and may experience disruptions from time to time, which has resulted and may result in unexpected fluctuations in SOFR. Introduction of an alternate reference rate also may create challenges in hedging and asset liability management and introduce additional basis risk and increased volatility for the FHLBNY and other market participants. While market activity in SOFR-linked financial instruments has continued to develop, there can be no guarantee that SOFR will become widely accepted and used across market segments and financial products in a timely manner and any other alternative reference rate may or may not be developed. Any disruption in the market transition away from LIBOR and towards SOFR or another alternate reference rate could result in increased financial, operational, legal, reputational, or compliance risks for the FHLBNY. We are not able to

predict the effect of a possible transition to SOFR or another alternate reference rate will have on our business, financial condition, and results of operations.

Changes in interest rates could significantly affect the FHLBNY’s financial condition and results of operations. The level of interest rates and the impact on our balance sheet spreads are important factors affecting the Bank’s interest rate risk management, profitability, and returns. We earn income from capital, and the level of market interest rates as impacted by the Federal Reserve and the capital markets, directly affects these earnings.

We earn income from the spread between interest earned on our outstanding advances, investments and shareholders’ capital, and interest paid on our Consolidated obligations and other interest-bearing liabilities. Although we use various methods and procedures to monitor and manage our exposure to changes in interest rates, we may experience instances when either our interest-bearing liabilities will be more sensitive to changes in interest rates than our interest-earning assets, or vice versa. In either case, interest rate movements contrary to our position could negatively affect our financial condition and results of operations. Moreover, the effect of changes in interest rates can be exacerbated by prepayment and extension risk, a risk that mortgage related assets will be refinanced by the mortgagor in low interest rate environments or will remain outstanding longer than expected at below market yields when interest rates increase.

The possibility of negative interest rates on U.S. Treasury or other market instruments could adversely affect our results of operations by, for example, reducing asset yields or spreads, creating operating and operating system issues, or having other adverse impacts on our business.

The FHLBNY’s funding depends on its ability to access the capital markets. Our primary source of funds is the sale of Consolidated obligations in the capital markets. Our ability to obtain funds through the sale of Consolidated obligations depends in part on prevailing conditions in the capital markets, which are, for the most part, beyond our control. Accordingly, we may not be able to obtain funding on acceptable terms, if at all. If we cannot access funding when needed on acceptable terms, our ability to support and continue operations could be adversely affected, which could negatively affect our financial condition and results of operations. If additional reforms are legislated over money market funds, they may have an adverse impact on the FHLBank discount note pricing, given that the funds are significant sponsors of short-term FHLBank debt. Ongoing changes to the regulatory environment that affect bank counterparties and debt underwriters could adversely affect our ability to access the debt markets or the cost of that funding.

Economic downturns, macro-economic events, and changes in federal monetary policy, including those related to widespread health emergencies or similar events, could have an adverse effect on the FHLBNY’s business and its results of operations. Our businesses and results of operations are sensitive to general business and economic conditions. These conditions include short- and long-term interest rates, inflation, money supply, fluctuations in both debt and equity capital markets, and the strength of the United States economy and the local economies in which we conduct our business. If any of these conditions deteriorate, our businesses and results of operations could be adversely affected. For example, a prolonged economic downturn could result in members needing fewer advances. In addition, our business and results of operations are significantly affected by the fiscal and monetary policies of the federal government and its agencies, including the Federal Reserve Board, which regulates the supply of money and credit in the United States. The Federal Reserve Board’s policies directly and indirectly influence the yield on interest-earning assets and the cost of interest-bearing liabilities, and can have far reaching impacts on the U.S. economy as a whole.

We note here that the Federal Open Market Committee (FOMC) recently approved emergency reductions to the target range for the Federal Funds rate and implemented other initiatives in response to the COVID-19 coronavirus outbreak and the potential negative impact on the U.S. economy. Further or similar action in response to this or any widespread health emergency or similar event, or impacts on the economy as a result of such event, could adversely affect our financial condition and results of operations.

Regulatory Risks

The FHLBanks are governed by federal laws and regulations, which could change or be applied in a manner detrimental to FHLBNY’s operations. The FHLBanks are government-sponsored enterprises (GSEs), organized under the authority of the FHLBank Act, and, as such, are governed by federal laws and regulations of the Finance Agency, an independent agency in the executive branch of the federal government. From time to time, Congress has amended the FHLBank Act in ways that significantly affected the FHLBanks and the manner in which the FHLBanks carry out their housing finance mission and business operations. New or modified legislation enacted by Congress or regulations adopted by the Finance Agency could have a negative effect on our ability to conduct business or our cost of doing business. Due to recent changes in the U.S. government administration and recent executive actions, there are additional uncertainties in the legislative and regulatory environment.

Changes in regulatory or statutory requirements, or in their application, could result in, among other things, changes in: our cost of funds; retained earnings requirements; liquidity requirements, debt issuance; dividend payments; capital redemption and repurchases; permissible business activities; the size, scope, or nature of our lending, investment, or mortgage purchase programs; our ability to appropriately compensate, recruit and retain our employees; or our compliance costs. Changes that restrict dividend payments, the growth of our current business, or the creation of new products or services could negatively affect our results of operations and financial condition. Further, the regulatory environment affecting members could be changed in a manner that would negatively affect their ability to acquire or own our capital stock or take advantage of our products and services.

As a result of these factors, the FHLBank System may have to pay a higher rate of interest on Consolidated obligations. The resulting increase in the cost of issuing Consolidated obligations could cause our advances to be less profitable and reduce our net interest margins (the difference between the interest rate received on advances and the interest rate paid on Consolidated obligations). If we change the pricing of our advances, they may no longer be attractive to members and outstanding advances may decrease. In any case, the increased cost of issuing Consolidated obligations could negatively affect our financial condition and results of operations.

Negative information about us, the FHLBanks or housing GSEs, in general, could adversely impact our cost and availability of financing. Negative information impacting us or any other FHLBank, such as material losses or increased risk of losses, could also adversely impact our cost of funds. More broadly, negative information about housing GSEs, in general, could adversely impact us. The housing GSEs — Fannie Mae, Freddie Mac, and the FHLBanks — issue highly rated agency debt to fund their operations. From time to time, negative announcements by any of the housing GSEs concerning accounting problems, risk-management issues, and regulatory enforcement actions have created pressure on debt pricing for all GSEs, as investors have perceived such instruments as bearing increased risk. Similar announcements by the FHLBanks may contribute to this pressure on debt pricing. One possible source of information that impacts us could come from plans for housing GSE reform. Such plans, including those introduced by the U.S. Treasury and HUD proposed certain recommendations for the reform of the housing GSEs. Although the focus of those recommendations is on Fannie Mae and Freddie Mac, the proposal includes certain recommendations for the FHLBanks. The proposed reforms could affect the FHLBNY’s current business activities with its members, particularly large financial institutions. These recommendations include reducing and altering the composition of FHLBanks investment portfolios, limiting the level of advances outstanding to individual members and restricting membership to allow each financial institution, inclusive of its affiliates, to be an active member in only a single FHLBank. Other recommendations or other plans could result in market uncertainty regarding the status of U.S. federal government support of housing GSEs, in general, including the FHLBanks, and our cost of financing could be adversely impacted as a result.

Any such negative information or other factors could result in the FHLBanks having to pay a higher rate of interest on COs to make them attractive to investors. If we maintain our existing pricing on our advances products and other services notwithstanding increases in CO interest rates, the spreads we earn would fall and our results of operations would be adversely impacted. If, in response to this decrease in spreads, we change the pricing of our advances, the advances may be less attractive to members and the amount of new advances and our outstanding advance balances may decrease. In either case, the increased cost of issuing COs could adversely impact our financial condition and results of operations.

Business Risks

A loss or change of business activities with large members could adversely affect the FHLBNY’s results of operations and financial condition. We have a high concentration of advances with three member institutions, and a loss or change of business activities with any of these institutions could adversely affect our results of operations and financial condition. Concentration risk for the FHLBNY is defined as the exposure to loss arising from a disproportionately large number of financial transactions with a limited number of individual customers, with a particular focus on members that have outstanding advances that account for more than 10% of advances by par value to the total par value of all advances outstanding as of a given date. For more information about concentration, see Note 21. Segment Information and Concentration to Financial Statements.

Withdrawal of one or more large members from our membership could result in a reduction of our total assets, capital, and net income. If one or more of our large members were to prepay their advances or repay the advances as they came due and no other advances were made to replace them, it could also result in a reduction of our total assets, capital, and net income. In prior years, we experienced significant prepayments of advances by large members, and prepayments due to the acquisition of a member by another bank.

While our analysis of the impact of the prepayments do not indicate a material adverse impact on our business and results of operations; however, these are the types of events that we consider to be potential negative factors that may arise from a high concentration of advances. The timing and magnitude of the effect of a reduction in the amount of advances would depend on a number of factors, including:

| · | the amount and the period over which the advances were prepaid or repaid; |

| · | the amount and timing of any corresponding decreases in activity-based capital; |

| · | the profitability of the advances; |

| · | the size and profitability of our short- and long-term investments; and |

| · | the extent to which Consolidated obligations (funding) matured as the advances were prepaid or repaid. |

At December 31, 2019, advances borrowed by insurance companies accounted for 24.9% of total advances (21.1% at December 31, 2018). Lending to insurance companies poses a number of unique risks not present in lending to federally insured depository institutions. For example, there is no single federal regulator for insurance companies. They are supervised by state regulators and subject to state insurance codes and regulations. There is uncertainty about whether a state insurance commissioner would try to void FHLBNY’s claims on collateral in the event of an insurance company failure. Even if ultimately unsuccessful, such a legal challenge could result in a delay in the liquidation of collateral and a loss of market value. For more information, see Financial Statements Note 9. Advances.

The FHLBNY has geographic concentrations that may adversely impact its business operations and/or financial condition. By nature of our regulatory charter and our business operations, we are exposed to credit risk as the result of limited geographic diversity. Our advance lending is limited by charter to operations to the four areas — New Jersey, New York, Puerto Rico and the U.S. Virgin Islands. We employ conservative credit rating and collateral policies to limit exposure, but a decline in regional economic conditions could create an exposure to us in excess of collateral held.

We have concentrations of mortgage loans in some geographic areas based on our investments in MPF loans and private-label MBS and on the receipt of collateral pledged for advances. To the extent that any of these geographic areas experiences significant declines in the local housing markets, declining economic conditions, or a natural disaster, we could experience increased losses on our investments in the MPF loans or the related MBS or be exposed to a greater risk that the pledged collateral securing related advances would be inadequate in the event of default on such an advance.

The FHLBNY relies upon derivative instruments to reduce its interest-rate risk, and changes in our credit ratings may adversely affect our ability to enter into derivative instruments on acceptable terms. Our financial strategies are highly dependent on our ability to enter into derivative instruments on acceptable terms to reduce our interest-rate risk. Rating agencies may from time to time change a rating or issue negative reports, which may adversely affect our ability to enter into derivative instruments with acceptable parties on satisfactory terms in

the quantities necessary to manage our interest-rate risk on Consolidated obligations or other financial instruments. This could negatively affect our financial condition and results of operations.

Changes in regulatory requirements related to derivative instruments may adversely affect our ability to enter into derivative instruments on acceptable terms. The ongoing implementation of derivatives and clearinghouse regulations could adversely impact the FHLBNY’s ability to execute derivatives to hedge interest rate risk, and increase our compliance costs and negatively impact our results of operations. Such regulations have impacted, and will continue to substantially impact, the derivatives markets by, among other things: (i) requiring extensive regulatory and public reporting of derivatives transactions; (ii) requiring a wide range of over-the-counter derivatives to be cleared through recognized clearing facilities and traded on exchanges or exchange-like facilities; (iii) requiring the collection and segregation of collateral for most uncleared derivatives; and (iv) significantly broadening limits on the size of positions that may be maintained in specified derivatives. These market structure reforms could make many derivatives products more costly to execute, may significantly reduce the liquidity of certain derivatives markets and could diminish customer demand for covered derivatives. Those changes could negatively impact the FHLBNY’s ability to execute derivatives in a cost efficient manner, which could have an adverse impact on its results of operations.

The FHLBNY faces competition for advances, loan purchases, and access to funding, which could adversely affect its businesses and the FHLBNY’s efforts to make advance pricing attractive to its members as well as it may adversely affect earnings. Our primary business is making advances to our members, and we compete with other suppliers of wholesale funding, both secured and unsecured, including investment banks, commercial banks and, in certain circumstances, other FHLBanks. Our members have access to alternative funding sources, which may offer more favorable terms than the ones we offer on our advances, including more flexible credit or collateral standards. We may make changes in policies, programs, and agreements affecting members from time to time, including, affecting the availability of and conditions for access to advances and other credit products, the MPF Program, the AHP, and other programs, products, and services, which could cause members to obtain financing from alternative sources. In addition, many of our competitors are not subject to the same regulations, which may enable those competitors to offer products and terms that we are not able to offer.

The availability of alternative funding sources that are more attractive to our members may significantly decrease the demand for our advances. Lowering the price of the advances to compete with these alternative funding sources may decrease the profitability of advances. A decrease in the demand for our advances or a decrease in our profitability on advances could adversely affect our financial condition and results of operations. In addition, changes to regulations governing our members’ businesses that reduce liquidity or capital requirements could serve to reduce demand for advances from the FHLBNY.

Certain FHLBanks, including the FHLBNY, also compete (primarily with Fannie Mae and Freddie Mac) for the purchase of mortgage loans from members. Some FHLBanks may also compete with other FHLBanks with which their members have a relationship through affiliates. We offer the MPF Program to our members. Competition among FHLBanks for MPF program business may be affected by the requirement that a member and its affiliates can sell loans into the MPF Program through only one FHLBank relationship at a time. Increased competition can result in a reduction in the amount of mortgage loans we are able to purchase and adversely impact income from this part of its business.

The FHLBanks, including the FHLBNY, also compete with the U.S. Department of the Treasury, Fannie Mae, Freddie Mac, and other GSEs, as well as corporate, sovereign, and supranational entities, for funds raised through the issuance of debt in the national and global debt markets. Increases in the supply of competing debt products may, in the absence of increases in demand, result in higher debt costs or lower amounts of debt issued at the same cost than otherwise would be the case. Increased competition could adversely affect our ability to have access to funding, reduce the amount of funding available to us, or increase the cost of funding available to us. Any of these effects could adversely affect our financial condition and results of operations.

Credit Risks