UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2008

Federal Home Loan Bank of New York

(Exact name of registrant as specified in its charter)

| | | | | |

| Federally Chartered Corporation | | 000-51397 | | 136400946 |

| (State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

101 Park Avenue, Floor 5, New York, New York

| | 10178-0599 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code:(212) 441-6616

| |

Not Applicable

|

| (Former name or former address if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 8.01 Other Events.

Each month, the Chief Executive Officer of the Bank issues a ‘Report from the President’ (the “Report”) to each shareholder. Such Reports may contain information that may be important to security holders. A copy of the Report to shareholders for the month of September 2008 issued on September 30, 2008 appears below.

2

Report from the President

September 30, 2008

| | | |

| TO: | | All Stockholders

(Individually Addressed) |

| | | |

| SUBJECT: | | Report for the Month |

At the Bank

A Once-in-a-Lifetime Event

Former Federal Reserve Chairman Alan Greenspan stated in September that we are experiencing a once-in-a-lifetime financial event. The extraordinary events of the past few weeks have caused confidence in the financial system to be tested. As a consequence, a turbulent and deteriorating market has continued much longer than expected. The effects on the Federal Home Loan Bank and our members have primarily been an increased cost of debt issuance and a corresponding increase in advance rates. Investors, including those who buy our consolidated obligations, are increasingly reluctant to lend money for periods in excess of a year. This limits our ability to meet our members’long-term funding needs. Fortunately, the strong demand for short-term credit has kept short-term advances flowing.

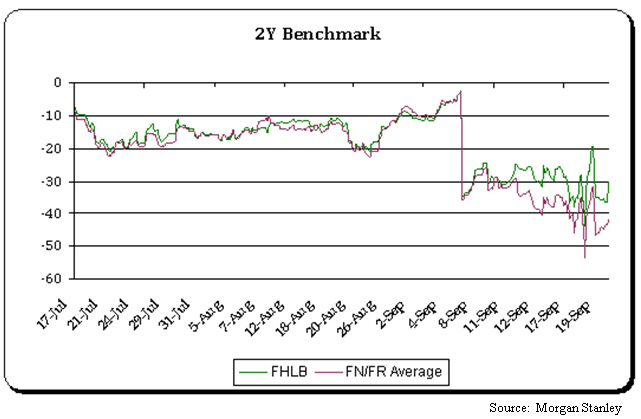

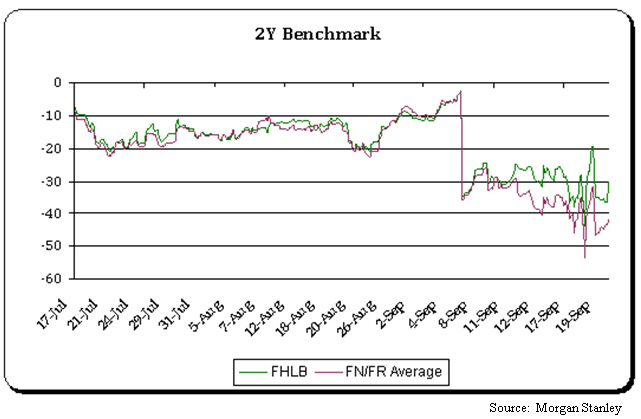

The spread between secondary Fannie/Freddie and Federal Home Loan Bank System benchmark notes has widened this past month. We expect this to be a temporary condition that will abate as the markets resume some degree of normality. The investors will fully appreciate Federal Housing Finance Agency Director James Lockhart’s statement that, “The Federal Home Loan Banks have performed remarkably well over the last year as they have a different business model than Fannie Mae and Freddie Mac and a different capital structure that grows as their lending activity grows.”

On the next page is a graph of the three-month intraday difference between the average of Fannie Mae and Freddie Mac spreads to Libor compared with Federal Home Loan Bank spreads to Libor. The graph illustrates how the Home Loan Banks moved from a slightly lower cost of funds compared with Fannie Mae and Freddie Mac in July to a higher cost for the Home Loan Banks in September. There is an obvious irony here because it is Fannie Mae and Freddie Mac, after years of missteps, that have been placed in conservatorship by the Government, not the Home Loan Banks. Apparently, some investors believe conservatorship is a more explicit backing by the Government.

101 Park Avenue

New York, NY 10178-0599

T:212.681.6000

F:212.441.6890

www.fhlbny.com

3

Report from the President

September 30, 2008

Page 2

As a cooperative organization, we continue to prudently manage our balance sheet while balancing the needs of our members. Responding to the effects of market turbulence, we have added a “liquidity risk premium” to our advance products. Despite this necessary action, members continue to rely on us to fund their balance sheet needs. This is most easily seen by the increase of advances to $100 billion by the end of September, which is a 33 percent increase from the end of September 2007. Advance terms and availability are constantly changing, reflecting the volatility in the markets. If you have a specific funding request, please contact Adam Goldstein, Senior Vice President, Sales and Marketing, at 212-441-6703. We are here to serve you in a reliable and safe and sound manner. We are in very stormy seas at the moment, but this storm will pass.

Federal Home Loan Bank of New York

4

Report from the President

September 30, 2008

Page 3

The U.S. Treasury Creates Backstop Lending Facility

for the 12 Federal Home Loan Banks

On September 9, 2008, the Federal Home Loan Bank of New York entered into a Lending Agreement (“Agreement”) with the U.S. Department of the Treasury (“Treasury”) that is intended to serve as a source of contingent liquidity. Each of the other 11 Federal Home Loan Banks also entered into such an agreement.

This secured facility is an implementation of the authority granted by Congress in the Housing and Economic Recovery Act of 2008 (“Act”), which allows the Secretary of the Treasury to provide financial support to the housing GSEs. This Act became law on July 30, 2008.

Any loans extended by the Treasury under the Agreement will be secured by advances to Federal Home Loan Bank of New York members or by mortgage-backed securities issued by Fannie Mae or Freddie Mac. Extensions of credit by the Treasury to the Federal Home Loan Banks, or to any Federal Home Loan Bank, will be considered a consolidated obligation and will be the joint and several obligation of all of the Federal Home Loan Banks.

The terms of the Agreement, which expires on December 31, 2009, are described in more detail in an 8-K filed by the Bank on the SEC’s EDGAR system on September 9, 2008. The Bank does not expect to access funding under the Agreement.

2008 FHLBNY Board “Member” Directors Ballots in the Mail

On Wednesday, October 1, 2008, election ballots will be mailed to the Chief Executive Officers of all eligible New Jersey and New York shareholder institutions participating in the 2008 election of Federal Home Loan Bank “member” directors. One seat from New Jersey and two seats from New York are up for election this year. Each of the individuals elected will serve terms starting on January 1, 2009.

The deadline for receiving voting ballots at the Home Loan Bank for the 2008 FHLBNY Member Director election is October 31, 2008, at 5:00 p.m. Please be sure to return your ballot to:

FHLBNY Director Elections

Federal Home Loan Bank of New York

101 Park Avenue

New York, New York 10178-0599

Federal Home Loan Bank of New York

5

Report from the President

September 30, 2008

Page 4

Separate Ballots for “Independent” Directors Soon to Be in the Mail

In addition, please be aware that, as a result of the adoption of the Housing and Economic Recovery Act of 2008, there will be a second, separate election conducted later in the year. Under the Act, the members of the Board who were formerly appointed by the Bank’s Federal regulator will now be called“independent” directors – and the independent directors will be elected by a vote of the entire membership.

This year’s independent director election will be held to fill three seats with terms beginning on January 1, 2009.

If you have any questions, please call Barbara Sperrazza, Corporate Secretary, at 212-441-6819.

As September closes, the financial markets remained extremely roiled with the House of Representative’s shocking rejection of the legislation designed to steady the financial sector. Be assured that we are doing all we can during this time of market stress to meet the needs of our members. We are profoundly grateful for the opportunity to serve you.

Sincerely,

Alfred A. DelliBovi

President

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations on these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Federal Home Loan Bank of New York

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | |

| | | Federal Home Loan Bank of New York |

| | | |

Date:September 30, 2008 | | By: /s/ Patrick A. Morgan |

| | | Name:Patrick A. Morgan |

| | | Title:Senior Vice President and Chief Financial Officer |

7