For more information about the Advisory Bulletin and our liquidity measures, see section Liquidity, Cash Flows, Short-Term Borrowings and Short-Term Debt, and Table 8.1 through Table 8.3 in this MD&A.

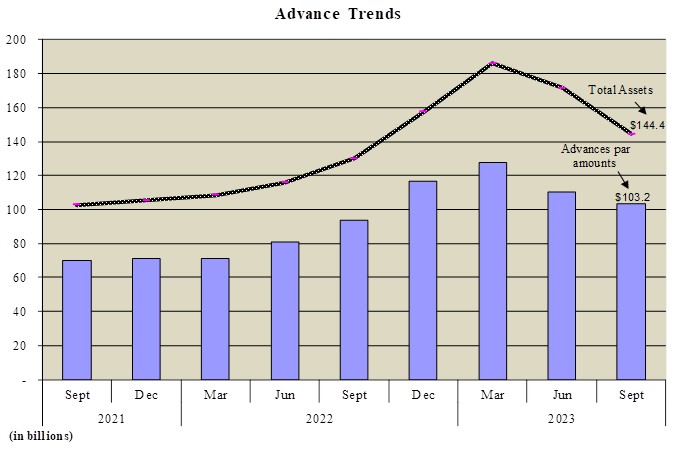

Advances — Par balances decreased at September 30, 2023 to $103.2 billion, compared to $116.9 billion at December 31, 2022. Short-term fixed-rate advances decreased by 49.1% to $12.6 billion at September 30, 2023, down from $24.7 billion at December 31, 2022. ARC advances, which are adjustable-rate borrowings, increased by 15.4% to $28.9 billion at September 30, 2023, compared to $25.1 billion at December 31, 2022. Given that advances are always well collateralized, a provision for credit losses was not necessary. We have no history of credit losses on advances.

Long-term investment debt securities — Long-term investment debt securities are designated as available-for-sale (AFS) or held-to-maturity (HTM). Our investment profile consists almost exclusively of GSE and Agency-issued (GSE-issued) securities.

In the AFS portfolio, long-term investments of floating-rate GSE-issued mortgage-backed securities were carried on the balance sheet at fair values of $410.2 million and $462.1 million at September 30, 2023 and December 31, 2022, respectively. Fixed-rate long-term investments in the AFS portfolio, comprised of fixed-rate GSE-issued mortgage-backed securities, were carried on the balance sheet at fair values of $7.0 billion and $5.5 billion at September 30, 2023 and December 31, 2022, respectively.

State and local housing finance agency obligations, primarily New York and New Jersey, were carried as AFS securities at $1.1 billion at September 30, 2023, slightly lower than the balance at December 31, 2022.

In the HTM portfolio, long-term investments were predominantly GSE-issued fixed- and floating-rate mortgage-backed securities and a portfolio of housing finance agency bonds. Fixed- and floating-rate mortgage-backed securities in the HTM portfolio were $11.8 billion and $9.2 billion at September 30, 2023 and December 31, 2022, respectively. No allowance for credit losses were deemed necessary for GSE-issued investments. Allowance for credit losses was $0.5 million on private-label MBS at September 30, 2023 versus $0.2 million at December 31, 2022.

In the HTM portfolio, State and local housing finance agency obligations were $0.2 billion at September 30, 2023 and December 31, 2022. Allowance for credit losses on State and local housing finance agency obligations in HTM portfolio was $0.1 million at September 30, 2023, slightly lower than the balance at December 31, 2022.

Equity Investments — We own grantor trusts that invest in highly-liquid registered mutual funds. Funds are classified as Equity Investments and were carried on the balance sheet at fair values of $84.7 million at September 30, 2023 and $81.8 million at December 31, 2022.

Mortgage loans held-for-portfolio — Mortgage loans are investments in Mortgage Partnership Finance (MPF) loans and Mortgage Asset Program (MAP) loans. As of March 31, 2021, the MAP mortgage loan program became our only active mortgage loan purchase program as we ceased to acquire mortgage loans through MPF.

Unpaid principal balance of MPF loans stood at $1.7 billion at September 30, 2023, a decrease of $112.6 million from the balance at December 31, 2022. Unpaid principal balance of MAP loans stood at $393.1 million at September 30, 2023 compared to $221.1 million at December 31, 2022.

Historically, credit performance has been strong in the MPF and MAP portfolio and delinquencies have been low. Residential collateral values have remained stable in the New York and New Jersey sectors, the primary geographic concentration for our MPF and MAP portfolio, and historical loss experience remains very low. Serious delinquencies (typically 90 days or more) at September 30, 2023, were lower than December 31, 2022. Allowance for credit losses increased to $3.4 million at September 30, 2023 compared to $1.9 million at December 31, 2022. The Bank transitioned models in June of 2023 and the newly adopted model assumptions are different than the prior model.

Capital ratios — Our capital position remains strong. At September 30, 2023, actual risk-based capital was $8.1 billion compared to $8.5 billion at December 31, 2022. Required risk-based capital was $989.9 million at September 30, 2023 compared to $749.5 million at December 31, 2022. To support $144.4 billion of total assets at September 30, 2023, the minimum required total capital was $5.8 billion or 4.0% of assets. Our actual regulatory risk-based capital was $8.1 billion, exceeding required total capital by $2.3 billion. These ratios have remained consistently above the required regulatory ratios through all periods in this report.

Leverage — At September 30, 2023 balance sheet leverage (based on U.S. GAAP) was 18.3 times shareholders’ equity compared to 18.9 times at December 31, 2022. Balance sheet leverage has generally remained steady over the last several years, although from