UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | | | |

| | |

¨ | | Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

þ | | Definitive Proxy Statement | | |

| | |

¨ | | Definitive Additional Materials | | |

| | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Vocus, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

þ | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | |

| | |

| | (5) | | Total fee paid: |

| |

| | |

| | |

¨ | | | | Fee paid previously with preliminary materials. |

| | |

¨ | | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| |

| | |

| | |

| | (2) | | Form, schedule or registration statement no.: |

| |

| | |

| | |

| | (3) | | Filing party: |

| |

| | |

| | |

| | (4) | | Date filed: |

| |

| | |

April 18, 2012

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Vocus, Inc. to be held at 2:00 PM ET, on Thursday, June 7, 2012, at the Baltimore Marriott Waterfront, 700 Aliceanna Street, Baltimore, Maryland.

At the annual meeting, you will be asked to elect one director for a three-year term, to ratify the selection of our independent registered public accounting firm for 2012, and to conduct an advisory vote on executive compensation. Details regarding the matters to be acted upon at this meeting appear in the accompanying Notice of Annual Meeting and Proxy Statement. The Board of Directors recommends that you vote “for” all of the proposals to be presented at the meeting.

Whether or not you plan to attend the annual meeting, we urge you to use our Internet voting system or to complete, sign and date the accompanying proxy card and return it in the enclosed postage-prepaid envelope as soon as possible so that your shares will be represented at the annual meeting. If you later decide to attend the annual meeting or change your vote, you may withdraw your proxy and vote in person at the annual meeting. Voting through our Internet voting system or by written proxy will ensure your representation at the annual meeting if you do not attend in person.

We thank you for your continued support of Vocus and look forward to seeing you at the annual meeting.

|

| Very truly yours, |

|

|

| Richard Rudman |

| Chief Executive Officer, President and Chairman |

VOCUS, INC.

12051 Indian Creek Court

Beltsville, Maryland 20705

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 7, 2012

The Annual Meeting of Stockholders of Vocus, Inc., a Delaware corporation, will be held at 2:00 PM ET, on Thursday, June 7, 2012, at the Baltimore Marriott Waterfront, 700 Aliceanna Street, Baltimore, Maryland, for the following purposes:

1. To elect one director to serve for a three-year term expiring at the 2015 Annual Meeting or until his successor is duly elected and qualified or until his earlier resignation or removal;

2. To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2012; and

3. To conduct a non-binding advisory vote on the compensation of the Company’s named executive officers (the “Say-on-Pay” vote).

These items of business are more fully described in the proxy statement accompanying this Notice.

Only stockholders of record at the close of business on April 13, 2012 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting and vote in person. To assure your representation at the meeting, however, you are urged to use our Internet voting system or to mark, sign, date, and return the enclosed proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. You may vote in person at the meeting even if you have previously used our Internet voting system or returned a proxy.

|

| Sincerely, |

|

|

Stephen Vintz Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

Beltsville, Maryland

April 18, 2012

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 7, 2012: The proxy statement and annual report to security holders are available at www.vocus.com.

VOCUS, INC.

12051 Indian Creek Court

Beltsville, Maryland 20705

PROXY STATEMENT

VOTING AND OTHER MATTERS

General

The enclosed proxy is solicited on behalf of Vocus, Inc., a Delaware corporation, by our Board of Directors for use at our Annual Meeting of Stockholders to be held on Thursday, June 7, 2012 at 2:00 PM ET, or at any adjournment thereof, for the purposes set forth in this proxy statement and in the accompanying meeting notice. The meeting will be held at the Baltimore Marriott Waterfront, 700 Aliceanna Street, Baltimore, Maryland.

These proxy solicitation materials will be mailed on or about April 25, 2012 to all stockholders entitled to vote at the meeting.

Voting Securities and Voting Rights

Stockholders of record at the close of business on April 13, 2012, which we have set as the record date, are entitled to notice of and to vote at the meeting. On the record date, there were outstanding 21,817,064 shares of our common stock. Each stockholder voting at the meeting, either in person or by proxy, may cast one vote per share of common stock held on all matters to be voted on at the meeting. In addition, at the close of business on April 13, 2012, there were 1,000,000 shares of our Series A convertible preferred stock outstanding, which in the aggregate are entitled to 3,025,600 votes.

The presence, in person or by proxy, of the holders of a majority of the voting power of our outstanding voting stock constitutes a quorum for the transaction of business at the meeting. Assuming that a quorum is present, a plurality of affirmative votes properly cast in person or by proxy will be required to elect a director, and a majority of affirmative votes properly cast in person or by proxy will be required to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2012.

Votes cast by proxy or in person at the meeting will be tabulated by the inspector of elections appointed for the meeting and will determine whether a quorum is present. The inspector of elections will treat abstentions and broker non-votes as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on the outcome of the election of a director. For purposes of the proposal to ratify the appointment of Ernst & Young LLP, broker non-votes are not considered shares entitled to vote on the matter and therefore will not be taken into account in determining the outcome of the vote on this proposal. Abstentions are considered shares entitled to vote on the matter and therefore will have the effect of a vote against the proposal.

Although the advisory vote on Say-on-Pay is non-binding as provided by law, our Board of Directors will review the results of the vote and take them into account in making future determinations concerning executive compensation. Approval, on an advisory basis, of the compensation of our named executive officers will be decided by a majority of the votes cast “for” or “against” the proposal. For purposes of the advisory Say-on-Pay vote, broker non-votes are not considered shares entitled to vote on the matter and therefore will not be taken into account in determining the outcome of the vote, whereas abstentions are considered shares entitled to vote on the matter and therefore will have the effect of a vote against the proposal.

A person may vote in one of the following two ways whether or not they plan to attend the Annual Meeting: (1) by completing a proxy on our Internet voting system at the address listed on the proxy card, or (2) by completing, signing and dating the accompanying proxy card and returning it in the postage-prepaid envelope enclosed for that purpose. If a person attends the meeting, he or she may vote in person even if such individual had previously returned a proxy card or voted on the Internet using our Internet voting system.

Voting of Proxies

When a proxy is properly executed and returned, the shares it represents will be voted at the meeting as directed. If no specification is indicated, the shares will be voted (1) “for” the election of the nominee set forth in this proxy statement, (2) “for” the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2012, and (3) “for” the approval of the compensation of the Company’s named executive officers.

Revocability of Proxies

Any person giving a proxy may revoke the proxy at any time before its use by delivering to us either a written notice of revocation or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Solicitation

We will pay for this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by certain of our directors and officers, personally or by telephone or e-mail, without additional compensation.

Deadline for Receipt of Stockholder Proposals

Proposals of stockholders intended for inclusion in the proxy statement to be furnished to all stockholders entitled to vote at our 2013 annual meeting of stockholders, pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, or Exchange Act, by the Securities and Exchange Commission, or SEC, must be received at our principal executive offices not later than December 26, 2012, which is 120 days prior to the first anniversary of the mailing date of this proxy statement. Any proposal must comply with the requirements as to form and substance established by the SEC for such proposal to be included in our proxy statement.

Under our bylaws, stockholders who wish to submit a proposal at the 2013 annual meeting, other than one that will be included in our proxy statement, must notify us between February 7, 2013 and March 9, 2013, unless the date of the 2013 annual meeting of the stockholders is more than 30 days before or more than 60 days after the one-year anniversary of the 2012 annual meeting. If a stockholder who wishes to present a proposal fails to notify us by March 9, 2013 and such proposal is brought before the 2013 annual meeting, then under the SEC’s proxy rules, the proxies solicited by management with respect to the 2013 annual meeting will confer discretionary voting authority with respect to the stockholder’s proposal on the persons selected by management to vote the proxies. If a stockholder makes a timely notification, the proxies may still exercise discretionary voting authority under circumstances consistent with the SEC’s proxy rules. Stockholders should submit their proposals to Vocus, Inc., 12051 Indian Creek Court, Beltsville, MD 20705, Attention: Corporate Secretary.

Annual Report and Other Matters

Our Annual Report on Form 10-K for the year ended December 31, 2011, which was mailed to stockholders with or preceding this proxy statement, contains financial and other information about our Company, but is not incorporated into this proxy statement and is not to be considered a part of these proxy soliciting materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

We will provide, without charge, additional copies of our Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the SEC to each stockholder of record as of the record date that requests a copy in writing. Any exhibits listed in the Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibit. Any such requests should be directed to our Company’s secretary at our executive offices set forth in this proxy statement.

PROPOSAL 1

ELECTION OF DIRECTOR

Nominee

Our certificate of incorporation and bylaws provide that the number of our directors shall be fixed from time to time by resolution of our Board of Directors. Presently, the number of directors is fixed at seven, and that number of directors is divided into three classes, with one class standing for election each year for a three-year term. At each annual meeting of stockholders, directors of a particular class will be elected for three-year terms to succeed the directors of that class whose terms are expiring. Six of our directors are elected by the holders of our common stock, and one of our directors is elected by the holder or holders of our convertible preferred stock, as described below under “—Other Director.” Gary Golding is in the class of directors whose term expires at the 2012 annual meeting, and Mr. Golding has been nominated by our Board of Directors for re-election for a three-year term expiring in 2015. Gary Greenfield and Robert Lentz are in the class of directors whose term will expire in 2013. Kevin Burns, Ronald Kaiser and Richard Rudman are in the class of directors whose term will expire in 2014. In February 2012, Richard Moore resigned as a member of the Board of Directors, and the Board of Directors appointed Jit Sinha as a member of the Board of Directors to serve as the initial director designated by the holder of our convertible preferred stock, filling the vacancy created by the resignation of Mr. Moore. Mr. Sinha is in the class of directors whose term expires at the 2012 annual meeting, and we expect that he will be re-elected by the holder of our convertible preferred stock to a three-year term expiring in 2015.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominee named above. Mr. Golding currently is a director of our Company. In the event that he is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee designated by the current Board of Directors to fill the vacancy. It is not expected that the nominee will be unable or will decline to serve as a director.

Upon recommendation of the Nominating and Corporate Governance Committee, the Board of Directors recommends a vote “for” the nominee named herein.

Nominee for Director Standing for Election

Gary Golding,55, has been a member of our Board of Directors since January 2000. Mr. Golding has been a general partner with Edison Venture Fund, a venture capital fund, since November 1997. Mr. Golding also serves on the board of directors of Tangoe, Inc., a public company, and on the board of directors of several privately held companies. Mr. Golding holds a B.A. degree in management from Boston College and a Masters degree in Urban and Regional Planning from the University of Pittsburgh.

The Board believes that Mr. Golding’s formal education, his service on the boards of several other companies, and his in-depth knowledge of the Company’s businesses and industry provide Mr. Golding with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Continuing Directors with Terms Expiring in 2013

Robert Lentz,51, co-founded Vocus and served as our Chief Technology Officer from 1992 until February 2008. Mr. Lentz has been a member of our Board of Directors since 1992. Prior to joining Vocus, Mr. Lentz served as President of Dataway Corporation, a software development company. From 2006 until 2010, Mr. Lentz also served on the board of directors of Savo, a privately held technology company.

The Board believes that Mr. Lentz’ former position as Chief Technology Officer of the Company and his in-depth knowledge of the Company’s businesses and industry provide Mr. Lentz with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Gary Greenfield, 57, has been a member of our Board of Directors since October 2008. Mr. Greenfield has served as Chairman, Chief Executive Officer and President of Avid Technology, Inc., a provider of digital media content-creation solutions, since December 2007. From 2003 to 2007, Mr. Greenfield was Chief Executive Officer of GXS, Inc., a privately held technology company. Mr. Greenfield has also served as Chief Executive Officer of Peregrine Systems, Inc., and President and Chief Executive Officer of Merant, and Chief Executive Officer of Intersolv, Inc. which merged with MicroFocus to form Merant. Mr. Greenfield serves on the board of directors of Epocrates, Inc. and GXS, Inc., both public reporting companies. Mr. Greenfield also serves on the board of directors of several privately held companies. Mr. Greenfield holds a B.S. degree from the U.S. Naval Academy, an M.S.A. degree from George Washington University, and an M.B.A. degree from Harvard Business School.

The Board believes that Mr. Greenfield’s formal education, his position as CEO of a public company, his service as a director on the boards of both private and public companies, and his demonstrated leadership over the course of his successful career provide Mr. Greenfield with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Continuing Directors with Terms Expiring in 2014

Kevin Burns,62, has been a member of our Board of Directors since October 2000 and was named our lead director in January 2008. Mr. Burns has been a managing principal of Lazard Technology Partners, a private equity firm, since March 1998. Mr. Burns founded Intersolv, Inc. (formerly Sage Software), a software company, in 1982 and served as its President and Chief Executive Officer until 1997. Mr. Burns also serves on the board of directors of BoxTone Inc., a privately held technology company. Mr. Burns holds a B.S. degree in finance from the Ohio State University and an M.B.A. in finance from the University of Colorado.

The Board believes that Mr. Burns’ formal education, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership with technology companies over the course of his successful career provide Mr. Burns with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Ronald Kaiser,58, has been a member of our Board of Directors since January 2005. From November 2009 to March 2011, Mr. Kaiser served as Chief Executive Officer and Chairman of the Board of MobileAccess Networks, Inc., a privately held provider of in-building wireless communications equipment. From January 2008 through October 2009 and since March 2011, Mr. Kaiser has served as an independent consultant. From January 2007 to January 2008, Mr. Kaiser served as the Chief Financial Officer for Sucampo Pharmaceuticals, Inc., a pharmaceutical research and development company. From March 2005 through December 2006, Mr. Kaiser served as Chief Financial officer of PharmAthene, Inc., a bio-defense company. From April 2003 to January 2005, Mr. Kaiser served as Chief Financial Officer of Air Cargo, Inc., a freight logistics and bill processing provider. In December 2004, Air Cargo filed a voluntary petition for bankruptcy under Chapter 11 of the United States Bankruptcy Code with the United States Bankruptcy Court. Mr. Kaiser has also served as a member of the board of directors of OPNET Technologies, Inc., a public company, since October 2003, as a member of the board of directors of Tangoe, Inc., a public company, since January 2009, and as a managing director of the Chesapeake Innovation Center, a Maryland incubator, since September 2003 and on the board of directors of a number of privately held companies and non-for-profit organizations. Mr. Kaiser holds B.A. degrees in accounting and in multidisciplinary-prelaw from Michigan State University.

The Board believes that Mr. Kaiser’s formal education, his experience as Chief Financial Officer of several public and private companies, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership over the course of his successful career provide Mr. Kaiser with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Richard Rudman,51, co-founded Vocus and has served as our Chief Executive Officer, President and Chairman since 1992. From 1986 through 1992, Mr. Rudman served as a senior executive at Dataway Corporation, a software development company. From 1984 through 1986, Mr. Rudman served as an accountant and systems analyst at Barlow Corporation, a privately held real estate development and management company. From 1979 through 1983, Mr. Rudman served in the United States Air Force. Mr. Rudman holds a B.S. degree in accounting from the University of Maryland and is a Certified Public Accountant.

The Board believes that Mr. Rudman’s formal education, his position as CEO of the Company, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership over the course of his successful career provide Mr. Rudman with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Other Director

Jit Sinha,37, has been a member of our Board of Directors since February 2012. Mr. Sinha is a General Partner of JMI Equity, a growth equity firm. Mr. Sinha also serves on the board of directors of several privately held companies. Previously, Mr. Sinha worked as a Principal at Bain Capital Ventures, and in operating roles at several software companies. Mr. Sinha holds a B.S. degree in finance and a B.A. degree in sociology from the University of Pennsylvania.

Board Independence

Our Board of Directors annually assesses the independence of the non-management directors by reviewing the financial and other relationships between the directors and us. This review is designed to determine whether these directors are independent under the criteria established by the NASDAQ Stock Market. Our Board of Directors has determined, after considering all the relevant facts and circumstances, including each director’s commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, that each of Messrs. Burns, Golding, Greenfield, Kaiser, Lentz and Sinha are independent directors, as “independence” is defined in the NASDAQ Marketplace Rules, because they have no relationship with us that would interfere with their exercise of independent judgment. Mr. Rudman is not an independent director by virtue of his employment with the Company.

Board Self-Evaluation

Our Board of Directors periodically conducts a self-evaluation of its performance, which includes a review of the Board’s composition, responsibilities, structure, processes and effectiveness.

Board Leadership Structure

Richard Rudman serves as both Chairman of the Board and Chief Executive Officer. The Board believes that having Mr. Rudman serve in both capacities is in the best interests of the Company and its stockholders because it enhances communication between the Board and management and allows Mr. Rudman to more effectively execute the Company’s strategic initiatives and business plans and confront its challenges. Mr. Rudman possesses detailed and in-depth knowledge of the opportunities and challenges facing the Company and is best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters.

The Board believes that the appointment of an independent Lead Director and the use of regular executive sessions of the non-employee directors, along with the Board’s strong committee system and substantial majority of independent directors, allow it to maintain effective oversight of management. The Lead Director’s responsibilities include: leading the independent directors in executive sessions of the Board of Directors; calling meetings of the independent directors; consulting with the Chairman on meeting schedules and agendas for

Board and committee meetings; providing feedback to the Chairman and acting as a sounding board with respect to strategies, accountability, relationships and other issues; serving as a liaison between the independent directors and the Chairman, and as a contact person to facilitate communications between the Company’s employees, stockholders, and other stakeholders with the non-employee members of the Board of Directors; and such other duties as the independent directors deem appropriate. Mr. Burns has served as our Lead Director since January 2008.

Board Oversight and Risk

Our Board of Directors oversees our management, which is responsible for the day-to-day issues of risk management. As part of its oversight of operations it reviews the performance of the Company and the risks involved in the operations of the Company and approves the Company’s operating plan and long term strategy. The Board’s committees assist the Board in fulfilling its oversight responsibilities with the Audit Committee focusing on the accounting and financial and reporting processes of our Company and the Compensation Committee concentrating on the risks arising from our compensation policies and programs. The Nominating and Corporate Governance committee manages risks associated with corporate governance and board organization, membership and structure.

Information Relating to Corporate Governance and the Board of Directors

Our bylaws authorize our Board of Directors to appoint among its members one or more committees, each consisting of one or more directors. Our Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

Our Board of Directors has adopted charters for the Audit, Compensation and Nominating and Corporate Governance Committees describing the authority and responsibilities delegated to each committee by the Board of Directors. Our Board of Directors has also adopted Corporate Governance Guidelines, a Code of Conduct and a Whistleblower Policy. We post on our website, atwww.vocus.com,the charters of our Audit, Compensation and Nominating and Corporate Governance Committees and our Corporate Governance Guidelines, Code of Conduct and Whistleblower Policy. These documents are also available in print to any stockholder requesting a copy in writing from our corporate secretary at our executive offices set forth in this proxy statement. We intend to disclose any amendments to or waivers of a provision of our Code of Conduct made with respect to our directors or executive officers on our website.

Interested parties may communicate with our Board of Directors or specific members of our Board of Directors, including our independent directors and the members of our various board committees, by submitting a letter addressed to the Board of Directors of Vocus, Inc. c/o any specified individual director or directors at the address listed herein. Any such letters will be sent to the indicated directors.

Investor Designated Director

On February 24, 2012, in connection with our acquisition of iContact Corporation, we issued 1,000,000 shares of Series A convertible preferred stock to JMI Equity Fund VI, L.P. (“JMI”), which had been a stockholder of iContact. Each share of Series A convertible preferred stock is initially convertible into 3.0256 shares of our common stock. Pursuant to the certificate of designation of the Series A convertible preferred stock, for so long as the outstanding shares of preferred stock continue to represent at least 5% of the total outstanding shares of our common stock, calculated assuming the conversion of all outstanding shares of preferred stock into shares of common stock, the holders of the preferred stock, voting as a separate class, will have the exclusive right to elect one director to our board of directors (the “Series A Director”). In addition, pursuant to an Investor Rights Agreement we entered into with JMI, the holders of the preferred stock have the right to nominate a director to our board of directors for as long as they hold 5% or more of our issued and outstanding capital stock (which nominee shall be the Series A Director for so long as the holders of preferred stock have the right to elect the Series A Director pursuant to the certificate of designation). Jit Sinha currently serves as the Series A Director.

Process for Selecting Nominees to the Board of Directors

The Board believes that Board members must have demonstrated excellence in their chosen field, high ethical standards and integrity, and sound business judgment. In addition, it seeks to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to the Company’s business. The Board believes that the current directors have an appropriate balance of knowledge, experience, attributes, skills and expertise as a whole to ensure that the Board appropriately fulfills its oversight responsibilities and acts in the best interests of stakeholders. The Board believes that each director satisfies its criteria for demonstrating excellence in his or her chosen field, high ethical standards and integrity, and sound business judgment.

In February 2010, the Board created a Nominating and Corporate Governance Committee and adopted a charter for the Nominating and Corporate Governance Committee. Messrs. Greenfield and Kaiser currently serve as members of the Nominating and Corporate Governance Committee. Mr. Moore served as a member of the Nominating and Corporate Governance Committee until his resignation from the Board of Directors on February 24, 2012.

Pursuant to the Committee’s charter, the Committee will periodically review the composition of the full Board and all committees of the Board to determine whether additional Board members with different qualifications or areas of expertise are needed to further enhance the composition of the Board and work with other members of the Board and the executive officers of the Company, if applicable, in attracting candidates with those qualifications. The Committee will also receive, review and respond to director nominations submitted in writing by the Company’s stockholders. The Nominating and Corporate Governance Committee’s criteria for selection of candidates include, but are not limited to: (i) diversity, age, background, skills and experience deemed appropriate by the Committee in its discretion, (ii) possession of personal qualities, characteristics and accomplishments deemed appropriate by the Committee in its discretion, (iii) knowledge and contacts in the communities and industries in which the Company conducts business, (iv) ability and willingness to devote sufficient time to serve on the Board of Directors and its committees, (v) knowledge and expertise in various activities deemed appropriate by the Committee in its discretion, and (vi) fit of the individual’s skills, experience and personality with those of other directors in maintaining an effective, collegial and responsive Board of Directors. Such persons should not have commitments that would conflict with the time commitments of a director of the Company.

The Nominating and Corporate Governance Committee does not have a written policy with regard to the consideration of diversity in identifying director nominees. However, the Nominating and Corporate Governance Committee considers diversity in identifying nominees for directors, and the qualities and skills sought in prospective members of the Board of Directors generally require that director candidates be qualified individuals who, if added to the Board of Directors, would provide the mix of director characteristics, experience, perspectives and skills appropriate for the Company.

The Board of Directors does not have a specific policy for consideration of nominees recommended by security holders due in part to the relatively small size of the Board of Directors and the lack of turnover in Board membership to date. However, security holders can recommend a prospective nominee for the Board of Directors by writing to our corporate secretary at the Company’s corporate headquarters and providing the information required by our bylaws, along with any additional supporting materials the security holder considers appropriate. The Nominating and Corporate Governance Committee will evaluate any nominees recommended by stockholders in the same manner in which the Committee evaluates nominees recommended by other sources. There have been no recommended nominees from security holders for election at the annual meeting. The Company pays no fees to third parties for evaluating or identifying potential nominees.

Committees of the Board of Directors

The Audit Committee

The purpose of the Audit Committee is (i) to oversee the accounting and financial and reporting processes of our Company and the audits of the financial statements of our Company, (ii) to provide assistance to our Board of Directors with respect to its oversight of the integrity of the financial statements of our Company, our Company’s compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of our Company’s internal audit function, if any, and independent registered public accounting firm, and (iii) to prepare the report required by the rules promulgated by the SEC to be included in this proxy statement. The primary responsibilities of the Audit Committee are set forth in its charter and include various matters with respect to the oversight of our Company’s accounting and financial reporting processes and audits of the financial statements of our Company on behalf of our Board of Directors. The Audit Committee also selects the independent registered public accounting firm to conduct the annual audit of the financial statements of our Company; reviews the proposed scope of such audit; reviews accounting and financial controls of our Company with the independent registered public accounting firm and our accounting staff; and, unless otherwise delegated by our Board of Directors to another committee, reviews and approves transactions between us and our directors, officers and their affiliates.

The Audit Committee currently consists of Messrs. Kaiser and Golding. Mr. Moore served on the Audit Committee until his resignation from the Board of Directors on February 24, 2012. The Board of Directors has determined that each of the members of the Audit Committee is independent under the NASDAQ Marketplace Rules and under rules adopted by the SEC pursuant to the Sarbanes-Oxley Act of 2002. The Board of Directors has also determined that all members of the Audit Committee meet the requirements for financial literacy and that Mr. Kaiser qualifies as an “audit committee financial expert” in accordance with applicable rules and regulations of the SEC. Mr. Kaiser serves as the Chairman of the Audit Committee.

The Compensation Committee

The purpose of the Compensation Committee includes recommending to our Board of Directors the compensation of the members of the Board of Directors; recommending to the Board of Directors the compensation of our Chief Executive Officer and all other executive officers of the Company; and discharging the responsibilities of our Board of Directors relating to our Company’s compensation programs and compensation of our Company’s executives. The Compensation Committee currently consists of Messrs. Burns, Golding and Kaiser. Mr. Burns serves as the Chairman of the Compensation Committee.

The Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee includes assisting the Board in establishing the minimum qualifications for a director nominee; identifying and evaluating individuals qualified to become Board members, consistent with criteria approved by the Board and Committee; recommending director nominees for re-election or to fill vacancies on the Board; and developing, recommending to the Board, and assessing corporate governance policies for the Company. The Nominating and Corporate Governance Committee currently consists of Messrs. Greenfield and Kaiser. Mr. Moore served on the Nominating and Corporate Governance Committee until his resignation from the Board of Directors on February 24, 2012. Mr. Greenfield serves as the Chairman of the Nominating and Corporate Governance Committee.

Board and Committee Meetings

Our Board of Directors held a total of seven meetings during the fiscal year ended December 31, 2011. During the fiscal year ended December 31, 2011, the Audit Committee held a total of nine meetings, the Compensation Committee held a total of four meetings, and the Nominating and Corporate Governance Committee held a total of two meetings. During 2011, no director attended fewer than 75% of the aggregate of

(i) the total number of meetings of our Board of Directors, and (ii) the total number of meetings held by all committees of our Board of Directors on which he was a member. We encourage each of our directors to attend the annual meeting of stockholders. Five of our directors attended our 2011 annual meeting of stockholders.

Director Compensation and Other Information

We use a combination of cash and equity compensation to attract and retain individuals to serve on our Board of Directors. In 2011, target annual total compensation for non-employee directors was $150,000 with additional amounts provided to committee chairs and our Lead Director. We do not compensate employee directors for their service on our Board.

Prior to 2012, the Director’s annual service term was from February 1 through January 31. In March 2012, the Board of Directors revised the service term in order to align such term with each Directors’ election at the Company’s annual meeting.

Retainer

In 2011, our non-employee directors earned an annual retainer of $50,000 for general service on the Board of Directors including attendance at board and committee meetings. Each standing committee chair and the Lead Director received an additional $10,000 retainer. Retainers may be paid in stock or cash, at each director’s election, and such amounts were paid or vested at the end of the Directors’ service term in January 2012. In 2012, non-employee directors will receive an annual retainer of $50,000 and each standing committee chairperson and the Lead Director will receive an additional retainer of $10,000, and such annual amounts shall be awarded on or about the date of the Company’s annual meeting with such amounts paid or vesting quarterly over the directors’ service year.

Equity Compensation

In addition to the retainer described above, non-employee directors are entitled to receive equity compensation. In 2011, each non-employee director received an annual restricted stock award with an estimated value of approximately $50,000 on the grant date. The chairperson of each standing committee and the Lead Director received an additional annual restricted stock award with an estimated value of approximately $15,000 on the grant date. These restricted stock awards vest at the end of the directors’ service year.

In 2012, each non-employee director will receive an annual restricted stock award with an estimated value of approximately $50,000 on the grant date. The chairperson of each standing committee and the Lead Director will receive an additional annual restricted stock award with an estimated value of approximately $15,000 on the grant date. These restricted stock awards will vest quarterly over the directors’ service year.

Additionally, each non-employee director receives a stock option grant with an estimated value of approximately $150,000 on the grant date. These stock options vest annually over a three-year period. Therefore, non-employee directors are not granted stock options every year, rather such grants are made approximately every three years to coincide with a director’s election or re-election. We attribute approximately $50,000 of value per year to such option grant. Grants of options to non-employee directors are at an exercise price per share equal to the closing price of our common stock on the NASDAQ Global Market on the grant date. The grant date fair value for these stock option grants was determined using the Black-Scholes option pricing model. In 2012, those non-employee directors set forth for re-election will receive such a stock option grant.

We reimburse our directors for reasonable travel and other expenses incurred in connection with attending board, committee or other Company meetings, and approved educational seminars.

We expect that each non-employee director will receive the same compensation received in 2011 for service on the Board of Directors in 2012 with payments and vesting occurring quarterly over the directors’ service year.

Each Director will receive a pro-rated retainer amount, restricted stock grant and stock option grant (for those Directors that did not receive such a stock option grant in 2011) for service during the period of February 1, 2012 through June 6, 2012 (the period between the original service year ending and the beginning of the new service year synchronized with the annual meeting).

The following table details the compensation earned by our non-employee directors in 2011:

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash(1) | | | Stock

Awards(2)(4) | | | Option

Awards(3)(4) | | | Total | |

Kevin Burns | | $ | — | | | $ | 152,215 | | | $ | 154,548 | | | $ | 306,763 | |

Gary Golding | | $ | — | | | $ | 101,374 | | | $ | — | | | $ | 101,374 | |

Gary Greenfield | | $ | — | | | $ | 126,783 | | | $ | — | | | $ | 126,783 | |

Ronald Kaiser | | $ | 60,000 | | | $ | 66,778 | | | $ | 154,548 | | | $ | 281,326 | |

Robert Lentz | | $ | 50,000 | | | $ | 51,362 | | | $ | — | | | $ | 101,362 | |

Richard Moore | | $ | 50,000 | | | $ | 51,362 | | | $ | — | | | $ | 101,362 | |

| (1) | For purposes of determining non-employee director cash compensation, the term of office for directors begins on February 1 and ends January 31 of the following year, which period does not coincide with our fiscal year. Cash amounts included in the table above represent the portion of the compensation earned during the directors’ 2011 service period. Retainer amounts paid in restricted stock at a director’s election in 2011 are included in the Stock Awards column. |

| (2) | On March 22, 2011, each of Messrs. Burns, Golding, Greenfield, Kaiser, Lentz and Moore was granted shares of our common stock. The aggregate number of shares subject to outstanding unvested stock awards held by each director listed in the table above as of December 31, 2011 was as follows: 6,428 shares for Mr. Burns; 4,281 shares for Mr. Golding; 5,354 shares for Mr. Greenfield; 2,820 shares for Mr. Kaiser; 2,169 shares for Mr. Lentz; and 2,169 shares for Mr. Moore. Messrs. Burns, Golding and Greenfield each elected to have their 2011 retainer amount paid in restricted stock and such amounts are reflected herein. |

| (3) | The aggregate number of shares subject to outstanding stock options held by each director listed in the table above as of December 31, 2011 was as follows: 22,715 shares for Mr. Burns; 18,885 shares for Mr. Golding; 13,746 shares for Mr. Greenfield; 22,715 shares for Mr. Kaiser; 5,895 shares for Mr. Lentz; and 18,885 shares for Mr. Moore. |

| (4) | The amounts reported do not reflect the compensation actually received by the director. Amounts shown reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. Assumptions used in the calculation of the amounts are included in Footnote 2 to the Company’s audited financial statements for the fiscal year ended December 31, 2011 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 15, 2012. |

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firm of Ernst & Young LLP, an independent registered public accounting firm, has audited the consolidated financial statements of our Company for the fiscal year ended December 31, 2011. Our Audit Committee has appointed Ernst & Young LLP to audit the consolidated financial statements of our Company for the fiscal year ending December 31, 2012. Our organizational documents do not require that our stockholders ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm. We are submitting the appointment of Ernst & Young LLP to our stockholders for ratification because we believe it is a matter of good corporate practice. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection, but may still retain Ernst & Young LLP. We anticipate that representatives of Ernst & Young LLP will be present at the meeting, will have the opportunity to make a statement if they desire, and will be available to respond to appropriate questions.

The Board of Directors recommends a vote “for” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012.

The aggregate fees billed to our Company by Ernst & Young LLP for the fiscal years ended December 31, 2010 and 2011 are as follows:

| | | | | | | | |

| | | 2011 | | | 2010 | |

Audit Fees(1) | | $ | 994,808 | | | $ | 1,109,744 | |

Audit-Related Fees(2) | | $ | 55,000 | | | $ | 116,245 | |

Tax Fees(3) | | $ | 90,054 | | | $ | 213,750 | |

| | | | | | | | |

Total | | $ | 1,139,862 | | | $ | 1,439,739 | |

| (1) | Audit Fees consist of fees incurred for the audits of our annual consolidated financial statements and internal control over financial reporting, for the review of our unaudited interim consolidated financial statements included in our quarterly reports on Form 10-Q for the first three quarters of each fiscal year and for fees incurred related to other SEC filings. |

| (2) | Audit-Related Fees consist of fees incurred for accounting consultations, due diligence in connection with planned acquisitions and research services. |

| (3) | Tax Fees consist of fees incurred for tax compliance, planning and advisory services and due diligence in connection with planned acquisitions. |

The charter of our Audit Committee provides that the duties and responsibilities of our Audit Committee include the pre-approval of all audit, audit-related, tax and other services permitted by law or applicable SEC regulations (including fee ranges) to be performed by our independent registered public accounting firm. Any services that will involve fees exceeding pre-approved levels will also require specific approval by the Audit Committee. Unless otherwise specified by the Audit Committee in pre-approving a service, the pre-approval will be effective for the year in which the pre-approval is given. The Audit Committee will not approve any non-audit services prohibited by applicable SEC regulations or any services in connection with a transaction initially recommended by the independent registered public accounting firm, the purpose of which may be tax avoidance and the tax treatment of which may not be supported by the Internal Revenue Code and related regulations.

To the extent deemed appropriate, the Audit Committee may delegate pre-approval authority to the Chairman of the Audit Committee or any one or more other members of the Audit Committee provided that any member of the Audit Committee who has exercised any such delegation must report any such pre-approval decision to the Audit Committee at its next scheduled meeting. The Audit Committee will not delegate to management the pre-approval of services to be performed by the independent registered public accounting firm.

Our Audit Committee requires that our independent registered public accounting firm, in conjunction with our Chief Financial Officer, be responsible for seeking pre-approval for providing services to us and that any request for pre-approval must inform the Audit Committee about each service to be provided and must provide detail as to the particular service to be provided.

All of the services provided by Ernst & Young LLP described above under the captions “Audit Fees”, “Audit-Related Fees” and “Tax Fees” were pre-approved by our Audit Committee.

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with recent legislation and rules adopted by the SEC, we are requesting our stockholders’ advisory approval of the compensation of our named executive officers, as disclosed in the “Compensation Discussion and Analysis,” the compensation tables, and the narrative discussion set forth in this proxy statement. This non-binding advisory vote is commonly referred to as a “say on pay” vote.

Our compensation program is designed to link executive pay levels with individual performance, our financial performance and stockholder returns as described in the Compensation Discussion and Analysis. The Company’s pay-for-performance oriented compensation program has operated to align payouts with relative shareholder value creation. The Company’s performance tracks its executive compensation, where cash compensation is generally consistent with the peer group median, and long-term incentives at or above the peer group 75th percentile.

The Compensation Committee, which is comprised entirely of independent directors, in consultation with a compensation consultant, is primarily responsible for establishing and reviewing the overall compensation philosophy of the Company, reviewing and approving the corporate goals and objectives relevant to the compensation for our named executive officers, and evaluating performance of the named executive officers in light of those goals. In 2011, the Committee consulted with PricewaterhouseCoopers LLC, a leading tax, accounting and compensation consulting firm, regarding 2011 compensation. In 2012, the Committee selected Pearl Meyer & Partners, a leading, independent compensation consulting firm, as its compensation consultant.

We are asking our stockholders to indicate their support for our executive compensation as described in this proxy statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation and the philosophy, policies and practices described in this proxy statement. For the reasons discussed above, the Board recommends that stockholders vote in favor of the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules and regulations of the SEC, including the Compensation Discussion and Analysis, compensation tables and the narrative discussion is hereby approved.”

Because your vote on this proposal is advisory, it will not be binding on the Board. However, the Compensation Committee and the Board will consider the outcome of the vote when making future compensation decisions.

The Board of Directors recommends a vote “for” the compensation of the named executive officers as disclosed in this proxy statement.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Company’s accounting and financial reporting processes and the audits of its financial statements, including the performance and compensation of the Company’s independent registered public accounting firm. Management has the primary responsibility for the financial statements and the financial reporting processes, including the systems of internal controls and the certification of the integrity and reliability of the Company’s internal control procedures.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed the Company’s audited balance sheets at December 31, 2010 and 2011 and the statements of operations, stockholders’ equity and cash flows for each of the three years ended December 31, 2009, 2010 and 2011, and have discussed them with management. The Audit Committee also reviewed with Ernst & Young LLP, the Company’s independent registered public accounting firm, the results of their audit. The Audit Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61(Communications with Audit and Finance Committees), as currently in effect. This discussion included, among other things, a review with the independent registered public accounting firm of the quality of the Company’s accounting principles, significant estimates and judgments, and the disclosures in the Company’s financial statements, including the disclosures related to critical accounting policies used by the Company. The Audit Committee has reviewed permitted services under rules of the Securities and Exchange Commission as currently in effect and discussed with Ernst & Young LLP their independence from management and the Company, including the matters in the written disclosures and the letter from the independent registered public accounting firm required by the Public Company Accounting Oversight Board Ethics and Independence Rule 3526 “Communication with Audit Committees Concerning Independence”, as currently in effect, and has considered and discussed the compatibility of non-audit services provided by Ernst & Young LLP with that firm’s independence. In addition, the Audit Committee discussed the rules of the Securities and Exchange Commission that pertain to the Audit Committee and the roles and responsibilities of Audit Committee members.

Based on its review of the financial statements and the aforementioned discussions, the Audit Committee concluded that it would be reasonable to recommend, and on that basis did recommend, to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011. The Audit Committee also approved the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2012.

Respectfully submitted by the Audit Committee,

Ronald Kaiser, Chair

Gary Golding

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

In this section, we provide an explanation and analysis of the material elements of the compensation provided to our named executive officers. Throughout this section, the individuals who served as chief executive officer and chief financial officer for 2011, as well as the other executive officers named in the “Summary Compensation Table” below, are referred to as our “named executive officers.”

Stockholder Advisory Vote on Executive Compensation

At our 2011 Annual Meeting of the Stockholders (the “2011 Annual Meeting”), we provided our stockholders with the opportunity to vote, on an advisory basis, to approve the compensation of our named executive officers as described in our proxy statement for the 2011 Annual Meeting. Our stockholders approved the compensation of our named executive officers with 80.3% of the votes cast in favor of such compensation. Our Compensation Committee determined that no changes needed to be made to our compensation policies and practices in response to the stockholder advisory vote given the support received from stockholders. While this vote was, and will continue to be, advisory and non-binding, our Compensation Committee considers the results when determining our compensation policies and practices.

In accordance with the advisory vote of our stockholders on the frequency of such advisory votes on named executive officer compensation at the 2011 Annual Meeting, we intend to present to stockholders a proposal for an advisory vote on named executive officer compensation each year until the next required vote on frequency. This year, the proposal is set forth above under “Proposal 3—Advisory Vote on Executive Compensation.”

Compensation Philosophy

The Compensation Committee of the Board of Directors has overall responsibility for recommending the compensation of our Chief Executive Officer, or CEO, and other executive officers to the Board of Directors for approval. Each member of the Committee is appointed by the Board and has been determined by the Board to be an independent director under applicable NASDAQ marketplace rules.

Our executive compensation program is intended to:

| | • | | Attract, retain, motivate and reward highly qualified executive officers who create value for our stockholders; |

| | • | | Reinforce our performance oriented, results-based culture that rewards individual, team and corporate success; and |

| | • | | Reflect the financial resources available to us based on our Board-approved annual business plan and our strategic objective to increase stockholder value. |

Our program is designed to link executive pay levels with individual performance, our financial performance and stockholder returns.

Key elements of our executive compensation program include:

| | • | | Annual base salaries that are competitive relative to other public technology companies in our peer group; |

| | • | | Non-equity incentive compensation that is solely based on financial performance; and |

| | • | | Long-term incentive compensation that is delivered through a combination of stock option and restricted stock awards. |

We believe that our executive compensation program makes a significant contribution to our success, mirrors our culture, promotes employee commitment to our Company, and adheres to high standards of corporate governance.

Compensation Committee Oversight of Executive Compensation

The Compensation Committee of the Board of Directors is responsible for overseeing executive compensation at Vocus. In 2011, the Committee consisted of the following directors—Kevin Burns (Chair), Gary Golding and Ronald Kaiser. All Committee members have extensive management and Board experience, including experience dealing with executive compensation issues.

The Compensation Committee operates under a charter adopted by the Board of Directors in 2005. The charter is posted in the “Investor Relations /Corporate Governance” section of our website atwww.vocus.com. As outlined in the charter, the Committee is primarily responsible for establishing and reviewing the overall compensation philosophy of the company, reviewing and approving the corporate goals and objectives relevant to the compensation for the CEO and other executive officers, evaluating performance of the CEO and other executive officers in light of those goals and recommending to the Board for approval the compensation of the CEO and other executive officers. The Committee is also responsible for approving new or revised compensation and benefit plans (or in some cases recommending them for Board approval).

At the beginning of each year, the Compensation Committee reviews the preceding year’s performance of the Company and of each individual executive officer, as well as each executive officer’s compensation, tenure, past employment experience and compensation history, and potential to contribute to our future growth. At that time, the Committee determines each executive officer’s compensation for the new year. As part of the Committee’s review, the CEO delivers a report on the performance of the Company and of each executive officer, including a self-assessment of his own performance. The CEO also proposes compensation packages for the executive officers (except for the CEO) based on the competitive benchmarking analysis provided by an independent compensation consultant, which the Committee considers in making its decisions. The Committee makes regular reports to the full Board of Directors on the Committee’s activities, and the Committee prepares an annual report on executive compensation for inclusion in our proxy statement.

The Committee met four times in 2011. The Chairman of the Compensation Committee prepared each meeting’s agenda, which was distributed to Committee members in advance of the meeting (along with support materials). All of the Committee members attended all of the meetings in 2011, except that one Committee member did not attend one meeting in 2011. The Committee asked the CEO and the Chief Financial Officer, or CFO, to attend portions of the meetings. A compensation consultant representative also attends Compensation Committee meetings by invitation (including executive sessions as requested) and is available to answer Committee members’ questions. Additionally, the Committee Chair meets periodically with management and the compensation consultant representative throughout the year.

The Compensation Committee has the sole authority to select, retain and/or replace any compensation or other outside consultant for assistance in the evaluation of director, CEO or other executive officers’ compensation, including the sole authority to approve the consultant’s fees and other retention terms. In 2011, the Compensation Committee selected PricewaterhouseCoopers, or PwC, as its compensation consultant. The

Committee considers PwC to be independent and selected PwC because of its experience in compensation consulting, and its knowledge of compensation practices in the technology industry. PwC does not serve as the Company’s independent registered public accounting firm. Services provided by the consultant have included evaluating our existing executive officer and director compensation based on market comparables, analyzing compensation design alternatives and advising us on proxy statement disclosure rules. The consultant did not provide specific recommendations on compensation decisions regarding the CEO or other executive officers.

In October 2011, the Committee selected Pearl Meyer & Partners, or PM&P, as its compensation consultant for 2012. The Committee considers PM&P to be independent and selected PM&P because of its experience in compensation consulting, and its knowledge of compensation practices in the technology industry.

Objectives of the Vocus Executive Compensation Programs

We believe strongly in pay-for-performance and measurement of quantifiable results. While compensation for the CEO and other executive officers should reflect the marketplace for similar positions, a significant portion of their compensation is earned based on our financial performance and the financial performance of each executive’s area of responsibility. Quantifiable financial performance objectives related to topline growth, profit margins and cash flow are established in advance and recommended by the Compensation Committee for approval by the full Board, early in the year. Our emphasis on measurable performance objectives emanates from our belief that sustained strong financial performance is an effective means of enhancing long-term stockholder return. Although qualitative objectives are important to the effective management of the Company, we do not tie incentive compensation to such qualitative objectives.

The Compensation Committee considers competitive benchmarking data in the establishment of base salaries, incentive targets, equity awards and total compensation levels. For purposes of comparing our executive compensation program with market practices, the Compensation Committee, with the assistance of a compensation consultant, reviews executive compensation from a group of peer companies, which we refer to as the “Vocus Peer Group.” The Vocus Peer Group for purposes of setting 2011 annual executive compensation included the following 15 companies: Actuate Corp., Ariba Inc., Blackboard, Inc., Concur Technologies, Inc., Constant Contact, Inc., DemandTec, Inc., Kenexa Corporation, Keynote Systems, Inc., Netsuite, Inc., RightNowTechnologies Inc., SuccessFactors, Taleo Corp., Terremark Corp., Ultimate Software Group Inc. and Websense Inc. These companies are technology companies that provide business applications software, frequently through an on-line, on-demand, or subscription service. While not necessarily direct competitors of Vocus, these companies have similar business models and are routinely used as comparable companies by analysts and investors.

The Committee concluded the following based on the results of PwC’s benchmarking study:

| | • | | Base salaries are generally consistent with the competitive 25th percentile. |

| | • | | Total cash compensation targets (base salary plus target annual incentive) at 100% achievement of financial goals are generally consistent with the competitive 50th percentile. |

| | • | | Total direct compensation targets (base salary plus target annual incentive plus fair value of equity incentive awards) at 100% achievement of financial goals generally approach the competitive 65th percentile. |

In February 2012, PM&P provided benchmarking information to the Compensation Committee. The Vocus Peer Group was reviewed and revised for purposes of setting 2012 annual executive compensation and includes the following 15 companies: Actuate Corp., Ariba Inc., Blackboard, Inc., Concur Technologies, Inc., Constant Contact, Inc., DemandTec, Inc., Kenexa Corporation, Keynote Systems, Inc., LogMeIn, Inc., Netsuite, Inc., RightNowTechnologies Inc., SuccessFactors, Taleo Corp., Ultimate Software Group Inc. and Websense Inc. The Vocus Peer Group was revised for 2012 to eliminate those peers that had been acquired and to include new

on-line, on-demand and software-as-a-service companies similar to the company in size and/or business model. For 2012, the Board then established total compensation targets at 100% achievement of financial goals approximating the competitive 60 to 65th percentile with an emphasis on long term equity incentives.

Elements of Vocus’ Executive Compensation Program

Our executive compensation program consists of five basic elements—base salary; quarterly variable incentive bonuses; long-term incentive compensation that is currently delivered through a combination of stock options and restricted stock; employee benefits and executive perquisites; and income protection features such as employment agreements and change-in-control provisions. The remainder of this section provides details on each of these elements of our executive compensation program.

Base Salary

The base salary for each of our executive officers is initially established through negotiation at the time of hire, based on such factors as the officer’s qualifications, experience, prior salary and competitive salary information. Any increases thereafter are determined by an assessment of the officer’s sustained performance as well as competitive salary information.

The Compensation Committee established 2011 base salaries for Vocus’ executive officers in March 2011, based on PwC’s benchmarking study and the Committee’s assessment of each officer’s sustained performance. In determining base salaries for executive officers other than the CEO, the Committee requested and received information from the CEO on the executive officer’s performance and contributions. The Compensation Committee considered economic, market, individual and company factors in its deliberations about executive compensation for 2011. In March 2011, the Committee recommended for approval by the full Board of Directors raises of 6%, 3% and 13% of base salary for Messrs. Rudman, Vintz and Wagner, respectively. The Committee did not recommend a raise of base salary for Mr. Weissberg. The Board established the 2011 base salaries for Messrs. Rudman, Vintz, Wagner and Weissberg at $425,000, $310,000, $310,000 and $275,000, respectively. The 2011 base salary changes for our executive officers reflect the annual review based on performance, compensation of market comparables and promotional increases. Specifically, Mr. Wagner’s base salary increase reflects his recent promotion to Chief Operating Officer.

In March 2012, the Committee recommended for approval by the full Board of Directors raises of 6%, 5% and 5% of base salary for Messrs. Rudman, Vintz and Wagner, respectively. The Committee did not recommend a raise of base salary for Mr. Weissberg. The Board established the 2012 base salaries for Messrs. Rudman, Vintz, Wagner and Weissberg at $450,000, $325,000, $325,000 and $275,000, respectively. The 2012 base salary changes for our executive officers reflect the annual review based on performance and compensation of market comparables.

Non-Equity Incentive Plan Compensation

Our non-equity incentive plan compensation is paid in cash quarterly and is intended to reward executive officers for short-term performance. Early in 2011, the CEO proposed specific financial objectives and targets for each executive officer, which were then approved by the Compensation Committee and the Board. The objectives and targets were derived directly from our business plan for 2011, as approved by the Board of Directors, and were considered by the Board to be achievable but challenging. The objectives included the following:

| | • | | Topline, which consists of total company sales plus revenue. Total company sales include amounts invoiced to customers under our subscription and related agreements as well as transaction-based sales from our e-commerce offerings; |

| | • | | Pro forma operating income, which consists of income from operations excluding stock-based compensation, amortization of acquired intangible assets, acquisition related expenses, the effect of adjustments to deferred revenue related to purchase accounting and adjustments to the fair value of contingent consideration for acquisition earn-outs; and |

| | • | | Free cash flow, which consists of cash provided by operating activities less cash paid for purchases of property and equipment, net of proceeds from disposals and capitalized software development costs plus excess tax benefits from stock-based compensation. |

The Committee also approved additional sales objectives for executives with those primary responsibilities.

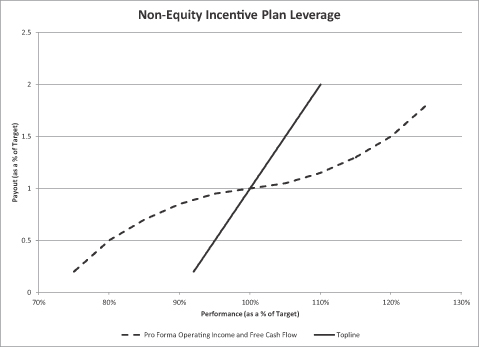

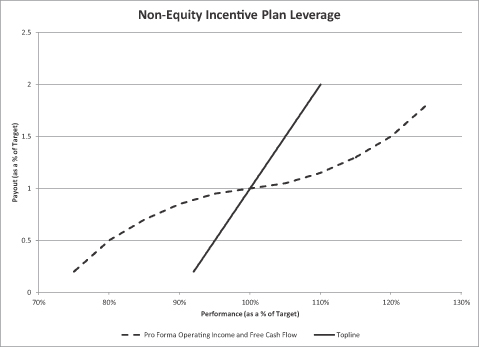

The Committee has set a minimum threshold for each specific financial objective. For topline incentive, at least 92% of the objective must be obtained in order to earn any payout under that objective. The payout for topline incentive is incrementally adjusted by 20% for performance that results in each incremental 2% variance to the target. For example, an executive officer would earn a 60% payout if 96% of the topline target were achieved, and would earn a 140% payout if 104% of the target were achieved. For operating income and free cash flow incentives, at least 75% of the objective must be obtained in order to earn any payout under that objective. The payout for such incentives is incrementally adjusted by 30%, 20%, 15%, 10%, 5%, 5%, 10%, 15%, 20% and 30% for performance that results in each incremental 5% variance to the target. For operating income and free cash flow incentives, an executive officer would earn an 85% payout if 90% of the performance target were achieved, and would earn a 115% payout if 110% of the target were achieved. If the target is achieved for an objective, the executive will receive 100% of the eligible payout for that specific objective. For performance that exceeds 110% of the topline target the payout is 200%, and for performance that exceeds 120% of the operating income and free cash flow targets, the payout is 180%, although such levels were not achieved in 2011. Payouts for additional sales objectives are also determined using the scales set forth above. There is currently no provision for repaying quarterly non-equity incentive upon a financial restatement, should one occur. The pay-for-performance relationship is graphically demonstrated below:

Non-equity incentive plan compensation that was earned during 2011 was calculated and paid shortly after the end of each quarter. Total amounts earned during 2011 (including the fourth-quarter non-equity incentive plan compensation that was paid in early 2012) are disclosed in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. Our financial performance during the year versus the pre-established targets resulted in 2011 non-equity incentive plan compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | |

Name | | Position | | Salary as %

of Cash

Comp Target | | | Incentive as %

of Cash

Comp Target | | | Total Cash

Target | | | 2011

Incentive

as %

of Target | | | 2011 Total

Cash | |

Richard Rudman | | CEO, President and Chairman | | | 50 | % | | | 50 | % | | $ | 850,000 | | | | 105 | % | | $ | 889,738 | |

Stephen Vintz | | EVP, CFO, Treasurer and Secretary | | | 61 | % | | | 39 | % | | $ | 510,000 | | | | 104 | % | | $ | 528,700 | |

William Wagner | | EVP and COO | | | 61 | % | | | 39 | % | | $ | 510,000 | | | | 91 | % | | $ | 461,680 | |

Norman Weissberg | | Senior Vice President, North American Sales | | | 52 | % | | | 48 | % | | $ | 525,000 | | | | 80 | % | | $ | 420,219 | |

The Board, based on the recommendation of the Compensation Committee, approved two refinements to the 2011 incentive plan to better align payouts with shareholder value creation. First, the potential payout opportunity below target performance was reduced, while the payout opportunity above target performance was increased. This change is expected to focus management on exceeding its performance goals. Second, the payout formula was changed from a “step” to a “linear” calculation. The Board believes that this will better align payouts and performance, with shareholder gains more tightly aligned with actual payouts. In March 2011, as part of the salary review process, the Board, based on the recommendation of the Compensation Committee, established the annual non-equity incentive compensation targets for Messrs. Rudman, Vintz, Wagner and Weissberg at $425,000, $200,000, $200,000 and $250,000, respectively. As a result, 2011 total cash compensation targets for these executives at 100% achievement of financial goals generally approximates the 60th percentile of the comparable peer companies.

Long-Term Incentive Compensation

We typically grant stock options and/or restricted stock to executive officers and other employees at the time of hire to motivate employees to build long-term stockholder value and as a retention tool to incentivize employees to remain employed with us. Thereafter, additional awards may be made at varying times and in varying amounts to reward an executive officer for past performance, to provide a continuing incentive for future performance and to further align executive officer and stockholder interests. Such grants are determined by an assessment of the named executive officer’s performance and responsibilities as well as competitive salary information. In 2011, our long-term incentive compensation consisted of both stock option and restricted stock awards.

Details on restricted stock awards granted during 2011 to our CEO and other named executive officers may be found in the table entitled “Grants of Plan-Based Awards.” Details on all stock option awards exercised in 2011 by our CEO and other named executive officers and restricted stock awards vested in 2011 may be found in the table entitled “Option Exercises and Stock Vested.” Details on all outstanding stock option awards and restricted stock award grants of our CEO and other named executive officers as of the end of 2011 may be found in the table entitled “Outstanding Equity Awards at Fiscal Year End.”

All executive officers received both stock option and restricted stock awards in 2011. On March 22, 2011, Mr. Rudman received an award of 41,757 shares of restricted stock and 140,997 stock options. Messrs. Vintz and Wagner each received awards of 18,069 shares of restricted stock and 61,013 stock options, and Mr. Weissberg received an award of 14,045 shares of restricted stock and 47,426 stock options. Consistent with our governance standards, these awards were approved by the Compensation Committee and the Board of Directors and vest annually over four years. Grants of stock options and restricted stock in 2011 were awarded under our 2005 Stock Award Plan.