SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

JOHN HANCOCK FUNDS III

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | ☐ | Fee paid previously with preliminary materials. |

| | ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

| | | |

|

Please vote today |

We need your input on an important

proposal that affects your investment |

| Online www.proxyvote.com |

| Phone 1-855-643-7451 |

| Mail Sign and return the

enclosed voting card |

|

| | | |

|

Please vote today |

We need your input on an important

proposal that affects your investment |

| Online |

| Phone |

| Mail |

|

Your action is required

John Hancock Bond Trust

John Hancock California Tax-Free Income Fund

John Hancock Capital Series

John Hancock Collateral Trust

John Hancock Current Interest

John Hancock Funds III

John Hancock Investment Trust

John Hancock Investment Trust II

John Hancock Municipal Securities Trust

John Hancock Sovereign Bond Fund

John Hancock Strategic Series

(each, a “Trust” and collectively, the “Trusts”)

July 21, 2022

Please vote today

Dear Shareholder:

I am writing to ask for your assistance with an important matter involving your investment in one or more of the investment portfolios (the “Funds”) of the Trusts listed above. You are being asked to vote on several proposed changes affecting the Funds. To consider and vote on these proposed changes, a Special Joint Meeting of Shareholders of the Trusts (the “meeting”) will be held at via telephone only in light of the COVID-19 pandemic, on September 9, 2022 at 2:30PM, Eastern Time. We encourage you to read the attached materials in their entirety.

The enclosed proxy statement sets forth three proposals on which you are being asked to vote. The first proposal, a routine item, concerns the election of trustees. Routine items make no fundamental or material changes to a Fund’s investment objectives, policies, or restrictions, or to the investment management contract. The other proposals are not considered routine items. All three proposals are summarized below.

The following is an overview of the proposals on which you are being asked to vote. Please note that none of these proposals is expected to have any material effect on the manner in which any Fund is managed or on its current investment objective, nor are they related to the current state of the financial markets. You will find a detailed explanation of each proposal in the enclosed proxy materials.

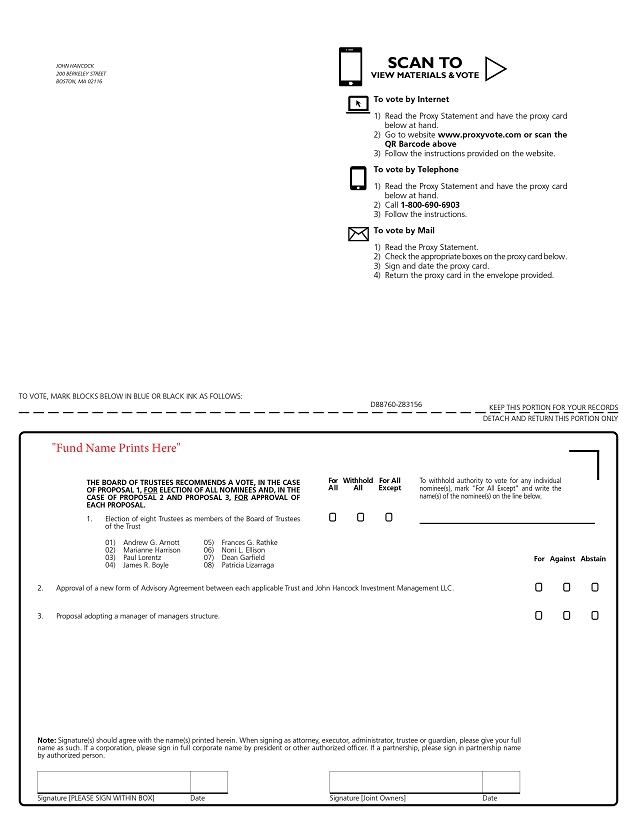

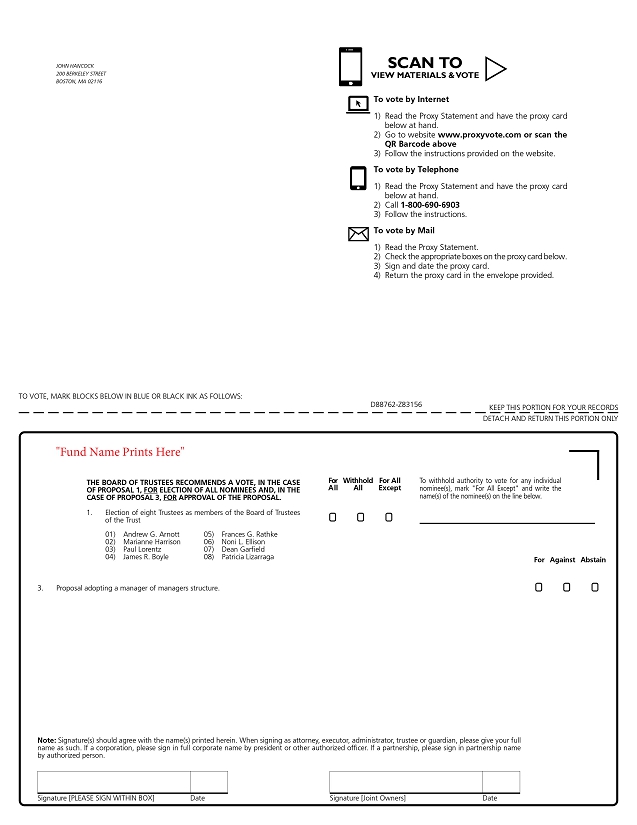

You are being asked to approve three proposals:

(1) Election of Trustees

You are being asked to elect eight Trustees as members of the Board of Trustees of each Trust (the “Board”).

(2) New Form of Advisory Agreement

Shareholders of certain Funds are being asked to approve a new form of Advisory Agreement between their Funds and John Hancock Investment Management LLC (“JHIM” or the “Advisor”). The purpose of this proposal is to streamline the advisory agreements across the John Hancock Fund Complex, primarily to provide more explicitly for a “manager of managers” structure, to clarify that the new form of Advisory Agreement covers only investment advisory services and to provide consistency in operational procedures across the John Hancock Fund Complex. These benefits contribute to a goal of maintaining, and even potentially reducing, operational costs. In addition, restricting the new form of Advisory Agreement to investment advisory services will facilitate the Advisor’s ability to manage those services that are “non-investment” in nature.

The new form of Advisory Agreement will not result in any change in advisory fee rates or the level, nature or quality of advisory services provided to the Funds, and will not increase the Funds’ overall expense ratios. Other details and impacts of this proposal are described in the accompanying proxy statement.

(3) Proposal adopting a Manager of Managers Structure

Shareholders of certain Funds are being asked to approve a “manager of managers” structure for their Funds. This structure would allow JHIM, subject to the approval of the Board, to replace a Fund’s subadvisor with an unaffiliated subadvisor or materially amend a Fund’s investment subadvisory agreement with an unaffiliated subadvisor without first obtaining shareholder approval, subject to certain conditions. This effectively would allow JHIM to hire and replace unaffiliated subadvisors to the Funds, subject to Board approval but without a Fund having to incur the cost and delay of holding a shareholder meeting to approve a new (or materially amend a current) investment subadvisory agreement. Shareholders would, however, be notified of any changes to a Fund’s subadvisor or subadvisors. This order does not extend to a subadvisor that is an “affiliated person,” as defined in Section 2(a)(3) of the Investment Company Act of 1940, of a Trust or the Advisor, other than by reason of serving as subadvisor to one or more of the Funds, which means that JHIM would not be permitted to replace an unaffiliated subadvisor with an affiliated subadvisor, or materially amend a subadvisory agreement with an affiliated subadvisor, without both Board and shareholder approval.

We Need Your Vote of Approval

After careful consideration, the Board has unanimously approved each of the applicable proposals and recommends that shareholders vote “FOR” their approval, but the final approval requires your vote. The enclosed proxy statement, which I strongly encourage you to read before voting, contains further explanation and important details of the proposals.

How to Vote

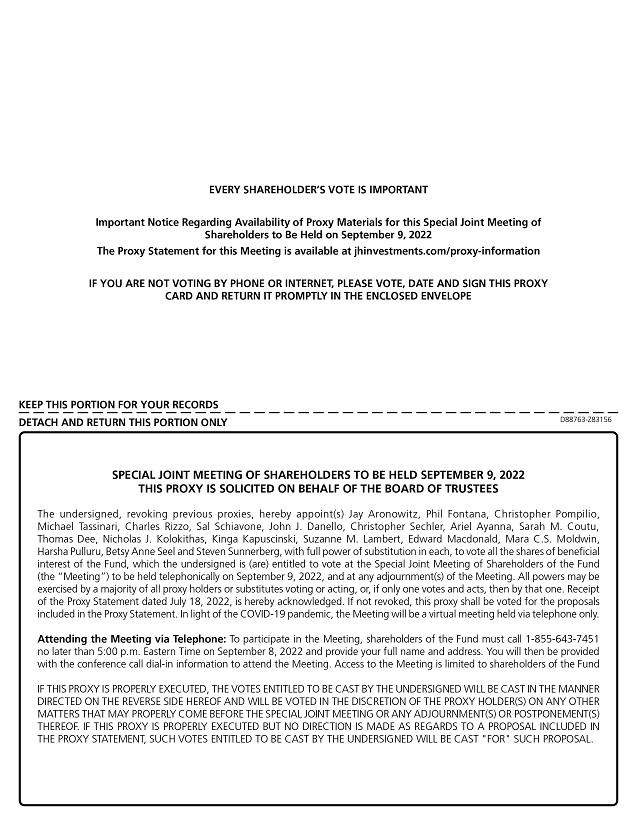

Attending the meeting via telephone

To participate in the meeting, shareholders of the Fund must call 1-855-643-7451 no later than 5:00 p.m. Eastern Time on September 8, 2022 and provide your full name and address. You will then be provided with the conference call dial-in information to attend the shareholder meeting. Access to the meeting is limited to shareholders of the Funds or each Fund.

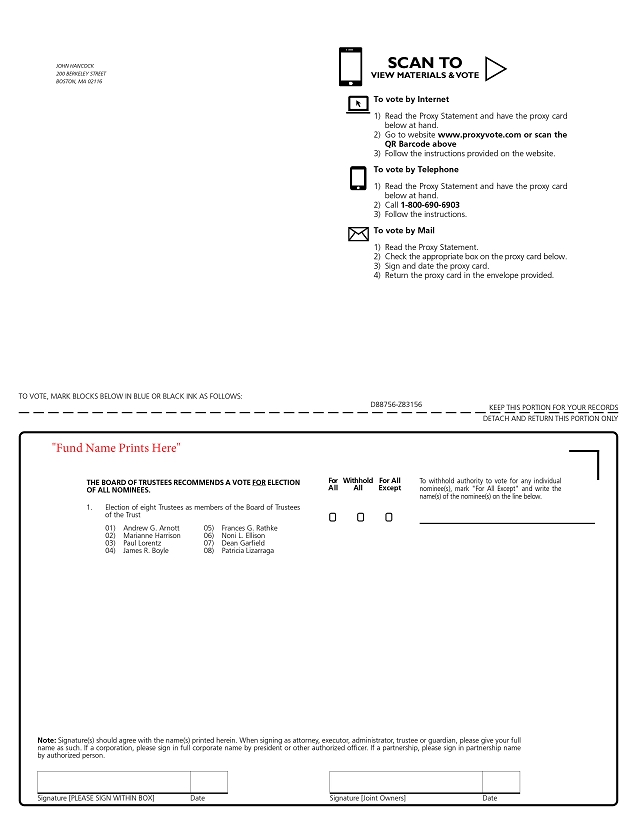

Please read the enclosed proxy statement, and vote your shares as described below. Voting today will save on the potential cost of future mailings to obtain shareholder votes. You may vote your respective shares by proxy in one of three ways:

Online: by visiting the website on your proxy card(s) and entering your control number

Phone: by calling the number listed on your proxy card(s)

Mail: by returning the enclosed proxy card(s)

| Sincerely, | |

| | |

| /s/ Andrew G. Arnott | |

| | |

| Andrew G. Arnott | |

| President and CEO | |

| John Hancock Investment Management | |

| Head of Wealth and Asset Management | |

| United States and Europe | |

John Hancock Investment Management Distributors LLC, 200 Berkeley Street, Boston, Massachusetts 02116, Member FINRA, SIPC • John Hancock Investment Management LLC • John Hancock Signature Services, Inc.

Your action is required

John Hancock Bond Trust

John Hancock California Tax-Free Income Fund

John Hancock Capital Series

John Hancock Collateral Trust

John Hancock Current Interest

John Hancock Funds III

John Hancock Investment Trust

John Hancock Investment Trust II

John Hancock Municipal Securities Trust

John Hancock Sovereign Bond Fund

John Hancock Strategic Series

(each, a “Trust” and collectively, the “Trusts”)

July 21, 2022

Please vote today

Dear Shareholder:

I am writing to ask for your assistance with an important matter involving your investment in one or more of the investment portfolios (the “Funds”) of the Trusts listed above. You are being asked to vote on several proposed changes affecting the Funds. To consider and vote on these proposed changes, a Special Joint Meeting of Shareholders of the Trusts (the “meeting”) will be held at via telephone only in light of the COVID-19 pandemic, on September 9, 2022 at 2:30PM, Eastern Time. We encourage you to read the attached materials in their entirety.

The enclosed proxy statement sets forth three proposals on which you are being asked to vote. The first proposal, a routine item, concerns the election of trustees. Routine items make no fundamental or material changes to a Fund’s investment objectives, policies, or restrictions, or to the investment management contract. The other proposals are not considered routine items. All three proposals are summarized below.

The following is an overview of the proposals on which you are being asked to vote. Please note that none of these proposals is expected to have any material effect on the manner in which any Fund is managed or on its current investment objective, nor are they related to the current state of the financial markets. You will find a detailed explanation of each proposal in the enclosed proxy materials.

You are being asked to approve three proposals:

(1) Election of Trustees

You are being asked to elect eight Trustees as members of the Board of Trustees of each Trust (the “Board”).

(2) New Form of Advisory Agreement

Shareholders of certain Funds are being asked to approve a new form of Advisory Agreement between their Funds and John Hancock Investment Management LLC (“JHIM” or the “Advisor”). The purpose of this proposal is to streamline the advisory agreements across the John Hancock Fund Complex, primarily to provide more explicitly for a “manager of managers” structure, to clarify that the new form of Advisory Agreement covers only investment advisory services and to provide consistency in operational procedures across the John Hancock Fund Complex. These benefits contribute to a goal of maintaining, and even potentially reducing, operational costs. In addition, restricting the new form of Advisory Agreement to investment advisory services will facilitate the Advisor’s ability to manage those services that are “non-investment” in nature.

The new form of Advisory Agreement will not result in any change in advisory fee rates or the level, nature or quality of advisory services provided to the Funds, and will not increase the Funds’ overall expense ratios. Other details and impacts of this proposal are described in the accompanying proxy statement.

(3) Proposal adopting a Manager of Managers Structure

Shareholders of certain Funds are being asked to approve a “manager of managers” structure for their Funds. This structure would allow JHIM, subject to the approval of the Board, to replace a Fund’s subadvisor with an unaffiliated subadvisor or materially amend a Fund’s investment subadvisory agreement with an unaffiliated subadvisor without first obtaining shareholder approval, subject to certain conditions. This effectively would allow JHIM to hire and replace unaffiliated subadvisors to the Funds, subject to Board approval but without a Fund having to incur the cost and delay of holding a shareholder meeting to approve a new (or materially amend a current) investment subadvisory agreement. Shareholders would, however, be notified of any changes to a Fund’s subadvisor or subadvisors. This order does not extend to a subadvisor that is an “affiliated person,” as defined in Section 2(a)(3) of the Investment Company Act of 1940, of a Trust or the Advisor, other than by reason of serving as subadvisor to one or more of the Funds, which means that JHIM would not be permitted to replace an unaffiliated subadvisor with an affiliated subadvisor, or materially amend a subadvisory agreement with an affiliated subadvisor, without both Board and shareholder approval.

We Need Your Vote of Approval

After careful consideration, the Board has unanimously approved each of the applicable proposals and recommends that shareholders vote “FOR” their approval, but the final approval requires your vote. The enclosed proxy statement, which I strongly encourage you to read before voting, contains further explanation and important details of the proposals.

How to Vote

Attending the meeting via telephone

To participate in the meeting, shareholders of the Fund must call 1-855-643-7451 no later than 5:00 p.m. Eastern Time on September 8, 2022 and provide your full name and address. You will then be provided with the conference call dial-in information to attend the shareholder meeting. Access to the meeting is limited to shareholders of the Funds or each Fund.

Please read the enclosed proxy statement, and vote your shares as described below. Voting today will save on the potential cost of future mailings to obtain shareholder votes. You may vote your respective shares by proxy in one of three ways:

Online: www.proxyvote.com

Phone: 1-855-643-7451

Mail: by returning the enclosed proxy card(s)

| Sincerely, | |

| | |

| /s/ Andrew G. Arnott | |

| | |

| Andrew G. Arnott | |

| President and CEO | |

| John Hancock Investment Management | |

| Head of Wealth and Asset Management | |

| United States and Europe | |

John Hancock Investment Management Distributors LLC, 200 Berkeley Street, Boston, Massachusetts 02116, Member FINRA, SIPC • John Hancock Investment Management LLC • John Hancock Signature Services, Inc.

JOHN HANCOCK BOND TRUST

JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND

JOHN HANCOCK CAPITAL SERIES

JOHN HANCOCK COLLATERAL TRUST

JOHN HANCOCK CURRENT INTEREST

JOHN HANCOCK FUNDS III

JOHN HANCOCK INVESTMENT TRUST

JOHN HANCOCK INVESTMENT TRUST II

JOHN HANCOCK MUNICIPAL SECURITIES TRUST

JOHN HANCOCK SOVEREIGN BOND FUND

JOHN HANCOCK STRATEGIC SERIES

(each, a “Trust” and collectively, the “Trusts”)

200 Berkeley Street

Boston, Massachusetts 02116

Notice of special joint meeting of shareholders

To the Shareholders of the Trusts:

Notice is hereby given that a Special Joint Meeting of Shareholders of all of the investment portfolios (the “Funds”) of the Trusts (the “Meeting”) will be held via telephone only in light of the COVID-19 pandemic, on September 9, 2022 at 2:30PM, Eastern Time. A Proxy Statement, which provides information about the purposes of the Meeting, is included with this Notice. The Funds involved in the Meeting are listed on the front cover of the Proxy Statement. As a registered shareholder, you would be voting on behalf of the Fund shares you own. The Meeting will be held for the following purposes:

| Proposal 1 | Election of eight Trustees as members of the Board of Trustees of each of the Trusts. |

| | |

| | All shareholders of each Trust will vote separately on Proposal 1. |

| | |

| Proposal 2 | Approval of a new form of Advisory Agreement between each applicable Trust and John Hancock Investment Management LLC. |

| | |

| | Shareholders of California Municipal Bond Fund, Classic Value Fund, Fundamental Large Cap Core Fund, and U.S. Global Leaders Growth Fund will each vote separately on Proposal 2. |

| | |

| Proposal 3 | Proposal adopting a manager of managers structure. |

| | |

| | Shareholders of Balanced Fund, California Municipal Bond Fund, Classic Value Fund, Financial Industries Fund, Fundamental Large Cap Core Fund, High Yield Municipal Bond Fund, and Regional Bank Fund will each vote separately on Proposal 3. |

Any other business that may properly come before the Meeting.

The Board of Trustees of the Trusts recommends that shareholders vote “FOR” all of the Proposals.

Each shareholder of record at the close of business on June 13, 2022 is entitled to receive notice of and to vote at the Meeting.

The Funds are sensitive to the health and travel concerns that shareholders may have and the protocols that federal, state, and local governments may impose at the time of the Meeting. Due to the difficulties arising from the COVID-19 pandemic, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the funds will announce alternative arrangements for the Meeting as soon as possible. If there are any such changes to the Meeting, the Funds may not deliver additional soliciting materials to shareholders or otherwise amend the funds’ proxy materials. Instead, the Funds plan to announce these changes, if any, by: (i) issuing a press release at jhinvestments.com/about-us/press-releases.com and encourage you to check this website before the meeting; and (ii) filing the announcement with the Securities and Exchange Commission. We are urging all shareholders to take advantage of voting by mail, the internet, or telephone, as provided on the attached proxy card.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to be Held on September 9, 2022:

The proxy statement is available at jhinvestments.com/proxy-information

| Sincerely, | |

| | |

| /s/ Christopher Sechler | |

| Christopher Sechler | |

| Secretary | |

July 21, 2022

Boston, Massachusetts

Your vote is important - Please vote your shares promptly.

Shareholders are invited to attend the Meeting by phone. Any shareholder who does not expect to attend the Meeting is urged to vote by:

| (i) | completing the enclosed proxy card(s), dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States; |

| (ii) | following the touch-tone telephone voting instructions found below; or |

| (iii) | following the Internet voting instructions found below. |

In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

Individual Accounts: Your name should be signed exactly as it appears on the proxy card(s).

Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown on the proxy card(s).

All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card.

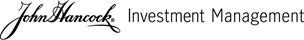

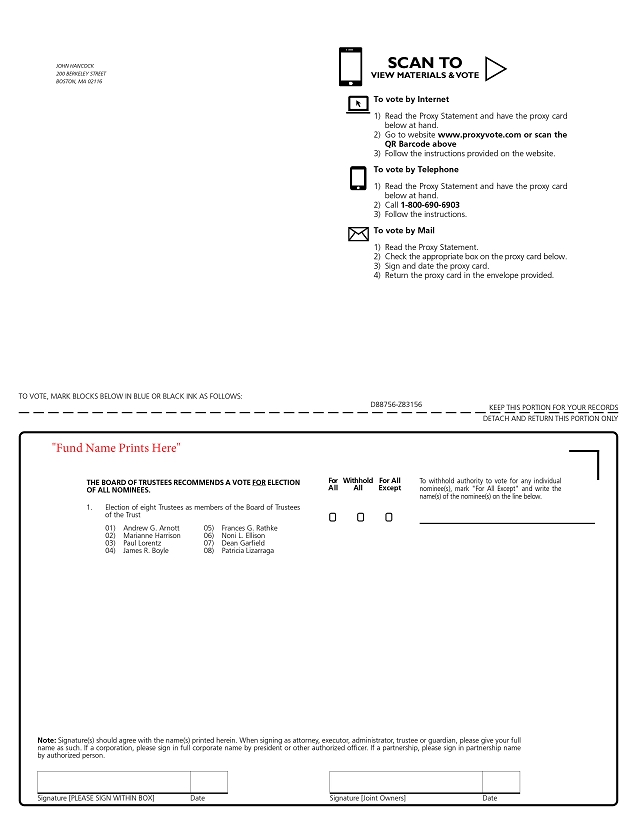

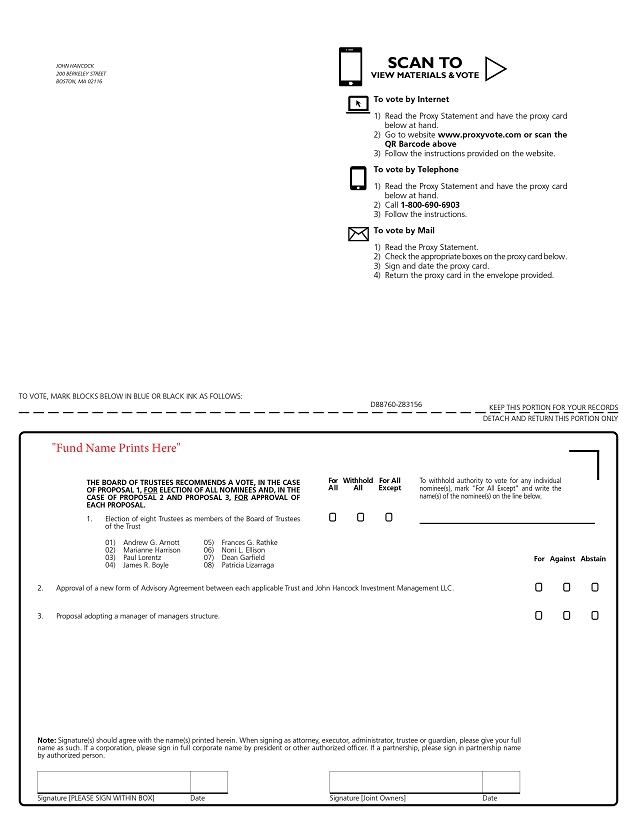

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE

Read the enclosed Proxy Statement, and have your proxy card(s) handy.

Call the toll-free number indicated on your proxy card(s).

Enter the control number found on the front of your proxy card(s).

Follow the recorded instructions to cast your vote.

INSTRUCTIONS FOR VOTING BY INTERNET

Read the enclosed Proxy Statement, and have your proxy card(s) handy.

Go to the Web site on the proxy card(s).

Enter the “control number” found on your proxy card(s).

Follow the instructions on the Web site.

JOHN HANCOCK BOND TRUST

JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND

JOHN HANCOCK CAPITAL SERIES

JOHN HANCOCK COLLATERAL TRUST

JOHN HANCOCK CURRENT INTEREST

JOHN HANCOCK FUNDS III

JOHN HANCOCK INVESTMENT TRUST

JOHN HANCOCK INVESTMENT TRUST II

JOHN HANCOCK MUNICIPAL SECURITIES TRUST

JOHN HANCOCK SOVEREIGN BOND FUND

JOHN HANCOCK STRATEGIC SERIES

(each, a “Trust” and, collectively, the “Trusts”)

PROXY STATEMENT

SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 9, 2022

JOHN HANCOCK BOND TRUST John Hancock ESG Core Bond Fund John Hancock Government Income Fund John Hancock High Yield Fund John Hancock Investment Grade Bond Fund John Hancock Short Duration Bond Fund JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND John Hancock California Municipal Bond Fund (formerly California Tax-Free Income Fund) JOHN HANCOCK CAPITAL SERIES John Hancock Classic Value Fund John Hancock U.S. Global Leaders Growth Fund JOHN HANCOCK COLLATERAL TRUST JOHN HANCOCK CURRENT INTEREST John Hancock Money Market Fund JOHN HANCOCK FUNDS III John Hancock Disciplined Value Fund John Hancock Disciplined Value Mid Cap Fund John Hancock Global Shareholder Yield Fund John Hancock International Growth Fund John Hancock U.S. Growth Fund (formerly U.S. Quality Growth Fund) JOHN HANCOCK INVESTMENT TRUST John Hancock Balanced Fund John Hancock Disciplined Value International Fund John Hancock Diversified Macro Fund John Hancock Diversified Real Assets Fund John Hancock Emerging Markets Equity Fund John Hancock ESG International Equity Fund John Hancock ESG Large Cap Core Fund | John Hancock Fundamental Large Cap Core Fund John Hancock Global Environmental Opportunities Fund John Hancock Global Thematic Opportunities Fund John Hancock Infrastructure Fund John Hancock International Dynamic Growth Fund John Hancock Mid Cap Growth Fund John Hancock Seaport Long/Short Fund John Hancock Small Cap Core Fund JOHN HANCOCK INVESTMENT TRUST II John Hancock Financial Industries Fund John Hancock Regional Bank Fund JOHN HANCOCK MUNICIPAL SECURITIES TRUST John Hancock High Yield Municipal Bond Fund John Hancock Municipal Opportunities Fund (formerly Tax-Free Bond Fund) John Hancock Short Duration Municipal Opportunities Fund JOHN HANCOCK SOVEREIGN BOND FUND John Hancock Bond Fund JOHN HANCOCK STRATEGIC SERIES John Hancock Income Fund John Hancock Managed Account Shares Investment-Grade Corporate Bond Portfolio John Hancock Managed Account Shares Non-Investment-Grade Corporate Bond Portfolio John Hancock Managed Account Shares Securitized Debt Portfolio |

The following table summarizes which Funds (and share classes) are being asked to vote on a particular Proposal.

| Proposal | Funds | Classes |

| 1 | All Funds | All Classes |

| 2 | California Municipal Bond Fund Classic Value Fund Fundamental Large Cap Core Fund U.S. Global Leaders Growth Fund | All Classes |

| 3 | Balanced Fund California Municipal Bond Fund Classic Value Fund Financial Industries Fund Fundamental Large Cap Core Fund High Yield Municipal Bond Fund Regional Bank Fund | All Classes |

Table of Contents

JOHN HANCOCK BOND TRUST

JOHN HANCOCK CALIFORNIA TAX-FREE INCOME FUND

JOHN HANCOCK CAPITAL SERIES

JOHN HANCOCK COLLATERAL TRUST

JOHN HANCOCK CURRENT INTEREST

JOHN HANCOCK FUNDS III

JOHN HANCOCK INVESTMENT TRUST

JOHN HANCOCK INVESTMENT TRUST II

JOHN HANCOCK MUNICIPAL SECURITIES TRUST

JOHN HANCOCK SOVEREIGN BOND FUND

JOHN HANCOCK STRATEGIC SERIES

(each, a “Trust” and collectively, the “Trusts”)

200 Berkeley Street

Boston, Massachusetts 02116

PROXY STATEMENT

SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 9, 2022

Introduction

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (the “Board” or “Trustees”) of each Trust of proxies to be used at a Special Joint Meeting of shareholders of the Trusts (the “Meeting”) to be held via telephone only, on September 9, 2022 at 2:30PM Eastern Time. Pursuant to the Agreement and Declaration of Trust of each Trust (the “Declaration of Trust”), the Board has designated June 13, 2022 as the record date for determining shareholders eligible to vote at the Meeting (the “Record Date”). All shareholders of record at the close of business on the Record Date are entitled to one vote for each share of beneficial interest of Funds held. This Proxy Statement is first being sent to shareholders on or about July 21, 2022.

The Funds are sensitive to the health and travel concerns that shareholders may have and the protocols that federal, state, and local governments may impose at the time of the Meeting. Due to the difficulties arising from the COVID-19 pandemic, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the funds will announce alternative arrangements for the Meeting as soon as possible. If there are any such changes to the Meeting, the Funds may not deliver additional soliciting materials to shareholders or otherwise amend the funds’ proxy materials. Instead, the Funds plan to announce these changes, if any, by: (i) issuing a press release at jhinvestments.com/about-us/press-releases.com and encourage you to check this website before the meeting; and (ii) filing the announcement with the Securities and Exchange Commission. We are urging all shareholders to take advantage of voting by mail, the internet, or telephone, as provided on the attached proxy card.

Each Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The shares of each of the 11 Trusts offered as of the Record Date were divided into series corresponding to a combined total of 40 portfolios (each, a “Fund”). The respective Funds are named on the cover of this Proxy Statement.

Investment Advisor and Administrator. John Hancock Investment Management LLC (“JHIM” or the “Advisor”) serves as investment advisor and administrator for each Trust and each Fund. Pursuant to an investment advisory agreement with each Trust, the Advisor is responsible for, among other things, administering the business and affairs of the Funds and selecting, contracting with, compensating and monitoring the performance of the investment subadvisors that manage the investment and reinvestment of the assets of the Funds pursuant to subadvisory agreements with the Advisor. JHIM is registered as an investment advisor under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Each of the subadvisors to the Funds is also registered as an investment advisor under the Advisers Act.

The Distributor. John Hancock Investment Management Distributors LLC (the “Distributor”) serves as each Fund’s distributor.

The offices of JHIM and the Distributor are located at 200 Berkeley Street, Boston, Massachusetts 02116, and their ultimate parent entity is Manulife Financial Corporation (“MFC”), a publicly traded company based in Toronto, Canada. MFC and its subsidiaries operate as “Manulife Financial” in Canada and Asia and primarily as “John Hancock” in the United States.

Each Fund will furnish, without charge, a copy of its most recent annual report and semi-annual report to any shareholder upon request. To obtain a report, please contact the relevant Fund by calling 800-225-5291. These reports are also available on the Internet at www.jhinvestments.com.

Proposal 1 — Election of Eight Trustees as Members of the Board of Trustees of Each Trust

(All Funds)

The Board of Trustees of the Trusts (the “Board” and, each member thereof, a “Trustee”) currently includes eleven (11) Trustees, including nine (9) independent Trustees (“Independent Trustees”) and two (2) non-independent Trustees (“Non-Independent Trustees”). Seven (7) of the Trustees (Peter Burgess, William Cunningham, Grace Fey, Deborah Jackson, Hassell McClellan, Steven Pruchansky, and Gregory Russo) were elected to serve on the Board at a shareholder meeting held on November 15, 2012, each as an Independent Trustee, and four (4) Trustees (Andrew G. Arnott, James R. Boyle, Marianne Harrison, and Frances G. Rathke) were appointed. The Board appointed Mr. Arnott and Ms. Harrison to serve as Non-Independent Trustees on June 20, 2017 and June 19, 2018, respectively, and Ms. Rathke to serve as Independent Trustee on September 15, 2020. In addition, although James R. Boyle initially was designated a Non-Independent Trustee, as of March 22, 2018, he is considered an Independent Trustee.

Four additional Trustees are being presented for election at the Meeting: Noni L. Ellison, Dean Garfield, Patricia Lizarraga and Paul Lorentz. If elected by the shareholders at the Meeting, Ms. Ellison, Mr. Garfield and Ms. Lizarraga will join the Board as Independent Trustees and Mr. Lorentz will join the Board as a Non-Independent Trustee. Following the shareholder election, fifteen Trustees would comprise the Board (three Non-Independent Trustees and twelve Independent Trustees), each of whom would have been elected by shareholders.

At the Meeting, only current Trustees that have not been elected by shareholders and nominated Trustees will be presented for election. If approved by shareholders, this would result in all of the Trustees being elected by shareholders and would allow the Board to appoint Trustees to fill future vacancies without requiring a shareholder vote until the number of elected Trustees drops below two-thirds of all Trustees. At that time, the Board would be required to proxy shareholders to add an additional Trustee.

Current Trustees that are not nominated for election will continue to serve as members of the Board. No current Trustees are proposed to be replaced.

Shareholders are being asked to elect each individual nominated by the Board listed below (each, a “Nominee” and collectively, the “Nominees”) as a member of the Board of Trustees of the Trusts. Four of the Nominees currently are Trustees of each Trust and have served in that capacity continuously since originally being appointed. Four of the Nominees, Ms. Ellison, Mr. Garfield, Ms. Lizarraga, and Mr. Lorentz have not served as Trustees of any Trust. Because each Trust is not required to, and does not, hold regular annual shareholder meetings, each Nominee, if elected, will hold office until his or her successor is elected and qualified or until he or she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed from a Trust (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding shares of a Trust.

At videoconference meetings held on May 24-25, 2022, the Nominating and Governance Committee of the Board considered the proposed Trustee candidates and determined to recommend the election of the Nominees to the full Board of the Trusts. Acting on that recommendation, at videoconference meetings held on June 21-23, 2022, the Board approved those nominations and called a meeting of shareholders to allow shareholders of the Trusts to vote on the election of the Nominees to the Board.

The persons named as proxies intend, in the absence of contrary instructions, to vote all proxies for the election of the Nominees. If, prior to the Meeting, any Nominee becomes unable to serve for any reason or for good cause will not serve, the persons named as proxies reserve the right to substitute another person or persons of their choice as nominee or nominees. All of the Nominees have consented to being named in this Proxy Statement and to serve if elected. The Trusts know of no reason why any Nominee would be unable or unwilling to serve if elected.

The business and affairs of the Trusts, including those of the Funds, are managed under the direction of the Board. As stated above, the 11 Trusts have a combined total of 40 separate Funds, and each Trustee oversees all Funds. In addition to the Funds, some Trustees also oversee other funds advised by JHIM or JHIM’s affiliates.

Information Concerning Nominees

The following tables set forth certain information regarding the Nominees: Andrew G. Arnott, James R. Boyle, Marianne Harrison, Frances G. Rathke, Noni L. Ellison, Dean Garfield, Patricia Lizarraga, and Paul Lorentz. The tables present information regarding the Nominees’ principal occupations which, unless specific dates are shown, are of at least five years’ duration. In addition, the tables include information concerning other directorships held by each Nominee in other registered investment companies or publicly traded companies. Information is listed separately for each Nominee who is an “interested person” (as defined in the 1940 Act) of the Trust (each a “Non-Independent Trustee”) and the Independent Trustees. As of December 31, 2021, the “John Hancock Fund Complex” consisted of 191 funds (including separate series of series mutual funds). The address of each Nominee is 200 Berkeley Street, Boston, Massachusetts 02116.

Eight Nominees Standing For Election

| Non-Independent Trustees Who Are Nominees |

Name

(Birth Year) | Current Position(s) with the Trusts1 | Principal Occupation(s) and Other Directorships During the Past 5 Years | Number of Funds in John Hancock Fund Complex Overseen by Trustee/Nominee |

Andrew G. Arnott2 (1971) | Trustee, each Trust (since 2017); President (since 2014) | Head of Wealth and Asset Management, United States and Europe, for John Hancock and Manulife (since 2018); Director and Executive Vice President, John Hancock Investment Management LLC (since 2005, including prior positions); Director and Executive Vice President, John Hancock Variable Trust Advisers LLC (since 2006, including prior positions); President, John Hancock Investment Management Distributors LLC (since 2004, including prior positions); President of various trusts within the John Hancock Fund Complex (since 2007, including prior positions). Trustee of various trusts within the John Hancock Fund Complex (since 2017). | 191 |

Marianne Harrison2 (1963) | Trustee, each Trust (since 2018) | President and CEO, John Hancock (since 2017); President and CEO, Manulife Canadian Division (2013–2017); Member, Board of Directors, Boston Medical Center (since 2021); Member, Board of Directors, CAE Inc. (since 2019); Member, Board of Directors, MA Competitive Partnership Board (since 2018); Member, Board of Directors, American Council of Life Insurers (ACLI) (since 2018); Member, Board of Directors, Communitech, an industry-led innovation center that fosters technology companies in Canada (2017–2019); Member, Board of Directors, Manulife Assurance Canada (2015–2017); Board Member, St. Mary’s General Hospital Foundation (2014–2017); Member, Board of Directors, Manulife Bank of Canada (2013–2017); Member, Standing Committee of the Canadian Life & Health Assurance Association (2013–2017); Member, Board of Directors, John Hancock USA, John Hancock Life & Health, John Hancock New York (2012–2013). Trustee of various trusts within the John Hancock Fund Complex (since 2018). | 191 |

Paul Lorentz2 1968 | Nominee for Trustee | Global Head, Manulife Wealth and Asset Management (Since 2017); General Manager, Manulife, Individual Wealth Management and Insurance (2013-2017); President, Manulife Investments (2010-2016). | 191 |

| (1) | Because each Trust is not required to and does not hold regular annual shareholder meetings, each Trustee holds office for an indefinite term until his or her successor is duly elected and qualified or until he or she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed from the Trust (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding shares of the Trust. |

| (2) | The Trustee is a Non-Independent Trustee due to current or former positions with the Advisor and certain of its affiliates. |

| Independent Trustees Who Are Nominees |

Name

(Birth Year) | Current Position(s) with the Trusts1 | Principal Occupation(s) and Other Directorships During the Past 5 Years | Number of Funds in John Hancock Fund Complex Overseen by Trustee/Nominee |

James R. Boyle (1959) | Trustee, each Trust except Collateral Trust (2005–2010, 2012–2014); Trustee all Trusts since 2015 | Foresters Financial, Chief Executive Officer (2018-2022) and board member (2017-2022). Manulife Financial and John Hancock, more than 20 years, retiring in 2012 as Chief Executive Officer, John Hancock and Senior Executive Vice President, Manulife Financial. Trustee of various trusts within the John Hancock Fund Complex (2005–2014 and since 2015). | 191 |

Frances G. Rathke (1960) | Trustee, each Trust (since 2020) | Director, Audit Committee Chair, Oatly Group AB (plant-based drink company) (since 2021); Director, Audit Committee Chair and Compensation Committee Member, Green Mountain Power Corporation (since 2016); Director, Treasurer and Finance & Audit Committee Chair, Flynn Center for Performing Arts (since 2016); Director and Audit Committee Chair, Planet Fitness (since 2016); Chief Financial Officer and Treasurer, Keurig Green Mountain, Inc. (2003-retired 2015). Trustee of various trusts within the John Hancock Fund Complex (since 2020). | 191 |

Noni L. Ellison (1971) | Nominee for Trustee | Senior Vice President, General Counsel & Corporate Secretary, Tractor Supply Company (rural lifestyle retailer) (Since 2021); General Counsel, Chief Compliance Officer & Corporate Secretary, Carestream Dental, L.L.C. (2017-2021); Associate General Counsel & Assistant Corporate Secretary, W.W. Grainger, Inc. (global industrial supplier) (2015-2017); Board Member, Goodwill of North Georgia, 2018 (FY2019) - 2020 (FY2021); Board Member, Howard University School of Law Board of Visitors (since 2021); Board Member, University of Chicago Law School Board of Visitors (since 2016); Board member, Children’s Healthcare of Atlanta Foundation Board (2021–present). | 191 |

Dean Garfield (1968) | Nominee for Trustee | Vice President, Netflix, Inc. (Since 2019); President & Chief Executive Officer, Information Technology Industry Council (2009-2019); NYU School of Law Board of Trustees (Since 2021); Member, U.S. Department of Transportation, Advisory Committee on Automation (Since 2021); President of the United States Trade Advisory Council (2010-2018); Board Member, College for Every Student (2017-2021); Board Member, The Seed School of Washington, D.C. (2012-2017). | 191 |

Patricia Lizarraga (1966) | Nominee for Trustee | Founder, Chief Executive Officer, Hypatia Capital Group (advisory and asset management company) (Since 2007); Independent Director, Audit Committee Chair, and Risk Committee Member, Credicorp, Ltd. (Since 2017); Independent Director, Audit Committee Chair, Banco De Credito Del Peru (Since 2017); Trustee, Museum of Art of Lima (Since 2009). | 191 |

| (1) | Because each Trust is not required to and does not hold regular annual shareholder meetings, each Trustee holds office for an indefinite term until his or her successor is duly elected and qualified or until he or she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed from the Trust (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding shares of the Trust. |

Correspondence intended for any of the Nominees may be sent to the attention of the individual Nominee or to the Board at 200 Berkeley Street, Boston, Massachusetts 02116. All communications addressed to the Board or individual Nominee will be logged and sent to the Board or individual Nominee.

Information Concerning Other Trustees

The following table sets forth information concerning the Trustees of the Trusts who are not standing for election at the Meeting. All of these Trustees are Independent Trustees. The address of each Independent Trustee who is not a Nominee is 200 Berkeley Street, Boston, Massachusetts 02116.

Trustees Not Standing For Election

| Independent Trustees Who Are Not Nominees |

Name

(Birth Year) | Current Position(s) with the Trusts1 | Principal Occupation(s) and Other Directorships During the Past 5 Years | Number of Funds in John Hancock Fund Complex Overseen by Trustee/Nominee |

Peter S. Burgess (1942) | Trustee, Bond Trust, California Tax-Free Income Fund, Capital Series, Current Interest, Investment Trust, Investment Trust II, Municipal Securities Trust, Sovereign Bond Fund and Strategic Series (since 2012); Trustee, John Hancock Funds III (2005–2006 and since 2012); Trustee, Collateral Trust (since 2015) | Consultant (financial, accounting, and auditing matters) (since 1999); Certified Public Accountant; Partner, Arthur Andersen (independent public accounting firm) (prior to 1999); Director, Lincoln Educational Services Corporation (2004–2021); Director, Symetra Financial Corporation (2010–2016); Director, PMA Capital Corporation (2004–2010). Trustee of various trusts within the John Hancock Fund Complex (since 2005). | 191 |

William H. Cunningham (1944) | Trustee, Bond Trust, Current Interest, and Investment Trust (since 1986); Trustee, California Tax-Free Income Fund and Municipal Securities Trust (since 1989); Trustee, Capital Series, Investment Trust II, Sovereign Bond Fund and Strategic Series, (since 2005); Trustee, John Hancock Funds III (since 2006); Trustee, Collateral Trust (since 2015). | Professor, University of Texas, Austin, Texas (since 1971); former Chancellor, University of Texas System and former President of the University of Texas, Austin, Texas; Director (since 2006), Lincoln National Corporation (insurance); Director, Southwest Airlines (since 2000). Trustee of various trusts within the John Hancock Fund Complex (since 1986). | 191 |

Grace K. Fey (1946) | Trustee, each Trust except Collateral Trust (since 2012); Trustee, Collateral Trust (since 2015) | Chief Executive Officer, Grace Fey Advisors (since 2007); Director and Executive Vice President, Frontier Capital Management Company (1988–2007); Director, Fiduciary Trust (since 2009). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | 191 |

Deborah C. Jackson (1952) | Trustee, each Trust except Collateral Trust (since 2008); Trustee, Collateral Trust (Since 2015) | President, Cambridge College, Cambridge, Massachusetts (since 2011); Board of Directors, Amwell Corporation (since 2020); Board of Directors, Massachusetts Women’s Forum (2018–2020); Board of Directors, National Association of Corporate Directors/New England (2015–2020); Chief Executive Officer, American Red Cross of Massachusetts Bay (2002–2011); Board of Directors of Eastern Bank Corporation (since 2001); Board of Directors of Eastern Bank Charitable Foundation (since 2001); Board of Directors of Boston Stock Exchange (2002– | 191 |

| Independent Trustees Who Are Not Nominees |

Name

(Birth Year) | Current Position(s) with the Trusts1 | Principal Occupation(s) and Other Directorships During the Past 5 Years | Number of Funds in John Hancock Fund Complex Overseen by Trustee/Nominee |

| | | 2008); Board of Directors of Harvard Pilgrim Healthcare (health benefits company) (2007–2011). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | |

Hassell H. McClellan (1945) | Trustee, Bond Trust, California Tax-Free Income Fund, Capital Series, Current Interest, , Investment Trust, Investment Trust II, Municipal Securities Trust, Sovereign Bond Fund and Strategic Series (since 2012), Trustee, John Hancock Funds III (2005–2006 and since 2012); Trustee, Collateral Trust, (since 2015) Chairperson of the Board, each Trust (since 2017) | Director/Trustee, Virtus Funds (2008–2020); Director, The Barnes Group (2010–2021); Associate Professor, The Wallace E. Carroll School of Management, Boston College (retired 2013). Trustee (since 2005) and Chairperson of the Board (since 2017) of various trusts within the John Hancock Fund Complex. | 191 |

Steven R. Pruchansky (1944) | Trustee, Bond Trust, California Tax-Free Income Fund, Current Interest, Investment Trust and Municipal Securities Trust (since 1994); Trustee, Capital Series, Investment Trust II, Sovereign Bond Fund and Strategic Series (since 2005); Trustee, John Hancock Funds III (since 2006); Vice Chairperson of the Board, each Trust except Collateral Trust (since 2012); Trustee and Vice Chairperson of the Board, Collateral Trust (since 2015) | Managing Director, Pru Realty (since 2017); Chairman and Chief Executive Officer, Greenscapes of Southwest Florida, Inc. (2014-2020); Director and President, Greenscapes of Southwest Florida, Inc. (until 2000); Member, Board of Advisors, First American Bank (until 2010); Managing Director, Jon James, LLC (real estate) (since 2000); Partner, Right Funding, LLC (2014-2017); Director, First Signature Bank & Trust Company (until 1991); Director, Mast Realty Trust (until 1994); President, Maxwell Building Corp. (until 1991). Trustee (since 1992), Chairperson of the Board (2011–2012), and Vice Chairperson of the Board (since 2012) of various trusts within the John Hancock Fund Complex. | 191 |

Gregory A. Russo (1949) | Trustee, Bond Trust, California Tax-Free Income Fund, Capital Series, Current Interest, Investment Trust, Investment Trust II, Municipal Securities Trust, Sovereign Bond Fund, and Strategic Series (since 2009); Trustee, John Hancock Funds III (since 2008); Trustee, Collateral Trust (since 2015) | Director and Audit Committee Chairman (2012–2020), and Member, Audit Committee and Finance Committee (2011–2020), NCH Healthcare System, Inc. (holding company for multi-entity healthcare system); Director and Member (2012-2018), and Finance Committee Chairman (2014-2018), The Moorings, Inc. (nonprofit continuing care community); Global Vice Chairman, Risk & Regulatory Matters, KPMG LLP (KPMG) (2002–2006); Vice Chairman, Industrial Markets, KPMG (1998–2002). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | 191 |

| (1) | Because each Trust is not required to and does not hold regular annual shareholder meetings, each Trustee holds office for an indefinite term until his or her successor is duly elected and qualified or until he or she dies, retires, resigns, is removed or becomes disqualified. Trustees may be removed from the Trust (provided the aggregate number of Trustees after such removal shall not be less than one) with cause or without cause, by the action of two-thirds of the remaining Trustees or by action of two-thirds of the outstanding shares of the Trust. |

Principal Officers Who Are Not Trustees or Nominees

The following table presents information regarding the current principal officers of the Trusts who are neither current Trustees nor Nominees, including their principal occupations which, unless specific dates are shown, are of at least five years’ duration. Each of the officers is an affiliated person of the Advisor. Each such officer’s business address is 200 Berkeley Street, Boston, Massachusetts 02116.

Name

(Birth Year) | Current Position(s) with the Trusts1 | Principal Occupation(s) During the Past 5 Years |

Charles A. Rizzo (1957) | Chief Financial Officer, all Trusts except Collateral Trust (since 2007); Chief Financial Officer, Collateral Trust (since 2015) | Vice President, John Hancock Financial Services (since 2008); Senior Vice President, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2008); Chief Financial Officer of various trusts within the John Hancock Fund Complex (since 2007). |

| Salvatore Schiavone (1965) | Treasurer, all Trusts except Collateral Trust (since 2012); Treasurer, Collateral Trust (since 2015) | Assistant Vice President, John Hancock Financial Services (since 2007); Vice President, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2007); Treasurer of various trusts within the John Hancock Fund Complex (since 2007, including prior positions). |

Christopher (Kit) Sechler (1973) | Secretary and Chief Legal Officer (since 2018) | Vice President and Deputy Chief Counsel, John Hancock Investment Management (since 2015); Assistant Vice President and Senior Counsel (2009–2015), John Hancock Investment Management; Assistant Secretary of John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2009); Chief Legal Officer and Secretary of various trusts within the John Hancock Fund Complex (since 2009, including prior positions). |

Trevor Swanberg (1979) | Chief Compliance Officer (since 2020) | Chief Compliance Officer, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2020); Deputy Chief Compliance Officer, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (2019–2020); Assistant Chief Compliance Officer, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (2016–2019); Vice President, State Street Global Advisors (2015–2016); Chief Compliance Officer of various trusts within the John Hancock Fund Complex (since 2016, including prior positions). |

| (1) | Each officer holds office for an indefinite term until his or her successor is duly elected and qualified or until he or she dies, retires, resigns, is removed or becomes disqualified. |

Additional Information about the Trustees and Nominees

In addition to the description of each Trustee’s or Nominee’s Principal Occupation(s) and Other Directorships set forth above, the following provides further information about each Trustee’s or Nominee’s specific experience, qualifications, attributes or skills with respect to each Trust. The information in this section should not be understood to mean that any of the Trustees or Nominees is an “expert” within the meaning of the federal securities laws.

The Board believes that the different perspectives, viewpoints, professional experience, education, and individual qualities of each Trustee or Nominee represent a diversity of experiences and a variety of complementary skills and expertise. Each Trustee and four of the Nominees have experience as board members. Mr. Arnott, Mr. Boyle, Ms. Harrison, and Ms. Rathke have experience as a Trustees of John Hancock funds. It is the Trustees’ belief that this allows the Board, as a whole, to oversee the business of the Funds and the other funds in the John Hancock Fund Complex in a manner consistent with the best interests of the Funds’ shareholders. When considering potential nominees to fill vacancies on the Board, and as part of its annual self-evaluation, the Board reviews the mix of skills and other relevant experiences of the Trustees.

Independent Trustees Standing for Election and Nominees

James R. Boyle – Mr. Boyle has high-level executive, financial, operational, governance, regulatory and leadership experience in the financial services industry, including in the development and management of registered investment companies, variable annuities, retirement and insurance products. Mr. Boyle is the former President and CEO of a large international fraternal life insurance company

and is the former President and CEO of multi-line life insurance and financial services companies. Mr. Boyle began his career as a Certified Public Accountant with Coopers & Lybrand.

Frances G. Rathke – Through her former positions in senior financial roles, as a former Certified Public Accountant, and as a consultant on strategic and financial matters, Ms. Rathke has experience as a leader overseeing, conceiving, implementing, and analyzing strategic and financial growth plans, and financial statements. Ms. Rathke also has experience in the auditing of financial statements and related materials. In addition, she has experience as a director of various organizations, including a publicly traded company and a non-profit entity.

Noni L. Ellison – As a senior vice president, general counsel, and corporate secretary with over 25 years of executive leadership experience, Ms. Ellison has extensive management and business expertise in legal, regulatory, compliance, operational, quality assurance, international, finance and governance matters.

Dean Garfield – As a former president and chief executive officer of a leading industry organization and current vice-president of a leading international company, Mr. Garfield has significant global executive operational, governance, regulatory, and leadership experience. He also has experience as a leader overseeing and implementing global public policy matters including strategic initiatives.

Patricia Lizarraga – Through her current positions as an independent board director, audit committee chair, and chief executive officer of an investment advisory firm, Ms. Lizarraga has expertise in financial services and investment matters, and operational and risk oversight. As former governance committee chair, Ms. Lizarraga has a strong understanding of corporate governance and the regulatory frameworks of the investment management industry.

Independent Trustees Not Standing for Election

Peter S. Burgess – As a financial consultant, Certified Public Accountant, and former partner in a major international public accounting firm, Mr. Burgess has experience in the auditing of financial services companies and mutual funds. He also has experience as a director of publicly traded operating companies.

William H. Cunningham – Mr. Cunningham has management and operational oversight experience as a former Chancellor and President of a major university. Mr. Cunningham regularly teaches a graduate course in corporate governance at the law school and at the Red McCombs School of Business at The University of Texas at Austin. He also has oversight and corporate governance experience as a current and former director of a number of operating companies, including an insurance company.

Grace K. Fey – Ms. Fey has significant governance, financial services, and asset management industry expertise based on her extensive non-profit board experience, as well as her experience as a consultant to non-profit and corporate boards, and as a former director and executive of an investment management firm.

Deborah C. Jackson – Ms. Jackson has leadership, governance, management, and operational oversight experience as the lead director of a large bank, president of a college, and as the former chief executive officer of a major charitable organization. She also has expertise in financial services matters and oversight and corporate governance experience as a current and former director of various other corporate organizations, including an insurance company, a regional stock exchange, a telemedicine company, and non-profit entities.

Hassell H. McClellan – As a former professor of finance and policy in the graduate management department of a major university, a director of a public company, and as a former director of several privately held companies, Mr. McClellan has experience in corporate and financial matters. He also has experience as a director of other investment companies not affiliated with the Trust.

Steven R. Pruchansky – Mr. Pruchansky has entrepreneurial, executive and financial experience as a senior officer and chief executive of business in the retail, service and distribution companies and a current and former director of real estate and banking companies.

Gregory A. Russo – As a retired Certified Public Accountant, Mr. Russo served as a partner and Global Vice Chairman in a major independent registered public accounting firm, as well as a member of its geographic boards of directors and International Executive Team. As a result of Mr. Russo’s diverse global responsibilities, he possesses accounting, finance and executive operating experience.

Non-Independent Trustees Standing for Election and Nominee

Andrew G. Arnott – Through his positions as Executive Vice President of John Hancock Financial Services; Director and Executive Vice President of John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC; President of John Hancock Investment Management Distributors LLC; and President of the John Hancock Fund Complex, Mr. Arnott has experience in the

management of investments, registered investment companies, variable annuities and retirement products, enabling him to provide management input to the Board.

Marianne Harrison – Through her position as President and CEO, John Hancock, and previous experience as President and CEO, Manulife Canadian Division, President and General Manager for John Hancock Long-Term Care Insurance, and Executive Vice President and Controller for Manulife, Ms. Harrison has experience as a strategic business builder expanding product offerings and distribution, enabling her to provide management input to the Board.

Paul Lorentz - Through his position as the Global Head of Manulife Wealth and Asset Management, Mr. Lorentz has experience with retirement, retail and asset management solutions offered by Manulife worldwide, enabling him to provide management input to the Board.

Duties of Trustees; Committee Structure

Each Trust is organized as a Massachusetts business trust. Under each Trust’s Declaration of Trust, the Trustees are responsible for managing the affairs of the Trust, including the appointment of advisors and subadvisors. Each Trustee and Nominee has the experience, skills, attributes or qualifications described above (see “Principal Occupation(s) and Other Directorships” and “Additional Information about the Trustees and Nominees” above). The Board appoints officers who assist in managing the day-to-day affairs of the Trust. The Board met five times during the fiscal years ended May 31, 2022 and March 31, 2022. The Board met six times during the fiscal years ended December 31, 2021 and October 31, 2021.

The Board has appointed an Independent Trustee as Chairperson. The Chairperson presides at meetings of the Trustees and may call meetings of the Board and any Board committee whenever he deems it necessary. The Chairperson participates in the preparation of the agenda for meetings of the Board and the identification of information to be presented to the Board with respect to matters to be acted upon by the Board. The Chairperson also acts as a liaison with the Funds’ management, officers, attorneys, and other Trustees generally between meetings. The Chairperson may perform such other functions as may be requested by the Board from time to time. The Board also has designated a Vice Chairperson to serve in the absence of the Chairperson. Except for any duties specified in each Trust’s Statement of Additional Information or pursuant to each Trust’s Declaration of Trust or By-laws, or as assigned by the Board, the designation of a Trustee as Chairperson or Vice Chairperson does not impose on that Trustee any duties, obligations or liability that are greater than the duties, obligations or liability imposed on any other Trustee, generally. The Board has designated a number of standing committees as further described below, each of which has a Chairperson. The Board also may designate working groups or ad hoc committees as it deems appropriate.

The Board believes that this leadership structure is appropriate because it allows the Board to exercise informed and independent judgment over matters under its purview, and it allocates areas of responsibility among committees or working groups of Trustees and the full Board in a manner that enhances effective oversight. The Board considers leadership by an Independent Trustee as Chairperson to be integral to promoting effective independent oversight of the Funds’ operations and meaningful representation of the shareholders’ interests, given the specific characteristics and circumstances of the Funds. The Board also believes that having a super-majority of Independent Trustees is appropriate and in the best interest of the Funds’ shareholders. Nevertheless, the Board also believes that having interested persons serve on the Board brings corporate and financial viewpoints that are, in the Board’s view, helpful elements in its decision-making process. In addition, the Board believes that Ms. Harrison and Messrs. Arnott and Boyle, as current or former senior executives of the Advisor and the Distributor (or of their parent company, MFC), and of other affiliates of the Advisor and the Distributor, provide the Board with the perspective of the Advisor and the Distributor in managing and sponsoring all of the Trust’s series. The leadership structure of the Board may be changed, at any time and in the discretion of the Board, including in response to changes in circumstances or the characteristics of each Trust.

Board Committees

The Board has established an Audit Committee; Compliance Committee; Contracts, Legal & Risk Committee; Investment Committee; and Nominating and Governance Committee. The current membership of each committee is set forth below.

Audit Committee. The Board has a standing Audit Committee composed solely of Independent Trustees (Messrs. Burgess and Cunningham and Ms. Rathke). Ms. Rathke serves as Chairperson of this Committee. This Committee reviews the internal and external accounting and auditing procedures of the Trusts and, among other things, considers the selection of an independent registered public accounting firm for the Trusts, approves all significant services proposed to be performed by their independent registered public accounting firm(s) and considers the possible effect of such services on their independence. Mr. Burgess has been designated by the Board as an “audit committee financial expert”, as defined in the SEC Rules. This Committee met four times during the fiscal years ended October 31, 2021, December 31, 2021, March 31, 2022, and May 31, 2022, respectively.

Compliance Committee. The Board also has a standing Compliance Committee (Mses. Fey and Jackson). Ms. Fey serves as Chairperson of this Committee. This Committee reviews and makes recommendations to the full Board regarding certain compliance matters relating to the Trusts. This Committee met four times during the fiscal years ended October 31, 2021, December 31, 2021, March 31, 2022, and May 31, 2022, respectively.

Contracts, Legal & Risk Committee. The Board also has a standing Contracts, Legal & Risk Committee (Messrs. Boyle, Pruchansky, and Russo). Mr. Russo serves as Chairperson of this Committee. This Committee oversees the initiation, operation, and renewal of the various contracts between the Trusts and other entities. These contracts include advisory and subadvisory agreements, custodial and transfer agency agreements and arrangements with other service providers. The Committee also reviews the significant legal affairs of the Funds, as well as any significant regulatory and legislative actions or proposals affecting or relating to the Funds or their service providers. The Committee also assists the Board in its oversight role with respect to the processes pursuant to which the Advisor and the subadvisors identify, manage and report the various risks that affect or could affect the Funds. This Committee met four times during the fiscal years ended October 31, 2021, December 31, 2021, March 31, 2022, and May 31, 2022, respectively.

Investment Committee. The Board also has an Investment Committee composed of all of the Trustees. The Investment Committee has four subcommittees with the Trustees divided among the four subcommittees (each an “Investment Sub-Committee”). Ms. Jackson and Messrs. Boyle, Cunningham, and Pruchansky serve as Chairpersons of the Investment Sub-Committees. Each Investment Sub-Committee reviews investment matters relating to a particular group of Funds in the John Hancock Fund Complex and coordinates with the full Board regarding investment matters. This Committee met five times during the fiscal years ended October 31, 2021, December 31, 2021, March 31, 2022 and May 31 2022, respectively.

Nominating and Governance Committee. The Board also has a Nominating and Governance Committee composed of all of the Independent Trustees. This Committee will consider nominees recommended by Trust shareholders. Nominations should be forwarded to the attention of the Secretary of the Trust at 200 Berkeley Street, Boston, Massachusetts 02116. Any shareholder nomination must be submitted in compliance with all of the pertinent provisions of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in order to be considered by this Committee. This Committee met five times during the fiscal years ended October 31, 2021, December 31, 2021, March 31, 2022, and May 31, 2022, respectively.

Shareholder nominations may be submitted to the Trust who will then forward the nominations to the Chairman of the Nominating and Governance Committee. Any shareholder nomination must be submitted in compliance with all of the pertinent provisions of Rule 14a-8 under the Exchange Act in order to be considered by the Nominating and Governance Committee. In evaluating a nominee recommended by a shareholder, the Nominating and Governance Committee, in addition to the criteria discussed above, may consider the objectives of the shareholder in submitting that nomination and whether such objectives are consistent with the interests of all shareholders. If the Board determines to include a shareholder’s candidate among the slate of its designated nominees, the candidate’s name will be placed on the Trust’s proxy card. If the Board determines not to include such candidate among its designated nominees, and the shareholder has satisfied the requirements of Rule 14a-8, the shareholder’s candidate will be treated as a nominee of the shareholder who originally nominated the candidate. In that case, the candidate will not be named on the proxy card distributed with the Trust’s proxy statement.

As noted in Exhibit A, while the re-nomination of existing Trustees will not be viewed as automatic, the Nominating and Governance Committee will generally favor the re-nomination of an existing Trustee rather than a new candidate if the re-nomination is consistent with the “Statement of Policy on Criteria for Selecting Independent Trustees” set forth in Annex A to Exhibit A. Consequently, while the Nominating and Governance Committee will consider nominees recommended by shareholders to serve as trustees, the Nominating and Governance Committee may only act upon such recommendations if there is a vacancy on the Board, or the Nominating and Governance Committee determines that the selection of a new or additional Trustee is in the best interests of the Trust. In the event that a vacancy arises or a change in the Board membership is determined to be advisable, the Nominating and Governance Committee will, in addition to any shareholder recommendations, consider candidates identified by other means as discussed in Exhibit A.

Annually, the Board evaluates its performance and that of its Committees, including the effectiveness of the Board’s Committee structure.

Risk Oversight

As registered investment companies, the Funds are subject to a variety of risks, including investment risks (such as, among others, market risk, credit risk and interest rate risk), financial risks (such as, among others, settlement risk, liquidity risk and valuation risk), compliance risks, and operational risks. As a part of its overall activities, the Board oversees the Funds’ risk management activities that are implemented by the Advisor, the Funds’ CCO and other service providers to the Funds. The Advisor has primary responsibility for the Funds’ risk management on a day-to-day basis as a part of its overall responsibilities. Each Fund’s subadvisor, subject to oversight of the Advisor, is primarily responsible for managing investment and financial risks as a part of its day-to-day investment responsibilities, as well as operational and compliance risks at its firm. The Advisor and the CCO also assist the Board in overseeing compliance with investment policies of the Funds and regulatory requirements and monitor the implementation of the various compliance policies and procedures approved by the Board as a part of its oversight responsibilities.

The Advisor identifies to the Board the risks that it believes may affect the Funds and develops processes and controls regarding such risks. However, risk management is a complex and dynamic undertaking and it is not always possible to comprehensively identify and/or mitigate all such risks at all times since risks are at times impacted by external events. In discharging its oversight responsibilities, the Board considers risk management issues throughout the year with the assistance of its various Committees as described below. Each Committee meets at least quarterly and presents reports to the Board, which may prompt further discussion of issues concerning the oversight of the Funds’ risk management. The Board as a whole also reviews written reports or presentations on a variety of risk issues as needed and may discuss particular risks that are not addressed in the Committee process.

The Board has established an Investment Committee, which consists of four Investment Sub-Committees. Each Investment Sub-Committee assists the Board in overseeing the significant investment policies of the relevant Funds and the performance of their subadvisors. The Advisor monitors these policies and subadvisor activities and may recommend changes in connection with the Funds to each relevant Investment Sub-Committee in response to subadvisor requests or other circumstances. On at least a quarterly basis, each Investment Sub-Committee reviews reports from the Advisor regarding the relevant Funds’ investment performance, which include information about investment and financial risks and how they are managed, and from the CCO or his/her designee regarding subadvisor compliance matters. In addition, each Investment Sub-Committee meets periodically with the portfolio managers of the Funds’ subadvisors to receive reports regarding management of the Funds, including with respect to risk management processes.

The Audit Committee assists the Board in reviewing with the independent auditors, at various times throughout the year, matters relating to the Funds’ financial reporting. In addition, this Committee oversees the process of each Fund’s valuation of its portfolio securities, assisted by the Funds’ Pricing Committee (composed of officers of the Trusts), which calculates fair value determinations pursuant to procedures adopted by the Board.

The Compliance Committee assists the Board in overseeing the activities of the Trusts’ CCO with respect to the compliance programs of the Funds, the Advisor, the subadvisors, and certain of the Funds’ other service providers (the Distributor and transfer agent). This Committee and the Board receive and consider periodic reports from the CCO throughout the year, including the CCO’s annual written report, which, among other things, summarizes material compliance issues that arose during the previous year and any remedial action taken to address these issues, as well as any material changes to the compliance programs.

The Contracts, Legal & Risk Committee assists the Board in its oversight role with respect to the processes pursuant to which the Advisor and the subadvisors identify, assess, manage and report the various risks that affect or could affect the Funds. This Committee reviews reports from the Funds’ Advisor on a periodic basis regarding the risks facing the Funds, and makes recommendations to the Board concerning risks and risk oversight matters as the Committee deems appropriate. This Committee also coordinates with the other Board Committees regarding risks relevant to the other Committees, as appropriate.

In addressing issues regarding the Funds’ risk management between meetings, appropriate representatives of the Advisor communicate with the Chairperson of the Board, the relevant Committee Chair, or the Trusts’ CCO, who is directly accountable to the Board. As appropriate, the Chairperson of the Board, the Committee Chairs and the Trustees confer among themselves, with the Trusts’ CCO, the Advisor, other service providers, external fund counsel, and counsel to the Independent Trustees, to identify and review risk management issues that may be placed on the full Board’s agenda and/or that of an appropriate Committee for review and discussion.

In addition, in its annual review of the Funds’ advisory, subadvisory and distribution agreements, the Board reviews information provided by the Advisor, the subadvisors, and the Distributor relating to their operational capabilities, financial condition, risk management processes and resources.

The Board may, at any time and in its discretion, change the manner in which it conducts its risk oversight role.

The Advisor also has its own, independent interest in risk management. In this regard, the Advisor has appointed a Risk and Investment Operations Committee, consisting of senior personnel from each of the Advisor’s functional departments. This Committee reports periodically to the Board and the Contracts, Legal & Risk Committee on risk management matters. The Advisor’s risk management program is part of the overall risk management program of John Hancock, the Advisor’s parent company. John Hancock’s Chief Risk Officer supports the Advisor’s risk management program, and at the Board’s request will report on risk management matters.

Compensation of Trustees

Each Trust pays fees to its Independent Trustees. Trustees are reimbursed for travel and other out-of-pocket expenses. The following tables show the compensation paid to each Independent Trustee for his or her service as a Trustee for the most recent fiscal years or periods indicated. Each Independent Trustee receives in the aggregate from the Trust and the other open-end funds in the John Hancock Fund Complex an annual retainer of $265,000, a fee of $22,000 for each regular meeting of the Trustees (in person or via videoconference or teleconference) and a fee of $5,000 for each special meeting of the Trustees (in person or via videoconference or teleconference). The Chairperson of the Board receives an additional retainer of $180,000. The Vice Chairperson of the Board receives an additional retainer of $20,000. The Chairperson of each of the Audit Committee, Compliance Committee, and Contracts, Legal & Risk Committee receives an additional $40,000 retainer. The Chairperson of each Investment Sub-Committee receives an additional $20,000 retainer.

The following tables provide information regarding the compensation paid by the Trusts and the other investment companies in the John Hancock Fund Complex to the Independent Trustees for their services during the most recent fiscal years. In these tables, the amount shown for each of Noni L. Ellison, Dean Garfield, and Patricia Lizarraga for all periods is “None” since each of these individuals is proposed to be elected to the Board of each Trust and does not currently serve as an Independent Trustee. For all periods shown below, each Trust did not pay compensation to the current Non-Independent Trustees or the Non-Independent Trustee Nominee, Paul Lorentz

Compensation for Fiscal Year Ended October 31, 2021

| Independent Trustee | Total Compensation from Capital Series ($) | Total Compensation from Investment Trust1 ($) | Total Compensation from Investment Trust II ($) | Total Compensation from the John Hancock Fund Complex ($)2 |

| Bardelis3 | 6,271 | 25,842 | 2,470 | 420,000 |

| Boyle | 6,271 | 25,842 | 2,470 | 420,000 |

| Burgess | 6,603 | 27,189 | 2,601 | 440,000 |

| Cunningham | 6,271 | 25,842 | 2,470 | 420,000 |

| Fey | 6,603 | 27,189 | 2,601 | 440,000 |

| Jackson | 6,271 | 25,842 | 2,470 | 420,000 |

| McClellan | 8,593 | 35,272 | 3,384 | 560,000 |

| Oates4 | 2,703 | 11,312 | 1,110 | 199,000 |

| Pruchansky | 6,271 | 25,842 | 2,470 | 420,000 |

| Rathke | 5,849 | 24,140 | 2,306 | 395,000 |

| Russo | 6,603 | 27,189 | 2,601 | 440,000 |

| Ellison | None | None | None | None |

| Garfield | None | None | None | None |

| Lizarraga | None | None | None | None |

| (1) | The following funds of John Hancock Investment Trust have fiscal years that end on October 31: John Hancock Balanced Fund, John Hancock Disciplined Value International Fund, John Hancock Diversified Macro Fund, John Hancock Emerging Markets Equity Fund, John Hancock ESG International Equity Fund, John Hancock ESG Large Cap Core Fund, John Hancock Fundamental Large Cap Core Fund, John Hancock Global Environmental Opportunities Fund, John Hancock Global Thematic Opportunities Fund, John Hancock Infrastructure Fund, John Hancock International Dynamic Growth Fund, John Hancock Seaport Long/Short Fund, and John Hancock Small Cap Core Fund. |

| (2) | There were approximately 191 series in the John Hancock Fund Complex as of October 31, 2021. |

| (3) | Mr. Bardelis retied as Trustee effective as of December 31, 2021. |

| (4) | Mr. Oates retired as Trustee effective as of April 30, 2021. |

Compensation for Fiscal Year Ended December 31, 2021

| Independent Trustee | Total Compensation from Collateral Trust ($) | Total Compensation from the Trust and the John Hancock Fund Complex($)1 |

| Bardelis2 | 4,469 | 420,000 |

| Boyle | 4,469 | 420,000 |

| Burgess | 4,469 | 440,000 |

| Cunningham | 4,469 | 420,000 |

| Fey | 4,469 | 440,000 |

| Jackson | 4,469 | 420,000 |

| McClellan | 4,469 | 560,000 |

| Oates3 | 2,085 | 177,000 |

| Pruchansky | 4,469 | 420,000 |

| Rathke | 4,455 | 395,000 |

| Russo | 4,469 | 440,000 |

| Ellison | None | None |