U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SB-2

Amendment No. 4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MANEKI MINING INC.

(Exact name of Registrant as specified in its charter)

NEVADA 1041 Gold Ores 98-0441032

(State or other jurisdiction of (SIC Code) (I.R.S. Employer

Incorporation or organization) Identification Number)

MANEKI MINING INC. SEAN PHILIP WATKINSON

4462 John Street. 4462 John Street,

Vancouver, B.C. Canada V5V 3X1 Vancouver, B.C. Canada V5V 3X1

(Name and address of principal (Agent for service of process)

executive offices)

Registrant’s telephone number, including area code: 604-764-6552

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of

this Registration Statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box.

If this Form is filed to register securities for an offering to be made on a continuous or delayed basis pursuant to Rule 415 under the Securities Act, check the following box. [X]

CALCULATION OF REGISTRATION FEE

TITLE OF EACH

CLASS OF

SECURITIES

TO BE

REGISTERED |

AMOUNT TO BE

REGISTERED | PROPOSED

MAXIMUM

OFFERING

PRICE PER

SHARE (1) | PROPOSED

MAXIMUM

AGGREGATE OFFERING

PRICE (1) |

AMOUNT OF

REGISTRATION FEE (1) |

| Common Stock | 1,750,000 shares | $0.02 | $35,000 | $4.12 |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE RERGISTRATION SHALL BECOME EFFECTIVE ON SUCH A DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

COPIES OF COMMUNICATION TO:

Stepp Law Group

32 Executive Park, Suite 105

Irvine, California 92614-6742

Tel: (949) 660-9700

SUBJECT TO COMPLETION, Dated November 30 , 2005

PROSPECTUS

MANEKI MINING INC.

1,750,000 SHARES

COMMON STOCK

The selling shareholders named in this are offering the 1,750,000 shares of our common stock offered through this prospectus. We will not receive any proceeds from this offering. We have set an offering price for these securities of $0.02 per share of our common stock offered through this prospectus.

| Offering Price | Underwriting Discounts and Commissions | Proceeds to Selling Shareholders |

Per Share | $0.02 | None | $0.02 |

Total | $35,000 | None | $35,000 |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at 0.02 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the NASD Over-The-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board electronic quotation service, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled “Risk Factors” on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may not be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: November 30, 2005

Table of Contents

Summary …………………………………………………………………………………………….4

Risk Factors ………………………………………………………………………...……………….6

Risks Related To Our Financial Condition and Business Model

- If we do not obtain additional financing, our business will fail ……………………...……..6

- We have yet to attain profitable operations and because we will need additional

financing to fund our exploration activities, our accountants believe there is substantial

doubt about the company’s ability to continue as a going concern ………………........….6

- Because our executive officer does not have formal training specific to the technicalities

of mineral exploration, there is a higher risk our business will fail .………………………. 7

- Since this is an exploration project, we face a high risk of business failure due to our

inability to predict the success of our business ……......………………………..………..7

- Because of the speculative nature of exploration of mining properties, there is

substantial risk that no commercially exploitable minerals will be found and our

business will fail ………...…..………………………………….....……………………7

- Even if we discover commercial reserves of precious metals on our mineral claim, we

may not be able to successfully obtain commercial production ……….………………….8

- Because we anticipate our operating expenses will increase prior to our earning

revenues, we may never achieve profitability …………………………………...……….8

- If competition for mineral claims in our area increases, the costs associated with

acquiring additional claims may increase and the availability may decrease;

therefore, we may not be able to acquire additional claim in our area of interest,

or any other areas affected by increased competition ………………………………...…..8

- Because of the inherent dangers involved in mineral exploration, there is a risk that

we may incur liability or damages as we conduct our business…………………..……….8

- Because access to our mineral claim may be restricted by inclement weather, we

may be delayed in our exploration ………………………………………………….…..8

- Because our president has only agreed to provide his services on a part-time basis,

he may not be able or willing to devote a sufficient amount of time to our business

operations, causing our business to fail………………………………………………..…9

- Because our president and sole director is a Canadian resident, difficulty may arise

in attempting to effect service or process on him in Canada ……………………………..9

- Because Mr. Eliopulos is a consultant to our compny and also a principal of the

company which owns the Poison Gulch claims, there is potential for a conflict of interest ...9

Risks Related To Legal Uncertainty and Regulations

- As we undertake exploration of our mineral claims, we will be subject to

compliance with government regulation that may increase the anticipated cost

of our exploration program ………………………………………..……………………9

Risks Related To This Offering

- If a market for our common stock does not develop, shareholders may be unable

to sell their shares …………………………………………………………..…………10

- If a market for our common stock develops, our stock price may be volatile …….……..10

- If the selling shareholders sell a large number of shares all at once or in blocks,

the market price of our shares would most likely decline ………………………..…..….10

- Because our stock is a penny stock, shareholders will be more limited in their

ability to sell their stock ………………………………………………………….....…10

Use of Proceeds ……………………………………………………………………………....……11

Determination of Offering Price …………………………………………………………………..…11

Dilution ………………………………………………………………………………………….....12

Selling Shareholders ………………………………………………………………………………..12

Plan of Distribution ……………………………………………………………………………....…14

Legal Proceedings …………………………………………………………………………….……15

Directors, Executive Officers, Promoters and Control Persons ………………………………...……15

Security Ownership of Certain Beneficial Owners and Management …………………………...........17

Description of Securities …………………………………………...………………………………18

Interest of Named Experts and Counsel …………………………………………………….…...…19

Disclosure of Commission Position of Indemnification for Securities Act Liabilities …..........……...….20

Organization within Last Five Years …………………………………………………….……....….20

Description of Business ………………………………………………………………….….…...…21

Plan of Operations …………………………………………………………………….………...…27

Certain Relationships and Related Transactions …………………………………��…….……....…30

Market for Common Equity and Related Stockholder Matters ……………………………..……….31

Executive Compensation ………………………………………………………………..……….…33

Financial Statements …………………………………………………………………….…………34

Changes in and Disagreements with Accountants …………………………………………...………53

Where You Can Find More Information …….………………………………………….………..…53

As used in this prospectus, unless the context otherwise requires, “we”, “us”, “our” “Maneki” refers to Maneki Mining Inc. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common shares.

Maneki Mining Inc.

We are in the business of mineral exploration. On December 3, 2004, we entered in a Mineral Lease Agreement whereby we leased from Ammetco Resources a total of eight (8) unpatented lode mining claims which we refer to as the Poison Gulch mineral claims. The Poison Gulch mineral claims are located in Owyhee County, Idaho. We leased the mineral claims from Ammetco Resources of Vancouver B.C., Canada. The Poison Gulch claims are 100% owned by Nevada Mine Properties II, Inc. of Reno, Nevada. The claims were leased to Prism Resources on November 15th 1996. Prism Resources changed its name to Ammetco Resources on October 18th 2002.

Our plan of operations is to conduct mineral exploration activities on the Poison Gulch mineral claims in order to assess whether these claims possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of gold, silver or any other valuable minerals. We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claims. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

Prior to acquiring a lease on the Poison Gulch mineral claims, we retained the services of Ken Brook, a Registered Professional Geologist. Mr. Brook prepared a geological report for us on the mineral exploration potential of the claims. Included in this report is a recommended three-phased exploration program which consists of staking additional claims, geological mapping, sampling, drill target development, and drilling. The first phase of the mineral exploration program consisting of geological mapping and sampling is oriented toward defining drill targets on mineralized zones within the Poison Gulch mineral claims.

At this time we are uncertain of the number of mineral exploration phases we will conduct before concluding that there are, or are not, commercially viable minerals on our claims. Further phases beyond the current exploration program will be dependent upon the number of factors such as our consulting geologist’s recommendations based upon ongoing exploration program results and our available funds.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. The summarized financial data presented below is derived from and

should be read in conjunction with our audited March 31, 2005 financial statements, including the notes those financial statements, which are included elsewhere in this prospectus.

Balance Sheet Data September 30, 2005 June 30, 2005 March 31, 2005

(unaudited) (unaudited) (audited)

Cash $ 18,056 $ 35,192 $ 33,066

Total Current Assets $ 23,056 $ 36,692 $ 37,252

Liabilities $ - $ 4,936 $ -

Total Stockholder’s Equity $ 23,056 $ 31,756 $ 37,252

Statement of Loss and Deficit |

|

|

From November 22, |

|

| 3 months ended September 30, 2005 | 6 months ended September 30, 2005 | 2005 (Inception) to September 30, 2005 |

| (unaudited) | (unaudited) | (unaudited) |

Revenue | $ - | $ - | $ - |

Net Loss for the Period | $ 5,372 | $ 21,446 | $ 26,944 |

|

|

|

|

|

We were incorporated on November 22, 2004 under the laws of the State of Nevada. Our principal offices are located at 4462 John Street, Vancouver, British Columbia, Canada. Our telephone number is (604) 764-6552.

The Offering

Securities Being Offered Up to 1,750,000 shares of our common stock.

Offering Price The offering price of the common stock is $0.02 per share.

We intend to apply to the NASD Over-the-Counter Bulletin

Board electronic quotation service to allow the trading of our

common stock upon our becoming a reporting entity under the

Securities Exchange Act of 1934. If our common stock

becomes so traded and a market for the stock develops, the

actual price of stock will be determined by prevailing market

prices at the time of sale or by private transaction negotiated

by the selling shareholders. The offering price would thus be

determined by market factors and the independent decisions of

the selling shareholders.

Minimum Number of Shares None

To Be Sold in This Offering

Securities Issued and to be Issued 3,250,000 shares of our common stock are issued and

outstanding as of the date of this prospectus. All of the

common stock to be sold under this prospectus will be sold by

existing shareholders and thus there will be no increase in our

issued and outstanding shares as a result of this offering. The

issuance to the selling shareholders was exempt due to the

provisions of Regulation S.

Use of Proceeds We will not receive any proceeds from the sale of the common

stock by the selling shareholders.

Risk Factors See “Risk Factors” and the other information in this

prospectus for a discussion of the factors you should consider

before deciding to invest in our common shares.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail

Our current operating funds will only cover part of the first phase of our exploration program. In order for us to perform any further exploration or extensive testing we will need to obtain additional financing. We currently do not have any operations and we have no income. Our business plan calls for significant expenses in connection with the exploration of our mineral claims. We will require additional financing to conduct our planned exploration programs. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We estimate that we will require approximately $235,000 in additional capital to carry through with our current business model. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Although we have no arrangements in place for any future equity financing, in the case that we did conduct a financing from the sale of our common stock, this finan cing would have a dilutive impact on our stockholders and could negatively affect the stock price. Obtaining additional financing would be subject to a number of factors, including the market prices for gold, silver and other minerals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe there is substantial doubt about the company’s ability to continue as a going concern

We have incurred a net loss of $26,944 for the period from November 22, 2004 (inception) to September, 2005 and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claim. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. Our auditors have made reference to the substantial doubt as to our ability to continue as a going concern in their audit report on our audited financial statements for the year ended March 31, 2005. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Because our executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail

Sean Philip Watkinson, our president and sole director has no formal training as a geologist or engineer. Additionally, he has never managed any company involved in mineral exploration or in starting or operating a mine. With no direct training or experience in these areas, our management may not be fully aware of many of the specific requirements related to working within this industry and hence may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Watkinson’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our lack of experience in this industry.

Since this is an exploration project, we face a high risk of business failure due to our inability to predict the success of our business

We are in the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on November 22, 2004 and to date have been involved primarily in organizational activities and the acquisition of the Poison Gulch property. We have not earned any revenues as of the date of this prospectus.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold, silver or other minerals in our leased mineral claim. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. The probability of an individual leased mineral claim ever having commercially exploitable

reserves is extremely remote, and in all probability our leased mineral claims do not contain any reserves, and any funds spent on the exploration of these claims will probably be lost. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Even if we discover commercial reserves of precious metals on our mineral claim, we may not be able to successfully obtain commercial production

Our mineral claim does not contain any known reserves of precious metals.. If our exploration programs are successful in discovering commercially exploitable reserves of precious metals, we will require additional funds in order to place the mineral claim into commercial production. At this time, there is a risk that we will not be able to obtain such financing as and when needed. It is premature to estimate the amount required to place the mineral claim into commercial production, as we do not have sufficient information about the claims.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claim, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

If competition for mineral claims in our area increases, the costs associated with acquiring additional claims may increase and the availability may decrease, therefore we may not be able to acquire additional claims in our area of interest, or any other areas affected by increased competition

Any increase in competition for mineral claims in the Poison Gulch area or any other area we find attractive to acquire additional claims, could increase the cost of acquiring additional mineral claims and/or reduce the availability of properties of merit. This could make it too expensive or impossible for us to acquire additional claims

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Because access to our mineral claim may be restricted by inclement weather, we may be delayed in our exploration

Once exploration begins, access to the claim may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our exploration efforts.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Our President is employed on a full time basis by another company. Because we are in the early stages of our business, Mr. Watkinson will not be spending a significant amount of time on our business. Mr. Watkinson expects to expend approximately 6 hours per week on our business. Competing demands on Mr. Watkinson's time may lead to a divergence between his interests and the interests of other shareholders.

Because our President and sole director is a Canadian Resident, difficulty may arise in attempting to effect service or process on him in Canada

Because Mr. Sean Philip Watkinson our sole director and officer, is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada or in enforcing a judgment against Maneki Mining's assets located outside of the United States .

Because Mr. Eliopulos is a consultant to our company and also a principal of the company which owns the Poison Gulch claims, there is potential for a conflict of interest

Mr. George J. Eliopulos entered into a service agreement with Maneki Mining Inc. on January 18th 2005 to serve as an independent consultant to our Company. Mr. Eliopulos is also a principal of Nevada Mine Properties II, the 100% owner of the Poison Gulch claims which Maneki Mining Inc. leases from Ammetco Resources. Because of this situation there is potential for a conflict of interest.

Risks Related To Legal Uncertainty and Regulations

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the State of Idaho as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We currently have budgeted $2,000 for regulatory compliance.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

There is currently no market for our common stock and a market may never develop. We currently plan to apply for listing of our common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, a public market may never materialize. If our common stock is not traded on the Over-the-Counter Bulletin Board electronic quotation service or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If a market for our common stock develops, our stock price may be volatile

If a market for our common stock develops, we anticipate that the market price of our common stock will be subject to wide fluctuations in response to several factors, including:

- the results of our geological exploration program;

- our ability or inability to arrange for financing;

- commodity prices for gold, silver or other minerals; and

- conditions and trends in the mining industry.

Further, if our common stock is traded on the Over-the-Counter Bulletin Board electronic quotation service, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline

The selling shareholders are offering 1,750,000 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 53.8% of the common shares outstanding as of the date of this prospectus.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock

The shares offered by this prospectus constitute a penny stock under the Securities and Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. Penny stocks generally are equity securities with a price of less than $5.00. Broker/dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker/dealer, and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules: the broker/dealer must make a special written determination that a penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of price fluctuations in the price of the stock and may reduce the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules, and accordingly, investors in this offering may find it difficult to sell their securities, if at all.

Forward-Looking Statements

This Prospectus contains forward-looking statements, including statements concerning possible or assumed results of exploration and/or operations of Maneki Mining Inc., and those proceeded by, followed by or that include the words “may,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of such terms and other comparable terminology. Investors should understand that the factors described below, in addition to those discussed elsewhere in this document could affect Maneki’s future results and could cause those results to differ materially from those expressed in such forward looking statements.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

The $0.02 per share offering price of our common stock was determined arbitrarily by us. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value. We intend to apply to the Over-the-Counter Bulletin Board electronic quotation service for the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders named in this prospectus.

Dilution

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 1,750,000 shares of common stock offered through this prospectus. The selling shareholders acquired the 1,750,000 shares of common stock offered through this prospectus from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) and completed on April 5th 2005. We will file with the Securities and Exchange Commission prospectus supplements to specify the names of any successors to the selling shareholders specified in this registration statement who are able to use the prospectus included in this registration statement to resell the shares registered by this registration statement.

The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

1. | the number of shares owned by each prior to this offering; |

2. | the total number of shares that are to be offered by each; |

3. | the total number of shares that will be owned by each upon completion of the offering; |

4. | the percentage owned by each upon completion of the offering; and |

5.

| the identity of the beneficial holder of any entity that owns the shares.

|

Name Of Selling Stockholder | Shares

Owned Prior

to this

Offering | Total Number of

Shares to Be

Offered for Selling

Shareholder

Account | Total Shares

to be Owned

Upon

Completion of this Offering | Percent

Owned Upon

Completion of this Offering |

David Black | 50,000 | 50,000 | nil | nil |

Lindsey Black | 12,500 | 12,500 | nil | nil |

Vlatka Bralic | 12,500 | 12,500 | nil | nil |

Charles Aaron Brezer | 150,000 | 150,000 | nil | nil |

Paul Condon | 12,500 | 12,500 | nil | nil |

Aleisha Friesen | 12,500 | 12,500 | nil | nil |

Jason Friesen | 12,500 | 12,500 | nil | nil |

Mike Kilgallin | 12,500 | 12,500 | nil | nil |

Sean H. Kilgallin | 50,000 | 50,000 | nil | nil |

Jason Kinnear | 12,500 | 12,500 | nil | nil |

Tony Klaassen | 50,000 | 50,000 | nil | nil |

Richard Lee Middlemiss | 150,000 | 150,000 | nil | nil |

Shaun Minten | 12,500 | 12,500 | nil | nil |

Thais O’Reilly | 12,500 | 12,500 | nil | nil |

Jim O’Toole | 300,000 | 300,000 | nil | nil |

Renee Parker | 12,500 | 12,500 | nil | nil |

Susan Parker | 12,500 | 12,500 | nil | nil |

Tim Paterson | 150,000 | 150,000 | nil | nil |

Robert Perry | 150,000 | 150,000 | nil | nil |

Jennifer Posnikoff | 12,500 | 12,500 | nil | nil |

Paula Simonsen | 12,500 | 12,500 | nil | nil |

Tim Stanford | 12,500 | 12,500 | nil | nil |

Janna Stephenson-Kinnear | 12,500 | 12,500 | nil | nil |

Pauline Vallee | 12,500 | 12,500 | nil | nil |

Joe Vallee | 12,500 | 12,500 | nil | nil |

Sheila VanDongen | 12,500 | 12,500 | nil | nil |

Bryan Velve | 50,000 | 50,000 | nil | nil |

Luciana Velve | 12,500 | 12,500 | nil | nil |

Kathy Watkinson | 300,000 | 300,000 | nil | nil |

Paul Watkinson | 12,500 | 12,500 | nil | nil |

Rena Elizabeth Watkinson | 50,000 | 50,000 | nil | nil |

Vicken Yeterian | 50,000 | 50,000 | nil | nil |

TOTAL | 1,750,000 | 1,750,000 | | |

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

Other than Rena Elizabeth Watkinson, the mother of Sean Philip Watkinson, Paul Watkinson, the father of Sean Philip Watkinson, and Kathy Watkinson, the sister of Sean Philip Watkinson, our sole officer and director, none of the selling shareholders:

(1) has had a material relationship with us other than as a shareholder at any time within the past three years; or

(2) has ever been one of our officers or directors.

Plan of Distribution

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

1. | On such public markets as the common stock may from time to time be trading; |

2. | In privately negotiated transactions; |

3. | Through the writing of options on the common stock; |

4. | In short sales; or |

5. | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.02 per share until such time as the shares of our common stock are traded on the Over-the-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the Over-the-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the Over-the-Counter Bulletin Board electronic quotation service, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. | The market price of our common stock prevailing at the time of sale; |

2. | A price related to such prevailing market price of our common stock; or |

3. | Such other price as the selling shareholders determine from time to time. |

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders named in this prospectus.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling shareholders and any broker-dealers who execute sales for the selling shareholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. | Not engage in any stabilization activities in connection with our common stock;

|

2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

|

3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

Legal Proceedings

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Nevada Agency and Trust, 50 West Liberty Street, Suite 880, Reno, Nevada 89501.

Directors, Executive Officers, Promoters and Control Persons

Our executive officers and directors and their respective ages as of November 30, 2005 are as follows:

Name | Age | Office(s) Held |

| | |

Sean Philip Watkinson | 29 | President, Secretary and Treasurer and Sole Director |

Set forth below is a brief description of the background and business experience of our sole officer and director.

Mr. Sean Philip Watkinson, is our president, secretary and treasurer and our sole director. Mr. Watkinson has been our president, secretary and treasurer and our sole director since our incorporation on November 22, 2004. Mr. Watkinson is also presently a real estate agent with

Re/Max Crest Realty (Westside) and has been with Re/Max since June 2002. Mr. Watkinson graduated from the University of British Columbia with a Bachelor of Arts in Geography in 2000. Mr. Watkinson was employed by the Vancouver School Board between graduation from the University of British Columbia in 2000 and his return in 2002. Mr. Watkinson then received his real estate licence through the Sauder School of Business at the University of British Columbia in 2002.

There are no orders, judgements, or decrees of any governmental agency or administrator, or of any court of competent jurisdiction, revoking or suspending for cause any license, permit or other authority to engage in the securities business or in the sale of a particular security or temporarily or permanently restraining Mr. Watkinson from engaging in or continuing any conduct, practice or employment in connection with the purchase or sale of securities, or convicting him of any felony or misdemeanor involving a security, or any aspect of the securities business or of theft or of any felony.

Compensation

We presently do not pay our sole director and officer any salary or consulting fee. We do not anticipate paying compensation to our sole director and officer for the foreseeable future.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We have no significant employees other than our President. We conduct our business through agreements with consultants and arms-length third parties. Mr. George J. Eliopulos is the only consultant we currently have an ongoing agreement with. Mr. Eliopulos charges the company for rendered to the company at the request of our President. Mr. Eliopolus at present is being utilized for his close proximity to the Poison Gulch property, in terms of filing fees and monitoring the property. Mr. Ken Brook a Consulting Geologist was retained by the Company to prepare a report on the Poison Gulch claims, dated December 2, 2004.

Consultants

On January 18th 2005, Maneki signed a service agreement between the company and George J. Eliopulos. Mr. Eliopulos is to serve as an independent consultant and not as an employee of the company. Mr. Eliopulos’ vast mining experience will add to the company’s expertise. Mr. Eliopulos is presently the

Senior Geologist for Altair Nanomaterials Inc., and has occupied this position since February 1998. Previously, Mr. Eliopulos was a Consulting Geologist for North Mining Inc., where he was responsible for the supervision of exploration drilling and budgeting for two mineral prospects in Oregon, from February 1997 to January 1998. From November 1994 to February 1997 he was the Consulting Geologist at Barrick Bullfrog, Inc. Mr. Eliopulos was also the Senior Geologist for Rio Algon Exploration, Inc. from January 1990 to August 1994, a Geologist for J. Prochnau & Co. from January 1985 to Dec. 1989, a Geologist for Tenneco Minerals Corporation from January 1977 to December 1984, a Geologist for Texasgulf, Inc., from June 1975 to December 1976, and a Mine Geologist with Homestake Mining Co. previous to that.

Committees of the Board of Directors

We presently do not have an audit committee, compensation committee, nominating committee, an executive committee of our board of directors, stock plan committee or any other committees. However, our board of directors is considering establish various committees in the future. We have no financial expert on our Board of Directors. We believe the cost related to retaining a financial expert at this time is prohibitive. Further, because of our start-up operations, we believe the services of a financial expert are not warranted.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of November 30, 2005 by:

i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities,

ii) each of our directors,

iii) named executive officers, and

iv) officers and directors as a group. Unless otherwise indicated, the shareholders listed possess sole voting and investment power with respect to the shares shown.

Title of Class | Name and Address of Beneficial

Owner | Amount and

Nature of

Beneficial Ownership | Percentage of

Common Stock (1) |

Directors and Officers | | | |

Common Stock | Sean Watkinson

4462 John St.

Vancouver, BC V5V 3X1

Canada | 1,000,000

Direct | 30.77% |

Significant Shareholders | | | |

Common Stock | Mark Hammer

74 W.14th Ave.

Vancouver, BC V5Y 1W6

Canada | 500,000

Direct | 15.38% |

Common Stock | Jim O’Toole

2869 Highbury St.

Vancouver, BC V6R 3T7 | 300,000

Direct | 9.23% |

Common Stock | Kathy Watkinson

863 E. 15th Ave.

Vancouver, BC V5T 2S1 | 300,000

Direct | 9.23% |

(1) | The percentage of common stock held is based on 3,250,000 shares of common stock issued and outstanding as of November 30, 2005. |

We are not aware of any arrangements that may result in "changes in control" as that term is defined by the provisions of Item 403(c) of Regulation S-B.

We believe that all persons named have full voting and investment power with respect to the shares indicated, unless otherwise noted in the table. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a "beneficial owner" of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

Description of Securities

General

Our authorized capital stock consists of 75,000,000 shares of common stock, with a par value of $0.001 per share. As of November 30, 2005, there were 3,250,000 shares of our common stock issued and outstanding that were held by thirty four (34) stockholders of record. There are no preferred shares authorized or issued.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy. Holders of our common stock representing thirty three and one-third percent (33 1/3%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividend Policy

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute does not apply to our company.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Williams & Webster, P.S., our independent certified public accountants, have audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Williams & Webster, P.S. has presented their report with respect to our audited financial statements. The report of Williams & Webster on the financial statements herein includes an explanatory paragraph that states that we have not generated revenues and have an accumulated deficit since inception which raises substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Stepp Law Group, a professional corporation, our independent legal counsel, has provided an opinion on the validity of our common stock.

Ken Brook, a Registered Professional Geologist, has provided us with a geological report on the mineral claims. We employed Ken Brook, on a flat rate consulting fee and he has no interest, nor does he expect any interest in the property or securities of Maneki Mining Inc.

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

Our articles of incorporation provide that we will indemnify an officer, director, or former officer or director, to the full extent permitted by law. We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act of 1933 is against public policy as expressed in the Securities Act of 1933, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court's decision.

Insofar as indemnification for liabilities resulting from the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in that Act and is, therefore, unenforceable.

Organization within Last Five Years

We were incorporated on November 22, 2004 under the laws of the State of Nevada. Our president, Mr. Sean Watkinson, is our sole promoter. Mr. Watkinson purchased 1,000,000 shares of our common stock effective January 5, 2005 for an aggregate purchase price of $10,000.

We signed a Mineral Lease Agreement for eight mineral claims, located in Owyhee County, Idaho with Ammetco Resources on December 3, 2004. Maneki Mining Inc. does not, nor ever had a relationship with Ammetco Resources aside from the lease of this property.

Description of Business

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold a lease on eight unpatented lode mining claims that we refer to as the Poison Gulch claims. Further exploration of these mineral claims is required before a final determination as to their viability can be made. Although exploratory work on the claims conducted prior to our obtaining a lease on the property has indicated some potential showings of mineralization, we are uncertain as to the potential existence of a commercially viable mineral deposit existing on the Poison Gulch claims. The results of exploratory work of prior companies are reported in the geological report entitled Summary Report for the Poison Gulch Property Owyhee County, Idaho, prepared for us by Ken Brook, a Registered Professional Geologist.

The Poison Gulch claims are located on federal lands. They are unpatented mining claims located on the public domain of the USA, that is, on lands administered by the Bureau of Land Management-Department of Interior. The claims must also be recorded in the State of Idaho, County of Owyhee.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of gold, silver or any other valuable minerals. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

Mineral Lease Agreement between Maneki Mining Inc. and Ammetco Resources

We entered into a lease agreement with Ammetco Resources on December 3, 2004, granting Maneki the exclusive right to explore, develop, and mine the Property for gold, silver, and other valuable minerals. The Property consists of eight unpatented lode mining claims located in Owyhee County and hereon referred to as the Poison Gulch Property. We selected this property based upon an independent geological report which we commissioned from Ken Brook, a Registered Professional Geologist, and his 1991 visit to the property, (See section below “Summary Report for the Poison Gulch Property Owyhee County, Idaho, Dated December 2, 2004) Mr. Brook recommended that we take a three-phased exploration approach to this property.

Terms of the lease require that we timely and properly pay the Federal, State, and County annual mining claim maintenance or rental fees, and shall execute and record or file, as applicable, proof of payment of these fees and of Ammetco Resources’ intention to hold the unpatented mining claims which constitute the Property. As well, any additional claims located or acquired by us within three miles from the exterior boundaries of the Poison Gulch claims shall be subject to the terms of this lease.

According to the lease Maneki has agreed to pay Ammetco Resources minimum payments which shall be paid in advance. Maneki paid Ammetco the sum of $4,000 upon execution of this lease. Maneki has the right to extend the lease upon payment of $5,000 on or before the first anniversary of the execution of the lease. Maneki has agreed to pay $10,000 on or before the second anniversary

of the execution of the lease. Maneki has agreed to pay $10,000 on or before the third anniversary of the execution of the lease. Maneki has agreed to pay $15,000 on or before the fourth anniversary of the execution of the lease. Maneki has also agreed that each annual payment beginning with the fifth anniversary will be $50,000 plus an annual increase or decrease equivalent to the rate of inflation. The buyout price of the claims under the lease is $5,000,000 (five million dollars) from which advance royalty payments, made up to the date of the buyout, may be subtracted from the buyout price Maneki will pay Ammetco a perpetual one-half percent (0.5%) royalty on net smelter returns thereafter. Ammetco shall be paid the production royalty quarterly by certified check by Maneki.

During the term of the agreement Maneki will pay Ammetco, as a landowner’s production royalty, a percentage of the net smelter returns from the sale of any valuable minerals, ore and product mined and sold from the property. “Net Smelter Returns” are defined in the lease agreement as the gross revenues actually received by Maneki from the sales of any valuable minerals extracted and produced from the property less the folloing charges:

- All costs to Maneki of weighing, sampling, determining moisture content and packaging such material and of loading and transporting it to the point of sale, including insurance and in-transit security costs.

- All smelter costs and all charges and penalties imposed by the smelter, refinery, or purchaser.

- Marketing costs and commissions.

The term of the lease is for twenty (20) years, renewable for an additional twenty (20) years so long as conditions of the lease are met.

Description and Location of the Poison Gulch mineral claims

The Poison Gulch Property claims consist of eight unpatented lode claims located in Owyhee County, Idaho.

Claim Name | BLM Serial Number |

Poison #1 | IMC # 179121 |

Poison #2 | IMC # 141587 |

Poison #3 | IMC # 141588 |

Poison #4 | IMC # 179122 |

Poison #5 | IMC # 179123 |

Poison #6 | IMC # 141591 |

Poison #7 | IMC # 141592 |

Poison #8 | IMC # 179124 |

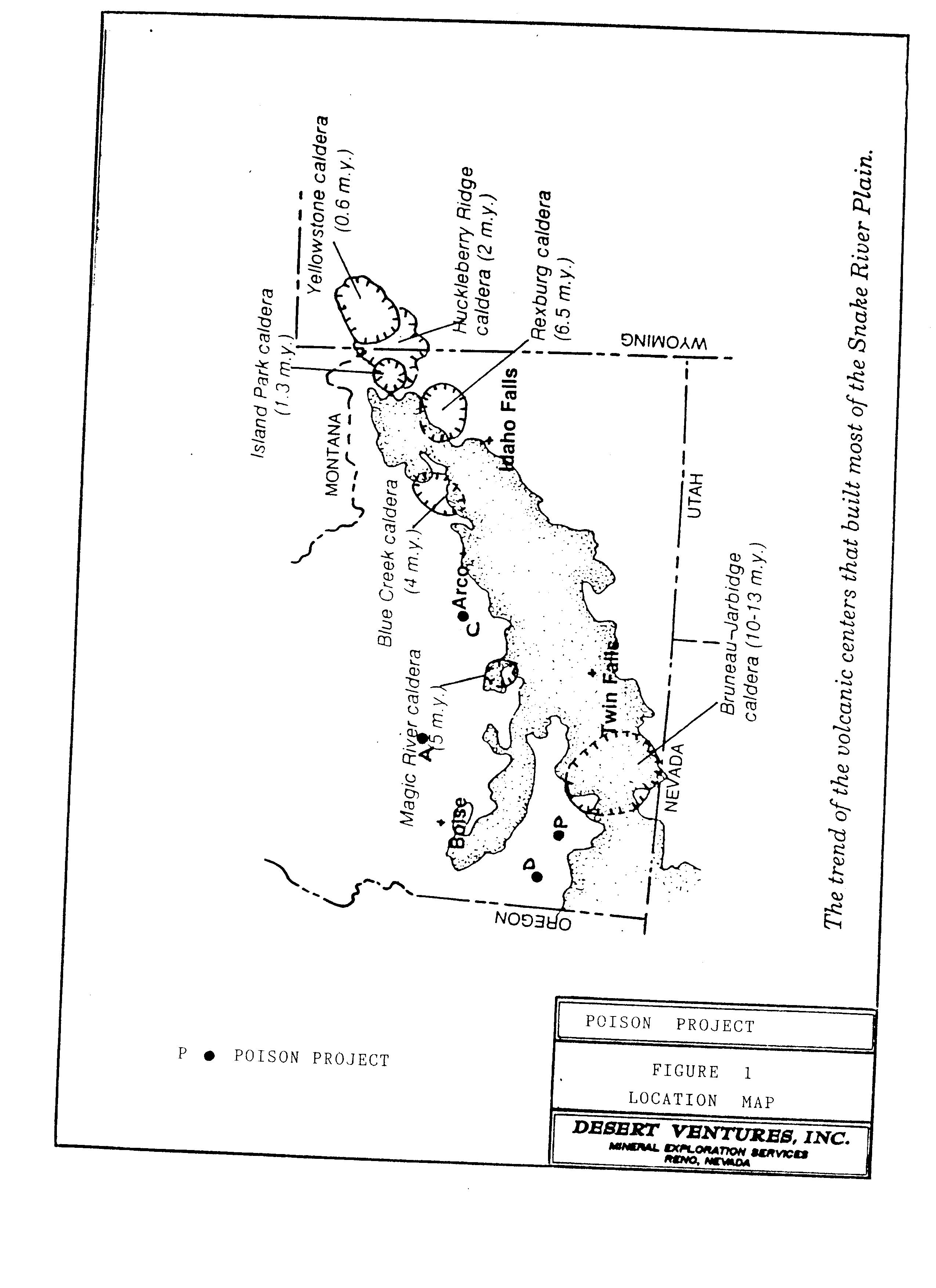

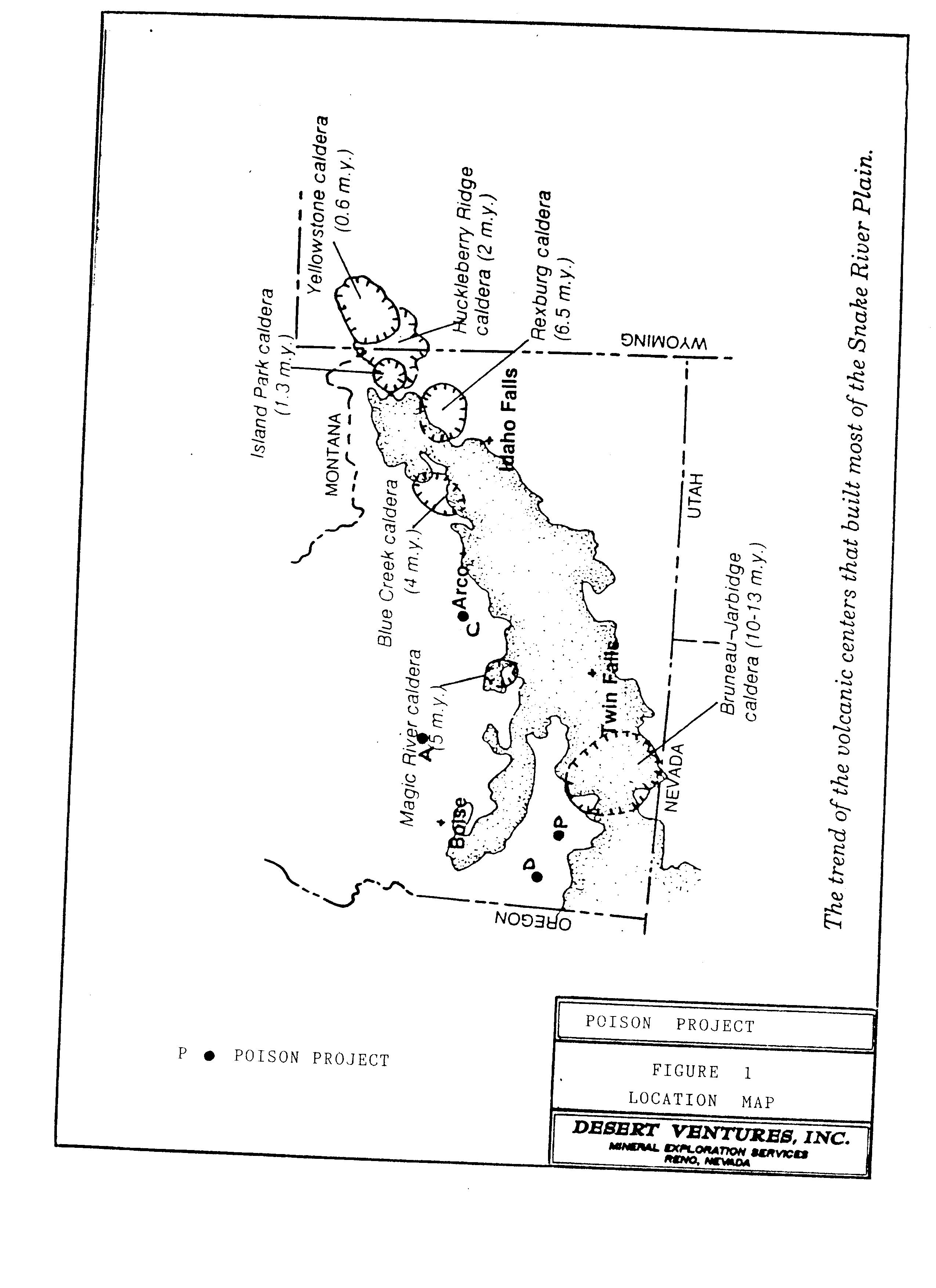

The Poison Gulch Property is located approximately 25 miles west-southwest of the village of Bruneau, Idaho. The eight claims are located in sections 14 and 23, T. 7 S., R. 1 E, Owyhee County, Idaho. The eight claims make up approximately 160 acres. The project are is accessed from the village of Grandview by going two miles southwest on Idaho route 78 to the Mud Flat road and then going 13 miles on the Mud Flat road until the pavement ends. Two point seven miles

beyond the end of the pavement, make a sharp right turn, follow the road northeast for two point one miles and turn left (west) on the jeep trail. Follow the trail two point eight miles to a gate in the fence. Continue traveling west and then southwest for approximately one mile to the center of the old workings. The claims are located on the southwestern edge of the Snake river Plain.

The property is undeveloped. Access may be gained by dirt roads. There are scattered, shallow prospect pits, dumps, and shafts assumed to have been dug pre World War II. The property is covered with sage, and receives sparse precipitation in this semi-arid area of southen Idaho. There are no facilities or infrastructure other than the narrow dirt roads crossing into the claim area. There is power in the village of Bruneau, Idaho, located about 25 miles East North-East of the property. However, it is premature to state where power would be obtained. No studies have been made of the most economical and efficient source of power.

This is a “grassroots” exploration project. Only minor, preliminary exploration has been conducted. A few rock samples were collected during a 1997 geological evaluation by Mr. E.B. Ekren. It is premature to state whether mining will be open pit or underground as the property is a “grassroots” exploration project that has not been drill tested.

In order for Ammetco Resources to retain title to the Poison Gulch Property, Ammetco, bound by the terms of a Letter Agreement dated November 6, 1996 between Prism Resources Inc. and Nevada Mine Properties II, Inc., and by a Certificate of Amendment of Articles of Incorporation dated February 14, 2002 (which documents a name change from Prism Resources to Ammetco Resources) must make annual payments of the Advance Royalty to Nevada Mine Properties II, Inc. of $15,000, adjusted annual changes in the Consumer Price Index with 1996 as the base year. Nevada Mine Proerties II, Inc. must confirm that annual Maintenance Fees are paid to the BLM and annual Notice of Intent Fees are paid to the Owyhee County Recorder prior to midnight August 31 of each year.

Under the lease agreement between Ammetco Resources and Maneki Mining Inc., Maneki must timely and properly pay the Federal, State, and County annual mining claim maintenance fees, and shall execute and record or file, as applicable, proof of payment of the annual maintenance fees and of Ammetco’s intention to hold the unpatented mining claims which constitute the property. If Maneki does not terminate the lease before June 1 or any subsequent year, Maneki will be obligated to pay the annual maintenance fees for that year or reimburse Ammetco for same. Maneki may extend the lease upon payment of amounts discussed in the section “Mineral Lease Agreement between Maneki Mining Inc. and Ammetco Resources” in this document.

Geological Exploration Program in General

We have obtained an independent Geological Report and have acquired a lease on the Poison Gulch mineral claims. We engaged Ken Brook, a Registered Professional Geologist, who has prepared this Geological Report and reviewed all available exploration data completed on the mineral claims.

Mr. Ken Brook is a graduate of the University of Texas at Austin, where he obtained a B.Sc. degree in geology in 1967 and subsequently obtained a Master of Science degree in geology from the University of Arizona in 1974. He is a registered consulting geologist in the states of California and Arizona, and a Fellow in the Geological Association of Canada. He has been engaged in his profession as a geologist since 1969 and has been employed by mining companies and others as a consulting geologist since 1977. He is also the president of Desert Ventures, Inc. a geological consulting firm in Reno, Nevada.

On July 23, 2005 we commenced the mapping of the property, our consulting geologists are in the process of preparing a formal report on the results. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. The details of the Geological Report are provided below.

Summary Report for the Poison Gulch Property Owyhee County, Idaho, Dated December 2, 2004

A primary purpose of the geological report was to review information from previous exploration of the mineral claims and to recommend exploration procedures to establish the feasibility of a mining project on the mineral claims. The summary report lists various results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of prior exploration. The summary report also gave conclusions regarding potential mineralization of the mineral claims and recommended a further geological exploration program.

Conclusions of the Summary Report for the Poison Gulch Property Owyhee County, Idaho

Based on Ken Brook’s only visit to the property in August 1991 and research of the property he came to the following conclusions:

The Poison Gulch property hosts gold values in small, discontinuous, iron-oxide-stained quartz veinlets within a broader, structurally controlled zone of clay alteration. The mineralization is hosted by Miocene volcanics, which are a common host for precious metal deposits in the western U.S. Previous exploration work has been limited to mapping and sampling of the often poorly exposed veinlets, but has documented a gold-mineralized zone. Higher gold values are associated with very high levels of arsenic and antimony and elevated mercury values. This association is typical of the upper levels of precious metal, epithermal vein deposits. The discontinuous nature of the quartz veinlets is also typical of the upper levels of epithermal systems.

The zone's lack of geophysical response is not surprising. Seldom do precious metal veins contain sufficient amounts of sulfide material to provide an Electromagnetic response. Based on the interpretation that the discontinuous nature of the quartz veinlets and the high toxic element values are indicative of the upper levels of an epithermal system, the main zone of mineralization could be 500 to 900-feet below the surface. The effectiveness of any geophysical method locating three to five-foot wide, quartz veins at this depth is questionable.

The strike length of strongly anomalous to high-grade gold values suggests that a significant, gold-bearing, epithermal event was localized by the Poison Gulch structures. The results of previous exploration efforts are sufficiently encouraging to warrant the recommendation of an exploration program to test the structures at depth.

Recommendations

Based on the conclusions of the Summary Report for the Poison Gulch Property Owyhee County, Idaho, Ken Brook, consulting geologist, recommended a three phase exploration program for the Poison Gulch property.

Phase One will consist of staking additional claims, digging trenches across the gold zone, careful sampling of mineralized zones in the trenches, detailed mapping of the gold zone and trenches. Estimated cost for Phase One is $41,932.

Phase Two will consist of selecting initial drill targets, posting the requisite reclamation bond with the Bureau of Land Management (BLM), obtaining the BLM permit to drill and drilling three, 700-foot, angle reverse circulation holes to test the mineralized structures at a depth of 500-feet, and three, 1000-foot, angle, reverse circulation holes to test the mineralized structures at a depth of 900-feet. Estimated cost for Phase Two is $107,908.

Phase Three will only be implemented if there is success, i.e., good gold intercepts in the Phase Two drill holes, and will consist of core holes wedged off from the successful reverse circulation holes to expand the mineralized zone(s). Estimated cost for Phase Three is $116,999.

With contingencies at 10% and claim holding costs for one year, the total project budget proposed is $298,463.

Competition

We are a junior mineral resource exploration company engaged in the business of mineral exploration. We compete with other junior mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral resource exploration companies. The presence of competing junior mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We also compete for mineral properties of merit with other junior exploration companies. Competition could reduce the availability of properties of merit or increase the cost of acquiring the mineral properties.

Government Regulations:

We will be required to conduct all mineral exploration activities in accordance with the Bureau of Land Management of the United States Department of the Interior. We will be required to obtain a permit prior to the initiation of the second stage of our planned exploration program as this stage will involve drilling on the property. We would be required to submit plan of operation in connection with the permit application. It is estimated that it would take approximately two to three months to obtain the required permit at an estimated cost to us of approximately $10,000.

Employees

We have no employees as of the date of this prospectus other than our president. We conduct our business largely through agreements with consultants and arms-length third parties.

Office Property

We maintain our executive office at 4462 John Street, Vancouver, B.C., Canada V5V 3X1. This office space is being provided to the company free of charge by our president, Mr. Watkinson. This arrangement provides us with the office space necessary at this point. Upon significant growth of the company it may become necessary to lease or acquire additional or alternative space to accommodate our development activities and growth.

Research and Development Expenditures

We have not incurred any material research or development expenditures since our incorporation. We have paid $4,000 for a mineral property lease which was expensed as an exploration cost.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Plan of Operations

Our business plan is to proceed with the exploration of the Poison Gulch mineral claims to determine whether there are commercially exploitable reserves of gold, silver or other metals. We decided to embark upon the initial phase of the exploration program recommended by Ken Brook, consulting geologist. However we decided to alter Phase One of the exploration program. We decided that Mr. Brook’s recommendation to stake additional claims as part of phase one may not be necessary at present time, and due to limited funds, the company believes that money is best spent at this point in the business plan on the claims that Maneki currently holds lease to. However, we do plan to stake additional claims in the future. We have broken down phase one into three steps. Step one consists of geologic mapping which is estimated to cost $8,169. Step two will

consist of sampling which is estimated to cost $19,835. Step three will consist of trenching which is estimated to cost $2,560. The total cost of phase one is estimated at $30,564.

We had sufficient cash reserves to proceed with step one of phase one which consists of geologic mapping of the claims. The anticipated cost of this step is $8,169.We began mapping the property on July 23, 2005 and expect to receive a formal report from our consulting geologist by December 2005. We advanced a $5,000 retainer to Steve Sutherland a consulting geologist to begin phase one. Once we receive the formal report on this step, our board of directors, in consultation with our consulting geologist, Mr. George J. Eliopulos, will asses how to proceed to the next Step. We expect to commence step two in early 2006 and have that step completed by march 2006, Step three will immediately follow and be concluded July, 2006.

The company will have sufficient capital to commence step two of the initial phase. However, most likely will not have sufficient cash on hand to complete this stage, and will need to raise the balance of the funds requires along with additional funds to meet ongoing capital needs. Once we receive preliminary results of the sampling we will assess whether to precede any further exploration phases. In making this determination to proceed with further exploration, we will make an assessment as to whether the results of the initial work completed are sufficiently positive to enable us to proceed. This assessment will include an assessment of our cash reserves after the completion of step one and the commencing of step two of the initial phase of exploration. Should the results of these steps prove not to be sufficiently positive to proceed with a further exploration on the Poison Gulch claims, we intend to seek out and acquire other North American mineral exploration properties which, in the opinion of our consulting geologist, offer attractive mineral exploration opportunities. However, we may not have sufficient financing to seek out and acquire other properties, and if we did have sufficient financing, it is possible that we would be unsuccessful in seeking out an acquiring alternative exploration properties.

Geological mapping, rock chip sampling, and shallow backhoe trenching, as well as compilation of the data in a digital format, are tools and data that identify where the gold mineralization occurs, the tenor of the mineralization, and the geometry of the mineralized body. Once these items are recorded and examined we can move to phase two.

If results are positive from our initial phase of exploration we intend to proceed to phase two of the exploration program. Rotary drilling tests the geologic model to determine if there is gold in sufficient quantity to justify continued exploration drilling, with the goal of outlining and accurately defining a body of potentially economic mineralization. The cost of this phase is estimated at $107,908. The drill test of the geologic and geochemical targets that are identified during phase one is basically “make or break” for the program. With favorable results exploration will proceed to phase three. In the event that we determined to conduct phase two of the exploration program we will need to raise the entire amount of the exploration phase along with additional funds to meet ongoing capital needs. We estimate to begin phase two in early fall 2006.

During this phase of the exploration program, our President will be devoting approximately five to ten hours per week of his time to our business. We do not foresee this limited involvement as negatively impacting our company over the next twelve months as all exploratory work is being performed by outside consultants. If, however, the demands of our business require more time of Mr. Watkinson such as raising additional capital or addressing unforeseen issues with regard to our

exploration efforts, he is prepared to adjust his timetable to devote more time to our business. However, he may not be able to devote sufficient time to the management of our business, as and when needed.

The advance to phase three core drilling will mean that phase two Reverse Circulation drilling intersected sufficient thickness of gold-bearing material that is “open” (undrilled) laterally to depth. phase three will test these undrilled extensions with an objective to determine the geometry of the mineralized body and to produce samples for the initial metallurgical tests. One or more Reverse Circulation holes will be twinned with core holes to confirm assay results. We would expect phase three to commence early 2007, with results by the summer of 2007. The cost of Phase Three is estimated at $116,999.

Initial geologic examination and data compilation will be completed by Mr. Steve Sutherland, with some assistance from Mr. George Eliopulos, geologists, both of whom have over 25 years experience in minerals exploration in the western US. Additional work programs will be completed under the supervision of Mr. Sutherland.