Filed Pursuant to Rule 424(b)(3)

File No. 333-126617

Prospectus Supplement

INTERESTSIN

EQUITABLE FEDERAL SAVINGS BANKOF GRAND ISLAND

EMPLOYEES’ SAVINGS & PROFIT SHARING PLANAND TRUST

AND

OFFERINGOF 171,300 SHARESOF

EQUITABLE FINANCIAL CORP.

COMMON STOCK ($.01 PAR VALUE)

This prospectus supplement relates to the offer and sale to participants in the Equitable Federal Savings Bank of Grand Island Employees’ Savings & Profit Sharing Plan and Trust of participation interests and shares of common stock of Equitable Financial.

401(k) Plan participants may direct Bank of New York, the trustee for the Equitable Financial Stock Fund, to use their current account balances to subscribe for and purchase shares of Equitable Financial common stock through the Equitable Financial Stock Fund. Based upon the value of the 401(k) Plan assets as of July 1, 2005, the Equitable Financial Stock Fund trustee may purchase up to 171,300 shares of Equitable Financial common stock, assuming a purchase price of $10.00 per share. This prospectus supplement relates to the election of 401(k) Plan participants to direct the Equitable Financial Stock Fund trustee to invest all or a portion of their 401(k) Plan accounts in Equitable Financial common stock.

The prospectus dated September 27, 2005 of Equitable Financial, which we have attached to this prospectus supplement, includes detailed information regarding the reorganization of Equitable Federal Savings from the mutual holding company form to the stock form, and the financial condition, results of operations and business of Equitable Federal Savings. This prospectus supplement provides information regarding the Plan. You should read this prospectus supplement together with the prospectus and keep both for future reference.

Please refer to “Risk Factors” beginning on page 19 of the prospectus.

Neither the Securities and Exchange Commission, the Office of Thrift Supervision, the Federal Deposit Insurance Corporation, nor any other state or federal agency or any state securities commission, has approved or disapproved these securities. Any representation to the contrary is a criminal offense.

These securities are not deposits or accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This prospectus supplement may be used only in connection with offers and sales by Equitable Financial of interests or shares of common stock under the Plan to employees of Equitable Federal Savings. No one may use this prospectus supplement to reoffer or resell interests or shares of common stock acquired through the Plan.

You should rely only on the information contained in this prospectus supplement and the attached prospectus. Equitable Financial, Equitable Federal Savings and the Plan have not authorized anyone to provide you with information that is different.

This prospectus supplement does not constitute an offer to sell or solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. Neither the delivery of this prospectus supplement and the prospectus nor any sale of common stock shall under any circumstances imply that there has been no change in the affairs of Equitable Federal Savings or the Plan since the date of this prospectus supplement, or that the information contained in this prospectus supplement or incorporated by reference is correct as of any time after the date of this prospectus supplement.

The date of this Prospectus Supplement is September 27, 2005.

TABLE OF CONTENTS

THE OFFERING

Securities Offered

The securities offered in connection with this prospectus supplement are participation interests in the Plan. Assuming a purchase price of $10.00 per share, the trustee may acquire up to 171,300 shares of Equitable Financial common stock for the Equitable Financial Stock Fund. The interests offered under this prospectus supplement are conditioned on the completion of the reorganization of Equitable Federal Savings. Your investment in the Equitable Financial Stock Fund in connection with the reorganization of Equitable Federal Savings is also governed by the purchase priorities contained in the plan of reorganization. See the“Limitations on Purchases of Shares” section of the prospectus attached to this prospectus supplement for a discussion of the purchase priorities contained in the plan of reorganization.

This prospectus supplement contains information regarding the Plan. The attached prospectus contains information regarding the reorganization of Equitable Federal Savings and the financial condition, results of operations and business of Equitable Federal Savings. The address of the principal executive office of Equitable Federal Savings is 113-115 North Locust Street, Grand Island, Nebraska 68801. The telephone number of Equitable Federal Savings is (308) 382-3136.

Election to Purchase Equitable Financial Common Stock in the Reorganization

In connection with the reorganization of Equitable Federal Savings, the Plan will permit you to direct the trustee to transfer all or part of the funds which represent your current beneficial interest in the assets of the Plan to the Equitable Financial Stock Fund. The trustee of the Plan will subscribe for Equitable Financial common stock offered for sale in connection with the reorganization in accordance with each participant’s direction.If there is not enough common stock in the reorganization to fill all subscriptions, the common stock will be apportioned and the trustee for the Plan may not be able to purchase all of the common stock you requested. In such case, the trustee will purchase shares in the open market, on your behalf, after the reorganization to fulfill your initial request. Such purchases may be at prices higher than the initial public offering price.

All plan participants are eligible to direct a transfer of funds to the Equitable Financial Stock Fund. However, such directions are subject to your subscription rights which are set forth in the plan of reorganization. Equitable Federal Savings has granted rights to subscribe for shares of Equitable Financial common stock in the following order of priority: (1) depositors who have $50.00 or more on deposit at Equitable Federal Savings as of December 23, 2003; (2) the Equitable Federal Savings Employee Stock Ownership Plan; (3) depositors who have $50.00 or more on deposit at Equitable Federal Savings as of June 30, 2005; and (4) depositors as of September 12, 2005 who were not able to subscribe for shares of Equitable Financial common stock under categories (1) and (3) and borrowers of Equitable Federal Savings as of June 10, 1992 who continue to be borrowers as of September 12, 2005. No individual may purchase more than $350,000 of Equitable Financial common stock in the offering. If you fall into one of the above subscription offering categories, you have subscription rights to purchase shares of Equitable Financial common stock in the offering and you may use funds in the Plan account to pay for the shares of Equitable Financial common stock which you are eligible to purchase.

Value of Participation Interests

As of July 8, 2005, the market value of the assets of the Plan equaled approximately $1,713,000. Plan participants have daily access to the value of their beneficial interest in the Plan. The value of Plan assets represents past contributions to the Plan on your behalf, plus or minus earnings or losses on the contributions, less previous withdrawals and loans.

Method of Directing Transfer

This prospectus supplement contains a form for you to direct a transfer to the Equitable Financial Stock Fund (the “Change of Investment Allocation Form”). If you wish to transfer all, or part, in multiples of not less

than 1%, of your beneficial interest in the assets of the Plan to the Equitable Financial Stock Fund, you should complete the Change of Investment Allocation Form. If you do not wish to make such an election at this time, you do not need to take any action. The minimum investment in the Equitable Financial Stock Fund during the initial public offering is $250.

Time for Directing Transfer

The deadline for submitting a direction to transfer amounts to the Equitable Financial Stock Fund in connection with the reorganization is Monday, October 17, 2005. You should return the Change of Investment Allocation Form included with this Prospectus Supplement to Terry Pfeifer by 4:00 p.m. on Monday, October 17, 2005.

Irrevocability of Transfer Direction

Your direction to transfer amounts credited to your account in the Plan to the Equitable Financial Stock Fund cannot be changed prior to the completion of the reorganization. Following the closing of the reorganization offering and initial purchase of shares in the Equitable Financial Stock Fund, you will be able to change your investment directions in accordance with the terms of the Plan.

Purchase Price of Equitable Financial Common Stock

The trustee will use the funds transferred to the Equitable Financial Stock Fund to purchase shares of Equitable Financial common stock in the reorganization. The trustee will pay the same price for shares of Equitable Financial common stock as all other persons who purchase shares of Equitable Financial common stock in the offering.If there is not enough common stock in the offering to fill all subscriptions, the common stock will be apportioned and the trustee for the Plan may not be able to purchase all of the common stock you requested. In such case, you may direct the trustee to purchase shares on your behalf after the reorganization in the open market, to fulfill your initial request. Such purchases may be at prices higher or lower than the reorganization offering price.

Nature of a Participant’s Interest in Equitable Financial Common Stock

The trustee will hold Equitable Financial common stock in the name of the Plan. The trustee will credit shares of common stock acquired at your direction to your account under the Plan. Therefore, earnings with respect to your account will not be affected by the investment designations of other participants in the Plan.

Voting and Tender Rights of Equitable Financial Common Stock

The trustee generally will exercise voting and tender rights attributable to all Equitable Financial common stock held by the Equitable Financial Stock Fund as directed by participants with interests in the Equitable Financial Stock Fund. With respect to each matter as to which holders of Equitable Financial common stock have a right to vote, you will be given voting instruction rights reflecting your proportionate interest in the Equitable Financial Stock Fund. The number of shares of Equitable Financial common stock held in the Equitable Financial Stock Fund that are voted for and against on each matter will be proportionate to the number of voting instruction rights exercised in such manner. If there is a tender offer for Equitable Financial common stock, the Plan provides that each participant will be allotted a number of tender instruction rights reflecting such participant’s proportionate interest in the Equitable Financial Stock Fund. The percentage of shares of Equitable Financial common stock held in the Equitable Financial Stock Fund that will be tendered will be the same as the percentage of the total number of tender instruction rights that are exercised in favor of the tender offer. The remaining shares of Equitable Financial common stock held in the Equitable Financial Stock Fund will not be tendered. The Plan makes provisions for participants to exercise their voting instruction rights and tender instruction rights on a confidential basis.

2

DESCRIPTION OF THE PLAN

Introduction

Effective July 1, 2005, Equitable Federal Savings amended its 401(k) Plan dated July 1, 2002, in its entirety into the Equitable Federal Savings Bank of Grand Island Employees’ Savings & Profit Sharing Plan and Trust. Equitable Federal Savings intends for the Plan to comply, in form and in operation, with all applicable provisions of the Internal Revenue Code and the Employee Retirement Income Security Act of 1974, as amended, or “ERISA.” Equitable Federal Savings may change the Plan from time to time in the future to ensure continued compliance with these laws. Equitable Federal Savings may also amend the Plan from time to time in the future to add, modify, or eliminate certain features of the plan, as it sees fit. As a plan governed by ERISA, federal law provides you with various rights and protections as a plan participant. Although the Plan is governed by many of the provisions of ERISA, your benefits under the plan are not guaranteed by the Pension Benefit Guaranty Corporation.

Reference to Full Text of the Plan. The following portions of this prospectus supplement provide an overview of the material provisions of the Plan. Equitable Federal Savings qualifies this overview in its entirety by reference to the full text of the Plan. You may obtain copies of the full Plan document by sending a request to Terry Pfeifer at Equitable Federal Savings. You should carefully read the full text of the Plan document to understand your rights and obligations under the plan.

Eligibility and Participation

Any employee of Equitable Federal Savings who has satisfied the plan eligibility requirements may participate in the plan as of the first day of the month following their satisfaction of the requirements. Employees who are at least 21 years of age may begin deferring into the Plan as of their date of hire. Participants are eligible for matching contributions upon the completion of three months of service.

As of July 1, 2005, 51 of the 64 employees at Equitable Federal Savings elected to participate in the Plan.

Contributions Under the Plan

Plan Participant Contributions. Subject to certain IRS limitations, the Plan permits each participant to make monthly contributions to the Plan equal to 75% of the participant’s monthly salary. Participants may change their rate of contribution with respect to pre-tax deferrals once each calendar month.

Equitable Federal Savings Contributions. The Plan provides that Equitable Federal Savings may make matching contributions. Equitable Federal matches 100% of each participant’s deferrals up to 6% of compensation.

Limitations on Contributions

Limitation on Employee Salary Deferral.Although the Plan permits you to defer up to 75% of your compensation, by law your total deferrals under the Plan, together with similar plans, may not exceed $14,000 for 2005. Employees who are age 50 and over may make additional catch-up contributions to the Plan, up to $4,000 for 2005. The Internal Revenue Service will periodically increase this annual limitation. Contributions in excess of this limitation, or excess deferrals, will be included in an affected participant’s gross income for federal income tax purposes in the year they are made. In addition, a participant will have to pay federal income taxes on any excess deferrals when distributed by the Plan to the participant, unless the excess deferral and any related income allocable is distributed to the participant not later than the first April 15th following the close of the taxable year in which the excess deferral is made. Any income on the excess deferral that is distributed not later than such date shall be treated, for federal income tax purposes, as earned and received by the participant in the taxable year in which the distribution is made.

3

Limitations on Annual Additions and Benefits. Under the requirements of the Internal Revenue Code, the Plan provides that the total amount of contributions and forfeitures (annual additions) credited to a participant during any year under all defined contribution plans of Equitable Federal Savings (including the Plan and the proposed Equitable Federal Savings Employee Stock Ownership Plan) may not exceed the lesser of 100% of the participant’s compensation or $42,000 for 2005.

Limitation on Plan Contributions for Highly Compensated Employees. Special provisions of the Internal Revenue Code limit the amount of salary deferrals and matching contributions that may be made to the Plan in any year on behalf of highly compensated employees in relation to the amount of deferrals and matching contributions made by or on behalf of all other employees eligible to participate in the Plan. If these limitations are exceeded, the level of deferrals by highly compensated employees must be adjusted.

In general, a highly compensated employee includes any employee who (1) was a five percent owner of the sponsoring employer at any time during the year or preceding year, or (2) had compensation for the preceding year in excess of $95,000 and, if the sponsoring employer so elects, was in the top 20% of employees by compensation for such year. The dollar amounts in the foregoing sentence are for 2005, but may be adjusted periodically by the IRS.

Top-Heavy Plan Requirements. If for any calendar year the Plan is a Top-Heavy Plan, then Equitable Federal Savings may be required to make certain minimum contributions to the Plan on behalf of non-key employees.

In general, the Plan will be treated as a “Top-Heavy Plan” for any calendar year if, as of the last day of the preceding calendar year, the aggregate balance of the accounts of participants who are Key Employees exceeds 60% of the aggregate balance of the accounts of all participants. Key Employees generally include any employee who, at any time during the calendar year or any of the four preceding years, is:

(1) an officer of Equitable Federal Savings having annual compensation in excess of $135,000 who is in an administrative or policy-making capacity,

(2) a person who owns, directly or indirectly, more than 5% of the stock of Equitable Financial, or stock possessing more than 5% of the total combined voting power of all stock of Equitable Financial, or

(3) a person who owns, directly or indirectly, combined voting power of all stock and more than 1% of the total stock of Equitable Financial and has annual compensation in excess of $150,000.

The foregoing dollar amounts are for 2005.

401(k) Plan Investments

Assets in the Plan Trust are invested in the funds specified below. The annual percentage return on these funds (net of fees) for the prior three years was:

| | | | | | | | | |

| | | 2004

| | | 2003

| | | 2002

| |

Money Market Fund | | 1.5 | % | | 1.3 | % | | 1.6 | % |

Stable Value Fund | | 4.2 | % | | 4.9 | % | | 5.3 | % |

Government Bond Fund | | 9.1 | % | | 1.9 | % | | 16.4 | % |

S&P 500 Stock Fund | | 10.9 | % | | 28.6 | % | | (22.4 | )% |

S&P 500/Value Stock Fund | | 15.7 | % | | 31.3 | % | | (21.2 | )% |

S&P 500/Growth Stock Fund | | 6.1 | % | | 25.5 | % | | (24.0 | )% |

S&P MidCap Stock Fund | | 16.7 | % | | 35.8 | % | | (15.0 | )% |

Russell 2000 Stock Fund | | 18.4 | % | | 46.7 | % | | (20.7 | )% |

International Stock Fund | | 20.5 | % | | 37.9 | % | | (18.5 | )% |

Nasdaq 100 Index Fund | | 10.5 | % | | 49.0 | % | | (37.6 | )% |

Asset Allocation Fund (Income Plus) | | 7.6 | % | | 12.6 | % | | (2.6 | )% |

Asset Allocation Fund (Growth & Income) | | 10.8 | % | | 20.7 | % | | (10.3 | )% |

Asset Allocation Fund (Growth) | | 13.8 | % | | 29.4 | % | | (18.8 | )% |

REIT Index Fund | | 31.2 | % | | N/A | | | N/A | |

4

The following is a brief description of the above noted funds.

Money Market Fund. This fund invests in a broad range of high-quality, short-term instruments issued by banks, corporations and the U.S. Government and its agencies. These instruments include certificates of deposit and U.S. Treasury bills. Its objective is short-term: to achieve competitive, short-term rates of return while preserving the value of your principal.

Stable Value Fund. This fund invests primarily in Guaranteed Investment Contracts and Synthetic Guaranteed Investment Contracts. These contracts pay a steady rate of interest over a certain period of time, usually between three and five years. Its objective is short to intermediate-term: to achieve a stable return over short to intermediate periods of time while preserving the value of your investment.

Government Bond Fund. This bond fund invests in U.S. Treasury bonds with a maturity of 20 years or more. Its objective is long-term: to earn a higher level of income along with the potential for capital appreciation.

S&P 500 Stock Fund. This stock fund invests in the stocks of a broad array of established U.S. companies. Its objective is long-term: to earn higher returns by investing in the largest companies in the U.S. economy.

S&P 500/Value Stock Fund.This fund invests in most, or all of the stocks held in the S&P/BARRA Value Index. The index represents approximately 50% of the market capitalization of the S&P 500 Stock Index. This fund is intended for long-term investors seeking a diversified portfolio of large-capitalization value stocks.

S&P 500/Growth Stock Fund. This fund seeks to track the S&P/BARRA Growth Index by investing in many or all of the same stocks that make up the S&P/BARRA Growth Index. The fund maintains a low turnover of securities which results in low trading costs for investors. This fund is intended for long-term investors seeking a diversified portfolio of large-capitalization value stocks.

S&P MidCap Stock Fund. This stock fund invests in the stocks of mid-sized U.S. companies, which are expected to grow faster than larger, more established companies. Its objective is long-term: to earn higher returns which reflect the growth potential of mid-sized companies.

Russell 2000 Stock Fund. This fund seeks to emulate the performance of the Russell 2000 Index. The Russell 2000 Index is a subset of the Russell 3000 Index. The Russell 3000 Index is based on ranking of all U.S. publicly traded companies by market capitalization size. The Russell 2000 represents those 2000 companies ranked by size below the top 1000 companies. It is broadly diversified in terms of industries and economic sectors. This fund is intended for long-term investors seeking the potential high returns from investing in smaller U.S. companies.

International Stock Fund. This fund invests in over 1,000 foreign stocks in 20 countries, based in Europe, Australia, and the Far East. Its objective is long-term: to offer the potential return of investing in the stocks of established non-U.S. companies, as well as the potential risk-reduction of broad diversification.

NASDAQ 100. The Pentegra Nasdaq 100 Stock Fund invests in most or all of the same stocks held in the Nasdaq 100 Index. The Nasdaq 100 Index reflects Nasdaq’s largest non-financial companies across major industry groups, including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology.

Income Plus Asset Allocation Fund. This fund diversifies among a broad range of stable value securities to reduce short-term risk among a broad range of large U.S. and international companies to capture growth potential. The fund is structured to take advantage of market opportunities with a small flexible component. Its objective is intermediate-term: to preserve the value of your investment over short periods of time and to offer some potential for growth.

5

Growth and Income Asset Allocation Fund. This fund diversifies among U.S. and international stocks, U.S. bonds, and stable value investments to pursue long-term appreciation and short-term stability and takes advantage of market opportunities with a small flexible component. Its objective is intermediate-term: to provide a balance between the pursuit of growth and protection from risk.

Growth Asset Allocation Fund. This fund diversifies among a broad range of domestic and international stocks and takes advantage of market opportunities with a large flexible component. Its objective is long-term: to pursue high growth of your investment over time.

REIT Index Fund. This fund seeks to track the investment returns of the Morgan Stanley REIT, a widely used barometer of the performance of the U.S. REIT equities market.

The Plan now provides the Equitable Financial Stock Fund as an additional choice to these investment alternatives. The Equitable Financial Stock Fund invests primarily in the common stock of Equitable Financial. Participants in the Plan may direct the trustee to invest all or a portion of their Plan account balance in the Equitable Financial Stock Fund.

The Equitable Financial Stock Fund consists of investments in the common stock of Equitable Financial Corp. made on the effective date of the reorganization. After the reorganization of Equitable Federal Savings, the trustee of the Plan will, to the extent practicable, use all amounts held by it in the Equitable Financial Stock Fund, including cash dividends paid on the common stock held in the fund, to purchase shares of common stock of Equitable Financial. Plan participants that invest in the Stock Fund will be permitted to direct the Stock Fund Trustee how to vote the shares of Equitable Financial common stock credited to their account.

As of the date of this prospectus supplement, none of the shares of Equitable Financial common stock have been issued or are outstanding and there is no established market for the Equitable Financial common stock. Accordingly, there is no record of the historical performance of the Equitable Financial Stock Fund. Performance of the Equitable Financial Stock Fund depends on a number of factors, including the financial condition and profitability of Equitable Financial and Equitable Federal Savings and market conditions for Equitable Financial common stock generally.

Once you have submitted your Change of Investment Allocation Form you will not be able to change your Plan investment directions until after the reorganization offering has been completed.Post-reorganization you will be able to change your investment directions on a daily basis.

Benefits Under the Plan

Vesting. Participants are 100% vested in their elective deferrals. All employer matching contributions vest at a rate of 20% per year after one year of service.

Withdrawals and Distributions From the Plan

Withdrawals Before Termination of Employment. You may receive in-service distributions from the Plan under limited circumstances in the form of hardship distributions and loans. In order to qualify for a hardship withdrawal, you must have an immediate and substantial need to meet certain expenses and have no other reasonably available resources to meet the financial need. If you qualify for a hardship distribution, the trustee will make the distribution proportionately from the investment funds in which you have invested your account balances. Participants and beneficiaries are eligible for Plan loans. The minimum loan amount is $1,000 calculated solely using a participant’s vested interest in his or her account.

Distribution Upon Retirement or Disability. Upon retirement or disability, you may receive a partial lump sum payment, a full lump sum payment, or installment payments from the Plan equal to the value of your account.

Distribution Upon Death. If you die before your benefits are paid from the Plan, your benefits will be paid to your surviving spouse or beneficiary under one or more of the forms available under the Plan.

6

Distribution Upon Termination for Any Other Reason. If you terminate employment for any reason other than retirement, disability or death and your account balance exceeds $500, the trustee will make your distribution on your normal retirement date, unless you request otherwise. If your account balances do not exceed $500, the trustee will generally distribute your benefits to you as soon as administratively practicable following termination of employment.

Nonalienation of Benefits. Except with respect to federal income tax withholding and as provided with respect to a qualified domestic relations order, benefits payable under the Plan will not be subject in any manner to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, charge, garnishment, execution, or levy of any kind, either voluntary or involuntary, and any attempt to anticipate, alienate, sell, transfer, assign, pledge, encumber, charge or otherwise dispose of any rights to benefits payable under the Plan will be void.

Applicable federal tax law requires the Plan to impose substantial restrictions on your right to withdraw amounts held under the Plan before your termination of employment with Equitable Federal Savings. Federal law may also impose an excise tax on withdrawals made from the Plan before you attain 59½ years of age regardless of whether the withdrawal occurs during your employment with Equitable Federal Savings or after termination of employment.

Administration of the Plan

The trustee with respect to the Plan is the named fiduciary of the Plan for purposes of Employee Retirement Income Security Act of 1974, as amended.

Trustees. The board of directors of Equitable Federal Savings appoints the trustee to serve at its pleasure. The board of directors has appointed Bank of New York as trustee of the Equitable Financial Stock Fund.

The trustee receives, holds and invests the contributions to the Plan in trust and distributes them to participants and beneficiaries in accordance with the terms of the Plan and the directions of the plan administrator. The trustee is responsible for investment of the assets of the trust.

Reports to Plan Participants

The plan administrator will furnish you a statement at least quarterly showing the balance in your account as of the end of that period, the amount of contributions allocated to your account for that period, and any adjustments to your account to reflect earnings or losses.

Plan Administrator

The current plan administrator of the Plan is Equitable Federal Savings. The plan administrator is responsible for the administration of the Plan, interpretation of the provisions of the plan, prescribing procedures for filing applications for benefits, preparation and distribution of information explaining the plan, maintenance of plan records, books of account and all other data necessary for the proper administration of the plan, and preparation and filing of all returns and reports relating to the plan which are required to be filed with the U.S. Department of Labor and the Internal Revenue Service, and for all disclosures required to be made to participants, beneficiaries and others under the Employee Retirement Income Security Act.

Amendment and Termination

Equitable Federal Savings intends to continue the Plan indefinitely. Nevertheless, Equitable Federal Savings may terminate the Plan at any time. If Equitable Federal Savings terminates the Plan in whole or in part, then regardless of other provisions in the plan, all affected participants will become fully vested in their accounts. Equitable Federal Savings reserves the right to make, from time to time, changes which do not cause any part of the trust to be used for, or diverted to, any purpose other than the exclusive benefit of participants or their beneficiaries; provided, however, that Equitable Federal Savings may amend the plan as it determines necessary or desirable, with or without retroactive effect, to comply with the Employee Retirement Income Security Act of 1974, as amended, or the Internal Revenue Code.

7

Merger, Consolidation or Transfer

If the Plan merges or consolidates with another plan or transfers the trust assets to another plan, and if either the Plan or the other plan is then terminated, the Plan requires that you would receive a benefit immediately after the merger, consolidation or transfer. The benefit would be equal to or greater than the benefit you would have been entitled to receive immediately before the merger, consolidation or transfer if the Plan had then terminated.

Federal Income Tax Consequences

The following is only a brief summary of the material federal income tax aspects of the Plan. You should not rely on this survey as a complete or definitive description of the material federal income tax consequences relating to the Plan. Statutory provisions change, as do their interpretations, and their application may vary in individual circumstances. Finally, the consequences under applicable state and local income tax laws may not be the same as under the federal income tax laws.You are urged to consult your tax advisor with respect to any distribution from the Plan and transactions involving the Plan.

As a “qualified retirement plan,” the Internal Revenue Code affords the Plan special tax treatment, including:

(1) The sponsoring employer is allowed an immediate tax deduction for the amount contributed to the plan each year;

(2) participants pay no current income tax on amounts contributed by the employer on their behalf; and

(3) earnings of the plan are tax-deferred, thereby permitting the tax-free accumulation of income and gains on investments.

Equitable Federal Savings will administer the Plan to comply in operation with the requirements of the Internal Revenue Code as of the applicable effective date of any change in the law. If Equitable Federal Savings receives an adverse determination letter regarding its tax exempt status from the Internal Revenue Service, all participants would generally recognize income equal to their vested interest in the Plan, the participants would not be permitted to transfer amounts distributed from the Plan to an Individual Retirement Account or to another qualified retirement plan, and Equitable Federal Savings may be denied certain deductions taken with respect to the Plan.

Lump Sum Distribution. A distribution from the Plan to a participant or the beneficiary of a participant will qualify as a lump sum distribution if it is made within one taxable year, on account of the participant’s death, disability or separation from service, or after the participant attains age 59½; and consists of the balance credited to the participant under this plan and all other profit sharing plans, if any, maintained by Equitable Federal Savings. The portion of any lump sum distribution required to be included in your taxable income for federal income tax purposes consists of the entire amount of the lump sum distribution less the amount of after-tax contributions, if any, you have made to any other profit sharing plans maintained by Equitable Federal Savings which is included in the distribution.

Equitable Financial Common Stock Included in Lump Sum Distribution. If a lump sum distribution includes Equitable Financial common stock, the distribution generally will be taxed in the manner described above, except that the total taxable amount will be reduced by the amount of any net unrealized appreciation with respect to Equitable Financial common stock, that is, the excess of the value of Equitable Financial common stock at the time of the distribution over its cost or other basis of the securities to the trust. The tax basis of Equitable Financial common stock for purposes of computing gain or loss on its subsequent sale equals the value of Equitable Financial common stock at the time of distribution, less the amount of net unrealized appreciation. Any gain on a subsequent sale or other taxable disposition of Equitable Financial common stock, to the extent of the amount of net unrealized appreciation at the time of distribution, will constitute long-term capital gain regardless of how long the Equitable Financial common stock, is held, or the “holding period.” Any gain on a subsequent sale or other taxable disposition of Equitable Financial common stock in excess of the amount of net

8

unrealized appreciation at the time of distribution will be considered long-term capital gain regardless of the holding period of Equitable Financial common stock. Any gain on a subsequent sale or other taxable disposition of Equitable Financial common stock in excess of the amount of net unrealized appreciation at the time of distribution will be considered either short-term or long-term capital gain, depending upon the length of the holding period of Equitable Financial common stock. The recipient of a distribution may elect to include the amount of any net unrealized appreciation in the total taxable amount of the distribution, to the extent allowed by the regulations to be issued by the IRS.

Distributions: Rollovers and Direct Transfers to Another Qualified Plan or to an IRA. You may roll over virtually all distributions from the Plan to another qualified retirement plan or to an individual retirement account.

We have provided you with a brief description of the material federal income tax aspects of the Plan which are of general application under the Internal Revenue Code. It is not intended to be a complete or definitive description of the federal income tax consequences of participating in or receiving distributions from the Plan. Accordingly, you are urged to consult a tax advisor concerning the federal, state and local tax consequences of participating in and receiving distributions from the Plan.

Restrictions on Resale

Any person receiving a distribution of shares of common stock under the Plan who is an “affiliate” of Equitable Financial under Rules 144 and 405 under the Securities Act of 1933, as amended, may reoffer or resell such shares only under a registration statement filed under the Securities Act of 1933, as amended, assuming the availability of a registration statement, or under Rule 144 or some other exemption of the registration requirements of the Securities Act of 1933, as amended. Directors, officers and substantial shareholders of Equitable Financial are generally considered “affiliates.” Any person who may be an “affiliate” of Equitable Federal Savings may wish to consult with counsel before transferring any common stock they own. In addition, participants are advised to consult with counsel as to the applicability of Section 16 of the Securities Exchange Act of 1934, as amended, which may restrict the sale of Equitable Financial common stock acquired under the Plan, or other sales of Equitable Financial common stock.

Persons who arenot deemed to be “affiliates” of Equitable Federal Savings at the time of resale will be free to resell any shares of Equitable Financial common stock distributed to them under the Plan, either publicly or privately, without regard to the registration and prospectus delivery requirements of the Securities Act of 1933, as amended, or compliance with the restrictions and conditions contained in the exemptive rules under federal law. An “affiliate” of Equitable Federal Savings is someone who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control, with Equitable Federal Savings. Normally, a director, principal officer or major shareholder of a corporation may be deemed to be an “affiliate” of that corporation. A person who may be deemed an “affiliate” of Equitable Federal Savings at the time of a proposed resale will be permitted to make public resales of the common stock only under a “reoffer” prospectus or in accordance with the restrictions and conditions contained in Rule 144 under the Securities Act of 1933, as amended, or some other exemption from registration, and will not be permitted to use this prospectus in connection with any such resale. In general, the amount of the common stock which any such affiliate may publicly resell under Rule 144 in any three-month period may not exceed the greater of one percent of Equitable Financial common stock then outstanding or the average weekly trading volume reported on the Nasdaq Stock Market during the four calendar weeks before the sale. Such sales may be made only through brokers without solicitation and only at a time when Equitable Financial is current in filing the reports required of it under the Securities Exchange Act of 1934, as amended.

SEC Reporting and Short-Swing Profit Liability

Section 16 of the Securities Exchange Act of 1934, as amended, imposes reporting and liability requirements on officers, directors and persons beneficially owning more than ten percent of public companies

9

such as Equitable Financial. Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the filing of reports of beneficial ownership. Within ten days of becoming a person required to file reports under Section 16(a), a Form 3 reporting initial beneficial ownership must be filed with the Securities and Exchange Commission. Certain changes in beneficial ownership involving allocation or reallocation of assets held in your Plan account must be reported periodically, either on a Form 4 within two days after a transaction, or annually on a Form 5 within 45 days after the close of a company’s fiscal year.

In addition to the reporting requirements described above, Section 16(b) of the Securities Exchange Act of 1934, as amended, provides for the recovery by Equitable Financial of profits realized by any officer, director or any person beneficially owning more than ten percent of the common stock resulting from the purchase and sale or sale and purchase of the common stock within any six-month period.

The SEC has adopted rules that exempt many transactions involving the Plan from the “short-swing” profit recovery provisions of Section 16(b). The exemptions generally involve restrictions upon the timing of elections to buy or sell employer securities for the accounts of any officer, director or any person beneficially owning more than ten percent of the common stock.

Except for distributions of the common stock due to death, disability, retirement, termination of employment or under a qualified domestic relations order, persons who are governed by Section 16(b) may, under limited circumstances involving the purchase of common stock within six months of the distribution, be required to hold shares of the common stock distributed from the Plan for six months following the distribution date.

LEGAL OPINION

The validity of the issuance of the common stock of Equitable Financial will be passed upon by Muldoon Murphy & Aguggia LLP, Washington, D.C. Muldoon Murphy & Aguggia LLP acted as special counsel for Equitable Federal Savings in connection with the reorganization of Equitable Federal Savings.

10

EQUITABLE FEDERAL SAVINGS BANKOF GRAND ISLAND EMPLOYEES’ SAVINGS & PROFIT SHARING PLANAND TRUST

CHANGE OF INVESTMENT ALLOCATION

1. Member Data

| | | | | | |

| Print your full name above | | (Last, first, middle initial) | | Social Security Number |

| | |

| | | | | |

|

|

| Street Address | | City | | State | | Zip |

2. Instructions

Equitable Federal Savings Bank of Grand Island Employees’ Savings & Profit Sharing Plan and Trust (the “Plan”) is giving Plan participants a special opportunity to invest their Plan account balances in a new investment fund - the Equitable Financial Stock Fund—which is comprised primarily of common stock issued by Equitable Financial in connection with the reorganization of Equitable Federal Savings from the mutual holding company form to the stock form. The percentage of a member’s account transferred at the direction of the member into the Equitable Financial Stock Fund will be used to purchase shares of Common Stock during the Offering. Please review the Prospectus (the “Prospectus”) and the Prospectus Supplement (the “Supplement”) before making any decision.

If there is not enough Common Stock in the reorganization to fill all subscriptions, the Common Stock will be apportioned and the trustee for the Plan may not be able to purchase all of the Common Stock you requested. In such case, you may direct the trustee to purchase shares in the open market, on your behalf, after the reorganization to fulfill your initial request. Such purchases may be at prices higher or lower than the initial offering price. If you wish to direct the trustee to purchase shares in the open market in the event of an over subscription please check the box below.

| | ¨ | Yes, I direct the Plan Trustee to purchase stock in the open market, if necessary. |

Investing in common stock entails some risks, and we encourage you to discuss this investment decision with your spouse and investment advisor. The Plan trustee and the Plan administrator are not authorized to make any representations about this investment other than what appears in the Prospectus and the Supplement, and you should not rely on any information other than what is contained in the Prospectus and the Supplement.For a discussion of certain factors that should be considered by each member as to an investment in the Common Stock, see “Risk Factors” beginning on page 19 of the Prospectus. Any shares purchased by the Plan pursuant to your election will be subject to the conditions or restrictions otherwise applicable to common stock, as discussed in the Prospectus and the Supplement.

3. Purchaser Information

Your ability to purchase Common Stock in the offering and to direct your Plan funds into the Equitable Financial Stock Fund may be based upon your subscription rights. Please indicate the EARLIEST date that applies to you:

| | ¨ | Check here if you had a $50.00 or more deposit with Equitable Federal Savings as of December 23, 2003. |

| | ¨ | Check here if you had a $50.00 or more deposit with Equitable Federal Savings as of June 30, 2005. |

| | ¨ | Check here if you had a deposit with Equitable Federal Savings as of September 12, 2005 or if you were a borrower of Equitable Federal Savings as of June 10, 1992 who continued to borrow as of September 12, 2005. |

i

4. Investment Directions (Applicable to Accumulated Balances Only)

To direct a transfer of all or part of the funds credited to your accounts to the Equitable Financial Stock Fund, you should complete and submit this form toTerry Pfeifer no later than October 17, 2005 at 4:00 p.m.Once your Change of Investment Allocation form is submitted, your investment directions are irrevocable. You may change your investment directions following the close of the reorganization offering.If you need any assistance in completing this form, please contactTerry Pfeifer at (308) 381-9900. If you do not complete and return this form toTerry Pfeifer by October 17, 2005, the funds credited to your account under the Plan will continue to be invested in accordance with your prior investment direction, or in accordance with the terms of the Plan if no investment direction had been provided.

I hereby revoke any previous investment direction and now direct that the percentage of the market value of the units that I have invested in the following funds, to the extent permissible, be transferred out of the specified fund and invested (in whole percentages) in the Equitable Financial Stock Fund as follows:

| | |

Fund

| | Percentage to be transferred

|

Money Market Fund | | %

|

Stable Value Fund | | %

|

Government Board Fund | | %

|

S&P 500 Stock Fund | | %

|

S&P 500/Value Stock Fund | | %

|

S&P 500/Growth Stock Fund | | %

|

S&P MidCap Stock Fund | | %

|

Russell 2000 Stock Fund | | %

|

International Stock Fund | | %

|

Nasdaq 100 Index Fund | | %

|

Asset Allocation Fund (Income Plus) | | %

|

Asset Allocation Fund (Growth & Income) | | %

|

Asset Allocation Fund (Growth) | | %

|

REIT Index Fund | | % |

| | |

|

Total | | % |

| | |

|

Note: The total amount transferred may not exceed the total value of your accounts.

ii

5.Investment Directions (Applicable to Future Contributions after the close of the initial public offering)

I hereby revoke any previous investment instructions and now direct that any future contributions and/or loan repayments, if any, made by me or on my behalf by Equitable Savings, including those contributions and/or repayments received by Equitable Federal Savings Bank of Grand Island during the same reporting period as this form, be invested in the following whole percentages. If I elect to invest in Equitable Financial common stock, such future contributions or loan repayments, if any, will be invested in the Equitable Financial Stock Fund the month following the conclusion of the offering.

| | |

| Fund | | Percentage invested

|

Money Market Fund | | %

|

Stable Value Fund | | %

|

Government Board Fund | | %

|

S&P 500 Stock Fund | | %

|

S&P 500/Value Stock Fund | | %

|

S&P 500/Growth Stock Fund | | %

|

S&P MidCap Stock Fund | | %

|

Russell 2000 Stock Fund | | %

|

International Stock Fund | | %

|

Nasdaq 100 Index Fund | | %

|

Asset Allocation Fund (Income Plus) | | %

|

Asset Allocation Fund (Growth & Income) | | %

|

Asset Allocation Fund (Growth) | | %

|

Equitable Financial Stock Fund | | %

|

REIT Index Fund | | % |

| | |

|

Total | | % |

| | |

|

6. Participant Signature and Acknowledgment—Required

By signing this Change of Investment Allocation Form, I authorize and direct the Plan Administrator and trustee to carry out my instructions. I acknowledge that I have been provided with and read a copy of the Prospectus and the Prospectus Supplement relating to the issuance of common stock. I am aware of the risks involved in the investment in common stock, and understand that the trustee and Plan administrator are not responsible for my choice of investment.

Pentegra Services, Inc. is hereby authorized to make the above listed change(s) to this member’s record.

| | |

| |

| |

|

Signature of Equitable Federal Savings Authorized Representative | | Date |

Minimum Stock Purchase is $250

Maximum Stock Purchase is $350,000

PLEASECOMPLETEANDRETURNTO TERRY PFEIFER

AT EQUITABLE FEDERAL SAVINGS

BY 4:00P.M.ON OCTOBER 17, 2005.

iii

PROSPECTUS

Proposed Holding Company for Equitable Federal Savings Bank of Grand Island, to become Equitable Bank

Up to 1,239,125 Shares of Common Stock

This is the initial public offering of shares of common stock of Equitable Financial Corp., a company to be formed in connection with the reorganization of Equitable Federal Savings Bank of Grand Island into the mutual holding company form of organization. The shares we are offering will represent approximately 43.1% of our outstanding common stock. Equitable Financial MHC, a mutual holding company to be formed in connection with the reorganization, will own approximately 55% of our outstanding common stock. The remaining 1.9% of our common stock will be held by Equitable Bank Charitable Foundation, a charitable foundation to be formed in connection with the reorganization. We intend to have our common stock quoted on the OTC Bulletin Board.

If you are or were a depositor or a borrower of Equitable Federal Savings Bank of Grand Island:

| | • | | You may have priority rights to purchase shares of common stock. |

If you are a participant in the Equitable Federal Savings Bank of Grand Island Employees’ Savings and Profit Sharing Plan:

| | • | | You may direct that all or part of your current account balances in this plan be invested in shares of common stock. |

| | • | | You will be receiving separately a supplement to this prospectus that describes your rights under this plan. |

If you fit neither of the categories above, but are interested in purchasing shares of our common stock:

| | • | | You may have an opportunity to purchase shares of common stock after priority orders are filled. |

We are offering up to 1,239,125 shares of common stock for sale on a best efforts basis, subject to certain conditions. We must sell a minimum of 915,875 shares to complete the offering. If, as a result of regulatory considerations, demand for the shares or changes in market conditions, the independent appraiser determines our market value has increased, we may sell up to 1,424,994 shares without giving you further notice or the opportunity to change or cancel your order. The offering is expected to terminate at 5:00 p.m., Central time, onOctober 24, 2005. We may extend this termination date without notice to you untilDecember 8, 2005, unless the Office of Thrift Supervision approves a later date, which will not be beyondNovember 3, 2007.

Sandler O’Neill & Partners, L.P. will use its best efforts to assist us in our selling efforts, but is not required to purchase any of the common stock that is being offered for sale. Purchasers will not pay a commission to purchase shares of common stock in the offering. All shares offered for sale are offered at a price of $10.00 per share.

The minimum purchase is 25 shares. Once submitted, orders are irrevocable unless the offering is terminated or extended beyondDecember 8, 2005. If the offering is extended beyondDecember 8, 2005, subscribers will have their funds promptly returned unless they reconfirm their subscription. Funds received before completion of the offering will be held in an escrow account at Equitable Federal Savings Bank or, at our discretion, at another insured financial institution, and will earn interest at our statement savings rate, which is currently 0.25% per annum. In addition, if we do not sell the minimum number of shares or if we terminate the offering for any other reason, we will promptly return your funds with interest at our statement savings rate.

We expect our directors and executive officers, together with their associates, to subscribe for 199,500 shares, which equals 16.1% of the shares offered for sale at the maximum of the offering range.

On September 27, 2005, the Office of Thrift Supervision conditionally approved the plan of reorganization and stock issuance. However, such approval does not constitute a recommendation or endorsement of this offering by that agency.

This investment involves a degree of risk, including the possible loss of principal.

Please read “Risk Factors” beginning on page 19.

OFFERING SUMMARY

Price Per Share: $10.00

| | | | | | | | | |

| | | Minimum

| | Maximum

| | Maximum As Adjusted

|

Number of shares | | | 915,875 | | | 1,239,125 | | | 1,424,994 |

Gross offering proceeds | | $ | 9,158,750 | | $ | 12,391,250 | | $ | 14,249,940 |

Estimated offering expenses | | $ | 755,000 | | $ | 792,000 | | $ | 813,000 |

Estimated net proceeds | | $ | 8,403,750 | | $ | 11,599,250 | | $ | 13,436,940 |

Estimated net proceeds per share | | $ | 9.18 | | $ | 9.36 | | $ | 9.43 |

These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Neither the Securities and Exchange Commission, the Office of Thrift Supervision nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Sandler O’Neill & Partners, L.P.

The date of this prospectus is September 27, 2005

TABLE OF CONTENTS

SUMMARY

This summary highlights selected information from this document and may not contain all the information that is important to you. To understand the reorganization and stock offering more fully, you should read this entire document carefully. For assistance, please contact our conversion center at (888) 585-5601.

THE COMPANIES

| | |

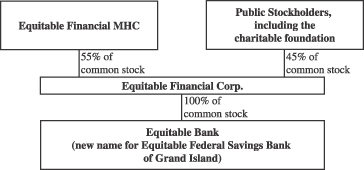

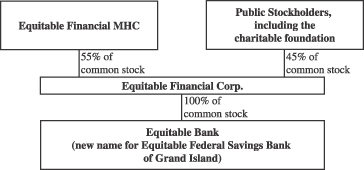

Equitable Financial MHC 113-115 North Locust Street Grand Island, Nebraska 68801 (308) 382-3136 | | Equitable Financial MHC is a federally chartered mutual holding company that we are forming to own 55% of the common stock of Equitable Financial Corp. (referred to in this prospectus as Equitable Financial). As a savings and loan holding company, Equitable Financial MHC will be subject to examination by, and otherwise must comply with the rules and regulations of, the Office of Thrift Supervision. As a mutual holding company, Equitable Financial MHC will be a non-stock company whose members are the depositors and certain borrowers of Equitable Federal Savings Bank. Under federal regulations, so long as Equitable Financial MHC exists, it will own a majority of the voting stock of Equitable Financial Corp., and through its board of directors, will be able to exercise voting control over most matters put to a vote of stockholders. The same persons who will comprise the board of directors of Equitable Financial Corp. and Equitable Bank will also comprise the board of directors of Equitable Financial MHC. Equitable Financial MHC is not currently an operating company and has not engaged in any business to date. Equitable Financial MHC will be formed upon completion of the reorganization. We do not expect that Equitable Financial MHC will engage in any business activity other than owning a majority of the common stock of Equitable Financial Corp. |

Equitable Financial Corp. 113-115 North Locust Street Grand Island, Nebraska 68801 (308) 382-3136 | | This offering is made by Equitable Financial. Equitable Financial is a federally chartered mid-tier stock holding company that we are forming. As a savings and loan holding company, Equitable Financial will be subject to examination by, and otherwise must comply with the rules and regulations of, the Office of Thrift Supervision. Equitable Financial is not currently an operating company and has not engaged in any business to date. After the reorganization, Equitable Federal Savings Bank will change its name to Equitable Bank and Equitable Financial will own all of Equitable Bank’s capital stock and will direct, plan and coordinate Equitable Bank’s business activities. In the future, Equitable Financial might also acquire or organize other operating subsidiaries, including other financial institutions or financial services companies, although it currently has no specific plans or agreements to do so. |

Equitable Federal Savings Bank of Grand Island 113-115 North Locust Street Grand Island, Nebraska 68801 (308) 382-3136 | | Equitable Federal Savings Bank is a community-oriented financial institution dedicated to serving the financial services needs of consumers and businesses within our market areas. Equitable Federal Savings Bank is subject to extensive regulation, examination and supervision by the Office of Thrift Supervision, our primary federal regulator, and the Federal Deposit Insurance Corporation, our deposit insurer. We attract deposits from the general public and use such funds to originate primarily one- to four-family residential real estate loans. |

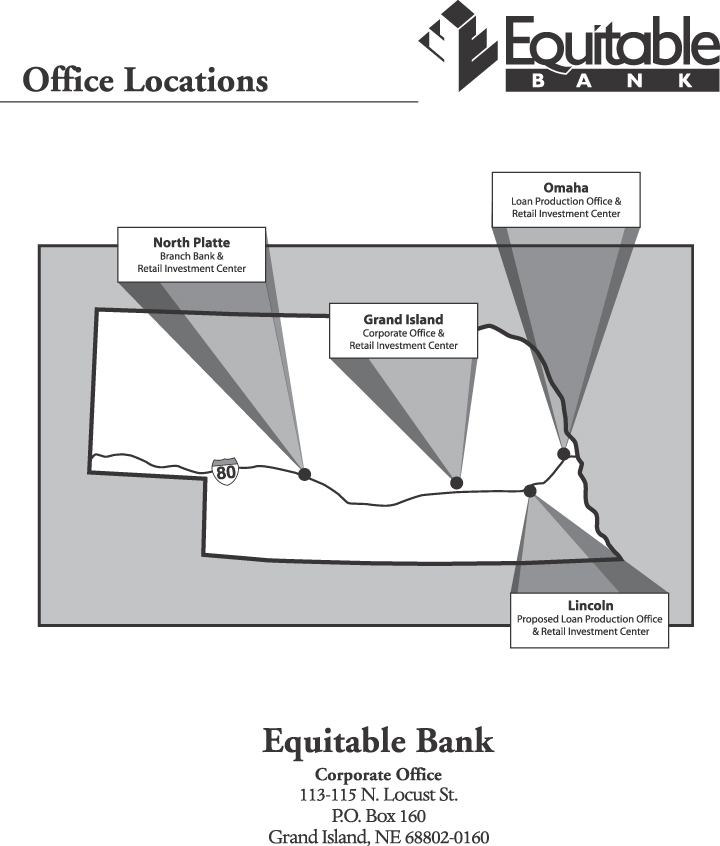

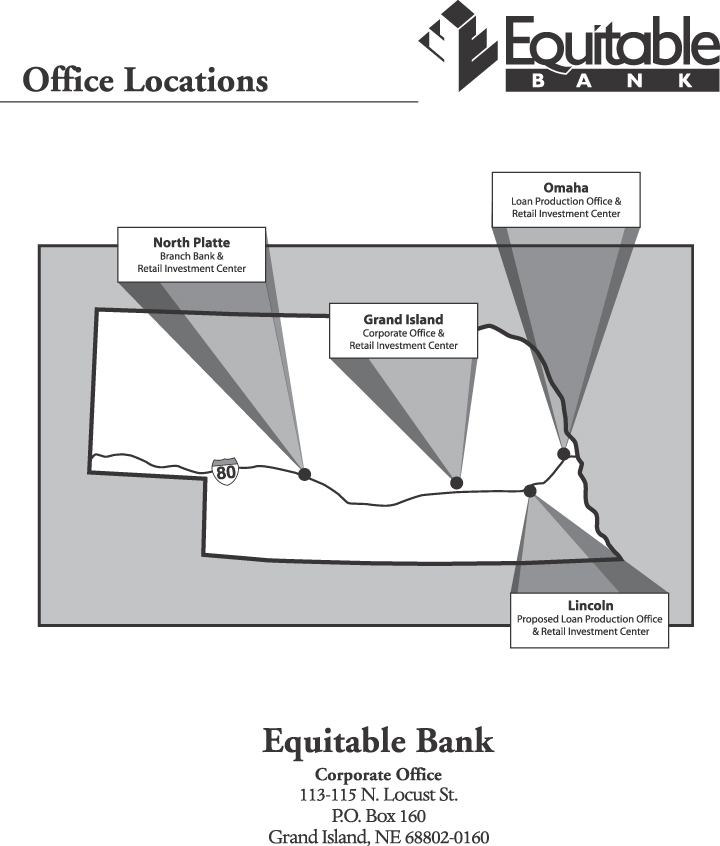

1

| | |

| | | To a lesser extent, we originate multi-family and nonresidential real estate loans, construction loans, commercial loans and consumer loans. At June 30, 2005, we operated out of our main office and two additional offices in Grand Island, Nebraska, a loan production office in North Platte, Nebraska and a loan production office in Omaha, Nebraska. At June 30, 2005, we had total assets of $145.4 million, deposits of $96.8 million and total members’ equity of $14.4 million. As part of the reorganization, Equitable Federal Savings Bank intends to change its name to Equitable Bank. |

| |

| Our Operating Strategy (page 52) | | Our mission is to operate and grow a profitable, community-oriented financial institution serving primarily retail customers and small businesses in our market areas. After the reorganization, we plan to continue our strategy of: • expanding our branch network and upgrading our existing branches; • pursuing opportunities to increase and diversify our loan portfolio in our expanding market areas; • increasing core deposits through the expansion of our branch network and new deposit products; • continuing to increase our sales of non-deposit investment products; and • applying disciplined underwriting practices to maintain the high quality of our loan portfolio. Since our formation in 1882, we have operated solely out of our offices located in Grand Island, Nebraska and have focused our lending in Grand Island and the surrounding area. Recently, our management began to implement a growth strategy that expands our presence in Grand Island and to additional markets in Nebraska that are also experiencing economic expansion. Since March 31, 2005, we have opened the following new offices: • an additional loan production and retail investment office in Grand Island that we intend to convert to a full-service branch in calendar year 2006; • a full-service branch in North Platte; and • a loan production office in Omaha that we intend to convert to a full-service branch at a new location in calendar year 2005. In addition, we intend to open a loan production and retail investment office in Lincoln in calendar year 2006 that we intend to convert to a full-service branch at a new location in 2006. In connection with this expansion of our branch network, we expect to hire approximately 22 new lending, retail investment and other employees to support our expanded infrastructure (13 of whom have been hired through June 30, 2005). In addition to branching, we will focus on upgrading existing facilities in an effort to better serve our customers. In September 2005, we will begin a complete remodel of our main office and minor renovations to our West Second Street drive-up facility in Grand Island. |

2

| | |

THE REORGANIZATION |

| Description of the Reorganization (page 94) | | Currently, we are a federally chartered mutual savings bank with no stockholders. Our depositors and certain borrowers currently have the right to vote on certain matters such as the election of directors and this reorganization. The mutual holding company reorganization process that we are now undertaking involves a series of transactions by which we will convert our organization from the mutual form of organization to the mutual holding company form of organization. In the mutual holding company structure, Equitable Federal Savings Bank will become a federally chartered stock savings bank to be named Equitable Bank and all of its stock will be owned by Equitable Financial. In addition, 43.1% of Equitable Financial’s stock will be owned by the public, including our employee stock ownership plan, 1.9% of Equitable Financial’s stock will be owned by Equitable Bank Charitable Foundation and 55% of Equitable Financial’s stock will be owned by Equitable Financial MHC. Our members will become members of Equitable Financial MHC and will have similar voting rights in Equitable Financial MHC as they currently have in Equitable Federal Savings Bank. |

| | |

| |

| | | After the reorganization, our ownership structure will be as follows:

|

| |

| | | The normal business operations of Equitable Federal Savings Bank will continue without interruption during the reorganization. The same directors who adopted the plan of reorganization and stock issuance and who continue to be directors of Equitable Federal Savings Bank at the time of the reorganization will serve Equitable Financial MHC, Equitable Financial and Equitable Bank after the reorganization. The initial officers of Equitable Financial MHC, Equitable Financial and Equitable Bank will be persons who are currently officers of Equitable Federal Savings Bank. |

3

| | |

| THE OFFERING |

| |

| Purchase Price | | The purchase price is $10.00 per share. |

| |

| Number of Shares to be Sold | | We are offering for sale between 915,875 and 1,239,125 shares of Equitable Financial common stock in this reorganization to persons other than Equitable Financial MHC and the charitable foundation. With regulatory approval, we may increase the number of shares to be sold to 1,424,994 shares without giving you further notice or the opportunity to change or cancel your order. The Office of Thrift Supervision will consider the level of subscriptions, the views of our independent appraiser, our financial condition and results of operations and changes in market conditions in connection with a request to increase the offering size. |

| | |

How We Determined the Offering

Range (page 109) | | We decided to offer between 915,875 and 1,239,125 shares, which is our offering range, based on an independent appraisal of our pro forma market value prepared by Keller & Company, Inc., an appraisal firm experienced in appraisals of financial institutions. Keller & Company will receive fees totaling $25,000 for its appraisal services, plus reimbursement of out-of-pocket expenses. Keller & Company estimates that as of August 23, 2005, our pro forma market value on a fully converted basis was between $21.3 million and $28.8 million, with a midpoint of $25.0 million. The term “fully converted” means that Keller & Company assumed that 100% of our common stock had been sold to the public or contributed to the charitable foundation, rather than the 45% that will be sold or contributed in connection with this offering. In preparing its appraisal, Keller & Company considered the information in this prospectus, including our financial statements. Keller & Company also considered the following factors, among others: • our historical, present and projected operating results and financial condition and the economic and demographic characteristics of our market areas; • a comparative evaluation of the operating and financial statistics of Equitable Federal Savings Bank with those of other similarly-situated, publicly-traded savings associations and savings association holding companies; • the effect of the capital raised in this offering on our net worth and earnings potential; • the trading market for securities of comparable institutions and general conditions in the market for such securities; and • our intention to make a contribution to the Equitable Bank Charitable Foundation of $100,000 in cash and 1.9% of Equitable Financial’s common stock. |

4

| | |

| | | Our board of directors determined that the common stock should be sold at $10.00 per share and that 43.1% of the shares of our common stock should be offered for sale to the public in the offering. The following table shows the number of shares that will be sold in the offering, issued to Equitable Financial MHC and contributed to the charitable foundation, based on the estimated valuation range and the purchase price. |

| | | | | | | |

| | | At Minimum

of Offering

Range

| | At Maximum

of Offering

Range

| | Percent of

Shares

Outstanding

| |

Shares sold in the offering | | 915,875 | | 1,239,125 | | 43.1 | % |

Shares issued to Equitable Financial MHC | | 1,168,750 | | 1,581,250 | | 55.0 | |

Shares contributed to the charitable foundation | | 40,375 | | 54,625 | | 1.9 | |

| | |

| |

| |

|

|

Total | | 2,125,000 | | 2,875,000 | | 100.0 | % |

| | |

| |

| |

|

|

| | | | | | | | |

| |

| | | Two measures that some investors use to analyze whether a stock might be a good investment are the ratio of the offering price to the issuer’s “tangible book value” and the ratio of the offering price to the issuer’s annual core earnings. Keller & Company considered these ratios in preparing its appraisal, among other factors. Tangible book value is the same as total equity, less intangibles, and represents the difference between the issuer’s tangible assets and liabilities. Core earnings, for purposes of the appraisal, was defined as net earnings after taxes, excluding the after-tax portion of income from nonrecurring items. Keller & Company’s appraisal also incorporates an analysis of a peer group of publicly traded fully converted savings associations and fully converted savings association holding companies that Keller & Company considered to be comparable to us. The following table presents a summary of selected pricing ratios for the peer group companies and the pricing ratios for us, with the ratios adjusted to the hypothetical case of being fully converted, utilized by Keller & Company in its appraisal. Our ratios are based on core earnings for the twelve months ended June 30, 2005 and tangible book value as of June 30, 2005. |

| | | | | | | | |

| | | Fully Converted

Price To

Core Earnings

Multiple

| | | Fully Converted

Price To

Tangible Book

Value Ratio

| |

Equitable Financial Corp. (pro forma): | | | | | | |

Minimum | | 51.81 | x | | 64.65 | % |

Maximum | | 51.86 | | | 72.24 | |

Peer group companies as of August 23, 2005: | | | | | | |

Average | | 20.63 | x | | 116.13 | % |

Median | | 20.99 | | | 114.81 | |

5

| | |

| | | Compared to the average pricing ratios of the peer group, at the maximum of the offering range, our stock would be priced at a premium of 151.4% to the peer group on a price-to-core earnings basis and a discount of 37.8% to the peer group on a price-to-tangible book basis. This means that, at the maximum of the offering range, a share of our common stock would be more expensive than the peer group on a core earnings per share basis and less expensive than the peer group on a tangible book value per share basis. |

| |

| | | The independent appraisal does not indicate market value. You should not assume or expect that the valuation described above means that our common stock will trade at or above the $10.00 purchase price after the reorganization. |

| |

| Mutual Holding Company Data | | The following table presents a summary of selected pricing ratios for publicly traded mutual holding companies and the pricing ratios for us, without the ratios being adjusted to the hypothetical case of being fully converted. |

| | | | | | |

| | |

| | | Non-Fully

Converted

Price To

Earnings Multiple

| | | Non-Fully Converted Price To

Tangible Book

Value Ratio

| |

Equitable Financial Corp. (pro forma): | | | | | | |

Minimum | | 76.92 | x | | 101.11 | % |

Maximum | | 100.00 | | | 130.03 | |

Publicly traded mutual holding companies as of August 23, 2005(1): | | | | | | |

Average | | 36.00 | x | | 188.10 | % |

Median | | 38.80 | | | 180.30 | |

| | (1) | The information for publicly traded mutual holding companies may not be meaningful for investors because it presents average and median information for mutual holding companies that issued a different percentage of their stock in their offerings than the 43.1% that we are offering to the public. In addition, the effect of stock repurchases also affects the ratios to a greater or lesser degree depending upon repurchase activity. |

| | |

| |

| Possible Change in Offering Range (page 109) | | Keller & Company will update its appraisal before we complete the stock offering. If, as a result of regulatory considerations, demand for the shares or changes in market conditions, Keller & Company determines that our pro forma market value has increased, we may sell up to 1,424,994 shares without further notice to you. If the pro forma market value of the common stock to be sold in the offering at that time is either below $9,158,750 or above $14,249,940, then, after consulting with the Office of Thrift Supervision, we may either: terminate the stock offering and promptly return all funds; promptly |

6

| | |

| | | return all funds, set a new offering range and give all subscribers the opportunity to place a new order for shares of Equitable Financial common stock; or take such other actions as may be permitted by the Office of Thrift Supervision and the Securities and Exchange Commission. |

| | |

| After-Market Performance of “First-Step” Mutual Holding Company Offerings | | The following table provides information regarding the after-market performance of the “first-step” mutual holding company offerings completed from June 30, 2004 through June 30, 2005. |

| | | | | | | | | | | | | | |

| | | | | Appreciation From Initial Offering Price

| |

Issuer (Market/Symbol)

| | Date of IPO

| | After

1 Day

| | | After

1 Week

| | | After

4 Weeks

| | | Through 9/21/05

| |

Heritage Financial Group (Nasdaq: HBOS) | | 06/30/2005 | | 7.5 | % | | 7.5 | % | | 9.0 | % | | 10.0 | % |

Colonial Bankshares, Inc. (Nasdaq: COBK) | | 06/30/2005 | | 6.0 | | | 9.9 | | | 7.5 | | | 10.0 | |

North Penn Bancorp, Inc. (OTCBB: NPEN) | | 06/02/2005 | | 10.0 | | | 2.5 | | | 1.5 | | | 1.5 | |

Rockville Financial, Inc. (Nasdaq: RCKB) | | 05/28/2005 | | 4.8 | | | 11.4 | | | 21.1 | | | 32.0 | |

FedFirst Financial Corporation (Nasdaq: FFCO) | | 04/07/2005 | | (6.6 | ) | | (9.3 | ) | | (14.9 | ) | | (11.0 | ) |

Brooklyn Federal Bancorp, Inc. (Nasdaq: BFSB) | | 04/06/2005 | | (0.5 | ) | | (1.0 | ) | | (4.5 | ) | | 16.0 | |

Prudential Bancorp, Inc. of PA (Nasdaq: PBIP) | | 03/30/2005 | | (1.5 | ) | | (6.5 | ) | | (12.0 | ) | | 19.5 | |

Kentucky First Federal Bancorp (Nasdaq: KFFB) | | 03/03/2005 | | 7.9 | | | 12.0 | | | 12.1 | | | 0.1 | |

Kearny Financial Corp. (Nasdaq: KRNY) | | 02/24/2005 | | 13.9 | | | 15.0 | | | 11.3 | | | 22.9 | |

Home Federal Bancorp, Inc. of LA (OTCBB: HFBL) | | 01/21/2005 | | (1.0 | ) | | 0.5 | | | (0.8 | ) | | (2.0 | ) |

BV Financial, Inc. (OTCBB: BVFL) | | 01/14/2005 | | (6.5 | ) | | (5.0 | ) | | (1.5 | ) | | (14.4 | ) |

Georgetown Bancorp, Inc. (OTCBB: GTWN) | | 01/06/2005 | | 2.0 | | | (0.5 | ) | | 0.1 | | | (8.0 | ) |

SFSB, Inc. (OTCBB: SFBI) | | 12/31/2004 | | 7.5 | | | (1.0 | ) | | (0.5 | ) | | (10.0 | ) |

Ocean Shore Holding Co. (Nasdaq: OSHC) | | 12/22/2004 | | 21.5 | | | 22.0 | | | 7.7 | | | 14.0 | |

Lincoln Park Bancorp (OTCBB: LPBC) | | 12/20/2004 | | 10.0 | | | 12.5 | | | 1.5 | | | (9.5 | ) |

Abington Community Bancorp, Inc. (Nasdaq: ABBC) | | 12/17/2004 | | 33.5 | | | 33.0 | | | 29.0 | | | 25.3 | |

Home Federal Bancorp, Inc. (Nasdaq: HOME) | | 12/07/2004 | | 24.9 | | | 26.8 | | | 23.9 | | | 27.0 | |

PSB Holdings, Inc. (Nasdaq: PSBH) | | 10/05/2004 | | 5.0 | | | 6.0 | | | 4.0 | | | 5.0 | |

Atlantic Coast Federal Corp. (Nasdaq: ACFC) | | 10/05/2004 | | 17.5 | | | 23.1 | | | 29.5 | | | 38.3 | |

Naugatuck Valley Financial Corp. (Nasdaq: NVSL) | | 10/01/2004 | | 8.0 | | | 8.1 | | | 4.2 | | | 28.0 | |

SI Financial Group, Inc. (Nasdaq: SIFI) | | 10/01/2004 | | 12.0 | | | 10.6 | | | 9.4 | | | 22.5 | |

| | | | | |

Average—all transactions | | | | 8.4 | | | 8.5 | | | 6.6 | | | N/M | |

Median—all transactions | | | | 7.5 | | | 8.1 | | | 4.2 | | | N/M | |

N/M—not meaningful

7

| | |

| | | This table is not intended to be indicative of how our stock may perform. Furthermore, this table presents only short-term price performance with respect to companies that only recently completed their initial public offerings and may not be indicative of the longer-term stock price performance of these companies.Stock price appreciation is affected by many factors, including, but not limited to:general market and economic conditions; the interest rate environment; the amount of proceeds a company raises in its offering; and numerous factors relating to the specific company, including the experience andability of management, historical and anticipated operating results, the nature and quality of the company’s assets, and the company’s market area. The companies listed in the table above may not be similar to Equitable Financial, the pricing ratios for their stock offerings may be different from the pricing ratios for Equitable Financial common stock and the market conditions in which these offerings were completed may be different from current market conditions. Any or all of these differences may cause our stock to perform differently from these other offerings. Before you make an investment decision, we urge you to carefully read this prospectus, including, but not limited to, the Risk Factors beginning on page 19. |

| | |

| | | You should be aware that, in certain market conditions, stock prices of thrift IPOs have decreased. For example, as the above table illustrates, the stock of eight companies traded at or below their initial offering price at various times through September 21, 2005. We can give you no assurance that our stock will not trade below the $10.00 purchase price or that our stock will perform similarly to other recent first-step mutual holding company offerings. As part of its appraisal of our pro forma market value, Keller & Company considered the after-market performance of mutual-to-stock conversions completed from June 30, 2004 through August 23, 2005, which was the date of its appraisal report. Keller & Company considered information regarding the new issue market for converting thrifts as part of its consideration of the market for thrift stocks. |

| |

| Possible Termination of the Offering | | We must sell a minimum of 915,875 shares to complete the offering. If we do not sell the minimum number of shares, or if we terminate the offering for any other reason, we will promptly return all funds with interest at our current statement savings rate. |

| |

| Conditions to Completing the Reorganization | | We are conducting the reorganization under the terms of our plan of reorganization and stock issuance. We cannot complete the reorganization and related offering unless: • the plan of reorganization and stock issuance is approved by at least amajority of votes eligible to be cast by members of Equitable Federal Savings Bank (depositors and certain borrowers of Equitable Federal Savings Bank); |

8

| | |

| | | • we sell at least the minimum number of shares offered; and • we receive the final approval of the Office of Thrift Supervision to complete the reorganization and offering. |

| |

| Reasons for the Reorganization (page 94) | | Our primary reasons for the reorganization are to: • increase the capital of Equitable Federal Savings Bank; • support future lending and operational growth; |

| | |