July 14, 2011

United States Securities and Exchange Commission

100 F St. NE

Washington, D.C. 20549

Attention of Mr. Donald Delaney

File No. 000-52689

Dear Sir:

We are responding to your letter dated July 1, 2011.

Form 10-K for Fiscal Year ended December 31, 2010:

We will comply and all future filings will show file number “000-52689”.

Board determination of independence, page 36:

The name Richard Crofts has been replaced by Terrance Ortslan. Do we need to file Amended 10-K?

Signatures, page 37:

All future filings will include the recommended wording.

Form 10-Q for Fiscal Quarter ended March 31, 2011:

Items 5 through 8:

Samlout property, Cambodia:

Nature of ownership in the property

On February 25, 2011 the Company entered into a Securities Exchange Agreement with MIG International Mining Group, a company organized under the laws of the Republic of Mauritius (“Cambodia Project”). The Company acquired 85% of the outstanding equity of MIG International Mining Group in exchange for an aggregate 57,000,000 newly issued common shares of the Company, par value $0.00001 per share and five hundred thousand (500,000) shares of the Company’s Series B Performing Preferred Stock, par value $0.00001 per share (the “Performing Preferred Shares”), which entitles the holder, to receive a dividend equal to forty-five percent (45%) of the net operating profit, after taxes. This Cambodia project consists of an area of approximately 140 sq miles in the Samlout/Samlaut area of Western Cambodia. The land is adjacent to Cambodia’s Pailin district, which is a producer of rubies.

Acquisition process of mineral rights

Mineral rights are acquired through solicitation as per the mining code established by the government of the country. The basis and duration of the mineral rights relate to the rules of the mining code of the concerned countries. These mining codes are readily available to the public for detailed information as per acquisition, mineral, surface, exploration, extraction licenses and rights.

Type of claims

The concessions are essentially alluvial and elluvial deposits. They are governmental exploration mining concessions.

Mineralization:

We show probable or proven reserves as defined by the SEC section (a) of Industry Guide 7. However, we wish to specify that we have utilized a cutting-edge remote exploration satellite technology to determine the probable reserves and this was followed with in the field geological samples, outcrops, holes, as explained below:

Revolutionary Satellite Technology

1. Structure-metric analysis - part of the technology, which processes satellite data to identify geological and tectonic formations, as well as areas of high mineralization (including potential source deposits). Paleo-reconstruction – part of the technology, which utilizes cartographic and satellite data reconstructing the relief plasticity in order to create subsurface paleo-channel maps. Such maps assist in understanding of geomorphology and migration of geo-medium to ascertain zones of alluvial deposits’ concentration. Such channel maps help analyze attraction/focal points and geological features indicative of a mining opportunity. In relation to the Cambodian license, the relief plasticity maps helped determine likely directions and patterns of fluid flow along with estimation of locations of probable placer deposits.

2. Geomorphologic analysis/Lineament analysis.

3. Spectrometric analysis.

Methodology

1. Structure-metric Analysis of Local Stress Fields

Structure-metric analysis is conducted with the purpose of identifying and delineating areas that have high potential for bearing mineralogical deposits in liquid or solid form.

In the process of analysis and interpretation of various types of satellite images based on the geometrization of terrain attributes and using a proprietary algorithm that takes into account principals of proportionality (Harmonic Division1) and the golden ratio φ2principle, we can:

● Accurately detect geological objects of any origin, regardless of the depth of its occurrence

● Delineate blind deposits

● Detect highly enriched areas of the ore-bearing formations

● Identify oil and natural gas bearing zones

● Solve other geological problems

Structure-metric modeling falls under the rules of fractal geometry3 and laws of proportional sectionalization of φ (the golden ratio). φ relationships are noted in many geological formations, including morpho-structural. These observations were described in the works of B.L. Lichkov, I.I. Shafronovskii and others. Fractals are the structure that consists of separate elementary particles, which are similar to the whole structure, that form a Hausdorff-Besicovitch (D) dimension set4 that exceeds its topological dimension (D1). Fractal geometry is a complex mathematical system, exempt from the rules of Euclidean geometry. According to the experimental and mathematical data, most objects found in nature are fractal with non-integer dimension5 . Application of these rules eliminates the subjectivity in geo-dynamic modeling during remote sensing and satellite-based analysis of selected territory.

This method was developed and perfected through the multiple studies of different ore-bearing bodies, detailed geological mapping of aero and satellite images, and geo-morphometric observations of landforms. Ultimately the method was formed into a system of universal geometric models, pertinent to all geological formations.

It has been established that any geological body (sedimentary complex, crystalline massif, mineral deposit, or hydrocarbon occurrence) lies within a strict system of geometric relations that can be shown as vector models of stress zones, comprising a complex multi-dimensional geometric form, similar in the appearance to the Calabi-Yau space6. A method based on the work of O.I. Slenzaka allows delineation of local stress zones. As a result of vast amount of observation, a proprietary empirical analysis algorithm was developed based on golden section; which, by using the stress vector zones, allows identification or justification of absence of any target at any location in the surface of the Earth. It was also established that a two-dimensional satellite image carries sufficient records of all geo-dynamic interactions occurring in the Earth's crust to enable such identification.

Every geological setting is characterized by its own unique geological and acoustical rigidity. A geological body can only create a certain pattern of interfering stress within its hosting environment with application of tectonic forces and translate it onto the visible surface. In this case, the main characteristics are the density and elasticity properties of the studied compounds. Thus the purpose of the structure-metric analysis is to solve the inverse problem – based on the results of geometric interpretation of the elements of the terrain, with further reconstruction of paleo-structural plan of deformation within the deeply buried horizons, identify presence or absence of the targeted object.

The previously mentioned algorithm enables the transformation of the original two-dimensional satellite image into a multi-dimensional vector model that carries information on all geological targets of interest, presenting themselves in the integral system of interactions. The algorithm also allows determination of the depth of target occurrence and its morphological characteristics (Figure 1).

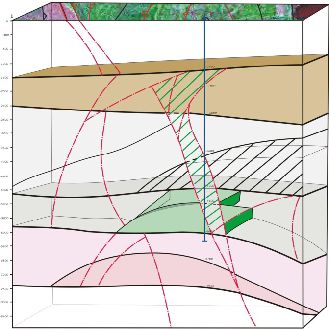

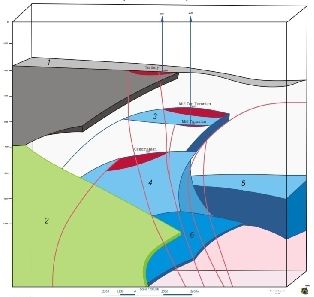

Figure 1: Examples of three-dimensional modeling of the structure-metric scanning of geologic exploration areas, based on the analysis of stress fields

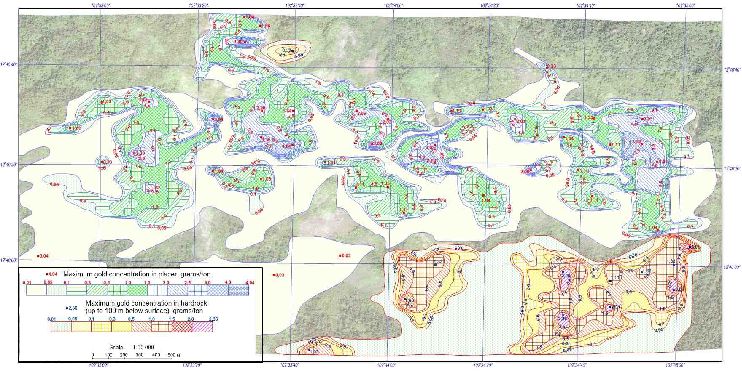

The technology allows us to determine the best outcrops concentrations showed on the isoline ore-bearing, (Figure 86) areas where for on site field detailed sampling, trenching, and holes.

Figure 86: isolines of gold concentration of Sector 2.

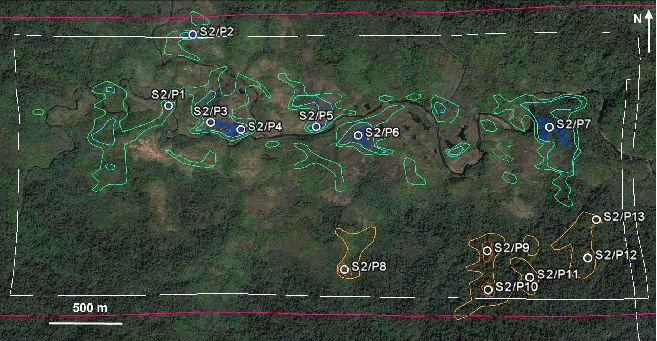

Figure 87: gold anomalies of Sector 2.

Field Sampling

Conclusion, we stand strong to prove that the technology and extensivity of the means utilized can qualify at the least that the reserves of 1.5 million troy ounces of gold and 9 000 kilograms qualify as most probable reserves as defined in part in Section (a) of the SEC Industry Guide 7.

This complete multi-million $ geological study can be made available to your expert.

1 http://en.wikipedia.org/wiki/Harmonic_division

2 http://en.wikipedia.org/wiki/Golden_ratio

3 http://en.wikipedia.org/wiki/Fractal

4 http://en.wikipedia.org/wiki/Hausdorff_dimension

5 Benoît Mandelbrot http://en.wikipedia.org/wiki/Benoît_Mandelbrot

6 http://en.wikipedia.org/wiki/Calabi–Yau_manifold

Exploration and Exploitation programs:

| 1) | The concessions are essentially alluvial and elluvial deposits. |

| 2) | Initialize a Geological Survey or 43-101 Budget : USD $200 000 (+ or – 10%) |

| 3) | Phase 1 Exploration Program could involve the following: |

● Geoscientific compilation of available information (BRGM, data bases, maps, etc. …)

● High-definition satellite images and geo-structural interpretation

● Airborne geophysical survey and data interpretation

● Detailed characterization of the property (mapping, sampling)

● Geological and structural mapping (surface and underground)

● Preliminary surveying

● Local prospecting of known mineralised occurrences

● Geological verification of known anomalies at the site

Budget : USD $500 000 (+ or – 10%)

Phase 2 & 3 Exploration Program :

● Following this first phase, a field exploration program could be planned and a geological prospecting team would verify in-depth the most significant anomalies (geophysics, imagery, old sites, etc.). The main goal would be to size the

property's mineralization as well as its extensions and ramifications. This portion could involve ground geophysics as well as investigation work (shafts, trenches, drilling).

● Exploration and geological mapping of the main targets (determined in phase 1), including sampling and in situ analysis with a hand analyzer, shafts, trenches and ground geophysics.

● Development: sizing and development of the Property, including definition of the mineralization boundaries by shallow drilling, detailed geology.

● Local logistics: establishment of a local geoscientific base, development of social contacts with the surrounding villages, improvement of transport infrastructure.

● Following this second phase, a third phase of more thorough investigation of the most promising targets could be undertaken, including detailed geophysics/geochemistry, definition drilling and a scoping study.

Budget : The budget of the second & third phases will be determined based on the results of phase 1 but could be estimated to be between USD $2 to 6 million depending on the required drilling program which could be between 3 to 10 000 meters of diamond core drilling.

PRODUCTION

| a) | Capital Costs – Road Construction, Extraction Equipment, Processing & Smelter Plant |

● A conventional ball mill processing plant could be installed to further exploit the non-alluvial Au ore present on the properties which would include a revolutionary closed loop VAT leaching process. The t/d of ore processed will have to

be determined based on the estimated resources of Au and Ag present on site. It can be estimated that the process plant will have to be engineered to process between 3 000 to 5 000 tons per day of the extracted ore, open pit mine. The

refinery/smelter plant will be engineered to produce doré or bullion bars.

● Budget : Can only be determined following once the complete exploration and engineering studies have been finalized. Estimation between USD $20 to 60 million.

| b) | 2. Cash Cost Production (estimation) |

● Estimated Pre-Tax cash flow projections for the Life of Mine production schedule, capital and operating cost estimated for a 5,000 tonnes per day case. A summary of the key criteria is provided below:

● Mill recovery by zone could average 90%. Silver to be evaluated

● Reduction in ounces for gold entrained in mill circuit.

● All currency is expressed in USD dollars.

● Mineable resources are based on Whittle(R) floating cones that used a gold metal price of $1,125 per ounce

● Net Smelter Return ("NSR") includes doré refining, transport, and insurance costs

● Pre-production period 2012 to 2013 inclusive

● Capital cost is US$ 27 to 60 million, excluding reclamation; and total operating cost is $9.67 per tonne processed or approx USD $347 per gold ounce produced

● Simple payback occurs before the mid-point of 2014 (less than 12 months from the start of production)

● The mine life capital unit cost could range between US $147-180 per ounce, for a Total

● Production Cost of approx USD $340-440 per ounce of gold

● The average annual gold production during operation is approx 67,000 – 80 000 ounces per year

● Due to the high grade of the mineral resources, the Project is protected if gold prices revert to a Troy Oz price range between USD$ 950-$1,200

| c) | Additional Information tied to Cash Cost Production |

● An evaluation of the possible economic significance of gold could considerably increase revenue and reduce production costs.

● Develop further on the revolutionary closed loop vat leaching process held by the

● company, design and costing of the waste/tailings dump, earthworks structures, mine

● contracting, processing, infrastructure, and administration

● Conduct data verification drilling and mineral resource on other and accessible properties located in the vicinity

● Conduct confirmatory pilot plant test work on representative ore and conduct additional bulk density test work

● Centralize and catalogue the various historical reports and databases

● Finalize Mine design, capital and operating cost estimates

● Conduct exploration on satellite zones and possible extensions

● Ramp-up production could commence in 2012 into 2013.

Montclerg property, Quebec, Canada:

Nature of ownership in the property

This project is situated on lands close to the town of St-Augustin de Woburn in an area known as the Eastern Townships, which is approximately 200 kilometres east of Montreal. The property consists of 23 mineral claims having an area of 17.5 square kilometres.

The Company’s interest consists in 100% interest in 23 mineral claims, located in Woburn Township, Quebec. The list of mineral claims is as follows: CDC 223460, CDC 223461, CDC 223462, CDC 223463, CDC 223464, CDC 223465, CDC 223466, CDC 223467, CDC 223468, CDC 223469, CDC 223470, CDC 223471, CDC 223472, CDC 2247014, CDC 2247015, CDC 2247016, CDC 2247017, CDC 2247425, CDC 2247426, CDC 2247427, CDC 2247428, CDC 2248594, CDC 2248595.

Description of the Net Smelter Royalty Agreement in the Montclerg property:

"Net Smelter Returns" shall mean gross revenues received from the sale by the Owner of all ore mined from the Property and from the sale by the Owner of concentrate, ore, metal and products derived from ore mined from the Properties, after deduction of the following:

| | ● | all smelting and refining costs, sampling, assaying and treatment charges and penalties including but not limited to metal losses, penalties for impurities and charges for refining, selling and handling by the smelter, refinery or other purchaser (including price participation charges by smelters and/or refiners); and |

| | | |

| | ● | costs of handling, transporting, securing and insuring such material from the Properties or from a concentrator, whether situated on or off the Properties, to a smelter, refinery or other place of treatment, and in the case of gold or silver concentrates or doré, security costs; and |

| | | |

| | ● | sales and other taxes based upon sales or production, but not income taxes pursuant to federal, provincial or territorial tax legislation; and |

| | | |

| | ● | marketing costs, including sales commissions, incurred in selling ore mined from the Properties and from concentrate, dolt, metal and products derived from ore mined from the Properties. |

Exploration program:

The Montclerg property is a “grass roots”. We plan to spend $500,000 on test drilling and in preparing a 43-101 report.

We are presently in the process of raising approximately $10 Million in equity funding to complete phase on the Samlout property and the initial exploration on Montclerg.

Patrick Vualu, GEO, member in good standing with the Quebec Order of Engineers since 2008 is qualified to conduct our exploration programs and prepare 43-101 reports.

The Issuer hereby acknowledges the following:

| | ● | the company is responsible for the adequacy and accuracy of the disclosures in the filing; |

| | | |

| | ● | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | | |

| | ● | the company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We trust that the information and explanations herein will be considered as adequate and complete and in conformity with SEC requirements. We will welcome any additional comments and will address them in a timely fashion. As we are in the process of completing our Form 10-Q for the period ended June 30, 2011 we will incorporate the information herein.

Should you have any questions or require any further information, please do not hesitate to contact us.

| Yours very truly | | | |

| | | | |

/s/ Robert Vivian | | | |

| Robert Vivian | | | |

| President & CEO | | | |

| Shamika 2 Gold Inc. | | | |

11