Exhibit 99.1 www.fhlb-pgh.com 2024 Third Quarter Member Conference Call Oct. 29, 2024

Cautionary Statement Regarding Forward-Looking Information Statements contained in this document, including statements describing the objectives, projections, estimates, or predictions of the future of the Federal Home Loan Bank of Pittsburgh (FHLBank), may be “forward-looking statements.” These statements may use forward- looking terms, such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “likely,” or their negatives or other variations on these terms. FHLBank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, the following: economic and market conditions, including, but not limited to, real estate, credit and mortgage markets; volatility of market prices, rates, and indices related to financial instruments, including, but not limited to, investments and contracts; the occurrence of man-made or natural disasters, endemics, global pandemics, climate change, conflicts or terrorist attacks or other geopolitical events; political events, including legislative, regulatory, litigation, or judicial events or actions, including those relating to environmental, social, and governance matters, or other developments that affect FHLBank, its members, counterparties, or investors in the consolidated obligations of the Federal Home Loan Banks (FHLBanks), such as any government- sponsored enterprise reforms, any changes resulting from the Federal Housing Finance Agency’s review and analysis of the Federal Home Loan Bank System (FHLBank System), including recommendations published in its “FHLBank System at 100: Focusing on the Future” report, changes in the Federal Home Loan Bank Act of 1932, as amended, changes in applicable sections of the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, or changes in other statutes or regulations applicable to the FHLBanks; risks related to mortgage-backed securities (MBS); changes in the assumptions used to estimate credit losses; changes in FHLBank’s capital structure; changes in FHLBank’s capital requirements; changes in expectations regarding FHLBank’s payment of dividends; membership changes; changes in the demand by FHLBank members for FHLBank advances; an increase in advance prepayments; competitive forces, including the availability of other sources of funding for FHLBank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; disruptions in the capital markets; changes in the FHLBank System’s debt rating or FHLBank’s rating; the ability of FHLBank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which FHLBank has joint and several liability; applicable FHLBank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; FHLBank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology and cybersecurity risks; and timing and volume of market activity. This presentation is not intended as a full business or financial review and should be viewed in the context of all other information, including, but not limited to, additional risk factors, made available by FHLBank in its filings with the Securities and Exchange Commission, which are available at www.sec.gov. Forward-looking statements speak only as of the date made and FHLBank has no obligation, and does not undertake publicly, to update or revise any forward-looking statement for any reason. 2

Agenda ▪ State of FHLBank Pittsburgh - David Paulson, President and Chief Executive Officer ▪ Financial Review - Ted Weller, Chief Financial Officer ▪ Operating Highlights and Outlook; Important Dates - Mark Evanco, Chief Business Development and Strategy Officer ▪ Closing Remarks and Member Questions - David Paulson 3

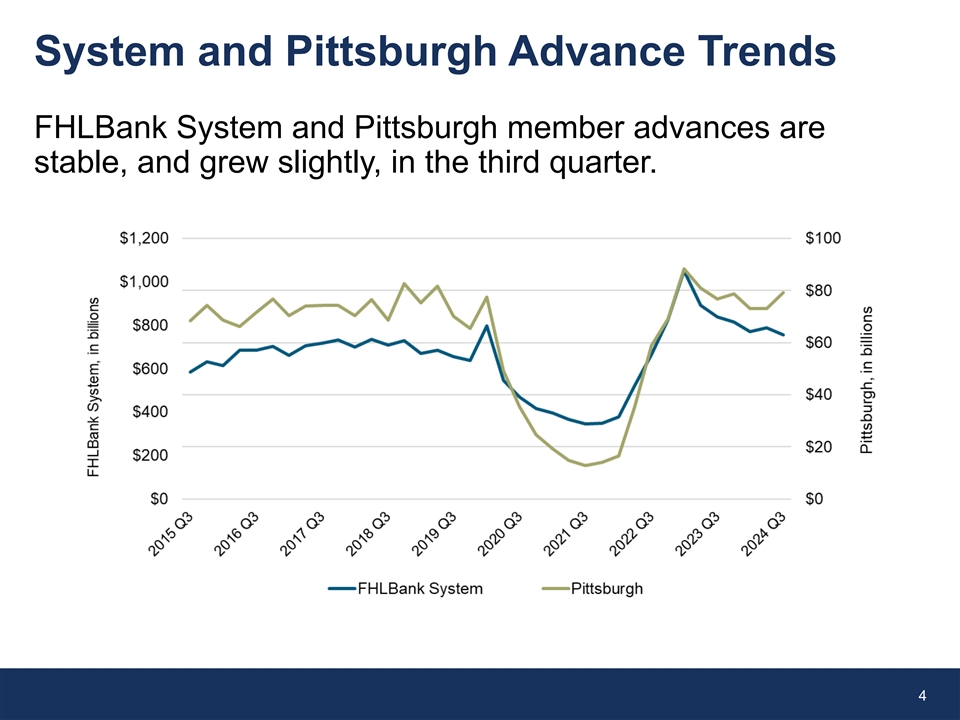

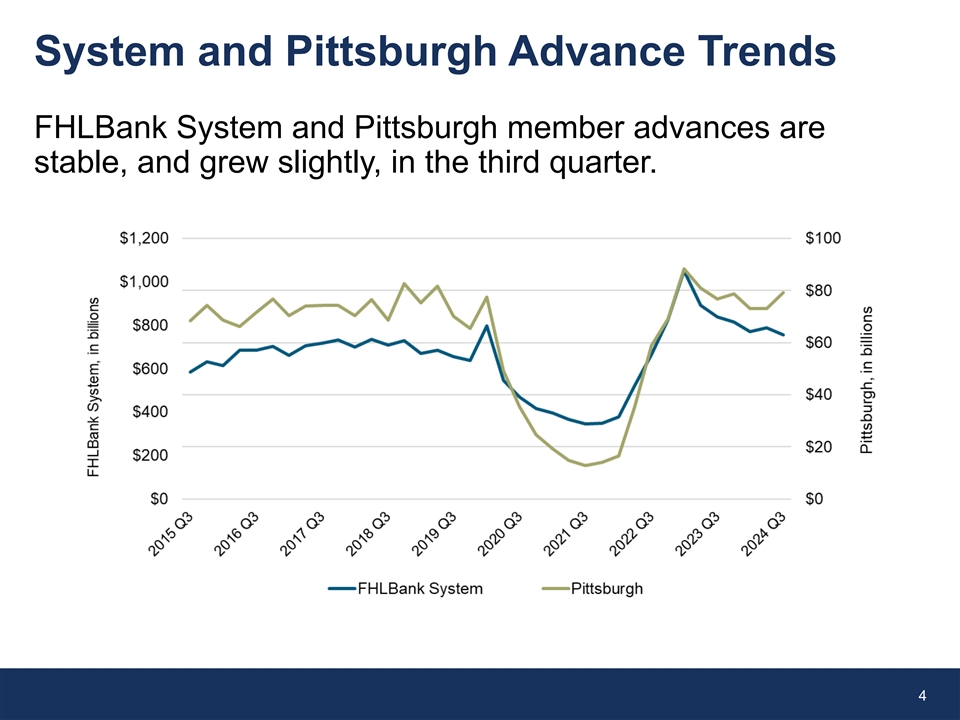

System and Pittsburgh Advance Trends FHLBank System and Pittsburgh member advances are stable, and grew slightly, in the third quarter. 4

FHLBank System Update The Federal Housing Finance Agency (FHFA) furthering specific areas from FHLBank System at 100 report, including: ▪ July / August 2024: Requests for Input (RFIs) on FHLBanks’ core Mission activities and Mission achievement and the FHLBanks’ Affordable Housing Program (AHP) competitive application process ▪ September 2024: Advisory Bulletins published on FHLBank Member Credit Risk Management and Climate Risk Management, respectively ▪ October 2024: Issued a notice of proposed rulemaking which addresses Boards of directors and executive management of the FHLBanks and the FHLBank System’s Office of Finance ▪ Ongoing: Discussions with the FHLBanks to further increase their AHP contributions, either voluntarily or through statute 5

Financial Review

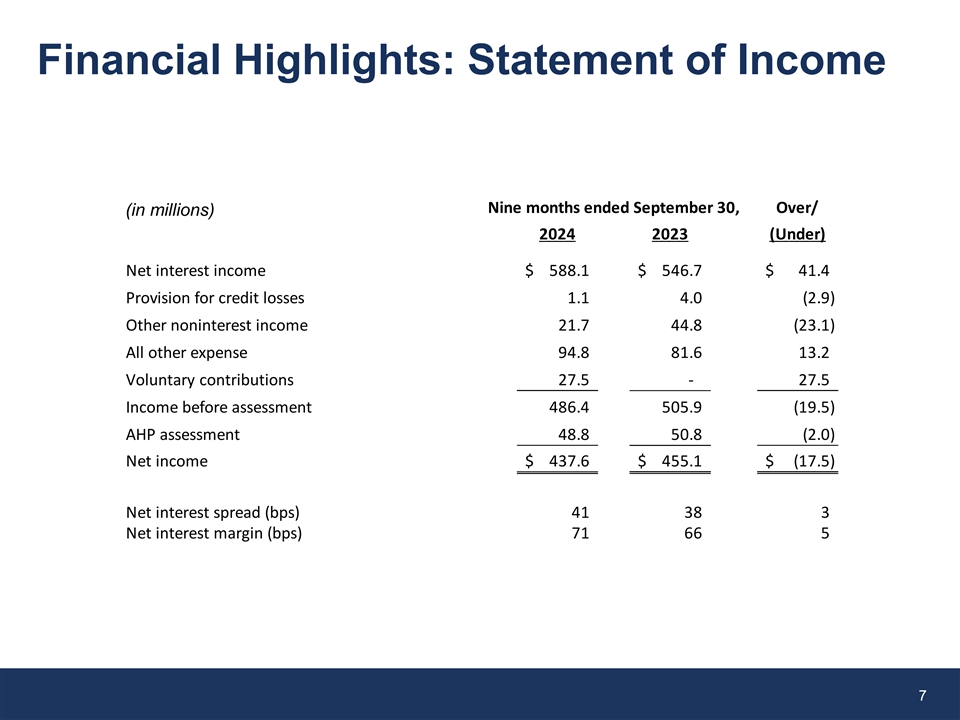

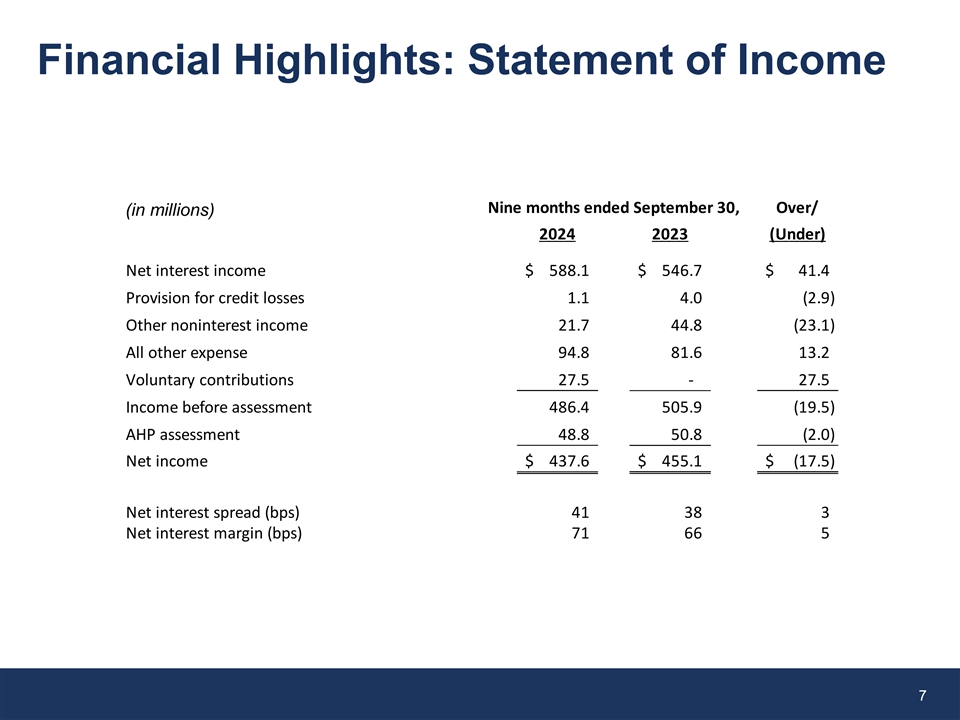

Financial Highlights: Statement of Income Nine months ended September 30, Over/ (in millions) 2024 2023 (Under) Net interest income $ 588.1 $ 546.7 $ 41.4 Provision for credit losses 1.1 4.0 (2.9) Other noninterest income 2 1.7 44.8 (23.1) All other expense 94.8 81.6 13.2 Voluntary contributions 2 7.5 - 2 7.5 Income before assessment 486.4 505.9 (19.5) AHP assessment 4 8.8 5 0.8 (2.0) Net income $ 437.6 $ 455.1 $ (17.5) Net interest spread (bps) 41 38 3 Net interest margin (bps) 71 66 5 7

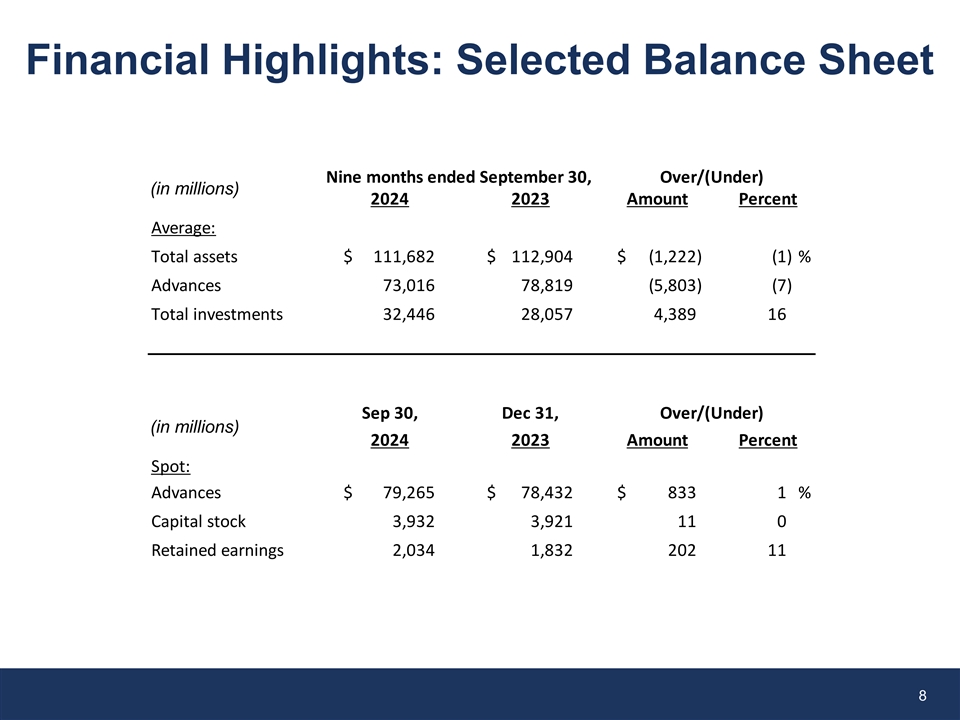

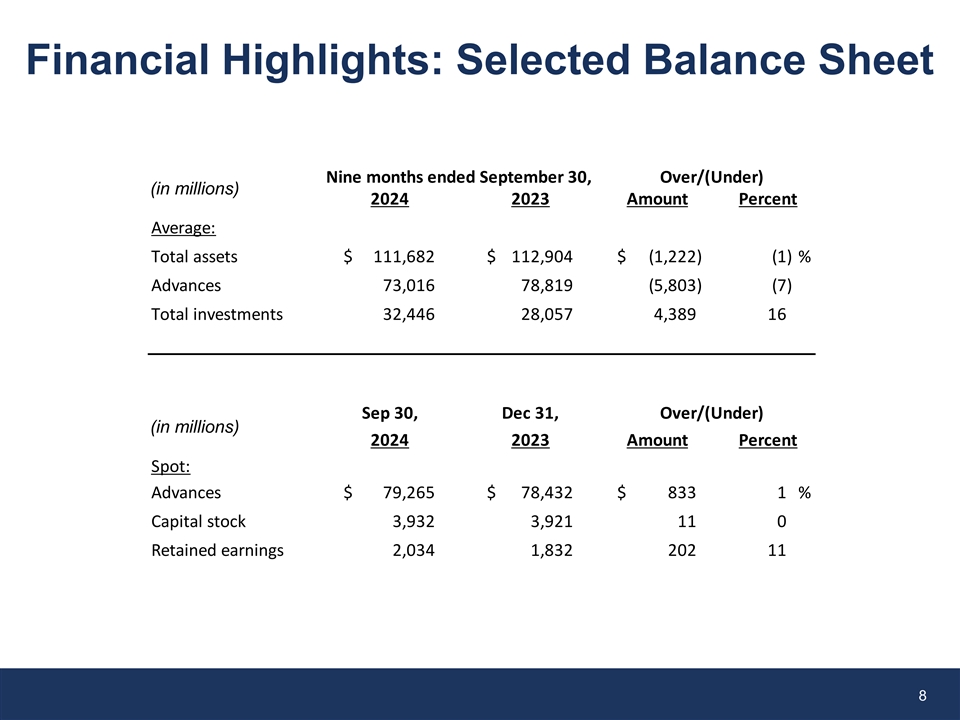

Financial Highlights: Selected Balance Sheet Nine months ended September 30, Over/(Under) (in millions) 2024 2023 Amount Percent Average: Total assets $ 111,682 $ 112,904 $ (1,222) (1) % Advances 7 3,016 78,819 (5,803) (7) Total investments 32,446 28,057 4,389 16 Sep 30, Dec 31, Over/(Under) (in millions) 2024 2023 Amount Percent Spot: Advances $ 79,265 $ 78,432 $ 833 1 % Capital stock 3,932 3,921 11 0 Retained earnings 2,034 1 ,832 202 11 8

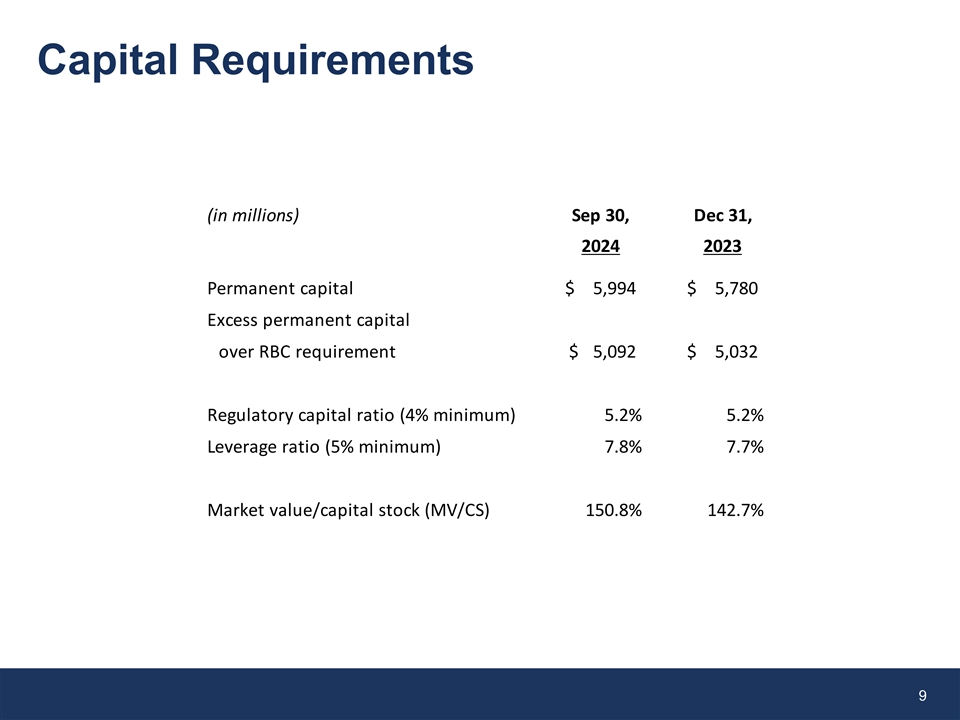

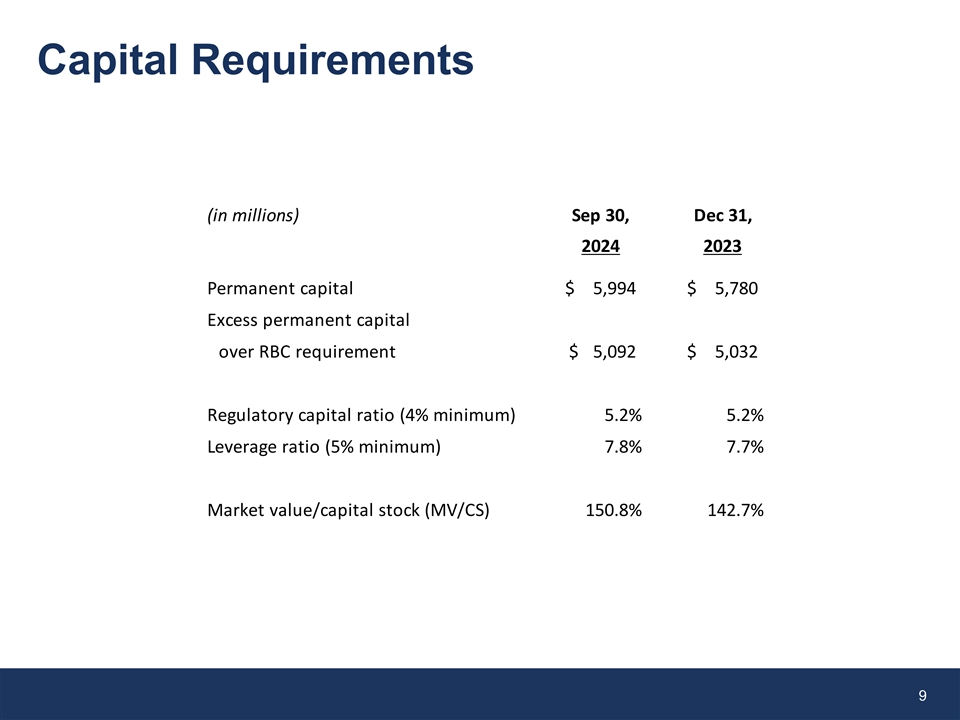

Capital Requirements (in millions) Sep 30, Dec 31, 2024 2023 Permanent capital $ 5,994 $ 5,780 Excess permanent capital over RBC requirement $ 5,092 $ 5,032 Regulatory capital ratio (4% minimum) 5.2% 5.2% Leverage ratio (5% minimum) 7.8% 7.7% Market value/capital stock (MV/CS) 150.8% 142.7% 9

Operating Highlights and Outlook; Important Dates

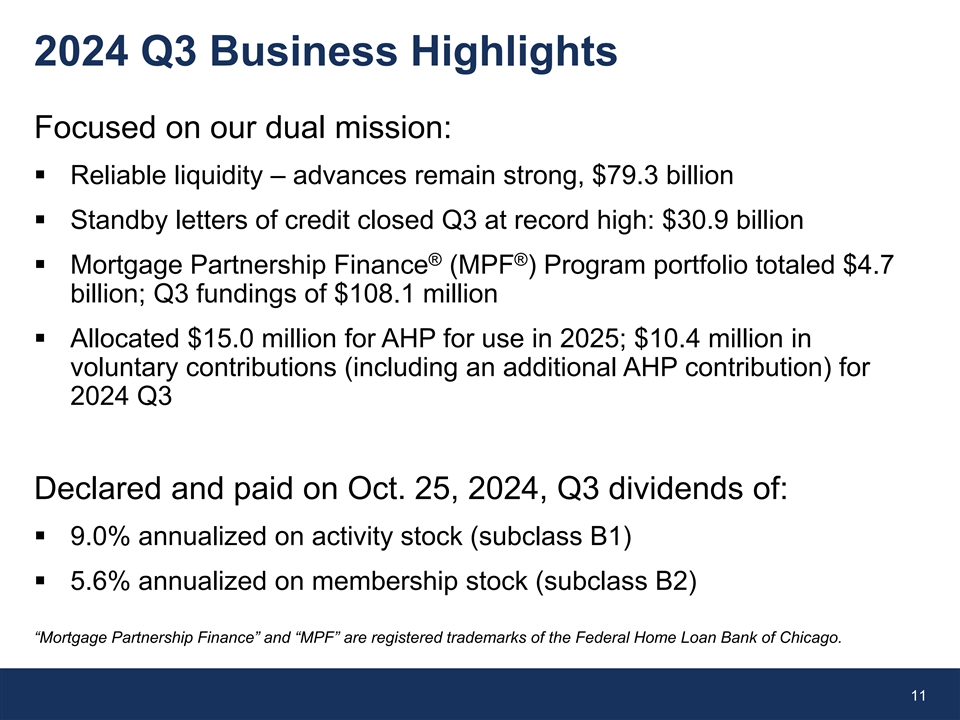

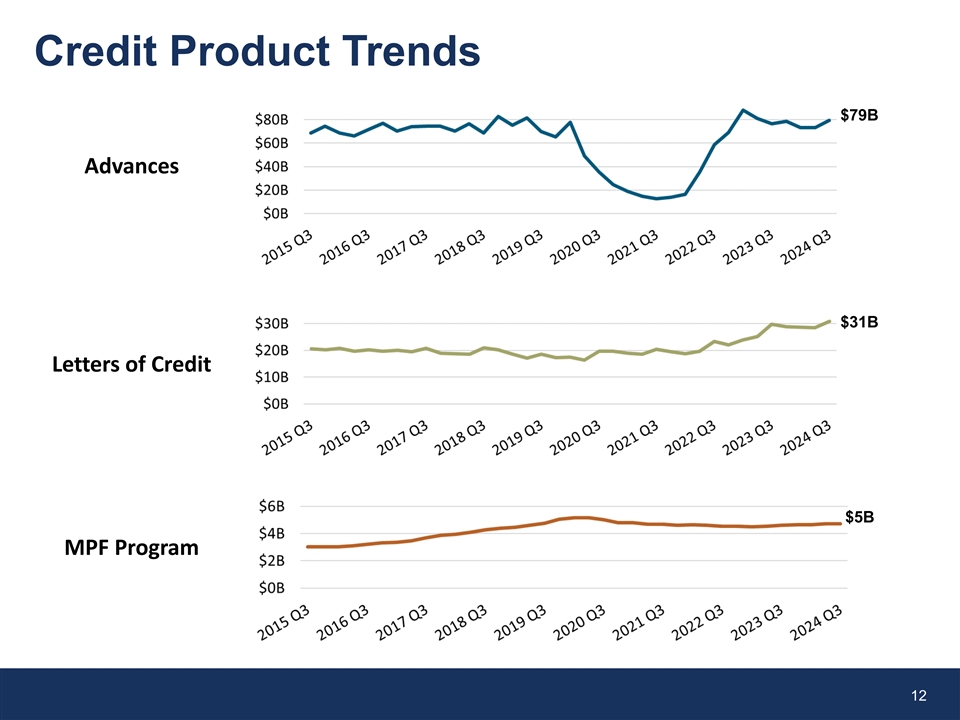

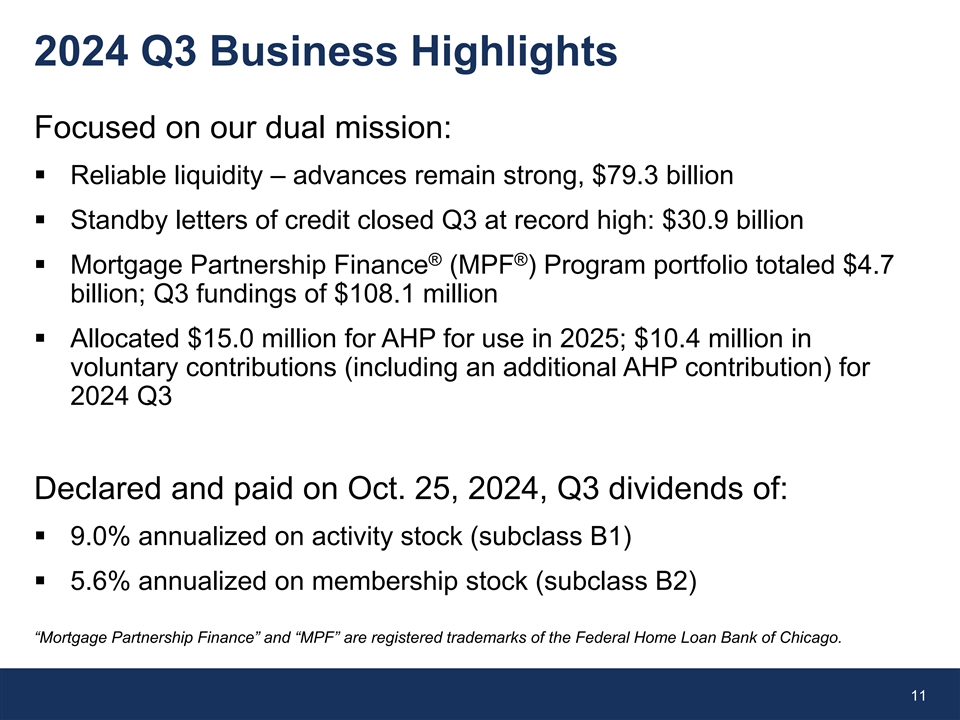

2024 Q3 Business Highlights Focused on our dual mission: ▪ Reliable liquidity – advances remain strong, $79.3 billion ▪ Standby letters of credit closed Q3 at record high: $30.9 billion ® ® ▪ Mortgage Partnership Finance (MPF ) Program portfolio totaled $4.7 billion; Q3 fundings of $108.1 million ▪ Allocated $15.0 million for AHP for use in 2025; $10.4 million in voluntary contributions (including an additional AHP contribution) for 2024 Q3 Declared and paid on Oct. 25, 2024, Q3 dividends of: ▪ 9.0% annualized on activity stock (subclass B1) ▪ 5.6% annualized on membership stock (subclass B2) “Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago. 11

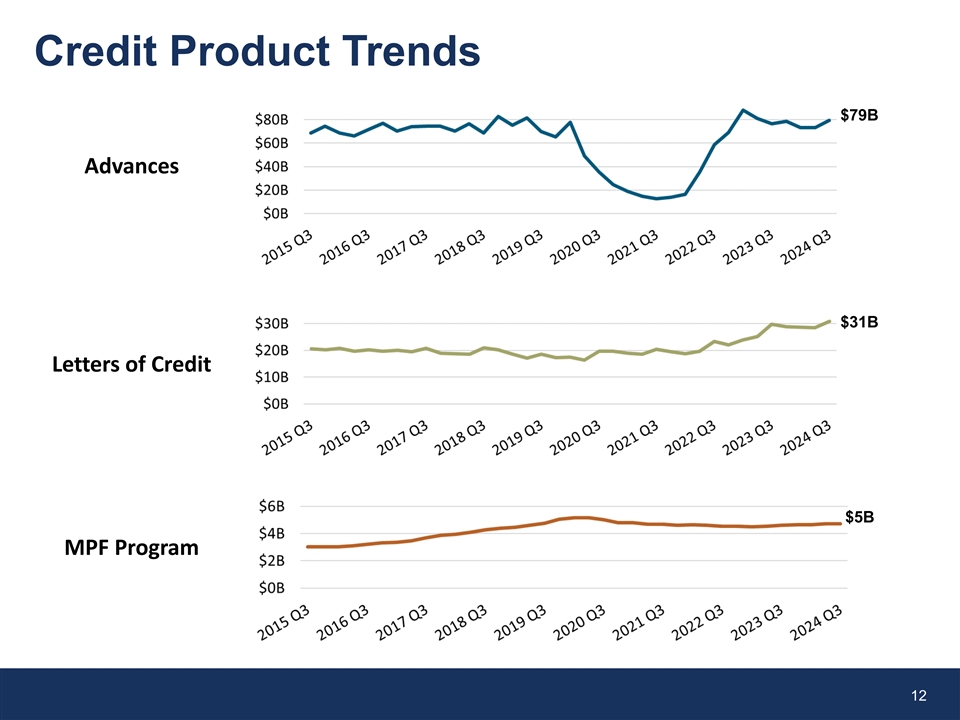

Credit Product Trends $79B Advances $31B Letters of Credit $5B MPF Program 12

Looking Forward Business factors that may impact operating results: ▪ Members’ advance demand ▪ Short-term interest rates ▪ Mortgage-backed security and MPF Program purchases/paydowns ▪ Disciplined expense management with planned strategic initiatives FHLBank Pittsburgh Board and management proactively evaluate our dividend approach: ▪ Dividends are subject to market conditions and results of operations ▪ Future dividend rates may not correlate directly with the pace or direction of interest rate changes The above reflects forward-looking information based on management’s expectations regarding economic and market conditions, and FHLBank Pittsburgh’s financial condition and operating results. Refer to Cautionary Statement Regarding Forward-Looking Information on slide 2 of this presentation. Any expected increase in dividends is not a guarantee or commitment regarding the payment or level of dividends. 13

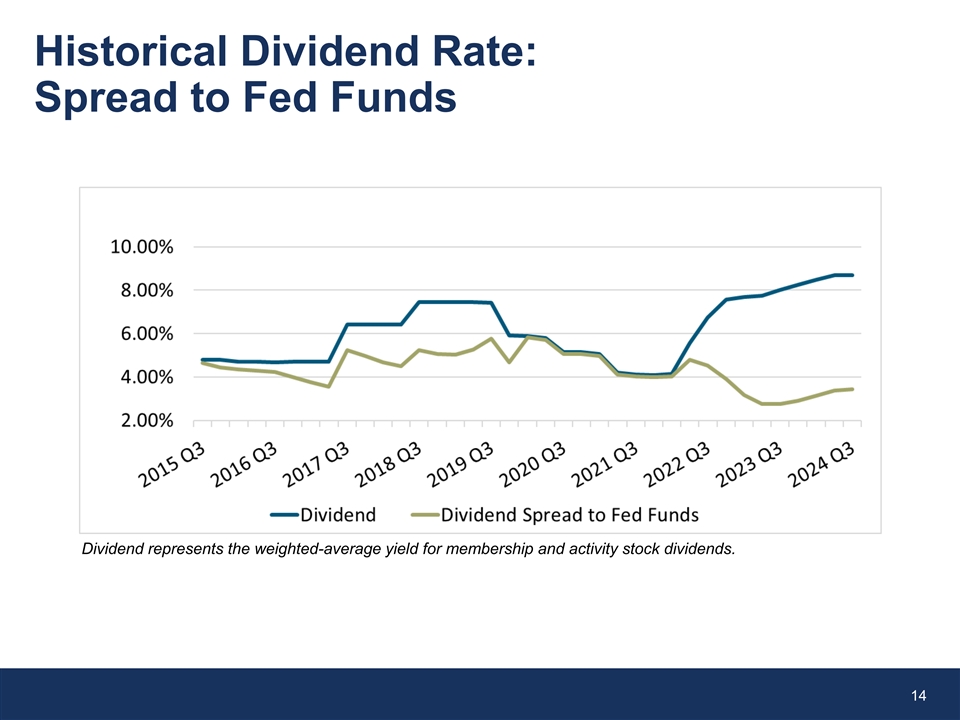

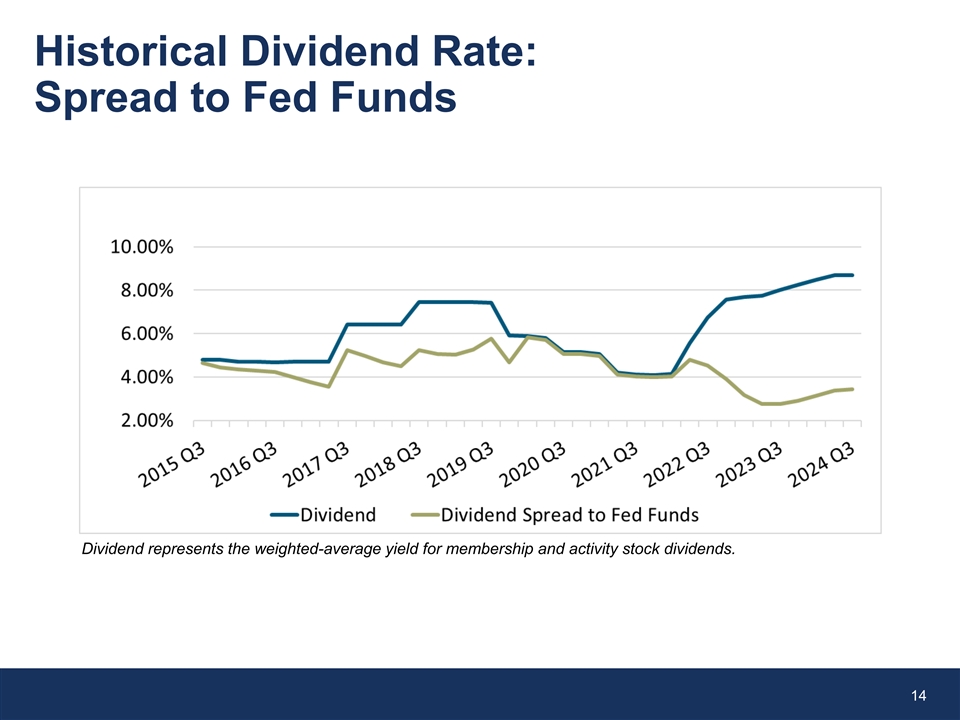

Historical Dividend Rate: Spread to Fed Funds Dividend represents the weighted-average yield for membership and activity stock dividends. 14

Important Dates/Events ▪ Community investment product availability: - Affordable Housing Program (AHP) and voluntary housing grant initiative awards will be announced in December 2024 - Home4Good awards will be announced in November - Community Lending Program (CLP) funds remain available ▪ Corporate office relocation: - One Oxford Centre, 301 Grant Street, Suite 2000, Pittsburgh ▪ Director election closes Nov. 7, 2024, 5 p.m. Eastern Time ▪ Member reporting: - Q3 Qualifying Collateral Report (QCR) due Nov. 15, 2024 ▪ Quarterly member conferences calls ending: - Financial and operating highlights will be shared via other channels 15

Member Questions

Contact Us Member Services (8 a.m. to 5 p.m., Monday through Friday) 800-288-3400, option 2 or member.services@fhlb-pgh.com Leadership Business Development Managers David Paulson Jeff Acquafondata (MPF Program) david.paulson@fhlb-pgh.com jeffa@fhlb-pgh.com Mark Evanco Fred Bañuelos (Community Investment) mark.evanco@fhlb-pgh.com fred.banuelos@fhlb-pgh.com Fred Duncan fred.duncan@fhlb-pgh.com Megan Krider (Community Investment) megan.krider@fhlb-pgh.com Vince Moye vincent.moye@fhlb-pgh.com Eric Slomer eric.slomer@fhlb-pgh.com Tom Westerlund tom.westerlund@fhlb-pgh.com Federal Home Loan www.fhlb-pgh.com @FHLBankPgh Bank of Pittsburgh 17