As filed with the Securities and Exchange Commission on January 4, 2007

Registration No. 333-126087

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-11

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

KBS Real Estate Investment Trust, Inc.

(Exact name of registrant as specified in its charter)

620 Newport Center Drive, Suite 1300

Newport Beach, California 92660

(949) 417-6500

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Charles J. Schreiber, Jr.

Chief Executive Officer

KBS Real Estate Investment Trust, Inc.

620 Newport Center Drive, Suite 1300

Newport Beach, California 92660

(949) 417-6500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq.

Carrie J. Hartley, Esq.

DLA Piper US LLP

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to public: As soon as practicable after the effectiveness of the registration statement.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

This Post-Effective Amendment No. 4 consists of the following:

| | 1. | The Registrant’s final form of Prospectus dated January 13, 2006, previously filed pursuant to Rule 424(b)(3) on February 2, 2006 and refiled herewith. |

| | 2. | Supplement No. 6 dated October 6, 2006 to the Registrant’s Prospectus dated January 13, 2006, previously filed pursuant to Rule 424(b)(3) on October 6, 2006 and refiled herewith. Supplement No. 6 supersedes and replaces all prior supplements to the Prospectus. |

| | 3. | Supplement No. 13 dated January 4, 2007 to the Registrant’s Prospectus dated January 13, 2006, included herewith, which will be delivered as an unattached document along with the Prospectus dated January 13, 2006 and Supplement No. 6 dated October 6, 2006. Supplement No. 13 supersedes and replaces all supplements subsequent to Supplement No. 6 to the Prospectus. |

| | 4. | Part II included herewith. |

| | 5. | Signature, included herewith. |

| | |

| | KBS REAL ESTATE INVESTMENT TRUST, INC. Maximum Offering of 280,000,000 Shares of Common Stock Minimum Offering of 250,000 Shares of Common Stock |

KBS Real Estate Investment Trust, Inc. is a newly organized Maryland corporation that intends to qualify as a real estate investment trust beginning with the taxable year that will end December 31, 2006. We expect to use substantially all of the net proceeds from this offering to acquire and manage a diverse portfolio of real estate assets composed primarily of office, industrial and retail properties located in large metropolitan areas in the United States. Because we have not yet identified any specific properties to purchase, we are considered to be a blind pool.

We are offering up to 200,000,000 shares of common stock in our primary offering for $10 per share, with volume discounts available to investors who purchase more than 50,000 shares through the same participating broker-dealer. Discounts are also available for other categories of investors. We are also offering up to 80,000,000 shares pursuant to our dividend reinvestment plan at a purchase price initially equal to $9.50 per share. We expect to offer shares of common stock in our primary offering until January 13, 2008.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 24 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| | • | | No public market currently exists for our shares of common stock, and we have no plans to list our shares on an exchange. Until our shares are listed, you may not sell your shares unless the buyer meets applicable suitability and minimum purchase standards. No one may own more than 9.8% of our stock unless exempted by our board. If you are able to sell your shares, you would likely have to sell them at a substantial loss. |

| | • | | We set the offering price of our shares arbitrarily. This price is unrelated to the book or net value of our assets or to our expected operating income. |

| | • | | We depend on our advisor to conduct our operations. Our advisor has no operating history or experience operating a public company. |

| | • | | We have no operating history, and our total assets consist of $200,000 cash. We have not identified any real estate assets to acquire. |

| | • | | All of our executive officers and some of our directors are also officers, managers and/or holders of a controlling interest in our advisor, our dealer manager and other affiliated KBS entities. As a result, they will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other KBS-advised programs and investors. Fees paid to our advisor in connection with transactions involving the purchase and management of our properties will be based on the cost of the investment, not on the quality of the investment or services rendered to us. This arrangement could influence our advisor to recommend riskier transactions to us. |

| | • | | If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of real estate assets and the value of your investment may vary more widely with the performance of specific assets. |

| | • | | We will pay substantial fees and expenses to our advisor, its affiliates and broker-dealers. These fees increase your risk of loss. |

| | • | | Although our distribution policy is not to use the proceeds of this offering to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds. Distributions paid from offering proceeds would constitute a return of capital. |

| | • | | We may incur debt exceeding 75% of the cost of our assets with the approval of the conflicts committee of our board. During the early stages of this offering, we expect that our conflicts committee will approve debt in excess of this limit, and we have begun discussions with lenders to obtain up to $197,675,000 in secured debt for the purchase of $200 million in real estate. If we incur this debt and only raise the minimum offering amount, our borrowings would equal 98.8% of the cost of our assets. High debt levels increase the risk of your investment. |

Neither the SEC, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment.

| | | | | | | | | | | | | | |

| | | Price

to Public | | | Selling

Commissions | | | Dealer

Manager Fee | | Net Proceeds

(Before Expenses) |

Primary Offering | | | | | | | | | | | | | | |

Per Share | | $ | 10.00 | * | | $ | 0.60 | * | | $ | 0.35 | | $ | 9.05 |

Total Minimum | | $ | 2,500,000.00 | * | | $ | 150,000.00 | * | | $ | 87,500.00 | | $ | 2,262,500.00 |

Total Maximum | | $ | 2,000,000,000.00 | * | | $ | 120,000,000.00 | * | | $ | 70,000,000.00 | | $ | 1,810,000,000.00 |

Dividend Reinvestment Plan | | | | | | | | | | | | | | |

Per Share | | $ | 9.50 | | | $ | 0.285 | | | $ | 0.00 | | $ | 9.215 |

Total Maximum | | $ | 760,000,000.00 | | | $ | 22,800,000.00 | | | $ | 0.00 | | $ | 737,200,000.00 |

| * | Discounts are available for some categories of investors. Reductions in selling commissions will result in corresponding reductions in the purchase price. |

The dealer manager, KBS Capital Markets Group LLC, our affiliate, is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum permitted purchase is $5,000. We will not sell any shares unless we raise gross offering proceeds of $2,500,000 from persons who are not affiliated with us or our advisor by January 13, 2007. Pending satisfaction of this condition, all subscription payments will be placed in an account held by the escrow agent, First Republic Trust Company, in trust for our subscribers’ benefit, pending release to us. If we do not raise gross offering proceeds of $2,500,000 by January 13, 2007, we will promptly return all funds in the escrow account (including interest), and we will stop selling shares. We will not deduct any fees if we return funds from the escrow account.

We will not sell any shares to Pennsylvania investors unless we raise $66.7 million in gross offering proceeds (including sales made to residents of other jurisdictions) from persons not affiliated with us or our advisor. If we do not raise this amount by January 13, 2008, we will promptly return all funds held in escrow for the benefit of Pennsylvania investors.

The date of this prospectus is January 13, 2006

SUITABILITY STANDARDS

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

In consideration of these factors, we have established suitability standards for investors in this offering and subsequent purchasers of our shares. These suitability standards require that a purchaser of shares have either:

| | • | | a net worth of at least $150,000; or |

| | • | | gross annual income of at least $45,000 and a net worth of at least $45,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states must meet the special suitability standards set forth below to purchase our shares.

Arizona, California, Iowa, Kansas, Massachusetts, Michigan, Missouri, New Mexico and Tennessee - Investors must have either (1) a net worth of at least $225,000 or (2) gross annual income of at least $60,000 and a net worth of at least $60,000.

Maine - Investors must have either (1) a net worth of at least $200,000 or (2) gross annual income of at least $50,000 and a net worth of at least $50,000.

Iowa, Kansas, Missouri, Ohio and Pennsylvania - In addition to the suitability requirements described above, investors must have a net worth of at least 10 times their investment in us.

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, furnishings and automobiles. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Those selling shares on our behalf must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each stockholder based on information provided by the stockholder regarding the stockholder’s financial situation and investment objectives. See “Plan of Distribution — Suitability Standards” for a detailed discussion of the determinations regarding suitability that we require of all those selling shares on our behalf.

i

TABLE OF CONTENTS

ii

| | |

Who can help answer my questions about the offering? | | 23 |

Risk Factors | | 24 |

Risks Related to an Investment in Us | | 24 |

Because no public trading market for your shares currently exists, it will be difficult for you to sell your shares and, if you are able to sell your shares, you will likely sell them at a substantial discount to the public offering price | | 24 |

If we are unable to find suitable investments, we may not be able to achieve our investment objectives or pay dividends | | 24 |

We may suffer from delays in locating suitable investments, which could limit our ability to make distributions and lower the overall return on your investment | | 25 |

Because this is a blind-pool offering, you will not have the opportunity to evaluate our investments before we make them, which makes your investment more speculative | | 25 |

If we are unable to raise substantial funds, we will be limited in the number and type of investments we may make and the value of your investment in us will fluctuate with the performance of the specific properties we acquire | | 26 |

Neither we nor our advisor have a prior operating history and our advisor does not have any experience operating a public company, which makes our future performance difficult to predict | | 26 |

Because we are dependent upon our advisor and its affiliates to conduct our operations, any adverse changes in the financial health of our advisor or its affiliates or our relationship with them could hinder our operating performance and the return on your investment | | 26 |

KBS Capital Markets Group is a newly formed entity with no operating history and our ability to implement our investment strategy is dependent, in part, upon the ability of KBS Capital Markets Group to successfully conduct this offering, which makes an investment in us more speculative | | 27 |

If we pay distributions from sources other than our cash flow from operations, we will have less funds available for the acquisition of properties and your overall return may be reduced | | 27 |

The loss of or inability to obtain key personnel could delay or hinder implementation of our investment strategies, which could limit our ability to make distributions and decrease the value of your investment | | 27 |

Our rights and the rights of our stockholders to recover claims against our independent directors are limited, which could reduce your and our recovery against them if they negligently cause us to incur losses | | 28 |

Risks Related to Conflicts of Interest | | 28 |

KBS Capital Advisors and its affiliates, including all of our executive officers and some of our directors, will face conflicts of interest caused by their compensation arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders | | 28 |

KBS Capital Advisors will face conflicts of interest relating to the purchase and leasing of properties and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive properties and obtain less creditworthy tenants, which could limit our ability to make distributions and reduce your overall investment return | | 29 |

iii

| | |

KBS Capital Advisors will face conflicts of interest relating to joint ventures that we may form with affiliates of KBS Capital Advisors, which conflicts could result in a disproportionate benefit to the other venture partners at our expense | | 30 |

KBS Capital Advisors, its affiliates and employees and our officers will face competing demands relating to their time and this may cause our operations and your investment to suffer | | 30 |

All of our executive officers and some of our directors face conflicts of interest related to the positions they hold with KBS Capital Advisors and its affiliates, including our dealer manager, which could hinder our ability to implement our business strategy and to generate returns to you | | 30 |

Risks Related to This Offering and Our Corporate Structure | | 31 |

Our charter limits the number of shares a person may own, which may discourage a takeover that could otherwise result in a premium price to our stockholders | | 31 |

Our charter permits our board of directors to issue stock with terms that may subordinate the rights of our common stockholders or discourage a third party from acquiring us in a manner that could result in a premium price to our stockholders | | 31 |

Your investment return may be reduced if we are required to register as an investment company under the Investment Company Act; if we become an unregistered investment company, we could not continue our business | | 31 |

You will have limited control over changes in our policies and operations, which increases the uncertainty and risks you face as a stockholder | | 32 |

Even if adopted, you may not be able to sell your shares under the proposed share redemption program and, if you are able to sell your shares under the program, you may not be able to recover the amount of your investment in our shares | | 32 |

The offering price of our shares was not established on an independent basis; the actual value of your investment may be substantially less than what you pay | | 33 |

Because the dealer manager is one of our affiliates, you will not have the benefit of an independent due diligence review of us, which is customarily performed in underwritten offerings; the absence of an independent due diligence review increases the risks and uncertainty you face as a stockholder | | 33 |

Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment | | 33 |

Payment of fees to KBS Capital Advisors and its affiliates will reduce cash available for investment and distribution and increases the risk that you will not be able to recover the amount of your investment in our shares | | 34 |

If we are unable to obtain funding for future capital needs, cash distributions to our stockholders and the value of our investments could decline | | 34 |

You may be more likely to sustain a loss on your investment because our sponsors do not have as strong an economic incentive to avoid losses as do sponsors who have made significant equity investments in their companies | | 34 |

General Risks Related to Investments in Real Estate | | 35 |

iv

| | |

Economic and regulatory changes that impact the real estate market generally may decrease the value of our investments and weaken our operating results | | 35 |

We will depend on tenants for our revenue, and, accordingly, our revenue and our ability to make distributions to you will be dependent upon the success and economic viability of our tenants | | 35 |

Properties that have significant vacancies could be difficult to sell, which could diminish the return on your investment | | 35 |

Our inability to sell a property when we want could limit our ability to pay cash distributions to you | | 36 |

If we sell a property by providing financing to the purchaser, we will bear the risk of default by the purchaser, which could delay or reduce the distributions available to our stockholders | | 36 |

Potential development and construction delays and resultant increased costs and risks may hinder our operating results and decrease our net income | | 36 |

Competition with third parties in acquiring properties and other investments may reduce our profitability and the return on your investment | | 37 |

Our joint venture partners could take actions that decrease the value of an investment to us and lower your overall return | | 37 |

The costs of complying with governmental laws and regulations may reduce our net income and the cash available for distributions to you | | 37 |

Discovery of previously undetected environmentally hazardous conditions may decrease our cash flows and limit our ability to make distributions | | 38 |

Costs associated with complying with the Americans with Disabilities Act may decrease cash available for distributions | | 38 |

Uninsured losses relating to real property or excessively expensive premiums for insurance coverage could reduce our cash flows and the return on your investment | | 38 |

Terrorist attacks and other acts of violence or war may affect the markets in which we plan to operate, which could delay or hinder our ability to meet our investment objectives and reduce your overall return | | 39 |

Risks Related to Real Estate-Related Investments | | 39 |

If we make or invest in mortgage loans, our mortgage loans may be affected by unfavorable real estate market conditions, which could decrease the value of those loans and the return on your investment | | 39 |

If we make or invest in mortgage loans, our mortgage loans will be subject to interest rate fluctuations that could reduce our returns as compared to market interest rates and reduce the value of the mortgage loans in the event we sell them; accordingly, the value of your investment would be subject to fluctuations in interest rates | | 40 |

Delays in liquidating defaulted mortgage loans could reduce our investment returns | | 40 |

Our investments in real estate-related common equity securities will be subject to specific risks relating to the particular issuer of the securities and may be subject to the general risks of investing in subordinated real estate securities, which may result in losses to us | | 40 |

Our investments in real estate-related preferred equity securities involve a greater risk of loss than traditional debt financing | | 41 |

v

| | |

The CMBS in which we may invest are subject to all of the risks of the underlying mortgage loans and the risks of the securitization process | | 41 |

The mezzanine loans in which we may invest would involve greater risks of loss than senior loans secured by income-producing real properties | | 41 |

To the extent that we make investments in real estate-related securities, a portion of those investments may be illiquid and we may not be able to adjust our portfolio in response to changes in economic and other conditions | | 42 |

Our investments may be sensitive to fluctuations in interest rates, and our hedging strategies may not be effective | | 42 |

If we use leverage in connection with our investment in CMBS, the risk of loss associated with this type of investment will increase | | 42 |

Delays in restructuring or liquidating non-performing real estate securities could reduce the return on your investment | | 43 |

Risks Associated with Debt Financing | | 43 |

We may incur mortgage indebtedness and other borrowings, which debt increases our risk of loss due to foreclosure | | 43 |

High mortgage rates may make it difficult for us to finance or refinance properties, which could reduce the number of properties we can acquire, our cash flows from operations and the amount of cash distributions we can make | | 44 |

Lenders may require us to enter into restrictive covenants relating to our operations, which could limit our ability to make distributions to our stockholders | | 44 |

Increases in interest rates could increase the amount of our debt payments and limit our ability to pay dividends to our stockholders | | 44 |

We have broad authority to incur debt and high debt levels could hinder our ability to make distributions and decrease the value of your investment | | 44 |

Federal Income Tax Risks | | 45 |

Failure to qualify as a REIT would reduce our net earnings available for investment or distribution | | 45 |

You may have current tax liability on distributions you elect to reinvest in our common stock | | 45 |

Even if we qualify as a REIT for federal income tax purposes, we may be subject to other tax liabilities that reduce our cash flow and our ability to make distributions to you | | 46 |

To maintain our REIT status, we may be forced to borrow funds during unfavorable market conditions to make distributions to our stockholders, which could increase our operating costs and decrease the value of your investment | | 46 |

To maintain our REIT status, we may be forced to forego otherwise attractive opportunities, which may delay or hinder our ability to meet our investment objectives and reduce your overall return | | 46 |

Retirement Plan Risks | | 47 |

If you fail to meet the fiduciary and other standards under ERISA or the Internal Revenue Code as a result of an investment in our stock, you could be subject to criminal and civil penalties | | 47 |

Cautionary Note Regarding Forward-Looking Statements | | 47 |

Estimated Use of Proceeds | | 48 |

Management | | 52 |

vi

vii

viii

PROSPECTUS SUMMARY

This prospectus summary highlights material information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements, before making a decision to invest in our common stock.

What is KBS Real Estate Investment Trust, Inc.?

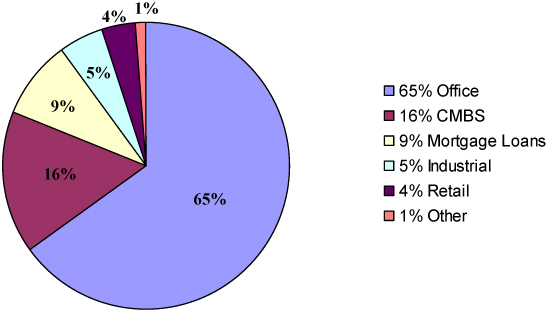

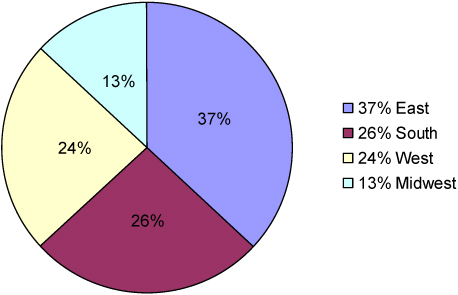

KBS Real Estate Investment Trust, Inc. is a newly organized Maryland corporation that intends to qualify as a real estate investment trust, or REIT, beginning with the taxable year that will end December 31, 2006. We intend to acquire and manage a diverse portfolio of real estate assets composed primarily of office, industrial and retail properties located in large metropolitan areas in the United States. We plan to diversify our portfolio by property type, geographic region, investment size and investment risk with the goal of attaining a portfolio of income-producing properties that provide attractive and stable returns to our investors. We may also invest in entities that make similar investments, mortgage loans and other real estate-related investments.

We were incorporated in the State of Maryland on June 13, 2005, and we currently do not own any real estate assets. Because we have not yet identified any specific properties to purchase, we are considered to be a blind pool.

Our external advisor, KBS Capital Advisors, will conduct our operations and manage our portfolio of real estate investments. We have no paid employees.

Our office is located at 620 Newport Center Drive, Suite 1300, Newport Beach, California 92660. Our telephone number is (949) 417-6500. Our fax number is (949) 417-6520, and our Web site address is www.kbsreit.com.

What is a REIT?

In general, a REIT is an entity that:

| | • | | combines the capital of many investors to acquire or provide financing for real estate investments; |

| | • | | allows individual investors to invest in a professionally managed, large-scale, diversified portfolio of real estate assets; |

| | • | | pays dividends to investors of at least 90% of its annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain); and |

| | • | | avoids the “double taxation” treatment of income that normally results from investments in a corporation because a REIT is not generally subject to federal |

1

| | corporate income taxes on that portion of its income distributed to its stockholders, provided certain income tax requirements are satisfied. |

However, under the Internal Revenue Code of 1986, as amended, REITs are subject to numerous organizational and operational requirements. If we fail to qualify for taxation as a REIT in any year after electing REIT status, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

What are your investment objectives?

Our primary investment objectives are:

| | • | | to provide you with attractive and stable cash dividends; and |

| | • | | to preserve and return your capital contribution. |

We will also seek to realize growth in the value of our investments by timing property sales to maximize asset value.

We may return all or a portion of your capital contribution in connection with the sale of the company or the properties we will acquire. Alternatively, you may be able to obtain a return of all or a portion of your capital contribution in connection with the sale of your shares.

Though we intend to make monthly distributions to our stockholders as soon as we have sufficient cash flow from our operations, we may be unable or limited in our ability to make distributions to you. Further, no public trading market for our shares currently exists and, until our shares are listed, if ever, it may be difficult for you to sell your shares. Until our shares are listed, you may not sell your shares unless the buyer meets the applicable suitability and minimum purchase standards.

Are there any risks involved in an investment in your shares?

Investing in our common stock involves a high degree of risk. You should carefully review the “Risk Factors” section of this prospectus beginning on page 24, which contains a detailed discussion of the material risks that you should consider before you invest in our common stock. Some of the more significant risks relating to an investment in our shares include:

| | • | | No public market currently exists for our shares of common stock, and we currently have no plans to list our shares on a national securities exchange or the Nasdaq National Market. Until our shares are listed, if ever, you may not sell your shares unless the buyer meets the applicable suitability and minimum purchase standards. In addition, our charter prohibits the ownership of more than 9.8% of our stock, unless exempted by our board of directors, which may inhibit large investors from purchasing your shares. Our shares cannot be readily sold and, if you are able to sell |

2

| | your shares, you would likely have to sell them at a substantial discount from their public offering price. |

| | • | | We established the offering price of our shares on an arbitrary basis. This price may not be indicative of the price at which our shares would trade if they were listed on an exchange or actively traded, and this price bears no relationship to the book or net value of our assets or to our expected operating income. |

| | • | | We are dependent on our advisor to select investments and conduct our operations. Our advisor has no operating history nor does it have any experience operating a public company. This inexperience makes our future performance difficult to predict. |

| | • | | We have no operating history and, as of the date of this prospectus, our total assets consist of $200,000 cash. Because we have not identified any real estate assets to acquire with proceeds from this offering, you will not have an opportunity to evaluate our investments before we make them, making an investment in us more speculative. |

| | • | | All of our executive officers and some of our directors are also officers, managers and/or holders of a direct or indirect controlling interest in our advisor, our dealer manager and other affiliated KBS entities. As a result, our executive officers, some of our directors, our advisor and its affiliates will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs and investors advised by KBS affiliates and conflicts in allocating time among us and these other programs and investors. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

| | • | | Our advisor and its affiliates will receive fees in connection with transactions involving the purchase and management of our properties. These fees will be based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our advisor to recommend riskier transactions to us. |

| | • | | If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of real estate assets and the value of your investment may vary more widely with the performance of specific assets. |

| | • | | We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which payments increase the risk that you will not earn a profit on your investment. |

| | • | | Although our distribution policy is not to use the proceeds of this offering to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds. Distributions paid from the net proceeds of this offering would constitute a return of capital. |

| | • | | Our policies do not limit us from incurring debt until our borrowings would exceed 75% of the cost (before deducting depreciation or other non-cash reserves) of all our assets, and we may exceed this limit with the approval of the conflicts committee of our board of directors. During the early stages of this offering, we expect that our conflicts committee will approve debt in excess of this limit, and we have begun |

3

| | discussions with lenders to obtain up to $197,675,000 in secured debt for the purchase of $200 million in real estate investments. If we incur this debt and only raise the minimum offering amount, our borrowings would equal approximately 98.8% of the cost of our assets. High debt levels could limit the amount of cash we have available to distribute and could result in a decline in the value of your investment. |

What is the role of the board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have five members of our board of directors, three of which are independent of KBS Capital Advisors and its affiliates. Our charter, which requires that a majority of our directors be independent of KBS Capital Advisors, creates a committee of our board consisting solely of all of our independent directors. This committee, which we call the conflicts committee, is responsible for reviewing the performance of KBS Capital Advisors and must approve other matters set forth in our charter. Our directors are elected annually by the stockholders.

Who is your advisor and what will the advisor do?

KBS Capital Advisors LLC is our advisor. As our advisor, KBS Capital Advisors will manage our day-to-day operations and our portfolio of real estate assets. Peter M. Bren and Charles J. Schreiber, Jr., two of our executive officers, and their team of real estate professionals, acting through KBS Capital Advisors, will make most of the decisions regarding the selection and the negotiation of real estate investments. KBS Capital Advisors will then make recommendations on all investments to our board of directors and the independent directors that constitute our conflicts committee will have the right to approve or reject all proposed investments. KBS Capital Advisors will also provide asset-management, marketing, investor-relations and other administrative services on our behalf with the goal of maximizing our operating cash flow.

What is the experience of your advisor?

KBS Capital Advisors is a recently organized limited liability company that was formed in the State of Delaware on October 18, 2004. Our advisor has no operating history and no experience managing a public company.

What is the experience of your sponsors?

Peter M. Bren, Charles J. Schreiber, Jr., Peter McMillan III and Keith D. Hall control and indirectly own our advisor and the dealer manager of this offering. We refer to these individuals as our “sponsors.” Of our sponsors, only Messrs. Bren and Schreiber possess management authority over our advisor’s operations.

Messrs. Bren and Schreiber each have been involved exclusively in real estate development, management, acquisition, disposition and financing for more than 30 years. Since

4

1992, Messrs. Bren and Schreiber have teamed to invest, manage, develop and sell high-quality U.S. commercial real estate assets for institutional investors. Together, they founded KBS Realty Advisors, a registered investment adviser with the Securities and Exchange Commission and a nationally recognized real estate investment adviser. When we refer to a “KBS-sponsored” fund or program, we are referring to entities sponsored by an investment adviser affiliated with Messrs. Bren and Schreiber, and when we refer to a “KBS-advised” investor, we are referring to institutional investors that have engaged an investment adviser affiliated with Messrs. Bren and Schreiber to provide real estate-related investment advice.

Messrs. Bren and Schreiber will work together at KBS Capital Advisors with their team of real estate professionals. The senior real estate professionals assembled by Messrs. Bren and Schreiber, who will be employed by our advisor as well as by KBS Realty Advisors, average over 20 years of direct real estate experience. These senior real estate professionals have been through multiple real estate cycles in their careers and have the expertise gained through hands-on experience in acquisitions, asset management, dispositions, development, leasing and property and portfolio management.

Historically, the business strategy of Messrs. Bren and Schreiber has been threefold: first, identify attractive investment opportunities that meet the investment objectives of their institutional clients; second, aggressively manage each asset acquired; third, execute a well-defined exit strategy for each investment made.

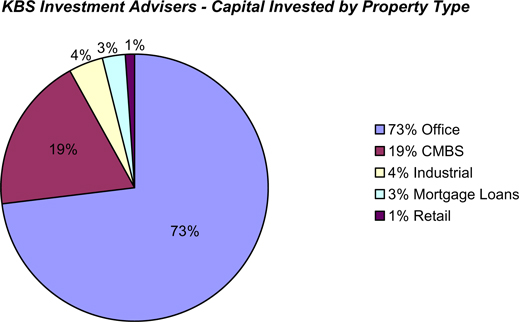

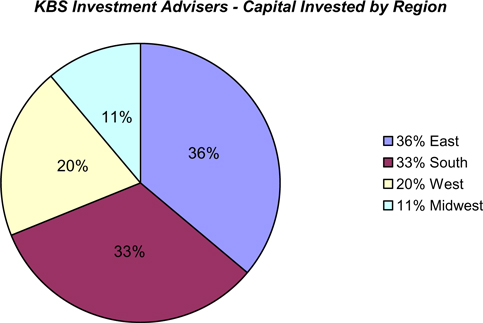

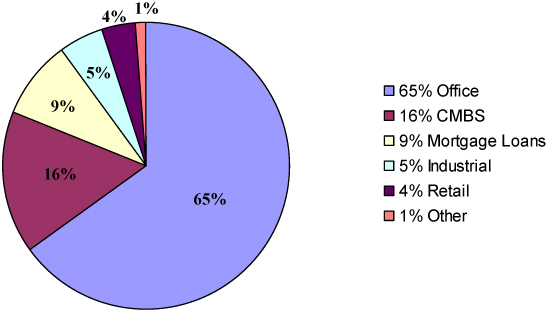

We believe the experience of Messrs. Bren and Schreiber and the team of real estate professionals they have assembled to manage our operations and their disciplined investment approach will allow us to successfully execute our business model. Since 1992, the experience of the investment advisers affiliated with Messrs. Bren and Schreiber include (as of December 31, 2004):

| | • | | Sponsoring nine private real estate funds that have investment objectives similar to ours and that have invested approximately $2.8 billion (including equity, debt and investment of income and sales proceeds) in 266 real estate assets; |

| | • | | Through these nine private real estate funds, raising $1.8 billion of equity from 38 institutional investors; and |

| | • | | Selling 200 of the 266 real estate assets acquired by these nine private real estate funds. |

In addition to their experience with the nine funds described above, investment advisers affiliated with Messrs. Bren and Schreiber have also been engaged by three institutional investors to recommend real estate acquisitions and manage their investments. The investment proceeds of these investors were not commingled. The investments were made pursuant to management agreements or partnership agreements that permitted the institutional investors to reject acquisitions recommended by the investment adviser. Because the investors were not as passive as those in the nine funds described above or as those who invest in this offering, we have not described the performance of the real estate assets acquired or managed for these investors. The amounts paid for the assets acquired and/or managed pursuant to these arrangements and for subsequent capital expenditures totaled $2.1 billion. On behalf of these three institutional investors, investment advisers affiliated with Messrs. Bren and Schreiber have sold 152 real estate assets.

5

With respect to the experience of our other sponsors, Messrs. McMillan and Hall founded Willowbrook Capital Group, LLC, an asset-management company. Prior to forming Willowbrook in 2000, Mr. McMillan served as the Executive Vice President and Chief Investment Officer of SunAmerica Investments, Inc., which was later acquired by AIG. As Chief Investment Officer, he was responsible for over $75 billion in assets, including residential and commercial mortgage-backed securities, public and private investment grade and non-investment grade corporate bonds and commercial mortgage loans and real estate investments.

Prior to forming Willowbrook, Mr. Hall was a Managing Director at CS First Boston, where he managed CSFB’s distribution strategy and business development for the Principal Transaction Group’s $18 billion real estate securities portfolio. Before joining CSFB in 1996, he served as a Director in the Real Estate Products Group at Nomura Securities, with responsibility for the company’s $6 billion annual pipeline of fixed-income securities. Mr. Hall spent the 1980s as a Senior Vice President in the High Yield Department of Drexel Burnham Lambert’s Beverly Hills office, where he was responsible for distribution of the group’s high-yield real estate securities.

None of our sponsors have previously sponsored or organized a publicly offered REIT. However, a KBS-sponsored fund has formed, managed and liquidated a private REIT that owned 10 retail centers.

Do you expect any of the institutions that invested in KBS-sponsored funds or that have been advised by your affiliates to invest in this offering?

We believe such institutional investors are more likely to invest in offerings that can be conducted with lower offering expenses than those found in a public offering, such as this one, in which the securities are sold by participating broker-dealers on a best-efforts basis. If institutional investors do participate in this offering, they would likely invest in amounts entitling them to volume discounts such that their returns, if any, would likely be greater than those who purchase shares in this offering at $10 per share.

How will KBS Capital Advisors select potential properties for acquisition?

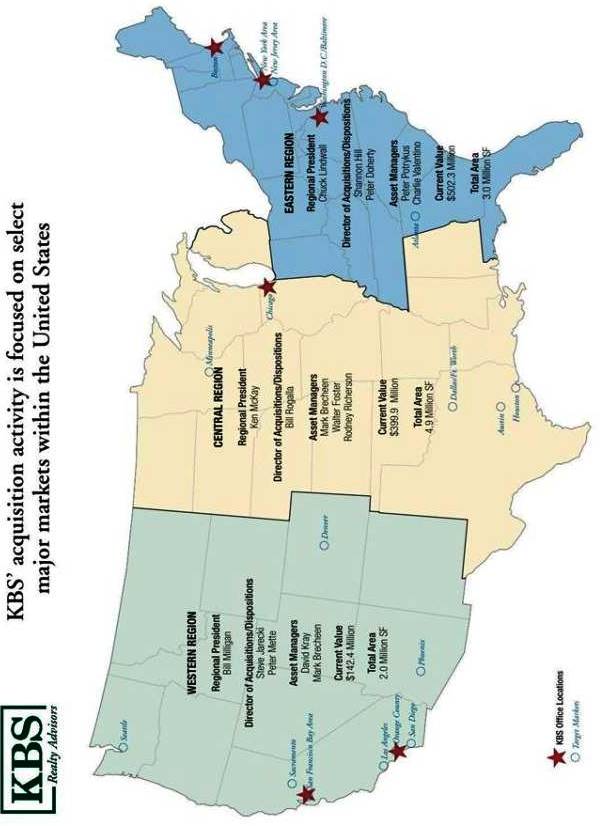

To find properties that best meet our criteria for investment, our advisor has developed a disciplined investment approach that combines the experience of its team of real estate professionals with a structure that emphasizes thorough market research, stringent underwriting standards and an extensive down-side analysis of the risks of each investment. KBS Capital Advisors will generally seek to acquire a diverse portfolio of commercial properties consisting principally of office, industrial and retail properties located in large metropolitan areas in the United States. Our advisor intends to diversify our portfolio by geographic region, property type, investment size and investment risk with the goal of attaining a portfolio of income-producing properties that will provide attractive and stable returns to our investors. We expect to allocate approximately 70% of our portfolio to core investments, which are generally existing properties with at least 80% occupancy and minimal near-term lease rollover. We will seek to invest approximately 30% of our assets in enhanced-return properties, which are higher-yield and higher-risk investments that our advisor will actively manage and seek to reposition. Examples of enhanced-return properties that we will seek to acquire and reposition include: properties with moderate vacancies or near-term lease rollovers; poorly managed and positioned properties; properties owned by distressed sellers; and built-to-suit properties.

6

Though these are the diversification guidelines within which our advisor will work, we believe that we are most likely to meet our investment objectives through the careful selection and underwriting of individual assets. When making an acquisition, we will emphasize the performance and risk characteristics of that individual investment, how that investment will fit with our portfolio-level performance objectives, the other assets in our portfolio and how the returns and risks of that investment compare to the returns and risks of available investment alternatives. In other words, we will not forgo a good investment opportunity because it does not precisely meet one of our diversification guidelines, but we will attempt to construct a portfolio that produces stable and attractive returns by spreading risk across different real estate investments.

May you invest in anything other than real property?

While we expect to invest principally in real properties, we may make other investments. We may invest in mortgage loans or acquire operating companies or other entities that own and operate assets that meet our investment objectives. We will make investments in other entities when we consider it more efficient to acquire an entity that already owns assets meeting our investment objectives than to acquire such assets directly. We may also participate with other entities (including non-affiliated entities) in property ownership through joint ventures, limited liability companies, partnerships and other types of common ownership. In order to diversify our portfolio or in response to changes in the real estate market, we may also invest in other property types (such as mixed-use properties) and other types of real estate-related investments. These other types of real estate-related investments include: real estate common and preferred equities, mortgage-backed securities and other forms of mortgage debt and certain illiquid securities, including mezzanine loans and bridge loans. There is no limit on the amount that we may invest in these types of real estate-related investments.

Will you use leverage?

Yes. We expect that once we have fully invested the proceeds of this offering, our debt financing will be approximately 50% of the cost of our real estate investments (before deducting depreciation or other non-cash reserves) plus the value of our other assets. There is no limitation on the amount we may borrow for the purchase of any single property. Our charter limits our borrowings to 75% of the cost (before deducting depreciation or other non-cash reserves) of all our assets; however, we may exceed that limit if a majority of the conflicts committee approves each borrowing in excess of our charter limitation and we disclose such borrowing to our stockholders in our next quarterly report with an explanation from the conflicts committee of the justification for the excess borrowing.

We do not intend to exceed the leverage limit in our charter except in the early stages of our development when the costs of our investments are most likely to exceed our net offering proceeds. To prevent a delay between the sale of shares and the purchase of properties, we have begun discussions to obtain up to $190 million in secured debt from national lenders. We would use these funds to purchase a portfolio of properties and other real estate-related investments at a cost of up to $200 million (including acquisition costs and expenses and the acquisition fee paid to our advisor). To the extent that initial sales in this offering are insufficient to fund the difference between the cost of the portfolio and the amount of debt secured from third-party lenders, we would likely secure a loan from affiliates of our advisor to fund the difference. We

7

will supplement this prospectus to disclose the terms of any financing arrangement we enter for the purchase of an initial portfolio of investments. We, however, can give you no assurance that we will be able to obtain such borrowings.

Careful use of debt will help us to achieve our diversification goals because we will have more funds available for investment. However, high levels of debt could cause us to incur higher interest charges and higher debt service payments, which would decrease the amount of cash available for distribution to our investors.

How will you structure the ownership and operation of your assets?

We plan to own substantially all of our assets and conduct our operations through KBS Limited Partnership, which we refer to as our Operating Partnership in this prospectus. We are the sole general partner of the Operating Partnership and, as of the date of this prospectus, our wholly owned subsidiary, KBS REIT Holdings LLC, is the sole limited partner of the Operating Partnership. Because we plan to conduct substantially all of our operations through the Operating Partnership, we are considered an UPREIT.

What is an “UPREIT”?

UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” The UPREIT structure is used because a sale of property directly to the REIT is generally a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may transfer the property to the UPREIT in exchange for limited partnership units in the UPREIT and defer taxation of gain until the seller later sells or exchanges his UPREIT units. Using an UPREIT structure may give us an advantage in acquiring desired properties from persons who may not otherwise sell their properties because of unfavorable tax results.

What conflicts of interest will your advisor face?

KBS Capital Advisors and its affiliates will experience conflicts of interest in connection with the management of our business. Messrs. Bren, McMillan, Hall and Schreiber, four of our executive officers, indirectly own and control KBS Capital Advisors. In addition, Messrs. Bren and Schreiber and several of the other employees of KBS Capital Advisors are also the key employees of KBS Realty Advisors and its affiliates, the advisors to the other KBS-sponsored programs and the investment advisers to institutional investors in real estate and real estate-related assets. Some of the material conflicts that KBS Capital Advisors and its affiliates will face include the following:

| | • | | Messrs. Bren and Schreiber, together with the other real estate professionals employed by KBS Capital Advisors and KBS Realty Advisors and its affiliates, must determine which investment opportunities to recommend to us or another KBS program or investor for whom KBS serves as an investment adviser; |

| | • | | KBS Capital Advisors and its affiliates may structure the terms of joint ventures between us and other KBS-sponsored programs or KBS-advised entities; |

8

| | • | | KBS Capital Advisors and its affiliates will have to allocate their time between us and other real estate programs and activities in which they are involved; |

| | • | | KBS Capital Advisors and its affiliates will receive fees in connection with transactions involving the purchase, management and sale of our properties regardless of the quality of the property acquired or the services provided to us; |

| | • | | KBS Capital Advisors and its affiliates, including our dealer manager, KBS Capital Markets Group, will receive fees in connection with our public offerings of equity securities; |

| | • | | The negotiation of the advisory agreement and the dealer manager agreement (including the substantial fees KBS Capital Advisors and its affiliates will receive thereunder) will not be at arm’s length; and |

| | • | | KBS Capital Advisors may terminate the advisory agreement without penalty upon 60 days’ written notice and, upon termination of the advisory agreement, KBS Capital Advisors may be entitled to a termination fee if (based upon an independent appraised value of the portfolio) it would have been entitled to a subordinated participation in net cash flows had the portfolio been liquidated on the termination date. |

9

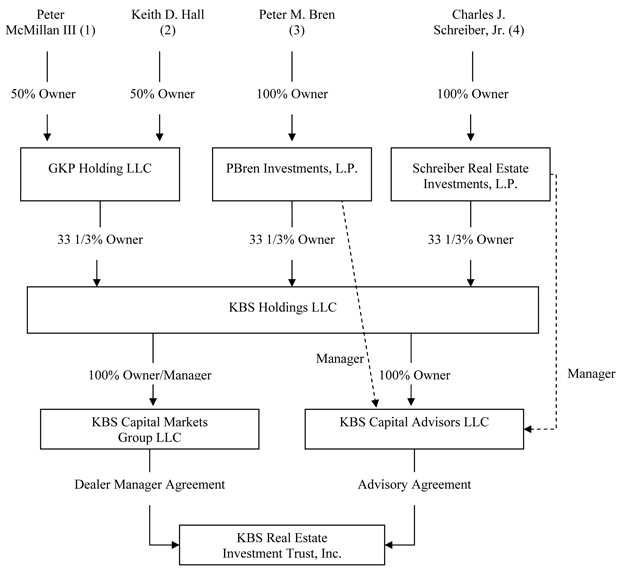

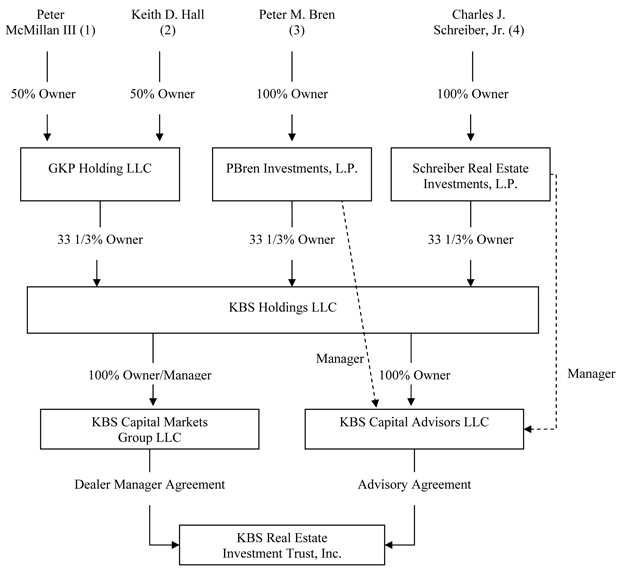

Who owns and controls the advisor?

The following chart shows the ownership structure of KBS Capital Advisors and entities affiliated with KBS Capital Advisors that will perform services for us:

| (1) | Peter McMillan III is our Executive Vice President, Treasurer, Secretary and one of our directors. |

| (2) | Keith D. Hall is our Executive Vice President. |

| (3) | Peter M. Bren is our President. Other than de minimis amounts owned by family members or family trusts, Mr. Bren indirectly owns and controls PBren Investments, L.P. |

10

| (4) | Charles J. Schreiber, Jr. is the Chairman of our Board, our Chief Executive Officer and one of our directors. Other than de minimis amounts owned by family members or trusts, Mr. Schreiber indirectly owns and controls Schreiber Real Estate Investments, L.P. |

As of the date of this prospectus, Messrs. McMillan, Hall, Bren and Schreiber have not received any compensation from us for services provided in their capacity as principals of KBS Capital Advisors or its affiliates. As principals of our advisor and entities that provide services to us, each of them will be eligible for stock-based awards under our Employee and Independent Director Incentive Stock Plan. In addition, in connection with this offering, we will pay or reimburse our advisor and its affiliates for the services described below.

What are the fees that you will pay to the advisor, its affiliates and your directors?

KBS Capital Advisors and its affiliates will receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. We will also compensate our independent directors for their service to us. The most significant items of compensation are included in the table below. Selling commissions may vary for different categories of purchasers. This table assumes that we sell all shares at the highest possible selling commissions (with no discounts to any categories of purchasers) and assumes a $9.50 price for each share sold through our dividend reinvestment plan. No dealer manager fee is payable on shares sold through our dividend reinvestment plan.

| | | | |

Type of Compensation

| | Determination of Amount

| | Estimated Amount for Minimum

Offering (250,000 shares)/Maximum

Offering (280,000,000 shares)

|

|

| Offering Stage |

| | |

Selling Commissions | | 6.0% of gross offering proceeds in primary offering and 3.0% of gross proceeds from sales under dividend reinvestment plan; all selling commissions will be reallowed to participating broker-dealers | | $150,000/$142,800,000 |

| | |

Dealer Manager Fee | | 3.5% of gross offering proceeds; dealer manager may reallow to any participating broker-dealer up to 1% of the gross offering proceeds attributable to that participating broker-dealer as a marketing fee; no dealer manager fee is payable on shares sold under our dividend reinvestment plan | | $87,500/$70,000,000 |

11

| | | | |

Type of Compensation

| | Determination of Amount

| | Estimated Amount for Minimum

Offering (250,000 shares)/Maximum

Offering (280,000,000 shares)

|

| | |

Other Organization and Offering Expenses | | To date, our advisor has paid organization and offering expenses on our behalf. We will reimburse our advisor for these costs and future organization and offering costs it may incur on our behalf but only to the extent that the reimbursement would not cause the selling commissions, the dealer manager fee and the other organization and offering expenses borne by us to exceed 15% of gross offering proceeds as of the date of the reimbursement. If we raise the maximum offering amount, we expect organization and offering expenses (other than selling commissions and the dealer manager fee) to be $22,400,000 or 0.81% of gross offering proceeds. These organization and offering expenses include all expenses (other than selling commissions and the dealer manager fee) to be paid by us in connection with the offering, including our legal, accounting, printing, mailing and filing fees, charges of our escrow holder, reimbursement of bona fide due diligence expenses of broker-dealers, reimbursement of our advisor for the salaries of its employees and other costs in connection with preparing supplemental sales materials, the cost of educational conferences held by us (including the travel, meal and lodging costs of registered representatives of broker-dealers) and attendance fees and cost reimbursement for employees of our affiliates to attend retail seminars conducted by broker-dealers. | | $137,500/$22,400,000 |

|

| Acquisition and Development Stage |

| | |

Acquisition Fees | | 0.75% of the cost of investments acquired by us, including acquisition expenses and any debt attributable to such investments | | $15,819/$13,321,340 |

|

| Operational Stage |

| | |

Asset Management Fees | | Monthly fee equal to one-twelfth of 0.75% of the sum of the cost of all real estate investments we own and of our investments in joint ventures, including acquisition fees, acquisition expenses and any debt attributable to such investments | | The actual amounts

are dependent upon

the total equity and

debt capital we raise

and the results of our

operations;

therefore, we cannot

determine these

amounts at the

present time. |

12

| | | | |

Type of Compensation

| | Determination of Amount

| | Estimated Amount for Minimum

Offering (250,000 shares)/Maximum

Offering (280,000,000 shares)

|

| | |

| Operating Expenses | | Reimbursement of our advisor’s cost of providing services to us, including our allocable share of the advisor’s overhead, such as rent, personnel costs, utilities and IT costs. However, we will not reimburse the advisor for personnel costs in connection with services for which our advisor earns acquisition fees or real estate commissions. | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

| | |

| Stock-based Compensation Awards | | We may issue stock-based awards to our independent directors and to affiliates of our advisor. The total number of shares of common stock we have reserved for issuance under our Employee and Independent Director Incentive Stock Plan is equal to 5% of our outstanding shares at any time but may not exceed 10,000,000 shares. | | Our board has not yet determined to grant any stock-based awards. We cannot determine these amounts at the present time. |

| | |

| Independent Director Compensation | | We will pay each of our independent directors an annual retainer of $25,000. We will also pay our independent directors for attending meetings as follows: (i) $2,500 for each board meeting attended, (ii) $2,000 for each committee meeting attended (except that the committee chairman will be paid $3,000 for each meeting attended), (iii) $1,000 for each teleconference board meeting attended, and (iv) $1,000 for each teleconference committee meeting attended (except that the committee chairman will be paid $3,000 for each teleconference committee meeting attended). All directors will receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the board of directors. | | Actual amounts are dependent upon the total number of board and committee meetings that each independent director attends. |

13

| | | | |

Type of Compensation

| | Determination of Amount

| | Estimated Amount for Minimum

Offering (250,000 shares)/Maximum

Offering (280,000,000 shares)

|

|

| Liquidation/Listing Stage |

| | |

| Real Estate Commissions | | For substantial assistance in connection with the sale of properties or other investments, we will pay KBS Capital Advisors or its affiliates 1% of the contract sales price of each property or other investment sold; provided, however, in no event may the real estate commissions paid to KBS Capital Advisors, its affiliates and unaffiliated third parties exceed 6% of the contract sales price. The conflicts committee will determine whether the advisor or its affiliate has provided substantial assistance to us in connection with the sale of an asset. Substantial assistance in connection with the sale of a property includes the advisor’s preparation of an investment package for the property (including a new investment analysis, rent rolls, tenant information regarding credit, a property title report, an environmental report, a structural report and exhibits) or such other substantial services performed by the advisor in connection with a sale. | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

| | |

| Subordinated Participation in Net Cash Flows (payable only if we are not listed on a national exchange) | | 15.0% of our net cash flows, whether from continuing operations, net sale proceeds or otherwise, after return of capital plus payment to investors of an 8.0% cumulative, non-compounded return on the capital contributed by investors | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

| | |

| Subordinated Incentive Listing Fee (payable only if we are listed on a national exchange) | | 15.0% of the amount by which our adjusted market value plus distributions exceeds the aggregate capital contributed by investors plus an amount equal to an 8.0% cumulative, non-compounded return to investors | | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

How many real estate properties do you currently own?

We currently do not own any properties. Because we have not yet identified any specific properties to purchase, we are considered to be a blind pool. As specific property acquisitions become probable, we will supplement this prospectus to provide information regarding the likely acquisition to the extent material to an investment decision with respect to our common stock. We will also describe material changes to our portfolio, including the closing of property acquisitions, by means of a supplement to this prospectus.

14

Will you acquire properties in joint ventures?

Probably. Among other reasons, joint venture investments permit us to own interests in large properties without unduly restricting the diversity of our portfolio. We may also want to acquire properties through a joint venture in order to diversify our portfolio of properties in terms of geographic region, property type and tenant industry group. In determining whether to invest in a particular joint venture, KBS Capital Advisors will evaluate the real estate assets that such joint venture owns or is being formed to own under the same criteria as our other investments.

What steps will you take to make sure you purchase environmentally compliant properties?

We will obtain a Phase I environmental assessment of each property purchased and, in our discretion, may obtain additional environmental assessments. We will not close the purchase of any property unless we are generally satisfied with the environmental status of the property.

If I buy shares, will I receive dividends and how often?

We intend to begin making distributions to our stockholders as soon as we have sufficient cash flow from our operations and we expect to pay dividends on a monthly basis. We intend to elect to be taxed as a REIT and to operate as a REIT beginning with our taxable year ending December 31, 2006. To maintain our qualification as a REIT, we will be required to make aggregate annual distributions to our stockholders of at least 90% of our REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain). Our board of directors may authorize distributions in excess of those required for us to maintain REIT status depending on our financial condition and such other factors as our board of directors deems relevant.

Our cash available for distribution may be less than 90% of our REIT taxable income. Further, because we may receive income from interest or rents at various times during our fiscal year, we may declare dividends in anticipation of cash flow that we expect to receive during a later period and we may pay these dividends in advance of our actual receipt of these funds. As a result, in order to comply with the REIT requirements and to make distributions relatively uniform, we may borrow funds or sell assets to make distributions. Though our board has the authority under our organizational documents, our distribution policy is not to use the proceeds of this offering to pay distributions. As explained below, for tax purposes the portion of your distribution that exceeds our current or accumulated earnings and profits will be treated as a return of capital to the extent of your adjusted tax basis in your shares, and thereafter will be treated as capital gain. To the extent that we pay distributions in excess of our current or accumulated earnings and profits, we expect that we would use borrowings or proceeds from the sale of assets to fund such distributions, though our board could authorize such distributions from the proceeds of this offering or future offerings. Our charter does not require that we make distributions to our stockholders and we have not established a minimum distribution level.

15

How will you calculate the payment of dividends to stockholders?

We intend to authorize, declare and pay dividends on a monthly basis. In order that investors may generally begin earning dividends immediately upon our acceptance of their subscription, we expect to use daily record dates for the determination of who is entitled to a dividend.

May I reinvest my dividends in shares of KBS Real Estate Investment Trust?

Yes. You may participate in our dividend reinvestment plan by checking the appropriate box on the Subscription Agreement or by filling out an enrollment form we will provide to you at your request. The purchase price for shares purchased under the dividend reinvestment plan will initially be $9.50. Three years after the completion of our offering stage, shares issued pursuant to our dividend reinvestment plan will be priced at the net asset value per share of our common stock, as estimated by our advisor or another firm chosen for that purpose. We will consider our offering stage complete when we are no longer publicly offering equity securities and have not done so for one year. If we pay selling commissions in connection with the sale of shares to you in our primary offering, we will pay a 3% selling commission on any dividends that you reinvest under our dividend reinvestment plan. These selling commissions may be higher than the selling commissions charged in connection with recent dividend reinvestment plan offerings by other unlisted, publicly offered REITs. Whether we pay a selling commission will not affect the purchase price you pay under the dividend reinvestment plan, but it will affect the net proceeds to us from the sale. The total return for our investors would likely be higher if we paid no selling commissions. We may amend or terminate the dividend reinvestment plan at our discretion at any time, provided that any amendment that adversely affects the rights or obligations of a participant (as determined in the sole discretion of the board of directors) will only take effect upon 10 days’ prior written notice to you.

Will the dividends I receive be taxable as ordinary income?

Yes and No. Generally, dividends that you receive, including dividends that are reinvested pursuant to our dividend reinvestment plan, will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. Participants in our dividend reinvestment plan will also be treated for tax purposes as having received an additional distribution to the extent that they purchase shares under the dividend reinvestment plan at a discount to fair market value. As a result, participants in our dividend reinvestment plan may have tax liability with respect to their share of our taxable income, but they will not receive cash dividends to pay such liability.

We expect that some portion of your dividends will not be subject to tax in the year in which they are received because depreciation expense reduces the amount of taxable income but does not reduce cash available for distribution. The portion of your distribution that is not subject to tax immediately is considered a return of capital for tax purposes and will reduce the tax basis of your investment. Dividends that constitute a return of capital, in effect, defer a portion of your tax until your investment is sold or we are liquidated, at which time you will be taxed at capital

16

gains rates. However, because each investor’s tax considerations are different, we suggest that you consult with your tax advisor.

How will you use the proceeds raised in this offering?

We expect to use substantially all of the net proceeds from this offering to acquire and manage a diverse portfolio of real estate assets composed primarily of office, industrial and retail properties located in large metropolitan areas in the United States. Depending primarily upon the number of shares we sell in this offering and assuming a $10.00 purchase price for shares sold in the primary offering and a $9.50 purchase price for shares sold under the dividend reinvestment plan, we estimate that we will use 84.4% to 91.0% of our gross offering proceeds, or between $8.44 and $8.97 per share, for investments and the repurchase of shares of our common stock under our proposed share redemption program. We will use the remainder to pay offering expenses, including selling commissions and the dealer manager fee, and to pay a fee to our advisor for its services in connection with the selection and acquisition of our real estate investments.

Until we invest the proceeds of this offering in real estate, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will not earn as high of a return as we expect to earn on our real estate investments, and we may be not be able to invest the proceeds in real estate promptly.

17

| | | | | | | | | | | | | | | | | | | | |

| | | 250,000 Shares

| | | 280,000,000 Shares

| |

| | | Minimum Offering

($10.00/share)

| | | Primary Offering

(200,000,000 shares)

($10.00/share)

| | | Div. Reinv. Plan

(80,000,000 shares)

($9.50/share)

| | | Total (280,000,000 shares)

| |

| | | $

| | %

| | | $

| | %

| | | $

| | %

| | | $

| | %

| |

Gross Offering Proceeds | | 2,500,000 | | 100.00 | % | | 2,000,000,000 | | 100.00 | % | | 760,000,000 | | 100.00 | % | | 2,760,000,000 | | 100.00 | % |

Selling Commissions | | 150,000 | | 6.00 | % | | 120,000,000 | | 6.00 | % | | 22,800,000 | | 3.00 | % | | 142,800,000 | | 5.17 | % |

Dealer Manager Fee | | 87,500 | | 3.50 | % | | 70,000,000 | | 3.50 | % | | 0 | | 0.00 | % | | 70,000,000 | | 2.54 | % |

Other Organization and Offering Expenses | | 137,500 | | 5.50 | % | | 20,500,000 | | 1.03 | % | | 1,900,000 | | 0.25 | % | | 22,400,000 | | 0.81 | % |

Acquisition Fees | | 15,819 | | 0.63 | % | | 13,321,340 | | 0.66 | % | | 0 | | 0.00 | % | | 13,321,340 | | 0.48 | % |

Initial Working Capital Reserve | | 0 | | 0.00 | % | | 0 | | 0.00 | % | | 0 | | 0.00 | % | | 0 | | 0.00 | % |

| | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

|

Amount Available for Investment | | 2,109,181 | | 84.37 | % | | 1,776,178,660 | | 88.81 | % | | 735,300,000 | | 96.75 | % | | 2,511,478,660 | | 91.00 | % |

| | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

|

What kind of offering is this?

We are offering up to 280,000,000 shares of common stock on a “best efforts” basis. We are offering 200,000,000 of these shares in our primary offering at $10 per share, with volume discounts available to investors who purchase more than 50,000 shares through the same participating broker-dealer. Discounts are also available for investors who purchase shares through certain distribution channels. We are offering up to 80,000,000 shares pursuant to our dividend reinvestment plan at a purchase price initially equal to $9.50 per share.

18

How does a “best efforts” offering work? What happens if you don’t raise at least $2,500,000 in gross offering proceeds?

When shares are offered on a “best efforts” basis, the broker-dealers participating in the offering have no firm commitment or obligation to purchase any of the shares but must use their best efforts to sell the shares. Therefore, we may not sell all or any of the shares that we are offering.

We will not sell any shares unless we raise a minimum of $2,500,000 in gross offering proceeds from persons who are not affiliated with us or our advisor. Pending satisfaction of this condition, all subscription payments will be placed in an account held by the escrow agent in trust for our subscribers’ benefit, pending release to us. If we do not raise $2,500,000 in gross offering proceeds by January 13, 2007, we will terminate this offering and promptly return all subscribers’ funds in the escrow account (plus interest). Funds in escrow will be invested in short-term investments that mature on or before the termination of the offering or that can be readily sold or otherwise disposed of for cash by such date without any dissipation of the offering proceeds invested. We will not deduct any fees if we return funds from the escrow account. Because of the higher minimum offering requirement for Pennsylvania investors (described below), subscription payments made by Pennsylvania investors will not count toward the $2,500,000 minimum offering for all other jurisdictions.

Notwithstanding our $2,500,000 minimum offering amount for all other jurisdictions, we will not sell any shares to Pennsylvania investors unless we raise a minimum of $66.7 million in gross offering proceeds (including sales made to residents of other jurisdictions). Pending satisfaction of this condition, all subscription payments by Pennsylvania investors will be placed in a separate account held by the escrow agent in trust for Pennsylvania subscribers’ benefit, pending release to us. If we have not reached this $66.7 million threshold within 120 days of the date that we first accept a subscription payment from a Pennsylvania investor, we will, within 10 days of the end of that 120-day period, notify Pennsylvania investors in writing of their right to receive refunds, with interest. If you request a refund within 10 days of receiving that notice, we will arrange for the escrow agent to promptly return by check your subscription amount with interest. Amounts held in the Pennsylvania escrow account from Pennsylvania investors not requesting a refund will continue to be held for subsequent 120-day periods until we raise at least $66.7 million or until the end of the subsequent escrow periods. At the end of each subsequent escrow period, we will again notify you of your right to receive a refund of your subscription amount with interest. In the event we do not raise gross offering proceeds of $66.7 million by January 13, 2008, we will promptly return all funds held in escrow for the benefit of Pennsylvania investors (in which case, Pennsylvania investors will not be required to request a refund of their investment). Purchases by persons affiliated with us or our advisor will not count toward the Pennsylvania minimum.

How long will this offering last?

We expect to sell the 200,000,000 shares offered in our primary offering over a two-year period. If we have not sold all of the shares within two years, we may continue this offering until January 13, 2009. Under rules recently promulgated by the SEC, in some circumstances we could continue our primary offering until as late as July 12, 2009. If we decide to continue our primary offering beyond two years from the date of this prospectus, we will provide that

19

information in a prospectus supplement. We may continue to offer shares under our dividend reinvestment plan beyond these dates until we have sold 80,000,000 shares through the reinvestment of dividends. In many states, we will need to renew the registration statement or file a new registration statement to continue the offering beyond one year from the date of this prospectus. We may terminate this offering at any time.

Who can buy shares?

An investment in our shares is only suitable for persons who have adequate financial means and who will not need immediate liquidity from their investment. Residents of most states can buy shares in this offering provided that they have either (1) a net worth of at least $45,000 and an annual gross income of at least $45,000 or (2) a net worth of at least $150,000. For the purpose of determining suitability, net worth does not include an investor’s home, home furnishings or personal automobiles. The minimum suitability standards are more stringent for investors in Arizona, California, Iowa, Kansas, Maine, Massachusetts, Michigan, Missouri, New Mexico, Ohio, Pennsylvania and Tennessee.

Who might benefit from an investment in our shares?