As filed with the Securities and Exchange Commission on September 25, 2008

Registration No. 333-126087

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 15 to

FORM S-11

on

Form S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

KBS Real Estate Investment Trust, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 20-2985918 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

620 Newport Center Drive, Suite 1300

Newport Beach, California 92660

(949) 417-6500

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Charles J. Schreiber, Jr.

Chief Executive Officer

KBS Real Estate Investment Trust, Inc.

620 Newport Center Drive, Suite 1300

Newport Beach, California 92660

(949) 417-6500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq.

Carrie J. Hartley, Esq.

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to public: From time to time after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. þ

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large Accelerated Filer ¨ | | | | Accelerated Filer ¨ |

Non-Accelerated Filer þ | | (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Explanatory note:This registration statement (reg. no. 333-126087) for the issuer’s primary offering and dividend reinvestment plan offering was first declared effective by the Staff on January 13, 2006. On September 17, 2008, the issuer filed post-effective amendment no. 14 to de-register the unsold shares in the primary offering. This post-effective amendment no. 15 to Form S-11 on Form S-3 amends the issuer’s registration statement to make it a dividend reinvestment plan only registration statement.

KBS REAL ESTATE INVESTMENT TRUST, INC.

Dividend Reinvestment Plan

Maximum Offering of 80,000,000 Shares of Common Stock

KBS Real Estate Investment Trust, Inc. is a Maryland corporation that elected to be taxed as a real estate investment trust, or REIT, beginning with the taxable year that ended December 31, 2006. We have invested in and manage a diverse portfolio of real estate properties and real estate-related investments. As of September 15, 2008, we owned 62 real estate properties, one master lease, 21 real estate loans receivable, and two investments in securities directly or indirectly backed by commercial mortgage loans. The 62 real estate properties total 20.4 million square feet, including properties held through a consolidated joint venture.

We are offering up to 80,000,000 shares of our common stock to our existing stockholders pursuant to our dividend reinvestment plan. Some of the significant features of the plan are:

| • | | Stockholders who elect to participate in the plan may choose to invest all or a portion of their cash distributions in shares of our common stock. |

| • | | We are initially offering the shares at a purchase price of $9.50 per share. |

| • | | We may offer shares of common stock under our dividend reinvestment plan until we have sold all 80,000,000 shares. |

| • | | We may amend or terminate the dividend reinvestment plan for any reason at any time, provided that any amendment that adversely affects the rights of participants will only take affect upon 10 days’ written notice to participants. |

| • | | Participants may terminate participation in the plan at any time upon written notice to us. For your termination to be effective for a particular distribution, we must have received your notice of termination at least 10 business days prior to the last day of the fiscal period to which the distribution relates. |

| • | | If you elect to participate in the dividend reinvestment plan and are subject to federal income taxation, you will incur a tax liability for distributions allocated to you even though you have elected not to receive the distributions in cash. In addition, to the extent you purchase shares through our dividend reinvestment plan at a discount to their fair market value, you will be treated for tax purposes as receiving an additional distribution equal to the amount of the discount. |

| • | | You may elect to participate in the plan by completing the Account Update Form available from your financial advisor or by calling our investor services line at 1-866-584-1381, administered by Phoenix Transfer, Inc. |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the risk factors included in our periodic reports and other information that we file with the SEC before you invest in our common stock. These risks include the following:

| • | | Our charter does not require our directors to seek stockholder approval to liquidate our assets by a specified date, nor does our charter require our directors to list our shares for trading by a specified date. No public market currently exists for our shares of common stock, and we have no plans to list our shares on an exchange. Until our shares are listed, you may not sell your shares unless the buyer meets the applicable suitability and minimum purchase standards. No one may own more than 9.8% of our stock unless exempted by our board. If you are able to sell your shares, you would likely have to sell them at a substantial loss. |

| • | | We set the offering price of our shares arbitrarily. This price is unrelated to the book or net value of our assets or to our operating income. |

| • | | We depend on our advisor to conduct our operations. Our advisor has a limited operating history and limited experience operating a public company. |

| • | | All of our executive officers and some of our directors are also officers, managers, directors and/or holders of a controlling interest in our advisor, our dealer manager and other affiliated KBS entities. As a result, they will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other KBS-advised programs and investors. Fees paid to our advisor in connection with transactions involving the purchase and management of our properties will be based on the cost of the investment, not on the quality of the investment or services rendered to us. This arrangement could influence our advisor to recommend riskier transactions to us. |

| • | | We have paid substantial fees and expenses to our advisor, its affiliates and broker-dealers. These fees increase your risk of loss. |

| • | | Although our distribution policy is not to use the proceeds of this offering to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds. Distributions paid from offering proceeds would constitute a return of capital. |

| • | | We fund our investments in part with debt. High debt levels increase the risk of your investment. |

Neither the SEC, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment.

| | | | | | | | | | | | |

| | | Price

to Public | | Selling

Commissions* | | Dealer

Manager Fee | | Net Proceeds

(Before Expenses) |

Dividend Reinvestment Plan | | | | | | | | | | | | |

Per Share | | $ | 9.50 | | $ | 0.285 | | $ | 0.00 | | $ | 9.215 |

Total Maximum | | $ | 760,000,000.00 | | $ | 22,800,000.00 | | $ | 0.00 | | $ | 737,200,000.00 |

* To the extent permitted under state securities laws, if we paid selling commissions in connection with the sale of shares to you in our primary offering, we may pay a 3% selling commission on any shares issued to you under our dividend reinvestment plan. We will not pay selling commissions on shares issued to residents of Ohio under the dividend reinvestment plan commencing with plan purchases for dividend record dates after September 30, 2008. We will pay any selling commissions to KBS Capital Markets Group, the dealer manager of our primary offering. KBS Capital Markets Group will reallow any selling commissions payable on shares purchased through the dividend reinvestment plan to the broker-dealer associated with such account. Broker-dealers may agree to waive selling commissions on dividend reinvestment plan shares in which case no selling commissions will be paid to any person in connection with the sale of such shares.

The date of this prospectus is September 25, 2008

SUITABILITY STANDARDS

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

In consideration of these factors, we have established suitability standards for investors in this offering and subsequent purchasers of our shares. These suitability standards require that a purchaser of shares have either:

| | • | | a net worth of at least $150,000; or |

| | • | | gross annual income of at least $45,000 and a net worth of at least $45,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states must meet the special suitability standards set forth below to purchase our shares.

Pennsylvania and Oregon - In addition to the general suitability requirements described above, investors must have a net worth of at least 10 times their investment in us.

Alaska, Iowa, Kansas, New Mexico, North Carolina, Ohio, Tennessee and Washington - Investors must have either (1) a net worth of at least $250,000, or (2) gross annual income of at least $70,000 and a net worth of at least $70,000.

In addition,Iowa investors must have a net worth of at least 10 times their investment in us, andOhio investors must have a net worth of at least 10 times their investment in us and our affiliates.

Furthermore, it is recommended by the Office of the Kansas Securities Commissioner thatKansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and similar direct participation investments. Liquid net worth is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Arizona, Arkansas, California, Massachusetts, Michigan and Missouri - Investors must have either (1) a net worth of at least $225,000 or (2) gross annual income of at least $60,000 and a net worth of at least $60,000.

In addition,Arkansas and Missouri investors must have a net worth of at least 10 times their investment in us.

Maine - Investors must have either (1) a net worth of at least $200,000 or (2) gross annual income of at least $50,000 and a net worth of at least $50,000.

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, furnishings and automobiles. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Our sponsor, those selling shares on our behalf and the broker-dealer or registered investment adviser associated with the stockholder’s account must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each stockholder based on information provided by the stockholder regarding the stockholder’s financial situation and investment objectives. See “Plan of Distribution – Suitability Standards” for a detailed discussion of the determinations regarding suitability that we require of all those selling shares on our behalf.

i

TABLE OF CONTENTS

ii

PROSPECTUS SUMMARY

This summary highlights material information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully before making a decision to participate in the dividend reinvestment plan. You should also review the section of this prospectus titled “Incorporation of Certain Information by Reference.”

What is KBS Real Estate Investment Trust, Inc.?

KBS Real Estate Investment Trust, Inc. is a Maryland corporation that elected to be taxed as a real estate investment trust, or REIT, beginning with the taxable year that ended December 31, 2006. We were formed on June 13, 2005.

We commenced our initial public offering of 280,000,000 shares of common stock on January 27, 2006. As of September 15, 2008, we had accepted aggregate gross offering proceeds of approximately $1.7 billion in our primary offering of 200,000,000 shares and $53.8 million under our dividend reinvestment plan offering of 80,000,000 shares. We ceased offering shares of common stock in our primary offering on May 30, 2008. We may continue to offer the shares registered under our dividend reinvestment plan, and offered by this prospectus, until we have sold all 80,000,000 shares.

We have used the proceeds of our primary offering to acquire and manage a diverse portfolio of real estate properties and real estate-related investments. We own substantially all of our assets and conduct our operations through KBS Limited Partnership, which we refer to as our Operating Partnership. We are the sole general partner of the Operating Partnership.

As of September 15, 2008, we owned 62 real estate properties, one master lease, 21 real estate loans receivable, and two investments directly or indirectly backed by commercial mortgage loans. The 62 real estate properties total 20.4 million square feet, including properties held through a consolidated joint venture. The real estate property portfolio includes 20 office buildings, one light industrial property, three corporate research properties, two distribution facilities, one industrial portfolio consisting of nine distribution and office/warehouse properties, one office/flex portfolio consisting of six buildings and a portfolio of 23 institutional-quality industrial properties and a master lease with respect to another property. We hold the 23 industrial properties and the master lease through a consolidated joint venture. At August 31, 2008, the portfolio was approximately 95% leased. Our real estate loans receivable portfolio includes three secured loans and one mezzanine loan that we originated as well as seven mezzanine real estate loans, two B-Notes, a partial ownership interest in three mezzanine real estate loans, two first mortgage loans, a partial ownership interest in a senior mortgage loan and two loans representing senior subordinated debt of a private REIT.

We have no paid employees. Our external advisor, KBS Capital Advisors LLC, conducts our operations and manages our portfolio of real estate investments.

Our office is located at 620 Newport Center Drive, Suite 1300, Newport Beach, California 92660. Our telephone number is (949) 417-6500. Our fax number is (949) 417-6520, and our Web site address iswww.kbsreit.com.

What is the dividend reinvestment plan?

We are offering up to 80,000,000 shares of our common stock to our existing stockholders pursuant to our dividend reinvestment plan. Pursuant to the plan, stockholders may elect to have all or a portion of their dividends and other distributions reinvested in additional shares of our common stock. The purchase price of shares under the dividend reinvestment plan will initially be $9.50 per share. Three years after the completion of our offering stage, shares issued pursuant to our dividend reinvestment plan will be priced at the estimated value per share of our common stock, as determined by our advisor or another firm chosen for that purpose. We will consider our offering stage complete when we are no longer publicly offering equity securities and have not done so for one year. We may offer shares of common stock under our dividend reinvestment plan until we have sold all 80,000,000 shares. As of September 15, 2008, we had sold 5,658,236 shares of common stock under our dividend reinvestment plan.

3

To the extent permitted under state securities laws, if we paid selling commissions in connection with the sale of shares to you in our primary offering, we may pay a 3% selling commission on any shares issued to you under our dividend reinvestment plan (which commission may be higher than the selling commission charged in connection with recent dividend reinvestment plan offerings by other non-traded, publicly offered REITs). We will not pay selling commissions on shares issued to residents of Ohio under the dividend reinvestment plan commencing with plan purchases for dividend record dates after September 30, 2008. Broker-dealers may agree to waive selling commissions on dividend reinvestment plan shares in which case no selling commissions will be paid to any person in connection with the sale of such shares.

We will pay selling commissions to KBS Capital Markets Group, the dealer manager of our primary offering. KBS Capital Markets Group will reallow any selling commissions payable on shares purchased through the dividend reinvestment plan to the broker-dealer associated with such account. We will not pay any dealer manager fees for shares sold under our dividend reinvestment plan.

Whether we pay a selling commission will not affect the purchase price you pay under the dividend reinvestment plan, but it will affect the net proceeds to us from the sale. The total return for our investors would likely be higher if we paid no selling commissions. We will not receive a fee for selling shares under the dividend reinvestment plan. Sales under our dividend reinvestment plan, however, may result in greater fee income for our advisor.

We may amend or terminate the dividend reinvestment plan at our discretion at any time, provided that any amendment that adversely affects the rights or obligations of a participant (as determined in the sole discretion of the board of directors) will only take effect upon 10 days’ prior written notice to you. At any time prior to the listing of our shares on a national securities exchange, you must cease participation in our dividend reinvestment plan if you no longer meet the suitability standards set forth in this prospectus, as amended and supplemented, or cannot make the other investor representations set forth in the then-current prospectus or in the Account Update Form. Participants must agree to notify us promptly when they no longer meet these standards.

You may elect to participate in the dividend reinvestment plan by completing the Account Update Form or other approved enrollment form available from your financial advisor or by calling our investor services line at 1-866-584-1381, administered by Phoenix Transfer, Inc. Your participation in the dividend reinvestment plan will begin with the next distribution made after receipt of your enrollment form. You can choose to have all or a portion of your distributions reinvested through the dividend reinvestment plan. You may also change the percentage of your distributions that will be reinvested at any time by completing a new Account Update Form or other form provided for that purpose. You should consult with your financial advisor before making any decision to increase your level of participation.

Who may participate in the dividend reinvestment plan?

All of our stockholders are eligible to participate in our dividend reinvestment plan; however, we may elect to deny your participation in the dividend reinvestment plan if you reside in a jurisdiction or foreign country where, in our judgment, the burden or expense of compliance with applicable securities laws makes your participation impracticable or inadvisable.

Who might benefit from participating in the dividend reinvestment plan?

An additional investment in our shares may be beneficial for you if you continue to meet the minimum suitability standards described in this prospectus as supplemented, seek to diversify your personal portfolio with a real estate-based investment, seek to preserve capital, seek to obtain the benefits of potential long-term capital appreciation and are able to hold your investment for a time period consistent with our liquidity strategy. On the other hand, we caution persons who require immediate liquidity or guaranteed income, or who seek a short-term investment, that an investment in our shares will not meet those needs. Participants in the dividend reinvestment plan should also consider the tax consequences of participation.

4

What are the tax consequences of participation in the dividend reinvestment plan?

If you elect to participate in the dividend reinvestment plan and are subject to federal income taxation, you will incur a tax liability for distributions allocated to you even though you have elected not to receive the distributions in cash but rather to have the distributions withheld and reinvested pursuant to the plan. Specifically, you will be treated as if you have received the distribution from us in cash and then applied such distribution to the purchase of additional shares. In addition, to the extent you purchase shares through our dividend reinvestment plan at a discount to their fair market value, you will be treated for tax purposes as receiving an additional distribution equal to the amount of the discount. Until three years after the completion of our offering stage, we expect that (i) we will sell shares under the dividend reinvestment plan at $9.50 per share, (ii) no secondary trading market for our shares will develop and (iii) our advisor will estimate the fair market value of a share to be $10.00. Therefore, until three years after the completion of our offering stage, participants in our dividend reinvestment plan will be treated as having received a distribution of $10.00 for each $9.50 reinvested by them under our dividend reinvestment plan. You will be taxed on the amount of such distribution as a dividend to the extent such distribution is from current or accumulated earnings and profits, unless we have designated all or a portion of the distribution as a capital gain distribution. We will withhold 28% of the amount of dividends or distributions paid if you fail to furnish a valid taxpayer identification number, fail to properly report interest or distributions or fail to certify that you are not subject to withholding.

How will you use the proceeds raised in this offering?

Depending primarily upon the number of shares we sell in this offering and assuming a $9.50 purchase price for shares sold under the dividend reinvestment plan, we estimate that we will use 96.75% of our gross offering proceeds from the dividend reinvestment plan for the repurchase of shares of our common stock under our share redemption program. We will use the remainder of the proceeds from the dividend reinvestment plan to pay offering expenses, including selling commissions. If all redemption requests under the share redemption program are honored or the share redemption program is suspended or terminated, then we may use the proceeds from the dividend reinvestment plan for investment in properties and other real estate-related assets, the repayment of debt, capital expenditures, tenant leasing costs or general corporate purposes. We cannot predict with any certainty how much, if any, dividend reinvestment plan proceeds will be available for these purposes. If we use proceeds to fund acquisitions in real estate or real estate-related investments, then we will pay our advisor acquisition fees equal to 0.75% of the cost of the investments (including debt and any acquisition expenses attributable to such investments). Though our board has the authority under our organizational documents, our distribution policy is not to use the proceeds of this offering to pay distributions.

| | | | | | | |

| | | Dividend Reinvestment Plan (80,000,000 shares) ($9.50/share) |

| | | | | | | |

Gross Offering Proceeds | | $ | 760,000,000 | | | | 100.00% |

Selling Commissions | | | 22,800,000 | | | | 3.00 |

Other Organization and Offering Expenses(1) | | | 1,910,000 | | | | 0.25 |

| | | | | | | |

Amount Available for Share Redemption Program | | $ | 735,290,000 | | | | 96.75% |

| | | | | | | |

(1) Includes all expenses (other than selling commissions) to be paid by us in connection with the offering, including our legal, accounting, printing, mailing and filing fees. KBS Capital Advisors has agreed to reimburse us to the extent selling commissions and other organization and offering expenses incurred by us in connection with the dividend reinvestment plan exceed 15% of aggregate gross offering proceeds from the plan. Organization and offering expenses represent management’s best estimate since these amounts cannot be precisely calculated at this time.

5

Are there any risks involved in an investment in your shares?

Investing in our common stock involves a high degree of risk. Some of the more significant risks related to an investment in our shares include:

| | • | | No public market currently exists for our shares of common stock, and we currently have no plans to list our shares on a national securities exchange. Until our shares are listed, if ever, you may not sell your shares unless the buyer meets the applicable suitability and minimum purchase standards. In addition, our charter prohibits the ownership of more than 9.8% of our stock, unless exempted by our board of directors, which may inhibit large investors from purchasing your shares. Our shares cannot be readily sold and, if you are able to sell your shares, you would likely have to sell them at a substantial discount from their public offering price. |

| | • | | We established the offering price of our shares on an arbitrary basis. This price may not be indicative of the price at which our shares would trade if they were listed on an exchange or actively traded, and this price bears no relationship to the book or net value of our assets or to our expected operating income. |

| | • | | Both we and our advisor have a limited operating history and limited experience operating a public company. This inexperience makes our future performance difficult to predict. |

| | • | | All of our executive officers and some of our directors are also officers, managers, directors and/or holders of a direct or indirect controlling interest in our advisor, our dealer manager and other affiliated KBS entities. As a result, our executive officers, some of our directors, our advisor and its affiliates will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs and investors advised by KBS affiliates and conflicts in allocating time among us and these other programs and investors. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

| | • | | Our advisor and its affiliates will receive fees in connection with transactions involving the purchase and management of our properties. These fees will be based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our advisor to recommend riskier transactions to us. |

| | • | | We have paid substantial fees and expenses to our advisor, its affiliates and broker-dealers, which payments increase the risk that you will not earn a profit on your investment. |

| | • | | Although our distribution policy is not to use the proceeds of this offering to make distributions, our organizational documents permit us to pay distributions from any source, including offering proceeds. Distributions paid from the net proceeds of this offering would constitute a return of capital. |

| | • | | Our policies do not limit us from incurring debt until our borrowings would exceed 75% of the cost (before deducting depreciation or other non-cash reserves) of our tangible assets, and we may exceed this limit with the approval of the conflicts committee of our board of directors. High debt levels could limit the amount of cash we have available to distribute and could result in a decline in the value of your investment. |

| | • | | Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our stockholders. |

| | • | | We depend on tenants for our revenue, and, accordingly, our revenue is dependent upon the success and economic viability of our tenants. |

| | • | | Our investments in mortgage, mezzanine, bridge and other loans as well as investments in mortgage-backed securities, collateralized debt obligations and other debt may be affected by unfavorable real estate market conditions, which could decrease the value of those assets and reduce the investment return to our stockholders. |

You should carefully review the risk factors disclosed under Part I, Item 1A of our annual report on Form 10-K for the year ended December 31, 2007, the risk factors disclosed under Part II, Item 1A of our quarterly reports on Form 10-Q for the periods ended March 31, 2008 and June 30, 2008, and any updated risk factors contained in future filings we make under the Securities Exchange Act of 1934, as amended.

6

What is the role of the board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have five members of our board of directors, three of which are independent of KBS Capital Advisors and its affiliates. Our charter, which requires that a majority of our directors be independent of KBS Capital Advisors, creates a committee of our board consisting solely of all of our independent directors. This committee, which we call the conflicts committee, is responsible for reviewing the performance of KBS Capital Advisors and must approve other matters set forth in our charter. Our directors are elected annually by the stockholders.

Our board of directors has adopted a policy that requires our conflicts committee to approve by a majority vote all of our acquisitions and dispositions of real estate and real estate-related investments. Our board of directors may revise this policy without the approval of our stockholders. The conflicts committee has approved an Investment Grade Securities Purchase Program pursuant to which the conflicts committee granted authority to the investment committee of our advisor to approve acquisitions of investment grade commercial mortgage-backed securities, collateralized debt obligations and credit default swaps up to an aggregate amount of $50.0 million.

Who is your advisor and what will the advisor do?

KBS Capital Advisors LLC is our advisor. As our advisor, KBS Capital Advisors will manage our day-to-day operations and our portfolio of real estate and real estate-related investments. Peter M. Bren, Charles J. Schreiber, Jr., Peter McMillan III and Keith D. Hall, each of whom is one of our executive officers, and their team of real estate professionals, acting through KBS Capital Advisors, will make most of the decisions regarding the selection and the negotiation of real estate investments. KBS Capital Advisors will then make recommendations on all investments to our board of directors and conflicts committee. KBS Capital Advisors will also provide asset-management, marketing, investor-relations and other administrative services on our behalf with the goal of maximizing our operating cash flow. KBS Capital Advisors is indirectly owned and controlled by Peter M. Bren, Charles J. Schreiber, Jr., Peter McMillan III and Keith D. Hall, who are our sponsors.

7

Who owns and controls the advisor?

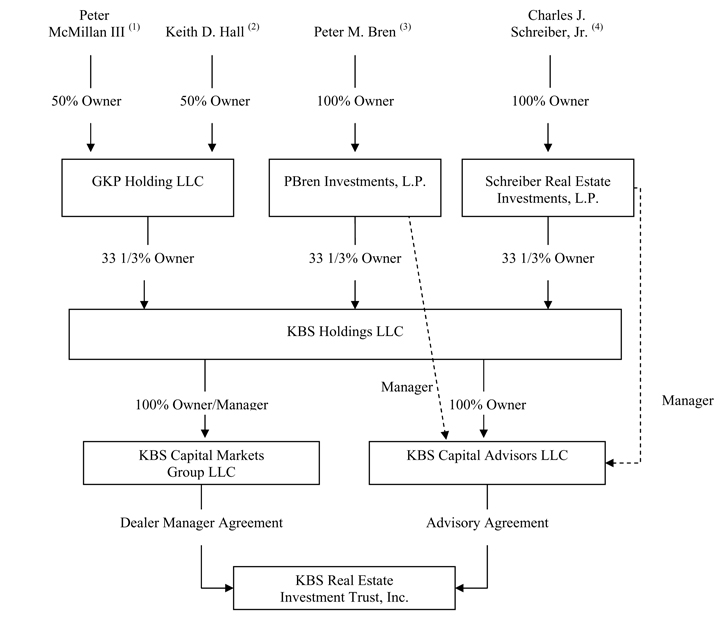

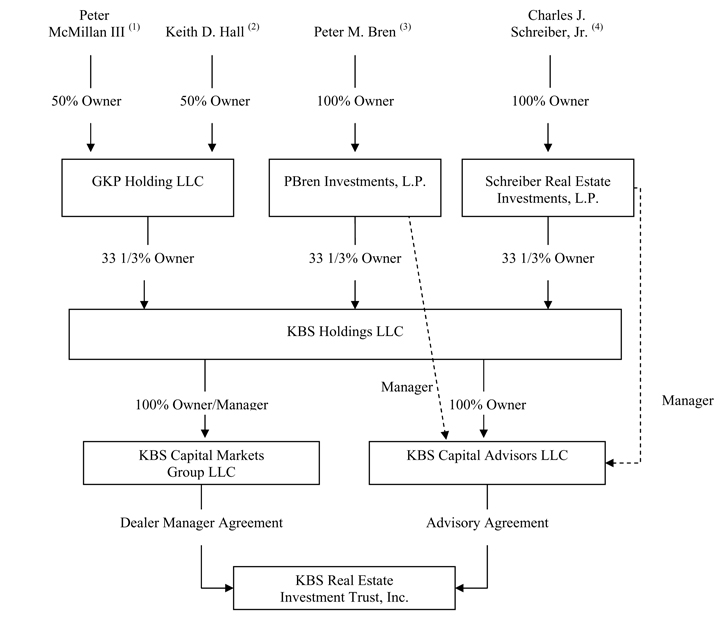

The following chart shows the ownership structure of KBS Capital Advisors and entities affiliated with KBS Capital Advisors that will perform services for us:

(1) Peter McMillan III is our Executive Vice President, Treasurer, Secretary and one of our directors.

(2) Keith D. Hall is our Executive Vice President.

(3) Peter M. Bren is our President. Other than de minimis amounts owned by family members or family trusts, Mr. Bren indirectly owns and controls PBren Investments, L.P.

(4) Charles J. Schreiber, Jr. is the Chairman of our Board, our Chief Executive Officer and one of our directors. Other than de minimis amounts owned by family members or trusts, Mr. Schreiber indirectly owns and controls Schreiber Real Estate Investments, L.P.

8

What are the fees that you will pay to the advisor, its affiliates and your directors?

Although we have executive officers who manage our operations, we have no paid employees. Our advisor, KBS Capital Advisors, and its affiliates manage our day-to-day affairs and our portfolio of real estate and real estate-related investments, subject to the board’s supervision. The following table summarizes all of the compensation and fees that we will pay to KBS Capital Advisors and its affiliates, including amounts to reimburse their costs in providing services, and amounts that we will pay to our independent directors. It also summarizes fees, compensation, expenses and reimbursements as of June 30, 2008 as well as the agreement from our advisor to advance to funds to us, as and if necessary, in connection with our declaration of distributions.

| | |

Form of Compensation/Expense

and Recipient | | Determination of Amount |

| |

| | | Organization and Offering Stage |

| |

Selling Commissions on Shares Sold in the Primary Offering – KBS Capital Markets Group | | We paid selling commissions of up to 6.0% of the gross proceeds from our primary offering before reallowance of commissions earned by participating broker-dealers. KBS Capital Markets Group, the dealer manager of our primary offering, reallowed 100% of commissions earned to participating broker-dealers. We ceased offering shares of common stock in our primary offering on May 30, 2008. From the commencement of the primary offering through June 30, 2008, we had paid selling commissions on shares sold through the primary offering of $93.5 million related to the sale of 168,770,793 shares of stock. |

| |

Sellings Commissions on Shares Sold in the Dividend Reinvestment Plan – KBS Capital Markets Group | | We pay selling commissions of up to 3.0% of the gross proceeds from the dividend reinvestment plan before reallowance of commissions earned to broker-dealers. KBS Capital Markets Group will reallow 100% of commissions payable on shares purchased through the dividend reinvestment plan to the broker-dealer associated with such account. From the commencement of the dividend reinvestment plan through June 30, 2008, we had paid selling commissions on shares sold through the dividend reinvestment plan of $1.0 million related to the sale of 3,828,554 shares of stock. |

| |

Dealer Manager Fee – KBS Capital Markets Group | | We paid dealer manager fees of up to 3.5% of the gross proceeds from our primary offering; no dealer manager fees are payable on shares sold under our dividend reinvestment plan. From its dealer manager fee, KBS Capital Markets Group reallowed to participating broker-dealers up to 1% of the gross proceeds attributable to that participating broker-dealer as a marketing fee, and in special cases KBS Capital Markets Group increased the reallowance. We ceased offering shares of common stock in our primary offering on May 30, 2008. From the commencement of the primary offering through June 30, 2008, we had paid dealer manager fees on shares sold through the primary offering of $58.7 million related to the sale of 168,770,793 shares of stock. |

9

| | |

Form of Compensation/Expense and Recipient | | Determination of Amount |

| |

Reimbursement of Other Organization and Offering Expenses – KBS Capital Advisors and KBS Capital Markets Group | | We reimburse KBS Capital Advisors and its affiliates for other organization and offerings expenses incurred on our behalf. After the termination of the primary offering, KBS Capital Advisors has agreed to reimburse us to the extent total organization and offering expenses (including selling commissions and the dealer manager fee) borne by us exceed 15% of the gross proceeds raised in the primary offering. KBS Capital Advisors will do the same after termination of the offering pursuant to our dividend reinvestment plan. These organization and offering expenses include all expenses (other than selling commissions and the dealer manager fee) to be paid by us in connection with the primary offering and the offering under the dividend reinvestment plan, including our legal, accounting, printing, mailing and filing fees, charges of our escrow holder and expenses of our advisor for administrative services related to the issuance of shares in the offering, reimbursement of KBS Capital Markets Group for amounts it may pay to reimburse the bona fide due diligence expenses of broker-dealers, reimbursement of our advisor for the salaries of its employees and other costs in connection with preparing supplemental sales materials, the cost of educational conferences held by us (including the travel, meal and lodging costs of registered representatives of broker-dealers) and reimbursement to KBS Capital Markets Group for travel, meals, lodging and attendance fees incurred by employees of KBS Capital Markets Group to attend retail seminars conducted by broker-dealers. From the commencement of the offerings through June 30, 2008, we had recorded organization and offering expenses related to the primary offering and the offering under the dividend reinvestment plan of $15.5 million, including both organization and offering costs incurred directly by us and those costs incurred by KBS Capital Advisors and its affiliates. KBS Capital Advisors and its affiliates incurred $10.5 million of this amount on our behalf, and $10.0 million had been reimbursed by us as of June 30, 2008. |

| |

| | | Acquisition and Development Stage |

| |

| Acquisition Fees – KBS Capital Advisors | | We pay our advisor an acquisition fee equal to 0.75% of the cost of investments acquired by us, including acquisition expenses and any debt attributable to such investments. This fee relates to services provided in connection with the selection and purchase or origination of real estate and real estate-related investments. From the commencement of the offerings through June 30, 2008, we have incurred acquisition fees of $16.0 million, all of which have been paid to the advisor. |

10

| | |

Form of Compensation/Expense and Recipient | | Determination of Amount |

| |

| Asset Management Fee – KBS Capital Advisors | | We pay the advisor a monthly fee equal to one-twelfth of 0.75% of the sum of the cost of all real estate investments we own and of our investments in joint ventures, including acquisition fees, acquisition expenses and any debt attributable to such investments. Notwithstanding the above, with respect to our investment in the joint venture that owns the National Industrial Portfolio, the asset management fee is calculated as a monthly fee equal to one-twelfth of 0.27% of the cost of the joint venture investment, which equals the product of (i) the amount actually paid or allocated to the purchase, development, construction or improvement of properties by the joint venture, inclusive of expenses related thereto, and the amount of any outstanding debt associated with such properties and the joint venture and (ii) the percentage that represents our economic interest in the joint venture. The advisor may also earn a performance fee related to the joint venture investment in the National Industrial Portfolio that would in effect make the advisor’s cumulative fees related to the investment equal to 0.75% of the cost of the joint venture investment on an annualized basis from the date of our investment in the joint venture through the date of calculation. This fee is conditioned upon the amount of our funds from operations. As of June 30, 2008, our operations were sufficient to meet the funds from operations condition per the advisory agreement with our advisor. As a result, as of June 30, 2008, we had accrued for incurred but unpaid performance fees of $2.2 million. Although these performance fees have been incurred as of June 30, 2008, the advisory agreement further provides that the payment of these fees shall only be made after the repayment of advances from the advisor (discussed below). As of June 30, 2008, $1.6 million of advances from the advisor remain unpaid. Although the asset management fees earned by the advisor through June 30, 2008 have been accrued for and expensed in the appropriate period in our financial statements, the advisor deferred, without interest, payment of the asset management fees it earned from July 2006 through September 2007; we have repaid $1.0 million of the $3.2 million initially deferred. Per the terms of the advisory agreement, the advisor may choose to be paid the accrued but unpaid asset management fees in such future period as the advisor may determine. From commencement of our offerings through June 30, 2008, we had accrued for and expensed $13.5 million of asset management fees and performance fees. Of this amount as of June 30, 2008, we had paid $9.1 million of asset management fees and there were $2.2 million of unpaid asset management fees related to the months of July 2006 through September 2007 and $2.2 million of unpaid performance fees related to our investment in the joint venture that owns the National Industrial Portfolio. If necessary in future periods, the advisor intends to defer payment of its asset management fee if the cumulative amount of our funds from operations for the period commencing January 1, 2006 plus the amount of the advance from the advisor is less than the cumulative amount of distributions declared and currently payable to our stockholders. The amount of cash available for distributions in future periods will be decreased by the repayment of the advance from the advisor and the payment of the advisor’s deferred asset management fee and unpaid performance fees. |

11

| | |

Form of Compensation/Expense and Recipient | | Determination of Amount |

| |

Other Operating Expenses – KBS Capital Advisors | | We may reimburse the expenses incurred by KBS Capital Advisors in connection with its provision of services to us, including our allocable share of the advisor’s overhead, such as rent, personnel costs, utilities and IT costs; however, we will not reimburse for personnel costs in connection with services for which KBS Capital Advisors receives acquisition fees or disposition fees. From the commencement of our offerings through June 30, 2008, we have reimbursed KBS Capital Advisors and its affiliates for approximately $0.2 million of operating expenses related to miscellaneous general and administrative costs incurred on our behalf. |

| |

| Advance – KBS Capital Advisors | | In connection with the declaration of distributions, we have entered into amendments to our advisory agreement with KBS Capital Advisors. Pursuant to the amendments, our advisor has agreed to advance funds to us equal to the amount by which the cumulative amount of distributions declared by our board of directors from January 1, 2006 through the period ending October 31, 2008 exceeds the amount of our funds from operations (as defined by NAREIT) from January 1, 2006 through October 31, 2008. We are only obligated to reimburse the advisor for this advance if and to the extent that our cumulative funds from operations for the period commencing January 1, 2006 through the date of any such reimbursement exceed the lesser of (i) the cumulative amount of any distributions declared and payable to our stockholders as of the date of such reimbursement or (ii) an amount that is equal to a 7.0% cumulative, non-compounded, annual return on invested capital for our stockholders for the period from July 18, 2006 through the date of such reimbursement. No interest will accrue on the advance being made by the advisor. From July 18, 2006 through September 15, 2008, the advisor had advanced an aggregate of $1.6 million to us, all of which is outstanding, for the payment of distributions and to cover our expenses, excluding depreciation and amortization, in excess of our revenues. No amount has been advanced since January 2007. |

| |

Stock-based Compensation Awards – Independent Directors and Affiliates of KBS Capital Advisors | | We may issue stock-based awards to our independent directors and to affiliates of our advisor. The total number of shares of common stock reserved for issuance under our Employee and Independent Director Incentive Stock Plan is equal to 5% of our outstanding shares at any time but may not exceed 10,000,000 shares. As of June 30, 2008, we had not issued any awards pursuant to this plan and we have no timetable for the grant of any awards under the plan. Furthermore, our board of directors has adopted a policy that prohibits grants of any awards of shares of common stock to any person under the Employee and Independent Director Stock Plan. |

12

| | |

Form of Compensation/Expense and Recipient | | Determination of Amount |

| |

| Independent Director Compensation | | We pay each of our independent directors an annual retainer of $25,000. We also pay our independent directors for attending meetings as follows: (i) $2,500 for each board meeting attended, (ii) $2,000 for each committee meeting attended (except that the committee chairman is paid $3,000 for each meeting attended), (iii) $1,000 for each teleconference board meeting attended, and (iv) $1,000 for each teleconference committee meeting attended (except that the committee chairman is paid $3,000 for each teleconference committee meeting attended). All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the board of directors. From our inception through June 30, 2008, we had incurred $680,853 of independent director fees and expenses, $11,249 of which was payable at June 30, 2008. |

| |

| | | Operational and Liquidation/Listing Stage |

| |

Subordinated Participation in Net Cash Flows – KBS Capital Advisors | | After investors in our offerings have received a return of their net capital contributions and an 8.0% per year cumulative, noncompounded return, KBS Capital Advisors is entitled to receive 15.0% of our net cash flows, whether from continuing operations, net sale proceeds or otherwise. In making this calculation, an investor’s net capital contribution is reduced to the extent distributions in excess of a cumulative, noncompounded, annual return of 8.0% are paid (from whatever source), except to the extent such distributions would be required to supplement prior distributions paid in order to achieve a cumulative, noncompounded, annual return of 8.0%. This fee is payable only if we are not listed on an exchange. No subordinated participation fees had been incurred as of June 30, 2008. Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

| |

| | | Liquidation/Listing Stage |

| |

Disposition Fees - KBS Capital Advisors or its affiliates | | For substantial assistance in connection with the sale of properties or other investments, we will pay KBS Capital Advisors or its affiliates a disposition fee of 1% of the contract sales price of each property or other investment sold; provided, however, in no event may the real estate commissions paid to KBS Capital Advisors, its affiliates and unaffiliated third parties exceed 6% of the contract sales price. The conflicts committee will determine whether the advisor or its affiliate has provided substantial assistance to us in connection with the sale of an asset. Substantial assistance in connection with the sale of a property includes the advisor’s preparation of an investment package for the property (including a new investment analysis, rent rolls, tenant information regarding credit, a property title report, an environmental report, a structural report and exhibits) or such other substantial services performed by the advisor in connection with a sale. No disposition fees had been incurred as of June 30, 2008. Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

13

| | |

Form of Compensation/Expense

and Recipient | | Determination of Amount |

| |

Subordinated Incentive Listing Fee – KBS Capital Advisors | | Upon listing of our common stock on a national securities exchange, we will pay a fee to our advisor equal to 15.0% of the amount by which (1) the market value of our outstanding stock plus distributions paid by us prior to listing exceeds (2) the sum of the total amount of capital raised from investors and the amount of cash flow necessary to generate an 8.0% per year cumulative, noncompounded return to investors. No subordinated incentive listing fee had been incurred as of June 30, 2008. Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. |

What conflicts of interest does your advisor face?

KBS Capital Advisors and its affiliates experience conflicts of interest in connection with the management of our business. Messrs. Bren, McMillan, Hall and Schreiber, our sponsors and four of our executive officers, indirectly own and control KBS Capital Advisors. KBS Capital Advisors is also the external advisor of KBS Real Estate Investment Trust II, Inc., which we refer to as KBS REIT II in this prospectus. In addition, Messrs. Bren and Schreiber and several of the other employees of KBS Capital Advisors are also the key employees of KBS Realty Advisors and its affiliates, the advisors to the private KBS-sponsored programs and the investment advisers to institutional investors in real estate and real estate-related assets. Some of the material conflicts that KBS Capital Advisors and its affiliates face include the following:

| | • | | Our sponsors, together with the other real estate professionals employed by KBS Capital Advisors, KBS Realty Advisors and their affiliates, must determine which investment opportunities to recommend to us, KBS REIT II, the one private KBS-sponsored program that is raising funds for investment as of the date of this prospectus for whom KBS serves as an advisor and is currently seeking investment opportunities as well as any programs KBS affiliates sponsor in the future; |

| | • | | KBS Capital Advisors and its affiliates may structure the terms of joint ventures between us and other KBS-sponsored programs or KBS-advised entities; |

| | • | | KBS Capital Advisors and its affiliates will have to allocate their time between us and other real estate programs and activities in which they are involved; |

| | • | | KBS Capital Advisors and its affiliates will receive fees in connection with transactions involving the purchase, origination, management and sale of our assets regardless of the quality of the asset acquired or the services provided to us; |

| | • | | KBS Capital Advisors and its affiliates, including our dealer manager, KBS Capital Markets Group, will receive fees in connection with our offerings of equity securities; |

| | • | | The negotiation of the advisory agreement and the dealer manager agreement (including the substantial fees KBS Capital Advisors and its affiliates receive thereunder) was not at arm’s length; |

| | • | | KBS Capital Advisors may terminate the advisory agreement without penalty upon 60 days’ written notice and, upon termination of the advisory agreement, KBS Capital Advisors may be entitled to a termination fee if (based upon an independent appraised value of the portfolio) it would have been entitled to a subordinated participation in net cash flows had the portfolio been liquidated on the termination date; and |

| | • | | We may seek stockholder approval to internalize our management by acquiring assets and personnel from our advisor for consideration that would be negotiated at that time. The payment of such consideration could result in dilution to your interest in us and could reduce the net income per share and funds from operations per share attributable to your investment. Additionally, in an internalization transaction, members of our advisor’s management that become our employees may receive more compensation than they receive from our advisor. These possibilities may provide incentives to our advisor or its management to pursue an internalization transaction rather than an alternative strategy, even if such alternative strategy might otherwise be in our stockholders’ best interests. |

14

What are your investment objectives?

Our primary investment objectives are:

| | • | | to provide you with attractive and stable cash dividends; and |

| | • | | to preserve and return your capital contribution. |

We will also seek to realize growth in the value of our investments by timing property sales to maximize asset value.

We may return all or a portion of your capital contribution in connection with the sale of the company or the assets we acquire. Alternatively, you may be able to obtain a return of all or a portion of your capital contribution in connection with the sale of your shares.

Though we intend to authorize and declare daily distributions that will be paid on a monthly basis, we have not established a minimum distribution level and may be unable or limited in our ability to make distributions to you. Further, no public trading market for our shares currently exists and, until our shares are listed, if ever, it may be difficult for you to sell your shares. Until our shares are listed, you may not sell your shares unless the buyer meets the applicable suitability and minimum purchase standards.

What is your target investment portfolio?

We have targeted to acquire approximately 70% core investments, which are generally existing properties with at least 80% occupancy and minimal near-term lease rollover, and approximately 30% real estate-related investments and enhanced-return properties. Though our target portfolio would consist of 30% real estate-related investments and enhanced-return properties, we will not forgo a good investment opportunity because it does not precisely fit our expected portfolio composition. Thus, to the extent that our advisor presents us with good investment opportunities that allow us to meet the REIT requirements under the Internal Revenue Code, our portfolio may consist of a greater percentage of enhanced-return properties and real estate-related investments.

Real estate-related investments are higher-yield and higher-risk investments that our advisor will actively manage. The real estate-related investments in which we may invest include: (i) mortgage loans; (ii) equity securities such as common stocks, preferred stocks and convertible preferred securities of real estate companies; (iii) debt securities such as mortgage-backed securities, commercial mortgages, mortgage loan participations and debt securities issued by other real estate companies; and (iv) certain types of illiquid securities, such as mezzanine loans and bridge loans. While we may invest in any of these real estate-related investments, we expect that the substantial majority of these investments will consist of mezzanine loans, commercial mortgage-backed securities and B-Notes as well as collateralized debt obligations.

Will you use leverage?

Yes. We expect that once we have fully invested the proceeds of our primary offering, our debt financing will be approximately 50% of the cost of our real estate investments (before deducting depreciation or other non-cash reserves) plus the value of our other assets. There is no limitation on the amount we may borrow for the purchase of any single property. Our charter limits our borrowings to 75% of the cost (before deducting depreciation or other non-cash reserves) of our tangible assets; however, we may exceed that limit if a majority of the conflicts committee approves each borrowing in excess of our charter limitation and we disclose such borrowing to our stockholders in our next quarterly report with an explanation from the conflicts committee of the justification for the excess borrowing. As of September 15, 2008, our borrowings were approximately 49% of the cost (before deducting depreciation or other non-cash reserves) of all of our real estate investments.

Careful use of debt will help us to achieve our diversification goals because we will have more funds available for investment. However, high levels of debt could cause us to incur higher interest charges and higher debt service payments, which would decrease the amount of cash available for distribution to our investors.

15

Are there any special restrictions on the ownership or transfer of shares?

Yes. Our charter contains restrictions on the ownership of our shares that prevent any one person from owning more than 9.8% of our aggregate outstanding shares unless exempted by our board of directors. These restrictions are designed to enable us to comply with ownership restrictions imposed on REITs by the Internal Revenue Code. Our charter also limits your ability to sell your shares unless (i) the prospective purchaser meets the suitability standards regarding income or net worth and (ii) the transfer complies with the minimum purchase requirements of our primary offering.

If I buy shares in this offering, how may I later sell them?

At the time you purchase the shares, they will not be listed for trading on any securities exchange or over-the-counter market. In fact, we expect that there will not be any public market for the shares when you purchase them, and we cannot be sure if one will ever develop. In addition, our charter imposes restrictions on the ownership of our common stock that will apply to potential purchasers of your shares. As a result, if you wish to sell your shares, you may not be able to do so promptly or at all, or you may only be able to sell them at a substantial discount from the price you paid.

After you have held your shares for at least one year, you may be able to have your shares repurchased by us pursuant to our share redemption program. The prices at which we will initially redeem shares are as follows:

| | • | | The lower of $9.25 or 92.5% of the price paid to acquire the shares from us for stockholders who have held their shares for at least one year; |

| | • | | The lower of $9.50 or 95.0% of the price paid to acquire the shares from us for stockholders who have held their shares for at least two years; |

| | • | | The lower of $9.75 or 97.5% of the price paid to acquire the shares from us for stockholders who have held their shares for at least three years; and |

| | • | | The lower of $10.00 or 100% of the price paid to acquire the shares from us for stockholders who have held their shares for at least four years. |

Notwithstanding the above, once we establish an estimated value per share of our common stock, the redemption price per share for all stockholders would be equal to the estimated value per share, as determined by our advisor or another firm chosen for that purpose. We expect to establish an estimated value per share beginning three years after the completion of our offering stage. We will consider our offering stage complete when we are no longer publicly offering equity securities and have not done so for one year.

The terms of our share redemption program are more generous with respect to redemptions sought upon a stockholder’s death or qualifying disability:

| | • | | There is no one-year holding requirement; |

| | • | | Until we establish an estimated value per share, which we expect to be three years after the completion of our offering stage, the redemption price is the amount paid to acquire the shares from us; and |

| | • | | Once we have established an estimated value per share, the redemption price would be the estimated value of the shares, as determined by our advisor or another firm chosen for that purpose. |

The share redemption program also contains numerous restrictions on your ability to sell your shares to us. Our share redemption program limits the number of shares we may redeem to those that we could purchase with the net proceeds from the sale of shares under our dividend reinvestment plan during the prior calendar year. During any calendar year, we may redeem no more than 5% of the weighted-average number of shares outstanding during the prior calendar year. We also have no obligation to redeem shares if the redemption would violate the restrictions on distributions under Maryland General Corporation Law, which prohibits distributions that would cause a corporation to fail to meet statutory tests of solvency. We may amend, suspend or terminate the program upon 30 days’ notice.

16

When will the company seek to list its shares of common stock?

We will seek to list our shares of common stock if and when our independent directors believe listing would be in the best interests of our stockholders. If we do not list our shares of common stock on a national securities exchange by November 2012, our charter requires that we either:

| | • | | seek stockholder approval of the liquidation of the company; or |

| | • | | if a majority of the conflicts committee determines that liquidation is not then in the best interests of our stockholders, postpone the decision of whether to liquidate the company. |

If a majority of the conflicts committee does determine that liquidation is not then in the best interests of our stockholders, our charter requires that the conflicts committee revisit the issue of liquidation at least annually. Further postponement of listing or stockholder action regarding liquidation would only be permitted if a majority of the conflicts committee again determined that liquidation would not be in the best interest of our stockholders. If we sought and failed to obtain stockholder approval of our liquidation, our charter would not require us to list or liquidate, and we could continue to operate as before. If we sought and obtained stockholder approval of our liquidation, we would begin an orderly sale of our properties and other assets. The precise timing of such sales would take account of the prevailing real estate and financial markets, the economic conditions in the submarkets where our properties are located and the federal income tax consequences to our stockholders. In making the decision to apply for listing of our shares, our directors will try to determine whether listing our shares or liquidating our assets will result in greater value for stockholders.

Who can help answer my questions about the dividend reinvestment plan?

If you have more questions about the dividend reinvestment plan, you should contact your financial advisor or contact:

KBS Capital Markets Group LLC

660 Newport Center Drive, Suite 1200

Newport Beach, California 92660

Telephone: (866) KBS-4CMG or (866) 527-4264

Fax: (949) 717-6201

www.kbs-cmg.com

17

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information included in or incorporated by reference into this prospectus contains forward-looking statements about our business, including, in particular, statements about our plans, strategies and objectives. You can generally identify forward-looking statements by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words. You should not rely on these forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements.

For a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition, you should carefully review the risk factors disclosed under Part I, Item 1A of our annual report on Form 10-K for the year ended December 31, 2007, the risk factors disclosed under Part II, Item 1A of our quarterly reports on Form 10-Q for the periods ended March 31, 2008 and June 30, 2008, and any updated risk factors contained in future filings we make under the Securities Exchange Act of 1934, as amended. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

DIVIDEND REINVESTMENT PLAN

Pursuant to our second amended and restated dividend reinvestment plan you may elect to have your dividends and other distributions reinvested in additional shares of our common stock. The following discussion summarizes the principal terms of this plan. Appendix A to this prospectus contains the full text of our second amended and restated dividend reinvestment plan as is currently in effect.

Eligibility

All of our stockholders are eligible to participate in our dividend reinvestment plan; however, we may elect to deny your participation in the plan if you reside in a jurisdiction or foreign country where, in our judgment, the burden or expense of compliance with applicable securities laws makes your participation impracticable or inadvisable.

At any time prior to the listing of our shares on a national securities exchange, you must cease participation in our dividend reinvestment plan if you no longer meet the suitability standards or cannot make the other investor representations set forth in the then-current prospectus or in the Account Update Form. Participants must agree to notify us promptly when they no longer meet these standards. See the “Suitability Standards” section of this prospectus (immediately following the cover page).

Election to Participate

You may elect to participate in the dividend reinvestment plan by completing the Account Update Form or other approved enrollment form available from your financial advisor or by calling our investor services line at 1-866-584-1381, administered by Phoenix Transfer, Inc. Your participation in the dividend reinvestment plan will begin with the next distribution made after receipt of your enrollment form. You can choose to have all or a portion of your distributions reinvested through the dividend reinvestment plan. You may also change the percentage of your distributions that will be reinvested at any time by completing a new Account Update Form or other form provided for that purpose. You should consult with your financial advisor before making any decision to increase your level of participation.

Stock Purchases

Shares will be purchased under the dividend reinvestment plan on the monthly distribution payment dates. The purchase of fractional shares is a permissible and likely result of the reinvestment of distributions under the dividend reinvestment plan.

The purchase price of shares purchased under the dividend reinvestment plan will initially be $9.50 per share. Three years after the completion of our offering stage, shares issued pursuant to our dividend reinvestment plan will be priced at the estimated value per share of our common stock, as determined by our advisor or another firm chosen for that purpose. We will consider our offering stage complete when we are no longer publicly offering equity securities and have not done so for one year. (For purposes of this definition, we do not consider “public equity offerings” to include offerings on behalf of selling stockholders or offerings related to any dividend reinvestment plan, employee benefit plan or the redemption of interests in our Operating Partnership.)

18

Account Statements

You or your designee will receive a confirmation of your purchases under the dividend reinvestment plan no less than quarterly. Your confirmation will disclose the following information:

| | • | | each distribution reinvested for your account during the period; |

| | • | | the date of the reinvestment; |

| | • | | the number and price of the shares purchased by you; and |

| | • | | the total number of shares in your account. |

In addition, within 90 days after the end of each calendar year, we will provide you with an individualized report on your investment, including the purchase dates, purchase price, number of shares owned and the amount of distributions made in the prior year. We will also provide to all participants in the plan, without charge, all supplements to and updated versions of this prospectus, as required under applicable securities laws.

Fees and Commissions

To the extent permitted by state securities laws, if we paid selling commissions in connection with the sale of shares to you in our primary offering, we may pay a 3% selling commission on any shares issued to you under our dividend reinvestment plan (which commission may be higher than the selling commission charged in connection with recent dividend reinvestment plan offerings by other non-traded, publicly offered REITs). We will not pay selling commissions on shares issued to residents of Ohio under the dividend reinvestment plan commencing with plan purchases for dividend record dates after September 30, 2008. Broker-dealers may agree to waive selling commissions on dividend reinvestment plan shares in which case no selling commissions will be paid to any person in connection with the sale of such shares.

We will pay selling commissions to KBS Capital Markets Group, the dealer manager of our primary offering. KBS Capital Markets Group will reallow any selling commissions payable on shares purchased through the dividend reinvestment plan to the broker-dealer associated with such account. We will not pay any dealer manager fees in connection with shares sold under this plan.

Whether we pay a selling commission will not affect the purchase price you pay under the dividend reinvestment plan, but it will affect the net proceeds to us from the sale. The total return for our investors would likely be higher if we paid no selling commissions. We will not receive a fee for selling shares under the dividend reinvestment plan. Sales under our dividend reinvestment plan, however, may result in greater fee income for our advisor. See “Management Compensation.”

Voting

You may vote all whole shares that you acquire through the dividend reinvestment plan.

Tax Consequences of Participation

If you elect to participate in the dividend reinvestment plan and are subject to federal income taxation, you will incur a tax liability for distributions allocated to you even though you have elected not to receive the distributions in cash but rather to have the distributions withheld and reinvested pursuant to the plan. Specifically, you will be treated as if you have received the distribution from us in cash and then applied such distribution to the purchase of additional shares. In addition, to the extent you purchase shares through our dividend reinvestment plan at a discount to their fair market value, you will be treated for tax purposes as receiving an additional distribution equal to the amount of the discount. Until three years after the completion of our offering stage, we expect that (i) we will sell shares under the dividend reinvestment plan at $9.50 per share, (ii) no secondary trading market for our shares will develop and (iii) our advisor will estimate the fair market value of a share to be $10.00. Therefore, until three years after the completion of our offering stage, participants in our dividend reinvestment plan will be treated as having received a distribution of $10.00 for each $9.50 reinvested by them under our dividend reinvestment plan. You will be taxed on the amount of such distribution as a dividend to the extent such distribution is from current or accumulated earnings and profits, unless we have designated all or a portion of the distribution as a capital gain distribution. See “Federal Income Tax Considerations — Taxation of Stockholders.” We will withhold 28% of the amount of dividends or distributions paid if you fail to furnish a valid taxpayer identification number, fail to properly report interest or distributions or fail to certify that you are not subject to withholding.

19

Termination of Participation

Once enrolled, you may continue to purchase shares under our dividend reinvestment plan until we have sold all of the shares registered in this offering, have terminated this offering or have terminated the dividend reinvestment plan. You may terminate your participation in the dividend reinvestment plan at any time by providing us with written notice. For your termination to be effective for a particular distribution, we must have received your notice of termination at least 10 business days prior to the last day of the fiscal period to which the distribution relates. Any transfer of your shares will effect a termination of the participation of those shares in the dividend reinvestment plan. We will terminate your participation in the dividend reinvestment plan to the extent that a reinvestment of your distributions would cause you to violate the ownership limit contained in our charter, unless you have obtained an exemption from the ownership limit from our board of directors.

Amendment or Termination of Plan

We may amend or terminate the dividend reinvestment plan for any reason at any time, provided that any amendment that adversely affects the rights or obligations of a participant (as determined in the sole discretion of the board of directors) will only take effect upon 10 days’ written notice to participants.

ESTIMATED USE OF PROCEEDS

The following table sets forth information about how we intend to use the proceeds raised under our dividend reinvestment plan. Organization and offering expenses represent management’s best estimate since these amounts cannot be precisely calculated at this time. Depending primarily upon the number of shares we sell in this offering and assuming a $9.50 purchase price for shares sold under the dividend reinvestment plan, we estimate that we will use 96.75% of our gross offering proceeds for the repurchase of shares of our common stock under our share redemption program. We will use the remainder of the proceeds from the dividend reinvestment plan to pay offering expenses, including selling commissions. If all redemption requests under the share redemption program are honored or the share redemption program is suspended or terminated, then we may use the proceeds from the dividend reinvestment plan for investment in properties and other real estate-related assets, the repayment of debt, capital expenditures, tenant leasing costs or general corporate purposes. We cannot predict with any certainty how much, if any, dividend reinvestment plan proceeds will be available for these purposes. If we use proceeds from this offering to fund acquisitions in real estate or real estate-related investments, then we will pay our advisor acquisition fees equal to 0.75% of the cost of the investments (including debt and any acquisition expenses attributable to such investments). Though our board has the authority under our organizational documents, our distribution policy is not to use the proceeds of this offering to pay distributions.

| | | | | | | | |