UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________

FORM 10-K

______________________________________________________

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-52606

______________________________________________________

KBS REAL ESTATE INVESTMENT TRUST, INC.

(Exact Name of Registrant as Specified in Its Charter)

______________________________________________________

|

| | |

| Maryland | | 20-2985918 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

800 Newport Center Drive, Suite 700 Newport Beach, California | | 92660 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(949) 417-6500

(Registrant’s Telephone Number, Including Area Code)

______________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

______________________________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large Accelerated Filer | | ¨ | | Accelerated Filer | | ¨ |

| Non-Accelerated Filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

There is no established market for the Registrant’s shares of common stock. On December 9, 2014, the board of directors of the Registrant approved an estimated value per share of the Registrant’s common stock of $4.52 based on the estimated value of the Registrant’s assets less the estimated value of the Registrant’s liabilities divided by the number of shares outstanding, all as of September 30, 2014. For a full description of the methodologies used to value the Registrant’s assets and liabilities in connection with the calculation of the estimated value per share as of December 9, 2014, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Market Information” of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2014. On December 8, 2015, the board of directors of the Registrant approved an estimated value per share of the Registrant’s common stock of $3.94 based on the estimated value of the Registrant’s assets less the estimated value of the Registrant’s liabilities, or net asset value, divided by the number of shares outstanding, all as of September 30, 2015, with the exception of an adjustment to the Registrant’s net asset value to give effect to the December 7, 2015 payment of a special distribution of $0.25 per share on the outstanding shares of common stock of the Registrant to the stockholders of record as of the close of business on December 1, 2015. For a full description of the methodologies used to value the Registrant’s assets and liabilities in connection with the calculation of the estimated value per share as of December 8, 2015, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Market Information.”

There were approximately 187,114,420 shares of common stock held by non-affiliates as of June 30, 2015, the last business day of the Registrant’s most recently completed second fiscal quarter.

As of March 14, 2016, there were 186,191,379 outstanding shares of common stock of the Registrant.

TABLE OF CONTENTS

|

| | | |

| | |

| | ITEM 1. | | |

| | ITEM 1A. | | |

| | ITEM 1B. | | |

| | ITEM 2. | | |

| | ITEM 3. | | |

| | ITEM 4. | | |

| | | |

| | ITEM 5. | | |

| | ITEM 6. | | |

| | ITEM 7. | | |

| | ITEM 7A. | | |

| | ITEM 8. | | |

| | ITEM 9. | | |

| | ITEM 9A. | | |

| | ITEM 9B. | | |

| | | |

| | ITEM 10. | | |

| | ITEM 11. | | |

| | ITEM 12. | | |

| | ITEM 13. | | |

| | ITEM14. | | |

| | | |

| | ITEM 15. | | |

| | | | |

| |

FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of KBS Real Estate Investment Trust, Inc. and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

The following are some of the risks and uncertainties, although not all of the risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking statements:

| |

| • | We are the first publicly offered investment program sponsored by the affiliates of our external advisor, KBS Capital Advisors LLC (“KBS Capital Advisors”), which makes our future performance difficult to predict. Our stockholders should not assume that our performance will be similar to the past performance of other real estate investment programs sponsored by affiliates of our advisor. |

| |

| • | All of our executive officers and some of our directors and other key real estate and debt finance professionals are also officers, directors, managers, key professionals and/or holders of a direct or indirect controlling interest in our advisor, the entity that acted as our dealer manager and/or other KBS-affiliated entities. As a result, they face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other KBS-sponsored programs and KBS-advised investors and conflicts in allocating time among us and these other programs and investors. These conflicts could result in unanticipated actions. |

| |

| • | We pay substantial fees to and expenses of our advisor and its affiliates. These payments increase the risk that our stockholders will not earn a profit on their investment in us and increase the risk of loss to our stockholders. |

| |

| • | We depend on tenants for the revenue generated by our real estate investments and, accordingly, the revenue generated by our real estate investments is dependent upon the success and economic viability of our tenants. Revenues from our properties could decrease due to a reduction in occupancy (caused by factors including, but not limited to, tenant defaults, tenant insolvency, early termination of tenant leases and non-renewal of existing tenant leases) and/or lower rental rates, making it more difficult for us to meet our debt service obligations and reducing our stockholders’ returns. |

| |

| • | We may not be able to refinance some or all of our existing indebtedness or to obtain additional debt financing on attractive terms. If we are not able to refinance existing indebtedness on attractive terms at or prior to its maturity, we may be forced to dispose of our assets sooner than we otherwise would and/or our lenders may take action against us. |

| |

| • | Our investments in real estate and real estate loans may be affected by unfavorable real estate market and general economic conditions, which could decrease the value of those assets and reduce the investment return to our stockholders. Revenues from our real property investments could decrease, making it more difficult for us to meet our debt service obligations. Revenues from the properties and other assets directly or indirectly securing our loan investments could decrease, making it more difficult for the borrowers under those loans to meet their payment obligations to us. In addition, decreases in revenues from the properties directly or indirectly securing our loan investments could result in decreased valuations for those properties, which could make it difficult for our borrowers to repay or refinance their obligations to us. These factors could make it more difficult for us to meet our debt service obligations and could reduce our stockholders’ return. |

| |

| • | Disruptions in the financial markets and uncertain economic conditions could adversely affect our ability to meet our debt service obligations and cash needs, reducing the value of our stockholders’ investment in us. |

| |

| • | Certain of our debt obligations have variable interest rates and related payments that vary with the movement of LIBOR or other indexes. Increases in these indexes could increase the amount of our debt payments and reduce our stockholders’ return. |

| |

| • | Our share redemption program provides only for redemptions sought upon a stockholder’s death, “qualifying disability” or “determination of incompetence” (each as defined in the share redemption program and, together with redemptions in connection with a stockholder’s death, “special redemptions”). The dollar amounts available for such redemptions are determined by our board of directors and may be reviewed and adjusted from time to time. Additionally, redemptions are further subject to limitations described in our share redemption program. We currently do not expect to have funds available for ordinary redemptions in the future. |

| |

| • | We may not be able to successfully operate and/or sell the GKK Properties (defined below) given the concentration of the GKK Properties in the financial services sector, the significant debt obligations we have assumed with respect to such GKK Properties, and our advisor’s limited experience operating, managing and selling bank branch properties. Moreover, we depend upon GKK Realty Advisors LLC (the “Property Manager”), an affiliate of Gramercy (defined below), to manage and conduct the operations of the GKK Properties and any adverse changes in or the termination of our relationship with the Property Manager could hinder the performance of the GKK Properties and the return on our stockholders’ investment in us. |

| |

| • | As a result of the transfer of the GKK Properties to us, a significant portion of our properties are leased to financial institutions, making us more economically vulnerable in the event of a downturn in the banking industry. |

| |

| • | Although the special committee of our board of directors has engaged a financial advisor to assist with the exploration of strategic alternatives for us, we are not obligated to enter into any particular transaction or any transaction at all. |

All forward-looking statements should be read in light of the risks identified in Part I, Item 1A of this Annual Report on Form 10-K.

PART I

Overview

KBS Real Estate Investment Trust, Inc. is a Maryland corporation that was formed on June 13, 2005 to invest in a diverse portfolio of real estate properties and real estate-related investments. We elected to be taxed as a real estate investment trust (“REIT”) beginning with the taxable year ended December 31, 2006 and we intend to continue to operate in such a manner. As used herein, the terms “we,” “our” and “us” refer to the Company and as required by context, KBS Limited Partnership, a Delaware limited partnership, which we refer to as our “Operating Partnership,” and to their subsidiaries. We own substantially all of our assets and conduct our operations through our Operating Partnership, of which we are the sole general partner. Subject to certain restrictions and limitations, our business is managed by KBS Capital Advisors pursuant to an advisory agreement. Our advisor owns 20,000 shares of our common stock. We have no paid employees.

On January 27, 2006, we launched our initial public offering of up to 200,000,000 shares of common stock in our primary offering and 80,000,000 shares of common stock under our dividend reinvestment plan. We ceased offering shares of common stock in our primary offering on May 30, 2008. We terminated our dividend reinvestment plan effective April 10, 2012. We sold 171,109,494 shares in our primary offering for gross offering proceeds of $1.7 billion and 28,306,086 shares under our dividend reinvestment plan for gross offering proceeds of $233.7 million.

As of December 31, 2015, we owned or, with respect to a limited number of properties, held a leasehold interest in, 364 real estate properties (of which eight properties were held for sale), including the GKK Properties. In addition, as of December 31, 2015, we owned four real estate loans receivable and a participation interest with respect to a real estate joint venture.

On September 1, 2011, we, through indirect wholly owned subsidiaries (collectively, “KBS”), entered into a Collateral Transfer and Settlement Agreement (the “Settlement Agreement”) with, among other parties, GKK Stars Acquisition LLC (“GKK Stars”), the wholly owned subsidiary of Gramercy Property Trust, Inc. (“Gramercy”) that indirectly owned the Gramercy real estate portfolio, to effect the orderly transfer of certain assets and liabilities of the Gramercy real estate portfolio to KBS in satisfaction of certain debt obligations under a mezzanine loan owed by wholly owned subsidiaries of Gramercy to KBS (the “GKK Mezzanine Loan”). The Settlement Agreement resulted in the transfer of the equity interests in certain subsidiaries of Gramercy (the “Equity Interests”) that indirectly owned or, with respect to a limited number of properties, held a leasehold interest in, 867 properties (the “GKK Properties”), consisting of 576 bank branch properties and 291 office buildings, operations centers and other properties. For a further discussion of the Settlement Agreement, the transfers of the GKK Properties and the debt related to these properties, see our Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC.

Our focus in 2016 is to manage our existing investment portfolio, which includes strategically selling assets; exploring short-term value-add opportunities for a small number of GKK Properties; and distributing operating cash flow and net sales proceeds to stockholders.

Objectives and Strategies

Our primary investment objectives were:

| |

| • | to preserve and return our stockholders’ capital contributions; and |

| |

| • | to manage our investments to allow our stockholders to realize a return on their investment. |

We have sought and will seek to achieve these objectives by managing our portfolio of real estate and real estate-related investments, which we acquired using a combination of equity raised in our initial public offering, debt financing and joint ventures. We diversified our portfolio by investment type, geographic region, and tenant/borrower base.

Our primary business objectives are: (i) to maintain and, if possible, improve the quality and income-producing ability of our investments; (ii) to position our investments to improve their value; and (iii) to manage our portfolio to remain compliant with REIT requirements under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). We intend to meet these objectives by utilizing the expertise of our advisor to diligently increase the occupancy of our real estate properties while structuring leases that enhance property operating performance. We will also, through our advisor, seek to improve the cash flows from our real estate-related investments, through continuing debt service, restructuring of terms and, if necessary, foreclosing on the collateral securing our real estate-related investments. All of our business activities are conducted with the intention of remaining compliant with REIT requirements; if we continue to qualify for taxation as a REIT, we will generally not be subject to federal corporate income taxes on our taxable income that is currently distributed to stockholders. This treatment substantially eliminates “double taxation” at the corporate and stockholder levels that usually results from investment in the stock of a corporation.

On January 27, 2016, our board of directors formed a special committee (the "Special Committee") composed of all of our independent directors to explore the availability of strategic alternatives involving us. While we conduct this process, we remain 100% focused on managing our properties.

As part of the process of exploring strategic alternatives, on February 23, 2016, the Special Committee engaged Evercore Group L.L.C. (“Evercore”) to act as our financial advisor and to assist the Special Committee with this process. Under the terms of the engagement, Evercore will provide various financial advisory services, as requested by the Special Committee as customary for an engagement in connection with exploring strategic alternatives. Although the Special Committee has engaged Evercore to assist us and the Special Committee with the exploration of strategic alternatives for us, we are not obligated to enter into any particular transaction or any transaction at all. Further, although we have begun the process of exploring strategic alternatives, there is no assurance that the process will result in stockholder liquidity, or provide a return to stockholders that equals or exceeds our estimated value per share.

Investment Portfolio

Real Estate Properties

We made investments in core office and industrial properties, which are generally lower risk, existing properties with at least 80% occupancy and minimal near-term lease rollover. We also own other types of properties, including bank branches, transferred to us pursuant to the Settlement Agreement (discussed above under “Overview”) and properties transferred to us through foreclosures or deeds-in-lieu of foreclosures. These properties had originally secured certain of our investments in real estate loans receivable. All of our properties are located in the United States. As of December 31, 2015, we owned 356 real estate properties held for investment. We also owned eight properties that were held for sale. The 356 real estate properties held for investment totaled 7.7 million rentable square feet and included the following:

| |

| • | Nine office buildings and three corporate research buildings; and |

| |

| • | GKK Properties consisting of 291 bank branch properties and 53 office buildings, operations centers and other properties. |

We originally intended to hold our core properties for four to seven years. With respect to the GKK Properties, our management continues to evaluate which properties to hold and which properties to sell. During the year ended December 31, 2015, we sold 34 properties (of which 31 were GKK Properties) and terminated the leasehold interest in three properties. The hold period of certain GKK Properties has been affected by the underlying debt structure and related defeasance costs and prepayment penalties. Additionally, economic and market conditions influence us to hold our investments for different periods of time.

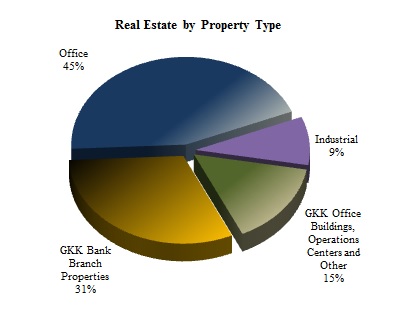

The following chart illustrates the composition of our real estate portfolio (excluding eight properties that were held for sale) as of December 31, 2015 based on the carrying value of the investments:

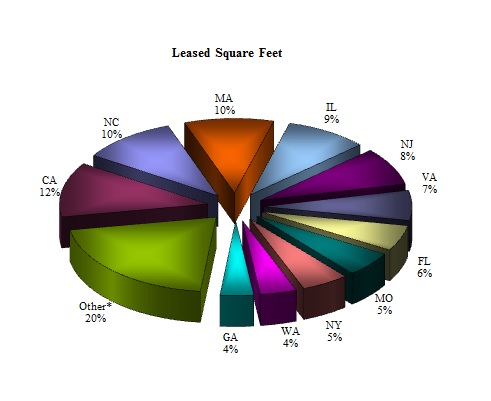

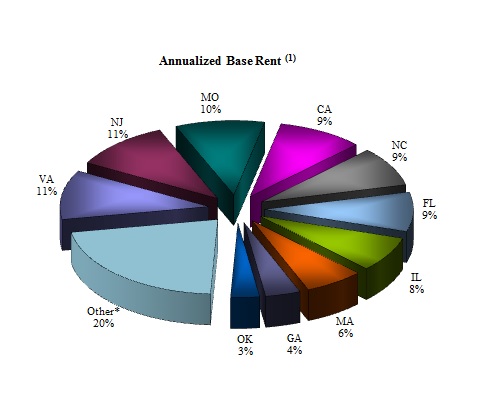

As noted above, our real estate property investments (excluding eight properties that were held for sale) are diversified by geographic location with properties in 30 states as shown in the charts below:

_____________________

*Other includes any state less than 3% of the total.

(1) Annualized base rent represents annualized contractual base rental income as of December 31, 2015, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term.

One of our objectives is to maintain a stable and diversified tenant base and have long-term relationships with our tenants in order to limit our exposure to any one tenant or industry. However, as a result of the transfers of the GKK Properties, beginning in December 2011 and as of December 31, 2015, we had a concentration of credit risk related to Bank of America, N.A., which represented approximately 16.9% of our annualized base rent as of December 31, 2015 and reduced the diversity of our tenant base. Annualized base rent represents annualized contractual base rental income as of December 31, 2015, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Also, as of December 31, 2015, we had a concentration of credit risk related to the finance industry, which represented approximately 46.5% of our annualized base rent. The finance industry concentration is due to the concentration in the GKK Properties. As of December 31, 2015, our real estate portfolio was 85% occupied (excluding properties that were held for sale). The chart below illustrates the diversity of tenant industries in our portfolio (excluding properties that were held for sale) based on total annualized base rent as of December 31, 2015:

_____________________

* All others includes any industry less than 2% of the total.

(1) Annualized base rent represents annualized contractual base rental income as of December 31, 2015, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term.

The carrying value of our real estate portfolio as of December 31, 2015 was $0.9 billion (including eight properties that were held for sale).

Real Estate-Related Investments

We have also invested in real estate-related investments including: (i) mortgage loans; (ii) mezzanine loans; (iii) participations in mortgage and mezzanine loans; (iv) B-Notes; and (v) real estate-related debt securities, such as commercial mortgage-backed securities (“CMBS”). We initially intended to hold our real estate-related investments until maturity. However, economic and market conditions may influence us to hold our investments for different periods of time. We may sell an asset before the end of the expected holding period if we believe that market conditions and asset positioning have maximized its value to us or the sale of the asset would otherwise be in the best interests of our stockholders.

As of December 31, 2015, we owned one mortgage loan, one mezzanine loan and two B-Notes. The book value (net of asset specific reserves) of our real estate-related investments as of December 31, 2015 was $27.3 million. As of December 31, 2015, our real estate-related investments consisted of four fixed rate real estate loans receivable with a weighted average annualized effective interest rate of 9.0%.

Financing Objectives

We financed the majority of our real estate acquisitions with a combination of the proceeds we received from our initial public offering and debt. In addition, we purchased certain real estate-related investments with a combination of the proceeds we received from our initial public offering and repurchase financing. We used debt financing to increase the amount available for investment and to increase overall investment yields to us and our stockholders. As of December 31, 2015, the weighted-average interest rate on our debt was 4.6%.

We have borrowed funds at a combination of fixed and variable rates. As of December 31, 2015, we had approximately $267.0 million and $164.1 million of fixed and variable rate debt outstanding, respectively. The weighted-average interest rates of our fixed rate debt and variable rate debt at December 31, 2015 were 6.0% and 2.2%, respectively.

Some of our debt allows us to extend the maturity dates, subject to certain conditions. Although we believe we will be permitted to extend the maturity dates of our current debt obligations, we can give no assurance in this regard. The following is a schedule of maturities, including principal amortization payments, for all of our notes payable outstanding as of December 31, 2015 (in thousands):

|

| | | |

| 2016 | $ | 67,950 |

|

| 2017 | 269,956 |

|

| 2018 | 4,707 |

|

| 2019 | 61,957 |

|

| 2020 | 2,728 |

|

| Thereafter | 23,840 |

|

| | $ | 431,138 |

|

We limit our total liabilities to 75% of the cost (before deducting depreciation or other noncash reserves) of all of our tangible assets; however, we may exceed this limit if the majority of the conflicts committee approves each borrowing in excess of that limitation and we disclose such borrowings to our stockholders in our next quarterly report with an explanation from the conflicts committee of the justification for the excess borrowing. We did not exceed this limitation on borrowings during any quarter of 2015. As of December 31, 2015, our borrowings and other liabilities were approximately 35% of both the cost (before deducting depreciation or other noncash reserves) and book value (before deducting depreciation) of our tangible assets, respectively.

Market Outlook – Real Estate and Real Estate Finance Markets

The following discussion is based on management’s beliefs, observations and expectations with respect to the real estate and real estate finance markets.

Current conditions in the global capital markets remain volatile. The slowdown in global economic growth, and the increase in oil production capacity, has had a ripple effect through the energy and commodity markets. Decreasing levels of demand for commodities have led to a weakening of global economic conditions, particularly in emerging market nations. Many nations in the developing world rely on metals, minerals and oil production as the basis of their economies. When demand for these resources drops, the economic environment deteriorates, and deflation becomes a very real risk. Over the past decade the United States has seen a resurgence of the domestic energy markets. The growth of domestic oil and natural gas production helped the U.S. economy rebound from the 2008-2009 recession. During the first quarter of 2016, supply pressures in the energy markets have driven down the price of oil to levels not seen in many years, and U.S. economic growth has slowed.

Central bank interventions and the use of monetary policy to combat the lingering effects of the 2008-2009 recession continue to affect the global economy. The U.S. Federal Reserve (the “FED”) pursued an accommodative monetary policy that included cutting interest rates and implementing a quantitative easing (“QE”) program. In 2015, the U.S. economy continued strengthening, and the FED ceased the QE program and raised the Target Funds rate by 25 basis points. In 2012, Japan embarked on a massive QE program designed to kick start the country’s economy. The Japanese economy remains weak, with little or no economic growth. In Europe, the European Central Bank (“ECB”) announced its own QE program in January 2015. The long awaited announcement led to lower European interest rates and a weakening of the Euro against other currencies. With much of the EU economy still experiencing low economic growth, the ECB is now poised to increase its QE program. While the intent of these policies is to spur economic growth, the size of these programs is unprecedented, and the ultimate impact on the global financial system is unknown.

In the United States, recent economic data has been mixed. Slow and steady growth in the labor markets has driven unemployment to 4.9% as of January 2016. The labor force participation rate continues to be relatively low and personal income growth has been modest. Consumer spending in the United States has been increasing, and consumer confidence levels are starting to reach levels last seen in the mid-2000’s. U.S. gross domestic product (“U.S. GDP”) has continued to grow. On an annual basis, U.S. GDP growth in 2014 was 2.4%, which was an improvement over 2013’s growth rate of 1.5%. In 2015 U.S. GDP growth came in at 2.4%, with the trend moving towards slower growth in the first quarter of 2016.

With the backdrop of increasing levels of global political conflict, and weaker international economic conditions, the U.S. dollar has remained a safe haven currency. The U.S. commercial real estate market has benefited from strong inflows of foreign capital. In 2015 commercial real estate transaction volumes increased 23%, making 2015 the second highest level of investment volume, behind only 2007. Foreign capital flows represent 17% of the 2015 volume. Initially, gateway markets such as New York City and San Francisco benefited from a high demand for commercial properties. Now investors have branched into secondary and tertiary markets, and demand for investments is leading to price increases and an uptick in construction and development. Some fear the potential creation of an asset bubble, particularly in the gateway metropolitan markets.

Impact on Our Real Estate Investments

The increased volatility in the global financial markets and the potential increase in U.S. interest rates are introducing a level of uncertainty into our outlook for the performance of the U.S. commercial real estate markets. Currently, both the investing and leasing environments are highly competitive. While there has been an increase in the amount of capital flowing into U.S. real estate markets, which has resulted in an increase in real estate values in certain markets, the uncertainty regarding the economic environment has made businesses reluctant to make long-term commitments, as is evidenced by the lower level of business investment and capital expenditures. Possible future declines in rental rates, slower or potentially negative net absorption of leased space and expectations of future rental concessions, including free rent to renew tenants early, to retain tenants who are up for renewal or to attract new tenants, may result in decreases in cash flows. Historically low interest rates could help offset some of the impact of these potential decreases in operating cash flow for properties financed with variable rate mortgages; however, interest rates likely will not remain at these historically low levels for the remaining life of many of our investments. In fact, the FED increased interest rates in Q4 2015. Currently we expect further increases in interest rates, but are uncertain as to the timing and levels. Interest rates have become more volatile as the global capital markets react to increasing economic and geopolitical risks.

Impact on Our Real Estate-Related Investments

All of our real estate-related investments are directly or indirectly secured by commercial real estate. As a result, our real estate-related investments, in general, have been and likely will continue to be impacted by the same factors impacting our real estate properties. The higher yields and the improving credit position of many U.S. tenants and borrowers have attracted global capital. However, the real estate and capital markets are fluid, and the positive trends can reverse quickly. Current economic conditions remain relatively volatile and can have a negative impact on the performance of collateral securing our loan investments, and therefore may impact the ability of some of the borrowers under our loans to make contractual interest payments to us.

We have fixed rate real estate-related loan investments with a total book value (excluding asset-specific loan loss reserves) of $33.8 million. On September 1, 2015, the Lawrence Village Plaza Loan Origination matured without repayment. We are currently negotiating an agreement in lieu of foreclosure with the borrower under the Lawrence Village Plaza Loan Origination to transfer title of the property securing the loan to us in full satisfaction of the debt outstanding under, and all other obligations related to, the Lawrence Village Plaza Loan Origination. No other real estate-related loan investments are scheduled to mature within one year from December 31, 2015. As of December 31, 2015, we had recorded $6.5 million of reserves for loan losses related to two of our real estate-related investments, one of which was the Lawrence Village Plaza Loan Origination.

Impact on Our Financing Activities

In light of the risks associated with potentially volatile operating cash flows from some of our real estate properties, and the possible increase in the cost of financing due to higher interest rates, we may have difficulty refinancing some of our debt obligations prior to or at maturity or we may not be able to refinance these obligations at terms as favorable as the terms of our existing indebtedness. Recent financial market conditions have improved from the bottom of the economic cycle, and short-term interest rates in the U.S. have increased. Market conditions can change quickly, potentially negatively impacting the value of our investments.

As of December 31, 2015, we had a total of $267.0 million of fixed rate notes payable and $164.1 million of variable rate notes payable. We have $68.0 million of debt maturing (including principal amortization payments) during the 12 months ending December 31, 2016.

Economic Dependency

We are dependent on our advisor for certain services that are essential to us, including the management of the daily operations of our real estate and real estate-related investment portfolio; the disposition of real estate and real estate-related investments; and other general and administrative responsibilities. In the event that KBS Capital Advisors is unable to provide any of these services, we will be required to obtain such services from other sources. We are also dependent on the Property Manager for the services under the Amended Services Agreement, including the operations, leasing and eventual dispositions of the GKK Properties.

Competitive Market Factors

The U.S. commercial real estate leasing markets remain competitive. We face competition from various entities for prospective tenants and to retain our current tenants, including other REITs, pension funds, insurance companies, investment funds and companies, partnerships and developers. Many of these entities have substantially greater financial resources than we do and may be able to accept more risk than we can prudently manage, including risks with respect to the creditworthiness of a tenant. As a result of their greater resources, those entities may have more flexibility than we do in their ability to offer rental concessions to attract and retain tenants. This could put pressure on our ability to maintain or raise rents and could adversely affect our ability to attract or retain tenants. As a result, our financial condition, results of operations, cash flow, ability to satisfy our debt service obligations and ability to pay distributions to our stockholders may be adversely affected.

We also face competition from many of the types of entities referenced above regarding the disposition of properties. These entities may possess properties in similar locations and/or of the same property types as ours and may be attempting to dispose of these properties at the same time we are attempting to dispose of some of our properties, providing potential purchasers with a larger number of properties from which to choose and potentially decreasing the sales price for such properties. Additionally, these entities may be willing to accept a lower return on their individual investments, which could further reduce the sales price of such properties. This competition could decrease the sales proceeds we receive for properties that we sell, assuming we are able to sell such properties, which could adversely affect our cash flows and the overall return for our stockholders.

Compliance with Federal, State and Local Environmental Law

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous real property owner or operator may be liable for the cost of removing or remediating hazardous or toxic substances on, under or in such property. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose liens on properties or restrictions on the manner in which properties may be used or businesses may be operated, and these restrictions may require substantial expenditures or prevent us from entering into leases with prospective tenants that may be impacted by such laws. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for the release of and exposure to hazardous substances, including asbestos-containing materials and lead-based paint. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances and governments may seek recovery for natural resource damage. The cost of defending against claims of environmental liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury, property damage or natural resource damage claims could reduce the amounts available for distribution to our stockholders.

Except for the GKK Properties and other properties to which we took title to through foreclosure or deed-in-lieu of foreclosure, all of our direct real estate investments were subject to Phase I environmental assessments prior to the time they were acquired. Some of our properties are subject to potential environmental liabilities arising primarily from historic activities at or in the vicinity of the properties. Based on our environmental diligence and assessments of our properties and our purchase of pollution and remediation legal liability insurance with respect to some of our properties, we do not believe that environmental conditions at our properties are likely to have a material adverse effect on our operations.

We own one property that is subject to activity use limitations (“AULs”) whereby the government has placed limitations on redevelopment of the property for certain uses, particularly residential uses. AULs are typically imposed on a property that has environmental contamination in exchange for less stringent environmental clean-up standards. In view of the location of the affected property, the environmental characteristics of the contaminants and the characteristics of the neighborhood, we do not believe that these AULs have a material impact on our portfolio valuation, but they could result in the depression of the value of the property, should we resell it for uses different from its existing uses. The property subject to AULs is ADP Plaza, located in Portland, Oregon.

Some of the properties in our portfolio had or have underground storage tanks either for space heating of the buildings, fueling motor vehicles, or industrial processes. Many of the underground storage tanks at the premises have been replaced over time. Given changing standards regarding closure of underground storage tanks and associated contamination, many of the tanks may not have been closed in compliance with current standards. Some of these properties likely have some residual petroleum or chemical contamination. Properties exhibiting these risks include 129 Concord Road, Billerica, Massachusetts (Rivertech) and ADP Plaza, Portland, Oregon.

Under the Settlement Agreement, we indirectly took title to or, with respect to a limited number of the GKK Properties, indirectly took a leasehold interest in, the GKK Properties on an “as is” basis. As such, we were not able to inspect the GKK Properties or conduct standard due diligence on certain of the GKK Properties before the transfers. Additionally, we did not receive representations, warranties and indemnities relating to the GKK Properties from Gramercy and/or its affiliates. Thus, the value of the GKK Properties may decline if we subsequently discover environmental problems with the GKK Properties.

Industry Segments

We operate in three business segments. Our segments are based on our method of internal reporting which classifies our operations by investment type: (i) real estate, (ii) real estate-related and (iii) commercial properties primarily leased to financial institutions received under the Settlement Agreement, or the GKK Properties. For financial data by segment, see Note 12, “Segment Information” in the notes to our consolidated financial statements filed herewith.

Employees

We have no paid employees. The employees of our advisor and its affiliates provide management, disposition, advisory and certain administrative services for us.

Principal Executive Office

Our principal executive offices are located at 800 Newport Center Drive, Suite 700, Newport Beach, California 92660. Our telephone number, general facsimile number and website address are (949) 417-6500, (949) 417-6501 and http://www.kbsreit.com, respectively.

Available Information

Access to copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other filings with the SEC, including amendments to such filings, may be obtained free of charge from the following website, http://www.kbsreit.com, through a link to the SEC’s website, http://www.sec.gov. These filings are available promptly after we file them with, or furnish them to, the SEC.

The following are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to an Investment in Us

Because no public trading market for our shares currently exists and because we have delayed the liquidation or the listing of our shares of common stock on a national securities exchange beyond 2015, our stockholders may not realize the cash value of their investment for an extended period.

There is no public market for our shares and we currently have no plans to list our shares on a national securities exchange. Until our shares are listed, if ever, our stockholders may not sell their shares unless the buyer meets the applicable suitability and minimum purchase standards. Any sale must also comply with applicable state and federal securities laws. In addition, our charter prohibits the ownership of more than 9.8% of our stock by any person, unless exempted by our board of directors, which may inhibit large investors from purchasing our shares. Our share redemption program only provides for redemptions sought upon a stockholder’s death, “qualifying disability” or “determination of incompetence” (each as defined in the share redemption program document and together with redemptions sought in connection with stockholder’s death, “special redemptions”). Such special redemptions are subject to an annual dollar limitation, which was $10.0 million in the aggregate for the calendar year 2015, and further subject to the limitations described in the share redemption program document. On December 8, 2015, our board of directors approved the same annual dollar limitation of $10.0 million in the aggregate for the calendar year 2016 (subject to review and adjustment during the year by the board of directors), and further subject to the limitations described in the share redemption program document. Based on historical redemption activity, we believe the $10.0 million redemption limitation for the calendar year 2016 will be sufficient for these special redemptions. During each calendar year, the annual dollar limitation for the share redemption program will be reviewed and adjusted from time to time. We currently do not expect to have funds available to resume ordinary redemptions in the future. Therefore, until further notice, and except with respect to special redemptions, stockholders will not be able to sell any of their shares back to us pursuant to our share redemption program. In addition, even if we were to resume ordinary redemptions, our share redemption program includes numerous restrictions that would limit a stockholder’s ability to sell his or her shares. In its sole discretion, our board of directors may amend, suspend or terminate our share redemption program upon 30 days’ notice. Therefore, it will be difficult for our stockholders to sell their shares promptly or at all. If a stockholder is able to sell his or her shares, it would likely be at a substantial discount to the price at which we sold the shares in our public offering or our estimated value per share. It is also likely that our shares would not be accepted as the primary collateral for a loan.

Disruptions in the financial markets and uncertain economic conditions could adversely affect market rental rates, our ability to service our existing indebtedness, our ability to refinance or secure additional debt financing on attractive terms and the values of our investments.

We have relied on debt financing to finance our properties and real estate-related assets and we may have difficulty refinancing some of our debt obligations prior to or at maturity or we may not be able to refinance these obligations at terms as favorable as the terms of our existing indebtedness. If we are not able to refinance our existing indebtedness on attractive terms at the various maturity dates, we may be forced to dispose of some of our assets. Recent financial market conditions have improved from the bottom of the economic cycle, but material risks are still present. Market conditions can change quickly, which could negatively impact the value of our assets. In the short-term, we anticipate that market conditions will continue to remain volatile and, combined with a challenging global macro-economic environment, may interfere with the implementation of our business strategy and/or force us to modify it.

Disruptions in the financial markets and uncertain economic conditions could adversely affect the values of our investments. It remains uncertain whether the capital markets can sustain the current levels of lending activity. Any disruption to the debt and capital markets could result in fewer buyers seeking to acquire commercial properties and possible increases in capitalization rates and lower property values. Furthermore, any decline in economic conditions could negatively impact commercial real estate fundamentals and result in lower occupancy, lower rental rates and declining values in our real estate portfolio and in the collateral securing our loan investments, which could have the following negative effects on us:

| |

| • | the values of our investments in commercial properties could decrease below the amounts paid for such investments; |

| |

| • | the value of collateral securing our loan investments could decrease below the outstanding principal amounts of such loans; |

| |

| • | revenues from our properties could decrease due to fewer tenants and/or lower rental rates, making it more difficult for us to meet our debt service obligations on debt financing; and/or |

| |

| • | revenues generated by the properties and other assets underlying our loan investments could decrease, making it more difficult for the borrowers to meet their payment obligations to us, which could in turn make it more difficult for us to meet our debt service obligations on debt financing. |

All of these factors could reduce our stockholders’ return and decrease the value of an investment in us.

Our stockholders should not assume that our performance will be similar to the performance of other real estate programs sponsored by affiliates of our advisor, which makes our future performance difficult to predict.

We are the first publicly offered investment program sponsored by the affiliates of our advisor, KBS Capital Advisors. Our stockholders should not assume that our performance will be similar to the past performance of other real estate investment programs sponsored by affiliates of our advisor. The private KBS-sponsored programs were not subject to the up-front commissions, fees and expenses associated with our initial public offering nor all of the laws and regulations that apply to us. For these reasons, our stockholders should be especially cautious when drawing conclusions about our future performance and our stockholders should not assume that it will be similar to the prior performance of other KBS-sponsored programs. The differences between us and the private KBS-sponsored programs significantly increase the risk and uncertainty our stockholders face.

Because we depend upon our advisor and its affiliates to conduct our operations, any adverse changes in the financial health of our advisor or its affiliates or our relationship with them could hinder our operating performance and the return on our stockholders’ investment.

We depend on our advisor to manage our operations and our portfolio of real estate and real estate-related assets. Our advisor depends upon the fees and other compensation that it receives from us and the other public KBS-sponsored programs in connection with the purchase, management and sale of assets to conduct its operations. Any adverse changes in the financial condition of KBS Capital Advisors or our relationship with KBS Capital Advisors and its affiliates could hinder their ability to successfully manage our operations and our portfolio of investments.

KBS Capital Advisors has limited experience operating, overseeing and selling bank branch properties, which could cause inefficiencies in the operation and sale of these properties, thereby reducing the value of our stockholders’ investment in us.

Our advisor has limited experience operating, overseeing and selling bank branch properties, which properties make up the majority of the GKK Properties. As such, and while we believe we have retained appropriate asset management by hiring the Property Manager to manage and provide certain other services related to the GKK Properties, we may not be able to operate, lease and/or sell these GKK Properties efficiently and effectively, which could prevent us from improving the value of our overall portfolio. Additionally, some of these bank branches are located outside of our target markets and our advisor has limited experience in these markets. For these reasons, there may be inefficiencies in the operation and sale of these GKK Properties, which may prevent us from recognizing the full potential value of these GKK Properties and may reduce the overall return to our stockholders.

Because of the Property Manager’s experience with managing the bank branch and bank-related properties that make up the majority of the GKK Properties, we depend upon the Property Manager to manage and conduct the operations of the GKK Properties and any adverse changes in or termination of our relationship with the Property Manager could hinder the performance of the GKK Properties and reduce the return on our stockholders’ investment.

Prior to the transfers of the GKK Properties to us under the Settlement Agreement, GKK Stars and its affiliates indirectly owned and managed the GKK Properties and thus have developed experience and expertise in the management and operations of bank branch and bank-related properties. As of the effective date of the Settlement Agreement, GKK Stars agreed to provide standard asset management services relating to the GKK Properties. On December 19, 2013, we, through an indirect wholly owned subsidiary (“KBS Acquisition Sub”), entered into an amended and restated asset management services agreement (the “Amended Services Agreement”) with the Property Manager, an affiliate of GKK Stars, with respect to the GKK Properties. The effective date of the Amended Services Agreement was December 1, 2013. Pursuant to the Amended Services Agreement, the Property Manager agreed to provide, among other services: standard asset management services, assistance related to dispositions, accounting services and budgeting and business plans for the GKK Properties (collectively, the “Services”). The Property Manager is not affiliated with us or KBS Acquisition Sub. Pursuant to the Amended Services Agreement, we made a payment in the amount of $12.0 million to the Property Manager in satisfaction of the profit participation provisions under the prior asset management services agreement. As compensation for the Services, we agreed to pay the Property Manager: (i) an annual fee of $7.5 million plus all GKK Property-related expenses incurred by the Property Manager, (ii) subject to certain terms and conditions in the Amended Services Agreement, a profit participation interest based on a percentage (ranging from 10% to 30%) of the amount by which the gross fair market value or gross sales price of certain identified portfolios of GKK Properties exceeds the sum of (a) an agreed-upon baseline value for such GKK Property portfolios plus (b) new capital expended to increase the value of GKK Properties within the portfolios and expenditures made to pay for tenant improvements and leasing commissions related to these GKK Properties as of the measurement date, and (iii) a monthly construction oversight fee equal to a percentage of construction costs for certain construction projects at the GKK Properties overseen by the Property Manager.

The Amended Services Agreement will terminate on December 31, 2016, with a one-year extension option at our option, subject to certain terms and conditions contained in the Amended Services Agreement. The Amended Services Agreement supersedes and replaces all prior agreements related to the Services among us and our affiliates and the Property Manager and its affiliates.

We depend on the Property Manager to efficiently conduct the management and operations of the GKK Properties. If the Amended Services Agreement is terminated, we would be required to obtain such management services for the GKK Properties from other sources, which sources may not have the experience or capabilities of the Property Manager or its affiliates. Additionally, as our advisor has limited experience operating bank branch properties, should the Property Manager or an affiliate cease managing the GKK Properties, our ability to efficiently and effectively manage the GKK Properties would be affected, and as a result, the value of our stockholders’ investment in us could decline.

To the extent distributions exceed current and accumulated earnings and profits, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize capital gain.

Our organizational documents permit us, to the extent permitted by Maryland law, to pay distributions from any source. We have paid distributions with proceeds from asset sales, loan repayments, financings, a loan from our advisor (which our advisor forgave without repayment) and our cash flow from operations. If we fund distributions from financings or sources other than cash flow from operations, the overall return to our stockholders may be reduced. On March 20, 2012, our board of directors approved the suspension of monthly distribution payments in order to manage our reduced cash flow from operations and to redirect available funds to reduce our debt. Our primary focus was and is the repayment of certain debt obligations. Reducing our debt will allow us to hold certain assets in our portfolio with a goal of improving their value and the returns to our stockholders. Our focus in 2016 is to manage our existing investment portfolio, which includes strategically selling assets and exploring short-term value-add opportunities for a small number of GKK Properties, and distributing operating cash flow and net sales proceeds to stockholders. We plan to continue to make strategic asset sales and, from time to time, may declare additional special distributions to our stockholders that would be funded with the net proceeds from those asset sales or from cash flow from other sources. We will continue our existing strategy of selling assets when we believe the assets have reached the stage that disposition will assist in improving returns to our investors. Our board of directors currently expects to authorize and declare distributions on a quarterly basis based on cash flow generated by our real estate and real estate-related investments. We can give no assurance regarding the timing or source of future distributions. We intend to maintain adequate cash reserves for liquidity, capital expenditures, debt repayments, future special redemptions under our share redemption program and other future capital needs.

To the extent distributions in excess of current and accumulated earnings and profits (i) do not exceed a stockholder’s adjusted basis in our stock, such distributions will not be taxable to a stockholder, but rather a stockholder’s adjusted basis in our stock will be reduced; and, (ii) exceed a stockholder’s adjusted basis in our stock, such distributions will be included in income as long-term capital gain if the stockholder has held its shares for more than one year and otherwise as short-term capital gain.

We may not have sufficient liquidity to fund our future capital needs. If we are unable to repay indebtedness or to fund future contractual commitments or required capital expenditures on our real estate investments, lenders or tenants may take legal action against us, which could have a material adverse effect on us and our stockholders’ return.

We cannot be certain that our business will generate sufficient cash flow from operations or from the sales of some of our real estate assets, that we will be able to raise funds in the capital markets or that future financing or refinancing will be available to us in an amount sufficient, if at all, to enable to us to fund our liquidity needs. If we are unable to repay indebtedness or to fund future contractual commitments or necessary capital expenditures on our real estate investments, our lenders or tenants may take legal action against us, which could have a material adverse effect on us and our stockholders’ return.

Economic conditions have had a significant impact on our real estate and real estate-related properties. In addition, these conditions have impacted the businesses of our tenants as well as the tenants in buildings securing our real estate-related investments. As a result of a decline in cash flows and projected future declines, on March 20, 2012, our board of directors approved the suspension of monthly distribution payments in order to manage our reduced cash flow from operations and to redirect available funds to reduce our debt. Our primary focus was and is the repayment of certain debt obligations. We expect to continue to use available funds to reduce and manage certain other debt obligations and fund cash flow needs. We plan to continue to make strategic asset sales and, from time to time, may declare additional special distributions to our stockholders that would be funded with the net proceeds from those asset sales or from cash flow from other sources.

Possible future declines in rental rates, slower or potentially negative net absorption of leasable space and expectations of future rental concessions, including free rent to renew tenants early, to retain tenants who are up for renewal or to sign new tenants, may result in additional decreases in cash flows from our properties. As a result of these same factors, the borrowers under our real estate-related investments have experienced a reduction in cash flows that has made it difficult for them to pay us debt service in some instances. Additionally, these reduced and potentially decreasing cash flows have had a negative impact on the valuation of the collateral directly or indirectly securing some of our real estate-related investments, and as a result, some of the borrowers may not be able to refinance their debt to us or sell the collateral at a price sufficient to repay our note balances in full when they come due. Further, we depend on the cash flow from our real estate and real estate-related investments to meet the debt service obligations under our financing arrangements, and we will depend on the proceeds from the sale of real estate and proceeds from the repayment of our real estate-related investments in order to repay our outstanding debt obligations.

All of these factors could limit our liquidity and impact our ability to properly maintain or make improvements to our real estate properties. If we are unable to meet future funding commitments or fund required capital expenditures, our borrowers or tenants may take legal action against us. This, in turn, could result in reductions in the value of our investments and therefore a reduction in the value of an investment in us.

We may not generate sufficient operating cash flow on a quarterly basis to fund our operations, which would reduce the value of an investment in us.

Our portfolio has recently experienced declines in cash flow from a number of our investments. A general decline in the occupancy of our portfolio, an important element to the continued growth of our portfolio, has resulted in lower current cash flow. Tenant-specific issues, including bankruptcy and downsizing, have resulted in decreases in our operating cash flow because these tenants have terminated their leases early, not renewed their leases or have not paid their contractual rent to us. Possible future declines in rental rates, slower or potentially negative net absorption of leased space and expectations of increases in future rental concessions, including three or more months of free rent to retain tenants who are up for renewal or to sign new tenants, may result in additional decreases in cash flow. In addition, we have experienced a decline in cash flow from our real estate-related investments, as some borrowers under our loans have been unable to make contractual interest payments to us. In particular, our investments in mezzanine and mortgage loans have been impacted as the operating performance and values of buildings directly or indirectly securing our investment positions have decreased from the date of our acquisition or origination of these investments. In such instances, some of the borrowers have not been able to refinance their debt owed to us or sell the collateral at a price sufficient to repay our note balances in full when they become due. Asset sales in 2012, 2013, 2014 and 2015 have resulted in, and expected future asset sales will result in, further decreases in operating cash flow.

Due to these factors, we may not generate sufficient operating cash flow on a quarterly basis to fund our operations. Our projected cash flow from operations may not be sufficient to cover our capital expenditures, amortization payment requirements on our debt obligations and principal pay-down requirements for our debt obligations at maturity or to allow us to meet the conditions for extension of our loans, which may require us to sell assets in order to meet our capital requirements. If our cash flow from operations deteriorates, we will be more dependent on asset sales to fund our operations and for our liquidity needs. Moreover, we may be unable to meet financial and operating covenants in our debt obligations, and our lenders may take action against us, including commencing foreclosure actions. If we are unable to meet future funding commitments or fund required capital expenditures, our borrowers or tenants may take legal action against us. This, in turn, could result in reductions in the value of our investments and therefore a reduction in the value of an investment in us. These factors could also have a material adverse effect on us and our stockholders’ return.

If we are unable to obtain funding for future capital needs, the value of our investments and our stockholders’ return could decline.

When tenants do not renew their leases or otherwise vacate their space, we will often need to expend substantial funds for improvements to the vacated space in order to attract replacement tenants. Even when tenants do renew their leases we may agree to make improvements to their space as part of our negotiations. If we need additional capital in the future to improve or maintain our properties or for any other reason, we may have to obtain funding from sources other than our cash flow from operations, such as borrowings, asset sales or future equity offerings. These sources of funding may not be available on attractive terms or at all. If we cannot procure additional funding for capital improvements, our investments may generate lower cash flows or decline in value, or both, which would reduce the value of our stockholders’ investment.

The loss of or the inability to retain or obtain key real estate and debt finance professionals at our advisor could delay or hinder implementation of our investment management and disposition strategies, which could decrease the value of an investment in our shares.

Our success depends to a significant degree upon the contributions of Peter M. Bren, Keith D. Hall, Peter McMillan III, and Charles J. Schreiber, Jr., each of whom would be difficult to replace. Neither we nor our advisor nor its affiliates have employment agreements with these individuals and they may not remain associated with us, our advisor or its affiliates. If any of these persons were to cease their association with us, our advisor or its affiliates, we may be unable to find suitable replacements and our operating results could suffer as a result. We do not intend to maintain key person life insurance on any person. We believe that our future success depends, in large part, upon our advisor’s and its affiliates’ ability to attract and retain highly skilled managerial, operational and marketing professionals. Competition for such professionals is intense, and our advisor and its affiliates may be unsuccessful in attracting and retaining such skilled individuals. Further, we have established strategic relationships with firms that have special expertise in certain services or detailed knowledge regarding real properties in certain geographic regions. Maintaining such relationships will be important for us to effectively compete with other investors for tenants in such regions. We may be unsuccessful in maintaining such relationships. If we lose or are unable to obtain the services of highly skilled professionals or do not establish or maintain appropriate strategic relationships, our ability to implement our investment management and disposition strategies could be delayed or hindered, and the value of our stockholders’ investment in us may decline.

Our rights and the rights of our stockholders to recover claims against our independent directors are limited, which could reduce our stockholders’ and our recovery against our independent directors if they negligently cause us to incur losses.

Maryland law provides that a director has no liability in that capacity if he or she performs his or her duties in good faith, in a manner he or she reasonably believes to be in the best interests of the company and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Our charter provides that no independent director shall be liable to us or our stockholders for monetary damages and that we will generally indemnify them for losses unless they are grossly negligent or engage in willful misconduct. As a result, our stockholders and we may have more limited rights against our independent directors than might otherwise exist under common law, which could reduce our stockholders’ and our recovery from these persons if they act in a negligent manner. In addition, we may be obligated to fund the defense costs incurred by our independent directors (as well as by our other directors, officers, employees (if we ever have employees) and agents) in some cases, which would decrease the return to our stockholders.

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (IT) networks and related systems.

We face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, persons inside our organization or persons with access to systems inside our organization, and other significant disruptions of our IT networks and related systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our IT networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations. Although we make efforts to maintain the security and integrity of these types of IT networks and related systems, and we have implemented various measures to manage the risk of a security breach or disruption, there can be no assurance that our security efforts and measures will be effective or that attempted security breaches or disruptions would not be successful or damaging. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in such attempted security breaches evolve and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected. Accordingly, we may be unable to anticipate these techniques or to implement adequate security barriers or other preventative measures, and thus it is impossible for us to entirely mitigate this risk.

A security breach or other significant disruption involving our IT networks and related systems could:

| |

| • | disrupt the proper functioning of our networks and systems and therefore our operations; |

| |

| • | result in misstated financial reports, violations of loan covenants and/or missed reporting deadlines; |

| |

| • | result in our inability to properly monitor our compliance with the rules and regulations regarding our qualification as a REIT; |

| |

| • | result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of, proprietary, confidential, sensitive or otherwise valuable information of ours or others, which others could use to compete against us or which could expose us to damage claims by third-parties for disruptive, destructive or otherwise harmful purposes and outcomes; |

| |

| • | require significant management attention and resources to remedy any damages that result; |

| |

| • | subject us to claims for breach of contract, damages, credits, penalties or termination of leases or other agreements; or |

| |

| • | damage our reputation among our stockholders. |

Any or all of the foregoing could have a material adverse effect on our results of operations, financial condition and cash flows.

We can give no assurances regarding any particular transaction in connection with the exploration of strategic alternatives.

Although the special committee has engaged Evercore to assist us and the Special Committee with the exploration of strategic alternatives for us, we are not obligated to enter into any particular transaction or any transaction at all. Further, although we have begun the process of exploring strategic alternatives, there is no assurance that the process will result in stockholder liquidity, or provide a return to stockholders that equals or exceeds our estimated value per share.

Risks Related to Conflicts of Interest

KBS Capital Advisors and its affiliates, including all of our executive officers and some of our directors and other key real estate and debt finance professionals, face conflicts of interest caused by their compensation arrangements with us and with other KBS-sponsored programs, which could result in actions that are not in the long-term best interests of our stockholders.

All of our executive officers and some of our directors and other key real estate and debt finance professionals are also officers, directors, managers, key professionals and/or holders of a direct or indirect controlling interest in our advisor, KBS Capital Markets Group LLC, the entity that acted as our dealer manager, and/or other KBS-affiliated entities. KBS Capital Advisors and its affiliates receive substantial fees from us. These fees could influence our advisor’s advice to us as well as the judgment of its affiliates. Among other matters, these compensation arrangements could affect their judgment with respect to:

| |

| • | the continuation, renewal or enforcement of our agreements with KBS Capital Advisors and its affiliates, including the advisory agreement; |

| |

| • | public offerings of equity by us, which would entitle our dealer manager to dealer-manager fees and may entitle KBS Capital Advisors to increased acquisition, origination and asset-management fees; |

| |

| • | sales of properties and other investments, which may entitle KBS Capital Advisors to disposition fees and possible subordinated incentive fees; |

| |

| • | whether and when we seek to list our common stock on a national securities exchange, which listing (i) may make it more likely for us to become self-managed or internalize our management or (ii) could entitle our advisor to a subordinated incentive listing fee, and which could also adversely affect the sales efforts for other KBS-sponsored programs, depending on the price at which our shares trade; and |

| |

| • | whether and when we seek to sell the company or its assets, which sale could entitle KBS Capital Advisors to a subordinated incentive fee and terminate the asset management fee. |

In addition, the fees our advisor receives in connection with the management of our assets are based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us.

KBS Capital Advisors faces conflicts of interest relating to the leasing and disposition of properties and such conflicts may not be resolved in our favor, which could limit our ability to make distributions to our stockholders and reduce our stockholders’ overall investment return.

We and other KBS-sponsored programs and KBS-advised investors rely on our sponsors and other key real estate professionals at our advisor, including Messrs. Bren, Hall, McMillan and Schreiber, to supervise the property management and leasing of properties. If the KBS team of real estate professionals directs creditworthy prospective tenants to properties owned by another KBS-sponsored program or KBS-advised investor when they could direct such tenants to our properties, our tenant base may have more inherent risk and our properties’ occupancy may be lower than might otherwise be the case.