Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21780

MFS SERIES TRUST XII

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009*

| * | This Form N-CSR pertains to the following series of the Registrant: MFS Sector Rotational Fund. The remaining series of the Registrant, MFS Lifetime Retirement Income Fund, MFS Lifetime 2010 Fund, MFS Lifetime 2020 Fund, MFS Lifetime 2030 Fund, and MFS Lifetime 2040 Fund, has a fiscal year end of April 30. |

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Table of Contents

SIPC Contact Information:

You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (202-371-8300) or by accessing SIPC’s website address (www.sipc.org).

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK GUARANTEE

10/31/09

MSR-ANN

Table of Contents

Dear Shareholders:

There remains some question as to when the global economy will achieve a sustainable recovery. While some economists and market watchers are optimistic that the worst is behind us, a number also agree with U.S. Federal Reserve Board Chairman Ben Bernanke who said in September that “even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time.”

Have we in fact turned the corner? We have seen tremendous rallies in the markets over the past six months. The Fed has cut interest rates aggressively toward zero to support credit markets, global deleveraging has helped diminish inflationary concerns, and stimulus measures have put more money in the hands of the government and individuals to keep the economy moving. Still, unemployment remains high, consumer confidence and spending continue to waiver, and the housing market, while improving, has a long way to go to recover.

Regardless of lingering market uncertainties, MFS® is confident that the fundamental principles of long-term investing will always apply. We encourage investors to speak with their advisors to identify and research long-term investment opportunities thoroughly. Global research continues to be one of the hallmarks of MFS, along with a unique collaboration between our portfolio managers and sector analysts, who regularly discuss potential investments before making both buy and sell decisions.

As we continue to dig out from the worst financial crisis in decades, keep in mind that while the road back to sustainable recovery will be slow, gradual, and even bumpy at times, conditions are significantly better than they were six months ago.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

December 15, 2009

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

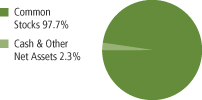

Portfolio structure

| Top ten holdings | ||

| International Business Machines Corp. | 3.0% | |

| Wyndham Worldwide | 2.6% | |

| Goldman Sachs Group, Inc. | 2.4% | |

| McKesson Corp. | 2.4% | |

| Google, Inc., “A” | 2.4% | |

| Freeport-McMoRan Copper & Gold, Inc. | 2.4% | |

| Hewlett-Packard Co. | 2.3% | |

| Franklin Resources, Inc. | 2.2% | |

| Apache Corp. | 2.2% | |

| Aflac, Inc. | 2.1% |

| Equity sectors | ||

| Technology | 17.0% | |

| Health Care | 14.1% | |

| Financial Services | 13.7% | |

| Energy | 13.0% | |

| Leisure | 9.8% | |

| Basic Materials | 8.3% | |

| Retailing | 6.7% | |

| Consumer Staples | 4.9% | |

| Industrial Goods & Services | 4.8% | |

| Utilities & Communications | 3.3% | |

| Special Products & Services | 2.1% |

Percentages are based on net assets as of 10/31/09.

The portfolio is actively managed and current holdings may be different.

2

Table of Contents

Summary of Results

For the twelve months ended October 31, 2009, Class A shares of the MFS Sector Rotational Fund (the “fund”) provided a total return of 1.77%, at net asset value. This compares with a return of 11.20% for the fund’s benchmark, the Russell 1000 Index.

Market Environment

The global economy and financial markets experienced substantial deterioration and extraordinary volatility over most of the reporting period. Through the first quarter of 2009, the strong headwinds in the U.S. included accelerated deterioration in the housing market, anemic corporate investment, a rapidly declining job market, and a much tighter credit environment. During the very early stages of the period, a series of tumultuous financial events hammered markets. As a result of this turbulent news, global equity markets pushed significantly lower and credit markets witnessed the worst market decline since the beginning of the credit crisis. The synchronized global downturn in economic activity experienced in the fourth quarter of 2008 and the first quarter of 2009 was among the most intense in the post-World War II period. Not only did Europe and Japan fall into very deep recessions, but an increasingly powerful engine of global growth – emerging markets – also contracted almost across the board. The subsequent recovery in global activity has been similarly synchronized, led importantly by emerging Asian economies, but broadening to include most of the global economy to varying degrees. Primary drivers of the recovery included an unwinding of the inventory destocking that took place earlier, as well as massive fiscal and monetary stimulus. As a result, credit conditions and equity indices improved considerably during the second half of the period. Nevertheless, the degree of financial and macroeconomic dislocation remained significant.

During the first half of the reporting period, the Fed implemented its final interest rate cut, while making increasing use of its new lending facilities to alleviate ever-tightening credit markets. On the fiscal front, the U.S. Treasury designed and began implementing a massive fiscal stimulus package. As inflationary concerns diminished in the face of global deleveraging, and equity and credit markets deteriorated more sharply, central banks around the world also cut interest rates dramatically. Globally, policy makers increasingly sought to coordinate their rescue efforts, which resulted in a number of international actions, such as the establishment of swap lines between the Federal Reserve and a number of other central banks, as well as a substantial increase in the financial resources of the International Monetary Fund. By the middle of the period, several central banks had approached their lower bound on policy rates

3

Table of Contents

Management Review – continued

and were examining the implementation and ramifications of quantitative easing as a means to further loosen monetary policy to offset the continuing fall in global economic activity. However, by the end of the period, there were broadening signs that the worst of the global macroeconomic deterioration had passed, which caused the subsequent rise in asset valuations. As most asset prices rebounded in the second half of the period and the demand for liquidity waned, the debate concerning monetary exit strategies had begun, creating added uncertainty regarding the forward path of policy rates.

Detractors from Performance

Stock selection in the technology sector was the primary detractor from performance relative to the Russell 1000 Index. Not owning computer and electronics maker Apple for the majority of the reporting period held back relative returns as this stock outperformed the benchmark. The timing of our transactions in network security software company Symantec (g) also had a negative impact on relative results. Shares of Symantec declined in the second quarter of 2009 as the company’s quarterly profits and revenue fell, reflecting a continued freeze on corporate technology spending.

Stock selection in the health care sector also hurt relative performance. Holdings of biomedical products maker Baxter International, and the timing of our transactions in molecular diagnostic products maker Myriad Genetics (g), negatively affected the fund’s relative returns. The stock price of Myriad fell in the second quarter of 2009 as the company reported disappointing revenue from its core molecular diagnostic segment. The company attributed the lackluster result to delays and cancellations of doctor visits as laid-off workers lost their health care coverage.

Security selection and, to lesser extents, our positioning in the retailing and transportation sectors hindered relative results. In the retailing sector, the timing of our transactions in apparel and accessories retailer Aeropostale had a negative impact on relative performance as the stock outperformed the benchmark. In the transportation sector, our overweighted position in railroad company Norfolk Southern (g) during the early part of the reporting period hampered relative returns as the company’s stock underperformed the benchmark.

Several stocks in other sectors hurt the fund’s relative performance, particularly during the first half of the reporting period, when these stocks considerably underperformed the benchmark. These included insurance company AFLAC, financial services firms Hudson City Bancorp (g) and Northern Trust Corp. (g), and utility company NStar (g).

4

Table of Contents

Management Review – continued

Contributors to Performance

Stock selection in the energy sector provided some support to relative performance. Holdings of offshore drilling companies, Noble Corp. and Transocean (g), were among the fund’s top contributors. Shares of Noble Corp. climbed amid a recovery in commodity prices and stronger earnings as a result of a combination of tight supply of deep-water offshore rigs and booking of long-term contracts. Our position in oil refiner Valero Energy (g) early in the reporting period, and avoiding weak-performing integrated oil company ExxonMobil, also boosted relative returns.

Stock selection in the industrial goods and services sector benefited relative results. Our holdings of project management provider Fluor Corp. (g) was among the top relative contributors. The fund added positions in Fluor Corp. when the company’s stock price was near its lowest during the reporting period, and its strong performance, subsequent to the onset of the financial crisis, proved favorable for relative returns. Our avoidance of industrial conglomerate General Electric was another positive factor for relative performance as this stock underperformed the benchmark.

Elsewhere, the timing of our transactions in for-profit educational services provider ITT Educational Services (g), financial services firm State Street Corp. (g), and information technology consulting firm Cognizant Technology Solutions (g) aided relative results. Not owning poor-performing financial services company Citigroup also helped.

Respectfully,

G. Michael Mara

Portfolio Manager

| (g) | Security was not held in the portfolio at period end. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

Table of Contents

PERFORMANCE SUMMARY THROUGH 10/31/09

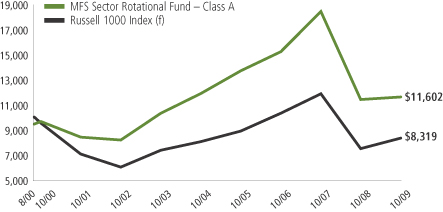

The following chart illustrates a representative class of the fund's historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment (t)

6

Table of Contents

Performance Summary – continued

Total Returns through 10/31/09

Average annual without sales charge

| Share class | Class inception date | 1-yr | 5-yr | Life (t) | ||||||||||

| A | 8/30/00 | 1.77% | (0.44)% | 2.29% | ||||||||||

| B | 1/03/07 | 0.99% | N/A | (10.88)% | ||||||||||

| C | 3/01/04 | 1.07% | (0.97)% | (0.30)% | ||||||||||

| W | 3/03/08 | 2.01% | N/A | (18.84)% | ||||||||||

| R1 | 5/01/08 | 1.07% | N/A | (23.31)% | ||||||||||

| R2 | 5/01/08 | 1.56% | N/A | (22.94)% | ||||||||||

| R3 | 5/01/08 | 1.77% | N/A | (22.75)% | ||||||||||

| R4 | 5/01/08 | 2.01% | N/A | (22.54)% | ||||||||||

| Comparative benchmark | ||||||||||||||

| Russell 1000 Index (f) | 11.20% | 0.71% | N/A | |||||||||||

| Average annual with sales charge | ||||||||||||||

| A With Initial Sales Charge (5.75%) | (4.08)% | (1.61)% | 1.63% | |||||||||||

| B With CDSC (Declining over six years from 4% to 0%) (x) | (3.01)% | N/A | (11.83)% | |||||||||||

| C With CDSC (1% for 12 months) (x) | 0.07% | (0.97)% | (0.30)% | |||||||||||

Class W, R1, R2, R3, and R4 shares do not have a sales charge.

| CDSC | – Contingent Deferred Sales Charge. |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark information is provided for “life” periods. (See Notes to Performance Summary.) |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definition

Russell 1000 Index – constructed to provide a comprehensive barometer for the large-cap segment of the U.S. equity universe based on total market capitalization, which represents approximately 92% of the investable U.S. equity market.

It is not possible to invest directly in an index.

7

Table of Contents

Performance Summary – continued

Notes to Performance Summary

Performance information in the chart and tables for periods prior to January 3, 2007, reflect performance information of the Penn Street Advisors Sector Rotational Portfolio, the fund’s predecessor (the “Predecessor Fund”). On January 3, 2007, the fund acquired all of the assets of the Predecessor Fund pursuant to an agreement and plan of reorganization, in exchange for Class A and Class C shares of the fund. The dates in the table are the inception dates for the predecessor fund’s Class A and C shares.

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

Table of Contents

Fund expenses borne by the shareholders during the period, May 1, 2009 through October 31, 2009

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2009 through October 31, 2009.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Table of Contents

Expense Table – continued

| Share Class | Annualized Expense Ratio | Beginning Account Value 5/01/09 | Ending Account Value 10/31/09 | Expenses Paid During Period (p) 5/01/09-10/31/09 | ||||||

| A | Actual | 1.38% | $1,000.00 | $1,132.86 | $7.42 | |||||

| Hypothetical (h) | 1.38% | $1,000.00 | $1,018.25 | $7.02 | ||||||

| B | Actual | 2.13% | $1,000.00 | $1,128.68 | $11.43 | |||||

| Hypothetical (h) | 2.13% | $1,000.00 | $1,014.47 | $10.82 | ||||||

| C | Actual | 2.13% | $1,000.00 | $1,128.56 | $11.43 | |||||

| Hypothetical (h) | 2.13% | $1,000.00 | $1,014.47 | $10.82 | ||||||

| W | Actual | 1.19% | $1,000.00 | $1,134.29 | $6.40 | |||||

| Hypothetical (h) | 1.19% | $1,000.00 | $1,019.21 | $6.06 | ||||||

| R1 | Actual | 2.13% | $1,000.00 | $1,128.56 | $11.43 | |||||

| Hypothetical (h) | 2.13% | $1,000.00 | $1,014.47 | $10.82 | ||||||

| R2 | Actual | 1.63% | $1,000.00 | $1,131.63 | $8.76 | |||||

| Hypothetical (h) | 1.63% | $1,000.00 | $1,016.99 | $8.29 | ||||||

| R3 | Actual | 1.38% | $1,000.00 | $1,132.74 | $7.42 | |||||

| Hypothetical (h) | 1.38% | $1,000.00 | $1,018.25 | $7.02 | ||||||

| R4 | Actual | 1.13% | $1,000.00 | $1,134.17 | $6.08 | |||||

| Hypothetical (h) | 1.13% | $1,000.00 | $1,019.51 | $5.75 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

10

Table of Contents

10/31/09

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Common Stocks - 97.7% | |||||

| Issuer | Shares/Par | Value ($) | |||

| Aerospace - 3.7% | |||||

| L-3 Communications Holdings, Inc. | 54,790 | $ | 3,960,765 | ||

| Raytheon Co. | 85,880 | 3,888,646 | |||

| $ | 7,849,411 | ||||

| Brokerage & Asset Managers - 4.2% | |||||

| Franklin Resources, Inc. | 44,820 | $ | 4,689,517 | ||

| Jefferies Group, Inc. (a) | 164,990 | 4,306,239 | |||

| $ | 8,995,756 | ||||

| Business Services - 1.1% | |||||

| Fiserv, Inc. (a) | 52,390 | $ | 2,403,129 | ||

| Chemicals - 1.7% | |||||

| E.I. du Pont de Nemours & Co. | 116,500 | $ | 3,707,030 | ||

| Computer Software - 1.7% | |||||

| Microsoft Corp. | 133,000 | $ | 3,688,090 | ||

| Computer Software - Systems - 6.7% | |||||

| Apple, Inc. (a) | 16,420 | $ | 3,095,170 | ||

| Hewlett-Packard Co. | 102,795 | 4,878,651 | |||

| International Business Machines Corp. | 52,690 | 6,354,941 | |||

| $ | 14,328,762 | ||||

| Consumer Products - 1.1% | |||||

| Colgate-Palmolive Co. | 28,790 | $ | 2,263,758 | ||

| Consumer Services - 1.0% | |||||

| Priceline.com, Inc. (a) | 12,850 | $ | 2,027,602 | ||

| Electronics - 5.3% | |||||

| Corning, Inc. | 284,100 | $ | 4,150,701 | ||

| Intel Corp. | 217,690 | 4,160,056 | |||

| Texas Instruments, Inc. | 128,220 | 3,006,759 | |||

| $ | 11,317,516 | ||||

| Energy - Independent - 10.9% | |||||

| Apache Corp. | 48,720 | $ | 4,585,526 | ||

11

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | |||

| Common Stocks - continued | |||||

| Energy - Independent - continued | |||||

| Devon Energy Corp. | 59,740 | $ | 3,865,775 | ||

| EnCana Corp. | 72,300 | 4,004,697 | |||

| Noble Energy, Inc. | 63,250 | 4,151,098 | |||

| Occidental Petroleum Corp. | 57,340 | 4,350,959 | |||

| Plains Exploration & Production Co. (a) | 82,620 | 2,189,430 | |||

| $ | 23,147,485 | ||||

| Food & Beverages - 3.8% | |||||

| Campbell Soup Co. | 67,080 | $ | 2,129,790 | ||

| Coca-Cola Enterprises, Inc. | 193,140 | 3,683,180 | |||

| Kraft Foods, Inc.,”A” | 85,680 | 2,357,914 | |||

| $ | 8,170,884 | ||||

| Gaming & Lodging - 4.7% | |||||

| WMS Industries, Inc. (a) | 112,380 | $ | 4,492,952 | ||

| Wyndham Worldwide | 320,260 | 5,460,433 | |||

| $ | 9,953,385 | ||||

| General Merchandise - 1.8% | |||||

| Target Corp. | 78,300 | $ | 3,792,069 | ||

| Insurance - 5.0% | |||||

| Aflac, Inc. | 109,870 | $ | 4,558,506 | ||

| Torchmark Corp. | 89,520 | 3,634,512 | |||

| Unum Group | 122,630 | 2,446,469 | |||

| $ | 10,639,487 | ||||

| Internet - 2.4% | |||||

| Google, Inc., “A” (a) | 9,500 | $ | 5,093,140 | ||

| Machinery & Tools - 1.1% | |||||

| Illinois Tool Works, Inc. | 49,940 | $ | 2,293,245 | ||

| Major Banks - 4.5% | |||||

| Goldman Sachs Group, Inc. | 30,570 | $ | 5,202,097 | ||

| JPMorgan Chase & Co. | 102,280 | 4,272,236 | |||

| $ | 9,474,333 | ||||

| Medical & Health Technology & Services - 5.5% | |||||

| McKesson Corp. | 87,430 | $ | 5,134,764 | ||

| Medco Health Solutions, Inc. (a) | 77,910 | 4,372,309 | |||

| Quest Diagnostics, Inc. | 40,190 | 2,247,827 | |||

| $ | 11,754,900 | ||||

12

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | |||

| Common Stocks - continued | |||||

| Medical Equipment - 2.1% | |||||

| Baxter International, Inc. | 82,780 | $ | 4,475,087 | ||

| Metals & Mining - 4.5% | |||||

| Freeport-McMoRan Copper & Gold, Inc. (a) | 68,530 | $ | 5,027,361 | ||

| Southern Copper Corp. | 143,670 | 4,525,605 | |||

| $ | 9,552,966 | ||||

| Natural Gas - Distribution - 1.4% | |||||

| Southern Union Co. | 154,430 | $ | 3,022,195 | ||

| Network & Telecom - 0.9% | |||||

| Garmin Ltd. | 59,880 | $ | 1,811,969 | ||

| Oil Services - 2.1% | |||||

| Noble Corp. | 107,570 | $ | 4,382,402 | ||

| Pharmaceuticals - 6.5% | |||||

| Bristol-Myers Squibb Co. | 173,240 | $ | 3,776,632 | ||

| Eli Lilly & Co. | 113,490 | 3,859,795 | |||

| Pfizer, Inc. | 125,500 | 2,137,265 | |||

| Watson Pharmaceuticals, Inc. (a) | 120,240 | 4,138,661 | |||

| $ | 13,912,353 | ||||

| Printing & Publishing - 1.6% | |||||

| FactSet Research Systems, Inc. | 52,700 | $ | 3,375,435 | ||

| Restaurants - 3.5% | |||||

| McDonald’s Corp. | 63,680 | $ | 3,732,285 | ||

| YUM! Brands, Inc. | 112,250 | 3,698,638 | |||

| $ | 7,430,923 | ||||

| Specialty Chemicals - 2.1% | |||||

| Lubrizol Corp. | 68,430 | $ | 4,554,701 | ||

| Specialty Stores - 4.9% | |||||

| Aeropostale, Inc. (a) | 107,550 | $ | 4,036,352 | ||

| Gap, Inc. | 196,520 | 4,193,737 | |||

| Ross Stores, Inc. | 51,600 | 2,270,916 | |||

| $ | 10,501,005 | ||||

13

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||

| Common Stocks - continued | ||||||

| Utilities - Electric Power - 1.9% | ||||||

| PG&E Corp. | 97,590 | $ | 3,990,455 | |||

| Total Common Stocks (Identified Cost, $195,434,776) | $ | 207,909,473 | ||||

| Money Market Funds (v) - 2.9% | ||||||

| MFS Institutional Money Market Portfolio, 0.13%, at Cost and Net Asset Value | 6,250,486 | $ | 6,250,486 | |||

| Total Investments (Identified Cost, $201,685,262) | $ | 214,159,959 | ||||

| Other Assets, Less Liabilities - (0.6)% | (1,227,887 | ) | ||||

| Net Assets - 100.0% | $ | 212,932,072 | ||||

| (a) | Non-income producing security. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

See Notes to Financial Statements

14

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 10/31/09

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |||

Investments- | |||

Non-affiliated issuers, at value (identified cost, $195,434,776) | $207,909,473 | ||

Underlying funds, at cost and value | 6,250,486 | ||

Total investments, at value (identified cost, $201,685,262) | $214,159,959 | ||

Receivables for | |||

Investments sold | 9,499,126 | ||

Fund shares sold | 242,571 | ||

Dividends | 177,727 | ||

Total assets | $224,079,383 | ||

| Liabilities | |||

Payables for | |||

Investments purchased | $9,773,477 | ||

Fund shares reacquired | 1,182,081 | ||

Payable to affiliates | |||

Investment adviser | 13,461 | ||

Shareholder servicing costs | 94,748 | ||

Distribution and service fees | 7,946 | ||

Administrative services fee | 354 | ||

Payable for independent Trustees’ compensation | 1,675 | ||

Accrued expenses and other liabilities | 73,569 | ||

Total liabilities | $11,147,311 | ||

Net assets | $212,932,072 | ||

| Net assets consist of | |||

Paid-in capital | $371,247,240 | ||

Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies | 12,474,697 | ||

Accumulated net realized gain (loss) on investments and foreign currency transactions | (171,189,462 | ) | |

Undistributed net investment income | 399,597 | ||

Net assets | $212,932,072 | ||

Shares of beneficial interest outstanding | 16,992,529 |

| Net assets | Shares outstanding | Net asset value per share (a) | ||||

Class A | $137,359,682 | 10,884,775 | $12.62 | |||

Class B | 12,027,666 | 979,205 | 12.28 | |||

Class C | 46,261,046 | 3,764,325 | 12.29 | |||

Class W | 15,823,568 | 1,248,783 | 12.67 | |||

Class R1 | 67,077 | 5,458 | 12.29 | |||

Class R2 | 67,584 | 5,458 | 12.38 | |||

Class R3 | 67,838 | 5,371 | 12.63 | |||

Class R4 | 1,257,611 | 99,154 | 12.68 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering prices per share were $13.39. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes W, R1, R2, R3, and R4. |

See Notes to Financial Statements

15

Table of Contents

Financial Statements

Year ended 10/31/09

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income | |||

Income | |||

Dividends | $4,323,493 | ||

Interest | 7,304 | ||

Dividends from underlying funds | 10,530 | ||

Foreign taxes withheld | (5,613 | ) | |

Total investment income | $4,335,714 | ||

Expenses | |||

Management fee | $1,884,254 | ||

Distribution and service fees | 1,163,982 | ||

Shareholder servicing costs | 561,096 | ||

Administrative services fee | 57,208 | ||

Independent Trustees’ compensation | 13,661 | ||

Custodian fee | 55,849 | ||

Shareholder communications | 44,831 | ||

Auditing fees | 36,873 | ||

Legal fees | 8,964 | ||

Miscellaneous | 154,671 | ||

Total expenses | $3,981,389 | ||

Fees paid indirectly | (144 | ) | |

Reduction of expenses by investment adviser | (45,098 | ) | |

Net expenses | $3,936,147 | ||

Net investment income | $399,567 | ||

| Realized and unrealized gain (loss) on investments | |||

Realized gain (loss) on investment transactions (identified cost basis) | $(72,576,197 | ) | |

Change in unrealized appreciation (depreciation) on investments | $68,670,569 | ||

Net realized and unrealized gain (loss) on investments | $(3,905,628 | ) | |

Change in net assets from operations | $(3,506,061 | ) |

See Notes to Financial Statements

16

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Years ended 10/31 | ||||||

| 2009 | 2008 | |||||

| Change in net assets | ||||||

| From operations | ||||||

Net investment income (loss) | $399,567 | $(113,028 | ) | |||

Net realized gain (loss) on investments and | (72,576,197 | ) | (94,856,493 | ) | ||

Net unrealized gain (loss) on investments and | 68,670,569 | (83,799,938 | ) | |||

Change in net assets from operations | $(3,506,061 | ) | $(178,769,459 | ) | ||

Change in net assets from fund share transactions | $(99,962,479 | ) | $218,901,393 | |||

Total change in net assets | $(103,468,540 | ) | $40,131,934 | |||

| Net assets | ||||||

At beginning of period | 316,400,612 | 276,268,678 | ||||

At end of period (including undistributed net investment | $212,932,072 | $316,400,612 | ||||

See Notes to Financial Statements

17

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Class A | Years ended 10/31 | |||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||

Net asset value, beginning of period | $12.40 | $20.02 | $17.50 | $16.77 | $15.10 | |||||||||

| Income (loss) from investment operations | ||||||||||||||

Net investment income (loss) (d) | $0.04 | $0.02 | $(0.03 | ) | $(0.03 | ) | $(0.06 | ) | ||||||

Net realized and unrealized gain (loss) | 0.18 | (7.64 | ) | 3.55 | 1.84 | 2.34 | ||||||||

Total from investment operations | $0.22 | $(7.62 | ) | $3.52 | $1.81 | $2.28 | ||||||||

| Less distributions declared to shareholders | ||||||||||||||

From net realized gain on investments | $— | $— | $(1.00 | ) | $(1.08 | ) | $(0.61 | ) | ||||||

Net asset value, end of period | $12.62 | $12.40 | $20.02 | $17.50 | $16.77 | |||||||||

Total return (%) (r)(s)(t) | 1.77 | (38.06 | ) | 20.99 | 11.22 | 15.33 | ||||||||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||||||||||

Expenses before expense reductions (f) | 1.41 | 1.38 | 1.38 | 2.90 | 2.82 | |||||||||

Expenses after expense reductions (f) | 1.39 | 1.38 | 1.37 | 1.75 | 1.75 | |||||||||

Net investment income (loss) | 0.34 | 0.13 | (0.14 | ) | (0.19 | ) | (0.39 | ) | ||||||

Portfolio turnover | 211 | 196 | 141 | 168 | 107 | |||||||||

Net assets at end of period (000 omitted) | $137,360 | $236,816 | $210,954 | $15,405 | $11,078 | |||||||||

See Notes to Financial Statements

18

Table of Contents

Financial Highlights – continued

| Class B | Years ended 10/31 | ||||||||

| 2009 | 2008 | 2007 (i) | |||||||

Net asset value, beginning of period | $12.16 | $19.75 | $17.03 | ||||||

| Income (loss) from investment operations | |||||||||

Net investment loss (d) | $(0.04 | ) | $(0.09 | ) | $(0.12 | ) | |||

Net realized and unrealized gain (loss) | 0.16 | (7.50 | ) | 2.84 | (g) | ||||

Total from investment operations | $0.12 | $(7.59 | ) | $2.72 | |||||

Net asset value, end of period | $12.28 | $12.16 | $19.75 | ||||||

Total return (%) (r)(s)(t) | 0.99 | (38.43 | ) | 15.97 | (n) | ||||

| Ratios (%) (to average net assets) and Supplemental data: | |||||||||

Expenses before expense reductions (f) | 2.12 | 2.03 | 1.98 | (a) | |||||

Expenses after expense reductions (f) | 2.10 | 2.03 | 1.98 | (a) | |||||

Net investment loss | (0.39 | ) | (0.53 | ) | (0.85 | )(a) | |||

Portfolio turnover | 211 | 196 | 141 | ||||||

Net assets at end of period (000 omitted) | $12,028 | $15,029 | $13,484 | ||||||

| Class C | Years ended 10/31 | ||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

Net asset value, beginning of period | $12.16 | $19.76 | $17.38 | $16.78 | $15.11 | ||||||||||

| Income (loss) from investment operations | |||||||||||||||

Net investment loss (d) | $(0.04 | ) | $(0.09 | ) | $(0.15 | ) | $(0.12 | ) | $(0.04 | ) | |||||

Net realized and unrealized gain (loss) | 0.17 | (7.51 | ) | 3.53 | 1.80 | 2.32 | |||||||||

Total from investment operations | $0.13 | $(7.60 | ) | $3.38 | $1.68 | $2.28 | |||||||||

| Less distributions declared to shareholders | |||||||||||||||

From net realized gain on investments | $— | $— | $(1.00 | ) | $(1.08 | ) | $(0.61 | ) | |||||||

Net asset value, end of period | $12.29 | $12.16 | $19.76 | $17.38 | $16.78 | ||||||||||

Total return (%) (r)(s)(t) | 1.07 | (38.46 | ) | 20.30 | 10.40 | 15.31 | |||||||||

| Ratios (%) (to average net assets) and Supplemental data: | |||||||||||||||

Expenses before expense reductions (f) | 2.12 | 2.03 | 1.98 | 3.65 | 3.57 | ||||||||||

Expenses after expense reductions (f) | 2.10 | 2.03 | 1.98 | 2.50 | 2.50 | ||||||||||

Net investment loss | (0.39 | ) | (0.53 | ) | (0.85 | ) | (0.94 | ) | (1.14 | ) | |||||

Portfolio turnover | 211 | 196 | 141 | 168 | 107 | ||||||||||

Net assets at end of period (000 omitted) | $46,261 | $61,857 | $51,831 | $139 | $39 | ||||||||||

See Notes to Financial Statements

19

Table of Contents

Financial Highlights – continued

| Class W | Years ended 10/31 | |||||

| 2009 | 2008 (i) | |||||

Net asset value, beginning of period | $12.42 | $17.96 | ||||

| Income (loss) from investment operations | ||||||

Net investment income (d) | $0.05 | $0.03 | ||||

Net realized and unrealized gain (loss) on investments | 0.20 | (5.57 | )(g) | |||

Total from investment operations | $0.25 | $(5.54 | ) | |||

Net asset value, end of period | $12.67 | $12.42 | ||||

Total return (%) (r)(s) | 2.01 | (30.85 | )(n) | |||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||

Expenses before expense reductions (f) | 1.20 | 1.13 | (a) | |||

Expenses after expense reductions (f) | 1.19 | 1.12 | (a) | |||

Net investment income | 0.36 | 0.30 | (a) | |||

Portfolio turnover | 211 | 196 | ||||

Net assets at end of period (000 omitted) | $15,824 | $1,430 | ||||

| Class R1 | Years ended 10/31 | |||||

| 2009 | 2008 (i) | |||||

Net asset value, beginning of period | $12.16 | $18.32 | ||||

| Income (loss) from investment operations | ||||||

Net investment loss (d) | $(0.05 | ) | $(0.04 | ) | ||

Net realized and unrealized gain (loss) on investments | 0.18 | (6.12 | )(g) | |||

Total from investment operations | $0.13 | $(6.16 | ) | |||

Net asset value, end of period | $12.29 | $12.16 | ||||

Total return (%) (r)(s) | 1.07 | (33.62 | )(n) | |||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||

Expenses before expense reductions (f) | 2.12 | 2.03 | (a) | |||

Expenses after expense reductions (f) | 2.10 | 2.03 | (a) | |||

Net investment loss | (0.41 | ) | (0.48 | )(a) | ||

Portfolio turnover | 211 | 196 | ||||

Net assets at end of period (000 omitted) | $67 | $66 | ||||

See Notes to Financial Statements

20

Table of Contents

Financial Highlights – continued

| Class R2 | Years ended 10/31 | ||||

| 2009 | 2008 (i) | ||||

Net asset value, beginning of period | $12.19 | $18.32 | |||

| Income (loss) from investment operations | |||||

Net investment income (d) | $0.01 | $0.00 | (w) | ||

Net realized and unrealized gain (loss) on investments | 0.18 | (6.13 | )(g) | ||

Total from investment operations | $0.19 | $(6.13 | ) | ||

Net asset value, end of period | $12.38 | $12.19 | |||

Total return (%) (r)(s) | 1.56 | (33.46 | )(n) | ||

| Ratios (%) (to average net assets) and Supplemental data: | |||||

Expenses before expense reductions (f) | 1.62 | 1.53 | (a) | ||

Expenses after expense reductions (f) | 1.60 | 1.52 | (a) | ||

Net investment income | 0.08 | 0.02 | (a) | ||

Portfolio turnover | 211 | 196 | |||

Net assets at end of period (000 omitted) | $68 | $67 | |||

| Class R3 | Years ended 10/31 | ||||

| 2009 | 2008 (i) | ||||

| Net asset value, beginning of period | $12.41 | $18.62 | |||

| Income (loss) from investment operations | |||||

Net investment income (d) | $0.04 | $0.02 | |||

Net realized and unrealized gain (loss) on investments | 0.18 | (6.23 | )(g) | ||

Total from investment operations | $0.22 | $(6.21 | ) | ||

Net asset value, end of period | $12.63 | $12.41 | |||

Total return (%) (r)(s) | 1.77 | (33.35 | )(n) | ||

| Ratios (%) (to average net assets) and Supplemental data: | |||||

| Expenses before expense reductions (f) | 1.37 | 1.27 | (a) | ||

| Expenses after expense reductions (f) | 1.35 | 1.27 | (a) | ||

| Net investment income | 0.33 | 0.28 | (a) | ||

| Portfolio turnover | 211 | 196 | |||

| Net assets at end of period (000 omitted) | $68 | $67 | |||

See Notes to Financial Statements

21

Table of Contents

Financial Highlights – continued

| Class R4 | Years ended 10/31 | ||||

| 2009 | 2008 (i) | ||||

| Net asset value, beginning of period | $12.43 | $18.62 | |||

| Income (loss) from investment operations | |||||

Net investment income (d) | $0.07 | $0.04 | |||

Net realized and unrealized gain (loss) on investments | 0.18 | (6.23 | )(g) | ||

Total from investment operations | $0.25 | $(6.19 | ) | ||

Net asset value, end of period | $12.68 | $12.43 | |||

Total return (%) (r)(s) | 2.01 | (33.24 | )(n) | ||

| Ratios (%) (to average net assets) and Supplemental data: | |||||

| Expenses before expense reductions (f) | 1.12 | 1.03 | (a) | ||

| Expenses after expense reductions (f) | 1.11 | 1.03 | (a) | ||

| Net investment income | 0.57 | 0.57 | (a) | ||

| Portfolio turnover | 211 | 196 | |||

| Net assets at end of period (000 omitted) | $1,258 | $1,069 | |||

| (a) | Annualized. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount is not in accordance with the net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amount of realized and unrealized gains and losses at such time. |

| (i) | For the period from the class’ inception, March 3, 2008 (Class W), January 3, 2007 (Class B), and May 1, 2008, (Classes R1, R2, R3 and R4) through the stated period end. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

See Notes to Financial Statements

22

Table of Contents

| (1) | Business and Organization |

MFS Sector Rotational Fund (the fund) is a series of MFS Series Trust XII (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

| (2) | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In making these estimates and assumptions, management has considered the effects, if any, of events occurring after the date of the fund’s Statement of Assets and Liabilities through December 17, 2009 which is the date that the financial statements were issued. Actual results could differ from those estimates. The fund can invest in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s legal, political, and economic environment.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Equity securities held short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

23

Table of Contents

Notes to Financial Statements – continued

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material affect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

The fund has adopted FASB Accounting Standard Codification 820, Fair Value Measurements and Disclosures (“ASC 820”), which provides a single definition of fair value, a hierarchy for measuring fair value and expanded disclosures about fair value measurements.

Various inputs are used in determining the value of the fund’s assets or liabilities carried at market value. These inputs are categorized into three broad

24

Table of Contents

Notes to Financial Statements – continued

levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments not reflected in total investments, such as futures, forwards, swap contracts, and written options. The following is a summary of the levels used as of October 31, 2009 in valuing the fund’s assets or liabilities carried at market value:

| Investments at Value | Level 1 | Level 2 | Level 3 | Total | ||||

| Equity Securities | $207,909,473 | $— | $— | $207,909,473 | ||||

| Mutual Funds | 6,250,486 | — | — | 6,250,486 | ||||

| Total Investments | $214,159,959 | $— | $— | $214,159,959 |

For further information regarding security characteristics, see the Portfolio of Investments.

Repurchase Agreements – The fund may enter into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement. The fund and other funds managed by MFS may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

25

Table of Contents

Notes to Financial Statements – continued

Derivatives – The fund may use derivatives for different purposes, including to earn income and enhance returns, to increase or decrease exposure to a particular market, to manage or adjust the risk profile of the fund, or as alternatives to direct investments. Derivatives may be used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost.

Derivative instruments include written options, purchased options, futures contracts, forward foreign currency exchange contracts, and swap agreements. For the year ended October 31, 2009, the fund did not invest in any derivative instruments and accordingly there is no impact to the financial statements.

Security Loans – State Street Bank and Trust Company (“State Street”), as lending agent, may loan the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. State Street provides the fund with indemnification against Borrower default. The fund bears the risk of loss with respect to the investment of cash collateral. On loans collateralized by cash, the cash collateral is invested in a money market fund or short-term securities. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is included in interest income on the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income. At October 31, 2009, there were no securities on loan.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All

26

Table of Contents

Notes to Financial Statements – continued

premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date. The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended October 31, 2009, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

During the year ended October 31, 2009, there were no significant adjustments due to differences between book and tax accounting.

27

Table of Contents

Notes to Financial Statements – continued

The fund declared no distributions for the years ended October 31, 2009 and October 31, 2008.

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 10/31/09 | |||

| Cost of investments | $201,707,428 | ||

| Gross appreciation | 19,871,061 | ||

| Gross depreciation | (7,418,530 | ) | |

| Net unrealized appreciation (depreciation) | $12,452,531 | ||

| Undistributed ordinary income | 399,597 | ||

| Capital loss carryforwards | (171,167,296 | ) |

As of October 31, 2009, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

| 10/31/15 | $(3,606,418 | ) | |

| 10/31/16 | (94,250,001 | ) | |

| 10/31/17 | (73,310,877 | ) | |

| $(171,167,296 | ) |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A shares approximately eight years after purchase.

| (3) | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund.

The management fee is computed daily and paid monthly at the following annual rates:

| First $1 billion of average daily net assets | 0.75 | % | |

| Next $1.5 billion of average daily net assets | 0.65 | % | |

| Next $2.5 billion of average daily net assets | 0.60 | % | |

| Average daily net assets in excess of $5 billion | 0.50 | % |

28

Table of Contents

Notes to Financial Statements – continued

MFS has engaged Valley Forge Capital Advisors, Inc. (Valley Forge) as a sub-adviser for the fund. MFS pays a sub-advisory fee at the following annual rates:

| First $1 billion of average daily net assets | 0.35 | % | |

| Next $1.5 billion of average daily net assets | 0.30 | % | |

| Next $2.5 billion of average daily net assets | 0.25 | % | |

| Average daily net assets in excess of $5 billion | 0.20 | % |

The fund is not responsible for paying a sub-advisory fee.

The management fee incurred for the year ended October 31, 2009 was equivalent to an annual effective rate of 0.75% of the fund’s average daily net assets.

Prior to March 1, 2009, MFS as investment adviser had agreed in writing to pay a portion of the fund’s total annual operating expenses, exclusive of interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment related expenses, such that total annual fund operating expenses did not exceed the following rates annually of the fund’s average daily net assets:

| Class A | Class B | Class C | Class W | Class R1 | Class R2 | Class R3 | Class R4 | |||||||

| 1.40% | 2.05% | 2.05% | 1.15% | 2.05% | 1.55% | 1.30% | 1.05% |

Effective March 1, 2009 the investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, exclusive of interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses, such that total annual fund operating expenses do not exceed the following rates annually of the fund’s average daily net assets:

| Class A | Class B | Class C | Class W | Class R1 | Class R2 | Class R3 | Class R4 | |||||||

| 1.40% | 2.15% | 2.15% | 1.25% | 2.15% | 1.65% | 1.40% | 1.15% |

This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until February 28, 2011. For the year ended October 31, 2009, this reduction amounted to $43,479 and is reflected as a reduction of total expenses in the Statement of Operations.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $35,991 for the year ended October 31, 2009, as its portion of the initial sales charge on sales of Class A shares of the fund.

The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a

29

Table of Contents

Notes to Financial Statements – continued

service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| Distribution Fee Rate (d) | Service Fee Rate (d) | Total Distribution Plan (d) | Annual Effective Rate (e) | Distribution and Service Fee | ||||||

| Class A | — | 0.25% | 0.25% | 0.29% | $521,165 | |||||

| Class B | 0.75% | 0.25% | 1.00% | 1.00% | 128,433 | |||||

| Class C | 0.75% | 0.25% | 1.00% | 1.00% | 508,331 | |||||

| Class W | 0.10% | — | 0.10% | 0.10% | 4,956 | |||||

| Class R1 | 0.75% | 0.25% | 1.00% | 1.00% | 629 | |||||

| Class R2 | 0.25% | 0.25% | 0.50% | 0.50% | 312 | |||||

| Class R3 | — | 0.25% | 0.25% | 0.25% | 156 | |||||

| Total Distribution and Service Fees | $1,163,982 | |||||||||

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’ average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the year ended October 31, 2009 based on each class’ average daily net assets. Prior to March 1, 2009, a 0.10% Class A distribution fee was paid by the fund. Effective March 1, 2009 the 0.10% Class A annual distribution fee was eliminated. |

Certain Class A shares purchased prior to September 1, 2008 are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 12 months of purchase. Certain Class A shares purchased on or subsequent to September 1, 2008 are subject to a CDSC in the event of a shareholder redemption within 24 months of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the year ended October 31, 2009, were as follows:

| Amount | ||

| Class A | $1,205 | |

| Class B | 51,551 | |

| Class C | 21,566 |

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the year ended October 31, 2009, the fee was $110,645, which equated to 0.0440% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to

30

Table of Contents

Notes to Financial Statements – continued

affiliated and unaffiliated service providers. For the year ended October 31, 2009, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $450,451.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets.

The administrative services fee incurred for the year ended October 31, 2009 was equivalent to an annual effective rate of 0.0228% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. For the year ended October 31, 2009, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $3,296 and are included in miscellaneous expense on the Statement of Operations. MFS has agreed to reimburse the fund for a portion of the payments made by the fund in the amount of $1,619, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO.

The fund may invest in a money market fund managed by MFS which seeks a high level of current income consistent with preservation of capital and liquidity. Income earned on this investment is included in dividends from underlying funds on the Statement of Operations. This money market fund does not pay a management fee to MFS.

31

Table of Contents

Notes to Financial Statements – continued

| (4) | Portfolio Securities |

Purchases and sales of investments, other than U.S. Government securities, purchased option transactions, and short-term obligations, aggregated $522,823,356 and $621,878,784, respectively.

| (5) | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| Year ended 10/31/09 | Year ended 10/31/08 (i) | |||||||||||

| Shares | Amount | Shares | Amount | |||||||||

| Shares sold | ||||||||||||

Class A | 3,661,010 | $41,409,446 | 14,264,446 | $253,862,599 | ||||||||

Class B | 251,704 | 2,802,335 | 810,927 | 14,240,519 | ||||||||

Class C | 697,739 | 7,801,758 | 3,347,984 | 59,019,766 | ||||||||

Class W | 1,533,399 | 19,195,956 | 131,799 | 2,324,464 | ||||||||

Class R1 | — | — | 5,458 | 100,000 | ||||||||

Class R2 | — | — | 5,458 | 100,000 | ||||||||

Class R3 | — | — | 5,371 | 100,000 | ||||||||

Class R4 | 62,566 | 706,136 | 95,833 | 1,580,727 | ||||||||

| 6,206,418 | $71,915,631 | 18,667,276 | $331,328,075 | |||||||||

| Shares reacquired | ||||||||||||

Class A | (11,874,955 | ) | $(137,799,188 | ) | (5,704,387 | ) | $(93,325,088 | ) | ||||

Class B | (508,769 | ) | (5,683,014 | ) | (257,337 | ) | (4,274,176 | ) | ||||

Class C | (2,020,789 | ) | (22,759,386 | ) | (884,270 | ) | (14,434,850 | ) | ||||

Class W | (399,707 | ) | (5,063,289 | ) | (16,708 | ) | (260,001 | ) | ||||

Class R4 | (49,464 | ) | (573,233 | ) | (9,781 | ) | (132,567 | ) | ||||

| (14,853,684 | ) | $(171,878,110 | ) | (6,872,483 | ) | $(112,426,682 | ) | |||||

| Net change | ||||||||||||

Class A | (8,213,945 | ) | $(96,389,742 | ) | 8,560,059 | $160,537,511 | ||||||

Class B | (257,065 | ) | (2,880,679 | ) | 553,590 | 9,966,343 | ||||||

Class C | (1,323,050 | ) | (14,957,628 | ) | 2,463,714 | 44,584,916 | ||||||

Class W | 1,133,692 | 14,132,667 | 115,091 | 2,064,463 | ||||||||

Class R1 | — | — | 5,458 | 100,000 | ||||||||

Class R2 | — | — | 5,458 | 100,000 | ||||||||

Class R3 | — | — | 5,371 | 100,000 | ||||||||

Class R4 | 13,102 | 132,903 | 86,052 | 1,448,160 | ||||||||

| (8,647,266 | ) | $(99,962,479 | ) | 11,794,793 | $218,901,393 | |||||||

| (i) | For the period from the class’ inception, March 3, 2008 (Class W) and May 1, 2008 (Classes R1, R2, R3, and R4), through the stated period end. |

Class I shares were not available for sale during the period. Please see the fund’s prospectus for details.

32

Table of Contents

Notes to Financial Statements – continued

| (6) | Line of Credit |

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the year ended October 31, 2009, the fund’s commitment fee and interest expense were $3,868 and $0, respectively, and are included in miscellaneous expense on the Statement of Operations.

| (7) | Transactions in Underlying Funds-Affiliated Issuers |

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the fund assumes the following to be affiliated issuers:

| Underlying Funds | Beginning Shares/Par Amount | Acquisitions Shares/Par Amount | Dispositions Shares/Par Amount | Ending Shares/Par Amount | |||||

| MFS Institutional Money Market Portfolio | — | 131,069,948 | (124,819,462 | ) | 6,250,486 | ||||

| Underlying Funds | Realized Gain (Loss) | Capital Gain Distributions | Dividend Income | Ending Value | |||||

| MFS Institutional Money Market Portfolio | $— | $— | $10,530 | $6,250,486 | |||||

33

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of MFS Series Trust XII and Shareholders of MFS Sector Rotational Fund:

We have audited the accompanying statement of assets and liabilities of MFS Sector Rotational Fund (the Fund), (one of the portfolios comprising MFS Series Trust XII), including the portfolio of investments, as of October 31, 2009, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period ended October 31, 2009. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the two years in the period ended October 31, 2006 were audited by another independent registered public accounting firm whose report, dated November 30, 2006, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2009, by correspondence with the Fund’s custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of MFS Sector Rotational Fund at October 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period ended October 31, 2009, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 17, 2009

34

Table of Contents

TRUSTEES AND OFFICERS — IDENTIFICATION AND BACKGROUND

The Trustees and officers of the Trust, as of December 1, 2009, are listed below, together with their principal occupations during the past five years. (Their titles may have varied during that period.) The address of each Trustee and officer is 500 Boylston Street, Boston, Massachusetts 02116.

Name, Date of Birth | Position(s) Held | Trustee/Officer Since (h) | Principal Occupations During | |||

| INTERESTED TRUSTEES | ||||||

| Robert J. Manning (k) (born 10/20/63) | Trustee | February 2004 | Massachusetts Financial Services Company, Chief Executive Officer, President, Chief Investment Officer and Director | |||

| Robert C. Pozen (k) (born 8/08/46) | Trustee | February 2004 | Massachusetts Financial Services Company, Chairman (since February 2004); Medtronic, Inc, (medical devices), Director (since 2004); Harvard Business School (education), Senior Lecturer (since 2008); Bell Canada Enterprises (telecommunications), Director (until February 2009); The Bank of New York, Director (finance), (March 2004 to May 2005); Telesat (satellite communications), Director (until November 2007) | |||

| INDEPENDENT TRUSTEES | ||||||