UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21780

MFS SERIES TRUST XII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Annual Report

April 30, 2024

MFS® Lifetime® Income Fund

MFS® Lifetime® 2025 Fund

MFS® Lifetime® 2030 Fund

MFS® Lifetime® 2035 Fund

MFS® Lifetime® 2040 Fund

MFS® Lifetime® 2045 Fund

MFS® Lifetime® 2050 Fund

MFS® Lifetime® 2055 Fund

MFS® Lifetime® 2060 Fund

MFS® Lifetime® 2065 Fund

| 1 |

| 11 |

| 16 |

| 37 |

| 48 |

| 59 |

| 68 |

| 70 |

| 72 |

| 122 |

| 158 |

| 159 |

| 162 |

| 163 |

| 163 |

| 163 |

| 163 |

| 163 |

| 165 |

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Portfolio Composition

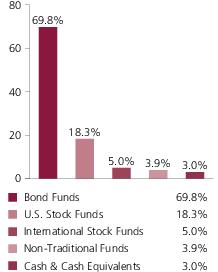

MFS Lifetime Income Fund

Portfolio holdings

| MFS Limited Maturity Fund | 20.1% |

| MFS Total Return Bond Fund | 19.4% |

| MFS Inflation-Adjusted Bond Fund | 9.9% |

| MFS Government Securities Fund | 9.4% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Blended Research Mid Cap Equity Fund | 2.9% |

| MFS Blended Research International Equity Fund | 2.5% |

| MFS High Income Fund | 2.0% |

| MFS Value Fund | 2.0% |

| MFS Blended Research Value Equity Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS Global Real Estate Fund | 1.9% |

| MFS Blended Research Core Equity Fund | 1.6% |

| MFS Research Fund | 1.6% |

| MFS Blended Research Growth Equity Fund | 1.6% |

| MFS Growth Fund | 1.6% |

| MFS Research International Fund | 1.5% |

| MFS Mid Cap Value Fund | 1.5% |

| MFS Mid Cap Growth Fund | 1.5% |

| MFS Emerging Markets Debt Fund | 1.0% |

| MFS Emerging Markets Debt Local Currency Fund | 1.0% |

| MFS Blended Research Small Cap Equity Fund | 1.0% |

| MFS International Growth Fund | 0.5% |

| MFS International Intrinsic Value Fund | 0.5% |

| MFS New Discovery Value Fund | 0.5% |

| MFS New Discovery Fund | 0.5% |

| Cash & Cash Equivalents | 3.0% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Portfolio Composition - continued

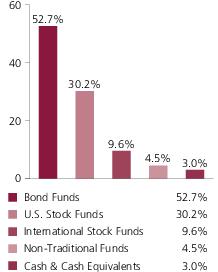

Portfolio holdings

| MFS Total Return Bond Fund | 18.0% |

| MFS Limited Maturity Fund | 17.2% |

| MFS Inflation-Adjusted Bond Fund | 9.9% |

| MFS Government Securities Fund | 9.3% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Blended Research Mid Cap Equity Fund | 3.2% |

| MFS Blended Research International Equity Fund | 2.9% |

| MFS High Income Fund | 2.6% |

| MFS Value Fund | 2.3% |

| MFS Blended Research Value Equity Fund | 2.3% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Blended Research Core Equity Fund | 1.9% |

| MFS Research Fund | 1.9% |

| MFS Blended Research Growth Equity Fund | 1.9% |

| MFS Growth Fund | 1.9% |

| MFS Research International Fund | 1.6% |

| MFS Mid Cap Value Fund | 1.6% |

| MFS Mid Cap Growth Fund | 1.6% |

| MFS Emerging Markets Debt Fund | 1.3% |

| MFS Emerging Markets Debt Local Currency Fund | 1.3% |

| MFS Blended Research Small Cap Equity Fund | 1.0% |

| MFS International Growth Fund | 0.7% |

| MFS International Intrinsic Value Fund | 0.6% |

| MFS New Discovery Value Fund | 0.5% |

| MFS New Discovery Fund | 0.5% |

| Cash & Cash Equivalents | 3.0% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Portfolio Composition - continued

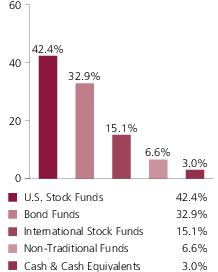

Portfolio holdings

| MFS Total Return Bond Fund | 12.5% |

| MFS Government Securities Fund | 9.3% |

| MFS Inflation-Adjusted Bond Fund | 9.0% |

| MFS Limited Maturity Fund | 7.1% |

| MFS Global Opportunistic Bond Fund | 6.4% |

| MFS Blended Research Mid Cap Equity Fund | 4.9% |

| MFS Blended Research International Equity Fund | 4.7% |

| MFS High Income Fund | 4.1% |

| MFS Value Fund | 3.3% |

| MFS Blended Research Value Equity Fund | 3.3% |

| MFS Blended Research Core Equity Fund | 2.9% |

| MFS Research Fund | 2.9% |

| MFS Blended Research Growth Equity Fund | 2.9% |

| MFS Growth Fund | 2.9% |

| MFS Mid Cap Value Fund | 2.4% |

| MFS Mid Cap Growth Fund | 2.4% |

| MFS Emerging Markets Debt Fund | 2.3% |

| MFS Research International Fund | 2.3% |

| MFS Commodity Strategy Fund | 2.3% |

| MFS Global Real Estate Fund | 2.2% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.2% |

| MFS International Growth Fund | 1.1% |

| MFS Blended Research Small Cap Equity Fund | 1.1% |

| MFS New Discovery Value Fund | 0.6% |

| MFS New Discovery Fund | 0.6% |

| MFS International New Discovery Fund | 0.3% |

| Cash & Cash Equivalents | 3.0% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Portfolio Composition - continued

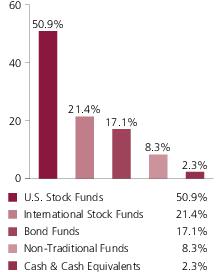

Portfolio holdings

| MFS Blended Research Mid Cap Equity Fund | 7.6% |

| MFS Blended Research International Equity Fund | 6.8% |

| MFS Government Securities Fund | 6.6% |

| MFS Total Return Bond Fund | 6.6% |

| MFS Inflation-Adjusted Bond Fund | 6.3% |

| MFS Global Opportunistic Bond Fund | 4.4% |

| MFS Value Fund | 4.3% |

| MFS Blended Research Value Equity Fund | 4.3% |

| MFS High Income Fund | 4.0% |

| MFS Blended Research Core Equity Fund | 3.9% |

| MFS Research Fund | 3.9% |

| MFS Blended Research Growth Equity Fund | 3.9% |

| MFS Growth Fund | 3.8% |

| MFS Mid Cap Value Fund | 3.8% |

| MFS Mid Cap Growth Fund | 3.7% |

| MFS Commodity Strategy Fund | 3.3% |

| MFS Global Real Estate Fund | 3.3% |

| MFS Research International Fund | 3.1% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.8% |

| MFS International Growth Fund | 1.8% |

| MFS Blended Research Small Cap Equity Fund | 1.6% |

| MFS International New Discovery Fund | 1.3% |

| MFS New Discovery Value Fund | 0.8% |

| MFS New Discovery Fund | 0.8% |

| MFS Blended Research Emerging Markets Equity Fund | 0.2% |

| MFS Emerging Markets Equity Fund | 0.1% |

| Cash & Cash Equivalents | 3.0% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research Mid Cap Equity Fund | 9.1% |

| MFS Blended Research International Equity Fund | 9.0% |

| MFS Value Fund | 5.1% |

| MFS Blended Research Value Equity Fund | 5.1% |

| MFS Blended Research Growth Equity Fund | 4.7% |

| MFS Growth Fund | 4.6% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Mid Cap Value Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS Inflation-Adjusted Bond Fund | 4.5% |

| MFS Mid Cap Growth Fund | 4.5% |

| MFS Commodity Strategy Fund | 4.2% |

| MFS Global Real Estate Fund | 4.1% |

| MFS Research International Fund | 3.5% |

| MFS High Income Fund | 3.4% |

| MFS International Intrinsic Value Fund | 2.7% |

| MFS International Growth Fund | 2.6% |

| MFS Emerging Markets Debt Fund | 2.6% |

| MFS Global Opportunistic Bond Fund | 2.6% |

| MFS International New Discovery Fund | 2.3% |

| MFS Total Return Bond Fund | 2.2% |

| MFS Blended Research Small Cap Equity Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 1.7% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

| MFS Blended Research Emerging Markets Equity Fund | 0.6% |

| MFS Emerging Markets Equity Fund | 0.6% |

| Cash & Cash Equivalents | 2.3% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

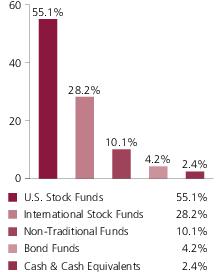

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research International Equity Fund | 10.2% |

| MFS Blended Research Mid Cap Equity Fund | 9.6% |

| MFS Value Fund | 5.3% |

| MFS Blended Research Value Equity Fund | 5.3% |

| MFS Blended Research Growth Equity Fund | 4.9% |

| MFS Growth Fund | 4.9% |

| MFS Mid Cap Value Fund | 4.8% |

| MFS Commodity Strategy Fund | 4.7% |

| MFS Mid Cap Growth Fund | 4.7% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS Global Real Estate Fund | 4.6% |

| MFS Research International Fund | 3.8% |

| MFS Inflation-Adjusted Bond Fund | 3.3% |

| MFS International New Discovery Fund | 3.3% |

| MFS International Intrinsic Value Fund | 3.2% |

| MFS International Growth Fund | 3.1% |

| MFS Blended Research Small Cap Equity Fund | 2.3% |

| MFS Total Return Bond Fund | 2.0% |

| MFS High Income Fund | 1.4% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Emerging Markets Debt Fund | 1.1% |

| MFS Global Opportunistic Bond Fund | 1.1% |

| MFS Blended Research Emerging Markets Equity Fund | 0.9% |

| MFS Emerging Markets Equity Fund | 0.8% |

| MFS Emerging Markets Debt Local Currency Fund | 0.7% |

| Cash & Cash Equivalents | 2.4% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

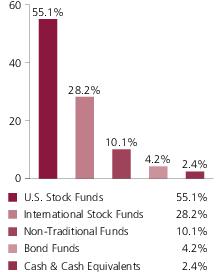

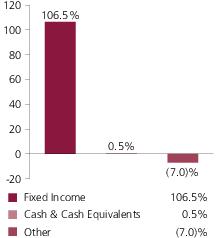

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research International Equity Fund | 11.1% |

| MFS Blended Research Mid Cap Equity Fund | 9.9% |

| MFS Value Fund | 5.5% |

| MFS Blended Research Value Equity Fund | 5.5% |

| MFS Commodity Strategy Fund | 5.1% |

| MFS Blended Research Growth Equity Fund | 5.1% |

| MFS Growth Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Growth Fund | 4.9% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS International Growth Fund | 3.5% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS Inflation-Adjusted Bond Fund | 2.4% |

| MFS Total Return Bond Fund | 1.8% |

| MFS New Discovery Value Fund | 1.3% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.1% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 2.4% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

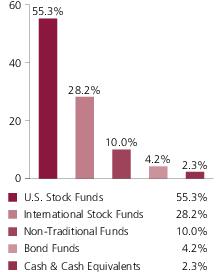

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research International Equity Fund | 11.1% |

| MFS Blended Research Mid Cap Equity Fund | 10.0% |

| MFS Value Fund | 5.5% |

| MFS Blended Research Value Equity Fund | 5.5% |

| MFS Commodity Strategy Fund | 5.2% |

| MFS Blended Research Growth Equity Fund | 5.1% |

| MFS Growth Fund | 5.0% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Global Real Estate Fund | 4.9% |

| MFS Mid Cap Growth Fund | 4.9% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS International New Discovery Fund | 4.0% |

| MFS Research International Fund | 4.0% |

| MFS International Growth Fund | 3.5% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS Inflation-Adjusted Bond Fund | 2.4% |

| MFS Total Return Bond Fund | 1.8% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Blended Research Emerging Markets Equity Fund | 1.1% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 2.4% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

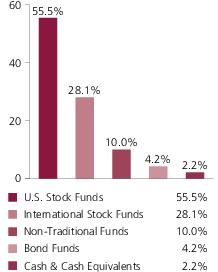

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research International Equity Fund | 11.1% |

| MFS Blended Research Mid Cap Equity Fund | 10.0% |

| MFS Value Fund | 5.5% |

| MFS Blended Research Value Equity Fund | 5.5% |

| MFS Blended Research Growth Equity Fund | 5.1% |

| MFS Growth Fund | 5.1% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS International New Discovery Fund | 4.1% |

| MFS Research International Fund | 4.0% |

| MFS International Growth Fund | 3.5% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS Inflation-Adjusted Bond Fund | 2.4% |

| MFS Total Return Bond Fund | 1.8% |

| MFS New Discovery Value Fund | 1.2% |

| MFS New Discovery Fund | 1.2% |

| MFS Emerging Markets Equity Fund | 1.0% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 2.3% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Portfolio Composition - continued

Portfolio holdings

| MFS Blended Research International Equity Fund | 11.0% |

| MFS Blended Research Mid Cap Equity Fund | 10.0% |

| MFS Value Fund | 5.5% |

| MFS Blended Research Value Equity Fund | 5.5% |

| MFS Blended Research Growth Equity Fund | 5.1% |

| MFS Growth Fund | 5.1% |

| MFS Mid Cap Value Fund | 5.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Mid Cap Growth Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS Blended Research Core Equity Fund | 4.6% |

| MFS Research Fund | 4.6% |

| MFS International New Discovery Fund | 4.1% |

| MFS Research International Fund | 4.0% |

| MFS International Growth Fund | 3.5% |

| MFS International Intrinsic Value Fund | 3.5% |

| MFS Blended Research Small Cap Equity Fund | 2.5% |

| MFS Inflation-Adjusted Bond Fund | 2.4% |

| MFS Total Return Bond Fund | 1.8% |

| MFS New Discovery Value Fund | 1.3% |

| MFS New Discovery Fund | 1.3% |

| MFS Blended Research Emerging Markets Equity Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 1.0% |

| Cash & Cash Equivalents | 2.2% |

Cash & Cash Equivalents includes the fund’s investments in MFS Institutional Money Market Portfolio, an underlying money market fund used for any strategic cash allocation and as a cash sweep vehicle. Cash & Cash Equivalents also includes other assets less liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Management Review

MFS Lifetime Funds

Market Environment

In response to the strongest inflationary period in four decades, global central banks tightened monetary policy significantly during the reporting period, helping reduce price pressures, although more work is needed before inflation returns to target. Geopolitical strains remained high amid ongoing conflicts in Ukraine and in the Middle East, while relations between China and the US remained tense. The US sought to restrict the flow of advanced technologies to China and China looked to use its industrial overcapacity to increase exports to developed markets to bolster its slow-growing domestic economy. The conflict in the Middle East caused trade flow disruptions between Asia and Europe as shipping traffic was routed away from the Red Sea.

Although inflation has yet to reach central banks’ targets, policymakers have indicated their desire to begin cutting rates in the months ahead, although stickier-than-expected inflation could delay cuts in the US. The prospects for easier monetary policy along with resilient global economic growth have been supportive factors for risky assets, such as equities and high-yield bonds. Long-term interest rates moderated during the latter half of the reporting period, although rising government debt levels remained a concern over the medium term. Advancements in artificial intelligence and the adoption of novel weight-loss drugs were two areas of focus for investors during the period.

MFS Lifetime Income Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime Income Fund (fund) provided a total return of 5.03%, at net asset value. This compares with a return of -1.47% for the fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index. The fund’s other benchmark, the MFS Lifetime Income Fund Blended Index (Blended Index), generated a return of 3.75%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

The fund’s investment selection within the fixed income segment was a primary contributor to relative performance. Here, the MFS Limited Maturity Fund aided relative results as short-term maturity issues performed well in a rising interest rate environment. Additionally, strong relative performance of the MFS Total Return Bond Fund, MFS Global Opportunistic Bond Fund and MFS Limited Maturity Fund bolstered relative returns as all three funds outperformed their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Within international equity funds, the MFS Research International Fund held back relative results as the fund lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2025 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2025 Fund (fund) provided a total return of 5.77%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2025 Fund Blended Index (Blended Index), generated a return of 4.60%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Management Review - continued

The fund’s investment selection within the fixed income segment was a primary contributor to relative performance. Here, the MFS Limited Maturity Fund aided relative results as short-term maturity issues performed well in a rising interest rate environment. Additionally, strong relative performance of the MFS Global Opportunistic Bond Fund, MFS Total Return Bond Fund and MFS Limited Maturity Fund bolstered relative returns as all three funds outperformed their respective benchmarks.

Within international equity funds, the MFS Research International Fund held back relative results as the fund lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2030 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2030 Fund (fund) provided a total return of 8.06%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2030 Fund Blended Index (Blended Index), generated a return of 7.38%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund held back relative results as the fund lagged its respective benchmark.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

The fund’s investment selection within the fixed income segment was a primary contributor to relative performance. Here, the MFS High Income Fund, MFS Limited Maturity Fund and MFS Emerging Markets Debt Fund aided relative results as all three funds performed well in a rising interest rate environment. Additionally, strong relative performance of the MFS Global Opportunistic Bond Fund and MFS Total Return Bond Fund bolstered relative returns as both funds outperformed their respective benchmarks.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2035 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2035 Fund (fund) provided a total return of 11.13%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2035 Fund Blended Index (Blended Index), generated a return of 11.01%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund held back relative results as the fund lagged its respective benchmark.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

The fund’s investment selection within the fixed income segment was a primary contributor to relative performance. Here, the MFS High Income Fund and MFS Emerging Markets Debt Fund aided relative results as those funds performed well in a rising interest rate environment. Additionally, strong relative performance of the MFS Global Opportunistic Bond Fund and MFS Total Return Bond Fund bolstered relative returns as both funds outperformed their respective benchmarks.

Management Review - continued

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2040 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2040 Fund (fund) provided a total return of 13.33%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2040 Fund Blended Index (Blended Index), generated a return of 13.60%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

The fund’s investment selection within the fixed income segment contributed to relative performance. Here, investments in the MFS High Income Fund and MFS Emerging Markets Debt Fund aided relative results as both funds performed well in a rising interest rate environment. Additionally, strong relative performance of the MFS Global Opportunistic Bond Fund bolstered relative returns as the fund outperformed its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2045 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2045 Fund (fund) provided a total return of 13.87%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2045 Fund Blended Index (Blended Index), generated a return of 14.71%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

The fund’s investment selection within the fixed income segment contributed to relative performance. Here, investments in the MFS High Income Fund and MFS Emerging Markets Debt Fund aided relative results as both funds performed well in a rising interest rate environment.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

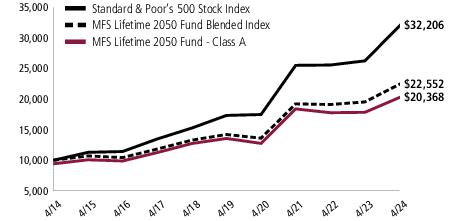

MFS Lifetime 2050 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2050 Fund (fund) provided a total return of 14.17%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2050 Fund Blended Index (Blended Index), generated a return of 15.40%. The

Management Review - continued

Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Within the fixed income segment, relative performance of the MFS Total Return Bond Fund contributed to relative results and more-than-offset negative contribution stemming from relative performance of the MFS Inflation-Adjusted Bond Fund that lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2055 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2055 Fund (fund) provided a total return of 14.17%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2055 Fund Blended Index (Blended Index), generated a return of 15.40%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Within the fixed income segment, relative performance of the MFS Total Return Bond Fund contributed to relative results and more-than-offset negative contribution stemming from relative performance of the MFS Inflation-Adjusted Bond Fund that lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

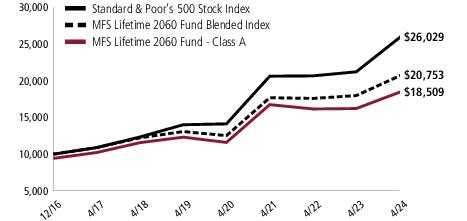

MFS Lifetime 2060 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2060 Fund (fund) provided a total return of 14.12%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2060 Fund Blended Index (Blended Index), generated a return of 15.40%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Management Review - continued

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Within the fixed income segment, relative performance of the MFS Total Return Bond Fund contributed to relative results and more-than-offset negative contribution stemming from relative performance of the MFS Inflation-Adjusted Bond Fund that lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

MFS Lifetime 2065 Fund

Summary of Results

For the twelve months ended April 30, 2024, Class A shares of the MFS Lifetime 2065 Fund (fund) provided a total return of 14.19%, at net asset value. This compares with a return of 22.66% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Lifetime 2065 Fund Blended Index (Blended Index), generated a return of 15.40%. The Blended Index reflects the blended returns of equity and fixed income market indices, with percentage allocations to each index designed to resemble the equity and fixed income allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary. The following commentary is based on fund results relative to the Blended Index.

Factors Affecting Performance

Within international equity funds, the MFS Research International Fund, MFS International New Discovery Fund and MFS International Growth Fund held back relative results as all three funds lagged their respective benchmarks.

Within the US equity funds segment, style selection was a headwind. Allocations to all strategies, with the exception of large-cap growth funds, held back relative returns as those funds lagged the US equity portion of the Blended Index. As the concentration in the US equity market has continued to increase, large-cap strategies have outperformed small- and mid-cap strategies. Conversely, manager selection boosted relative returns, as funds such as MFS Blended Research Mid Cap Equity Fund, MFS Blended Research Value Equity Fund and MFS Blended Research Core Equity Fund outpaced their respective benchmarks.

Within the fixed income segment, relative performance of the MFS Total Return Bond Fund contributed to relative results and more-than-offset negative contribution stemming from relative performance of the MFS Inflation-Adjusted Bond Fund that lagged its respective benchmark.

The fund’s investments within the non-traditional funds had no material impact on relative performance over the reporting period.

Respectfully,

Portfolio Manager(s)

Joseph Flaherty, Benjamin Nastou, Natalie Shapiro, and Erich Shigley

Note to Shareholders: Effective August 28, 2023, Benjamin Nastou and Erich Shigley were added as Portfolio Managers of the fund. Effective June 1, 2025, Joseph Flaherty will no longer be a Portfolio Manager of the fund.

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

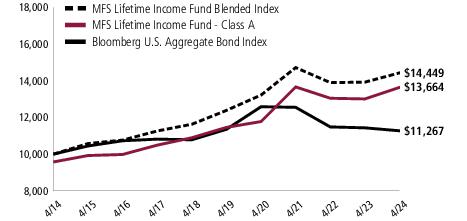

Performance Summary THROUGH 4/30/24

The following charts illustrate a representative class of each fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

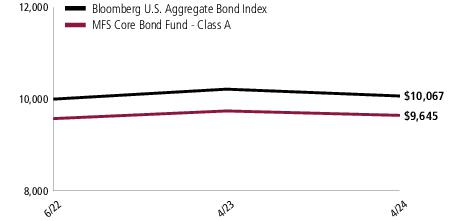

MFS Lifetime Income Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 5.03% | 3.58% | 3.62% | N/A |

| B | 9/29/2005 | 4.25% | 2.79% | 2.85% | N/A |

| C | 9/29/2005 | 4.34% | 2.81% | 2.85% | N/A |

| I | 9/29/2005 | 5.38% | 3.84% | 3.89% | N/A |

| R1 | 9/29/2005 | 4.25% | 2.81% | 2.86% | N/A |

| R2 | 9/29/2005 | 4.77% | 3.31% | 3.35% | N/A |

| R3 | 9/29/2005 | 5.03% | 3.57% | 3.62% | N/A |

| R4 | 9/29/2005 | 5.29% | 3.84% | 3.87% | N/A |

| R6 | 8/29/2016 | 5.41% | 3.94% | N/A | 4.19% |

Comparative benchmark(s)

| | | | | |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| MFS Lifetime Income Fund Blended Index (f)(z) | 3.75% | 3.13% | 3.75% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | 0.88% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

Performance Summary - continued

With sales charge

| | 1-yr | 5-yr | 10-yr | Life (t) |

A

With Initial Sales Charge (4.25%) | 0.57% | 2.69% | 3.17% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 0.25% | 2.44% | 2.85% | N/A |

C

With CDSC (1% for 12 months) (v) | 3.34% | 2.81% | 2.85% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (z) | The weights of the components of the blended benchmark (MFS Lifetime Income Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at September 29, 2005 (the fund’s inception date) and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Bloomberg U.S. Aggregate Bond Index | 71.0% | 71.0% |

| Standard & Poor’s 500 Stock Index | 20.0% | 20.0% |

| MSCI EAFE Index (net div) | 5.0% | 5.0% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.0% | 2.0% |

| Bloomberg Commodity Index | 2.0% | 2.0% |

Performance Summary - continued

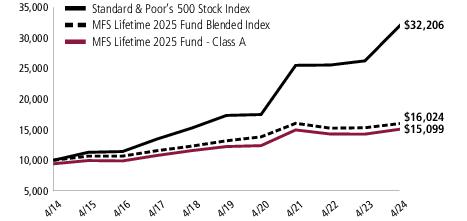

MFS Lifetime 2025 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 5.77% | 4.28% | 4.83% | N/A |

| B | 11/02/2012 | 5.00% | 3.50% | 4.03% | N/A |

| C | 11/02/2012 | 4.96% | 3.50% | 4.03% | N/A |

| I | 11/02/2012 | 6.06% | 4.52% | 5.07% | N/A |

| R1 | 11/02/2012 | 4.99% | 3.48% | 4.03% | N/A |

| R2 | 11/02/2012 | 5.60% | 4.02% | 4.56% | N/A |

| R3 | 11/02/2012 | 5.76% | 4.27% | 4.82% | N/A |

| R4 | 11/02/2012 | 6.11% | 4.52% | 5.07% | N/A |

| R6 | 8/29/2016 | 6.12% | 4.67% | N/A | 5.49% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2025 Fund Blended Index (f)(z) | 4.60% | 3.97% | 4.83% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | (0.31)% | 3.05% | 4.21% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 1.00% | 3.15% | 4.03% | N/A |

C

With CDSC (1% for 12 months) (v) | 3.96% | 3.50% | 4.03% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2025 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Bloomberg U.S. Aggregate Bond Index | 67.70% | 65.50% |

| Standard & Poor’s 500 Stock Index | 22.40% | 24.00% |

| MSCI EAFE Index (net div) | 5.90% | 6.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.00% | 2.00% |

| Bloomberg Commodity Index | 2.00% | 2.00% |

Performance Summary - continued

MFS Lifetime 2030 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 8.06% | 5.68% | 6.11% | N/A |

| B | 9/29/2005 | 7.27% | 4.89% | 5.31% | N/A |

| C | 9/29/2005 | 7.21% | 4.90% | 5.31% | N/A |

| I | 9/29/2005 | 8.35% | 5.95% | 6.35% | N/A |

| R1 | 9/29/2005 | 7.24% | 4.90% | 5.31% | N/A |

| R2 | 9/29/2005 | 7.82% | 5.42% | 5.84% | N/A |

| R3 | 9/29/2005 | 8.06% | 5.69% | 6.11% | N/A |

| R4 | 9/29/2005 | 8.36% | 5.95% | 6.37% | N/A |

| R6 | 8/29/2016 | 8.49% | 6.09% | N/A | 7.11% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2030 Fund Blended Index (f)(z) | 7.38% | 5.84% | 6.22% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 1.84% | 4.44% | 5.48% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 3.27% | 4.56% | 5.31% | N/A |

C

With CDSC (1% for 12 months) (v) | 6.21% | 4.90% | 5.31% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2030 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Bloomberg U.S. Aggregate Bond Index | 54.00% | 50.00% |

| Standard & Poor’s 500 Stock Index | 31.90% | 34.50% |

| MSCI EAFE Index (net div) | 9.50% | 10.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 2.30% | 2.50% |

| Bloomberg Commodity Index | 2.30% | 2.50% |

Performance Summary - continued

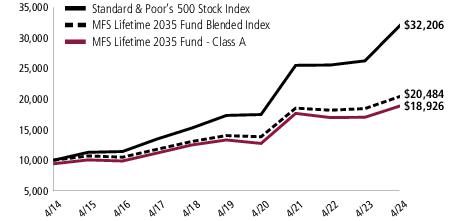

MFS Lifetime 2035 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 11.13% | 7.28% | 7.22% | N/A |

| B | 11/02/2012 | 10.24% | 6.46% | 6.41% | N/A |

| C | 11/02/2012 | 10.27% | 6.46% | 6.41% | N/A |

| I | 11/02/2012 | 11.44% | 7.55% | 7.47% | N/A |

| R1 | 11/02/2012 | 10.25% | 6.43% | 6.40% | N/A |

| R2 | 11/02/2012 | 10.85% | 7.00% | 6.95% | N/A |

| R3 | 11/02/2012 | 11.14% | 7.27% | 7.21% | N/A |

| R4 | 11/02/2012 | 11.45% | 7.54% | 7.49% | N/A |

| R6 | 8/29/2016 | 11.59% | 7.70% | N/A | 8.54% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2035 Fund Blended Index (f)(z) | 11.01% | 7.85% | 7.43% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 4.74% | 6.02% | 6.59% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 6.24% | 6.15% | 6.41% | N/A |

C

With CDSC (1% for 12 months) (v) | 9.27% | 6.46% | 6.41% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. The comparative benchmark performance information provided for the “life” period is from the inception date of the Class A shares. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2035 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor’s 500 Stock Index | 44.30% | 46.50% |

| Bloomberg U.S. Aggregate Bond Index | 34.00% | 30.00% |

| MSCI EAFE Index (net div) | 15.10% | 16.50% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 3.30% | 3.50% |

| Bloomberg Commodity Index | 3.30% | 3.50% |

Performance Summary - continued

MFS Lifetime 2040 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/29/2005 | 13.33% | 8.04% | 7.75% | N/A |

| B | 9/29/2005 | 12.50% | 7.22% | 6.94% | N/A |

| C | 9/29/2005 | 12.46% | 7.23% | 6.95% | N/A |

| I | 9/29/2005 | 13.60% | 8.30% | 7.99% | N/A |

| R1 | 9/29/2005 | 12.46% | 7.21% | 6.94% | N/A |

| R2 | 9/29/2005 | 13.03% | 7.75% | 7.47% | N/A |

| R3 | 9/29/2005 | 13.31% | 8.03% | 7.75% | N/A |

| R4 | 9/29/2005 | 13.58% | 8.30% | 8.02% | N/A |

| R6 | 8/29/2016 | 13.72% | 8.44% | N/A | 9.22% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2040 Fund Blended Index (f)(z) | 13.60% | 8.84% | 8.02% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 6.81% | 6.77% | 7.12% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 8.50% | 6.92% | 6.94% | N/A |

C

With CDSC (1% for 12 months) (v) | 11.46% | 7.23% | 6.95% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2040 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor's 500 Stock Index | 52.75% | 53.25% |

| MSCI EAFE Index (net div) | 21.20% | 22.00% |

| Bloomberg U.S. Aggregate Bond Index | 17.75% | 16.25% |

| Bloomberg Commodity Index | 4.15% | 4.25% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 4.15% | 4.25% |

Performance Summary - continued

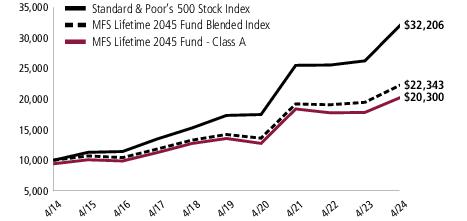

MFS Lifetime 2045 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 13.87% | 8.40% | 7.97% | N/A |

| B | 11/02/2012 | 12.99% | 7.58% | 7.17% | N/A |

| C | 11/02/2012 | 12.99% | 7.59% | 7.17% | N/A |

| I | 11/02/2012 | 14.11% | 8.66% | 8.26% | N/A |

| R1 | 11/02/2012 | 12.93% | 7.56% | 7.15% | N/A |

| R2 | 11/02/2012 | 13.59% | 8.12% | 7.70% | N/A |

| R3 | 11/02/2012 | 13.85% | 8.39% | 7.97% | N/A |

| R4 | 11/02/2012 | 14.11% | 8.66% | 8.24% | N/A |

| R6 | 8/29/2016 | 14.27% | 8.82% | N/A | 9.52% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2045 Fund Blended Index (f)(z) | 14.71% | 9.46% | 8.37% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 7.33% | 7.12% | 7.34% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 8.99% | 7.27% | 7.17% | N/A |

C

With CDSC (1% for 12 months) (v) | 11.99% | 7.59% | 7.17% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2045 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor’s 500 Stock Index | 55.25% | 55.75% |

| MSCI EAFE Index (net div) | 25.20% | 26.00% |

| Bloomberg U.S. Aggregate Bond Index | 10.25% | 8.75% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 4.65% | 4.75% |

| Bloomberg Commodity Index | 4.65% | 4.75% |

Performance Summary - continued

MFS Lifetime 2050 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 9/15/2010 | 14.17% | 8.47% | 8.01% | N/A |

| B | 9/15/2010 | 13.32% | 7.66% | 7.21% | N/A |

| C | 9/15/2010 | 13.33% | 7.66% | 7.21% | N/A |

| I | 9/15/2010 | 14.46% | 8.73% | 8.28% | N/A |

| R1 | 9/15/2010 | 13.32% | 7.66% | 7.21% | N/A |

| R2 | 9/15/2010 | 13.89% | 8.20% | 7.74% | N/A |

| R3 | 9/15/2010 | 14.18% | 8.46% | 8.01% | N/A |

| R4 | 9/15/2010 | 14.49% | 8.73% | 8.28% | N/A |

| R6 | 8/29/2016 | 14.60% | 8.90% | N/A | 9.56% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2050 Fund Blended Index (f)(z) | 15.40% | 9.67% | 8.47% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 7.60% | 7.19% | 7.37% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 9.32% | 7.36% | 7.21% | N/A |

C

With CDSC (1% for 12 months) (v) | 12.33% | 7.66% | 7.21% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2050 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor's 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

Performance Summary - continued

MFS Lifetime 2055 Fund

Growth of a Hypothetical $10,000 Investment

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 11/02/2012 | 14.17% | 8.48% | 8.01% | N/A |

| B | 11/02/2012 | 13.32% | 7.66% | 7.20% | N/A |

| C | 11/02/2012 | 13.34% | 7.67% | 7.21% | N/A |

| I | 11/02/2012 | 14.49% | 8.74% | 8.23% | N/A |

| R1 | 11/02/2012 | 13.34% | 7.68% | 7.20% | N/A |

| R2 | 11/02/2012 | 13.89% | 8.22% | 7.74% | N/A |

| R3 | 11/02/2012 | 14.16% | 8.47% | 8.01% | N/A |

| R4 | 11/02/2012 | 14.47% | 8.75% | 8.28% | N/A |

| R6 | 8/29/2016 | 14.66% | 8.92% | N/A | 9.57% |

Comparative benchmark(s)

| | | | | |

| Standard & Poor’s 500 Stock Index (f) | 22.66% | 13.19% | 12.41% | N/A |

| MFS Lifetime 2055 Fund Blended Index (f)(z) | 15.40% | 9.67% | 8.47% | N/A |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | (1.54)% | N/A |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 1.20% | N/A |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 2.11% | N/A |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 4.38% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | 7.61% | 7.20% | 7.37% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 9.32% | 7.36% | 7.20% | N/A |

C

With CDSC (1% for 12 months) (v) | 12.34% | 7.67% | 7.21% | N/A |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2055 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

Performance Summary - continued

MFS Lifetime 2060 Fund

Growth of a Hypothetical $10,000 Investment (t)

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | Life (t) |

| A | 12/06/2016 | 14.12% | 8.49% | 9.54% |

| B | 12/06/2016 | 13.27% | 7.67% | 8.74% |

| C | 12/06/2016 | 13.30% | 7.68% | 8.74% |

| I | 12/06/2016 | 14.39% | 8.76% | 9.83% |

| R1 | 12/06/2016 | 14.15% | 7.95% | 8.92% |

| R2 | 12/06/2016 | 13.92% | 8.22% | 9.29% |

| R3 | 12/06/2016 | 14.12% | 8.49% | 9.55% |

| R4 | 12/06/2016 | 14.45% | 8.74% | 9.81% |

| R6 | 12/06/2016 | 14.65% | 8.90% | 9.95% |

Comparative benchmark(s)

| | | | |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 13.19% | 13.79% |

| MFS Lifetime 2060 Fund Blended Index (f)(z) | 15.40% | 9.67% | 10.36% |

| Bloomberg Commodity Index (f) | 2.89% | 7.04% | 3.93% |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (0.16)% | 0.79% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (1.17)% | 1.85% |

| MSCI EAFE Index (net div) (f) | 9.28% | 6.18% | 7.37% |

Average annual with sales charge

| | | | |

A

With Initial Sales Charge (5.75%) | 7.56% | 7.21% | 8.67% |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 9.27% | 7.37% | 8.74% |

C

With CDSC (1% for 12 months) (v) | 12.30% | 7.68% | 8.74% |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2060 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

Performance Summary - continued

MFS Lifetime 2065 Fund

Growth of a Hypothetical $10,000 Investment (t)

Total Returns through 4/30/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | Life (t) |

| A | 9/01/2021 | 14.19% | 1.37% |

| C | 9/01/2021 | 13.47% | 0.66% |

| I | 9/01/2021 | 14.58% | 1.67% |

| R1 | 9/01/2021 | 13.33% | 0.63% |

| R2 | 9/01/2021 | 13.99% | 1.17% |

| R3 | 9/01/2021 | 14.20% | 1.38% |

| R4 | 9/01/2021 | 14.47% | 1.63% |

| R6 | 9/01/2021 | 14.66% | 1.70% |

Comparative benchmark(s)

| | | |

| Standard & Poor's 500 Stock Index (f) | 22.66% | 5.76% |

| MFS Lifetime 2065 Fund Blended Index (f)(z) | 15.40% | 3.48% |

| Bloomberg Commodity Index (f) | 2.89% | 5.70% |

| Bloomberg U.S. Aggregate Bond Index (f) | (1.47)% | (4.67)% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) (f) | (0.88)% | (8.41)% |

| MSCI EAFE Index (net div) (f) | 9.28% | 1.47% |

Average annual with sales charge

| | | |

A

With Initial Sales Charge (5.75%) | 7.62% | (0.85)% |

C

With CDSC (1% for 12 months) (v) | 12.47% | 0.66% |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Performance Summary - continued

| (z) | The weights of the components of the blended benchmark (MFS Lifetime 2065 Fund Blended Index) (a custom index) are designed to change systematically over time on a preset schedule. The table below depicts the individual component weights (in percent) at the beginning and at the end of the reporting period: |

| | 4/30/24 | 4/30/23 |

| Standard & Poor’s 500 Stock Index | 57.00% | 57.00% |

| MSCI EAFE Index (net div) | 28.00% | 28.00% |

| Bloomberg U.S. Aggregate Bond Index | 5.00% | 5.00% |

| Bloomberg Commodity Index | 5.00% | 5.00% |

| FTSE EPRA Nareit Developed Real Estate Index (net div) | 5.00% | 5.00% |

Benchmark Definition(s)

Bloomberg Commodity Index(a) – a highly liquid and diversified benchmark for the commodity futures market. The index tracks trades on futures contracts for physical commodities, such as energy (petroleum, gas), precious metals (gold, silver), industrial metals (zinc, copper), grains (corn, wheat), livestock (pork bellies), among others, and are traded in a variety of currencies.

Bloomberg U.S. Aggregate Bond Index(a) – a market capitalization-weighted index that measures the performance of the U.S. investment-grade, fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with at least one year to final maturity.

FTSE EPRA Nareit Developed Real Estate Index(c) (net div) – measures the performance of eligible real estate equities worldwide that generate a majority of their revenue and income through the ownership, disposure and development of income-producing real estate.

MSCI EAFE (Europe, Australasia, Far East) Index(e) (net div) – a market capitalization-weighted index that is designed to measure equity market performance in the developed markets, excluding the U.S. and Canada.

Standard & Poor's 500 Stock Index(g) – a market capitalization-weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

It is not possible to invest directly in an index.

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

| (c) | FTSE International Limited (“FTSE”)© FTSE 2019. “FTSE®” is a trademark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. “FT-SE®”, “FOOTSIE®” and “FTSE4GOOD®” are trademarks of the London Stock Exchange Group companies. “Nareit®” is a trademark of the National Association of Real Estate Investment Trusts (“Nareit”) and “EPRA®” is a trademark of the European Public Real Estate Association (“EPRA”) and all are used by FTSE under license. The FTSE EPRA Nareit Developed Real Estate Index is calculated by FTSE. Neither FTSE, Euronext N.V., Nareit, nor EPRA sponsor, endorse, or promote this product and are not in any way connected to it and do not accept any liability. All intellectual property rights in the index values and constituent list vests in FTSE, Euronext N.V., Nareit, and EPRA. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE's express written consent. |

| (e) | Morgan Stanley Capital International (“MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| (g) | “Standard & Poor's®” and “S&P®” are registered trademarks of Standard & Poor's Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's product(s) is not sponsored, endorsed, sold, or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in such product(s). |

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund's share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods, for certain classes for certain funds.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers each fund's performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance Summary - continued

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the funds may receive proceeds from litigation settlements, without which performance would be lower.

Expense Tables

Fund expenses borne by the shareholders during the period,

November 1, 2023 through April 30, 2024

As a shareholder of the funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including distribution and service (12b-1) fees; and other fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the fees and expenses which each fund bears directly, each fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which each fund invests. Because the underlying funds have varied expenses and fee levels and each fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by each fund will vary. If these transactional and indirect costs were included, your costs would have been higher.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2023 through April 30, 2024.

Actual Expenses