As filed with the Securities and Exchange Commission on December 14, 2006

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF CERTAIN REAL ESTATE COMPANIES

CBRE REALTY FINANCE, INC.

(Exact name of Registrant as specified in its governing instruments)

City Place One

185 Asylum Street 37th Floor

Hartford, CT 06103

(860) 275-6200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Keith Gollenberg

Chief Executive Officer and President

City Place One

185 Asylum Street 37th Floor

Hartford, CT 06103

(860) 275-6200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Larry P. Medvinsky, Esq.

Clifford Chance US LLP

31 West 52nd Street

New York, New York 10019

(212) 878-8000

(212) 878-8375 (Facsimile)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | |

Title of Securities Being Registered | | Number of Shares to be Registered | | Proposed Maximum Aggregate Offering Price Per Share | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee(2) |

Common Stock, $0.01 par value | | 20,463,751 | | $ | 16.38 | | $ | 335,196,241 | | $ | 35,866 |

| | (1) | Estimated solely for the purpose of determining the registration fee in accordance with Rule 457(o) of the Securities Act of 1933 based upon the average of the high and low trading prices of the common stock on the New York Stock Exchange on December 12, 2006. |

| | (2) | Calculated in accordance with Rule 457(o) under the Securities Act of 1933. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, nor it is a solicitation of an offer to buy these securities, in any state in whichthe offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 14, 2006

PROSPECTUS

20,463,751 Shares

Common Stock

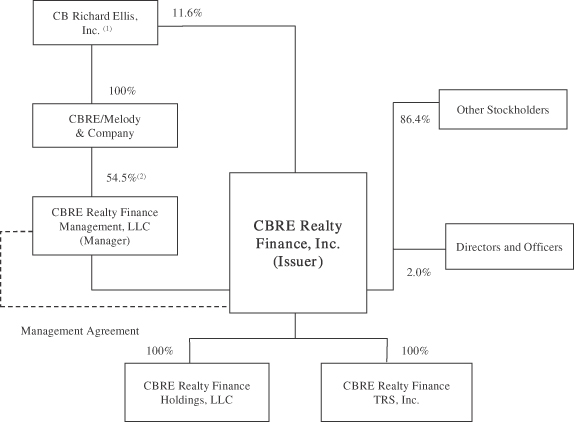

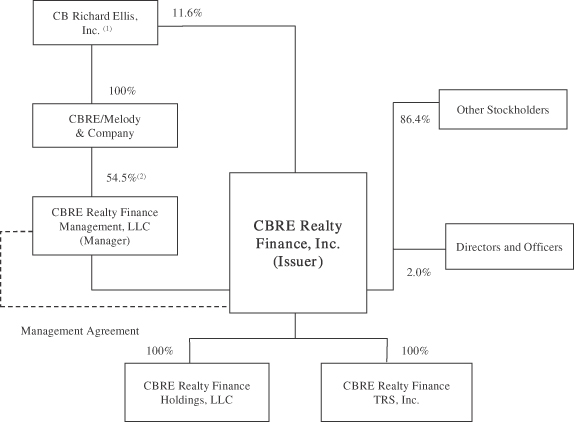

CBRE Realty Finance, Inc. is a commercial real estate specialty finance company that primarily focuses on originating, acquiring, investing in, financing and managing a diversified portfolio of commercial real estate-related loans and securities. We are externally managed and advised by CBRE Realty Finance Management, LLC, an indirect subsidiary of CB Richard Ellis, Inc. and a direct subsidiary of CBRE Melody & Company.

This prospectus relates to the resale of up to 20,463,751 shares of our common stock that the selling stockholders named in this prospectus may offer for sale from time to time.

The registration of these shares does not necessarily mean the selling stockholders will offer or sell all or any of these shares of common stock. We will not receive any of the proceeds from the sales of any shares of our common stock by the selling stockholders, but will incur expenses in connection with the registration of these shares.

The selling stockholders from time to time may offer and resell the shares held by them directly or through agents or broker-dealers on terms to be determined by the time of sale. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offer will be set forth in a prospectus supplement that will accompany this prospectus. A prospectus supplement also may add, update or change information contained in this prospectus. Each of the selling stockholders reserves the sole right to accept or reject, in whole or in part, any proposed purchase of the shares to be made directly or through agents.

Our common stock is listed on the New York Stock Exchange, or the NYSE, under the symbol “CBF.” On December 12, 2006, the closing sale price of our common stock on the NYSE was $16.46 per share.

We have elected to be treated as a real estate investment trust, or REIT, for U.S. federal income tax commencing with our taxable year ended December 31, 2005. To assist us in qualifying as a REIT, generally no person may own more than 9.8% by number or value, whichever is more restrictive, of our outstanding shares of common stock or more than 9.8% by number or value, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock, subject to important exceptions. In addition, our charter contains various other restrictions on the ownership and transfer of our capital stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 19 of this prospectus for some risks regarding an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2006

TABLE OF CONTENTS

i

ii

SUMMARY

This summary highlights information contained elsewhere in this prospectus. You should read the information set forth under “Risk Factors” and the other information included in this prospectus. Except where the context suggests otherwise, the terms “we,” “us” and “our” refer to CBRE Realty Finance, Inc. and its subsidiaries; “Manager” refers to CBRE Realty Finance Management, LLC our external manager; “CBRE” refers to CB Richard Ellis Group, Inc. or CB Richard Ellis, Inc., “CBRE/Melody” refers to CBRE Melody & Company and “our management team” refers to our five executive officers (other than our chairman) listed under “Management.” The term “common stock outstanding on a fully-diluted basis” means all outstanding shares of our common stock at such time plus all outstanding shares of restricted stock and shares of common stock issuable upon the exercise of outstanding options, which is not the same as the meaning of “fully-diluted” under generally accepted accounting principles, or GAAP.

Our Company

We are a commercial real estate specialty finance company that has elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2005. Our objective is to grow our portfolio and provide attractive total returns to our investors over time through a combination of dividends and capital appreciation. Our business primarily focuses on originating, acquiring, investing in, financing and managing a diversified portfolio of commercial real estate-related loans and securities. Our initial investment focus is on opportunities in North America. Future distributions and capital appreciation are not guaranteed and we have only limited operating history and experience operating as a REIT upon which you can base an assessment of our ability to achieve our objectives.

We are externally managed and advised by CBRE Realty Finance Management, LLC, or our Manager, an indirect subsidiary of CB Richard Ellis, Inc., or CBRE, and a direct subsidiary of CBRE Melody & Company, or CBRE/Melody. CBRE indirectly owns approximately 54.5% of the economic interest in our Manager and the remainder is owned in the aggregate by our executive officers and certain executives of CBRE/Melody. We capitalize on both the market knowledge and insight provided by CBRE’s domestic and global reach, origination capabilities, broad range of commercial real estate services, servicing platform and access to existing business relationships, as well as the broad commercial real estate experience of our management team. We source our investments through two primary channels: our unique relationship with the CBRE/Melody origination system, which we refer to as the affiliated CBRE system, and the origination capabilities of our management team, including their relationships with borrowers, sellers of whole loans, various financial institutions and other financial intermediaries, which we refer to as our internal origination system. Of our approximately $1,201.5 million of investments held as of September 30, 2006, approximately 52.7% was sourced through the affiliated CBRE system. We expect that the percentage of our investments sourced by the affiliated CBRE system will grow. In addition, with respect to most of our investments, we utilize CBRE’s market insight and other services to assist our underwriting.

In pursuing our objectives, our Manager leverages the experience and infrastructure of CBRE and the investment experience of our management team, including:

| | • | | access to product and information resulting from CBRE’s broad relationships with real estate owners and developers, financial institutions and tenants; |

| | • | | CBRE’s market knowledge and insights gained by the scope and expertise of its mortgage origination, investment sales, leasing, property management and valuation, industry specialists and research divisions, as well as its mature infrastructure; |

1

| | • | | a market leading origination platform through CBRE/Melody, the mortgage origination and servicing subsidiary of CBRE and one of the largest real estate intermediaries in the U.S., with 114 originators in 33 offices throughout the U.S. as of December 31, 2005; and |

| | • | | a seasoned management team with significant experience in buying, manufacturing and financing commercial real estate investments, with an average of over 20 years of experience in all aspects of real estate lending, investment, management, finance, underwriting, origination, risk management, capital markets and structured finance. |

Our relationship with CBRE and our ability to capitalize on its relationships, market knowledge, reputation, infrastructure and expertise provides us with the ability to identify, underwrite and evaluate investment opportunities, and to execute on such investments quickly and effectively and manage our assets. In addition, we believe that the market insight gained by CBRE through the scope and expertise of its investment sales, mortgage banking, leasing, property management and research divisions throughout its broad geographic network should allow us to anticipate market trends while giving us direct access to targeted investment opportunities.

We are a comprehensive provider of real estate financing solutions capable of financing the most senior capital positions as well as subordinate interests and equity participations. We capitalize on the opportunity to offer innovative and customized financing solutions to borrowers. Our management team has substantial experience in responding to unique borrowing needs by customizing financial products that are tailored to meet the borrowers’ business objectives. The combination of flexibility, service and a principal investor relationship should produce long-term and advantageous relationships for us.

Through at least the initial term of the management agreement, our Manager will be solely dedicated to the operations of our company. All of the employees of our Manager are fully dedicated to the operations of our Manager. Through at least the initial term of our management agreement, we will serve as the exclusive investment vehicle, subject to certain exceptions, sponsored by CBRE that focuses primarily on the acquisition and financing of commercial real estate-related loans, structured finance debt investments and CMBS.

Our Investment Portfolio

Our investments target the following asset classes:

| | • | | Subordinated interests in first mortgage real estate loans, or B Notes; |

| | • | | Mezzanine loans related to commercial real estate that is senior to the borrower’s equity position but subordinated to other third-party financing; |

| | • | | Commercial mortgage-backed securities, or CMBS; and |

| | • | | Joint venture investments, including joint venture interests in entities that own real estate, preferred equity and other higher-yielding structured debt and equity products. |

2

As of September 30, 2006, our investment portfolio of approximately $1,201.5 million in assets consisted of the following:

| | | | | | | | | | | | | | | | | |

| | | Carrying

Value | | Number of

Investments | | Percent of Total

Investments | | | Weighted Average | |

Security Description | | | | | Coupon | | | Yield to

Maturity | | | Loan to Value,

or LTV | |

| | | (In thousands) | | | | | | | | | | | | | | |

Whole loans(1) | | $ | 593,770 | | 24 | | 49.4 | % | | 6.76 | % | | 6.46 | % | | 69 | % |

B Notes | | | 155,302 | | 7 | | 12.9 | % | | 9.05 | % | | 9.06 | % | | 71 | % |

Mezzanine loans | | | 204,909 | | 11 | | 17.1 | % | | 9.40 | % | | 9.02 | % | | 69 | % |

CMBS | | | 189,578 | | 40 | | 15.8 | % | | 6.40 | % | | 8.31 | % | | — | |

Joint venture investments(2) | | | 57,914 | | 7 | | 4.8 | % | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,201,473 | | 89 | | 100.0 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) | Includes originated whole loans, acquired whole loans and bridge loans. |

| (2) | Includes our equity investment in two limited liability companies which are deemed to be variable interest entities, or VIEs, which we consolidate in our audited financial statements because we are deemed to be the primary beneficiary of these VIEs under Financial Accounting Standard Board Interpretation No. 46R, or FIN 46R. |

Our investment guidelines require us to maintain a geographically diverse portfolio of assets. Our initial investment focus is on opportunities in North America. Our board of directors may change these guidelines or initial investment focus at any time without the approval of our stockholders. As of September, 2006, our investment portfolio consisted of assets primarily located in four regions of the U.S., with approximately 27.0% of our investments located in the East, approximately 24.0% in the South, approximately 35.0% in the West and approximately 8.0% in the Midwest. The remaining 5.0% of our investments are located throughout the U.S.

Because we have elected to be taxed as a REIT and intend to operate our business so as to be excluded from regulation under the Investment Company Act of 1940, as amended, or the 1940 Act, we are required to invest a substantial majority of our assets in qualifying real estate assets, such as whole loans secured by mortgages and Qualifying B Notes, as defined herein. Therefore, the percentage of our assets we may invest in other types of investments will be limited, unless they are structured to comply with various U.S. federal income tax requirements for REIT qualification and the requirements for exclusion from 1940 Act registration.

CB Richard Ellis

CBRE (NYSE: CBG) is the largest global commercial real estate services firm, based on 2005 revenue, offering a full range of services to owners, lenders, tenants and investors in office, retail, industrial, multi-family and other commercial real estate. As of December 31, 2005, excluding affiliate and partner offices, CBRE operated in over 220 offices worldwide with approximately 14,500 employees. CBRE’s business is focused on several core competencies, including strategic advice and execution assistance for property leasing and sales, forecasting, valuations, origination and servicing of commercial mortgage loans, facilities and project management and real estate investment management. We believe CBRE is one of only three commercial real estate services companies with a global brand. As a result of this global brand recognition and geographic reach, large corporations, institutional owners and other owners and occupiers of real estate recognize CBRE as a leading provider of world-class, comprehensive real estate services. CBRE is a leader in many of the local markets in which it operates, including New York, Los Angeles, Chicago, London and Paris. CBRE has a well-balanced, highly diversified client base that includes more than 70 of the Fortune 100 companies.

3

CBRE Melody & Company

CBRE/Melody, a wholly-owned subsidiary of CBRE, is one of the largest originators of commercial real estate loans in the U.S. based on origination volume. CBRE/Melody originates and services commercial mortgage loans primarily through relationships established with investment banks, commercial banks, specialty lenders, insurance companies, pension funds and governmental agencies. As of December 31, 2005, including affiliate and partner offices, CBRE/Melody operated in 33 offices nationwide with approximately 294 employees, including 114 originators. CBRE’s mortgage loan origination and servicing operations are conducted exclusively through CBRE/Melody.

Our Business Strengths

Originating Investments. We source our investments through two primary channels: the affiliated CBRE system and our internal origination system. The combination of these systems allows us to evaluate a large number of investment opportunities. Our ability to have greater control over and access to the originating activities is directly tied to the principal investor relationship we share with a borrower. Our origination capabilities flow from our direct relationships with our borrowers in addition to acquiring investments from third party financial institutions and other intermediaries, where investments are underwritten, structured, priced and sold in the secondary market. As a result of our origination capabilities, we believe that we can create more efficient investment pricing and a more customized investment risk position for those investments we originate.

Access to CBRE. We have a significant business strength through our access to the resources and experience of CBRE, which includes the following:

| | • | | CBRE Sponsorship. Our relationship with CBRE, which had 14,500 employees as of December 31, 2005, provides us with access to borrowers, investors, origination and acquisition opportunities and the market knowledge gained through CBRE’s network of dedicated professionals. We believe that to replicate the scope of this platform and the services it provides to us would be cost prohibitive. Further, we believe this platform is highly scalable and will allow us to grow our operations and take advantage of and/or structure new financial products without additional significant infrastructure costs. |

| | • | | Extensive Origination Base. CBRE’s extensive and recognized origination platform consisting of approximately 114 originators in 33 offices, including affiliate and partner offices, as of December 31, 2005, with experience in originating, underwriting and structuring a myriad of real estate finance products in all geographic areas across the U.S. enables us to be a provider of real estate financial services that can offer financing solutions ranging from the most senior capital positions through subordinate interest to equity participations. |

| | • | | Strategic Relationships and Market Insight. CBRE’s strong relationships with real estate owners and developers, tenants, lenders, property managers and other financial institutions and financial services companies across the U.S. provide us with access to investment opportunities throughout the U.S. and complements the national relationship network of our senior management. Additionally, we have an Advisory Council that is made up of 23 CBRE executives and key CBRE/Melody originators from around the U.S. Their breadth and diversity of experience provide us with the perspective and influence of industry leaders across the U.S. in all aspects of commercial real estate. |

Dedicated Manager. Through at least the initial term of the management agreement, our Manager will be solely dedicated to the operations of our company. Our Manager has 24 employees, all of whom are fully dedicated to the operations of our Manager. We believe that these exclusive arrangements and the size and depth of our Manager’s team distinguish our arrangement with our Manager from many other externally-managed mortgage REITs.

4

Experienced Management Team. Our management team has significant experience in commercial real estate and has an average of over 20 years of experience in real estate investing and lending, including significant experience in originating and structuring real estate financial products, real estate capital markets, private equity investments, whole loan sales, match funding, finance, risk management, private equity fund formation and securitizations.

Product Diversity and Structuring Flexibility. Our ability to provide a wide range of financing products and our ability to customize financing structures to meet borrowers’ needs is one of our key business strengths. We are a full-service provider of real estate financing solutions capable of financing the most senior capital positions as well as subordinate interests and equity participations.

Disciplined Underwriting and Efficient Execution. Our underwriting involves comprehensive financial, structural, operational and legal due diligence to assess the risks of investments so that we can optimize pricing and structuring. With the knowledge, experience and relationships of our management team and CBRE, CBRE/Melody’s position as one of the U.S.’s leading commercial mortgage originators and servicers and the support of CBRE’s leasing, sales, appraisal, research and property management operations, we believe that we have the capability to underwrite quickly and efficiently any issue on any real estate asset.

Summary Risk Factors

An investment in shares of our common stock involves various risks. You should consider carefully the risks discussed below and under “Risk Factors” before purchasing our common stock.

| | • | | We have a limited operating history and our manager has limited experience operating a REIT and no prior experience operating a public company, therefore, our manager may not operate us successfully. |

| | • | | Our ability to achieve returns for our stockholders is dependent on our ability both to generate sufficient cash flow to pay distributions and to achieve capital appreciation, and we cannot assure you we will do either. |

| | • | | We are dependent upon our Manager and certain key personnel of our Manager and may not find a suitable replacement if our Manager terminates the management agreement or such key personnel are no longer available to us. |

| | • | | Our Manager is entitled to receive a base management fee which is tied to the amount of our equity and not to the performance of our investment portfolio, which could reduce its incentive to seek profitable opportunities for our portfolio. |

| | • | | Our Manager is entitled to incentive compensation based on our financial performance, which may lead it to place emphasis on the short-term maximization of funds from operations. This could result in increased risk to the value of our investment portfolio. |

| | • | | We may not terminate the management agreement between us and our Manager without cause until after December 31, 2008. Upon termination without cause after this initial term or upon a failure to renew the management agreement, we would be required to pay our Manager a substantial termination fee. These and other provisions in our management agreement make termination without cause or non-renewal difficult and costly. |

| | • | | We may change our investment strategy without stockholder consent, which could result in investments that are different, and possibly more risky, than the proposed investments we describe in this prospectus. |

| | • | | There are potential conflicts of interest in our relationship with our Manager, which could result in decisions that are not in the best interests of our stockholders. Our management agreement with our Manager was negotiated between related parties and its terms, including fees payable, may not be as favorable to us as if it had been negotiated with an unaffiliated third party. In addition, affiliates of our |

5

| | Manager may sponsor or manage other investment vehicles in the future with an investment focus similar to our focus, which could result in us competing for access to the benefits that we expect our relationship with our Manager to provide to us. |

| | • | | We leverage our investments and we are not limited in the amount of leverage we may use. Our use of leverage may have the effect of increasing losses when economic conditions are unfavorable. |

| | • | | The assets in which we invest are subject to the credit risk of the underlying real estate collateral and in the event of default of such real estate collateral and the exhaustion of any underlying or additional credit support, we may not recover our full investment. |

| | • | | The yields on our investments may be sensitive to changes in prevailing interest rates and changes in prepayment rates, which may result in a mismatch between our asset yields and borrowing rates and consequently reduce or eliminate income derived from our investments or result in losses. |

| | • | | We have not established a minimum distribution payment level and we cannot assure you of our ability to make distributions in the future. If we make distributions from uninvested offering proceeds, or borrow to make distributions, which would generally be considered to be a return of capital for tax purposes, our future earnings and cash available for distribution may be reduced from what they otherwise would have been. |

| | • | | If we fail to qualify as a REIT, we will be subject to income tax at regular corporate rates, which would reduce the amount of cash available for distribution to our stockholders and adversely affect the value of our stock. |

| | • | | The REIT qualification rules impose limitations on the types of investments and activities which we may undertake, including limitation on our use of hedging transactions and derivatives, and these limitations may, in some cases, preclude us from pursuing the most economically beneficial investment alternatives. |

| | • | | If our CDO issuers we hold equity in and that are taxable REIT subsidiaries are subject to U.S. federal income tax at the entity level, it would greatly reduce the amounts those entities would have available to distribute to us and to pay their creditors. |

| | • | | Because we intend to operate in such a manner to be excluded from regulation as an investment company under the 1940 Act, the assets that we may acquire are limited by the provisions of the 1940 Act and the rules and regulations promulgated thereunder. |

| | • | | If we fail to acquire and maintain assets meeting the requirements to be excluded from regulation as an investment company under the 1940 Act, we would have to register as an investment company, which would adversely affect our business. |

Our Business Strategy

Our business strategy is to, over time, generate a diversified portfolio of commercial real estate investments and leverage these investments to produce attractive total returns to our stockholders. We believe that we have access to many investment and finance opportunities that emerge from our affiliation with CBRE. We source our investments through two primary channels: the affiliated CBRE system and our internal origination system. We believe that the relationships and the market insight provided by our affiliation with CBRE combined with the broad experience of our management team allow us to anticipate market trends and provide a wide variety of products to a diverse borrower base in multiple asset classes. This enables us to adjust our investment strategy to take advantage of market opportunities and structure our financing products in order to meet the needs of our borrower clients.

6

In each financing transaction we undertake, we seek to control as much of the capital structure as possible. We generally seek to accomplish this through the direct origination of whole loans and other investments, the ownership of which permits a wide variety of syndication and securitization executions. By providing a single source of financing to a borrower, we intend to streamline the lending process, give greater certainty to the borrower and retain the portion of the capital structure that will generate what we believe to be the most attractive and appropriate total returns based on our risk assessment of the investment.

We intend to diligently grow and manage our portfolio with the objective of providing attractive total returns to our investors through a combination of dividends and capital appreciation. We generate income principally from the spread between the yields on our assets and the cost of our borrowing and hedging activities. Future distributions and capital appreciation are not guaranteed, however, and we have only limited operating history and REIT experience upon which you can base an assessment of our ability to achieve our objectives.

Our ability to manage our real estate risk is a critical component of our success. We actively manage and maintain the credit quality of our portfolio by using our management team’s expertise in structuring and repositioning investments to improve the quality and yield on managed investments.

Our Financing Strategy

General Policies. We finance the acquisition of our investments primarily by borrowing against or “leveraging” our existing portfolio and using the proceeds to acquire additional investments as well as through capital raises. Our leverage policy permits us to leverage up to 80% of the total value of our assets. We anticipate our overall leverage will be between 70% and 80% of the total value of our assets; but our actual leverage will depend on our mix of assets. Our charter and bylaws do not limit the amount of indebtedness we can incur, and our board of directors has discretion to deviate from or change our indebtedness policy at any time. We use leverage for the sole purpose of financing our portfolio and not for the purpose of speculating on changes in interest rates. Our financing strategy focuses on the use of match-funded financing structures. This means that we seek to match the maturities and/or repricing schedules of our financial obligations with those of our investments to minimize the risk that we have to refinance our liabilities prior to the maturities of our assets and to reduce the impact of changing interest rates on earnings.

Warehouse Facilities. We use short-term financing, in the form of warehouse facilities. Warehouse lines are typically collateralized loans made to investors who invest in securities and loans that in turn pledge the resulting securities and loans to the warehouse lender. As of September 30, 2006, we had outstanding obligations under five master repurchase agreements totaling $242.1 million with a weighted average borrowing rate of 6.30%. As of September 30, 2006, we had outstanding obligations under one mortgage loan purchase agreement totaling $169.7 million with a weighted average borrowing rate of 6.09%. The borrowings under this facility were paid off on October 4, 2006 and the facility was closed.

Collateralized Debt Obligations. For longer-term funding, we utilize securitization structures, particularly CDOs, as well as other match-funded financing structures. We believe CDO financing structures are an appropriate financing vehicle for our targeted real estate asset classes, because they will enable us to obtain long-term match-funded cost of funds and minimize the risk that we have to refinance our liabilities prior to the maturities of our investments while giving us the flexibility to manage credit risk and, subject to certain limitations, to take advantage of profit opportunities. As of September 30, 2006, we had capitalized our CDO subsidiary with $47.25 million of common and preferred equity and held $44.25 million of debt in our CDO subsidiary.

7

Sourcing Potential Investment Opportunities

We recognize that investing in our targeted asset classes is highly competitive, and that we compete with many other mortgage REITs, specialty finance companies and other lenders for profitable investment opportunities. Given this competitive environment, it is important for us to have access to the broadest supply of new investment and finance opportunities, which we refer to as our gross origination flow, so that we can be highly selective in those opportunities that we decide to pursue. We source our investment opportunities through two primary channels: the affiliated CBRE system and our internal origination system.

Affiliated CBRE System. We believe that CBRE/Melody has one of the strongest and most active origination systems in the U.S. CBRE/Melody’s 114 originators are located throughout the major markets and their primary goal is to find the best capital source for their borrowers and clients. CBRE/Melody generated more than $17.8 billion of mortgage loans, joint venture equity, bridge loans, construction loans, net leased finance, whole loan dispositions and other combined real estate transactions in approximately 1,300 transactions in 2005. We believe our affiliation with CBRE and CBRE/Melody is a distinct advantage for us in sourcing, analyzing and managing investments across all of our product types. All of our Manager’s investment professionals have direct and substantial interaction with sales, leasing and financing brokers within CBRE and CBRE/Melody. As a result, we are introduced to numerous investment opportunities. The volume of potential investments originated through this affiliation allows us to be highly selective about those opportunities we seek to pursue in order to meet our financial and operating objectives. Of our approximately $1,201.5 million of investments held as of September 30, 2006, approximately 52.7% was sourced through the affiliated CBRE system.

Our Internal Origination System. Our management team’s deep experience in all aspects of real estate lending, investment, capital markets and management also provides us with a valuable origination system. Over the years, our management team has developed extensive relationships with borrowers, sellers of whole loans, various financial institutions and other financial intermediaries throughout the U.S. These relationships provide us with a broad range of investment and finance opportunities, including seasoned loans, purchased securities and private equity. The depth and diversity of these relationships will provide us with investment and finance opportunities across all major product types and markets.

Conflicts of Interests

We are entirely dependent upon our Manager for our day-to-day management and do not have any independent officers. Ray Wirta, our chairman, is the vice chairman of CBRE and Michael Melody, one of our directors, is the vice chairman of CBRE/Melody. Our chairman, chief executive officer, chief financial officer and executive vice presidents also serve as officers of our Manager. As a result, we, our Manager, our executive officers and directors and CBRE may face conflicts of interests because of our relationships with each other. These conflicts include the following:

| | • | | The management agreement between us and our Manager was negotiated between related parties, and the terms, including fees payable, may not be as favorable to us as if it had been negotiated with an unaffiliated third party. The interests of these officers and directors in the affairs of CBRE and CBRE/Melody, respectively, may conflict from time to time with our interests. |

| | • | | CBRE or its affiliates provide various services to our company, including but not limited to, the provision of certain research, appraisal and servicing activities for which CBRE and its affiliates are provided market rate fees. Although such arrangements are approved by a majority of our independent directors, they are negotiated among related parties. |

| | • | | We have not adopted a policy that expressly prohibits our directors, officers, security holders or affiliates from having a direct or indirect pecuniary interest in any investment to be acquired or disposed of by us or any of our subsidiaries or in any transaction to which we or any of our subsidiaries is a party or has an interest. Nor do we have a policy that expressly prohibits any such persons from engaging for |

8

| | their own account in business activities of the types conducted by us. However, our code of business conduct and ethics contains a conflict of interest policy that prohibits our directors, officers and employees from engaging in any transaction that involves an actual or apparent conflict of interest with us. |

| | • | | The compensation we pay to our Manager consists of both a base management fee that is not tied to our performance and an incentive management fee that is based entirely on our performance. The risk of the base management fee component is that it may not provide sufficient incentive to our Manager to seek to achieve attractive returns to us. The risk of incentive management fee component is that it may cause our Manager to place undue emphasis on the maximization of short-term funds from operations at the expense of other criteria, such as preservation of capital, in order to achieve a higher incentive fee. Investments with higher yield potential are generally riskier or more speculative. This could result in increased risk to the value of our investment portfolio. |

| | • | | Our Manager does not assume any responsibility beyond the duties specified in the management agreement and will not be responsible for any action of our board of directors in following or declining to follow its advice or recommendations. Our Manager and its officers, managers, employees and affiliates will not be liable to us, our directors or our stockholders for, and we have agreed to indemnify them for all claims and damages arising from, acts or omissions performed in good faith in accordance with and pursuant to the management agreement, except by reason of acts constituting bad faith, willful misconduct, gross negligence, or reckless disregard of their duties under the management agreement. As a result, we could experience poor performance or losses for which our Manager would not be liable. |

Conflicts of Interests Resolution Policies

We have implemented several policies, through board action and through the terms of our constituent documents and of our agreements with CBRE, to help address potential conflicts of interest:

| | • | | Our board of directors has adopted a policy that a majority of our board of directors will be independent directors, and that a majority of our independent directors must make any determinations on our behalf with respect to the relationships or transactions that present a conflict of interest for our directors or officers. |

| | • | | Our board of directors has adopted a policy that decisions concerning our management agreement with our Manager, including termination, renewal and enforcement thereof, or concerning any acquisition of assets from CBRE or its affiliates or other participation in any transactions with CBRE or its affiliates outside of the management agreement must be reviewed and approved by a majority of our independent directors. |

| | • | | Our management agreement provides that our determinations to terminate the management agreement for cause or because the management fees are unfair to us or because of a change in control of our Manager will be made by a majority vote of our independent directors. |

| | • | | Our independent directors will periodically review the general investment standards established for our Manager under the management agreement. |

| | • | | Our management agreement with our Manager provides that our Manager may not assign certain duties under the management agreement, except to certain of its affiliates, without the approval of a majority of our independent directors. |

9

Management Agreement

We have entered into a management agreement with our Manager that provides for the day-to-day management of our operations. The management agreement requires our Manager to manage our business affairs in conformity with the policies and the investment guidelines that are approved and monitored by our board of directors. Our Manager’s role as manager is under the supervision and direction of our board of directors.

The initial term of the management agreement expires on December 31, 2008 and will be automatically renewed for a one-year term each anniversary date thereafter. After the initial term, our independent directors will review our Manager’s performance annually and the management agreement may be terminated annually based upon (i) unsatisfactory performance that is materially detrimental to us (as determined by (1) the affirmative vote of at least two-thirds of our independent directors, or (2) a vote of the holders of at least a majority of the outstanding shares of our common stock), or (ii) a determination by our independent directors that the compensation payable to our Manager are not fair, subject to our Manager’s right to prevent such a compensation termination by accepting a mutually acceptable reduction of management fees. A termination fee will be paid to our Manager upon such termination. We may also terminate the management agreement with 60 days’ prior written notice from our board of directors, without payment of a termination fee, for cause, as defined in the management agreement.

Pursuant to the management agreement, our Manager is entitled to receive a base management fee, incentive compensation and, in certain circumstances, a termination fee and reimbursement of certain expenses as described in the management agreement. The following table summarizes the fees payable to our Manager pursuant to the management agreement.

| | |

Fee | | Summary Description |

Base Management Fee | | Payable monthly in arrears in an amount equal to 1/12th of the sum of (i) 2.0% of the first $400 million of our gross stockholders’ equity (as defined in the management agreement), or equity, (ii) 1.75% of our equity in an amount in excess of $400 million and up to $800 million and (iii) 1.50% of our equity in excess of $800 million. Our Manager uses the proceeds from its management fee in part to pay compensation to its officers and employees who, notwithstanding that certain of them also are our officers, receive no cash compensation directly from us. |

| |

Incentive Fee | | Payable quarterly in an amount equal to the product of: • 25% of the dollar amount by which • our Funds From Operations (as defined in the management agreement) (after the base management fee and before incentive compensation) per share of our common stock for such quarter (based on the weighted average number of shares outstanding for such quarter) • exceeds an amount equal to • the weighted average of the price per share of our common stock in our June 2005 private offering and our October 2006 initial public offering, and the prices per share of our common stock in any subsequent offering by us, in each case at the time of issuance thereof, multiplied by the greater of • 2.25% or |

10

| | |

Fee | | Summary Description |

| |

| | • 0.75% plus one-fourth of the Ten Year Treasury Rate (as defined in the management agreement) for such quarter; • multiplied by the weighted average number of shares of our common stock outstanding during such quarter. |

| |

Termination Fee | | Payable upon termination without cause or non-renewal of the management agreement in an amount equal to three times the sum of the annual base management fee and the annual incentive compensation earned by our Manager during the previous 12-month period immediately preceding the date of termination, calculated as of the end of the most recently completed fiscal quarter prior to the date of termination. |

For the three months and nine months ended September 30, 2006 and the period from June 9, 2005, the date we commenced operations, through December 31, 2005, our Manager had earned base management fees of approximately $1.6 million, $4.4 million and $3.2 million, respectively. We did not accrue or pay any incentive fees through September 30, 2006.

Our Distribution Policy

U.S. federal income tax law requires that a REIT distribute annually at least 90% of its REIT taxable income, determined without regard to the deduction for dividends paid and excluding net capital gain.

In order to maintain our REIT qualification and to generally not be subject to U.S. federal income and excise tax, we intend to make regular quarterly distributions of all or substantially all of our net taxable income to holders of our common stock. Any future distributions we make will be at the discretion of our board of directors and will depend upon, among other things, our actual results of operations. These results and our ability to pay distributions will be affected by various factors, including the net interest and other income from our portfolio, our operating expenses and any other expenditures.

On October 19, 2005, we declared a quarterly distribution of $0.06 per share of our common stock which was paid on November 15, 2005 to stockholders of record as of October 28, 2005 solely from earnings and profits. On December 27, 2005, we declared a quarterly distribution of $0.13 per share of our common stock which was paid on January 13, 2006 to stockholders of record as of December 28, 2005 solely from earnings and profits. On April 7, 2006, we declared a quarterly distribution of $0.17 per share of our common stock which was paid on April 25, 2006 to stockholders of record as of April 14, 2006 solely from earnings and profits. On June 20, 2006, we declared a quarterly distribution of $0.18 per share of our common stock which was paid on July 17, 2006 to stockholders of record as of June 30, 2006 solely from earnings and profits. On September 5, 2006, we declared a quarterly distribution of $0.28 per share of our common stock which was paid on October 11, 2006 to stockholders of record as of September 18, 2006 solely from earnings and profits. All distributions out of earnings and profits were funded through cash flows from operating activities from the quarter in which such distribution was paid or accumulated from prior periods; provided, however, that approximately $0.09 per share of the distribution paid on July 17, 2006 was funded from cash flows from operating activities and $0.09 per share from financing activities primarily from realized gains on derivatives. We cannot assure you that we will have sufficient cash available for future quarterly distributions at this level, or at all.

To the extent that our cash available for distribution is less than 90% of our REIT taxable income, we may consider various funding sources to cover any such shortfall, including borrowing under our warehouse facilities,

11

selling certain of our assets or future offerings. Our distribution policy enables us to review the alternative funding sources available to us from time to time.

Exclusion From Regulation Under the 1940 Act

We conduct our operations so that we are not required to register as an investment company. Under Section 3(a)(1) of the 1940 Act, a company is not deemed to be an “investment company” if:

| | • | | it neither is, nor holds itself out as being, engaged primarily, nor proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or |

| | • | | it neither is engaged nor proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and does not own or propose to acquire “investment securities” having a value exceeding 40% of the value of its total assets on an unconsolidated basis, or the 40% Test. “Investment securities” excludes U.S. government securities and securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) of the 1940 Act. |

Because we are a holding company that will conduct our businesses through wholly-owned or majority-owned subsidiaries, the securities issued by our subsidiaries that are excepted from the definition of “investment company” under Section 3(c)(1) or Section 3(c)(7) of the 1940 Act, together with any other investment securities we may own, may not have a combined value in excess of 40% of the value of our total assets on an unconsolidated basis. This requirement limits the types of businesses in which we may engage through our subsidiaries.

CBRE Realty Finance Holdings, LLC, our subsidiary that holds, through wholly-owned subsidiaries, substantially all of our real-estate-related securities, also intends to conduct its operations so that it is not required to register as an investment company because less than 40% of the value of its total assets on an unconsolidated basis will consist of “investment securities.” CBRE Realty Finance Holdings, LLC in the future may seek to be exempt from 1940 Act regulation under Section 3(c)(5)(C). Certain of the wholly-owned subsidiaries of CBRE Realty Finance Holdings, LLC intend to be exempt from 1940 Act regulation under Section 3(c)(5)(C). Any entity relying on Section 3(c)(5)(C) for its 1940 Act exemption must have at least 55% of its portfolio invested in qualifying real estate assets (which, in general, must consist of whole mortgage loans and other liens on and interests in real estate) and another 25% of its portfolio invested in other real estate-related assets.

Based on no-action letters issued by the Staff of the Securities and Exchange Commission, or the SEC, we classify our investments in whole loans as qualifying real estate assets, as long as the loans are “fully secured” by an interest in real estate. That is, if the loan-to-value ratio of the loan is equal to or less than 100%, then we consider the loan a qualifying real estate asset. We do not consider loans with loan-to-value ratios in excess of 100% to be qualifying real estate assets that come within the 55% basket, but only real estate-related assets that come within the 25% basket. With respect to our investments in B Notes, we take the position that B Notes are qualifying real estate assets that come within the 55% basket, or Qualifying B Notes, where we have the unilateral right to (i) instruct the servicer to foreclose on a defaulted mortgage loan, (ii) replace the servicer in the event the servicer, in its discretion, elects not to foreclose on such a loan, and (iii) purchase the A Note in the event of a default on the mortgage loan and foreclose on the loan. We note that the SEC Staff has not provided any guidance on the treatment of B Notes for Section 3(c)(5)(C) purposes and any such guidance may require us to adjust our B Note investment strategy. We will treat our mezzanine loans and our CMBS investments as real estate-related assets that come within the 25% basket. Our joint venture investments may constitute qualifying real estate assets if we have the right to approve certain major decisions affecting the joint venture. The treatment of other investments as qualifying real estate assets and real estate-related assets is based on the characteristics of the underlying collateral and the particular type of loan including whether we have foreclosure rights with respect to those securities or loans that have underlying real estate collateral.

12

Because CBRE Realty Finance Holdings, LLC will not be relying on Section 3(c)(1) or 3(c)(7) for its 1940 Act exemption, our investment therein will not constitute an “investment security” for purposes of the 40% Test. We believe that CBRE Realty Finance TRS, Inc., our TRS, is exempted from 1940 Act regulation under Section 3(c)(7) of the 1940 Act. Therefore, our investment in our TRS will constitute an “investment security” for purposes of the 40% Test. Our CDO subsidiary is a QRS, that is expected to be exempted under the 1940 Act under Section 3(c)(5)(C). Additionally, we expect to form separate subsidiaries for each additional CDO or other securitizations we sponsor. We expect that each such subsidiary will rely on the exception provided by Section 3(c)(5)(C) or 3(c)(7) under the 1940 Act.

The determination of whether an entity is a majority-owned subsidiary of our company is made by us. The 1940 Act defines a majority-owned subsidiary of a person as a company 50% or more of the outstanding voting securities of which are owned by such person, or by another company which is a majority-owned subsidiary of such person. The 1940 Act further defines voting securities as any security presently entitling the owner or holder thereof to vote for the election of directors of a company. We treat companies, including CDO subsidiaries, in which we own at least a majority of the outstanding voting securities as majority-owned subsidiaries for purposes of the 40% Test. We have not requested the SEC to approve our treatment of any company as a majority-owned subsidiary and the SEC has not done so. If the SEC were to disagree with our treatment of one or more companies, including CDO subsidiaries, as majority-owned subsidiaries, we would need to adjust our investment strategy and invest our assets in order to continue to pass the 40% Test. Any such adjustment in our investment strategy could have a material adverse effect on us.

We may seek a no-action letter from the SEC Staff regarding how certain of our investment strategies fit within the exclusions from regulation under the 1940 Act that we and our subsidiaries are using. To the extent that the SEC Staff provides more specific guidance regarding the treatment of assets as qualifying real estate assets or real estate-related assets, we may be required to adjust our investment strategy accordingly. Any additional guidance from the SEC Staff could provide additional flexibility to us, or it could further inhibit our ability to pursue the investment strategy we have chosen.

If we or our subsidiaries fail to maintain our exclusions or exemptions from the 1940 Act, we would become subject to substantial regulation with respect to our capital structure (including our ability to use leverage), management, operations, transactions with affiliated persons (as defined in the 1940 Act), and portfolio composition, including restrictions with respect to diversification and industry concentration and other matters. Compliance with the 1940 Act will, accordingly, limit our ability to make certain investments.

Our Formation and Structure

We were organized as a Maryland corporation in May 2005 and completed a private offering of our common stock in June 2005 in which we raised net proceeds of approximately $282.5 million. Credit Suisse Securities (USA) LLC, Deutsche Bank Securities Inc., Banc of America Securities LLC and Citigroup Global Markets Inc. served as the initial purchasers/placement agents in the private offering. CBRE, through one of its affiliates, purchased from us 1,100,000 shares of our common stock in the private offering, representing 5.1% of our common stock on a fully-diluted basis as of December 31, 2005. Certain of our executive officers and directors and certain executive officers and directors of CBRE and CBRE/Melody purchased 964,101 shares of our common stock in that offering, representing 4.5% of our common stock on a fully-diluted basis as of December 31, 2005. Additionally, certain other employees of CBRE and CBRE/Melody purchased 732,114 shares of our common stock in that offering, representing 3.4% of our common stock on a fully-diluted basis as of December 31, 2005. Upon completion of our June 2005 private offering, we granted to our Manager, its employees and certain of its related persons 565,087 shares of restricted stock and options to purchase 813,600 shares of our common stock with an exercise price of $15.00 per share, representing 6.5% of our common stock on a fully-diluted basis as of December 31, 2005. Additionally, 34,913 shares of restricted stock and options to

13

purchase 186,400 shares of our common stock were made available for issuance to our Manager or to employees or other related parties of our Manager as directed by our Manager. Upon completion of our June 2005 private offering, we granted to our directors 2,668 shares of restricted stock in the aggregate. In January 2006, we granted to certain employees of our Manager 119,500 shares of restricted stock, net of forfeitures (34,913 shares of which were issued at the direction of our Manager in accordance with the previous sentence) and options to purchase 66,550 shares of our common stock, net of forfeitures (all of which were issued at the direction of our Manager in accordance with the previous sentence), with an exercise price of $15.00 per share. In August 2006, two former employees of our Manager forfeited 20,300 shares of restricted stock and options to purchase 18,100 shares of our common stock. Additionally, in August 2006, we granted to certain employees of CBRE/Melody options to purchase 17,850 shares of our common stock, with an exercise price of $15.00 per share. In September 2006, 10,833 shares of restricted stock and options to purchase 6,667 shares were forfeited by former employees of our Manager, and additional options to purchase 2,000 shares were granted to one of these former employees.

Our investment activities are managed by our Manager and, through it, by CBRE and CBRE/Melody, which we consider to be our promoters, and are supervised by our investment committee and board of directors. Ray Wirta, vice chairman and director of CBRE and chairman of our Manager, is our chairman. Michael Melody, the executive managing director of our Manager and vice chairman of CBRE/Melody, is one of our directors.

14

The following chart illustrates the structure and ownership of our company after this offering on a fully-diluted basis, and the management relationship between our Manager and us as of December 12, 2006.

| (1) | Excludes shares of common stock beneficially owned by Mr. Ray Wirta, our chairman, and Mr. Michael Melody, one of our directors, and includes 1,791,595 shares of common stock owned by certain other officers, directors and other employees of CBRE and CBRE/Melody and our Manager. |

| (2) | The remainder is owned in the aggregate by our executive officers and certain executives or other employees of CBRE/Melody. |

Registration Rights and Lock-Up Agreements

Registration Rights Agreement. Pursuant to a registration rights agreement among us, Credit Suisse Securities (USA) LLC, Banc of America Securities LLC, Citigroup Global Markets Inc. and Deutsche Bank Securities Inc., for the benefit of certain holders of our common stock, entered into on June 9, 2005, which we refer to as the registration rights agreement, we were required, among other things, to file with the SEC by March 6, 2006, the resale shelf registration statement of which this prospectus is a part, registering all of the 20,000,000 shares of common stock purchased or placed by Credit Suisse Securities (USA) LLC, Banc of America Securities LLC, Citigroup Global Markets Inc. and Deutsche Bank Securities Inc. in our June 2005 private offering (excluding the 1,067,604 shares registered and sold by certain selling stockholders in our October 2006 initial public offering). We are also registering by this resale shelf registration statement 22,355 shares of restricted stock, net of forfeitures, issued by us to our independent directors and certain employees of the Manager, pursuant to our 2005 equity incentive plan, 600,000 shares of restricted stock and 909,000 shares of common stock underlying options issued to our Manager upon the completion our June 2005 private offering, which restricted stock and options have been subsequently allocated by the Manager to its employees or other

15

related parties, at the its discretion. The resale shelf registration statement of which this prospectus is a part was initially filed on December 14, 2006. We are required under the registration rights agreement to use our commercially reasonable efforts to cause the resale shelf registration statement of which this prospectus is a part to become effective under the Securities Act as promptly as practicable after the filing (and to maintain the resale shelf registration statement continuously effective under the Securities Act for a specified period).

We will be permitted to suspend the use, from time to time, of the registration statement of which this prospectus is a part (and therefore suspend sales under the registration statement) for certain periods, referred to as “blackout periods,” if:

| | • | | the lead underwriter in any underwritten public offering by us of our common stock advises us that an offer or sale of shares covered by the registration statement would have a material adverse effect on our offering; |

| | • | | our board of directors determines in good faith that the sale of shares covered by the registration statement would materially impede, delay or interfere with any proposed financing, offer or sale of securities, acquisition, corporate reorganization or other significant transaction involving our company; or |

| | • | | our board of directors determines in good faith that it is in our best interests or it is required by law that we supplement the registration statement or file a post-effective amendment to the registration statement in order to ensure that the prospectus included in the registration statement contains the financial information required under Section 10(a)(3) of the Securities Act, discloses any fundamental change in the information included in the prospectus or discloses any material information with respect to the plan of distribution that was not disclosed in the registration statement or any material change to that information, |

and we provide the stockholders notice of the suspension. The cumulative blackout periods in any 12 month period commencing on the closing of the offering may not exceed an aggregate of 90 days and furthermore may not exceed 45 consecutive days, except as a result of a refusal by the SEC to declare any post-effective amendment to the registration statement as effective after we have used all commercially reasonable efforts to cause the post-effective amendment to be declared effective, in which case, we must terminate the blackout period immediately following the effective date of the post-effective amendment.

Lock-up Agreements. Subject to certain exceptions, we, our directors and officers, members of our Investment Committee, our Manager, CBRE and their affiliates have agreed to be bound by lock-up agreements that prohibit us and them from selling, pledging, transferring or otherwise disposing of any of our common stock or securities convertible into our common stock for 180 days after September 27, 2006 (March 26, 2007), the date of the prospectus relating to our October 2006 initial public offering. Credit Suisse Securities (USA) LLC, Deutsche Bank Securities Inc., Citigroup Global Markets Inc. and Wachovia Capital Markets, LLC may, in their discretion, release all or any portion of the common stock subject to the lock-up agreements with our directors and officers at any time without notice or stockholder approval, in which case our other stockholders would also be released from the restrictions pursuant to the registration rights agreement.

Place of Business

Our principal office is located at City Place 1, 185 Asylum Street, 37th Floor, Hartford, CT 06103 and our telephone number is (860) 275-6200. We believe that our office facilities are suitable and adequate for our business as it is conducted. Our website is located athttp://www.cbrerealtyfinance.com. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this prospectus or any other report or document we file with or furnish to the SEC.

16

Summary Consolidated Financial Information

The following table presents summary historical consolidated financial information as of September 30, 2006, for the three months and nine months ended September 30, 2006 and for the period May 10 (inception) to December 31, 2005. The summary historical consolidated financial information as of December 31, 2005 and for the period May 10, 2005 (inception) to December 31, 2005 presented below under the captions “Consolidated Income Statement Data” and “Consolidated Balance Sheet Data” have been derived from our consolidated financial statements audited by Ernst & Young LLP, an independent registered public accounting firm, whose report with respect thereto is included elsewhere in this prospectus. The summary historical condensed consolidated financial information as of September 30, 2006 and for the three month period and for the nine month period then ended have been derived from our unaudited condensed consolidated financial statements included elsewhere in the prospectus. Since the information presented below is only a summary and does not provide all of the information contained in our historical consolidated financial statements, including the related notes, you should read it in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements, including the related notes, included elsewhere in this prospectus.

| | | | | | | | | | | |

| | | For the Three

Months Ended

September 30, 2006 | | | For the Nine

Months Ended

September 30, 2006 | | | For the Period

May 10, 2005

(inception) to

December 31, 2005 |

| | | (unaudited) | | | (unaudited) | | | |

| | | (in thousands, except per share and share data) |

Consolidated Income Statement Data: | | | | | | | | | | | |

Revenues: | | | | | | | | | | | |

Investment income | | $ | 18,109 | | | $ | 42,017 | | | $ | 9,342 |

Real estate operating income | | | 1,705 | | | | 3,802 | | | | — |

Other income | | | 877 | | | | 2,602 | | | | 3,057 |

| | | | | | | | | | | |

Total revenue | | | 20,691 | | | | 48,421 | | | | 12,399 |

| | | | | | | | | | | |

Expenses: | | | | | | | | | | | |

Interest expense | | | 13,273 | | | | 27,940 | | | | 2,664 |

Management fees | | | 1,595 | | | | 4,444 | | | | 3,158 |

Property operating expenses | | | 858 | | | | 1,734 | | | | — |

Other general and administrative expenses (including $950, $768, $2,779 and $953, respectively, of stock-based compensation) | | | 2,441 | | | | 6,925 | | | | 5,549 |

Depreciation and amortization | | | 487 | | | | 1,165 | | | | — |

| | | | | | | | | | | |

Total expenses | | | 18,654 | | | | 42,208 | | | | 11,371 |

| | | | | | | | | | | |

Gain on sale of investment | | | 410 | | | | 258 | | | | — |

Gain (loss) on derivatives | | | (1 | ) | | | 3,634 | | | | 24 |

| | | | | | | | | | | |

Income (loss) from continuing operations before equity in net income of unconsolidated joint ventures | | | 2,446 | | | | 10,105 | | | | — |

Equity in earnings of unconsolidated joint ventures | | | (187 | ) | | | 50 | | | | — |

| | | | | | | | | | | |

Net income (loss) before minority interest | | | 2,259 | | | | 10,155 | | | | — |

Minority interest | | | (20 | ) | | | (41 | ) | | | — |

| | | | | | | | | | | |

Net income (loss) | | $ | 2,279 | | | $ | 10,196 | | | $ | 1,052 |

| | | | | | | | | | | |

Weighted-average number of common stock outstanding: | | | | | | | | | | | |

Basic | | | 20,484,286 | | | | 20,177,897 | | | | 20,000,000 |

| | | | | | | | | | | |

Diluted | | | 20,579,115 | | | | 20,313,795 | | | | 20,108,317 |

| | | | | | | | | | | |

Earnings per share of common stock: | | | | | | | | | | | |

Basic | | $ | 0.11 | | | $ | 0.51 | | | $ | 0.05 |

| | | | | | | | | | | |

Diluted | | $ | 0.11 | | | $ | 0.50 | | | $ | 0.05 |

| | | | | | | | | | | |

Dividends declared per share of common stock | | $ | 0.28 | | | $ | 0.63 | | | $ | 0.19 |

| | | | | | | | | | | |

17

| | | | | | |

| | | As of

September 30, 2006 | | As of

December 31, 2005 |

| | | (in thousands) |

Consolidated Balance Sheet Data:(1) | | | | | | |

Total investments, net | | $ | 1,201,473 | | $ | 538,068 |

Total assets | | $ | 1,353,469 | | $ | 623,718 |

Repurchase obligations | | $ | 411,785 | | $ | 304,825 |

Mortgages payable | | $ | 49,503 | | $ | 25,001 |

Bonds payable | | $ | 508,500 | | $ | — |

Total liabilities | | $ | 1,073,528 | | $ | 343,651 |

Minority interest | | $ | 859 | | $ | 436 |

Stockholders’ equity | | $ | 279,082 | | $ | 279,631 |

| (1) | Aggregates our loans and other lending investments, net; CMBS, at fair value; and real estate, net line items from our balance sheet. The real estate, net represents two joint venture investments as of September 30, 2006 (one as of December 31, 2005) that are considered VIEs that we consolidate under Financial Accounting Standard Board Interpretation No. 46R, or FIN 46R, because we are deemed to be the primary beneficiary of the VIEs. These interests are reflected on our balance sheet separately as real estate, net of $64,293 as of September 30, 2006 and $31,923 as of December 31, 2005, mortgage indebtedness of $49,503 as of September 30, 2006 and $25,001 as of December 31, 2005 and minority interest of $859 as of September 30, 2006 and $436 as of December 31, 2005, with other amounts of $2,434 as of September 30, 2006 and $1,803 as of December 31, 2005, net, in relevant other balance sheet line items which in the aggregate net out to $16,366 as of September 30, 2006 and $8,289 as of December 31, 2005. We disclose the net amount above in the consolidated balance sheet data under total investments, net. |

18

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in this prospectus. If any of the risks discussed in this prospectus occurs, our business, financial condition, liquidity and results of operations could be materially and adversely affected. If this were to happen, the price of our common stock could decline significantly and you could lose all or a part of your investment.

Risks Related To Our Business

We have a limited operating history and limited experience operating as a REIT and we may not be able to successfully operate our business or generate sufficient revenue to make or sustain dividends to stockholders.

We have a limited operating history and limited experience operating as a REIT. We are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objectives as described in this prospectus and that the value of your investment could decline substantially. Our ability to achieve attractive total returns to our stockholders is dependent on our ability both to generate sufficient cash flow to pay an attractive dividend and to achieve capital appreciation, and we cannot assure you we will do either. There can be no assurance that we will be able to generate sufficient revenue from operations to pay our operating expenses and make distributions to stockholders.

The U.S. federal income tax laws impose numerous constraints on the operations of REITs. Our Manager’s limited experience in managing a portfolio of assets under such constraints may hinder its ability to achieve our investment objective. In addition, maintaining our REIT qualification limits the types of investments we are able to make. Our investors did not acquire an interest in CBRE, CBRE/Melody or their subsidiaries through our October 2006 initial public offering. We can offer no assurance that our Manager will replicate CBRE’s or CBRE/Melody’s historical success or our management team’s success in its previous endeavors, and we caution you that our investment returns could be substantially lower than the returns achieved by those funds or previous endeavors.

We are dependent upon our Manager and certain key personnel of CBRE and CBRE/Melody provided to us through our Manager and may not find a suitable replacement if our Manager terminates the management agreement or such key personnel are no longer available to us.

We have no employees. Our officers are employees of our Manager. We have no separate facilities and are completely reliant on our Manager, which has significant discretion as to the implementation of our operating policies and strategies. We depend on the diligence, skill and network of business contacts of the management of our Manager, and, through our Manager, of CBRE and CBRE/Melody. The management team of our Manager evaluates, negotiates, structures, closes and monitors our investments. We believe that our success depends on the continued service of the management team of our Manager, including Keith Gollenberg, Michael Angerthal, James Evans, Paul Martin and Thomas Podgorski. The departure of any of the members of the management of our Manager, or a significant number of the investment professionals of our Manager could have a material adverse effect on our performance. We are also subject to the risk that our Manager will terminate the management agreement and that no suitable replacement will be found to manage us. We can offer no assurance that our Manager will remain our external manager or that we will continue to have access to our Manager’s, CBRE’s or CBRE/Melody’s principals and professionals or their information or deal flow. If our Manager terminates the management agreement, key officers leave our Manager or we do not have access to CBRE’s or CBRE/Melody’s principals and professionals or their information or deal flow, we may be unable to execute our business plan.

Termination of our management agreement would be costly.

Termination of the management agreement with our Manager without cause is difficult and costly. The management agreement provides that it may only be terminated without cause following the initial period

19

annually (i) upon the affirmative vote of at least two-thirds of our independent directors, or (ii) by a vote of the holders of at least a majority of the outstanding shares of our common stock, based upon (1) unsatisfactory performance by our Manager that is materially detrimental to us or (2) a determination that the compensation payable to our Manager is not fair, subject to our Manager’s right to prevent such a termination by accepting a mutually acceptable reduction of management fees. Our Manager will be provided 180 days’ prior notice of any such termination and will be paid a termination fee equal to the amount of three times the sum of the annual base management fee and the annual incentive compensation earned by our Manager during the 12-month period immediately preceding the date of termination, calculated as of the end of the most recently completed fiscal quarter prior to the date of termination. These provisions may increase the effective cost to us of terminating the management agreement, thereby adversely affecting our ability to terminate our Manager without cause.

In addition, our Manager may terminate the management agreement (i) upon 60 days’ prior written notice to us in the event we default in the performance or observation of any material term, condition or covenant in the management agreement for a period of 60 days after such written notice or (ii) in the event we become regulated as an “investment company” under the 1940 Act. In the event that the management agreement is terminated by our Manager as a result of default by us, we are required to pay our Manager a termination fee equal to the amount of three times the sum of the annual base management fee and the annual incentive compensation earned by our Manager during the 12-month period immediately preceding the date of the termination, calculated as of the end of the most recently completed fiscal quarter prior to the date of termination. No termination fee is payable by us if the management agreement is terminated because we have become regulated as an investment company under the 1940 Act.

The base management fee payable to our Manager is payable regardless of our performance.