UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

LUNA GOLD CORP.

(Exact Name of Registrant as specified in its Charter)

| Canada | No. 1040 | 98-0226032 |

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification |

| Incorporation or Organization) | Classification Code Number) | No.) |

Suite 920, 475 West Georgia Street

Vancouver, B.C., Canada, V6B 4M9

Tel: (604) 689-7317 Fax: (604) 688-0094

(Address and telephone number of principal executive offices)

Tim Searcy

President and Principal Executive Officer

Suite 920, 475 West Georgia Street

Vancouver, B.C., Canada, V6B 4M9

(604) 689-7317

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________

Copies of communications to:

| Paul A. Visosky, Esq. | Michael H. Taylor, Esq. |

| DuMoulin Black | Lang Michener LLP |

| 10th Floor, 595 Howe Street | 1500 – 1055 West Georgia Street |

| Vancouver, B.C., Canada, V6C 2T5 | Vancouver, B.C., Canada, V6E 4N7 |

| (604) 602-6816 | (604) 689-9111 |

__________

Approximate date of commencement of proposed sale to the public:As soon as practicable after the

requisite votes are obtained pursuant to the solicitation by Luna Gold Corp. referred to in this

Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a

holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check

the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

– 2 –

CALCULATION OF REGISTRATION FEE

Title of Each Class

of Securities to be

Registered

| Aggregate

Proposed Amount

to be Registered(1)

| Proposed

Maximum Offering

Price(2)(3) | Proposed Maximum

Aggregate Offering

Price(2)(3) | Amount of

Registration Fee |

Common Shares,

no par value | 24,572,700 | $0.114 | $2,801,287 | $329.71 |

| (1) | Based upon the number of common shares of Luna Gold Corp., a Canadian corporation, expected to be issued to the existing shareholders of Luna Gold Corp., a Wyoming corporation, on a one-for-one basis upon completion of the Continuation described in this Registration Statement and based on 24,572,700 shares of common stock of Luna Gold Corp., a Wyoming corporation, issued and outstanding as of July 8, 2005. |

| |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f)(1) under theSecurities Act of 1933, as amended (the “Securities Act”). |

| |

| (3) | The Proposed Maximum Offering Price Per Share is calculated in accordance with Rule 457(h) of the Securities Act based upon the estimated sales price of the shares based on the closing price of shares of the Registrant’s common stock on July 8, 2005. The Proposed Aggregate Maximum Aggregate Offering Price is based on the Proposed Maximum Offering Price Per Share times the total number of shares of common stock to be registered. These amounts are calculated solely for the purpose of calculating the registration fee pursuant to Rule 457(h)(1) under the Securities Act. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

THE INFORMATION IN THIS PROXY STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT OFFER OR SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROXY STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROXY STATEMENT/PROSPECTUS SUBJECT TO COMPLETION, DATED JULY 8, 2005.

__________

– 3 –

LUNA GOLD CORP.

Suite 920, 475 West Georgia Street

Vancouver, B.C., Canada, V6B 4M9

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

A special meeting of the stockholders of Luna Gold Corp. will be held onu, 2005, atua.m., at the offices of the Company located at Suite 920, 475 West Georgia Street, Vancouver, B.C., Canada, V6B 4M9, for the purpose of voting upon a proposal to change the jurisdiction of incorporation of our company from Wyoming to Canada (the “Continuation”). The Continuation will be accomplished through the adoption by the stockholders of Luna Gold Corp. of certain special resolutions which will authorize Luna Gold Corp. to complete the Continuation. If Luna Gold Corp. completes the Continuation, Luna Gold Corp. will be continued under the CanadaBusiness Corporations Act and will cease to be incorporated in Wyoming and, as a result, will be governed by the CanadaBusiness Corporations Act. Only stockholders of record at the close of business onu, 2005 are entitled to notice of and to vote at the meeting. Stockholders of record are not entitled to appraisal rights of the fair value of their shares. If you do not expect to attend in person, please sign and return the enclosed proxy card.

By Order of the Board of Directors of Luna Gold Corp.,

“Tim Searcy”

Tim Searcy

President and Chief Executive Officer

__________

– 4 –

LUNA GOLD CORP.

Suite 920, 475 West Georgia Street

Vancouver, B.C., Canada, V6B 4M9

LETTER TO STOCKHOLDERS RESPECTING SPECIAL MEETING

u, 2005

Dear Luna Gold Corp. stockholder:

You are cordially invited to attend a special meeting of stockholders to be held onu, 2005, atua.m., at the offices of the Company located at Suite 920, 475 West Georgia Street, Vancouver, B.C., Canada, V6B 4M9. The purpose of the meeting is to allow you to vote on our proposed continuation special resolutions that would change Luna Gold’s domicile from Wyoming to Canada (the “Continuation”). If we complete the Continuation our company will be governed by the CanadaBusiness Corporations Act (the “CBCA”). We believe that the Continuation will more accurately reflect our operations, which are headquartered in Canada, and the principal trading market for our common shares, which is the TSX Venture Exchange.

Our Board of Directors has declared the Continuation advisable and recommends that you vote in favor of the Continuation of Luna Gold from Wyoming to Canada. Our officers and directors, who currently hold approximately 3.15% of our outstanding shares, have indicated that they intend to vote for the approval of the Continuation. We are calling a special meeting of the stockholders to vote on the Continuation and are soliciting proxies for use at the meeting. The record date for voting at the meeting isu, 2005. Stockholders of record are not entitled to appraisal rights of the fair value of their shares if they vote against the Continuation.

SEE “RISK FACTORS,” BEGINNING ON PAGE 19 OF THIS PROXY STATEMENT/PROSPECTUS FOR A DISCUSSION OF CERTAIN RISKS, INCLUDING TAX EFFECTS, RELATING TO THE CONTINUATION AND THE OWNERSHIP OF COMMON SHARES IN LUNA GOLD.

This proxy statement/prospectus is first being mailed to holders of Luna Gold common stock on or aboutu, 2005.

PLEASE NOTE THAT NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THIS PROXY STATEMENT/PROSPECTUS INCORPORATES IMPORTANT BUSINESS AND FINANCIAL INFORMATION ABOUT LUNA GOLD THAT IS NOT INCLUDED IN OR DELIVERED WITH THIS DOCUMENT. THIS INFORMATION IS AVAILABLE WITHOUT CHARGE TO HOLDERS OF LUNA GOLD COMMON STOCK UPON WRITTEN OR ORAL REQUEST. REQUESTS SHOULD BE MADE TO LUNA GOLD AT THE FOLLOWING ADDRESS:

– 5 –

Luna Gold Corp.

Attention: Secretary

Suite 920, 475 West Georgia Street

Vancouver, B.C., Canada, V6B 4M9

Telephone: (604) 689-7317

TO OBTAIN TIMELY DELIVERY, YOU SHOULD REQUEST INFORMATION NO LATER THANu, 2005.

Sincerely,

“Tim Searcy”

Tim Searcy

President and Chief Executive Officer

– 6 –

TABLE OF CONTENTS

– 7 –

– 8 –

– 9 –

PART I

SUMMARY

THIS SUMMARY PROVIDES AN OVERVIEW OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT/PROSPECTUS AND DOES NOT CONTAIN ALL OF THE INFORMATION YOU SHOULD CONSIDER. YOU SHOULD READ THE MORE DETAILED INFORMATION SET FORTH IN THIS DOCUMENT AND THE DOCUMENTS TO WHICH WE REFER YOU. WE HAVE INCLUDED PAGE REFERENCES TO DIRECT YOU TO MORE COMPLETE DESCRIPTIONS OF THE TOPICS PRESENTED IN THIS SUMMARY. IN THIS DOCUMENT THE SYMBOL “CDN$” REFERS TO CANADIAN DOLLARS AND THE SYMBOL “$” REFERS TO UNITED STATES DOLLARS. IN THIS DOCUMENT REFERENCES TO “THE COMPANY”, “OUR COMPANY”, “LUNA GOLD”, “WE” AND “OUR” REFER TO LUNA GOLD CORP.

Luna Gold

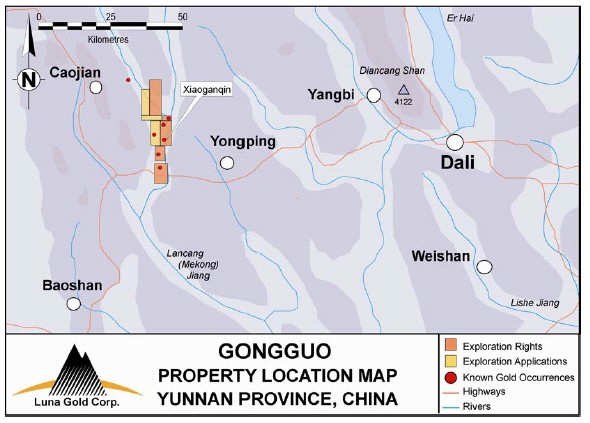

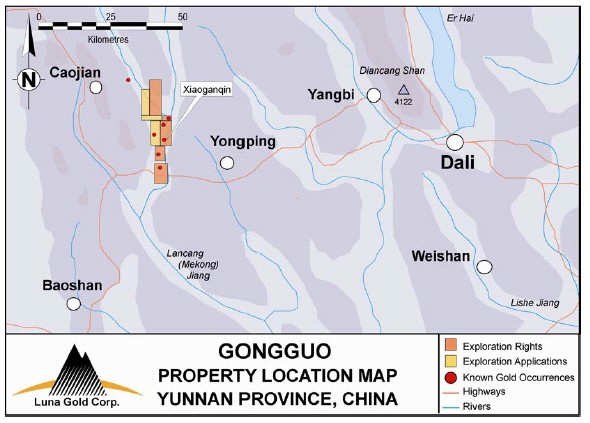

We are currently engaged in the business of mineral exploration. We have interests in two properties in China’s Yunnan Province, namely the Gongguo Project and the Dongchuan Project, and two properties in Nevada, namely the Blue Mountain Property and the Red Rock Property. Our business is headquartered in Vancouver, British Columbia, where the majority of our directors and officers reside and our head office is located. Our shareholders are primarily located in Canada and the primary market for our common stock is in Canada on the TSX Venture Exchange (the “TSX”).

Our office is located at Suite 920, 475 West Georgia Street, Vancouver, British Columbia, Canada, V6B 4M9. Our telephone number is (604) 689-7317 and our facsimile number is (604) 688-0094.

We are currently incorporated under the corporate laws of Wyoming. We are proposing to change our jurisdiction of incorporation from Wyoming to the Canadian federal jurisdiction under the CanadaBusiness Corporations Act(the “CBCA”) through a process known as a continuation (the “Continuation” or the “Continuance”). A continuance or continuation is a process by which a corporation which is not incorporated under the laws of Canada may change its jurisdiction of incorporation to Canada. Under the CBCA, if the laws of its home jurisdiction allow for it and a resolution authorizing the Continuance is approved by two-thirds of the company’s shareholders, a company may be “continued” as a Canadian corporation by filing Articles of Continuance with the Director under the CBCA. We refer to this process in this proxy statement/prospectus as the Continuation. After the completion of the Continuation, Luna Gold will be a Canadian corporation governed by the CBCA. We will continue to conduct the business in which we are currently engaged. The Continuation will not result in any material effect on our operations. The business and operations of Luna Gold following the Continuation will be identical in most respects to our current business, except that we will no longer be subject to the corporate laws of the State of Wyoming but will be subject to the CBCA. The Canadian company will be liable for all the debts and obligations of the Wyoming company, and the officers and directors of the company will be the officers and directors of Luna Gold. The differences between the laws will not materially affect our business but will affect your rights as a stockholder. The differences between the applicable laws of the two jurisdictions are discussed in greater detail under “Comparative Rights of Stockholders” on page 36 of this proxy statement/prospectus.

Reference in this proxy statement/prospectus to "Luna Gold Wyoming" are to Luna Gold Corp., a Wyoming corporation, as we are currently incorporated. Reference to "Luna Gold Canada" are to Luna Gold Corp., a Canadian corporation, as we would be continued under the CBCA if the Continuation is approved by our shareholders.

Upon effectiveness of the Continuation Luna Gold will file a Form 8-A with the United States Securities and Exchange Commission (the “SEC”) in order to register its securities under Section 12(g) of theSecurities Exchange Act of 1934 (the “Exchange Act”).

– 10 –

Factors you should consider

Reasons for the Continuation

We believe that the Continuation to Canada will more accurately reflect our operations, which have always been headquartered in and managed from Canada, our shareholder base, which is primarily located in Canada, and the principal market for our common stock, which is in Canada on the TSX. We also believe that Luna Gold should continue to Canada because it is the jurisdiction in which we have traditionally raised financing to fund our business operations.

Risk factors which may affect your vote

Factors such as possible adverse tax consequences of our common stock following the Continuation may affect your vote on the Continuation and your interest in owning Luna Gold common shares. In evaluating the merits of the proposed Continuation, you should carefully consider the risk factors and the other information included in this proxy statement/prospectus.

Although you are entitled to dissent from the proposed Continuation, Wyoming law does not grant appraisal rights to dissenting shareholders in a Continuation.

Material tax consequences for stockholders

The following is a brief summary of the material tax consequences the Continuation will have for stockholders. Stockholders should consult their own tax advisers with respect to their particular circumstances. A more detailed summary of the factors affecting the tax consequences for stockholders is set out under “Material United States Federal Tax Consequences” and “Material Canadian Income Tax Consequences” on pages 30 and 33, respectively, of this proxy statement/prospectus

United States federal tax consequences

The Continuance of Luna Gold from Wyoming to Canada is, for United States federal income tax purposes, treated as the transfer of the assets of Luna Gold to a Canadian company in exchange for stock of the Canadian company, followed by a distribution of the stock in the Canadian company to the stockholders of Luna Gold, and then the exchange by Luna Gold Wyoming’s stockholders of their Luna Gold Wyoming stock for Luna Gold Canada stock. Luna Gold must recognize gain (but not loss) on the assets held by it at the time of the Continuance to the extent that the fair market value of any assets exceeds its respective basis. The calculation of any potential gain is made separately for each asset held by Luna Gold Wyoming. No loss will be allowed for any asset that has a taxable basis in excess of its fair market value. Management of Luna Gold does not believe the fair market value of any of its assets exceeds their tax basis. Therefore, management is of the view that no gain should be recognized by Luna Gold as a result of the Continuance.

The Continuance will be treated by shareholders as the exchange by you, our shareholders, of your stock for stock of the Canadian company. The shareholders will not be required to recognize any U.S. gain or loss on this transaction. A shareholder’s adjusted basis in the shares of Luna Gold Canada received in the exchange will be equal to such shareholder’s adjusted basis in the shares of Luna Gold Wyoming surrendered in the exchange. A shareholder’s holding period in the shares of Luna Gold Canada received in the exchange should include the period of time during which such shareholder held his or her shares in Luna Gold Wyoming. For a more complete discussion of the United States income tax consequences, please see “Material United States Federal Tax Consequences” on page 30 of this proxy statement/prospectus.

– 11 –

Canadian tax consequences

Luna Gold should not incur any liability for Canadian income tax on Continuation. Luna Gold will become a resident of Canada as a result of the Continuation, and consequently thereafter will be liable for Canadian income tax on its world-wide taxable income, if any, subject only to such relief, if any, to which it may be entitled under any Canadian bilateral income tax treaty that may apply to it.

Stockholders should not incur any liability for Canadian income tax on the Continuation, regardless of the stockholder’s fiscal residence. Thereafter, Canadian rules on the taxation of dividends paid by taxable Canadian corporations will apply to stockholders on dividends, if any, paid by Luna Gold. For a more detailed summary of the Canadian tax consequences, please see “Material Canadian Income Tax Considerations” on page 33 of this proxy statement/prospectus.

How the Continuation will affect your rights as a stockholder

Although you will continue to hold the same number of shares you now hold following the Continuation of Luna Gold to Canada, the shares will be issued by a Canadian company as compared to the shares you currently hold which were issued by a Wyoming company. The rights of stockholders under Wyoming law differ in certain substantive ways from the rights of stockholders under the CBCA. Examples of some of the changes in stockholder rights which will result from the Continuation are:

| | Action by Shareholders without Meeting: |

| | | |

| | - | under Wyoming law, stockholders may act without a meeting, if notice of the proposed action is given to all shareholders, and the corporation obtains the written consent of the majority of the voting power of the outstanding common stock entitled to vote on the matter; |

| | | |

| | - | under Canadian law, stockholders may only act by way of a resolution passed at a duly called meeting unless all stockholders otherwise entitled to vote consent in writing; |

| | | |

| | Charter Amendments: |

| | | |

| | - | under Wyoming law, unless the Charter or Bylaws require a greater vote, a Charter or Bylaw amendment requires approval by vote of the holders of a majority of the votes entitled to be cast on the amendment; |

| | | |

| | - | Under Canadian law, an amendment to a corporation’s Charter requires approval by two- thirds majority of the stockholders; |

| | | |

| | Dissenter’s Rights: |

| | | |

| | - | dissenter’s rights are available to stockholders under more circumstances under Canadian law than under Wyoming law; |

| | | |

| | Director’s Liability: |

| | | |

| | - | stockholders have a statutory oppression remedy under Canadian law that does not exist under Wyoming statute. It is similar to the common law action in Wyoming for breach of fiduciary duty, but the Canadian remedy does not require stockholders to prove that the directors acted in bad faith; and |

| | | |

| | - | a director’s liability may not be limited under Canadian law as it may under Wyoming law. |

– 12 –

Price volatility

We cannot predict what effect the Continuation will have on our market price prevailing from time to time or the liquidity of our shares.

Accounting treatment of the Continuation

For United States accounting purposes, the Continuation of our company from a Wyoming corporation to a Canadian corporation represents a non-substantive exchange to be accounted for in a manner consistent with a transaction between entities under common control. All assets, liabilities, revenues and expense will be reflected in the accounts of Luna Gold Canada based on existing carrying values at the date of the exchange. The historical comparative figures of Luna Gold will be those of Luna Gold as a Wyoming company.

We are presently a reporting issuer under securities legislation in a number of Canadian provinces. We will continue to be subject to the securities laws of the Canadian provinces as those laws apply to Canadian reporting issuers upon completion of the Continuation. As a Canadian reporting issuer, we will be required to prepare our annual and interim consolidated financial statements in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”).

We currently prepare our consolidated financial statements in accordance with United States Generally Accepted Accounting Principles (“US GAAP”) in the United States. We file our audited annual financial statements with the SEC on Annual Reports on Form 10-KSB and our unaudited interim financial statements with the SEC on Quarterly Reports on Form 10-QSB. Upon completion of the Continuation, we anticipate that we will meet the definition of a “foreign private issuer” in the United States under the Exchange Act. As a reporting foreign private issuer, we anticipate that we will file an Annual Report on Form 20-F (a “Form 20-F Annual Report”) each year with the SEC. The Form 20-F Annual Report will include financial statements prepared in accordance with Canadian GAAP with a reconciliation to US GAAP. We will not be required to file interim quarterly reports on Form 10-QSB, however we will be required to file our interim financial statements and management discussion and analysis that we prepare as a reporting issuer under Canadian securities legislation with the SEC on SEC Form 6-K. The interim financial statements will be prepared in accordance with Canadian GAAP, whereas our current Quarterly Reports on Form 10-QSB include interim financial statements prepared in accordance with US GAAP.

In addition, as a foreign private issuer, our directors, officers and 10% stockholders will not be subject to the insider reporting requirements of Section 16(b) of the Exchange Act and we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-United States companies and will not apply to Luna Gold upon the Continuation.

Appraisal rights

As a Canadian company there will be more situations in which the stockholders of Luna Gold will be able to exercise appraisal rights than currently exist for stockholders of a Wyoming company. Under Wyoming law stockholders of record are entitled to the fair value of all or a portion of their shares in certain corporate transactions, such as a merger. However, such appraisal rights are not available in a Continuation. Under Canadian law, the holders of shares of any class of a corporation have the right to dissent when a company amends its articles of incorporation to change any provisions restricting or constraining the issue, transfer or ownership of shares of that class. In addition, under Canadian law stockholders also have dissenters’ rights when a company proposes to amend its articles of incorporation to add, change or remove any restrictions on the business or businesses that the corporation may carry on, amalgamate (other than a vertical short-form amalgamation with a wholly-owned subsidiary), continue to another jurisdiction, sell, lease or exchange all or substantially all of its property, or carry out a going private or a squeeze-out transaction. A shareholder who properly exercises his or her rights of dissent is entitled to be paid the fair market value of his or her shares in respect of which he or she dissents.

– 13 –

Regulatory approvals

We will have to comply with Wyoming and Canadian regulatory requirements in order to complete the Continuation to Canada.

Under Wyoming law, we will have to:

| | - | post a bond or deposit in the amount of $50,000 in an appropriate Wyoming depository for six months; |

| |

| | - | send our audited financial statements to the Wyoming Secretary of State; |

| |

| | - | publish a public notice in Wyoming about our Continuance to Canada; |

| |

| | - | provide a statement to the Wyoming Secretary of State of any legal actions which have been instituted by or against our company and which are pending; |

| |

| | - | maintain an agent for service process in the State of Wyoming for a period of at least one year; and |

| |

| | - | pay a special toll charge to the Wyoming Secretary of State based on our net actual asset value. |

In Canada, we will have to file our new corporate governing documents with the Director under the CBCA. These will replace our Wyoming corporate governing documents. Our Continuance to Canada would become effective when: the Wyoming Secretary of State issues a Certificate of Transfer transferring us to Canada and the Director under the CBCA issues us a Certificate of Continuance.

Disclosure obligations

Even if we continue to Canada, we will still have to comply with reporting requirements under United States securities law. However, these requirements would be reduced because we would no longer be a United States company.

Whether or not we continue to Canada, we will remain subject to Canadian disclosure requirements including publishing news releases, filing information about major changes for Luna Gold, sending you quarterly and annual financial statements and filing reports about trading in our shares by our officers, directors and major shareholders.

Our recommendations to stockholders

Taking into consideration all of the factors and reasons for the conversion set forth above and elsewhere in this proxy statement/prospectus, the Board of Directors has approved the Continuation and recommends that stockholders of Luna Gold vote FOR approval of the Continuance.

The special meeting

Matters to be voted on

Luna Gold stockholders will be asked to approve the Continuation by way of special resolution. The complete text of the proposed Continuation special resolutions to be considered at our special meeting is attached to this proxy statement/prospectus as Appendix I (the “Continuation Special Resolutions”). The Continuation will have the effect of changing our domicile from Wyoming to Canada.

– 14 –

Vote needed to approve the Continuation

Approval of the Continuation requires the affirmative vote of our stockholders holding at least two-thirds of the outstanding shares of Luna Gold common stock. The directors and executive officers of Luna Gold together directly own approximately 3.15% of the total number of outstanding shares of Luna Gold common stock. These stockholders have indicated that they intend to vote all their shares for the approval of the Continuation.

SUMMARY FINANCIAL INFORMATION

THE FOLLOWING SUMMARY CONTAINS UNAUDITED FINANCIAL INFORMATION FOR THE FIRST QUARTER ENDED MARCH 31, 2005 AND AUDITED FINANCIAL INFORMATION FOR THE YEARS ENDED DECEMBER 31, 2004 AND DECEMBER 31, 2003 AND INCLUDES BALANCE SHEET AND STATEMENT OF OPERATIONS DATA FROM THE UNAUDITED AND AUDITED FINANCIAL STATEMENTS OF LUNA GOLD. THE INFORMATION CONTAINED IN THESE TABLES SHOULD BE READ IN CONJUNCTION WITH “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” HEREIN BELOW AND THE FINANCIAL STATEMENTS AND ACCOMPANYING NOTES INCLUDED HEREIN.

Our financial statements have been prepared in accordance with US GAAP. The application of Canadian GAAP, which will be applicable to our financial statements if the Continuation is approved, would not result in any material differences to our financial statements.

The accompanying unaudited financial information includes all adjustments considered necessary (consisting only of normal recurring adjustments) for a fair presentation. Results for the three-month period ended March 31, 2005 are not necessarily indicative of the results that may be expected for the year ended December 31, 2005, or any future period.

– 15 –

Unaudited Summary Financial Information

Balance Sheet Data:

| | | | | | December 31, | |

| | | March 31, 2005 | | | 2004 | |

| | | (unaudited) | | | (audited) | |

| | | | | | | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 687,691 | | $ | 1,497,859 | |

| Accounts receivable | | 8,285 | | | 11,435 | |

| Related party receivables | | 150,000 | | | -- | |

| Prepaid expenses | | 5,000 | | | 6,023 | |

| | | | | | | |

| | | | | | | |

| Total current assets | | 850,976 | | | 1,515,317 | |

| Equipment | | 3,966 | | | 4,788 | |

| | | | | | | |

| Investment in resource properties joint ventures | | 617,816 | | | 251,197 | |

| | | | | | | |

| | | | | | | |

| Total assets | $ | 1,472,758 | | $ | 1,771,302 | |

| | | | | | | |

| Liabilities and stockholders’ deficiency | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable and accrued liabilities | $ | 55,772 | | $ | 62,192 | |

| Note payable | | -- | | | 49,997 | |

| Payables to related parties | | 45,324 | | | 576,523 | |

| | | | | | | |

| Total current liabilities | | 101,096 | | | 688,71 | |

| | | | | | | |

| | | | | | | |

| Subscriptions received in advance of share offering | | -- | | | 1,639,065 | |

| | | | | | | |

| | | | | | | |

| Total liabilities | | 101,096 | | | 2,327,777 | |

| | | | | | | |

| Stockholders’ equity (deficiency): | | | | | | |

| Common stock, no par value, unlimited authorized shares; issued | | 7,899,276 | | | 5,628,926 | |

| 24,572,700 | | | | | | |

| At March 31, 2005 and 17,004,863 at December 31, 2004 | | | | | | |

| Additional paid-in capital | | 182,746 | | | 182,746 | |

| Deficit before inception of new business | | (4,796,115 | ) | | (4,796,115 | ) |

| Deficit accumulated since inception of new business | | (1,891,565 | ) | | (1,542,432 | ) |

| Accumulated other comprehensive income: | | | | | | |

| Cumulative translation adjustment | | (22,680 | ) | | (29,600 | ) |

| | | | | | | |

| Total stockholder’s deficiency | | 1,371,662 | | | (556,475 | ) |

| | | | | | | |

| Total liabilities and stockholders’ equity | $ | 1,472,758 | | $ | 1,771,302 | |

– 16 –

Statement of Operations Data:

| | | | | | | | | Period from | |

| | | | | | | | | January 20/03 | |

| | | | | | | | | (inception of new | |

| | | Three month period | | | business) to March 31, | |

| | | ended March 31, | | | 2005 | |

| | | (Unaudited) | | | (Unaudited) | |

| | | | | | | | | | |

| | | 2005 | | | 2004 | | | | |

| | | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Business development | $ | -- | | $ | -- | | $ | 23,440 | |

| Consulting fees | | 35,503 | | | 14,123 | | | 288,751 | |

| Depreciation and amortization | | 782 | | | 294 | | | 3,092 | |

| Equity in loss from operation of resource | | 181,023 | | | -- | | | 379,971 | |

| Properties joint ventures | | | | | | | | | |

| Exploration expense | | 49,628 | | | 75,215 | | | 412,366 | |

| Filing fees | | 18,561 | | | 2,682 | | | 52,919 | |

| General and administrative | | 9,167 | | | 5,172 | | | 93,957 | |

| Investor relations | | 1,027 | | | -- | | | 23,102 | |

| Management fees to related parties | | 6,115 | | | 5,689 | | | 49,635 | |

| Marketing and promotion | | 2,306 | | | -- | | | 12,968 | |

| Organization expense | | -- | | | -- | | | 1,096 | |

| Professional fees | | 25,215 | | | 15,865 | | | 244,589 | |

| Rent | | 3,587 | | | 6,827 | | | 57,749 | |

| Travel and conference | | 11,392 | | | -- | | | 165,599 | |

| Wages and benefits | | 19,591 | | | -- | | | 62,486 | |

| | | | | | | | | | |

| Total Expenses | | 363,897 | | | 125,867 | | | 1,871,720 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loss from operations | | (363,897 | ) | | (125,867 | ) | | (1,871,720 | ) |

| Foreign exchange gain (loss) | | 16,493 | | | -- | | | (18,116 | ) |

| Interest expense | | (1,729 | ) | | -- | | | (1,729 | ) |

| | | | | | | | | | |

| Net loss for the period | $ | (349,133 | ) | $ | (125,867 | ) | $ | (1,891,565 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| Loss per common share, basic and diluted | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.13 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| Weighted average number of common | | | | | | | | | |

| shares outstanding: basic and diluted | | 23,059,131 | | | 12,491,946 | | | 14,156,539 | |

– 17 –

Audited Summary Financial Information

Balance Sheet Data:

| | | December 31, | | | December 31, | |

| | | 2004 | | | 2003 | |

| | | (audited) | | | (audited) | |

| | | | | | | |

| Assets | | | | | | |

| | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 1,497,859 | | $ | 11,483 | |

| Amounts receivable | | 11,435 | | | 1,919 | |

| Prepaid expenses | | 6,023 | | | 11,507 | |

| | | | | | | |

| Total current assets | | 1,515,317 | | | 24,909 | |

| | | | | | | |

| Equipment | | 4,788 | | | 3,008 | |

| | | | | | | |

| Investments in resource property joint ventures | | 251,197 | | | -- | |

| Total assets | $ | 1,771,302 | | $ | 27,917 | |

| | | | | | | |

| Liabilities and Stockholders’ Deficiency | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable and accrued liabilities | $ | 62,192 | | $ | 18,715 | |

| Note Payable | | 49,997 | | | -- | |

| Payables to related parties | | 576,523 | | | 46,218 | |

| | | | | | | |

| Total current liabilities | | 688,712 | | | 64,933 | |

| | | | | | | |

| Subscriptions received in advance of share | | | | | | |

| offering | | 1,639,065 | | | -- | |

| | | | | | | |

| Total liabilities | | 2,327,777 | | | 64,933 | |

| | | | | | | |

| Stockholders’ equity (deficiency): | | | | | | |

| Common stock, no par value, unlimited | | | | | | |

| authorized shares; issued 17,004,863 at | | | | | | |

| December 31, 2004 and 12,441,946 at December | | | | | | |

| 31, 2003 | | 5,628,926 | | | 5,068,305 | |

| Additional paid-in capital | | 182,746 | | | 182,746 | |

| Deficit before inception of new business | | (4,796,115 | ) | | (4,796,115 | ) |

| Deficit accumulated since inception of new | | | | | | |

| business | | (1,542,432 | ) | | (466,688 | ) |

| Accumulated other comprehensive income: | | | | | | |

| Cumulative translation adjustment | | (29,600 | ) | | (25,264 | ) |

| Total stockholders’ deficiency | | (556,475 | ) | | (37,016 | ) |

| Total liabilities and stockholders’ deficiency | $ | 1,771,302 | | $ | 27,917 | |

– 18 –

Statement of Operations Data:

| | | | | | | | | Period from January | |

| | | | | | | | | 20, 2003 (inception of | |

| | | | | | | | | new business) to | |

| | | | | | | | | December 31, 2004 | |

| | | Year ended December 31 | | | (audited) | |

| | | 2004 | | | 2003 | | | | |

| | | (audited) | | | (audited) | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Operating Expenses: | | | | | | | | | |

| Business development | $ | 23,440 | | $ | -- | | $ | 23,440 | |

| Consulting fees | | 182,823 | | | 70,425 | | | 253,248 | |

| Depreciation and Amortization | | 1,125 | | | 1,295 | | | 2,310 | |

| Marketing and promotion | | 2,309 | | | 8,353 | | | 10,662 | |

| Equity in loss from operation | | 198,948 | | | -- | | | 198,948 | |

| of resource properties joint | | | | | | | | | |

| ventures | | | | | | | | | |

| Exploration expense | | 159,821 | | | 204,917 | | | 362,738 | |

| Filing fees | | 13,221 | | | 21,137 | | | 34,358 | |

| General and administrative | | 53,595 | | | 32,516 | | | 84,790 | |

| Investor relations | | 21,448 | | | 627 | | | 22,075 | |

| Management fees to related | | 23,049 | | | 21,486 | | | 43,520 | |

| parties | | | | | | | | | |

| Organization expense | | 1,096 | | | -- | | | 1,096 | |

| Professional fees | | 138,680 | | | 82,022 | | | 219,374 | |

| Rent | | 29,596 | | | 25,783 | | | 54,162 | |

| Travel and conference | | 154,207 | | | -- | | | 154,207 | |

| Wages and benefits | | 42,895 | | | -- | | | 42,895 | |

| Total Expenses | | 1,046,253 | | | 468,561 | | | 1,507,823 | |

| | | | | | | | | | |

| Loss from operations | | (1,046,253 | ) | | (468,561 | ) | | (1,507,823 | ) |

| Foreign exchange loss | | (29,491 | ) | | (5,115 | ) | | (34,609 | ) |

| Net loss for the period | $ | (1,075,744 | ) | $ | (473,676 | ) | $ | (1,542,432 | ) |

| | | | | | | | | | |

| Loss per common share, basic | | | | | | | | | |

| and diluted | $ | (0.07 | ) | $ | (0.04 | ) | $ | (0.12 | ) |

| | | | | | | | | | |

| Weighted average number of | | | | | | | | | |

| common shares outstanding: | | | | | | | | | |

| Basic and diluted | | 14,846,993 | | | 11,055,644 | | | 13,029,628 | |

– 19 –

RISK FACTORS

An investment in Luna Gold common stock involves certain risks. In evaluating us and our business, investors should carefully consider the following risk factors in addition to the other information included in this proxy statement/prospectus.

You should read the first set of risk factors in deciding whether to approve our Continuation from Wyoming to Canada. You may also find it helpful to read the subsequent risk factors so you understand more clearly the risks associated with the business of Luna Gold.

This proxy statement/prospectus contains statements that plan for or anticipate the future. We believe that some of these statements are “forward-looking” statements. Forward-looking statements include statements about the future of our industry, statements about future business plans and strategies, and most other statements that are not historical in nature. In this proxy statement/prospectus, forward-looking statements use words like “anticipate,” “plan,” “believe,” “expect,” and “estimate.” However, because forward-looking statements involve future risks and uncertainties, there are factors, including those discussed below, that could cause actual results to differ materially from those expressed or implied. We have attempted to identify the major factors that could cause differences between actual and planned or expected results, but we may not have identified all of those factors. You therefore should not place undue reliance on forward-looking statements. Also, we have no obligation to publicly update forward-looking statements we make in this proxy statement/prospectus.

Risks related to the Continuance

Luna Gold may still be treated as a U.S. corporation and taxed on its worldwide income after the Continuance.

The Continuance of Luna Gold from Wyoming to Canada is for corporate purposes a migration of Luna Gold from Wyoming to Canada. Transactions whereby U.S. corporations migrate to a foreign jurisdiction are perceived to be an abuse of the U.S. tax rules because thereafter the foreign entity is not subject to U.S. tax on its worldwide income. As a result, Section 7874(b) of theInternal Revenue Code of 1986, as amended (the “Code”) was enacted in 2004 to address this perceived abuse. Section 7874(b) of the Code provides generally that a corporation that migrates from the Untied States will nonetheless remain subject to U.S. tax on its worldwide income unless the migrating entity has substantial business activities in the foreign country in which it is migrating when compared to its total business activities.

If Section 7874(b) of the Code were to apply to the migration of Luna Gold from Wyoming to Canada, it would cause Luna Gold Canada to be subject to United States federal income taxation on its worldwide income. Section 7874(b) of the Code will apply to the Luna Gold migration unless Luna Gold Canada has substantial business activities in Canada when compared to its total business activities. All of Luna Gold’s employees, its only permanent office and all of its administrative functions are located in Canada. Luna Gold’s only business activity relates to four early stage mining prospects, two in China and two in the United States. Luna Gold has no employees, no permanent offices and no facilities in any country other than Canada. Accordingly, Luna Gold intends to take the position that it has substantial business activity in Canada in relation to its worldwide activities and that Section 7874(b) of the Code does not apply to cause Luna Gold, after the migration, to be subject to U.S. income tax on its worldwide income.

There is no guidance as to what “substantial business activity” is “when compared to its total business activities.” Accordingly, U.S. tax counsel has not expressed any view with respect to this issue. The position adopted by Luna Gold may be challenged by the U.S. tax authorities with the result that Luna Gold may remain subject to U.S. federal income tax on its worldwide income even after Continuation. In addition to U.S. income taxes, were Section 7874(b) of the Code to apply to Luna Gold, Luna Gold could be subject to penalties for failure to file U.S. tax returns, late fees and interest on past due taxes.

– 20 –

We may owe additional United States taxes as a result of the Continuation if our conclusions relating to the value of our assets are incorrect.

Assuming Section 7874(b) of the Code, as described above, does not apply, the Continuance of Luna Gold from Wyoming to Canada is, for U.S. federal income tax purposes, treated as the transfer of the assets of Luna Gold to a Canadian company in exchange for stock of the Canadian company, followed by a distribution of the stock in the Canadian company to the stockholders of Luna Gold, and then the exchange by Luna Gold Wyoming’s stockholders of their Luna Gold Wyoming stock for Luna Gold Canada stock. Luna Gold must recognize gain (but not loss) on the assets held by it at the time of the Continuance to the extent that the fair market value of any assets exceeds its respective basis. The calculation of any potential gain is made separately for each asset held by Luna Gold Wyoming. No loss will be allowed for any asset that has a taxable basis in excess of its fair market value. Management of Luna Gold does not believe the fair market value of any of its assets exceeds their tax basis. Accordingly, Luna Gold intends to take the position that no United States taxes will be owed as a result of the proposed Continuation.

The valuation of Luna Gold’s assets may be challenged by the United States Internal Revenue Service (“IRS”). Should the IRS disagree with the valuation of Luna Gold’s assets, they could reassess the deemed proceeds on the Continuance to a higher amount. It is possible on any such reassessment that the tax liability to could be significant and we may not have the available cash at that time to settle the liability owing. Should we be unable to settle any such liability, we may have to cease operations in which case our stockholders would likely lose their investment in our company.

The stock price of our common shares may be volatile. In addition, demand in the United States for our shares may be decreased by the change in domicile.

The market price of our common shares may be subject to significant fluctuations in response to variations in results of operations and other factors. Developments affecting the mining industry generally, including general economic conditions and government regulation, could also have a significant impact on the market price for our shares. In addition, the stock market has experienced a high level of price and volume volatility. Market prices for the stock of many similar companies have experienced wide fluctuations which have not necessarily been related to the operating performance of such companies. These broad market fluctuations, which are beyond the control of Luna Gold, could have a material adverse effect on the market price of our shares. We cannot predict what effect, if any, the Continuation will have on the market price prevailing from time to time or the liquidity of our common shares. The change in domicile may decrease the demand for our shares in the United States. The decrease may not be offset by increased demand for Luna Gold’s shares in Canada.

Risks associated with our company

Due to our recurring losses, negative cash flows from operations, working capital deficiency and because our officers and directors may not loan any money to us, we may not be able to achieve our objectives and may have to suspend or cease exploration activity.

As we have no producing properties, additional debt or equity financing will be required in the future in order to provide working capital for operations in the future. This debt or equity may not be available on reasonable terms or on any terms at all. Our auditors’ report on our 2004 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

– 21 –

Because the probability of an individual prospect ever having reserves is extremely remote, in all probability our properties do not contain any reserves, and any funds spent on exploration will be lost.

Because the probability of an individual prospect ever having commercially viable reserves is extremely remote, in all probability our properties do not contain any reserves, and any funds spent on exploration will be lost. If we cannot raise further funds as a result, we may have to suspend or cease operations entirely which would result in the loss of your investment.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease mineral exploration activity.

We were incorporated in 1986 and were engaged in the business of streaming media business. In 2003 we changed our business to mineral exploration. We have just recently commenced our mineral exploration activity and have not realized any revenues therefrom. We have no mineral exploration history upon which an evaluation of our future success or failure can be made. Our net loss since incorporation is $6,687,680 as at March 31, 2005. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| | - | our ability to locate a profitable mineral property; |

| |

| | - | our ability to generate revenues; and |

| |

| | - | our ability to reduce exploration costs. |

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. We cannot guarantee we will be successful in generating revenues in the future. Failure to generate revenues will cause us to go out of business.

Because the majority of our officers and directors do not have technical training or experience in starting, and operating a mine, we will have to hire qualified personnel. If we can’t locate qualified personnel, we may have to suspend or cease exploration activity which will result in the loss of your investment.

Because the majority of our officers and directors are inexperienced with exploring for, starting, and operating a mine, we will have to hire qualified persons to perform surveying, exploration, and excavation of our property. The majority of our officers and directors have no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Their decisions and choices may not take into account standard engineering or managerial approaches, mineral exploration companies commonly use. Consequently, our exploration, earnings and ultimate financial success could suffer irreparable harm due to certain of management’s lack of experience in this industry. As a result we may have to suspend or cease exploration activity which will result in the loss of your investment.

We have no known ore reserves. Without ore reserves we cannot generate income and if we cannot generate income we will have to cease exploration activity which will result in the loss your investment.

We have no known ore reserves. Without ore reserves, we cannot generate income and if we cannot generate income we will have to cease exploration activity, which will result in the loss of your investment.

– 22 –

If we don’t raise enough money for exploration, we will have to delay exploration or go out of business, which will result in the loss of your investment.

We are in the very early exploration stage and we will need additional financing to continue our exploration activity. Since there is no assurance that we may raise the necessary additional financing, you may be investing in a company that will not have the funds necessary to continue its exploration activity. If that occurs we will have to delay exploration or cease our exploration activity which will result in the loss of your investment.

Because we are small and do not have much capital, we must limit our exploration and as a result may not find an ore body. Without an ore body, we cannot generate revenues and you will lose your investment.

Because we are small and do not have much capital, we must limit our exploration. Because we may have to limit our exploration, we may not find an ore body, even though our properties may contain mineralized material. Without an ore body, we cannot generate revenues and you will lose your investment.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend exploration activity.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will continue to attempt to locate products, equipment and materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Because our officers and directors have other outside business activities and may not be in a position to devote a majority of their time to our exploration activity, our exploration activity may be sporadic which may result in periodic interruptions or suspensions of exploration.

Because our officers and directors have other outside business activities and may not be in a position to devote a majority of their time to our exploration activity, our exploration activity may be sporadic and occur at times which are convenient to our officers and directors. As a result, exploration of our property may be periodically interrupted or suspended.

Because title to our Blue Mountain property is held in the name of another entity pending our acquisition thereof, if it transfers our property to someone other than us, we will cease exploration activities.

Title to our Blue Mountain property has not been transferred to us. Title to our property is recorded in the name of Nassau Ltd. If Nassau Ltd. transfers title to another party, it will obtain good title and we will have no continuing interests or rights in this property. If that happens we will be harmed in that we will not own this property and we will have to cease exploration activity.

Because we may be unable to meet property payment obligations or be unable to acquire necessary mining licenses, we may lose interests in our exploration properties.

The agreements pursuant to which we acquired our interests in properties provide that we must make a series of cash payments over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute our share of ongoing expenditures. If we fail to make such payments or expenditures in a timely fashion, we may lose our interest in those properties. Further, even if we do complete exploration activities, we may not be able to obtain the necessary licenses to conduct mining operations on the properties, and thus would realize no benefit from its exploration activities on the properties.

– 23 –

Because mineral exploration and development activities are inherently risky, we may be exposed to environmental liabilities. If such an event were to occur it may result in a loss of your investment.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. At present, none of our properties has a known body of commercial ore. Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in extraction operations and the conduct of exploration programs. Although we carry liability insurance with respect to our mineral exploration operations, we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which we cannot insure or against which we may elect not to insure. There are also physical risks to the exploration personnel working in the rugged terrain of China, often in poor climate conditions. Previous mining operations may have caused environmental damage at certain of our properties. It may be difficult or impossible to assess the extent to which such damage was caused by us or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective. If any of our properties is found to have commercial quantities of ore, we would be subject to additional risks respecting any development and production activities. Most exploration projects do not result in the discovery of commercially mineable deposits of ore.

Because we have not put a mineral deposit into production before, we will have to acquire outside expertise. If we are unable to acquire such expertise we may be unable to put our properties into production and you may lose your investment.

We have no experience in placing mineral deposit properties into production, and our ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that we will have available to us the necessary expertise when and if we place mineral deposit properties into production.

Because Chinese regulations require the State Administration of Exchange Control to approve the remittance of certain types of income out of China, we may be unable to repatriate our earnings. If we are unable to repatriate our earnings from China, you may lose your investment.

Chinese regulations provide that, subject to payment of applicable taxes, foreign investors may remit out of China, in foreign exchange, profits or dividends derived from a source within China. Remittance by foreign investors of any other amounts (including, for instance, proceeds of sale arising from a disposal by a foreign investor of any of his investment in China) out of China is subject to the approval of the State Administration of Exchange Control or its local branch office. No assurance can be given that such approval would be granted if the Company disposes of all or part of its interest in its China projects. Further, there can be no assurance that additional restrictions on the repatriation of earnings in China will not be imposed in the future.

Because certain of our mineral interests are in China, you will be exposed to political risk. Such political risk could result in our losing interests in our properties in China. If this occurs you could lose your investment.

Our mineral interests in China may be affected by varying degrees of political instability and the policies of other nations in respect of these countries. These risks and uncertainties include military repression, political and labor unrest, extreme fluctuations in currency exchange rates, high rates of inflation, terrorism, hostage taking and expropriation. Our mining, exploration and development activities may be affected by changes in government, political instability and the nature of various government regulations

– 24 –

relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business and/or holdings. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and safety factors. Our operations in China entail significant governmental, economic, social, medical and other risk factors common to all developing countries. The status of China as a developing country may make it more difficult for us to obtain any required financing because of the investment risks associated with these countries.

Because some of our operations are in China we may be adversely affected by economic uncertainty characteristic of developing countries. Such adverse affects could result in a loss of your investment.

Our operations in China may be adversely affected by the economic uncertainty characteristic of developing countries. Operations in China are subject to risks relating to China’s relatively recent transition to a market economy administered by a socialist government. While China has recently permitted private economic activities, the government of China has exercised and continues to exercise substantial control over virtually every sector of China’s economy through regulation and state ownership. Our prospects, results of operations and financial condition may be adversely affected by political, economic and social uncertainties in China, changes in China’s leadership, diplomatic developments and changes or lack of certainty in the laws and regulations of China.

Because the acquisition of title to resource properties in China is a very time consuming process that may be subject to dispute, we may not be able to acquire title to our properties. This may result in a loss of the properties and your investment.

The acquisition of title to resource properties or interests therein is a very detailed and time-consuming process. Title to and the area of resource concessions may be disputed. Our resource properties or interests in China are registered or are in the process of being registered in the name of our joint venture companies. There is no guarantee of title to any of our properties. The properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. Title may be based upon interpretation of the country’s laws, which laws may be ambiguous, inconsistently applied and subject to reinterpretation or change. We have not surveyed the boundaries of any of our mineral properties and consequently the boundaries of the properties may be disputed.

Because our joint venture company may require certain approvals to advance our operations we are at risk of not receiving such approvals. If we don’t receive the necessary approvals we may lose our property interests resulting in a loss of your investment.

While our joint venture companies are authorized to explore for gold on our projects, they are required to obtain further approvals from regulatory authorities in China in order to explore for minerals other than gold or to conduct mining operations. In order for our interest in the joint venture company to increase to 90% as contemplated by the joint venture agreements, the joint venture company may be required to obtain approvals from Chinese authorities. There is no assurance that such approvals would be granted by the Chinese authorities at all or on terms favourable to the continued operations of the joint venture company. The laws of China governing the establishment of joint venture companies are ambiguous, inconsistently applied and subject to reinterpretation or change. While we believe that the joint venture company will be properly established and that we have taken the steps necessary to obtain our interest in the projects, there can be no guarantee that such steps will be sufficient to preserve our interests in the project.

– 25 –

Because our joint venture partners have more influence with various levels of government we may not be able to protect our property interests in China. If we are unable to protect our interests you may lose your investment.

We operate in China through a joint venture with a government controlled entity. Although this connection benefits us in some respects, there is a substantial inequality with respect to the influence of the respective joint venture parties with the various levels of government. The government holds a substantial degree of subjective control over the application and enforcement of laws and the conduct of business. This inequality would become particularly detrimental if a business dispute arose between joint venture parties. We are endeavoring to maintain positive relations with both our joint venture partner and local governments, but there can be no guarantee that these measures will be sufficient to protect our interests in China.

Trading in our common stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our common stock.

Our securities are referred to as “penny stocks” which are not perceived favorably in the market place. The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Our securities are subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with a net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must:

| | - | make a special suitability determination for the purchase of such securities; |

| |

| | - | have received the purchaser’s written consent to the transaction prior to the purchase; |

| |

| | - | deliver to the purchaser, prior to the transaction, a disclosure schedule prepared by the SEC relating to the penny stock market; |

| |

| | - | disclose to the purchaser the commission payable to the broker-dealer and the registered representative; |

| |

| | - | provide the purchaser with current quotations for the securities; |

| |

| | - | if he is the sole market maker, disclose that fact to the purchaser and his presumed control over the market; and |

| |

| | - | provide the purchaser with monthly statements disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. |

Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our securities in the market.

CONTINUATION PROPOSAL

Background to the Continuation proposal

The Board of Directors of Luna Gold has determined that it is advisable for Luna Gold to continue from Wyoming to Canada. Management has determined that a Continuation will be the most effective means of achieving the desired change of domicile. The WyomingBusiness Corporation Act (the “WBCA”) allows a corporation that is duly incorporated, organized, existing and in good standing under Wyoming law to continue into a foreign entity pursuant to a continuance approved by the stockholders of the Wyoming corporation.

– 26 –

Under the proposed Continuation, if the stockholders approve the Continuation, then Articles of Transfer will be filed with the Secretary of State of Wyoming. Articles of Continuance will also be filed with the Director of Business Corporations in Canada. Upon the filing, Luna Gold will be continued as a Canadian corporation and will be governed by the laws of Canada. The assets and liabilities of the Canadian corporation immediately after the Continuation will be identical to the assets and liabilities of the Wyoming company immediately prior to the Continuation. The current officers and directors of the Wyoming company will be the officers and directors of the Canadian corporation. The change of domicile will not result in any material change to the business of Luna Gold and will not have any effect on the relative equity or voting interests of our stockholders. Each previously outstanding share of Luna Gold common stock will become one share of the Canadian corporation. The change in domicile will, however, result in changes in the rights and obligations of current Luna Gold stockholders under applicable corporate laws. For an explanation of these differences see “Comparative Rights of Stockholders” on page 36 of this proxy statement/prospectus. In addition, the Continuation may have material tax consequences to stockholders which may or may not be adverse to any particular stockholders depending on the stockholder’s particular circumstances. For a more detailed explanation of the tax consequences, see “Material United States Federal Tax Consequences” and “Material Canadian Income Tax Consequences” on pages 30 and 33, respectively, of this proxy statement/prospectus.

Pursuant to Section 17-16-1720 of the WBCA, the Board of Directors of Luna Gold has adopted a resolution approving the Continuation. The effect of this Continuance will be to change the domicile of Luna Gold from Wyoming to Canada. Such resolution shall be submitted to the stockholders of Luna Gold at a special meeting. Due notice of the time, place and purpose of the meeting shall be mailed to each holder of stock, whether voting or non-voting, at the address of the stockholder as it appears on the records of the corporation, at least 20 days prior to the date of the meeting. At the meeting, the Continuation Special Resolutions shall be considered and a vote taken for its adoption or rejection. If the holders of two-thirds of the outstanding shares of Luna Gold vote for the adoption of the Continuation Special Resolutions, Luna Gold shall file with the Secretary of State of Wyoming an application for a Certificate of Transfer and file a notice of registered office, a notice of directors and Articles of Continuance with the Director under the CBCA. The current officers and directors of the Wyoming company will be the officers and directors of the Canadian company. Upon the filing of the Continuation in accordance with the WBCA and payment to the Wyoming Secretary of State of all fees prescribed thereto, together with the compliance with all other requirements, the Continuation shall become effective in accordance with the WBCA. Upon receipt of the Articles of Continuance and payment of all applicable fees, the Director under the CBCA shall issue a Certificate of Continuance, and the Continuance shall be effective on the date shown in the Certificate of Continuance.

Reasons for the change in domicile

We believe that the Continuance to Canada will more accurately reflect our operations, which have always been head quartered in and managed from Canada, and the principal market for our common stock which is in Canada on the TSX. Our Board of Directors also believes that continuing Luna Gold to Canada more accurately reflects the nature of our business because it is the jurisdiction from which our business has always been financed. Furthermore, our executive offices, as well as the majority of our officers and directors, are located in Canada, and a majority of our issued and outstanding common stock is owned of record by non-United States residents.

Financial Statement Reporting

We are presently a reporting issuer under securities legislation in a number of Canadian provinces. We will continue to be subject to the securities laws of the Canadian provinces as those laws apply to Canadian reporting issuers upon completion of the Continuation. As a Canadian reporting issuer, we will be required to prepare our annual and interim consolidated financial statements in accordance with Canadian GAAP.

– 27 –

We presently prepare our consolidated financial statements in accordance with US GAAP in the United States. We file our audited annual financial statements with the SEC on Annual Reports on Form 10-KSB and our unaudited interim financial statements with the SEC on Quarterly Reports on Form 10-QSB. Upon completion of the Continuation, we anticipate that we will meet the definition of a “foreign private issuer” in the United States under the Exchange Act. As a reporting foreign private issuer, we anticipate that we will file a Form 20-F Annual Report each year with the SEC. The Form 20-F Annual Report will include financial statements prepared in accordance with Canadian GAAP with a reconciliation to US GAAP. We will not be required to file interim quarterly reports on Form 10-QSB, however we will be required to file our interim financial statements and management discussion and analysis that we prepare as a reporting issuer under Canadian securities legislation with the SEC on SEC Form 6-K. The interim financial statements will be prepared in accordance with Canadian GAAP, whereas our current Quarterly Reports on Form 10-QSB include interim financial statements prepared in accordance with US GAAP.

In addition, as a foreign private issuer, our directors, officers and 10% stockholders will not be subject to the insider reporting requirements of Section 16(b) of the Exchange Act and we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-United States companies and will not apply to Luna Gold upon the conversion.

Effective time of the Continuation

The Continuation will become effective upon:

| | 1. | the approval of the Continuation Special Resolutions by the stockholders of Luna Gold at the special meeting or any adjournment thereof; |

| |

| | 2. | the delivery of a duly executed application for a Certificate of Transfer to the Wyoming Secretary of State in accordance with Section 17-16-1720 of the WBCA; |

| |

| | 3. | the issuance of a Certificate of Transfer by the Wyoming Secretary of State; and |

| |

| | 4. | the issuance of a Certificate of Continuance by the Director of Business Corporations under the CBCA in accordance with Sections 187 and 262 of the CBCA. |

We anticipate that the Articles of Transfer and Articles of Continuance will be filed promptly after the special meeting of Luna Gold stockholders.

Conditions to the consummation of the Continuation

The Board of Directors of Luna Gold has adopted and approved the Continuation. Therefore, the only condition required for Luna Gold to adopt the Continuation and become continued into Canada is that the stockholders must duly approve the Continuation pursuant to the proposed Continuation Special Resolutions. The only material consent, approval or authorization of or filing with any governmental entity required to consummate the Continuation are the approval of the stockholders of Luna Gold in accordance with the WBCA, the filing of the application for a Certificate of Transfer with the Wyoming Secretary of State, the issuance of a Certificate of Transfer by the Wyoming Secretary of State and the filing of Articles of Continuance with the Director of Business Corporations under the CBCA.

Exchange of share certificates

No exchange of certificates that, prior to the Continuation, represented shares of Luna Gold common stock is required with respect to the Continuation and the transactions contemplated by it. Promptly after the effective time of the Continuation, we shall mail to each record holder of certificates that immediately prior to the effective time of the Continuation represented shares of our common stock, a letter of transmittal and instructions for use in surrendering those certificates. Upon the surrender of each certificate formerly representing Luna Gold stock, together with a properly completed letter of transmittal,

– 28 –

we shall issue in exchange a share certificate of Luna Gold, the Canadian company, and the stock certificate representing shares in the Wyoming company shall be cancelled. Until so surrendered and exchanged, each Luna Gold stock certificate shall represent solely the right to receive shares in the new company.

Warrants and stock options

As of the effective time of the Continuation, all warrants and options to purchase shares of Luna Gold common stock granted or issued prior to the effective time of the Continuation will remain warrants and options to purchase shares in Luna Gold as continued under the CBCA.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED THE CONTINUATION DESCRIBED IN THIS PROXY/PROSPECTUS AND RECOMMENDS THAT STOCKHOLDERS APPROVE THE CONTINUATION.

In reaching its decision, the Board of Directors reviewed the fairness to Luna Gold and its stockholders of the proposed Continuation and considered, without assigning relative weights to, the following factors:

| | - | the fact that the majority of Luna Gold’s directors and executive officers and our current principal executive office are currently located in Canada, and always have been; |

| |

| | - | the majority of Luna Gold’s shareholders are resident in Canada; |

| |

| | - | the fact that the principal market for Luna Gold’s common shares is in Canada on the TSX and that most financing activities carried out to raise funds for Luna Gold’s exploration programs are completed in Canada; |

| |

| | - | the belief that there will be minimal United States tax consequences of the proposed Continuation; and |

| |

| | - | the fact that the stockholders have an opportunity to vote on the proposed Continuation. |

Without relying on any single factor listed above more than any other factor, the Board of Directors, based upon their consideration of all such factors taken as a whole, have concluded that the Continuation proposal is fair to Luna Gold and its stockholders. ACCORDINGLY, THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE PROPOSED CONTINUATION SPECIAL RESOLUTIONS CONTAINED IN THIS PROXY/PROSPECTUS.

VOTING AND PROXY INFORMATION

Special meeting

A special meeting of the stockholders of Luna Gold Corp. will be held onu, 2005, atua.m., at the offices of at the offices of the Company located at Suite 920, 475 West Georgia Street, Vancouver, B.C., Canada, V6B 4M9 (or at any adjournments or postponements thereof) to consider and vote on a proposal to effect the proposed Continuation, which will have the effect of transferring the jurisdiction of incorporation of Luna Gold from the State of Wyoming to Canada, and to vote on any other matters that may properly come before such meeting. The presence, in person or by proxy, of at least two stockholders holding 10% of the outstanding shares of Luna Gold common stock will constitute a quorum. The vote of any stockholder who is represented at the special meeting by proxy will be cast as specified in the proxy. If no vote is specified in a duly executed and delivered proxy, such vote will be cast for the proposal. Any stockholder of record who is present at the special meeting in person will be entitled to vote

– 29 –

at the meeting regardless of whether the stockholder has previously granted a proxy for the special meeting.

THE BOARD OF DIRECTORS OF LUNA GOLD HAS APPROVED THE CONTINUANCE AND RECOMMENDS THAT STOCKHOLDERS VOTE IN FAVOR OF ITS APPROVAL.

Proxy solicitation

The total cost of soliciting proxies will be borne by us. Proxies may be solicited by officers and regular employees of Luna Gold without extra remuneration, by personal interviews, telephone and by electronic means. We anticipate that banks, brokerage houses and other custodians, nominees and fiduciaries will forward soliciting material to stockholders and those persons will be reimbursed for the related out-of-pocket expenses they incur.

Record date

Only those stockholders of record at the close of business onu, 2005, as shown in Luna Gold’s records, will be entitled to vote or to grant proxies to vote at the special meeting.

Vote required for approval

Approval of Luna Gold’s proposed Continuation Special Resolutions require the affirmative vote of the stockholders of Luna Gold holding two-thirds of the shares of Luna Gold common stock. Abstentions and broker “non-votes” will have the effect of votes against the Continuation. As of July 8, 2005, there were 24,572,700 shares of common stock issued and outstanding. The directors and executive officers of Luna Gold directly own, in the aggregate, 775,082 shares (approximately 3.15%) of the total number of shares of Luna Gold common stock outstanding at the record date. These persons have indicated that they will vote all of their shares for the approval of the Continuation Special Resolutions.

Proxies instruction

Each Luna Gold stockholder as ofu, 2005, will receive a proxy card. A stockholder may grant a proxy to vote for or against, or to abstain from voting on, the Continuation Special Resolutions by marking his/her proxy card appropriately and executing it in the space provided.