October 30, 2014

We have acted as special United States counsel to DHT Holdings, Inc., a company incorporated under the laws of the Republic of the Marshall Islands (the “Company”), in connection with the filing by the Company with the Securities and Exchange Commission (the “Commission”) of a registration statement (the “Registration Statement”) on Form F-3 under the Securities Act of 1933, as amended (the “Securities Act”), covering the resale by holders of up to $150,000,000 principal amount of the Company’s 4.5% Convertible Senior Notes due 2019 ( the “Notes”) and the common stock, par value $0.01 per share, of the Company (the “Common Stock”), which may be issued upon conversion of the Notes. The Notes were issued pursuant to an Indenture and First Supplemental Indenture both dated as of September 15, 2014 (together the “Indenture”), among the Company and U.S. Banks National Association, as trustee (the “Trustee”).

In rendering our opinion, we have reviewed the Registration Statement and have examined such records, representations, documents, certificates or other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below. In this examination, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified, conformed, or photostatic copies, and the authenticity of the originals of such copies. In making our examination of documents executed, or to be executed, by the parties indicated therein, we have assumed that each party, including the Company, is duly organized and existing under the laws of the applicable jurisdiction of its organization and had, or will have, the power, corporate or other, to enter into and perform all obligations thereunder, and we have also assumed the due authorization by all requisite action, corporate or other, and execution and delivery by each party indicated in the documents and that such documents constitute, or will constitute, valid and binding obligations of each party.

In rendering our opinion, we have considered the applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), regulations promulgated thereunder by the U.S. Department of Treasury (the “Regulations”), pertinent judicial authorities, rulings of the U.S. Internal Revenue Service, and such other authorities as we have considered relevant, in each case as in effect on the date hereof. It should be noted that the Code, Regulations, judicial decisions, administrative interpretations and other authorities are subject to change at any time, possibly with retroactive effect. It should also be noted that (as discussed in the Registration Statement) there are legal uncertainties regarding certain of the issues relevant to our opinion – in particular, the issue regarding whether the Company is currently a passive foreign investment company. A material change in any of the materials or authorities upon which our opinion is based could affect the conclusions set forth herein. There can be no assurance, moreover, that any opinion expressed herein will be accepted by the Internal Revenue Service, or if challenged, by a court.

Based upon the foregoing, although the discussion in the Registration Statement under the heading “Tax Considerations – U.S. Federal Income Tax Considerations” does not purport to discuss all possible United States federal income tax consequences of the acquisition, ownership and disposition of the Notes and the Common Stock, we hereby confirm that the statements of law (including the qualifications thereto) under such heading represent our opinion of the material United States federal income tax consequences of the acquisition, ownership and disposition of the Common Stock, subject to certain assumptions expressly described in the Registration Statement under such heading.

We express no other opinion, except as set forth above. We disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or subsequent changes in applicable law. Any changes in the facts set forth or assumed herein may affect the conclusions stated herein.

We are admitted to practice in the State of New York and express no opinion as to matters governed by any laws other than the laws of the State of New York and the Federal laws of the United States of America. In particular, we do not purport to pass on any matter governed by the laws of the Republic of the Marshall Islands.

We hereby consent to the filing of this opinion with the Commission as Exhibit 8.1 to the Registration Statement. We also consent to the reference to our firm under the caption “Legal Matters” in the prospectus forming a part of the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| | | Very truly yours, | |

| | | | |

| | | | |

| | | | |

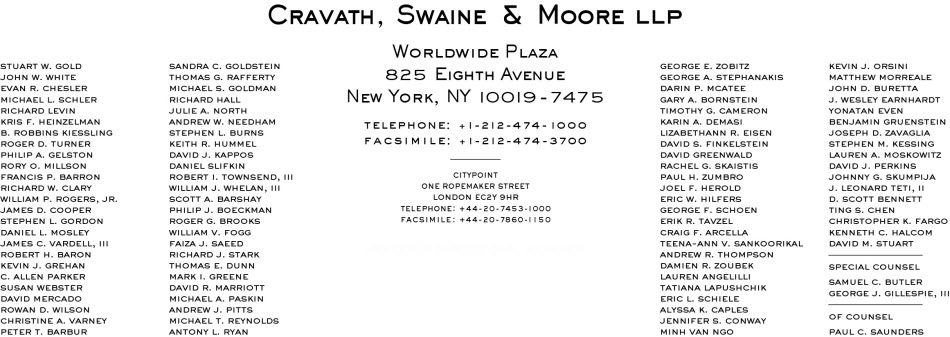

| | | /s/ Cravath, Swaine & Moore LLP | |

| | | | |

DHT Holdings, Inc.

2 Church Street

Hamilton HM 11

Bermuda

O

3