Investor Presentation December 23, 2013

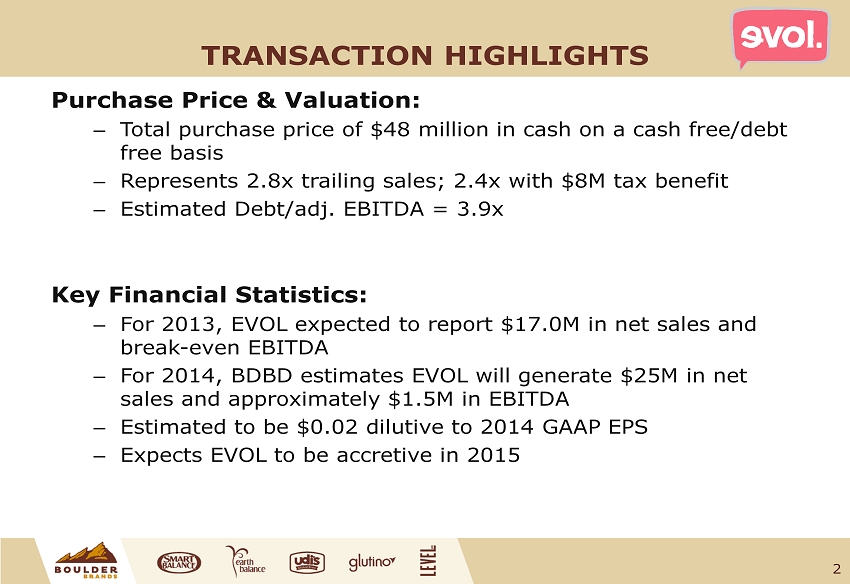

TRANSACTION HIGHLIGHTS Purchase Price & Valuation: – Total purchase price of $48 million in cash on a cash free/debt free basis – Represents 2.8x trailing sales; 2.4x with $8M tax benefit – Estimated Debt/adj. EBITDA = 3.9x Key Financial Statistics: – For 2013, EVOL expected to report $17.0M in net sales and break - even EBITDA – For 2014, BDBD estimates EVOL will generate $25M in net sales and approximately $1.5M in EBITDA – Estimated to be $0.02 dilutive to 2014 GAAP EPS – Expects EVOL to be accretive in 2015 2

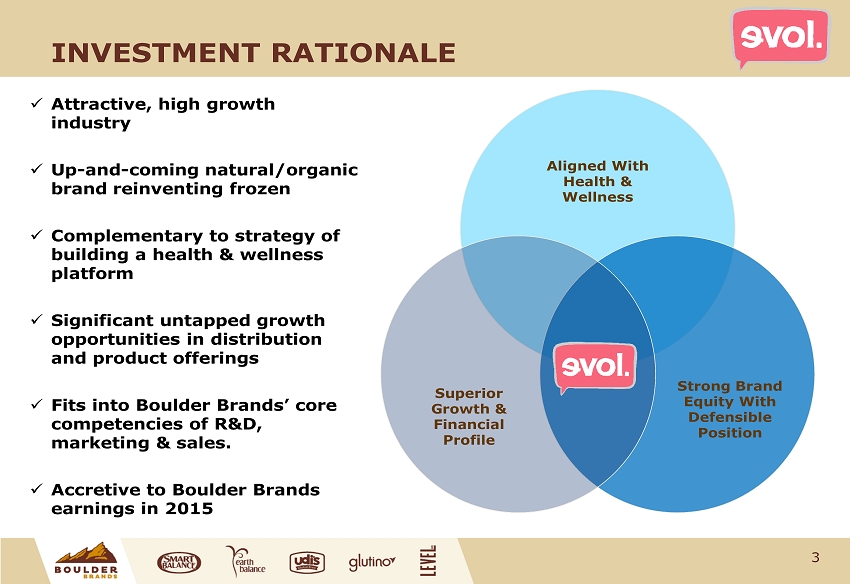

INVESTMENT RATIONALE x Attractive, high growth industry x Up - and - coming natural/organic brand reinventing frozen x Complementary to strategy of building a health & wellness platform x Significant untapped growth opportunities in distribution and product offerings x Fits into Boulder Brands’ core competencies of R&D, marketing & sales. x Accretive to Boulder Brands earnings in 2015 3 Aligned With Health & Wellness Strong Brand Equity With Defensible Position Superior Growth & Financial Profile

------------------------------------------------------------------------- Fueling Growth ------------------------------ ----------- -------------------------------- Innovation + Channels + Brands HEART HEALTH GLUTEN - FREE DIET PLANT - BASED PURE & SIMPLE PLANT - BASED DIET PURE & SIMPLE A NEW PLATFORM FOR BOULDER BRANDS DIABETES 4

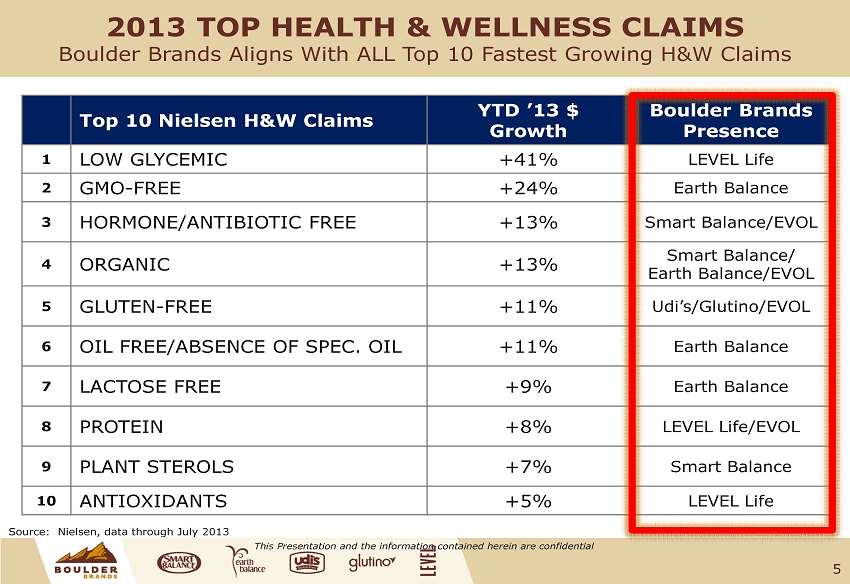

2013 TOP HEALTH & WELLNESS CLAIMS Boulder Brands Aligns With ALL Top 10 Fastest Growing H&W Claims Top 10 Nielsen H&W Claims YTD ’13 $ Growth Boulder Brands Presence 1 LOW GLYCEMIC +41% LEVEL Life 2 GMO - FREE +24% Earth Balance 3 HORMONE/ANTIBIOTIC FREE +13% Smart Balance/EVOL 4 ORGANIC +13% Smart Balance/ Earth Balance/EVOL 5 GLUTEN - FREE +11% Udi’s/Glutino/EVOL 6 OIL FREE/ABSENCE OF SPEC. OIL +11% Earth Balance 7 LACTOSE FREE +9% Earth Balance 8 PROTEIN +8% LEVEL Life/EVOL 9 PLANT STEROLS +7% Smart Balance 10 ANTIOXIDANTS +5% LEVEL Life 5 Source: Nielsen, data through July 2013 This Presentation and the information contained herein are confidential

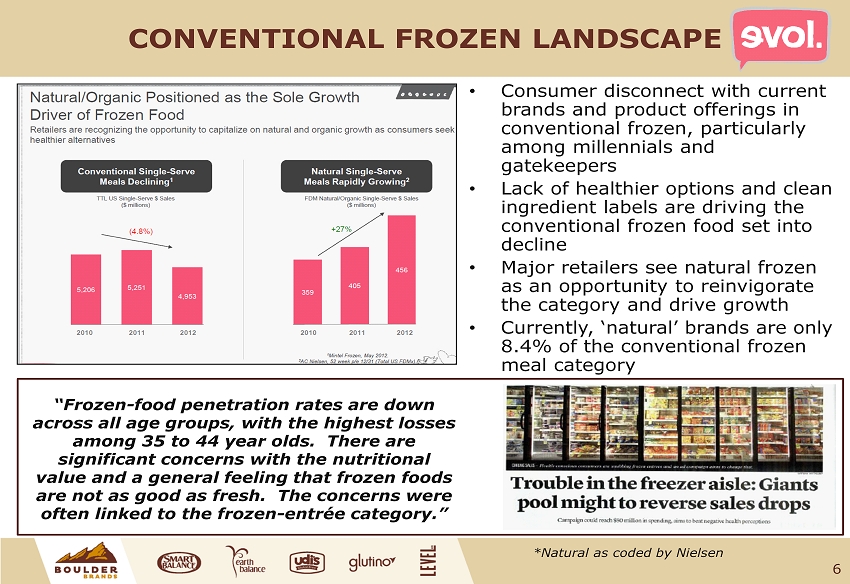

CONVENTIONAL FROZEN LANDSCAPE • Consumer disconnect with current brands and product offerings in conventional frozen, particularly among millennials and gatekeepers • Lack of healthier options and clean ingredient labels are driving the conventional frozen food set into decline • Major retailers see natural frozen as an opportunity to reinvigorate the category and drive growth • Currently, ‘natural’ brands are only 8.4% of the conventional frozen meal category “Frozen - food penetration rates are down across all age groups, with the highest losses among 35 to 44 year olds. There are significant concerns with the nutritional value and a general feeling that frozen foods are not as good as fresh. The concerns were often linked to the frozen - entrée category.” *Natural as coded by Nielsen 6

COMPANY OVERVIEW • Founded in 2002 • USDA Production facility in Boulder, CO • Currently has 29 unique items – 17 Burritos, 8 Bowls and 4 Quesadillas – 5 Club Offerings • 70% sales growth rate estimate for 2013 $- $500 $1,000 $1,500 $2,000 $2,500 10/31/09 01/23/10 04/17/10 07/10/10 10/02/10 12/25/10 03/19/11 06/11/11 09/03/11 11/26/11 02/18/12 05/12/12 08/04/12 09/29/12 01/19/13 04/13/13 07/06/13 09/28/13 Thousands EVOL Sales Growth XAOC Burrito Bowls Quesadilla 7

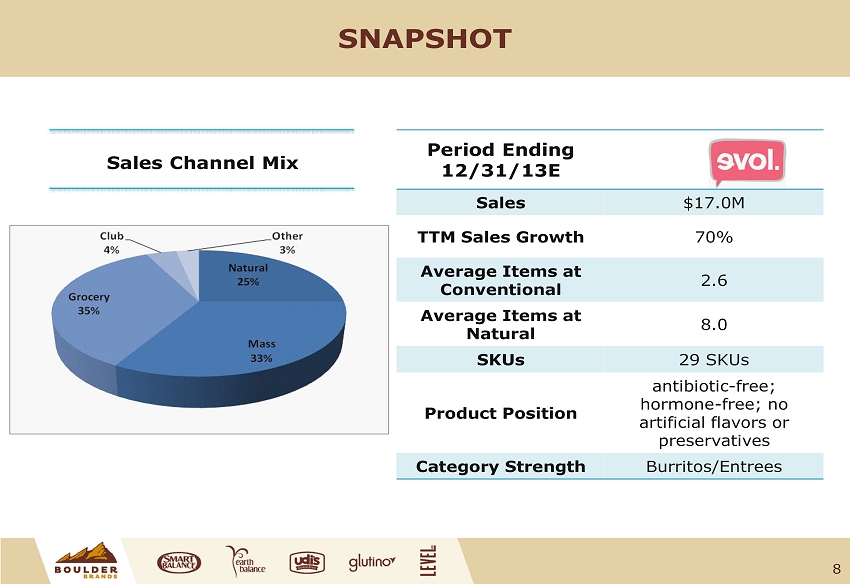

SNAPSHOT 8 Period Ending 12/31/13E Sales $17.0M TTM Sales Growth 70% Average Items at Conventional 2.6 Average Items at Natural 8.0 SKUs 29 SKUs Product Position antibiotic - free; hormone - free; no artificial flavors or preservatives Category Strength Burritos/Entrees Sales Channel Mix

BRAND POSITIONING • EVOL is bringing innovation to the frozen food category • Simple ingredients appeal to moms and the millennial generation who otherwise wouldn’t be in the category 9

CONVENTIONAL GROWTH BY CATEGORY Handhelds • Handhelds account for 47% of conventional sales – 17 SKUs • Average ACV conventional – 23% Entrees • Entrees account for 53% of conventional sales – 8 SKUs • Average ACV conventional – 30% *Source Nielsen 12 wks ending 9.28.2013 10

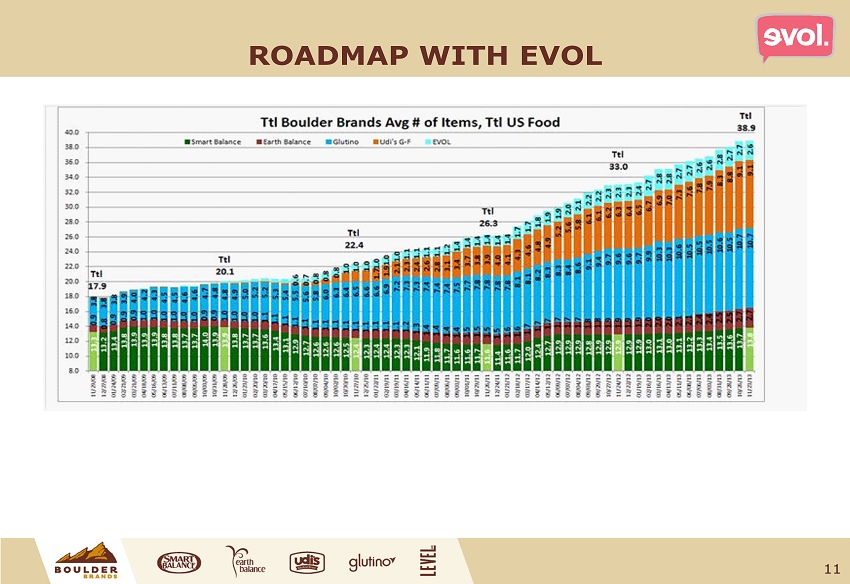

11 ROADMAP WITH EVOL

“NEW AGE FROZEN” OPPORTUNITIES Frozen - 4 Door Set 12 • With EVOL acquisition Boulder Brands would add a premier ‘pure & simple ’ brand to the portfolio • Leverage Boulder Brands sales team for a Fast track EVOL build out on existing items • Convert EVOL gluten - free to Udi’s • Launch EVOL pizza on Udi’s pizza platform • Use EVOL platform to launch Udi’s entrees • Gives Boulder Brands a two brand frozen strategy in Pizza and Meals • Allows BDBD to take a leadership position in the “new wave of frozen”

ACQUISITION CONCLUSION Fast - track to Udi’s frozen entrees: – Platform and management expertise in frozen product development • Pizza, entrees, handheld Become category leader for new age frozen: – Similar to Udi’s – EVOL has high level of engagement from retailers to revitalize frozen meals Gross margin improvement potential: – Current 30% gross margins – highly manual, batch production 13