Annex I

Information Statement

Boulder Brands, Inc.

1600 Pearl Street, Suite 300

Boulder, Colorado 80302

INFORMATION STATEMENT PURSUANT TO SECTION 14(f) OF THE SECURITIES

EXCHANGE ACT OF 1934, AS AMENDED AND RULE 14f-1 THEREUNDER

WE ARE NOT ASKING FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being mailed on December 9, 2015 to holders of record of Common Stock, par value $0.0001 per share, of Boulder Brands, Inc. (“Boulder Brands” or the “Company”), a Delaware corporation, as a part of the Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”) of Boulder Brands with respect to the cash tender offer (the “Offer”) by Slope Acquisition Inc. (the “Purchaser”), a Delaware corporation and a wholly owned direct subsidiary of Pinnacle Foods Inc. (“Pinnacle”), a Delaware corporation, to purchase all issued and outstanding shares of Boulder Brands’ common stock (the “Shares” or the “Common Stock”). Unless the context indicates otherwise, in this Information Statement, we use the terms the “Company,” “us,” “we,” and “our” to refer to Boulder Brands. You are receiving this Information Statement in connection with the possible appointment of persons designated by Purchaser without a meeting of stockholders to a majority of the seats on Boulder Brands’ board of directors (the “Board”). Such designation would be made pursuant to the Agreement and Plan of Merger, dated as of November 24, 2015, by and among Boulder Brands, Purchaser and Pinnacle (as such agreement may be amended or supplemented from time to time in accordance with its terms, the “Merger Agreement”).

Pursuant to the Merger Agreement, Purchaser commenced on December 9, 2015 a tender offer to purchase all outstanding shares of Common Stock of Boulder Brands at a price per share of $11.00, subject to any required withholding of taxes, net to the seller in cash without interest (such amount, as it may be adjusted from time to time on the terms and subject to the conditions set forth in the Merger Agreement, the “Offer Price”). The Merger Agreement provides, among other things, that as soon as practicable after the consummation of the Offer and subject to the satisfaction or waiver of the applicable conditions set forth in the Merger Agreement, Purchaser will be merged with and into Boulder Brands in accordance with Section 251(h) the General Corporation Law of the State of Delaware or the DGCL (the “Merger”), with Boulder Brands surviving as an direct wholly owned subsidiary of Pinnacle, pursuant to which all then outstanding shares of Common Stock (other than shares of Common Stock held in treasury, owned by Boulder Brands or any of its wholly owned subsidiaries or by Pinnacle or any of its subsidiaries, or shares of Common Stock held by stockholders who have validly exercised their appraisal rights under the DGCL) will be converted into the right to receive the Offer Price, subject to any required withholding of taxes, net to the seller in cash without interest.

The detailed terms and conditions of the Offer are set forth in the Offer to Purchase, dated December 9, 2015 (the “Offer to Purchase”), filed as Exhibit (a)(1)(A) to the tender offer statement on Schedule TO filed by Pinnacle on December 9, 2015 (the “Schedule TO”), and the related Letter of Transmittal, filed as Exhibit (a)(1)(B) to the Schedule TO. The Offer is initially scheduled to expire at 12:00 midnight, New York City Time, on, January 7, 2016, unless Purchaser extends the Offer (such date, including any such extensions, the “Expiration Date”).

The Merger Agreement provides that, effective after initial acceptance for payment by Purchaser of the shares of Common Stock tendered pursuant to the Offer representing at least a majority of then outstanding shares of Common Stock (other than shares of Common Stock held in treasury, owned by Boulder Brands or any

I-1

of its wholly owned subsidiaries or by Pinnacle or any of its subsidiaries, or shares of Common Stock held by stockholders who have validly exercised their appraisal rights pursuant to Section 262 of the DGCL) (such time hereinafter referred to as the “Acceptance Time”), subject to compliance with applicable laws and applicable rules of the NASDAQ Global Select Market, Purchaser shall be entitled to elect or designate such number of directors, rounded up to the next whole number, on the Board as is equal to the product of (i) the total number of directors on the Board (after giving effect to the directors elected or designated by Purchaser pursuant to this sentence) multiplied by (ii) the percentage that the aggregate number of shares of Common Stock beneficially owned by Pinnacle, Purchaser and each of their subsidiaries bears to the total number of shares of Common Stock then outstanding. Boulder Brands and the Board shall, upon Purchaser’s request at any time following the Acceptance Time, take all such actions necessary to implement the foregoing.

Notwithstanding the foregoing, the Merger Agreement provides that at all times prior to the completion of the Merger, Boulder Brands shall cause the Board to maintain at least three (3) independent directors who were members of the Board on or prior to November 24, 2015 who are not officers, directors or employees of Pinnacle, Purchaser, or any of their subsidiaries (the “Continuing Directors”). After the Acceptance Time and until completion of the Merger, the affirmative vote of a majority of the Continuing Directors shall be required (i) for Boulder Brands to amend or terminate the Merger Agreement, (ii) to exercise or waive any of Boulder Brands’ rights under the Merger Agreement, (iii) to amend Boulder Brands’ certificate of incorporation, or (iv) to take any other action of the Board under or in connection with the Merger Agreement.

This Information Statement is required by Section 14(f) of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 thereunder, in connection with the possible appointment of Purchaser’s designees to the Board.

You are urged to read this Information Statement carefully. We are not, however, soliciting your proxy, and you are not required to take any action with respect to the subject matter of this Information Statement.

This Information Statement supplements certain information in the Schedule 14D-9 to which this Information Statement is attached as Annex A. You are not required to take any action with respect to the subject matter of this Information Statement. The information contained in this Information Statement (including information incorporated by reference herein) concerning Purchaser and concerning Pinnacle’s designees has been furnished to Boulder Brands by Pinnacle and Purchaser, and Boulder Brands assumes no responsibility for the accuracy or completeness of such information.

PURCHASER’S DESIGNEES TO THE BOARD

As of the date of this Information Statement, Purchaser has not determined who will be its designees to the Board. However, the designees will be selected from the list of potential designees provided below (the “Potential Designees”). The Potential Designees have consented to serve as directors of Boulder Brands if so designated. None of the Potential Designees currently is a director of, or holds any position with, Boulder Brands. Pinnacle and Purchaser have informed Boulder Brands that, to their knowledge, none of the Potential Designees beneficially owns any equity securities or rights to acquire any equity securities of Boulder Brands, has a familial relationship with any director or executive officer of Boulder Brands or has been involved in any transactions with Boulder Brands or any of its directors, executive officers or affiliates that are required to be disclosed pursuant to the rules of the U.S. Securities and Exchange Commission.

Pinnacle and Purchaser have informed Boulder Brands that, to their knowledge, none of the Potential Designees has been convicted in a criminal proceeding (excluding traffic violations or misdemeanors) or has been a party to any judicial or administrative proceeding during the past ten years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person

I-2

from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

It is expected that Purchaser’s designees may assume office at any time following the purchase by Purchaser of shares of Common Stock pursuant to the Offer, which purchase cannot be earlier than January 8, 2016. At such time, Purchaser will become entitled to designate at least a majority of the members of the Board. It is currently not known which, if any, of the current directors of Boulder Brands would resign.

| | | | | | | | |

Name | | Age | | | Present Principal Occupation or

Employment and Five Year

Employment History | |

Robert J. Gamgort | | | 53 | | | | * | |

Craig Steeneck | | | 58 | | | | * | |

M. Kelley Maggs | | | 63 | | | | * | |

Mary Beth DeNooyer | | | 45 | | | | * | |

| * | See biographies immediately below table. |

Robert J. Gamgort currently is the Chief Executive Officer and a Director of Pinnacle, positions he has held since July 2009. From September 2002 to April 2009, Mr. Gamgort served as North American President for Mars Incorporated.

Craig Steeneck currently is the Executive Vice President and Chief Financial Officer of Pinnacle, positions he has held since July 2007.

M. Kelley Maggs currently is the Executive Vice President and General Counsel of Pinnacle, positions he has held since March 2013. Previously, Mr. Maggs had served as Senior Vice President, General Counsel and Secretary of Pinnacle, positions he had held since Pinnacle’s inception in 2001.

Mary Beth DeNooyer currently is the Executive Vice President and Chief Human Resources Officer of Pinnacle, positions she has held since May 2013. From April 2011 through June 2012, Ms. DeNooyer served as Senior Vice President and Chief Human Resources Officer for the division of Sara Lee which was spun-off as Hillshire Brands. From March 2010 to June 2012, Ms. DeNooyer served as Senior Vice President, Compensation and Benefits at Sara Lee. Ms. DeNooyer held Human Resources leadership positions at The Pepsi Bottling Group from 1998 to 2010.

INFORMATION CONCERNING OUTSTANDING SECURITIES

The authorized share capital of Boulder Brands consists of 250,000,000 shares of Common Stock, par value $0.0001. There is no class of preferred stock currently authorized. As of December 7, 2015, a total of 63,116,425 shares of Common Stock were issued and outstanding. The shares of Common Stock constitute the only class of Boulder Brands’ securities that is entitled to vote at a meeting of Boulder Brands’ stockholders. As of the date of this Information Statement, Pinnacle and Purchaser, do not own of record any shares of Common Stock of Boulder Brands.

I-3

CURRENT BOARD OF DIRECTORS

The following table sets forth certain information with respect to the directors and executive officers of Boulder Brands as of December 7, 2015:

| | |

James B. Leighton Age 59 | | James B. Leighton has been a member of our Board of Directors since August 2007, our interim Chief Executive Officer since June 10, 2015 and our Chief Operating Officer since October 2013. Mr. Leighton is additionally a member of our Finance Committee. From 2009 to 2013, Mr. Leighton held numerous general management positions, including President of Perdue Foods, a large privately-held food and protein company. From 2006 to 2009, Mr. Leighton served as the President of Operations and Supply Chain and President of Perdue Foods. From 2002 to 2006, Mr. Leighton served as the senior vice president of operations of ConAgra Foods, Inc., one of the largest food companies in the United States. He has also held senior level management and executive positions with Celestial Seasonings, The Hain-Celestial Group, and Nabisco. He was founder and CEO of National Health Management Inc. Mr. Leighton holds a BA in business administration and industrial relations from the University of Iowa and an MBA from Keller Graduate School of Management, where he also taught graduate students Leadership and Organizational Behavior. Mr. Leighton served on the non-profit Foundation and Corporation Boards for Atlantic General Hospital and is the creator and author of Getting FIT—Unleashing the Power of Fully Integrated Teams. Mr. Leighton’s entrepreneurial, operations, general management and manufacturing experience within foodservice, retail, and international channels provides him with a broad perspective on Boulder Brands’ operations and allows him to be a key contributor to the Board’s oversight of Boulder Brands’ business. In addition, Mr. Leighton’s extensive experience with commodity supply businesses serves as an important resource to the Board, and Mr. Leighton has greatly assisted Boulder Brands in developing its strategic plan. |

| |

R. Dean Hollis Age 55 | | R. Dean Hollis, who became the Chairman of our Board of Directors on March 18, 2015, has been a member of our Board of Directors since July 2011 and served as our Independent Lead Director from October 2013 until his appointment as the Chairman of the Board. Mr. Hollis is also a member of our Audit Committee and our Governance and Nominating Committee. Mr. Hollis has more than 35 years of business experience across food, retail, and consumer product companies. Currently, he is a Senior Advisor for Oaktree Capital Management, an $85 billion investment firm. In addition, he oversees several privately held investments and serves on several boards, including Advance Pierre Foods, Diamond Foods, Inc., and Landec Corporation. Mr. Hollis currently serves as Chair of the Advance Pierre Foods board and Chair of Landec Corporation’s Compensation Committee. Until 2008, Mr. Hollis was with ConAgra Foods, Inc. where for 21 years he held many executive-level positions, including President and Chief Operating Officer, consumer foods and international. In that role, Mr. Hollis developed and executed a worldwide business transformation strategy while overseeing the largest part of the ConAgra Foods, Inc. portfolio, including its $12 billion consumer and customer branded businesses across all channels. Prior to joining ConAgra Foods, Inc., Mr. Hollis was with the TreeSweet Companies, holding management positions in both sales and marketing. He began his career in the consumer products division of Georgia-Pacific, where he spent four years advancing through a variety of sales management positions. Mr. Hollis holds a BS in Psychology from Stetson University, where he is on the Board of Directors and received the Distinguished Alumni Award in 2005. |

I-4

| | |

| | As indicated above, Mr. Hollis has held key management positions at companies in the packaged food and consumer products industries and also has considerable board experience. Drawing on these experiences in combination with his financial literacy, Mr. Hollis is an important contributor to the development of Boulder Brands’ business and growth strategy and to the oversight of its corporate governance, as well as its accounting and financial reporting processes and requirements. Mr. Hollis has greatly assisted Boulder Brands in developing its strategic plan. |

| |

Benjamin D. Chereskin Age 57 | | Benjamin D. Chereskin has been a member of our Board of Directors since October 2013. Mr. Chereskin chairs the Compensation Committee and serves as a member of our Finance Committee and our Governance and Nominating Committee. In 2009, Mr. Chereskin founded Profile Capital Management LLC, an investment management firm. From 1993-2009, Mr. Chereskin was a Managing Director at Madison Dearborn Partners, a private equity investment firm, where he led the firm’s consumer investment practice. Prior to co-founding Madison Dearborn Partners, Mr. Chereskin held various positions with its predecessor, First Chicago Venture Capital from 1984 through 1993. While at Madison Dearborn, Mr. Chereskin led many notable transactions and served on the board of numerous portfolio companies, including: Cornerstone Brands (acquired by Home Shopping Network); Carrols Corporation; Tuesday Morning Corporation (TUES-Nasdaq); Cinemark, Inc. (CNK-NYSE); Bolthouse Farms (acquired by Campbell’s Soup Company); L.A. Fitness (private), and CDW Corporation (CDW-Nasdaq). Mr. Chereskin currently serves on the Board of Directors of CDW Corporation (Audit Committee) and Cinemark, Inc. (Strategic Planning Committee). Additionally, Mr. Chereskin serves as Chairman of KIPP: Chicago. Mr. Chereskin earned an MBA from Harvard Graduate School of Business Administration and an A.B. from Harvard College. Mr. Chereskin is an investment professional with 30 years of private equity investment experience and also has considerable board experience. |

| |

Gerald J “Bud” Laber Age 72 | | Gerald J. “Bud” Laber has been a member of our Board of Directors since June 2005. Mr. Laber chairs the Audit Committee and is a member of our Compensation Committee and Governance and Nominating Committee. Mr. Laber has been a private investor since 2000, when he retired after 33 years of service with Arthur Andersen. Mr. Laber was an audit partner with Arthur Andersen from 1980 to 2000, and, with the exception of a leave for military service from 1966 through 1968, was employed by Arthur Andersen from 1965 until retiring in 2000. Mr. Laber is a Certified Public Accountant and is a member of the American Institute of Certified Public Accountants and the Colorado Society of Certified Public Accountants. Currently, Mr. Laber is: (i) on the Board of Directors and Chair of the Audit Committee of Scott’s Liquid Gold since February 2004; (ii) on the Board of Directors, Chair of the Audit Committee and member of the Compensation Committee for Allied Motion Technologies, Inc. since November 2010; and (iii) on the Board of Directors and chair of the Audit Committee of two companies that are no longer public reporting companies. He served as President of The Catholic Foundation of Northern Colorado from January 2008 until November 2012. Formerly, Mr. Laber (i) served on the Board of Directors and as Chair of the Audit Committee of Spectralink Corporation from April 2004 to March 2007, and (ii) served on the Board of Directors and Audit Committee of Applied Films Corporation from July 2004 to July 2007 (Audit Chair from October 2005 to July 2007). Each of these companies is, or was, publicly traded. Mr. Laber holds a BSBA in Accounting from the University of South Dakota and is a member of the Board of Trustees of the University of South Dakota Foundation. |

I-5

| | |

| | As a result of these professional and other experiences, Mr. Laber is able to provide key assistance to the Board and its Audit Committee in overseeing Boulder Brands accounting and financial reporting responsibilities. |

| |

James E. Lewis Age 66 | | James E. Lewis has been a Director of Boulder Brands since our inception in May 2005 and served as our Vice Chairman until May 14, 2007. He is Chairman of the Finance Committee and a member of the Audit and Compensation Committees. Mr. Lewis has more than 40 years of financial and business experience in the mining, commodity trading, financial services, and food industries. For the last 20 years, he has been an entrepreneur in these industries and has been actively involved in starting, buying, building, operating, managing, financing (including IPOs), selling, merging, restructuring, consolidating and liquidating companies. Before that, Mr. Lewis held various executive financial positions in the coal and uranium mining industry and was in public accounting with Arthur Andersen. Mr. Lewis is a certified public accountant and is a member of the American Institute of Certified Public Accountants and the Colorado Society of Certified Public Accountants. He holds a BBA in Accounting from Texas Tech University. Mr. Lewis’ extensive entrepreneurial experience in various industries provides a unique perspective and contribution to our Board of Directors. In addition, Mr. Lewis has a strong background in both accounting and the food industry, as well as significant experience in finance, capital markets, and mergers and acquisitions, which provide Mr. Lewis with a unique ability to contribute to our Board of Directors. |

| |

Thomas K. McInerney Age 69 | | Thomas K. McInerney has been a member of our Board of Directors since July 2011. Mr. McInerney chairs our Governance and Nominating Committee and is a member of our Finance and Compensation Committees. Mr. McInerney has more than 25 years of business experience in the beverage industry, across management, sales, marketing, and finance. Since 1996, Mr. McInerney has been a managing partner of Lindsey & Company, an executive search firm. Previously, he was vice president and general manager of the largest division of Tropicana Dole North America. Mr. McInerney was also the executive vice president of marketing for the House of Seagram, the U.S. spirits affiliate of Joseph E. Seagram and Sons, Inc. Mr. McInerney was employed by the Seagram Corporation for 20 years. He began his career with National Distillers and Chemical Corporation where he held a number of sales, market research, and product management assignments. Mr. McInerney is a former board member of 6 Figure Jobs.com, the National Advertising Review Board, the Traffic Audit Bureau, and the Association of National Advertisers. He holds a BA in political science from Villanova and served as a Marine officer in Vietnam. Mr. McInerney’s significant experience in all aspects of the consumer goods industry makes him an indispensable resource to the Board and management. In addition, Mr. McInerney’s experience as an executive search consultant provides Boulder Brands with expertise in the identification, assessment, and selection of executive talent, as well as expertise with compensation-related issues. |

I-6

EXECUTIVE OFFICERS OF BOULDER BRANDS

Information regarding our executive officers, as of December 7, 2015 is provided below:

| | | | | | |

Name | | Age | | | Title |

James B. Leighton | | | 50 | | | Interim Chief Executive Officer and Chief Operating Officer |

Christine Sacco | | | 39 | | | Chief Financial Officer |

Timothy Kraft | | | 36 | | | Chief Legal Officer and Corporate Secretary |

Phil Anson | | | 37 | | | Chief Commercial Officer |

For information with respect to Mr. Leighton, please see the information about the members of our Board of Directors under “Current Board of Directors.”

Christine Sacco was appointed as Boulder Brands’ Chief Financial Officer effective as of January 1, 2012. Prior to this appointment, Ms. Sacco was Boulder Brands’ Vice President and Operations Controller since January, 2008. Ms. Sacco also served as the Principal Accounting Officer from January 1, 2011 until March 30, 2012. Prior to joining Boulder Brands’, Ms. Sacco served as Vice President, Treasurer, and Director of Financial Reporting of Alpharma Inc., where she worked from October 2002 until January 2008. Ms. Sacco began her career at Ernst & Young LLP. She is a Certified Public Accountant and holds a BS in Accounting from St. Thomas Aquinas College.

Timothy Kraft has been Boulder Brands’ Chief Legal Officer and Corporate Secretary since December 2014. Mr. Kraft previously served as Senior Vice President, Associate General Counsel from 2012-2014, and Vice President of Legal from 2009-2012. Before joining Boulder Brands, Mr. Kraft was with the law firm of Davis & Kuelthau where he focused on general corporate and transactional law. Mr. Kraft has handled legal matters for Boulder Brands since 2006 when he was an integral member of the external legal team that assisted Boulder Specialty Brands, Inc. in its acquisition of the Smart Balance business in May of 2007. Mr. Kraft also has prior work experience with Nike, Inc., Coca-Cola Enterprises and Philip Morris USA. He is a graduate of Truman State University (BA in Business Administration) and Marquette University Law School (JD).

Phil Anson is the founder of EVOL Foods and joined Boulder Brands when it acquired EVOL Foods in 2013. After running Boulder Brands’ Frozen Foods segment and expanding both distribution and product offerings under the EVOL and Udi’s Brands, Phil was appointed the role of Chief Innovation Officer, where he has spent the last six months building a world class innovation team and center while optimizing processes. He has 15 years of experience as a Natural Foods Entrepreneur in food manufacturing, marketing, sales, distribution, finance and strategic planning. Phil is a long-time culinary enthusiast and creative innovator who successfully grew one of the most compelling challenger brands found in the market today.

CORPORATE GOVERNANCE

Director Independence

The rules of the NASDAQ Global Select Market (Nasdaq), on which our stock is traded, require that the Board be comprised of a majority of “independent directors.” Currently 5 of 6 (approximately 83%) of our directors are independent. In determining the independence of our directors, the Board considered the criteria specified by Nasdaq regarding independence generally, and for the members of the Compensation Committee, took into account the additional standards applicable to directors serving on that committee. In addition, the members of the audit committee satisfy the additional independent standards specified by Nasdaq and the SEC for members of the audit committee.

Based upon the information submitted by each of its directors, and following the recommendation of the Governance and Nominating Committee, the Board has determined that the following directors are independent: Benjamin D. Chereskin, R. Dean Hollis, Gerald J. “Bud” Laber, James E. Lewis and Thomas K. McInerney.

I-7

Meeting of Independent Directors

The independent directors meet in executive session, without members of management present, from time to time, including as part of each quarterly Board meeting. Before the separation of the roles of Chairman and Chief Executive Officer that occurred in 2015 and as more fully described below, our Independent Lead Director acted as chairman of these meetings. Since the change in the Board’s structure the Chairman presides over the meetings.

Board Leadership Structure

On March 18, 2015, our Board approved the separation of the roles of Chairman and Chief Executive Officer. Mr. R. Dean Hollis, who has been serving as our Independent Lead Director, was appointed as the non-executive Chairman. The Board’s decision to separate the Chairman and Chief Executive Officer roles was made as part of the Board’s ongoing evaluation of Boulder Brands’ governance policies and practices and after considering the views expressed by various stockholders of Boulder Brands in connection with our continuing stockholder outreach efforts.

In light of this change to the Board’s leadership structure, the Board also updated its corporate governance guidelines and calls for the Board to annually elect a Chairman from among its independent directors. The Chairman serves as liaison between the Chief Executive Officer (or, currently our Interim Chief Executive Officer, Mr. Leighton), on the one hand, and the independent directors, on the other hand, and has the following duties and responsibilities:

| | • | | Calling meetings of the Board and executive sessions of the independent directors; |

| | • | | Presiding at all meetings of the Board and all executive sessions of the independent directors; |

| | • | | Setting the agenda and schedule for each meeting of the Board; |

| | • | | Determining the information to be sent to the Board and instructing members of management to provide such information; |

| | • | | Being available for consultation and direct communication with major stockholders; and |

| | • | | Providing advice and counsel to the Chief Executive Officer and other senior members of management in connection with strategic planning and other matters of strategic importance to Boulder Brands. |

Boulder Brands’ corporate governance guidelines provide that the Board will determine whether the offices of Chief Executive Officer and Chairman of the Board should be combined or separate, based on an analysis of then-existing facts and what is in the best interests of Boulder Brands at any particular time. If the offices of the Chief Executive Officer and Chairman are again combined in the future, the Board will elect a lead director from among its independent directors on an annual basis. In 2014 through the time the Board separated the roles in March 2015, Mr. Hollis served as our Independent Lead Director.

The Board also has four standing committees—an Audit Committee, a Compensation Committee, a Governance and Nominating Committee, and a Finance Committee. The Audit Committee, Compensation Committee, and Governance and Nominating Committee each has an independent director serving as its respective chairman and each is comprised solely of independent directors. The Finance Committee has an independent director serving as its chairman and a majority of its members are independent directors.

Board’s Role in Risk Oversight

Risk is an integral part of Board and committee deliberations throughout the year. The full Board has responsibility for the general risk oversight of Boulder Brands. As part of the Board’s oversight role, the Board has delegated responsibility for the oversight of specific risks to Board committees as follows:

| | • | | The Audit and Finance Committees work together to identify and review all material risks of Boulder Brands, and oversee the development by management of a plan to manage these risks. Both committees |

I-8

| | discuss with management and review Boulder Brands’ policies with respect to risk assessment, risk management, Boulder Brands’ significant financial risk exposures and the actions management has taken to limit, monitor, control or mitigate such exposures. The Finance Committee focuses primarily on Boulder Brands’ non-financial and operational risks, while the Audit Committee focuses primarily on Boulder Brands’ financial risks. |

| | • | | The Compensation Committee reviews Boulder Brands’ compensation policies and practices for its employees as they relate to risk management practices and risk-taking incentives. Along with the Audit and Finance Committees, the Compensation Committee also ensures that annual and long-term performance goals, their associated payouts, our equity compensation programs and other compensation practices do not engender excessive risk-taking by the executive officers. |

In addition, the role of our Board in our Company’s risk oversight process includes receiving regular reports from management on areas of material risk to our Company, including operational, financial, legal and regulatory, and strategic and reputational risks.

Compensation Risk

The Compensation Committee annually conducts a review as to whether any portion of the compensation program encourages executives to take unnecessary and excessive risks. Following this year’s review, the Compensation Committee concluded that the various elements of the compensation programs used by Boulder Brands were not reasonably likely to encourage executives to take unnecessary or excessive risks that could result in material harm to Boulder Brands.

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines that contribute to the overall operating framework of the Board and Boulder Brands. These guidelines cover topics including goals of the Board, director responsibilities, role of the Chairman of the Board and role of the lead director (when applicable), Board composition and structure, a director resignation policy, Board meetings, Board committees, performance evaluations, succession planning and director compensation. A copy of the corporate governance guidelines, which were recently updated in connection with the appointment of an independent non-executive Chairman of the Board, is available on our website at www.boulderbrands.com.

No Hedging Policy

Boulder Brands’ Insider Trading Policy prohibits all directors, officers and employees of Boulder Brands from effecting hedging or similar monetization transactions with respect to the shares of Boulder Brands.

Stock Ownership Guidelines

To further align the interests of our directors and executive officers and our stockholders, the Board has adopted stock ownership guidelines under which each of our executive officers and directors are required to maintain, within four years of becoming subject to the policy, vested equity holdings with a value at least equal to, in the case of our chief executive officer, six times his annual base salary and, in the case of our other executive officers, three times the executive’s annual base salary and each of our non-management directors will be required to maintain vested equity holdings with a value at least equal to three times the director’s annual cash retainer fee. Each of our named executive officers and directors who were serving in such position at the time the policy was adopted in March 2012 are currently on track to be in compliance as of December 31, 2015 and each of our named executive officers and directors who became subsequently subject to the policy are currently on track to be in compliance within the prescribed period. A copy of the stock ownership guidelines is available on our website at www.boulderbrands.com.

I-9

Communications between Stockholders and the Board

Stockholders may send communications to Boulder Brands’ directors (or any subset of the directors), as a group or individually, by writing to the group or any particular individual: c/o the Corporate Secretary, 1600 Pearl Street, Suite 300, Boulder, Colorado 80302. The Corporate Secretary will forward communications relating to matters within the Board’s purview to the directors, communications relating to matters within a Board committee’s area of responsibility to the Chair of the appropriate committee, and communications relating to ordinary business matters, such as consumer complaints, to the appropriate Company executive. The Corporate Secretary will not forward solicitations, junk mail and obviously frivolous or inappropriate communications, but makes them available to any non-management director who requests them.

Committees of the Board of Directors

Our Board currently has an Audit Committee, a Compensation Committee, a Governance and Nominating Committee, and a Finance Committee. The composition, duties and responsibilities of these committees are set forth below. Committee membership is reviewed annually.

Audit Committee. The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”), is composed of Messrs. Hollis, Laber and Lewis, and is chaired by Mr. Laber. The directors we have appointed to our Audit Committee are each independent members of our Board of Directors as defined by Nasdaq’s independence requirements for audit committee members. Each member of our Audit Committee is financially literate, and our Board of Directors has determined that Mr. Laber, Mr. Hollis and Mr. Lewis each qualifies as an “audit committee financial expert,” as such term is defined by SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. The Audit Committee met nine times during 2014.

The principal responsibilities of and functions to be performed by the Audit Committee are established in the Audit Committee charter, including assisting the Board with its oversight responsibilities regarding:

| | • | | the accounting and financial reporting processes of Boulder Brands; |

| | • | | the integrity of Boulder Brands’ financial statements; |

| | • | | Boulder Brands’ compliance with legal and regulatory requirements; |

| | • | | appointing Boulder Brands’ independent registered public accounting firm; |

| | • | | the registered independent auditor’s qualifications and independence; |

| | • | | the performance of Boulder Brands’ internal audit function; |

| | • | | the performance of Boulder Brands’ independent auditor; |

| | • | | reviewing any related party transactions and apparent or potential conflicts of interest; and |

| | • | | the audits of Boulder Brands’ financial statements. |

The Audit Committee charter, a copy of which is available on our website at www.boulderbrands.com, was adopted by the Board of Directors and is reviewed annually by the Audit Committee.

Compensation Committee. The Compensation Committee is composed of Messrs. Chereskin, Laber, Lewis and McInerney, and is chaired by Mr. Chereskin. All of the members of our Compensation Committee are independent as defined by Nasdaq’s independence requirements for Compensation Committee members. The Compensation Committee held 17 meetings in 2014. The duties and responsibilities of the Compensation Committee include, among other items:

| | • | | designing in consultation with management or the Board, and recommending to the Board for approval, and evaluating, the compensation plans, policies and programs of Boulder Brands, especially those regarding executive compensation and compensation of the Board; |

I-10

| | • | | determining the compensation of the Chief Executive Officer and all other officers (as such term is defined in Rule 16a-1 promulgated under the Exchange Act) of Boulder Brands; |

| | • | | reviewing the executive compensation disclosure that is prepared by Boulder Brands for inclusion in Boulder Brands’ proxy materials and preparing a related Compensation Committee Report in accordance with applicable rules and regulations of the SEC; |

| | • | | adopting and implementing compensation programs that are designed to attract, motivate and retain high quality employees, encourage superior performance, promote accountability and assure that employee interests are aligned reasonably with the interests of Boulder Brands’ stockholders; and |

| | • | | developing and implementing programs that are consistent with, and foster goals that will provide incentives to our executives that promote the achievement of Boulder Brands’ growth strategy, while at the same time, balancing risk. |

A copy of the Compensation Committee charter, which contains further details as to the Compensation Committee’s duties and authorities, is available on our website at www.boulderbrands.com .

Finance Committee. The Finance Committee is composed of Messrs. Chereskin, Leighton, Lewis and McInerney, and is chaired by Mr. Lewis. The purpose of the Finance Committee is to assist the Board in satisfying its duties relating to the financing strategy, financial policies and financial condition of Boulder Brands. The Finance Committee’s responsibilities include, among other things, reviewing and making recommendations to the Board concerning items such as Boulder Brands’ capital structure, credit rating, cash flow and financial position, operating plans, capital budgets, risk assessment and analysis, commodities and hedging policies and insurance programs. The Finance Committee met five times in 2014.

A copy of the Finance Committee charter is available on our website at www.boulderbrands.com.

Governance and Nominating Committee. The Governance and Nominating Committee is composed of Messrs. Chereskin, Hollis, Laber and McInerney, and is chaired by Mr. McInerney. Each of the members of the committee are independent as defined by Nasdaq’s independence requirements. The Governance and Nominating Committee met six times in 2014. The purpose of the Governance and Nominating Committee is to assist the Board in:

| | • | | the identification of qualified candidates to become Board members; |

| | • | | the recommendation of Board nominees for election as directors at the next annual or special meeting of stockholders at which directors are to be elected; |

| | • | | the recommendation of candidates to the Board to fill any interim vacancies on the Board; and |

| | • | | the development and recommendation to the Board of a set of corporate governance guidelines and principles applicable to Boulder Brands. |

The Governance and Nominating Committee evaluates director nominees recommended by stockholders in the same manner in which it evaluates other director nominees. Boulder Brands has established, through its Governance and Nominating Committee, selection criteria that identify desirable skills and experience for prospective Board members, and which takes into account, among other factors, an evaluation of the optimal size of the Board, succession planning considerations and a review of key skill sets, experience and strengths represented by the members currently serving on the Board. With respect to each candidate, the Governance and Nominating Committee considers the potential candidate’s independence and how a candidate would complement the current members’ skills and strengths, as well as the candidate’s leadership and strategic thinking skills, willingness to make a time commitment, breadth of knowledge about matters affecting us and our industry, skills and experience in different disciplines important to us and our industry, sound business judgment and other criteria determined by the Governance and Nominating Committee from time to time. The Governance

I-11

and Nominating Committee does not have a specific diversity policy, but in making its recommendations to the Board of Directors, the Governance and Nominating Committee considers, as a matter of practice, diversity as well as candidates’ age, experience, profession, skills, geographic representation and background, all to provide the Board and Boulder Brands with directors that have an appropriate mix of experience, knowledge, perspective and judgment. As part of this process, the Governance and Nominating Committee considers the skills, experience and strengths of the current members of the Board and how a particular nominee may complement and enhance the current Board’s composition.

In connection with the 2015 nominees, Boulder Brands did not pay a fee to any third party to identify or assist in identifying or evaluating potential nominees, but may retain a search firm in the future if the Governance and Nominating Committee determines that it is appropriate. The Governance and Nominating Committee considers individuals recommended by stockholders for nomination as a director in accordance with the procedures described below.

A copy of the Governance and Nominating Committee charter is available on our website at www.boulderbrands.com.

Code of Business Conduct and Ethics

Boulder Brands’ employees, officers and directors are required to abide by Boulder Brands’ Code of Business Conduct and Ethics (the “Code of Ethics”), which is intended to ensure that Boulder Brands’ business is conducted in a consistently legal and ethical manner. The Code of Ethics covers all areas of conduct, including, among other things, conflicts of interest, fair dealing and the protection of confidential information, as well as strict compliance with all laws, regulations and rules. Any waiver of the policies or procedures set forth in the Code of Ethics in the case of executive officers or directors may be made only by the board of directors or the audit committee and will be promptly disclosed as required by law or Nasdaq listing requirements. The full text of the Code of Ethics is available on our website at www.boulderbrands.com.

Number of Meetings of the Board of Directors and Committees for Fiscal Year ended December 31, 2014

The Board held 14 meetings during 2014. Directors are expected to attend Board meetings and meetings of committees for which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. The standing committees of the Board held an aggregate of 51 meetings during 2014. All directors are invited to all quarterly committee meetings, whether or not they serve on the committee, and generally, for informational and efficiency purposes, all in attendance for the committee meetings attend the specific meeting for each committee. Each director attended at least 75% of the aggregate number of meetings of the Board and the Board committees on which the director served during the period.

Attendance at the 2014 Annual Meetings of the Stockholders

The Company has no policy requiring directors and director nominees to attend the annual meeting of stockholders; however, all directors and director nominees are encouraged to attend and the annual Board meeting is scheduled on the same day and in the same location as the annual meeting of stockholders so that our directors are able to attend both. All but one of our directors attended the 2014 annual meeting of stockholders.

PRINCIPAL STOCKHOLDERS OF THE COMPANY

The following table sets forth information regarding the beneficial ownership of our common stock as of December 7, 2015 by:

| | • | | each of Boulder Brands’ directors; |

| | • | | each of Boulder Brands’ NEOs as of the fiscal year ended December 31, 2014; |

I-12

| | • | | each person known by Boulder Brands to be the beneficial owner of more than 5% of any class of our voting stock; and |

| | • | | all of Boulder Brands’ executive officers and directors, as a group. |

Unless otherwise indicated, we believe that all persons named in the following table have sole voting and investment power with respect to all shares of stock beneficially owned by them. As of December 7, 2015, Boulder Brands had 63,116,425 shares of Common Stock issued and outstanding.

| | | | | | | | |

Name and Address of Beneficial Owner | | Beneficial Ownership of

Common Stock | | | Percentage of Outstanding

Common Stock | |

Stephen B. Hughes(1)(2) | | | 3,339,915 | | | | 5.0 | % |

James B. Leighton(1)(3) | | | 352,077 | | | | * | |

Norman Matar(1)(4) | | | 688,282 | | | | 1.1 | % |

TJ McIntyre(1)(5) | | | 211,126 | | | | * | |

Duane Primozich(1)(6) | | | 173,814 | | | | * | |

Christine Sacco(1)(7) | | | 354,100 | | | | * | |

Timothy Kraft (1)(8) | | | 94,000 | | | | * | |

Philip Anson(1)(9) | | | 75,000 | | | | * | |

Benjamin D. Chereskin(1) | | | 82,500 | | | | * | |

R. Dean Hollis(1) | | | 60,000 | | | | * | |

Gerald J. “Bud” Laber(1)(10) | | | 245,098 | | | | * | |

James E. Lewis(1)(11) | | | 1,097,433 | | | | 1.8 | % |

Thomas K. McInerney(1) | | | 58,250 | | | | * | |

Adage Capital Partners, L.P. and affiliates(12) | | | 6,018,093 | | | | 9.5 | % |

Mario Gabelli and affiliates(13) | | | 5,900,005 | | | | 9.4 | % |

PRIMECAP Management Company(14) | | | 6,134,000 | | | | 9.7 | % |

The Vanguard Group, Inc.(15) | | | 3,676,469 | | | | 5.8 | % |

BlackRock, Inc.(16) | | | 3,537,230 | | | | 5.6 | % |

Dimensional Fund Advisors LP(17) | | | 3,325,906 | | | | 5.3 | % |

Morgan Stanley(18) | | | 3,197,804 | | | | 5.1 | % |

All directors and executive officers as a group (13 individuals) | | | 6,831,595 | | | | 9.8 | % |

| (1) | The business address of each of the noted individuals is 1600 Pearl Street, Suite 300, Boulder, Colorado 80302. Except as noted below, in calculating the number of shares beneficially owned and the percentage ownership, shares underlying options held by that individual that are either currently exercisable or exercisable within 60 days from December 7, 2015 are deemed outstanding. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other individual or entity. |

| (2) | Mr. Hughes’ employment with Boulder Brands ended on June 9, 2015. The amount and nature of Mr. Hughes’ holdings noted below is based on information as that date. Beneficial Ownership includes (i) 101,000 shares owned by Mr. Hughes’ spouse; (ii) 3,000 shares owned by Mr. Hughes’ son; and (iii) 239,265 shares owned in equal 79,755 share increments by the Caroline Elise Hughes Irrevocable Trust, the John Trevelyn Hughes Irrevocable Trust, and the Henry Thomas Hughes Irrevocable Trust, trusts established for the benefit of Mr. Hughes’ three children and as to which his spouse is the trustee. Beneficial Ownership excludes 150,128 shares sold in November 2005 by Mr. Hughes, at a price equal to that paid by him, to three irrevocable trusts established in favor of adult members of Mr. Hughes’ family, as to which Mr. Hughes disclaims beneficial ownership. The voting rights for shares held in the three trusts are exercisable by the trustee, Mr. Stephen Feldhaus. Beneficial ownership includes 1,825,000 shares of Common Stock issuable upon the exercise of options within 60 days of March 26, 2015. Beneficial ownership also excludes 425,000 stock options which Mr. Hughes transferred on November 16, 2012 to Sunset Oasis Limited Partnership (the “Sunset Limited Partnership”), a Delaware limited partnership of |

I-13

| | which Mr. Hughes was then the sole limited partner. 4,250 of these options were transferred as a capital contribution to Hughes Enterprises, LLC (the “Sunset General Partner”), a Delaware limited liability company which is the general partner of the Sunset Limited Partnership and then by the Sunset General Partner as a capital contribution to the Sunset Limited Partnership. Mr. Hughes was the sole member of the Sunset General Partner at that time. On November 19, 2012, Mr. Hughes transferred 100% of his interests in the Sunset Limited Partnership by assigning as gifts (x) all rights in the Sunset General Partner to a sibling and (y) all of his Sunset Limited Partnership interests to his three children and his three siblings in varying percentages. Of these 425,000 stock options that are excluded from Mr. Hughes beneficial ownership: (a) 50,000 stock options are exercisable; and (b) 375,000 stock options are exercisable, if at all, if the closing price for a share of common stock of Boulder Brands is at least $20.25 per share for 20 of 30 consecutive trading days. Of the shares beneficially owned, Mr. Hughes and his spouse have pledged 1,329,886 shares as security in connection with a loan and the three irrevocable trusts referenced above have pledged 239,265 shares as security in connection with three loans. These shares were pledged, and the underlying indebtedness incurred, to facilitate a significant personal investment made by Mr. Hughes in connection with Boulder Brands’ founding. |

| (3) | Beneficial ownership includes 272,500 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (4) | Mr. Matar no longer held a position as an executive officer as of December 16, 2014. The amount and nature of Mr. Matar’s holdings noted below is based on information as of that date. Beneficial ownership includes 600,000 shares of Common Stock issuable upon the exercise of options within 60 days of December 16, 2014. Beneficial ownership excludes: 150,000 stock options which are exercisable, if at all, if the closing price for a share of common stock of Boulder Brands is at least $20.25 per share for 20 of 30 consecutive trading days. |

| (5) | Mr. McIntyre’s employment with Boulder Brands ended as of July 17, 2015. The amount and nature of Mr. McIntyre’s holdings noted below is based on information as of that date. Beneficial ownership includes: (i) 1,500 shares of Common Stock owned by Mr. McIntyre’s spouse; (ii) 300 shares of Common Stock held by each of Mr. McIntyre’s son and daughter; and (iii) 203,750 shares of Common Stock issuable upon the exercise of options within 60 days of July 17, 2015. |

| (6) | Mr. Primozich’s employment with Boulder Brands ended as of October 5, 2015. The amount and nature of Mr. Primozich’s holdings noted below is based on information as of that date. Beneficial ownership includes 173,814 shares of Common Stock issuable upon the exercise of options within 60 days of October 5, 2015. |

| (7) | Beneficial ownership includes 350,000 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (8) | Beneficial ownership includes 93,750 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (9) | Beneficial ownership includes 75,000 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (10) | Beneficial ownership includes: (i) 19,000 shares of Common Stock held by Mr. Laber’s spouse; (ii) 24,000 shares of Common Stock held in Mr. Laber’s IRA rollover account; (iii) 16,000 shares of Common Stock held in Mr. Laber’s 401(k); and (iv) 135,000 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (11) | Beneficial ownership includes: (i) 560,919 shares of Common Stock owned by Mr. Lewis’s spouse, (ii) 159,511 shares of Common Stock owned by the Estate of Lee Anne Lewis, of which Mr. Lewis is the personal representative and beneficiary, as to which Mr. Lewis disclaims beneficial ownership except to the extent of his pecuniary interests therein, and (iii) 135,000 shares of Common Stock issuable upon the exercise of options within 60 days of December 7, 2015. |

| (12) | Share information is as of December 31, 2014 and derived from a Schedule 13G/A filed on February 17, 2015 by Adage Capital Partners, L.P., Adage Capital Partners GP, LLC, Adage Capital Advisors, LLC, Robert Atchinson and Philip Gross. The business address of these reporting persons is 200 Claredon Street, 52nd Floor, Boston, Massachusetts 02116. Each reporting person included in the Schedule 13G/A reported that, as of December 31, 2014, it shared power to vote and dispose of 6,018,093 shares. |

I-14

| (13) | Share information is as of June 30, 2015 and derived from a Schedule 13D/A filed on July 2, 2015 by Gabelli Funds, LLC, GAMCO Asset Management, Inc., Gabelli Securities, Inc., Teton Advisors, Inc., GGCP, Inc., GAMCO Investors, Inc. and Mario J. Gabelli. The business address of these reporting persons is One Corporate Center, Rye, NY 10580. According to the Schedule 13D, as of July 2, 2015, (i) Gabelli Funds, LLC beneficially owned, and possessed sole power to vote and sole power to dispose, 2,531,868 shares, (ii) GAMCO Asset Management, Inc. beneficially owned 2,707,524 shares and possessed sole power to vote 2,493,751 and sole power to dispose 2,707,524 shares, (iii) Gabelli Securities, Inc. beneficially owned, and possessed sole power to vote and sole power to dispose, 90,000 shares, (iv) Teton Advisors, Inc. beneficially owned, and possessed sole power to vote and sole power to dispose, 563,973 shares, and (v) GAMCO Investors, Inc. beneficially owned, and possessed sole power to vote and sole power to dispose, 6,640 shares. According to the Schedule 13D, each of Mario Gabelli, GGCP, Inc. and GAMCO Investors, Inc. is deemed to have beneficial ownership of the shares owned beneficially by each of the foregoing persons. |

| (14) | Share information is as of June 4, 2015 and is derived from a Schedule 13G/A filed on June 4, 2015 by PRIMECAP Management Company. The business address of PRIMECAP Management Company is 225 South Lake Ave., #400, Pasadena, CA 91101. PRIMECAP Management Company reported that, as of June 4, 2015, it possessed sole power to vote with respect to 5,098,600 shares and sole power to dispose of 6,134,000 shares. |

| (15) | Share information is as of December 31, 2014 and derived from a Schedule 13G/A filed on February 11, 2015 by The Vanguard Group, Inc. The business address of The Vanguard Group, Inc. is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group, Inc. reported that, as of December 31, 2014, it possessed sole power to vote 86,607 shares, sole power to dispose 3,595,862 shares and shared to dispose 80,607 shares. |

| (16) | Share information is as of December 31, 2014 and is derived from a Schedule 13G/A filed on February 2, 2015 by BlackRock, Inc. The business address of BlackRock, Inc. is 40 East 52nd Street, New York, NY 10022. BlackRock, Inc. reported that, as of December 31, 2014, it possessed sole power to vote 3,393,757 shares and sole power to dispose 3,533,730 shares. |

| (17) | Share information is as of December 31, 2014 and derived from a Schedule 13G/A filed on February 5, 2015 by Dimensional Fund Advisors LP. The business address of Dimensional Fund Advisors LP is Palisades West, Building One, 6300 Bee Cave Road, Austin, Texas 78746. Dimensional Fund Advisors LP reported that, as of December 31, 2013, it may have possessed sole power to vote with respect to 3,201,280 shares and sole power to dispose of 3,325,906 shares. According to the Schedule 13G/A, the shares reported on that Schedule are owned by investment companies, trusts and/or separate accounts for which Dimensional Fund Advisors LP or one of its subsidiaries acts as an investment advisor, sub-advisor or manager and Dimensional Fund Advisors LP disclaims beneficial ownership of those shares. |

| (18) | Share information is as of November 25, 2015 and derived from a Schedule 13G filed on December 4, 2015 by Morgan Stanley. The business address of Morgan Stanley is 1585 Broadway, New York, New York 10036. Morgan Stanley reported that, as of November 25, 2015, it beneficially owned 3,197,804 shares, possessed sole power to vote 3,175,769 shares and possessed shared power to vote 13,515 shares and shared power to dispose of 3,197,804 shares. |

I-15

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS

Introduction

In accordance with SEC regulations, the Compensation Discussion and Analysis and compensation disclosure tables that follow address compensation with respect to our fiscal year ended December 31, 2014. At that time, our named executive officers (“NEOs”) included those executives set forth in the table below and therefore the information in this section and the tables that follow regarding their compensation in respect the fiscal year ended December 31, 2014 has been included in fulfillment of the SEC requirements. Since December 31, 2014, Mr. Hughes, Mr. McIntyre and Mr. Primozich have left their positions with Boulder Brands:

| | |

Named Executive Officers as of 12/31/14 | | Position as of 12/31/2014 |

Stephen B. Hughes | | Chairman and Chief Executive Officer(1) |

James B. Leighton | | Chief Operating Officer |

Christine Sacco | | Chief Financial Officer |

TJ McIntyre | | Executive Vice President and General Manager, Natural Brands(2) |

Duane Primozich | | Executive Vice President and General Manager, Balance Brands(3) |

Norman Matar | | Former Chief Legal Officer and Corporate Secretary |

| (1) | Mr. Hughes employment with Boulder Brands ended as of June 9, 2015. |

| (2) | Mr. McIntyre’s employment with Boulder Brands ended as of July 17, 2015. |

| (3) | Mr. Primozich’s employment with Boulder Brands ended as of October 5, 2015. |

Executive Summary

Company Performance—2014

As we have previously reported, 2014 was a challenging year for Boulder Brands, with performance below several key operating and financial goals and a decline in stock price over a year ago. The environment in which we operate can create challenges from a variety of sources. We have identified three primary headwinds that negatively impacted our 2014 performance, including the weaker than expected operating environment for buttery spreads, service issues in our natural segment, and higher costs for egg whites, a key ingredient in our gluten free baking business. Even with these challenges we maintained our position as one of the fastest growing companies in the food industry. Specifically, we have the second highest reported revenue CAGR (compound annual growth rate) within the industry for the period 2010-2014 and the second highest (tied for 2nd) reported adjusted EBITDA CAGR for the period 2010-2014 (each, as reported by Thompson One Database (n.d.), retrieved March 9, 2015 from http://www.thompsonone.com).

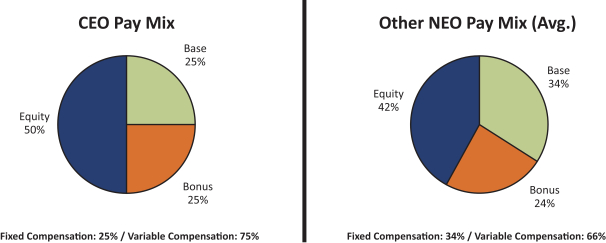

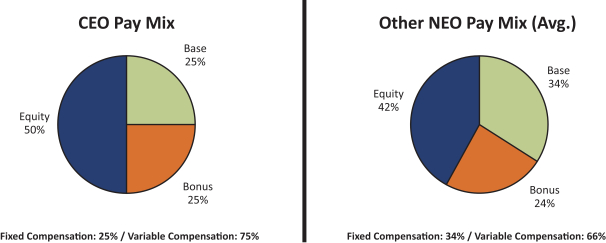

Compensation of the Chief Executive Officer and Pay for Performance Alignment

Our compensation programs are designed to reward strong Company performance and to pay less compensation when Company performance is not as strong. For the CEO, approximately 75% of his total pay opportunity in 2014 was based on variable compensation, the value of which is directly tied to our Company’s performance. In light of our financial results in 2014, the CEO did not receive any payment under our Incentive Program and, therefore, his overall cash-based compensation for 2014 decreased by approximately $790,000 from a year ago.

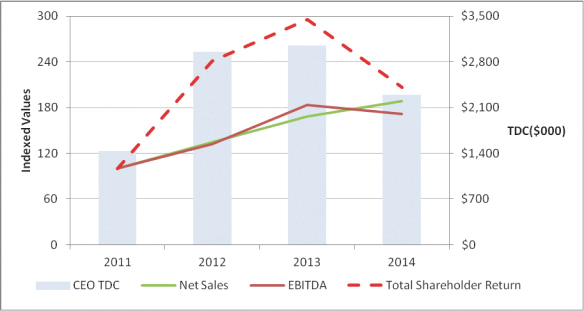

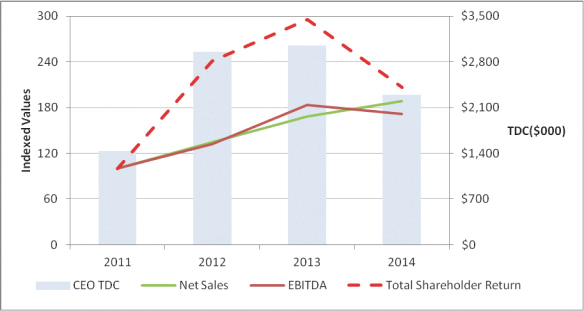

The graph below demonstrates the strong alignment over the past three years of shareowner value creation, net sales and adjusted EBITDA growth with CEO total direct compensation (“TDC”). TDC consists of 2014 base salary, annual cash bonus earned for 2014 (as noted above, no bonus was paid for 2014) and periodic equity grants made in 2012 that were annualized over Boulder Brands’ typical vesting period of four years. Note, no

I-16

equity awards were granted in 2014; however the CEO was permitted to participate in a performance-based long-term cash plan (value not included in table below) which only pays out upon achievement of certain performance hurdles (see “2014 Long-Term Cash Incentive Bonus Program”) during the four-year performance period. For 2014, TDC declined significantly, reflecting not only the financial challenges faced by Boulder Brands in the second half of 2014 but also that our programs have been designed to strongly tie pay to actual company performance.

Compensation Decisions and Actions—2014

Compensation decisions made during 2014 reflect our overall performance and continued efforts to integrate the recent acquisitions into our business strategy and operations. In addition, the importance of retaining and recruiting key management personnel remains critical to our long-term success, vision and strategy.

Following several years of transformational growth though a series of acquisitions, including Glutino Food Group (“Glutino”) in August 2011, Udi’s Healthy Foods, LLC (“Udi’s”) in July 2012, and Davies Bakery (“Davies”), Level Life Foods (“Level”) and Phil’s Fresh Foods, LLC (“EVOL”) in 2013, in 2014 we focused on the internal growth of these and our other core brands. We have focused on strategic planning and have established a platform for future growth. Moving from a sales and marketing “virtual” company platform, to a company with full scale operations in addition to our historic sales and marketing functions, we are adjusting to growth in all areas of our business operations.

The incredible growth of our company in recent years has created a unique set of challenges for the management team, particularly our NEOs, whose roles, duties, and responsibilities have expanded and become more complex in order to match our expanded and more complex business operations. The Compensation Committee (referred to in this Compensation Discussion & Analysis as the “Committee”) desires to ensure that our policies and programs appropriately reflect our company’s current size and operations, while also maintaining sufficient flexibility to allow for continuing evolution of our compensation programs. In addition, the Committee has reviewed and reflected on the feedback provided to us through our stockholder outreach program.

I-17

In this challenging year, the Committee followed its pay for performance philosophy, resulting in the following key decisions:

| | • | | Limited Cash Compensation Adjustments. Only limited salary adjustments were approved in 2014 for certain NEOs. Following a review of base salary levels in connection with the adoption of Boulder Brands’ peer group, as discussed below, limited changes were recommended for Mr. McIntyre and Mr. Primozich to align their base salaries and target bonus opportunity levels with the market median of our new peer group (as discussed below), which changes took effect in 2015. |

| | • | | No Annual Cash Incentives. The Committee set aggressive performance goals for the threshold, target and maximum possible payout levels under our Amended and Restated Company Financial Performance Incentive Program (the “Incentive Program”) based upon net sales and adjusted EBITDA for 2014, which metrics were chosen to be consistent with our strategic plan and operations goals at the beginning of the year. Since the threshold performance goals were not met, NEOs did not earn any annual incentive awards for 2014, nor were any discretionary performance-related bonus awards granted. |

| | • | | Peer Group Adoption. In 2014, the Committee adopted a peer group to benchmark executive compensation levels and the structure/design of compensation programs at comparable companies. This decision was made, in part, to reflect Boulder Brands’ transformation from our “virtual” company business model to our current full scale activities in the natural foods industry. The Committee engaged Pearl Meyer & Partners to assist in developing a list of peer companies and adopted the new peer group in the third quarter of 2014. Since that time, the Committee has begun to consider the peer company data for purposes of evaluating and making compensation-related decisions. The information reviewed by the Committee includes, in part, compensation levels and practices for executives holding comparable positions at the peer group companies. The Committee believes that use of specific peer group data points will aide the Committee in creating compensation packages that are best positioned to retain our named executive officers, and where appropriate, recruit additional talented management team members. It is the intention of the Committee to more fully utilize the peer group data in determining the mix of compensation elements and setting compensation levels for the named executive officers beginning in 2015. |

| | • | | Compensation Design Philosophy. In connection with the adoption of a peer group, in 2014 the Committee also determined that it would, as an overall philosophy, generally, adopt programs and compensation designs targeted to achieving total compensation levels for each named executive officer at the median of compensation awarded by our peer group companies for executives in similar positions. |

Good Compensation Governance Practices

Our executive compensation program reflects our strong commitment to good governance and is designed to mitigate inappropriate risk-taking by our NEOs. Aspects of our compensation that reflect these policies include:

| | • | | Compensation Mix: Our compensation mix is not overly weighted toward short-term annual incentives and the percentages of compensation tied to short-term and long-term incentives taken together result in a majority of the compensation for our executive officers being tied directly to Company performance. |

| | • | | Peer Group: As discussed above, in the third quarter of 2014, the Committee, with the assistance of our independent compensation consultant, selected a peer group for purposes measuring the total compensation levels for our named executive officers relative to our peers, and began to implement a new aspect of our compensation design strategy intended to set total compensation levels for each of our named executives at approximately the median of the total compensation levels awarded by our peer group companies for similar positions. |

I-18

| | • | | Aggressive Incentive Compensation Thresholds: In 2014, our annual incentive compensation awards were subject to the achievement of aggressive threshold, target and maximum performance goals. Our Incentive Program provides for annual bonus compensation under a two-step program including a “base plan” and a “supplemental plan,” pursuant to which no amount will be paid under the base plan unless threshold performance goals under the base plan are met, and no amount will be paid under the supplemental plan unless target goals are achieved under the base plan. Since 2014 threshold goals under the base plan for net sales and adjusted EBITDA were not met, the NEOs did not earn an annual bonus in 2014, reflecting a direct tie between company performance and the level of compensation. |

| | • | | Grant Vesting Policy Encourages Long-term View: Compensatory equity grants to employees, including our NEOs, are designed to vest either over a four-year period or based upon achieving specified performance conditions, which mitigates the risk of our executives and employees taking short-term risks and focuses their attention on stability and Boulder Brands’ long-term growth strategy. If stockholders vote to approve the Boulder Brands Inc. Third Amended and Restated Stock and Award Plan under Item 3 of this proxy statement, Boulder Brands intends to grant an even higher percentage of grant awards that vest solely on the achievement of performance goals. |

| | • | | Holdbacks: To ensure that annual bonuses under our Incentive Program award sustained Company growth, in the case of our NEOs, our Incentive Program provides that any payment amounts in respect of performance above target bonus opportunities be held back for one year and subject to further performance conditions in the following year, such that performance in the subsequent year must equal or exceed the target performance with respect to the Incentive Program for the prior year before the above target payment from the prior year is made (the “Prior Year Holdback”). |

| | • | | Negative Discretion: Our Incentive Program provides that the Committee may exercise complete negative discretion with respect to all bonus amounts (and may choose to award no bonus for a given year, even where performance target have been met). |

| | • | | Clawback Policy: We maintain a “no fault” clawback policy under which our executive officers will be required, subject to the discretion of our independent directors, to repay to Boulder Brands incentive bonuses they receive based on financial results that subsequently (within three years of the original payment) become the subject of a restatement due to material noncompliance by Boulder Brands with any financial reporting requirement, regardless of any finding of misconduct. |

| | • | | Limited Perquisites and No Supplemental Retirement Benefits: We provide limited perquisites and no retirement or supplemental executive retirement programs for our executives. |

| | • | | Annual Say on Pay: In accordance with our stockholder’s preference, we conduct an annual advisory “say on pay” stockholder vote, maximizing the opportunity to receive feedback on the compensation programs for our NEOs. |

| | • | | Independent Consultants: The Committee engages only independent compensation consultants that do not provide any services to management and that have no prior relationship with management prior to the engagement. |

| | • | | Risk Reviews: We regularly conduct compensation risk reviews; our Committee maintains significant oversight of the ongoing evaluation of the relationship between our compensation programs and risk. |

| | • | | Stock Ownership Guidelines: We maintain robust stock ownership guidelines under which, after an initial phase-in period, each of our executive officers is required to maintain vested equity holdings with a value equal to at least, in the case of our chief executive officer, six times his annual base salary and, in the case of each of our other executive officers, three times the executive’s annual base salary. Each of our NEOs is currently on track to be in compliance by the required date applicable to each NEO in accordance with the guidelines. |

| | • | | Recoupment Policy: We maintain a recoupment policy in our stock plan that requires an employee who is terminated for cause to forfeit all awards previously granted to the employee retroactive to the date the employee first engaged in the conduct that was the basis for such termination. |

I-19

| | • | | Anti-Hedging Policy: The Company’s Insider Trading Policy prohibits all officers (as well as all employees and directors) of Boulder Brands from effecting hedging or similar monetization transactions with respect to the shares of Boulder Brands. |

| | • | | 100% Performance-Based Equity Awards for CEO: Since 2008, 100% of equity awards granted to the CEO vest only upon achievement of performance goals. |

Say-on-Pay Results in 2014 and Stockholder Outreach

We carefully consider and value our stockholders’ opinions on our executive compensation program, and take stockholder feedback seriously. In reviewing the compensation programs over the course of 2014, our Committee considered the results from last year’s say-on-pay vote (69% of votes cast approved) as well as our discussions with stockholders as part of our ongoing stockholder outreach program which began in 2013. Since our outreach efforts began, we have met several times with many of our top 20 shareholders about our executive compensation programs and corporate governance practices. In particular, since the time of our annual stockholder’s meeting in 2014, Company representatives have contacted 16 of our stockholders and the chairperson of the Committee and other representatives of Boulder Brands spoke directly with 5 stockholders, representing approximately 26% of our overall stockholder base, to collect feedback and to inform them of our compensation-related initiatives, including our future plans to utilize peer group benchmarking and potentially a shift towards concentrating our long-term equity compensation program on annual grants rather than more periodic grants. Besides these initiatives, based on these discussions in 2013 and 2014, we have instituted, or continue to institute, a number of compensation program changes, including:

| | • | | A more structured approach to compensation decision-making whereby a new internal pay equity structure was adopted implementing 14 “bands” of employee positions, each with suggested cash and equity compensation ranges; |

| | • | | Elimination of the practice of providing annual cost of living salary increases for named executive officers, in favor of merit-based increases; |

| | • | | Incorporating a more formal peer group analysis into evaluation of compensation levels for our named executive officers. |

Compensation Actions Impacting 2015 Compensation Design

The Committee has made several adjustments to how NEO compensation will be designed and structured beginning in 2015. These changes, discussed in each relevant section in this Compensation Discussion and Analysis, include:

| | • | | More extensive analysis of data derived from Boulder Brands’ newly established peer group as part of making decisions related to NEO compensation mix and levels of compensation; |

| | • | | Adopting a philosophy that targets total compensation for each NEO at the median relative to peer group total compensation levels for similar positions; |

| | • | | Approving base salary increases, if any, based on merit and eliminating cost of living increases for NEOs; |

| | • | | Evaluating and setting annual bonus program goals for threshold, target and maximum award payout opportunities based on the probability of achievement in consideration of peer group data and company performance; and |

| | • | | Establishing an equity grant program focused on annual awards, with a majority of grants to NEOs taking the form of performance-based restricted stock units (subject to stockholder approval of the Boulder Brands, Inc. Third Amended and Restated Stock and Awards Plan pursuant to Item 3 of this proxy statement.) |

I-20

We encourage you to read this Compensation Discussion and Analysis for a detailed discussion and analysis of our executive compensation program, including information about the fiscal 2014 compensation of the NEOs.

Compensation Program Objectives

Current Philosophy and Objectives

In keeping with our vision and strategy, Boulder Brands’ compensation program is designed to attract, retain and motivate executives who are capable of delivering superior business results in the extremely competitive natural foods industry. We compensate our executives through a mix of base salary and incentive bonuses, if performance goals are met, and, in some years, long-term equity compensation with an emphasis on incentives that reward strong business performance and achievement of performance goals that align the interests of management with the interests of our stockholders. Our compensation programs are designed to pay for performance, be competitive and minimize pay elements, such as perquisites, that do not directly support Boulder Brands’ values and business strategy, even if common in the marketplace. In addition to the above overriding principles, our Committee relies on the following guidelines to assist it in setting compensation levels (both short and long term) for executives:

| | • | | compensation programs are designed to emphasize pay for performance by closely tying total compensation to the success of Boulder Brands and each executive’s contribution to that success; and |

| | • | | compensation programs should be flexible so that there is an opportunity for greater compensation for superior performance balanced by the risk of lower compensation when performance is less successful. |

In this regard, Boulder Brands’ philosophy is that members of senior management have a stronger and more direct impact on Boulder Brands’ ability to achieve its strategic and business goals and that therefore a larger percentage of their compensation should be performance-based and driven by long-term equity awards.