Exhibit (a)(5)(D)

|

Good becomes BETTER!

Town Hall Meeting December 10, 2015

Bob Gamgort ?CEO

Reinvigorating Iconic Brands

1 |

|

|

Forward?Looking Statements

Statements in this document may contain, in addition to historical information, certain forward?looking statements. Some of these forward?looking statements may containwords like “believe,” “may,” “could,” “would,” “might,” “possible,” “should,” “expect,” “intend,” “plan,” “anticipate,” or “continue,” the negative of these words, other terms of similar meaning or they may use future dates. Forward?looking statements in this document include without limitation statements regarding the planned completion of the transaction. These statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including, but not limited to, risksand uncertainties related to: statements regarding theanticipated benefits of the transaction; statements regarding the anticipated timing of filings and approvals relating to the transaction; statements regarding the expected timing of the completion of the transaction; the percentage of the Company’s stockholders tendering their shares in the Offer; the possibility that competing offers will be made; the possibility that various closing conditions for the transaction may not be satisfied or waived; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, vendors and other business partners; stockholder litigation in connection with the transaction; and other risks and uncertainties discussed in the Company’s filings with the SEC, including the “Risk Factors” sections of the Company’s Annual Report on Form 10?K for the year ended December 31, 2014 and subsequent quarterly reports on Form 10?Q, as well as the tender offer documents to be filed by Pinnacle and Purchaser and the Solicitation/Recommendation Statement to be filed by the Company. The Company undertakes no obligation to update any forward?looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward?looking statements in this document are qualified in their entirety by this cautionary statement.

On December 9, 2015, Pinnacle Foods Inc. (“Pinnacle”) filed with the SEC a Tender Offer Statement on Schedule TO regarding the tender offer for all shares of common stock of Boulder Brands, Inc. (“Boulder”). Boulder’s stockholders are strongly advised to read the tender offer materials carefully and in their entirety (as updated and amended from time to time) filed by Pinnacle with the SEC, because they contain important information that Boulder’s stockholders should consider before tendering their shares. The tender offer statement and other documents filed by Pinnacle with the SEC are available for free at the SEC’s website (http://www.sec.gov)or by directing a request to Pinnacle by contacting D.F. King & Co., Inc., Information Agent for the Offering, toll?free at

1 (800) 499?8159.

1

|

WHY THIS MAKES SENSE

3

|

Basis for Interest

? Expanded presence in complementary health and wellness categories, expect to utilize BDBD HQ as base for Health & Wellness expansion.

? Leverage Pinnacle’s scale and capabilities in frozen manufacturing / distribution and sales /category management to accelerate growth and efficiency.

? Provides foundation to plug?in additional health and wellness assets via acquisition.

4

|

Our goal: Expand what makes Boulder special while capitalizing on the scale and capabilities of Pinnacle

5

|

WHO WE ARE

6

|

Our mission:

|

[gra]

|

March 28, 2013

|

Executive Leadership Team

Bob Craig Mark Mike Chris Mike Mary Beth Kelley

Gamgort Steeneck Schiller Wittman Boever Barkley DeNooyer Maggs

EVP &

EVP & Chief EVP & Chief

Chief EVP & Chief President EVP & Chief EVP & Chief EVP &

Supply Human

Executive Financial North Customer Marketing General

Chain Resources

Officer Officer America Officer Officer Counsel

Officer Officer

Retail

28 years in 24 years in 29 years in 35 years in 24 years in 20 years in 22 years in 22 years in

CPG CPG CPG CPG CPG CPG CPG CPG

industry industry industry industry industry industry industry industry

10

|

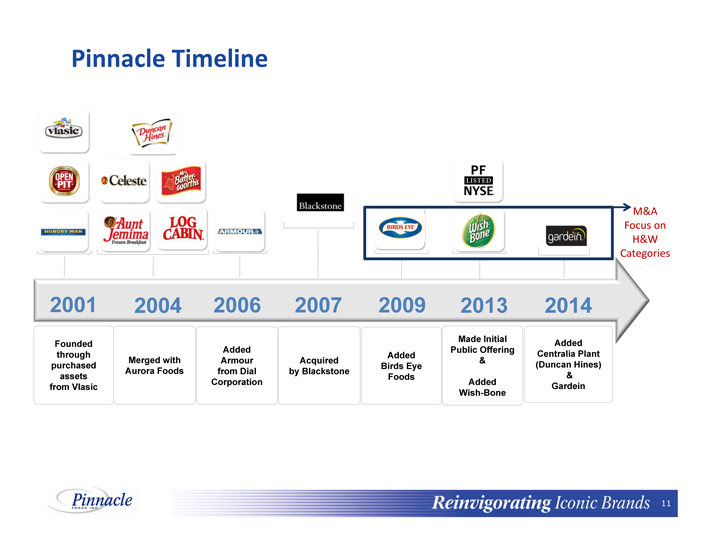

Pinnacle Timeline

M&A Focus on H&W Categories

2001 2004 2006 2007 2009 2013 2014

Made Initial Added Founded Added Public Offering through Added Centralia Plant Merged with Armour Acquired & purchased Birds Eye (Duncan Hines) Aurora Foods from Dial by Blackstone assets Foods & Corporation Added from Vlasic Gardein Wish-Bone

11

|

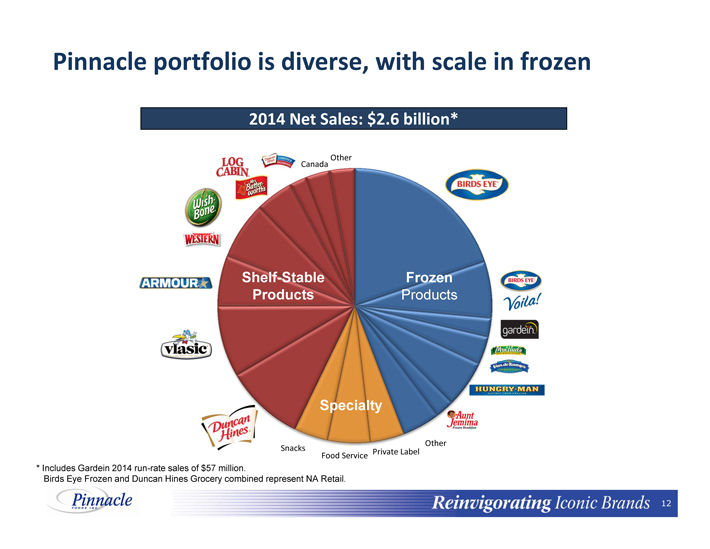

Pinnacle portfolio is diverse, with scale in frozen

2014 Net Sales: $2.6 billion*

Canada Other

Shelf-Stable Frozen Products Products

Specialty

Other Snacks Private Label Food Service

* Includes Gardein 2014 run-rate sales of $57 million.

Birds Eye Frozen and Duncan Hines Grocery combined represent NA Retail.

12

|

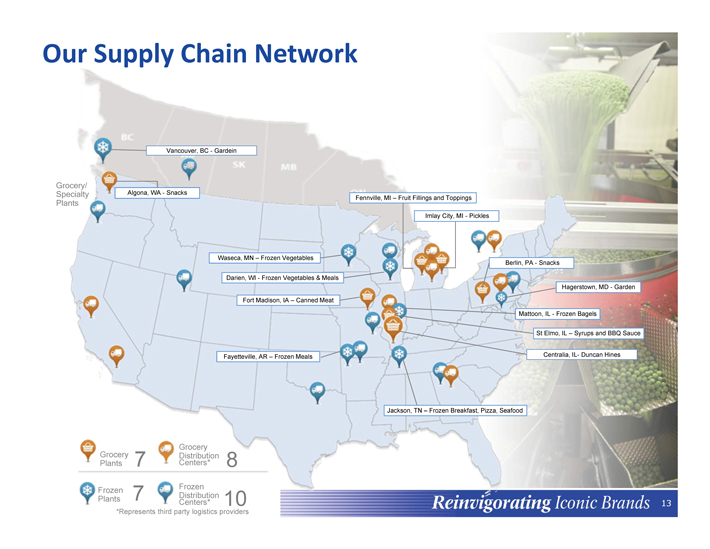

Our Supply Chain Network

Vancouver, BC—Gardein

Grocery/

Specialty Algona, WA—Snacks

Fennville, MI – Fruit Fillings and Toppings

Plants

Imlay City, MI—Pickles

Waseca, MN – Frozen Vegetables

Berlin, PA—Snacks

Darien, WI—Frozen Vegetables & Meals

Hagerstown, MD—Garden Fort Madison, IA – Canned Meat Mattoon, IL—Frozen Bagels

St Elmo, IL – Syrups and BBQ Sauce

Fayetteville, AR – Frozen Meals Centralia, IL- Duncan Hines

Jackson, TN – Frozen Breakfast, Pizza, Seafood

Grocery Grocery Distribution Plants 7 Centers* 8 Frozen Frozen Plants 7 Distribution Centers* 10

*Represents third party logistics providers

|

WHAT WE DO

14

|

Pinnacle Strategy

Long?Term

? Portfolio management directs

Organic Growth Algorithm

investments to highest ROI opportunities

Net Sales In Line with reinvigoration Categories? Brand driven by strong innovation and renovation programs Operating Income 4 – 5%

? Industry leading productivity and EPS 7 – 8% overhead cost structure minimizes

“brand tax” Dividend Yield

3 – 4%

? High Free Cash Flow conversion provides optionality to drive

10 – 12%

shareholder return

Accretive acquisitions would accelerate growth further

15

|

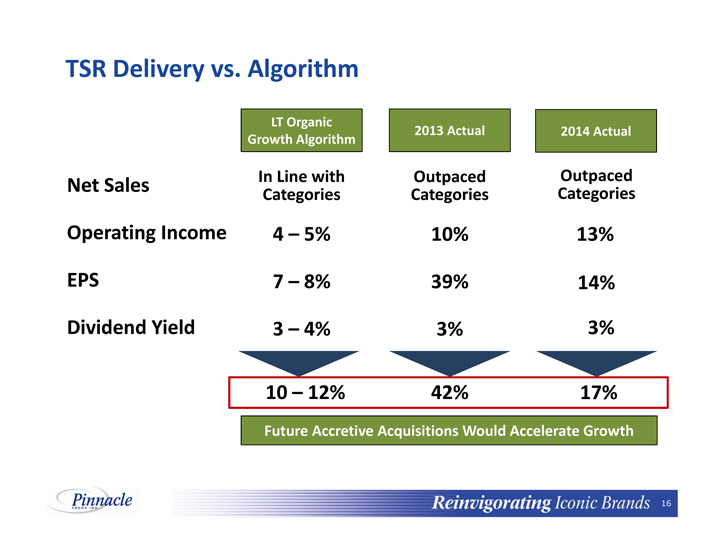

TSR Delivery vs. Algorithm

LT Organic

2013 Actual 2014 Actual Growth Algorithm

In Line with Outpaced Outpaced

Net Sales

Categories Categories Categories

Operating Income 4 – 5% 10% 13% EPS 7 – 8% 39% 14% Dividend Yield 3 – 4% 3% 3%

10 – 12% 42% 17%

Future Accretive Acquisitions Would Accelerate Growth

16

|

Pinnacle Portfolio Management Strategy

Leadership Brands Foundation Brands

Invest in innovation and marketing Focus on brand “renovation” to drive sales growth and share Deliver competitive pricing and quality expansion merchandising

Focus on “breakthrough” innovation

17

|

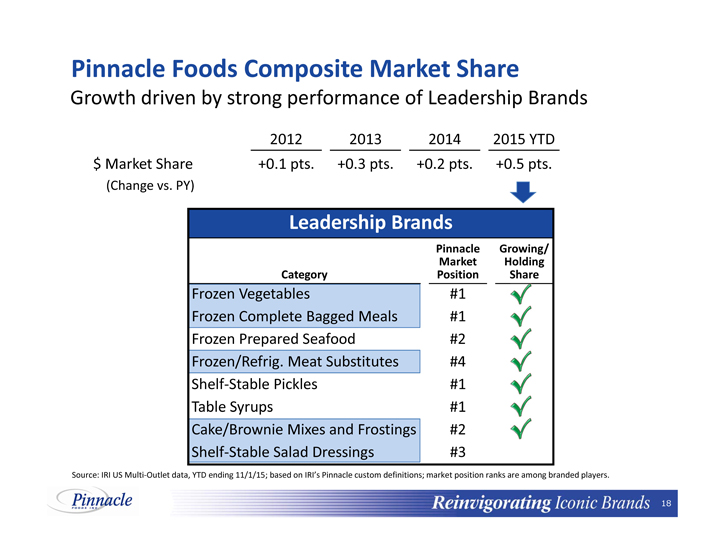

Pinnacle Foods Composite Market Share

Growth driven by strong performance of Leadership Brands

2012 2013 2014 2015 YTD $ Market Share +0.1 pts. +0.3 pts. +0.2 pts. +0.5 pts.

(Change vs. PY)

Leadership Brands

Pinnacle Growing/ Market Holding Category Position Share

Frozen Vegetables #1 Frozen Complete Bagged Meals #1 Frozen Prepared Seafood #2 Frozen/Refrig. Meat Substitutes #4 Shelf?Stable Pickles #1 Table Syrups #1 Cake/Brownie Mixes and Frostings #2 Shelf?Stable Salad Dressings #3

Source: IRI US Multi?Outlet data, YTD ending 11/1/15; based on IRI’s Pinnacle custom definitions; market position ranks

are among branded players.

18

|

Pinnacle has experience doing this as well…

$1 Billion Sales

19

|

Birds Eye Voila!

Vegetable?rich complete meals at a great value

Regular Size $ Market Share

39.8%

33.9%

28.0%

23.7%

21.1%

17.2%

15.7%

Family Size

2009 2010 2011 2012 2013 2014 2015 YTD

? More than doubled share and grew consumption 88% since acquisition? 2015 YTD consumption +16%? Adding capacity in Q4 2015

Source: IRI US Multi?Outlet data; based on IRI’s Pinnacle custom definitions.

20

|

2015 Birds Eye Innovation

Full Flavor

Blends Protein

Disney®

21

|

$55mm capital investment

22

|

2016 New Products

23

|

Rapidly?growing innovator in the plant?based protein segment Acquired November 14, 2014

Reinvigorating Iconic Brands

24

|

2015 New Products

Reinvigorating Iconic Brands

25

|

HOW WE DO IT

Reinvigorating Iconic Brands

26

|

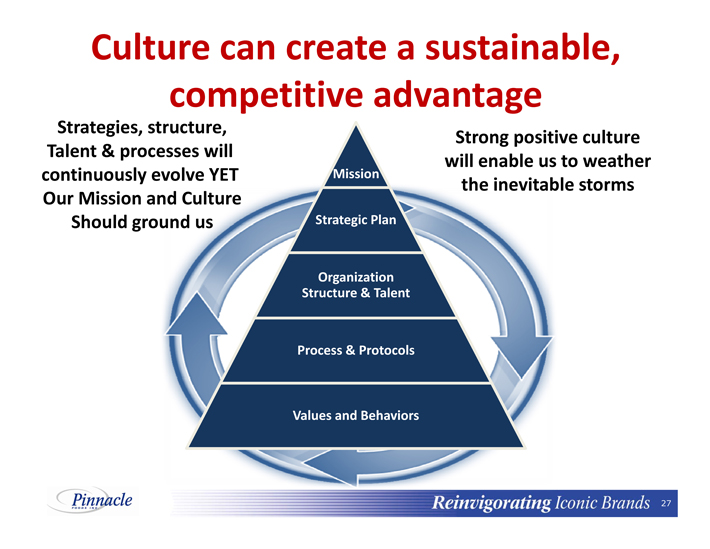

Culture can create a sustainable, competitive advantage

Strategies, structure,

Strong positive culture Talent & processes will will enable us to weather continuously evolve YET Mission the inevitable storms Our Mission and Culture Should ground us Strategic Plan

Organization Structure & Talent

Process & Protocols

Values and Behaviors

Reinvigorating Iconic Brands

27

|

|

Reinvigorating Iconic Brands

|

Reinvigorating Iconic Brands

|

Reinvigorating Iconic Brands

|

Reinvigorating Iconic Brands

collaboration

31

|

|

Reinvigorating Iconic Brands

|

NEXT STEPS

Reinvigorating Iconic Brands

35

|

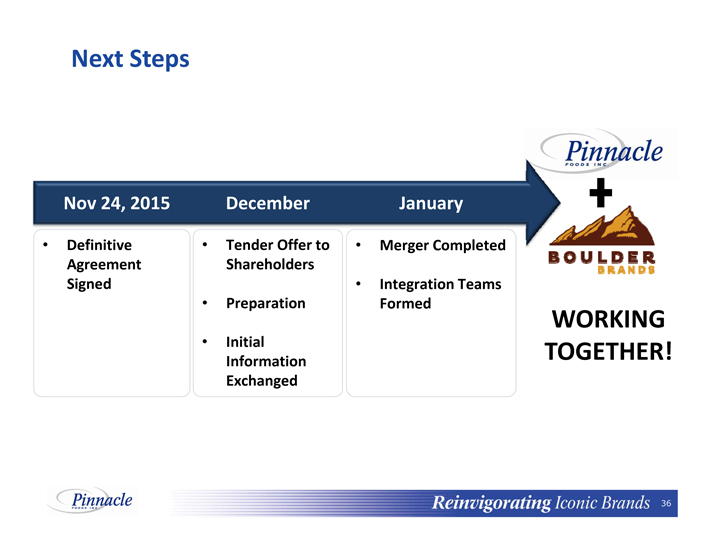

Next Steps

Nov 24, 2015 December January

‡ Definitive ‡ Tender Offer to ‡ Merger Completed Agreement Shareholders Signed ‡ Integration Teams

‡ Preparation Formed

WORKING

‡ Initial TOGETHER!

Information Exchanged

Reinvigorating Iconic Brands

36

|

Reinvigorating Iconic Brands

37