Welcome

Summer Member Meetings 2011

Agenda

• Welcome

• Recent Financial Results

• Washington Update

• <Break>

• Member Update

• U.S. Economic Conditions: Impact on

Members and FHLBC Solutions

1

This presentation contains forward-looking statements which are

based upon our current expectations and speak only as of the date

hereof. These statements may use forward-looking terms, such as

“anticipates,” “believes,” “expects,” “could,” “plans,” “estimates,”

“may,” “should,” “will,” or their negatives or other variations on these

terms. We caution that, by their nature, forward-looking statements

involve risk or uncertainty, that actual results could differ materially

from those expressed or implied in these forward-looking

statements, and that actual events could affect the extent to which a

particular objective, projection, estimate, or prediction is realized.

These forward-looking statements involve risks and uncertainties

including, but not limited to, instability in the credit and debt markets,

economic conditions (including effects on, among other things,

mortgage-backed securities), changes in mortgage interest rates

and prepayment speeds on mortgage assets, our ability to

2

successfully transition to a new business model and to pay future

dividends and the risk factors set forth in our periodic filings with the

Securities and Exchange Commission, which are available on our

website at www.fhlbc.com. In addition, certain information included

here speaks only as of the particular date or dates included in this

presentation, and the information in the presentation may have become

out of date. We do not undertake an obligation, and disclaim any duty,

to update any of the information in this presentation. The data and

valuations provided in this presentation are for information purposes

only and are provided as an accommodation and without charge. This

presentation is not intended to constitute legal, investment, or financial

advice or the rendering of legal, consulting, or other professional

services of any kind. “Mortgage Partnership Finance,” “MPF,” “MPF

Xtra,” “DPP,” and “DPP Advantage” are registered trademarks of the

Federal Home Loan Bank of Chicago.

3

Recent Financial Results

Roger Lundstrom

Chief Financial Officer

5

2010: Strong Transitional Year

• Bank achieved strong profitability

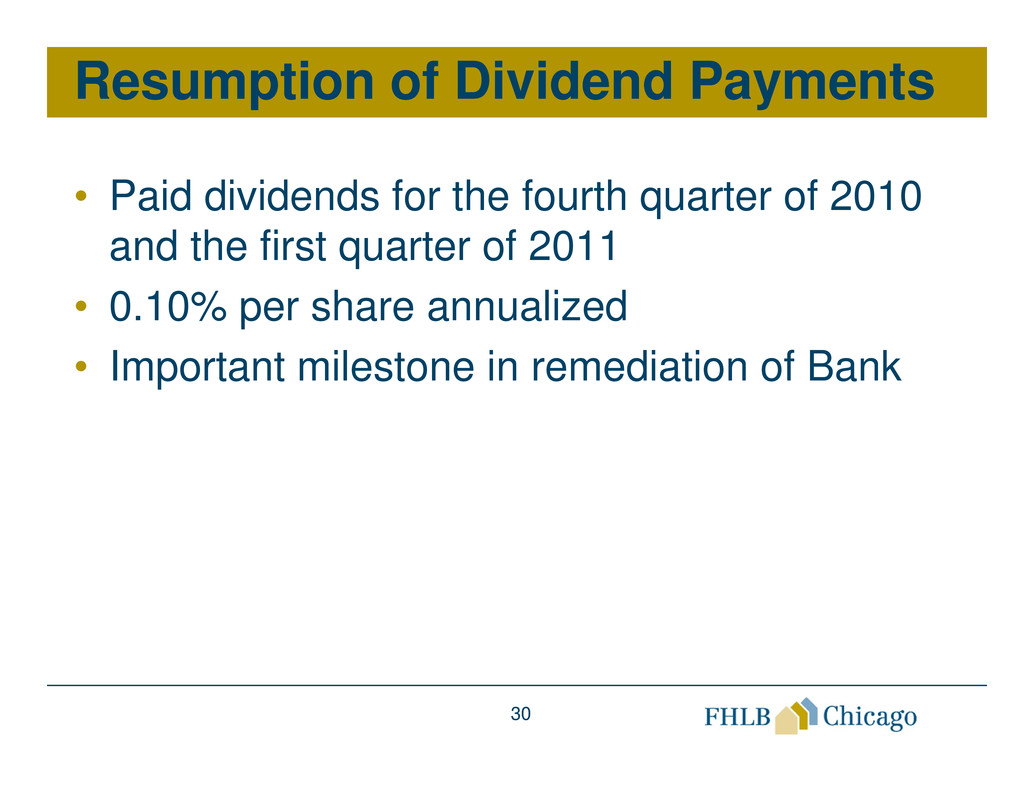

• Bank paid a dividend for the fourth quarter

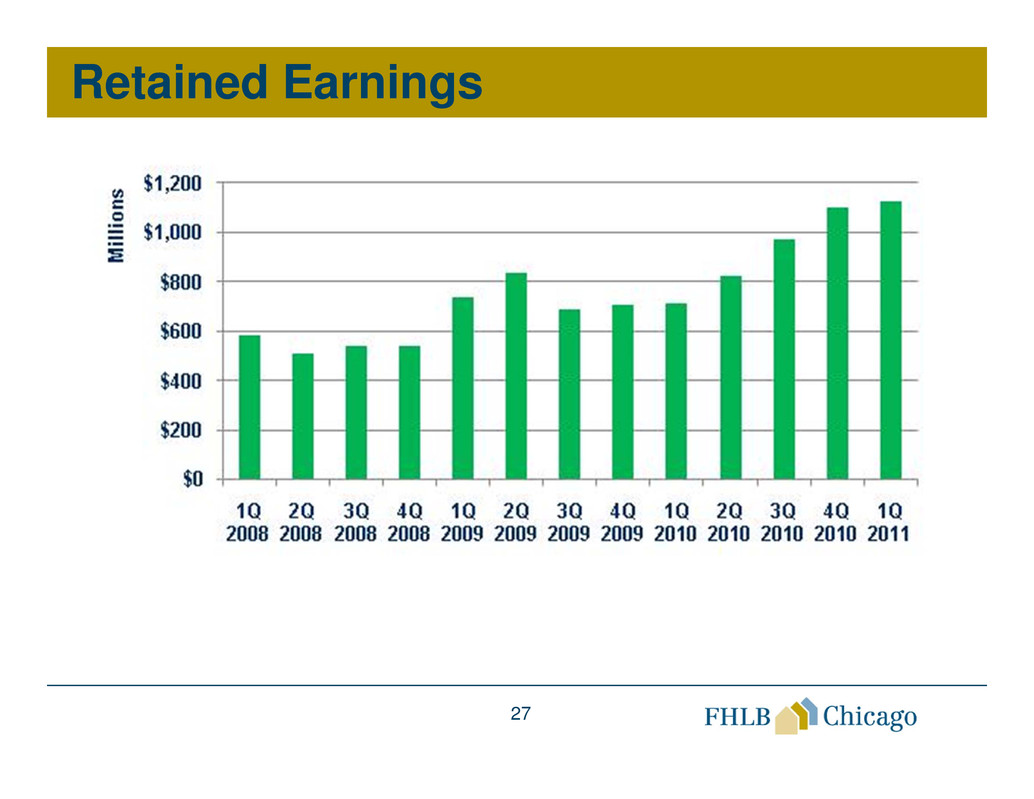

• Retained earnings reached record level

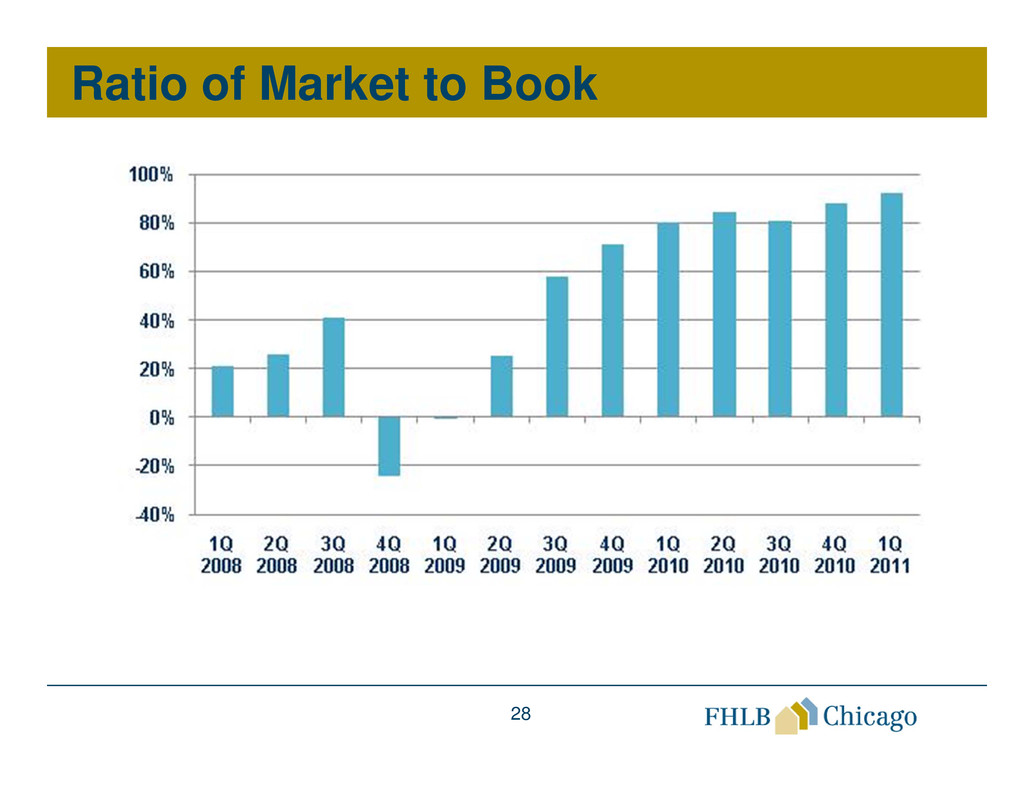

• Market value of the Bank grew robustly

• While there are still factors that impact

specific quarters, income is becoming more

consistent

6

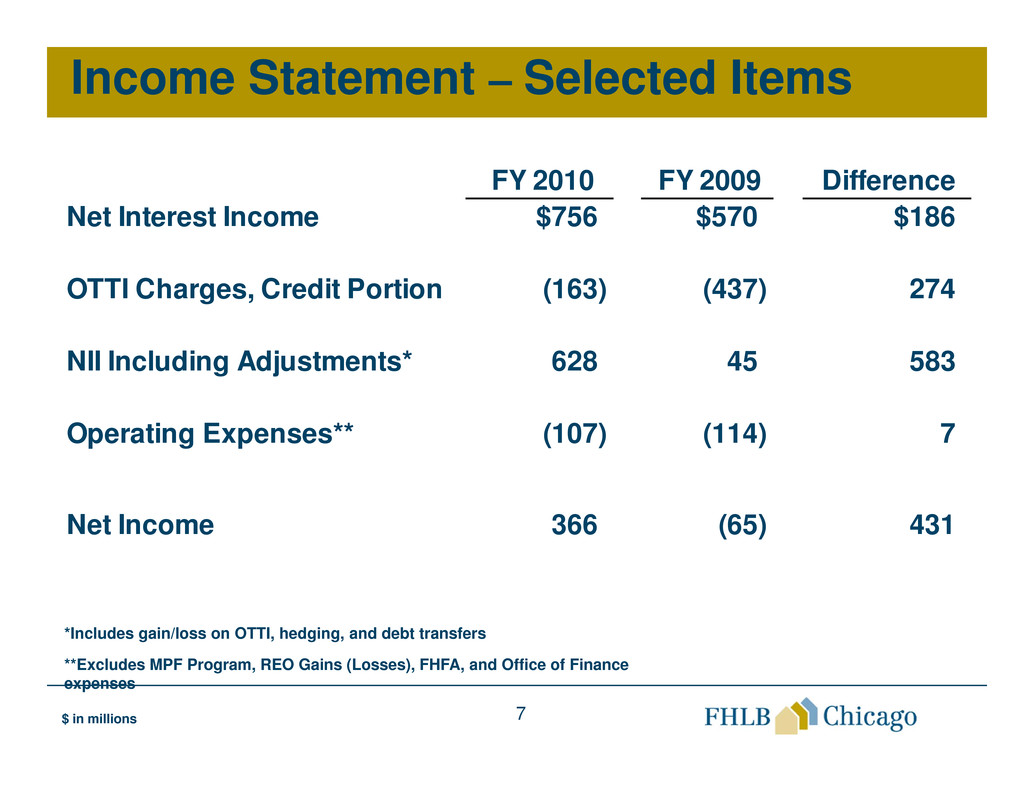

Income

7$ in millions

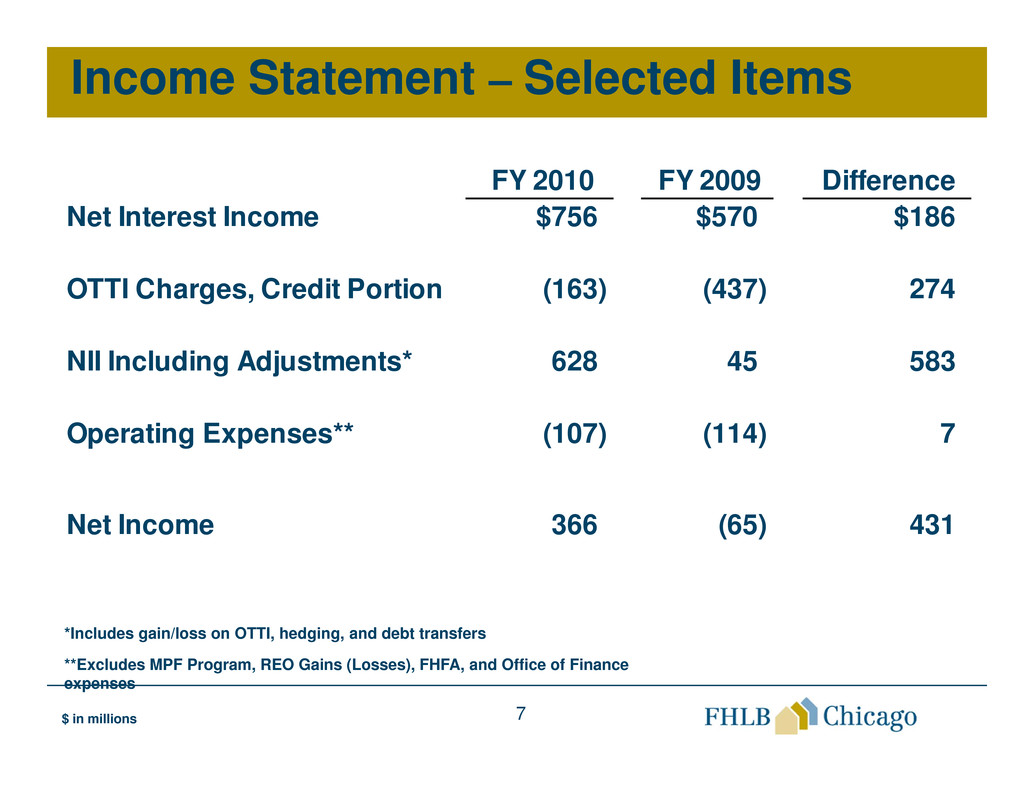

Income Statement – Selected Items

*Includes gain/loss on OTTI, hedging, and debt transfers

**Excludes MPF Program, REO Gains (Losses), FHFA, and Office of Finance

expenses

FY 2010 FY 2009 Difference

Net Interest Income $756 $570 $186

OTTI Charges, Credit Portion (163) (437) 274

NII Including Adjustments* 628 45 583

Operating Expenses** (107) (114) 7

Net Income 366 (65) 431

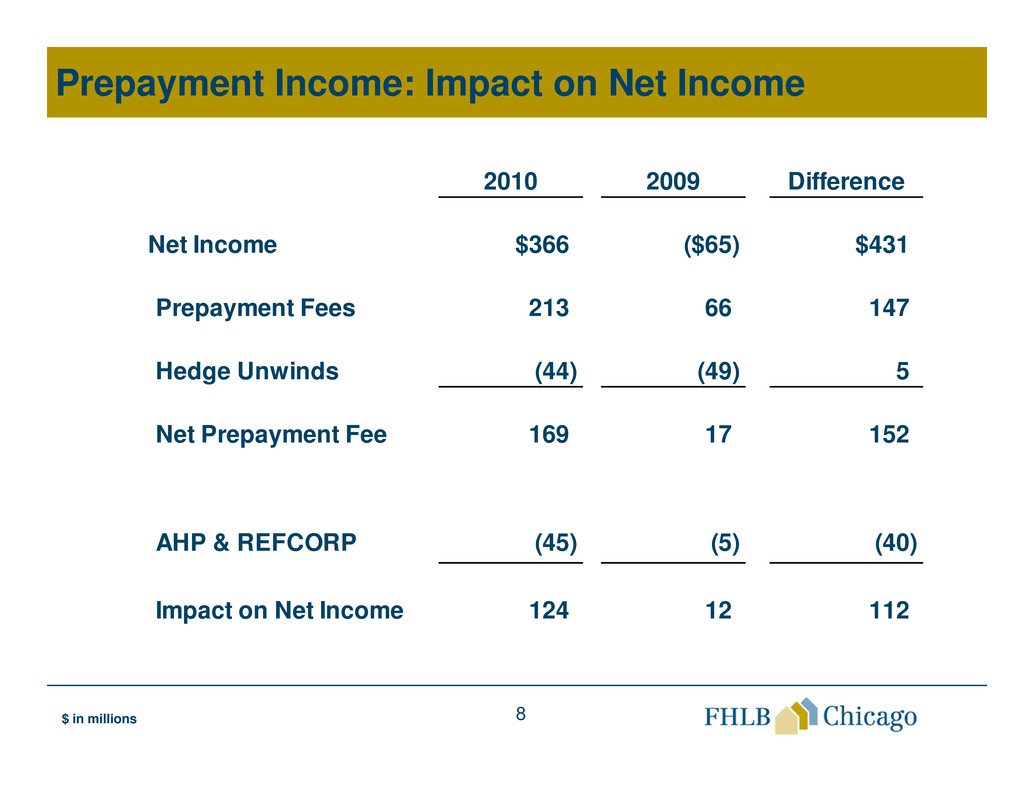

8

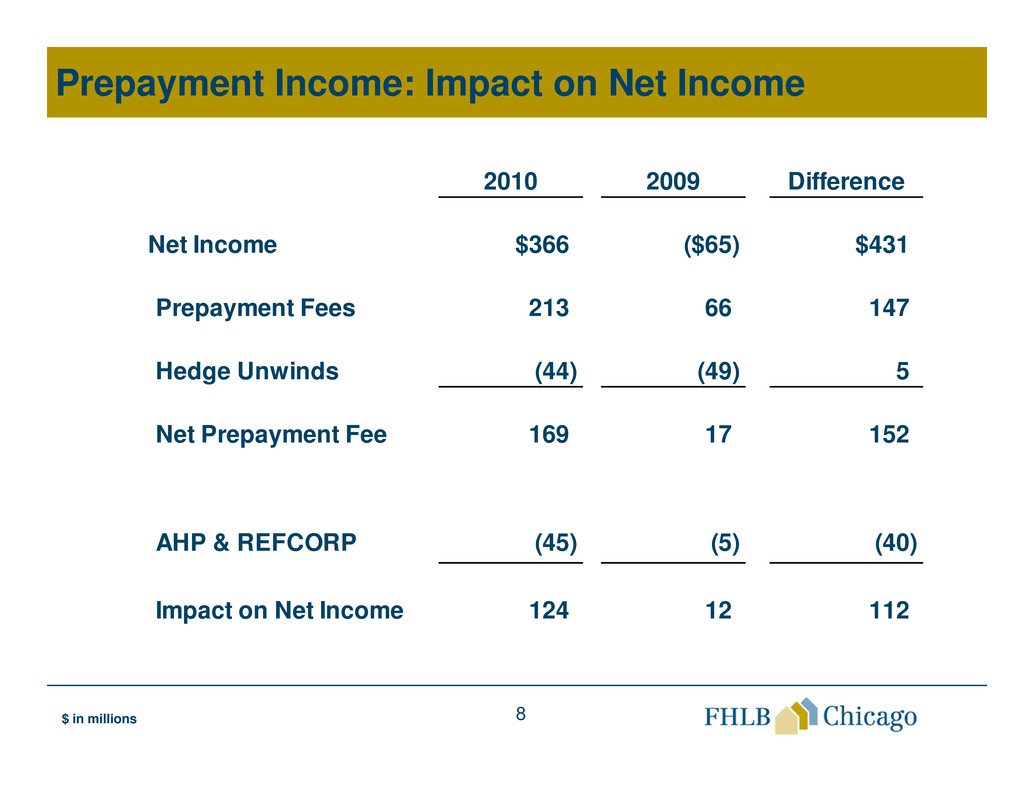

Prepayment Income: Impact on Net Income

2010 2009 Difference

Net Income $366 ($65) $431

Prepayment Fees 213 66 147

Hedge Unwinds (44) (49) 5

Net Prepayment Fee 169 17 152

AHP & REFCORP (45) (5) (40)

Impact on Net Income 124 12 112

$ in millions

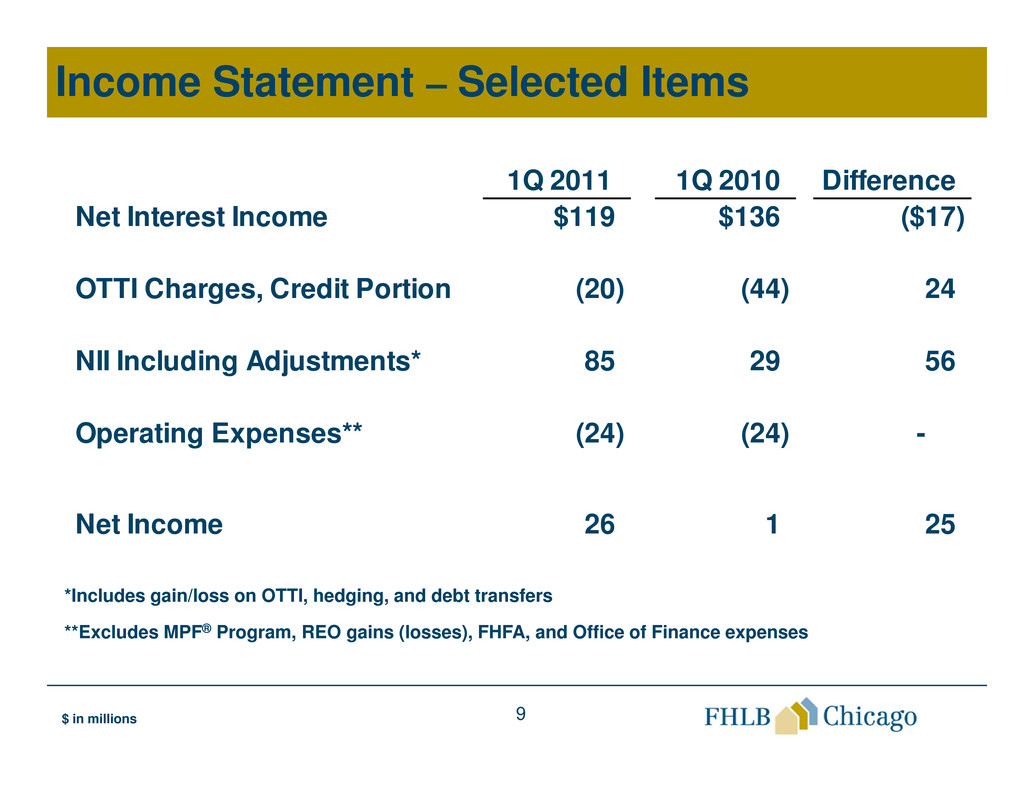

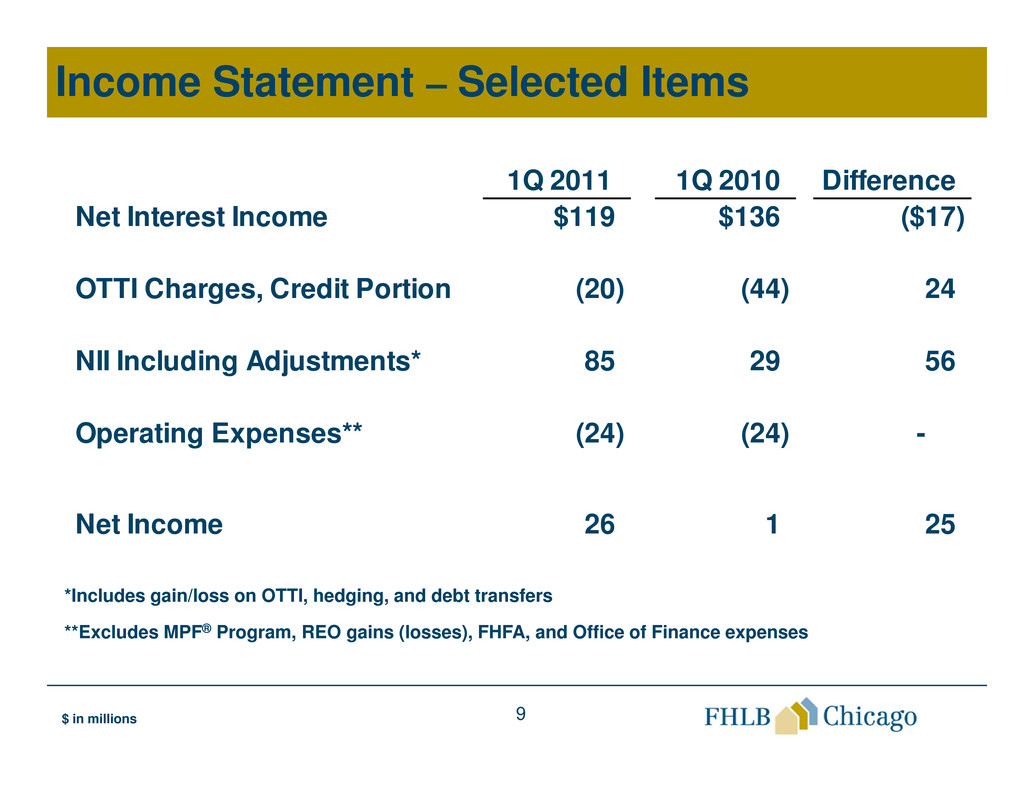

9$ in millions

Income Statement – Selected Items

*Includes gain/loss on OTTI, hedging, and debt transfers

**Excludes MPF® Program, REO gains (losses), FHFA, and Office of Finance expenses

1Q 2011 1Q 2010 Difference

Net Interest Income $119 $136 ($17)

OTTI Charges, Credit Portion (20) (44) 24

NII Including Adjustments* 85 29 56

Operating Expenses** (24) (24) -

Net Income 26 1 25

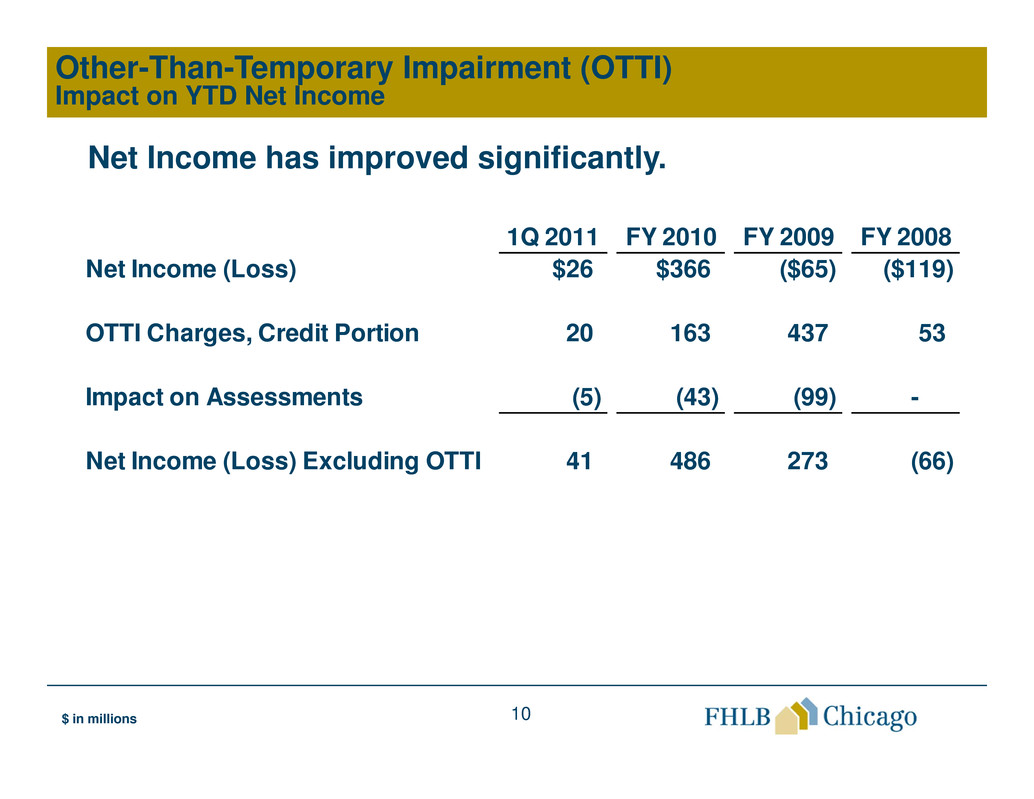

10

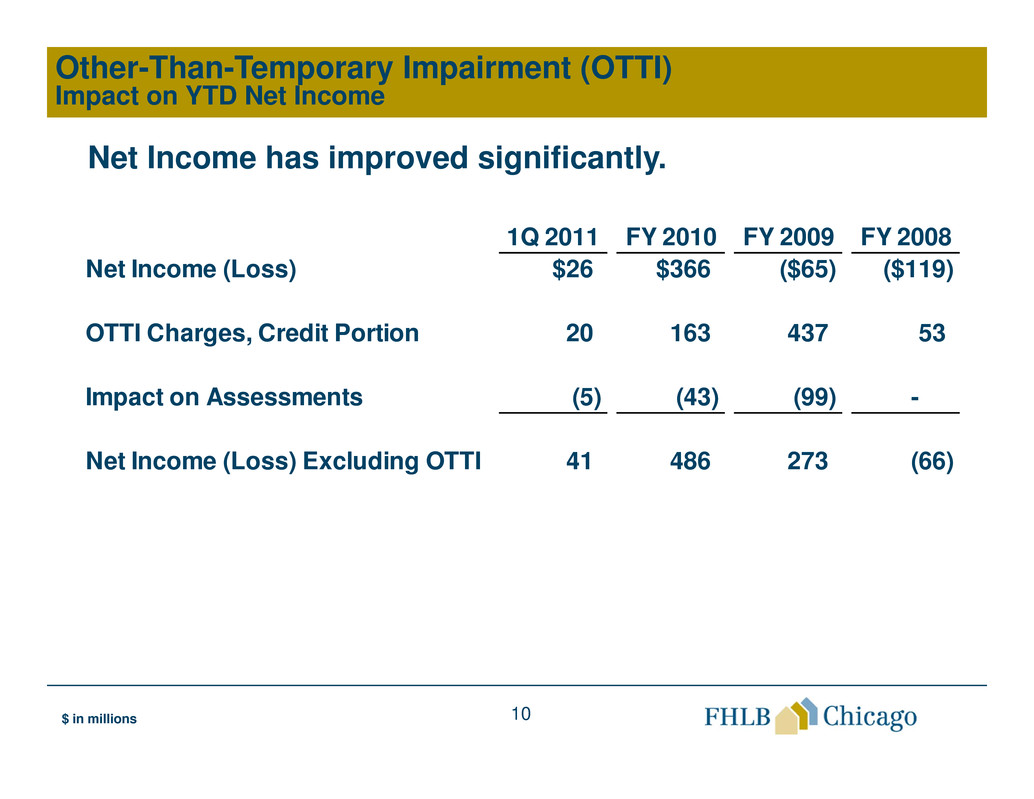

Other-Than-Temporary Impairment (OTTI)

Impact on YTD Net Income

$ in millions

Net Income has improved significantly.

1Q 2011 FY 2010 FY 2009 FY 2008

Net Income (Loss) $26 $366 ($65) ($119)

OTTI Charges, Credit Portion 20 163 437 53

Impact on Assessments (5) (43) (99) -

Net Income (Loss) Excluding OTTI 41 486 273 (66)

11

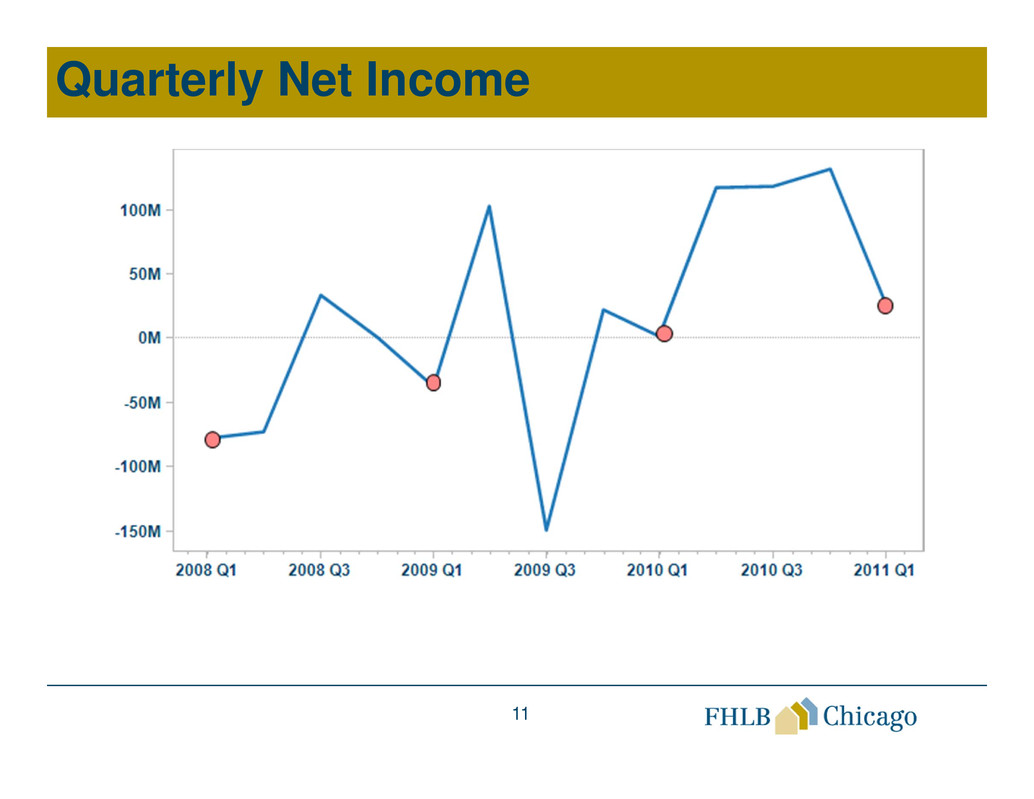

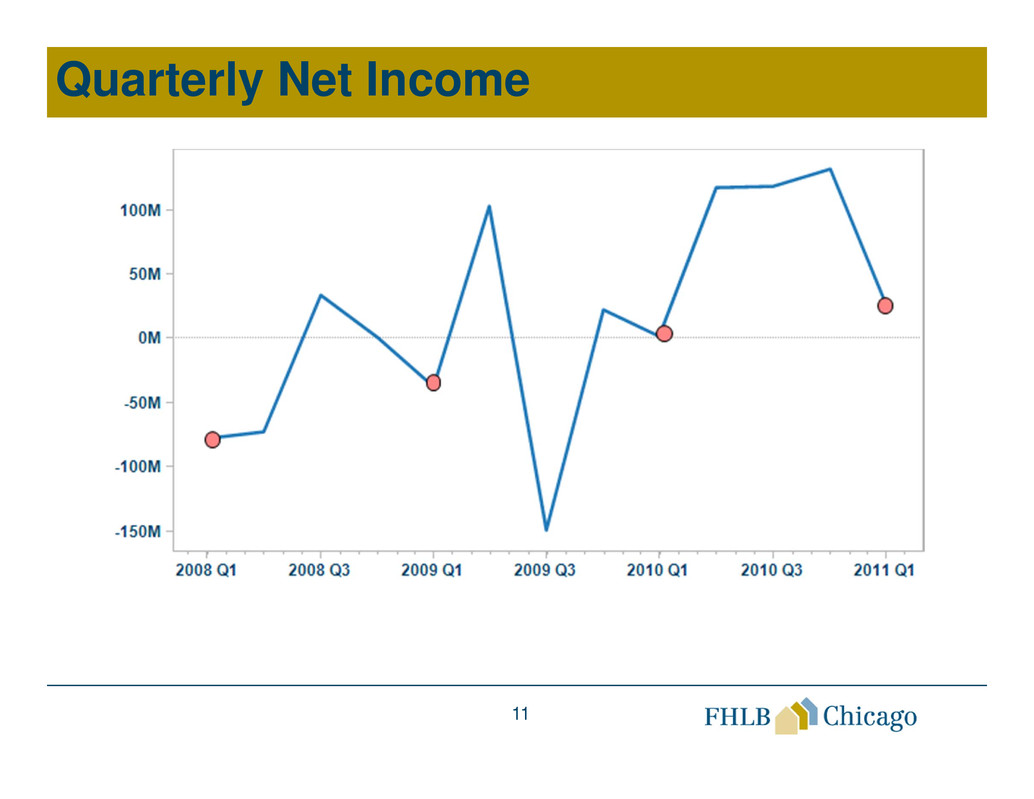

Quarterly Net Income

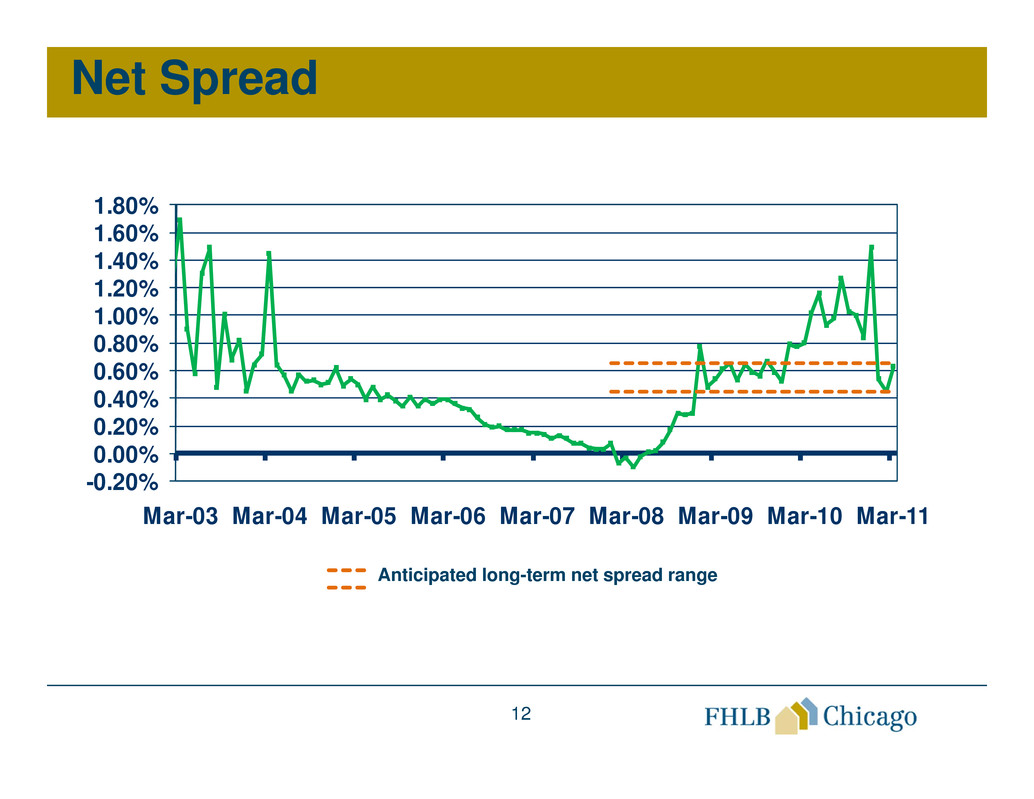

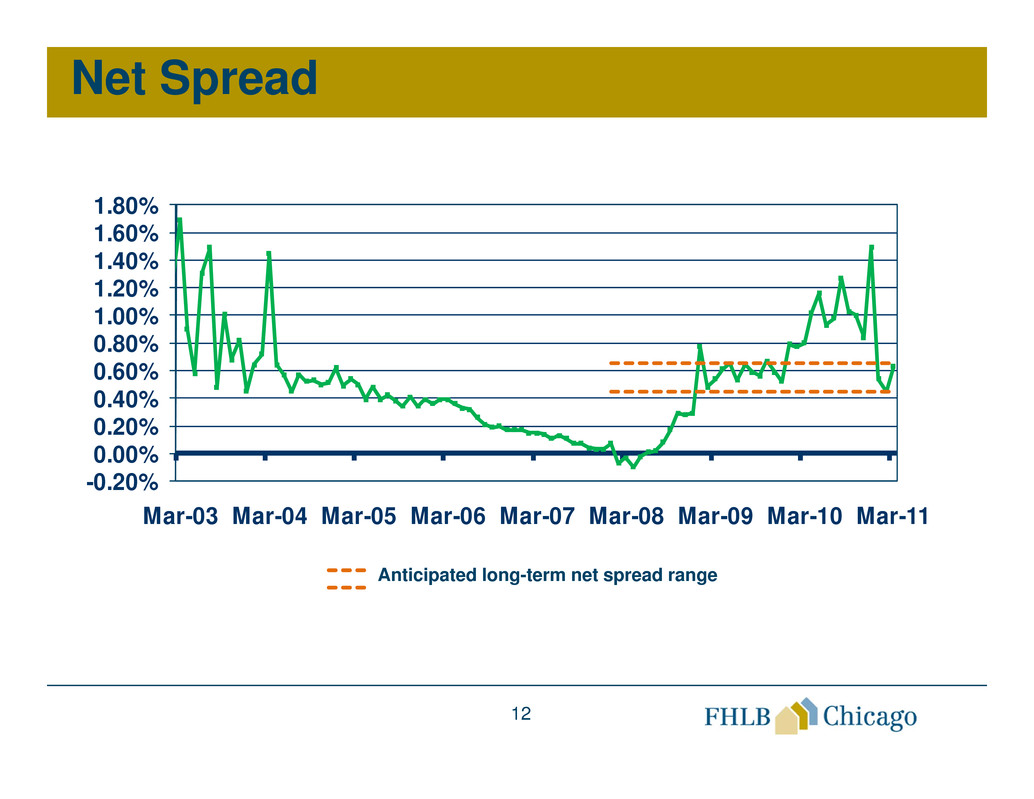

-0.20%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11

Net Spread

12

Anticipated long-term net spread range

13

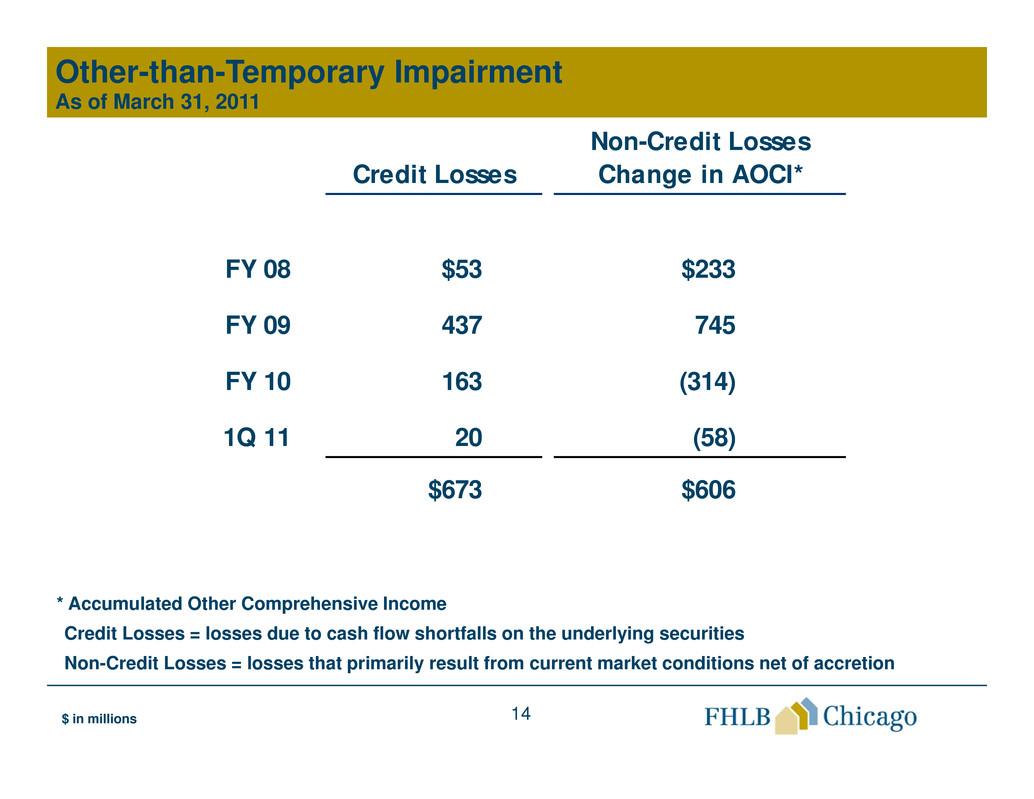

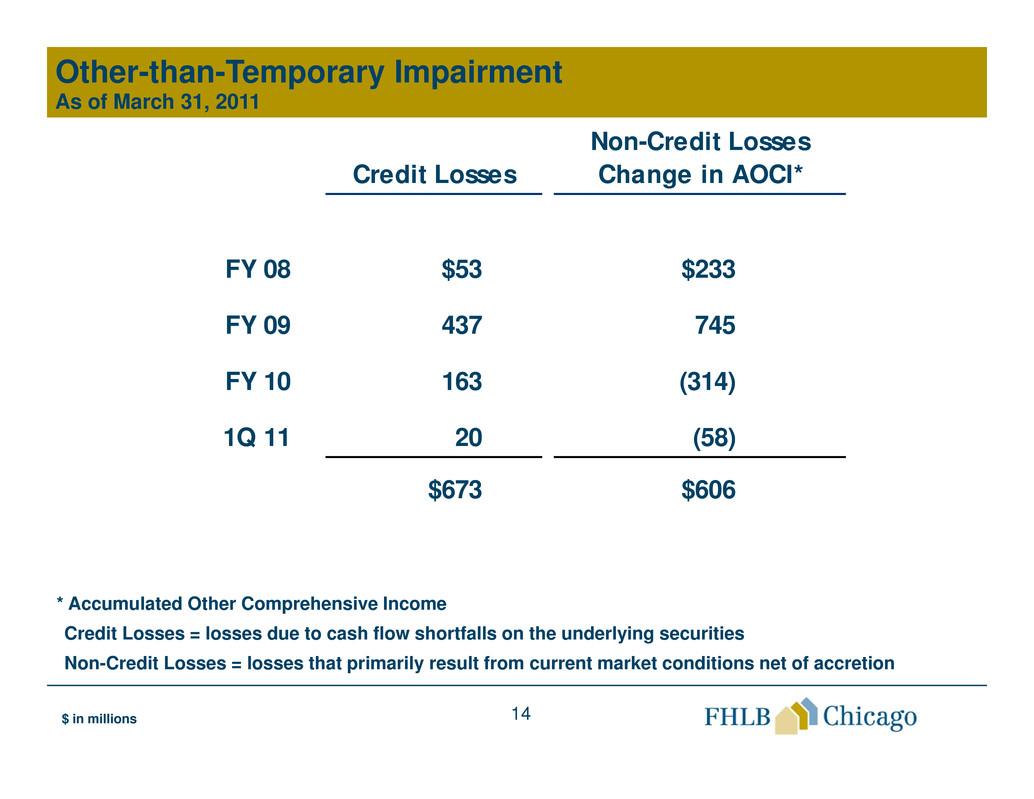

Other-Than-Temporary Impairment

14

Other-than-Temporary Impairment

As of March 31, 2011

$ in millions

* Accumulated Other Comprehensive Income

Credit Losses = losses due to cash flow shortfalls on the underlying securities

Non-Credit Losses = losses that primarily result from current market conditions net of accretion

FY 08 $53 $233

FY 09 437 745

FY 10 163 (314)

1Q 11 20 (58)

$673 $606

Non-Credit Losses

Change in AOCI*Credit Losses

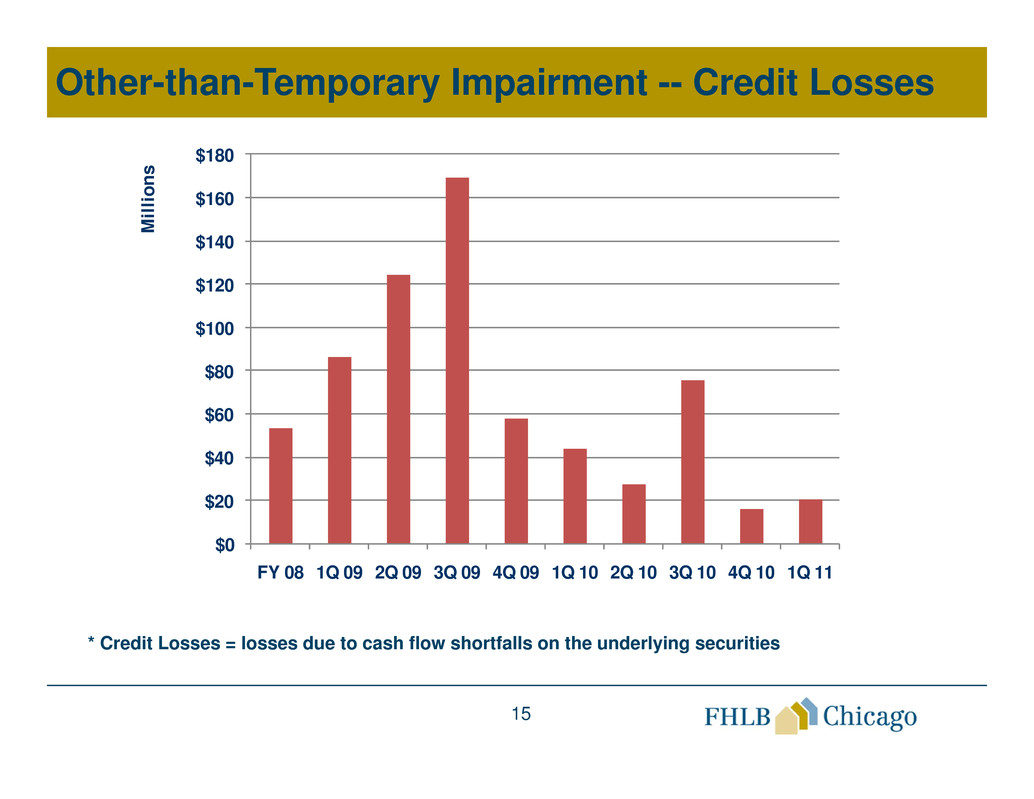

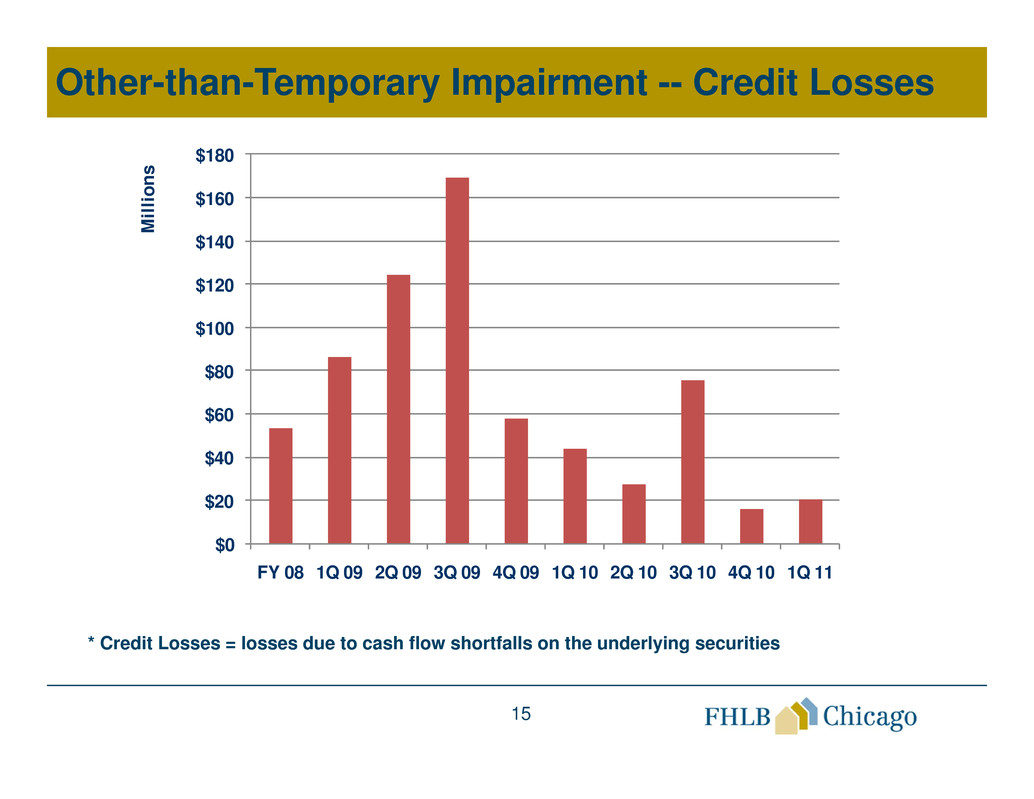

Other-than-Temporary Impairment -- Credit Losses

* Credit Losses = losses due to cash flow shortfalls on the underlying securities

15

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

FY 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11

M

i

l

l

i

o

n

s

16

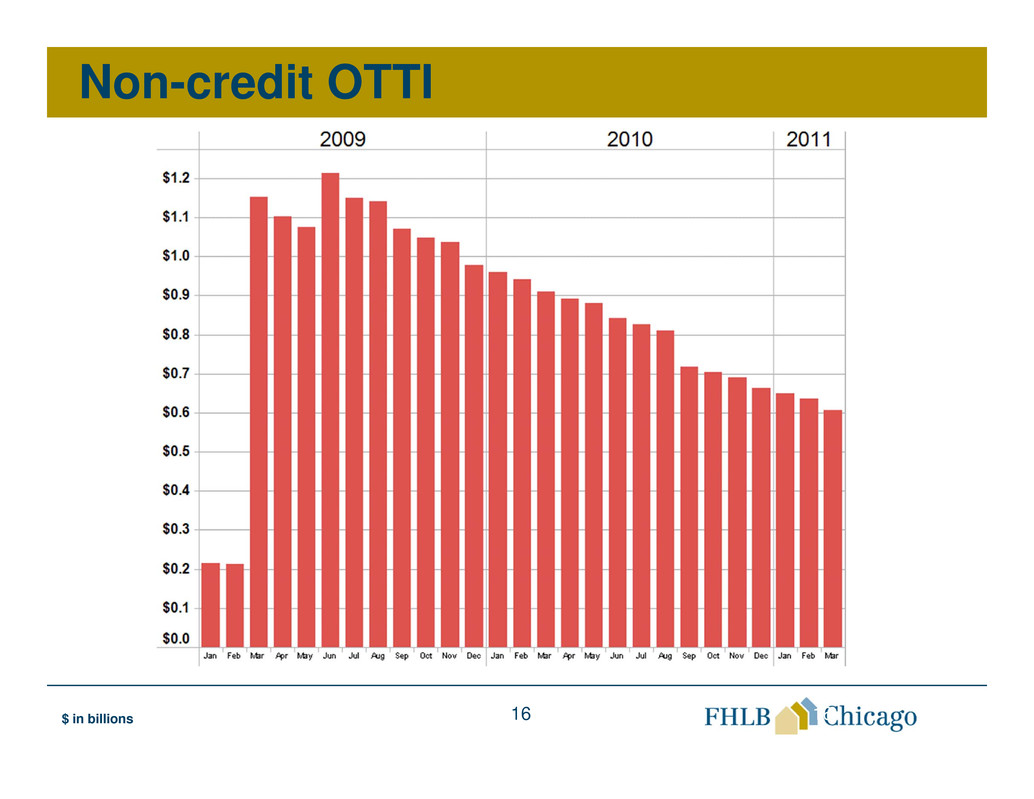

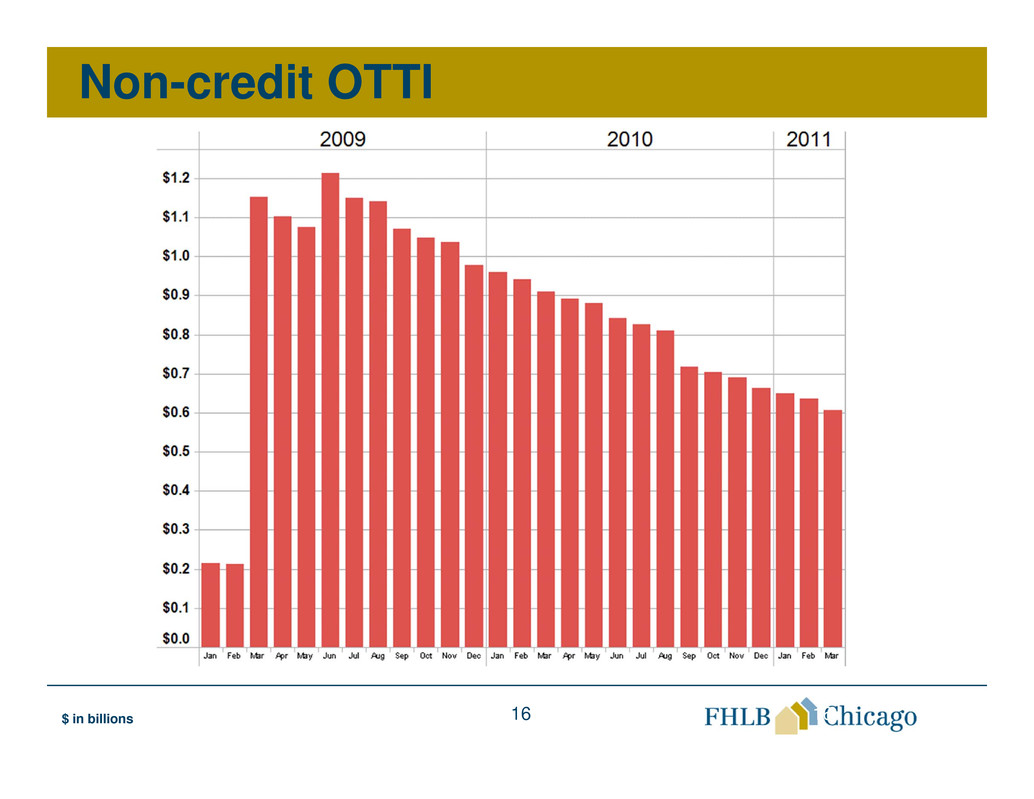

Non-credit OTTI

$ in billions 16

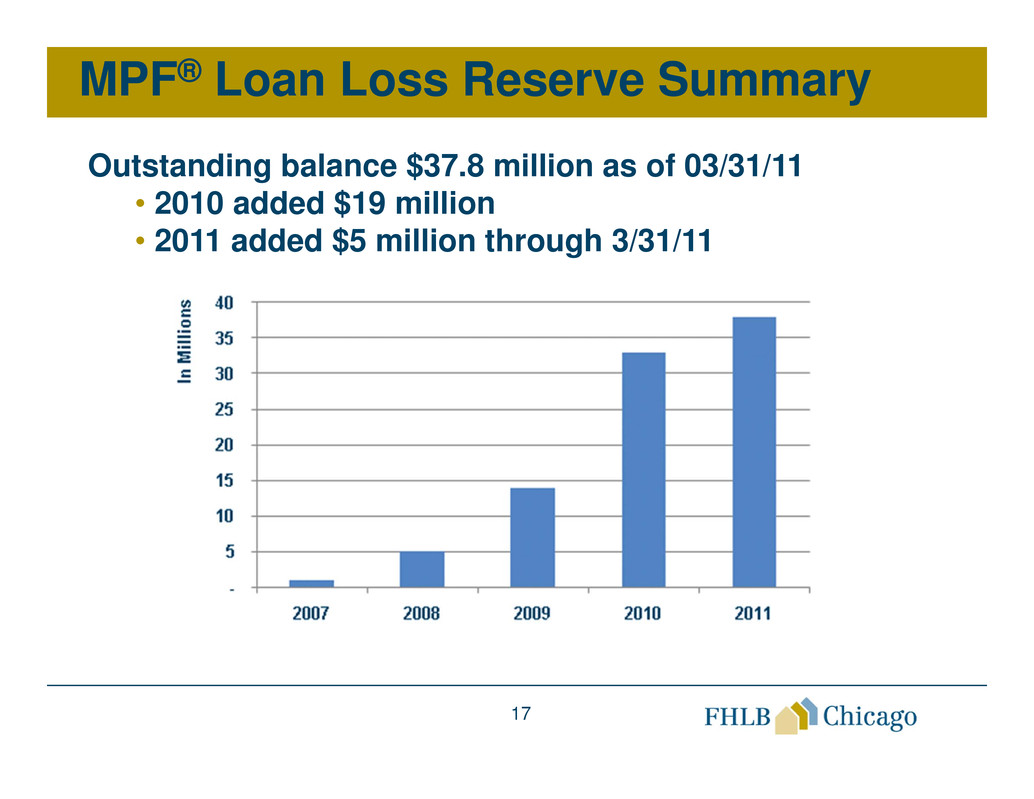

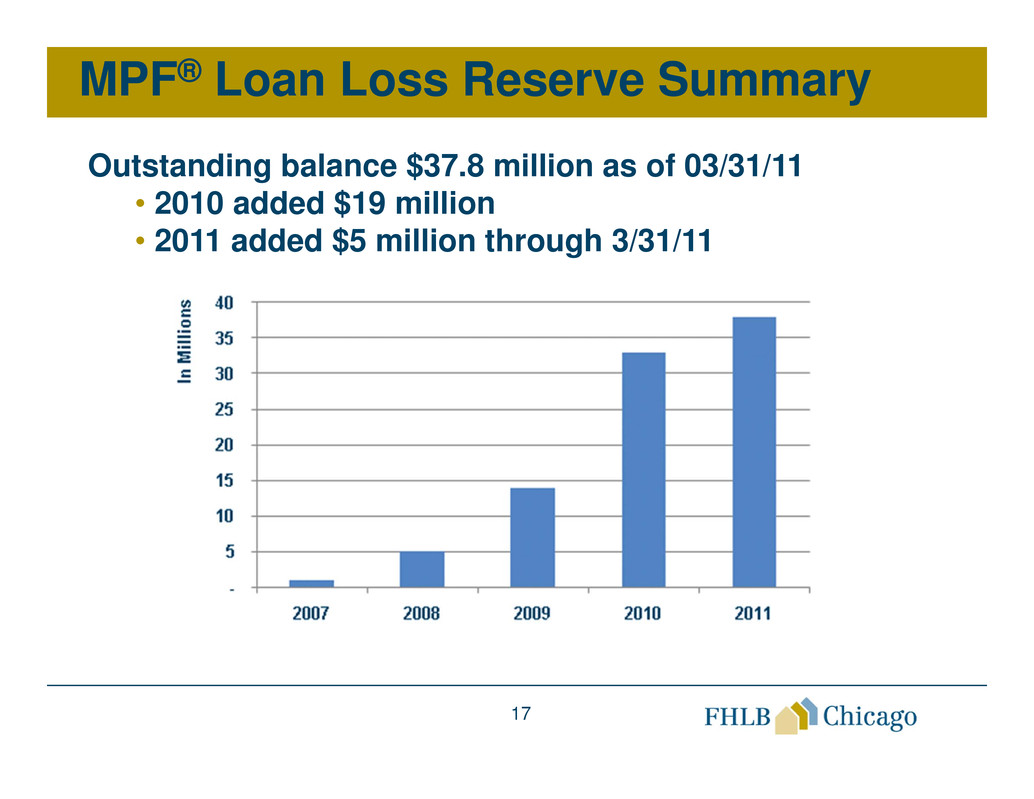

MPF® Loan Loss Reserve Summary

17

Outstanding balance $37.8 million as of 03/31/11

• 2010 added $19 million

• 2011 added $5 million through 3/31/11

18

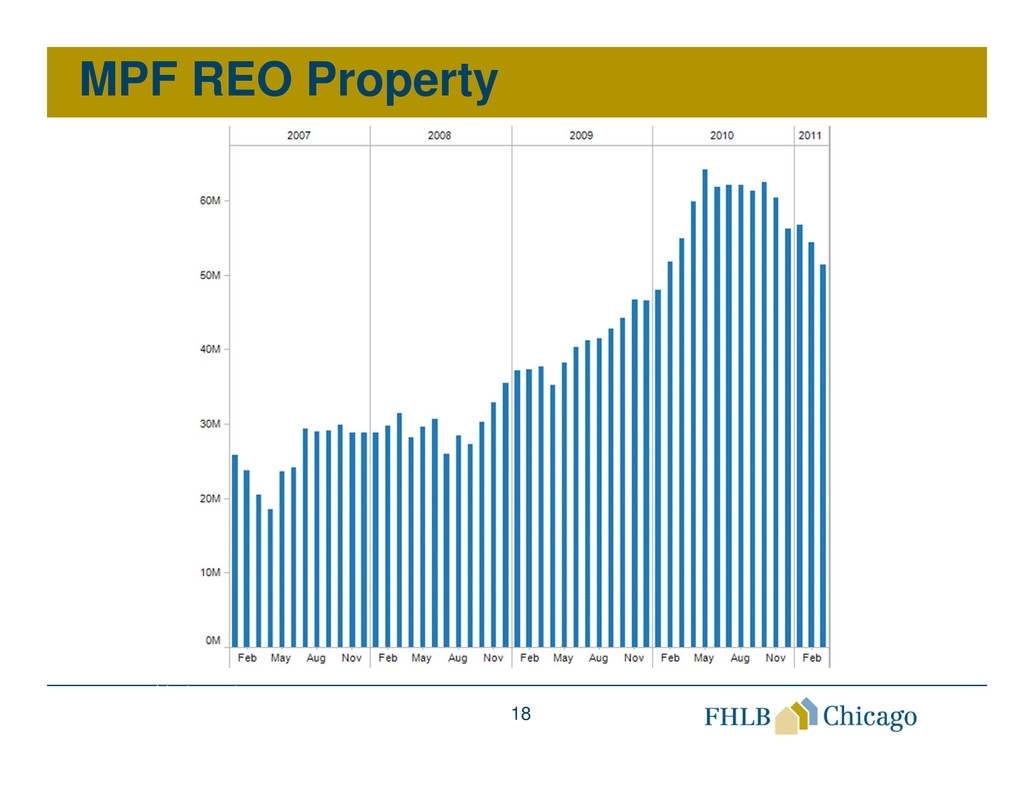

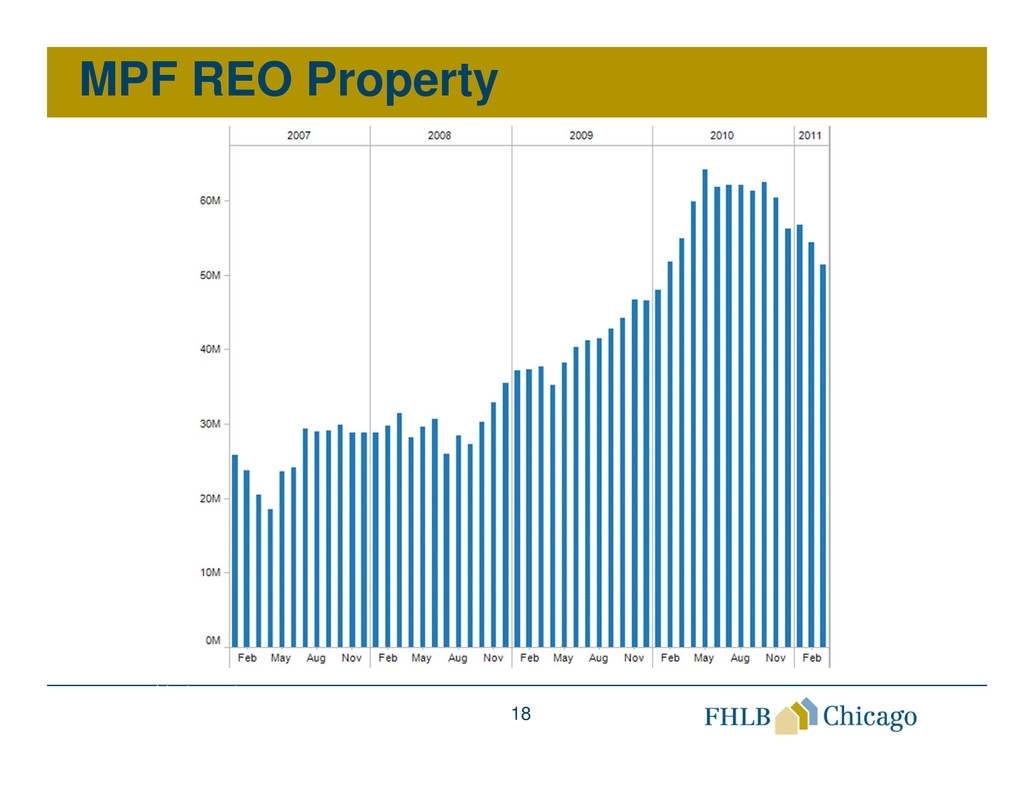

MPF REO Property

$ in thousands

19

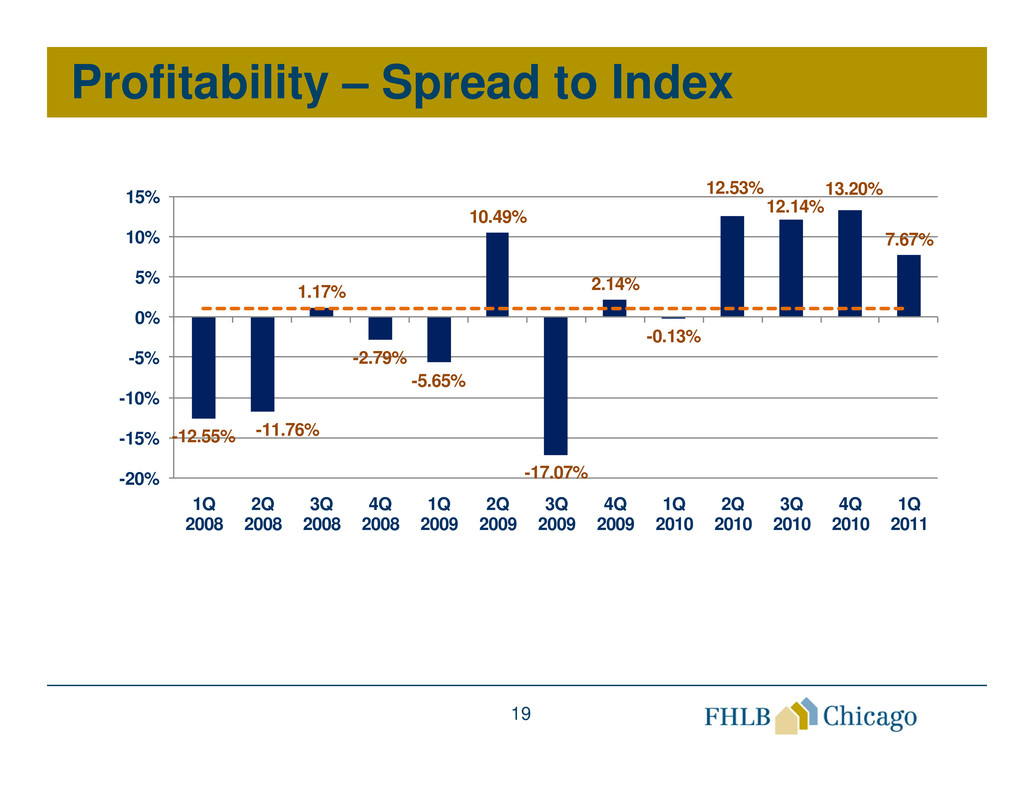

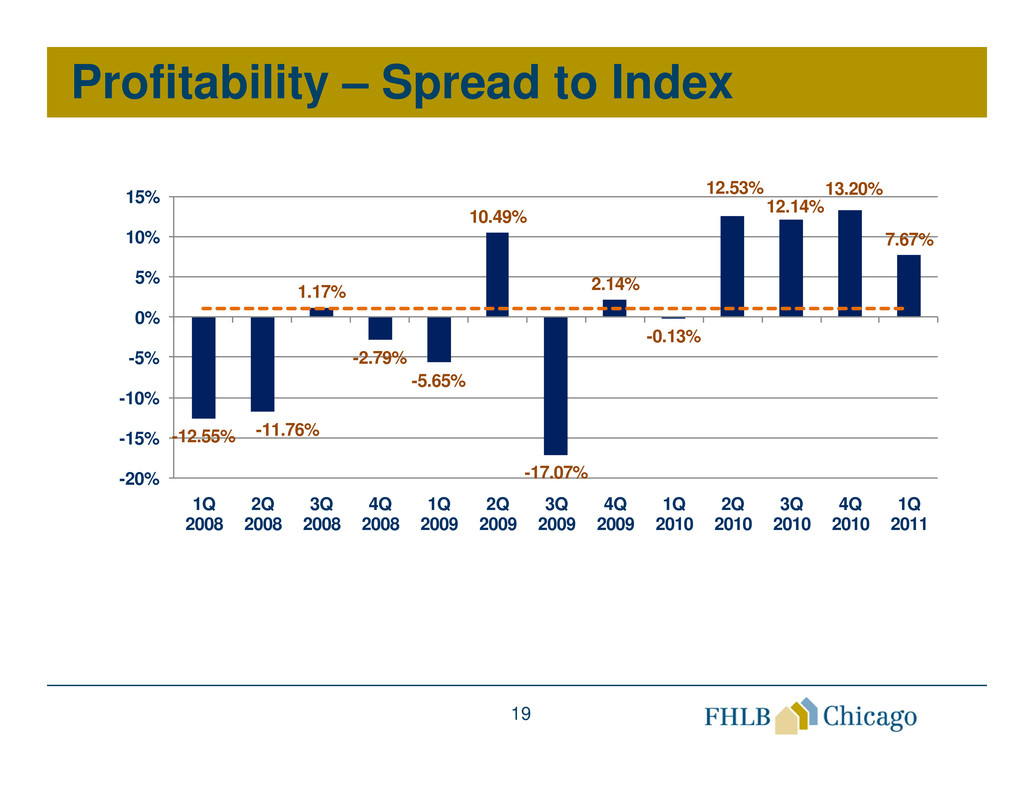

Profitability – Spread to Index

-12.55% -11.76%

1.17%

-2.79%

-5.65%

10.49%

-17.07%

2.14%

-0.13%

12.53%

12.14%

13.20%

7.67%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

1Q

2008

2Q

2008

3Q

2008

4Q

2008

1Q

2009

2Q

2009

3Q

2009

4Q

2009

1Q

2010

2Q

2010

3Q

2010

4Q

2010

1Q

2011

20

Balance Sheet

21

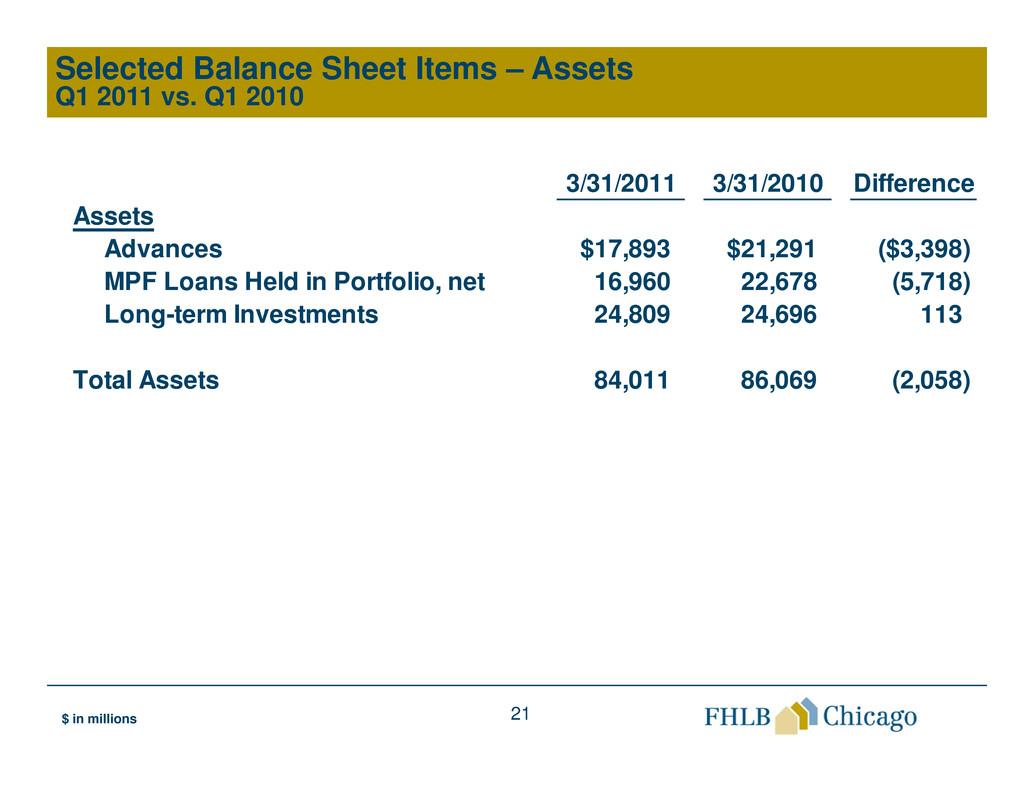

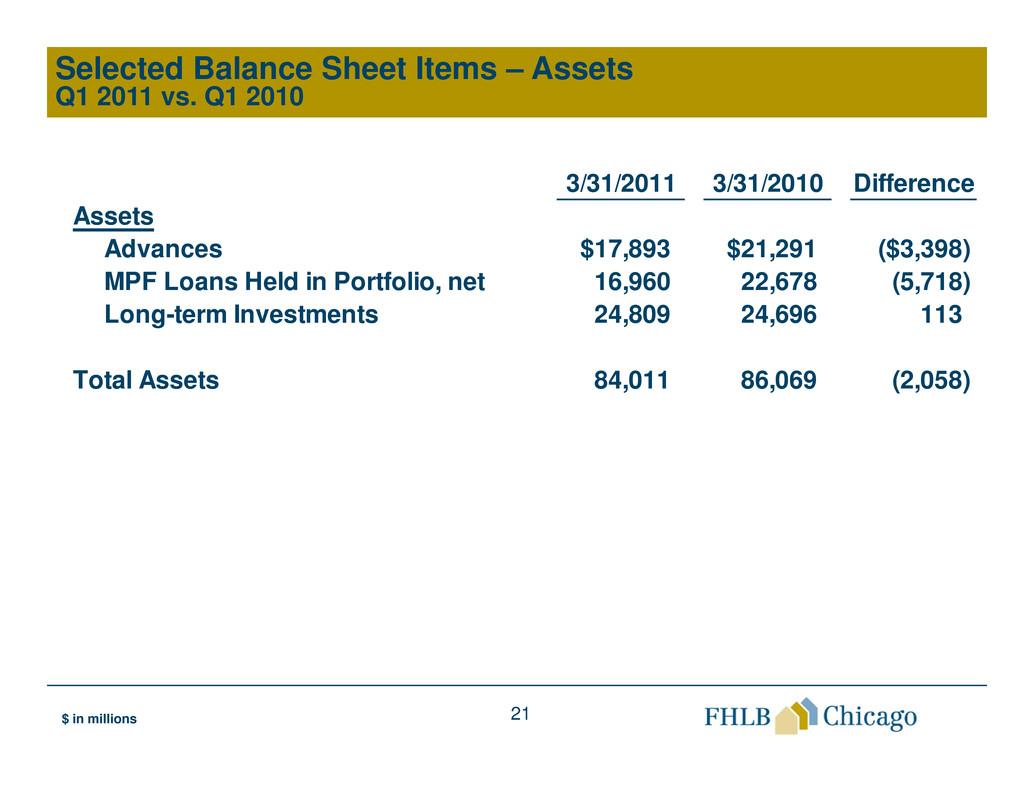

Selected Balance Sheet Items – Assets

Q1 2011 vs. Q1 2010

$ in millions

3/31/2011 3/31/2010 Difference

Assets

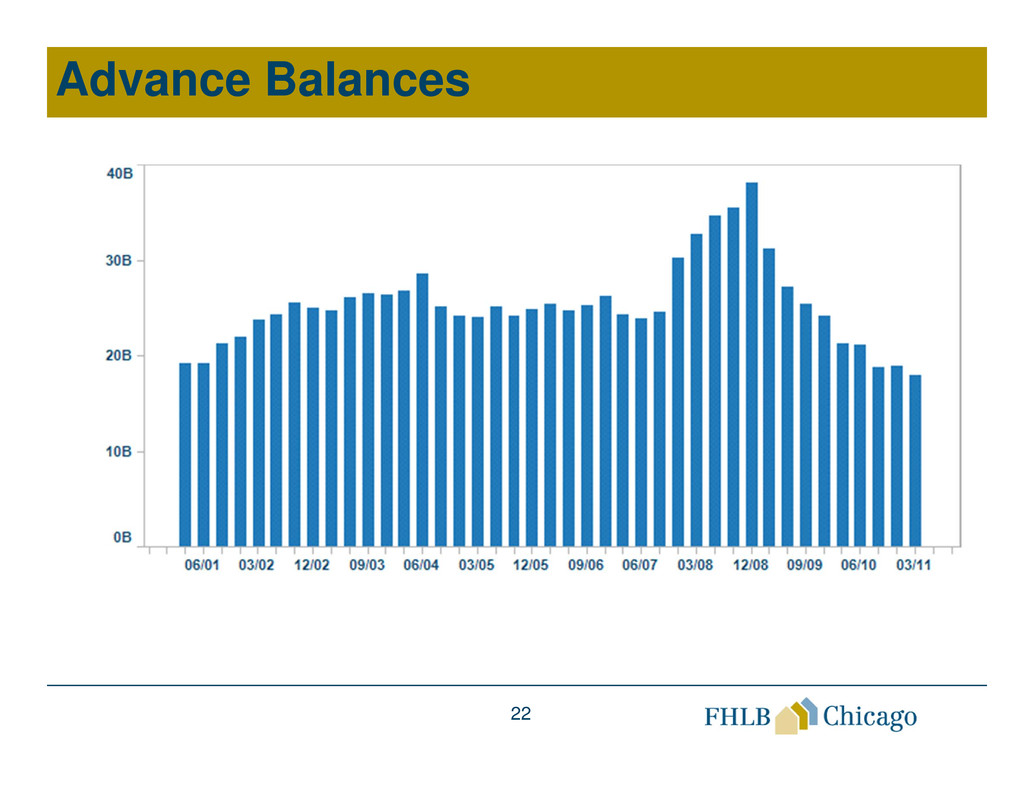

Advances $17,893 $21,291 ($3,398)

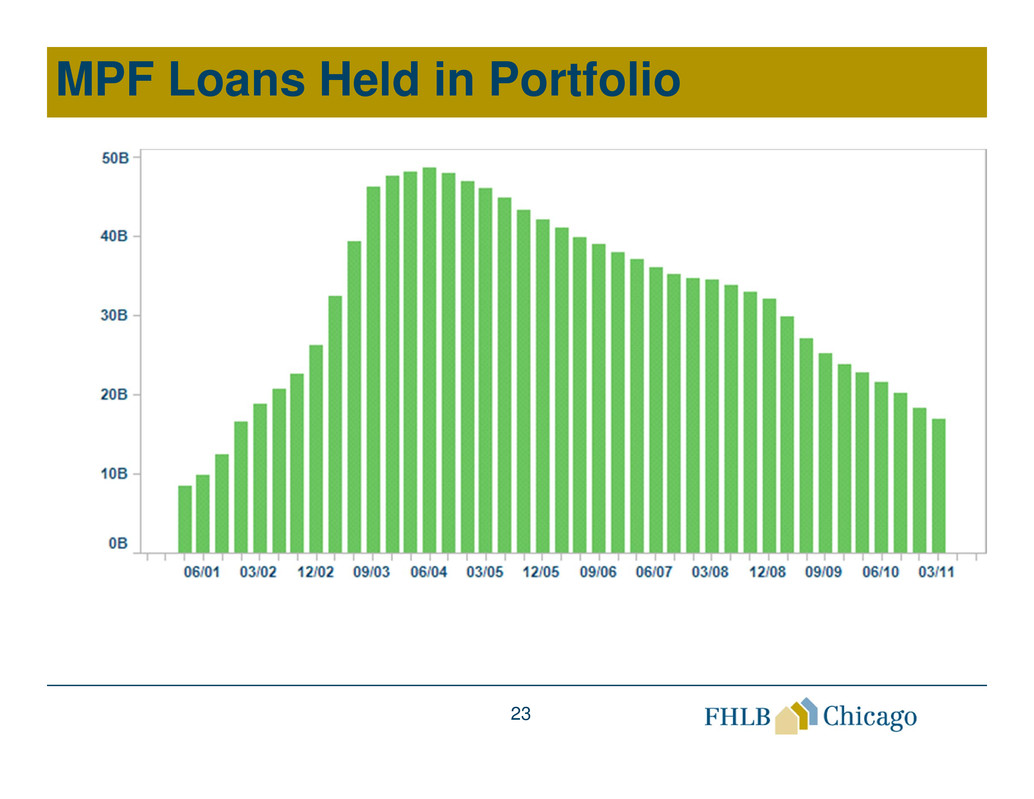

MPF Loans Held in Portfolio, net 16,960 22,678 (5,718)

Long-term Investments 24,809 24,696 113

Total Assets 84,011 86,069 (2,058)

22

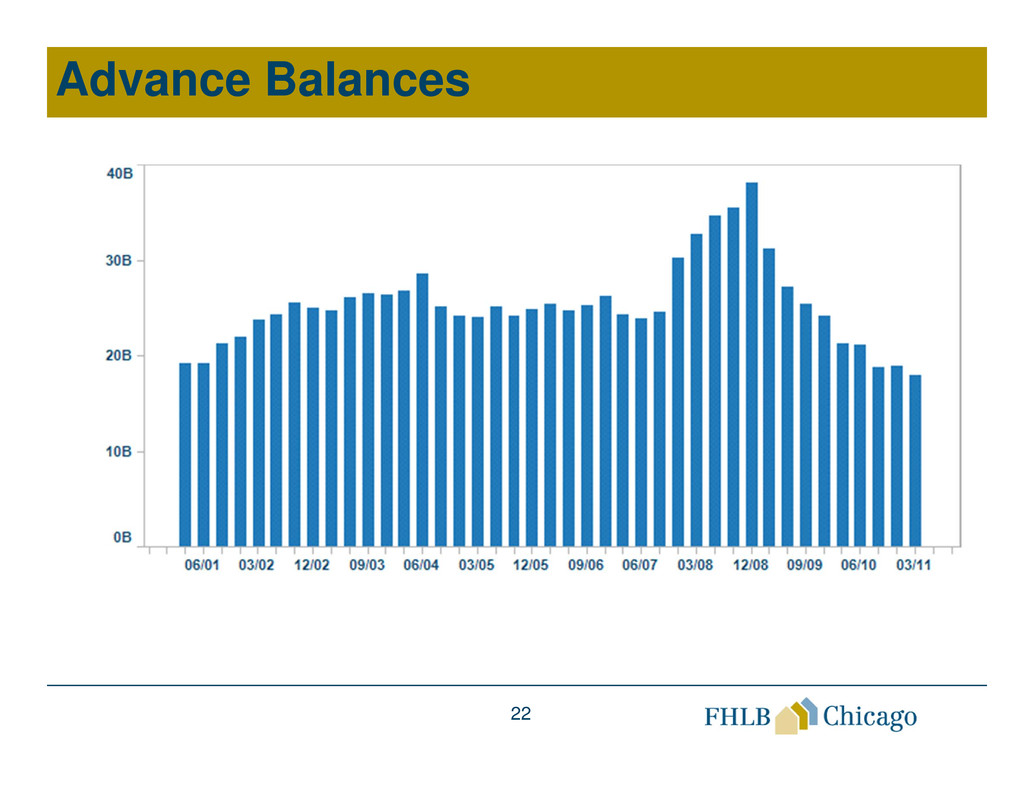

Advance Balances

23

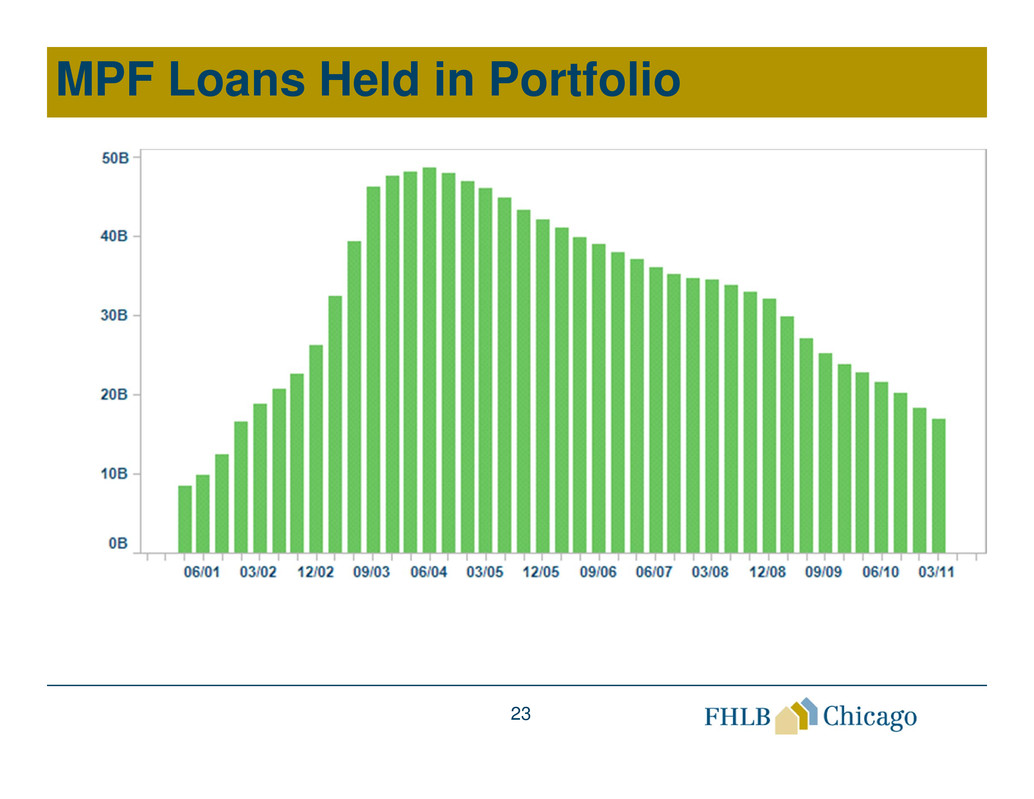

MPF Loans Held in Portfolio

24

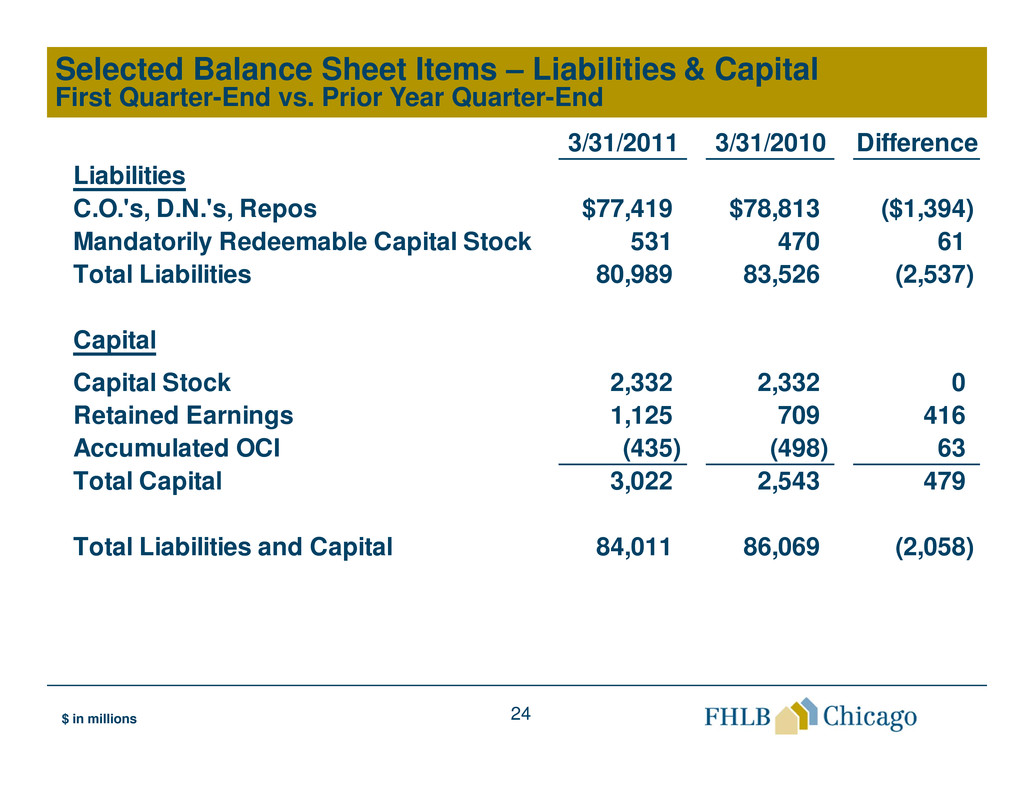

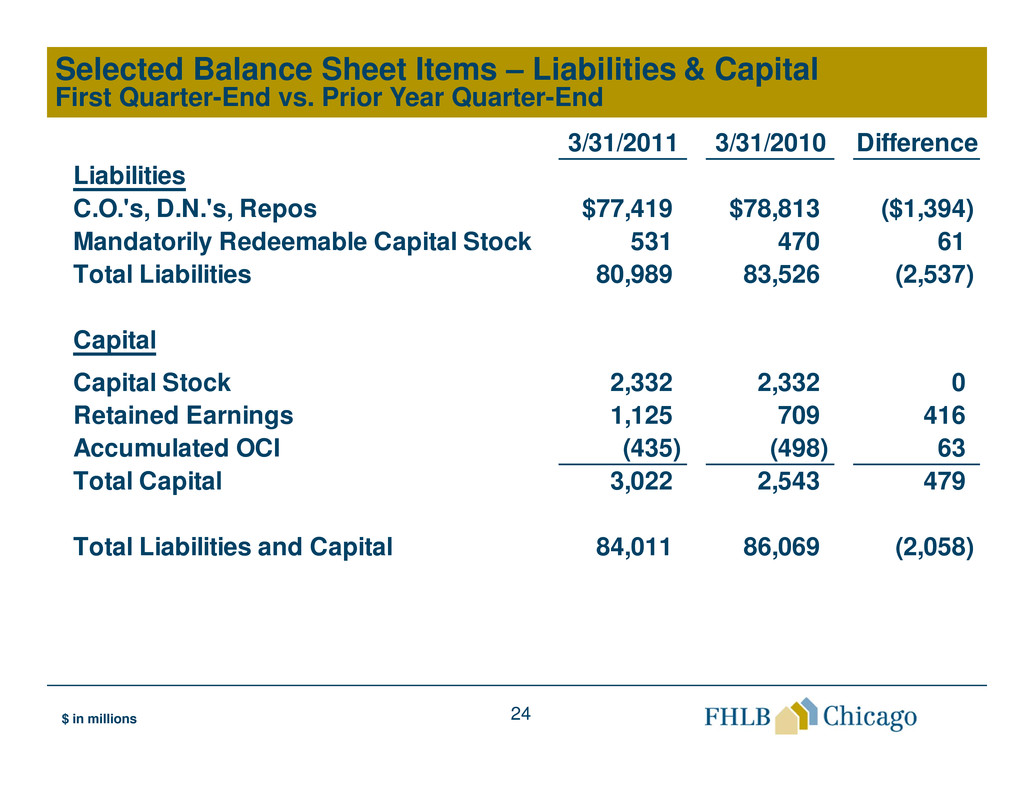

Selected Balance Sheet Items – Liabilities & Capital

First Quarter-End vs. Prior Year Quarter-End

$ in millions

3/31/2011 3/31/2010 Difference

Liabilities

C.O.'s, D.N.'s, Repos $77,419 $78,813 ($1,394)

Mandatorily Redeemable Capital Stock 531 470 61

Total Liabilities 80,989 83,526 (2,537)

Capital

Capital Stock 2,332 2,332 0

Retained Earnings 1,125 709 416

Accumulated OCI (435) (498) 63

Total Capital 3,022 2,543 479

Total Liabilities and Capital 84,011 86,069 (2,058)

25

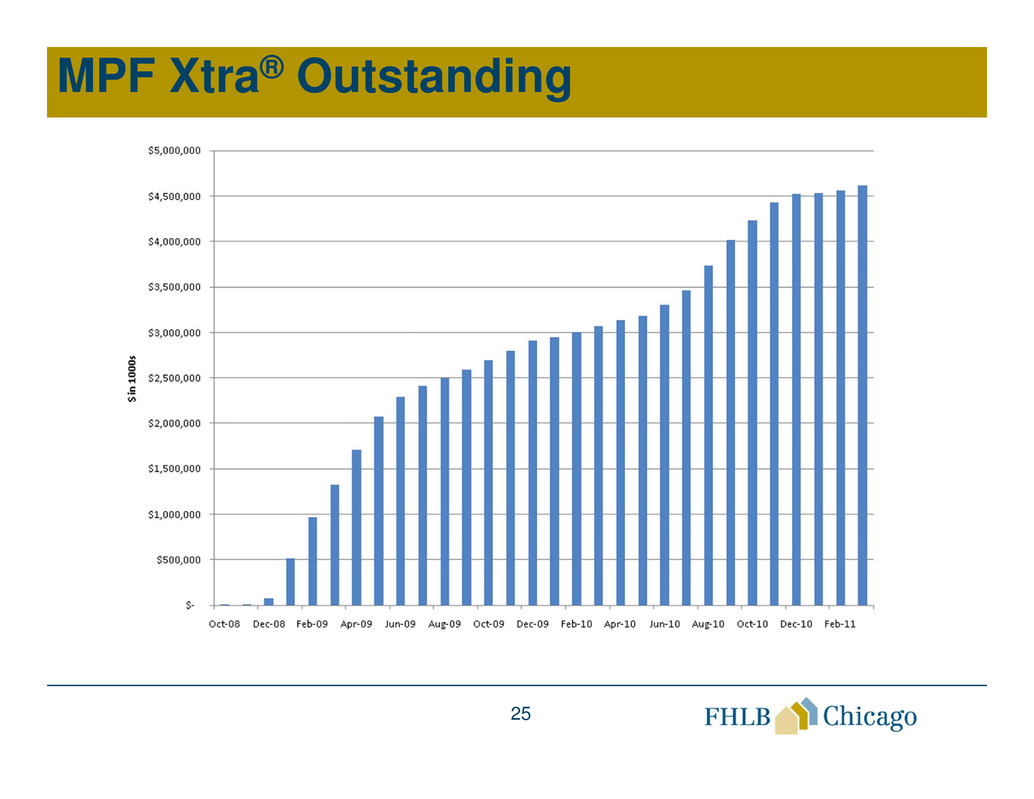

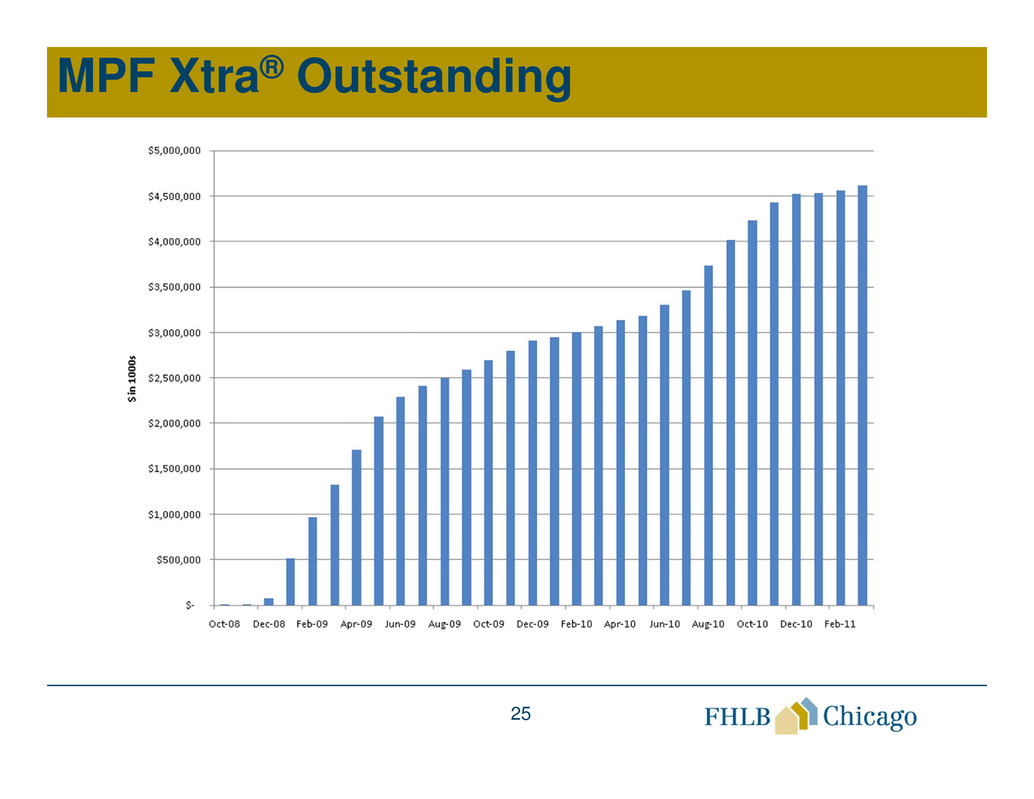

MPF Xtra® Outstanding

Advances and MPF

2626

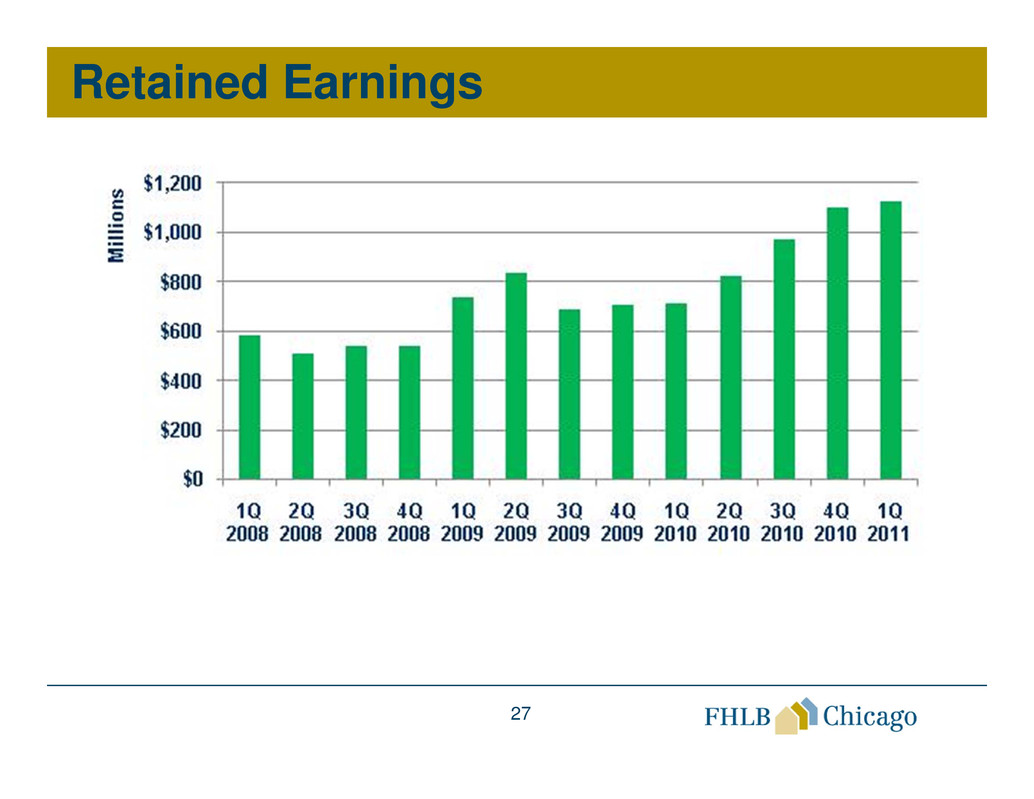

Retained Earnings

27

28

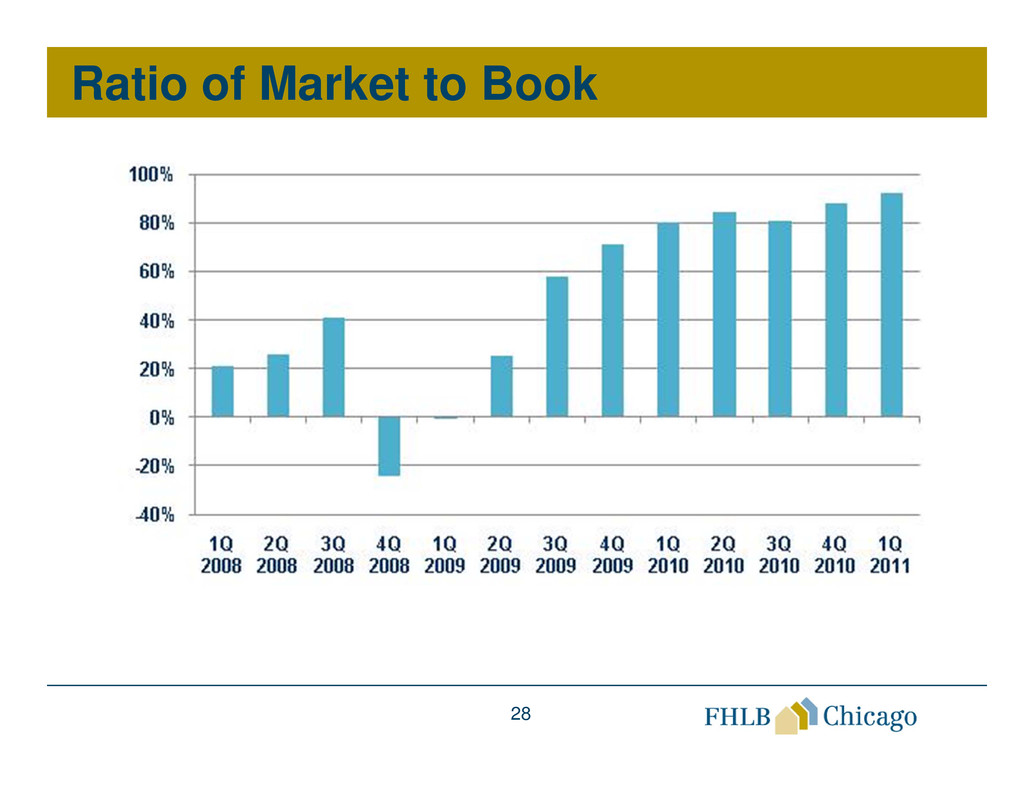

Ratio of Market to Book

29

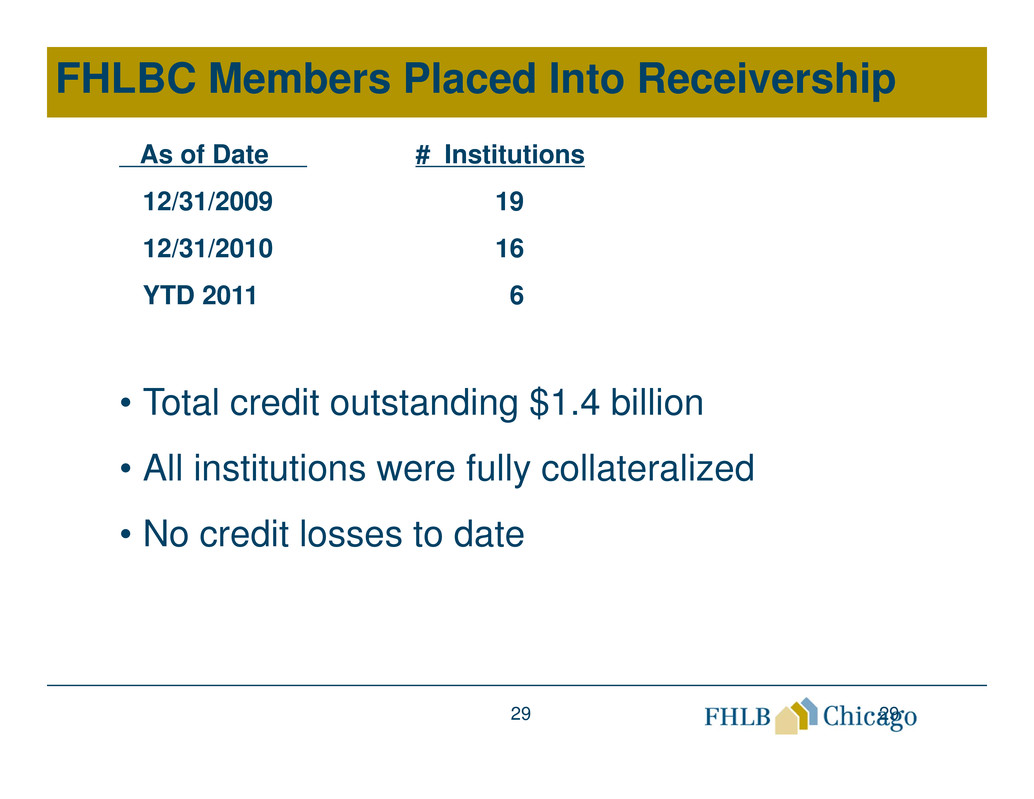

FHLBC Members Placed Into Receivership

As of Date # Institutions

12/31/2009 19

12/31/2010 16

YTD 2011 6

• Total credit outstanding $1.4 billion

• All institutions were fully collateralized

• No credit losses to date

29

30

Resumption of Dividend Payments

• Paid dividends for the fourth quarter of 2010

and the first quarter of 2011

• 0.10% per share annualized

• Important milestone in remediation of Bank

31

Conclusions

• The financial health of the Bank improved

dramatically in 2010

• Future Bank balance sheet will be more

heavily impacted by member use and needs

• Retained earnings growth was robust,

providing a strong foundation for future Bank

initiatives

• Returns are becoming more consistent,

although future economic conditions may

impact that consistency

Washington Update

Matt Feldman

President and CEO

33

Public Policy Issues and FHLBanks

• Capital Plan (FHLB Chicago)

• GSE Reform and FHLBanks

• FHLBank System Capital Initiative

• Housing Finance Reform

• How these debates may affect you and your

customers

34

FHLB Chicago Capital Plan

• Plan submitted to FHFA

• Substantive conversations have taken place

• FHLB Chicago is positioned to implement

subject to regulator approval

• Members will have ample time to review plan

and have opportunities to ask questions

– Information Statement

– Meetings

– Webinars

35

System Capital Initiative

• REFCORP obligation ending soon

• Restricted retained earnings program

expected to begin in subsequent quarter

• Impact on investment portfolios for

FHLBanks

• FHFA recent remarks regarding size of

FHLBank investment portfolios

36

GSE Reform and FHLBanks

• Current focus is on Fannie and Freddie

• Debate centers on timing and method of

resolution of held portfolios

• Bills have been introduced that address

Fannie and Freddie, but so far have been

silent on FHLBanks

• Passage of bills not likely until after 2012

election

37

Focus on Fannie and Freddie

• In the meantime, Fannie and Freddie

continue to play huge role in providing

liquidity to conventional, conforming, fixed-

rate mortgages

• Fannie and Freddie also support affordable

housing

38

Filling Fannie and Freddie’s Shoes

• Issues around filling/replacing those roles

– Government support of secondary mortgage

market

– Indirect support of affordable housing

– “Skin in the game” and risk retention

– Covered bonds

– Rethinking homeownership

30-year prepayable mortgages

Mortgage interest deduction

39

GSE Reform and FHLBanks

• Obama Administration issued White Paper in

February explicitly addressing FHLBanks

• Acknowledged FHLBanks’ “vital role” in

providing stable source of liquidity to

institutions of all sizes

• Recommended limiting membership to one

FHLBank

• Recommended limiting advances

• Supported FHFA efforts to reduce

investment portfolios

40

Limiting Membership to One FHLBank

• Intent: focus FHLBanks on community

financial institutions

• Aligns FHLBank priorities with those of

community financial institutions

• Opportunity to create covered bond market

for use by “too big to fail” originators

• Reality: concentrates risk in one FHLBank

41

Limiting Levels of Advances

• Intent: recognizes that large members can

access capital markets in other ways

• Intent: protect system from large members

triggering joint and several liability

• Reality: small/medium members would also

be impacted

• Reality: all members benefit from the scale

provided by the largest financial institutions

that are members

42

Why Continue Multiple Memberships?

• FHLBanks provide contingent liquidity during

times of stress when other sources might be

unavailable

• Larger scale of system borrowing enhances

market and pricing for funding

• Large members provide capital support for

current members

• Reduction in capital and assets could lead to

consolidation of FHLBanks

43

Possible Outcome

• Large institutions are likely to remain as

FHLBank members

– Support their access to funding during

times of economic unrest

– Supports operations of 12 FHLBanks with

ownership residing within each District

44

Other Issues Involving FHLBanks

• Should FHLBanks be explicitly guaranteed

by the government?

• Considerations:

– Replace the implied guarantee with an

explicit guarantee

– Public policy issues include commitment to

community banking in the United States

45

Other Issues Involving FHLBanks

• Is government involvement in secondary

mortgage market necessary?

• Considerations:

– Support of securitizations of mortgages

– Risk to taxpayers

– Public policy issues including affordable

housing and conventional, conforming

mortgages

46

Other Issues Involving FHLBanks

• Is government support for affordable housing

necessary?

• Support could be direct or indirect

• Considerations:

– Viability of programs

– Affordable housing goals may have

contributed to the housing crisis

– Need for affordable housing: will private

sector fill the void?

47

Importance for FHLB Chicago…and You

• Secondary mortgage market will change, but

will survive

• Your approach to mortgage origination may

change

• MPF® Program may have to change in

response to changes

48

Importance for FHLB Chicago…and Uou

• FHLB Chicago investment portfolio will

decrease as business model is implemented

• “Income bridge” from investment portfolio

intact, but not permanent

• FHLB Chicago has a diversified mix of

members

49

FHLBC Participation in Debates

• Government Relations Outreach

• Submission of comment letters

• Bank Presidents Conference Public Policy

Committee

• Council of Federal Home Loan Banks

• Work closely with trade associations at both

state and national levels

50

And so in conclusion, maybe…

• Many proposals, much rhetoric:

– Most represent light without heat!

• A few things are likely:

There will be mortgage aggregators and

guarantors with some form of explicit federal

support to provide certainty and continuity to the

fixed-rate mortgage market

FHLBanks will continue to provide liquidity and

term financing to community financial institutions

All of this will take several years to play out, and:

51

And so in conclusion, maybe…

In the end, nobody will be totally

satisfied with the solutions!

Member Update

Chad Brandt

Executive Vice President

Banking and Advances Product Group

53

Member Update

• Membership Trends: What FHLB Chicago

Members are Saying

• Joint Responsibilities in a Cooperative

• Changing the Way We Do Business

• Partnering with Members

54

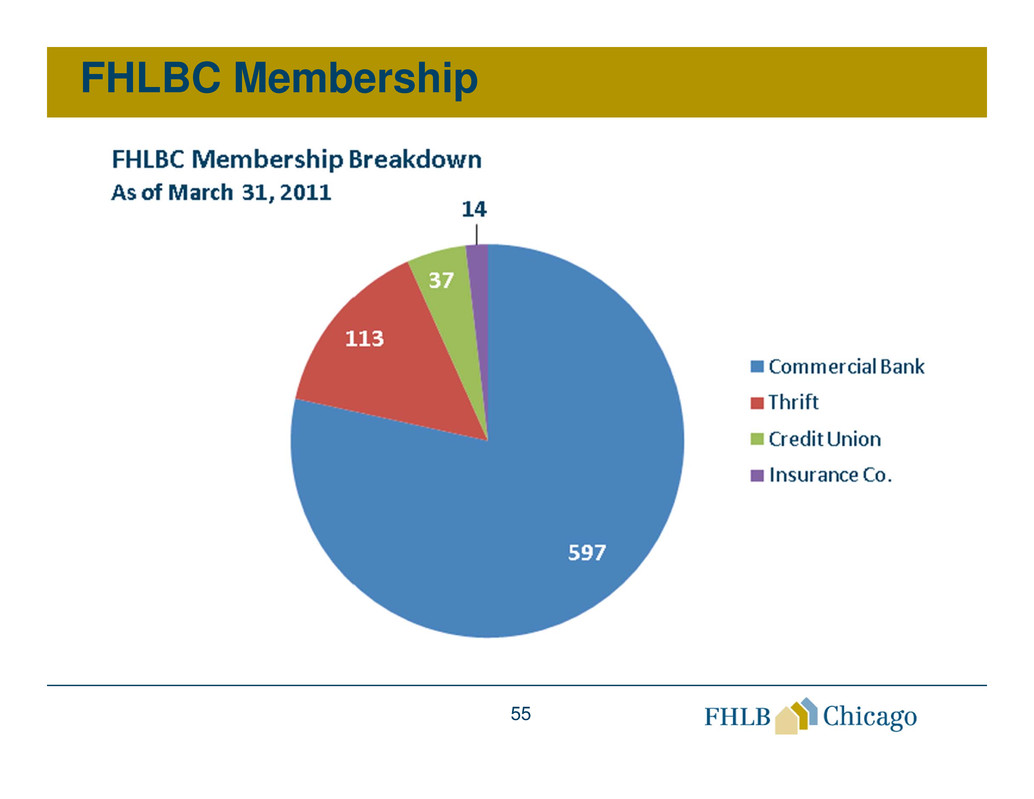

Quick Update on Membership

• Reaching out to prospective members in all

sectors

• As members have been resolved or merged

out of district, we have added 35 new

members since 2007

• We expect to add our first CDFI in June

• Resumption of dividend and capital plan

approval will make it easier for some

prospects to become members

55

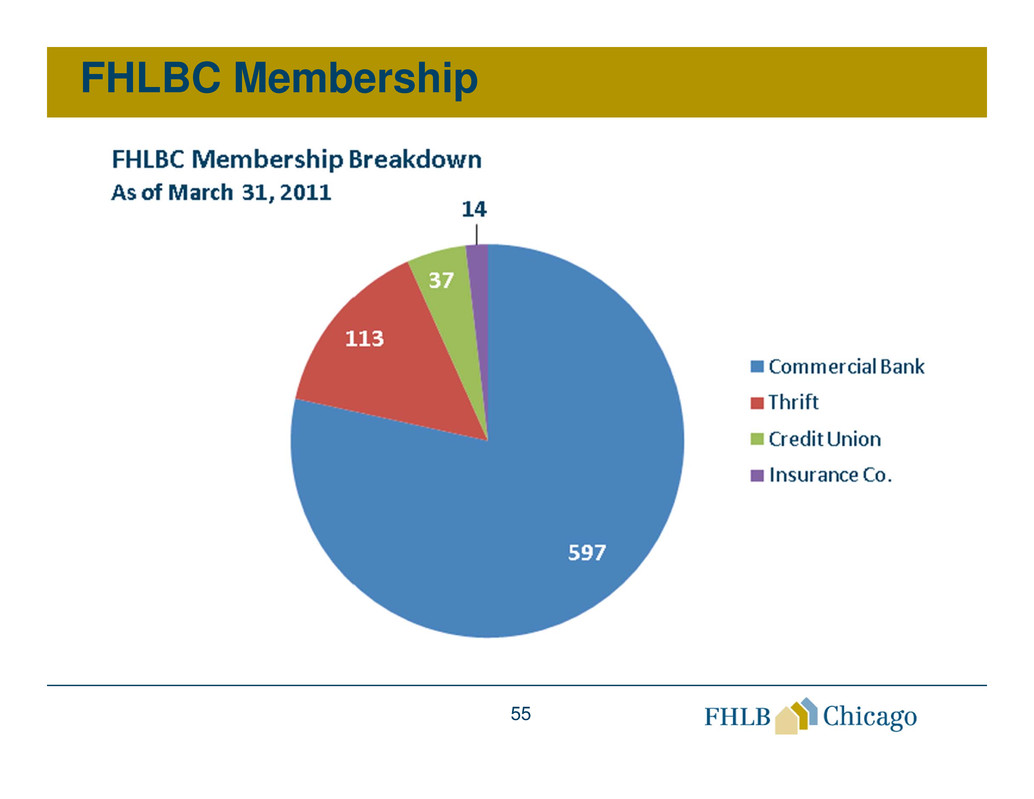

FHLBC Membership

56

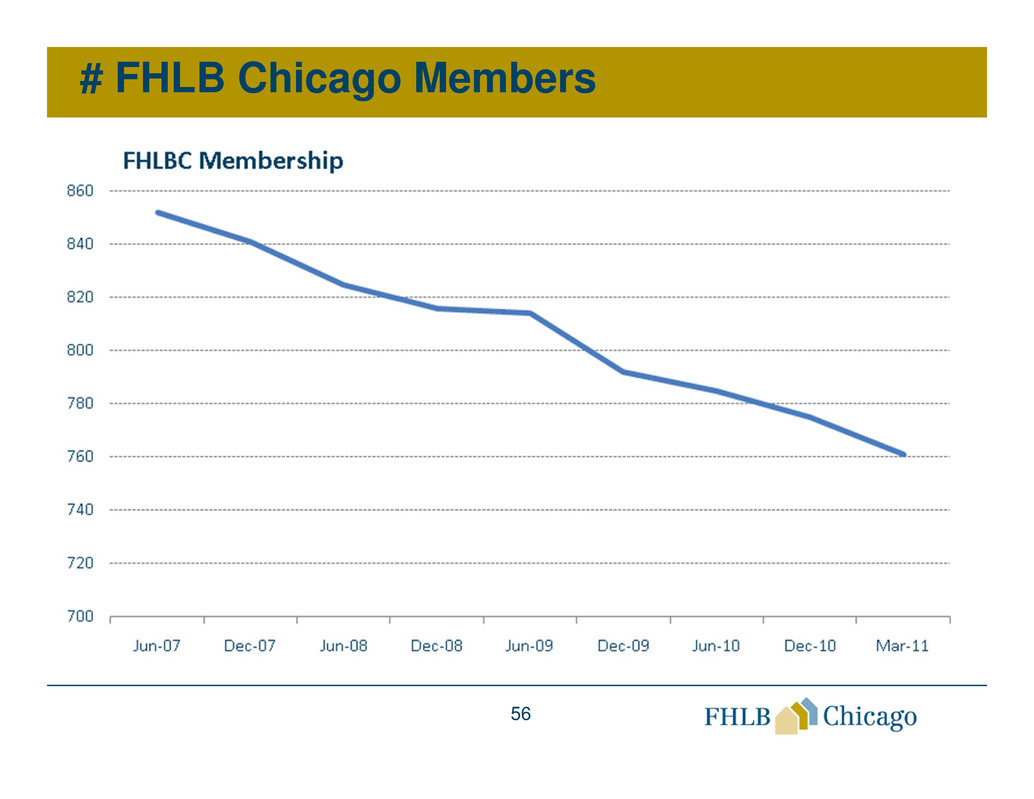

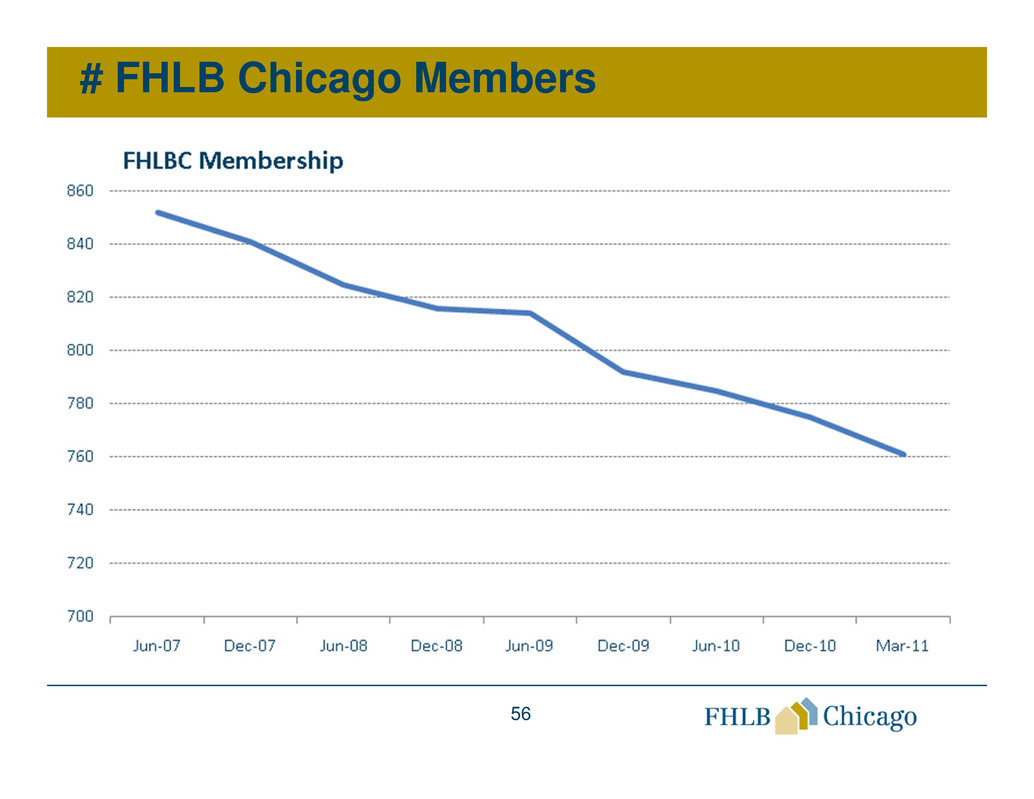

# FHLB Chicago Members

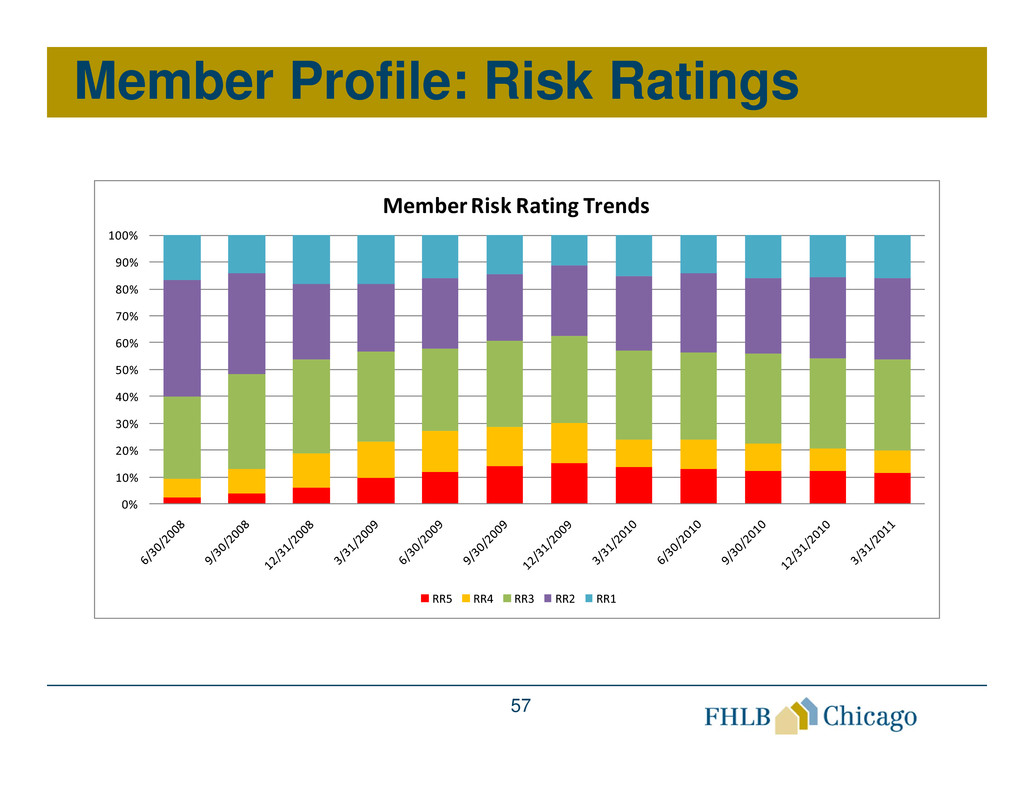

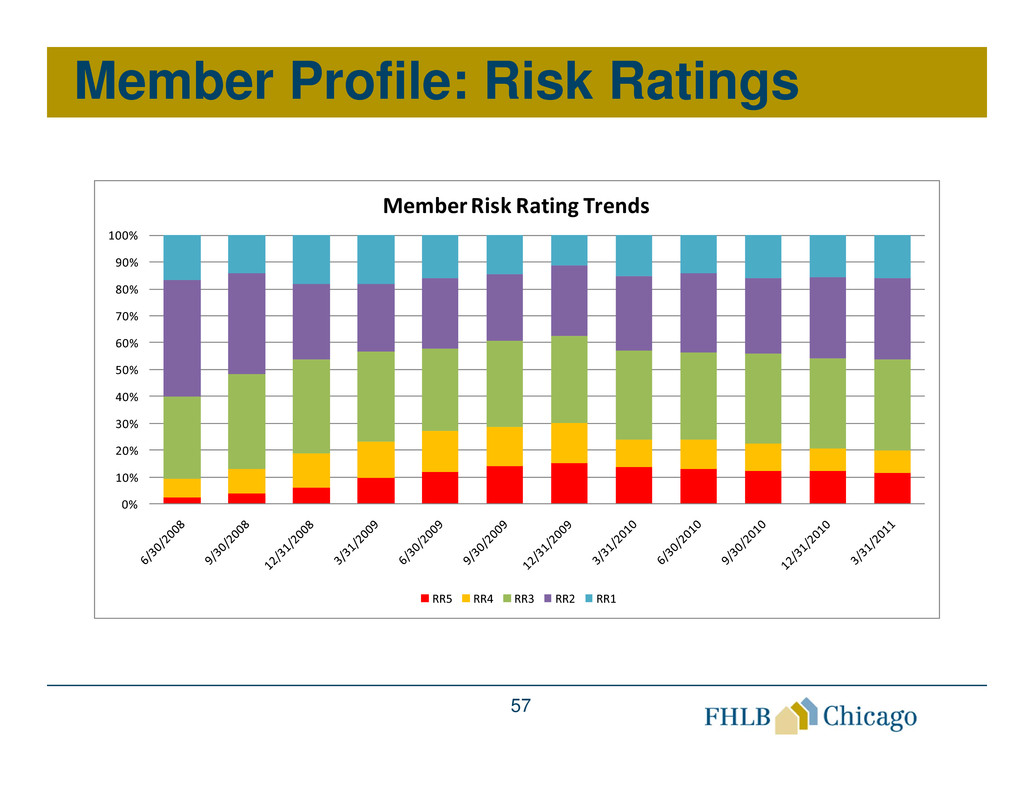

Member Profile: Risk Ratings

57

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Member Risk Rating Trends

RR5 RR4 RR3 RR2 RR1

58

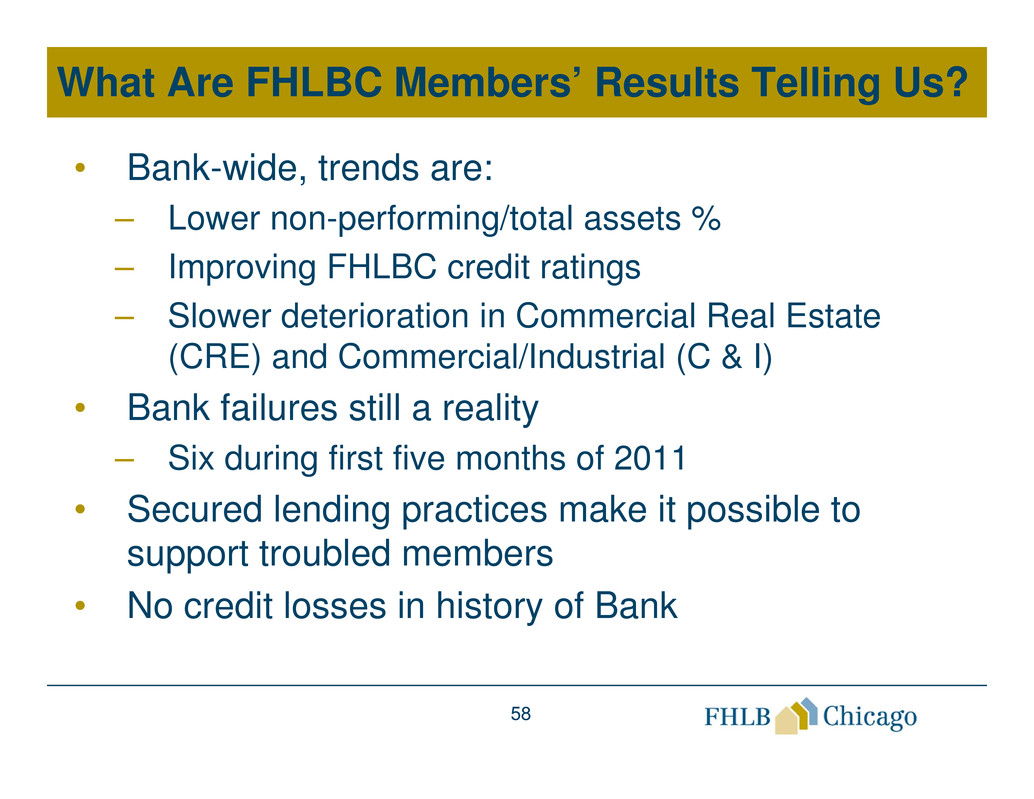

What Are FHLBC Members’ Results Telling Us?

• Bank-wide, trends are:

– Lower non-performing/total assets %

– Improving FHLBC credit ratings

– Slower deterioration in Commercial Real Estate

(CRE) and Commercial/Industrial (C & I)

• Bank failures still a reality

– Six during first five months of 2011

• Secured lending practices make it possible to

support troubled members

• No credit losses in history of Bank

59

What Are FHLBC Members Telling Us?

• Most members that are borrowing are funding

short-term, but

• We are also starting to see some terming out

• Advance structures and terms are flexible and can

match your view of the market and your funding

strategy

60

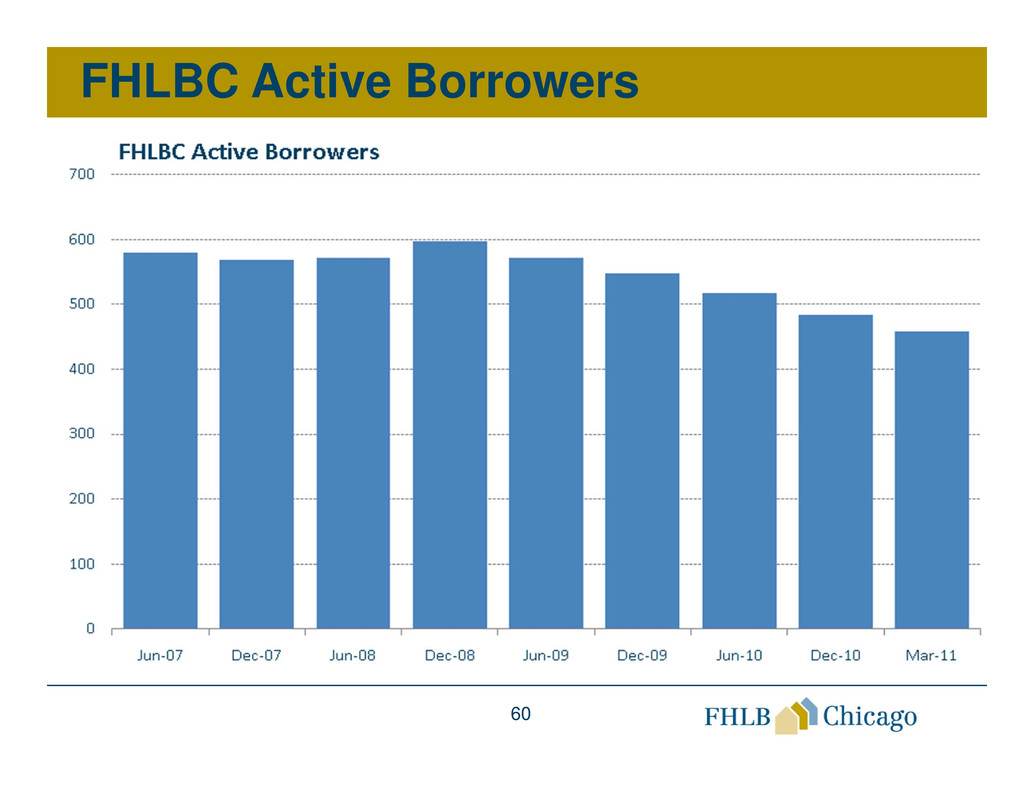

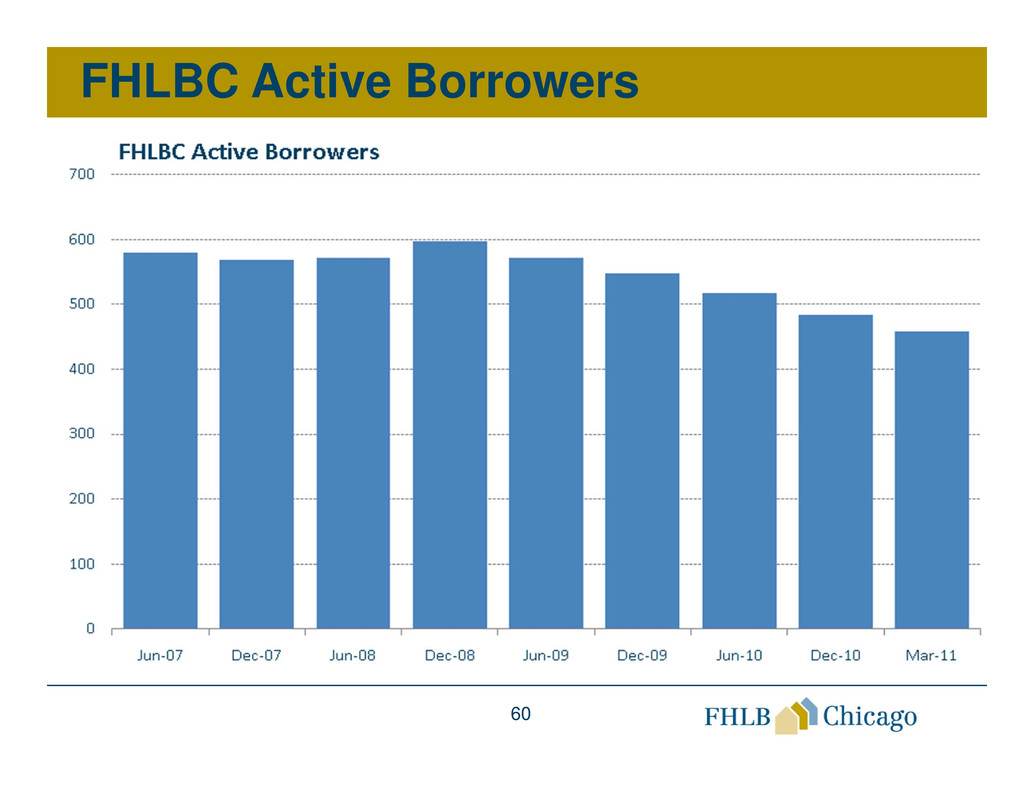

FHLBC Active Borrowers

61

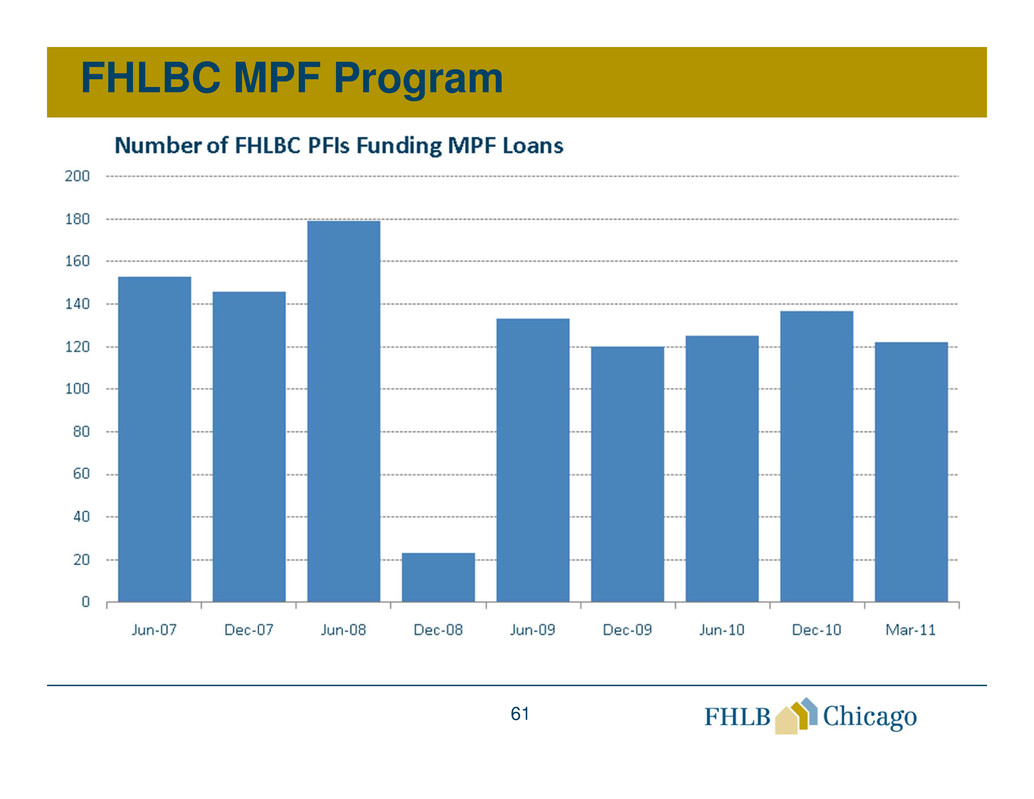

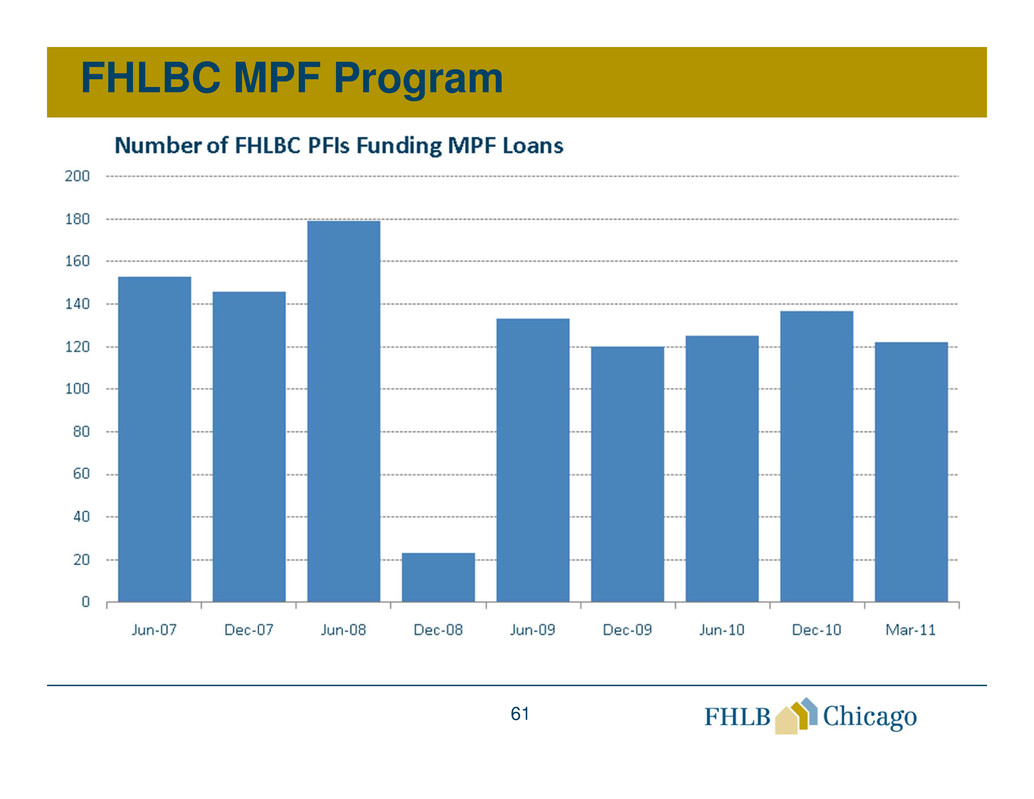

FHLBC MPF Program

62

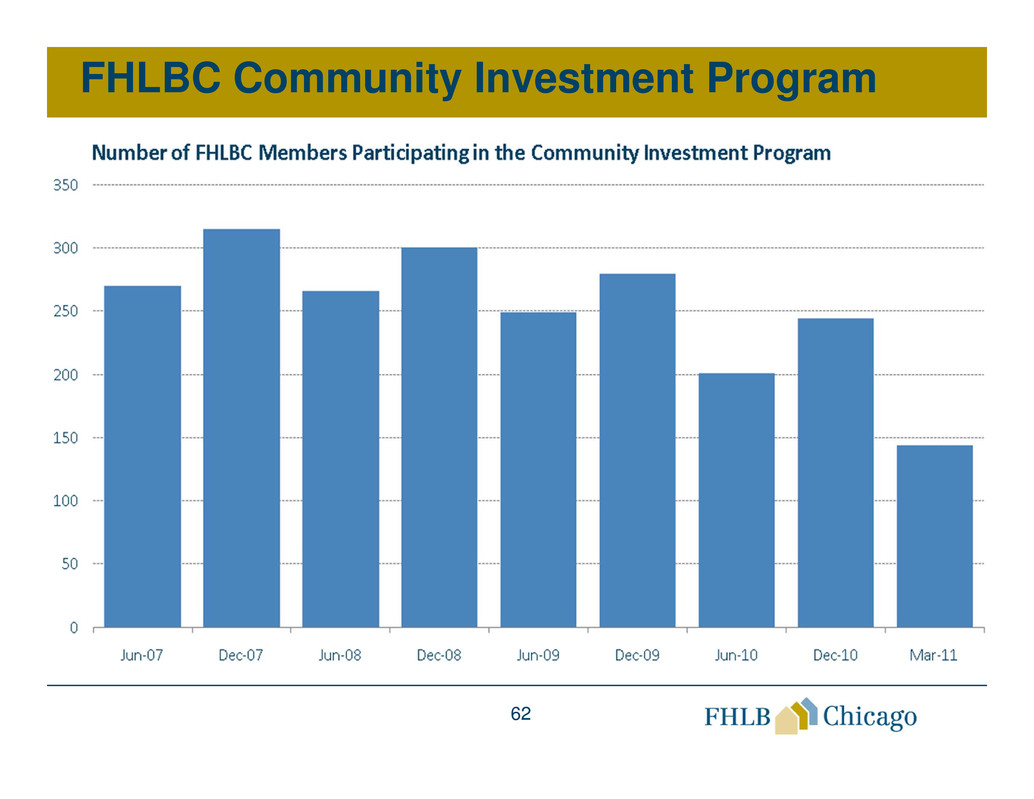

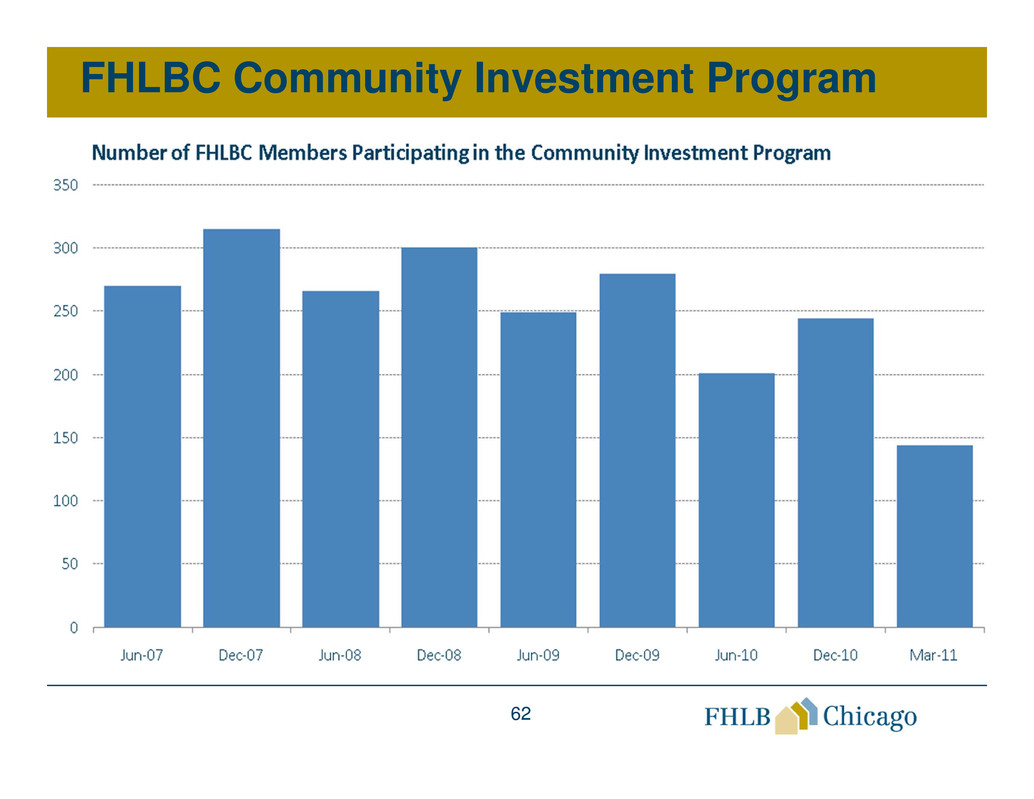

FHLBC Community Investment Program

63

Survey of Member Opinions

• Survey attached to meeting invitation

• A cross-section of members (size)

participated

• Interesting, if not statistically significant

• Insight into opportunities to partner with

FHLB Chicago

64

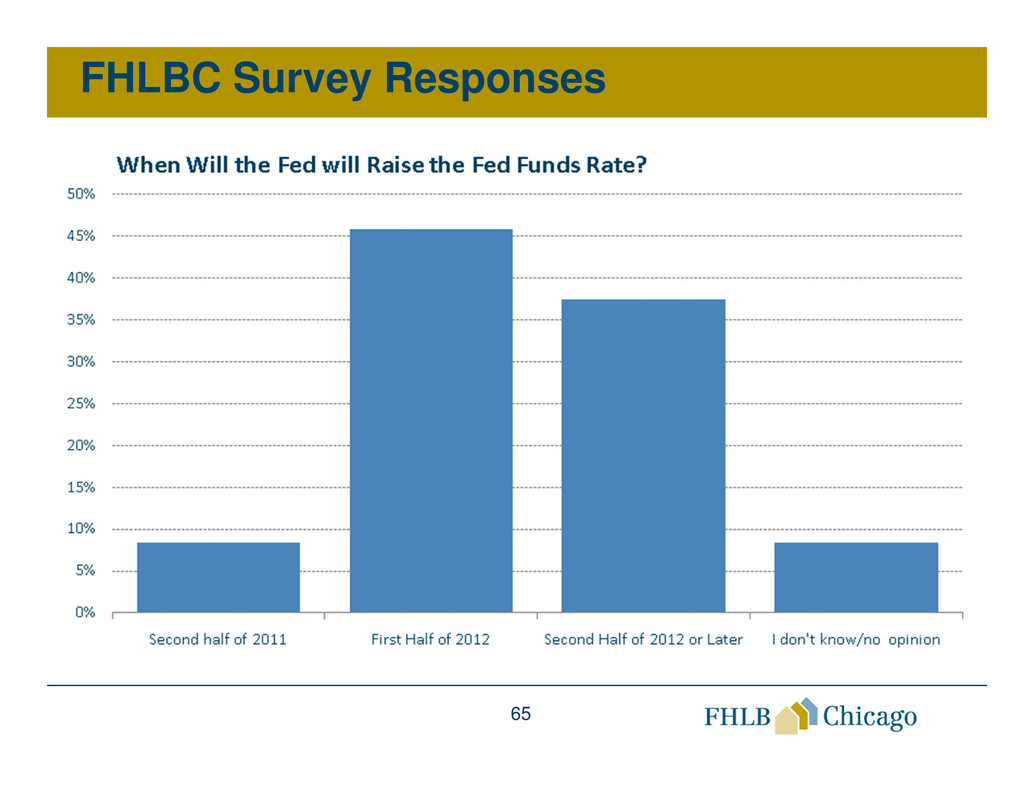

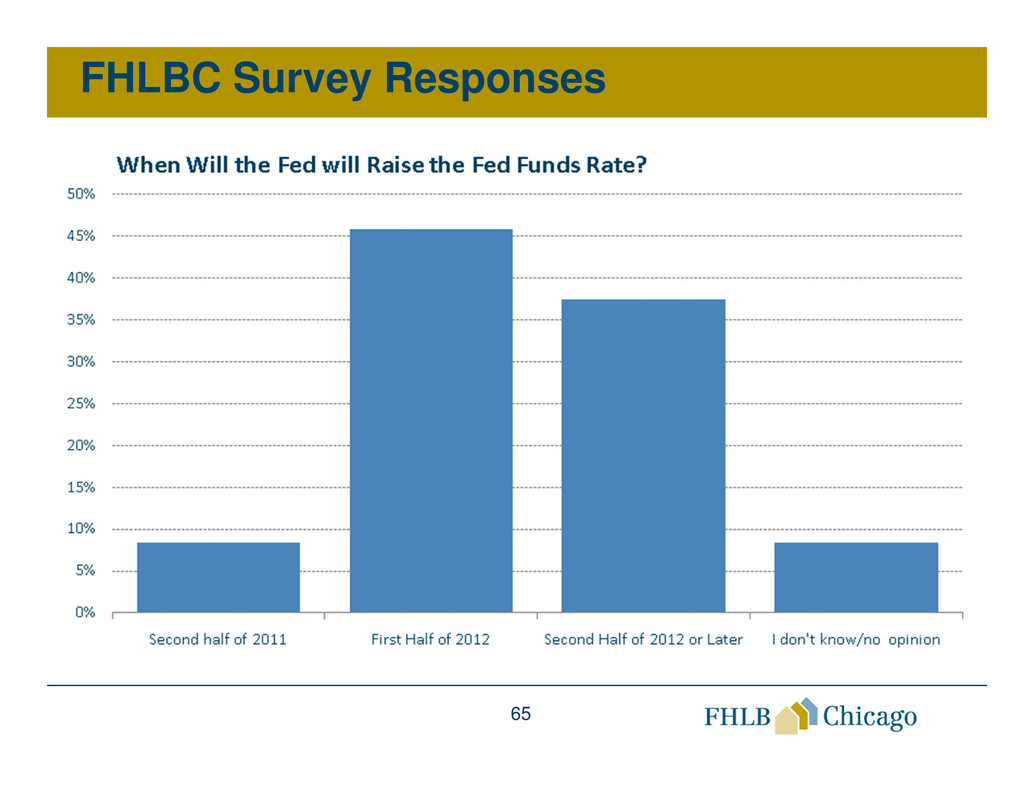

When will Fed raise rates?

• 82% said 2012

• 32% said second half of 2012

• So, how do you prepare for the rate

increase?

• Options:

– Stay short, if you’re borrowing at all

– Take some chips and term out to take

advantage of low rates

65

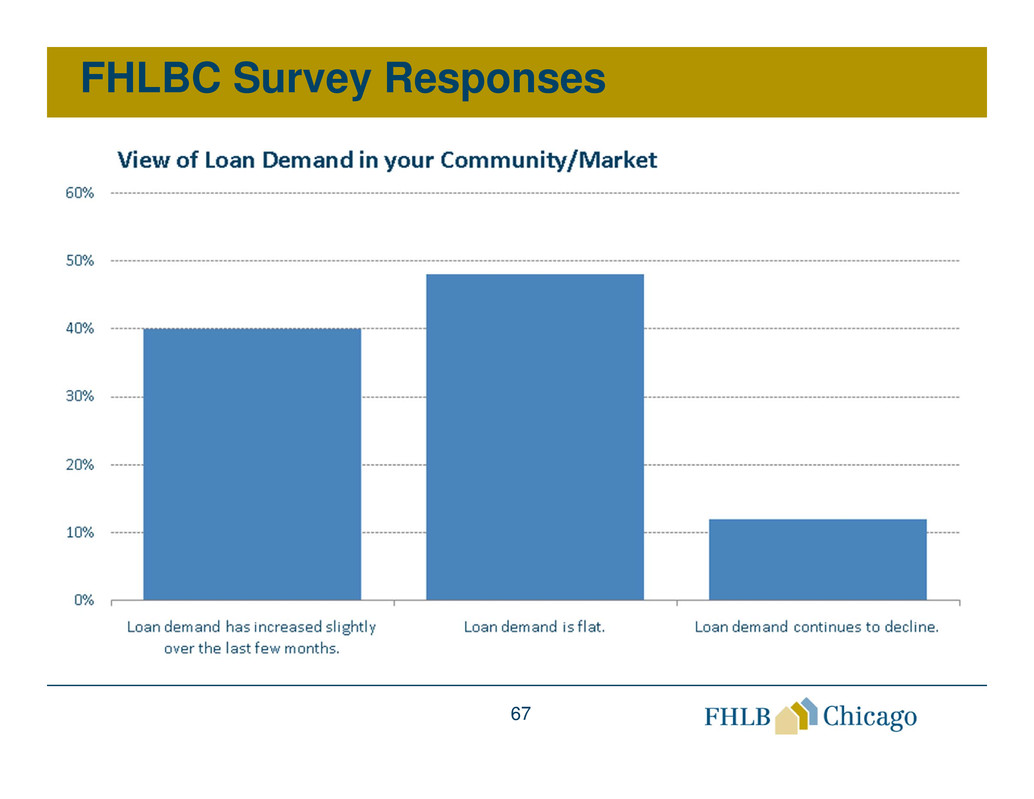

FHLBC Survey Responses

66

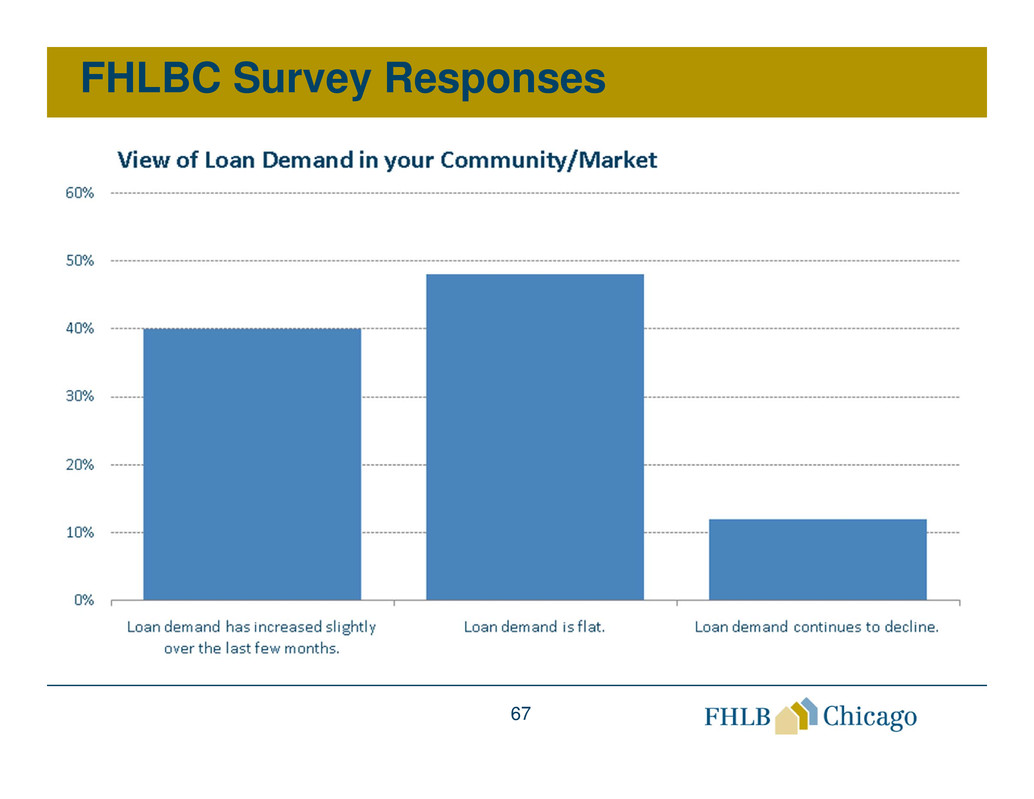

View of Loan Demand

• Nearly half said loan demand is flat

• Minority (13%) said demand continues to fall

• Do you think demand is picking up?

– Those who said yes, cited CRE more than

residential mortgages or C & I

67

FHLBC Survey Responses

68

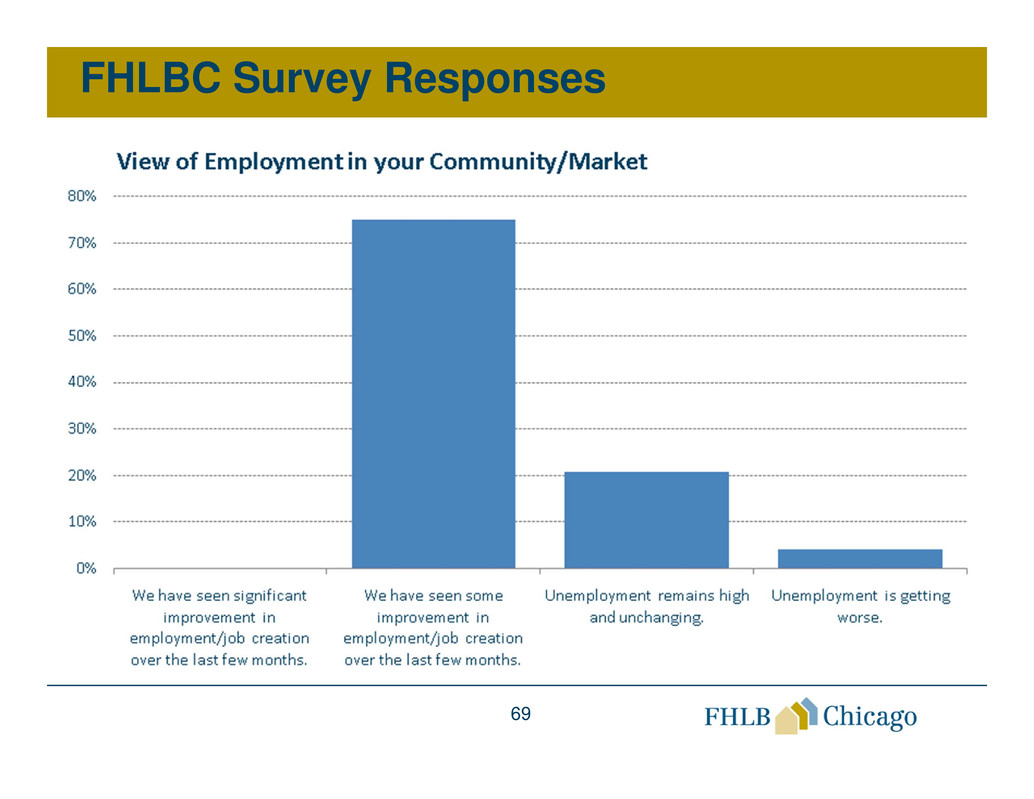

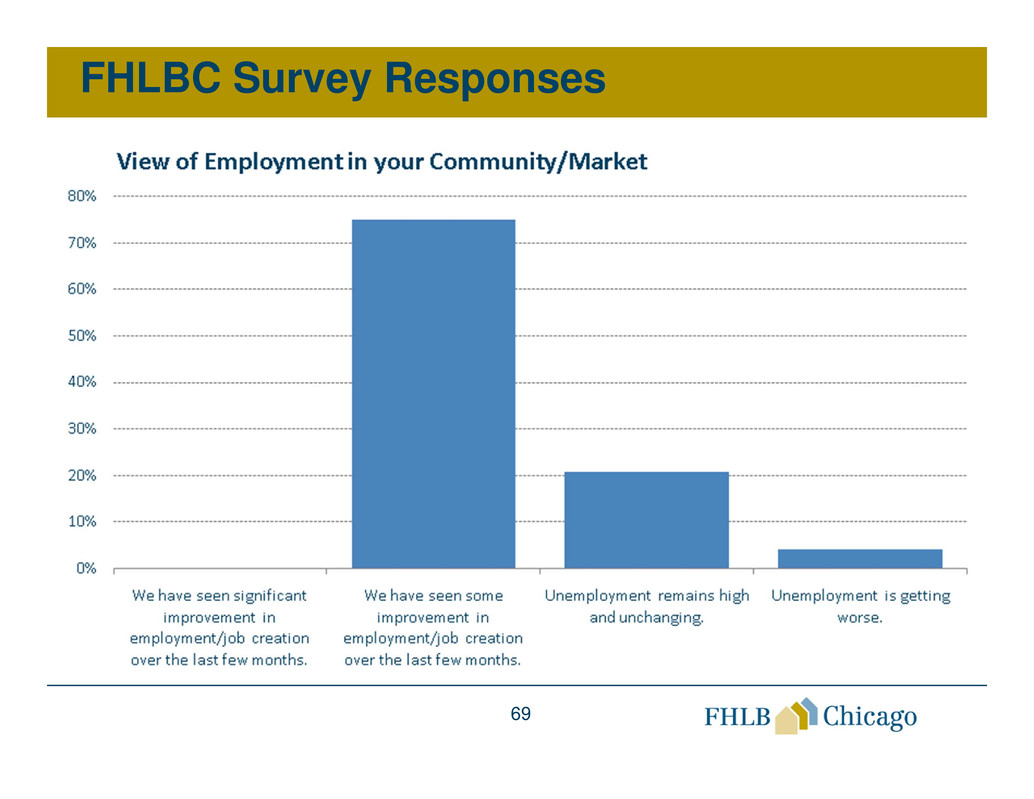

View of Employment

• Nearly three-quarters cited “some

improvement”

• Zero said “significant improvement”

• We know employment is linked to loan

demand

69

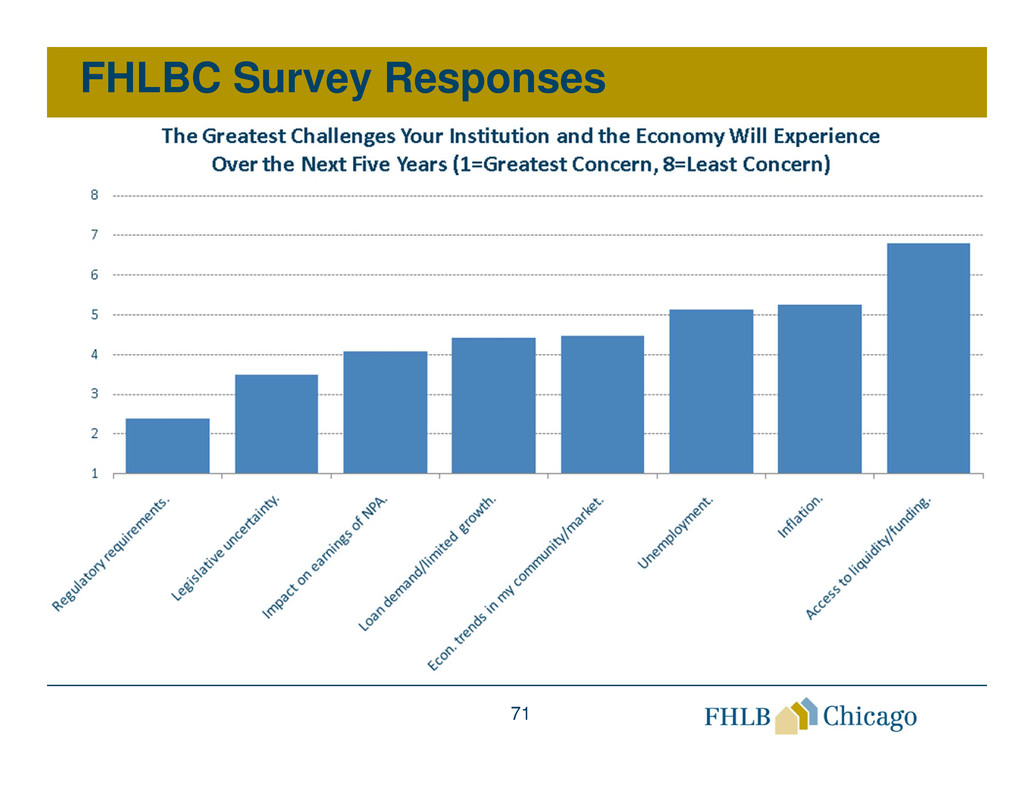

FHLBC Survey Responses

70

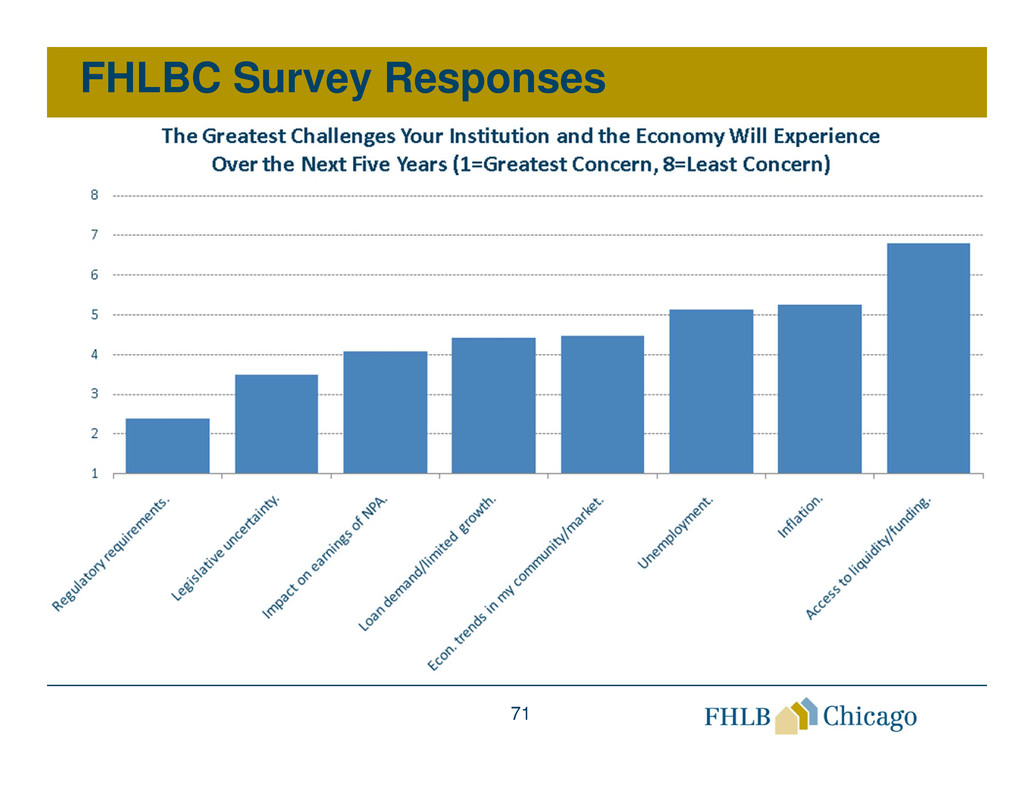

Challenges to Institution and Economy

• Eight choices to be ranked

• Impact on earnings of non-performing assets

• Insufficient loan demand/limited opportunities

for growth

• Regulatory requirements

• Access to liquidity/funding

• Legislative

71

FHLBC Survey Responses

72

What Does FHLBC Do in the Meantime?

• New tagline reflects strategic and tactical

plans:

– Member owned. Member focused.

• How?

– Emphasis on cooperative structure

– Emphasis on member needs

73

How can we partner in this uncertain time?

• Advances

– Member use makes the cooperative work

– FHLBC has lowered pricing

Competitive with repo transactions

When rates rise, more competitive with

brokered CDs

– Term out some of your portfolio now

– Community Investment Cash Advances for

eligible projects

74

How can we partner in this uncertain time?

• Letters of Credit

– Standby LOCs

For Performance Guarantees

To Secure Public Unit Deposits

Credit Enhancement for Bond Financing

• Direct Pay LOCs

75

How can we partner in this uncertain time?

• Using Advances for balance sheet

management

– Developing funding strategies to match your

institution’s goals and philosophy

– Managing interest rate risk

76

How can we partner in this uncertain time?

• MPF Xtra

– Members can continue to offer important core

mortgage products while maintaining

customer relationships

– Retain valuable servicing fee income

– Exceptional customer service for members of

all sizes

• MPF risk-sharing product available through

FHLB Boston

77

How can we partner in this uncertain time?

• Affordable Housing Program

– Application now available (Due August 1)

– $23 million available in 2011

– Excellent way to build partnerships with

community organizations

– Webinars/training in June

– More information on website

78

How can we partner in this uncertain time?

• Downpayment Plus® and Downpayment

Plus Advantage®

– More than $10 million still available

– Down payment assistance to eligible

buyers

– Not just for first-time buyers

79

Striving to be better business partners

• Lower advance pricing

• Expanded collateral eligibility and

streamlined collateral reporting available

through updated Advances Agreement

– More than 200 members have executed new

agreement

– Agreement brings us more in line with best

practices in the FHLBank System

80

Striving to be better business partners

• Improved financial results

• Resumption of dividend

• Awaiting approval for capital plan, but in the

meantime…

• GOLF!!! We’ll be “back in the swing”

– August 4, 2011 Weaver Ridge, Peoria

– August 11, 2011 Grand Geneva, Lake Geneva

– August 18, 2011 The Bull, Sheboygan

• Watch your mail and email for details

U.S. Economic Conditions:

Impact on Members and FHLBC

Solutions

Patrick A. Quinn

Senior Vice President

Banking and Advances Product Group

82

Outline

• Update On Economic Conditions

• The Economy’s Mild Recovery

• The Federal Reserve and QE2

• Impact On FHLBC Members

• Member Solutions

• Summary

83

Update On Economic Conditions

• The U.S. economy is experiencing the weakest

post-recessionary recovery in modern times.

• Many economic forecasts at the start of 2011 were

looking for much stronger growth.

• However, recent economic data suggests that

momentum is slowing and strong headwinds

prevail.

• Is this a temporary blip?

• Not according to the bond market.

84

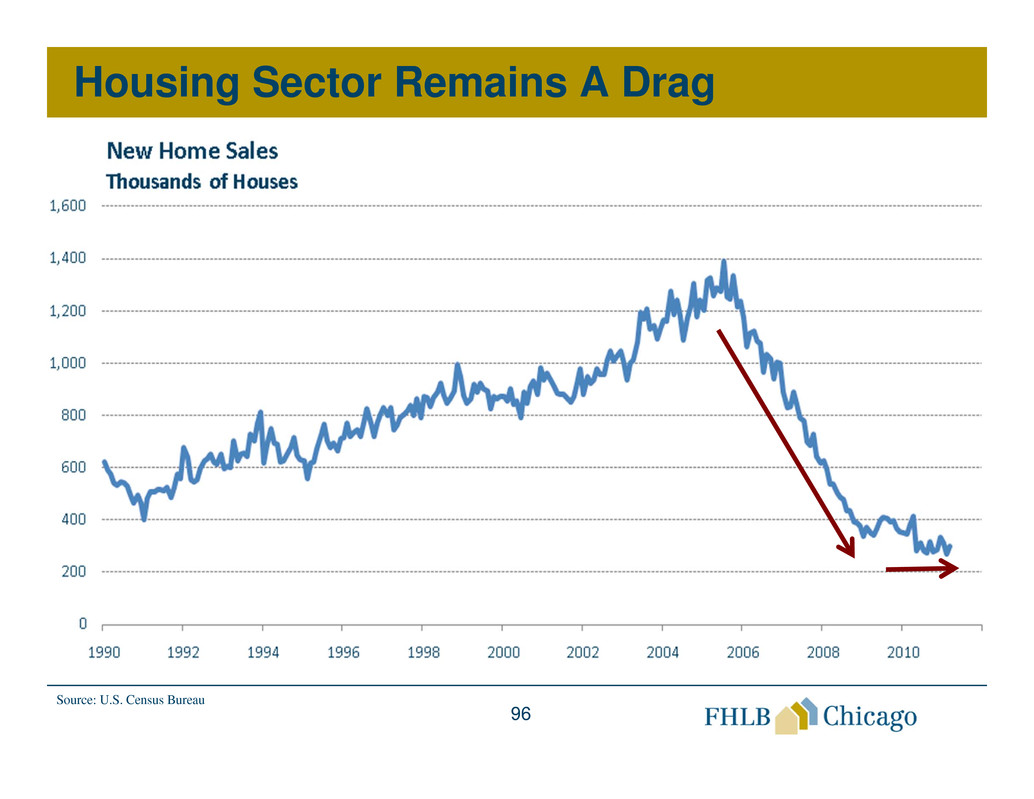

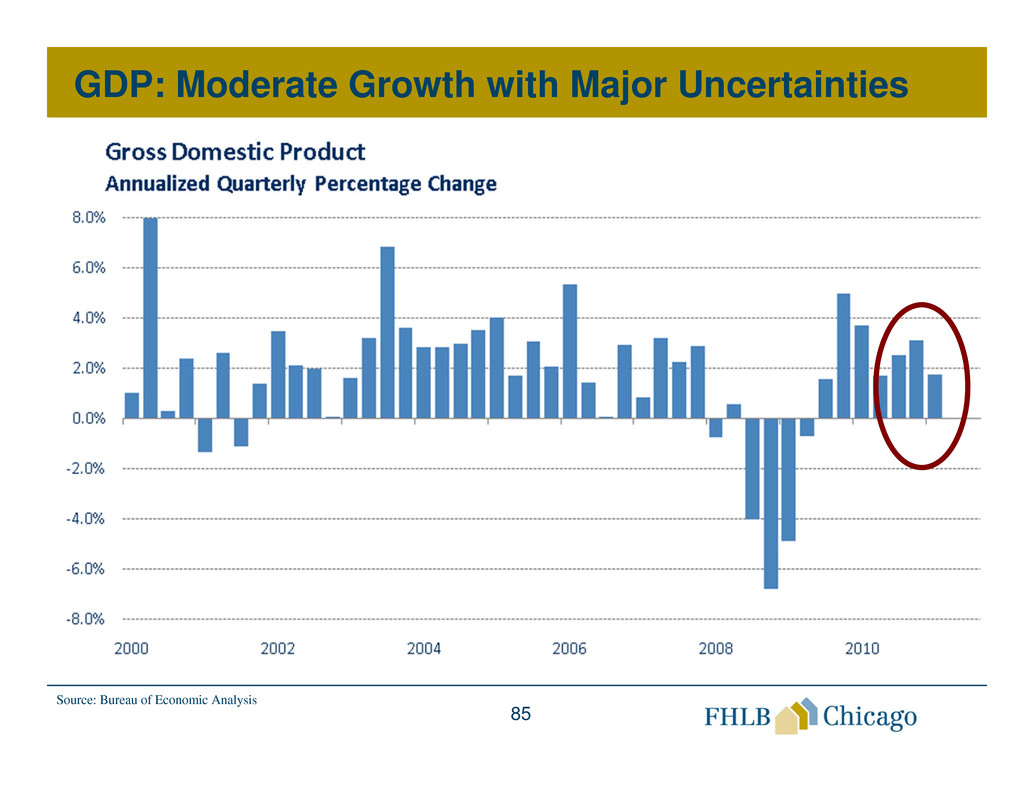

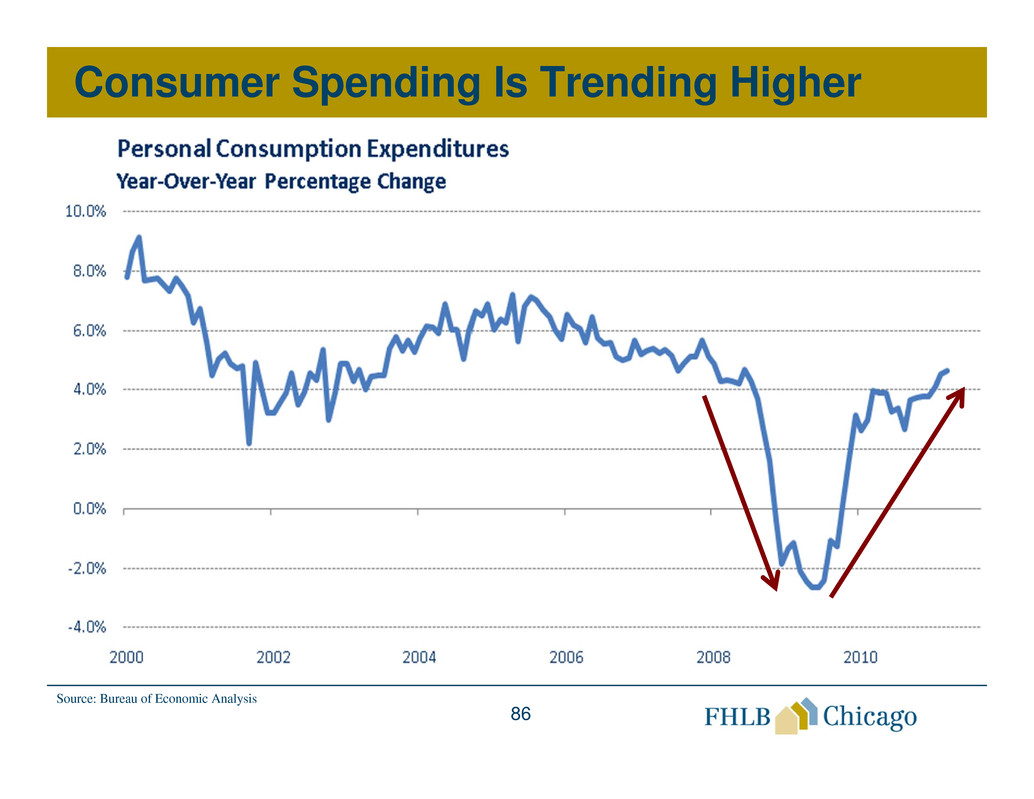

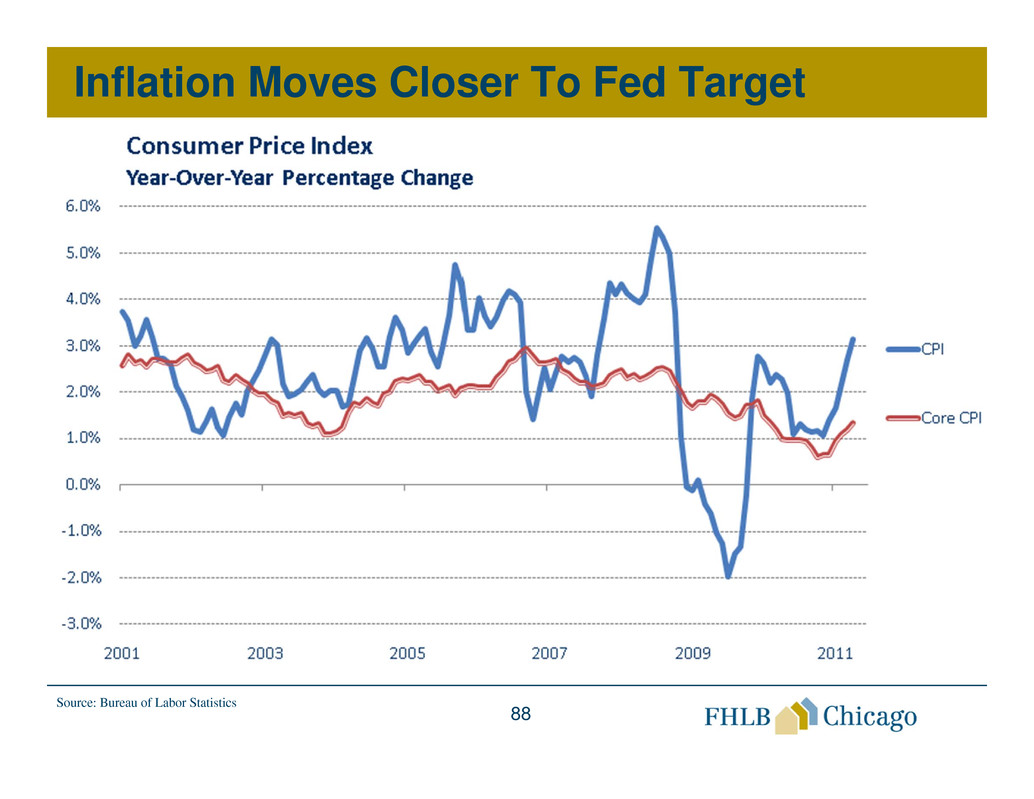

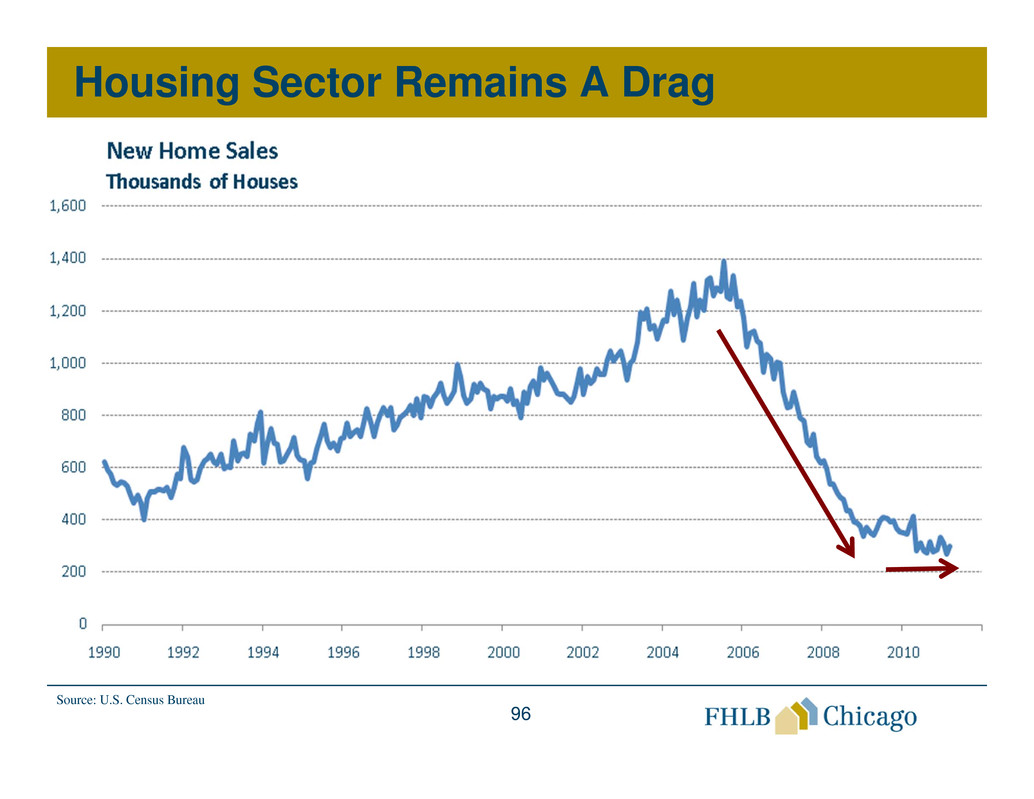

Update On Economic Conditions

• Since the “end” of the recession (June 2009):

– GDP has risen 2.8%;

– Consumer spending has increased by $745B (7.5%);

– Core inflation has increased 1.75%;

– Non-farm payrolls have increased 489k;

– New home sales have decreased 18.4%; and

– Household debt has fallen $734B (6.0%)

85

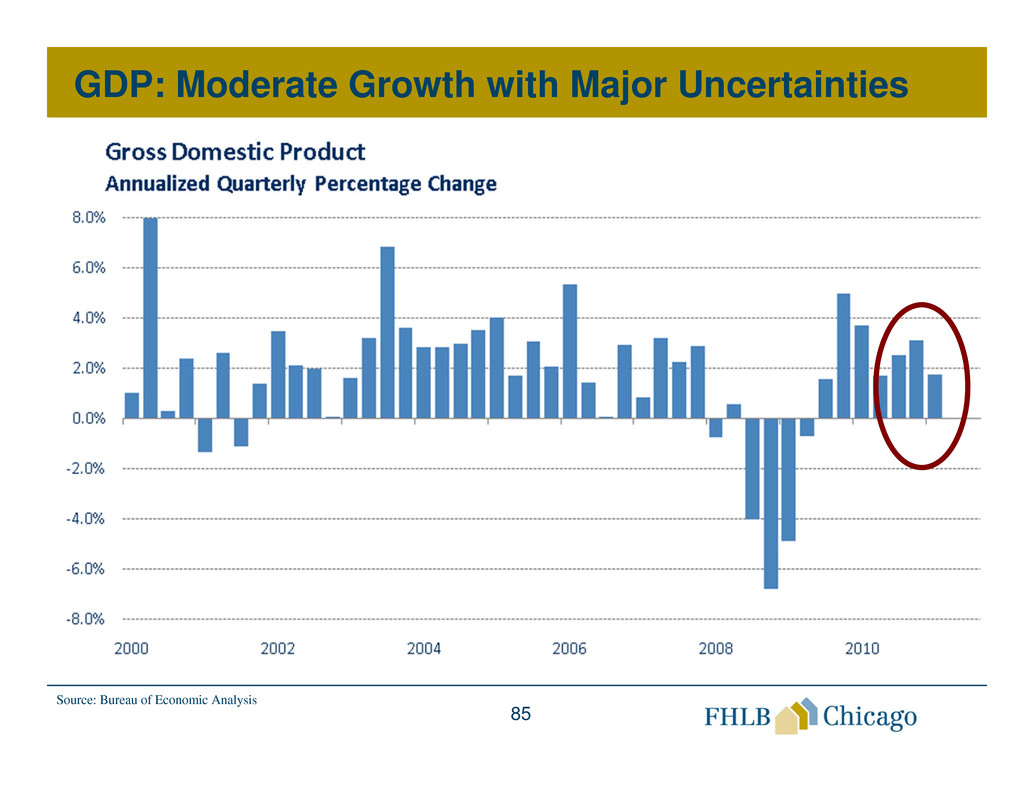

GDP: Moderate Growth with Major Uncertainties

Source: Bureau of Economic Analysis

86

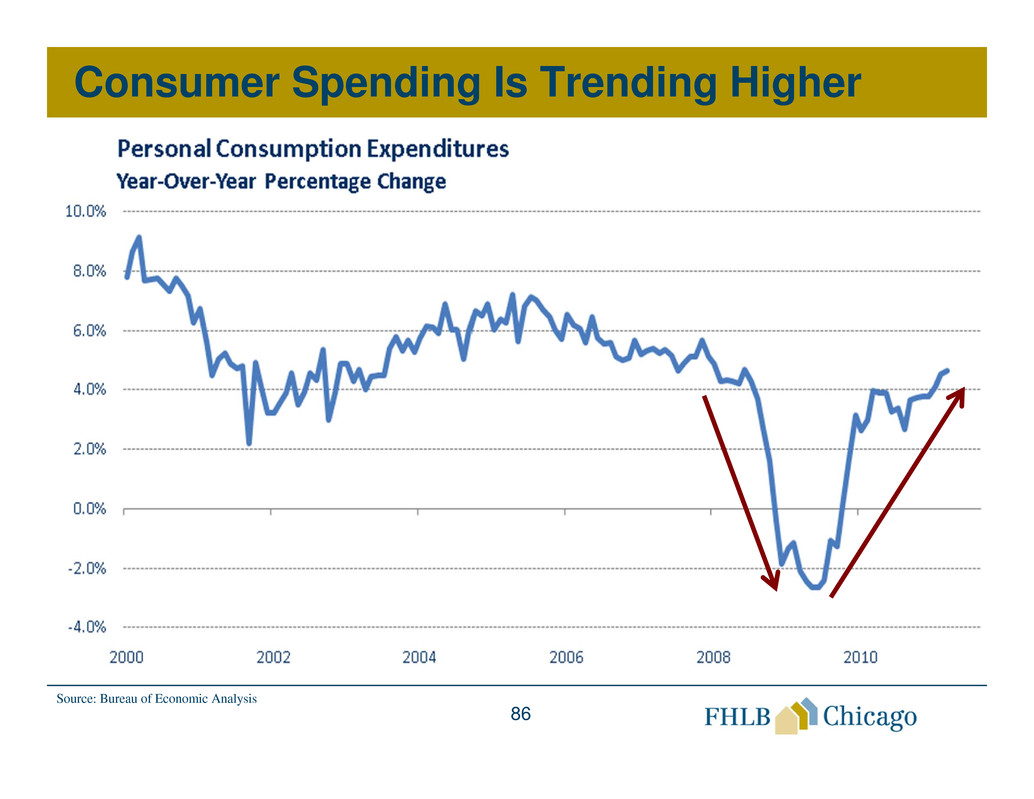

Consumer Spending Is Trending Higher

Source: Bureau of Economic Analysis

87

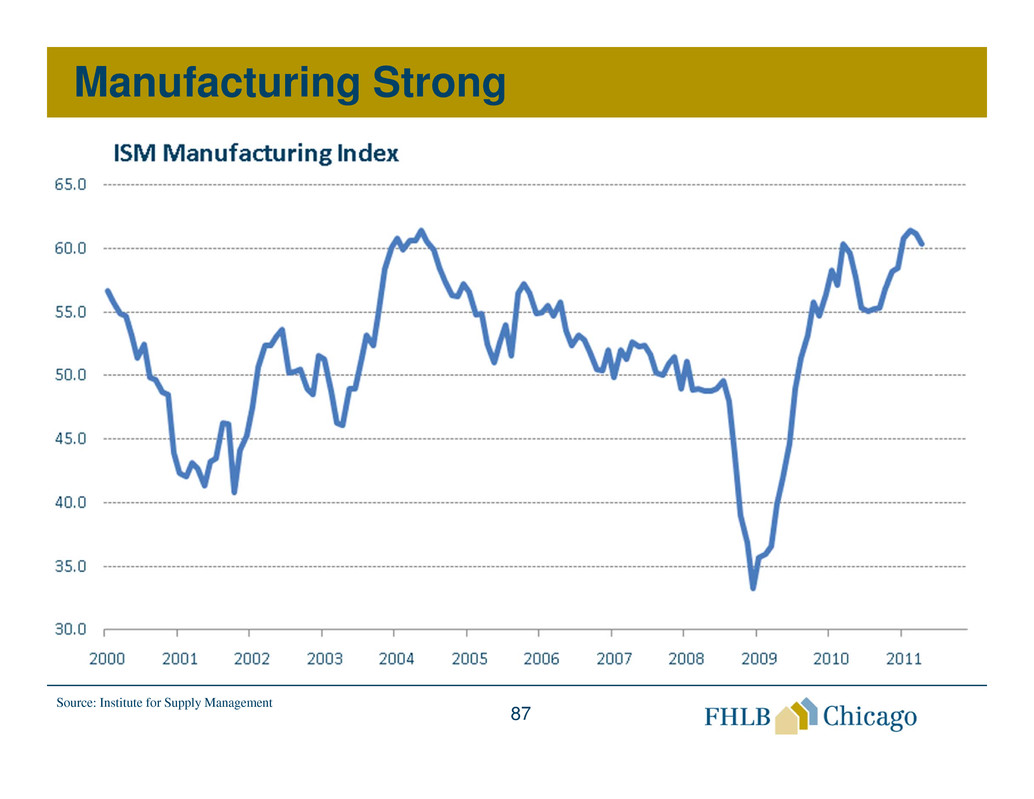

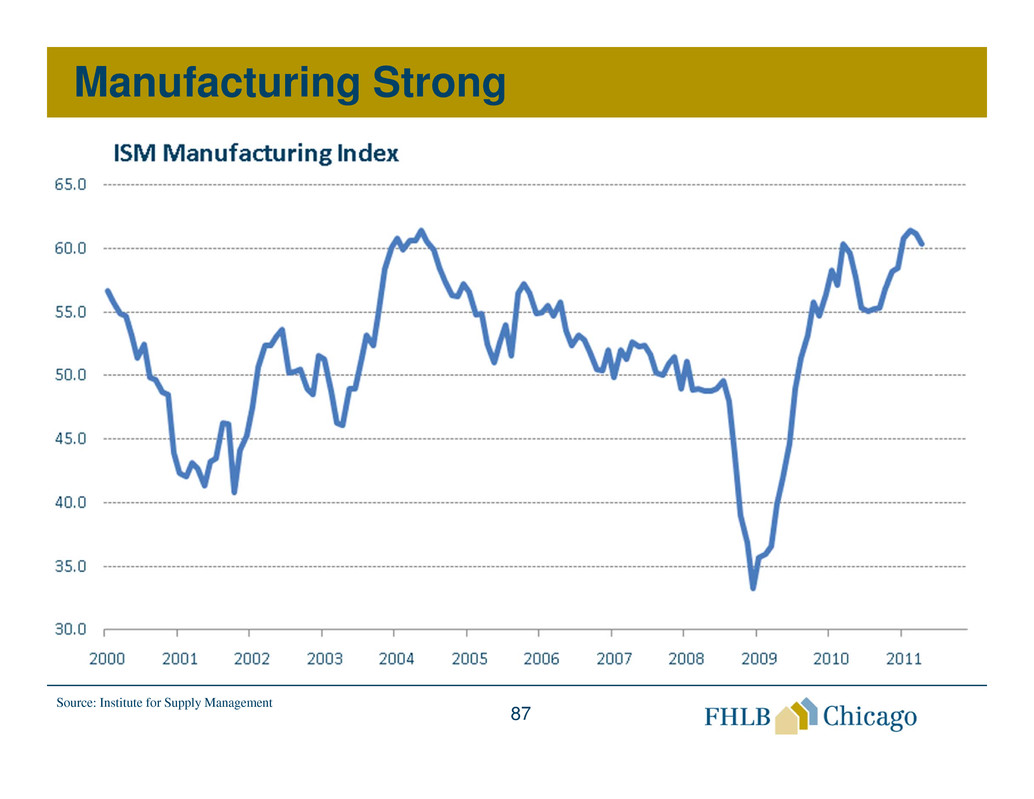

Manufacturing Strong

Source: Institute for Supply Management

88

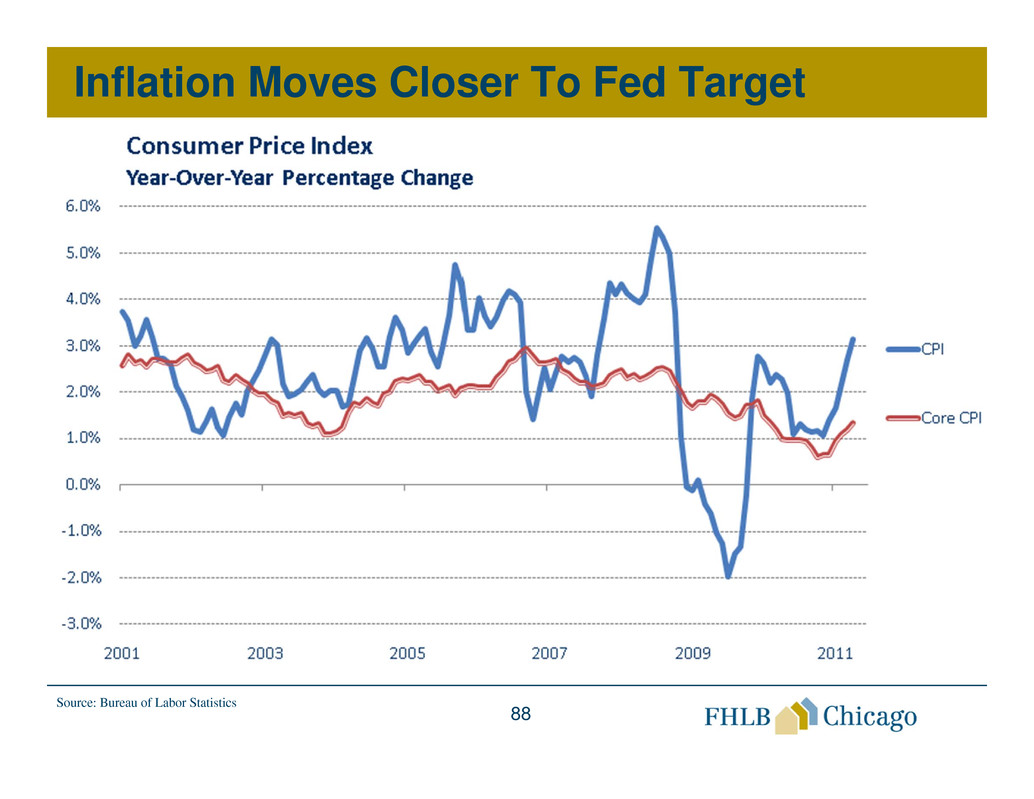

Inflation Moves Closer To Fed Target

Source: Bureau of Labor Statistics

89

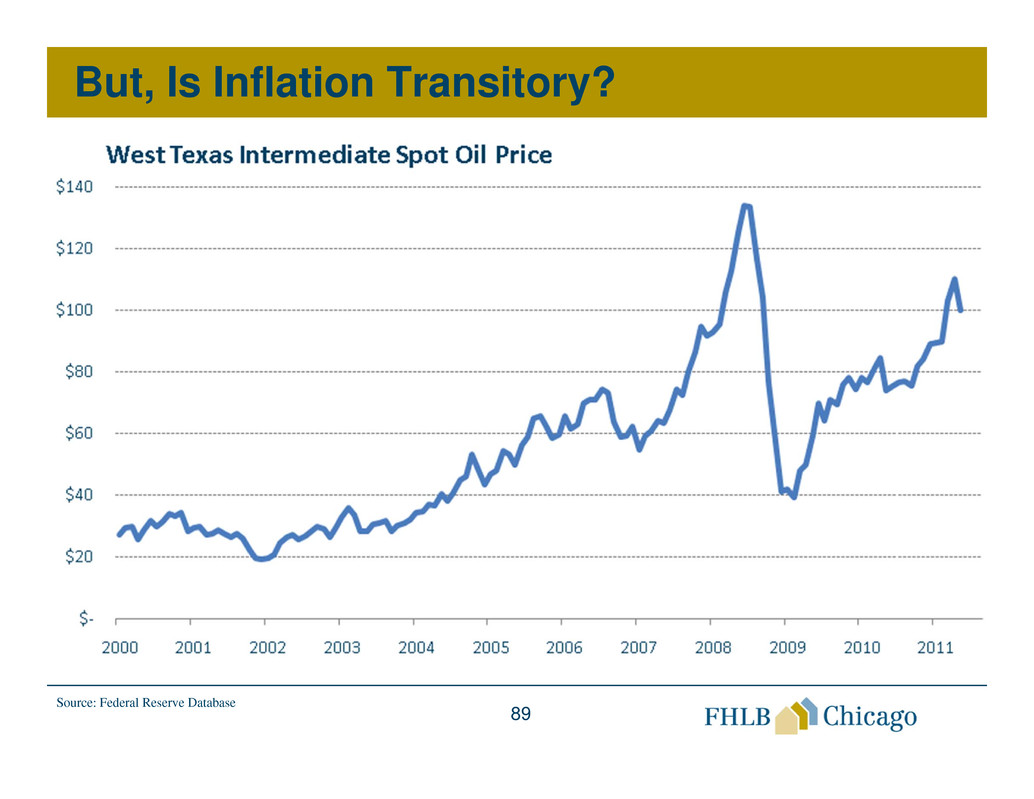

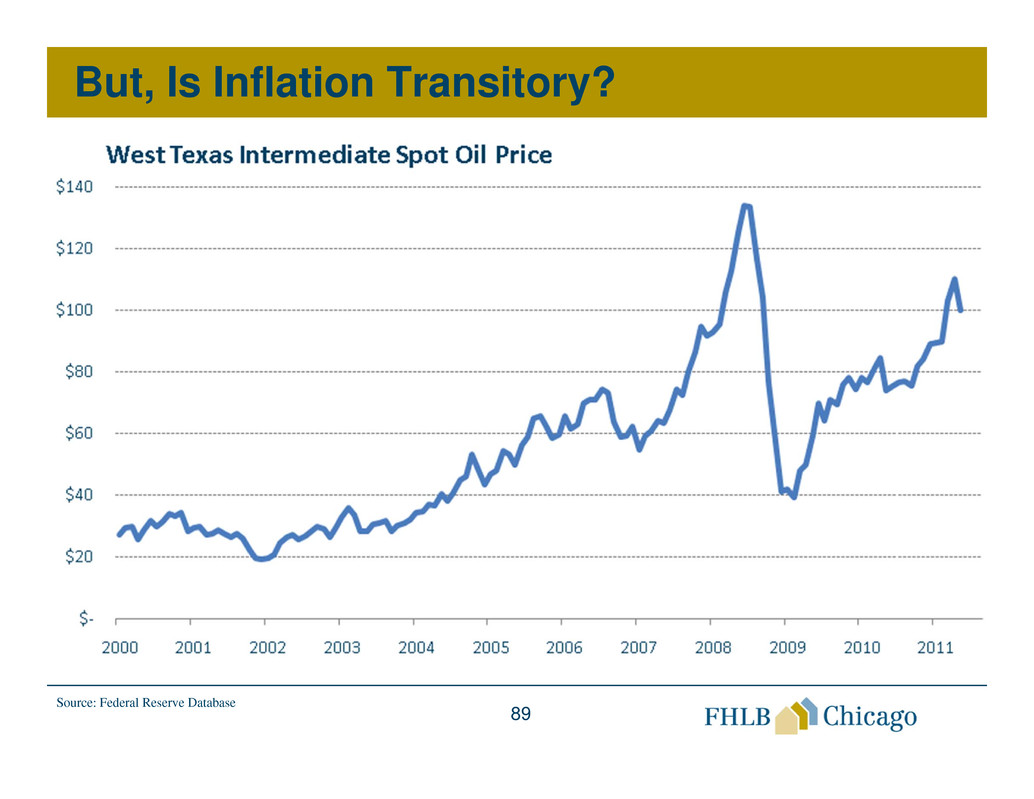

But, Is Inflation Transitory?

Source: Federal Reserve Database

90

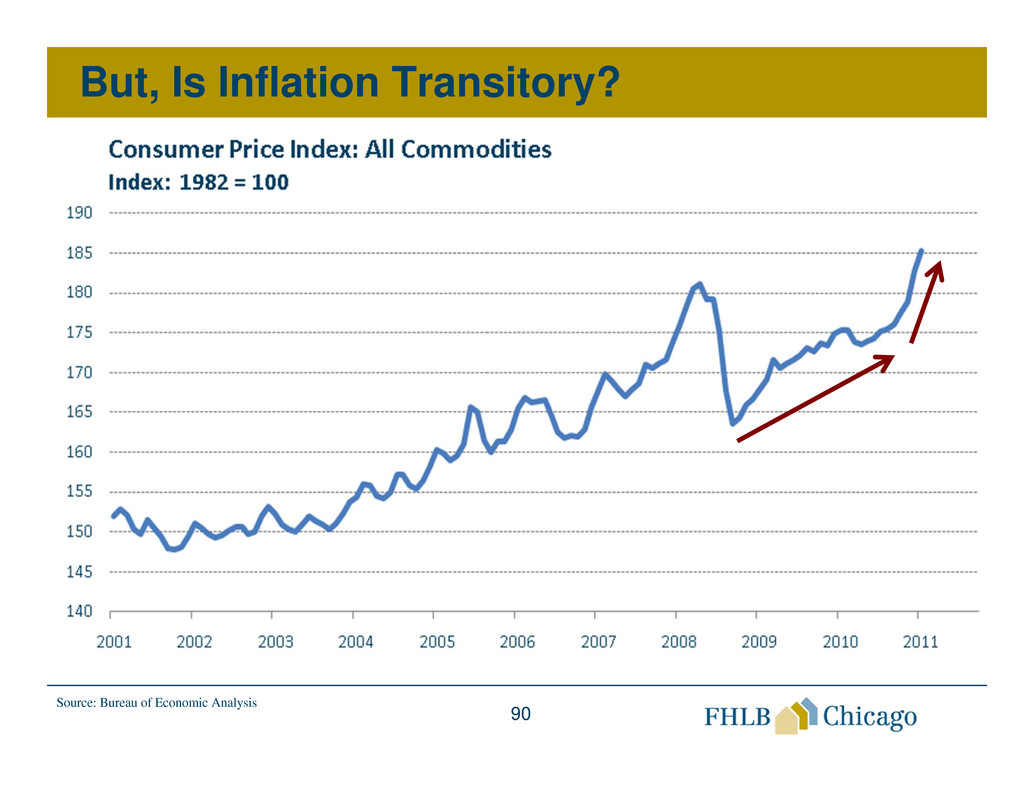

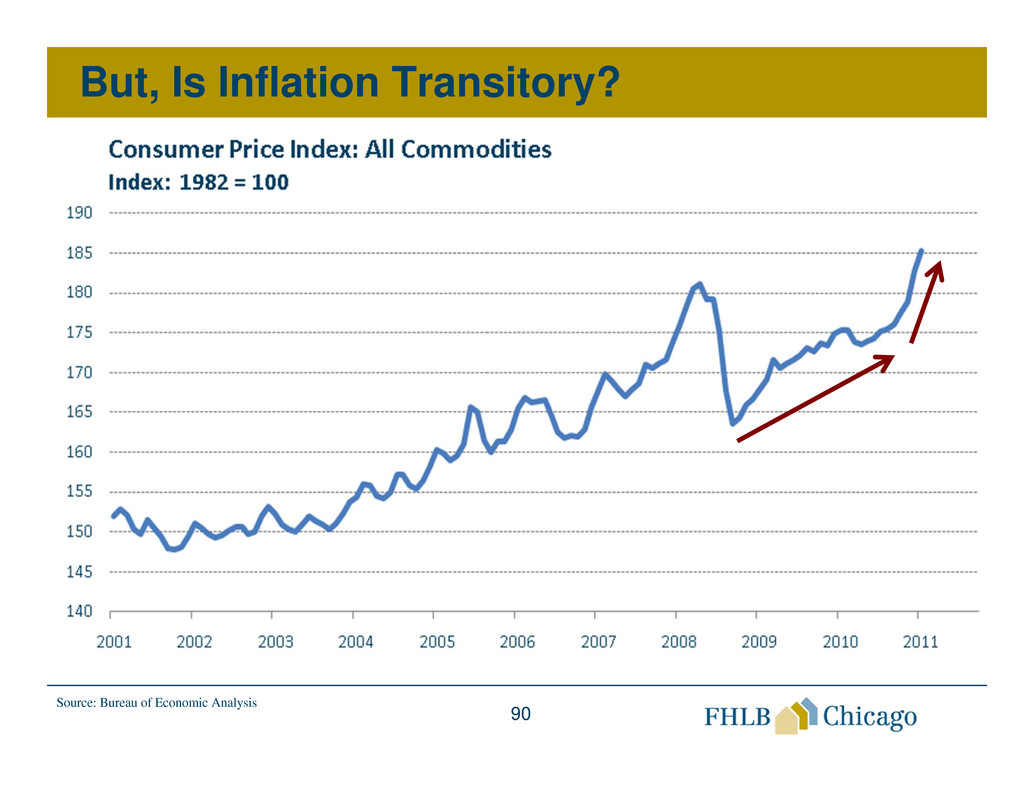

But, Is Inflation Transitory?

Source: Bureau of Economic Analysis

91

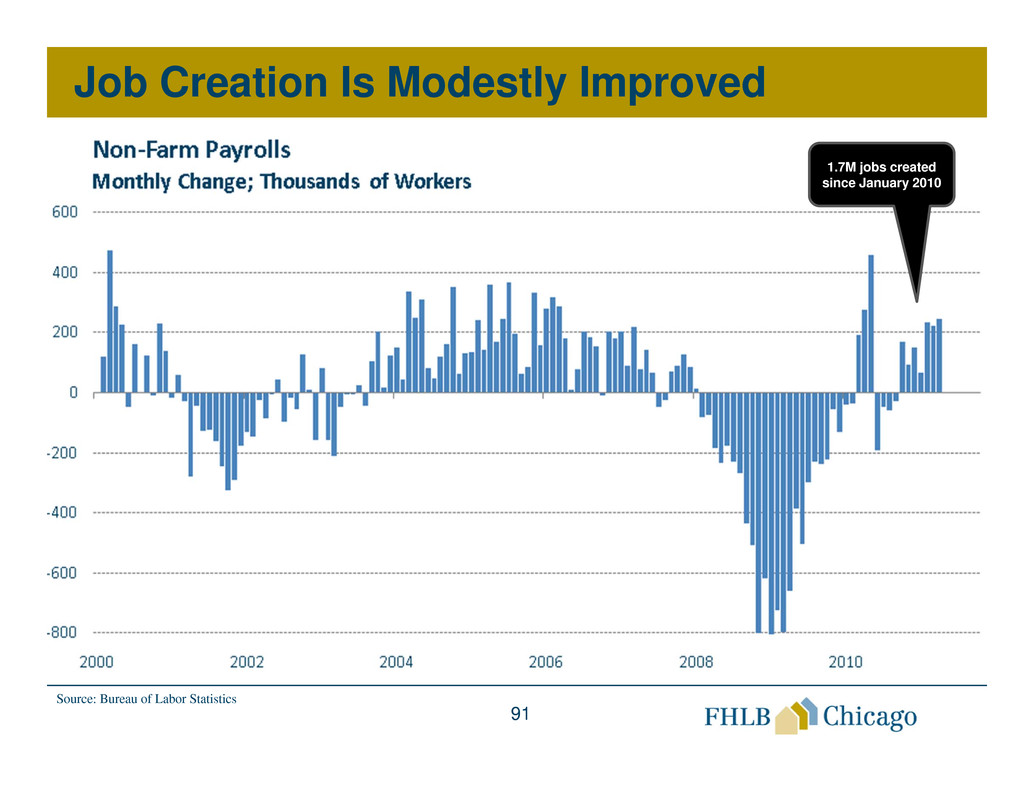

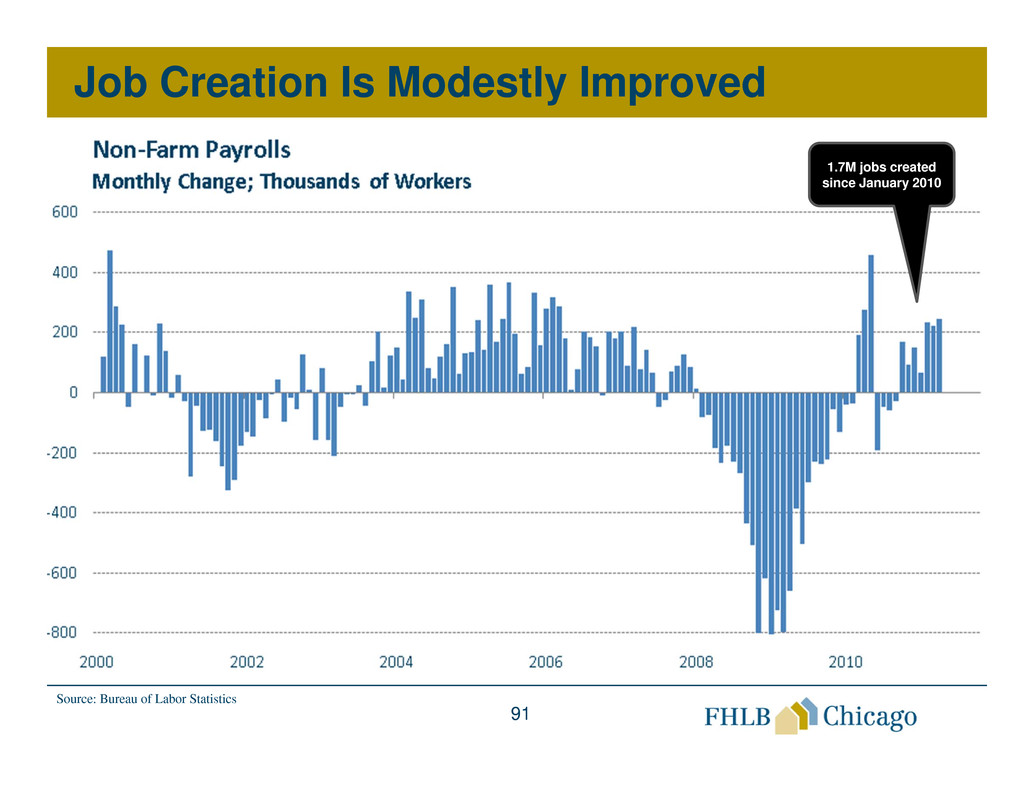

Job Creation Is Modestly Improved

Source: Bureau of Labor Statistics

1.7M jobs created

since January 2010

92

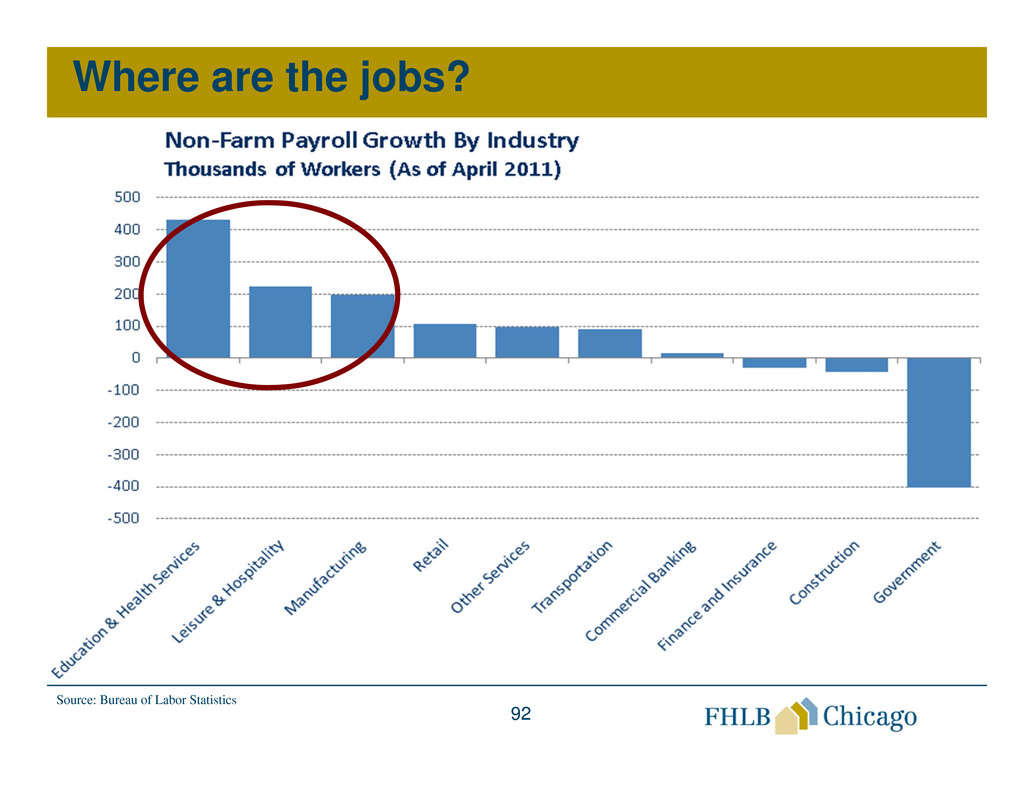

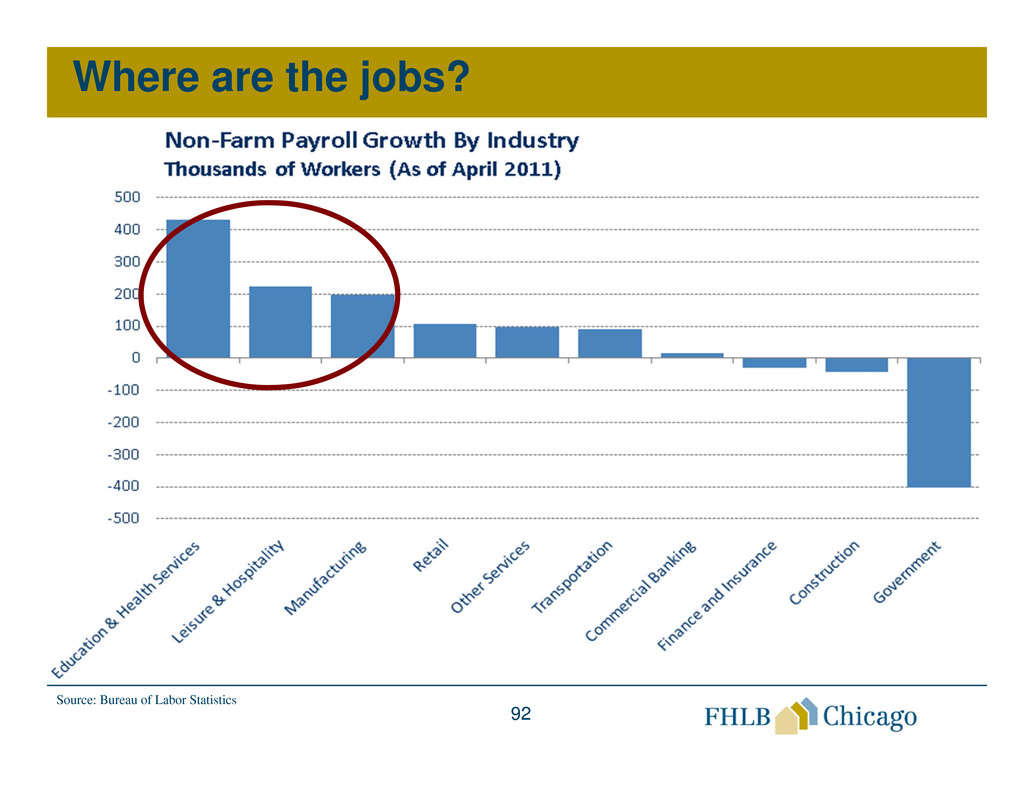

Where are the jobs?

Source: Bureau of Labor Statistics

93

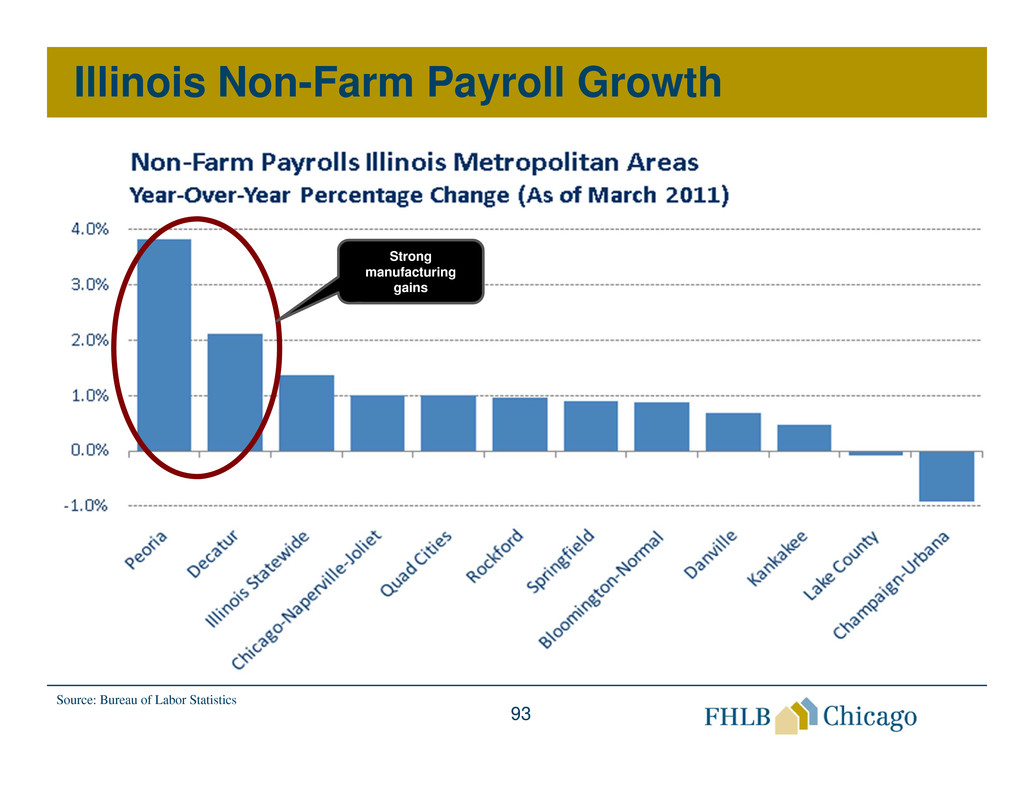

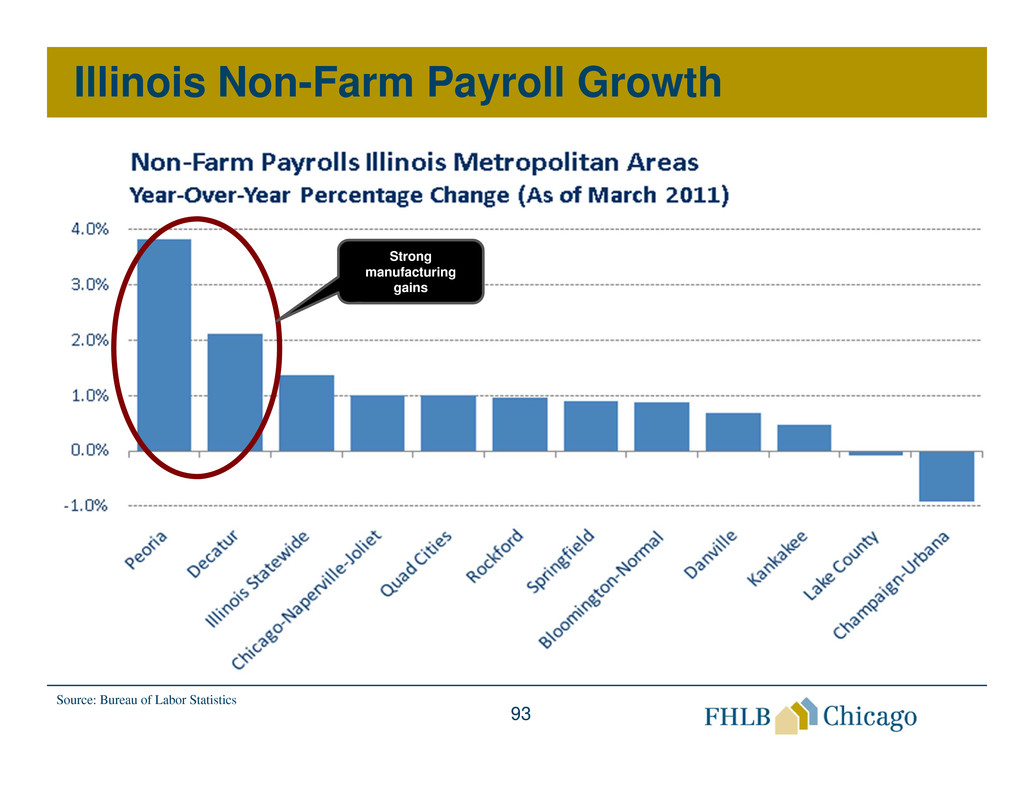

Illinois Non-Farm Payroll Growth

Source: Bureau of Labor Statistics

Strong

manufacturing

gains

94

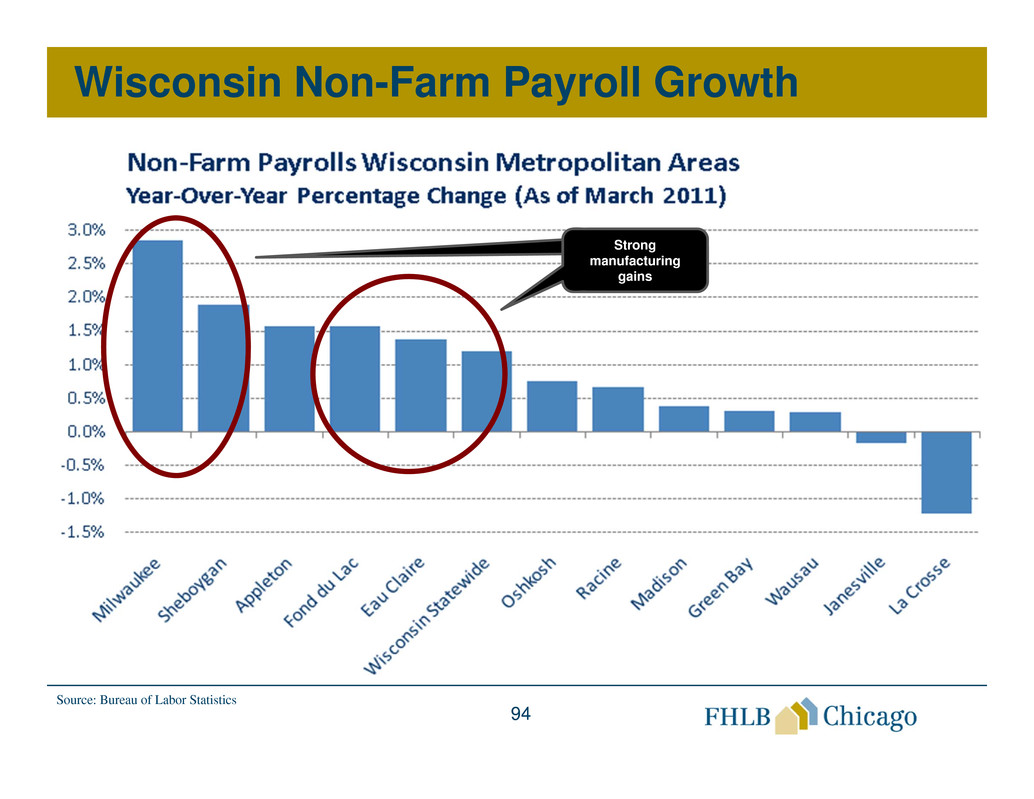

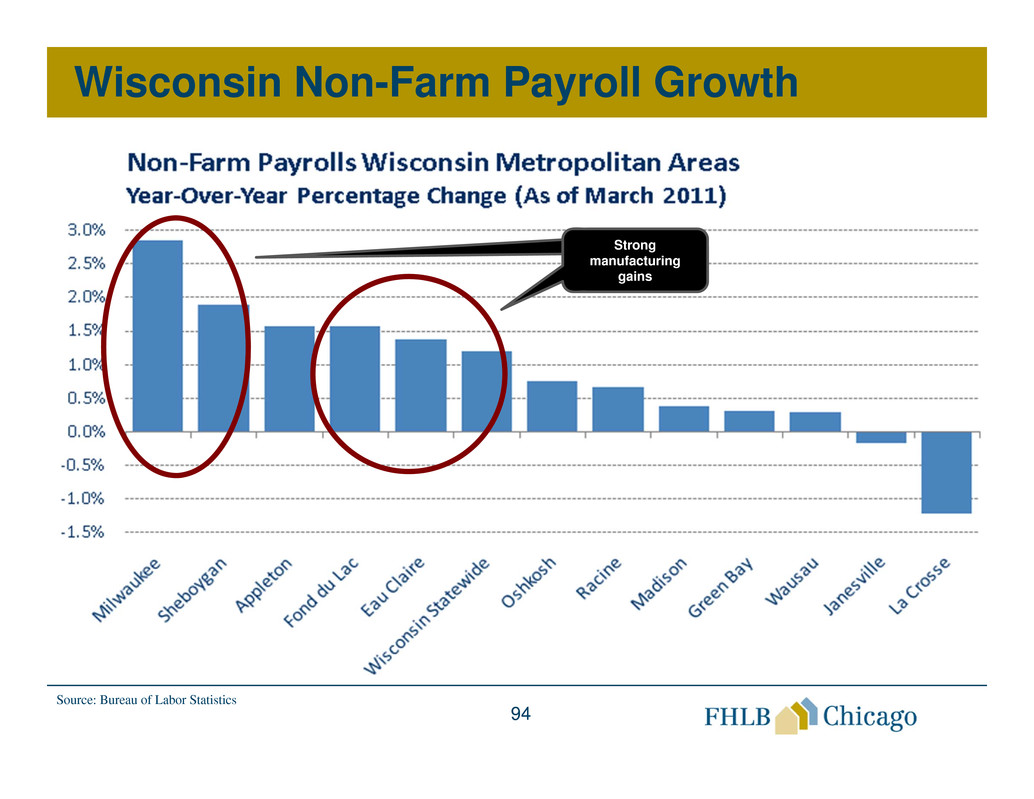

Wisconsin Non-Farm Payroll Growth

Source: Bureau of Labor Statistics

Strong

manufacturing

gains

95

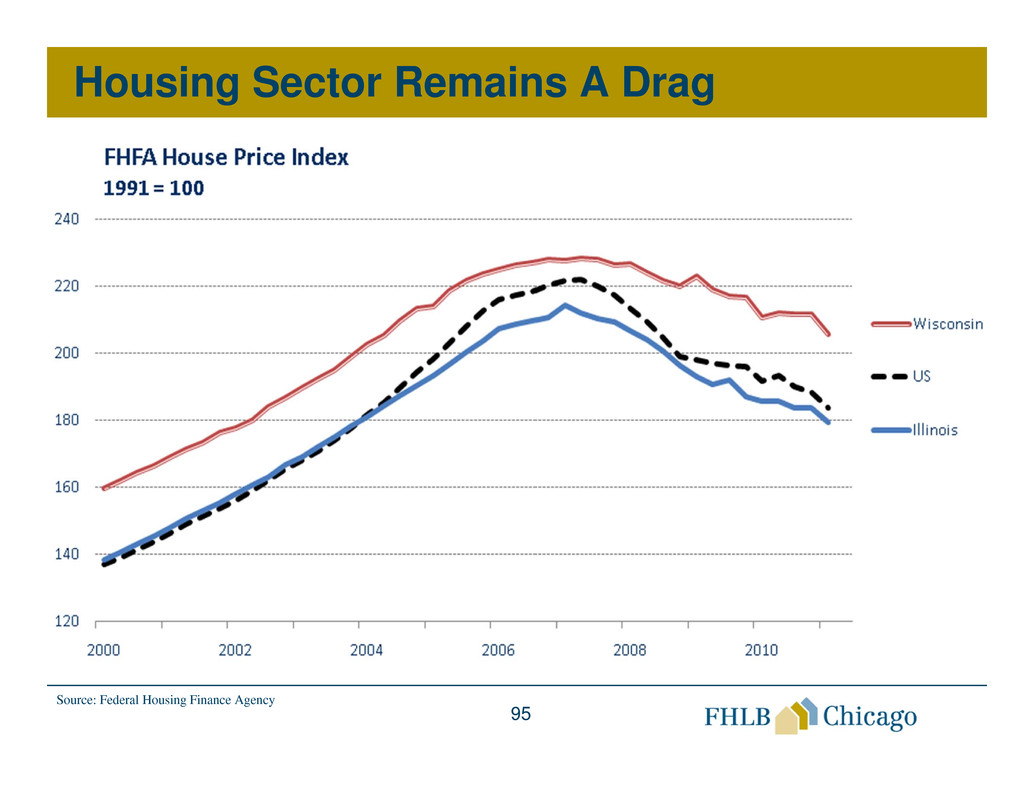

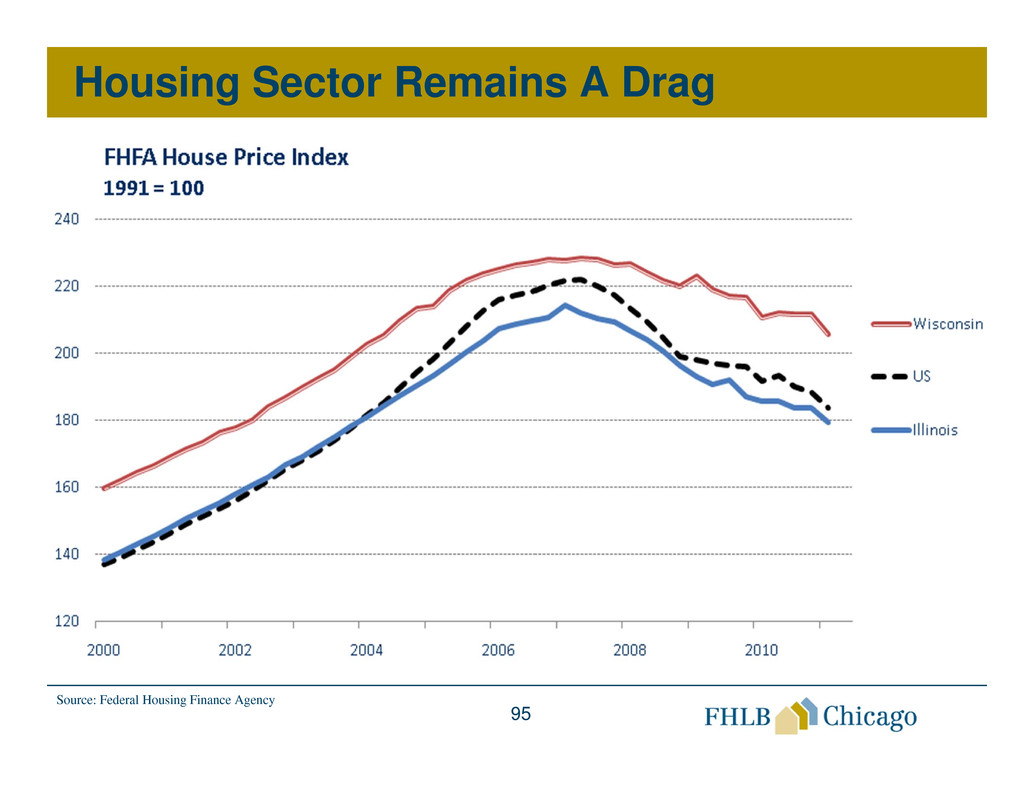

Housing Sector Remains A Drag

Source: Federal Housing Finance Agency

96

Housing Sector Remains A Drag

Source: U.S. Census Bureau

97

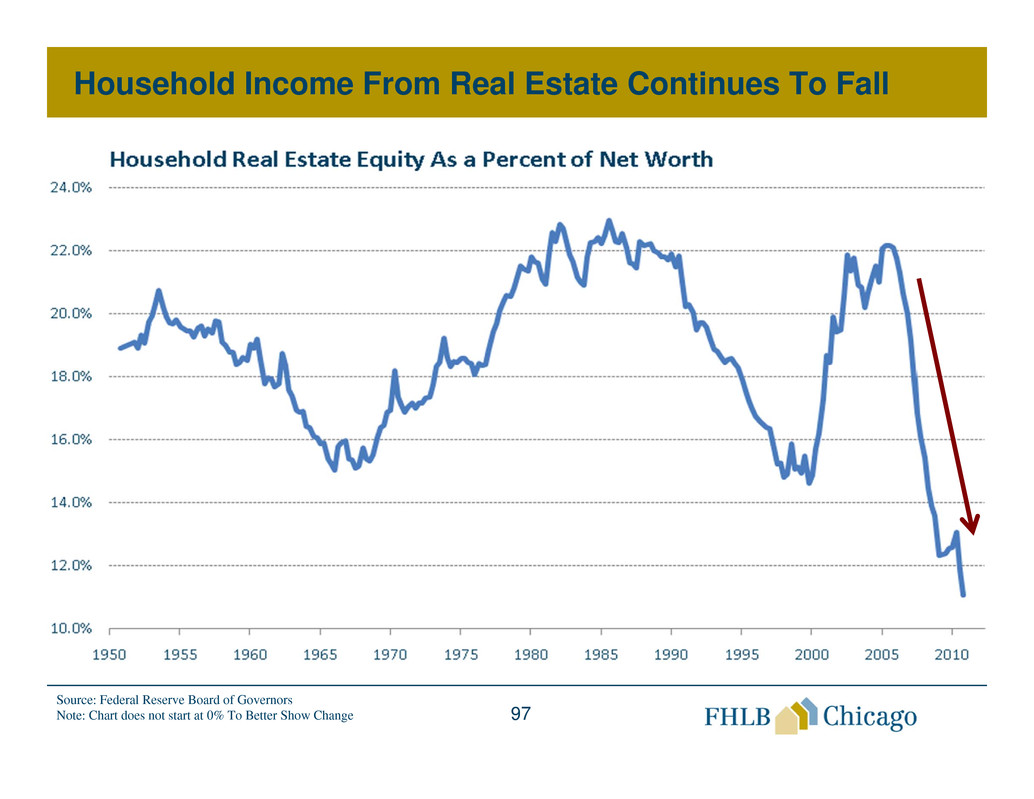

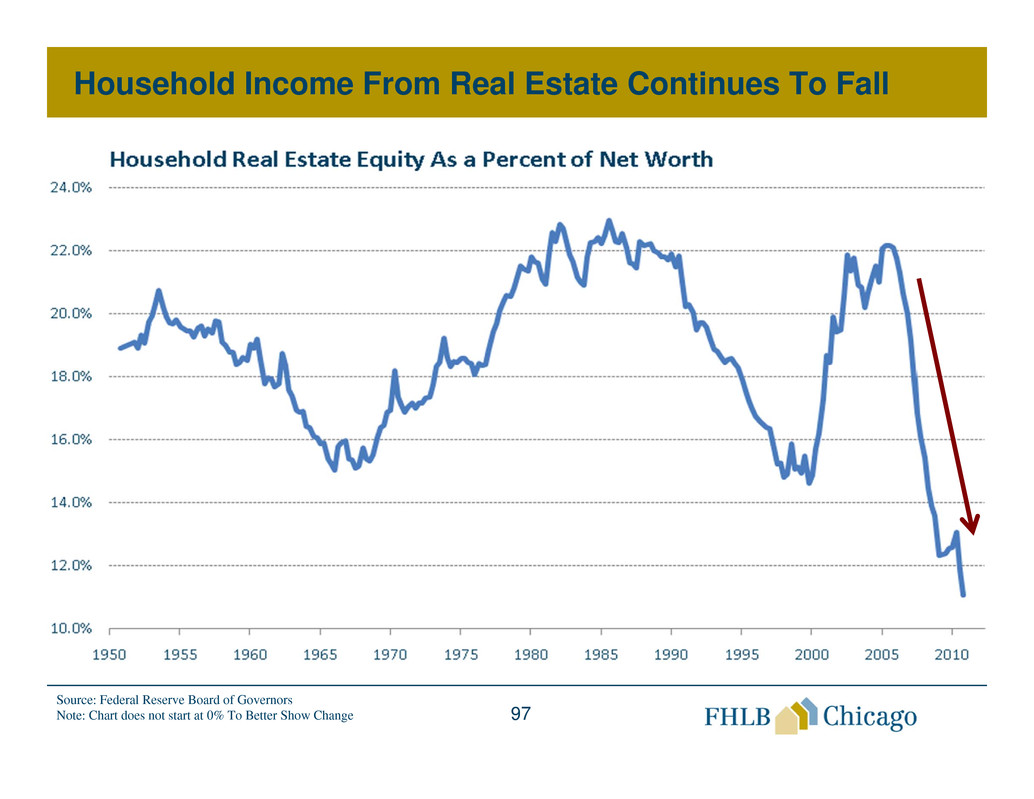

Household Income From Real Estate Continues To Fall

Source: Federal Reserve Board of Governors

Note: Chart does not start at 0% To Better Show Change

98

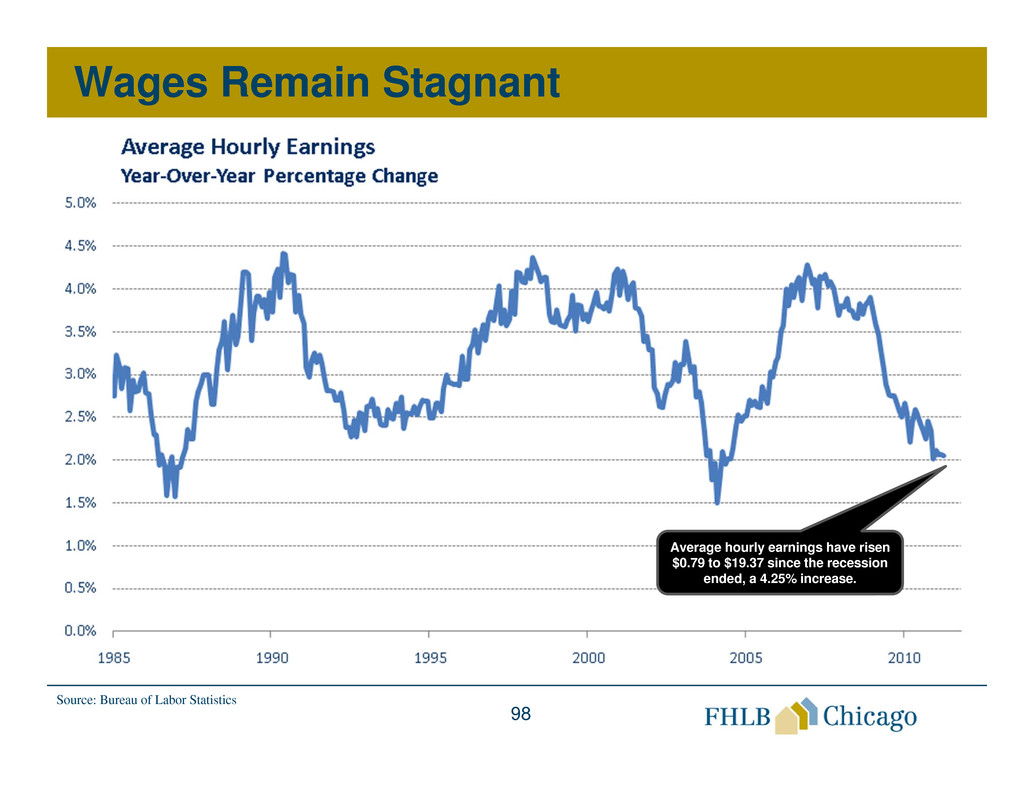

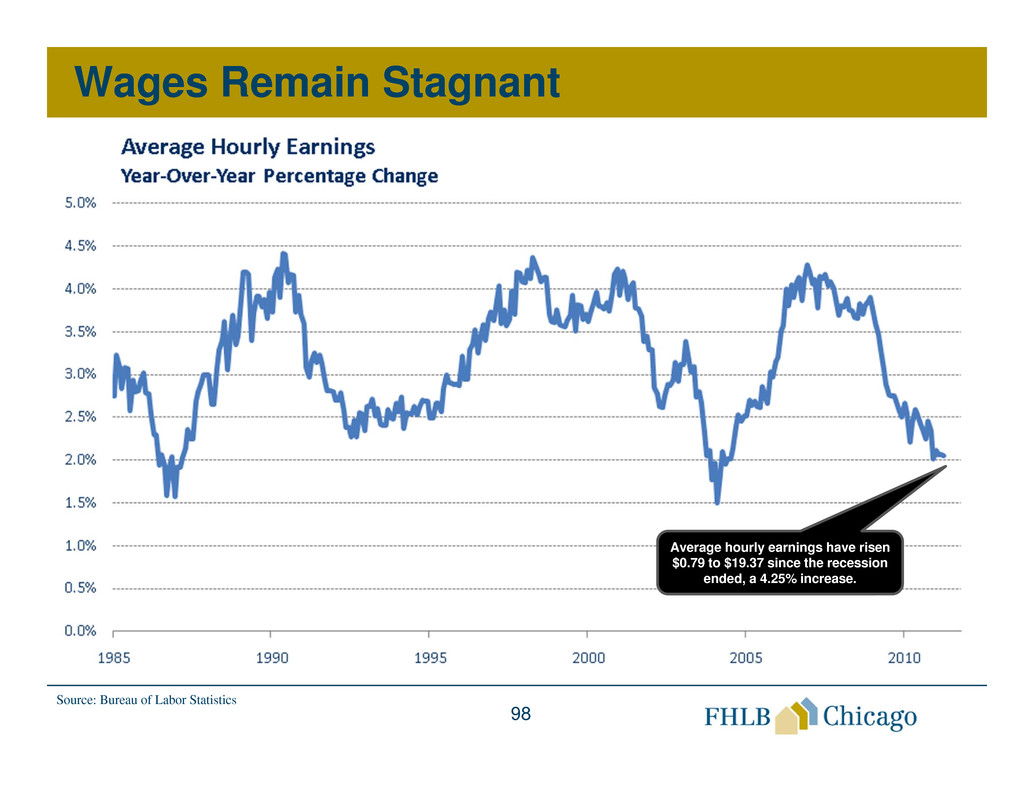

Wages Remain Stagnant

Source: Bureau of Labor Statistics

Average hourly earnings have risen

$0.79 to $19.37 since the recession

ended, a 4.25% increase.

99

Economic Solutions

• The Federal Reserve balance sheet continues to

expand as the Fed remains aggressive in its

response to economic conditions.

• Quantitative Easing 2 (QE2) is scheduled to end on

June 30, which has only added more uncertainty to

the direction of interest rates.

• Where does the Fed go from here?

100

End of Quantitative Easing Draws Near

Source: Federal Reserve Board of Governors

*$670B in Treasury purchases less an estimated $124B in

MBS paydown reinvestments

The Federal Reserve has

purchased $525B* of the

$600B program which ends

June 30.

101

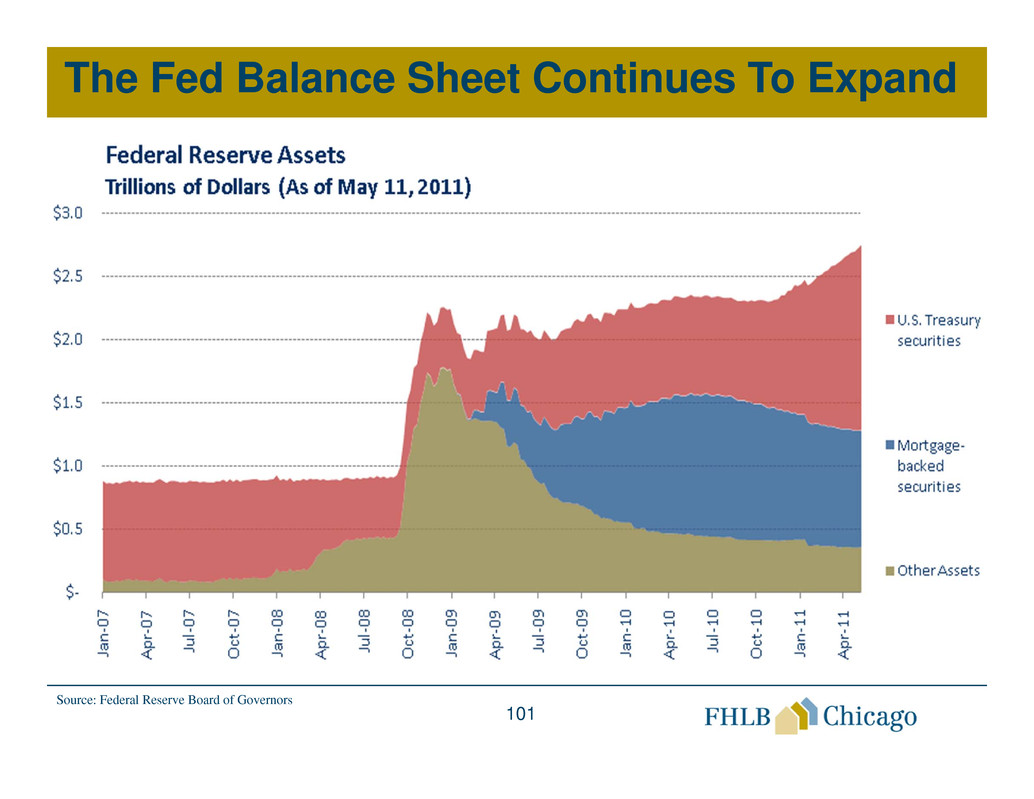

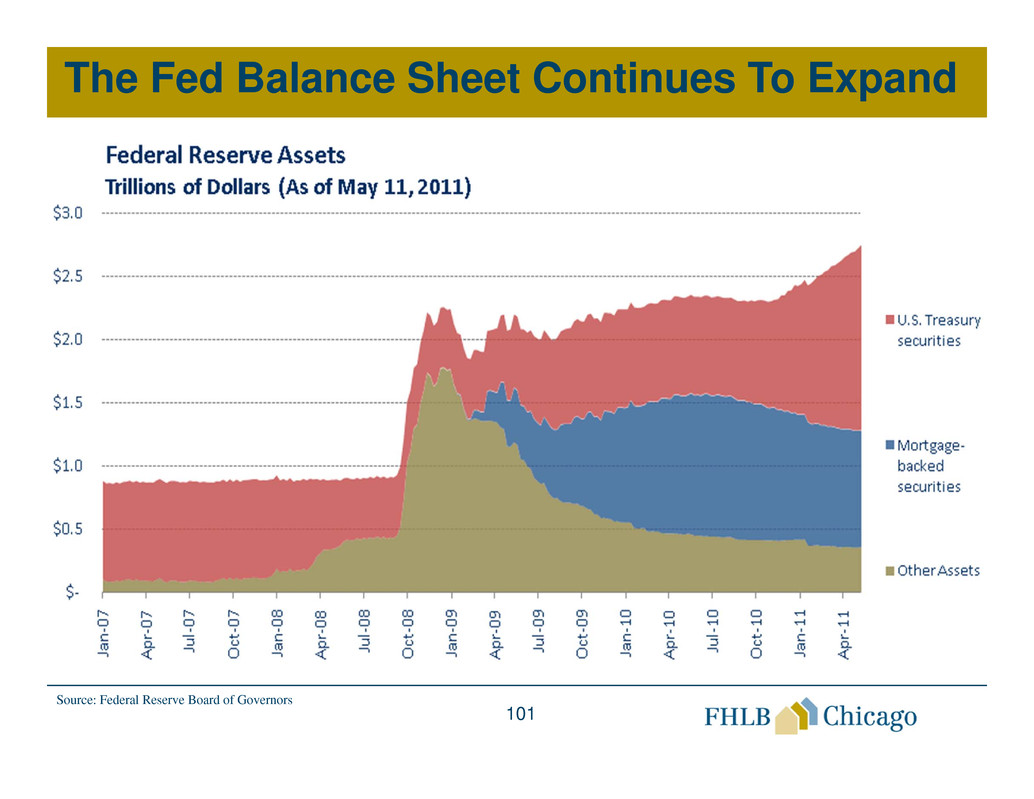

The Fed Balance Sheet Continues To Expand

Source: Federal Reserve Board of Governors

102

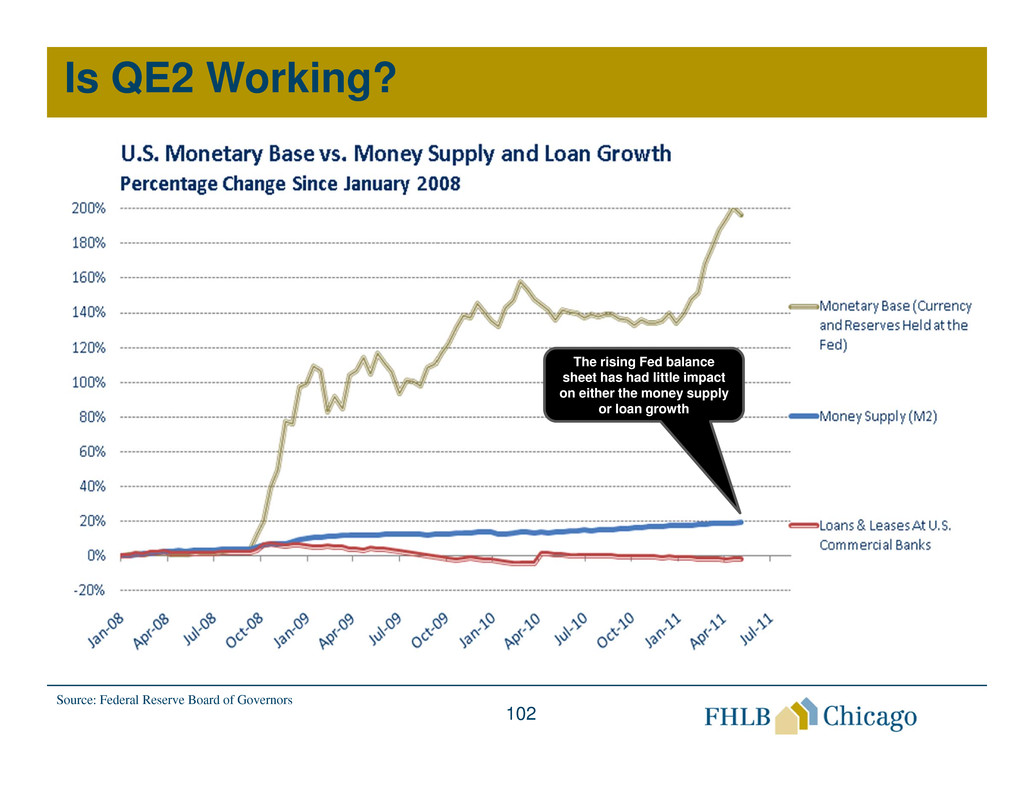

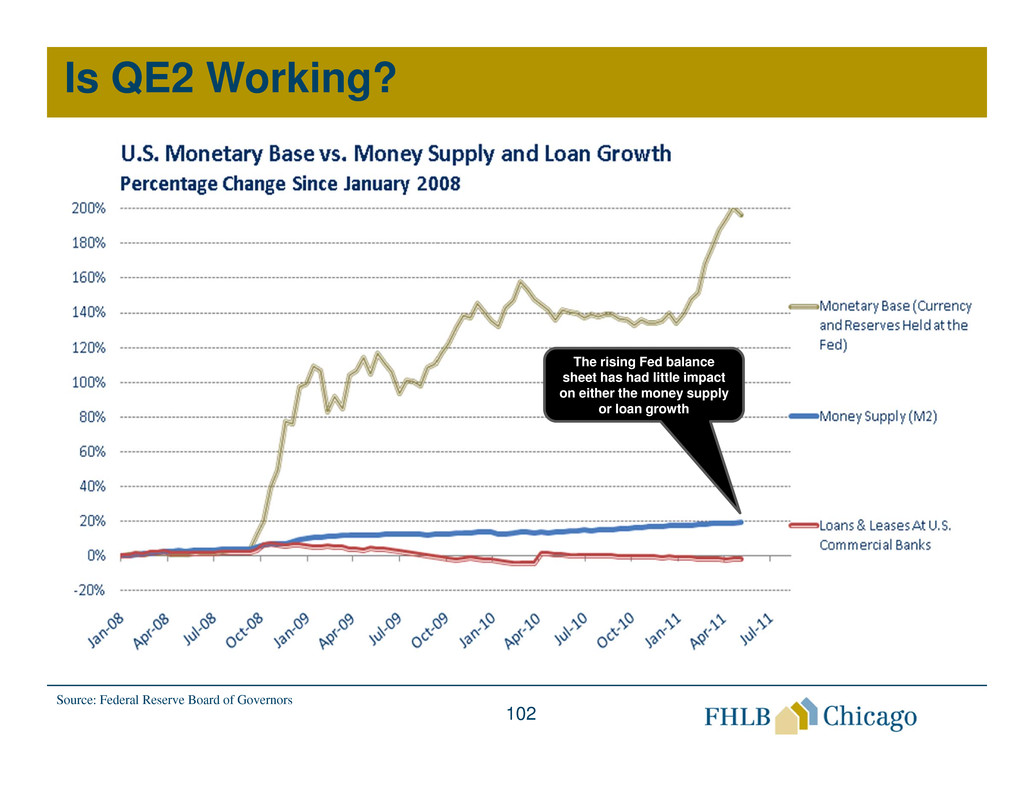

Is QE2 Working?

Source: Federal Reserve Board of Governors

The rising Fed balance

sheet has had little impact

on either the money supply

or loan growth

103

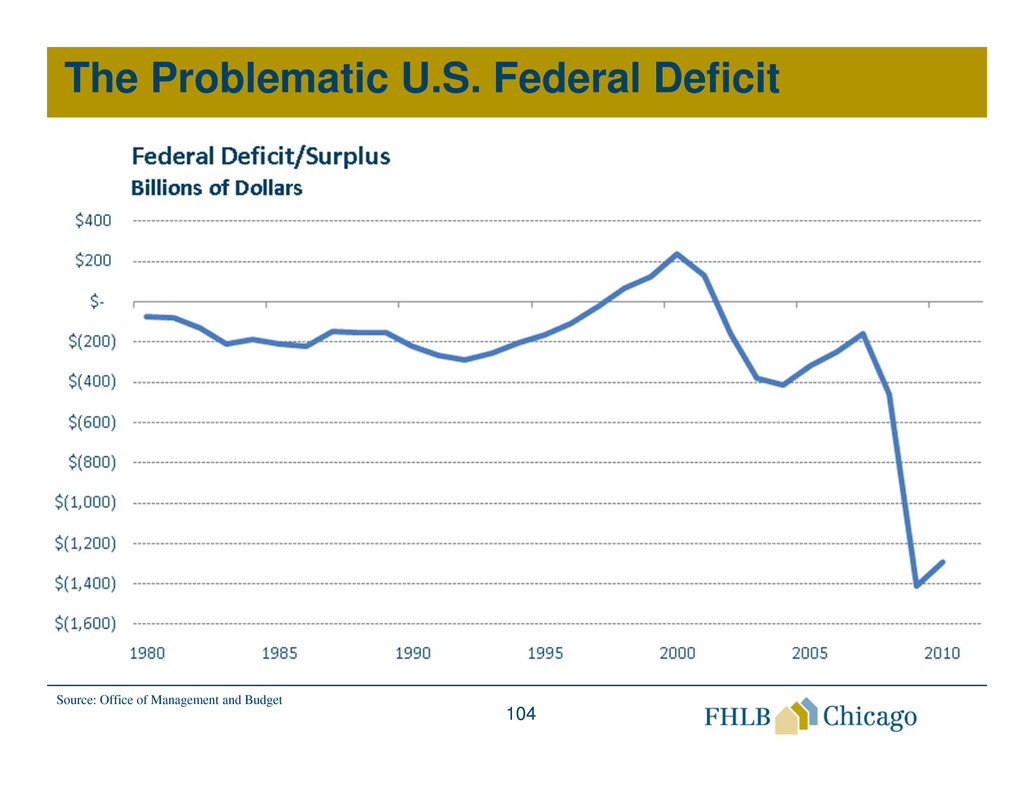

The Problematic U.S. Federal Deficit

• The risks associated with the U.S. fiscal problems

are enormous at this point in the economic

recovery.

• The impact of a fiscal crisis, including higher interest

rates and drastic spending cuts, would severely

hamper GDP growth.

• A strong economic recovery would alleviate the

financial crisis.

• Failing to successfully resolve the debt ceiling issue

could threaten the recovery.

104

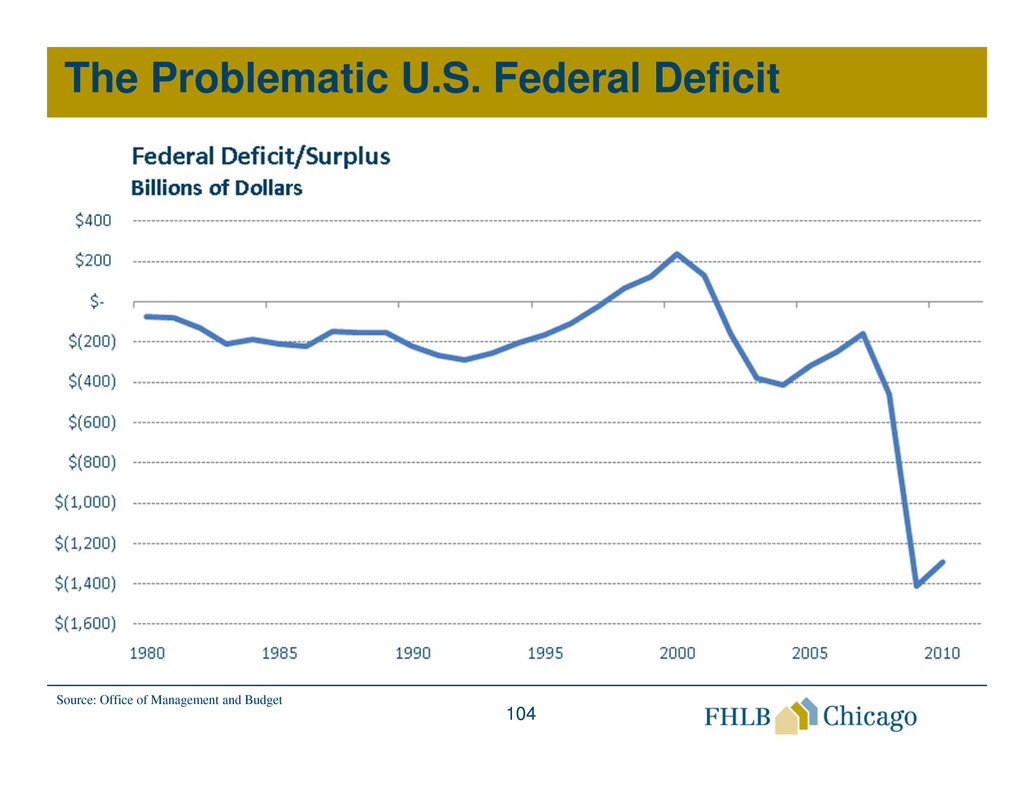

The Problematic U.S. Federal Deficit

Source: Office of Management and Budget

105

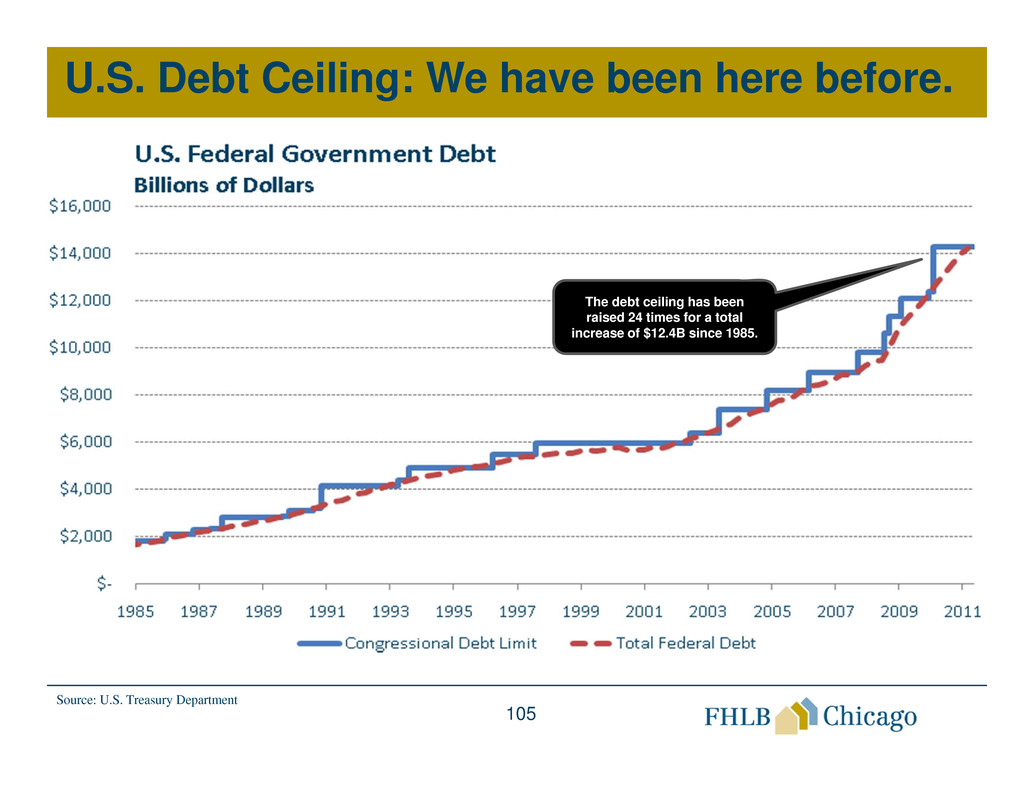

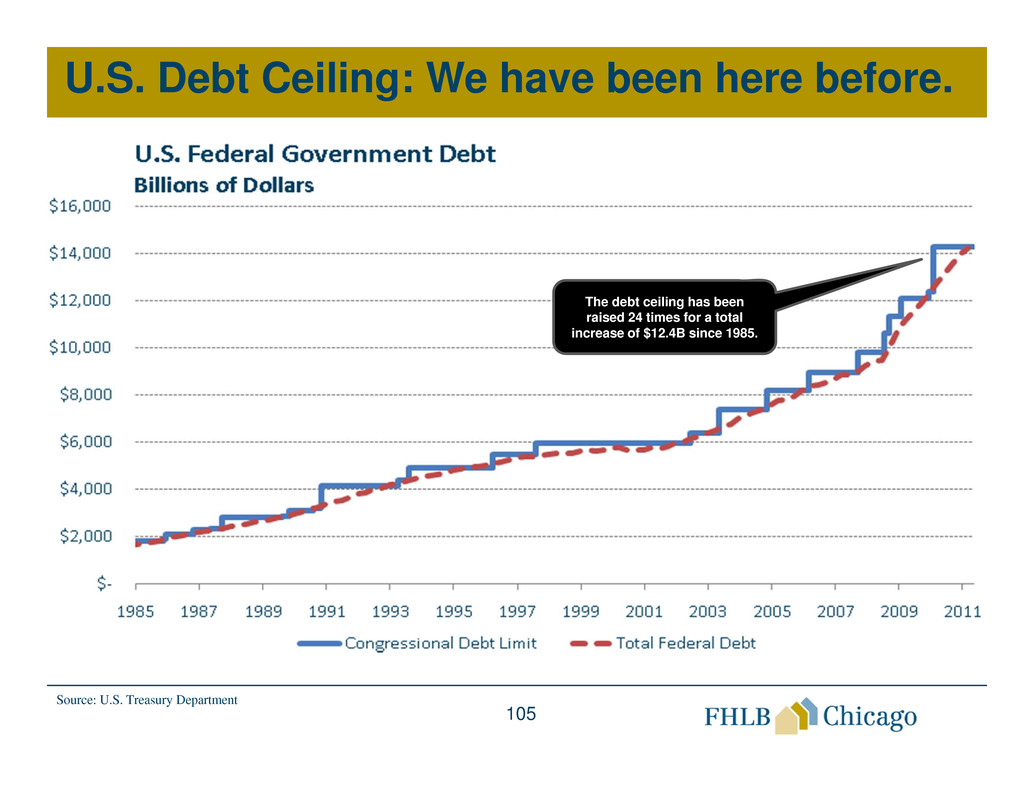

U.S. Debt Ceiling: We have been here before.

Source: U.S. Treasury Department

The debt ceiling has been

raised 24 times for a total

increase of $12.4B since 1985.

106

Quotes on Economic Conditions

“Even with the many

challenges we face,

the economy is

healing and getting

stronger”

--Treasury Secretary

Timothy Geithner

Detroit Economic Club

April 28, 2011

“Our economy is far

from where we would

like it to be.”

-- Federal Reserve

Chairman Ben

Bernanke

Community Affairs

Research Conference

April 20, 2011

107

Quotes on Inflation

“To be sure, we see some

increase in headline

inflation due to higher

food and energy prices,

but we do not expect

these to materially boost

underlying inflationary

trends.”

-- Federal Reserve Bank of

Chicago President Evans

U. of South Carolina

March 28, 2011

“It does seem improbable

that the inflation rate

would ever get beyond

3.5 percent, let alone

knock on the door of 10

percent. But I’m here to

tell you it’s going to 10

percent.”

-- Economic Journalist Jim

Grant

Associated Press Interview

May 20, 2011

108

Quotes on Fiscal Situation

"Although we believe these

strengths currently outweigh

what we consider to be the

U.S.'s meaningful economic

and fiscal risks and large

external debtor position, we

now believe that they might

not fully offset the credit

risks over the next two years

at the 'AAA' level."

-- Standard & Poor's credit

analyst Nikola G. Swann

Press Release

April 18, 2011

“If ever there was an

organization more corrupt,

incompetent, and less

capable of issuing an

intelligent analysis on debt

than S&P, I am unaware of

them.”

-- Economic Journalist Barry

Ritholtz

www.ritholtz.com/blog

April 18, 2011

109

Status Of U.S. Banks

• The banking industry continues to recover.

• FDIC-insured commercial banks posted net income

of $29B in the first quarter of 2011, the best

quarterly result since Q2 2007.

• Loan-loss provisions continue to fall, $20.7B in

1Q11 from $51.6B one year ago.

• The FDIC “Problem List” now includes 888 banks.

• The Deposit Insurance Fund (DIF) balance was

-$1.0B in1Q11 from -$7.4B one year ago and the

FDIC reports in its Quarterly Banking Profile that

the balance should turn positive in Q211.

110

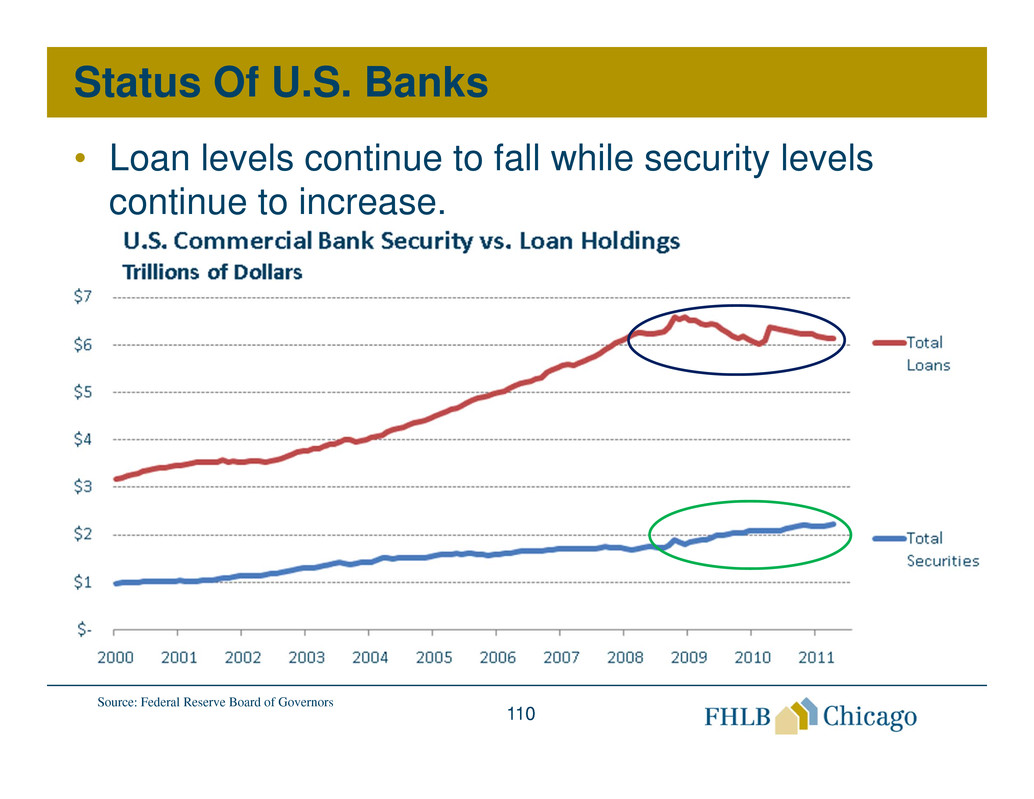

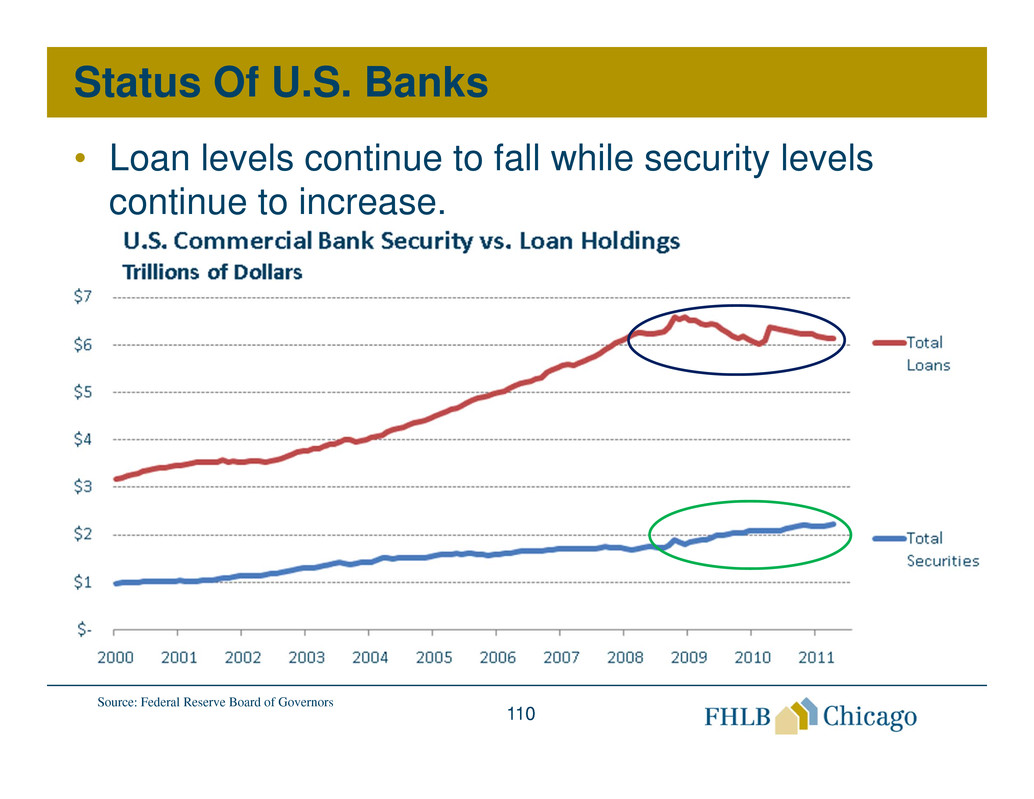

Status Of U.S. Banks

• Loan levels continue to fall while security levels

continue to increase.

Source: Federal Reserve Board of Governors

111

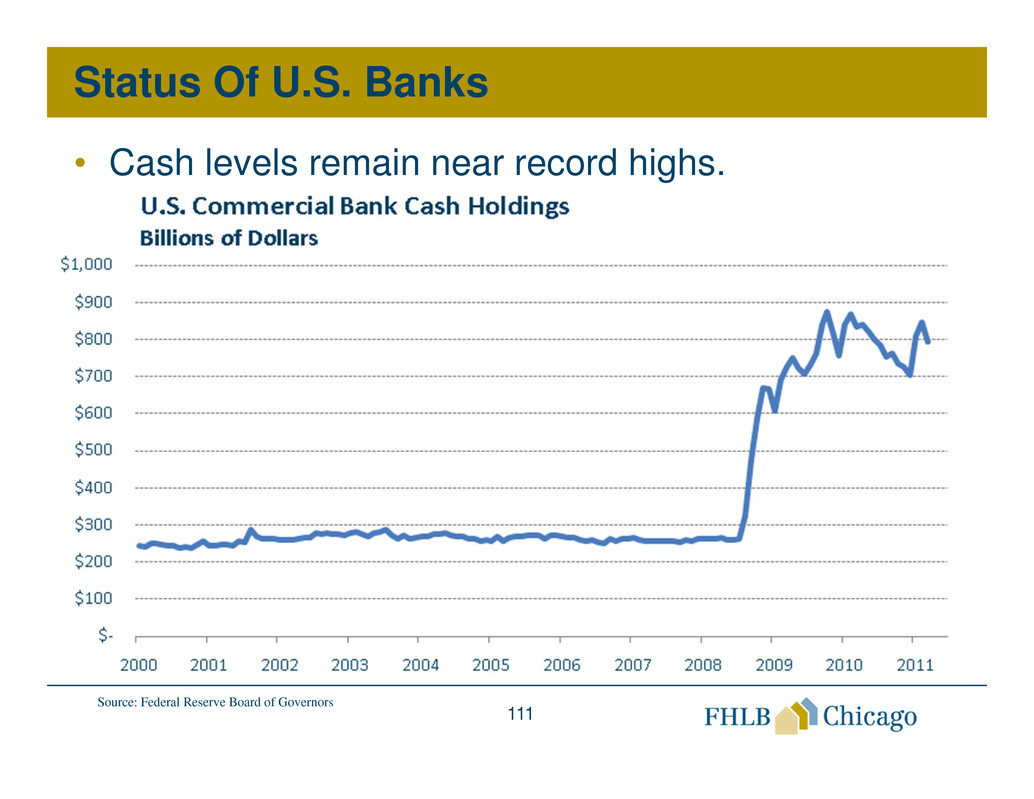

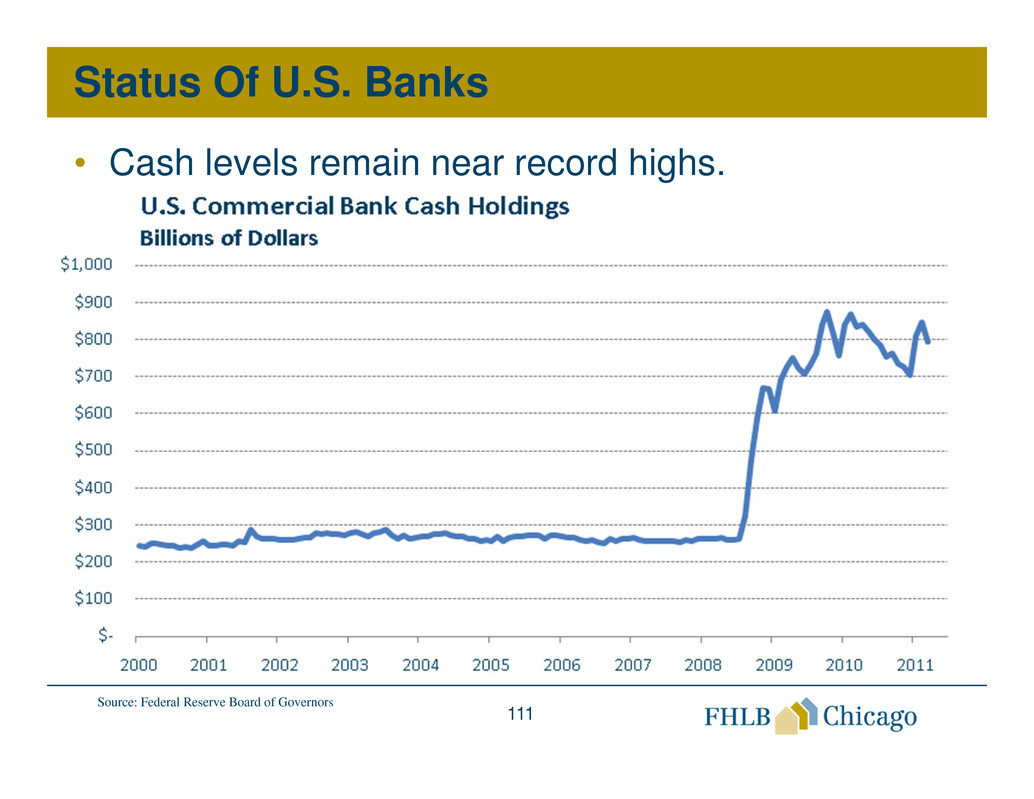

Status Of U.S. Banks

• Cash levels remain near record highs.

Source: Federal Reserve Board of Governors

112

Impact On FHLBC Members

• Members continue to favor the short end of the

yield curve for their funding needs.

• According to market movements, analysts,

economists, and investors have pushed back their

forecasts for possible Fed rate hikes as short-term

rates have moved even lower.

113

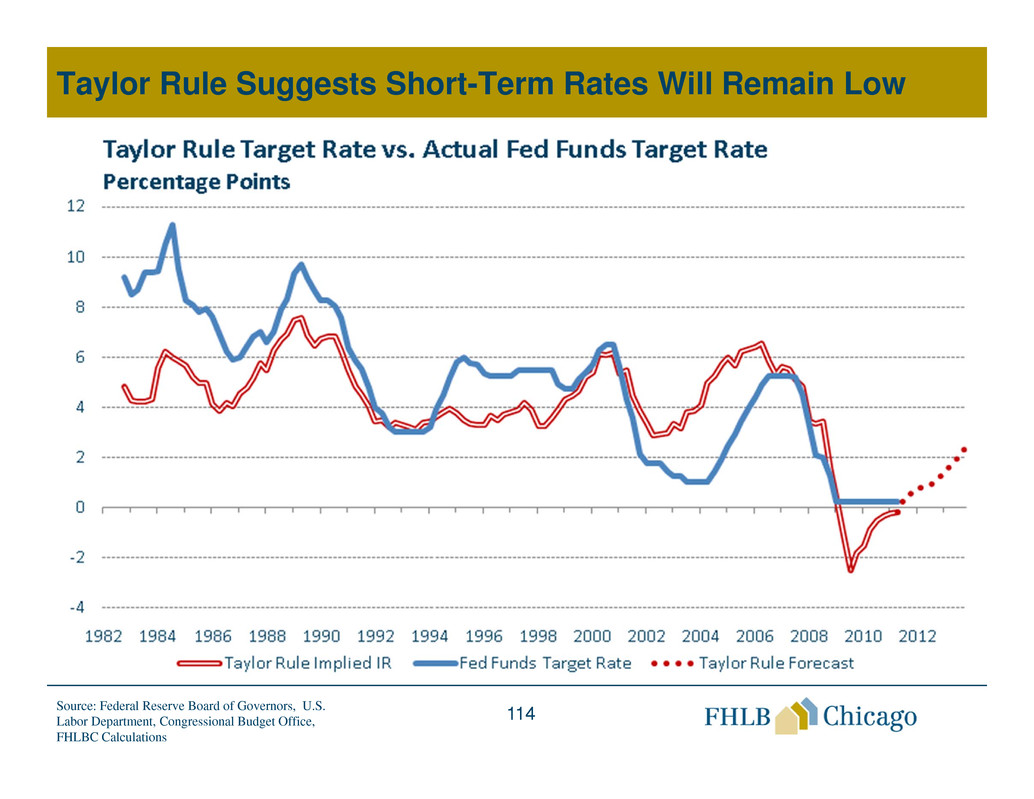

Taylor Rule Suggests Low Rates

• Taylor Rule was developed by John Taylor in 1993

as an estimation of the short-term interest rate

needed to stabilize both the economy and inflation.

• Taylor’s Rule suggests that the real short-term

interest rate is determined by three factors:

– Where actual inflation is in relation to the target

inflation rate.

– How far economic activity is above or below the full

employment level (Potential GDP).

– The short-term interest rate that is consistent with

full-employment.

114

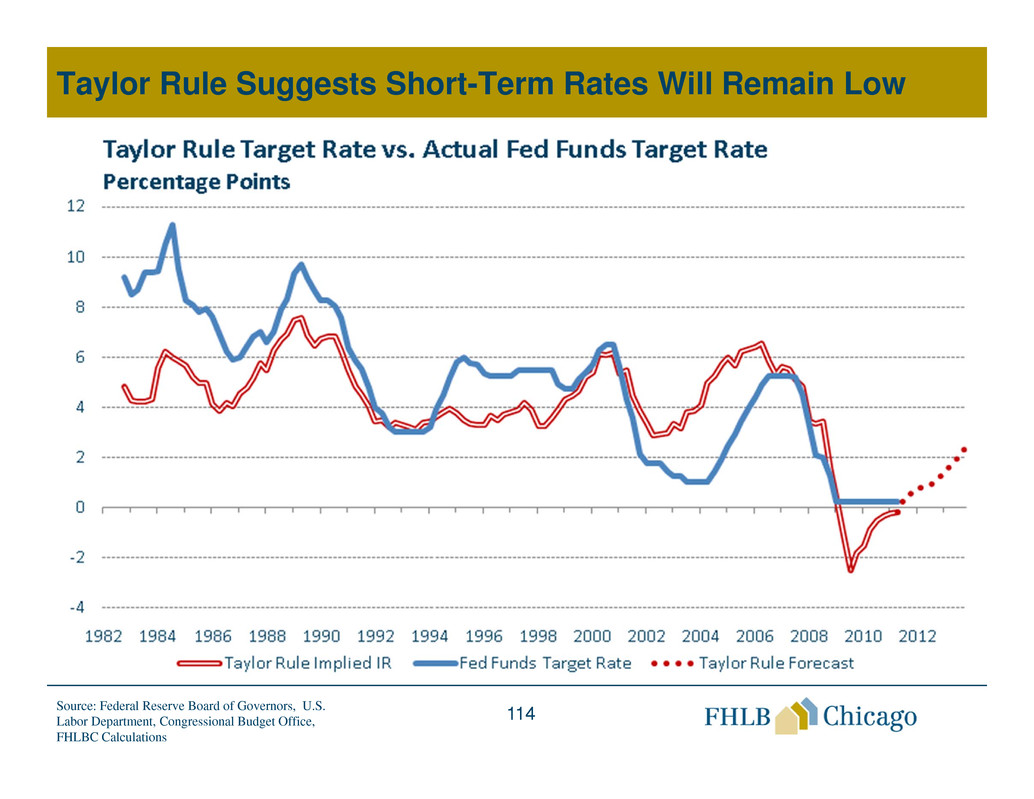

Taylor Rule Suggests Short-Term Rates Will Remain Low

Source: Federal Reserve Board of Governors, U.S.

Labor Department, Congressional Budget Office,

FHLBC Calculations

115

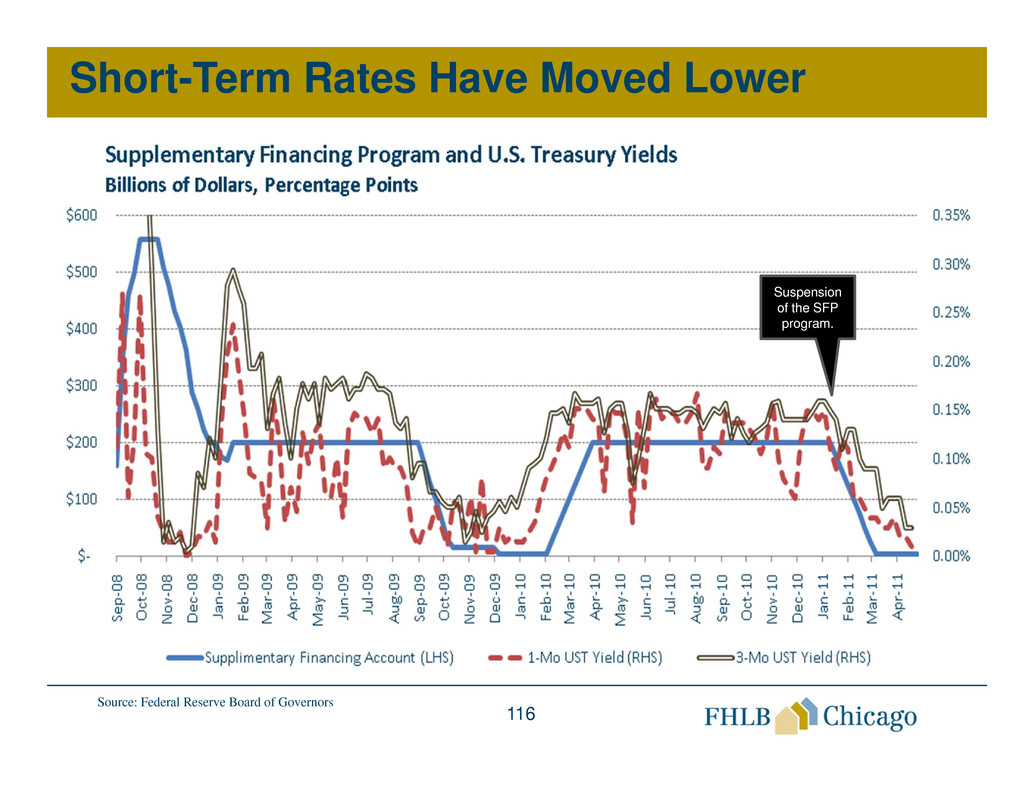

Short-Term Rates Have Moved Lower

• Other factors…

• Less short-term collateral available

• Suspension of the U.S. Treasury Supplemental

Financing Program (SFP) due to debt-ceiling

issues

– SFP: $200B Treasury Bill issuance program

designed to assist the Federal Reserve in its

liability management program was reduced to

$15B

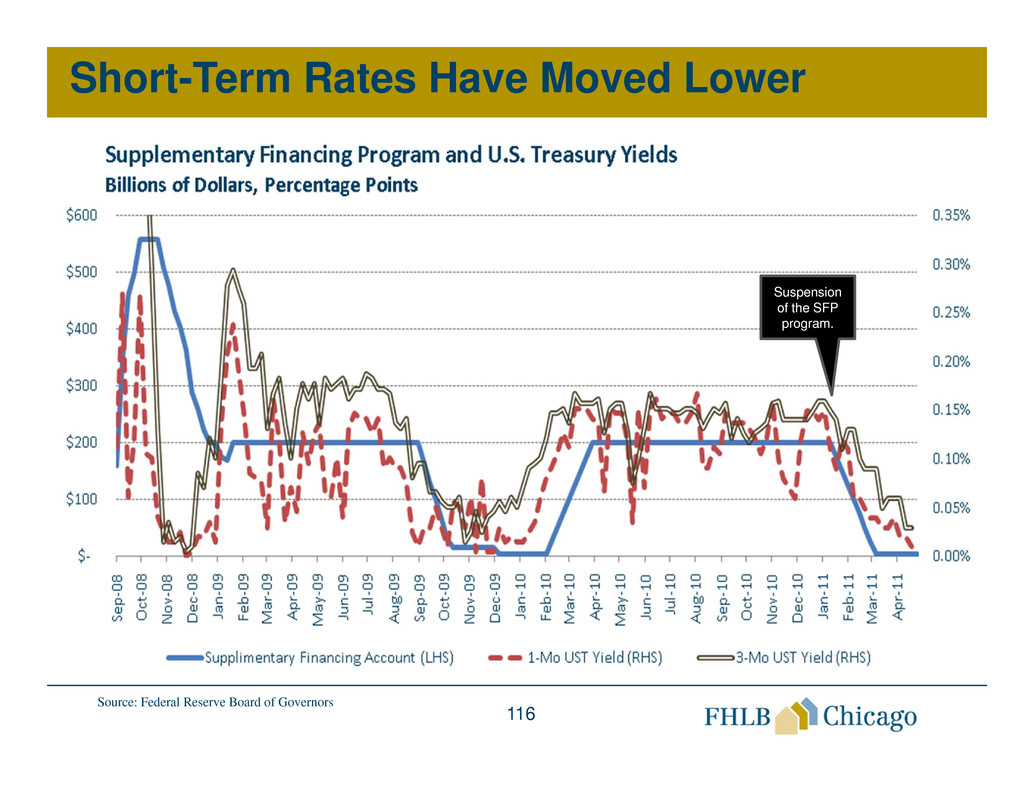

116

Short-Term Rates Have Moved Lower

Source: Federal Reserve Board of Governors

Suspension

of the SFP

program.

117

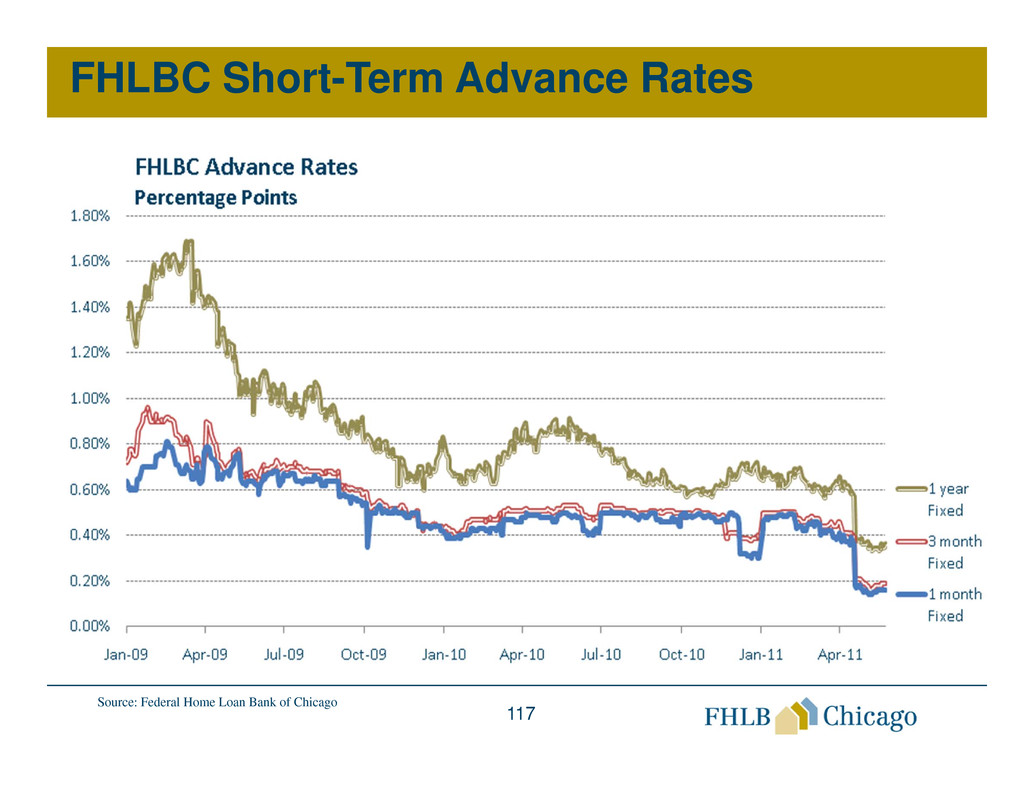

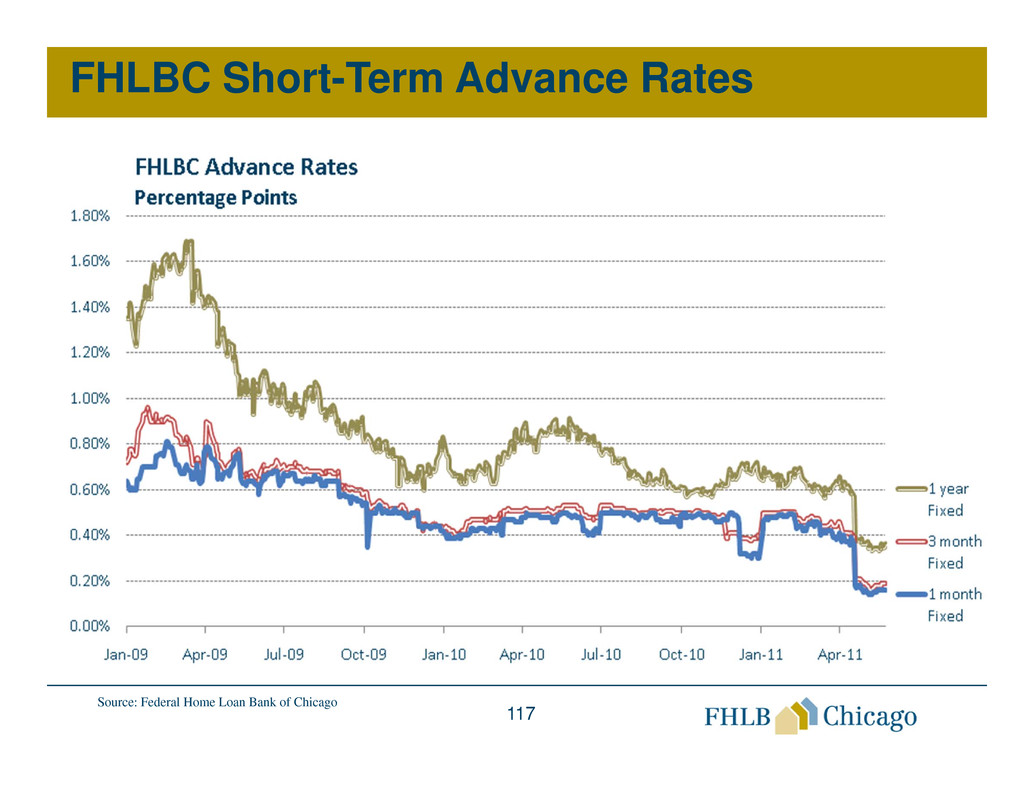

FHLBC Short-Term Advance Rates

Source: Federal Home Loan Bank of Chicago

118

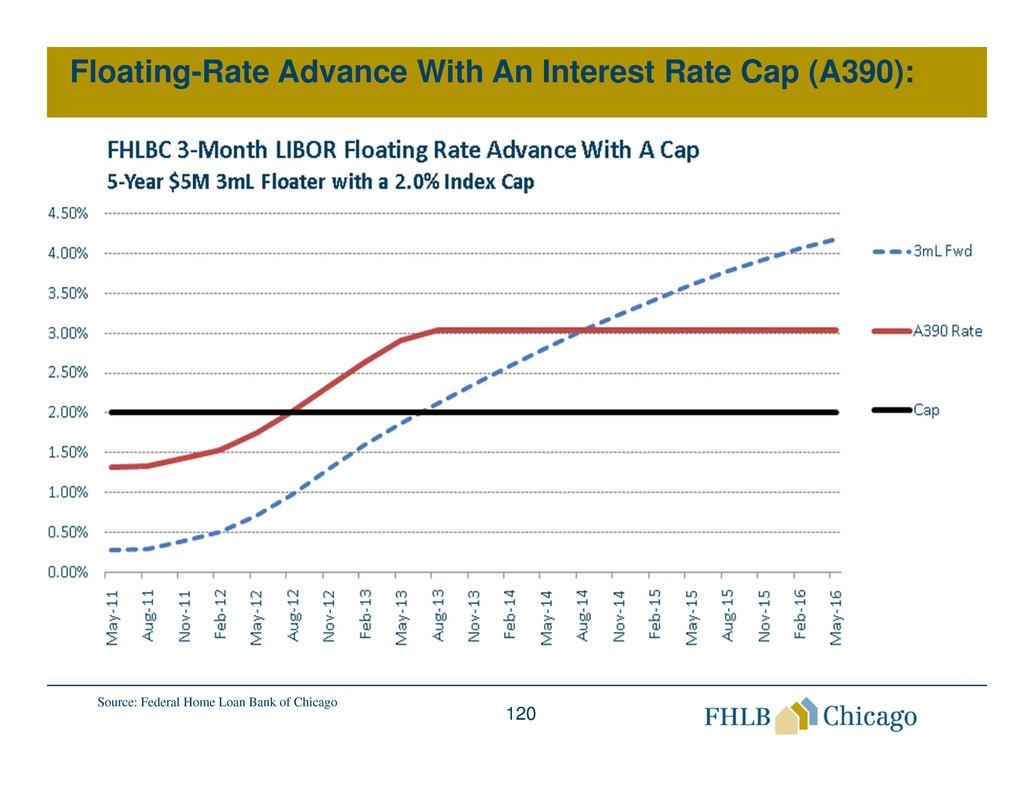

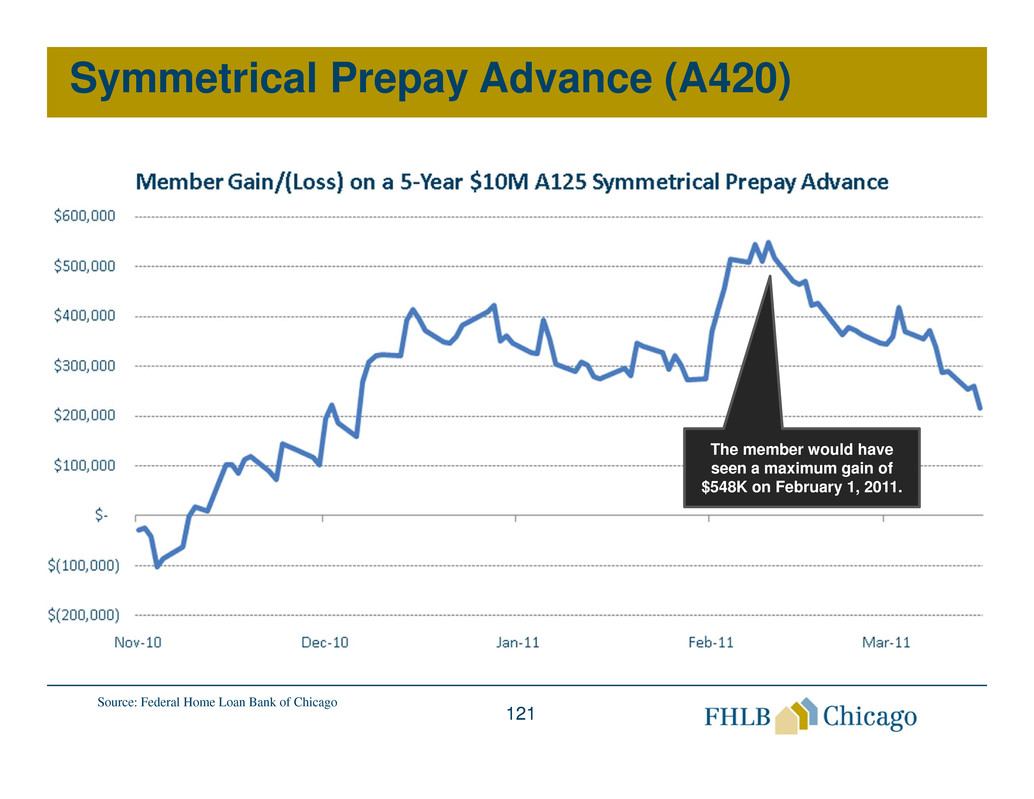

Impact On FHLBC Members

• Members who have concerns about rising interest

rates are extending the duration of their liabilities

with FHLBC advances to potentially enhance their

net interest margins when rates move higher.

• Popular term structures to prepare for higher rates:

– Fixed-rate term advances

– Floating-rate term advances with interest-rate

caps

– Symmetrical prepay advances

119

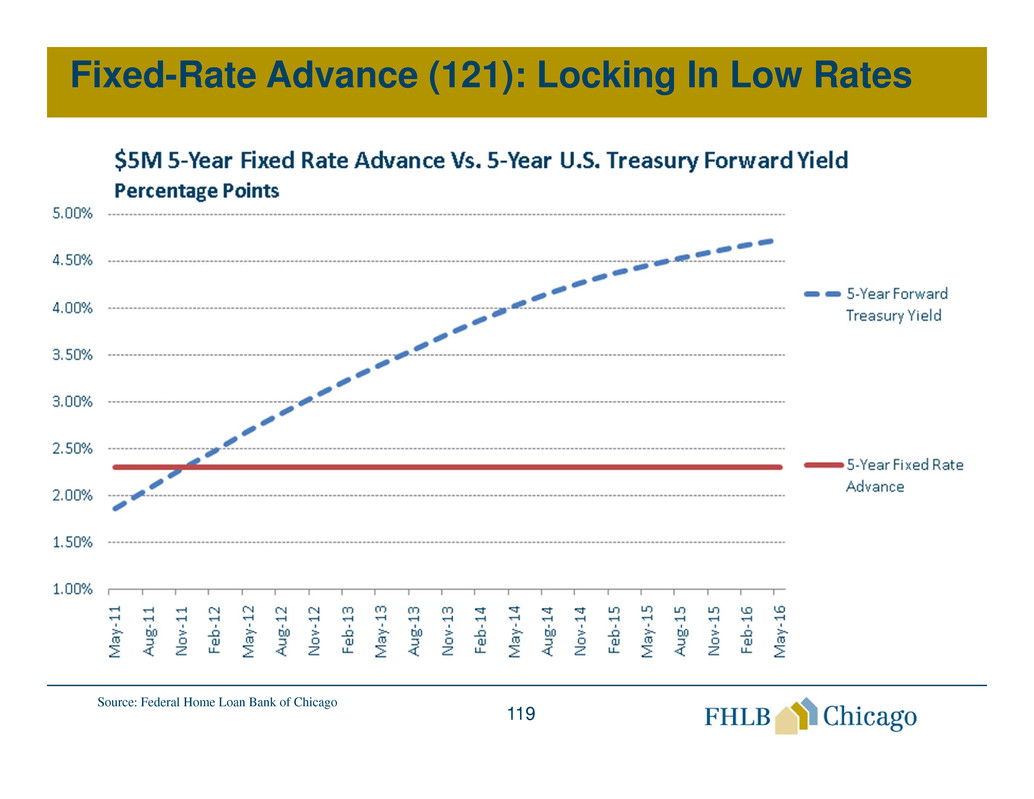

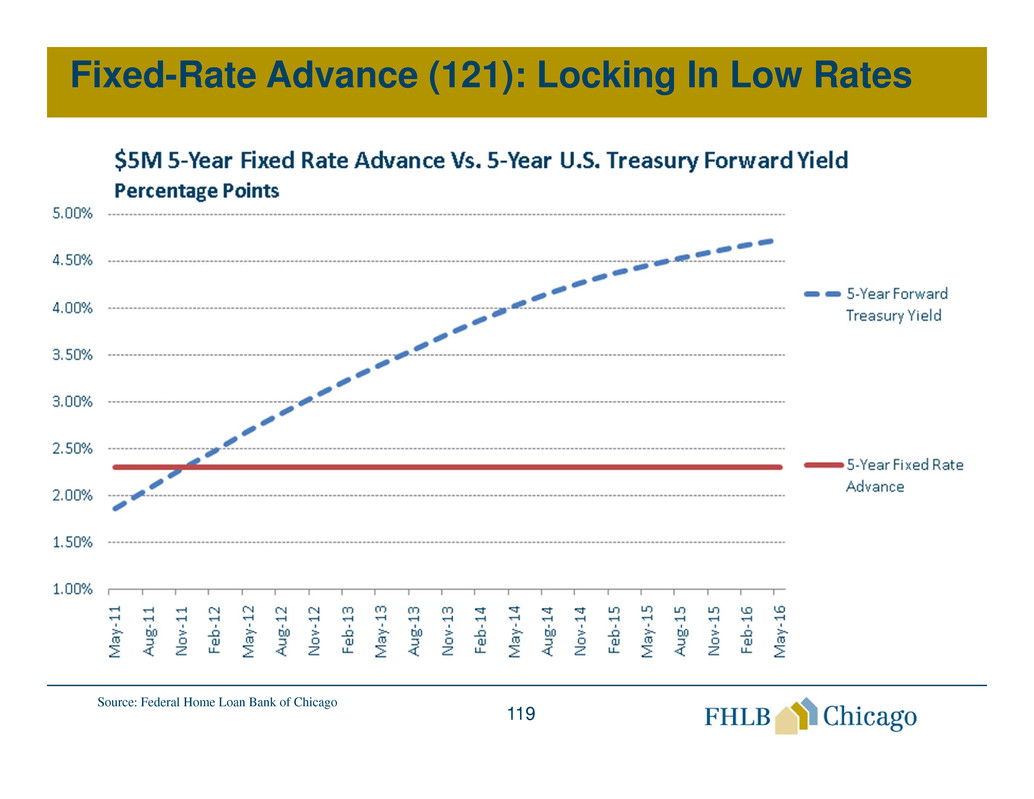

Fixed-Rate Advance (121): Locking In Low Rates

Source: Federal Home Loan Bank of Chicago

120

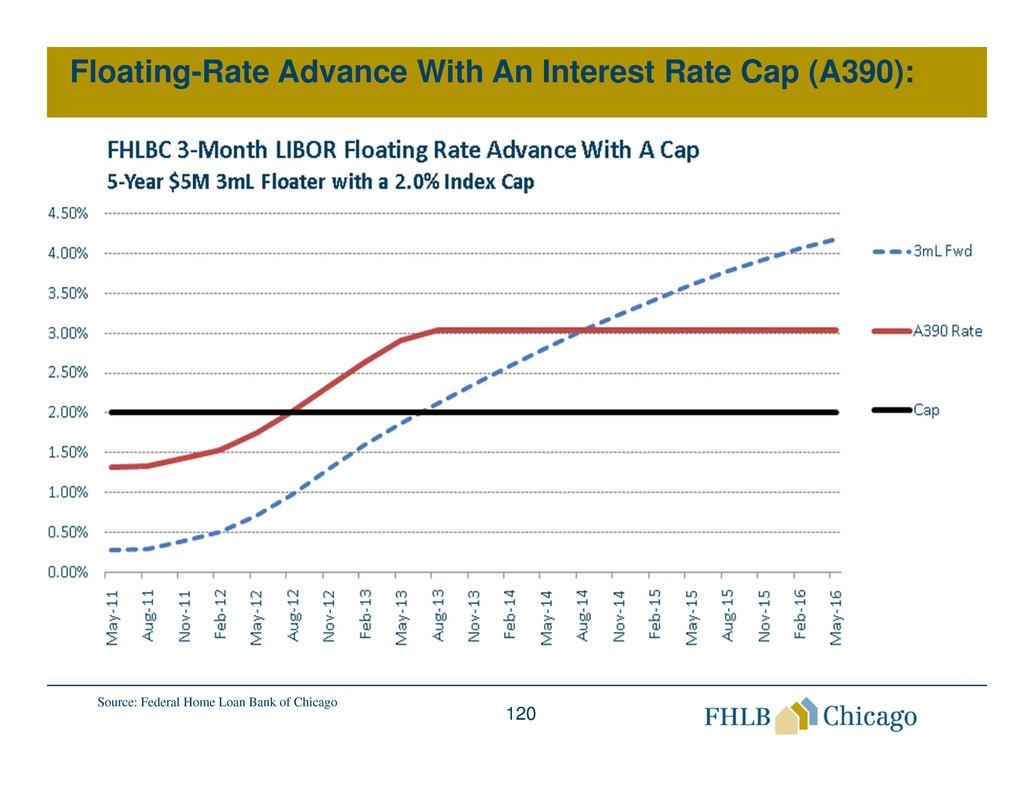

Floating-Rate Advance With An Interest Rate Cap (A390):

Source: Federal Home Loan Bank of Chicago

121

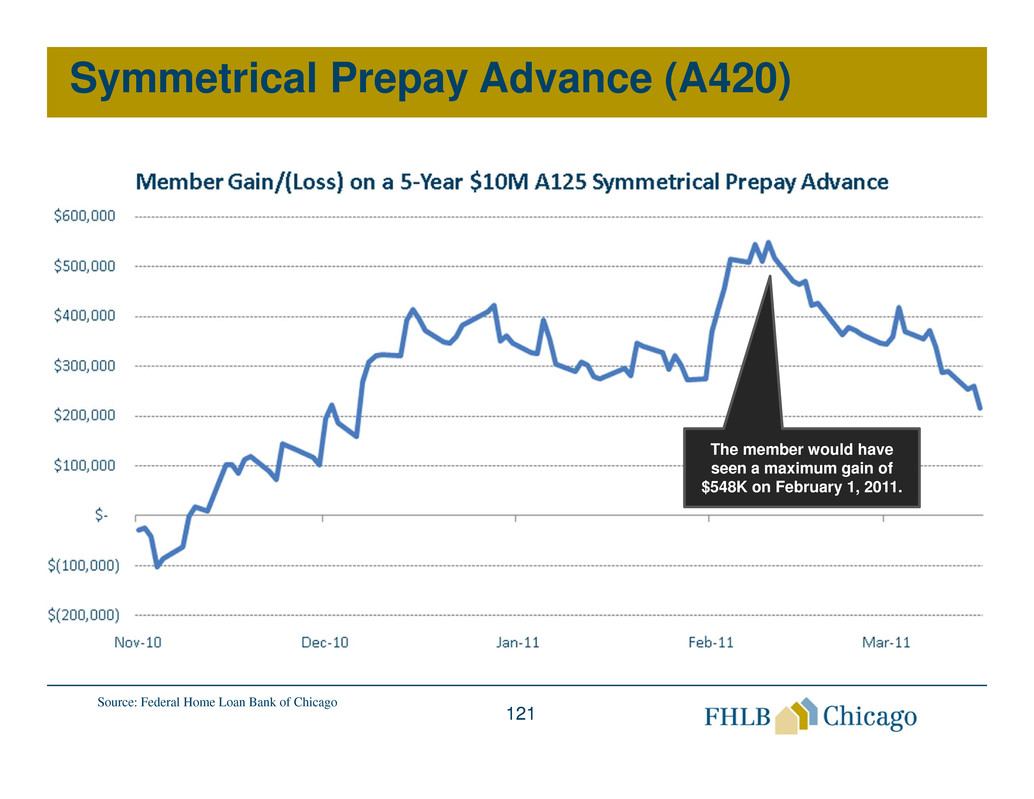

Symmetrical Prepay Advance (A420)

Source: Federal Home Loan Bank of Chicago

The member would have

seen a maximum gain of

$548K on February 1, 2011.

122

New Products

• Short-term floating rate advances

– Market Fed Effective Daily Floating Rate

Advance (A016)

– Late-Day Advances (A014 and A015)

– Member Overdraft Advance (A013)

• More to Come

123

Summary

• U.S. economic conditions are mixed as the economy

struggles to gain momentum.

• Employment and wage growth are the key economic

components.

• Members are utilizing the steep yield curve to enhance

their balance sheets using FHLBC products.

• Economic Uncertainties:

– Regulatory Changes

– End of Federal Reserve Purchases

– U.S. Fiscal Issues

124

FHLBC Member Services

• FHLBC Weekly Market Update

– Every Thursday afternoon at 3 p.m.

– Recent guests discussing topics such as:

Commercial real estate

Economic conditions

Asset liability management

Status of the municipal bond market

Leverage strategies

More to come!

125

Contact Information

Matt Feldman Roger Lundstrom

mfeldman@fhlbc.com rlundstrom@fhlbc.com

312-565-5834 312-565-5714

Chad Brandt Patrick Quinn

cbrandt@fhlbc.com pquinn@fhlbc.com

312-565-6915 312-552-1733