Welcome FHLBC Member Meetings November 2013 Exhibit 99.1

Matt Feldman, President and CEO

3 This presentation contains forward-looking statements which are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “anticipates,” “believes,” “expects,” “could,” “plans,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. We caution that, by their nature, forward-looking statements involve risk or uncertainty, that actual results could differ materially from those expressed or implied in these forward- looking statements, and that actual events could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, instability in the credit and debt markets, economic conditions (including effects on, among other things, mortgage-backed securities), changes in mortgage interest rates and prepayment speeds on mortgage assets, our ability to successfully transition to a new business model and to pay future dividends (including enhanced dividends on activity stock), our ability to meet required conditions to repurchase or redeem excess capital stock from our members, including maintaining compliance with our minimum regulatory capital requirements and determining our financial condition is sound enough to support such repurchases and redemptions, our ability to implement the Reduced Capitalization Advance Program, and the risk factors set forth in our periodic filings with the Securities and Exchange Commission, which are available on our website at www.fhlbc.com. We assume no obligation to update any forward-looking statements made in this presentation. In addition, certain information included here speaks only as of the particular date or dates included in this presentation, and the information in the presentation may have become out of date. We do not undertake an obligation, and disclaim any duty, to update any of the information in this presentation.

4 The data, scenarios and valuations provided in this presentation are for information purposes only and are provided as an accommodation and without charge. The data, scenarios and valuations are estimates only and may not represent the actual or indicative terms at which new (or economically equivalent) transactions could be entered into or the actual or indicative terms at which existing (or economically equivalent) transactions could be prepaid, terminated, liquidated, assigned or unwound. The scenarios and valuations were derived using proprietary pricing models and estimates and assumptions about relevant future market conditions and other matters, all of which are subject to change without notice. The scenarios and valuations were prepared without any consideration of your institution’s balance sheet composition, hedging strategies or financial assumptions and plans, any of which may affect the relevance of these valuations to your own analysis. We make no representations or warranties about the accuracy or suitability of any information in this presentation. This presentation is not intended to constitute legal, investment, or financial advice or the rendering of legal, consulting, or other professional services of any kind. “Mortgage Partnership Finance,” “MPF”, “MPF Xtra,” and “DPP” are registered trademarks of the Federal Home Loan Bank of Chicago. “Community First” is a trademark of the Federal Home Loan Bank of Chicago.

5 Agenda • FHLBC Updates • Guest Speakers

6 Housing Finance Reform and the FHLBanks • Bills in both Senate and House Recognize Importance of FHLBanks to our members • FHFA is moving forward with its plans for Fannie and Freddie and for the Common Securitization Platform • The FHLBanks need to be prepared to support our members throughout the process and thereafter • The Council of Federal Home Loan Banks unanimously approved positions, and I would like to share a few of them with you today.

7 FHLBank Consensus Positions 1. Our first priority must be to preserve our ability to provide low-cost funding and liquidity to members through advances, AMA programs, letters of credit, the Affordable Housing Programs, and other traditional member-centric products. This includes preserving our: Cooperative business model Joint and several liability for FHLBank debt Nexus to the Federal government, and Current investment authorities

8 FHLBank Consensus Positions 2. We support efforts to expand the FHLBanks’ role as aggregators of mortgage loans originated by our members. • May pool loans on balance sheet temporarily to improve secondary market execution. • Investors could be government-backed or private- sector security issuers and investors, including members, non-members and other FHLBanks.

9 FHLBank Consensus Positions 3. We support statutory change to provide FHLBanks authority to securitize mortgage loans and become MBS issuers, either directly or through subsidiaries or affiliates, provided existing powers are not negatively affected. Member needs would dictate any exercise of such authority An appropriate and legal capital structure would be necessary Prudent regulatory oversight would be required No undue risk to an individual FHLBank or counterparts, given the joint and several nature of FHLBank debt.

10 Additional FHLBank Positions • We must preserve the existing FHLBank mortgage programs. • We can be part of the solution to housing finance reform, but not the only solution. • We should accept the authority to be a securitizer of loans but we should not be mandated to do so. • We oppose shrinking the membership base, or imposing any limits on existing members.

Recent Financial Results Roger Lundstrom Chief Financial Officer

12 For a complete discussion of our financial results for the quarter ended September 30, 2013, please read our Form 10-Q which we expect to file on November 6, 2013 and will be available through our website. *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

Third Quarter 2013 Selected Financial Highlights 13 • Bank achieved strong profitability • No other-than-temporary impairment losses on private label MBS incurred • Reduction in loan loss reserve on MPF portfolio • Retained earnings reached $2.0 billion level for the Bank in the third quarter 2013 • Bank declared a dividend at two different rates for Class B1 activity stock and Class B2 membership stock • Reduced Capitalization Advance Program (RCAP) was announced *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

Income Statement

Year to Date September 30, 2013 Year to Date September 30, 2012 Difference Net interest income $332 $429 ($97) OTTI charges, credit portion - (15) 15 Net interest income, including adjustments* 342 383 (41) Non-interest expense** (72) (70) (2) Net Income 304 275 29 $ in millions 15 *Includes gain/(loss) on OTTI, trading securities, hedging, fair value option instruments, and debt extinguishment. **Includes compensation and benefits & other operating. *All quarterly results are unaudited. Third quarter 2013 results are preliminary. Selected Income Statement Items: Year to Date

Balance Sheet

17 Selected Balance Sheet Items: Assets 9/30/2013 12/31/2012 Difference Selected Assets Advances $14,843 $14,530 $313 MPF loans held in portfolio, net* 8,191 10,432 (2,241) Total investment securities 29,992 34,250 (4,258) Total Assets 61,120 69,584 (8,464) *All quarterly results are unaudited. Third quarter 2013 results are preliminary. *Net of allowance for credit losses of $32 million at September 30, 2013 and $42 million at December 31, 2012 $ in millions

18 Minimum Regulatory Capital Requirements Compliance The Bank continues to be in compliance with all required capital requirements. *All quarterly results are unaudited. Third quarter 2013 results are preliminary. September 30, 2013 Actual Requirement Capital-to-assets ratio 5.82% 4.00% (re ulatory) Leverage capital-to-assets ratio 8.73% 5.00% (regulatory) Risk-based capital $3.56 $1.49 $ in billions

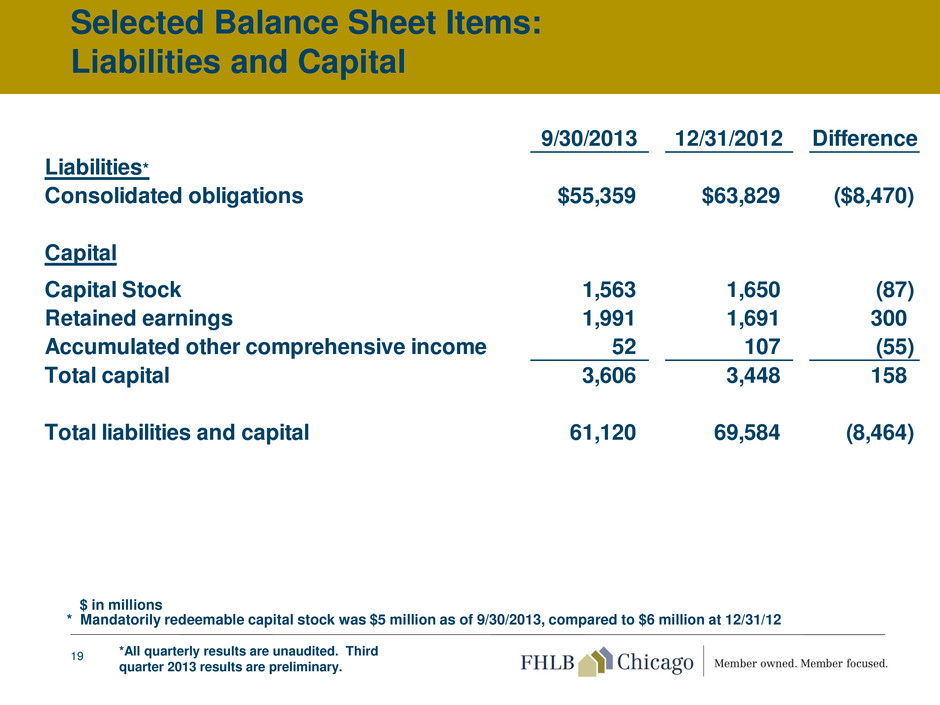

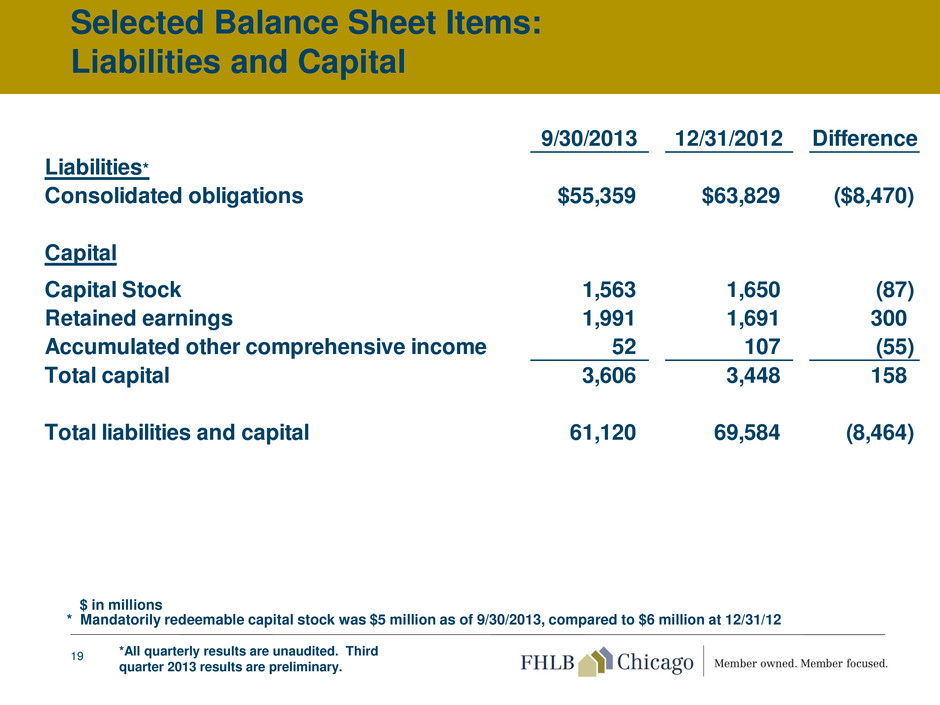

19 Selected Balance Sheet Items: Liabilities and Capital 9/30/2013 12/31/2012 Difference Liabilities* Consolidated obligations $55,359 $63,829 ($8,470) Capital Capital Stock 1,563 1,650 (87) Retained earnings 1,991 1,691 300 Accumulated other comprehensive income 52 107 (55) Total capital 3,606 3,448 158 Total liabilities and capital 61,120 69,584 (8,464) * Mandatorily redeemable capital stock was $5 million as of 9/30/2013, compared to $6 million at 12/31/12 *All quarterly results are unaudited. Third quarter 2013 results are preliminary. $ in millions

20 Quarter-End Advance Balances, at Par *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

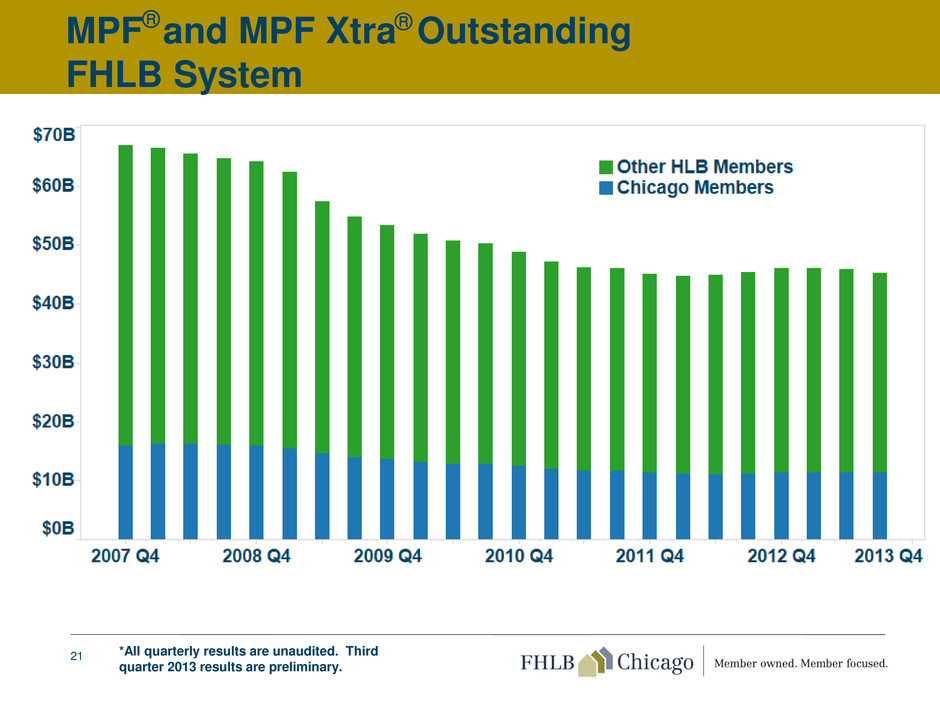

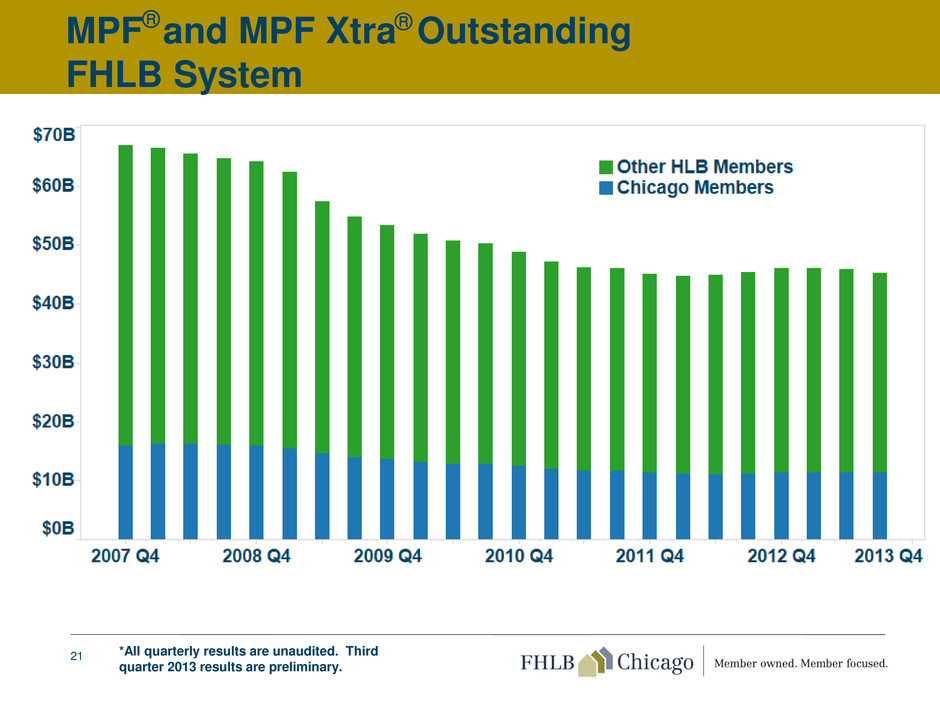

21 MPF and MPF Xtra Outstanding FHLB System ® ® *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

Retained Earnings Growth Bank retained earnings reached $2.0 billion in the third quarter 2013. Subject to our performance in the future, we plan to continue to build retained earnings to benefit our members in three important ways: • First and foremost, we are positioning the Bank to assure you that we will always be ready and available to support your short- term financing needs, in all economic scenarios. • Second, we are building a layer of protection for your stock investment in the Bank to maintain its liquidity. • Finally, as we are demonstrating through the Reduced Capitalization Advance Program (RCAP), we are exploring ways to provide you with greater leverage to borrow from the Bank. 22 *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

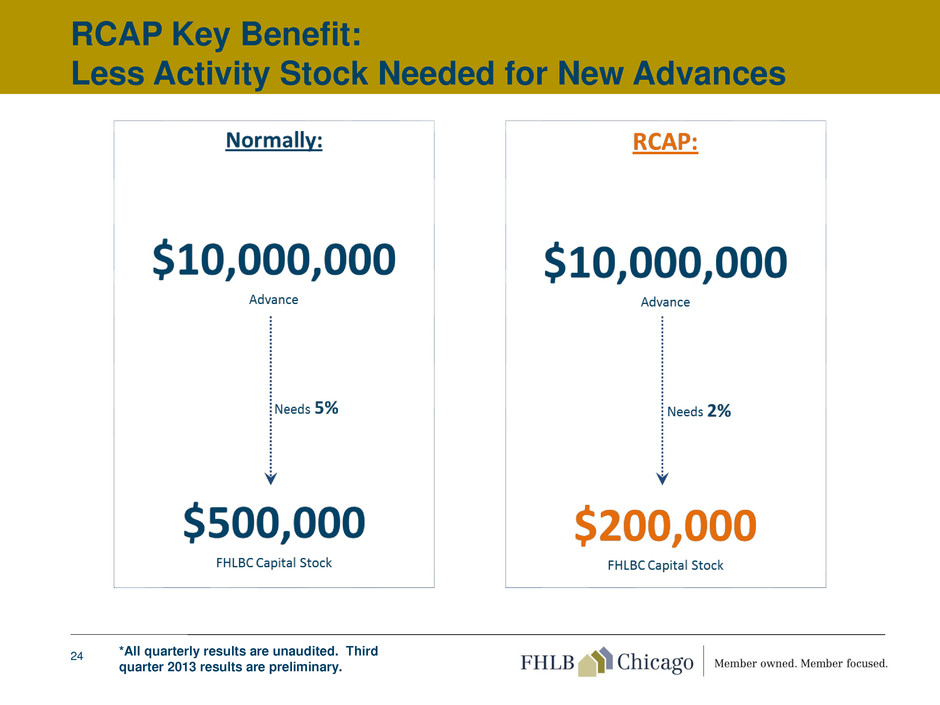

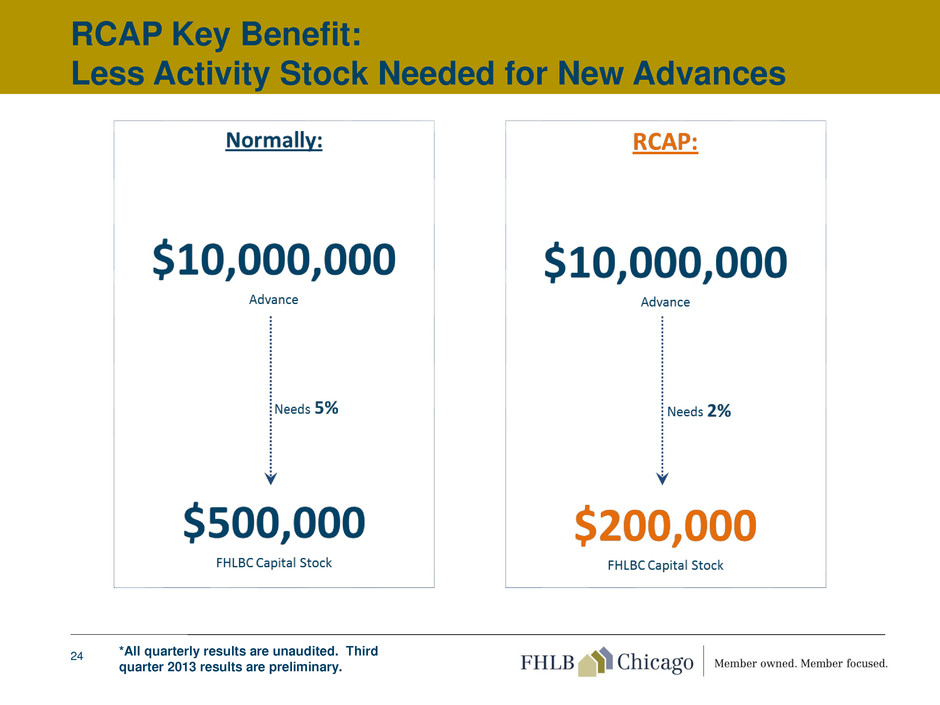

Reduced Capitalization Advance Program (RCAP) • On October 8th, 2013, the Bank introduced RCAP in order to increase the value of membership by using the Bank’s financial strength. • RCAP will allow members to leverage stock with activity stock of 2% to support longer-term advances instead of the normal 5% under the Capital Plan’s general provisions. • $10 billion in advances will be available under the RCAP program: Group A: $1 billion will be reserved for members with less than $1.095 billion of assets, calculated as the 3-year average of year-end assets as of 12/31/2012. This amount is available until 12/16/2013. Group B: $9 billion will be open to all other members. • Program began on October 29th on a first-come first-served basis and runs through December 31, 2013. 23 *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

24 RCAP Key Benefit: Less Activity Stock Needed for New Advances *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

Dividend 25 Cash dividend declared by Board of Directors based on preliminary third quarter 2013 results • Reward Members that use the Bank: • Class B1 activity stock: equal to annual yield of 1.30% • Class B2 membership stock: equal to annual yield of 0.30% • Based on average stock outstanding for the third quarter of 2013 • Payment Date: November 15, 2013 *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

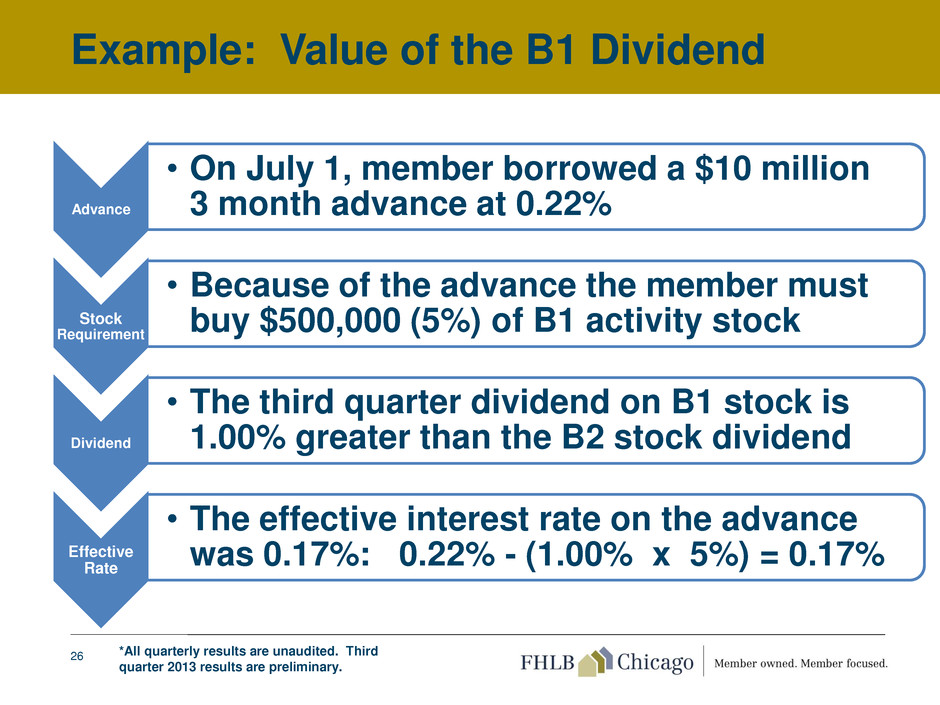

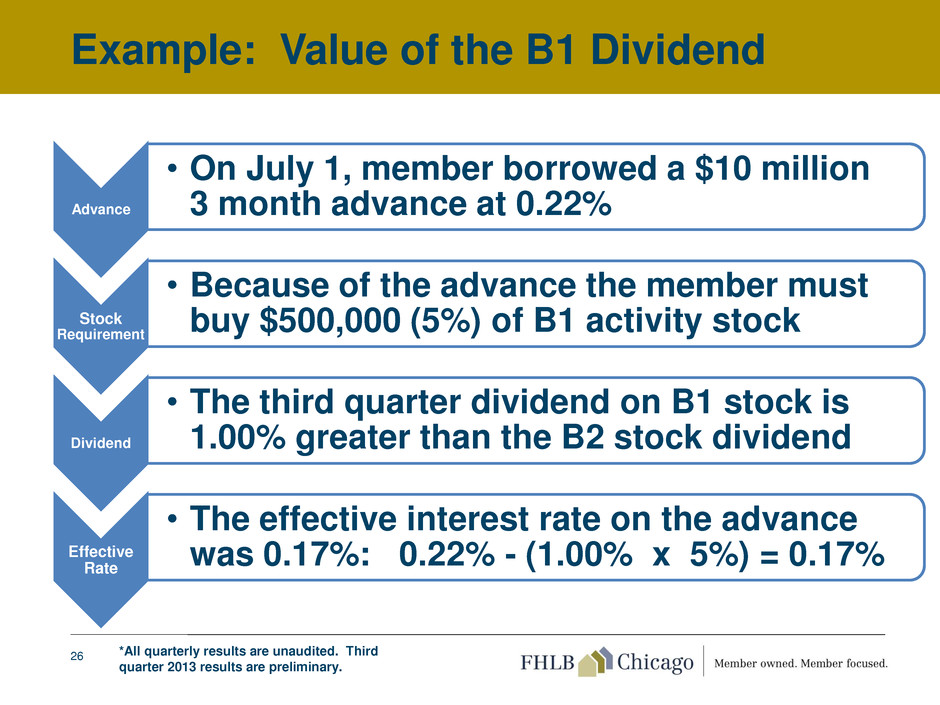

Advance • On July 1, member borrowed a $10 million 3 month advance at 0.22% Stock Requirement • Because of the advance the member must buy $500,000 (5%) of B1 activity stock Dividend • The third quarter dividend on B1 stock is 1.00% greater than the B2 stock dividend Effective Rate • The effective interest rate on the advance was 0.17%: 0.22% - (1.00% x 5%) = 0.17% Example: Value of the B1 Dividend 26 *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

• The financial health of the Bank remains strong. • Future Bank balance sheet will be more heavily impacted by member use and needs. • Retained earnings growth was robust, providing a strong foundation for future bank initiatives that provide member value. Conclusions 27 *All quarterly results are unaudited. Third quarter 2013 results are preliminary.

• $50 million revolving loan fund • Designed to support affordable housing and economic development in Illinois and Wisconsin • Evaluating proposals made by potential partner community organizations • Plan to continue making commitments on a rolling basis until the $50 million is exhausted • We currently plan to make our first commitment by the end of this year Community First Fund™ Update 28

29

John Stocchetti EVP, Products & Operations Member Products Update 30

Member Products - A Continuing Story 31 Listening MPF Product Enhancements eBanking Rollout MPF Invest and Grow Strategy Member Outreach ) ) ( (

Five Word Objective 32 To serve our members well

33 eBanking

eBanking Vision – 2012 Regional Meetings eBanking Transactions Authorization Initiate PUD LOC and Safekeeping Manage a portion of advances business, including transaction initiation, use of calculators, ability to manage capital stock, & reporting capabilities Manage collateral balances, transactions, QCR listing, pledge & release Manage cash via intraday balance, transaction activity, & EFT initiation Apply for AHP/DPP® Grants at your fingertips 34

eBanking Results To Date 35 Project fully completed June 2013 as scheduled 245 members have completed the registration process and are able to conduct transactions 37 members are working through the registration process 169 members made themselves eligible for Affordable Housing Program online and 143 applications were submitted Approximately 25% of all standard advances were done via eBanking in September, including one that was over $100 million Members have also initiated letters of credit, safekeeping, and wires online Managing transaction authorizations online has been “a hit” – members communicate the importance of “self-sufficiency”

eBanking – Future Enhancements 36 Create Capital Stock Module and produce stock recalculation and CEO notifications Redesign Safekeeping Module (add pledge and release collateral form, confirmation of submitted form, dual validation of submission, and form history) Admin Module enhancements (enhance member control on account and module access and add subscriptions to email lists) Add tool tips Liquidity and Funding Module enhancements Information and Documents page enhancements Notifications enhancements (calendar reminders of maturity dates and notifications to Member Security Administrators about pending items) Standardize styles across all pages Re-write AHP reports

37 It’s Not Just About Automation Customer Service Reporting Training & Education How may I help you? $ % # Operating Safely & Soundly Infrastructure Enhancement $ Member Outreach Product Enhancements

Member Product Support Group (MPSG) Member Outreach 38

Member Products Outreach 39 Continuing initiatives targeting specific members educating them on how to use the Bank 2013 initiatives: “Calling Teams” communicating the benefits of: Wiring on eBanking Utilizing a PUD LOC Expanding Collateral Usage Expanding Safekeeping Usage

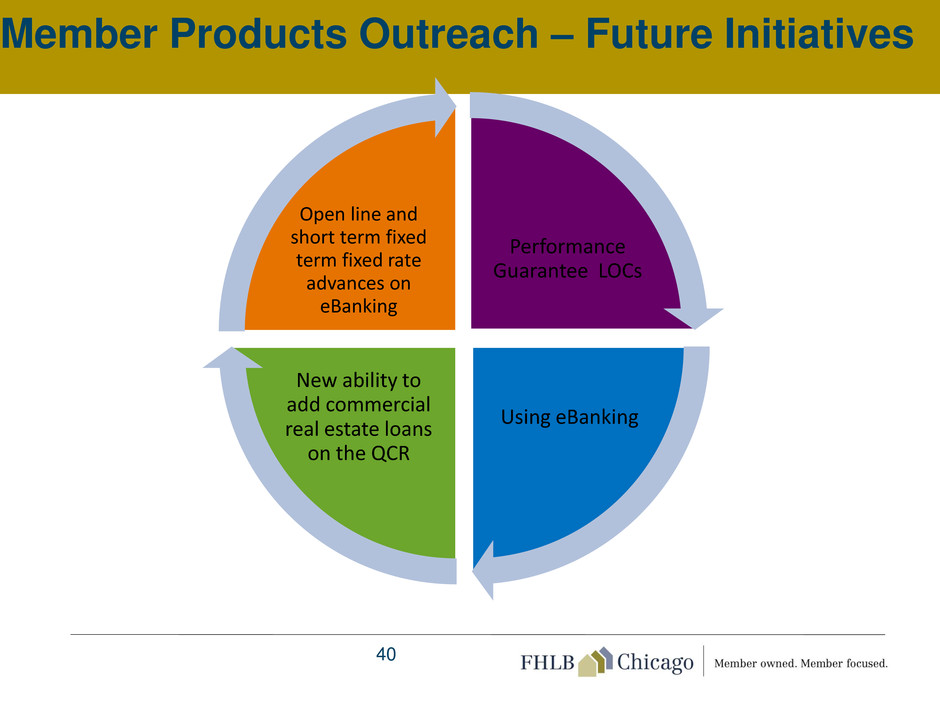

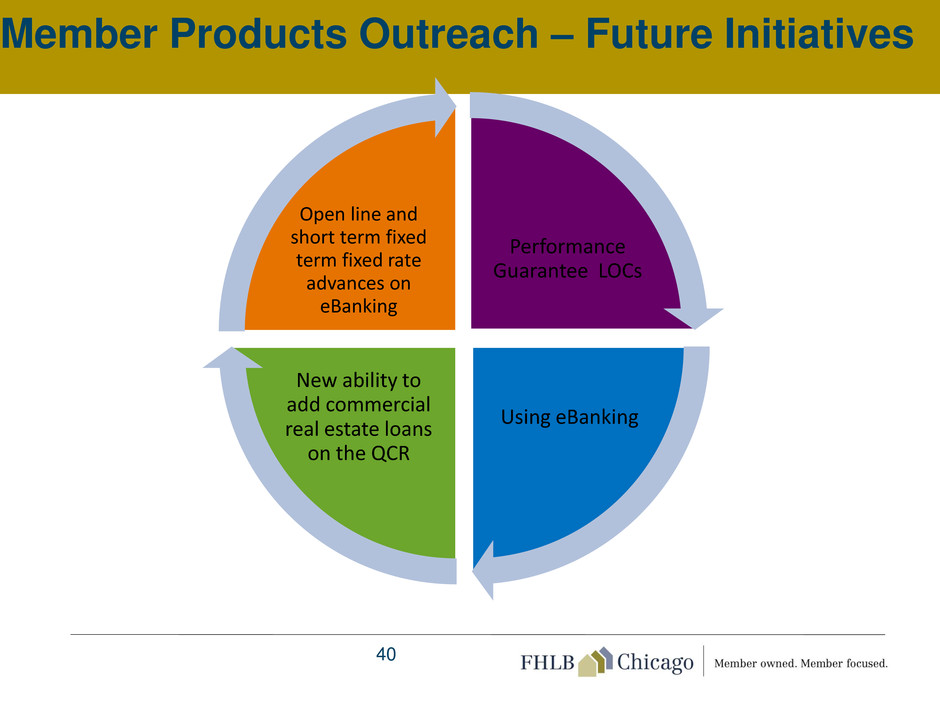

Member Products Outreach – Future Initiatives 40 Performance Guarantee LOCs Using eBanking New ability to add commercial real estate loans on the QCR Open line and short term fixed term fixed rate advances on eBanking

41 MPF UPDATE

Strategic Vision – Invest & Grow 2013 SELLERS FLOW PFI PFI PFI PFI PFI Fannie Mae MPF Banks Private Capital Ginnie Mae PFI PFI PFI PFI PFI PFI Other Investors OPERATIONAL SUPPORT FHLB Chicago INVESTORS PFI PFI Mortgage Program Loans 42

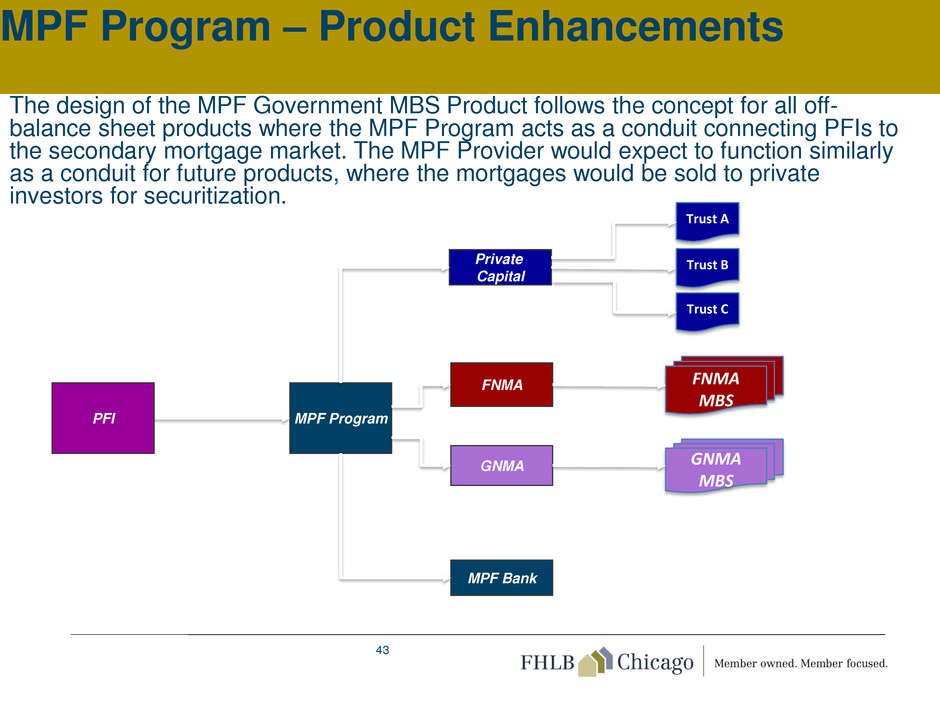

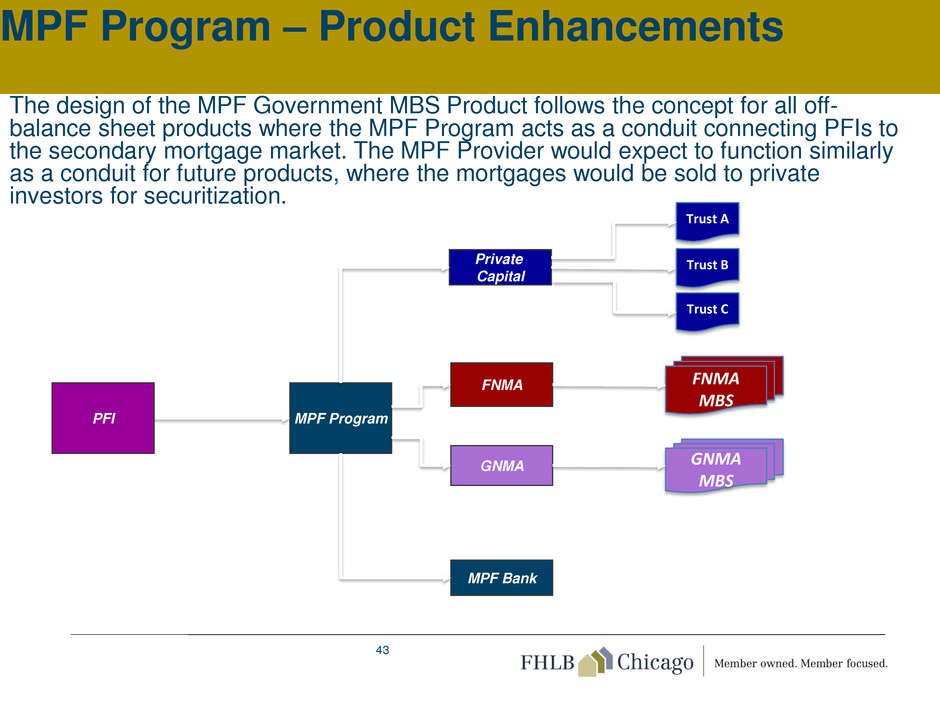

The design of the MPF Government MBS Product follows the concept for all off- balance sheet products where the MPF Program acts as a conduit connecting PFIs to the secondary mortgage market. The MPF Provider would expect to function similarly as a conduit for future products, where the mortgages would be sold to private investors for securitization. MPF Program – Product Enhancements 43 MPF Program Private Capital PFI FNMA FNMA MBS MPF Bank Trust A Trust C Trust B GNMA GNMA MBS

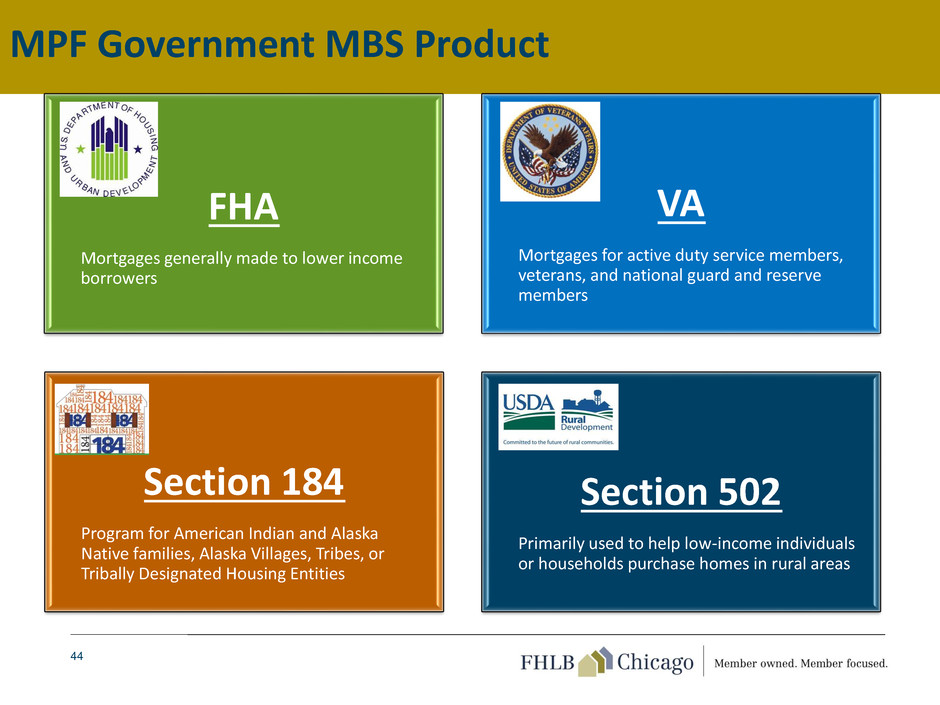

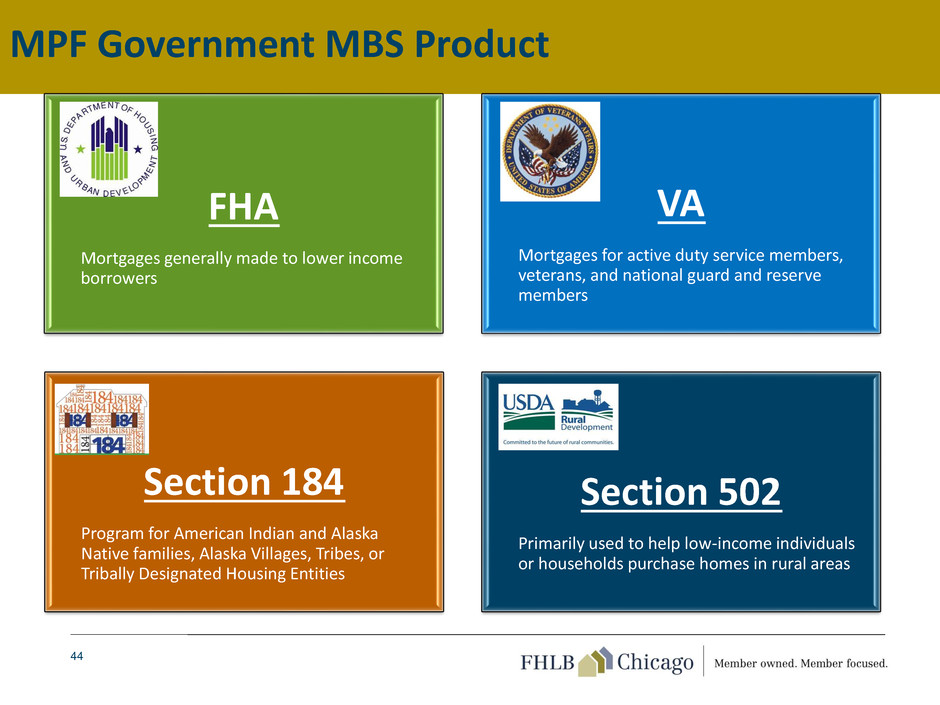

44 FHA Mortgages generally made to lower income borrowers VA Mortgages for active duty service members, veterans, and national guard and reserve members Section 184 Program for American Indian and Alaska Native families, Alaska Villages, Tribes, or Tribally Designated Housing Entities Section 502 Primarily used to help low-income individuals or households purchase homes in rural areas MPF Government MBS Product

Select 2013 MPF Developments 45 Conditional Approval Received for MPF Government MBS Product Enhanced QC PFI Training & Education Reorganization to Better Support Documentation & Operations Needs Systems Enhancements

MPF – The Future Continued expanded QC Expanded PFI training Continued systems enhancements Enhanced Account Management function and PFI outreach Continued focus on new products 46

47 We hear your voice We research your needs We implement your suggestions We Are Listening Don’t be shy, we WANT to hear from you!

Conference organized to directly engage and support the technology efforts of our members 2013 Focus: Managing Technology Risk • Technology trends • Cybercrime in Financial Services • State of Risk Management • Business Continuity Management • Vendor Management • Social Engineering Aggregate technology purchasing power of members 48 Member Technology Conference

49 Selling into the Secondary Market 101

50 Questions