Subject to Completion and Modification

SLM FUNDING LLC HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND THE OTHER DOCUMENTS SLM FUNDING LLC HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT SLM FUNDING LLC AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE ATWWW.SEC.GOV. ALTERNATIVELY, SLM FUNDING LLC, ANY UNDERWRITER OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING 1-800-321-7179.

Preliminary Remarketing Free-Writing Prospectus

(up to)

$

CLASS A-3 NOTES

SLM Student Loan Trust 2005-7

Issuing Entity

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

The remarketing agents are remarketing, on behalf of SLM Student Loan Trust 2005-7, the class A-3 notes (the “class A-3 notes”). The class A-3 notes were originally issued by the trust on August 11, 2005. If successfully remarketed on April 25, 2008, the class A-3 notes will have the following terms:

| | | | | | | | | | | | |

Class

| | Outstanding

Principal Amount

| | Interest Rate

| | Price

| | | Next Reset Date*

| | Legal

Maturity Date

|

Class A-3 Notes | | $ | 266,000,000 | | 3-month LIBOR plus % | | 100.00 | % | | N/A | | July 25, 2025 |

| * | Absent a failed remarketing or an exercise of the related call option on or before the April 25, 2008 reset date, there will be no subsequent reset dates for the class A-3 notes. |

Other than as provided herein, no person has been authorized to give any information or to make any representations other than those contained in this preliminary remarketing free-writing prospectus and, if given or made, such information or representations must not be relied upon. This preliminary remarketing free-writing prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities other than the class A-3 notes nor an offer of such securities to any person in any state or other jurisdiction in which it is unlawful to make such offer or solicitation. The delivery of this preliminary remarketing free-writing prospectus at any time does not imply that the information herein is correct as of any time after its date.

All existing class A-3 noteholders are hereby advised that if you want to retain your class A-3 notes you are required to submit a hold notice prior to 12:00 noon, New York City time, on April 17, 2008, to one of the remarketing agents. Otherwise your notes will be deemed to have been tendered for remarketing.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the class A-3 notes, nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this preliminary remarketing free-writing prospectus. Any representation to the contrary is a criminal offense.

The notes are asset-backed securities and are obligations of the issuing entity. They are not obligations of or interests in SLM Corporation, the sponsor, the depositor, any seller of loans to the depositor, the administrator, the servicer or any of their affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

Remarketing Agents

| | | | |

Banc of America Securities LLC | | Deutsche Bank Securities | | Merrill Lynch & Co. |

April 3, 2008

THIS PRELIMINARY REMARKETING FREE-WRITING PROSPECTUS SUPERSEDES IN ITS ENTIRETY THE PRELIMINARY REMARKETING FREE-WRITING PROSPECTUS DATED APRIL 2, 2008.

REMARKETING TERMS SUMMARY

On April 25, 2008 (absent a failed remarketing, or the exercise by SLM Corporation or one of its subsidiaries of its call option), the class A-3 notes will be reset from their current terms to the following terms, which terms will be applicable until the final maturity date for the class A-3 notes:

| | | |

| | | Class A-3 Notes |

Original principal amount | | $ | 266,000,000 |

Current outstanding principal amount | | $ | 266,000,000 |

Principal amount being remarketed(1) | | $ | |

Remarketing Terms Determination Date | | | April 15, 2008 |

Notice Date(2) | | | April 17, 2008 |

Spread Determination Date | | | April 22, 2008 |

Current reset date | | | April 25, 2008 |

All Hold Rate | | | Three-Month LIBOR plus % |

Next applicable reset date(3) | | | N/A |

Interest rate mode | | | Floating |

Index | | | Three-Month LIBOR(4) |

Spread(5) | | | Plus % |

Day-count basis | | | Actual/360 |

Weighted average remaining life | | | (6) |

(1) | Subject to the receipt of timely delivered Hold Notices. |

(2) | Unless an existing class A-3 noteholder submits a Hold Notice to one of the remarketing agents prior to 12:00 noon, New York City time, on the Notice Date, such notes will be irrevocably deemed to have been tendered for remarketing. |

(3) | Absent a failed remarketing or an exercise of the related call option on or before the April 25, 2008 reset date, there will be no subsequent reset dates for the class A-3 notes. |

(4) | Three-month LIBOR will be reset on each LIBOR Determination Date in accordance with the procedures set forth under “Description of the Notes—Determination of Indices—LIBOR” in this preliminary remarketing free-writing prospectus. |

(5) | To be determined on the Spread Determination Date. |

(6) | The weighted average remaining life to maturity of the class A-3 notes at various assumed prepayment rates will be found in Exhibit I “Weighted Average Remaining Life of the Class A-3 Notes,” which will be attached to the preliminary remarketing prospectus supplement to be sent to potential investors on the remarketing terms determination date. |

i

The remarketing agents may be contacted as follows:

Banc of America Securities LLC

Mail Code: NY1-301-02-01

9 West 57th Street

New York, New York 10019

Attention: Patrick Beranek

Telephone: 212-847-5095

E-mail: patrick.beranek@bankofamerica.com

Deutsche Bank Securities Inc.

1251 Avenue of the Americas

New York, New York 10020

Attention: Brian Wiele

Telephone: 212-250-7730

Facsimile: 212-797-2031

E-mail: brian.wiele@db.com

Merrill Lynch, Pierce, Fenner & Smith Incorporated

Merrill Lynch World Headquarters

4 World Financial Center

New York, New York 10019

Attention: Brian Kane

Telephone: 212-449-3660

E-mail: brian_f_kane@ml.com

ii

INTRODUCTION

The Student Loan-Backed Notes issued by SLM Student Loan Trust 2005-7 consist of the class A-3 notes, as well as the class A-5 notes (referred to as the “other reset rate notes” and together with the class A-3 notes, the “reset rate notes”), the class A-1, class A-2 and class A-4 notes (collectively referred to as the “floating rate class A notes”) and the class B notes (which, together with the floating rate class A notes, and the reset rate notes are referred to as the “notes”). As of the date of this preliminary remarketing free-writing prospectus, the class A-1 notes have been paid in full and are no longer outstanding. None of the notes other than the class A-3 notes (collectively referred to as the “other notes”) are being offered under this preliminary remarketing free-writing prospectus. Any information contained herein with respect to the other notes is provided only to present a better understanding of the class A-3 notes. The class A-3 notes were originally offered for sale pursuant to the prospectus supplement, dated August 3, 2005, and the related base prospectus, dated August 1, 2005.

Banc of America Securities LLC, Deutsche Bank Securities Inc. and Merrill Lynch, Pierce, Fenner & Smith Incorporated are serving as the remarketing agents (in such capacity, collectively, the “remarketing agents”) for the class A-3 notes.

The notes were issued on August 11, 2005 (which was the original “closing date”), are obligations of an issuing entity known as SLM Student Loan Trust 2005-7 (referred to as the “trust”), and are secured by the assets of the trust, which consist primarily of a pool of consolidation student loans (the “trust student loans”).

Principal and interest on the notes are payable as described herein on the 25th day of each January, April, July and October or, if such day is not a business day, then on the next business day (each, a “distribution date”). April 25, 2008 is the initial “reset date” for the class A-3 notes. The first distribution date after the initial reset date is scheduled to occur on July 25, 2008. If successfully remarketed, interest will accrue on the class A-3 notes at the rate specified in the summary until their final maturity date. Interest will accrue on the outstanding principal balance of the class A-3 notes during three-month accrual periods and will be paid on each distribution date. Until the final maturity date, interest on the class A-3 notes will be calculated based on the actual number of days elapsed in each accrual period and a 360-day year. Each accrual period will begin on a distribution date and end on the day before the next distribution date.

Investors in the class A-3 notes are strongly urged to keep in contact with the remarketing agents because notices and required information pertaining to the remarketing sent to the clearing agencies by the administrator or the remarketing agents, as applicable, may not be communicated in a timely manner to the related beneficial owners.

iii

THE INFORMATION IN THIS PRELIMINARY REMARKETING FREE-WRITING

PROSPECTUS IS NOT COMPLETE, IS PRELIMINARY IN NATURE, AND IS NOT

INTENDED TO PROVIDE A COMPLETE DESCRIPTION OF THE NOTES, THE

TRUST OR THE REMARKETING. THIS PRELIMINARY REMARKETING FREE-WRITING

PROSPECTUS WILL BE SUPPLEMENTED OR SUPERSEDED IN ITS

ENTIRETY BY A PRELIMINARY REMARKETING PROSPECTUS SUPPLEMENT

AND A BASE PROSPECTUS THAT WILL PROVIDE ADDITIONAL INFORMATION

ON THE REMARKETING OF THE CLASS A-3 NOTES.

NOTICE TO INVESTORS

The class A-3 notes may not be offered or sold to persons in the United Kingdom in a transaction that results in an offer to the public within the meaning of the securities laws of the United Kingdom.

The class A-3 notes are currently listed on the Luxembourg Stock Exchange. You may consult with Deutsche Bank Luxembourg S.A., the Luxembourg listing agent for the class A-3 notes, for additional information regarding their status.

FORWARD-LOOKING STATEMENTS

Certain statements contained in or incorporated by reference in this preliminary remarketing free-writing prospectus consist of forward-looking statements relating to future economic performance or projections and other financial items. These statements can be identified by the use of forward-looking words such as “may,” “will,” “should,” “expects,” “believes,” “anticipates,” “estimates,” or other comparable words. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance with governmental regulations, customer preferences and various other matters, many of which are beyond our control. Because we cannot predict the future, what actually happens may be very different from what is contained in our forward-looking statements.

iv

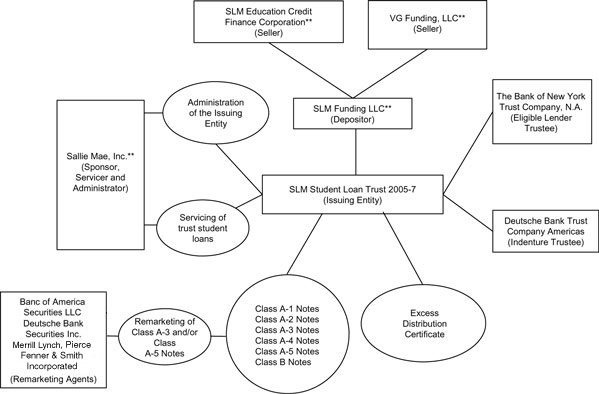

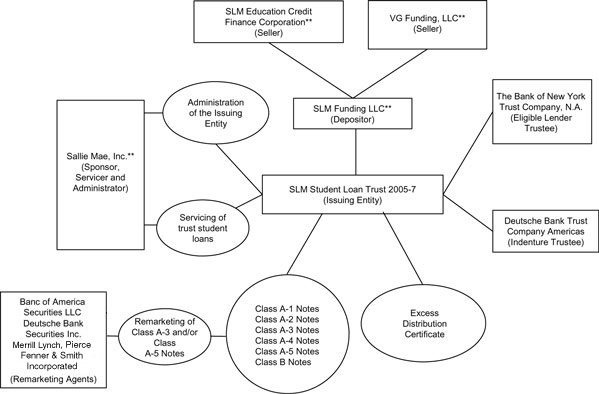

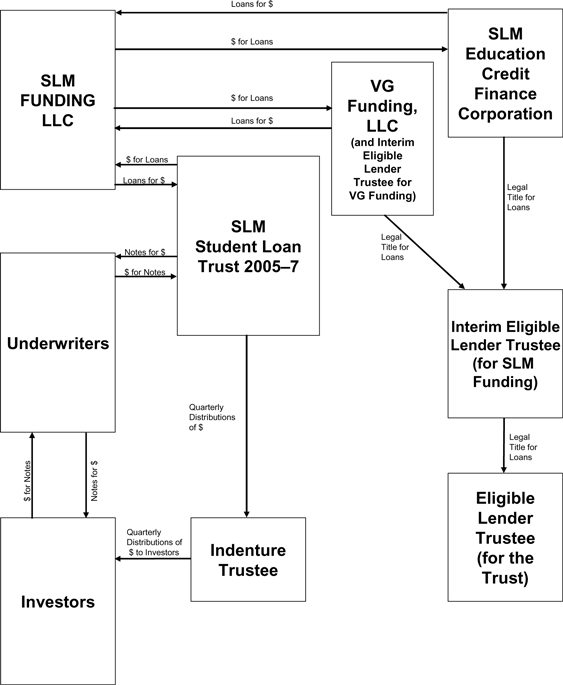

SUMMARY OF PARTIES

TO THE TRANSACTION*

| * | This chart provides only a simplified overview of the relations between the key parties to the transaction. Refer to this preliminary remarketing free-writing prospectus for a further description. |

| ** | Each of these entities is a direct or indirect wholly-owned subsidiary of SLM Corporation. |

v

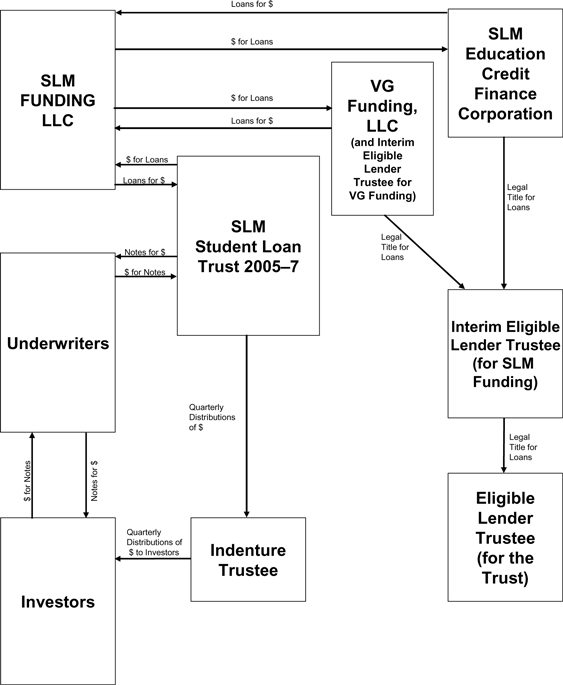

PAYMENT FLOWS AND

DELIVERIES ON THE ORIGINAL

CLOSING DATE

vi

ISSUING ENTITY

SLM Student Loan Trust 2005-7.

CLASS A-3 NOTES

The Reset Rate Class A-3 Student Loan-Backed Notes that are being remarketed hereunder were originally issued by the trust on August 11, 2005 in the principal amount of $266,000,000 and are currently outstanding in the same amount.

Interest.Interest will accrue on the outstanding principal balance of the class A-3 notes during each accrual period and will be paid on each distribution date. If successfully remarketed, the class A-3 notes will bear interest until their legal maturity date at an annual rate equal to three-month LIBOR plus % based on the actual number of days elapsed in each accrual period and a 360-day year (for purposes of this preliminary remarketing free-writing prospectus, three-month LIBOR is referred to as “LIBOR”). During their initial reset period, the class A-3 notes have borne interest at a fixed annual rate of 4.41%. Each accrual period will begin on a distribution date and will end on the day before the next distribution date. The next accrual period for the class A-3 notes will begin on April 25, 2008 and end on July 24, 2008.

Principal.Payments of principal to the class A-3 notes will be made sequentially after the class A-2 notes and before the class A-4 notes and class A-5 notes. The class A-1 notes, which were earlier in the sequence of principal payments, have been paid in full and are no longer outstanding; however, the class A-2 notes are still outstanding. Absent an event of default, no principal will be paid to the class A-3 notes until the outstanding principal balance of the class A-2 notes has been reduced to zero.

The initial reset date for the class A-3 notes is April 25, 2008. Absent a failed remarketing or an exercise of the related call option by SLM Corporation or one of its subsidiaries with respect to that reset date, there will be no subsequent reset dates for the class A-3 notes. The legal maturity date for the class A-3 notes is July 25, 2025.

No principal payments have been allocated to the class A-3 notes prior to the date of this preliminary remarketing free-writing prospectus and there are no sums on deposit in the accumulation account for the class A-3 notes. Therefore, there will be no payment of principal on the class A-3 notes from the trust on the April 25, 2008 reset date.

Reset Date Procedures.

Remarketing Terms Determination Date.Not later than the remarketing terms determination date, which for the class A-3 notes is April 15, 2008, and for the other class of reset rate notes will be at least eight business days prior to the related reset date, the remarketing agents, in consultation with the administrator, will determine for the applicable class, among other things, the applicable interest rate mode, the length of the reset period, the identities of any eligible swap counterparties, if applicable, and the all hold rate. The all hold rate for any class of reset rate notes will be the interest rate applicable for that class of reset rate notes for the next reset period if all holders of that class of reset rate notes choose not to tender their notes to the remarketing agents, which for the class A-3 notes and the initial reset date occurring on April 25, 2008 is equal to LIBOR plus %. In connection with the initial reset date, holders of the

1

class A-3 notes will be given not less than two business days to choose whether to hold their notes by delivering a hold notice to the remarketing agents. In the absence of the delivery of a hold notice to the remarketing agents by the notice date, which is April 17, 2008 for the class A-3 notes, such holders will be deemed to have tendered their notes to the remarketing agents for remarketing.

Hold Notices.On or prior to the notice date, which for the class A-3 notes is April 17, 2008, hold notices may be presented to the remarketing agents and such notes will be retained by the related noteholder. Any class A-3 notes for which a hold notice is not timely received will be deemed to be tendered and will be remarketed on the related reset date.

Absent a failed remarketing, holders of reset rate notes that wish to sell all or some of their reset rate notes on a reset date for that class of reset rate notes will be able to obtain a 100% repayment of principal by tendering the applicable amount of their reset rate notes pursuant to the remarketing process. Tender is not mandatory if such class of reset rate notes being remarketed is denominated in U.S. Dollars in both the then-current reset period and the immediately following reset period. In all other situations, tender is mandatory, and the holders of such reset rate notes will be deemed to have tendered their notes pursuant to the remarketing process. If there is a failed remarketing of the applicable class of reset rate notes, however, holders of such reset rate notes will be required to retain their reset rate notes during the immediately following reset period, absent any separate secondary market trades, and will not be permitted to exercise any remedies as a result of the failure of their class of reset rate notes to be remarketed on the related reset date.

Spread Determination Date.Absent receipt by the remarketing agents of hold notices from 100% of the holders of the class A-3 notes or an exercise of the related call option, the spread will be determined by the remarketing agents on the spread determination date, which is April 22, 2008 with respect to the class A-3 notes, as the lowest spread to LIBOR, but not less than the all hold rate (which is equal to LIBOR plus % for the class A-3 notes), which would permit all of the notes tendered for remarketing to be purchased at a price equal to 100% of the outstanding principal balance of that class. In such case, absent a failed remarketing on April 25, 2008, the class A-3 notes will be reset to bear interest until their final maturity date at a floating rate equal to the sum of LIBOR plus %.

Spread Supplement Account.In the event of a successful remarketing of the class A-3 notes, SLM Corporation, the indirect parent of the trust, or one of its affiliates, intends to make a one-time capital contribution to the trust in an amount that represents the excess of the expected cash flow requirements in order to pay noteholders of the class A-3 notes interest at the annualized stated reset rate of interest over the amount that would be payable by the trust if such class of notes bore an annual rate of interest equal to LIBOR plus 0.75% (as evidenced by a satisfaction of the rating agency condition). Such amounts will be deposited into a newly created trust account (the “spread supplement account”) for the benefit of the class A-3 noteholders exclusively. On each distribution date, the indenture trustee will withdraw the excess of interest earned on the class A-3 notes at the applicable stated reset rate of interest over interest that would have been payable on such class of notes if they bore interest at an annual rate of LIBOR plus 0.75% and pay such amounts directly to the class A-3 noteholders. All investment earnings on the spread supplement account will be paid to the excess distribution certificateholder on each

2

distribution date. No amounts on deposit in the spread supplement account will become a part of available funds nor may be used to satisfy any other obligations of the trust. On each distribution date, any amount on deposit in the spread supplement account in excess of the required specified balance for such account will be withdrawn and paid to the excess distribution certificateholder. Following payment in full of all outstanding amounts on the class A-3 notes, any sums remaining on deposit in the spread supplement account will be withdrawn on the related distribution date and paid to the excess distribution certificateholder.

Reset Date.The initial reset date for the class A-3 notes is April 25, 2008. Absent a failed remarketing, there will be no subsequent reset dates with respect to the class A-3 notes. Reset dates for the other reset rate notes will always occur on a distribution date. The related reset period will always end on a distribution date and may not extend beyond the maturity date of that class of notes. Absent a failed remarketing, holders that wish to be repaid on a reset date will be able to obtain a 100% repayment of principal by tendering their reset rate notes pursuant to the remarketing process. If there is a failed remarketing of a class of reset rate notes, however, existing holders of that class will not be permitted to exercise any remedies as a result of the failure of their class of reset rate notes to be remarketed on the related reset date.

With respect to the class A-3 notes, the trust will be obligated to make payments of interest from available funds at an annual rate equal to LIBOR plus 0.75%. Amounts due in excess of that interest rate will be paid solely from amounts on deposit in the spread supplement account.

Failed Remarketing.There will be a failed remarketing for the class A-3 notes if:

| • | | the remarketing agents cannot determine the applicable required reset terms on or before the remarketing terms determination date; |

| • | | the remarketing agents cannot establish the required spread on the spread determination date; |

| • | | either sufficient committed purchasers cannot be obtained for all of the class A-3 notes at the spread set by the remarketing agents, or committed purchasers default on their purchase obligations and the remarketing agents choose not to purchase the class A-3 notes themselves; |

| • | | any rating agency then rating the notes has not confirmed or upgraded its then-current ratings of any class of notes, if that confirmation is required; or |

| • | | certain conditions specified in the remarketing agreement are not satisfied. |

In the event of a failed remarketing, all existing holders of the class A-3 notes will retain their notes, the interest rate for the class A-3 notes will be reset to a failed remarketing rate of LIBOR plus 0.75% and the related reset period will be three months.

Call Option.SLM Corporation, or one of its subsidiaries, has the option to purchase each class of reset rate notes in its entirety on its related reset date. If it exercises this right, the interest rate for that class of reset rate notes will be (1) for any class for which no related interest rate swap

3

agreement was in effect during the previous reset period, the floating rate applicable for the most recent reset period during which the failed remarketing rate was not in effect, or (2) for any class for which a related interest rate swap agreement was in effect during the previous reset period (as is the case for the class A-3 notes), a LIBOR based rate equal to the weighted average of the floating rates of interest that the trust paid to the swap counterparties hedging the basis risk for that class of reset rate notes during the preceding reset period.

This rate will continue to apply for each reset period while SLM Corporation or any subsidiary retains that class of reset rate notes. In either case, the next reset date will occur on the next distribution date.

The administrator will notify the Luxembourg Stock Exchange of any exercise of the related call option and a notice will be published in a leading newspaper having general circulation in Luxembourg, which is expected to bed’Wort.

Denominations. The class A-3 notes will be available for purchase in minimum denominations of $100,000 and additional increments of $1,000 in excess thereof. The class A-3 notes will be available only in book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear System. You will not receive a certificate representing your class A-3 notes except in very limited circumstances.

DATES

The closing date for the original offering was August 11, 2005.

The statistical cutoff date for the original offering was July 25, 2005.

A distribution date for each class of notes is the 25th of each January, April, July and October. If any January 25, April 25, July 25 or October 25 is not a business day, the distribution date will be the next business day.

Interest and principal will be payable to holders of record as of the close of business on the record date, which is the day before the related distribution date.

Unless otherwise indicated, all information regarding the notes and the pool of trust student loans is presented as of March 1, 2008. We refer to this date as the statistical disclosure date.

WEIGHTED AVERAGE REMAINING LIFE OF THE CLASS A-3 NOTES

The projected weighted average life of the class A-3 notes to maturity under various assumed prepayment scenarios will be found in Exhibit I “Weighted Average Remaining Life of the Class A-3 Notes” to the preliminary remarketing prospectus supplement, to be sent to potential investors on the remarketing terms determination date.

THE OTHER NOTES

The trust also issued on the closing date its class A-1 (no longer outstanding), class A-2, class A-4, class A-5 and class B notes, as more specifically described below.

4

Floating Rate Class A Notes:

| • | | Class A-1 Student Loan-Backed Notes in the original principal amount of $453,000,000, none of which remain outstanding; |

| • | | Class A-2 Student Loan-Backed Notes in the original principal amount of $315,000,000, and currently outstanding in the amount of $265,158,821.00; and |

| • | | Class A-4 Student Loan-Backed Notes in the original principal amount of $307,339,000 and currently outstanding in the same amount. |

Class B Notes:

| • | | Class B Student Loan-Backed Notes in the original principal amount of $47,052,000 and currently outstanding in the same amount. |

We sometimes refer to the floating rate class A notes and the reset rate notes collectively as the class A notes. We sometimes refer to the floating rate class A notes and the class B notes as the floating rate notes. We sometimes refer to the class A notes and the class B notes as the notes.

Interest accrues on the outstanding principal balances of the floating rate notes during three-month accrual periods and is paid on each distribution date.

An accrual period for the floating rate notes begins on a distribution date and ends on the day before the next distribution date.

Interest Rates. The outstanding floating rate notes bear interest at an annual rate equal to the sum of LIBOR and the applicable spread listed in the table below:

| | | |

Class | | Spread | |

Class A-2 | | plus 0.09 | % |

| |

Class A-4 | | plus 0.15 | % |

| |

Class B | | plus 0.31 | % |

For the floating rate notes, interest is calculated based on the actual number of days elapsed in each accrual period divided by 360.

The Other Reset Rate Notes:

Reset Rate Class A-5 Student Loan-Backed Notes in the original principal amount of $180,000,000 and currently outstanding in the same amount.

Interest.Until their initial reset date, the class A-5 notes bear interest at an annual rate equal to LIBOR plus 0.09%.

5

Interest on the class A-5 notes (until at least their initial reset date) will be calculated based on the actual number of days elapsed in each accrual period and a 360-day year.

An accrual period for any class of reset rate notes (including the class A-3 notes) that bears interest at a floating rate based upon LIBOR begins on a distribution date and ends on the day before the next distribution date.

Principal.If any class of reset rate notes bears interest at a fixed rate during a reset period (as has been the case with respect to the class A-3 notes during their initial reset period), that class generally will not receive payments of principal until the end of the related reset period, except as described under“—Termination of the Trust” below. Rather, all amounts allocated to that class as principal will instead be deposited into an accumulation account. On the related reset date for such class the trust will pay all sums, less any investment earnings, on deposit in the related accumulation account, including amounts deposited on that reset date, to the noteholders of that class as a distribution of principal.

Initial Reset Date.The initial reset date for the class A-5 notes is July 25, 2013.

Reset Date Procedures.The interest rate mode for subsequent reset periods for the other reset rate notes may be based on a floating rate index or may be a fixed rate. The floating rate may be based on EURIBOR, GBP-LIBOR or another non-U.S. Dollar currency-based rate, LIBOR, the 91-day U.S. treasury bill rate, a U.S. treasury constant maturity rate, the prime rate, a commercial paper rate or the federal funds rate. Any interest rate mode other than a floating rate based on LIBOR or a commercial paper rate will require each rating agency then rating the notes to confirm the then-current rating of each class of notes.

Depending on the rate and timing of prepayments on the trust student loans or the existence of an accumulation account, a class of the other reset rate notes may be repaid earlier than the next related reset date.

Swap Agreements. If on any reset date, a class of other reset rate notes is reset to or continues to bear a fixed rate of interest, the trust will enter into one or more interest rate swap agreements, to be effective until the next related reset date, with one or more eligible swap counterparties. Each swap counterparty will be obligated to pay the trust interest at the required fixed rate and the trust will be obligated to pay each swap counterparty interest at LIBOR plus or minus a spread, as determined by a bidding process.

If the remarketing agents, in consultation with the administrator, determine that such action would be in the best interest of the trust based on then-current market conditions, the trust will also enter into one or more interest rate swap agreements with one or more eligible swap counterparties to hedge against basis risk for any reset period where the related floating rate of interest is not based on LIBOR or a commercial paper rate.

The trust may not enter into any new interest rate swap agreements unless each rating agency then rating the notes confirms its then-current ratings of each class of notes.

6

If, on any reset date, the class A-5 notes are reset to a currency other than U.S. Dollars, the trust will enter into one or more currency swap agreements to be effective until the next related reset date.

ALL NOTES

Interest Payments. Interest accrued on the outstanding principal balance of the notes during each accrual period will be payable on the related distribution date.

Principal Payments. Principal will be payable or allocable on each distribution date in an amount generally equal to (a) the principal distribution amount for that distribution date plus (b) any shortfall in the payment of principal as of the preceding distribution date. We apply or allocate principal sequentially on each distribution date:

| • | | first, the class A noteholders’ principal distribution amount, sequentially to the class A-2 notes, the class A-3 notes, the class A-4 notes and the class A-5 notes, in that order, until their respective principal balances are reduced to zero; and |

| • | | second, on each distribution date on an after the stepdown date, and provided that no trigger event is in effect on such distribution date, the class B noteholders’ principal distribution amount, to the class B notes, until their principal balance is reduced to zero. |

If the class A-3 notes and/or class A-5 notes are then structured not to receive a payment of principal until the end of the related reset period (as is the case with respect to the initial reset period for the class A-3 notes), the principal payments will be allocated to the related accumulation account for such class until amounts on deposit in that account, less any investment earnings, are sufficient to reduce the outstanding principal balance of the related class or its U.S. Dollar equivalent, as applicable, to zero.

Amounts received by the trust in a non-U.S. Dollar currency from a swap counterparty with respect to principal will be paid or allocated to the applicable reset rate noteholders from the related currency account on the related distribution date.

Principal will not be paid to a class of reset rate notes on any distribution date if that class is then structured not to receive a payment of principal until the end of the related reset period, unless that distribution date is also a reset date. Instead, principal will be allocated to that class of reset rate notes and set aside in the related accumulation account.

Amounts on deposit in any accumulation account, exclusive of investment earnings, will generally be distributed to the related reset rate noteholders or the related swap counterparty, as applicable, only on the next related reset date.

Until the stepdown date, the class B notes will not be entitled to any payments of principal. On each distribution date on and after the stepdown date, provided that no trigger event is in effect, the class B notes will be entitled to their pro rata share of principal, subject to the existence of sufficient available funds.

7

The stepdown date will be the earlier of: (1) the July 2011 distribution date or (2) the first date on which no class A notes remain outstanding.

The class A noteholders’ principal distribution amount is equal to the principal distribution amount times the class A percentage, which is equal to 100% minus the class B percentage. The class B noteholders’ principal distribution amount is equal to the principal distribution amount times the class B percentage.

The class B percentage is 0% prior to the stepdown date and on any other distribution date if a trigger event is in effect. On each other distribution date, it is the percentage obtained by dividing (1) the aggregate principal balance of the class B notes by (2) the aggregate principal balance or U.S. Dollar equivalent of all outstanding notes less all amounts on deposit in any accumulation account (exclusive of any investment earnings), in each case immediately prior to that distribution date.

A trigger event will be in effect on any distribution date if the outstanding principal balance of the notes, less any amounts on deposit in any accumulation account, exclusive of any investment earnings and after giving effect to distributions to be made on that distribution date, would exceed the adjusted pool balance for that distribution date.

Maturity Dates.

| • | | The class A-1 notes were repaid in full on the October 2007 distribution date; |

| • | | the class A-2 notes will mature no later than April 25, 2022; |

| • | | the class A-3 notes will mature no later than July 25, 2025; |

| • | | the class A-4 notes will mature no later than October 25, 2029; and |

| • | | the class A-5 and class B notes will mature no later than January 25, 2040. |

The actual maturity of any class of notes could occur earlier if, for example:

| • | | there are prepayments on the trust student loans; |

| • | | the servicer exercises its option to purchase any remaining trust student loans, which will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance; or |

| • | | the indenture trustee auctions the remaining trust student loans (which, absent an event of default under the indenture, will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance). |

Subordination of the Class B Notes.Payments of interest on the class B notes will be subordinate to payments of interest on the class A notes and to trust swap payments due to any swap counterparty, if applicable. In general, payments of principal on the class B notes will be subordinate to the payment of both interest and principal on the class A notes, trust swap

8

payments due to any swap counterparty and any deposits required to be made into any supplemental interest account or any investment reserve account.

Security for the Notes. The notes are secured by the assets of the trust, primarily the trust student loans.

INDENTURE TRUSTEE AND PAYING AGENT

The trust issued the notes under an indenture dated August 1, 2005.

Under the indenture, Deutsche Bank Trust Company Americas acts as indenture trustee for the benefit of, and to protect the interests of, the noteholders and acts as paying agent for the notes.

LUXEMBOURG PAYING AGENT

As long as the rules of the Luxembourg Stock Exchange require a Luxembourg paying agent, the depositor will cause a paying agent to be appointed. Currently, Deutsche Bank Luxembourg S.A. acts as the Luxembourg paying agent with respect to the class A-3 notes.

ELIGIBLE LENDER TRUSTEE

The trust was created under a trust agreement dated as of July 29, 2005. The Bank of New York Trust Company, N.A. is the successor eligible lender trustee under the trust agreement. It holds legal title to the assets of the trust.

REMARKETING AGENTS

The remarketing agents will be entitled to a fee on each reset date in connection with a successful remarketing of a class of reset rate notes from amounts on deposit in the remarketing fee account. In connection with a successful remarketing of the class A-3 notes, the remarketing agents will be paid a remarketing fee by the trust in an amount not to exceed $931,000. The trust will also reimburse the remarketing agents, on a subordinated basis, for certain out-of-pocket expenses incurred in connection with each reset date.

ADMINISTRATOR

Sallie Mae, Inc. (“Sallie Mae”), under the related administration agreement, acts as the administrator of the trust. Sallie Mae is a Delaware corporation and a wholly-owned subsidiary of SLM Corporation. Subject to certain conditions, Sallie Mae may transfer its obligations as administrator to an affiliate.

INFORMATION ABOUT THE TRUST

The trust is a Delaware statutory trust.

The only activities of the trust that are currently permitted are acquiring, owning and managing the trust student loans and the other assets of the trust, issuing and making payments on the notes, entering into any required swap agreements and other related activities.

9

SLM Funding LLC, as depositor, after acquiring the student loans from one of VG Funding LLC or SLM Education Credit Finance Corporation (“SLM ECFC”) under separate purchase agreements, sold them to the trust on the closing date under a sale agreement. The depositor is a limited liability company of which SLM ECFC is the sole member. Chase Bank USA, National Association, as interim eligible lender trustee, held legal title to the student loans for the depositor under an interim trust arrangement prior to their transfer to the trust and then as eligible lender trustee for the benefit of the trust under the trust agreement. The Bank of New York Trust Company, N.A., now serves as successor interim eligible lender trustee for the depositor and successor eligible lender trustee on behalf of the trust.

Its Assets

The current assets of the trust include:

| • | | the trust student loans; |

| • | | collections and other payments on the trust student loans; |

| • | | funds it will hold from time to time in its trust accounts, including the collection account, the remarketing fee account, the reserve account, any accumulation account, any supplemental interest account, any investment reserve account, any investment premium purchase account, and, if either class of reset rate notes is denominated in a currency other than U.S. Dollars, any related currency account, and, assuming a successful remarketing of the class A-3 notes on the April 25, 2008 reset date, the spread supplement account; |

| • | | its rights under any swap agreement entered into from time to time with respect to one or more classes of reset rate notes; |

| • | | its rights under the transfer and servicing agreements, including the right to require VG Funding, SLM ECFC, the depositor or the servicer to repurchase trust student loans from it or to substitute student loans under certain conditions; and |

| • | | its rights under the guaranty agreements with guarantors. |

The rest of this section describes the trust student loans and trust accounts more fully.

Trust Student Loans. The trust student loans are education loans to students and parents of students made under the Federal Family Education Loan Program, known as FFELP. All of the trust student loans are consolidation loans. Consolidation loans are used to combine a borrower’s obligations under various federally authorized student loan programs into a single loan.

The trust student loans had an initial pool balance of approximately $1,500,391,111 as of the original statistical cutoff date and a pool balance of approximately $1,054,055,726 as of the statistical disclosure date. As of the statistical disclosure date, the weighted average annual borrower interest rate of the trust student loans was approximately 3.59% and their weighted average remaining term to scheduled maturity was approximately 250 months.

10

Any special allowance payments on the trust student loans are based on (a) the three-month commercial paper rate as to approximately 99.91% of the loans by principal balance and (b) the 91-day treasury bill rate as to approximately 0.09% of the loans by principal balance.

Collection Account. The administrator will deposit collections on the trust student loans, interest subsidy payments and special allowance payments into the collection account, as described in this preliminary remarketing free-writing prospectus and as will be described in more detail in the preliminary remarketing prospectus supplement and the related base prospectus to be distributed to potential investors on the remarketing terms determination date.

Reserve Account.The administrator established and maintains the reserve account as an asset of the trust in the name of the indenture trustee. As of the statistical disclosure date, the amount on deposit in the reserve account was $2,657,231.47. Funds in the reserve account may be replenished on each distribution date by additional funds available after all prior required distributions have been made.

Amounts in the reserve account in excess of the specified reserve account balance on any distribution date will be deposited into the collection account for distribution on that distribution date.

The specified reserve account balance is the amount required to be maintained in the reserve account. The specified reserve account balance for any distribution date will be equal to the greater of (a) 0.25% of the pool balance at the end of the related collection period and (b) $2,280,587. It will be subject to adjustment as described in this preliminary remarketing free-writing prospectus. In no event will it exceed the outstanding balance of the notes, less all amounts then on deposit, exclusive of any investment earnings, in any accumulation account.

A collection period is the three-month period ending on the last day of December, March, June or September, in each case for the distribution date in the following month.

The reserve account will be available to cover any shortfalls in payments of the primary servicing fee, the administration fee, the remarketing fees, if any, the class A noteholders’ interest distribution amount, payments due to any swap counterparty with respect to interest, certain swap termination payments and the class B noteholders’ interest distribution amount. As of the distribution date in January 2008, amounts on deposit in the reserve account have not been required for these purposes.

In addition, the reserve account will be available:

| • | | on the related maturity date for each class of class A notes and upon termination of the trust, to cover shortfalls in payments of the class A noteholders’ principal and accrued interest to the related class of notes; and |

| • | | on the class B maturity date and upon termination of the trust, to cover shortfalls in payments of the class B noteholders’ principal and accrued interest to the class B notes, any carryover servicing fees, any remaining swap termination payments and remarketing fees and expenses. |

11

The reserve account enhances the likelihood of payment to noteholders. In certain circumstances, however, the reserve account could be depleted. This depletion could result in shortfalls in distributions to noteholders.

If the market value of the reserve account, together with amounts on deposit in any supplemental interest account on any distribution date, is sufficient to pay the remaining principal (for such purpose, as reduced by all amounts, other than investment earnings, on deposit in any accumulation account) and interest accrued on the notes and any carryover servicing fees, amounts on deposit in those accounts will be so applied on that distribution date.

Capitalized Interest Account. All funds on deposit in the capitalized interest account that was created and funded on the closing date were transferred to the collection account on the October 2007 distribution date. No additional sums will be subsequently deposited into this account.

Remarketing Fee Account. The administrator established and maintains a remarketing fee account as an asset of the trust in the name of the indenture trustee, for the benefit of the remarketing agents. Beginning on the distribution date that is one year prior to the initial reset date or next reset date, as applicable, for the applicable class of reset rate notes, and through the reset date, the trust is required to deposit into the remarketing fee account available funds up to the related quarterly required amount on each related distribution date, until the balance on deposit in the remarketing fee account reaches the targeted level for the related reset date, prior to the payment of interest on the notes. As of the statistical disclosure date, there was approximately $744,800.00 on deposit in the remarketing fee account. As of the April 25, 2008 distribution date, the required amount for this account will not exceed $931,000. Investment earnings on deposit in the remarketing fee account are withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date.

In addition, if on any distribution date, a class A note interest shortfall would exist, or if on the maturity date for any class of class A notes, available funds would not be sufficient to reduce the principal balance of that class to zero, the amount of that class A note interest shortfall or principal deficiency, as applicable, to the extent sums are on deposit in the remarketing fee account, may be withdrawn from that account and used for payment of interest or principal on the class A notes.

Accumulation Accounts. The administrator will establish and maintain in the name of the indenture trustee a separate accumulation account for the benefit of each class of reset rate notes whenever that class is structured not to receive a payment of principal until the end of the related reset period (as has been the case for the class A-3 notes during their initial reset period). On each distribution date, the indenture trustee will deposit any principal amounts allocated to that class, in U.S. Dollars, of reset rate notes into the accumulation account. All sums, less any investment earnings, on deposit in that accumulation account will be paid:

| • | | if the related class of reset rate notes is then denominated in U.S. Dollars, on the next related reset date for that class to the related reset rate noteholders, after all other required distributions have been made on that reset date; or |

12

| • | | if the related class of reset rate notes is then denominated in a currency other than U.S. Dollars, on or about the next related reset date for such class, to the related currency swap counterparty or counterparties, which will in turn pay the applicable currency equivalent of those amounts to the trust, for payment to the applicable reset rate noteholders on the second business day following that related reset date, after all other required distributions have been made on that reset date. |

Amounts on deposit in an accumulation account (exclusive of investment earnings) may be used only to pay principal to the related class of reset rate notes and for no other purpose. Investment earnings on deposit in any accumulation account will be withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date.

Amounts on deposit in an accumulation account may be invested in eligible investments that can be purchased at a price equal to par, at a discount, or at a premium. Eligible investments may be purchased at a premium over par only if there are sufficient amounts on deposit in the investment premium purchase account described below to pay the amount of the purchase price in excess of par.

Currently, there are no funds on deposit in any accumulation account for any class of reset rate notes.

Investment Premium Purchase Accounts. On the closing date, and as required on any subsequent reset date, the administrator established and maintains in the name of the indenture trustee one or more investment premium purchase accounts. On each distribution date when funds are deposited into an accumulation account, the indenture trustee is required to deposit, subject to sufficient available funds, an amount generally equal to 1.0% of the amount deposited into such accumulation account into the investment premium purchase account, together with any carryover amounts from previous distribution dates if there were insufficient available funds on any previous distribution date to make the required deposits in full.

Amounts on deposit in an investment premium purchase account may be used from time to time to pay amounts in excess of par on eligible investments purchased with funds on deposit in the related accumulation account. Amounts not used to pay such premium purchase amounts will become available funds on future distribution dates pursuant to a formula set forth in the administration agreement.

Currently, there are no funds on deposit in any investment premium account for any class of reset rate notes.

Investment Reserve Accounts. On the closing date, and as required on any subsequent reset date, the administrator established and maintains in the name of the indenture trustee one or more investment reserve accounts. On any distribution date and to the extent of available funds, if the ratings of any eligible investments in an accumulation account have been downgraded by one or more rating agencies, the indenture trustee will deposit into the investment reserve account an amount, if any, to be set by each applicable rating agency in satisfaction of the rating agency condition, which amount will not exceed the amount of the unrealized loss on the related eligible investments. On each distribution date, all amounts on deposit in the investment reserve account

13

either will be withdrawn from that investment reserve account and deposited into the related accumulation account in an amount required to offset any realized losses on eligible investments related to that accumulation account, or will be deposited into the collection account to be used as available funds on that distribution date.

Currently, there are no funds on deposit in any investment reserve account for any class of reset rate notes.

Supplemental Interest Accounts. The administrator will establish and maintain in the name of the indenture trustee a supplemental interest account with respect to each accumulation account. On each distribution date when amounts are deposited into or are on deposit in an accumulation account for a class of reset rate notes, the indenture trustee, subject to sufficient available funds, will deposit into the related supplemental interest account an amount sufficient to pay either to the related reset rate noteholders or to each related swap counterparty, as applicable, the floating rate payments due to the applicable class of reset rate noteholders or the swap counterparty, as applicable, through the next related distribution date at the related LIBOR-based floating rate on all amounts on deposit in the related accumulation account, after giving effect to an assumed rate of investment earnings on that account. All amounts on deposit in each supplemental interest account will be withdrawn on or before each distribution date, deposited into the collection account and included in available funds for that distribution date.

Currently, there are no funds on deposit in any supplemental interest account for any class of reset rate notes.

Currency Accounts. If any class of reset rate notes are denominated in a currency other than U.S. Dollars during any related reset period, then the administrator will establish and maintain a currency account for that currency in the name of the indenture trustee, for the benefit of the holders of the applicable class of reset rate notes. Any payments received from a swap counterparty in a currency other than U.S. Dollars will be deposited into that currency account as will be described in the prospectus to be attached to the preliminary remarketing prospectus supplement, to be sent to potential investors on the remarketing terms determination date.

Currently, there are no funds on deposit in any currency account for any class of reset rate notes.

ADMINISTRATION OF THE TRUST

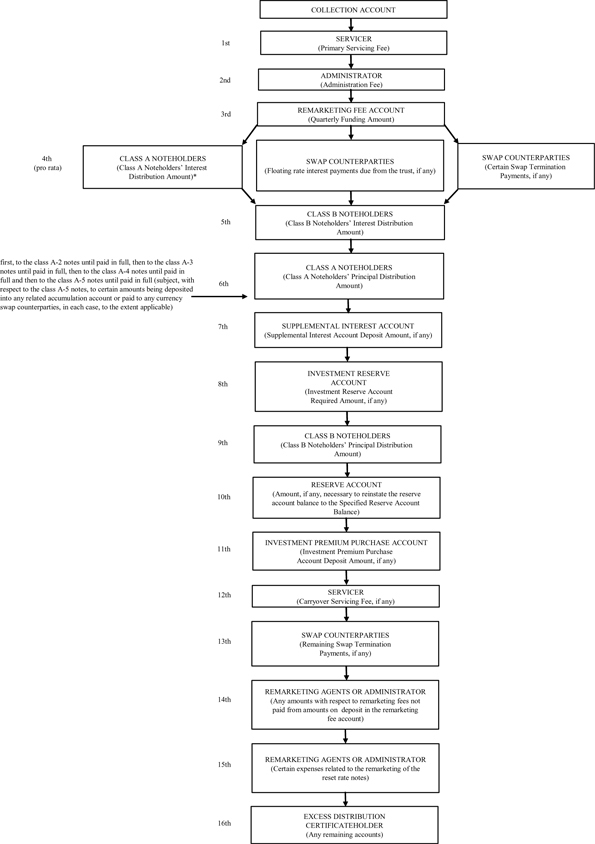

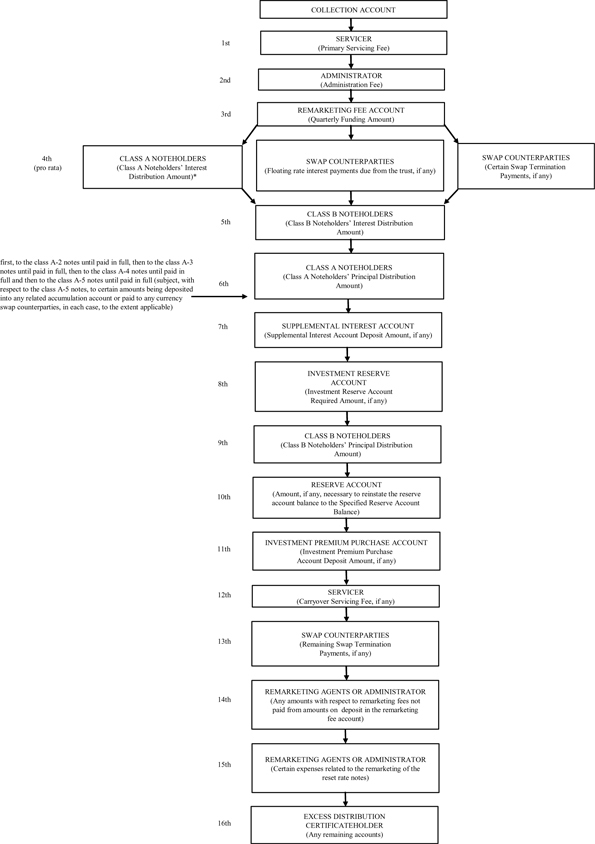

Distributions

Sallie Mae, as administrator, will instruct the indenture trustee to withdraw funds on deposit in the collection account and the various accounts described above. These funds will be applied monthly to the payment of the primary servicing fee and on each distribution date generally as shown in the following chart.

14

| * | Amounts of interest due to the class A-3 noteholders in excess of an annualized percentage equal to LIBOR plus 0.75% will not be paid from available funds but will instead be withdrawn on each applicable distribution date from the spread supplement account and paid directly to the class A-3 noteholders. |

15

Transfer of the Assets to the Trust

Under a sale agreement, the depositor sold the trust student loans to the trust, with the eligible lender trustee holding legal title to the trust student loans.

If the depositor breaches a representation under the sale agreement regarding a trust student loan, generally the depositor will have to cure the breach, repurchase or replace that trust student loan or reimburse the trust for losses resulting from the breach.

Each seller has similar obligations under the purchase agreements.

Servicing of the Assets

Under a servicing agreement, Sallie Mae, as servicer, is responsible for servicing, maintaining custody of and making collections on the trust student loans. It also bills and collects payments from the guaranty agencies and the Department of Education.

The servicer manages and operates the loan servicing functions for the SLM Corporation family of companies. The servicer may enter into subservicing agreements with respect to some or all of its servicing obligations, but these arrangements will not affect the servicer’s obligations to the trust. Under some circumstances, the servicer may transfer its obligations as servicer.

If the servicer breaches a covenant under the servicing agreement regarding a trust student loan, generally it will have to cure the breach, purchase that trust student loan or reimburse the trust for losses resulting from the breach.

Compensation of the Servicer

The servicer receives two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee for any month is equal to 1/12th of an amount not to exceed 0.50% of the outstanding principal amount of the trust student loans.

The primary servicing fee is payable out of available funds and amounts on deposit in the reserve account on the 25th of each month, or if the 25th day is not a business day, then on the next business day. Fees are calculated as of the last day of the preceding calendar month. Fees include amounts from any prior monthly servicing payment dates that remain unpaid.

The carryover servicing fee is payable to the servicer on each distribution date out of available funds.

The carryover servicing fee is the sum of:

| • | | the amount of specified increases in the costs incurred by the servicer; |

| • | | the amount of specified conversion, transfer and removal fees; |

16

| • | | any amounts described in the first two bullets that remain unpaid from prior distribution dates; and |

| • | | interest on any unpaid amounts. |

TERMINATION OF THE TRUST

The trust will terminate upon:

| • | | the maturity or other liquidation of the last trust student loan and the disposition of any amount received upon its liquidation; and |

| • | | the payment of all amounts required to be paid to the noteholders. |

Optional Purchase

The servicer may purchase or arrange for the purchase of all remaining trust student loans on any distribution date when the pool balance is 10% or less of the initial pool balance. The exercise of this purchase option will result in the early retirement of the remaining notes, including an early distribution of all amounts then on deposit in any accumulation account. The purchase price will equal the amount required to prepay in full, including all accrued interest, the remaining trust student loans as of the end of the preceding collection period, but will not be less than a prescribed minimum purchase amount.

This prescribed minimum purchase amount is the amount that would be sufficient to:

| • | | reduce the outstanding principal amount of each class of notes then outstanding on the related distribution date to zero; and |

| • | | pay to noteholders the interest payable on the related distribution date. |

For these purposes, if any class of reset rate notes:

| • | | is then structured not to receive a payment of principal until the end of the related reset period, the outstanding principal balance of that class of reset rate notes will be deemed to have been reduced by any amounts on deposit, exclusive of any investment earnings, in the related accumulation account; and/or |

| • | | is then denominated in a non-U.S. Dollar currency, the U.S. Dollar equivalent of the then-outstanding principal balance of that class of reset rate notes will be determined based upon the exchange rate provided for in the related currency swap agreement or agreements. |

The pool balance as of the statistical disclosure date is approximately 70.3% of the initial pool balance.

Auction of Trust Assets

17

The indenture trustee will offer for sale all remaining trust student loans at the end of the collection period when the pool balance is 10% or less of the initial pool balance. The trust auction date will be the third business day before the related distribution date. An auction will be consummated only if the servicer has first waived its optional purchase right. The servicer will waive its option to purchase the remaining trust student loans if it fails to notify the eligible lender trustee and the indenture trustee, in writing, that it intends to exercise its purchase option before the indenture trustee accepts a bid to purchase the trust student loans. The depositor and its affiliates, including SLM ECFC and Sallie Mae, and unrelated third parties may offer bids to purchase the trust student loans. The depositor or any affiliate may not submit a bid representing greater than fair market value of the trust student loans.

If at least two bids are received, the indenture trustee will solicit and re-solicit new bids from all participating bidders until only one bid remains or the remaining bidders decline to resubmit bids. The indenture trustee will accept the highest of the remaining bids if it equals or exceeds (a) the minimum purchase amount described under “Optional Purchase” above (plus any amounts owed to the servicer as carryover servicing fees) or (b) the fair market value of the trust student loans as of the end of the related collection period, whichever is higher. If at least two bids are not received or the highest bid after the re-solicitation process does not equal or exceed that amount, the indenture trustee will not complete the sale. The indenture trustee may, and at the direction of the depositor will be required to, consult with a financial advisor, including any of the original underwriters of the notes, or the administrator, to determine if the fair market value of the trust student loans has been offered.

The net proceeds of any auction sale, plus all amounts (other than investment earnings) then on deposit in any accumulation account, will be used to retire any outstanding notes on the related distribution date.

If the sale is not completed, the indenture trustee may, but will not be under any obligation to, solicit bids for sale of the trust student loans after future collection periods upon terms similar to those described above, including the servicer’s waiver of its option to purchase remaining trust student loans.

If the trust student loans are not sold as described above, on each subsequent distribution date, if the amount on deposit in the reserve account after giving effect to all withdrawals, except withdrawals payable to the depositor, exceeds the specified reserve account balance, the administrator will direct the indenture trustee to distribute the amount of the excess as accelerated payments or allocations of note principal. The indenture trustee may or may not succeed in soliciting acceptable bids for the trust student loans either on the trust auction date or subsequently.

INITIAL INTEREST RATE SWAP AGREEMENT

On the closing date, the trust entered into an interest rate swap agreement with The Royal Bank of Scotland plc, as initial swap counterparty, to hedge the basis risk that resulted from the payment of a fixed rate of interest on the class A-3 notes during their initial reset period.

18

In accordance with its terms, the initial interest rate swap agreement with respect to the class A-3 notes will terminate on April 25, 2008, whether or not the class A-3 notes are successfully remarketed.

ADDITIONAL INTEREST RATE SWAP AGREEMENTS

If, on any reset date, the related class of reset rate notes is reset to bear a fixed rate of interest or is otherwise required to satisfy the rating agency condition, the trust will enter into one or more interest rate swap agreements to be effective until the next related reset date.

CURRENCY SWAP AGREEMENTS

If, on any reset date, the class A-5 notes are reset to a currency other than U.S. Dollars, the trust will enter into one or more currency swap agreements to be effective until the next related reset date.

TAX CONSIDERATIONS

Subject to important considerations described in the prospectus to be attached to the preliminary remarketing prospectus supplement, to be sent to potential investors on the remarketing terms determination date:

| • | | Federal tax counsel for the trust is of the opinion that the class A-3 notes will be characterized as debt for federal income tax purposes. |

| • | | Federal tax counsel for the trust is of the opinion that the trust will not be characterized as an association or a publicly traded partnership taxable as a corporation for federal income tax purposes. |

| • | | Delaware tax counsel for the trust is of the opinion that the same characterizations will apply for Delaware state income tax purposes as for federal income tax purposes and that noteholders who were not otherwise subject to Delaware taxation on income would not become subject to Delaware taxation as a result of their ownership of notes. |

ERISA CONSIDERATIONS

Subject to important considerations and conditions described in this preliminary remarketing free-writing prospectus and the prospectus to be attached to the preliminary remarketing prospectus supplement, to be sent to potential investors on the remarketing terms determination date, the class A-3 notes may, in general, be purchased by or on behalf of an employee benefit plan, including an insurance company general account, that is subject to Title I of ERISA or Section 4975 of the Internal Revenue Code only if an exemption from the prohibited transaction rules applies, so that the purchase and holding of the class A-3 notes by or on behalf of the plan will not result in a non-exempt prohibited transaction. Each fiduciary who purchases any note will be deemed to represent that such an exemption exists and applies to it.

RATINGS

19

The notes are currently rated as follows:

| • | | Class A notes (including the class A-3 notes): “AAA” by Fitch, “Aaa” by Moody’s and “AAA” by S&P. |

| • | | Class B notes: “AAA” by Fitch, “Aa1” by Moody’s and “AA+” by S&P. |

LISTING INFORMATION

The class A-3 notes are currently listed on the Luxembourg Stock Exchange. You may consult with Deutsche Bank S.A., the Luxembourg listing agent for the notes, for additional information regarding their status. You can contact the listing agent at 2 Boulevard Konrad Adenauer L-1115, Luxembourg.

So long as the class A-3 notes are listed on the Luxembourg Stock Exchange, and its rules so require, notices relating to that class of notes, including if any of such class is delisted, will be published in a leading newspaper having general circulation in Luxembourg, which is expected to be d’Wort and/or on the Luxembourg Stock Exchange’s website at: http://www.bourse.lu.

The class A-3 notes are currently able to be cleared and settled through Clearstream, Luxembourg and Euroclear.

IDENTIFICATION NUMBERS

The class A-3 notes have the following identification numbers:

CUSIP Number:

| • | | Class A-3 Notes: 78442G QH 2 |

International Securities Identification Number (ISIN):

| • | | Class A-3 Notes: US78442GQH29 |

European Common Code:

Class A-3 Notes: 022702815

20

SLM Student Loan Trust 2005-7

Issuing Entity

(up to)

$

Class A-3 Student Loan-Backed Notes

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Remarketing Agents

Banc of America Securities LLC

Deutsche Bank Securities

Merrill Lynch & Co.

April 3, 2008