FHLBI Update 2013 Shareholder Symposium Cindy L. Konich President - CEO presented by August 2013

FHLBI Performance Results FHLB System Performance Legislative / Regulatory Update Agenda 3

$ in millions Six Months Ended 6/30/13 Six Months Ended 6/30/12 % Change ‘13 v. ‘12 Net Interest Income* $ 125 $ 120 4% Other Income (Loss), Net 28 (6) NM Other Expenses 31 30 4% Income before Assessments 122 84 45% AHP Assessments 13 9 39% Net Income $ 109 $ 75 46% Earnings Update 4 *After provision for credit losses

$ in millions June 30 2013 Dec 31 2012 Increase (Decrease) Amount Percent Advances $19,101 $18,130 $ 971 5% Mortgage Loans 6,167 6,001 166 3% MBS / ABS 7,487 7,876 (389) -5% Cash and Short-term Investments 3,537 5,465 (1,928) -35% Other Long-term Investments 3,473 3,609 (136) -4% Total Assets $39,915 $41,228 $ (1,313) -3% Balance Sheet Highlights – Selected Asset Accounts 5

$ in millions June 30 2013 Dec 31 2012 Increase (Decrease) Amount Percent Consolidated Obligations $35,532 $36,332 $ (800) -2% Capital Stock $ 1,672 $ 1,634 $ 38 2% Mandatorily Redeemable Capital Stock 256 451 (195) -43% Total Regulatory Capital Stock $ 1,928 $ 2,085 $ (157) -8% Total Retained Earnings $ 672 $ 592 $ 80 14% Regulatory Capital $ 2,600 $ 2,677 $ (77) -3% Regulatory Capital Ratio 6.5% 6.5% Balance Sheet Highlights – Selected Liability/Capital Accounts 6

7 Total FHLBI Member Advances by Member Type (at par) Member advances as of reporting date $0 $5 $10 $15 $20 $25 2007 2008 2009 2010 2011 2012 2Q 2013 Banks/Thrifts Credit Unions Insurance Companies $ in billions

8 Advances: Meeting Member Needs Capitalize on market opportunities Defend against rising interest rates Ladder funding Targeted specials

$178 $66 $106 $245 $222 $320 $370 $363 $330 $313 $63 $168 $130 $122 0 10 20 30 40 50 60 70 $0 $100 $200 $300 $400 $500 $600 11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2 MPP Purchases MPF Purchases Cumulative New Sellers Mortgage Purchase Growth 9 • Legacy portfolio at 36% vs. 61% in 2010 • Balance up 6.7% since 6.30.12 • $0.5 billion MPF purchases through 6.30.13 $ in millions

10 Building Mortgage Portfolio MPP Advantage drives growing member participation Committed to providing excellent customer service Consistent guidelines and pricing Diversification through FHLB Topeka MPF participation

$506 $521 $536 $550 $567 $608 $21 $28 $35 $42 $50 $64 $0 $200 $400 $600 $800 Q1 Q2 Q3 Q4 Q1 Q2 Retained Earnings Restricted Retained Earnings Total Retained Earnings 11 2012 2013 $ in millions

12 FHLBI Class B-1 Dividend vs. LIBOR 2012 2013 2009 2010 2011

2013 • AHP allocation is $11.4M • $6.2M for homeownership initiatives 2012 results • 27 projects with $10.5M in subsidy • 649 units of affordable housing created • $5.3M disbursed to 743 households through homeownership initiatives Affordable Housing Program 13

Strengthening Communities 14 Lazarus Place in Muskegon Heights, MI provides 4 apartments, along with comprehensive care coordination services, for the homeless. Community Shores Bank assisted with an AHP award of $310,310. Breanna Hubbard’s three-bedroom home in Muncie, IN was renovated with the help of a $15,000 AHP grant through MutualBank.

Growth in System Advances (6.30.13 vs. 12.31.12) 15 25.3% 20.7% 14.7% 13.5% 11.6% 5.8% 5.4% 3.2% 2.2% 0.2% -0.2% -0.4% 7.7% -5% 0% 5% 10% 15% 20% 25% 30% SEA CIN CHI TOP NY SF IN BOS ATL PIT DAL DSM SYS Source: FHFA Call Report System

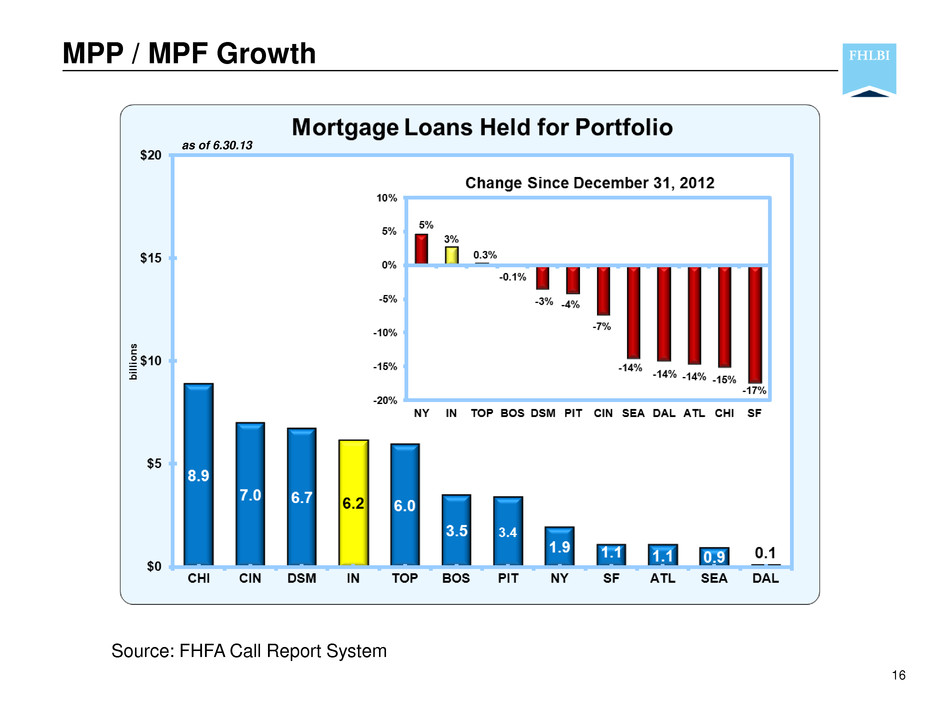

MPP / MPF Growth 16 Source: FHFA Call Report System as of 6.30.13

Earnings Performance 17 Source: FHLBI 10Q and FHFA Call Report System

11.3% 10.3% 7.8% 6.5% 6.2% 5.9% 5.7% 5.5% 5.4% 5.4% 5.3% 5.3% 6.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% SF BOS SEA IN PIT DSM CIN CHI TOP DAL NY ATL SYS Regulatory Capital Ratios 18 Well Capitalized as of 6.30.13 Source: FHFA Call Report System

FHLB System Summary 19 Advances stabilizing System income strong Capital profile improving FHLBanks showing improvement

Legislative / Regulatory Update 20 In midst of real housing finance reform debate Reforming the GSEs • Housing Finance Reform & Taxpayer Protection Act • PATH Act Proactive in GSE reform & other public policy initiatives • 28 visits to Capitol Hill thru June

Housing Finance Reform Position 21 Top priority to ensure that FHLB System 7,600 members remain integral to housing finance system Community-based lenders must be assured access to secondary market FHLBs: A System that works!

Staying the Course – Membership Benefits 22 As Customers Flexible advance structures & reliability Successful MPP Advantage Grants & funding for housing and economic development Excellent customer service As Shareholders Strong core earnings Retained earnings growth Dividends well above LIBOR Solid regulatory capital position =

Thank you for joining us today. We appreciate your business and support. Safe Harbor Statement This presentation contains forward-looking statements concerning plans, objectives, goals, strategies, future events or performance, which are not statements of historical fact. The forward-looking statements contained in this release reflect our current beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward-looking statements. You are referred to the documents filed by us with the SEC, specifically reports on Form 10-K and Form 10-Q including risk factors that could cause actual results to differ from forward-looking statements. These reports are available at www.sec.gov. The financial information contained within this presentation is unaudited.