F&G Investor Update Spring 2023 Note: Spring 2023 Investor Update refreshed per 8-K filed July 13, 2023

F&G Investor Update | Spring 2023 2 Disclaimer & Forward-Looking Statements This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. Some of the forward-looking statements can be identified by the use of terms such as “believes”, “expects”, “may”, “will”, “could”, “seeks”, “intends”, “plans”, “estimates”, “anticipates” or other comparable terms. Statements that are not historical facts, including statements regarding our expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on management's beliefs, as well as assumptions made by, and information currently available to, management. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties which forward-looking statements are subject to include, but are not limited to: general economic conditions and other factors, including prevailing interest and unemployment rate levels and stock and credit market performance; natural disasters, public health crises, international tensions and conflicts, geopolitical events, terrorist acts, labor strikes, political crisis, accidents and other events; concentration in certain states for distribution of our products; the impact of interest rate fluctuations; equity market volatility or disruption; the impact of credit risk of our counterparties; changes in our assumptions and estimates regarding amortization of our deferred acquisition costs, deferred sales inducements and value of business acquired balances; regulatory changes or actions, including those relating to regulation of financial services affecting (among other things) underwriting of insurance products and regulation of the sale, underwriting and pricing of products and minimum capitalization and statutory reserve requirements for insurance companies, or the ability of our insurance subsidiaries to make cash distributions to us; and other factors discussed in “Risk Factors” and other sections of the Company’s Form 10-K and other filings with the Securities and Exchange Commission.

F&G Investor Update | Spring 2023 3 Non-GAAP Financial Measures Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, this presentation includes non-GAAP financial measures, which the Company believes are useful to help investors better understand its financial performance, competitive position and prospects for the future. Management believes these non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Our non-GAAP measures may not be comparable to similarly titled measures of other organizations because other organizations may not calculate such non-GAAP measures in the same manner as we do. The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. By disclosing these non-GAAP financial measures, the Company believes it offers investors a greater understanding of, and an enhanced level of transparency into, the means by which the Company’s management operates the Company. Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP net earnings, net earnings attributable to common shareholders, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are provided within. On January 1, 2023, F&G has adopted Accounting Standard Update 2018-12, “Targeted Improvements to the Accounting for Long-Duration Contracts” (LDTI), as issued by the Financial Accounting Standards Board. This update significantly amends the accounting and disclosure requirements for long-duration insurance contracts. Adoption of this guidance is reflected in F&G’s consolidated financial statements using the full retrospective transition method effective January 1, 2023 with changes applied as of January 1, 2021, also referred to as the transition date. Prior periods are presented on a comparable basis to reflect impacts under the LDTI accounting standard. In addition, F&G has subsequently filed an 8-K on July 13, 2023 with supplemental disclosures reflecting a refinement of its methodology for calculating the market related liability adjustment included in its non-GAAP financial measure of adjusted net earnings ("ANE"). The change also impacted other non-GAAP financial measures that derive from ANE, including adjusted net earnings per diluted share, adjusted return on average equity excluding AOCI and adjusted return on assets. We have restated all time periods in this updated Spring 2023 investor presentation for this change.

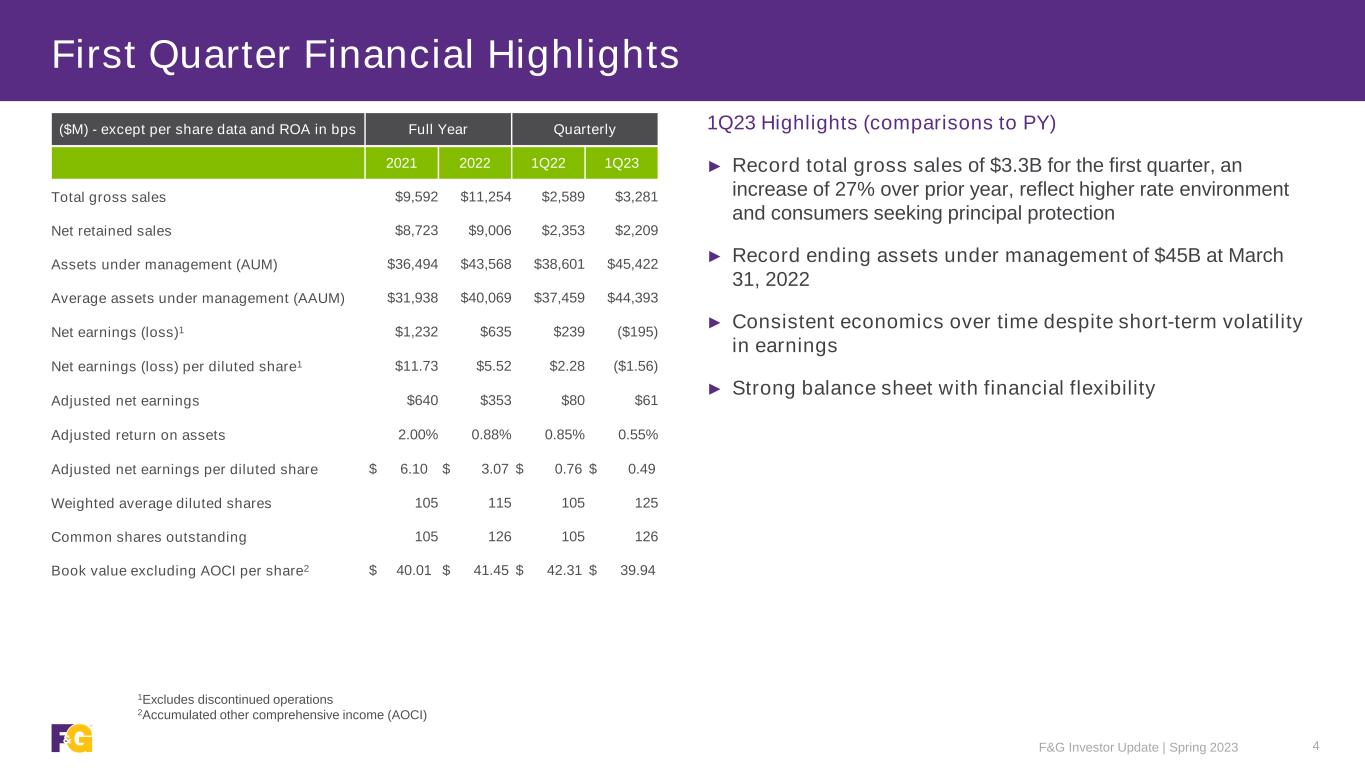

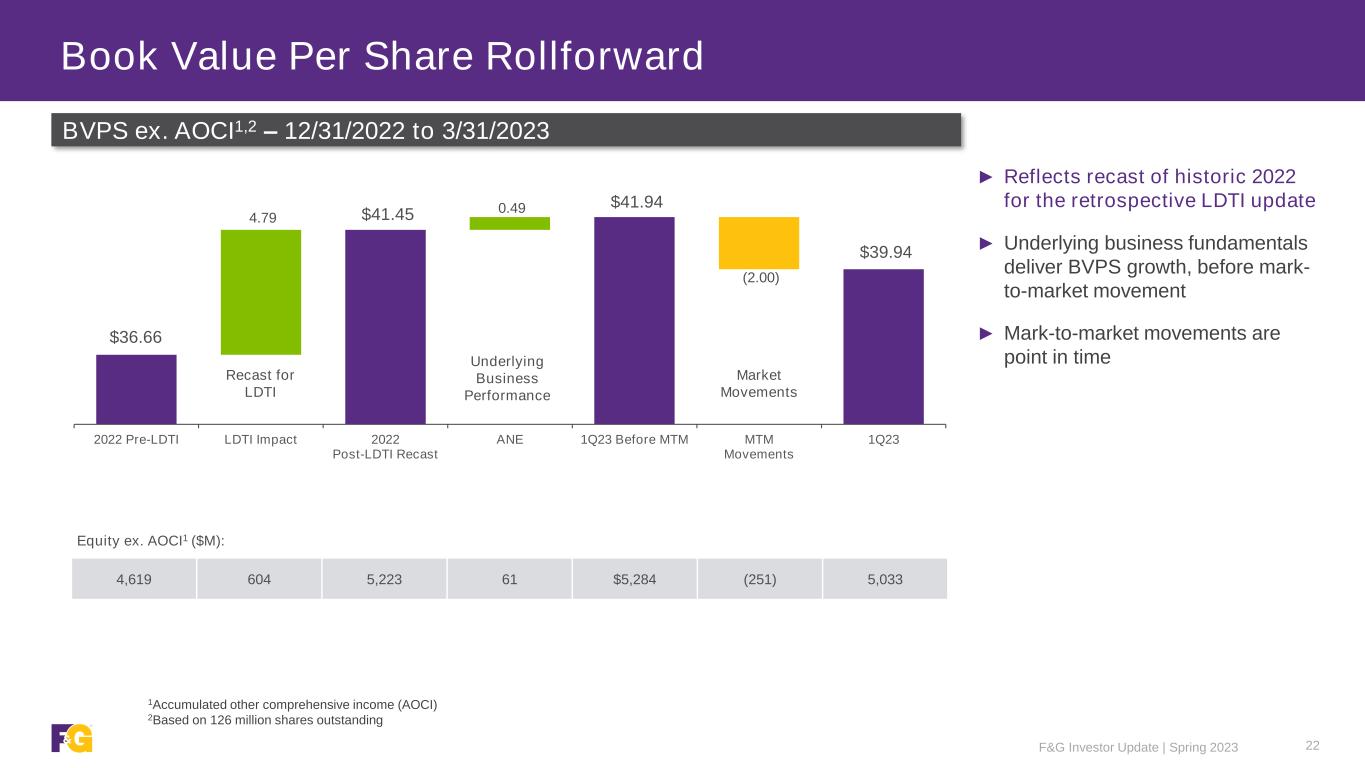

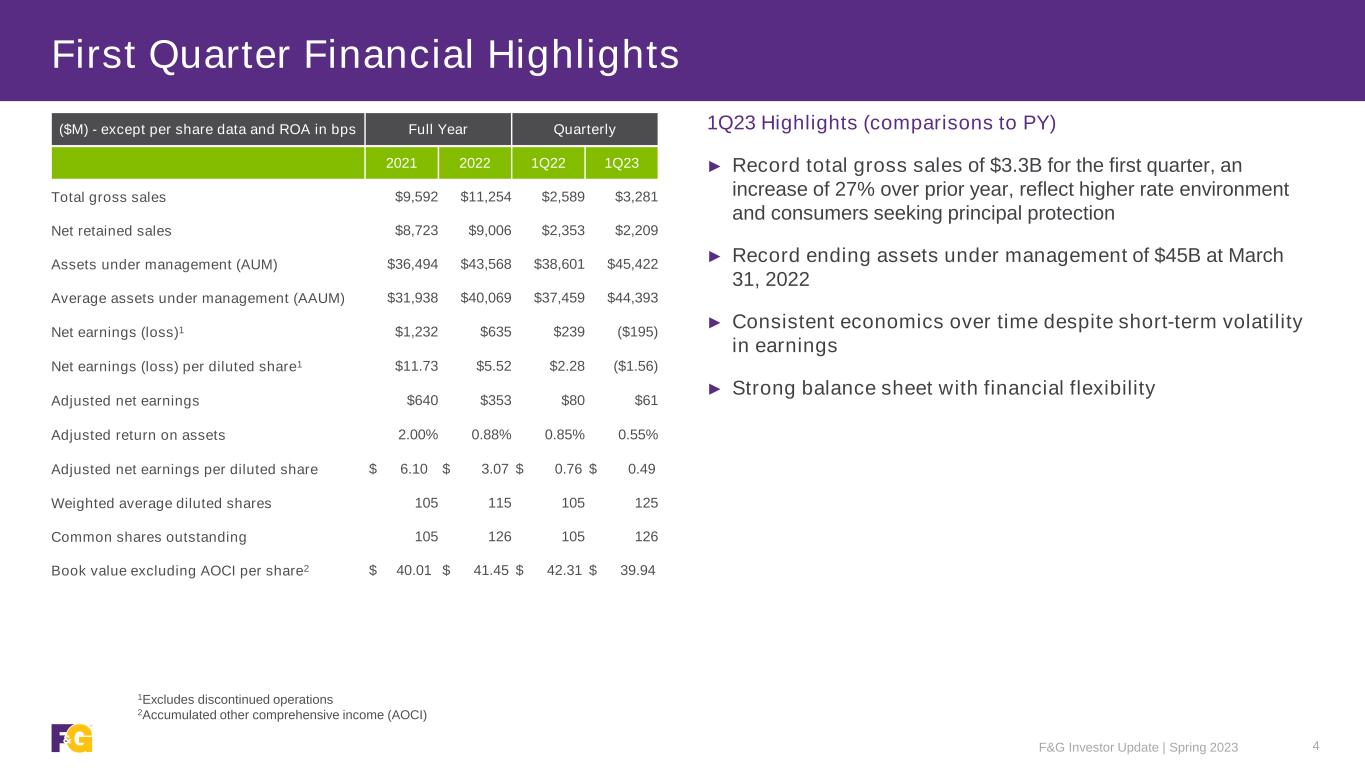

F&G Investor Update | Spring 2023 4 First Quarter Financial Highlights 1Q23 Highlights (comparisons to PY) ► Record total gross sales of $3.3B for the first quarter, an increase of 27% over prior year, reflect higher rate environment and consumers seeking principal protection ► Record ending assets under management of $45B at March 31, 2022 ► Consistent economics over time despite short-term volatility in earnings ► Strong balance sheet with financial flexibility ($M) - except per share data and ROA in bps Full Year Quarterly 2021 2022 1Q22 1Q23 Total gross sales $9,592 $11,254 $2,589 $3,281 Net retained sales $8,723 $9,006 $2,353 $2,209 Assets under management (AUM) $36,494 $43,568 $38,601 $45,422 Average assets under management (AAUM) $31,938 $40,069 $37,459 $44,393 Net earnings (loss)1 $1,232 $635 $239 ($195) Net earnings (loss) per diluted share1 $11.73 $5.52 $2.28 ($1.56) Adjusted net earnings $640 $353 $80 $61 Adjusted return on assets 2.00% 0.88% 0.85% 0.55% Adjusted net earnings per diluted share $ 6.10 $ 3.07 $ 0.76 $ 0.49 Weighted average diluted shares 105 115 105 125 Common shares outstanding 105 126 105 126 Book value excluding AOCI per share2 $ 40.01 $ 41.45 $ 42.31 $ 39.94 1Excludes discontinued operations 2Accumulated other comprehensive income (AOCI)

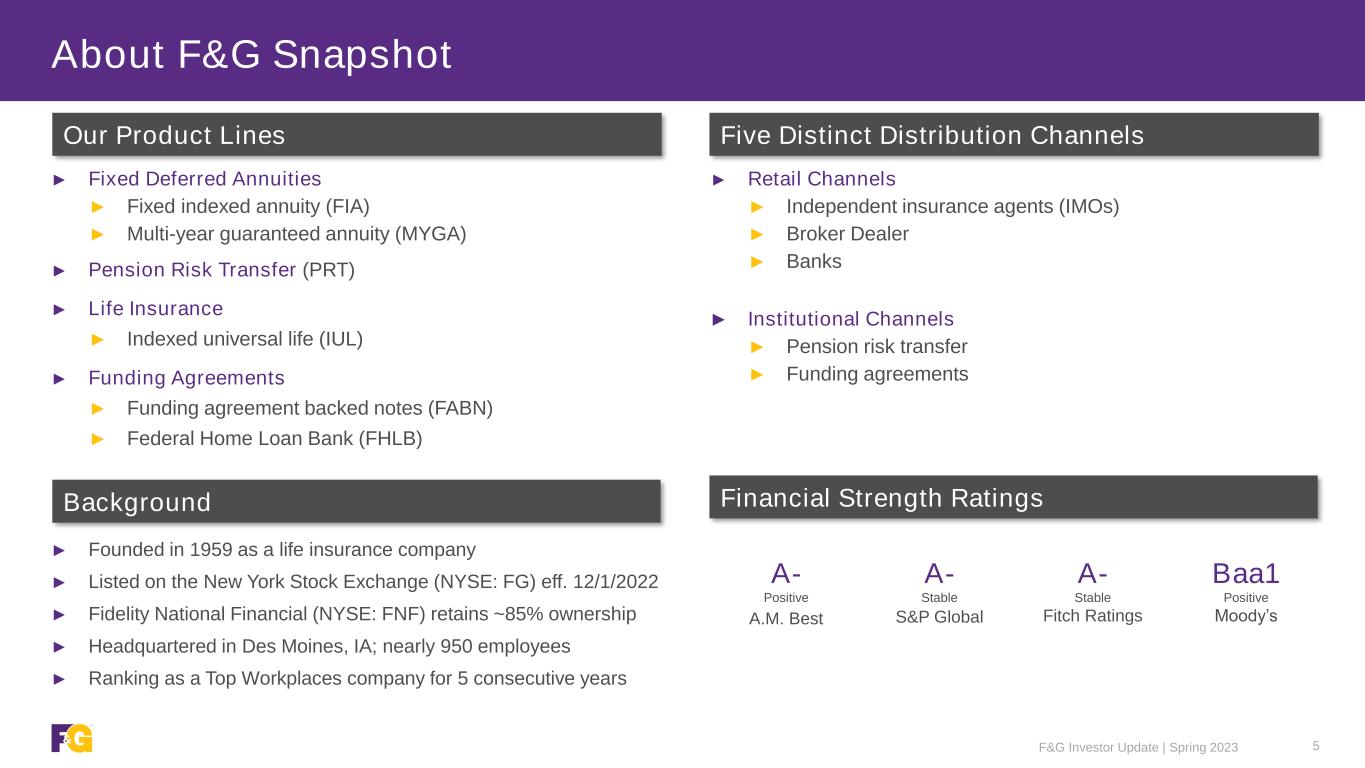

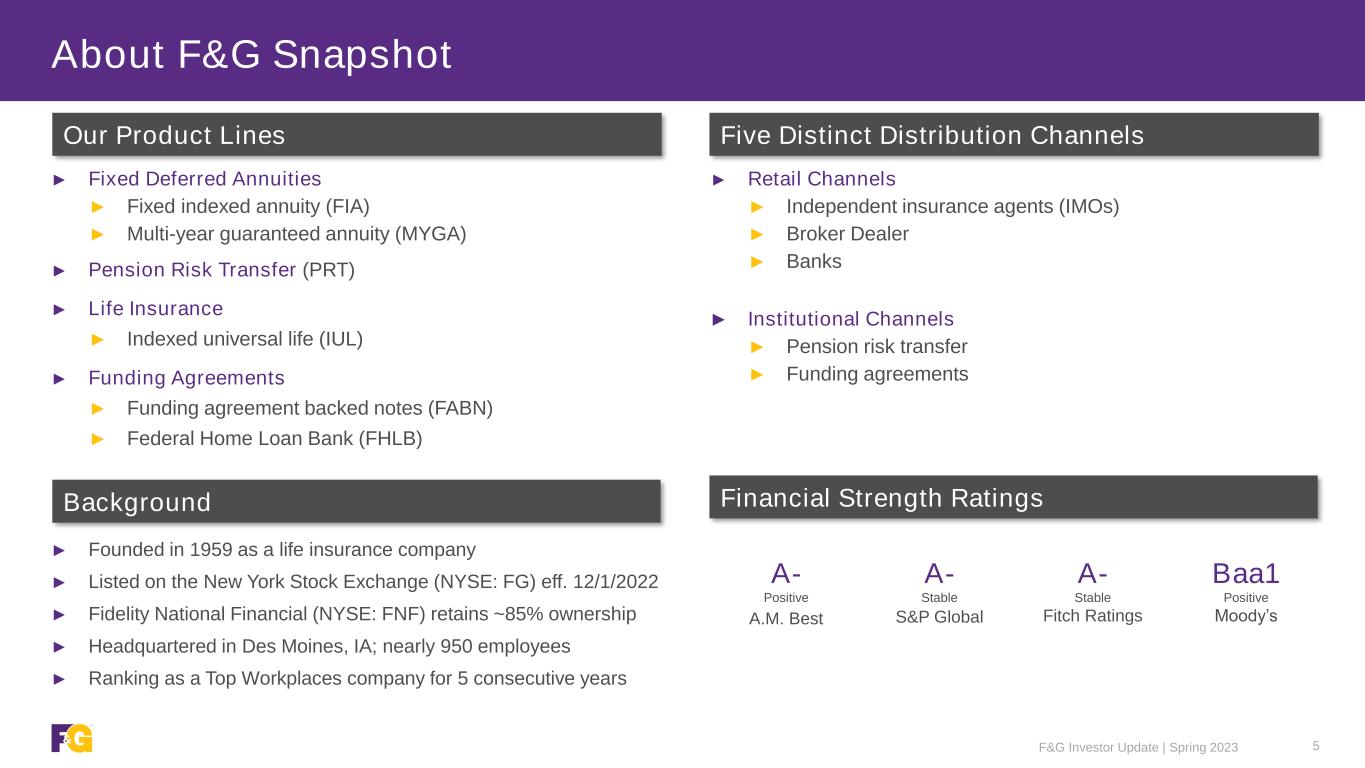

F&G Investor Update | Spring 2023 5 About F&G Snapshot Five Distinct Distribution ChannelsOur Product Lines ► Retail Channels ► Independent insurance agents (IMOs) ► Broker Dealer ► Banks ► Institutional Channels ► Pension risk transfer ► Funding agreements Background ► Founded in 1959 as a life insurance company ► Listed on the New York Stock Exchange (NYSE: FG) eff. 12/1/2022 ► Fidelity National Financial (NYSE: FNF) retains ~85% ownership ► Headquartered in Des Moines, IA; nearly 950 employees ► Ranking as a Top Workplaces company for 5 consecutive years ► Fixed Deferred Annuities ► Fixed indexed annuity (FIA) ► Multi-year guaranteed annuity (MYGA) ► Pension Risk Transfer (PRT) ► Life Insurance ► Indexed universal life (IUL) ► Funding Agreements ► Funding agreement backed notes (FABN) ► Federal Home Loan Bank (FHLB) A- Positive A.M. Best A- Stable S&P Global A- Stable Fitch Ratings Baa1 Positive Moody’s Financial Strength Ratings

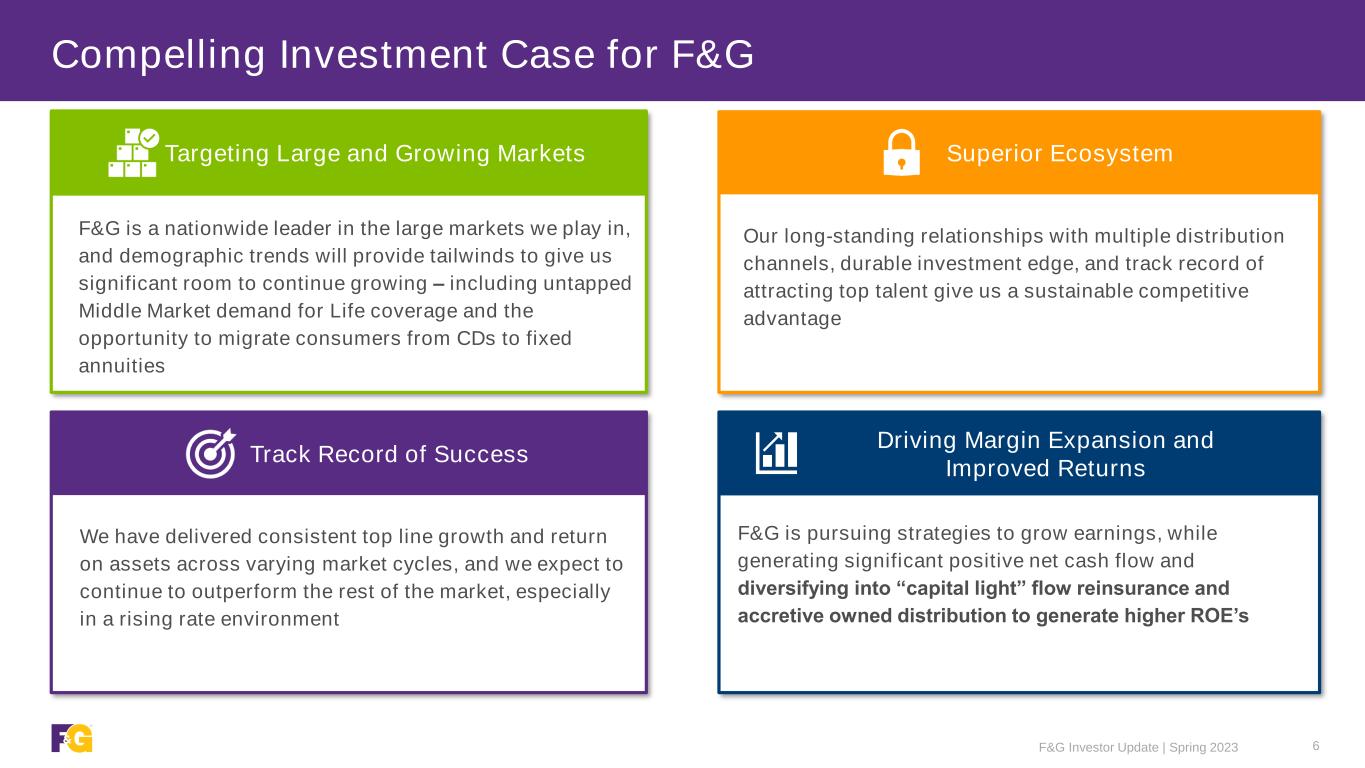

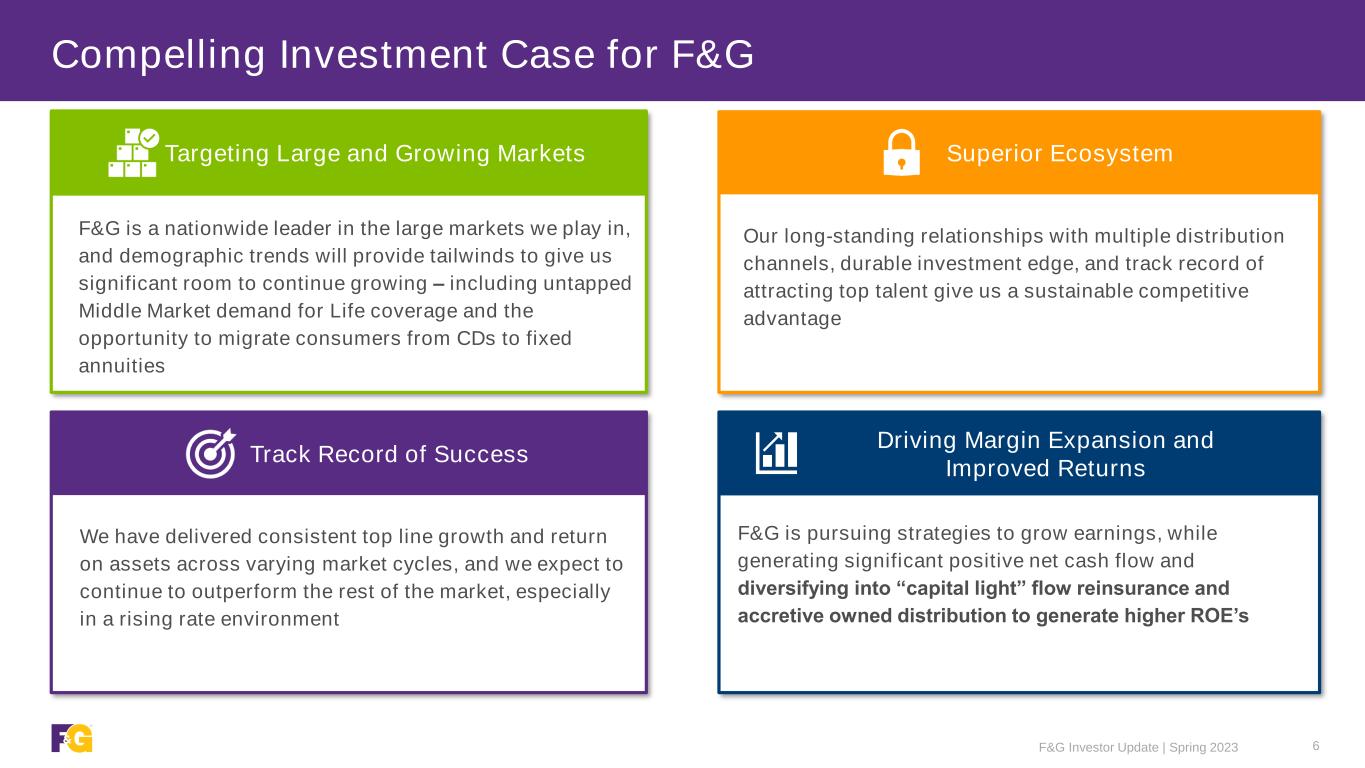

F&G Investor Update | Spring 2023 6 Compelling Investment Case for F&G Targeting Large and Growing Markets F&G is a nationwide leader in the large markets we play in, and demographic trends will provide tailwinds to give us significant room to continue growing – including untapped Middle Market demand for Life coverage and the opportunity to migrate consumers from CDs to fixed annuities Driving Margin Expansion and Improved Returns F&G is pursuing strategies to grow earnings, while generating significant positive net cash flow and diversifying into “capital light” flow reinsurance and accretive owned distribution to generate higher ROE’s Track Record of Success Superior Ecosystem Our long-standing relationships with multiple distribution channels, durable investment edge, and track record of attracting top talent give us a sustainable competitive advantage We have delivered consistent top line growth and return on assets across varying market cycles, and we expect to continue to outperform the rest of the market, especially in a rising rate environment

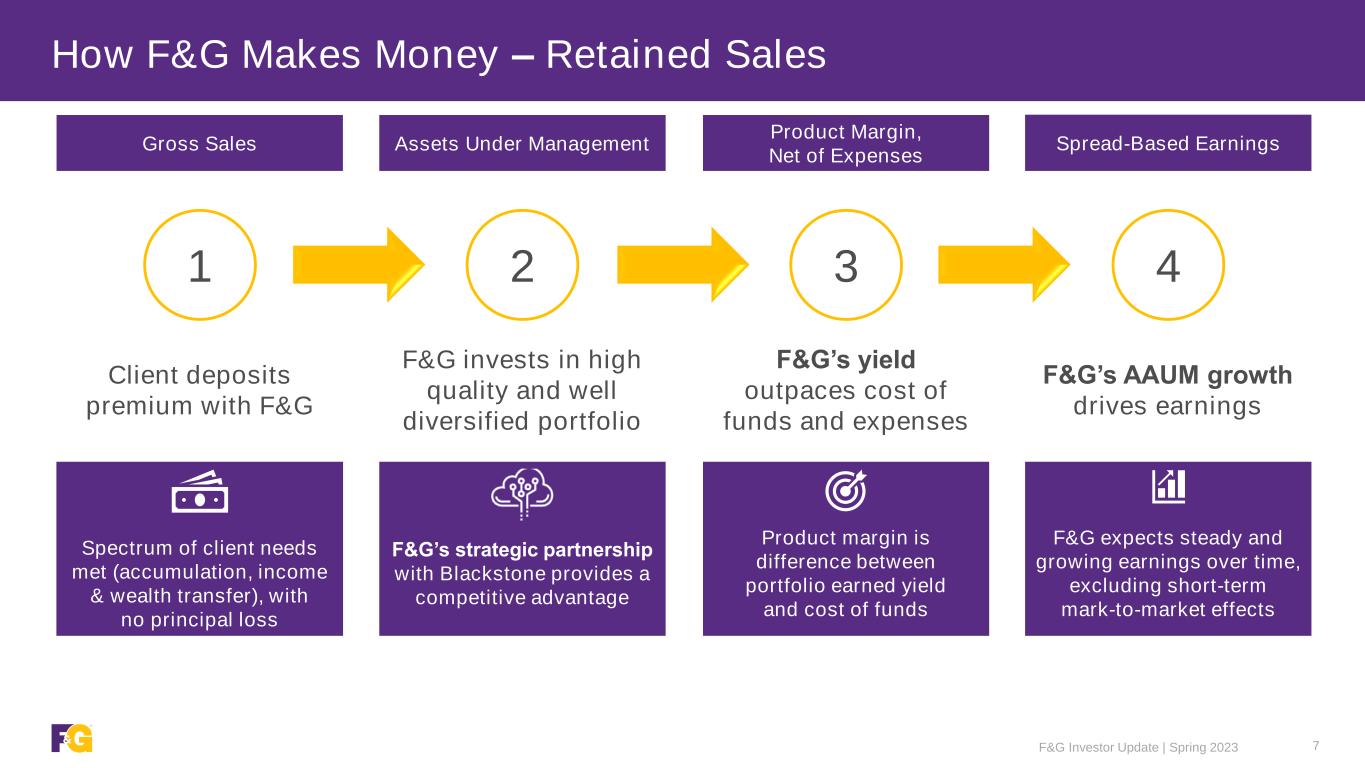

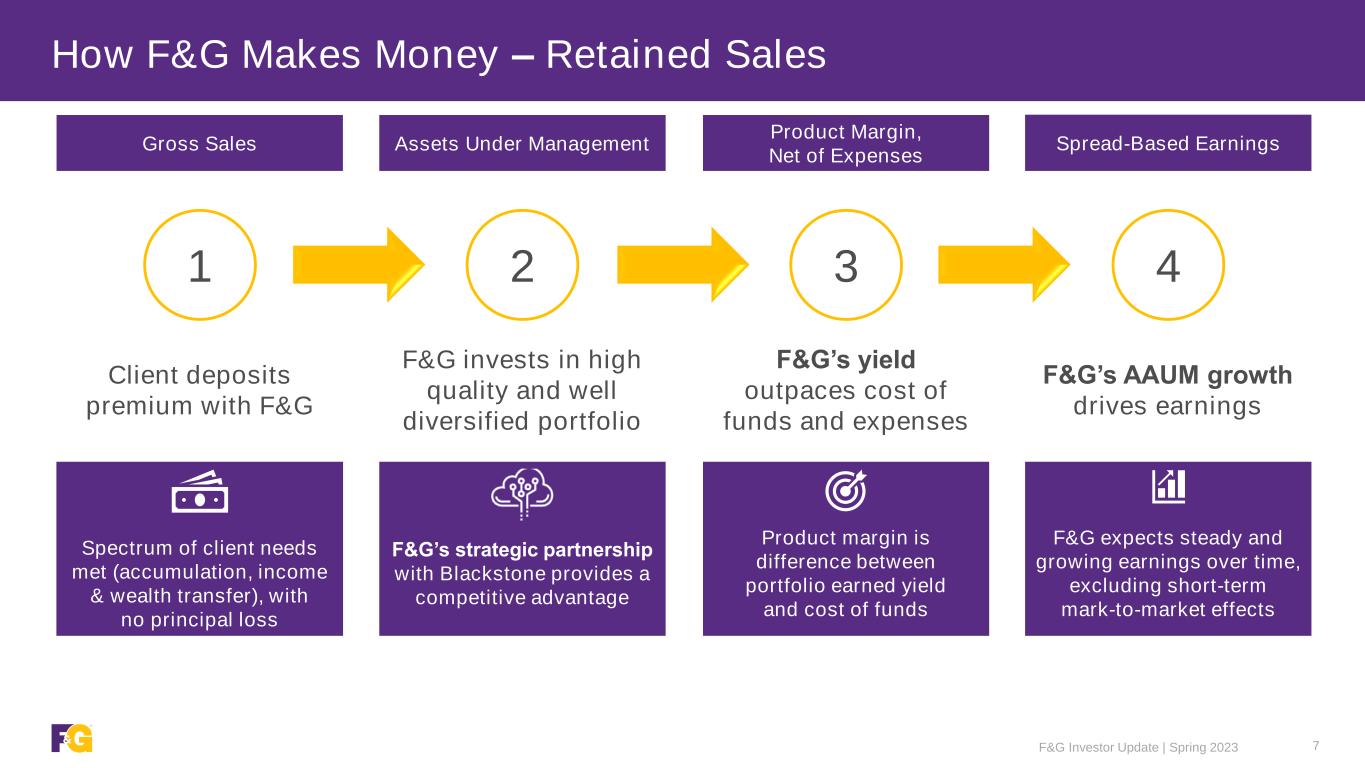

F&G Investor Update | Spring 2023 7 How F&G Makes Money – Retained Sales Client deposits premium with F&G 1 F&G invests in high quality and well diversified portfolio 2 F&G’s yield outpaces cost of funds and expenses 3 F&G’s AAUM growth drives earnings 4 Spectrum of client needs met (accumulation, income & wealth transfer), with no principal loss F&G’s strategic partnership with Blackstone provides a competitive advantage Product margin is difference between portfolio earned yield and cost of funds F&G expects steady and growing earnings over time, excluding short-term mark-to-market effects Gross Sales Assets Under Management Product Margin, Net of Expenses Spread-Based Earnings

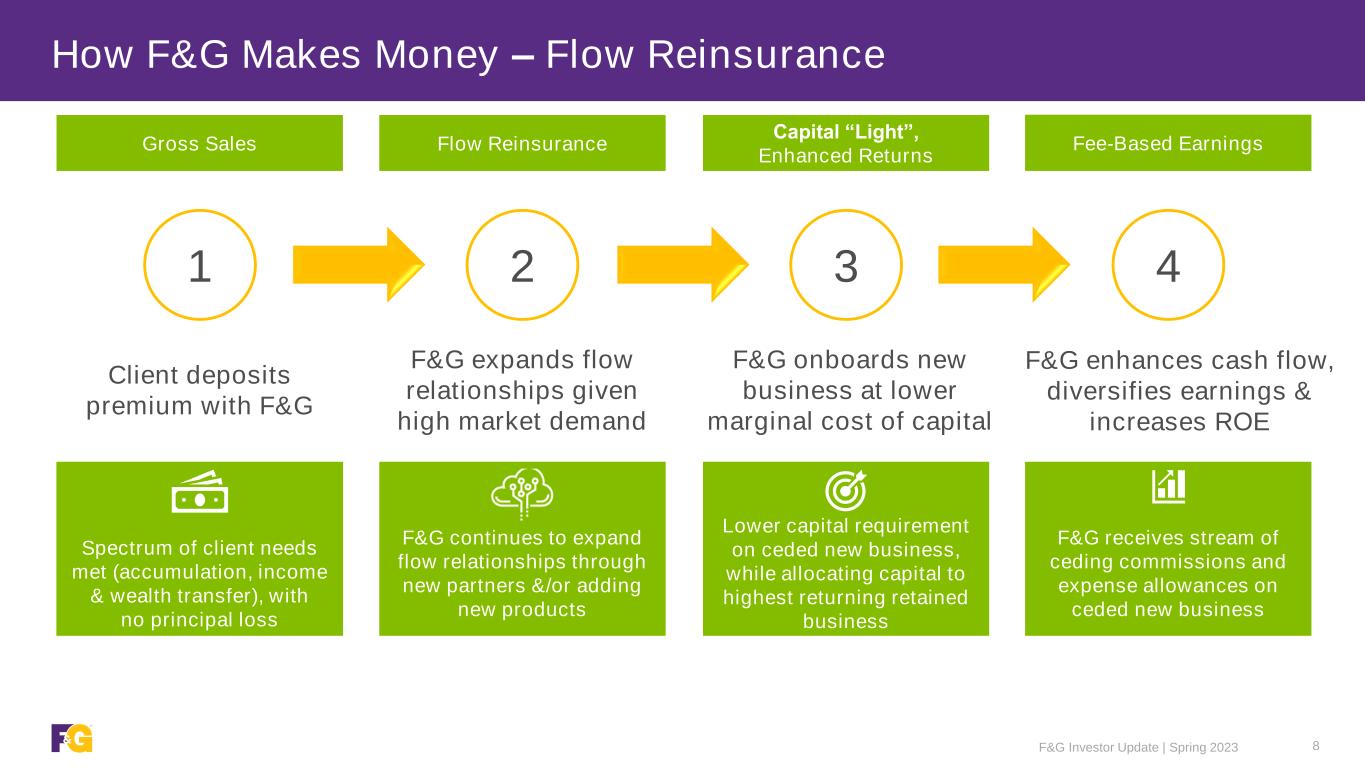

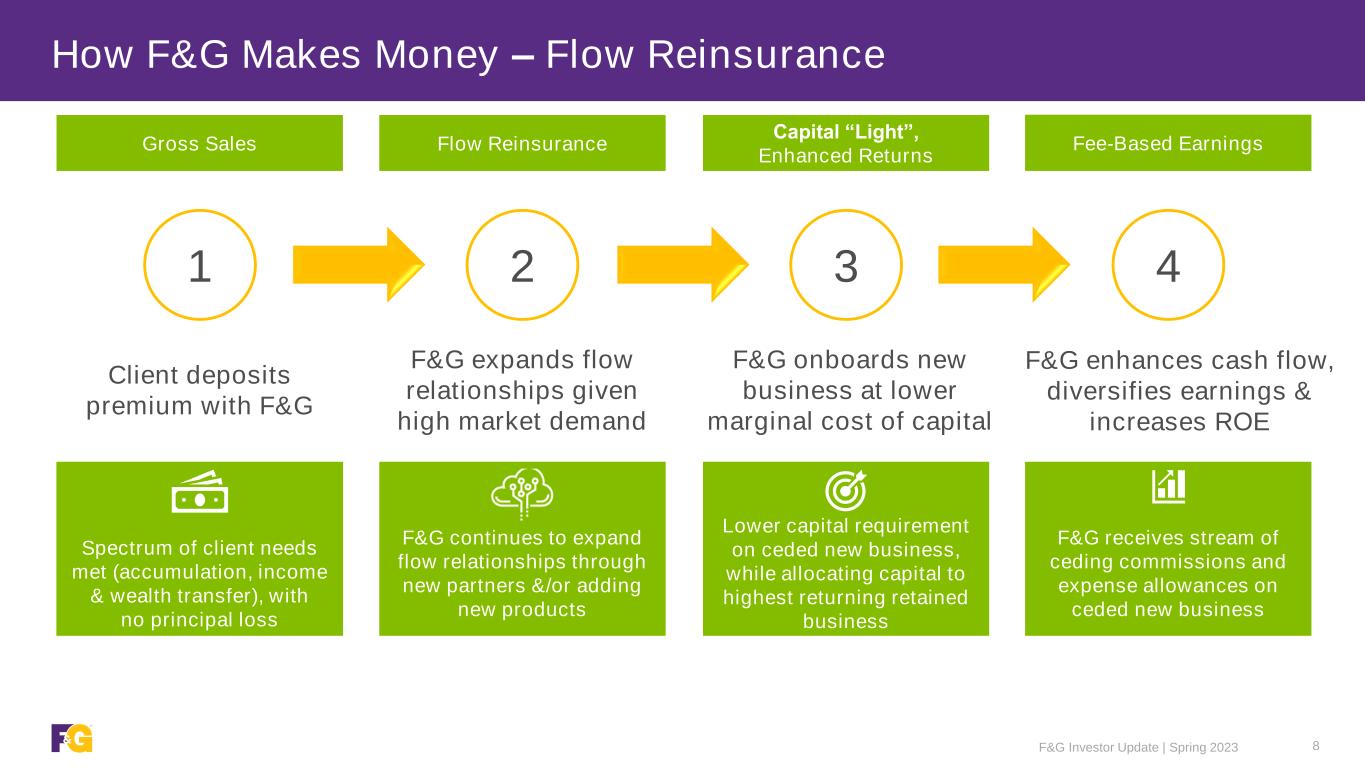

F&G Investor Update | Spring 2023 8 How F&G Makes Money – Flow Reinsurance Client deposits premium with F&G 1 F&G expands flow relationships given high market demand 2 F&G onboards new business at lower marginal cost of capital 3 F&G enhances cash flow, diversifies earnings & increases ROE 4 Spectrum of client needs met (accumulation, income & wealth transfer), with no principal loss F&G continues to expand flow relationships through new partners &/or adding new products Lower capital requirement on ceded new business, while allocating capital to highest returning retained business F&G receives stream of ceding commissions and expense allowances on ceded new business Gross Sales Flow Reinsurance Capital “Light”, Enhanced Returns Fee-Based Earnings

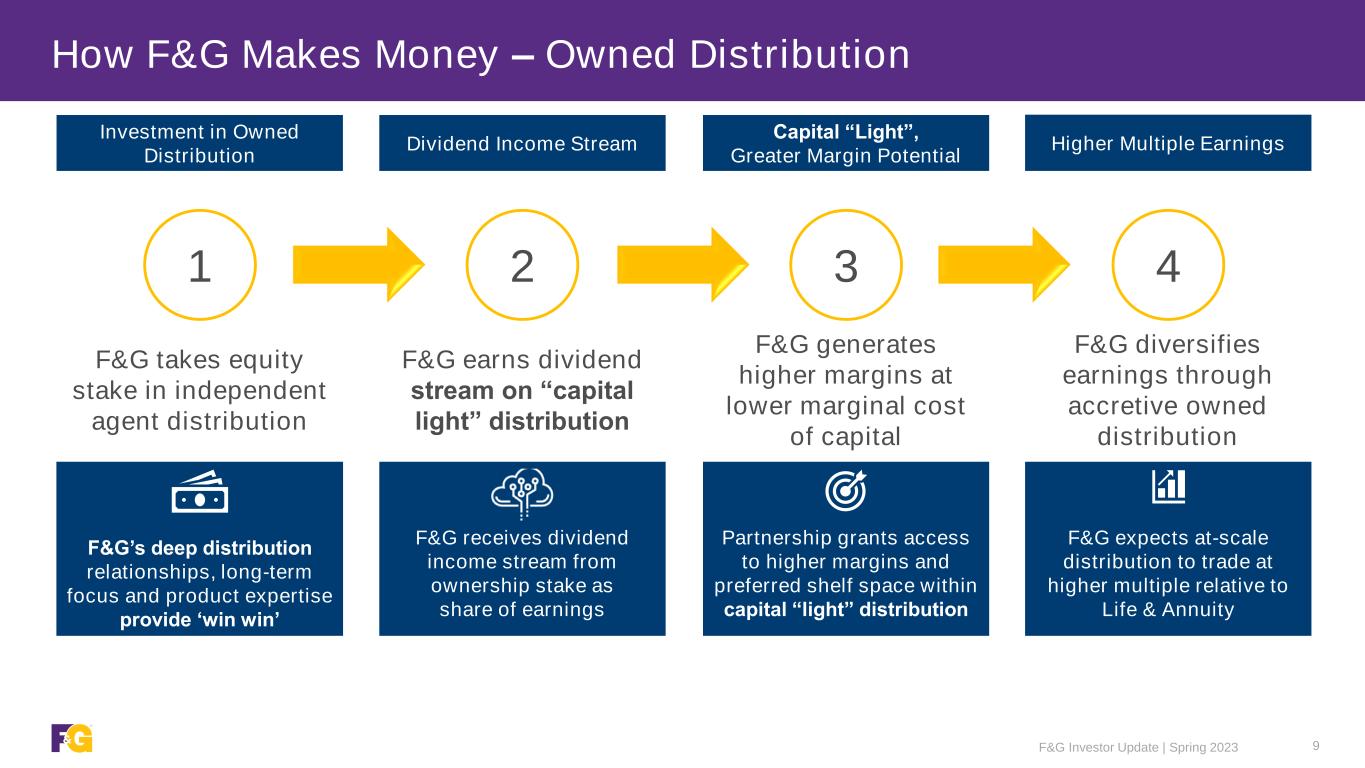

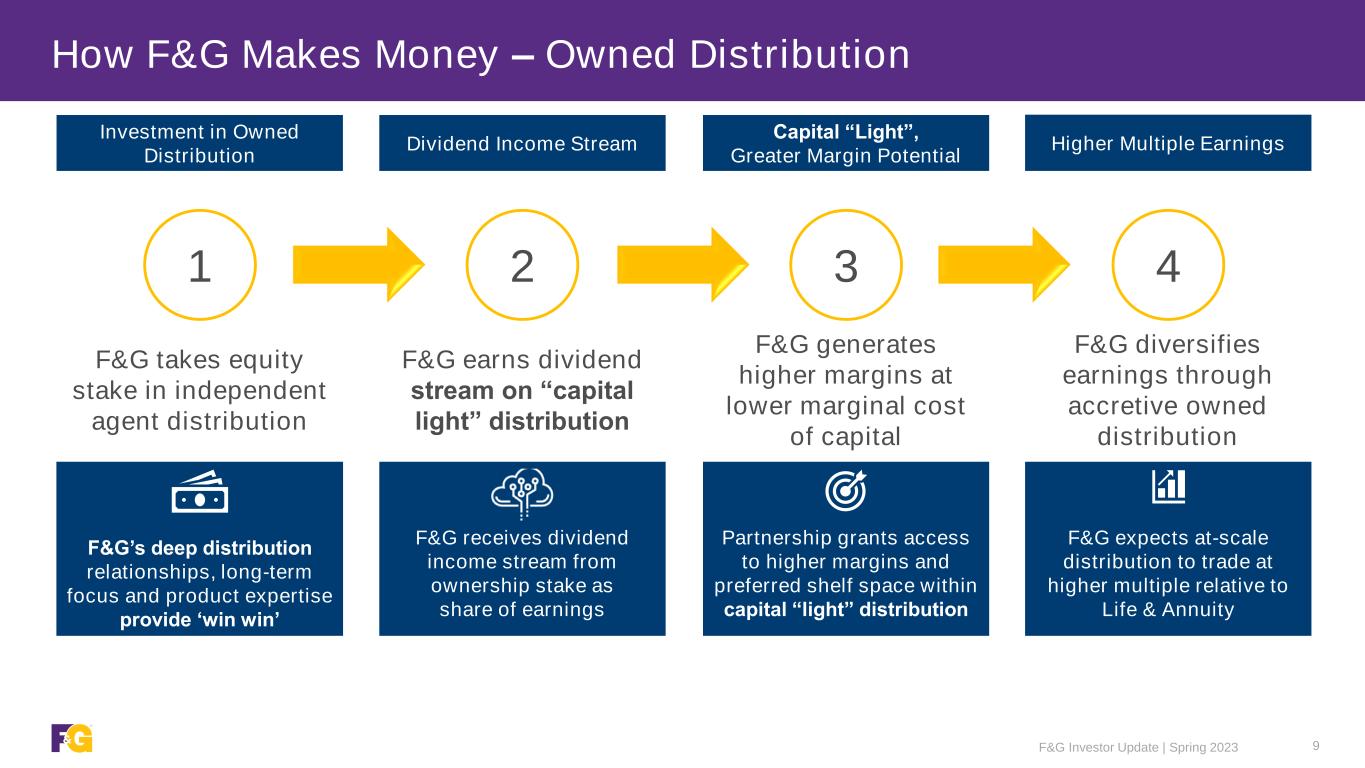

F&G Investor Update | Spring 2023 9 How F&G Makes Money – Owned Distribution F&G takes equity stake in independent agent distribution 1 F&G earns dividend stream on “capital light” distribution 2 F&G generates higher margins at lower marginal cost of capital 3 F&G diversifies earnings through accretive owned distribution 4 F&G’s deep distribution relationships, long-term focus and product expertise provide ‘win win’ F&G receives dividend income stream from ownership stake as share of earnings Partnership grants access to higher margins and preferred shelf space within capital “light” distribution F&G expects at-scale distribution to trade at higher multiple relative to Life & Annuity Investment in Owned Distribution Dividend Income Stream Capital “Light”, Greater Margin Potential Higher Multiple Earnings

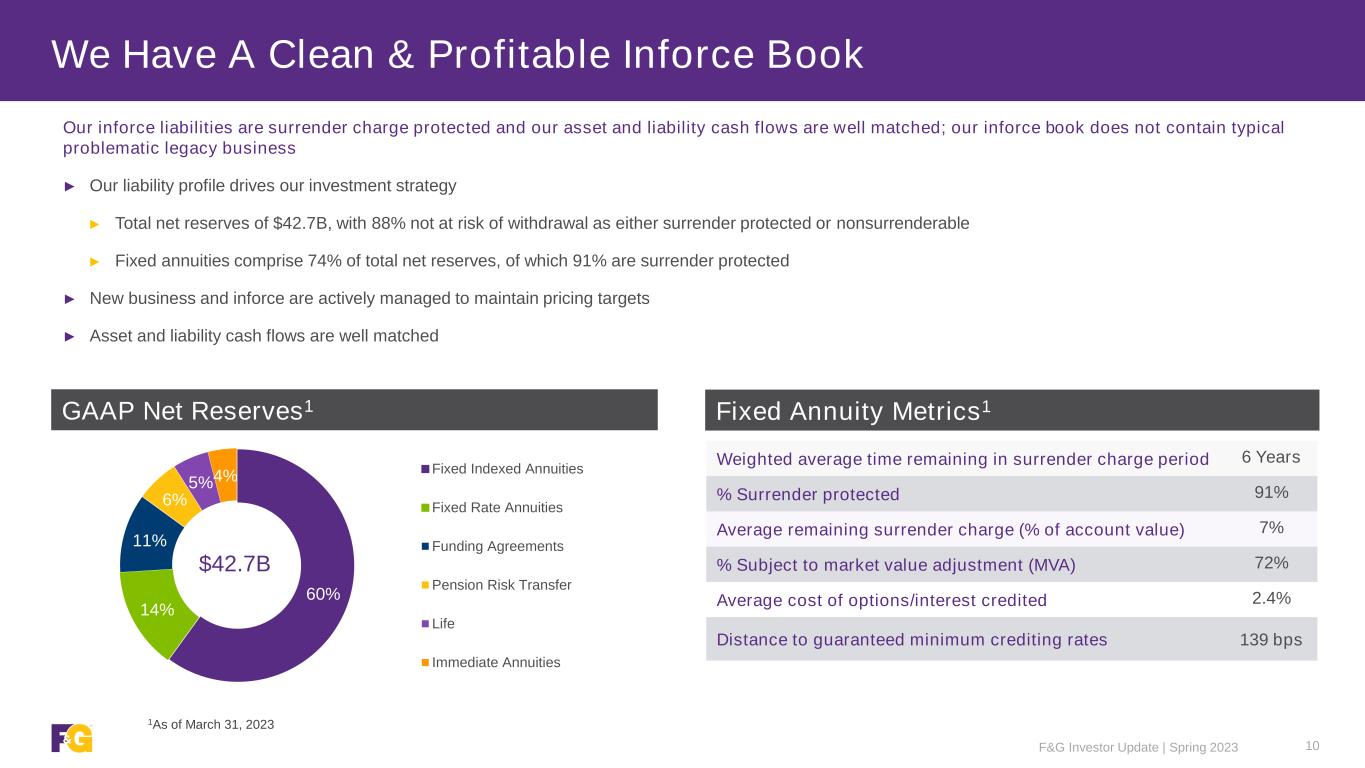

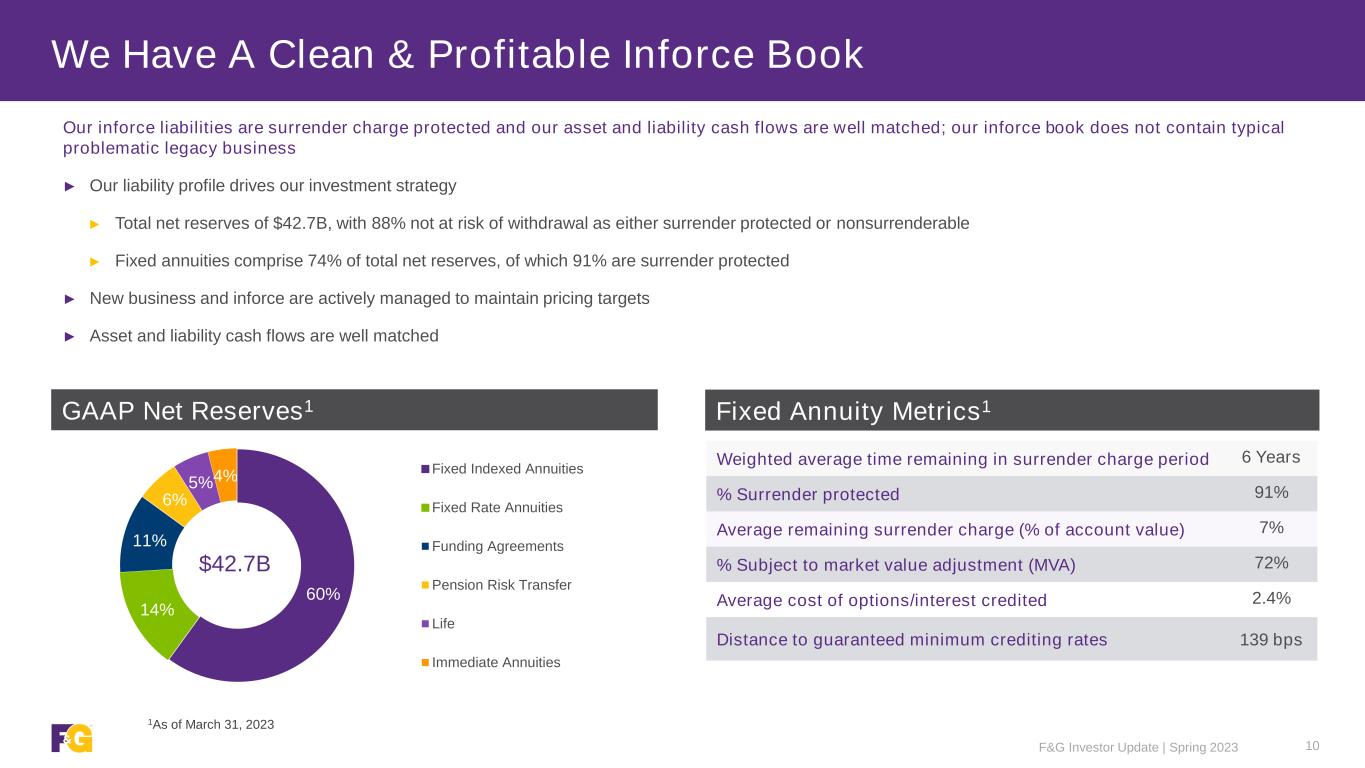

60% 14% 11% 6% 5%4% Fixed Indexed Annuities Fixed Rate Annuities Funding Agreements Pension Risk Transfer Life Immediate Annuities $42.7B F&G Investor Update | Spring 2023 We Have A Clean & Profitable Inforce Book GAAP Net Reserves1 Fixed Annuity Metrics1 10 Weighted average time remaining in surrender charge period 6 Years % Surrender protected 91% Average remaining surrender charge (% of account value) 7% % Subject to market value adjustment (MVA) 72% Average cost of options/interest credited 2.4% Distance to guaranteed minimum crediting rates 139 bps Our inforce liabilities are surrender charge protected and our asset and liability cash flows are well matched; our inforce book does not contain typical problematic legacy business ► Our liability profile drives our investment strategy ► Total net reserves of $42.7B, with 88% not at risk of withdrawal as either surrender protected or nonsurrenderable ► Fixed annuities comprise 74% of total net reserves, of which 91% are surrender protected ► New business and inforce are actively managed to maintain pricing targets ► Asset and liability cash flows are well matched 1As of March 31, 2023

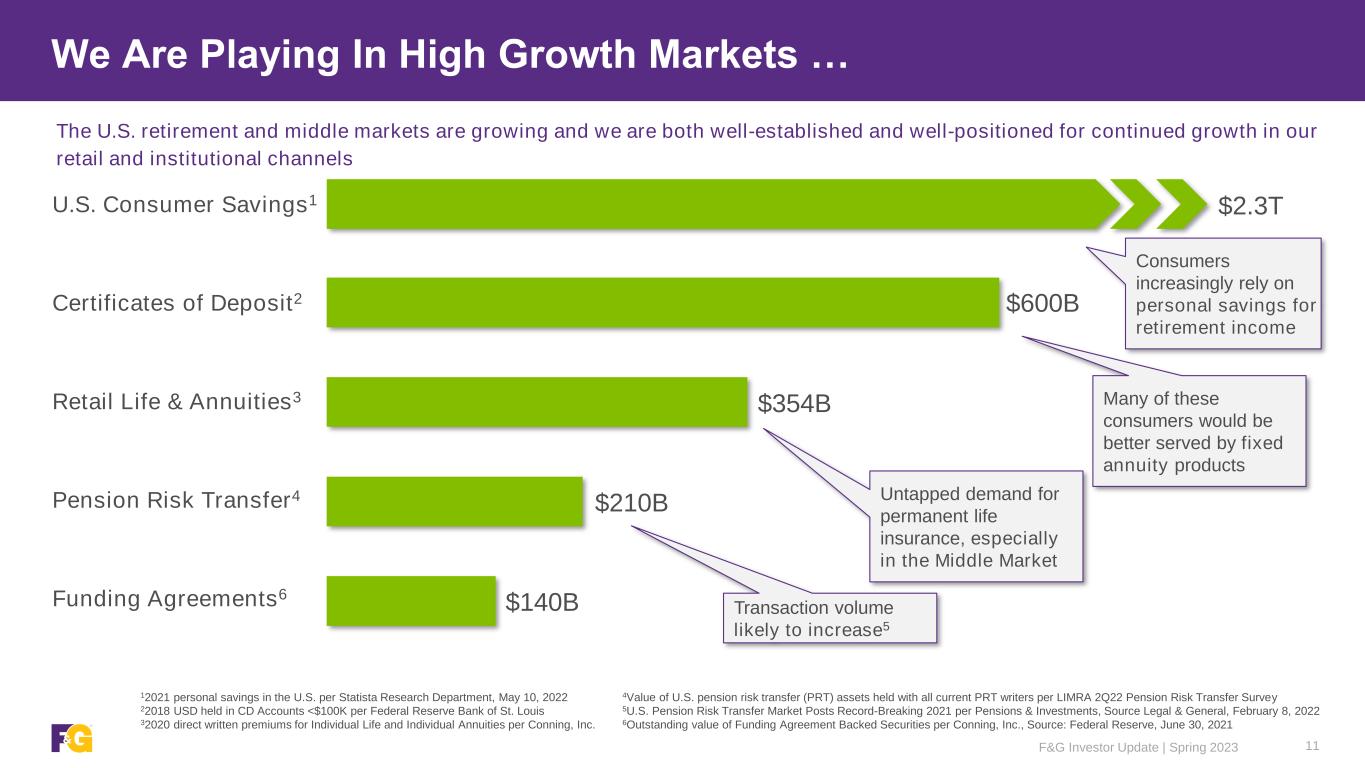

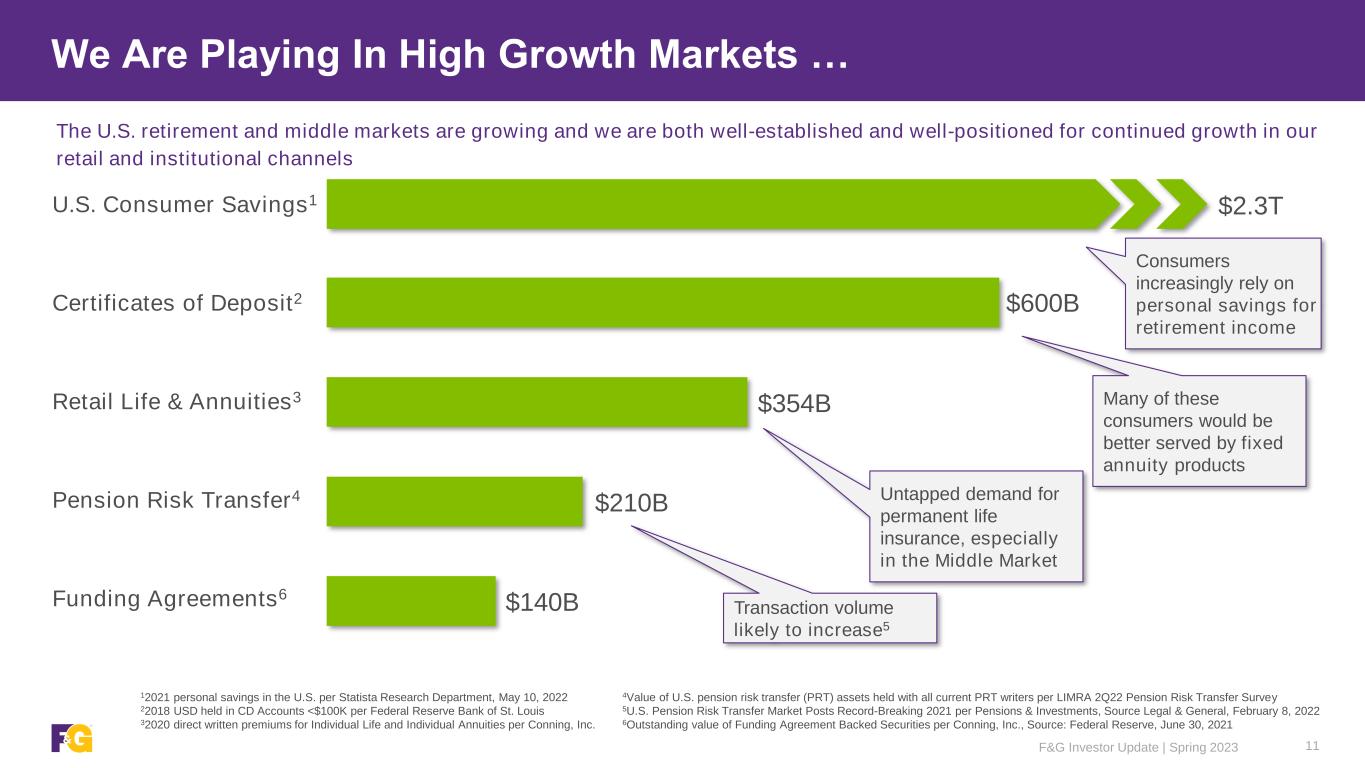

F&G Investor Update | Spring 2023 11 We Are Playing In High Growth Markets … U.S. Consumer Savings1 Certificates of Deposit2 Retail Life & Annuities3 Pension Risk Transfer4 Funding Agreements6 $140B $210B $354B 12021 personal savings in the U.S. per Statista Research Department, May 10, 2022 22018 USD held in CD Accounts <$100K per Federal Reserve Bank of St. Louis 32020 direct written premiums for Individual Life and Individual Annuities per Conning, Inc. $600B 4Value of U.S. pension risk transfer (PRT) assets held with all current PRT writers per LIMRA 2Q22 Pension Risk Transfer Survey 5U.S. Pension Risk Transfer Market Posts Record-Breaking 2021 per Pensions & Investments, Source Legal & General, February 8, 2022 6Outstanding value of Funding Agreement Backed Securities per Conning, Inc., Source: Federal Reserve, June 30, 2021 $2.3T Untapped demand for permanent life insurance, especially in the Middle Market Transaction volume likely to increase5 The U.S. retirement and middle markets are growing and we are both well-established and well-positioned for continued growth in our retail and institutional channels Consumers increasingly rely on personal savings for retirement income Many of these consumers would be better served by fixed annuity products

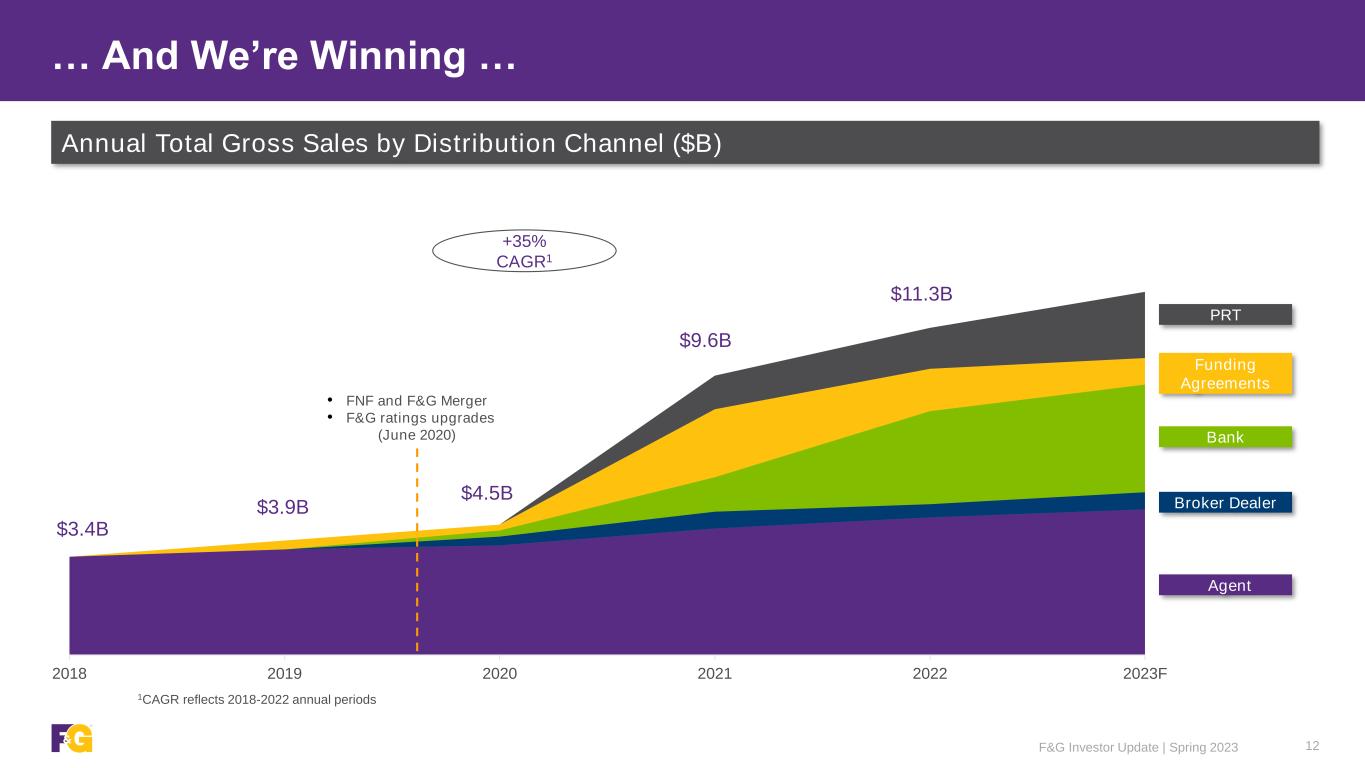

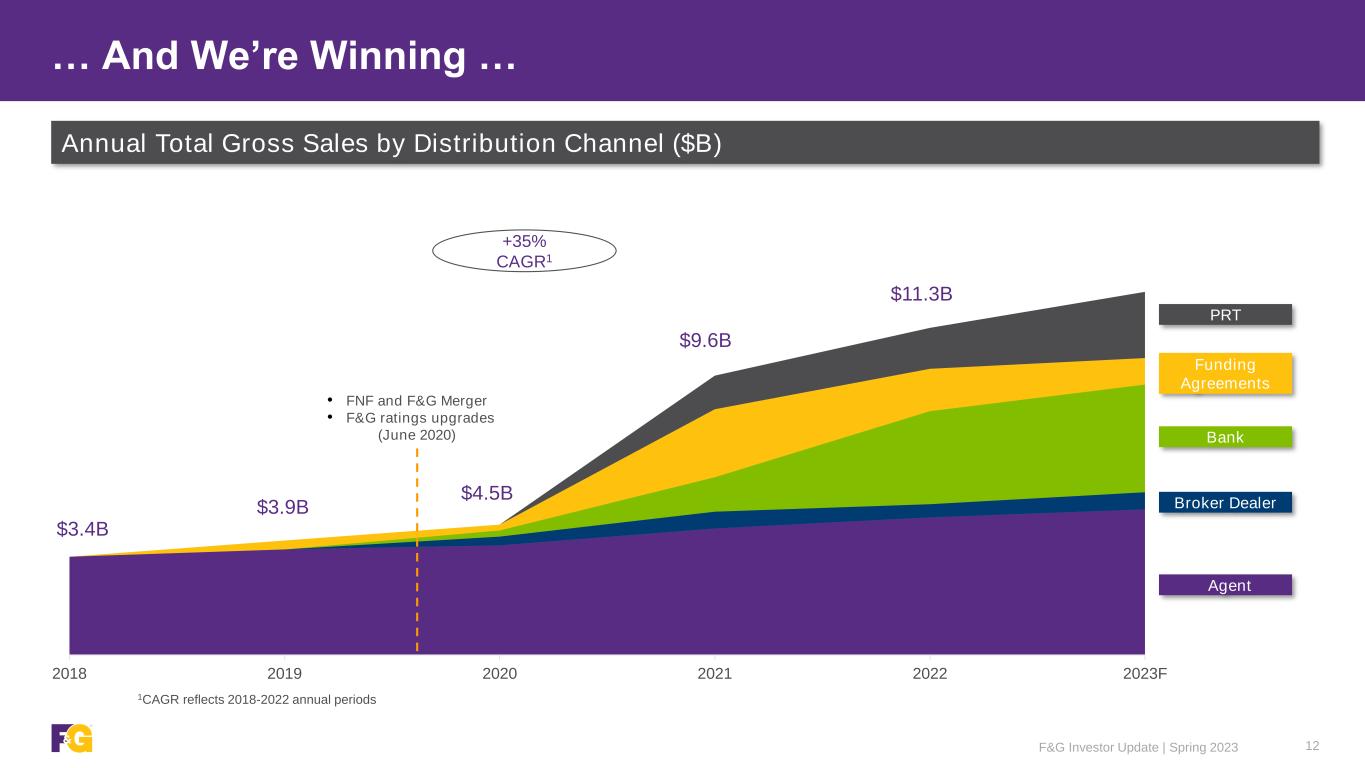

2018 2019 2020 2021 2022 2023F F&G Investor Update | Spring 2023 12 Funding Agreements Agent PRT Broker Dealer Bank $9.6B $4.5B $3.9B $3.4B +35% CAGR1 Annual Total Gross Sales by Distribution Channel ($B) • FNF and F&G Merger • F&G ratings upgrades (June 2020) 1CAGR reflects 2018-2022 annual periods … And We’re Winning … $11.3B

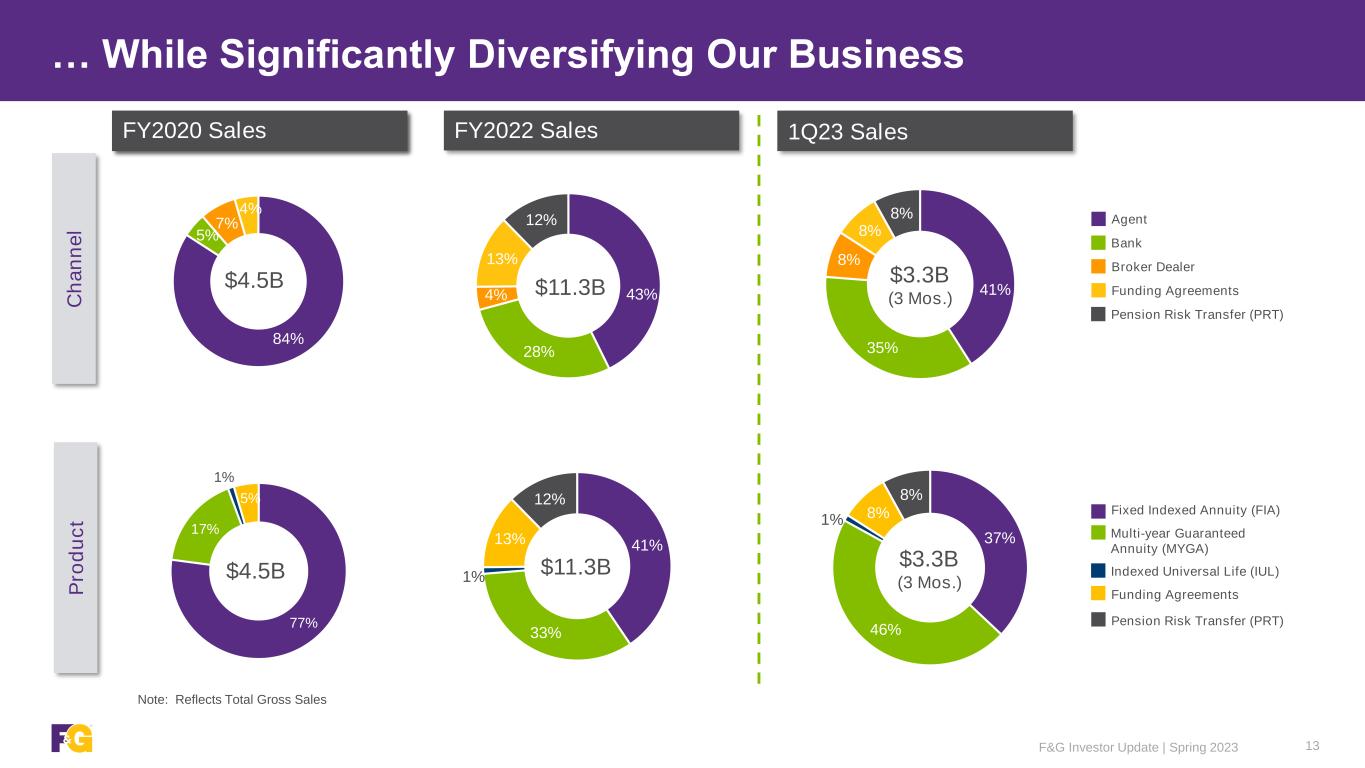

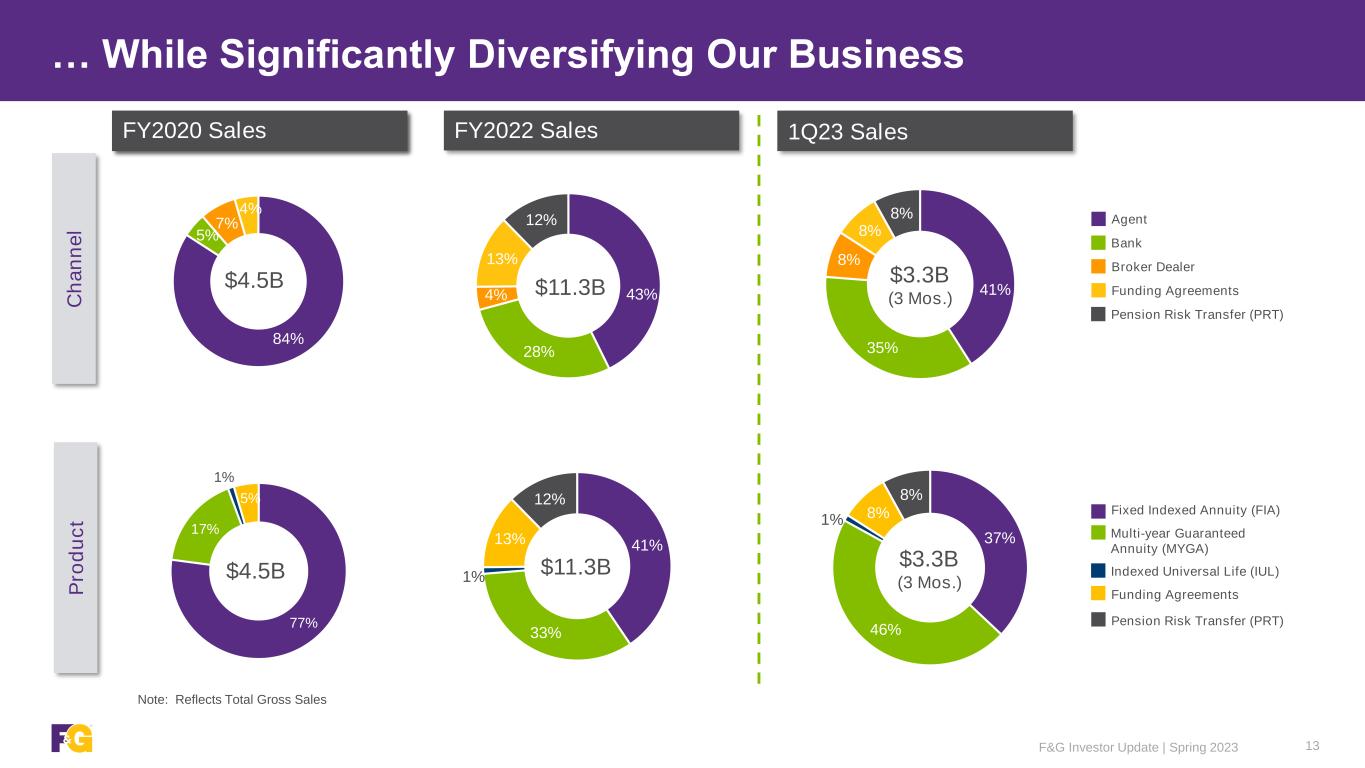

41% 35% 8% 8% 8% $3.3B (3 Mos.) 13 … While Significantly Diversifying Our Business Note: Reflects Total Gross Sales FY2022 SalesFY2020 Sales 1Q23 Sales Bank Broker Dealer Agent Funding Agreements Pension Risk Transfer (PRT) C h a n n e l P ro d u c t 37% 46% 1% 8% 8% $3.3B (3 Mos.) Multi-year Guaranteed Annuity (MYGA) Indexed Universal Life (IUL) Funding Agreements Fixed Indexed Annuity (FIA) Pension Risk Transfer (PRT) F&G Investor Update | Spring 2023 43% 28% 4% 13% 12% $11.3B 41% 33% 1% 13% 12% $11.3B 77% 17% 1% 5% $4.5B 84% 5% 7% 4% $4.5B

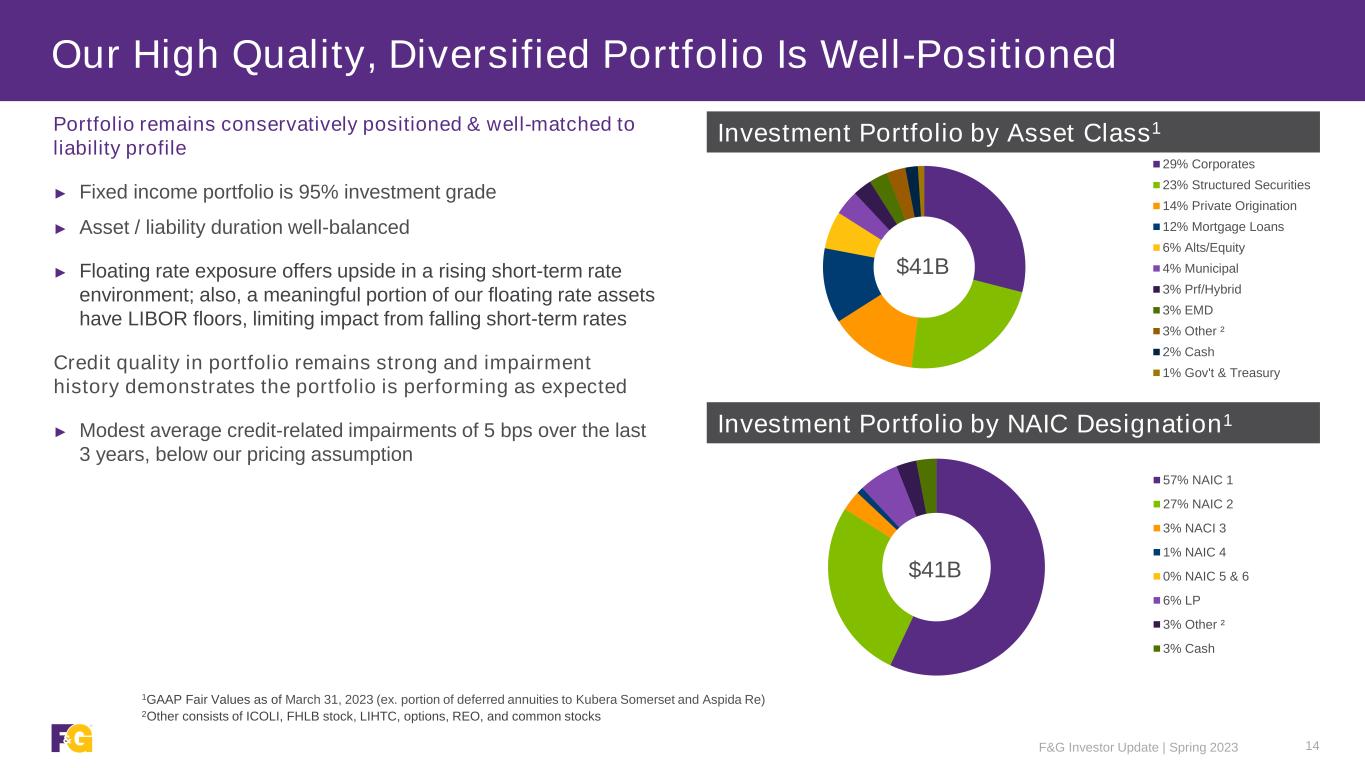

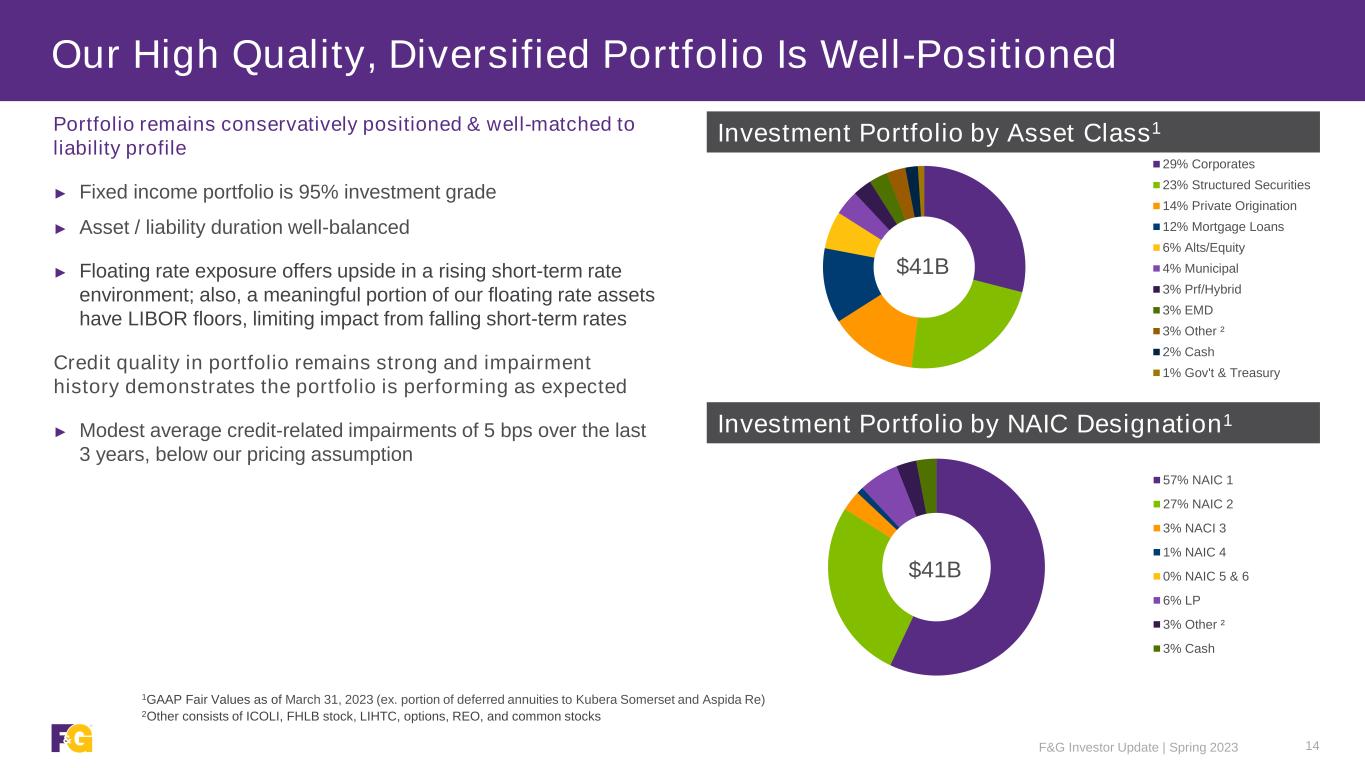

57% NAIC 1 27% NAIC 2 3% NACI 3 1% NAIC 4 0% NAIC 5 & 6 6% LP 3% Other ² 3% Cash 29% Corporates 23% Structured Securities 14% Private Origination 12% Mortgage Loans 6% Alts/Equity 4% Municipal 3% Prf/Hybrid 3% EMD 3% Other ² 2% Cash 1% Gov't & Treasury Our High Quality, Diversified Portfolio Is Well-Positioned 14 Portfolio remains conservatively positioned & well-matched to liability profile ► Fixed income portfolio is 95% investment grade ► Asset / liability duration well-balanced ► Floating rate exposure offers upside in a rising short-term rate environment; also, a meaningful portion of our floating rate assets have LIBOR floors, limiting impact from falling short-term rates Credit quality in portfolio remains strong and impairment history demonstrates the portfolio is performing as expected ► Modest average credit-related impairments of 5 bps over the last 3 years, below our pricing assumption Investment Portfolio by NAIC Designation1 1GAAP Fair Values as of March 31, 2023 (ex. portion of deferred annuities to Kubera Somerset and Aspida Re) 2Other consists of ICOLI, FHLB stock, LIHTC, options, REO, and common stocks Investment Portfolio by Asset Class1 $41B $41B F&G Investor Update | Spring 2023

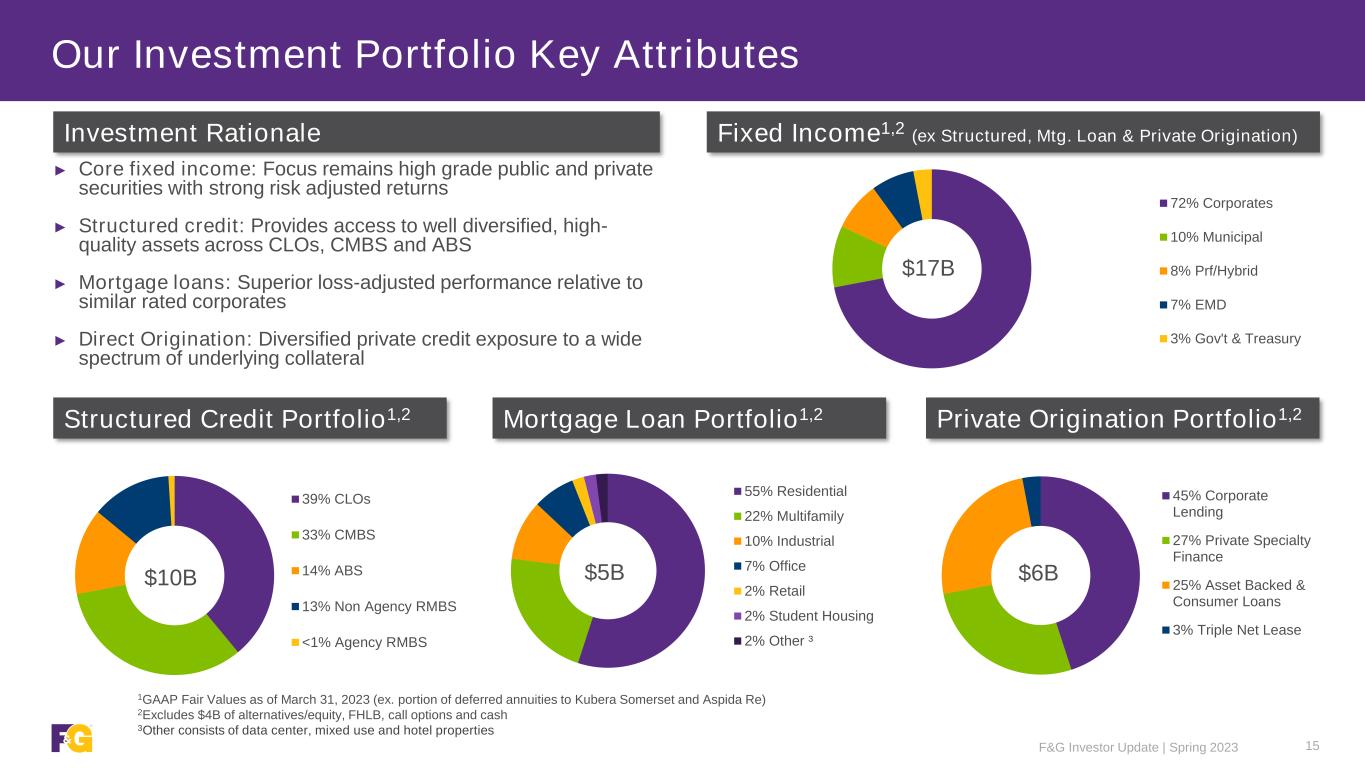

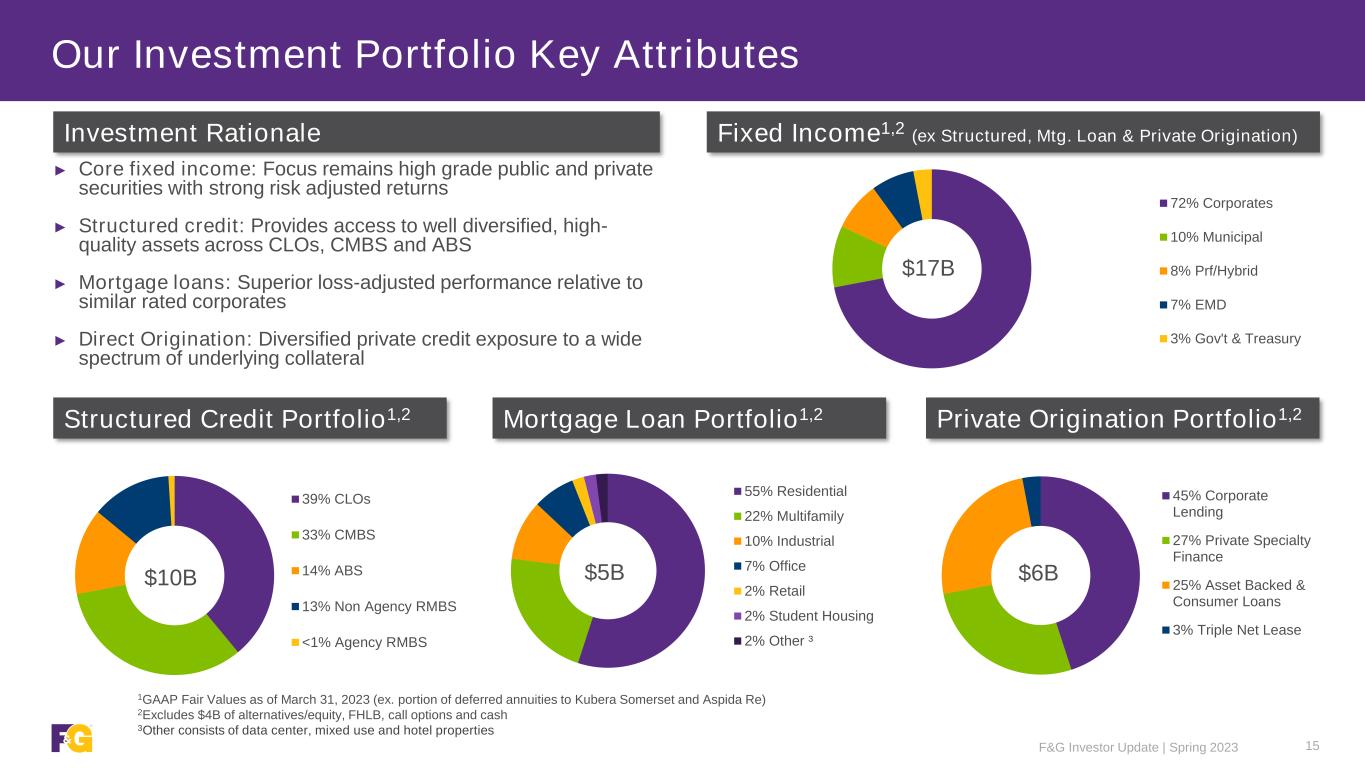

39% CLOs 33% CMBS 14% ABS 13% Non Agency RMBS <1% Agency RMBS 55% Residential 22% Multifamily 10% Industrial 7% Office 2% Retail 2% Student Housing 2% Other ³ 72% Corporates 10% Municipal 8% Prf/Hybrid 7% EMD 3% Gov't & Treasury Our Investment Portfolio Key Attributes F&G Investor Update | Spring 2023 15 Structured Credit Portfolio1,2 ► Core fixed income: Focus remains high grade public and private securities with strong risk adjusted returns ► Structured credit: Provides access to well diversified, high- quality assets across CLOs, CMBS and ABS ► Mortgage loans: Superior loss-adjusted performance relative to similar rated corporates ► Direct Origination: Diversified private credit exposure to a wide spectrum of underlying collateral Investment Rationale Fixed Income1,2 (ex Structured, Mtg. Loan & Private Origination) 1GAAP Fair Values as of March 31, 2023 (ex. portion of deferred annuities to Kubera Somerset and Aspida Re) 2Excludes $4B of alternatives/equity, FHLB, call options and cash 3Other consists of data center, mixed use and hotel properties $10B Mortgage Loan Portfolio1,2 $5B Private Origination Portfolio1,2 $6B $17B 45% Corporate Lending 27% Private Specialty Finance 25% Asset Backed & Consumer Loans 3% Triple Net Lease

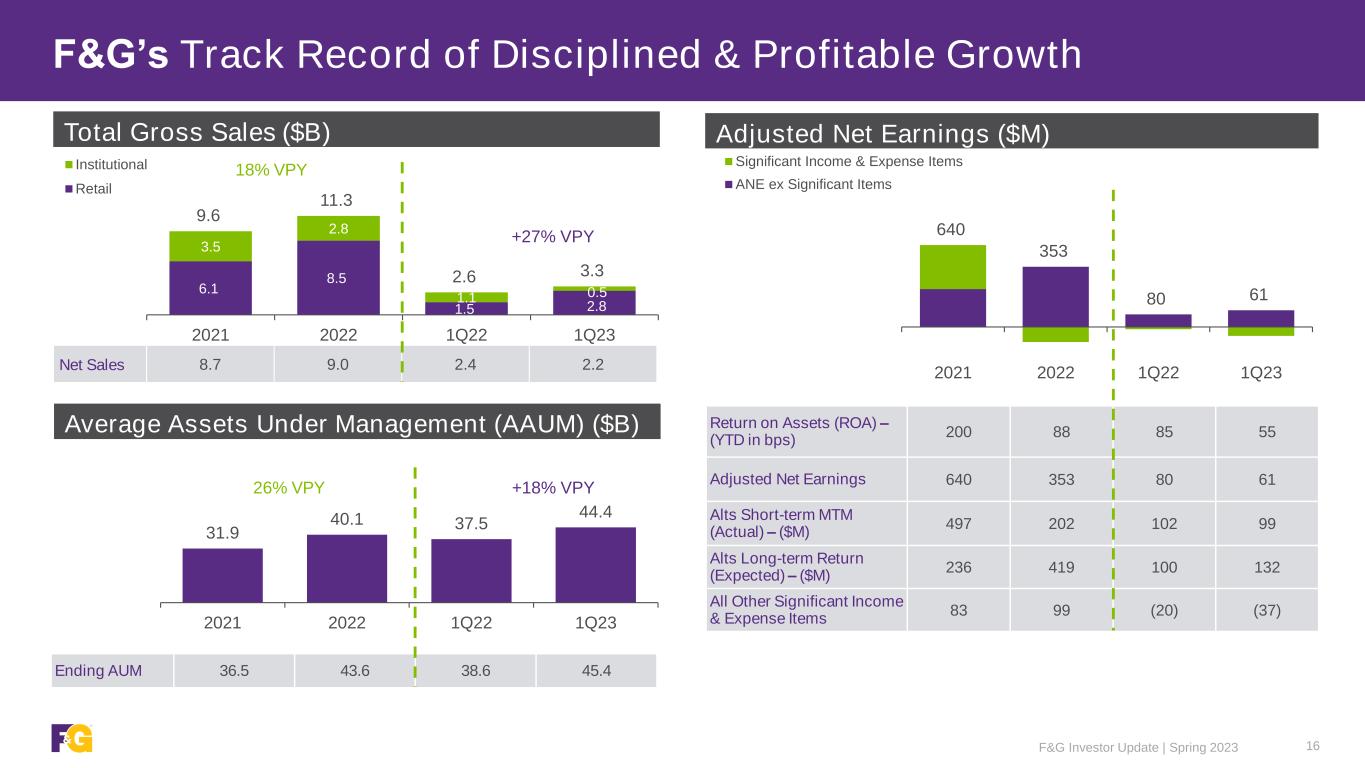

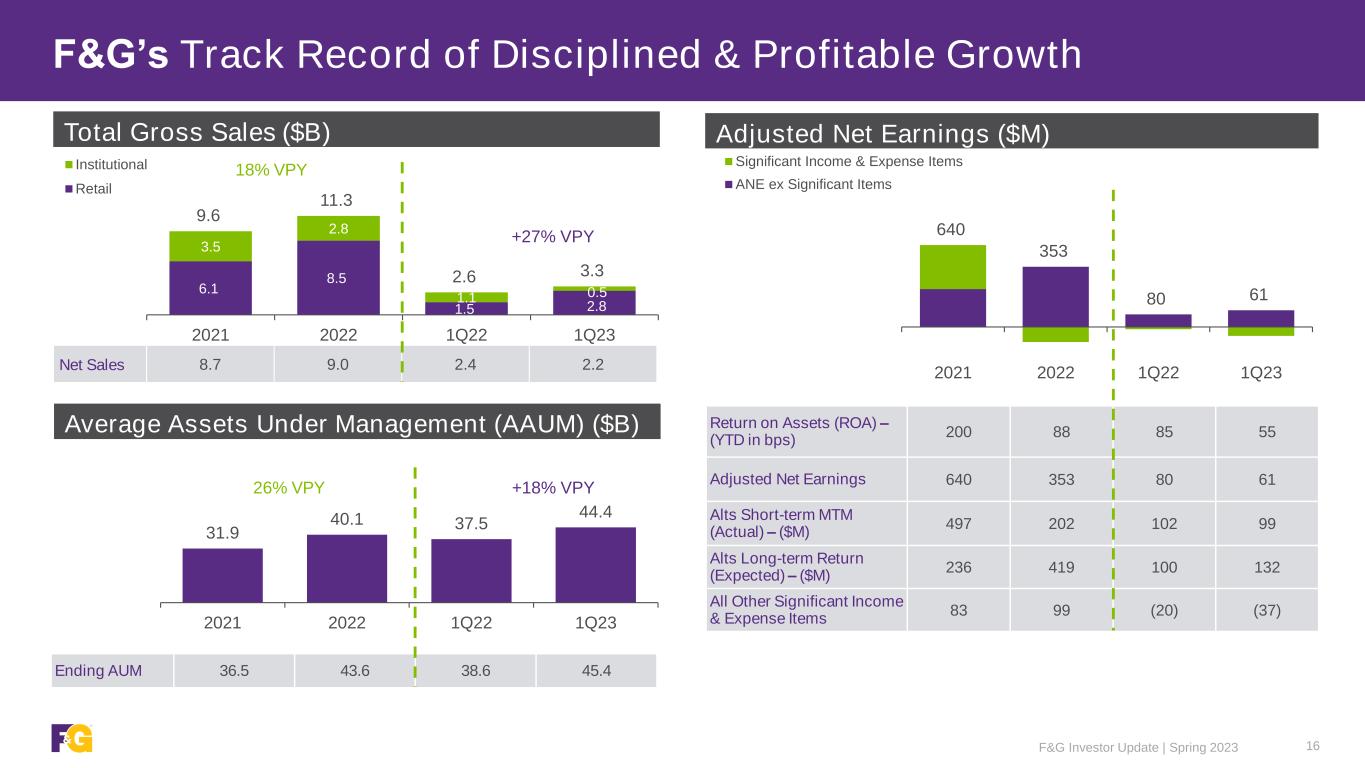

31.9 40.1 37.5 44.4 2021 2022 1Q22 1Q23 F&G Investor Update | Spring 2023 16 F&G’s Track Record of Disciplined & Profitable Growth Total Gross Sales ($B) Average Assets Under Management (AAUM) ($B) Ending AUM 36.5 43.6 38.6 45.4 Return on Assets (ROA) – (YTD in bps) 200 88 85 55 Adjusted Net Earnings 640 353 80 61 Alts Short-term MTM (Actual) – ($M) 497 202 102 99 Alts Long-term Return (Expected) – ($M) 236 419 100 132 All Other Significant Income & Expense Items 83 99 (20) (37) Adjusted Net Earnings ($M) Net Sales 8.7 9.0 2.4 2.2 6.1 8.5 1.5 2.8 3.5 2.8 1.1 0.5 9.6 11.3 2.6 3.3 2021 2022 1Q22 1Q23 Institutional Retail +27% VPY +18% VPY 18% VPY 26% VPY 640 353 80 61 2021 2022 1Q22 1Q23 Significant Income & Expense Items ANE ex Significant Items

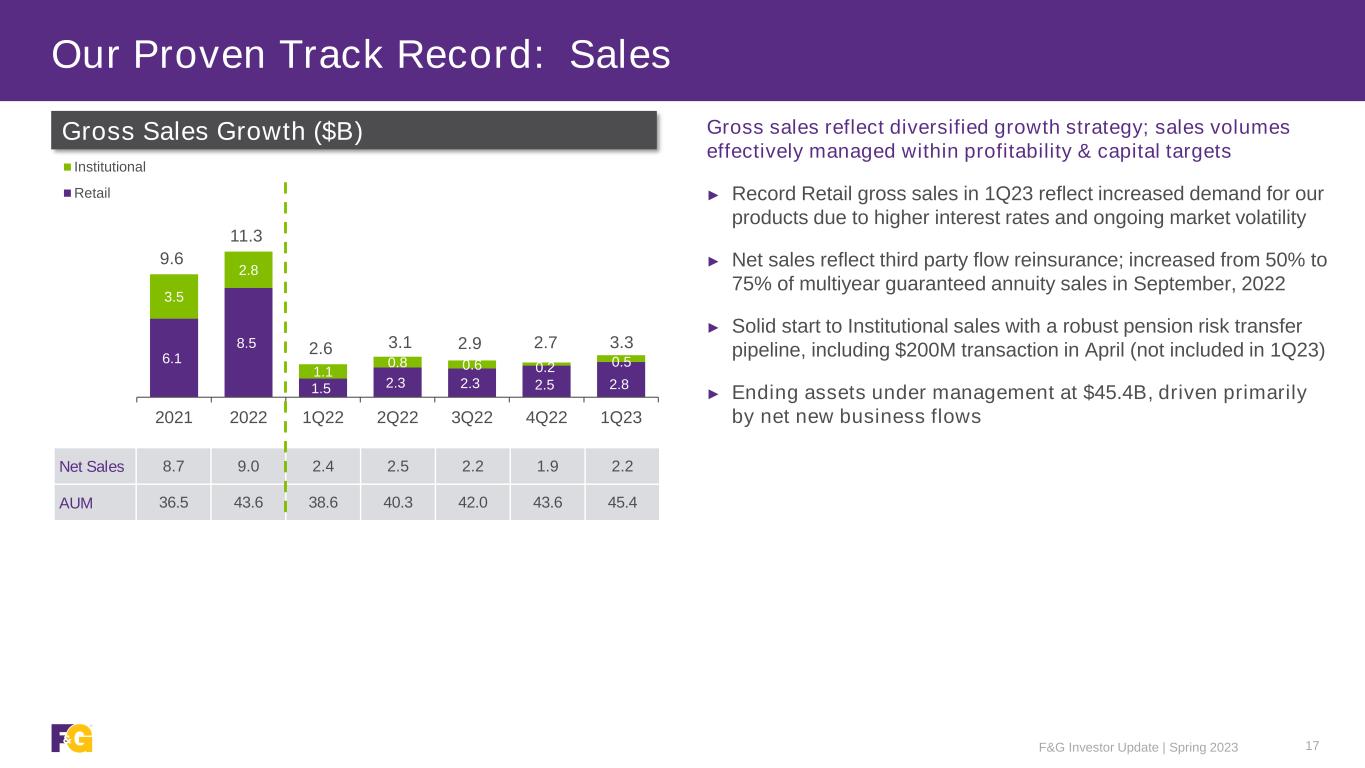

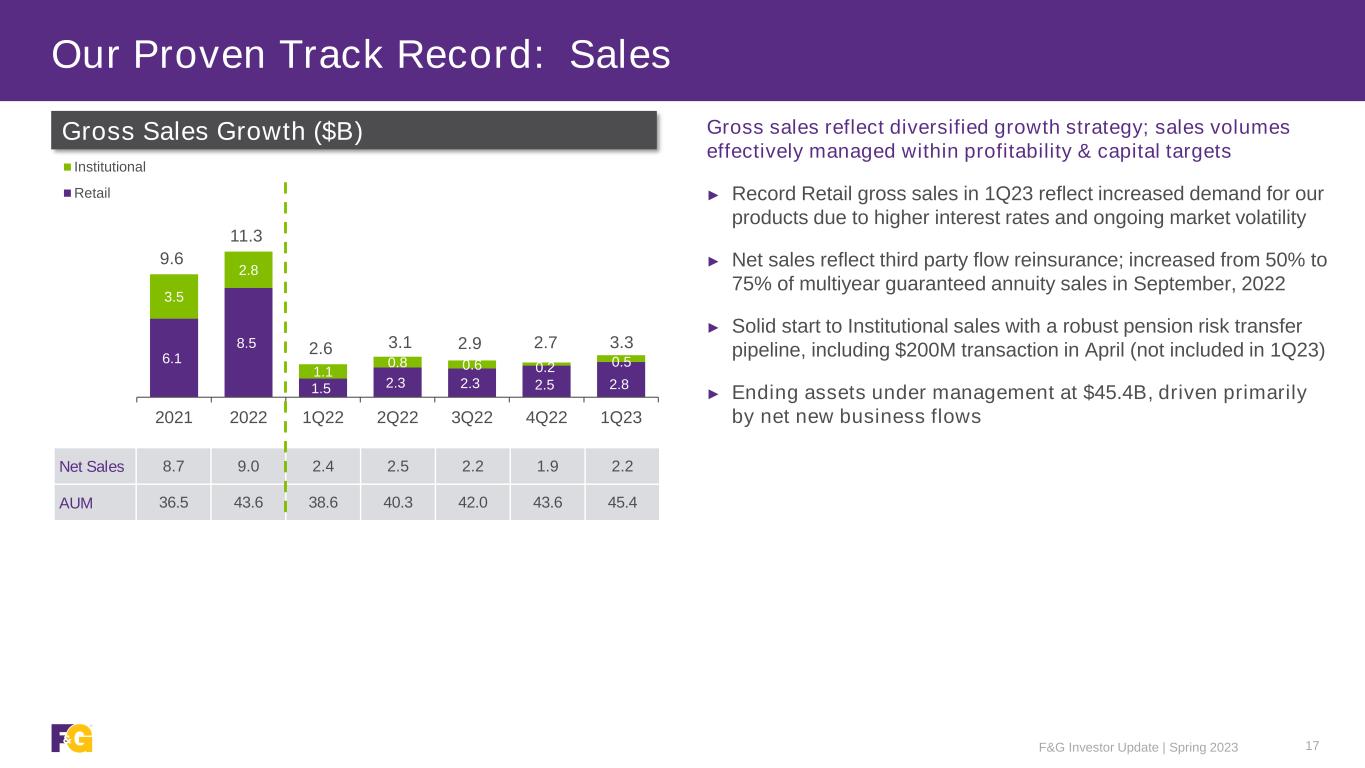

6.1 8.5 1.5 2.3 2.3 2.5 2.8 3.5 2.8 1.1 0.8 0.6 0.2 0.5 9.6 11.3 2.6 3.1 2.9 2.7 3.3 2021 2022 1Q22 2Q22 3Q22 4Q22 1Q23 Institutional Retail F&G Investor Update | Spring 2023 17 Our Proven Track Record: Sales Gross Sales Growth ($B) Net Sales 8.7 9.0 2.4 2.5 2.2 1.9 2.2 AUM 36.5 43.6 38.6 40.3 42.0 43.6 45.4 Gross sales reflect diversified growth strategy; sales volumes effectively managed within profitability & capital targets ► Record Retail gross sales in 1Q23 reflect increased demand for our products due to higher interest rates and ongoing market volatility ► Net sales reflect third party flow reinsurance; increased from 50% to 75% of multiyear guaranteed annuity sales in September, 2022 ► Solid start to Institutional sales with a robust pension risk transfer pipeline, including $200M transaction in April (not included in 1Q23) ► Ending assets under management at $45.4B, driven primarily by net new business flows

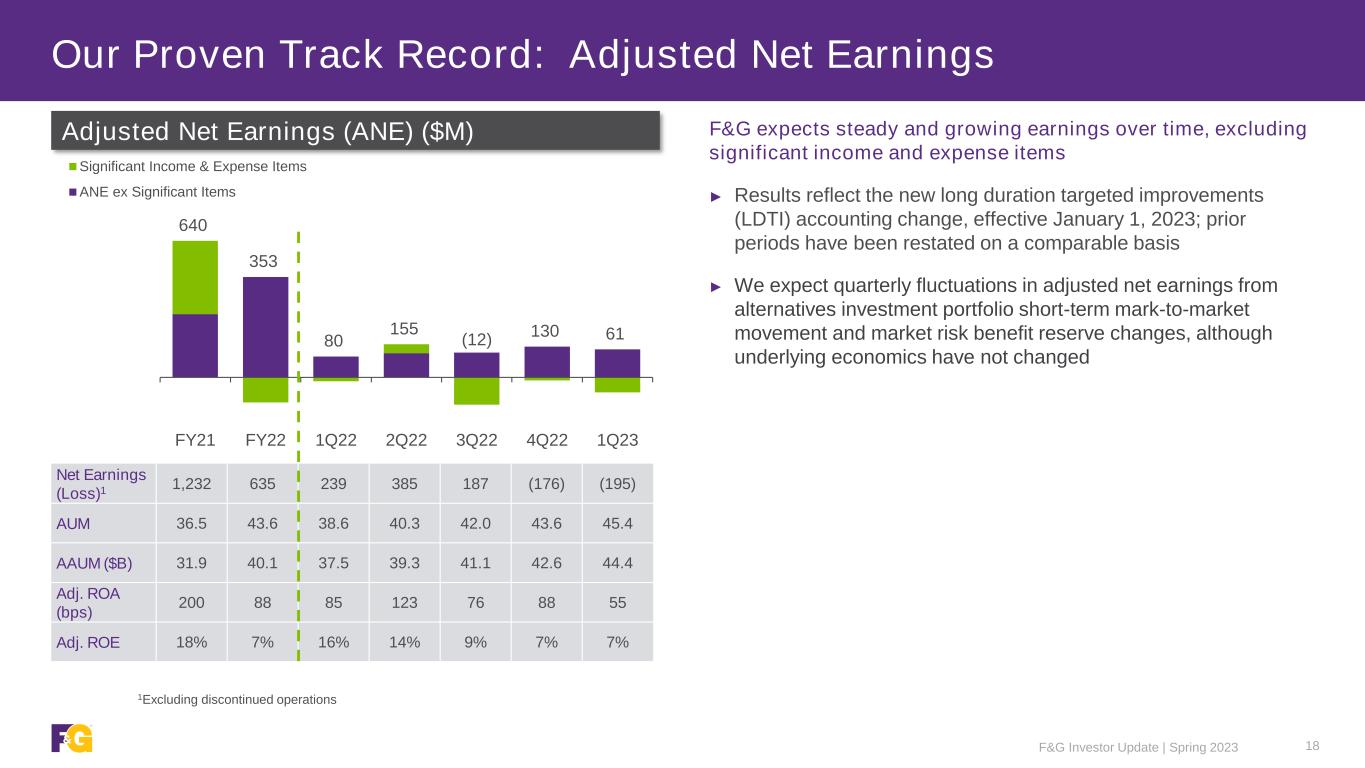

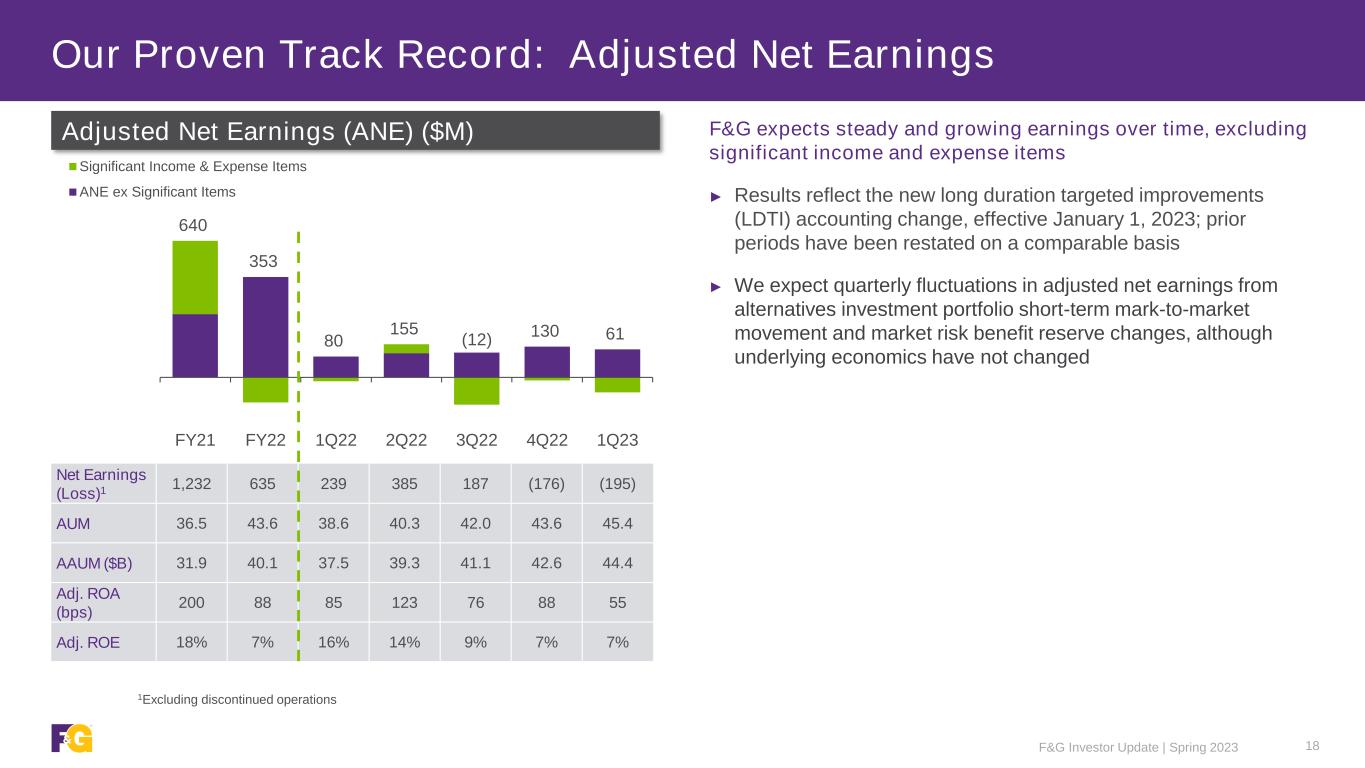

640 353 80 155 (12) 130 61 FY21 FY22 1Q22 2Q22 3Q22 4Q22 1Q23 Significant Income & Expense Items ANE ex Significant Items F&G Investor Update | Spring 2023 18 Our Proven Track Record: Adjusted Net Earnings 1Excluding discontinued operations Adjusted Net Earnings (ANE) ($M) Net Earnings (Loss)1 1,232 635 239 385 187 (176) (195) AUM 36.5 43.6 38.6 40.3 42.0 43.6 45.4 AAUM ($B) 31.9 40.1 37.5 39.3 41.1 42.6 44.4 Adj. ROA (bps) 200 88 85 123 76 88 55 Adj. ROE 18% 7% 16% 14% 9% 7% 7% F&G expects steady and growing earnings over time, excluding significant income and expense items ► Results reflect the new long duration targeted improvements (LDTI) accounting change, effective January 1, 2023; prior periods have been restated on a comparable basis ► We expect quarterly fluctuations in adjusted net earnings from alternatives investment portfolio short-term mark-to-market movement and market risk benefit reserve changes, although underlying economics have not changed

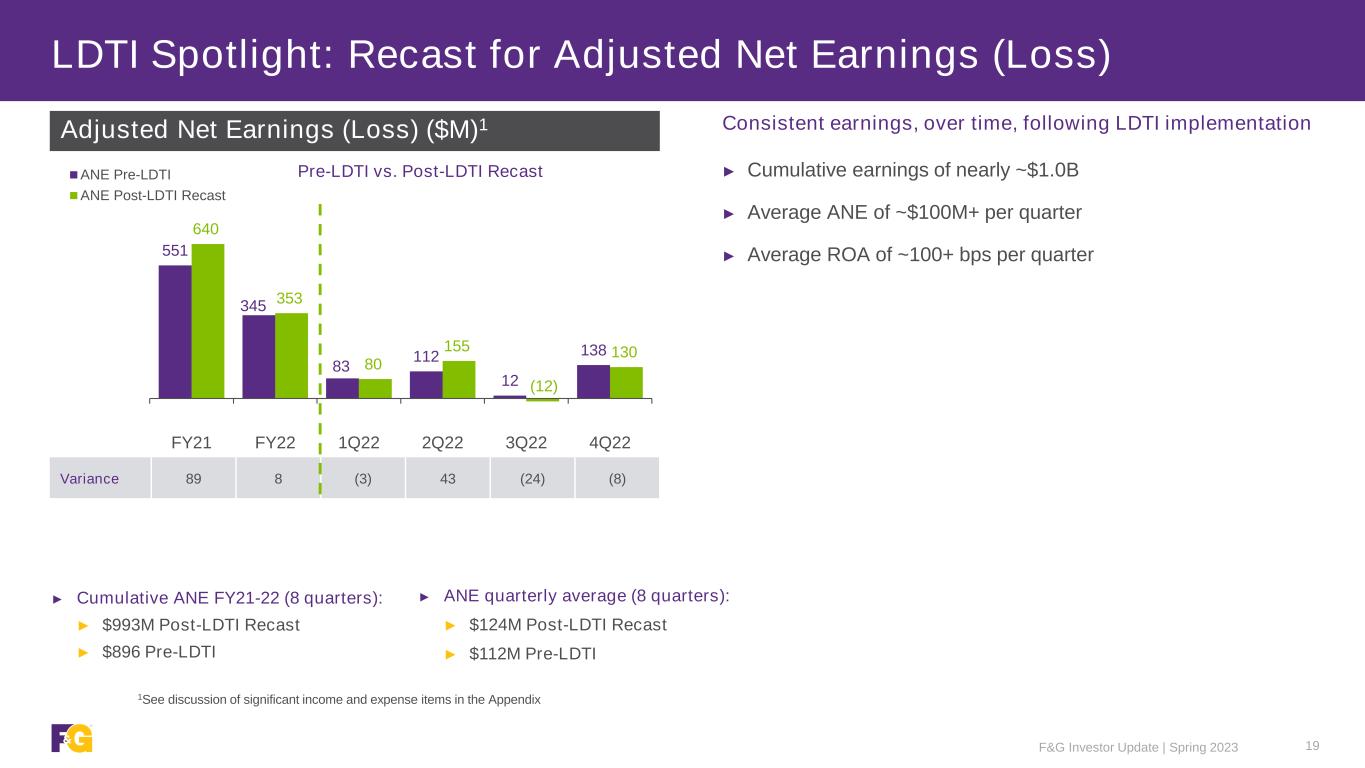

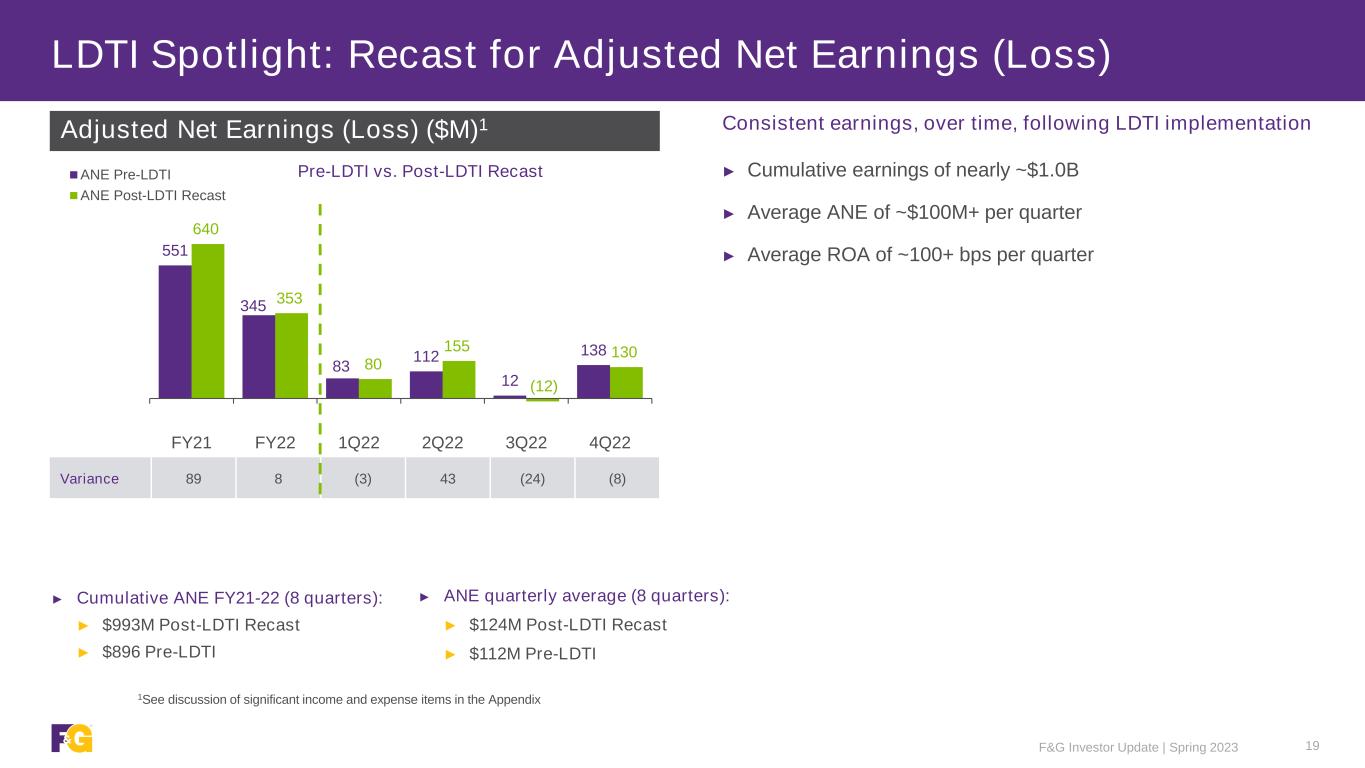

551 345 83 112 12 138 640 353 80 155 (12) 130 FY21 FY22 1Q22 2Q22 3Q22 4Q22 ANE Pre-LDTI ANE Post-LDTI Recast Adjusted Net Earnings (Loss) ($M)1 LDTI Spotlight: Recast for Adjusted Net Earnings (Loss) F&G Investor Update | Spring 2023 19 1See discussion of significant income and expense items in the Appendix Pre-LDTI vs. Post-LDTI Recast Variance 89 8 (3) 43 (24) (8) ► ANE quarterly average (8 quarters): ► $124M Post-LDTI Recast ► $112M Pre-LDTI ► Cumulative ANE FY21-22 (8 quarters): ► $993M Post-LDTI Recast ► $896 Pre-LDTI Consistent earnings, over time, following LDTI implementation ► Cumulative earnings of nearly ~$1.0B ► Average ANE of ~$100M+ per quarter ► Average ROA of ~100+ bps per quarter

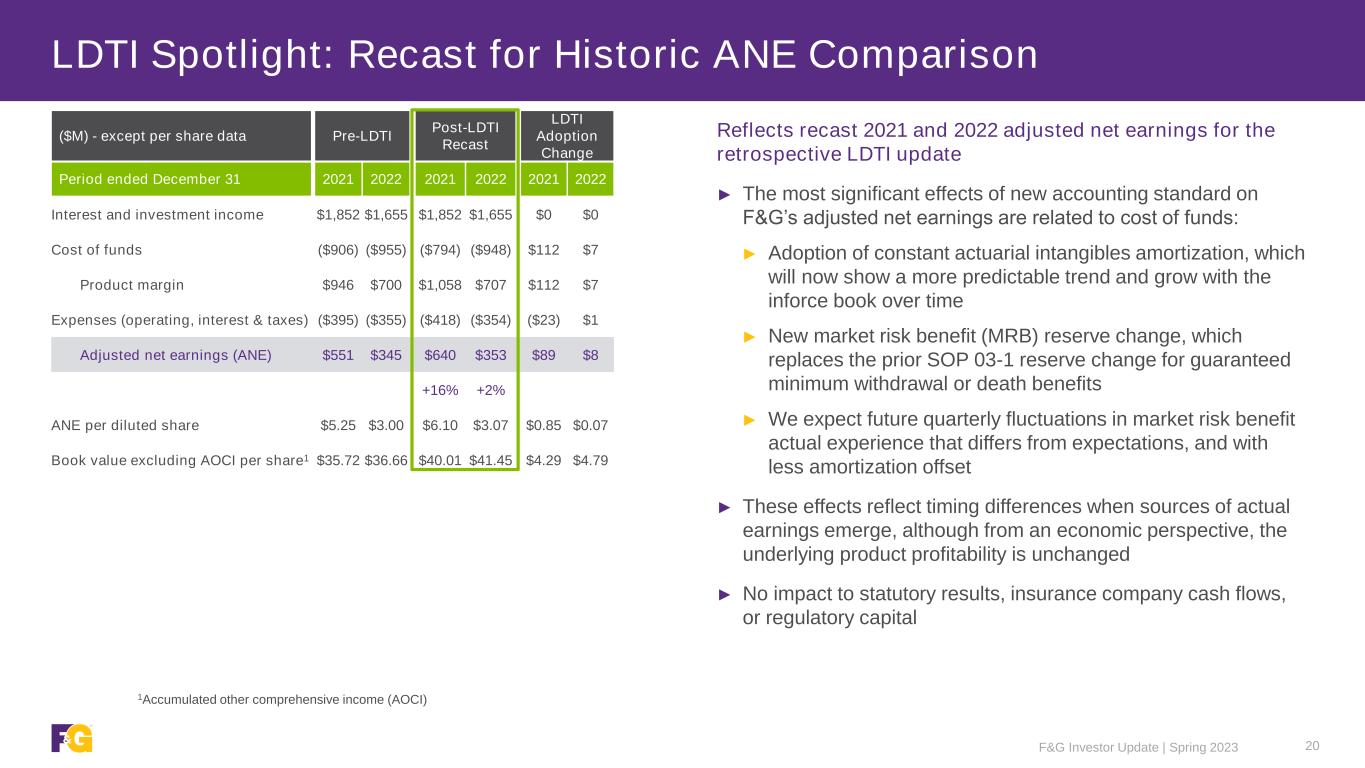

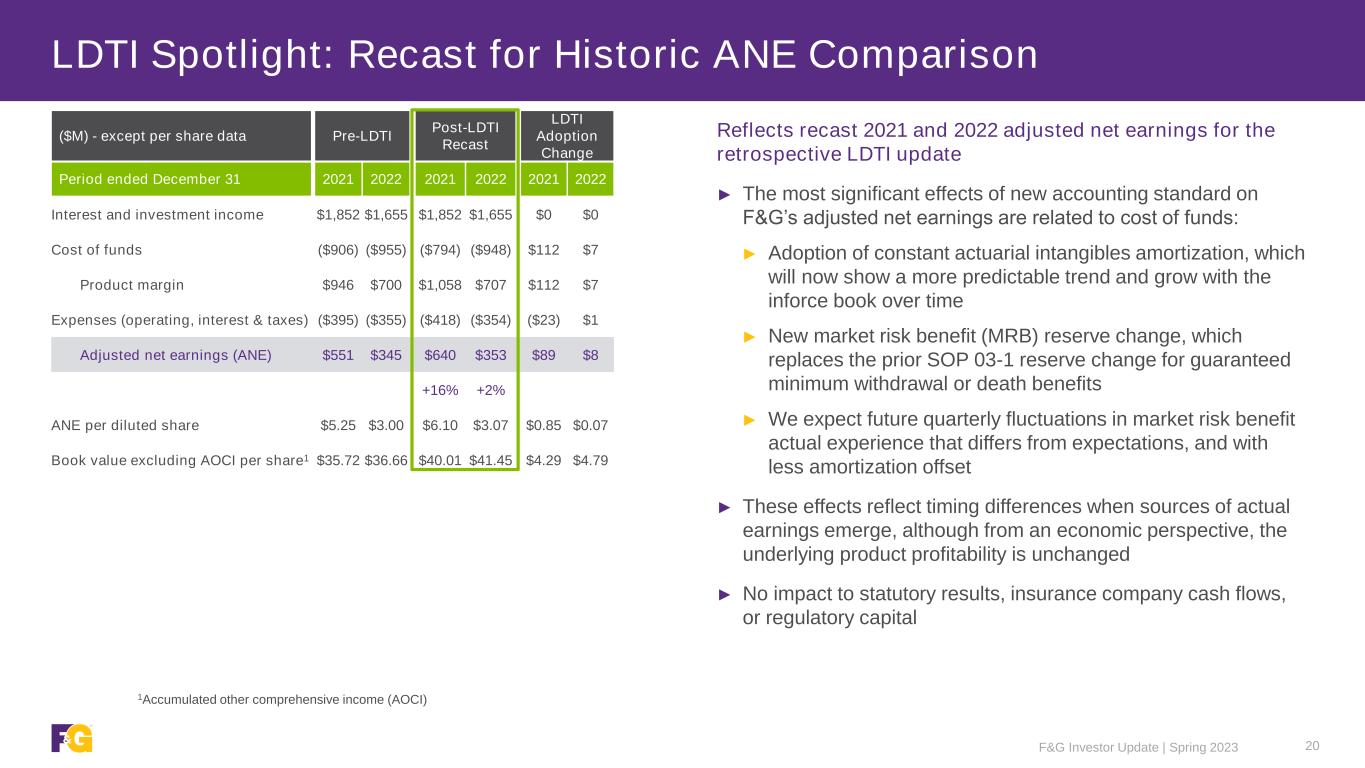

F&G Investor Update | Spring 2023 20 LDTI Spotlight: Recast for Historic ANE Comparison 1Accumulated other comprehensive income (AOCI) ($M) - except per share data Pre-LDTI Post-LDTI Recast LDTI Adoption Change Period ended December 31 2021 2022 2021 2022 2021 2022 Interest and investment income $1,852 $1,655 $1,852 $1,655 $0 $0 Cost of funds ($906) ($955) ($794) ($948) $112 $7 Product margin $946 $700 $1,058 $707 $112 $7 Expenses (operating, interest & taxes) ($395) ($355) ($418) ($354) ($23) $1 Adjusted net earnings (ANE) $551 $345 $640 $353 $89 $8 +16% +2% ANE per diluted share $5.25 $3.00 $6.10 $3.07 $0.85 $0.07 Book value excluding AOCI per share1 $35.72 $36.66 $40.01 $41.45 $4.29 $4.79 Reflects recast 2021 and 2022 adjusted net earnings for the retrospective LDTI update ► The most significant effects of new accounting standard on F&G’s adjusted net earnings are related to cost of funds: ► Adoption of constant actuarial intangibles amortization, which will now show a more predictable trend and grow with the inforce book over time ► New market risk benefit (MRB) reserve change, which replaces the prior SOP 03-1 reserve change for guaranteed minimum withdrawal or death benefits ► We expect future quarterly fluctuations in market risk benefit actual experience that differs from expectations, and with less amortization offset ► These effects reflect timing differences when sources of actual earnings emerge, although from an economic perspective, the underlying product profitability is unchanged ► No impact to statutory results, insurance company cash flows, or regulatory capital

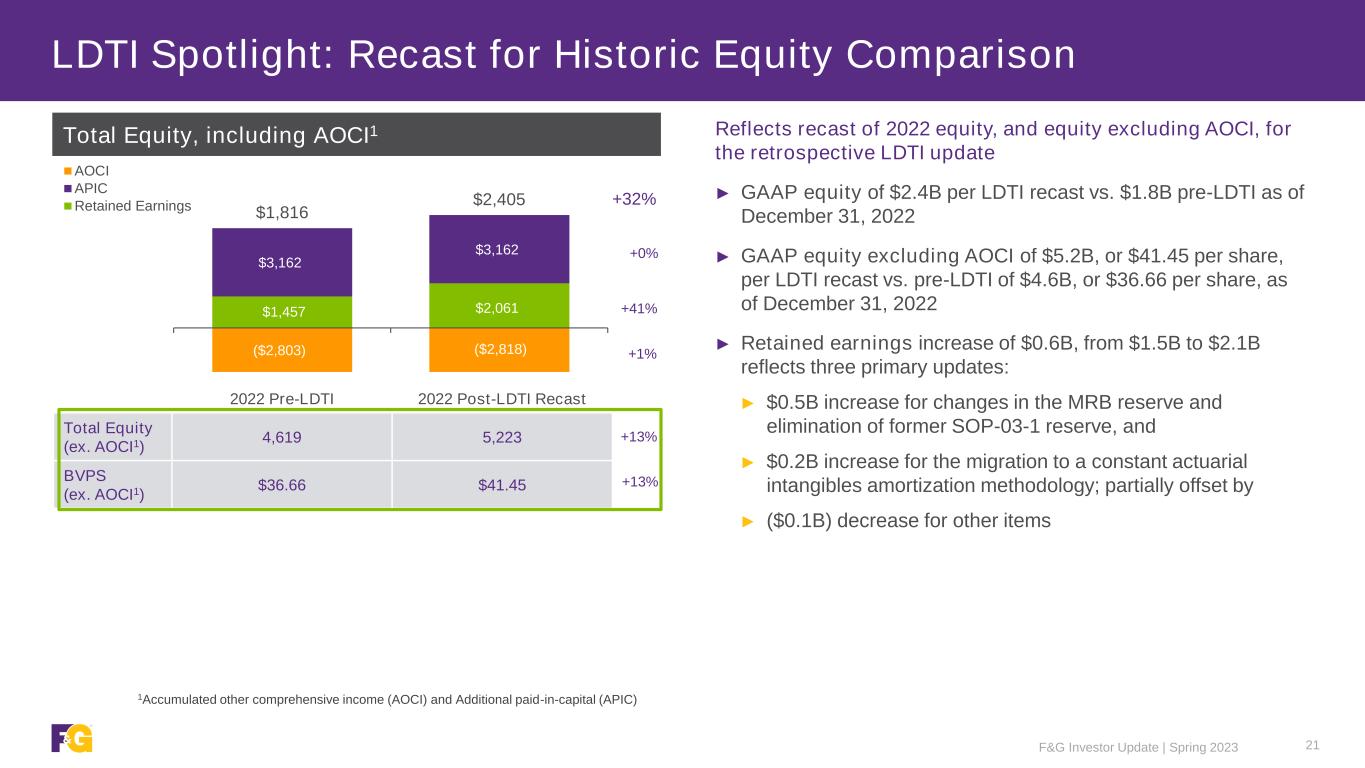

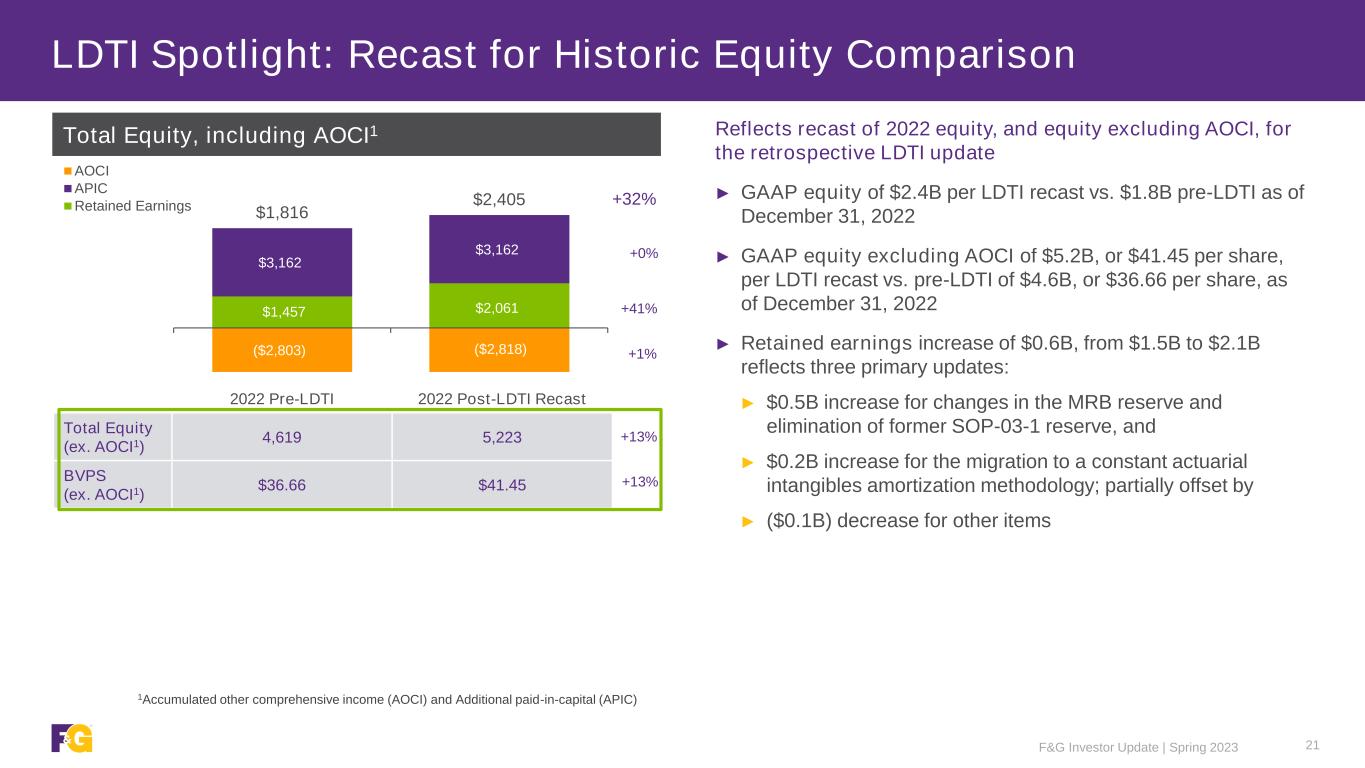

$1,457 $2,061 $3,162 $3,162 ($2,803) ($2,818) $1,816 $2,405 AOCI APIC Retained Earnings LDTI Spotlight: Recast for Historic Equity Comparison F&G Investor Update | Spring 2023 Total Equity, including AOCI1 1Accumulated other comprehensive income (AOCI) and Additional paid-in-capital (APIC) 21 +32% +41% +1% +13% +13% Reflects recast of 2022 equity, and equity excluding AOCI, for the retrospective LDTI update ► GAAP equity of $2.4B per LDTI recast vs. $1.8B pre-LDTI as of December 31, 2022 ► GAAP equity excluding AOCI of $5.2B, or $41.45 per share, per LDTI recast vs. pre-LDTI of $4.6B, or $36.66 per share, as of December 31, 2022 ► Retained earnings increase of $0.6B, from $1.5B to $2.1B reflects three primary updates: ► $0.5B increase for changes in the MRB reserve and elimination of former SOP-03-1 reserve, and ► $0.2B increase for the migration to a constant actuarial intangibles amortization methodology; partially offset by ► ($0.1B) decrease for other items +0% 2022 Pre-LDTI 2022 Post-LDTI Recast Total Equity (ex. AOCI1) 4,619 5,223 BVPS (ex. AOCI1) $36.66 $41.45

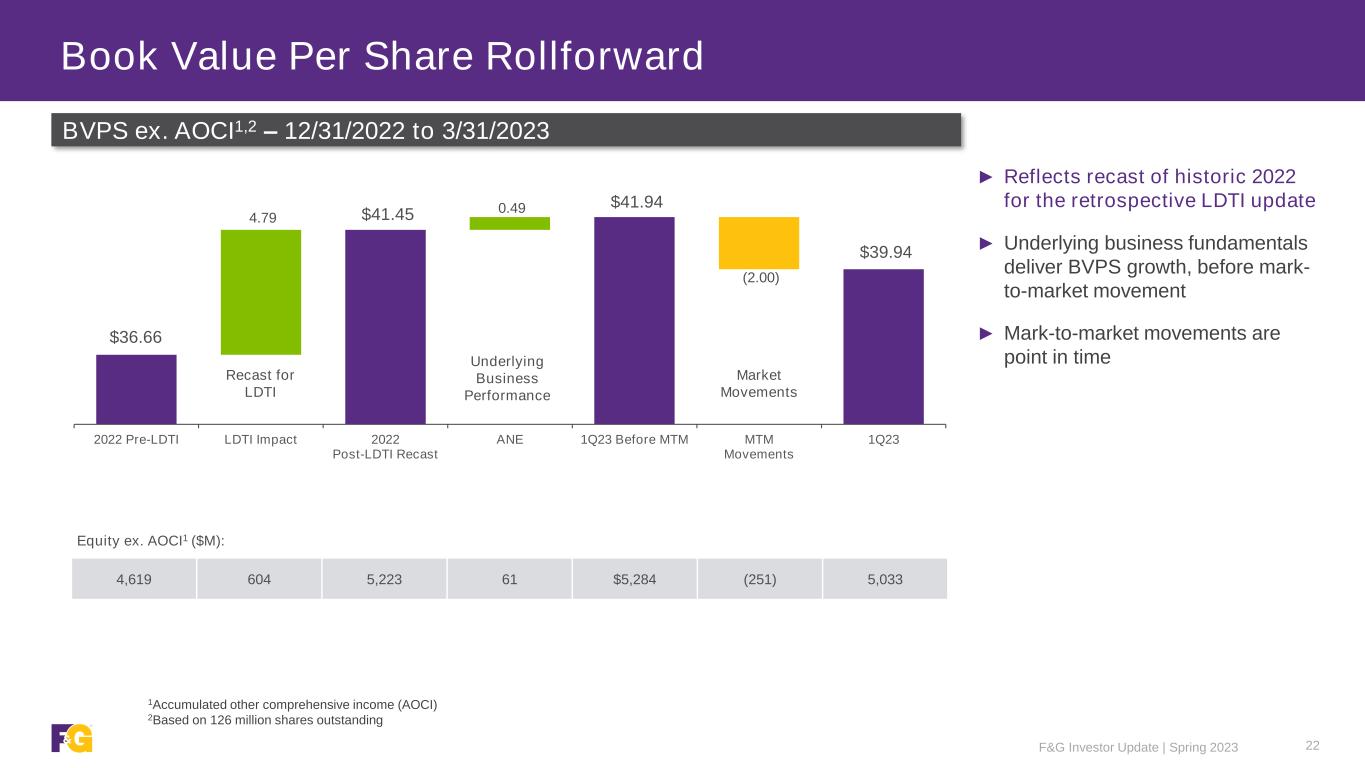

F&G Investor Update | Spring 2023 1 $36.66 $41.45 $41.94 $39.94 4.79 0.49 (2.00) 2022 Pre-LDTI LDTI Impact 2022 Post-LDTI Recast ANE 1Q23 Before MTM MTM Movements 1Q23 ► Reflects recast of historic 2022 for the retrospective LDTI update ► Underlying business fundamentals deliver BVPS growth, before mark- to-market movement ► Mark-to-market movements are point in time Book Value Per Share Rollforward BVPS ex. AOCI1,2 – 12/31/2022 to 3/31/2023 1Accumulated other comprehensive income (AOCI) 2Based on 126 million shares outstanding 22 4,619 604 5,223 61 $5,284 (251) 5,033 Equity ex. AOCI1 ($M): Market Movements Recast for LDTI Underlying Business Performance

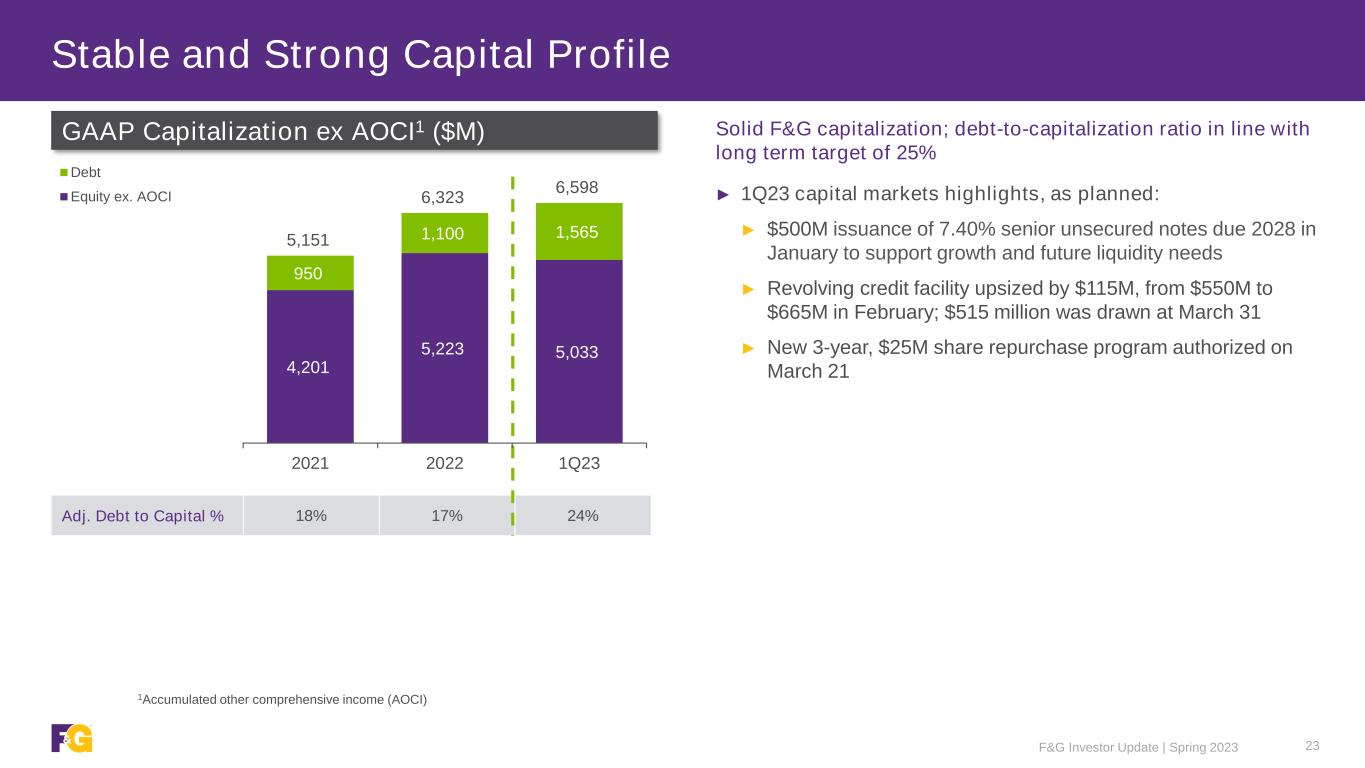

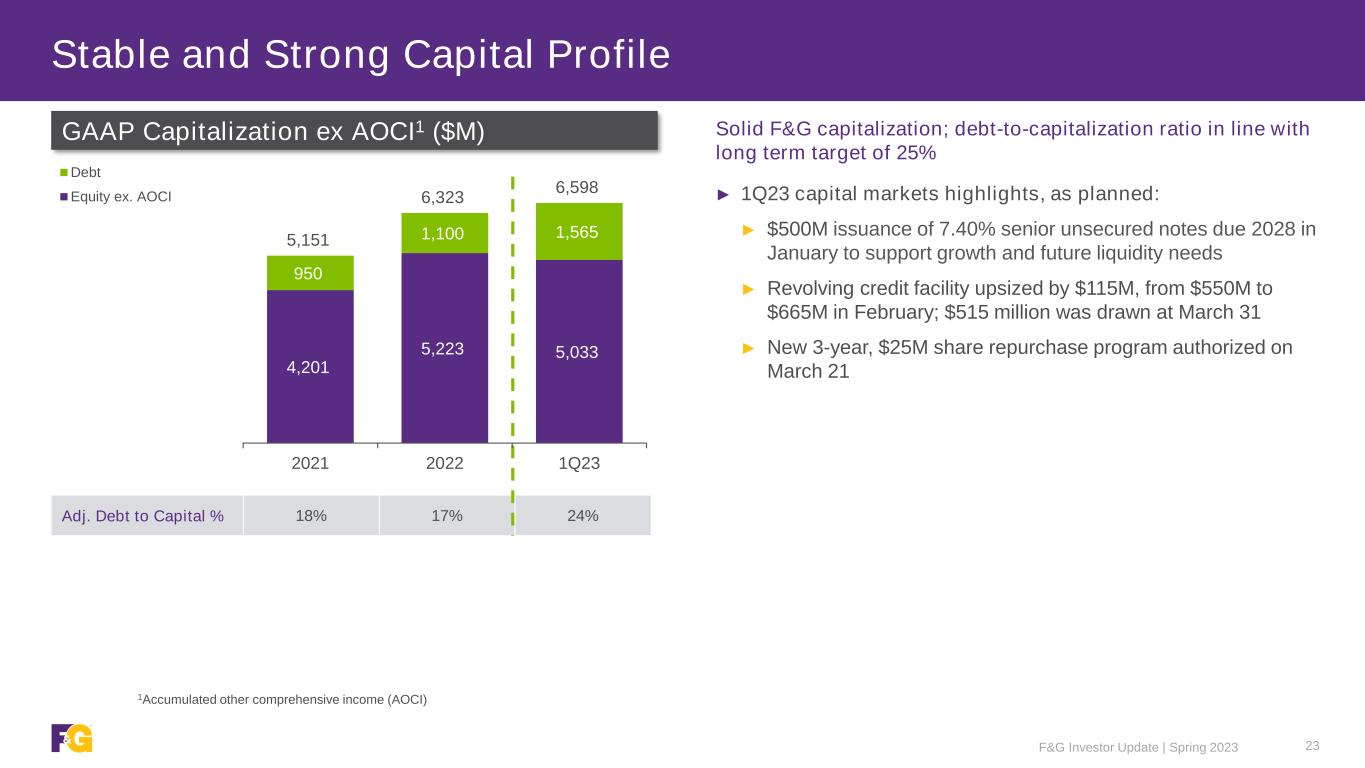

F&G Investor Update | Spring 2023 23 Stable and Strong Capital Profile Stable and Strong GAAP Capital ProfileSolid F&G capitalization; debt-to-capitalization ratio in line with long term target of 25% ► 1Q23 capital markets highlights, as planned: ► $500M issuance of 7.40% senior unsecured notes due 2028 in January to support growth and future liquidity needs ► Revolving credit facility upsized by $115M, from $550M to $665M in February; $515 million was drawn at March 31 ► New 3-year, $25M share repurchase program authorized on March 21 Adj. Debt to Capital % 18% 17% 24% GAAP Capitalization ex AOCI1 ($M) 1Accumulated other comprehensive income (AOCI) 4,201 5,223 5,033 950 1,100 1,565 5,151 6,323 6,598 2021 2022 1Q23 Debt Equity ex. AOCI

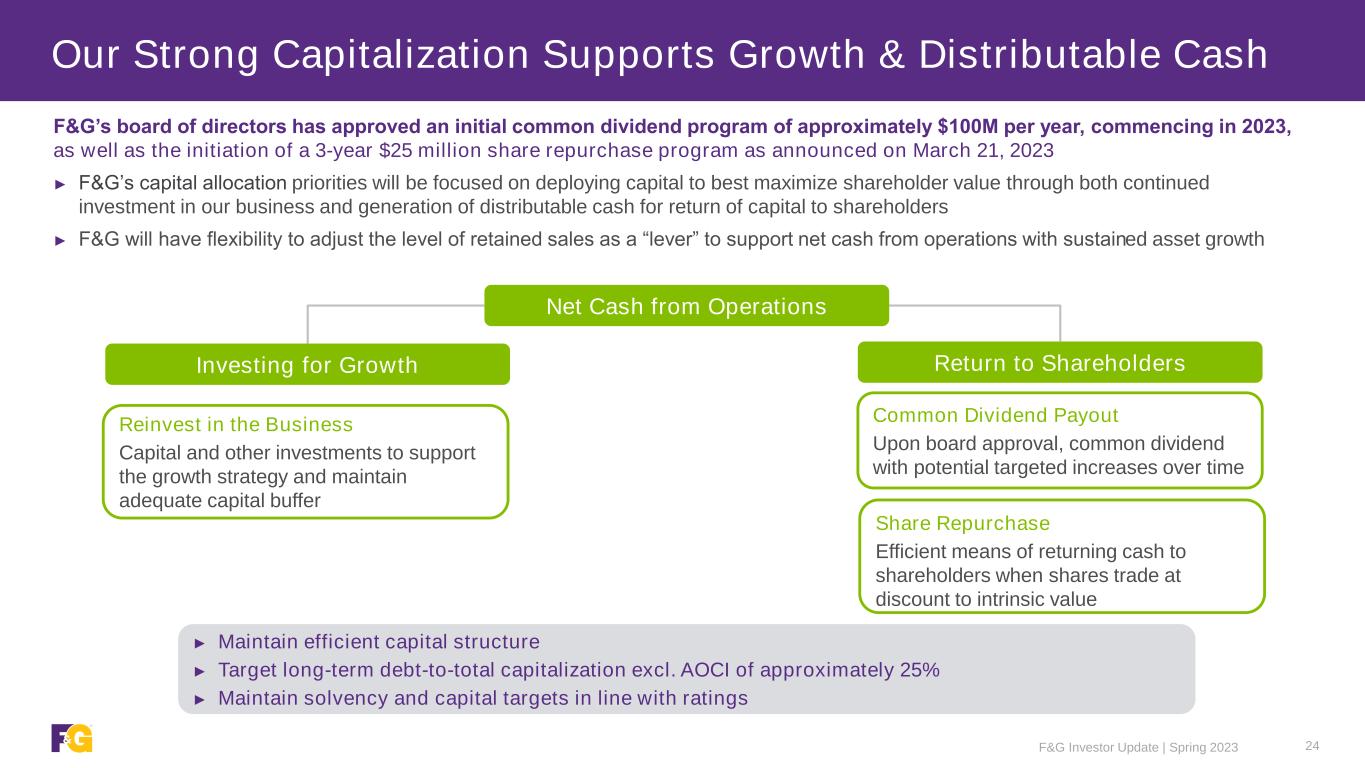

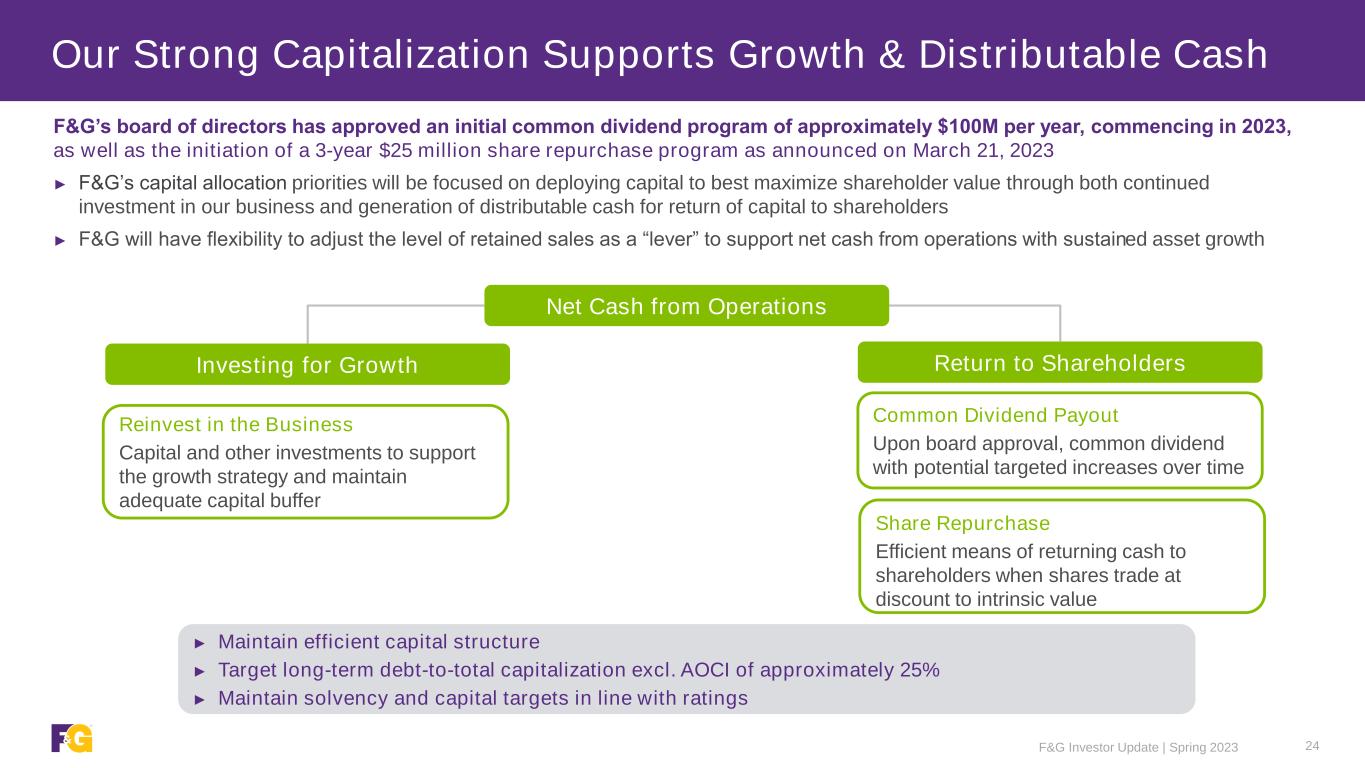

F&G Investor Update | Spring 2023 24 Our Strong Capitalization Supports Growth & Distributable Cash F&G’s board of directors has approved an initial common dividend program of approximately $100M per year, commencing in 2023, as well as the initiation of a 3-year $25 million share repurchase program as announced on March 21, 2023 ► F&G’s capital allocation priorities will be focused on deploying capital to best maximize shareholder value through both continued investment in our business and generation of distributable cash for return of capital to shareholders ► F&G will have flexibility to adjust the level of retained sales as a “lever” to support net cash from operations with sustained asset growth Investing for Growth Reinvest in the Business Capital and other investments to support the growth strategy and maintain adequate capital buffer Net Cash from Operations Return to Shareholders Common Dividend Payout Upon board approval, common dividend with potential targeted increases over time ► Maintain efficient capital structure ► Target long-term debt-to-total capitalization excl. AOCI of approximately 25% ► Maintain solvency and capital targets in line with ratings Share Repurchase Efficient means of returning cash to shareholders when shares trade at discount to intrinsic value

Appendix – Investments F&G Investor Update | Spring 2023 25

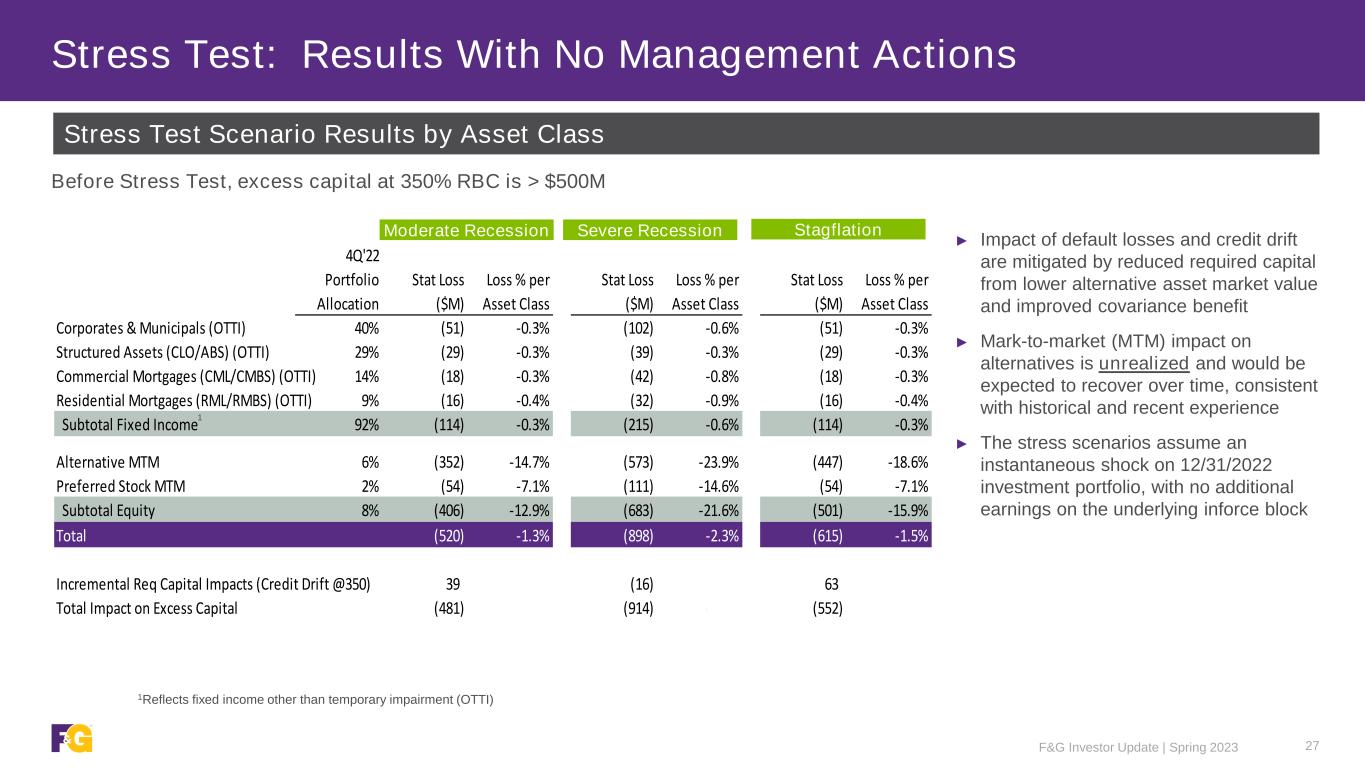

Stress Testing Scenarios and Methodology Investment Portfolio Stress Testing F&G Investor Update | Spring 2023 26 ► Recession and Stagflation scenarios are modeled by F&G and Blackstone investments and risk teams ► Moderate Recession: Based on characteristics from recessions in 1990/1991 (1st Gulf War), 2001 (dot-com and 9/11) and 2020 (COVID-19) ► Severe Recession: Based on characteristics from the Great Recession (2007-2009) ► Stagflation: Introduced to provide perspective to risks potentially emerging from current macroeconomic trends ► Methodology: Used cumulative historical credit migration, defaults and recoveries assuming instantaneous shock with no management actions ► Top-down losses and credit migration applied to corporates, muni’s, preferred stock and alternatives ► Bottom up, collateral level loss modeling for CLO’s, CMBS and RMBS; applied Global Financial Crisis (GFC) collateral level constant default rates (CDRs) and severity to post-GFC (2.0/3.0) structures which feature higher levels of subordination and tighter collateral eligibility requirements

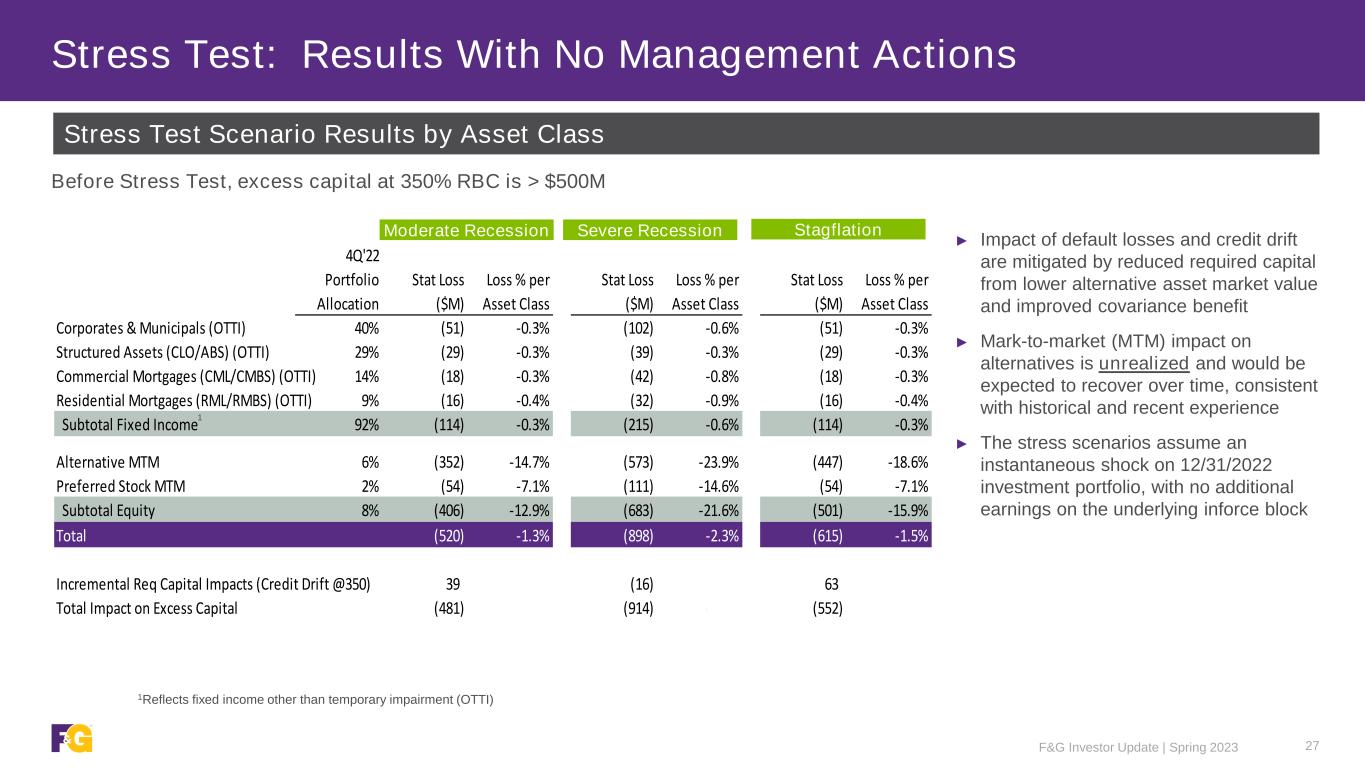

Stress Test Scenario Results by Asset Class F&G Investor Update | Spring 2023 27 Stress Test: Results With No Management Actions ► Impact of default losses and credit drift are mitigated by reduced required capital from lower alternative asset market value and improved covariance benefit ► Mark-to-market (MTM) impact on alternatives is unrealized and would be expected to recover over time, consistent with historical and recent experience ► The stress scenarios assume an instantaneous shock on 12/31/2022 investment portfolio, with no additional earnings on the underlying inforce block Excess Capital at 350 RBC is over $500m for FGLIC Retained Stat Loss ($M) Loss % per Asset Class Stat Loss ($M) Loss % per Asset Class Stat Loss ($M) Loss % per Asset Class Corporates & Municipals (OTTI) 40% (51) -0.3% (102) -0.6% (51) -0.3% Structured Assets (CLO/ABS) (OTTI) 29% (29) -0.3% (39) -0.3% (29) -0.3% Commercial Mortgages (CML/CMBS) (OTTI) 14% (18) -0.3% (42) -0.8% (18) -0.3% Residential Mortgages (RML/RMBS) (OTTI) 9% (16) -0.4% (32) -0.9% (16) -0.4% Subtotal Fixed Income 92% (114) -0.3% (215) -0.6% (114) -0.3% Alternative MTM 6% (352) -14.7% (573) -23.9% (447) -18.6% Preferred Stock MTM 2% (54) -7.1% (111) -14.6% (54) -7.1% Subtotal Equity 8% (406) -12.9% (683) -21.6% (501) -15.9% Total (520) -1.3% (898) -2.3% (615) -1.5% Incremental Req Capital Impacts (Credit Drift @350) 39 0.1% (16) 0.0% 63 0.2% Total Impact on Excess Capital (481) -1.2% (914) -2.3% (552) -1.4% Recession Scenario Deep Recession Scenario Stagflation Scenario 4Q'22 Portfolio Allocation Moderate Recession Severe Recession Stagflation Before Stress Test, excess capital at 350% RBC is > $500M 1Reflects fixed income other than temporary impairment (OTTI) 1

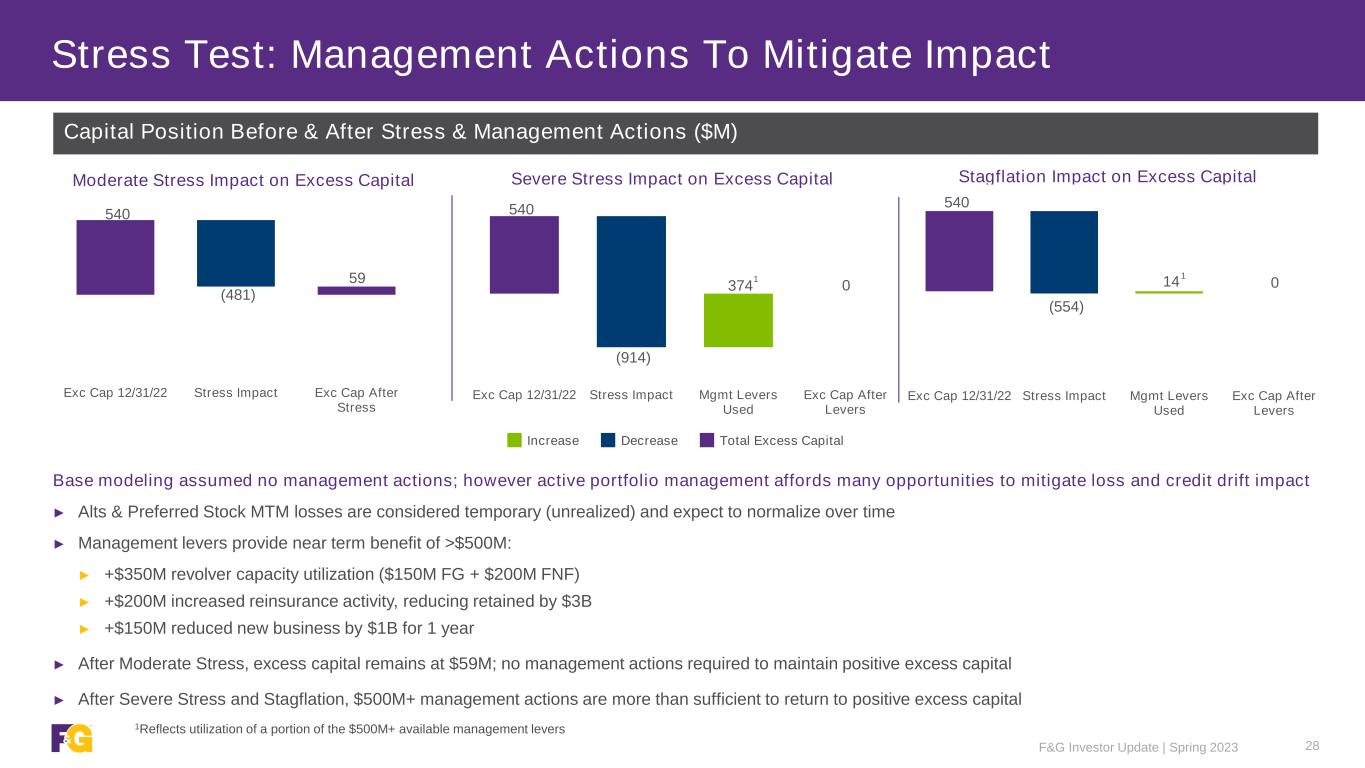

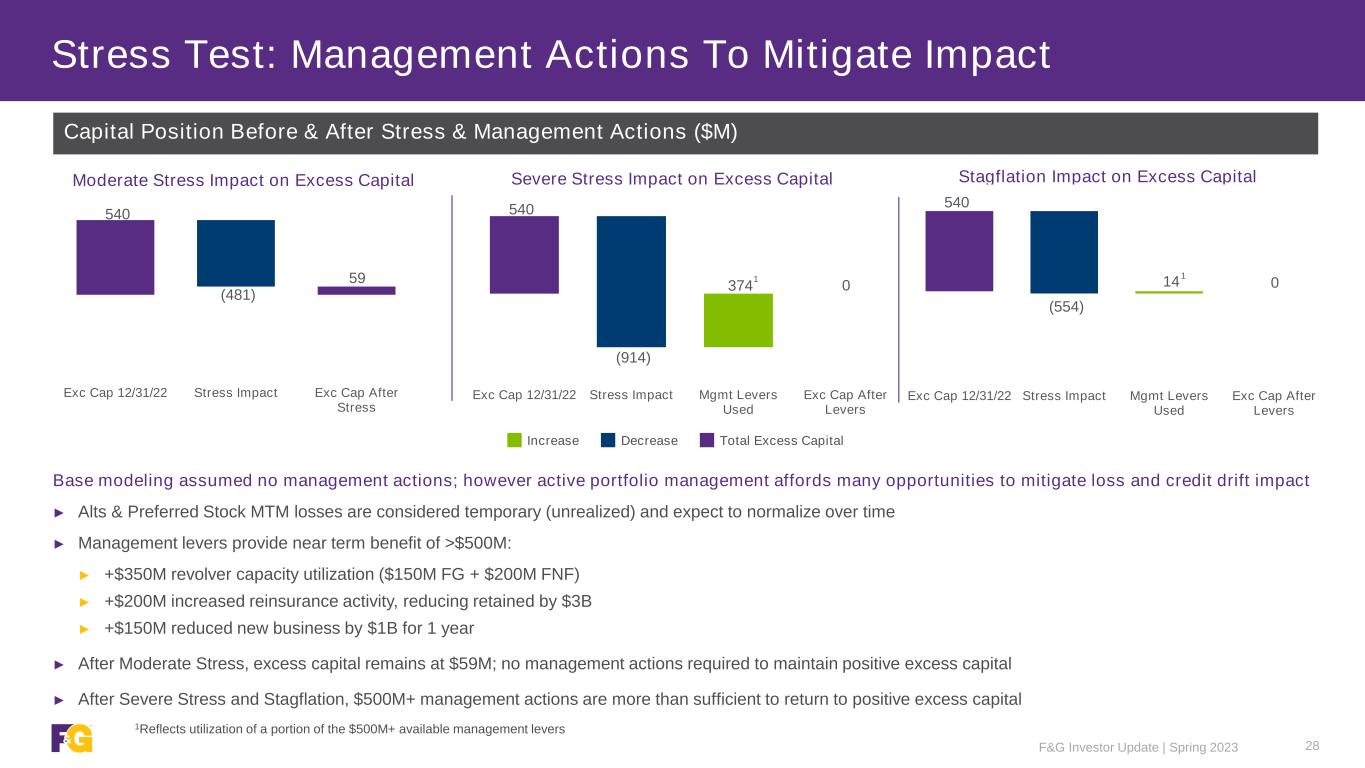

Capital Position Before & After Stress & Management Actions ($M) F&G Investor Update | Spring 2023 28 Stress Test: Management Actions To Mitigate Impact Total Excess CapitalDecreaseIncrease Moderate Stress Impact on Excess Capital Severe Stress Impact on Excess Capital Stagflation Impact on Excess Capital Base modeling assumed no management actions; however active portfolio management affords many opportunities to mitigate loss and credit drift impact ► Alts & Preferred Stock MTM losses are considered temporary (unrealized) and expect to normalize over time ► Management levers provide near term benefit of >$500M: ► +$350M revolver capacity utilization ($150M FG + $200M FNF) ► +$200M increased reinsurance activity, reducing retained by $3B ► +$150M reduced new business by $1B for 1 year ► After Moderate Stress, excess capital remains at $59M; no management actions required to maintain positive excess capital ► After Severe Stress and Stagflation, $500M+ management actions are more than sufficient to return to positive excess capital 540 59 (481) Exc Cap 12/31/22 Stress Impact Exc Cap After Stress 540 0 (914) 374 Exc Cap 12/31/22 Stress Impact Mgmt Levers Used Exc Cap After Levers 540 0 (554) 14 Exc Cap 12/31/22 Stress Impact Mgmt Levers Used Exc Cap After Levers 1 1 1Reflects utilization of a portion of the $500M+ available management levers

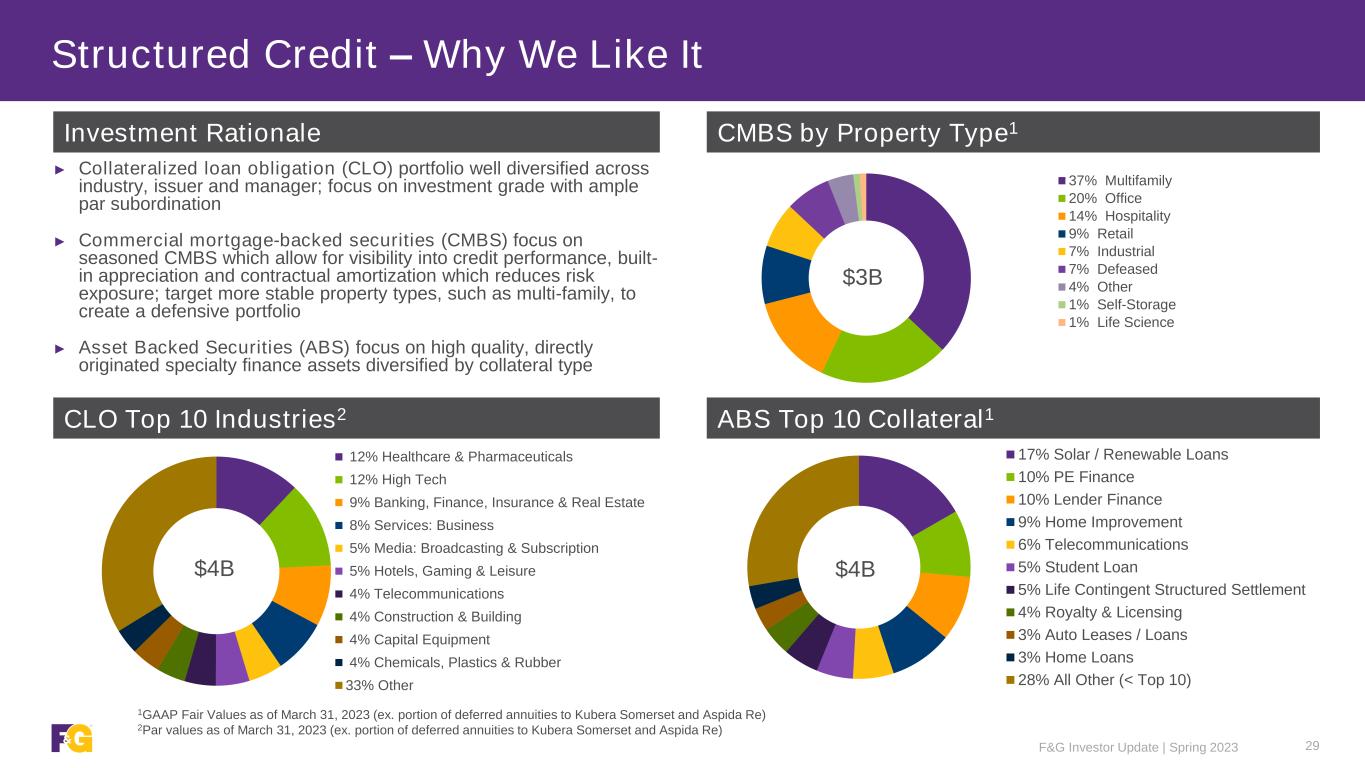

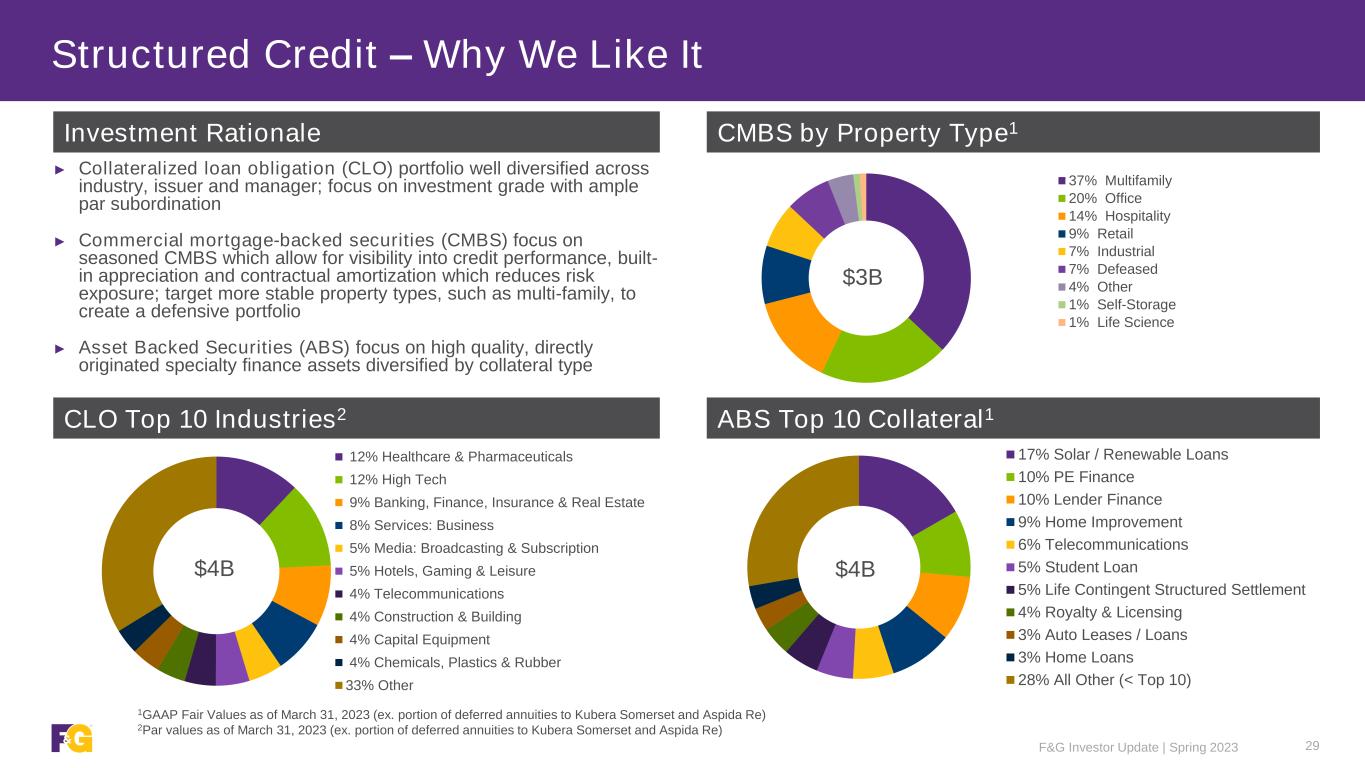

Structured Credit – Why We Like It F&G Investor Update | Spring 2023 29 CLO Top 10 Industries2 ► Collateralized loan obligation (CLO) portfolio well diversified across industry, issuer and manager; focus on investment grade with ample par subordination ► Commercial mortgage-backed securities (CMBS) focus on seasoned CMBS which allow for visibility into credit performance, built- in appreciation and contractual amortization which reduces risk exposure; target more stable property types, such as multi-family, to create a defensive portfolio ► Asset Backed Securities (ABS) focus on high quality, directly originated specialty finance assets diversified by collateral type Investment Rationale CMBS by Property Type1 1GAAP Fair Values as of March 31, 2023 (ex. portion of deferred annuities to Kubera Somerset and Aspida Re) 2Par values as of March 31, 2023 (ex. portion of deferred annuities to Kubera Somerset and Aspida Re) 12% Healthcare & Pharmaceuticals 12% High Tech 9% Banking, Finance, Insurance & Real Estate 8% Services: Business 5% Media: Broadcasting & Subscription 5% Hotels, Gaming & Leisure 4% Telecommunications 4% Construction & Building 4% Capital Equipment 4% Chemicals, Plastics & Rubber 33% Other $4B 37% Multifamily 20% Office 14% Hospitality 9% Retail 7% Industrial 7% Defeased 4% Other 1% Self-Storage 1% Life Science $3B ABS Top 10 Collateral1 17% Solar / Renewable Loans 10% PE Finance 10% Lender Finance 9% Home Improvement 6% Telecommunications 5% Student Loan 5% Life Contingent Structured Settlement 4% Royalty & Licensing 3% Auto Leases / Loans 3% Home Loans 28% All Other (< Top 10) $4B

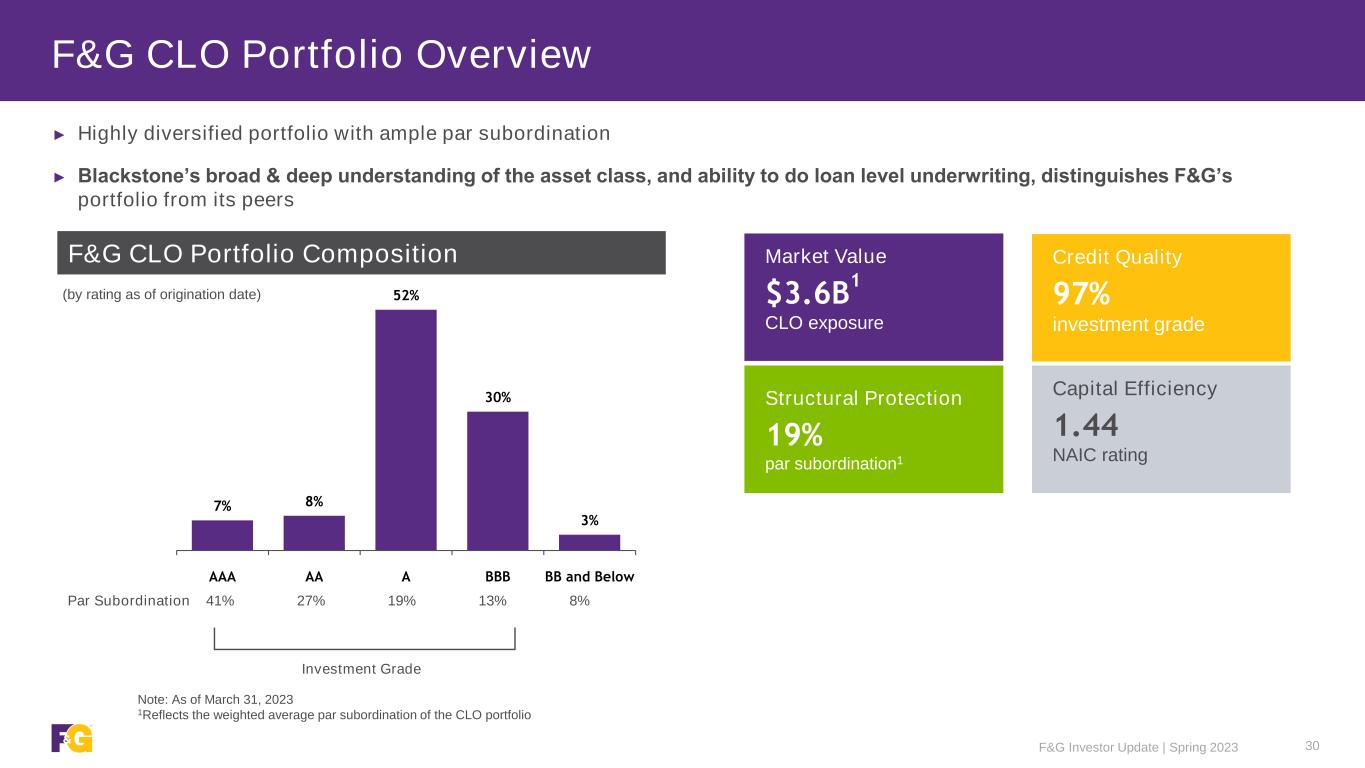

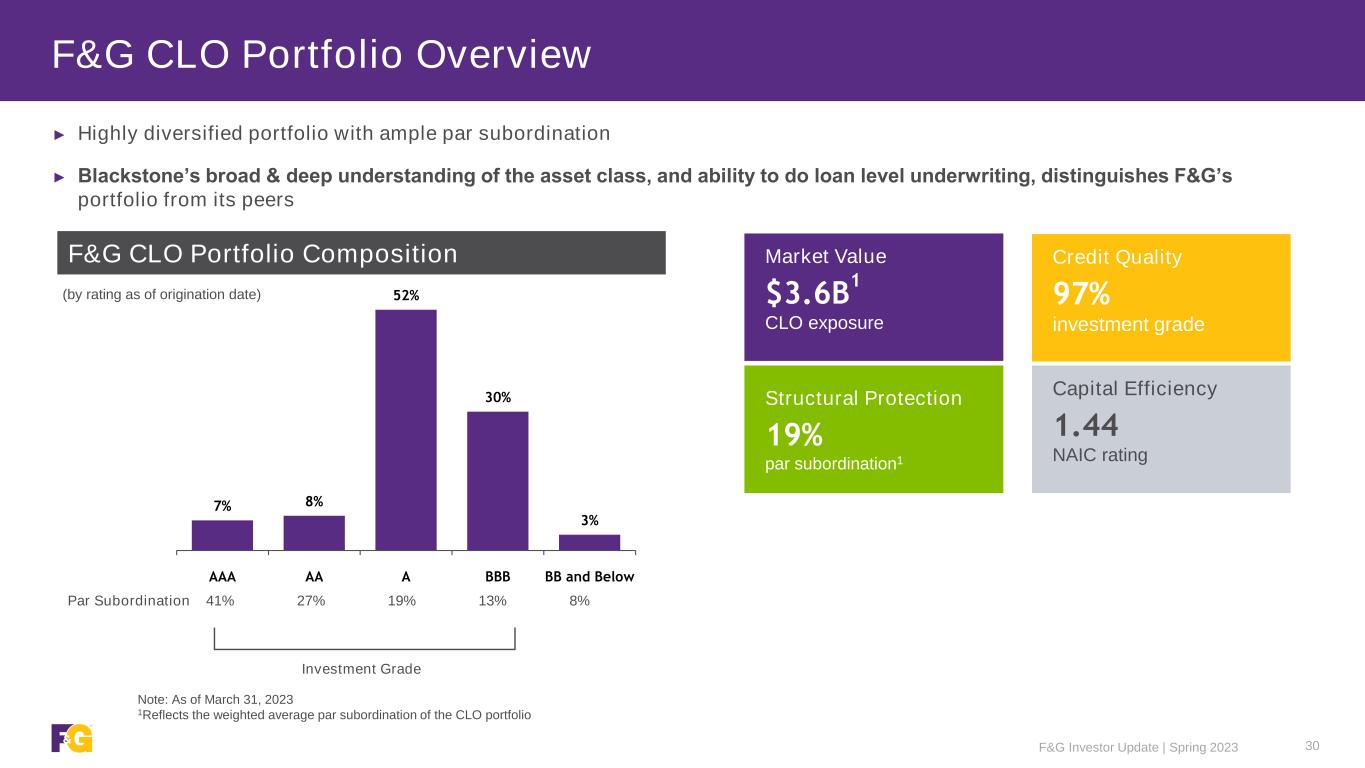

F&G CLO Portfolio Overview F&G Investor Update | Spring 2023 F&G CLO Portfolio Composition ► Highly diversified portfolio with ample par subordination ► Blackstone’s broad & deep understanding of the asset class, and ability to do loan level underwriting, distinguishes F&G’s portfolio from its peers Note: As of March 31, 2023 1Reflects the weighted average par subordination of the CLO portfolio (by rating as of origination date) Investment Grade Par Subordination 41% 27% 19% 13% 8% Credit Quality 97% investment grade Structural Protection 19% par subordination1 Capital Efficiency 1.44 NAIC rating Market Value $3.6B 1 CLO exposure 30 7% 8% 52% 30% 3% AAA AA A BBB BB and Below

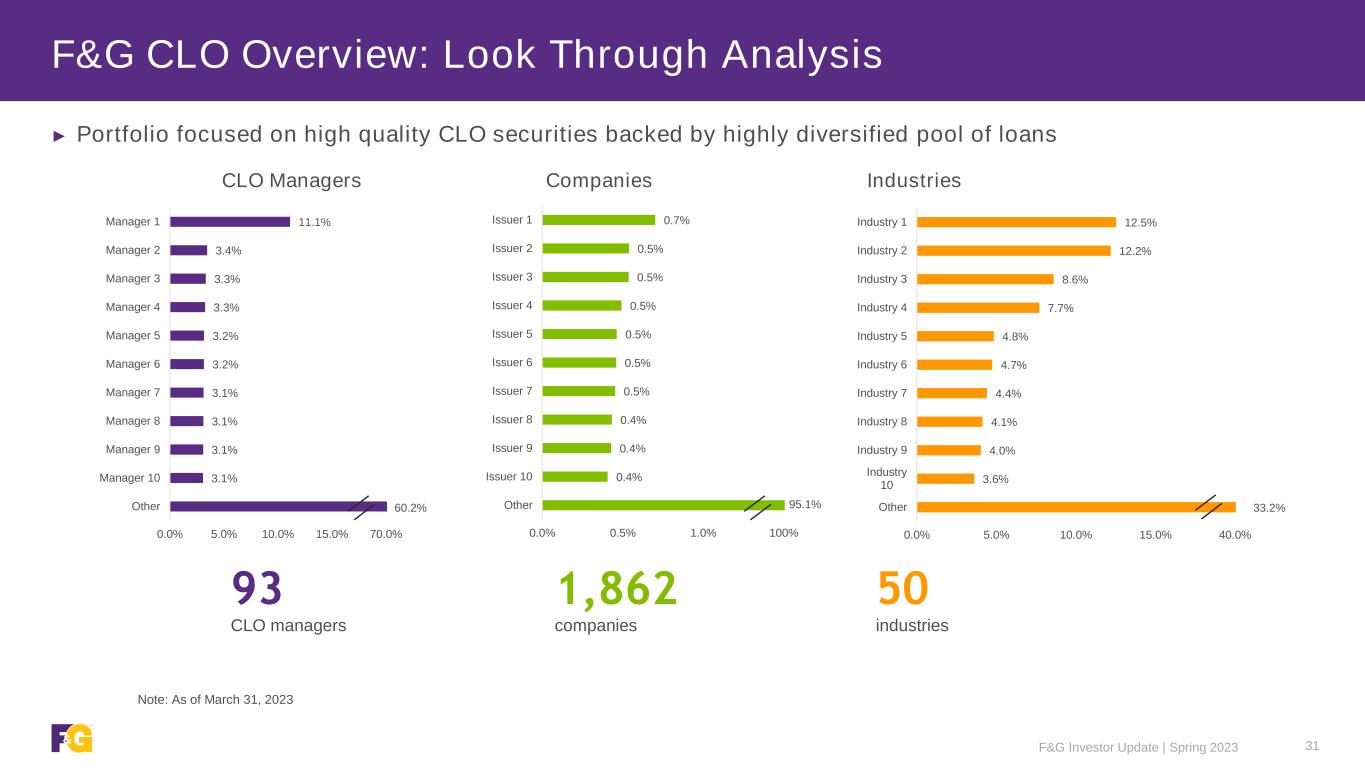

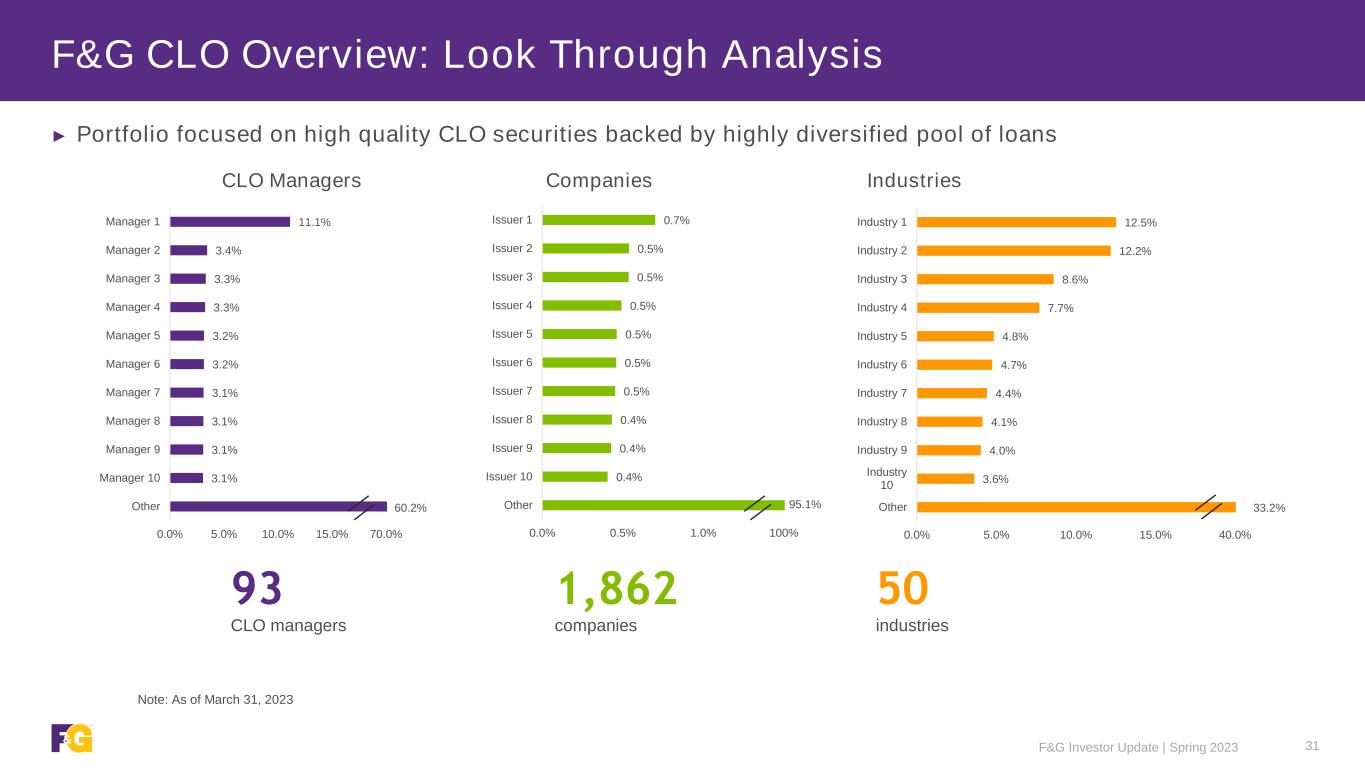

F&G Investor Update | Spring 2023 F&G CLO Overview: Look Through Analysis ► Portfolio focused on high quality CLO securities backed by highly diversified pool of loans Note: As of March 31, 2023 IndustriesCompaniesCLO Managers 31 93 CLO managers 1,862 companies 50 industries 11.1% 3.4% 3.3% 3.3% 3.2% 3.2% 3.1% 3.1% 3.1% 3.1% 0.0% 5.0% 10.0% 15.0% 70.0% Manager 1 Manager 2 Manager 3 Manager 4 Manager 5 Manager 6 Manager 7 Manager 8 Manager 9 Manager 10 Other 60.2% 0.7% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.4% 0.4% 0.4% 0.0% 0.5% 1.0% 100% Issuer 1 Issuer 2 Issuer 3 Issuer 4 Issuer 5 Issuer 6 Issuer 7 Issuer 8 Issuer 9 Issuer 10 Other 95.1% 12.5% 12.2% 8.6% 7.7% 4.8% 4.7% 4.4% 4.1% 4.0% 3.6% 0.0% 5.0% 10.0% 15.0% 40.0% Industry 1 Industry 2 Industry 3 Industry 4 Industry 5 Industry 6 Industry 7 Industry 8 Industry 9 Industry 10 Other 33.2%

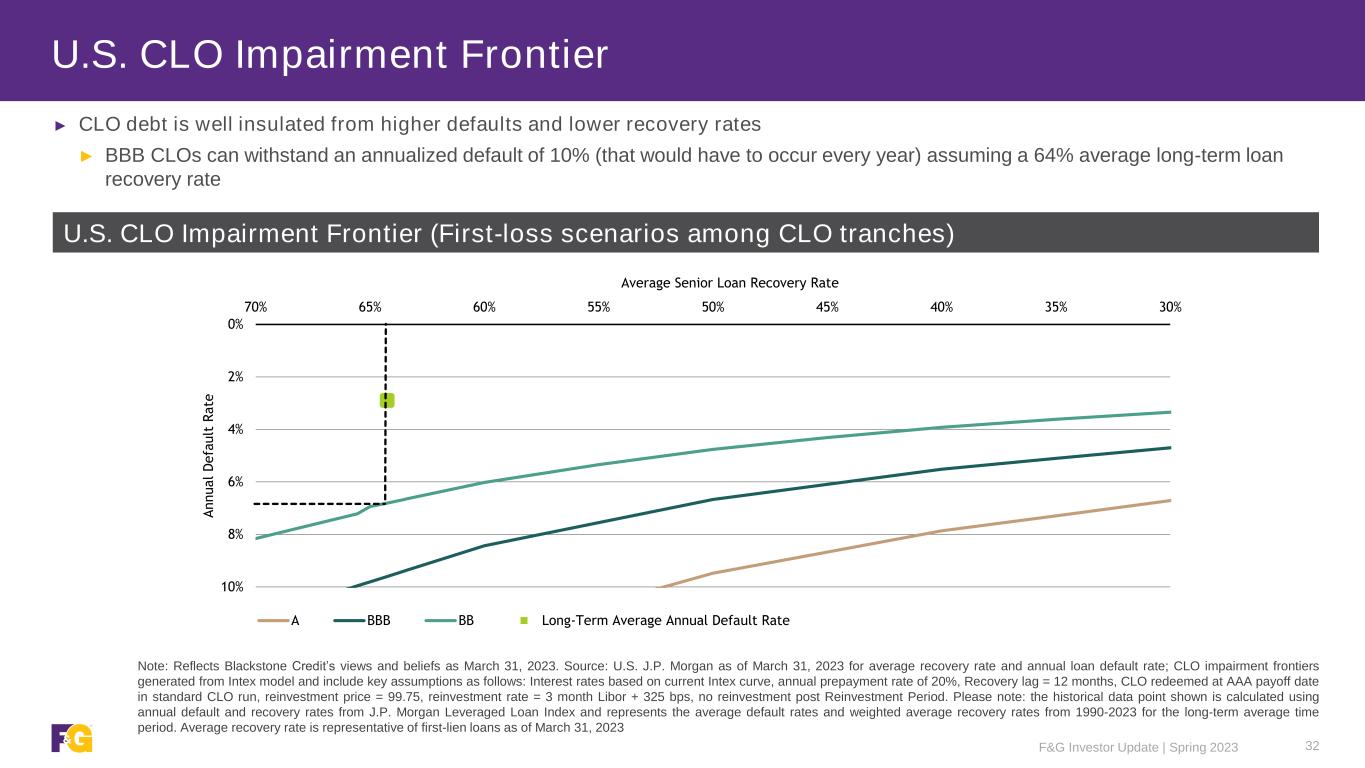

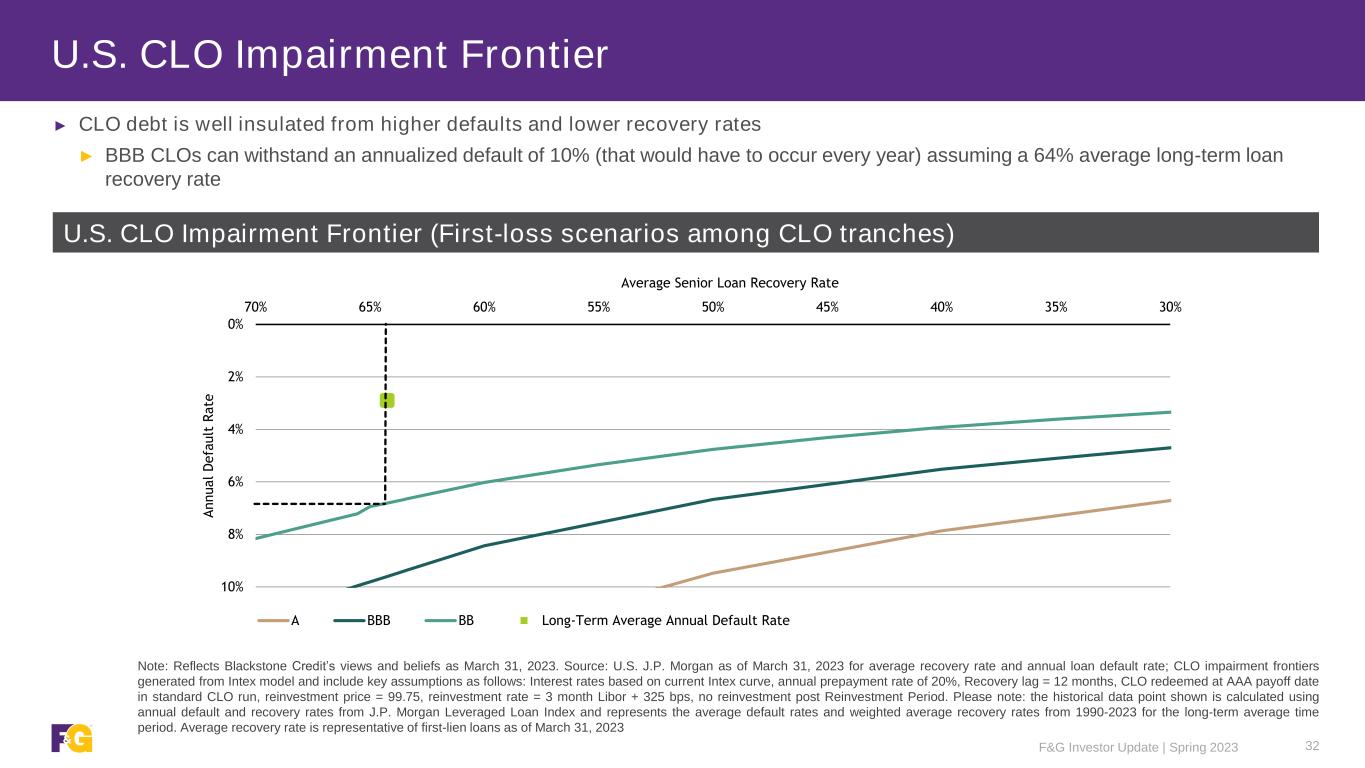

U.S. CLO Impairment Frontier (First-loss scenarios among CLO tranches) U.S. CLO Impairment Frontier F&G Investor Update | Spring 2023 ► CLO debt is well insulated from higher defaults and lower recovery rates ► BBB CLOs can withstand an annualized default of 10% (that would have to occur every year) assuming a 64% average long-term loan recovery rate Note: Reflects Blackstone Credit’s views and beliefs as March 31, 2023. Source: U.S. J.P. Morgan as of March 31, 2023 for average recovery rate and annual loan default rate; CLO impairment frontiers generated from Intex model and include key assumptions as follows: Interest rates based on current Intex curve, annual prepayment rate of 20%, Recovery lag = 12 months, CLO redeemed at AAA payoff date in standard CLO run, reinvestment price = 99.75, reinvestment rate = 3 month Libor + 325 bps, no reinvestment post Reinvestment Period. Please note: the historical data point shown is calculated using annual default and recovery rates from J.P. Morgan Leveraged Loan Index and represents the average default rates and weighted average recovery rates from 1990-2023 for the long-term average time period. Average recovery rate is representative of first-lien loans as of March 31, 2023 32 0% 2% 4% 6% 8% 10% 30%35%40%45%50%55%60%65%70% A n n u a l D e fa u lt R a te Average Senior Loan Recovery Rate A BBB BB Long-Term Average Annual Default Rate

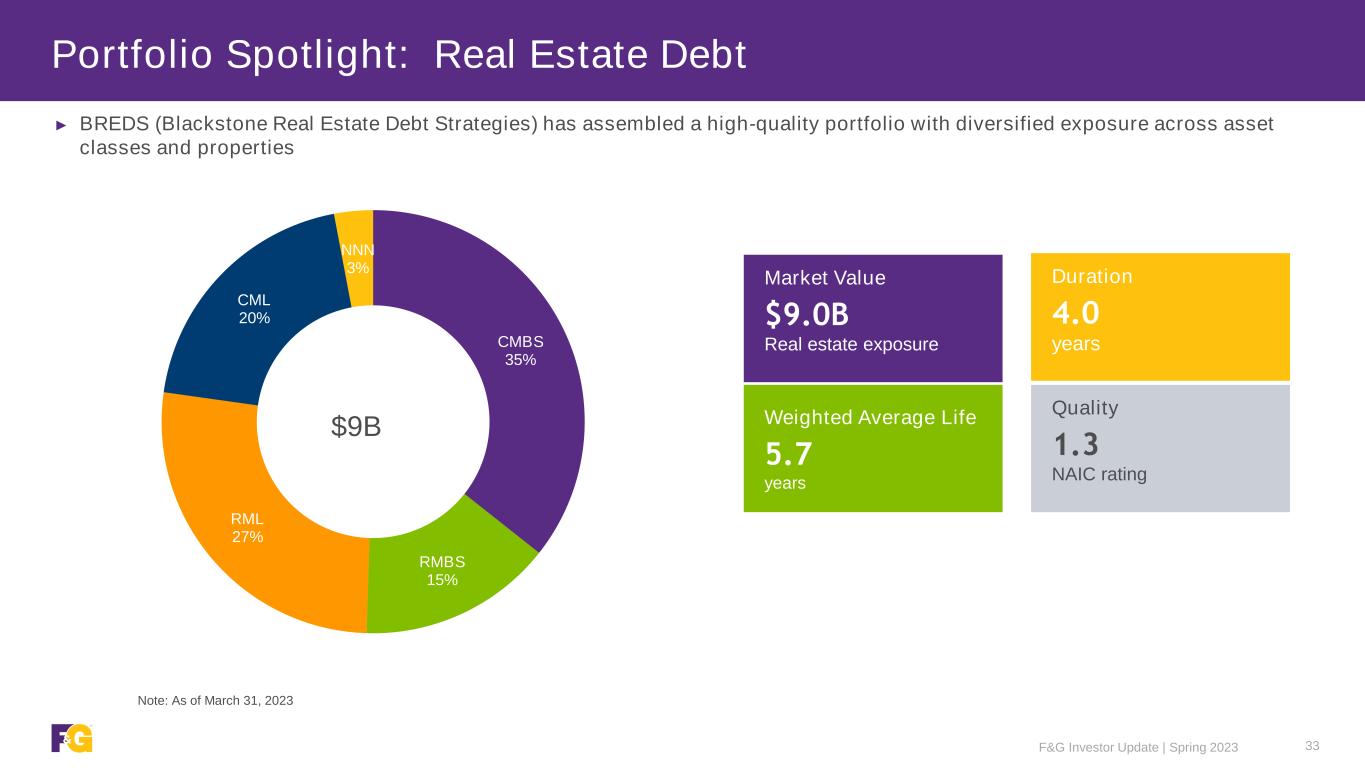

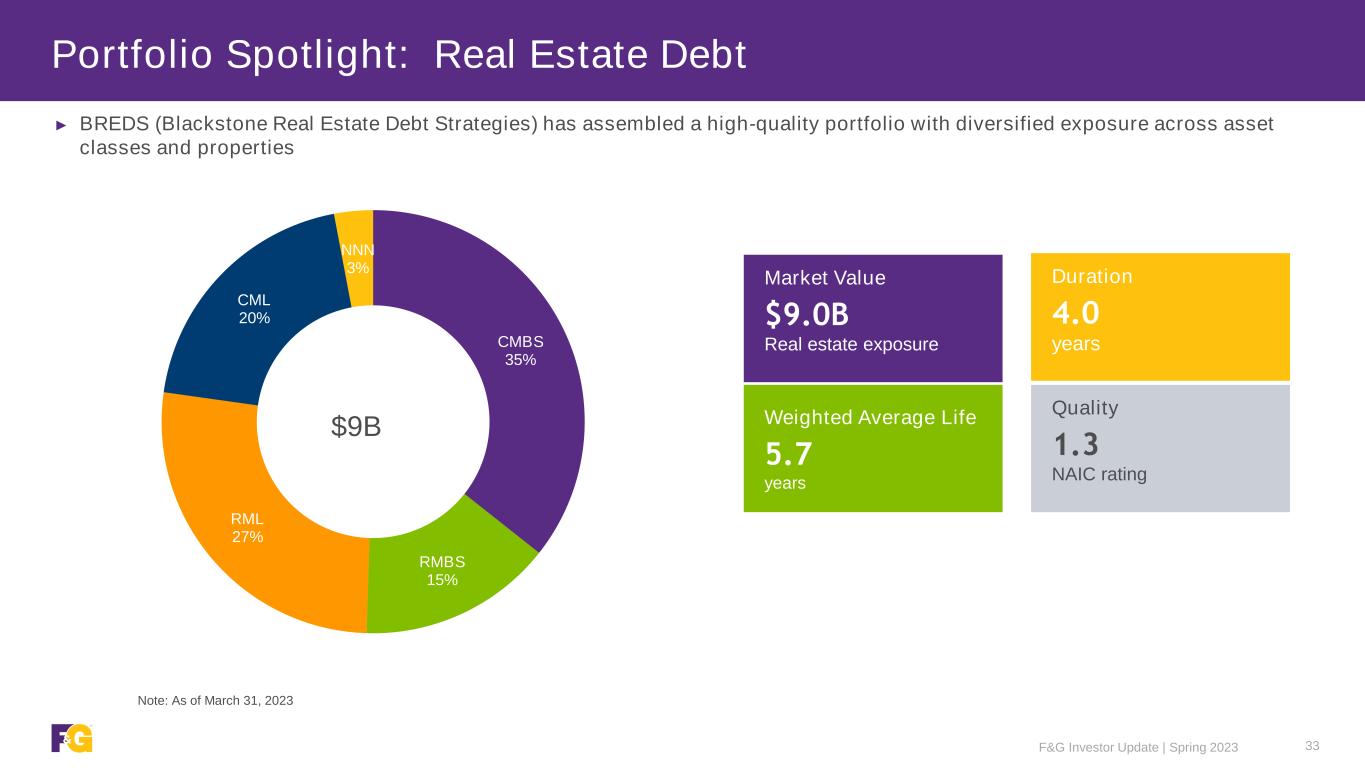

F&G Investor Update | Spring 2023 33 Portfolio Spotlight: Real Estate Debt ► BREDS (Blackstone Real Estate Debt Strategies) has assembled a high-quality portfolio with diversified exposure across asset classes and properties Note: As of March 31, 2023 CMBS 35% RMBS 15% RML 27% CML 20% NNN 3% $9B Duration 4.0 years Weighted Average Life 5.7 years Quality 1.3 NAIC rating Market Value $9.0B Real estate exposure

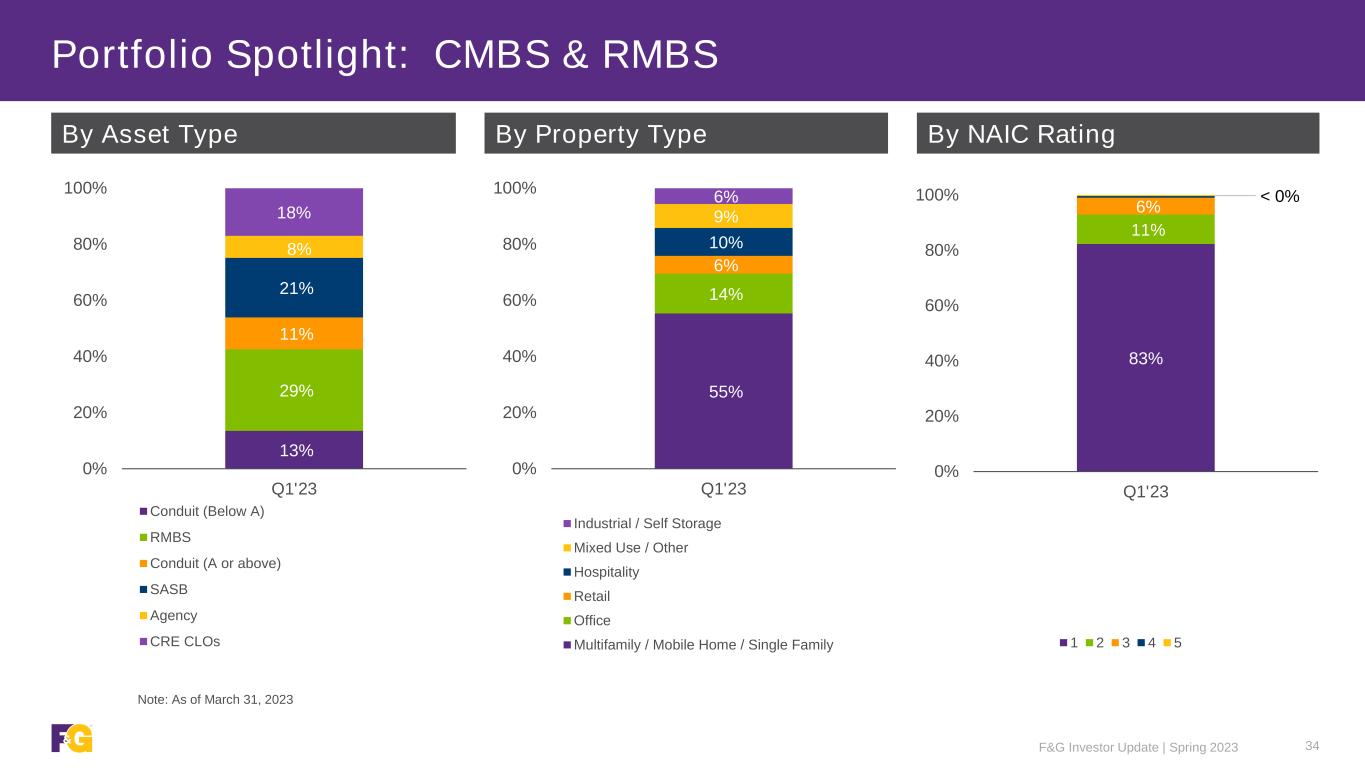

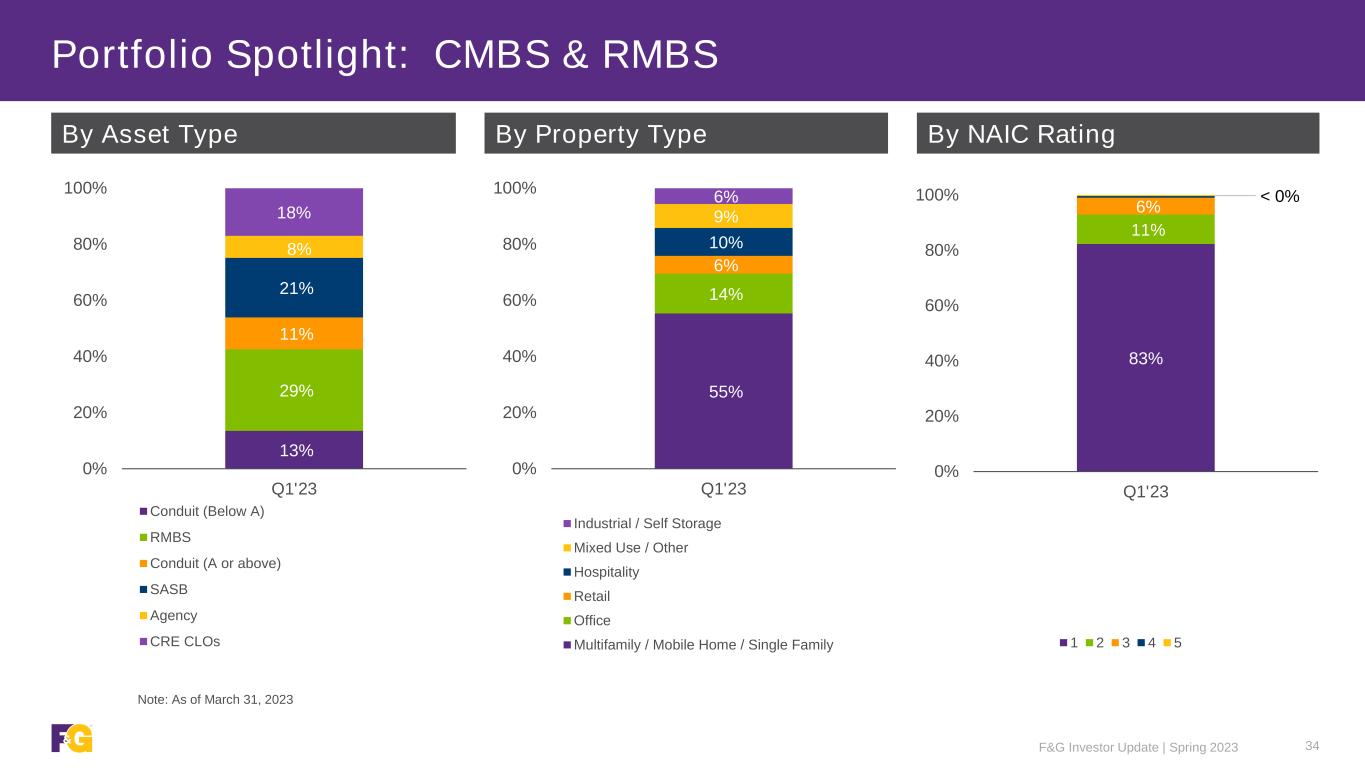

By Asset Type By NAIC RatingBy Property Type Portfolio Spotlight: CMBS & RMBS F&G Investor Update | Spring 2023 Note: As of March 31, 2023 34 13% 29% 11% 21% 8% 18% 0% 20% 40% 60% 80% 100% Q1'23 Conduit (Below A) RMBS Conduit (A or above) SASB Agency CRE CLOs 55% 14% 6% 10% 9% 6% 0% 20% 40% 60% 80% 100% Q1'23 Industrial / Self Storage Mixed Use / Other Hospitality Retail Office Multifamily / Mobile Home / Single Family 83% 11% 6% < 0% 0% 20% 40% 60% 80% 100% Q1'23 1 2 3 4 5

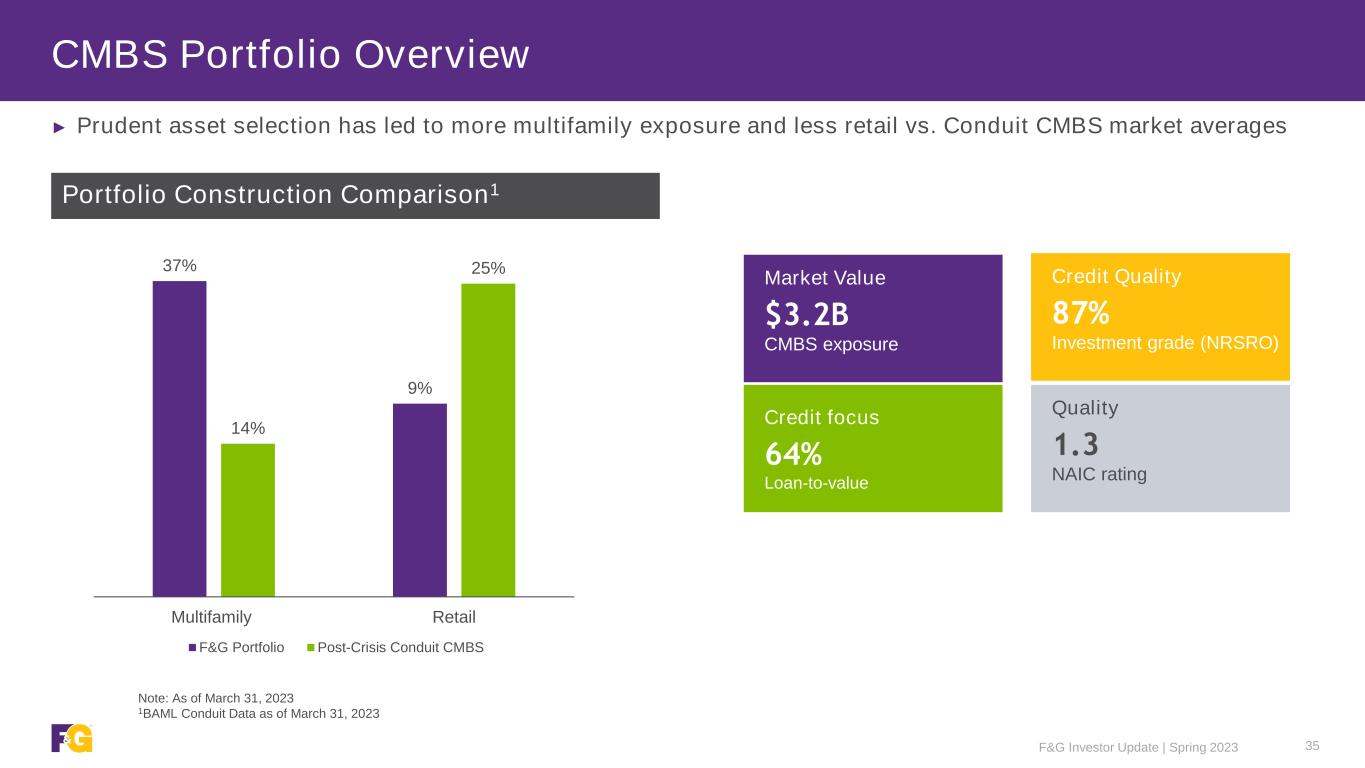

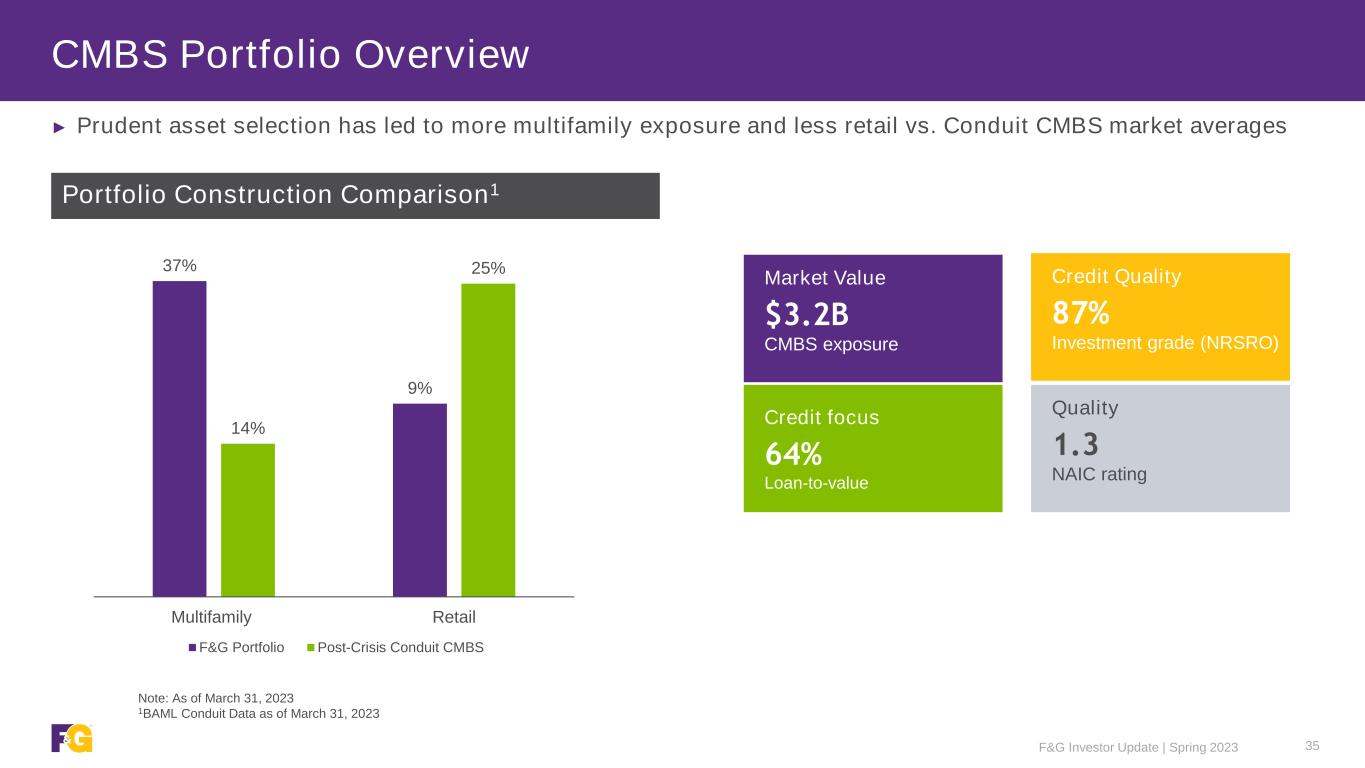

► Prudent asset selection has led to more multifamily exposure and less retail vs. Conduit CMBS market averages Portfolio Construction Comparison1 CMBS Portfolio Overview F&G Investor Update | Spring 2023 Note: As of March 31, 2023 1BAML Conduit Data as of March 31, 2023 Credit Quality 87% Investment grade (NRSRO) Quality 1.3 NAIC rating Market Value $3.2B CMBS exposure Credit focus 64% Loan-to-value 37% 9% 14% 25% Multifamily Retail F&G Portfolio Post-Crisis Conduit CMBS 35

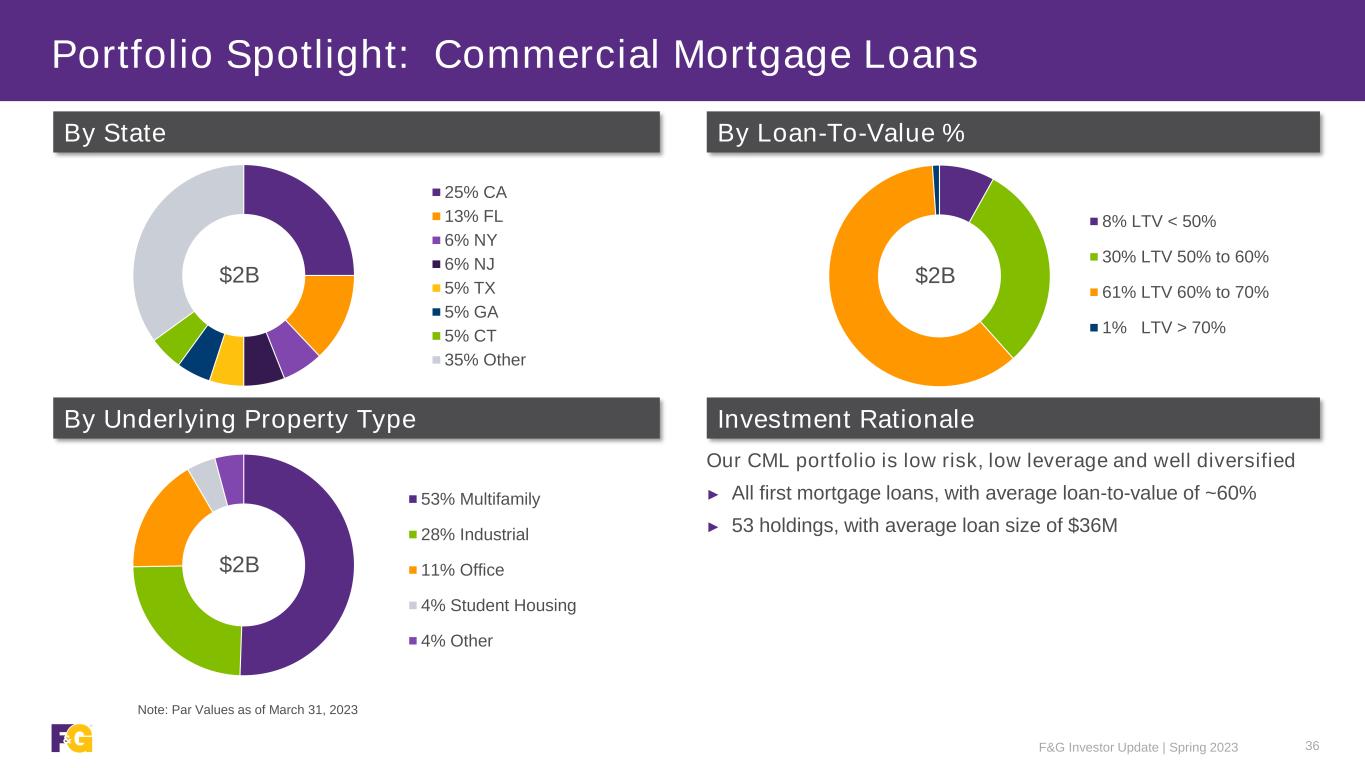

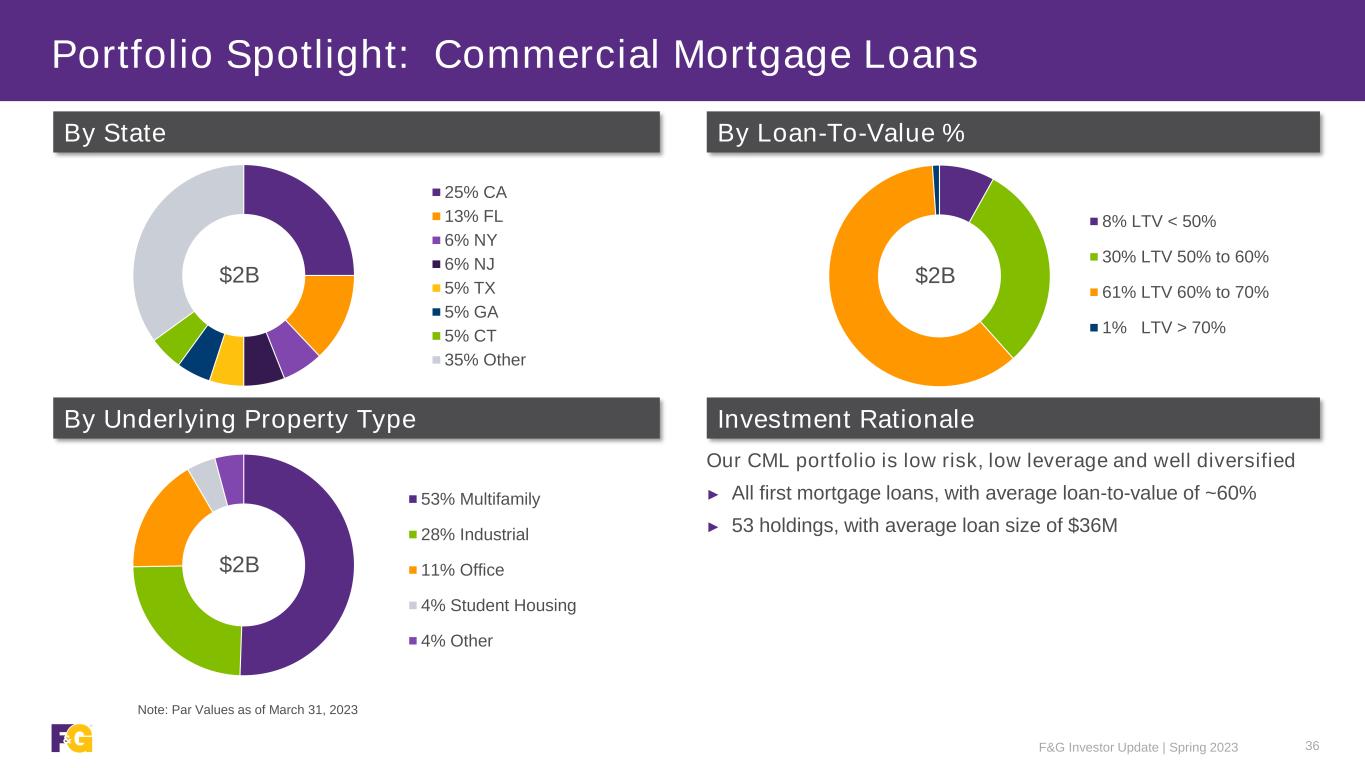

53% Multifamily 28% Industrial 11% Office 4% Student Housing 4% Other $2B F&G Investor Update | Spring 2023 36 By Underlying Property Type Our CML portfolio is low risk, low leverage and well diversified ► All first mortgage loans, with average loan-to-value of ~60% ► 53 holdings, with average loan size of $36M Investment Rationale By State By Loan-To-Value % Note: Par Values as of March 31, 2023 Portfolio Spotlight: Commercial Mortgage Loans 8% LTV < 50% 30% LTV 50% to 60% 61% LTV 60% to 70% 1% LTV > 70% $2B 25% CA 13% FL 6% NY 6% NJ 5% TX 5% GA 5% CT 35% Other $2B

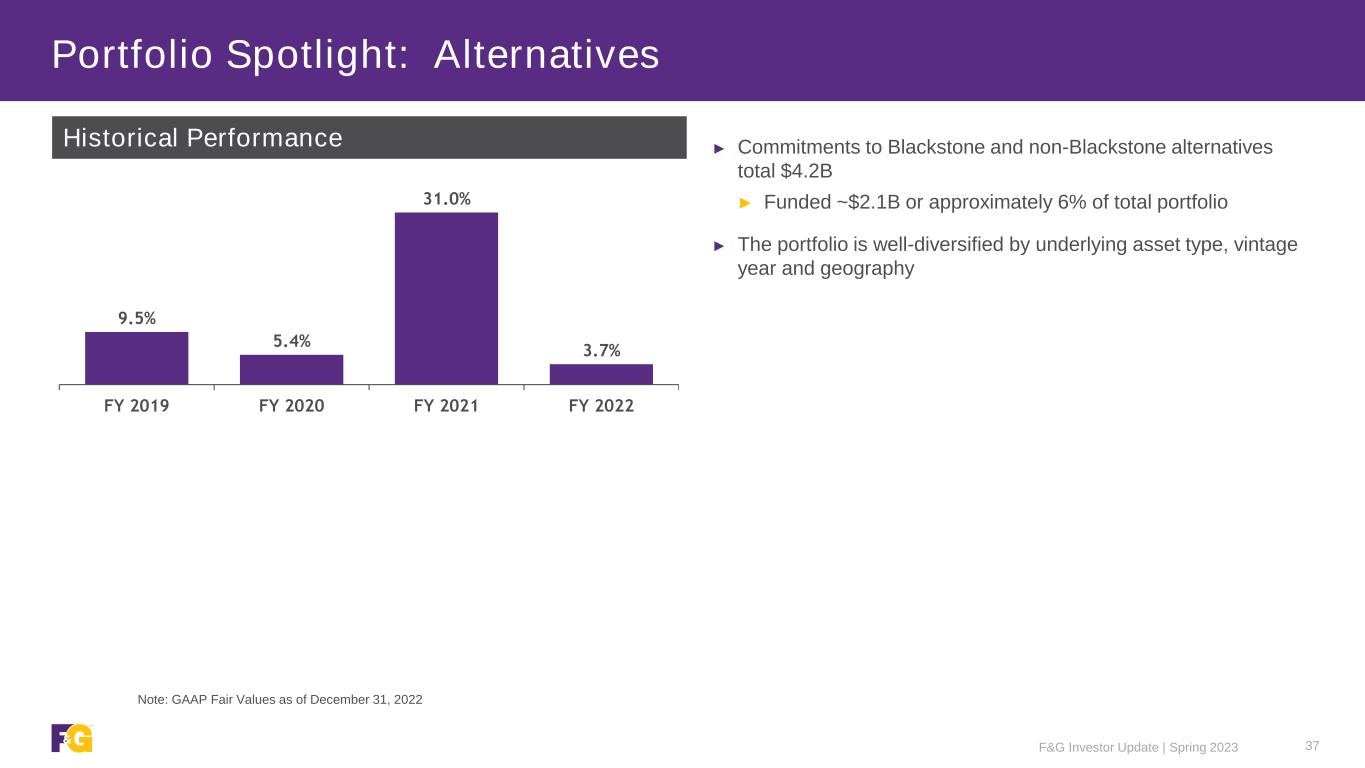

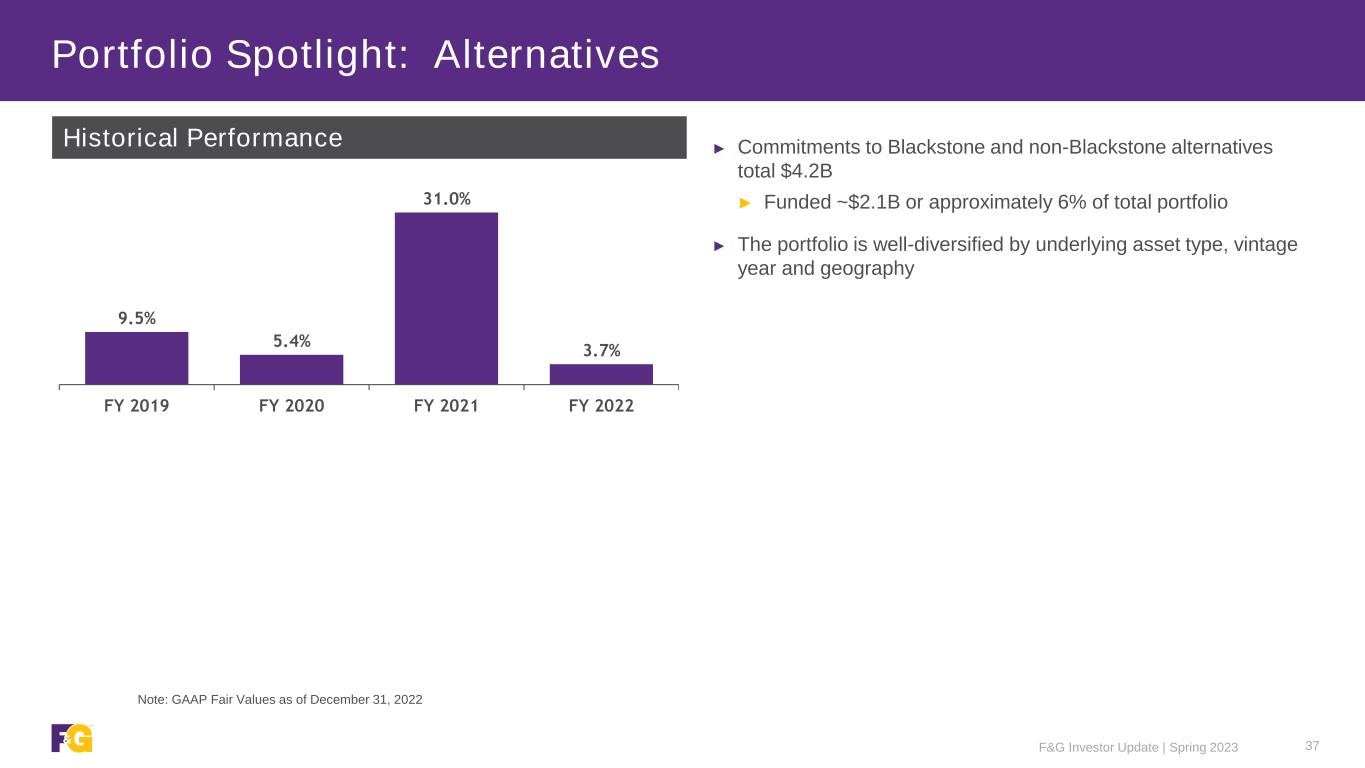

F&G Investor Update | Spring 2023 37 Portfolio Spotlight: Alternatives ► Commitments to Blackstone and non-Blackstone alternatives total $4.2B ► Funded ~$2.1B or approximately 6% of total portfolio ► The portfolio is well-diversified by underlying asset type, vintage year and geography Historical Performance Note: GAAP Fair Values as of December 31, 2022 9.5% 5.4% 31.0% 3.7% FY 2019 FY 2020 FY 2021 FY 2022

This document (together with any attachments, appendices, and related materials, the “Materials”) is provided on a confidential basis for informational due diligence purposes only and is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell, or a solicitation of an offer to buy, any security or instrument in or to participate in any account, program, trading strategy with any Blackstone fund, account or other investment vehicle (each a “Fund”) managed or advised by Blackstone Inc. or its affiliates (“Blackstone”), nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision. If such offer is made, it will only be made by means of an offering memorandum or operative documents (collectively with additional offering documents, the “Offering Documents”), which would contain material information (including certain risks of investing in such Fund) not contained in the Materials and which would supersede and qualify in its entirety the information set forth in the Materials. Any decision to invest in a Fund should be made after reviewing the Offering Documents of such Fund, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting and tax advisers to make an independent determination of the suitability and consequences of an investment in such Fund. In the event that the descriptions or terms described herein are inconsistent with or contrary to the descriptions in or terms of the Offering Documents, the Offering Documents shall control. None of Blackstone, its funds, nor any of their affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of a Fund or any other entity, transaction, or investment. All information is as of the date on the cover, unless otherwise indicated and may change materially in the future. Capitalized terms used herein but not otherwise defined have the meanings set forth in the Offering Documents. The Materials contain highly confidential information regarding Blackstone and a Fund’s investments, strategy and organization. Your acceptance of the Materials constitutes your agreement that the Materials are designated as “trade secret” and “highly confidential” by Blackstone and are neither publicly available nor do they constitute a public record and that you shall (i) keep confidential all the information contained in the Materials, as well as any information derived by you from the information contained in the Materials (collectively, “Confidential Information”) and not disclose any such Confidential Information to any other person (including in response to any Freedom of Information Act, public records statute, or similar request), (ii) not use any of the Confidential Information for any purpose other than to evaluate or monitor investments in a Fund, (iii) not use the Confidential Information for purposes of trading securities, including, without limitation, securities of Blackstone or its portfolio companies, (iv) except to download the Materials from BXAccess, not copy the Materials without the prior consent of Blackstone, and (v) promptly return any or all of the Materials and copies hereof to Blackstone upon Blackstone's request, in each case subject to the confidentiality provisions more fully set forth in a Fund’s Offering Documents and any other written agreement(s) between the recipient and Blackstone, a current or potential portfolio company, or a third-party service provider engaged by Blackstone in connection is with evaluation of a potential investment opportunity. Blackstone Securities Partners L.P. (“BSP”) a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine—and BSP does not engage in a determination regarding—whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor. In considering any investment performance information contained in the Materials, prospective investors should bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that a Fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. Blackstone Proprietary Data. Certain information and data provided herein is based on Blackstone proprietary knowledge and data. Portfolio companies may provide proprietary market data to Blackstone, including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures, and valuations for multiple assets. Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and existing investments. While Blackstone currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Blackstone’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof. Case Studies. The selected investment examples, case studies and/or transaction summaries presented or referred to herein may not be representative of all transactions of a given type or of investments generally and are intended to be illustrative of the types of investments that have been made or may be made by a Fund in employing such Fund’s investment strategies. It should not be assumed that a Fund will make equally successful or comparable investments in the future. Moreover, the actual investments to be made by a Fund or any other future fund will be made under different market conditions from those investments presented or referenced in the Materials and may differ substantially from the investments presented herein as a result of various factors. Prospective investors should also note that the selected investment examples, case studies and/or transaction summaries presented or referred to herein have involved Blackstone professionals who will be involved with the management and operations of a Fund as well as other Blackstone personnel who will not be involved in the management and operations of such Fund. Certain investment examples described herein may be owned by investment vehicles managed by Blackstone and by certain other third-party equity partners, and in connection therewith Blackstone may own less than a majority of the equity securities of such investment. Further investment details are available upon request. Conflicts of Interest. There may be occasions when a Fund’s general partner and/or the investment advisor, and their affiliates will encounter potential conflicts of interest in connection with such Fund’s activities including, without limitation, the allocation of investment opportunities, relationships with Blackstone’s and its affiliates’ investment banking and advisory clients, and the diverse interests of such Fund’s limited partner group. There can be no assurance that the Sponsor will identify, mitigate, or resolve all conflicts of interest in a manner that is favorable to the Partnership. F&G Investor Update | Spring 2023 38 Blackstone Related Important Disclosures

F&G Investor Update | Spring 2023 39 Blackstone Related Important Disclosures (continued) Diversification; Potential Lack Thereof. Diversification is not a guarantee of either a return or protection against loss in declining markets. The number of investments which a Fund makes may be limited, which would cause the Fund’s investments to be more susceptible to fluctuations in value resulting from adverse economic or business conditions with respect thereto. There is no assurance that any of the Fund’s investments will perform well or even return capital; if certain investments perform unfavorably, for the Fund to achieve above-average returns, one or a few of its investments must perform very well. There is no assurance that this will be the case. In addition, certain geographic regions and/or industries in which the Fund is heavily invested may be more adversely affected from economic pressures when compared to other geographic regions and/or industries. Epidemic / Pandemic. Certain countries have been susceptible to epidemics, most recently COVID-19, which may be designated as pandemics by world health authorities. The outbreak of such epidemics, together with any resulting restrictions on travel or quarantines imposed, has had and will continue to have a negative impact on the economy and business activity globally (including in the countries in which the Funds invest), and thereby is expected to adversely affect the performance of the Funds’ Investments. Furthermore, the rapid development of epidemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, presents material uncertainty and risk with respect to the Funds and the performance of their Investments. ERISA Fiduciary Disclosure. The foregoing information has not been provided in a fiduciary capacity under ERISA, and it is not intended to be, and should not be considered as, impartial investment advice. Estimates / Targets. Any estimates, targets, forecasts, or similar predictions or returns set forth herein are based on assumptions and assessments made by Blackstone that it considers reasonable under the circumstances as of the date hereof. They are necessarily speculative, hypothetical, and inherently uncertain in nature, and it can be expected that some or all of the assumptions underlying such estimates, targets, forecasts, or similar predictions or returns contained herein will not materialize and/or that actual events and consequences thereof will vary materially from the assumptions upon which such estimates, targets, forecasts, or similar predictions or returns have been based. Among the assumptions to be made by Blackstone in performing its analysis are (i) the amount and frequency of current income from an investment, (ii) the holding period length, (iii) EBITDA growth and cost savings over time, (iv) the manner and timing of sale, (v) exit multiples reflecting long-term averages for the relevant asset type, (vi) customer growth and other business initiatives, (vii) availability of financing, (viii) potential investment opportunities Blackstone is currently or has recently reviewed and (ix) overall macroeconomic conditions such as GDP growth, unemployment and interest rate levels. Inclusion of estimates, targets, forecasts, or similar predictions or returns herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of such information, and neither Blackstone nor a Fund is under any obligation to revise such returns after the date provided to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such returns are later shown to be incorrect. None of Blackstone, a Fund, their affiliates or any of the respective directors, officers, employees, partners, shareholders, advisers and agents of any of the foregoing makes any assurance, representation or warranty as to the accuracy of such assumptions. Investors and clients are cautioned not to place undue reliance on these forward-looking statements. Recipients of the Materials are encouraged to contact Fund representatives to discuss the procedures and methodologies used to make the estimates, targets, forecasts, and/or similar predictions or returns and other information contained herein. Forward-Looking Statements. Certain information contained in the Materials constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward‐looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Blackstone believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10‐K for the most recent fiscal year ended December 31 of that year and any such updated factors included in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Materials and in the filings. Blackstone undertakes no obligation to publicly update or review any forward‐looking statement, whether as a result of new information, future developments or otherwise. Highly Competitive Market for Investment Opportunities. The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that a Fund will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that a Fund will be able to fully invest its committed capital. There is no guarantee that investment opportunities will be allocated to a Fund and/or that the activities of Blackstone’s other funds will not adversely affect the interests of such Fund. Illiquidity and Variable Valuation. A Fund is intended for long-term investment by investors that can accept the risks associated with making highly speculative, primarily illiquid investments in privately negotiated transactions. There is no organized secondary market for investors’ interests in any Fund nor is there an organized market for which to sell a Fund’s underlying investments, and none is expected to develop. Withdrawal and transfer of interests in a Fund are subject to various restrictions, and similar restrictions will apply in respect of the Fund’s underlying investments. Further, the valuation of a Fund’s investments will be difficult, may be based on imperfect information and is subject to inherent uncertainties, and the resulting values may differ from values that would have been determined had a ready market existed for such investments, from values placed on such investments by other investors and from prices at which such investments may ultimately be sold. Images. The Materials contain select images of certain investments that are provided for illustrative purposes only and may not be representative of an entire asset or portfolio or of a Fund’s entire portfolio. Such images may be digital renderings of investments rather than actual photos.

Index Comparison. The volatility and risk profile of the indices presented is likely to be materially different from that of a Fund. In addition, the indices employ different investment guidelines and criteria than a Fund and do not employ leverage; as a result, the holdings in a Fund and the liquidity of such holdings may differ significantly from the securities that comprise the indices. The indices are not subject to fees or expenses and it may not be possible to invest in the indices. The performance of the indices has not been selected to represent an appropriate benchmark to compare to a Fund’s performance, but rather is disclosed to allow for comparison of a Fund’s performance to that of well-known and widely recognized indices. A summary of the investment guidelines for the indices presented are available upon request. In the case of equity indices, performance of the indices reflects the reinvestment of dividends. Leverage; Borrowings Under a Subscription Facility. A Fund may use leverage, and a Fund may utilize borrowings from Blackstone Inc. or under its subscription-based credit facility in advance of or in lieu of receiving investors’ capital contributions. The use of leverage or borrowings magnifies investment, market and certain other risks and may be significant. A Fund’s performance will be affected by the availability and terms of any leverage as such leverage will enhance returns from investments to the extent such returns exceed the costs of borrowings by such Fund. The leveraged capital structure of such assets will increase their exposure to certain factors such as rising interest rates, downturns in the economy, or deterioration in the financial condition of such assets or industry. In the event an investment cannot generate adequate cash flow to meet its debt service, a Fund may suffer a partial or total loss of capital invested in the investment, which may adversely affect the returns of such Fund. In the case of borrowings used in advance of or in lieu of receiving investors’ capital contributions, such use will result in higher or lower reported returns than if investors’ capital had been contributed at the inception of an investment because calculations of returns to investors are based on the payment date of investors’ capital contributions. In addition, because a Fund will pay all expenses, including interest, associated with the use of leverage or borrowings, investors will indirectly bear such costs. Material, Non-Public Information. In connection with other activities of Blackstone, certain Blackstone personnel may acquire confidential or material non-public information or be restricted from initiating transactions in certain securities, including on a Fund’s behalf. As such, a Fund may not be able to initiate a transaction or sell an investment. In addition, policies and procedures maintained by Blackstone to deter the inappropriate sharing of material non-public information may limit the ability of Blackstone personnel to share information with personnel in Blackstone’s other business groups, which may ultimately reduce the positive synergies expected to be realized by a Fund as part of the broader Blackstone investment platform. No Assurance of Investment Return. Prospective investors should be aware that an investment in a Fund is speculative and involves a high degree of risk. There can be no assurance that a Fund will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met (or that the returns will be commensurate with the risks of investing in the type of transactions described herein). The portfolio companies in which a Fund may invest (directly or indirectly) are speculative investments and will be subject to significant business and financial risks. A Fund’s performance may be volatile. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. A Fund’s fees and expenses may offset or exceed its profits. No Operating History. Prospective investors should note that the Fund has not yet commenced operations and therefore has no operating history upon which prospective investors may evaluate its performance. Past activities of investment vehicles managed or sponsored by Blackstone provide no assurance of future success. Moreover, the prior investment results of the existing Funds are provided for illustrative purposes only and not to imply that such results will be obtained in the future. Non-GAAP Measures. Non-GAAP measures (including, but not limited to, time weighted gross and net returns, including income and appreciation, across all time periods) are estimates based on information available to Blackstone as of the date cited, including information received from third parties. There may not be uniform methods for calculating such measures and such methods are subject to change over time. Blackstone believes that such non-GAAP measures constitute useful methods to convey information to current and prospective investors that Blackstone believes is relevant and meaningful in understanding and/or evaluating the fund or investment in question. However, such non-GAAP measures should not be considered to be more relevant or accurate than GAAP methodologies and should not be viewed as alternatives to GAAP methodologies. In addition, third party information used to calculate such non-GAAP measures is believed to be reliable, but no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates take any responsibility for any such information. Opinions. Opinions expressed reflect the current opinions of Blackstone as of the date appearing in the Materials only and are based on Blackstone’s opinions of the current market environment, which is subject to change. Certain information contained in the Materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Reliance on Key Management Personnel. The success of a Fund will depend, in large part, upon the skill and expertise of certain Blackstone professionals. In the event of the death, disability or departure of any key Blackstone professionals, the business and the performance of a Fund may be adversely affected. Some Blackstone professionals may have other responsibilities, including senior management responsibilities, throughout Blackstone and, therefore, conflicts are expected to arise in the allocation of such personnel’s time (including as a result of such personnel deriving financial benefit from these other activities, including fees and performance-based compensation). Russian Invasion of Ukraine. On February 24, 2022, Russian troops began a full-scale invasion of Ukraine and, as of the date of this Material, the countries remain in active armed conflict. Around the same time, the United States, the United Kingdom, the European Union, and several other nations announced a broad array of new or expanded sanctions, export controls, and other measures against Russia, Russia-backed separatist regions in Ukraine, and certain banks, companies, government officials, and other individuals in Russia and Belarus. The ongoing conflict and the rapidly evolving measures in response could be expected to have a negative impact on the economy and business activity globally (including in the countries in which the Fund invests), and therefore could adversely affect the performance of the Fund’s investments. The severity and duration of the conflict and its impact on global economic and market conditions are impossible to predict, and as a result, could present material uncertainty and risk with respect to the Fund and the performance of its investments and operations, and the ability of the Fund to achieve its investment objectives. Similar risks will exist to the extent that any portfolio entities, service providers, vendors or certain other parties have material operations or assets in Russia, Ukraine, Belarus, or the immediate surrounding areas. F&G Investor Update | Spring 2023 40 Blackstone Related Important Disclosures (continued)

F&G Investor Update | Spring 2023 41 Blackstone Related Important Disclosures (continued) Target Allocations. There can be no assurance that a Fund will achieve its objectives or avoid substantial losses. Allocation strategies and targets depend on a variety of factors, including prevailing market conditions, investment availability and Blackstone’s allocation procedures. There is no guarantee that such strategies and targets will be achieved and any particular investment may not meet the target criteria. Third-Party Information. Certain information contained in the Materials has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Appendix – Finance F&G Investor Update | Spring 2023 42

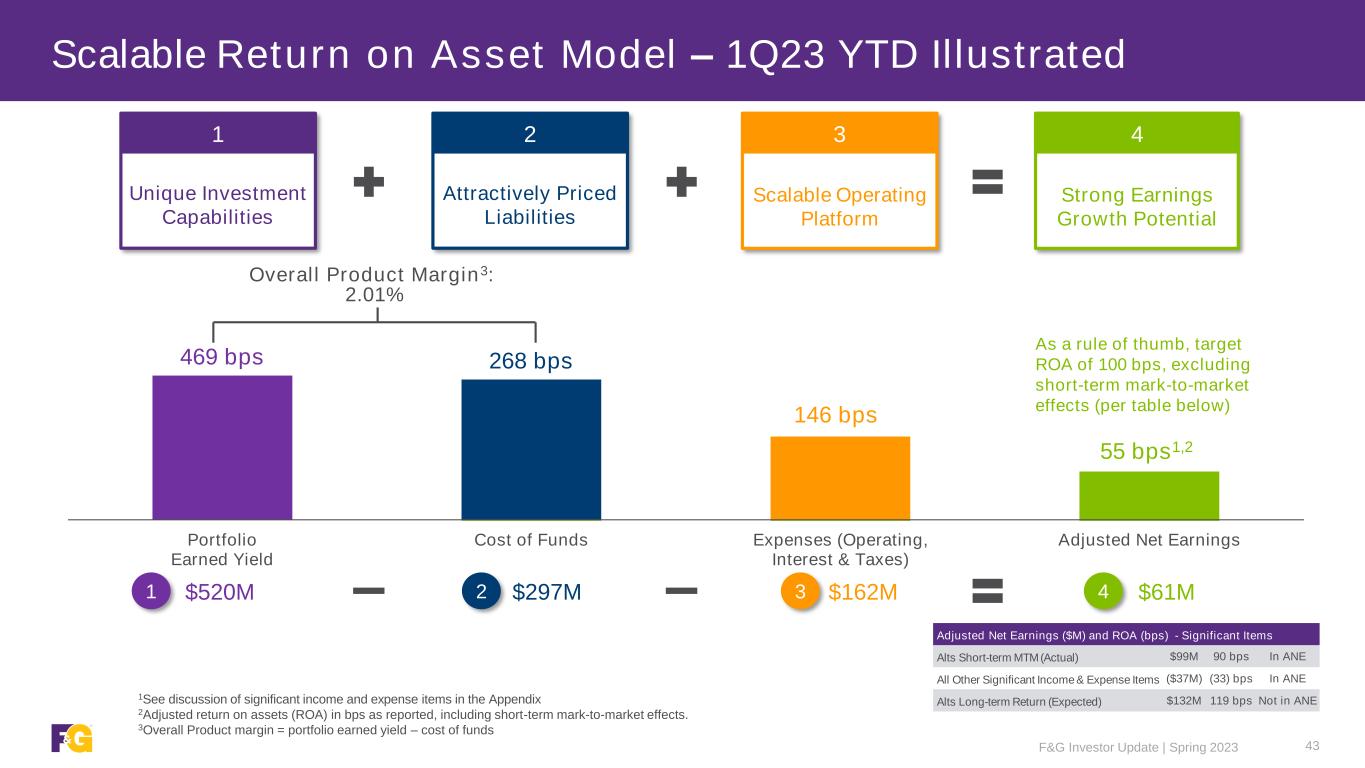

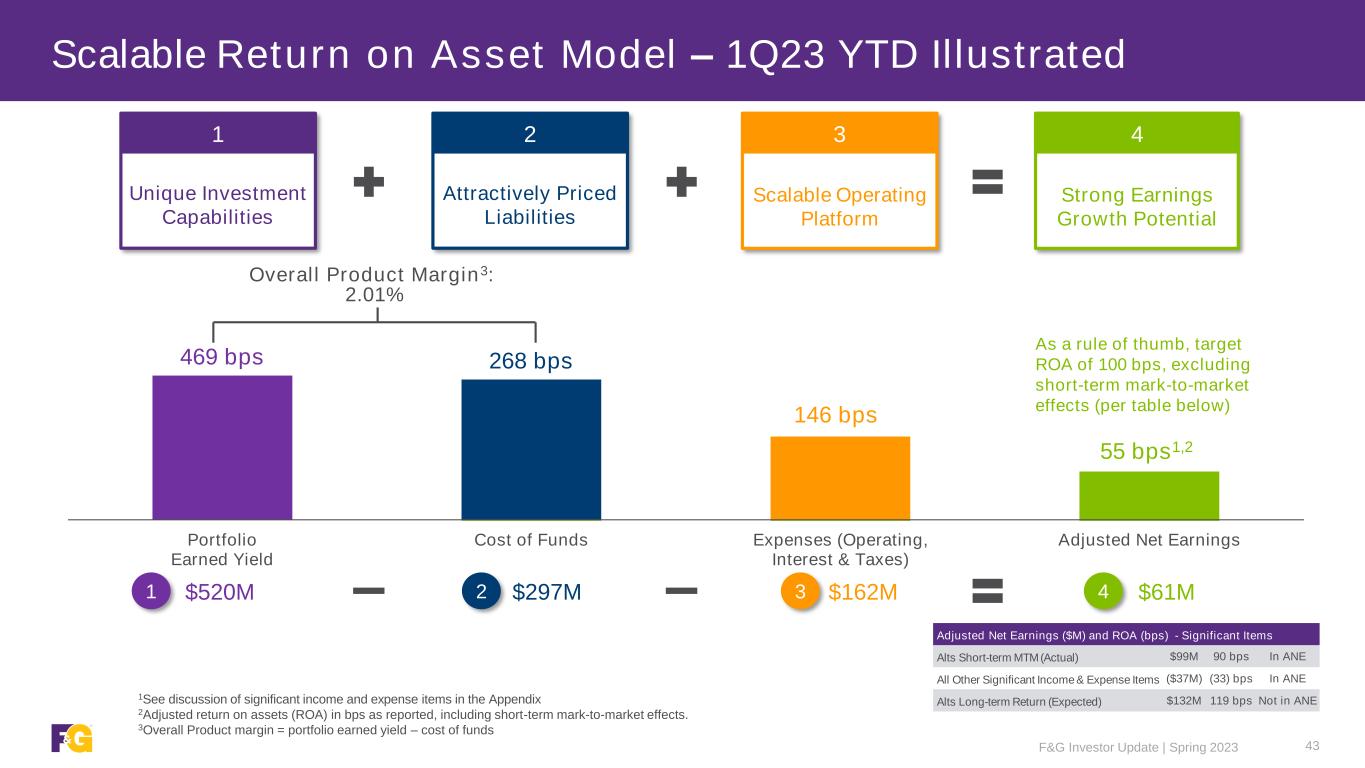

F&G Investor Update | Spring 2023 43 Scalable Return on Asset Model – 1Q23 YTD Illustrated 1See discussion of significant income and expense items in the Appendix 2Adjusted return on assets (ROA) in bps as reported, including short-term mark-to-market effects. 3Overall Product margin = portfolio earned yield – cost of funds 469 bps 268 bps 146 bps 55 bps1,2 Portfolio Earned Yield Cost of Funds Expenses (Operating, Interest & Taxes) Adjusted Net Earnings Unique Investment Capabilities Attractively Priced Liabilities Scalable Operating Platform Strong Earnings Growth Potential Overall Product Margin3: 2.01% 1 2 3 4$520M $297M $162M $61M 1 2 3 4 As a rule of thumb, target ROA of 100 bps, excluding short-term mark-to-market effects (per table below) Adjusted Net Earnings ($M) and ROA (bps) - Significant Items Alts Short-term MTM (Actual) $99M 90 bps In ANE All Other Significant Income & Expense Items ($37M) (33) bps In ANE Alts Long-term Return (Expected) $132M 119 bps Not in ANE

F&G Investor Update | Spring 2023 44 ANE Results – Significant Income and Expense Items1 1Refer to “Non-GAAP Financial Measures Definitions” Significant Income and Expense Items Reflected in ANE Alternatives Long-term Expected Return Not Reflected in ANE Weighted Average Diluted Shares Outstanding Three months ended March 31, 2023 Adjusted net earnings of $61 million for the three months ended March 31, 2023 included $99 million of investment income from alternative investments, partially offset by $37 million tax valuation allowance. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $132 million. $62 $132 125 December 31, 2022 Adjusted net earnings of $130 million for the three months ended December 31, 2022 included $41 million of investment income from alternative investments and $58 million one-time tax benefit from carryback of capital losses. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $113 million. $99 $113 125 September 30, 2022 Adjusted net loss of $12 million for the three months ended September 30, 2022 included $11 million of investment loss from alternative investments and $11 million of other net expense items. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $106 million. ($22) $106 125 June 30, 2022 Adjusted net earnings of $155 million for the three months ended June 30, 2022 included $70 million of investment income from alternative investments, $66 million gain from actuarial assumption updates, and $6 million of CLO redemption gains and other income. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $100 million. $142 $100 107 March 31, 2022 Adjusted net earnings of $80 million for the three months ended March 31, 2022 included $102 million of investment income from alternative investments, $18 million income of CLO redemption gains and other investment income, partially offset by $38 million tax valuation allowance expense. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $100 million. $82 $100 105 Year ended December 31, 2022 Adjusted net earnings of $353 million for the year ended December 31, 2022 included $202 million of investment income from alternative investments, $66 million gain from actuarial assumption updates, $20 million net, tax benefits and $13 million net, CLO redemption gains and other income and expense items. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $419 million. $301 $419 115 December 31, 2021 Adjusted net earnings of $640 million for the year ended December 31, 2021 included $497 million investment income from alternative investments, $73 million of CLO redemption gains and other income and $10 million of other items. Alternative investments investment income based on management’s long-term expected return of approximately 10% was $236 million. $580 $236 105

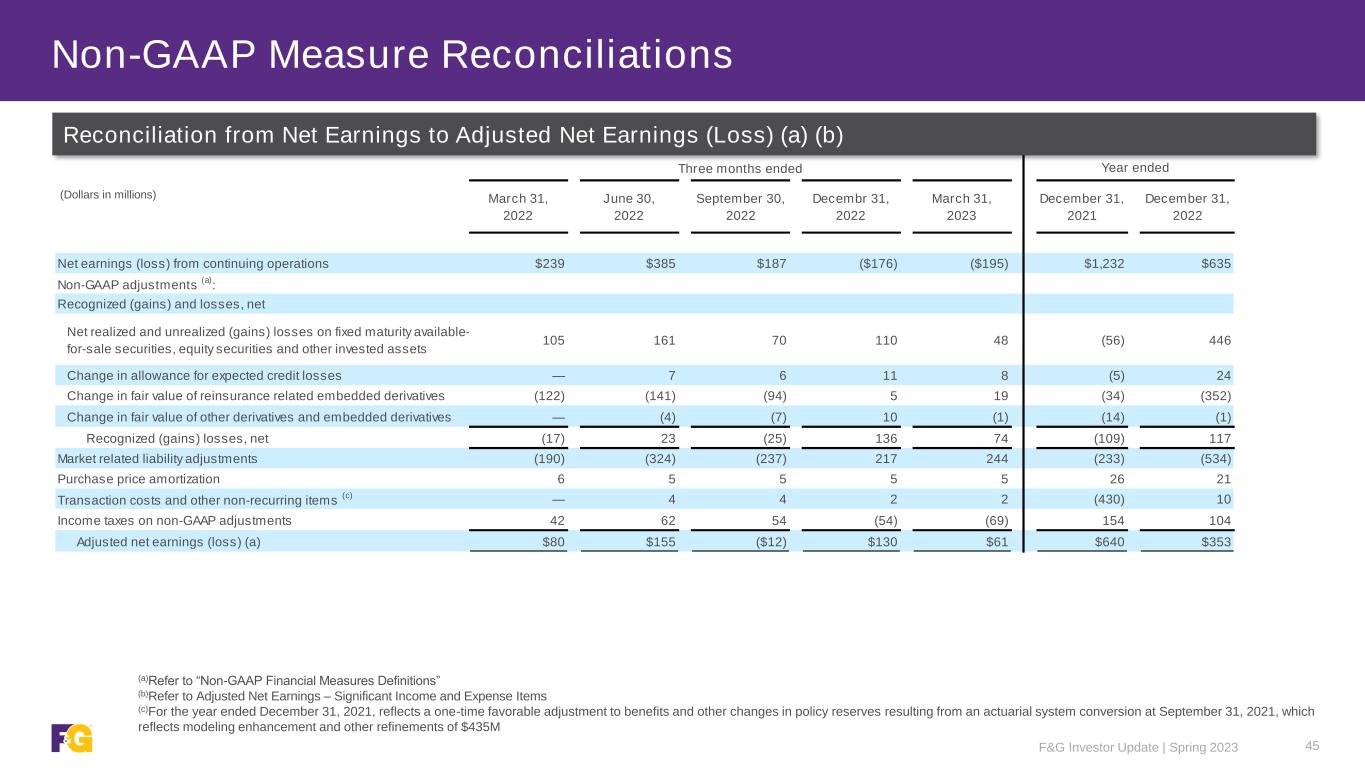

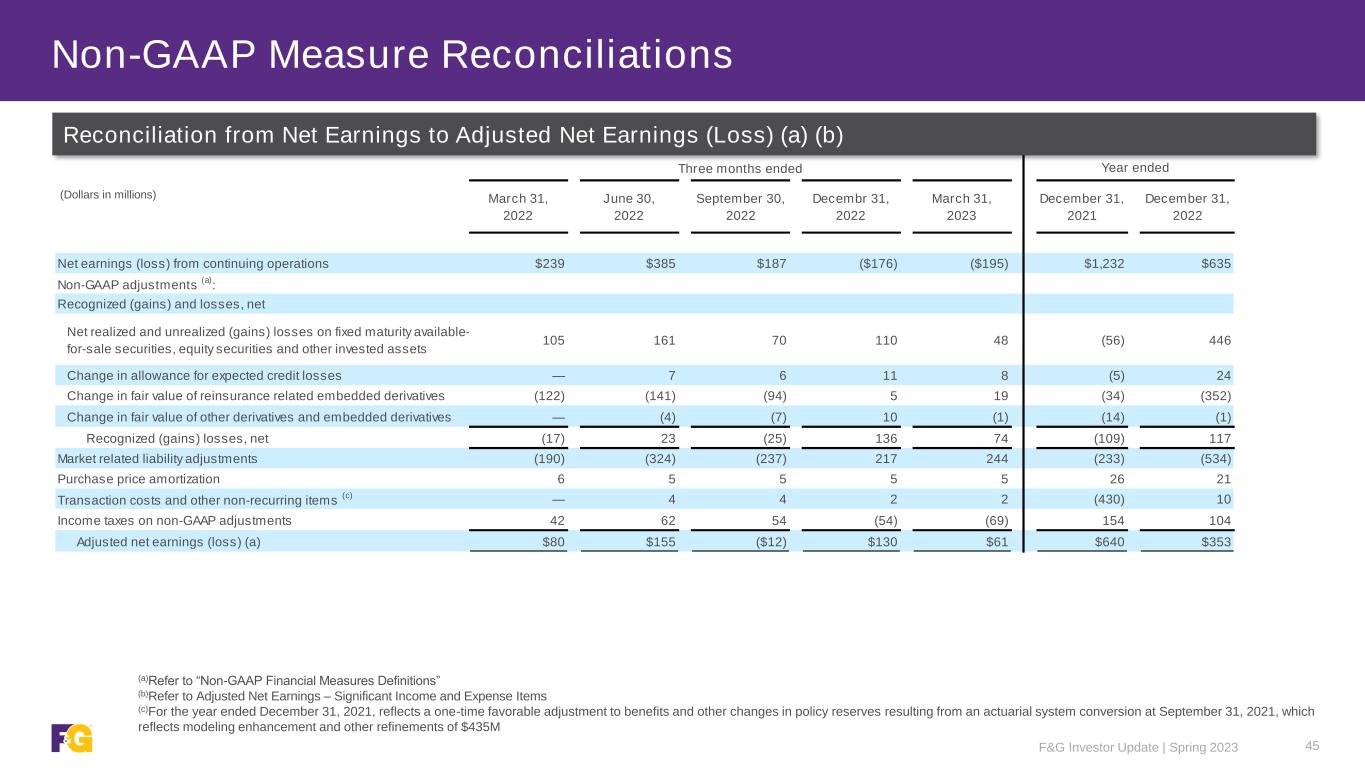

Three months ended March 31, 2022 June 30, 2022 September 30, 2022 Decembr 31, 2022 March 31, 2023 December 31, 2021 December 31, 2022 Net earnings (loss) from continuing operations $239 $385 $187 ($176) ($195) $1,232 $635 Non-GAAP adjustments (a) : Recognized (gains) and losses, net Net realized and unrealized (gains) losses on fixed maturity available- for-sale securities, equity securities and other invested assets 105 161 70 110 48 (56) 446 Change in allowance for expected credit losses — 7 6 11 8 (5) 24 Change in fair value of reinsurance related embedded derivatives (122) (141) (94) 5 19 (34) (352) Change in fair value of other derivatives and embedded derivatives — (4) (7) 10 (1) (14) (1) Recognized (gains) losses, net (17) 23 (25) 136 74 (109) 117 Market related liability adjustments (190) (324) (237) 217 244 (233) (534) Purchase price amortization 6 5 5 5 5 26 21 Transaction costs and other non-recurring items (c) — 4 4 2 2 (430) 10 Income taxes on non-GAAP adjustments 42 62 54 (54) (69) 154 104 Adjusted net earnings (loss) (a) $80 $155 ($12) $130 $61 $640 $353 Year ended F&G Investor Update | Spring 2023 45 Non-GAAP Measure Reconciliations (a)Refer to “Non-GAAP Financial Measures Definitions” (b)Refer to Adjusted Net Earnings – Significant Income and Expense Items (c)For the year ended December 31, 2021, reflects a one-time favorable adjustment to benefits and other changes in policy reserves resulting from an actuarial system conversion at September 31, 2021, which reflects modeling enhancement and other refinements of $435M (Dollars in millions) Reconciliation from Net Earnings to Adjusted Net Earnings (Loss) (a) (b)

F&G Investor Update | Spring 2023 46 Non-GAAP Measures and Definitions DEFINITIONS The following represents the definitions of non-GAAP measures used by F&G. Adjusted Net Earnings Adjusted net earnings is a non-GAAP economic measure we use to evaluate financial performance each period. Adjusted net earnings is calculated by adjusting net earnings (loss) from continuing operations to eliminate: i. Recognized (gains) and losses, net: the impact of net investment gains/losses, including changes in allowance for expected credit losses and other than temporary impairment (“OTTI”) losses, recognized in operations; and the effect of changes in fair value of the reinsurance related embedded derivative; ii. Market related liability adjustments: the impacts related to changes in the fair value, including both realized and unrealized gains and losses, of index product related derivatives and embedded derivatives, net of hedging cost; the impact of initial pension risk transfer deferred profit liability losses, including amortization from previously deferred pension risk transfer deferred profit liability losses; and the changes in the fair value of market risk benefits by deferring current period changes and amortizing that amount over the life of the market risk benefit; iii. Purchase price amortization: the impacts related to the amortization of certain intangibles (internally developed software, trademarks and value of distribution asset (“VODA”)) recognized as a result of acquisition activities; iv. Transaction costs: the impacts related to acquisition, integration and merger related items; v. Other “non-recurring,” “infrequent” or “unusual items”: Management excludes certain items determined to be “non-recurring,” “infrequent” or “unusual” from adjusted net earnings when incurred if it is determined these expenses are not a reflection of the core business and when the nature of the item is such that it is not reasonably likely to recur within two years and/or there was not a similar item in the preceding two years; vi. Income taxes: the income tax impact related to the above mentioned adjustments is measured using an effective tax rate, as appropriate by tax jurisdiction. While these adjustments are an integral part of the overall performance of F&G, market conditions and/or the non-operating nature of these items can overshadow the underlying performance of the core business. Accordingly, management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Adjusted net earnings should not be used as a substitute for net earnings (loss). However, we believe the adjustments made to net earnings (loss) in order to derive adjusted net earnings provide an understanding of our overall results of operations.

F&G Investor Update | Spring 2023 47 Non-GAAP Measures and Definitions (continued) Adjusted Net Earnings per Common Share Adjusted net earnings per common share is calculated as adjusted net earnings divided by the weighted-average common shares outstanding. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Adjusted Net Earnings per Diluted Share Adjusted net earnings per diluted share is calculated as adjusted net earnings divided by the weighted-average diluted shares outstanding. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Adjusted Return on Assets (ROA) Adjusted return on assets is calculated by dividing annualized adjusted net earnings by year-to-date AAUM. Return on assets is comprised of net investment income, less cost of funds, and less expenses (including operating expenses, interest expense and income taxes) consistent with our adjusted net earnings definition and related adjustments. Cost of funds includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing financial performance and profitability earned on AAUM. Adjusted Return on Average Equity excluding AOCI (Adj. ROE) Adjusted return on average equity is calculated by dividing annualized adjusted earnings (loss), by total average equity excluding AOCI. Average equity excluding AOCI for the twelve months rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be a useful internally and for investors and analysts to assess the level return driven by the Company's adjusted earnings (loss).

F&G Investor Update | Spring 2023 48 Non-GAAP Measures and Definitions (continued) Assets Under Management (AUM) AUM uses the following components: i. total invested assets at amortized cost, excluding derivatives, net of reinsurance qualifying for risk transfer in accordance with GAAP; ii. related party loans and investments; iii. accrued investment income; iv. the net payable/receivable for the purchase/sale of investments, and v. cash and cash equivalents excluding derivative collateral at end of the period Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on assets available for reinvestment. Average Assets Under Management (AAUM) AAUM is calculated as AUM at the beginning of the period and the end of each month in the period, divided by the total number of months in the period plus one. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on assets available for reinvestment. Book Value per Share (including and excluding AOCI) Book value per share including and excluding AOCI is calculated as total equity (or total equity excluding AOCI) divided by the total number of shares of common stock outstanding. Management considers this to be a useful measure internally and for investors and analysts to assess the capital position of the Company.

F&G Investor Update | Spring 2023 49 Non-GAAP Measures and Definitions (continued) Return on Average Equity excluding AOCI Return on average equity excluding AOCI is calculated by dividing the rolling four quarters net earnings (loss), by total average equity excluding AOCI. Average equity excluding AOCI for the twelve months rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Sales Annuity, IUL, funding agreement and non-life contingent PRT sales are not derived from any specific GAAP income statement accounts or line items and should not be viewed as a substitute for any financial measure determined in accordance with GAAP. Sales from these products are recorded as deposit liabilities (i.e. contractholder funds) within the Company's consolidated financial statements in accordance with GAAP. Life contingent PRT sales are recorded as premiums in revenues within the consolidated financial statements. Management believes that presentation of sales, as measured for management purposes, enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition. Total Capitalization excluding AOCI Total Capitalization excluding AOCI is based on Total Equity and the aggregate principal amount of debt and Total Equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts to help assess the capital position of the Company. Total Debt-to-Capitalization excluding AOCI Debt-to-capital ratio excluding AOCI is computed by dividing total aggregate principal amount of debt by total capitalization (total debt plus total equity excluding AOCI). Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing its capital position.

F&G Investor Update | Spring 2023 50 Non-GAAP Measures and Definitions (continued) Total Equity excluding AOCI Total equity excluding AOCI is based on total equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts assessing the level of earned equity on total equity. Yield on AAUM Yield on AAUM is calculated by dividing annualized net investment income by AAUM. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the level of return earned on AAUM.