Note 1: (1) June 30, 2007 shareholders' equity includes common stock subject to possible conversion.

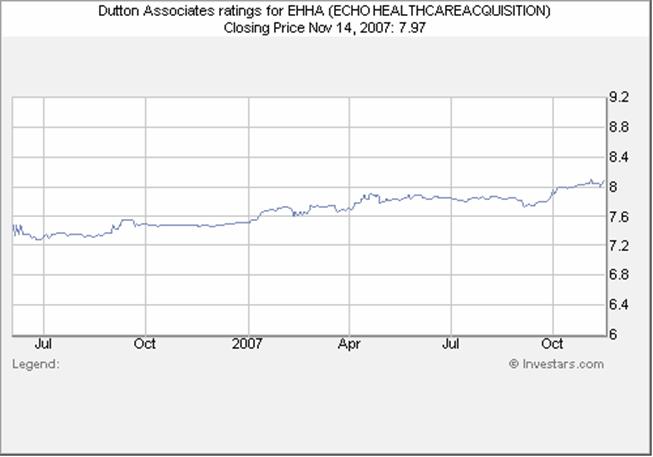

Rating: Neutral

Summary and Conclusion

Echo Healthcare Acquisition Corporation is a special purpose acquisition company (“SPAC”) that was formed to acquire one or more domestic or international operating businesses in the healthcare industry. On September 11, 2006, Echo announced that it had reached a definitive agreement to acquire privately held XLNT Veterinary Care Inc., which provides primary care services to companion animals through a network of 26 fully owned veterinary hospitals in California. The Company expects the acquisition, which requires approval of Echo’s and XLNT’s shareholders, to close following a special meeting scheduled for December 12, 2007, to, among other things, allow shareholders to vote on the proposed merger. Following completion of the merger, Echo plans to change its name to Pet DRx Corporation. Additional information about Echo and the proposed transaction, as well as other matters, can be found in the Company’s S-4 filed with the Securities and Exchange Commission (SEC) on November 8, 2007.

XLNT’s goal is to become a preferred provider of veterinary services in select markets by acquiring and integrating veterinary care facilities. The Company believes that by assembling dominant clusters of veterinary facilities in individual markets it can achieve significant economies of scale and operating efficiencies, while taking advantage of incremental revenue growth opportunities. The cornerstone of XLNT’s business strategy is implementation of a highly productive “hub and spoke” structure in select geographic markets in which the Company is able to acquire enough veterinary hospitals to obtain a market share leadership position.

A number of characteristics of the veterinary industry appear to make it an excellent candidate for consolidation. It is growing rapidly and highly fragmented, and it has attractive financial characteristics, since it is largely a cash business and, historically, bad debts have been low, there has been little pricing pressure from insurance or managed care companies, and liability has been limited, with a low risk of litigation. Further, consolidation by means of acquisition could provide needed liquidity for veterinary hospital owners seeking to monetize their investment. Because of the large number of independent operators, we believe that the veterinary industry is relatively inefficient and, as a result, consolidation benefits from economies of scale, cost savings and revenue-growth initiatives could be substantial.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

We believe that Echo’s proposed merger with XLNT makes sense for both parties. Most simply stated, Echo, with more than $58 million of capital to invest (as of October 31, 2007, before merger-related costs and amounts that may be paid to holders of up to 20% of Echo share if they elect to convert their shares to cash), has the money to fund rapid growth through acquisitions of veterinary industry hospitals, while XLNT has hands-on industry expertise and has successfully assembled a network of animal hospitals in several California markets. We believe that the combined Company could grow rapidly if, post merger, it is able to acquire hospitals at prices and financing terms in line with XLNT’s historical experience and that significant revenue, margin and cost-saving benefits could be realized if the Company is able to take advantage of economies of scale and other integration opportunities, fill in markets, and achieve greater critical mass. We are initiating coverage of Echo common with a Neutral rating.

Introduction

Echo is a SPAC, also known as a blank check company, with no significant operations. It was formed in June 2005 for the purpose of acquiring, through a merger, capital stock exchange, cash acquisition, or other similar business combination, one or more domestic or international operating businesses in the healthcare industry.

In March 2006, Echo raised $57.5 million, gross, from an initial public offering of units (including the over-allotment option) and the sale of warrants to the founding directors. Each unit, which consisted of one share of common stock and one warrant, was sold for $8.00. Beginning in June 2006, the common stock and warrants included in the Company’s units began trading separately under the symbols EHHA and EHHAW, respectively. Approximately $54.9 million from the net proceeds of the offering together with the proceeds from the sale of warrants was placed in a trust fund, pending its use to complete an acquisition or acquisitions. As of October 31, 2007, there was approximately $58.2 million in the trust account.

Currently, Echo has no operations and no revenue. To date, the Company’s activities have been limited to organizational functions, completion of an initial public offering, and pursuit of an initial target acquisition.

On September 11, 2006, Echo announced that it had reached a definitive agreement to acquire privately held XLNT Veterinary Care Inc., which provides primary care services to companion animals through a network of 26 fully owned veterinary hospitals in California. The Company expects the acquisition, which requires approval of Echo’s and XLNT’s shareholders, to close following a special meeting to, among other things, allow shareholders to vote on the proposed merger. The merger will be accounted for as a reverse acquisition, and XLNT will be treated as the acquirer for accounting and financial reporting purposes.

Structure of Proposed Transaction

Echo anticipates issuing approximately 15.8 million new shares to complete the acquisition of XLNT. This figure is based on the number of XLNT common shares outstanding (including mandatory conversion of Series A and Series B preferred shares and anticipated conversion of $8.9 million of convertible debt) as of October 31, 2007. In addition, holders of XLNT options and warrants will receive, upon exercise, approximately 1.6 million shares of Echo common stock, and Echo will reserve 539,868 shares of common stock for issuance upon the conversion of convertible debt assumed by Echo in the merger. The actual number of shares issued at closing could be different from these figures, depending on whether any outstanding XLNT options or warrants are exercised or convertible debt is converted prior to that time.

Based on these figures, the total number of Echo common shares outstanding after the acquisition will be approximately 24.6 million. In addition, we estimate that there will be approximately 8.0 million Echo warrants and options outstanding at that time. This figure includes an Echo option issued to the underwriters in connection with Echo’s initial public offering (IPO) to purchase 312,500 units. Each unit consists of one share of common stock and one warrant to acquire one share of Echo common stock for $10 per unit.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 1. Shares, Warrants and Options – Post Merger

| | | | Number | |

| | | Common Stock: | | |

| | | Echo shares outstanding (1) | 8,750,000 | |

| | | | | |

| | | Echo shares expected to be | | |

| | | issued to acquire XLNT (2) | 15,800,594 | |

| | | | | |

| | | Total outstanding post merger | 24,550,594 | |

| | | | | |

| | | Warrants and Options: | | |

| | | Echo warrants outstanding (3) | 7,645,833 | |

| | | | | |

| | | Option to acquire Echo units (4) | 312,500 | |

| | | | | |

| | | Total Echo warrants and options | | |

| | | expected to be outstanding | | |

| | | after the XLNT acquisition | 7,958,333 | |

| | | | | |

| | | Shares of Echo common stock | | |

| | | reserved for issuance upon exercise | |

| | | of XLNT warrants and options | | |

| | | assumed in the merger | 1,614,299 | |

| | | | | |

| | | Echo shares reserved for issuance | | |

| | | upon conversion of XLNT conv. debt | | |

| | | assumed by Echo in the merger | 539,868 | |

| | | | | |

| (1) 781,250 shares of Echo common are in escrow and will be released 3/17/09; 781,250 shares are in escrow to be released when stock price is equal or greater than $11.50 for 20 days of any 30-day trading period beginning after completion of a business combination. |

| |

| (2) Assuming mandatory conversion of XLNT Series A and Series B preferred stock and conversion of $8.9 million of XLNT convertible debt; based on the outstanding shares of XLNT common stock on September 30, 2007. |

| |

| (3) Warrants become exercisable on the date an acquisition is completed. |

| |

| (4) The option is to acquire up to 312,500 units. Each unit consists of one share of Echo common stock and one warrant to acquire one share of Echo common stock for $10 per unit. The option is exercisable on the consummation of a business combination and expires on March 17, 2011. |

| |

| Source: Company S-4 filed with the SEC on November 8, 2007. |

The estimated equity value of the transaction, at the time of Echo’s November 8, 2007 S-4 filing with the SEC, was approximately $122.8 million. This translates into an exchange ratio for each XLNT share of 0.7808 shares of Echo common stock. In addition, on June 30, 2007, XLNT had $27.6 million of debt (including capital lease obligations and net of $8.9 million assumed to be converted prior to the merger), bringing the total estimated value of the transaction to approximately $150 million.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

The merger requires approval of Echo’s and XLNT’s shareholders. In addition, either party can terminate the transaction if, among other things, it is not completed by March 22, 2008, if 20% or more of Echo’s common shareholders exercise their conversion rights (see below), or if a governmental entity issues a final decree prohibiting the merger. If the merger is not consummated, Echo probably will be liquidated and the cash held in the trust fund distributed, pro rata, to Echo’s common stockholders (excluding initial stockholders who purchased their shares prior to the initial public offering).

Conversion Rights

When Echo seeks stockholder approval of the XLNT acquisition, the Company will offer each holder of shares issued in the Company’s initial public offering, other than the Company’s initial shareholders, the right to convert the shares to cash if the stockholder votes against the acquisition before the acquisition is approved and completed. Echo stockholders electing to exercise their conversion rights will receive their pro rata share of the funds deposited in the trust account (including accrued interest, net of taxes). As of October 31, 2007, there was approximately $58.2 million in the trust account (including accrued interest, net of taxes) and the conversion amount was approximately $8.06 per share. However, the actual rate when the acquisition closes may differ from this amount, depending on how much interest is earned on the funds in the trust account after October 31, 2007, and any taxes due on the interest earned. If holders of more than 20% of Echo’s shares exercise their conversion rights, the transaction will not be consummated and no shares will be converted to cash.

Post-Acquisition Financial and Strategic Highlights

As shown in Table 2, following completion of the acquisition, the combined Company’s balance sheet highlights (based on Echo’s and XLNT’s June 30, 2007 balance sheets) include cash and equivalents of approximately $48 million to $59 million (depending on the number of Echo shares assumed to be converted to cash), total assets of approximately $120 million to $131 million, and shareholders’ equity of approximately $74 million to $85 million.

Table 2. Selected Unaudited Pro Forma Consolidated Balance Sheet Highlights

of Echo Healthcare Corp. and XLNT Veterinary Care Inc.

(U.S. dollars in thousands)

| | | As of 6/30/07 | |

| | | Assuming | | | Assuming | |

| | | No Conv. (1) | | | Max. Conv. (2) | |

| | | | | | | |

| Cash and cash equivalents | | $ | 59,135 | | | $ | 47,685 | |

| Working capital | | $ | 51,123 | | | $ | 39,673 | |

| Total assets | | $ | 131,153 | | | $ | 119,703 | |

| Long-term obligations (3) | | $ | 33,643 | | | $ | 33,643 | |

| Total liabilities | | $ | 45,748 | | | $ | 45,748 | |

| Stockholders' equity | | $ | 85,405 | | | $ | 73,955 | |

| | | | | | | | | |

| (1) Assumes no Echo stockholders seek conversion of their shares to cash. | |

| (2) Assumes that 19.99% shares of Echo common stock are converted to cash. | |

(3) Less current portion. | |

| | |

| Source: Company S-4 filed with the SEC on November 8, 2007. | |

Pro forma consolidated income statement highlights for the combined Company for 2006 and the first half of 2007 are detailed in Table 3. Pro forma 2006 revenue totaled approximately $70.3 million, or an average of approximately $2.7 million per facility; the operating loss was $1.8 million, and the net loss (depending on the number of Echo shares assumed to be converted to cash) ranged from $4.1 million to $4.4 million. For the six months ended June 30, 2007, pro forma revenue totaled approximately $35.2 million, the operating loss was $5.3 million and the net loss ranged from $6.8 million to $7.0 million.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 3. Selected Unaudited Pro Forma Consolidated Income Statement Highlights

of Echo Healthcare Corp. and XLNT Veterinary Care, Inc.

(U.S. dollars in thousands, except per share data)

| | | Six Mo. Ended 6/30/07 | | | 12 Mo. Ended 12/31/06 | |

| | | Assuming | | | Assuming | | | Assuming | | | Assuming | |

| | | No Conv. (1) | | | Max. Conv. (2) | | | No Conv. (1) | | | Max. Conv. (2) | |

| | | | | | | | | | | | | |

| Net Revenue | | $ | 35,168 | | | $ | 35,168 | | | $ | 70,278 | | | $ | 70,278 | |

| Operating loss | | $ | (5,283 | ) | | $ | (5,283 | ) | | $ | (1,828 | ) | | $ | (1,828 | ) |

| Warrant liability expense | | $ | (490 | ) | | $ | (490 | ) | | $ | (367 | ) | | $ | (367 | ) |

| Interest expense | | $ | (2,169 | ) | | $ | (2,169 | ) | | $ | (4,266 | ) | | $ | (4,266 | ) |

| Net loss | | $ | (6,778 | ) | | $ | (7,032 | ) | | $ | (4,098 | ) | | $ | (4,352 | ) |

| Net loss per share - basic | | $ | (0.30 | ) | | $ | (0.34 | ) | | $ | (0.20 | ) | | $ | (0.22 | ) |

| Shares used - basic and diluted | | | 22,306 | | | | 20,869 | | | | 20,889 | | | | 19,769 | |

| | | | | | | | | | | | | | | | | |

(1) Assumes no Echo stockholders seek conversion of their shares to cash. | |

(2) Assumes that 19.99% shares of Echo common stock are converted to cash. | |

| | |

| Source: Company S-4 filed with the SEC on November 8, 2007. | |

The figures in Table 2 and Table 3 are based on estimates and assumptions that are preliminary and are not necessarily indicative of the consolidated results of operations or financial condition that would have been reported had the proposed merger been completed as of the dates shown. They also are not necessarily representative of future consolidated results or financial condition.

Following completion of the acquisition, Echo plans to change its name to Pet DRx Corporation. Long term, the Company’s goal is to become a preferred provider of high-quality veterinary care in the United States. We believe that Echo’s decision to expand in the veterinary industry is based on the industry’s favorable growth and demographic characteristics and its potential for consolidation through acquisition.

Veterinary Industry Characteristics

The veterinary industry is growing rapidly. According to the American Pet Products Manufacturers Association, pet industry expenditures in the U.S. increased from approximately $28.5 billion in 2001 to $38.5 billion in 2006. It estimates 2007 spending at nearly $41 billion. In 2006, an estimated 63% of households owned at least one pet (including a cat, dog or other companion animal).

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 4. Total U.S. Pet Industry Expenditures

(U.S. dollars in billions)

| | | | Estimated | |

Year | | | Spending | |

| | | | | |

| 1994 | | | $ | 17.0 | |

| | | | | | |

| 1996 | | | $ | 21.0 | |

| | | | | | |

| 1998 | | | $ | 23.0 | |

| | | | | | |

| 2001 | | | $ | 28.5 | |

| 2002 | | | $ | 29.5 | |

| 2003 | | | $ | 32.4 | |

| 2004 | | | $ | 34.4 | |

| 2005 | | | $ | 36.3 | |

| 2006 | | | $ | 38.5 | |

| 2007E | | | $ | 40.8 | |

| | | | | | |

| CAGR (1): | | | | | |

1994-2006 | | | | 7.0 | % |

2001-2006 | | | | 6.2 | % |

| 2001-2007E | | | | 6.2 | % |

| | | | | | |

| (1) Compound annual growth rate |

Source: American Pet Products Manufacturers Association.

We believe that growth in consumer spending on pets is being driven by several factors. Many owners view pets as members of the family, and this emotional connection has contributed, we believe, to a willingness to spend larger amounts on pet health and welfare, including preventative care. Also, increasingly, healthcare technology developed for humans is being transferred to animal care, resulting in improved diagnostic, medical and pharmaceutical technologies and, therefore, in more options to treat pets and extend their lives.

In 2006, the American Pet Manufacturers Association estimated that the majority of pet industry expenditures were for food, veterinary care, supplies and over-the-counter medicines.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 5. Total U.S. Pet Industry Expenditure Breakdown

(U.S. dollars in billions)

| | | | | | | | | Percent |

| | | 2006A | | | 2007E | | | Change |

| Food | | $ | 15.4 | | | $ | 16.1 | | | | 4.5% |

| Vet care | | $ | 9.2 | | | $ | 9.8 | | | | 6.5% |

| Supplies/OTC medicines | | $ | 9.3 | | | $ | 9.9 | | | | 6.5% |

| Live animal purchases | | $ | 1.9 | | | $ | 2.1 | | | | 10.5% |

| Pet services - grooming & boarding | | $ | 2.7 | | | $ | 2.9 | | | | 7.4% |

| | | | | | | | | | | | |

| Total | | $ | 38.5 | | | $ | 40.8 | | | | 6.0% |

| | | | | | | | | | | | |

Breakdown: | | | | | | | | | | | |

| Food | | | 40.0 | % | | | 39.5 | % | | | |

| Vet care | | | 23.9 | % | | | 24.0 | % | | | |

| Supplies/OTC medicines | | | 24.2 | % | | | 24.3 | % | | | |

| Live animal purchases | | | 4.9 | % | | | 5.1 | % | | | |

| Pet services - grooming & | | | | | | | | | | | |

| boarding | | | 7.0 | % | | | 7.1 | % | | | |

| | | | | | | | | | | | |

| Total | | | 100.0 | % | | | 100.0 | % | | | |

| | | | | | | | | | | | |

| Source: American Pet Products Manufacturers Association. | | | | | | | | | | | |

Veterinary Industry Consolidation Potential

A number of characteristics of the veterinary industry appear to make it an excellent candidate for consolidation, including the following.

| · | It is highly fragmented. According to the American Veterinary Medical Association, there were approximately 17,500 animal hospitals in the U.S. in 1991 and more than 22,000 at the end of 2005. Further, most hospitals are independently owned and operated, and there has been relatively little concentration in the industry. We estimate that the top three owners and operators of animal hospitals, VCA Antech; Banfield, The Pet Hospital®; and National Veterinary Associates, control approximately 5% of the total. Therefore, large, established competition is limited. Since most veterinary hospitals are relatively small and independently operated, we believe that it often is difficult for them to achieve economies of scale or significant operating efficiencies. |

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 6. Estimated Market Share of Leading Veterinary Hospital Chains

| | No. of | |

| | Hospitals | |

Leading veterinary chains: | | |

| VCA Antech | 441 | (1) |

| Banfield, The Pet Hospital | 630 | (2) |

| National Veterinary Associates | 96 | (3) |

| | | |

| Total | 1,167 | |

| | | |

| Total veterinary hospitals in the U.S. (4) | 22,000 | |

| | | |

| Leading chains' share of total number | | |

| of veterinary hospitals in the U.S. | 5% | |

| | | |

| (1) As of September 30, 2007 | | |

| (2) Estimate as of September 19, 2007 | | |

| (3) As of April 10, 2007 | | |

| (4) Number of veterinary hospitals that are members |

of the American Veterinary Medical Association. |

| |

Source: Company Websites, Company press releases, SEC filings, American Veterinary Medical Association. |

| · | It has attractive financial characteristics. It is largely a cash business, with most payments made at the time service is provided, and, as a result, bad debts are low. Historically, there has been little pricing pressure from insurance or managed care companies, since they account for a small percentage of payments, and liability has been limited, with a low risk of litigation. Also, we believe that the industry’s barriers to entry are relatively high, in light of the high capital cost of starting a practice today, especially given the investment in high-technology laboratory and treatment equipment increasingly necessary to be competitive and to provide state-of-the art care. Also, veterinarians require extensive education and training. |

| · | Currently, because of the large number of independent operators, we believe that the veterinary industry is relatively inefficient. Therefore, it appears that the consolidation benefits arising from economies of scale, cost savings, operating efficiencies and revenue growth initiatives could be substantial. These benefits include: (1) Economies from operating clusters of hospitals in individual markets and spreading the costs of marketing, administrative and financial services, such as advertising, purchasing, human resources, and accounting, over a large number of units; (2) Discounts and distribution savings arising from volume purchases of supplies and equipment; (3) Efficiencies from applying best practices chain wide, utilizing management information systems and enhancing personnel training; (4) Revenue growth and productivity gains from providing more products and services at each location; and (5) Revenue growth and market share gains from brand building. |

| · | Consolidation could provide needed liquidity for owners seeking to monetize their investment and/or to fund the rising capital requirements of maintaining a veterinary hospital. In addition, quality-of-life issues may be considerations for some owners seeking more flexible work schedules and/or a wider array of benefits than are possible with an independent practice and/or those wanting to spend less time on administrative tasks and more time providing patient care. |

XLNT Veterinary Care, Inc.

XLNT Veterinary Care, which operates under the name Pet DRx, was formed by Robert Wallace in 2004 to consolidate the veterinary care industry. When XLNT reached an acquisition agreement with Echo in September 2006, XLNT owned 11 hospitals in California. Since then it has acquired 15 more veterinary hospitals in California, including three in October 2006, two in November 2006, four in December 2006, four in February 2007 and two in March 2007. The Company has grown from a startup with revenue of $660,000 for the year ended December 31, 2004, when it completed its first acquisitions, to the owner and operator of 26 facilities at present with pro forma revenue (calculated as if all 26 facilities were owned on January 1, 2006) of $70.3 million for the 12 months ended December 31, 2006.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Currently, XLNT owns 26 facilities in Silicon Valley and the Bay area of Northern California, Greater Los Angles, San Diego, Murrieta, and the desert communities of Coachella Valley (the Palm Springs region), which it acquired for a total of approximately $61.5 million. Some of these facilities may be combined in order to achieve economies of scale and operating efficiencies.

XLNT’s goal is to become a preferred provider of veterinary services in select markets by acquiring and integrating veterinary care facilities. The cornerstone of the Company’s business strategy is implementation of a highly productive “hub and spoke” structure in select geographic markets in which the Company is able to acquire enough veterinary hospitals to obtain a market share leadership position.

The hub and spoke structure consists of a “hub” facility capable of providing a wide range of diagnostic and specialized medical services, such as x-rays, ultra-sound, internal medicine, surgery, cardiology, ophthalmology, oncology, dermatology, and 24-hour urgent care, which serves a large number of “spoke” general purpose hospitals. In addition, the Company anticipates developing affiliate relationships with independent veterinary hospitals to become “feeder” spokes for the hub. Although this hub and spoke structure is not yet fully in place in any market, we believe that it is most developed in the Coachella Valley. Initially, we expect the acquisitions to be in California, but long term, we expect the Company to expand in other major markets in the U.S.

Integration Opportunities

XLNT believes that by assembling dominant clusters of veterinary facilities in individual markets it can achieve significant economies of scale and operating efficiencies, while taking advantage of incremental revenue growth opportunities. Key revenue growth and productivity improvement initiatives include expanding hospital hours; emphasizing wellness care as a supplement to treatment of medical problems; introducing or improving ancillary services for pets; and creating and marketing a brand identity. Cost cutting strategies include rolling out integrated management information systems to gather, monitor, and analyze information by hospital and chain wide and centralization of administrative and support services, such as accounting, purchasing, human resources, and payroll.

Specific steps that XLNT is taking or planning to take to maximize the performance of acquired facilities include the following.

| · | Expansion of hospital hours, especially on weekends, to more fully serve client needs and increase the number of client visits. Management estimates that expanding Saturday hours and opening on Sunday can, on average, boost a facility’s revenue 15% annually. |

| · | Enhancement of hospital procedures to boost facility utilization and productivity, improve quality of care, and increase patient visits. Two important aspects of these efforts include an emphasis on wellness programs in addition to treatment of medical problems and a greater focus on best practices in diagnostic and treatment. Among other things, wellness programs include preventive care, such as vaccinations and annual dental and physical checkups, aimed at avoiding medical problems or detecting them early when they are most treatable. The Company intends to support these programs with outbound marketing to schedule regular wellness appointments. In addition, it plans to roll out a medical software program, Cornerstone, to all of its facilities. Cornerstone is being customized by XLNT’s Chief Medical Officer, Dr. Stephen Ettinger, to incorporate best practices in veterinary medical care and diagnosis. The resulting protocols can be used by the Company’s veterinarians to ensure the most appropriate diagnosis and treatment for each patient. |

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

| · | Introduction or expansion of high-margin ancillary products and services, such as pet merchandise, grooming, boarding, training, and pet daycare, at all hospitals so as to maximize utilization of each facility’s space, increase client visits, enhance client loyalty, generate referrals for medical services, and boost revenue and profit. |

| · | Creation of Pet DRx as each market’s most recognizable and trusted veterinary care brand. Acquired facilities will transition to this name, and, in time, management expects to use it on a line of high-quality merchandise available for sale in each hospital. Pet DRx merchandise being considered includes pet odor-eliminating candles, vet-recommended dog training treats, and pet shampoos. |

| · | Initiation of cable, print and direct mail advertising and marketing campaigns in each market, once it reaches sufficient number of hospitals to justify the expenditure, in order to communicate and reinforce the chain’s brand identity with consumers. |

| · | Rollout of integrated management information systems to gather, monitor and analyze information by hospital and chain wide, which management anticipates will allow it to cut costs and improve financial and operational management. One area of focus initially will be developing a perpetual inventory system using barcode technology and a companywide intranet product ordering system to better track and control merchandise purchases and inventory levels. |

| · | Centralization of administrative and support services, such as accounting, purchasing, human resources, and payroll in order to eliminate duplicate activities previously performed at individual hospitals, cut costs and free healthcare professionals to maximize the time they spend on patient care. |

To date, we believe that XLNT has made limited progress on these consolidation strategies. Also, since 20 of its 26 acquisitions, or 76% of the total, were completed in 2006 and 2007, its operating history is very brief. However, the performance of its first acquisitions, two hospitals in Northern California acquired in September 2004, is encouraging, based on hospital same-store sales growth, which was 16% year over year in 2005, the first full year after they were acquired, 12% in 2006 and 11% in the first half of 2007. The first half 2007 same-store sales growth for six animal hospitals owned for the full 12 months of the applicable period was 5%.

Table 7. Hospital Same-Store Sales Growth (1)

| | Year-over |

| | Year Growth (1) |

| 2005 | 16% |

| 2006 | 12% |

| 1st Half 2007 | 11% |

| |

| (1) For Bascom Animal Hospital and |

| Lawrence Pet Hospital, both acquired |

| in 2004. |

Source: Company S-4 filed with the SEC on November 8, 2007.

Performance for a larger group of acquired hospitals in the first 12 months post-acquisition also is positive, as shown in Table 8.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 8. Acquired Hospital Revenue Growth – First 12 Months

| | | | | | Year-over-Year | |

| | | No. of | | | Revenue Growth 1st | |

Year | | Acquis. | | | 12 Mo. Post Acquis. (2) | |

| 2004 | | | 2 | | | | 13% |

| 2005 | | | 4 | | | | 12% |

| 2006 (1) | | | 3 | | | | 6% |

| | | | | | | | | |

| (1) Acquisitions completed before 7/1/06. | |

| (2) Average annual facility revenue growth | |

| | |

| Source: Company financial reports. | |

This growth was achieved even though management was devoting a substantial amount of time to raising capital, identifying and completing additional acquisitions, and pursuing the sale of the Company to Echo Healthcare.

XLNT Management Team

Currently, XLNT’s management team is led by Robert Wallace, who has served as XLNT’s Chief Executive Officer (CEO) and a Director since its inception in 2004. His responsibilities include investor relations, business development and strategic vision. In addition, he was Chairman of the Board from 2004 until November 2006. His previous veterinary industry experience includes founding Pets’ RX in 1993 and serving as that company’s Chairman until its sale, in 1996, to, among others, Veterinary Centers of America Inc. (which was subsequently purchased by VCA Antech [WOOF: $41.65]). Mr. Wallace founded XLNT for the purpose of acquiring and integrating veterinary facilities, as previously described.

Steven T. Johnson joined XLNT in July 2007 as President and Chief Operating Officer. In addition, he is a member of the Company’s Board of Directors. Prior to joining XLNT, Mr. Johnson was President of Fresenius Medical Care North America, with total operational and financial responsibility for the West Business Unit, and before that he was Regional Vice President/Vice President of Operations at Renal Care Group from 2002 to 2005.

On September 27, 2007, XLNT announced the appointment of Gregory J. Eisenhauer, CFA as its Chief Financial Officer (CFO), effective immediately. Mr. Eisenhauer has more than 25 years of financial experience. Most recently, from 2006 to 2007, he was CFO of the Diagnostic Division of Healthsouth Corporation (HLS: $20.54), one of the nation’s largest healthcare services providers. Prior to that, he served as Executive Vice President (EVP) and CFO for Proxymed (PILL: $2.55), a healthcare information technology company (from 2003 to 2005); EVP and CFO for U.S. Healthworks, an occupational health clinic company; and in various capacities, including Senior Vice President, CFO and Secretary, at RehabCare Group (RHB: $21.33), a rehabilitation program management services provider.

George A. Villasana, XLNT’s General Counsel and Secretary, came to the Company in June 2007 from AutoNation, Inc., (AN: $16.68) where he was Senior Corporate Counsel. AutoNation is the largest automotive retailer in the U.S. In addition to experience as a corporate attorney, Mr. Villasana served as a staff attorney with the SEC from 1995 to 1997. We believe that this regulatory experience could be invaluable post merger when the combined Company is required to comply with Sarbanes Oxley and other reporting requirements.

In March 2007, Dr. Stephen Ettinger joined XLNT as Chief Medical Officer (CMO). In addition, he chairs XLNT’s medical advisory board. Dr. Ettinger has extensive experience in several aspects of the veterinary industry. Before joining XLNT, he was Director of the one of the oldest and best recognized practices in California, California Animal Hospital Veterinary Specialty Group in Los Angeles, which XLNT acquired in March 2007. Prior to that, he was co-founder of Berkeley Veterinary Medical Group, the first group veterinary specialty practice in the U.S. In addition, from 1972 until 1980, Dr. Ettinger was a Clinical Professor of Veterinary Medicine at UC Davis. He has written or collaborated on numerous veterinary medicine textbooks. His areas of expertise include small animal veterinary internal medicine, small animal cardiology, hospital management, and professional veterinary development. As CMO, he is assisting XLNT in implementing best practices in diagnosis and treatment in all its veterinary facilities. In addition, since he is well known and highly respected in the industry, we believe that he will be an asset to XLNT in its efforts to acquire desirable veterinary hospitals and to recruit and keep talented veterinarians.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Mr. Wallace, Mr. Johnson, Mr. Eisenhauer, Mr. Villasana, and Dr. Ettinger are expected to retain their current positions at the merged company once the combination is complete.

While it appears that XLNT has experienced executives in key positions, we believe that a number of important positions remain to be filled in finance, marketing, real estate, and purchasing, among other areas.

XLNT Financial Highlights

Highlights of XLNT’s reported results for 2004, 2005, 2006 and the first half of 2007 are detailed in Table 9. During this period, revenue increased from approximately $660,000 in 2004 from two veterinary hospitals acquired that year, to $17.4 million in 2006 and $28.4 million in the first half of 2007, and operating losses increased from approximately $230,000 in 2004 to approximately $1.0 million in 2005, $1.4 million in 2006, and $4.4 million in the first half of 2007.

We believe that XLNT’s first half of 2007 results were adversely affected by relatively high expenses, including costs related to preparing for the planned merger of Echo and XLNT. Such costs include legal fees, consultant fees and higher-than-normal accounting and auditing fees, given the need to complete an audit on substantially all of its facilities. Also, since the Company’s permanent management team, especially its financial team not being fully in place yet, it has been using a large number of high-cost temporary workers and consultants.

In the first half of 2007, XLNT’s selling, general and administrative expenses increased by $4.8 million versus the prior-year level. Approximately $2.4 million of this increase was related to the audits of 21 hospital acquisitions and of XLNT’s consolidated results for the periods ending December 31, 2004, 2005 and 2006 and the review of XLNT’s first quarter 2007 results. In addition, legal expenses related to corporate issues were up approximately $400,000 year over year, and corporate salaries, including the cost of temporary workers and consultants, rose $1.1 million.

Balance sheet highlights on June 30, 2007 include cash and equivalents of approximately $4.8 million, a working capital deficit of $2.7 million, long-term obligations (excluding current maturities) of $34.4 million, and shareholders’ equity of $31.6 million.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 9. Selected Financial Data for XLNT

(U.S. dollars in thousands, except per share data)

| | | | | | | | | | | | 6 Mo. Ended | |

| | | 12 Mo. Ended 12/31: | | | 6/30/2007 | |

| | | 2004 (1) | | | 2005 | | | 2006 | | | 2007 (2) | |

| | | | | | | | | | | | | |

| Net Revenue | | $ | 660 | | | $ | 4,740 | | | $ | 17,442 | | | $ | 28,403 | |

| Operating loss | | $ | (230 | ) | | $ | (1,034 | ) | | $ | (1,420 | ) | | $ | (4,395 | ) |

| Interest expense,net | | $ | (45 | ) | | $ | (186 | ) | | $ | (423 | ) | | $ | (1,396 | ) |

| Net loss | | $ | (275 | ) | | $ | (1,310 | ) | | $ | (1,868 | ) | | $ | (5,801 | ) |

| Net loss per share - basic & diluted | | $ | (0.16 | ) | | $ | (0.42 | ) | | $ | (0.41 | ) | | $ | (1.12 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | As of | | | | | | | | | |

| | | | | | | 6/30/07 | | | | | | | | | |

| Cash and cash equivalents | | | | | | $ | 4,803 | | | | | | | | | |

| Working capital deficit | | | | | | $ | (2,657 | ) | | | | | | | | |

| Total assets | | | | | | $ | 76,808 | | | | | | | | | |

| Long-term obligations (3) | | | | | | $ | 34,426 | | | | | | | | | |

| Stockholders' equity | | | | | | $ | 31,625 | | | | | | | | | |

| Common stock issued & outst. | | | | | | | 5,509 | | | | | | | | | |

| Book value per share | | | | | | $ | 5.74 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1) From March 10, 2004 through December 31, 2004. | |

(2) Unaudited | |

| (3) Less current portion | |

| | |

| Source: Company S-4 filed with the SEC on November 8, 2007. | |

We do not believe that XLNT’s reported revenue for the periods shown in Table 9 are necessarily indicative of its revenue potential at present, since it was making acquisitions throughout this period. Pro forma 2006 results for the combined Company (including Echo, which currently has no operations), as if the acquisitions of all 26 of the veterinary facilities currently owned by XLNT were completed as of January 1, 2006 are detailed in Table 10. Pro forma revenue totaled approximately $70.3 million, or an average of approximately $2.7 million per facility; gross profit was $2.9 million or roughly 4% of revenue; and the operating loss was $1.8 million. For the first six months of 2007, pro forma revenue totaled $35.2 million and the operating loss was $5.3 million.

Seasonally, the first and fourth quarters are the year’s weakest for the veterinary industry in most markets. Industry revenue generally is strongest during warm-weather months when pets spend more time outdoors, where they are more likely to be injured and are more susceptible to disease and parasites. One exception to this seasonal pattern is the desert communities of the Coachella Valley, where the population rises during the winter.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 10. Unaudited Pro Forma Combined Statement of Operations Data

of Echo Healthcare Corp. and XLNT Veterinary Care, Inc.

(In thousands, except per share data)

| | | 12 Mo. Ended | | | 6 Mo. Ended | |

| | | 12/31/06 (1) | | | 12/31/06 (2) | | | 6/30/07 (1) | | | 6/30/07 (2) | |

| | | | | | | | | | | | | |

| Net Revenue | | $ | 70,278 | | | $ | 70,278 | | | $ | 35,168 | | | $ | 35,168 | |

| Cost of sales | | $ | 67,407 | | | $ | 67,407 | | | $ | 33,987 | | | $ | 33,987 | |

| Gross profit | | $ | 2,871 | | | $ | 2,871 | | | $ | 1,181 | | | $ | 1,181 | |

| General & administrative exp. | | $ | 4,699 | | | $ | 4,699 | | | $ | 6,464 | | | $ | 6,464 | |

| Total operating expenses | | $ | 4,699 | | | $ | 4,699 | | | $ | 6,464 | | | $ | 6,464 | |

| Operating loss | | $ | (1,828 | ) | | $ | (1,828 | ) | | $ | (5,283 | ) | | $ | (5,283 | ) |

| Interest & other income, net | | $ | 2,744 | | | $ | 2,321 | | | $ | 1,518 | | | $ | 1,095 | |

| Interest expense | | $ | (4,266 | ) | | $ | (4,266 | ) | | $ | (2,169 | ) | | $ | (2,169 | ) |

| Warrant liability expense | | $ | (367 | ) | | $ | (367 | ) | | $ | (490 | ) | | $ | (490 | ) |

| Pretax income | | $ | (3,717 | ) | | $ | (4,140 | ) | | $ | (6,424 | ) | | $ | (6,847 | ) |

| Income tax expense | | $ | (381 | ) | | $ | (212 | ) | | $ | (354 | ) | | $ | (185 | ) |

| Net (loss) | | $ | (4,098 | ) | | $ | (4,352 | ) | | $ | (6,778 | ) | | $ | (7,032 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share | | $ | (0.20 | ) | | $ | (0.22 | ) | | $ | 0.30 | | | $ | (0.34 | ) |

| Basic & diluted shares outs. | | | 20,889 | | | | 19,769 | | | | 22,306 | | | | 20,869 | |

| | | | | | | | | | | | | | | | | |

| (1) Assumes no Echo stockholders seek conversion of their stock to cash. | |

| (2) Assumes that 19.99% shares of Echo common stock are converted to cash. | |

| | |

| Source: Company S-4 filed with the SEC on November 8, 2007. | |

Acquisition Strategy

From 2004 through March 2007, XLNT acquired 26 veterinary facilities in California for a total of approximately $61.5 million. Based on our estimates, XLNT acquired the 26 facilities it currently owns for, on average, less than one time revenue. The facilities acquired include general practice veterinary hospitals that provide basic health care and related services for companion pets and specialty hospitals staffed by board-certified veterinarians in a number of specialties (such as internal medicine, surgery, oncology, etc.)

Table 11. Acquisition Statistics

(U.S. dollars in thousands)

| | | | | | | | | Pro Forma | | Acq. Cost/ | |

| | | No. of | | | Acquisition | | | 2006 Rev. of | | Pro Forma | |

Year | | Acquisitions | | | Cost | | | Acq. Co. | | Revenue | |

| | | | | | | | | | | | |

| 2004 | | 2 | | | $ | 2,261 | | | | | | |

| 2005 | | 4 | | | $ | 8,176 | | | | | | |

| 2006 | | 14 | | | $ | 23,465 | | | | | | |

Subtotal | | 20 | | | $ | 33,902 | | | $ | 37,659 | | | 90 | % |

| | | | | | | | | | | | | | | |

| 2007 | | 6 | | | $ | 27,627 | | | $ | 32,619 | | | 85 | % |

| | | | | | | | | | | | | | | |

Total | | 26 | | | $ | 61,529 | | | $ | 70,278 | | | 88 | % |

| | | | | | | | | | | | | | | |

Source: Company S-4 filed with the SEC on November 8, 2007. | |

Although the details of each of XLNT’s acquisitions have varied, we believe that the Company typically has paid 60% or less of the purchase price in cash (net of cash acquired). Most of the balance has consisted of notes and liabilities assumed. While the terms of the acquisition notes vary, we believe that most often they amortize over three to five years, pay interest of 7% to 8% and, in some instances, may be convertible into XLNT common stock. In addition, there may be earn-out provisions in the acquisition purchase agreement and an employment contract with the selling veterinarian that keeps him with the practice for three to five years post acquisition.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 12. Acquisition Consideration Paid

(U.S. dollars in thousands)

| | | | | | | | | | | | 6 Mo. | | | | |

| | | 12 Mo. Ended 12/31: | | | Ended | | | | |

Consideration: | | 2004 | | | 2005 | | | 2006 | | | 6/30/07 (1) | | | Total | |

| | | | | | | | | | | | | | | | |

| Cash, net of cash acquired | | $ | 841 | | | $ | 3,970 | | | $ | 13,255 | | | $ | 16,532 | | | $ | 34,598 | |

| Notes payable, unsecured | | $ | 100 | | | $ | 765 | | | $ | 3,820 | | | $ | 4,355 | | | $ | 9,040 | |

| Liabilities assumed | | $ | 90 | | | $ | 1,230 | | | $ | 3,519 | | | $ | - | | | $ | 4,839 | |

| Convertible notes | | $ | - | | | $ | 1,785 | | | $ | 1,600 | | | $ | 6,440 | | | $ | 9,825 | |

| Note payable, secured | | $ | - | | | $ | - | | | $ | 850 | | | $ | - | | | $ | 850 | |

| Common stock | | $ | 1,100 | | | $ | - | | | $ | - | | | $ | - | | | $ | 1,100 | |

| Direct costs | | $ | 130 | | | $ | 426 | | | $ | 421 | | | $ | 300 | | | $ | 1,277 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 2,261 | | | $ | 8,176 | | | $ | 23,465 | | | $ | 27,627 | | | $ | 61,529 | |

| | | | | | | | | | | | | | | | | | | | | |

| Percent of total: | | | | | | | | | | | | | | | | | | | | |

| Cash, net of cash acquired | | | 37 | % | | | 49 | % | | | 56 | % | | | 60 | % | | | 56 | % |

| Notes payable, unsecured | | | 4 | % | | | 9 | % | | | 16 | % | | | 16 | % | | | 15 | % |

| Liabilities assumed | | | 4 | % | | | 15 | % | | | 15 | % | | | 0 | % | | | 8 | % |

| Convertible notes | | | 0 | % | | | 22 | % | | | 7 | % | | | 23 | % | | | 16 | % |

| Note payable, secured | | | 0 | % | | | 0 | % | | | 4 | % | | | 0 | % | | | 1 | % |

| Common stock | | | 49 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 2 | % |

| Direct costs | | | 6 | % | | | 5 | % | | | 2 | % | | | 1 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | |

(1) Convertible notes issued for acquisitions completed in 2007 can be converted into 1,110,345 shares of XLNT common stock. | |

| | |

| Source: Company S-4 filed with the SEC on November 8, 2007. | |

We believe that this financial structure for acquisitions has two important advantages for XLNT:

| · | It ensures that the seller has an ongoing interest in the performance of the veterinary facility and |

| · | It limits the amount of cash that XLNT must pay up front and, therefore, increases the number of acquisitions that can be completed with cash on hand. |

Advantages for the seller include:

| · | Receipt of the majority of the purchase price up front in cash, allowing the seller to monetize a significant part of his investment. |

| · | Receipt of the balance of the purchase price in a medium-term note with an attractive interest rate. |

Also, we believe that for some sellers, the knowledge that their practices will continue and that XLNT plans to make investments to expand services, improve diagnostic capabilities, and enhance the overall quality of care may be important considerations.

In most cases, XLNT has acquired only the veterinary practice, but in five instances, it has also purchased the real estate where the acquired facility is located. Although the Company would prefer to acquire real estate as part of its acquisitions, its experience is that veterinarian/owners often prefer to retain the real estate and lease it back to the Company post acquisition providing them with an ongoing stream of income. Also, in some instances, where XLNT wants to move a practice, because its building is dated, too small, can’t be expanded or for some other reason, it may prefer not to buy the space.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

At present, XLNT’s acquisition activity is on hold, and it will not resume until some time after completion of the merger. If the merger is not completed, XLNT expects to continue to pursue its growth strategy as an independent company. When XLNT resumes its acquisition strategy, we believe that the Company generally will seek established, profitable veterinary facilities with the following characteristics.

| · | Annual revenue of at least $1.5 million for general care hospitals (spokes) or at least $4 million for specialty care facilities (hubs). |

| · | Fill-in hospitals in existing markets in Northern California and Silicon Valley, Greater Los Angeles, San Diego, and Coachella Valley, which will allow it to further develop its hub and spoke structure and maximize related integration and market share benefits. |

| · | Veterinarian owners who will remain active in their practices for at least three to five years post acquisition. |

While we expect XLNT’s focus initially to be on major California markets, in time, we expect it to expand into other states. In fact, the Company has begun researching other markets that it believes may have attractive acquisition targets.

XLNT and Echo — A Mutually Beneficial Combination

We believe that Echo’s proposed acquisition of XLNT makes sense for both parties. Most simply stated, Echo has a substantial amount of capital to fund veterinary hospital acquisitions, while XLNT has experience identifying and completing veterinary hospital acquisitions.

Capital Availability — With more than $58 million earmarked for acquisitions (before merger-related and conversion-associated uses of cash and other costs; after such expenses, the actual amount available for acquisitions will be less than this amount), Echo appears to have substantial capital to fund XLNT’s existing strategy of assembling concentrations of animal hospitals through acquisition. Assuming, based on the historical averages for XLNT’s already completed acquisitions, a payment structure of approximately 60% cash and 40% notes and a purchase price of about 90% to one time revenue, we estimate the investment of $50 million to $55 million (after cash uses noted above) in animal hospital purchases could, over time, add $83 million to $102 million of incremental annual revenue to the current pro forma annual revenue run rate of approximately $70 million. This projection does not take into account organic growth at owned facilities, which we believe has the potential to contribute additional revenue if the Company successfully implements its integration strategies, as previously described. If the amount of cash available for acquisitions is more or less than these amounts, or the payment structure or acquisition prices vary from these assumptions, actual results would, of course, be different (and perhaps substantially lower) than these estimates.

Consolidation Experience— Since its inception, XLNT has acquired 26 veterinary hospitals in California. Therefore, its management appears to have valuable expertise in identifying promising acquisition candidates and structuring and financing purchases. Further, we believe that it should be well positioned to attract high-quality acquisitions post-merger for several reasons. First, it has established enough critical mass in several important California markets to have attracted the attention of potential sellers. Second, the addition of Dr. Ettinger as CMO may give the Company credibility with veterinarians who are familiar with his work in the industry. Third, the promise of less time spent on administrative activities and more time spent with patients may appeal to some veterinarians who do not enjoy the business aspects of running an independent practice. Likewise, XLNT’s ability to improve the quality of care by investing in diagnostic and treatment technology at general practice hospitals and making a full-service specialty and emergency care facility readily available for referrals may attract veterinarians seeking to offer their patients state-of-the-art care.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Growth Potential— XLNT has successfully assembled a network of animal hospitals in several California markets. We believe that there are significant revenue, margin and cost-saving benefits to be realized if the Company is able to take advantage of economies of scale and other integration opportunities, fill in markets, and achieve greater critical mass.

Veterinary Company Valuation Analysis

We believe that the most comparable publicly traded company to Echo Healthcare, following completion of the XLNT acquisition, is VCA Antech. Therefore, in our opinion, an analysis of VCA Antech’s performance, especially with regard to its animal hospitals, is relevant to a discussion of Echo’s valuation.

VCA Antech is a leading animal healthcare services company. It provides veterinary services and diagnostic testing to support veterinary care. In addition, VCA sells diagnostic imaging equipment and other medical technology products and related services to the veterinary industry.

In our opinion, VCA’s business has very attractive financial characteristics, characterized by healthy margins, high returns and strong cash generation. Highlights of VCA’s 2006 financial and operating performance include the following:

| · | Revenue of approximately $983 million in the 12 months ended December 31, 2006, up 17% year over year. |

| · | Operating income of nearly $193 million or 19.6% of revenue, EBITDA of $215 million or 21.8% of revenue, and net profit of $106 million or 10.7% of revenue. |

| · | Return on average shareholders’ equity of nearly 29% and return on average assets of more than 11%. |

| · | “Free cash flow” (cash flow generated by operations less capital expenditures) of nearly $92 million, based on cash generated by operations of approximately $127 million, net of capital expenditures (before acquisitions) of $35 million. |

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 13. VCA Antech – Financial Statistics

(U.S. dollars in thousands, except per share data)

| | | 12 Months Ended December 31: | |

| | | 2004 | | | 2005 | | | 2006 | |

| | | | | | | | | | |

| Revenue | | $ | 674,089 | | | $ | 839,666 | | | $ | 983,313 | |

| Year-over-Year Growth | | | | | | | 25 | % | | | 17 | % |

| Gross Profit | | $ | 183,531 | | | $ | 225,867 | | | $ | 270,564 | |

| Gross Margin | | | 27.2 | % | | | 26.9 | % | | | 27.5 | % |

| | | | | | | | | | | | | |

| Operating Profit | | $ | 135,215 | | | $ | 159,241 | | | $ | 192,527 | |

| Year-over-Year Growth | | | | | | | 18 | % | | | 21 | % |

| Operating Margin | | | 20.1 | % | | | 19.0 | % | | | 19.6 | % |

| | | | | | | | | | | | | |

| Net Income | | $ | 63,572 | | | $ | 67,816 | | | $ | 105,529 | |

| Year-over-Year Growth | | | | | | | 7 | % | | | 56 | % |

| Net Margin | | | 9.4 | % | | | 8.1 | % | | | 10.7 | % |

| | | | | | | | | | | | | |

| Depreciation & Amortization | | $ | 15,815 | | | $ | 19,335 | | | $ | 22,242 | |

| EBITDA | | $ | 151,030 | | | $ | 178,576 | | | $ | 214,769 | |

| Year-over-Year Growth | | | | | | | 18 | % | | | 20 | % |

| EBITDA/Revenue | | | 22.4 | % | | | 21.3 | % | | | 21.8 | % |

| | | | | | | | | | | | | |

| Year-end Total Assets | | $ | 742,100 | | | $ | 898,405 | | | $ | 971,957 | |

| Average Assets | | | | | | $ | 820,253 | | | $ | 935,181 | |

| Year-end Shareholders' Equity | | $ | 232,759 | | | $ | 308,751 | | | $ | 430,305 | |

| Average Shareholders' Equity | | | | | | $ | 270,755 | | | $ | 369,528 | |

| | | | | | | | | | | | | |

| Return on: | | | | | | | | | | | | |

| Average Assets | | | | | | | 8.3 | % | | | 11.3 | % |

| Average Shareholders' Equity | | | | | | | 25.0 | % | | | 28.6 | % |

| | | | | | | | | | | | | |

| Cash Flow from Operations | | $ | 86,359 | | | $ | 115,100 | | | $ | 126,890 | |

| Capital Expenditures | | $ | 23,954 | | | $ | 29,209 | | | $ | 35,316 | |

| Net Cash Flow | | $ | 62,405 | | | $ | 85,891 | | | $ | 91,574 | |

| Diluted Shares Outstanding | | | 83,361 | | | | 83,996 | | | | 84,882 | |

| Net Cash Flow Per Dil. Share | | $ | 1 | | | $ | 1 | | | $ | 1 | |

| | |

| Source: Company financial reports. | |

VCA’s animal hospitals performed well in 2006, with revenue, gross profit and operating profit all up 16% to 17% year over year. Hospital revenue totaled $712 million. The company owned and operated 379 animal hospitals at year end and estimated average revenue per hospital was approximately $1.9 million during the year. Revenue per same-store facility increased nearly 6% in 2006, as a result of an increase of 7.4% in average revenue per order, which more than offset a decline in the number of orders.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 14. VCA Antech – Animal Hospital Financial Statistics

| | | 12 Months Ended December 31: | |

| | | 2004 | | | 2005 | | | 2006 | |

| Animal Hospital Revenue (000) | | $ | 481,023 | | | $ | 607,565 | | | $ | 711,997 | |

| Year-over-Year Growth | | | | | | | 26 | % | | | 17 | % |

| Animal Hospital Gross Profit (000) | | $ | 93,546 | | | $ | 118,239 | | | $ | 138,358 | |

| Year-over-Year Growth | | | | | | | 26 | % | | | 17 | % |

| Gross Margin | | | 19.4 | % | | | 19.5 | % | | | 19.4 | % |

| | | | | | | | | | | | | |

| Animal Hospital Selling, Gen. | | | | | | | | | | | | |

| and Administrative Exp. (000) | | $ | 12,761 | | | $ | 16,224 | | | $ | 20,232 | |

| | | | | | | | | | | | | |

| Animal Hospital Gross Profit | | | | | | | | | | | | |

| Less Sell., Gen. & Adm. Exp. (000) | | $ | 80,785 | | | $ | 102,015 | | | $ | 118,126 | |

| Year-over-Year Growth | | | | | | | 26 | % | | | 16 | % |

| | | | | | | | | | | | | |

| Animal Hospital Oper. Marg. | | | 16.8 | % | | | 16.7 | % | | | 16.6 | % |

| | | | | | | | | | | | | |

| Number of Hospitals | | | 315 | | | | 367 | | | | 379 | |

| Avg. Number of Hospitals | | | 278 | | | | 341 | | | | 373 | |

| Revenue Per Avg. Hospital (000) | | $ | 1,730 | | | $ | 1,782 | | | $ | 1,909 | |

| | | | | | | | | | | | | |

| Same-Store Facility: | | | | | | | | | | | | |

| Orders | | | -0.8 | % | | | -1.9 | % | | | -1.5 | % |

| Average Revenue Per Order | | | 5.7 | % | | | 8.7 | % | | | 7.4 | % |

| Same-Store Revenue | | | 4.9 | % | | | 6.6 | % | | | 5.8 | % |

| | |

| Source: Company financial reports. | |

In the first nine months of 2007, VCA’s revenue was $872 million, up 18% year over year, operating income grew 22% year over year, and net income was $96 million, up 12% versus a year earlier. On September 30, 2007, VCA operated 441 animal hospitals. Revenue per same-store facility increased 6.0% year over year in the first nine months.

As shown in Table 15, VCA currently has a market capitalization of approximately $3.5 billion and trades at about 3.1 times revenue and at an enterprise value-to-EBITDA ratio of 16.4 times.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 15. VCA Antech – Valuation Data

| Symbol | | WOOF | |

| Price (11/12/07) | | $ | 41.65 | |

| Year | | Dec. | |

| | | | | |

| Shares Outstanding (000) (1) | | | 84,253 | |

| Market Capitilization (000) | | $ | 3,509,137 | |

| | | | | |

| TTM Revenue (000) (2) | | $ | 1,114,338 | |

| Market Cap./Revenue | | | 3.1 | |

| | | | | |

| Shareholders' Equity (000) (3) | | $ | 541,746 | |

| Book Value/Share (3) | | $ | 6.43 | |

| Price/Book Value Per Shr. | | | 6.5 | |

| | | | | |

| Total Debt (000) (3) | | $ | 562,202 | |

| Enterprise Value (000) | | $ | 4,071,339 | |

| | | | | |

| TTM EBITDA (000) (2) | | $ | 248,891 | |

| EBITDA/Revenue | | | 22.3 | % |

| | | | | |

| Earnings (Loss) Per Share (4) | | | | |

| 2006 | | $ | 1.16 | |

| 2007E | | $ | 1.41 | |

| 2008E | | $ | 1.64 | |

| | | | | |

| Price/Earnings Per Share | | | | |

| 2007E | | | 29.5 | |

| 2008E | | | 25.4 | |

| | | | | |

| Enterprise Value/TTM EBITDA | | | 16.4 | |

| | | | | |

| (1) As of August 6, 2007 | | | | |

| (2) Trailing 12 months through September 30, 2007 | |

| (3) As of September 30, 2007 | | | | |

| (4) Source: Yahoo finance | | | | |

| | | | | |

| Source: Company financial reports | |

While we believe that VCA is the most comparable publicly traded company to Echo (post merger), investors should note the following differences between Echo and VCA, which could affect the post-merger valuation of Echo’s shares relative to VCA’s valuation.

| · | Echo will have a smaller market capitalization and less liquidity. If Echo issues approximately 15.8 shares to complete the purchase of XLNT, its market capitalization, based on the current share price, will be less than $200 million. This compares to VCA’s market capitalization of nearly $3.5 billion at present. Also, post merger, an estimated 38% of Echo’s outstanding shares will be held by management, so its market capitalization based on float will be even lower. (For detailed information about post-merger share ownership by Directors and officers and a group, please see Echo’s S-4 filed with the SEC on November 8, 2007). |

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

| · | XLNT has a limited operating history. XLNT acquired its first animal hospital in 2004, but the majority of its facilities (20 of 26, or 77%) were acquired in 2006 and 2007. Thus, while the Company has successfully completed a series of acquisitions, its operating history is quite short, its consolidation strategy is in its early stages, and it has not yet reported a profit. In contrast, VCA has made a series of successful acquisitions in recent years. In 2004, it acquired National Petcare Centers, Inc., which operated 67 animal hospitals, and, in 2005, it acquired Pet’s Choice, which operated 46 animal hospitals. In 2004, 2005 and 2006, in addition to these purchases, it acquired another 62 animal hospitals, or an average of 21 animal hospitals per year. During the first nine months of 2007, it completed the acquisition of Healthy Pet, Corp., which owned 44 animal hospitals (and a small laboratory), and acquired 29 additional animal hospitals. (The actual increase in the number of animal hospitals operated by VCA Antech during these periods was less than these figures mainly because some hospitals were sold, closed or relocated into existing animal hospitals). From 2004 through 2006, the Company’s revenue and net earnings grew consistently year over year, and growth continued in the first nine months of 2007. |

| · | The merged companies will be less diversified than VCA. In addition to animal hospitals, VCA has a high-margin laboratory business. While VCA’s animal hospitals had gross and operating margins of 19.4% and 16.6%, respectively, in 2006, its laboratory business’s gross and operating margins were 46.2% and 39.5%, respectively. Post-merger, Echo’s business will largely consist of general-purpose and specialty veterinary hospitals. |

· | Echo has an abbreviated history as a public company. |

Taking these factors into account, we believe that Echo’s shares initially are likely to trade at a lower valuation than VCA’s relative to revenue.

Based on pro forma 2006 revenue of approximately $70 million, the estimated value of the XLNT transaction of approximately $150 million is approximately 2.1 times revenue. This figure does not take into account the Company’s potential to grow revenue once the merger is complete and acquisition activity resumes. As discussed previously, if the combined Company has $50 – $55 million, post merger, to invest in acquisitions, we believe that it could acquire veterinary facilities that generate revenue of approximately $83 million to $102 million (based on purchase prices of 90% of revenue to one time revenue, which is in line with to above the average prices it has paid for acquisitions already completed, and a payment structure of 60% cash and 40% notes), bringing the annualized revenue run rate for the Company to approximately $153 million to $172 million. This figure does not reflect the potential for strategies such as expanded hours, a focus on wellness, and the roll out of ancillary services to boost revenue at already owned hospitals.

Table 16 estimates a range of possible market capitalizations for the post-merger combined company assuming that it is able to add $83 million to $102 million of revenue as described above and trades at a substantial discount to VCA’s current market capitalization-to-revenue multiple of 3.1 times. At present, it is impossible to know at what valuation the combined Company will trade once the merger is complete. Therefore, these figures should not be viewed as predictions of post-merger valuations. Also, the revenue estimates are based on a number of assumptions (as detailed above), which may not prove to be accurate. For example, among other things, if the Company has less cash than anticipated because of shareholder conversions of stock to cash, if is not able to identify and complete acquisitions of veterinary hospitals as anticipated, and/or if acquisition prices or terms are less favorable than in the past, revenue could be lower than these estimates. Also, the timing of future acquisitions is uncertain.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 16. Valuation Parameters

| | | | Estimated | | | | |

| | | | Market | | | Estimated | |

Estimated | | | Cap./Rev. | | | Market | |

Revenue | | | Multiple | | | Capitalization | |

(mil.) | | | | | | (mil.) | |

Low End of Revenue Estimate Range: | |

| $ | 153.0 | | | | 1.0 | | | $ | 153 | |

| $ | 153.0 | | | | 1.5 | | | $ | 230 | |

| $ | 153.0 | | | | 2.0 | | | $ | 306 | |

| $ | 153.0 | | | | 2.5 | | | $ | 383 | |

| | | | | | | | | | | |

High End of Revenue Estimate Range: | |

| $ | 172.0 | | | | 1.0 | | | $ | 172 | |

| $ | 172.0 | | | | 1.5 | | | $ | 258 | |

| $ | 172.0 | | | | 2.0 | | | $ | 344 | |

| $ | 172.0 | | | | 2.5 | | | $ | 430 | |

| | |

| Source: Dutton Associates estimates. | |

Post-Merger Management

Anticipated Directors, executive officers and key employees of the combined Company post-merger are detailed in Table 17. The table shows eight Directors. A ninth Director, as yet not designated, is expected to be named by Echo prior to completion of the merger, bringing the post-merger total to nine. It is anticipated that five of the nine Directors will be independent, as defined by the rules and regulations of the SEC and NASDAQ.

We believe that the Board has extensive experience in healthcare, finance and investments, as summarized below:

| · | Gene Burleson has 24 years of experience in the healthcare industry. |

| · | Joel Kanter has been President of Windy City, Inc., a privately held investment company, since 1986. |

| · | Richard Johnston is a Managing Member of Camden Partners Holdings, LLC, and has more than 40 years of investment experience and is focused primarily on investments in the health care sector. |

| · | Zubeen Shroff is a Managing Director of Galen Partners, a healthcare private equity firm. |

| · | Richard Martin retired in 2001 as President of Medtronic Physio-Control Corp., the successor company to Physio-Control International Corporation, the worldwide leader in external defibrillation, monitoring and noninvasive pacing devices. |

| · | J. David Reed has been XLNT’s Director of Hospital Operations for Northern California since October 2004. He owned and operated Bascom Animal Hospital and Lawrence Pet Hospital, which were acquired by XLNT in 2004. |

The resumes of Mr. Wallace, Mr. Johnson, Mr. Villasana, Dr. Ettinger, and Mr. Eisenhauer, who are expected to hold senior executive positions at the combined Company (and, in the case of Mr. Wallace and Mr. Johnson also serve on the combined Company’s Board of Directors), were discussed in detail previously. Additional information about all the combined Company’s anticipated executive officers and Directors can be found Echo’s S-4 filing with the SEC.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Table 17. Board of Directors and Executive Officers– At Time Of Merger

| | | | | Anticipated Position with | | |

Individual | | Age (1) | | Merged Company | | Current Positions |

| | | | | | | |

| Gene Burleson | | 66 | | Chairman of the Board | | Chairman of the Board & CEO, Echo Healthcare |

| | | | | | | |

| Zubeen Shroff | | 42 | | Vice Chairman and Director | | Director, XLNT |

| | | | | | | |

| Richard Johnston | | 72 | | Director | | Director, XLNT |

| | | | | | | |

| Joel Kanter | | 50 | | Director | | President, Secretary & Director, Echo Healthcare |

| | | | | | | Director, XLNT |

| | | | | | | |

| Richard O. Martin, Phd. | | 67 | | Director | | Director, Echo Healthcare |

| | | | | | | |

| Dr. J. David Reed | | 59 | | Director | | Director, XLNT; Director of XLNT's Hospital |

| | | | | | | Operations for Northern California |

| | | | | | | |

| Robert Wallace | | 59 | | Director and CEO | | Director & CEO, XLNT |

| | | | | | | |

| Steven T. Johnson | | 55 | | Director, President and COO | | Director, President and COO, XLNT |

| | | | | | | |

| George A. Villasana | | 39 | | General Counsel and Secretary | | General Counsel & Secretary, XLNT |

| | | | | | | |

| Gregory J. Eisenhauer | | 48 | | Chief Financial Officer | | Chief Financial Officer, XLNT |

| |

(1) As of 8/31/07 |

| |

| Source: Company S-4 filed with the SEC on November 7, 2007. |

Risks

Echo faces a variety of financial and operational risks related to its business strategy and its proposed merger with XLNT, among other things. Risks are discussed in detail in the Company’s S-4 filed with the SEC on November 8, 2007 and should be thoroughly reviewed by investors. Among the risks are the following:

XLNT Transaction

As discussed in detail previously, Echo has signed a definitive agreement to acquire XLNT. However, this transaction requires approval by Echo’s and XLNT’s shareholders. In addition, either party can terminate the transaction if, among other things, it is not completed by March 22, 2008, if 20% or more of Echo’s common shareholders exercise their conversion rights (as discussed previously), or if a governmental entity issues a final decree prohibiting the merger. If the merger is not consummated, Echo probably will be liquidated and the cash held in the trust fund distributed, pro rata, to Echo’s common stockholders (excluding initial stockholders who purchased their shares prior to the initial public offering).

Acquisition Strategy

Echo’s business strategy is to grow in part by completing selective acquisitions in the veterinary industry. Such a strategy is subject to a variety of risks, related to, among other things, successfully identifying, completing and integrating acquisitions; realizing anticipated cost savings and efficiency improvements; retaining key personnel; and obtaining capital to fund acquisitions. Also, the timing of acquisitions is uncertain and it could take longer than anticipated to complete future acquisitions, which could negatively affect future growth.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Limited Operating History

Echo’s management has no experience in the veterinary industry, and, although XLNT has made a series of acquisitions of animal hospitals in the past four years, its operating experience is limited, the “hub and spoke” structure that it plans to implement is untested, and its ability to realize anticipated cost savings and efficiency improvements is unproven.

Economic Risk

Although veterinary spending historically has been somewhat less sensitive to changes in economic activity than spending on products and services perceived by the consumer to be more discretionary, it likely would be affected by an economic downturn. Further, because veterinary hospital operations are characterized by relatively high fixed costs, especially for personnel and rent, revenue shortfalls could have a disproportionate negative effect on earnings.

Litigation Risk

Although to date the veterinary industry has had little liability exposure (unlike the human healthcare system), there is no guarantee that this will not change in the future.

Weaknesses in Controls

XLNT’s management and auditors have identified material weaknesses in the Company’s internal controls over financial reporting. As a public company, over time, it will be required to comply with Sarbanes-Oxley, which could be costly and could divert management’s attention from pursuing its strategic initiatives.

Substantial Number of Shares Available for Sale

A substantial number of the combined Company’s shares will become eligible for resale in the public markets following completion of the merger, including the following: warrants to purchase approximately 7.6 million shares will become exercisable on the date the merger is consummated; 781,250 shares of Echo common stock will be released from escrow after the merger when and if Echo’s common stock trades at a price of $11.50 per share for 20 of 30 consecutive trading days, and another 781,250 shares will be released from escrow and eligible for resale on March 17, 2009. Sales of substantial numbers of such shares could put pressure on the Company’s share price and/or limit its upside. Also, underwriters in Echo’s IPO acquired an option to purchase up to 312,500 units (each unit consists of one share of Echo common stock and one warrant to purchase one share of Echo common stock at $10 per unit) that are exercisable when a business combination closes.

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Dutton Associates Current Ratings Distribution |

Rating | % Total |

| Not rated | 2.86 |

| Strong Buy | 8.57 |

| Buy | 13.57 |

| Strong Speculative Buy | 28.57 |

| Speculative Buy | 32.14 |

| Neutral | 12.14 |

| Avoid | 2.14 |

Dutton Associates • 4989 Golden Foothill Parkway, Suite 4 • El Dorado Hills, CA 95762 • Phone (916) 941-8119

Echo Healthcare Acquisition Corporation |

Analyst: Sally H. Wallick, CFA

Ms. Wallick has spent nearly 25 years as an analyst in the research departments of Alex. Brown & Sons and Legg Mason Wood Walker in Baltimore. Most recently, she was Managing Director with Legg Mason Wood Walker following leisure, retail, and consumer companies. Prior to Legg Mason, she was with Alex Brown for 15 years following retail, consumer, and transportation companies. She received her B.A. degree from the College of William and Mary, Williamsburg, VA, and her MBA from Loyola College, Baltimore, MD.

Analyst Certification:

I, Sally H. Wallick, CFA hereby certify that the views expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.