UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

---------------------------------------------------------

(Exact name of registrant as specified in charter)

200 BERKELEY STREET, BOSTON, MA 02116

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

SALVATORE SCHIAVONE, 197 CLARENDON STREET, BOSTON, MA 02116

------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 663-4497

--------------

| Date of fiscal year end: 7/31 |

| ------ |

| | |

| Date of reporting period: 7/31/19 |

| ------- |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared five annual reports to shareholders for the year ended July 31, 2019 for series of John Hancock Funds II with July 31 fiscal year end. The first report applies to Short Duration Credit Opportunities Fund, the second report applies to Absolute Return Currency Fund, the third report applies to Fundamental All Cap Core Fund, the fourth report applies to Diversified Strategies Fund and the fifth report applies to Global Absolute Return Strategies Fund.

John Hancock

Short Duration Credit Opportunities Fund

Annual report 7/31/19

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A and Class C shares) or 888-972-8696 (Class I, Class R2, Class R4, Class R6, and Class NAV shares) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

It was a rather volatile time for bond markets in the United States during the 12 months ended July 31, 2019, with investor uncertainty surrounding trade with China and the broader health of the global economy leading to some dramatic swings in performance. The trend in longer-term yields was decidedly downward, with the 10-year U.S. Treasury finishing the period at just above 2%, triggering an inverted yield curve shortly after period end. In July, the U.S. Federal Reserve stepped in with a reduction in short-term interest rates in an attempt to offer a measure of stimulus to jittery markets, and investors greeted the news favorably.

While the economic fundamentals in the United States appear fairly solid, with a strong labor market and a confident consumer base, there are sure to be patches of market turbulence as the year goes on, particularly as the threat of a recession looms. As always, your best resource in unpredictable markets is your financial advisor, who can help position your portfolio so that it's sufficiently diversified to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Short Duration Credit Opportunities Fund

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 5 | | Discussion of fund performance |

| 7 | | A look at performance |

| 9 | | Your expenses |

| 11 | | Fund's investments |

| 48 | | Financial statements |

| 52 | | Financial highlights |

| 59 | | Notes to financial statements |

| 73 | | Report of independent registered public accounting firm |

| 74 | | Tax information |

| 75 | | Continuation of investment advisory and subadvisory agreements |

| 82 | | Trustees and Officers |

| 86 | | More information |

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 1

INVESTMENT OBJECTIVE

The fund seeks to maximize total return, which consists of income on its investments and capital appreciation.

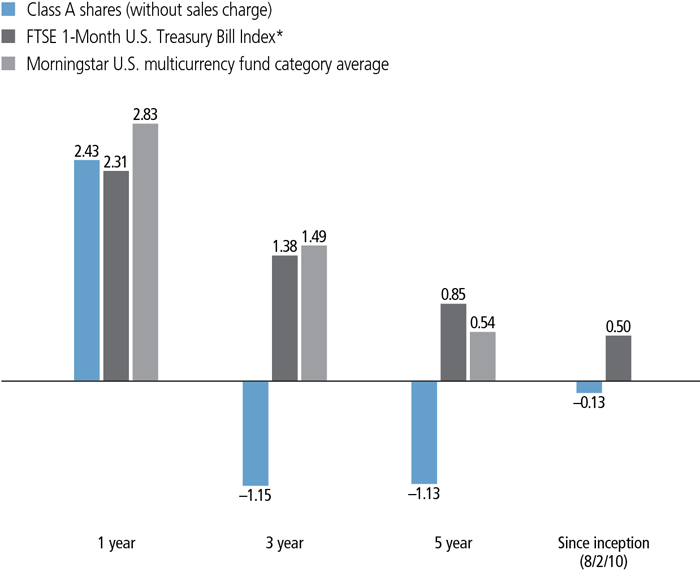

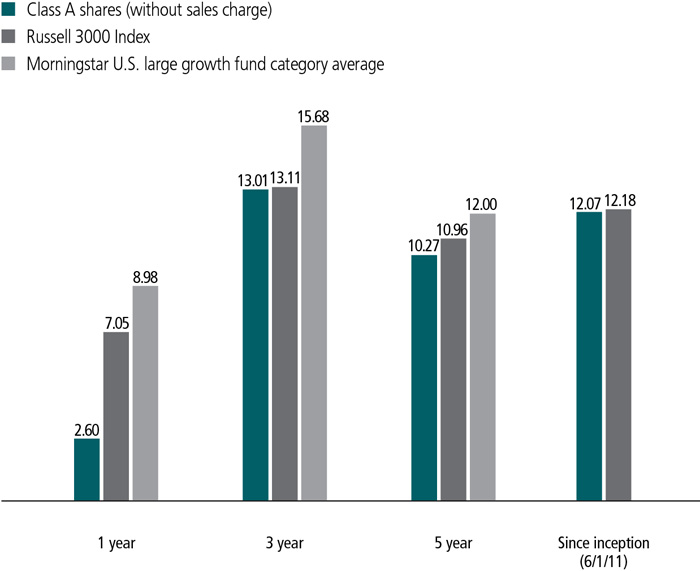

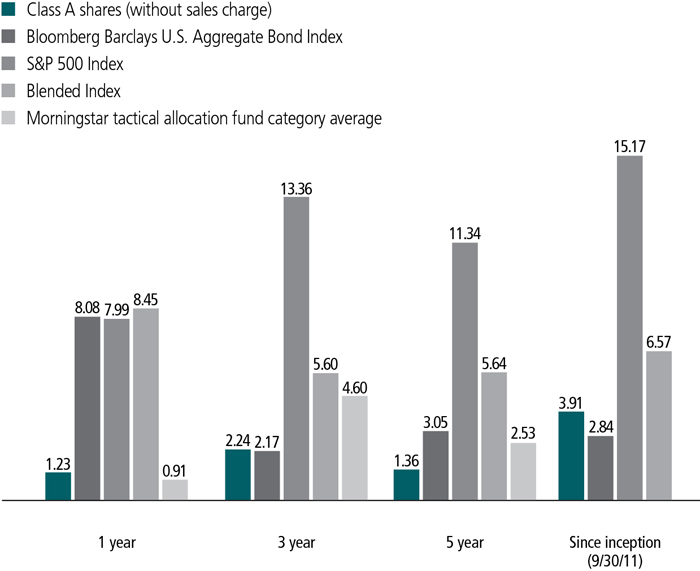

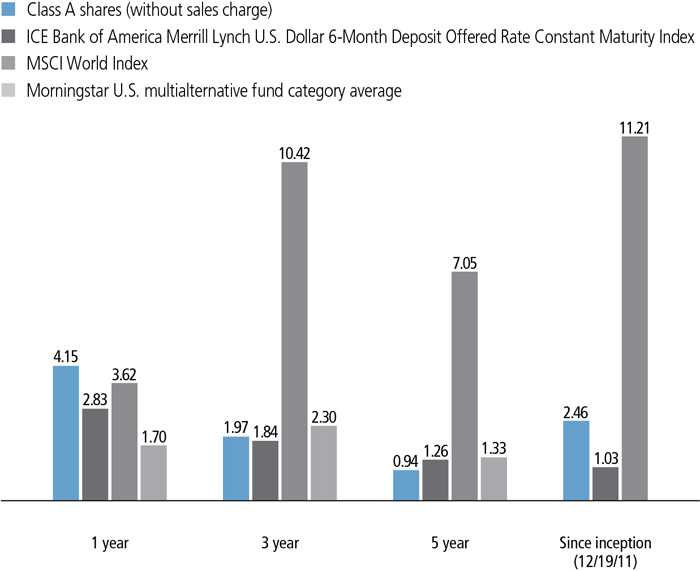

AVERAGE ANNUAL TOTAL RETURNS AS OF 7/31/19 (%)

The Bloomberg Barclays 1 - 5 Year U.S. Credit Index includes investment-grade corporate and international U.S. dollar-denominated bonds with maturities of 1 to 5 years.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower. Since-inception returns for the Morningstar fund category average are not available.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 2

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

Bonds produced broad-based gains in the 12-month period

The U.S. Federal Reserve's shift to a more accommodative monetary policy fueled healthy total returns for the world fixed-income markets.

The fund underperformed its benchmark

An effort to manage credit risk prevented the fund from fully participating in the rally.

Security selection added value

The fund's holdings in senior loans, securitized assets, and investment-grade corporates outpaced the respective categories.

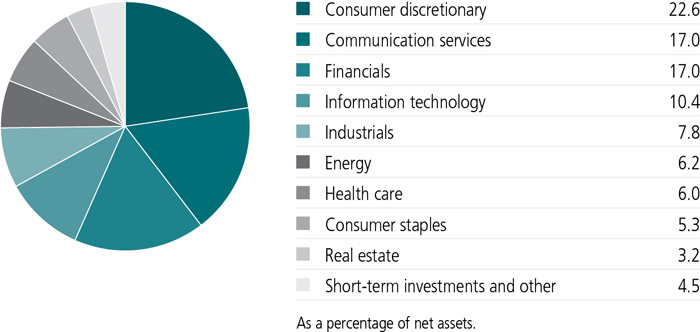

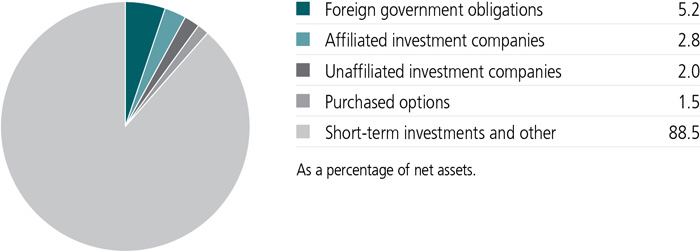

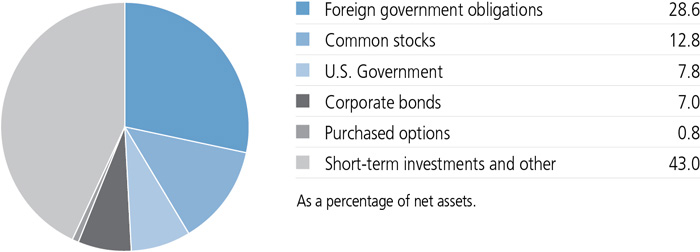

PORTFOLIO COMPOSITION AS OF 7/31/19 (%)

A note about risks

The fund is subject to various risks as described in the fund's prospectus. For more information, please refer to the "Principal risks" section of the prospectus.

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 3

QUALITY COMPOSITION AS OF 7/31/19 (%)

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 4

Discussion of fund performance

Can you describe investment conditions during the 12 months ended July 31, 2019?

The world fixed-income markets delivered a gain, with both interest-rate- and credit-sensitive assets participating in the rally. A backdrop of low inflation and slow growth gave the U.S. Federal Reserve (Fed) and other major central banks the latitude to begin reducing interest rates, fueling strong returns for higher-quality issues such as government bonds and investment-grade corporates. High-yield corporate and emerging-market debt also gained ground thanks to investors' hearty appetite for risk from late December 2018 onward. Securitized assets and bank loans, while lagging somewhat, nonetheless posted solid absolute returns.

What elements of the fund's positioning helped and hurt results?

Although the fund produced a positive return, it finished behind its benchmark, the Bloomberg Barclays 1-5 Year U.S. Credit Index. A decision to hedge some of the portfolio's credit exposure by buying protection on high-yield, investment-grade, and emerging-market indexes at various points throughout the year was a key factor in the shortfall. While this strategy prevented the fund from fully capitalizing on the market's advance, we believed a defensive approach was warranted given the uncertainty surrounding trade policy and global growth. Derivatives were an additional detractor.

Security selection was a net positive for relative performance, with favorable results in senior loans, securitized assets, and investment-grade corporates offsetting a weaker showing in the emerging markets. Overweights in corporates and U.S. dollar-denominated emerging-market debt added value, but the benefit was counterbalanced by an overweight in the securitized space.

COUNTRY COMPOSITION AS OF 7/31/19 (%)

| | |

| United States | 74.8 |

| United Kingdom | 2.3 |

| Canada | 1.4 |

| Ireland | 1.4 |

| Netherlands | 1.2 |

| Indonesia | 1.0 |

| Other countries | 17.9 |

| TOTAL | 100.0 |

| As a percentage of net assets. | |

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 5

What were some of the key portfolio changes of the past 12 months?

We reduced the portfolio's weighting in local currency emerging-market issues to guard against the possibility of further strength in the U.S. dollar. We also lowered the fund's allocation to senior loans, since floating-rate assets may experience reduced demand now that the Fed is cutting rates. Separately, we sought to capitalize on the rally in rate-sensitive assets by increasing the portfolio's duration during the second calendar quarter.

How was the fund positioned at the end of the period?

Although global economic growth was in positive territory at the end of July, uncertainty regarding U.S. trade policy remained high. In addition, the likelihood of several additional Fed rate cuts appeared to be priced into the market already—indicating that any shift in the outlook could represent a meaningful headwind to performance.

Believing these factors argued for near-term caution, especially in light of the continued tightness in yield spreads across the credit sectors, we closed the period with a below-average risk profile and continued hedges on the fund's positions in investment-grade corporates, high yield, and the emerging markets.

Can you tell us about changes to the fund's portfolio management team?

Effective December 31, 2018, we added Kumaran Damodaran, Ph.D.; Matthew Kearns, CFA; David Oliver, CFA; William Perry; Hunter Schwartz; Stuart Sclater-Booth; and David Torchia to the team. Effective June 30, 2019, Marianne Rossi retired.

MANAGED BY

| |

| The Short Duration Credit Opportunities Fund is managed by a team that broadly manages across global fixed-income markets at Stone Harbor Investment Partners LP. |

The views expressed in this report are exclusively those of the portfolio management team at Stone Harbor Investment Partners LP, and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund's investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 6

TOTAL RETURNS FOR THE PERIOD ENDED JULY 31, 2019

| | | | | | | | | | | | |

Average annual

total returns (%)

with maximum sales charge | | Cumulative total

returns (%)

with maximum sales charge | | SEC 30-day

yield (%)

subsidized | | SEC 30-day

yield (%)

unsubsidized1 |

| | 1-year | 5-year | Since

inception2 | | | 5-year | Since

inception2 | | as of

7-31-19 | | as of

7-31-19 |

| Class A | 1.88 | 1.48 | 2.99 | | | 7.64 | 33.20 | | 3.12 | | 3.12 |

| Class C3 | 2.74 | 1.28 | 2.88 | | | 6.54 | 31.85 | | 2.52 | | 2.51 |

| Class I4 | 4.87 | 2.32 | 3.57 | | | 12.15 | 40.69 | | 3.52 | | 3.51 |

| Class R23,4 | 4.74 | 2.15 | 3.34 | | | 11.21 | 37.72 | | 3.38 | | 3.37 |

| Class R43,4 | 4.84 | 2.24 | 3.38 | | | 11.70 | 38.32 | | 3.48 | | 3.37 |

| Class R63,4 | 4.99 | 2.38 | 3.46 | | | 12.47 | 39.28 | | 3.62 | | 3.62 |

| Class NAV4 | 5.00 | 2.47 | 3.74 | | | 12.96 | 42.98 | | 3.64 | | 3.63 |

| Index† | 5.96 | 2.40 | 3.03 | | | 12.58 | 33.73 | | — | | — |

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 2.5% and the applicable contingent deferred sales charge (CDSC) on Class C shares. The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.5% to 2.5%, effective 2-3-14. Class C shares sold within one year of purchase are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R2, Class R4, Class R6, and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Net expenses reflect contractual expense limitations in effect until November 30, 2019 and are subject to change. Had the contractual fee waivers and expense limitations not been in place, gross expenses would apply. The expense ratios are as follows:

| | | | | | | | |

| | Class A | Class C | Class I | Class R2 | Class R4 | Class R6 | Class NAV |

| Gross (%) | 1.19 | 1.89 | 0.89 | 1.29 | 1.14 | 0.79 | 0.78 |

| Net (%) | 1.18 | 1.88 | 0.88 | 1.28 | 1.03 | 0.78 | 0.77 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the Bloomberg Barclays 1-5 Year U.S. Credit Index. |

See the following page for footnotes.

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 7

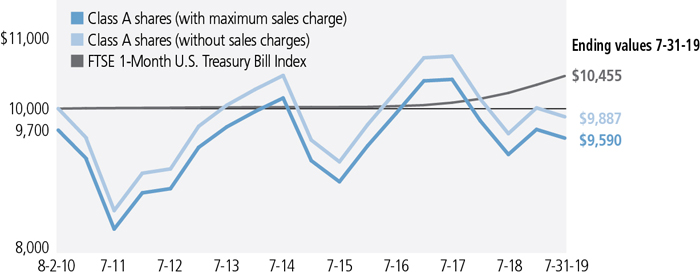

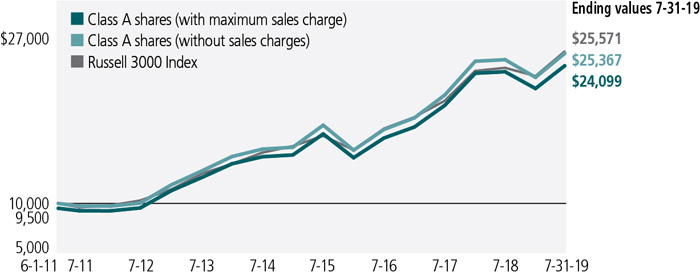

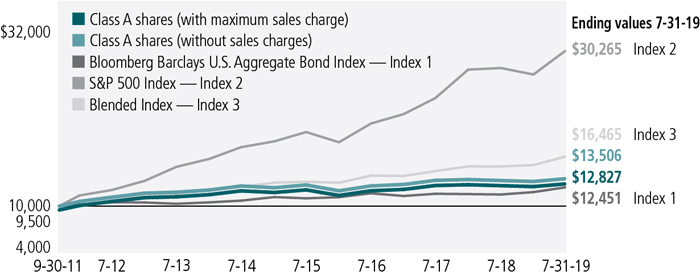

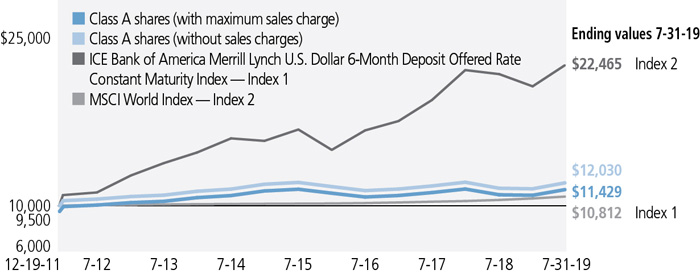

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Short Duration Credit Opportunities Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the Bloomberg Barclays 1-5 Year U.S. Credit Index.

| | | | | |

| | Start date | With maximum

sales charge ($) | Without

sales charge ($) | Index ($) |

| Class C3,5 | 11-2-09 | 13,185 | 13,185 | 13,373 |

| Class I4 | 11-2-09 | 14,069 | 14,069 | 13,373 |

| Class R23,4 | 11-2-09 | 13,772 | 13,772 | 13,373 |

| Class R43,4 | 11-2-09 | 13,832 | 13,832 | 13,373 |

| Class R63,4 | 11-2-09 | 13,928 | 13,928 | 13,373 |

| Class NAV4 | 11-2-09 | 14,298 | 14,298 | 13,373 |

The values shown in the chart for "Class A with maximum sales charge" have been adjusted to reflect the reduction in the Class A maximum sales charge from 4.5% to 2.5%, which became effective on 2-3-14.

The Bloomberg Barclays 1-5 Year U.S. Credit Index includes investment-grade corporate and international U.S. dollar-denominated bonds with maturities of 1 to 5 years.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Unsubsidized yield reflects what the yield would have been without the effects of waivers and reimbursements. |

| 2 | From 11-2-09. |

| 3 | Class C shares were first offered on 6-27-14; Class R2, Class R4, and Class R6 shares were first offered on 3-27-15. Returns prior to these dates are those of Class A shares (first offered on 11-2-09) that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| 4 | For certain types of investors as described in the fund's prospectuses. |

| 5 | The contingent deferred sales charge is not applicable. |

ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND 8

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■Transaction costs,which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses, and is based on the fund’s actual return. It assumes an account value of $1,000.00 on February 1, 2019, with the same investment held until July 31, 2019.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at July 31, 2019, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return). It assumes an account value of $1,000.00 on February 1, 2019, with the same investment held until July 31, 2019. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 9 |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | Account

value on

2-1-2019 | Ending

value on

7-31-2019 | Expenses

paid during

period ended

7-31-20191 | Annualized

expense

ratio |

| Class A | Actual expenses/actual returns | $1,000.00 | $1,038.60 | $5.96 | 1.18% |

| | Hypothetical example | 1,000.00 | 1,018.90 | 5.91 | 1.18% |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,035.00 | 9.59 | 1.90% |

| | Hypothetical example | 1,000.00 | 1,015.40 | 9.49 | 1.90% |

| Class I | Actual expenses/actual returns | 1,000.00 | 1,040.10 | 4.55 | 0.90% |

| | Hypothetical example | 1,000.00 | 1,020.30 | 4.51 | 0.90% |

| Class R2 | Actual expenses/actual returns | 1,000.00 | 1,039.40 | 5.31 | 1.05% |

| | Hypothetical example | 1,000.00 | 1,019.60 | 5.26 | 1.05% |

| Class R4 | Actual expenses/actual returns | 1,000.00 | 1,039.90 | 4.80 | 0.95% |

| | Hypothetical example | 1,000.00 | 1,020.10 | 4.76 | 0.95% |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 1,040.70 | 4.00 | 0.79% |

| | Hypothetical example | 1,000.00 | 1,020.90 | 3.96 | 0.79% |

| Class NAV | Actual expenses/actual returns | 1,000.00 | 1,040.70 | 3.95 | 0.78% |

| | Hypothetical example | 1,000.00 | 1,020.90 | 3.91 | 0.78% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 10 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | |

AS OF 7-31-19

| | Rate (%) | Maturity date | | Par value^ | Value |

| U.S. Government and Agency obligations 0.8% | | | | $7,113,439 |

| (Cost $7,134,080) | | | | | |

| U.S. Government Agency 0.8% | | | 7,113,439 |

| Federal Home Loan Mortgage Corp. | | | |

| 30 Yr Pass Thru (12 month LIBOR + 1.650%) (A) | 2.211 | 12-01-42 | | 666,922 | 679,186 |

| 30 Yr Pass Thru (12 month LIBOR + 1.624%) (A) | 2.543 | 04-01-46 | | 1,285,812 | 1,301,384 |

| 30 Yr Pass Thru (12 month LIBOR + 1.616%) (A) | 4.617 | 05-01-43 | | 264,092 | 273,799 |

| 30 Yr Pass Thru (12 month LIBOR + 1.743%) (A) | 4.775 | 01-01-37 | | 48,951 | 51,457 |

| 30 Yr Pass Thru (12 month LIBOR + 1.864%) (A) | 4.902 | 03-01-42 | | 34,587 | 36,408 |

| Federal National Mortgage Association | | | |

| 30 Yr Pass Thru (12 month LIBOR + 1.600%) (A) | 2.306 | 08-01-45 | | 205,866 | 208,135 |

| 30 Yr Pass Thru (12 month LIBOR + 1.620%) (A) | 2.391 | 11-01-46 | | 1,260,686 | 1,264,408 |

| 30 Yr Pass Thru (12 month LIBOR + 1.582%) (A) | 2.844 | 12-01-44 | | 903,527 | 915,207 |

| 30 Yr Pass Thru (12 month LIBOR + 1.571%) (A) | 4.464 | 04-01-37 | | 564,651 | 591,061 |

| 30 Yr Pass Thru (12 month LIBOR + 1.657%) (A) | 4.563 | 08-01-35 | | 193,063 | 201,570 |

| 30 Yr Pass Thru (12 month LIBOR + 1.772%) (A) | 4.666 | 04-01-44 | | 420,453 | 442,597 |

| 30 Yr Pass Thru (1 Year CMT + 2.227%) (A) | 4.670 | 01-01-37 | | 244,095 | 257,493 |

| 30 Yr Pass Thru (12 month LIBOR + 1.764%) (A) | 4.706 | 10-01-38 | | 137,316 | 144,548 |

| Government National Mortgage Association | | | |

| 30 Yr Pass Thru (1 Year CMT + 1.500%) (A) | 4.000 | 01-20-41 | | 536,895 | 552,642 |

| 30 Yr Pass Thru | 4.500 | 01-15-40 | | 95,840 | 103,206 |

|

| 30 Yr Pass Thru | 6.000 | 08-15-35 | | 79,641 | 90,338 |

| Foreign government obligations 11.6% | | | $101,768,222 |

| (Cost $99,342,577) | | | | | |

| Angola 0.3% | | | 2,546,148 |

| Republic of Angola | | | | | |

| Bond (6 month LIBOR + 4.500%) (A) | 7.391 | 12-07-23 | | 189,000 | 179,550 |

| Bond | 8.250 | 05-09-28 | | 294,000 | 313,001 |

| Bond (B) | 9.375 | 05-08-48 | | 456,000 | 503,082 |

| Bond | 9.500 | 11-12-25 | | 285,000 | 329,976 |

| Bond (6 month LIBOR + 7.500%) (A) | 10.373 | 07-01-23 | | 1,115,385 | 1,220,539 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 11 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Argentina 0.6% | | | $5,460,226 |

| Republic of Argentina | | | | | |

| Bond | 4.500 | 02-13-20 | | 396,000 | 373,230 |

| Bond | 6.875 | 04-22-21 | | 1,889,000 | 1,695,378 |

| Bond | 7.820 | 12-31-33 | EUR | 3,629,150 | 3,391,618 |

| Bahrain 0.1% | | | 1,152,128 |

| Kingdom of Bahrain | | | | | |

| Bond (B) | 6.000 | 09-19-44 | | 140,000 | 137,928 |

| Bond | 6.125 | 08-01-23 | | 200,000 | 214,861 |

| Bond (B) | 6.750 | 09-20-29 | | 303,000 | 337,510 |

| Bond (B) | 7.000 | 10-12-28 | | 408,000 | 461,829 |

| Belarus 0.1% | | | 499,809 |

| Republic of Belarus | | | | | |

| Bond | 6.200 | 02-28-30 | | 200,000 | 211,799 |

| Bond | 7.625 | 06-29-27 | | 255,000 | 288,010 |

| Benin 0.1% | | | 725,574 |

| Republic of Benin | | | | | |

| Bond (B) | 5.750 | 03-26-26 | EUR | 637,000 | 725,574 |

| Bolivia 0.1% | | | 560,166 |

| Plurinational State of Bolivia | | | | | |

| Bond | 4.500 | 03-20-28 | | 576,000 | 560,166 |

| Brazil 0.8% | | | 6,697,927 |

| Brazil Minas SPE | | | | | |

| Bond | 5.333 | 02-15-28 | | 1,183,500 | 1,260,428 |

| Bond (B) | 5.333 | 02-15-28 | | 107,100 | 114,062 |

| Federative Republic of Brazil | | | | | |

| Bill (C) | 5.321 | 07-01-20 | BRL | 480,000 | 119,834 |

| Bond | 4.500 | 05-30-29 | | 552,000 | 575,460 |

| Bond | 4.625 | 01-13-28 | | 8,000 | 8,492 |

| Bond | 5.000 | 01-27-45 | | 1,126,000 | 1,161,480 |

| Bond | 5.625 | 01-07-41 | | 315,000 | 350,475 |

| Bond | 8.250 | 01-20-34 | | 152,000 | 209,762 |

| Note | 10.000 | 01-01-21 | BRL | 4,740,000 | 1,324,909 |

| Note | 10.000 | 01-01-23 | BRL | 2,080,000 | 608,840 |

| Note | 10.000 | 01-01-25 | BRL | 410,000 | 123,304 |

| Note | 10.000 | 01-01-27 | BRL | 2,740,000 | 840,881 |

| Cameroon 0.0% | | | 102,104 |

| Republic of Cameroon | | | | | |

| Bond (B) | 9.500 | 11-19-25 | | 94,000 | 102,104 |

| Chile 0.1% | | | 1,260,625 |

| Republic of Chile | | | | | |

| Bond | 4.500 | 03-01-21 | CLP | 130,000,000 | 194,830 |

| Bond | 4.500 | 03-01-26 | CLP | 250,000,000 | 399,920 |

| Bond (B) | 4.700 | 09-01-30 | CLP | 395,000,000 | 665,875 |

| 12 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Colombia 0.6% | | | $5,313,302 |

| Bogota Distrito Capital | | | | | |

| Bond | 9.750 | 07-26-28 | COP | 427,000,000 | 145,113 |

| Republic of Colombia | | | | | |

| Bond | 3.875 | 04-25-27 | | 144,000 | 150,265 |

| Bond | 4.375 | 03-21-23 | COP | 3,180,000,000 | 946,177 |

| Bond | 4.500 | 01-28-26 | | 325,000 | 349,863 |

| Bond | 4.500 | 03-15-29 | | 797,000 | 871,129 |

| Bond | 5.000 | 06-15-45 | | 143,000 | 159,016 |

| Bond | 5.200 | 05-15-49 | | 545,000 | 626,750 |

| Bond | 8.125 | 05-21-24 | | 312,000 | 383,916 |

| Bond | 9.850 | 06-28-27 | COP | 3,200,000,000 | 1,244,613 |

| Bond | 10.375 | 01-28-33 | | 278,000 | 436,460 |

| Czech Republic 0.1% | | | 612,720 |

| Czech Republic | | | | | |

| Bond | 0.250 | 02-10-27 | CZK | 10,110,000 | 402,824 |

| Bond | 0.950 | 05-15-30 | CZK | 1,300,000 | 53,596 |

| Bond | 1.000 | 06-26-26 | CZK | 2,620,000 | 110,662 |

| Bond | 2.750 | 07-23-29 | CZK | 930,000 | 45,638 |

| Dominican Republic 0.2% | | | 1,939,519 |

| Government of Dominican Republic | | | | | |

| Bond | 5.500 | 01-27-25 | | 202,000 | 214,880 |

| Bond (B) | 5.875 | 04-18-24 | | 93,000 | 99,631 |

| Bond | 5.950 | 01-25-27 | | 290,000 | 316,103 |

| Bond (B) | 6.000 | 07-19-28 | | 202,000 | 221,192 |

| Bond | 6.600 | 01-28-24 | | 347,000 | 385,607 |

| Bond (B) | 7.450 | 04-30-44 | | 595,000 | 702,106 |

| Ecuador 0.2% | | | 1,704,640 |

| Republic of Ecuador | | | | | |

| Bond | 7.875 | 01-23-28 | | 888,000 | 870,240 |

| Bond (B) | 10.750 | 01-31-29 | | 745,000 | 834,400 |

| Egypt 0.4% | | | 3,602,667 |

| Arab Republic of Egypt | | | | | |

| Bond (B) | 4.750 | 04-16-26 | EUR | 125,000 | 143,412 |

| Bond (B) | 5.577 | 02-21-23 | | 192,000 | 198,553 |

| Bond (B) | 5.625 | 04-16-30 | EUR | 979,000 | 1,103,986 |

| Bond (B) | 6.125 | 01-31-22 | | 609,000 | 635,536 |

| Bond (B) | 6.375 | 04-11-31 | EUR | 426,000 | 499,950 |

| Bond (B) | 8.500 | 01-31-47 | | 934,000 | 1,021,230 |

| El Salvador 0.2% | | | 1,539,838 |

| Republic of El Salvador | | | | | |

| Bond | 5.875 | 01-30-25 | | 214,000 | 219,620 |

| Bond (B) | 6.375 | 01-18-27 | | 345,000 | 355,785 |

| Bond (B) | 7.375 | 12-01-19 | | 180,000 | 181,802 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 13 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| El Salvador (continued) | | | |

| Bond | 7.650 | 06-15-35 | | 523,000 | $568,114 |

| Bond | 8.250 | 04-10-32 | | 189,000 | 214,517 |

| Ghana 0.2% | | | 1,890,087 |

| Republic of Ghana | | | | | |

| Bond (B) | 8.125 | 03-26-32 | | 531,000 | 539,576 |

| Bond (B) | 8.950 | 03-26-51 | | 269,000 | 277,667 |

| Bond (B) | 10.750 | 10-14-30 | | 845,000 | 1,072,844 |

| Hungary 0.0% | | | 400,407 |

| Republic of Hungary | | | | | |

| Bond | 5.375 | 03-25-24 | | 147,000 | 164,401 |

| Bond | 7.625 | 03-29-41 | | 149,000 | 236,006 |

| Indonesia 0.7% | | | 6,628,208 |

| Republic of Indonesia | | | | | |

| Bond (B) | 3.850 | 07-18-27 | | 1,339,000 | 1,403,613 |

| Bond (B) | 4.350 | 01-08-27 | | 305,000 | 329,815 |

| Bond | 4.750 | 02-11-29 | | 404,000 | 455,553 |

| Bond | 5.250 | 01-17-42 | | 673,000 | 779,520 |

| Bond (B) | 5.250 | 01-08-47 | | 52,000 | 60,788 |

| Bond | 7.500 | 08-15-32 | IDR | 2,920,000,000 | 205,204 |

| Bond | 7.500 | 05-15-38 | IDR | 2,889,000,000 | 201,049 |

| Bond | 8.250 | 05-15-36 | IDR | 8,904,000,000 | 665,688 |

| Bond | 8.375 | 03-15-24 | IDR | 12,860,000,000 | 975,679 |

| Bond | 8.375 | 09-15-26 | IDR | 11,300,000,000 | 859,451 |

| Bond | 8.375 | 03-15-34 | IDR | 9,130,000,000 | 691,848 |

| Iraq 0.1% | | | 657,805 |

| Republic of Iraq | | | | | |

| Bond (B) | 6.752 | 03-09-23 | | 636,000 | 657,805 |

| Ivory Coast 0.1% | | | 856,455 |

| Republic of Ivory Coast | | | | | |

| Bond (B) | 6.125 | 06-15-33 | | 507,000 | 478,746 |

| Bond | 6.125 | 06-15-33 | | 400,000 | 377,709 |

| Jordan 0.1% | | | 543,643 |

| Kingdom of Jordan | | | | | |

| Bond (B) | 5.750 | 01-31-27 | | 531,000 | 543,643 |

| Kenya 0.1% | | | 1,029,034 |

| Republic of Kenya | | | | | |

| Bond | 6.875 | 06-24-24 | | 339,000 | 364,126 |

| Bond (B) | 7.000 | 05-22-27 | | 211,000 | 220,660 |

| Bond (B) | 8.000 | 05-22-32 | | 211,000 | 223,779 |

| Bond | 8.250 | 02-28-48 | | 211,000 | 220,469 |

| Lebanon 0.3% | | | 2,532,859 |

| Republic of Lebanon | | | | | |

| 14 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Lebanon (continued) | | | |

| Bond | 6.150 | 06-19-20 | | 151,000 | $144,043 |

| Bond | 6.250 | 11-04-24 | | 221,000 | 174,045 |

| Bond | 6.600 | 11-27-26 | | 24,000 | 18,580 |

| Bond | 6.650 | 04-22-24 | | 858,000 | 696,976 |

| Bond | 6.650 | 11-03-28 | | 82,000 | 62,772 |

| Bond | 6.650 | 02-26-30 | | 78,000 | 58,697 |

| Bond | 8.250 | 04-12-21 | | 1,477,000 | 1,377,746 |

| Malaysia 0.1% | | | 761,474 |

| Government of Malaysia | | | | | |

| Bond | 3.733 | 06-15-28 | MYR | 570,000 | 138,966 |

| Bond | 3.885 | 08-15-29 | MYR | 610,000 | 151,182 |

| Bond | 3.900 | 11-30-26 | MYR | 165,000 | 40,776 |

| Bond | 3.906 | 07-15-26 | MYR | 1,250,000 | 309,081 |

| Bond | 4.498 | 04-15-30 | MYR | 470,000 | 121,469 |

| Mexico 0.6% | | | 5,349,602 |

| Government of Mexico | | | | | |

| Bond | 3.750 | 01-11-28 | | 271,000 | 274,252 |

| Bond | 4.350 | 01-15-47 | | 203,000 | 198,181 |

| Bond | 4.500 | 04-22-29 | | 1,188,000 | 1,262,250 |

| Bond | 4.750 | 03-08-44 | | 128,000 | 132,160 |

| Bond | 5.750 | 03-05-26 | MXN | 12,910,000 | 616,527 |

| Bond | 7.500 | 06-03-27 | MXN | 15,710,000 | 821,080 |

| Bond | 7.750 | 11-13-42 | MXN | 8,680,000 | 445,411 |

| Bond | 10.000 | 12-05-24 | MXN | 27,412,500 | 1,599,741 |

| Nigeria 0.2% | | | 2,110,947 |

| Federal Republic of Nigeria | | | | | |

| Bond (B) | 6.500 | 11-28-27 | | 1,078,000 | 1,104,033 |

| Bond (B) | 7.143 | 02-23-30 | | 265,000 | 274,093 |

| Bond (B) | 7.625 | 11-28-47 | | 577,000 | 582,843 |

| Bond (B) | 7.875 | 02-16-32 | | 141,000 | 149,978 |

| Oman 0.3% | | | 2,447,826 |

| Sultanate of Oman | | | | | |

| Bond | 3.625 | 06-15-21 | | 521,000 | 517,947 |

| Bond (B) | 4.875 | 02-01-25 | | 499,000 | 498,002 |

| Bond (B) | 5.375 | 03-08-27 | | 1,016,000 | 993,974 |

| Bond (B) | 6.000 | 08-01-29 | | 439,000 | 437,903 |

| Pakistan 0.1% | | | 746,160 |

| Republic of Pakistan | | | | | |

| Bond | 6.875 | 12-05-27 | | 716,000 | 746,160 |

| Panama 0.2% | | | 1,596,137 |

| Republic of Panama | | | | | |

| Bond | 3.160 | 01-23-30 | | 1,062,000 | 1,071,558 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 15 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Panama (continued) | | | |

| Bond | 3.750 | 03-16-25 | | 499,000 | $524,579 |

| Papua New Guinea 0.1% | | | 711,720 |

| Independent State of Papua New Guinea | | | | | |

| Bond (B) | 8.375 | 10-04-28 | | 659,000 | 711,720 |

| Paraguay 0.1% | | | 827,062 |

| Republic of Paraguay | | | | | |

| Bond (B) | 5.400 | 03-30-50 | | 318,000 | 358,548 |

| Bond (B) | 6.100 | 08-11-44 | | 388,000 | 468,514 |

| Peru 0.2% | | | 1,798,433 |

| Republic of Peru | | | | | |

| Bond | 4.125 | 08-25-27 | | 233,000 | 258,865 |

| Bond | 5.625 | 11-18-50 | | 170,000 | 236,302 |

| Bond (B) | 5.940 | 02-12-29 | PEN | 350,000 | 118,281 |

| Bond (B) | 6.150 | 08-12-32 | PEN | 2,790,000 | 957,983 |

| Bond | 6.550 | 03-14-37 | | 160,000 | 227,002 |

| Poland 0.4% | | | 3,367,275 |

| Republic of Poland | | | | | |

| Bond | 2.000 | 04-25-21 | PLN | 290,000 | 75,483 |

| Bond | 2.500 | 01-25-23 | PLN | 1,910,000 | 505,162 |

| Bond | 2.500 | 04-25-24 | PLN | 1,290,000 | 342,876 |

| Bond | 2.750 | 04-25-28 | PLN | 1,918,000 | 519,671 |

| Bond | 2.750 | 10-25-29 | PLN | 2,770,000 | 754,445 |

| Bond | 4.000 | 10-25-23 | PLN | 4,165,000 | 1,169,638 |

| Qatar 0.3% | | | 2,670,920 |

| State of Qatar | | | | | |

| Bond (B) | 4.000 | 03-14-29 | | 728,000 | 793,041 |

| Bond (B) | 4.500 | 04-23-28 | | 199,000 | 224,747 |

| Bond | 4.817 | 03-14-49 | | 780,000 | 902,850 |

| Bond (B) | 5.103 | 04-23-48 | | 424,000 | 509,807 |

| Bond | 5.103 | 04-23-48 | | 200,000 | 240,475 |

| Romania 0.2% | | | 1,911,048 |

| Government of Romania | | | | | |

| Bond | 3.875 | 10-29-35 | EUR | 363,000 | 467,139 |

| Bond | 4.125 | 03-11-39 | EUR | 143,000 | 184,236 |

| Bond (B) | 4.625 | 04-03-49 | EUR | 136,000 | 187,135 |

| Bond | 5.000 | 02-12-29 | RON | 2,400,000 | 587,788 |

| Bond | 5.125 | 06-15-48 | | 434,000 | 484,750 |

| Russia 0.9% | | | 7,508,686 |

| Government of Russia | | | | | |

| Bond | 4.250 | 06-23-27 | | 600,000 | 626,767 |

| Bond | 4.750 | 05-27-26 | | 800,000 | 858,931 |

| Bond | 4.875 | 09-16-23 | | 200,000 | 215,268 |

| 16 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Russia (continued) | | | |

| Bond | 5.100 | 03-28-35 | | 800,000 | $872,266 |

| Bond | 5.250 | 06-23-47 | | 1,600,000 | 1,802,429 |

| Bond | 5.625 | 04-04-42 | | 200,000 | 236,250 |

| Bond | 7.050 | 01-19-28 | RUB | 51,960,000 | 814,771 |

| Bond | 7.400 | 12-07-22 | RUB | 40,340,000 | 643,691 |

| Bond | 7.700 | 03-23-33 | RUB | 11,427,000 | 184,796 |

| Bond | 7.750 | 09-16-26 | RUB | 31,960,000 | 520,273 |

| Bond | 7.950 | 10-07-26 | RUB | 21,710,000 | 357,306 |

| Bond | 8.150 | 02-03-27 | RUB | 22,520,000 | 375,938 |

| Saudi Arabia 0.2% | | | 1,673,865 |

| Kingdom of Saudi Arabia | | | | | |

| Bond (B) | 4.375 | 04-16-29 | | 115,000 | 126,835 |

| Bond (B) | 4.500 | 04-17-30 | | 106,000 | 118,228 |

| Bond | 4.500 | 10-26-46 | | 701,000 | 745,934 |

| Bond (B) | 5.000 | 04-17-49 | | 195,000 | 222,677 |

| Bond | 5.000 | 04-17-49 | | 403,000 | 460,191 |

| Senegal 0.1% | | | 555,754 |

| Republic of Senegal | | | | | |

| Bond (B) | 6.250 | 05-23-33 | | 560,000 | 555,754 |

| South Africa 0.5% | | | 4,478,091 |

| Republic of South Africa | | | | | |

| Bond | 4.665 | 01-17-24 | | 56,000 | 57,884 |

| Bond | 4.875 | 04-14-26 | | 591,000 | 605,286 |

| Bond | 5.000 | 10-12-46 | | 55,000 | 51,946 |

| Bond | 5.875 | 06-22-30 | | 164,000 | 174,887 |

| Bond | 6.250 | 03-31-36 | ZAR | 26,830,000 | 1,347,907 |

| Bond | 6.300 | 06-22-48 | | 351,000 | 376,356 |

| Bond | 7.000 | 02-28-31 | ZAR | 11,460,000 | 674,477 |

| Bond | 8.875 | 02-28-35 | ZAR | 700,000 | 45,714 |

| Bond | 10.500 | 12-21-26 | ZAR | 14,670,000 | 1,143,634 |

| Sri Lanka 0.3% | | | 2,456,209 |

| Republic of Sri Lanka | | | | | |

| Bond (B) | 5.750 | 04-18-23 | | 288,000 | 288,286 |

| Bond (B) | 6.125 | 06-03-25 | | 393,000 | 385,725 |

| Bond | 6.200 | 05-11-27 | | 504,000 | 486,709 |

| Bond | 6.250 | 07-27-21 | | 477,000 | 485,082 |

| Bond (B) | 6.750 | 04-18-28 | | 624,000 | 610,978 |

| Bond (B) | 7.850 | 03-14-29 | | 192,000 | 199,429 |

| Suriname 0.0% | | | 103,880 |

| Government of Suriname | | | | | |

| Bond | 9.250 | 10-26-26 | | 112,000 | 103,880 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 17 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Thailand 0.2% | | | $1,822,759 |

| Kingdom of Thailand | | | | | |

| Bond | 2.875 | 12-17-28 | THB | 26,210,000 | 924,678 |

| Bond | 3.775 | 06-25-32 | THB | 22,930,000 | 898,081 |

| Tunisia 0.0% | | | 322,240 |

| Banque Centrale de Tunisia | | | | | |

| Bond | 5.625 | 02-17-24 | EUR | 294,000 | 322,240 |

| Turkey 0.5% | | | 4,473,311 |

| Hazine Mustesarligi Varlik Kiralama AS | | | | | |

| Bond (B) | 5.800 | 02-21-22 | | 119,000 | 119,988 |

| Republic of Turkey | | | | | |

| Bond | 5.125 | 02-17-28 | | 75,000 | 68,545 |

| Bond | 5.750 | 03-22-24 | | 100,000 | 98,630 |

| Bond | 5.750 | 05-11-47 | | 754,000 | 639,338 |

| Bond | 6.000 | 03-25-27 | | 372,000 | 360,202 |

| Bond | 6.125 | 10-24-28 | | 389,000 | 376,033 |

| Bond | 6.250 | 09-26-22 | | 946,000 | 964,819 |

| Bond | 6.875 | 03-17-36 | | 177,000 | 173,782 |

| Bond | 7.375 | 02-05-25 | | 521,000 | 547,430 |

| Bond | 7.400 | 02-05-20 | TRY | 740,000 | 126,626 |

| Bond | 8.000 | 03-12-25 | TRY | 3,510,000 | 463,828 |

| Bond | 10.700 | 02-17-21 | TRY | 1,210,000 | 200,777 |

| Bond | 10.700 | 08-17-22 | TRY | 490,000 | 78,140 |

| Bond | 11.000 | 02-24-27 | TRY | 1,320,000 | 194,180 |

| Bond | 12.200 | 01-18-23 | TRY | 370,000 | 60,993 |

| Ukraine 0.3% | | | 2,518,393 |

| Republic of Ukraine | | | | | |

| Bond (B) | 6.750 | 06-20-26 | EUR | 705,000 | 848,517 |

| Bond (B) | 7.375 | 09-25-32 | | 431,000 | 437,896 |

| Bond | 7.750 | 09-01-23 | | 233,000 | 249,170 |

| Bond (B) | 7.750 | 09-01-26 | | 60,000 | 63,307 |

| Bond (B) | 7.750 | 09-01-27 | | 110,000 | 116,063 |

| Bond (B) | 8.994 | 02-01-24 | | 564,000 | 625,790 |

| GDP-Linked Bond (D) | 2.171* | 05-31-40 | | 209,000 | 177,650 |

| Uruguay 0.3% | | | 2,668,537 |

| Republic of Uruguay | | | | | |

| Bond | 4.125 | 11-20-45 | | 197,000 | 203,700 |

| Bond | 4.375 | 10-27-27 | | 723,000 | 787,173 |

| Bond | 5.100 | 06-18-50 | | 781,865 | 893,289 |

| Bond | 5.625 | 06-19-47 | | 628,000 | 714,350 |

| Bond (B) | 8.500 | 03-15-28 | UYU | 2,670,000 | 70,025 |

| Venezuela 0.0% | | | 209,535 |

| Republic of Venezuela | | | | | |

| Bond (E) | 7.750 | 10-13-19 | | 1,374,000 | 209,535 |

| 18 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Zambia 0.0% | | | $422,467 |

| Republic of Zambia | | | | | |

| Bond (B) | 5.375 | 09-20-22 | | 56,000 | 39,284 |

|

| Bond (B) | 8.500 | 04-14-24 | | 533,000 | 383,183 |

| Corporate bonds 38.7% | | | $339,457,988 |

| (Cost $328,772,202) | | | | | |

| Communication services 4.7% | | 41,670,411 |

| Diversified telecommunication services 1.0% | | |

| Altice France SA (B) | 7.375 | 05-01-26 | | 720,000 | 761,544 |

| AT&T, Inc. | 4.350 | 03-01-29 | | 2,225,000 | 2,403,599 |

| Axtel SAB de CV (B) | 6.375 | 11-14-24 | | 214,000 | 221,225 |

| Frontier Communications Corp. | 9.000 | 08-15-31 | | 704,000 | 381,920 |

| Frontier Communications Corp. | 10.500 | 09-15-22 | | 150,000 | 93,750 |

| Intelsat Jackson Holdings SA | 5.500 | 08-01-23 | | 525,000 | 483,656 |

| Midcontinent Communications (B) | 5.375 | 08-15-27 | | 230,000 | 235,750 |

| UPCB Finance IV, Ltd. (B) | 5.375 | 01-15-25 | | 485,000 | 497,125 |

| Verizon Communications, Inc. (B) | 4.016 | 12-03-29 | | 2,115,000 | 2,294,934 |

| Zayo Group LLC (B) | 5.750 | 01-15-27 | | 725,000 | 735,875 |

| Ziggo BV (B) | 5.500 | 01-15-27 | | 510,000 | 520,838 |

| Entertainment 0.1% | | |

| Lions Gate Capital Holdings LLC (B) | 6.375 | 02-01-24 | | 480,000 | 503,400 |

| Netflix, Inc. | 4.875 | 04-15-28 | | 645,000 | 666,366 |

| Interactive media and services 0.3% | | |

| Tencent Holdings, Ltd. (B) | 3.595 | 01-19-28 | | 2,300,000 | 2,370,391 |

| Media 2.6% | | |

| AMC Networks, Inc. | 4.750 | 08-01-25 | | 750,000 | 763,125 |

| Cablevision Systems Corp. | 5.875 | 09-15-22 | | 515,000 | 547,188 |

| CCO Holdings LLC (B) | 5.125 | 05-01-27 | | 520,000 | 536,250 |

| CCO Holdings LLC (B) | 5.375 | 06-01-29 | | 590,000 | 611,388 |

| CCO Holdings LLC (B) | 5.500 | 05-01-26 | | 410,000 | 427,938 |

| Charter Communications Operating LLC | 6.384 | 10-23-35 | | 1,600,000 | 1,888,923 |

| Charter Communications Operating LLC | 6.484 | 10-23-45 | | 1,375,000 | 1,617,050 |

| Comcast Corp. | 4.700 | 10-15-48 | | 2,100,000 | 2,463,750 |

| Cox Communications, Inc. (B) | 3.500 | 08-15-27 | | 2,275,000 | 2,328,064 |

| CSC Holdings LLC (B) | 7.500 | 04-01-28 | | 650,000 | 715,813 |

| Discovery Communications LLC | 3.950 | 03-20-28 | | 2,200,000 | 2,270,168 |

| DISH DBS Corp. | 7.750 | 07-01-26 | | 1,555,000 | 1,516,125 |

| Nexstar Broadcasting, Inc. (B) | 5.625 | 08-01-24 | | 515,000 | 534,956 |

| Omnicom Group, Inc. | 3.600 | 04-15-26 | | 2,100,000 | 2,169,990 |

| Sirius XM Radio, Inc. (B) | 4.625 | 07-15-24 | | 260,000 | 267,618 |

| Sirius XM Radio, Inc. (B) | 5.000 | 08-01-27 | | 785,000 | 809,531 |

| Telenet Finance Luxembourg Notes Sarl (B) | 5.500 | 03-01-28 | | 600,000 | 608,407 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 19 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | | |

| Media (continued) | | |

| The Interpublic Group of Companies, Inc. | 4.650 | 10-01-28 | | 2,150,000 | $2,377,902 |

| Unitymedia GmbH (B) | 6.125 | 01-15-25 | | 305,000 | 317,581 |

| Virgin Media Secured Finance PLC (B) | 5.500 | 05-15-29 | | 585,000 | 599,333 |

| Wireless telecommunication services 0.7% | | |

| Millicom International Cellular SA (B) | 6.250 | 03-25-29 | | 139,000 | 150,016 |

| Sprint Capital Corp. | 8.750 | 03-15-32 | | 1,100,000 | 1,368,125 |

| T-Mobile USA, Inc. | 5.375 | 04-15-27 | | 645,000 | 684,506 |

| T-Mobile USA, Inc. | 6.500 | 01-15-26 | | 325,000 | 346,028 |

| Vodafone Group PLC | 5.000 | 05-30-38 | | 3,250,000 | 3,580,263 |

| Consumer discretionary 3.8% | | 33,312,181 |

| Auto components 0.2% | | |

| Dana Financing Luxembourg Sarl (B) | 6.500 | 06-01-26 | | 385,000 | 400,400 |

| Lear Corp. | 5.250 | 05-15-49 | | 1,175,000 | 1,168,570 |

| Panther BF Aggregator 2 LP (B) | 6.250 | 05-15-26 | | 495,000 | 512,177 |

| Automobiles 1.2% | | |

| BMW US Capital LLC (B) | 3.625 | 04-18-29 | | 2,200,000 | 2,342,579 |

| Ford Motor Credit Company LLC | 4.389 | 01-08-26 | | 2,125,000 | 2,134,746 |

| General Motors Financial Company, Inc. | 4.300 | 07-13-25 | | 2,300,000 | 2,370,274 |

| Hyundai Capital America (B) | 3.000 | 10-30-20 | | 2,300,000 | 2,305,956 |

| Hyundai Capital America (B) | 3.250 | 09-20-22 | | 1,175,000 | 1,186,163 |

| Diversified consumer services 0.1% | | |

| Weight Watchers International, Inc. (B) | 8.625 | 12-01-25 | | 800,000 | 776,944 |

| Hotels, restaurants and leisure 0.9% | | |

| Boyd Gaming Corp. | 6.000 | 08-15-26 | | 220,000 | 229,900 |

| Boyd Gaming Corp. | 6.375 | 04-01-26 | | 325,000 | 342,875 |

| Churchill Downs, Inc. (B) | 5.500 | 04-01-27 | | 290,000 | 303,866 |

| Golden Nugget, Inc. (B) | 6.750 | 10-15-24 | | 365,000 | 375,724 |

| Hilton Domestic Operating Company, Inc. (B) | 4.875 | 01-15-30 | | 465,000 | 477,788 |

| International Game Technology PLC (B) | 6.250 | 01-15-27 | | 470,000 | 509,950 |

| Jacobs Entertainment, Inc. (B) | 7.875 | 02-01-24 | | 355,000 | 377,188 |

| Royal Caribbean Cruises, Ltd. | 2.650 | 11-28-20 | | 2,275,000 | 2,278,461 |

| Sands China, Ltd. | 4.600 | 08-08-23 | | 2,100,000 | 2,232,855 |

| Station Casinos LLC (B) | 5.000 | 10-01-25 | | 480,000 | 489,120 |

| Household durables 0.1% | | |

| TopBuild Corp. (B) | 5.625 | 05-01-26 | | 535,000 | 547,706 |

| Internet and direct marketing retail 0.5% | | |

| Alibaba Group Holding, Ltd. | 4.000 | 12-06-37 | | 2,100,000 | 2,207,098 |

| Amazon.com, Inc. | 3.875 | 08-22-37 | | 2,000,000 | 2,213,716 |

| 20 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer discretionary (continued) | | |

| Leisure products 0.0% | | |

| Diamond Sports Group LLC (B) | 5.375 | 08-15-26 | | 310,000 | $315,038 |

| Multiline retail 0.3% | | |

| Dollar Tree, Inc. | 4.000 | 05-15-25 | | 2,175,000 | 2,267,102 |

| JC Penney Corp., Inc. | 7.400 | 04-01-37 | | 500,000 | 120,000 |

| JC Penney Corp., Inc. (B) | 8.625 | 03-15-25 | | 210,000 | 104,475 |

| Specialty retail 0.3% | | |

| AutoZone, Inc. | 3.750 | 04-18-29 | | 2,150,000 | 2,248,066 |

| Party City Holdings, Inc. (B)(F) | 6.625 | 08-01-26 | | 775,000 | 745,938 |

| Textiles, apparel and luxury goods 0.2% | | |

| Hanesbrands, Inc. (B) | 4.625 | 05-15-24 | | 650,000 | 674,512 |

| Levi Strauss & Company | 5.000 | 05-01-25 | | 555,000 | 575,813 |

| The William Carter Company (B) | 5.625 | 03-15-27 | | 455,000 | 477,181 |

| Consumer staples 2.2% | | 19,134,038 |

| Beverages 0.3% | | |

| Cott Holdings, Inc. (B) | 5.500 | 04-01-25 | | 505,000 | 517,625 |

| Keurig Dr. Pepper, Inc. | 3.430 | 06-15-27 | | 2,200,000 | 2,234,126 |

| Food and staples retailing 0.4% | | |

| Albertsons Companies LLC | 5.750 | 03-15-25 | | 215,000 | 219,300 |

| Albertsons Companies LLC | 6.625 | 06-15-24 | | 575,000 | 599,438 |

| Ingles Markets, Inc. | 5.750 | 06-15-23 | | 654,000 | 667,080 |

| The Kroger Company | 4.450 | 02-01-47 | | 1,075,000 | 1,057,793 |

| Walmart, Inc. | 3.050 | 07-08-26 | | 1,150,000 | 1,201,220 |

| Food products 1.0% | | |

| Adecoagro SA (B) | 6.000 | 09-21-27 | | 295,000 | 282,094 |

| B&G Foods, Inc. | 5.250 | 04-01-25 | | 825,000 | 820,875 |

| Chobani LLC (B) | 7.500 | 04-15-25 | | 775,000 | 720,750 |

| Dean Foods Company (B) | 6.500 | 03-15-23 | | 470,000 | 260,850 |

| JBS Investments GmbH (B) | 6.250 | 02-05-23 | | 82,000 | 83,436 |

| JBS Investments II GmbH (B) | 7.000 | 01-15-26 | | 290,000 | 310,445 |

| JBS USA LUX SA (B) | 6.500 | 04-15-29 | | 1,065,000 | 1,143,544 |

| Mars, Inc. (B) | 3.600 | 04-01-34 | | 2,300,000 | 2,475,179 |

| Minerva Luxembourg SA (B) | 6.500 | 09-20-26 | | 187,000 | 190,506 |

| NBM US Holdings, Inc. (B) | 7.000 | 05-14-26 | | 133,000 | 137,190 |

| Pilgrim's Pride Corp. (B) | 5.750 | 03-15-25 | | 375,000 | 387,188 |

| Pilgrim's Pride Corp. (B) | 5.875 | 09-30-27 | | 410,000 | 430,500 |

| Post Holdings, Inc. (B) | 5.500 | 03-01-25 | | 420,000 | 436,800 |

| Post Holdings, Inc. (B) | 5.500 | 12-15-29 | | 420,000 | 424,725 |

| Sigma Holdco BV (B) | 7.875 | 05-15-26 | | 355,000 | 329,263 |

| Food, beverage and tobacco 0.2% | | |

| Imperial Brands Finance PLC (B) | 3.500 | 07-26-26 | | 2,000,000 | 1,990,789 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 21 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Consumer staples (continued) | | |

| Household products 0.2% | | |

| Energizer Holdings, Inc. (B) | 5.500 | 06-15-25 | | 685,000 | $695,489 |

| Spectrum Brands, Inc. | 5.750 | 07-15-25 | | 450,000 | 466,178 |

| Personal products 0.1% | | |

| Prestige Brands, Inc. (B) | 6.375 | 03-01-24 | | 610,000 | 633,455 |

| Revlon Consumer Products Corp. | 6.250 | 08-01-24 | | 615,000 | 418,200 |

| Energy 5.7% | | 49,867,219 |

| Energy equipment and services 0.3% | | |

| Apergy Corp. | 6.375 | 05-01-26 | | 405,000 | 413,100 |

| Inkia Energy, Ltd. (B) | 5.875 | 11-09-27 | | 223,000 | 232,143 |

| Nabors Industries, Inc. | 5.500 | 01-15-23 | | 840,000 | 785,400 |

| Rowan Companies, Inc. | 7.375 | 06-15-25 | | 695,000 | 524,725 |

| SESI LLC | 7.125 | 12-15-21 | | 870,000 | 635,100 |

| SESI LLC | 7.750 | 09-15-24 | | 425,000 | 255,000 |

| Oil, gas and consumable fuels 5.4% | | |

| Abu Dhabi Crude Oil Pipeline LLC (B) | 3.650 | 11-02-29 | | 303,000 | 323,786 |

| Abu Dhabi Crude Oil Pipeline LLC (B) | 4.600 | 11-02-47 | | 1,163,000 | 1,312,736 |

| AI Candelaria Spain SLU (B) | 7.500 | 12-15-28 | | 326,000 | 364,957 |

| Alta Mesa Holdings LP | 7.875 | 12-15-24 | | 460,000 | 161,000 |

| Anadarko Petroleum Corp. | 6.450 | 09-15-36 | | 1,875,000 | 2,295,626 |

| Antero Midstream Partners LP (B) | 5.750 | 03-01-27 | | 1,120,000 | 1,050,022 |

| Antero Midstream Partners LP (B) | 5.750 | 01-15-28 | | 465,000 | 434,194 |

| Antero Resources Corp. (F) | 5.000 | 03-01-25 | | 600,000 | 536,892 |

| Apache Corp. | 5.100 | 09-01-40 | | 2,150,000 | 2,129,056 |

| Boardwalk Pipelines LP | 5.950 | 06-01-26 | | 2,125,000 | 2,357,081 |

| Concho Resources, Inc. | 3.750 | 10-01-27 | | 2,300,000 | 2,369,673 |

| DCP Midstream Operating LP | 5.125 | 05-15-29 | | 450,000 | 463,500 |

| Diamondback Energy, Inc. | 4.750 | 11-01-24 | | 445,000 | 457,104 |

| Empresa Nacional del Petroleo | 3.750 | 08-05-26 | | 210,000 | 215,838 |

| Enterprise Products Operating LLC (4.875% to 8-16-22, then 3 month LIBOR + 2.986%) | 4.875 | 08-16-77 | | 2,425,000 | 2,326,691 |

| Eterna Capital Pte, Ltd. (6.500% Cash or 1.000% PIK) | 6.500 | 12-11-22 | | 114,888 | 113,021 |

| Eterna Capital Pte, Ltd. (8.000% Cash or PIK) | 8.000 | 12-11-22 | | 31,414 | 25,019 |

| Geopark, Ltd. (B) | 6.500 | 09-21-24 | | 245,000 | 254,800 |

| Hilcorp Energy I LP (B) | 5.750 | 10-01-25 | | 830,000 | 807,175 |

| KazMunayGas National Company JSC (B) | 4.750 | 04-24-25 | | 407,000 | 440,586 |

| KazMunayGas National Company JSC (B) | 4.750 | 04-19-27 | | 517,000 | 558,805 |

| KazMunayGas National Company JSC | 5.375 | 04-24-30 | | 1,114,000 | 1,248,612 |

| 22 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy (continued) | | |

| Oil, gas and consumable fuels (continued) | | |

| KazMunayGas National Company JSC (B) | 5.750 | 04-19-47 | | 249,000 | $285,186 |

| KazMunayGas National Company JSC (B) | 6.375 | 10-24-48 | | 587,000 | 709,213 |

| KazTransGas JSC (B) | 4.375 | 09-26-27 | | 547,000 | 568,966 |

| Kinder Morgan Energy Partners LP | 5.500 | 03-01-44 | | 1,050,000 | 1,194,442 |

| Laredo Petroleum, Inc. | 5.625 | 01-15-22 | | 535,000 | 494,875 |

| Marathon Petroleum Corp. | 3.800 | 04-01-28 | | 1,025,000 | 1,047,226 |

| Marathon Petroleum Corp. | 5.125 | 12-15-26 | | 1,200,000 | 1,327,586 |

| Murphy Oil Corp. | 5.750 | 08-15-25 | | 475,000 | 486,875 |

| Nostrum Oil & Gas Finance BV (B) | 7.000 | 02-16-25 | | 160,000 | 96,077 |

| Oasis Petroleum, Inc. (B) | 6.250 | 05-01-26 | | 490,000 | 464,226 |

| Oasis Petroleum, Inc. | 6.875 | 03-15-22 | | 475,000 | 472,791 |

| Pertamina Persero PT (B) | 3.650 | 07-30-29 | | 320,000 | 321,884 |

| Pertamina Persero PT | 5.250 | 05-23-21 | | 242,000 | 252,835 |

| Pertamina Persero PT (B) | 5.625 | 05-20-43 | | 513,000 | 579,686 |

| Pertamina Persero PT | 6.450 | 05-30-44 | | 363,000 | 453,627 |

| Petroamazonas EP (B) | 4.625 | 02-16-20 | | 641,667 | 638,458 |

| Petroamazonas EP (B) | 4.625 | 11-06-20 | | 200,000 | 197,536 |

| Petrobras Global Finance BV | 5.750 | 02-01-29 | | 245,000 | 263,498 |

| Petrobras Global Finance BV | 6.900 | 03-19-49 | | 211,000 | 237,132 |

| Petroleos de Venezuela SA (E) | 5.375 | 04-12-27 | | 64,000 | 8,960 |

| Petroleos de Venezuela SA (E) | 6.000 | 05-16-24 | | 3,771,996 | 528,079 |

| Petroleos de Venezuela SA (E) | 6.000 | 11-15-26 | | 1,826,000 | 255,640 |

| Petroleos de Venezuela SA (E) | 9.750 | 05-17-35 | | 3,459,000 | 484,260 |

| Petroleos del Peru SA | 4.750 | 06-19-32 | | 403,000 | 434,841 |

| Petroleos Mexicanos | 4.250 | 01-15-25 | | 336,000 | 313,992 |

| Petroleos Mexicanos | 4.625 | 09-21-23 | | 89,000 | 87,710 |

| Petroleos Mexicanos | 4.875 | 01-24-22 | | 660,000 | 666,600 |

| Petroleos Mexicanos | 7.190 | 09-12-24 | MXN | 4,586,400 | 198,043 |

| Petroleos Mexicanos | 7.470 | 11-12-26 | MXN | 2,300,000 | 94,514 |

| Petroleos Mexicanos | 9.500 | 09-15-27 | | 97,000 | 109,368 |

| Petronas Capital, Ltd. (B) | 4.500 | 03-18-45 | | 452,000 | 528,510 |

| QEP Resources, Inc. | 5.250 | 05-01-23 | | 585,000 | 532,350 |

| Range Resources Corp. | 5.000 | 03-15-23 | | 460,000 | 402,357 |

| Sabine Pass Liquefaction LLC | 5.000 | 03-15-27 | | 2,175,000 | 2,371,365 |

| Saudi Arabian Oil Company (B) | 3.500 | 04-16-29 | | 538,000 | 550,569 |

| Saudi Arabian Oil Company (B) | 4.250 | 04-16-39 | | 540,000 | 561,729 |

| Sinopec Group Overseas Development 2016, Ltd. | 2.750 | 09-29-26 | | 223,000 | 219,484 |

| Sinopec Group Overseas Development 2017, Ltd. | 3.250 | 09-13-27 | | 223,000 | 226,126 |

| Sinopec Group Overseas Development 2017, Ltd. | 3.625 | 04-12-27 | | 753,000 | 783,004 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 23 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Energy (continued) | | |

| Oil, gas and consumable fuels (continued) | | |

| Sinopec Group Overseas Development 2018, Ltd. | 4.250 | 09-12-28 | | 735,000 | $805,276 |

| SM Energy Company | 5.625 | 06-01-25 | | 145,000 | 125,788 |

| SM Energy Company | 6.125 | 11-15-22 | | 275,000 | 268,813 |

| Southwestern Energy Company | 6.200 | 01-23-25 | | 775,000 | 668,438 |

| Targa Resources Partners LP (B) | 6.500 | 07-15-27 | | 1,235,000 | 1,344,631 |

| The Oil and Gas Holding Company BSCC (B) | 7.625 | 11-07-24 | | 671,000 | 750,429 |

| Unit Corp. | 6.625 | 05-15-21 | | 515,000 | 459,959 |

| Western Midstream Operating LP | 5.300 | 03-01-48 | | 975,000 | 863,500 |

| Western Midstream Operating LP | 5.450 | 04-01-44 | | 1,375,000 | 1,261,560 |

| Whiting Petroleum Corp. | 6.625 | 01-15-26 | | 825,000 | 777,563 |

| Financials 7.0% | | 61,950,896 |

| Banks 4.9% | | |

| Banco Mercantil del Norte SA (6.750% to 9-27-24, then 5 Year CMT + 4.967%) (B)(G) | 6.750 | 09-27-24 | | 187,000 | 186,533 |

| Banco Mercantil del Norte SA (7.500% to 6-27-29, then 10 Year CMT + 5.470%) (B)(G) | 7.500 | 06-27-29 | | 124,000 | 125,116 |

| Banco Nacional de Comercio Exterior SNC (3.800% to 8-11-21, then 5 Year CMT + 3.000%) (B) | 3.800 | 08-11-26 | | 443,000 | 446,881 |

| Banco Nacional de Comercio Exterior SNC (3.800% to 8-11-21, then 5 Year CMT + 3.000%) | 3.800 | 08-11-26 | | 115,000 | 116,007 |

| Bank of America Corp. | 3.950 | 04-21-25 | | 4,100,000 | 4,297,159 |

| Bank of America Corp. (4.078% to 4-23-39, then 3 month LIBOR + 1.320%) | 4.078 | 04-23-40 | | 2,400,000 | 2,580,799 |

| Bank of Montreal | 2.500 | 06-28-24 | | 1,425,000 | 1,422,369 |

| Barclays PLC | 4.836 | 05-09-28 | | 1,000,000 | 1,017,499 |

| Barclays PLC | 5.250 | 08-17-45 | | 1,100,000 | 1,173,009 |

| Brazil Loan Trust 1 (B) | 5.477 | 07-24-23 | | 157,212 | 163,894 |

| Citigroup, Inc. | 4.400 | 06-10-25 | | 4,025,000 | 4,288,354 |

| Citigroup, Inc. (2.876% to 7-24-22, then 3 month LIBOR + 0.950%) | 2.876 | 07-24-23 | | 375,000 | 377,892 |

| Deutsche Bank AG | 3.700 | 05-30-24 | | 2,325,000 | 2,293,219 |

| Fifth Third Bancorp | 3.650 | 01-25-24 | | 2,150,000 | 2,250,609 |

| HSBC Holdings PLC (3.950% to 5-18-23, then 3 month LIBOR + 0.987%) | 3.950 | 05-18-24 | | 2,225,000 | 2,317,398 |

| Intesa Sanpaolo SpA (B) | 3.875 | 07-14-27 | | 4,575,000 | 4,430,940 |

| JPMorgan Chase & Co. | 3.625 | 12-01-27 | | 2,100,000 | 2,177,356 |

| KeyBank NA | 3.900 | 04-13-29 | | 2,150,000 | 2,294,300 |

| Mizuho Financial Group, Inc. (B) | 2.632 | 04-12-21 | | 2,325,000 | 2,329,850 |

| 24 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Financials (continued) | | |

| Banks (continued) | | |

| Santander Holdings USA, Inc. | 3.700 | 03-28-22 | | 2,175,000 | $2,223,345 |

| Standard Chartered PLC (4.247% to 1-20-22, then 3 month LIBOR + 1.150%) (B) | 4.247 | 01-20-23 | | 2,225,000 | 2,291,850 |

| Synovus Financial Corp. | 3.125 | 11-01-22 | | 2,325,000 | 2,327,906 |

| The Royal Bank of Scotland Group PLC | 6.100 | 06-10-23 | | 1,975,000 | 2,125,530 |

| Ukreximbank Via Biz Finance PLC | 9.625 | 04-27-22 | | 181,500 | 190,461 |

| Capital markets 1.0% | | |

| 1MDB Global Investments, Ltd. | 4.400 | 03-09-23 | | 2,000,000 | 1,934,346 |

| Credit Suisse Group AG (4.207% to 6-12-23, then 3 month LIBOR + 1.240%) (B) | 4.207 | 06-12-24 | | 2,250,000 | 2,356,341 |

| The Goldman Sachs Group, Inc. (2.905% to 7-24-22, then 3 month LIBOR + 0.990%) | 2.905 | 07-24-23 | | 2,275,000 | 2,292,639 |

| UBS Group Funding Switzerland AG (B) | 2.650 | 02-01-22 | | 2,300,000 | 2,310,616 |

| Consumer finance 0.7% | | |

| Capital One Financial Corp. | 3.750 | 03-09-27 | | 3,275,000 | 3,403,281 |

| Synchrony Financial | 3.700 | 08-04-26 | | 2,400,000 | 2,421,904 |

| Diversified financial services 0.3% | | |

| GE Capital International Funding Company Unlimited Company | 3.373 | 11-15-25 | | 2,325,000 | 2,367,558 |

| MDC-GMTN BV (B) | 4.500 | 11-07-28 | | 234,000 | 262,997 |

| Insurance 0.1% | | |

| Nippon Life Insurance Company (5.100% to 10-16-24, then 5 Year U.S. ISDAFIX + 3.650%) (B) | 5.100 | 10-16-44 | | 1,075,000 | 1,152,938 |

| Health care 1.9% | | 16,941,685 |

| Health care equipment and supplies 0.0% | | |

| Hologic, Inc. (B) | 4.375 | 10-15-25 | | 370,000 | 371,569 |

| Health care providers and services 1.3% | | |

| CVS Health Corp. | 4.100 | 03-25-25 | | 2,125,000 | 2,236,765 |

| CVS Health Corp. | 4.780 | 03-25-38 | | 125,000 | 132,398 |

| DaVita, Inc. | 5.000 | 05-01-25 | | 580,000 | 568,412 |

| HCA, Inc. | 5.250 | 06-15-49 | | 2,750,000 | 2,894,018 |

| HCA, Inc. | 5.375 | 09-01-26 | | 595,000 | 644,088 |

| HCA, Inc. | 5.625 | 09-01-28 | | 790,000 | 871,133 |

| Tenet Healthcare Corp. | 4.625 | 07-15-24 | | 675,000 | 687,656 |

| Tenet Healthcare Corp. (B) | 6.250 | 02-01-27 | | 605,000 | 626,175 |

| UnitedHealth Group, Inc. | 3.875 | 08-15-59 | | 2,825,000 | 2,842,018 |

| Life sciences tools and services 0.1% | | |

| Charles River Laboratories International, Inc. (B) | 5.500 | 04-01-26 | | 720,000 | 761,400 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 25 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Health care (continued) | | |

| Pharmaceuticals 0.5% | | |

| Bausch Health Companies, Inc. (B) | 6.125 | 04-15-25 | | 815,000 | $834,112 |

| Bausch Health Companies, Inc. (B) | 7.000 | 01-15-28 | | 695,000 | 715,850 |

| Catalent Pharma Solutions, Inc. (B) | 5.000 | 07-15-27 | | 230,000 | 236,325 |

| Endo DAC (B) | 6.000 | 02-01-25 | | 630,000 | 378,000 |

| IQVIA, Inc. (B) | 5.000 | 05-15-27 | | 580,000 | 604,580 |

| Mallinckrodt International Finance SA (B) | 5.625 | 10-15-23 | | 490,000 | 309,778 |

| Par Pharmaceutical, Inc. (B) | 7.500 | 04-01-27 | | 215,000 | 195,113 |

| Teva Pharmaceutical Finance Netherlands III BV | 2.200 | 07-21-21 | | 1,100,000 | 1,032,295 |

| Industrials 2.9% | | 25,117,081 |

| Aerospace and defense 0.4% | | |

| The Boeing Company | 3.600 | 05-01-34 | | 2,325,000 | 2,433,235 |

| TransDigm, Inc. (B) | 6.250 | 03-15-26 | | 700,000 | 734,125 |

| Air freight and logistics 0.4% | | |

| FedEx Corp. | 4.400 | 01-15-47 | | 2,300,000 | 2,361,299 |

| Gol Finance, Inc. (B) | 7.000 | 01-31-25 | | 310,000 | 312,325 |

| Park-Ohio Industries, Inc. | 6.625 | 04-15-27 | | 535,000 | 533,663 |

| XPO Logistics, Inc. (B) | 6.125 | 09-01-23 | | 200,000 | 205,820 |

| XPO Logistics, Inc. (B) | 6.750 | 08-15-24 | | 225,000 | 239,839 |

| Building products 0.2% | | |

| American Woodmark Corp. (B) | 4.875 | 03-15-26 | | 670,000 | 664,138 |

| Griffon Corp. | 5.250 | 03-01-22 | | 870,000 | 866,738 |

| Commercial services and supplies 0.6% | | |

| ACCO Brands Corp. (B) | 5.250 | 12-15-24 | | 725,000 | 743,125 |

| Covanta Holding Corp. | 5.875 | 07-01-25 | | 655,000 | 679,563 |

| GFL Environmental, Inc. (B) | 8.500 | 05-01-27 | | 465,000 | 509,175 |

| Waste Management, Inc. | 4.150 | 07-15-49 | | 2,125,000 | 2,346,903 |

| Waste Pro USA, Inc. (B) | 5.500 | 02-15-26 | | 480,000 | 490,800 |

| West Corp. (B) | 8.500 | 10-15-25 | | 490,000 | 412,825 |

| Electrical equipment 0.1% | | |

| Resideo Funding, Inc. (B) | 6.125 | 11-01-26 | | 710,000 | 749,938 |

| Machinery 0.2% | | |

| Allison Transmission, Inc. (B) | 4.750 | 10-01-27 | | 400,000 | 400,000 |

| Mueller Water Products, Inc. (B) | 5.500 | 06-15-26 | | 475,000 | 495,188 |

| SPX FLOW, Inc. (B) | 5.625 | 08-15-24 | | 700,000 | 728,875 |

| Road and rail 0.2% | | |

| Ryder System, Inc. | 3.875 | 12-01-23 | | 2,000,000 | 2,101,971 |

| Trading companies and distributors 0.7% | | |

| Air Lease Corp. | 3.625 | 12-01-27 | | 3,550,000 | 3,592,684 |

| GATX Corp. | 4.550 | 11-07-28 | | 2,100,000 | 2,286,927 |

| 26 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Industrials (continued) | | |

| Trading companies and distributors (continued) | | |

| United Rentals North America, Inc. | 6.500 | 12-15-26 | | 625,000 | $676,375 |

| Transportation infrastructure 0.1% | | |

| Aeropuerto Internacional de Tocumen SA | 5.625 | 05-18-36 | | 243,000 | 275,805 |

| Aeropuerto Internacional de Tocumen SA (B) | 6.000 | 11-18-48 | | 184,000 | 223,790 |

| Rumo Luxembourg Sarl (B) | 7.375 | 02-09-24 | | 48,000 | 51,955 |

| Information technology 1.4% | | 12,119,292 |

| Communications equipment 0.2% | | |

| Hughes Satellite Systems Corp. | 6.625 | 08-01-26 | | 675,000 | 727,961 |

| ViaSat, Inc. (B) | 5.625 | 04-15-27 | | 475,000 | 496,366 |

| IT services 0.3% | | |

| Fiserv, Inc. | 3.200 | 07-01-26 | | 2,375,000 | 2,427,897 |

| Semiconductors and semiconductor equipment 0.7% | | |

| Broadcom, Inc. (B) | 4.250 | 04-15-26 | | 2,275,000 | 2,292,510 |

| Entegris, Inc. (B) | 4.625 | 02-10-26 | | 645,000 | 653,063 |

| Qorvo, Inc. | 5.500 | 07-15-26 | | 520,000 | 547,716 |

| Versum Materials, Inc. (B) | 5.500 | 09-30-24 | | 540,000 | 577,800 |

| Xilinx, Inc. | 2.950 | 06-01-24 | | 2,250,000 | 2,280,493 |

| Software 0.1% | | |

| Nuance Communications, Inc. | 5.625 | 12-15-26 | | 600,000 | 633,000 |

| SS&C Technologies, Inc. (B) | 5.500 | 09-30-27 | | 560,000 | 582,400 |

| Technology hardware, storage and peripherals 0.1% | | |

| Seagate HDD Cayman | 4.875 | 06-01-27 | | 896,000 | 900,086 |

| Materials 3.7% | | 32,274,111 |

| Chemicals 1.2% | | |

| Axalta Coating Systems LLC (B) | 4.875 | 08-15-24 | | 450,000 | 463,500 |

| CF Industries, Inc. | 5.150 | 03-15-34 | | 925,000 | 913,438 |

| CNAC HK Finbridge Company, Ltd. | 3.500 | 07-19-22 | | 328,000 | 329,536 |

| CNAC HK Finbridge Company, Ltd. | 5.125 | 03-14-28 | | 1,290,000 | 1,428,467 |

| Element Solutions, Inc. (B) | 5.875 | 12-01-25 | | 765,000 | 778,388 |

| GCP Applied Technologies, Inc. (B) | 5.500 | 04-15-26 | | 450,000 | 461,250 |

| Huntsman International LLC | 4.500 | 05-01-29 | | 2,250,000 | 2,315,458 |

| INEOS Group Holdings SA (B)(F) | 5.625 | 08-01-24 | | 255,000 | 254,363 |

| Nutrien, Ltd. | 5.000 | 04-01-49 | | 2,150,000 | 2,401,344 |

| OCI NV (B) | 6.625 | 04-15-23 | | 890,000 | 923,566 |

| OCP SA (B) | 6.875 | 04-25-44 | | 196,000 | 235,153 |

| Trinseo Materials Operating SCA (B) | 5.375 | 09-01-25 | | 235,000 | 222,369 |

| Construction materials 0.3% | | |

| U.S. Concrete, Inc. | 6.375 | 06-01-24 | | 515,000 | 535,600 |

| Vulcan Materials Company | 4.500 | 06-15-47 | | 2,300,000 | 2,274,346 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 27 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Materials (continued) | | |

| Containers and packaging 0.6% | | |

| Ardagh Packaging Finance PLC (B) | 4.125 | 08-15-26 | | 170,000 | $170,213 |

| Ardagh Packaging Finance PLC (B) | 6.000 | 02-15-25 | | 925,000 | 955,063 |

| Berry Global, Inc. (B) | 4.500 | 02-15-26 | | 540,000 | 539,179 |

| Berry Global, Inc. | 5.125 | 07-15-23 | | 245,000 | 250,206 |

| Cascades, Inc. (B) | 5.500 | 07-15-22 | | 685,000 | 691,850 |

| Crown Americas LLC | 4.750 | 02-01-26 | | 575,000 | 591,100 |

| Plastipak Holdings, Inc. (B)(F) | 6.250 | 10-15-25 | | 275,000 | 246,895 |

| WRKCo, Inc. | 3.900 | 06-01-28 | | 1,600,000 | 1,653,569 |

| Metals and mining 1.2% | | |

| Anglo American Capital PLC (B) | 4.000 | 09-11-27 | | 2,350,000 | 2,373,062 |

| ArcelorMittal | 4.550 | 03-11-26 | | 2,150,000 | 2,253,246 |

| Corp. Nacional del Cobre de Chile (B) | 3.625 | 08-01-27 | | 114,000 | 118,449 |

| Corp. Nacional del Cobre de Chile (B) | 4.375 | 02-05-49 | | 1,386,000 | 1,492,597 |

| Corp. Nacional del Cobre de Chile (B) | 4.500 | 09-16-25 | | 709,000 | 767,184 |

| Corp. Nacional del Cobre de Chile | 5.625 | 10-18-43 | | 136,000 | 171,150 |

| Freeport-McMoRan, Inc. | 4.550 | 11-14-24 | | 460,000 | 471,730 |

| Freeport-McMoRan, Inc. | 5.450 | 03-15-43 | | 425,000 | 393,482 |

| Indonesia Asahan Aluminium Persero PT (B) | 5.710 | 11-15-23 | | 195,000 | 214,695 |

| Kaiser Aluminum Corp. | 5.875 | 05-15-24 | | 510,000 | 530,400 |

| Newmont Goldcorp Corp. | 6.250 | 10-01-39 | | 975,000 | 1,264,963 |

| Paper and forest products 0.4% | | |

| Boise Cascade Company (B) | 5.625 | 09-01-24 | | 850,000 | 871,250 |

| Flex Acquisition Company, Inc. (B) | 6.875 | 01-15-25 | | 340,000 | 301,750 |

| Louisiana-Pacific Corp. | 4.875 | 09-15-24 | | 580,000 | 591,600 |

| Mercer International, Inc. | 5.500 | 01-15-26 | | 835,000 | 801,600 |

| Norbord, Inc. (B) | 5.750 | 07-15-27 | | 440,000 | 444,400 |

| Norbord, Inc. (B) | 6.250 | 04-15-23 | | 545,000 | 577,700 |

| Real estate 2.4% | | 20,972,243 |

| Equity real estate investment trusts 2.1% | | |

| American Homes 4 Rent LP | 4.250 | 02-15-28 | | 2,250,000 | 2,354,452 |

| Crown Castle International Corp. | 3.200 | 09-01-24 | | 2,250,000 | 2,295,351 |

| Digital Realty Trust LP | 2.750 | 02-01-23 | | 100,000 | 99,996 |

| Digital Realty Trust LP | 4.750 | 10-01-25 | | 1,975,000 | 2,155,276 |

| HCP, Inc. | 3.250 | 07-15-26 | | 1,700,000 | 1,719,473 |

| MGM Growth Properties Operating Partnership LP (B) | 5.750 | 02-01-27 | | 745,000 | 803,862 |

| Office Properties Income Trust | 4.250 | 05-15-24 | | 2,475,000 | 2,502,359 |

| Public Storage | 3.385 | 05-01-29 | | 2,275,000 | 2,388,095 |

| SITE Centers Corp. | 4.250 | 02-01-26 | | 2,125,000 | 2,232,389 |

| Welltower, Inc. | 3.950 | 09-01-23 | | 2,075,000 | 2,180,361 |

| 28 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Real estate (continued) | | |

| Real estate investment trusts 0.3% | | |

| WEA Finance LLC (B) | 3.500 | 06-15-29 | | 2,200,000 | $2,240,629 |

| Utilities 3.0% | | 26,098,831 |

| Electric utilities 1.6% | | |

| Electricite de France SA (B) | 4.500 | 09-21-28 | | 2,050,000 | 2,260,403 |

| Enel Finance International NV (B) | 4.625 | 09-14-25 | | 3,350,000 | 3,603,675 |

| Eskom Holdings SOC, Ltd. (B) | 5.750 | 01-26-21 | | 307,000 | 307,768 |

| Eskom Holdings SOC, Ltd. (B) | 7.125 | 02-11-25 | | 118,000 | 122,425 |

| Eskom Holdings SOC, Ltd. (B) | 8.450 | 08-10-28 | | 125,000 | 137,882 |

| FirstEnergy Corp. | 4.850 | 07-15-47 | | 2,075,000 | 2,385,317 |

| Georgia Power Company | 4.300 | 03-15-42 | | 1,100,000 | 1,177,557 |

| NextEra Energy Capital Holdings, Inc. | 3.342 | 09-01-20 | | 2,200,000 | 2,221,493 |

| NSTAR Electric Company | 3.200 | 05-15-27 | | 1,025,000 | 1,058,498 |

| Vistra Operations Company LLC (B) | 5.000 | 07-31-27 | | 220,000 | 225,225 |

| Vistra Operations Company LLC (B) | 5.625 | 02-15-27 | | 645,000 | 680,475 |

| Gas utilities 0.1% | | |

| Southern Gas Corridor CJSC | 6.875 | 03-24-26 | | 400,000 | 469,743 |

| Independent power and renewable electricity producers 0.6% | | |

| Calpine Corp. | 5.750 | 01-15-25 | | 716,000 | 716,000 |

| Exelon Generation Company LLC | 5.600 | 06-15-42 | | 2,050,000 | 2,343,187 |

| Minejesa Capital BV (B) | 4.625 | 08-10-30 | | 217,000 | 221,352 |

| Minejesa Capital BV (B) | 5.625 | 08-10-37 | | 33,000 | 35,441 |

| Mong Duong Finance Holdings BV (B) | 5.125 | 05-07-29 | | 214,000 | 216,067 |

| NRG Energy, Inc. | 5.750 | 01-15-28 | | 645,000 | 686,925 |

| Vistra Energy Corp. (B) | 8.000 | 01-15-25 | | 630,000 | 666,225 |

| Multi-utilities 0.7% | | |

| ACWA Power Management and Investments One, Ltd. (B) | 5.950 | 12-15-39 | | 637,000 | 683,466 |

| CenterPoint Energy, Inc. | 4.250 | 11-01-28 | | 2,100,000 | 2,285,715 |

| Cometa Energia SA de CV (B) | 6.375 | 04-24-35 | | 200,850 | 209,135 |

| Dominion Energy, Inc. | 2.579 | 07-01-20 | | 2,275,000 | 2,275,946 |

|

| Sempra Energy | 4.000 | 02-01-48 | | 1,100,000 | 1,108,911 |

| Term loans (H) 18.1% | | | $159,019,802 |

| (Cost $162,573,985) | | | | | |

| Communication services 3.4% | 29,675,375 |

| Diversified telecommunication services 1.0% | | |

| Altice France SA, USD Term Loan B11 (1 month LIBOR + 2.750%) | 4.984 | 07-31-25 | | 1,680,254 | 1,617,244 |

| Consolidated Communications, Inc., 2016 Term Loan B (1 month LIBOR + 3.000%) | 5.240 | 10-04-23 | | 1,619,319 | 1,508,866 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | 29 |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | |

| Diversified telecommunication services (continued) | | |

| Conterra Ultra Broadband Holdings, Inc., Term Loan (2 month LIBOR + 4.500%) | 6.840 | 04-24-26 | | 900,000 | $902,250 |

| Frontier Communications Corp., 2017 Term Loan B1 (1 month LIBOR + 3.750%) | 5.990 | 06-15-24 | | 1,588,023 | 1,568,173 |

| Intelsat Jackson Holdings SA, 2017 Term Loan B3 (1 month LIBOR + 3.750%) | 5.991 | 11-27-23 | | 835,000 | 836,787 |

| Level 3 Parent LLC, 2017 Term Loan B (1 month LIBOR + 2.250%) | 4.484 | 02-22-24 | | 964,000 | 964,405 |

| Telesat Canada, Term Loan B4 (3 month LIBOR + 2.500%) | 4.830 | 11-17-23 | | 1,684,249 | 1,684,249 |

| Entertainment 0.1% | | |

| UFC Holdings LLC, 2019 Term Loan (1 month LIBOR + 3.250%) | 5.490 | 04-29-26 | | 1,117,949 | 1,119,693 |

| Interactive media and services 0.3% | | |

| MH Sub I LLC, 2017 1st Lien Term Loan (1 month LIBOR + 3.750%) | 5.984 | 09-13-24 | | 1,344,281 | 1,335,879 |

| TierPoint LLC, 2017 1st Lien Term Loan (1 month LIBOR + 3.750%) | 5.984 | 05-06-24 | | 936,198 | 865,983 |

| Media 1.6% | | |

| Charter Communications Operating LLC, 2017 Term Loan B (3 month LIBOR + 2.000%) | 4.330 | 04-30-25 | | 1,112,503 | 1,114,149 |

| Cogeco Communications USA II LP, 2017 1st Lien Term Loan (1 month LIBOR + 2.250%) | 4.484 | 01-03-25 | | 1,029,800 | 1,026,968 |

| Creative Artists Agency LLC, 2018 Term Loan B (1 month LIBOR + 3.000%) | 5.234 | 02-15-24 | | 1,676,508 | 1,679,023 |

| CSC Holdings LLC, 2017 1st Lien Term Loan (1 month LIBOR + 2.250%) | 4.575 | 07-17-25 | | 1,705,378 | 1,698,983 |

| Cumulus Media New Holdings, Inc., Exit Term Loan (1 month LIBOR + 4.500%) | 6.740 | 05-15-22 | | 741,024 | 745,656 |

| Hubbard Radio LLC, 2015 Term Loan B (1 month LIBOR + 3.500%) | 5.740 | 03-28-25 | | 770,235 | 767,670 |

| Nascar Holdings, Inc., Term Loan B (I) | TBD | 07-26-26 | | 995,000 | 999,358 |

| Tribune Media Company, Term Loan (1 month LIBOR + 3.000%) | 5.234 | 12-27-20 | | 183,524 | 183,294 |

| Tribune Media Company, Term Loan C (1 month LIBOR + 3.000%) | 5.234 | 01-27-24 | | 2,287,387 | 2,283,110 |

| Unitymedia Finance LLC, Term Loan B (3 month LIBOR + 2.250%) | 4.604 | 09-30-25 | | 1,825,000 | 1,823,431 |

| Virgin Media Bristol LLC, USD Term Loan K (1 month LIBOR + 2.500%) | 4.825 | 01-15-26 | | 1,325,000 | 1,327,491 |

| 30 | JOHN HANCOCK SHORT DURATION CREDIT OPPORTUNITIES FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

| Communication services (continued) | |

| Wireless telecommunication services 0.4% | | |

| SBA Senior Finance II LLC, 2018 Term Loan B (1 month LIBOR + 2.000%) | 4.240 | 04-11-25 | | 1,434,903 | $1,430,326 |

| Sprint Communications, Inc., 1st Lien Term Loan B (1 month LIBOR + 2.500%) | 4.750 | 02-02-24 | | 1,418,477 | 1,414,577 |

| Syniverse Holdings, Inc., 2018 1st Lien Term Loan (1 month LIBOR + 5.000%) | 7.325 | 03-09-23 | | 850,996 | 777,810 |

| Consumer discretionary 2.3% | 20,432,437 |

| Auto components 0.0% | | |

| Panther BF Aggregator 2 LP, USD Term Loan B (1 month LIBOR + 3.500%) | 5.734 | 04-30-26 | | 560,000 | 559,653 |

| Diversified consumer services 0.4% | | |

| PCI Gaming Authority, Term Loan (1 month LIBOR + 3.000%) | 5.234 | 05-29-26 | | 695,000 | 699,594 |

| Sunshine Luxembourg VII Sarl, Term Loan (I) | TBD | 07-16-26 | | 1,045,000 | 1,048,396 |

| Weight Watchers International, Inc., 2017 Term Loan B (1 and 3 month LIBOR + 4.750%) | 7.095 | 11-29-24 | | 1,564,830 | 1,550,167 |

| Whatabrands LLC, Term Loan B (I) | TBD | 07-23-26 | | 410,000 | 411,283 |

| Hotels, restaurants and leisure 0.9% | | |

| 1011778 BC ULC, Term Loan B3 (1 month LIBOR + 2.250%) | 4.484 | 02-16-24 | | 945,278 | 945,042 |