UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21779

JOHN HANCOCK FUNDS II

---------------------------------------------------------

(Exact name of registrant as specified in charter)

200 BERKLEY STREET, BOSTON, MA 02116

-------------------------------------------------------------

(Address of principal executive offices) (Zip code)

SALVATORE SCHIAVONE, 200 Berkeley Street, BOSTON, MA 02116

------------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 663-4497

--------------

Date of fiscal year end: August 31

------

Date of reporting period: August 31, 2020

-------

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared seven annual reports to shareholders for the period ended August 31, 2020. The first report applies to the Alternative Asset Allocation Fund, the second report applies to the Floating Rate Income Fund, the third report applies to the Multi-Asset High Income Fund (formerly Income Allocation Fund), the fourth report applies to the New Opportunities Fund, the fifth report applies to the Strategic Income Opportunities Fund, the sixth report applies to the 16 of the Registrant’s Funds, and the seventh applies to 5 of the Registrant’s Funds.

John Hancock

Alternative Asset Allocation Fund

Annual report 8/31/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A and Class C shares) or 888-972-8696 (Class I and Class R Suite) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

Despite the heightened fears over the coronavirus (COVID-19), which sent markets tumbling during the latter half of February and early March, global financial markets delivered positive returns for the 12-month period ended August 31, 2020. In response to the first-quarter sell-off, the U.S. Federal Reserve acted quickly, lowering interest rates to near zero and reinstating quantitative easing, as well as announcing its plans to shore up short-term debt. Many other nations followed suit and credit spreads rebounded off their highs as liquidity concerns eased.

Of course, it would be a mistake to consider the market's turnaround a trustworthy signal of assured or swift economic recovery. While there has been economic growth in much of the developed world, the pace has slowed in many areas as spending remains far below prepandemic levels.

From an investment perspective, we continue to think that maintaining a focus on long-term objectives while pursuing a risk-aware strategy is a prudent way forward. Above all, we believe the counsel of a trusted financial professional continues to matter now more than ever. Periods of heightened uncertainty are precisely the time to review your financial goals and follow a plan that helps you make the most of what continues to be a challenging situation.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Alternative Asset Allocation Fund

Table of contents

| | | |

| 2 | | Your fund at a glance |

| 4 | | Manager's discussion of fund performance |

| 6 | | A look at performance |

| 8 | | Your expenses |

| 10 | | Fund's investments |

| 12 | | Financial statements |

| 16 | | Financial highlights |

| 22 | | Notes to financial statements |

| 31 | | Report of independent registered public accounting firm |

| 32 | | Tax information |

| 33 | | Continuation of investment advisory and subadvisory agreements |

| 40 | | Statement regarding liquidity risk management |

| 43 | | Trustees and Officers |

| 47 | | More information |

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 1

INVESTMENT OBJECTIVE

The fund seeks long-term growth of capital.

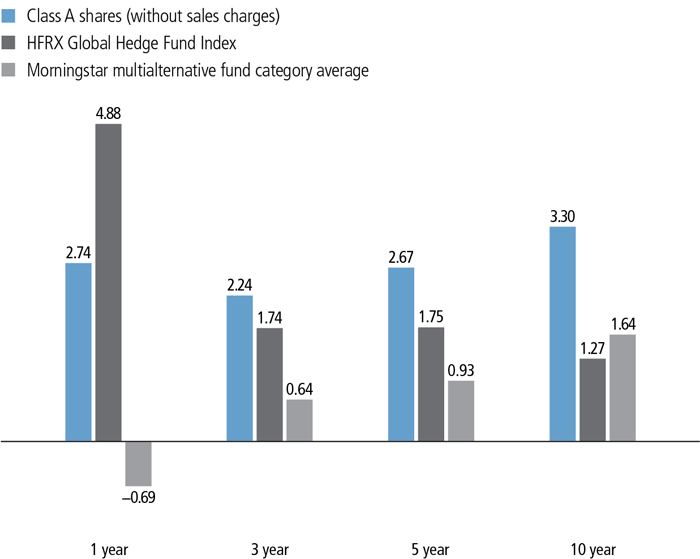

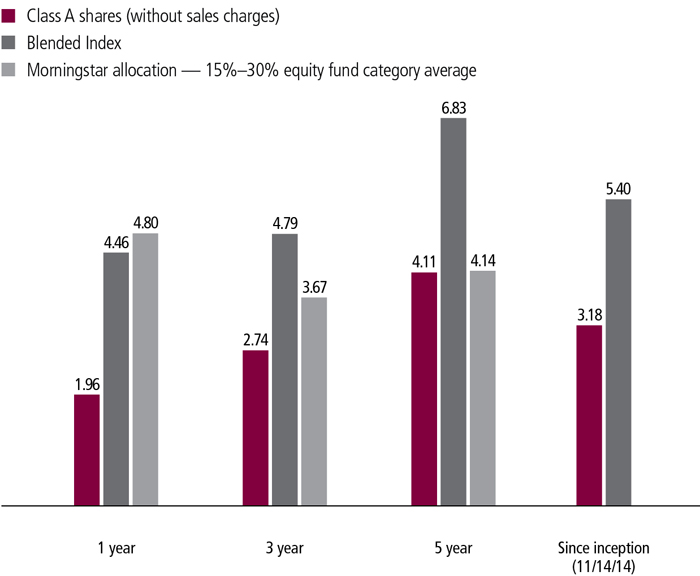

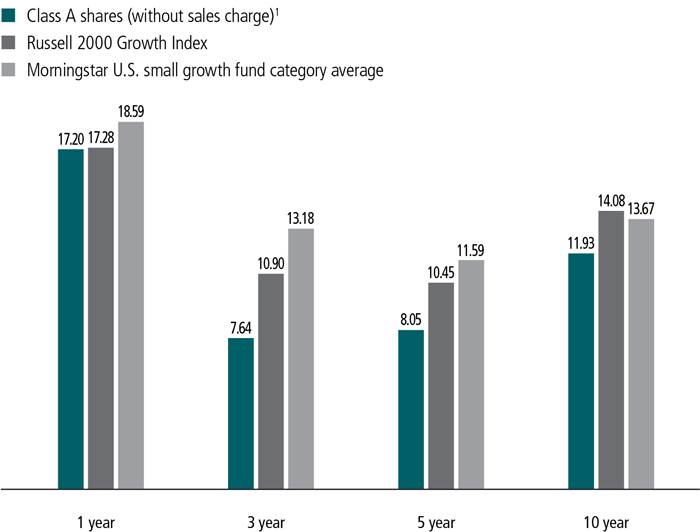

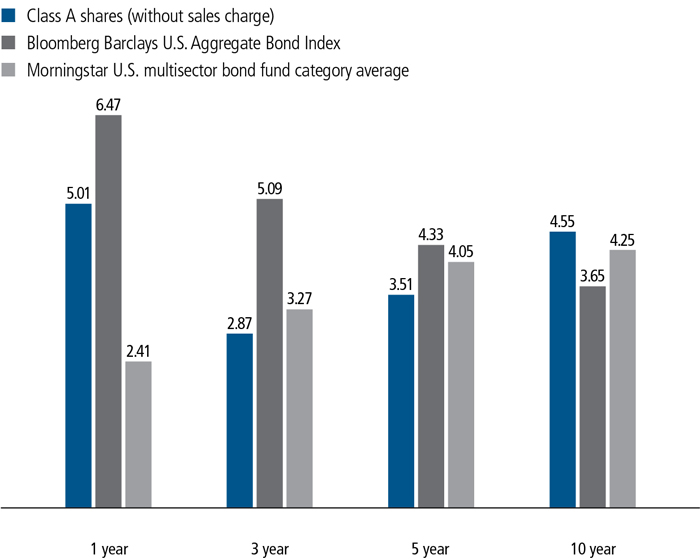

AVERAGE ANNUAL TOTAL RETURNS AS OF 8/31/2020 (%)

The HFRX Global Hedge Fund Index is composed of all eligible hedge fund strategies including four principal strategies: equity hedge, event driven, macro/managed futures, and relative value arbitrage.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

The fund's Morningstar category average is a group of funds with similar investment objectives and strategies and is the equal-weighted return of all funds per category. Morningstar places funds in certain categories based on their historical portfolio holdings. Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower. Since-inception returns for the Morningstar fund category average are not available.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 2

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

Financial assets experienced elevated volatility

Higher-risk asset categories—after performing well through mid-February—sold off sharply in response to the economic slowdown caused by the coronavirus pandemic, but they regained the lost ground from April onward.

The fund delivered a positive return, but it underperformed its benchmark, the HFRX Global Hedge Fund Index

Absolute return strategies, while experiencing more limited downside than the broader financial markets in the February-March sell-off, detracted for the full period.

The Alternative Investment Approaches portfolio contributed

This segment of the portfolio, where the underlying managers use opportunistic techniques, was a positive driver of performance.

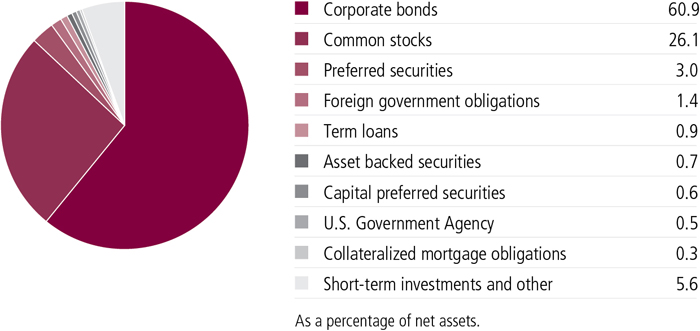

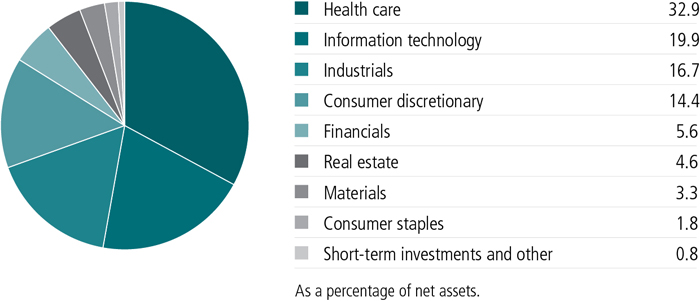

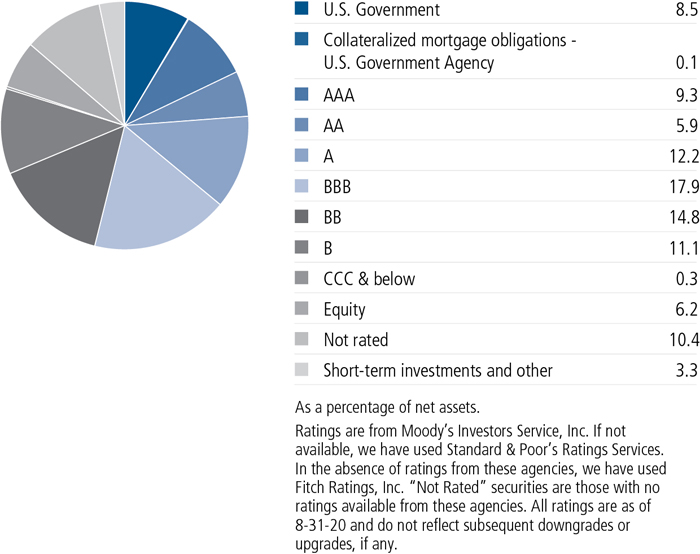

ASSET ALLOCATION AS OF 8/31/2020 (%)

| | | |

| Affiliated investment companies | 74.8 |

| | Absolute return strategies | 35.3 |

| | Alternative investment approaches | 32.4 |

| | Alternative markets | 7.1 |

| Unaffiliated investment companies | 25.1 |

| | Absolute return strategies | 11.8 |

| | Alternative investment approaches | 9.4 |

| | Alternative markets | 3.9 |

| Short-term investments and other | 0.1 |

As a percentage of net assets.

A note about risks

The fund may be subject to various risks as described in the fund's prospectus. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future, could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social, and economic risks. Any such impact could adversely affect the fund's performance, resulting in losses to your investment. For more information, please refer to the "Principal risks" section of the prospectus.

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 3

Manager's discussion of fund performance

What elements of the fund's positioning helped and hurt absolute performance during the period ended August 31, 2020?

The Alternative Investment Approaches portfolio, where the underlying managers use opportunistic techniques, accounted for the majority of the fund's positive return. Both Seaport Long/Short Fund (Wellington) and Hedged Equity Fund (JPMorgan) delivered robust gains due to their net long positions in equities. In addition, Short Duration Credit Opportunities Fund (Stone Harbor) and Strategic Income Opportunities Fund (MIM US)—both of which use a flexible approach to fixed-income investing—benefited from the strength in the credit-sensitive segments of the bond market. The Alternative Investment Approaches portfolio had a weighting of approximately 42% of total fund assets as of the end of August.

The Alternative Markets portfolio, which includes asset classes where the drivers of performance are often unrelated to those of traditional investments, was an additional contributor. This segment of the fund was invested in global infrastructure stocks, gold, real estate securities, and commodity futures. The majority of the portfolio's positive absolute return came from DB Gold Fund (Invesco), which benefited from the combination of a weaker U.S. dollar, investors' search for safe havens, and negative real interest rates in much of the developed world. The Alternative Markets portfolio was weighted at 11% as of period end.

Absolute Return strategies (those designed to generate positive performance across a variety of scenarios) detracted from results. These strategies typically have a low correlation to equities and other riskier segments of the financial markets, which was a headwind given the gains for stocks and the bond market's credit sectors over the full period. An allocation to Absolute Return Currency Fund (First Quadrant) added value, as did positions in merger arbitrage portfolios. However, holdings in Alternative Risk Premia Fund (Unigestion) and Diversified Macro Fund (Graham) detracted. At the close of the period, the Absolute Return portfolio's weighting stood at approximately 47%.

What changes did you make to the portfolio?

We continued to rotate the fund's holdings in an effort to optimize the investment mix and capitalize on what we see as the most compelling risk/return opportunities on a longer-term basis. We added Alternative Risk Premia Fund to the Absolute

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 4

Return portfolio, and we funded the purchase by eliminating Disciplined Alternative Yield Fund (Boston Partners) and closing out smaller positions in both commodity-related ETFs and non-U.S. REITs. We also continued to reduce the fund's position in strategies where we saw lower upside potential and/or diversification benefits. These shifts illustrate the fund's evolution, as we continue to seek a performance profile with low correlation to traditional equities and fixed income.

How was the fund positioned at period end?

While most segments of the financial markets performed well during the past 12 months, uncertainty remained prevalent and the major asset categories appear to be on track for muted returns in the coming years. Global equities have surged close to all-time highs even as earnings have fallen, indicating a sharp increase in valuations. At the same time, the near-zero level of global interest rates means that core bonds may offer little in terms of either yield or potential price appreciation. With this as background, we have sought to position the fund to act as a third lever for investors seeking a source of total return with a lower correlation to traditional equity and fixed-income investments.

MANAGED BY

| |

| Nathan W. Thooft, CFA, Manulife IM (US) |

| Christopher Walsh, CFA, Manulife IM (US) |

The views expressed in this report are exclusively those of Nathan W. Thooft, CFA, Manulife Investment Management, and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund's investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 5

TOTAL RETURNS FOR THE PERIOD ENDED AUGUST 31, 2020

| | | | | | | | |

Average annual total returns (%)

with maximum sales charge | | Cumulative total returns (%)

with maximum sales charge |

| | 1-year | 5-year | 10-year1 | | | 5-year | 10-year1 |

| Class A | -2.39 | 1.62 | 2.77 | | | 8.37 | 31.42 |

| Class C2 | 1.04 | 1.96 | 2.64 | | | 10.18 | 29.73 |

| Class I2,3 | 3.04 | 2.96 | 3.62 | | | 15.73 | 42.69 |

| Class R22,3 | 2.65 | 2.56 | 3.18 | | | 13.46 | 36.77 |

| Class R42,3 | 2.91 | 2.83 | 3.40 | | | 14.96 | 39.69 |

| Class R62,3 | 3.15 | 3.09 | 3.66 | | | 16.42 | 43.23 |

| Index † | 4.88 | 1.75 | 1.27 | | | 9.07 | 13.48 |

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 5% and the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R2, Class R4, and Class R6 shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. Net expenses reflect contractual expense limitations in effect until December 31, 2020 and are subject to change. Had the contractual fee waivers and expense limitations not been in place, gross expenses would apply. The following expense ratios include expenses of the affiliated underlying funds in which the fund invests. The expense ratios are as follows:

| | | | | | | |

| | Class A | Class C | Class I | Class R2 | Class R4 | Class R6 |

| Gross (%) | 1.78 | 2.48 | 1.48 | 1.87 | 1.72 | 1.37 |

| Net (%) | 1.70 | 2.40 | 1.40 | 1.79 | 1.54 | 1.29 |

Please refer to the most recent prospectus and annual or semiannual report for more information on expenses and any expense limitation arrangements for each class.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility and other factors, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

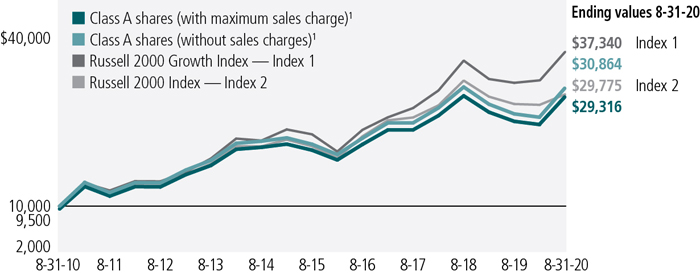

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the HFRX Global Hedge Fund Index. |

See the following page for footnotes.

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 6

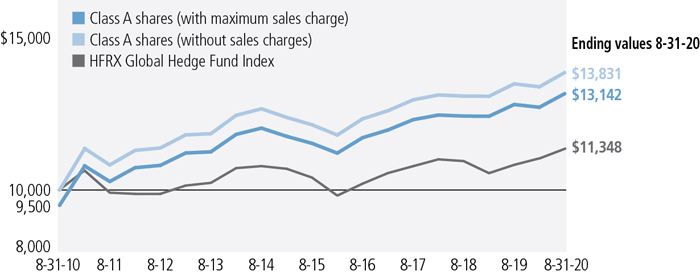

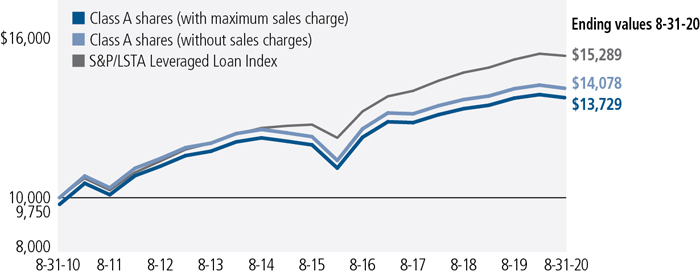

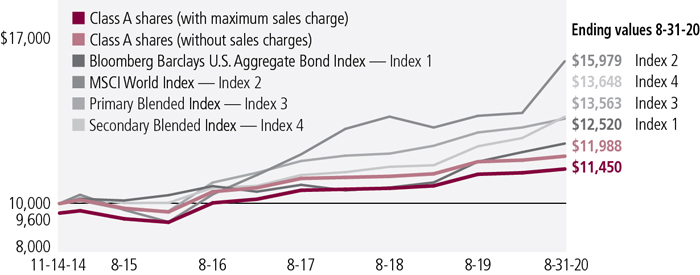

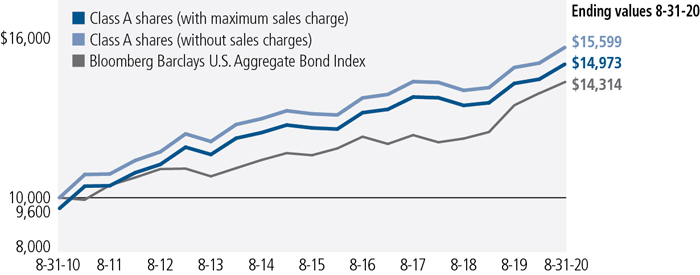

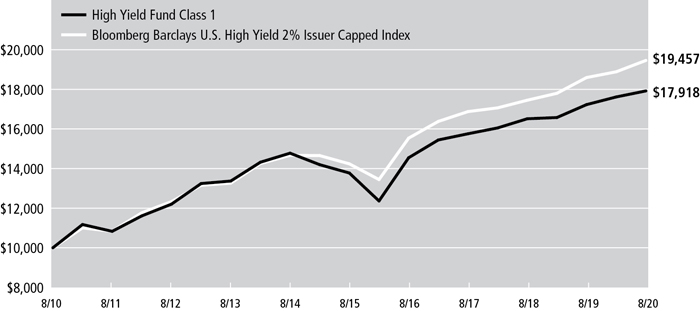

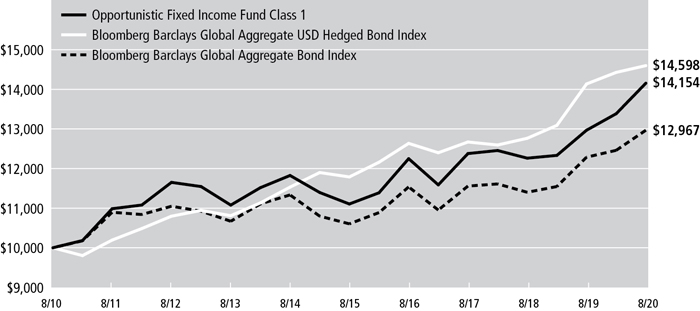

This chart and table show what happened to a hypothetical $10,000 investment in John Hancock Alternative Asset Allocation Fund for the share classes and periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the HFRX Global Hedge Fund Index.

| | | | | |

| | Start date | With maximum

sales charge ($) | Without

sales charge ($) | Index ($) |

| Class C2,.4 | 8-31-10 | 12,973 | 12,973 | 11,348 |

| Class I2,3 | 8-31-10 | 14,269 | 14,269 | 11,348 |

| Class R22,3 | 8-31-10 | 13,677 | 13,677 | 11,348 |

| Class R42,3 | 8-31-10 | 13,969 | 13,969 | 11,348 |

| Class R62,3 | 8-31-10 | 14,323 | 14,323 | 11,348 |

The HFRX Global Hedge Fund Index is composed of all eligible hedge fund strategies, including four principal strategies: equity hedge, event driven, macro/managed futures, and relative value arbitrage.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would result in lower returns.

Footnotes related to performance pages

| 1 | Performance information prior to 12-20-10 reflects an allocation to a different mix of underlying funds, and would have been different if the fund's investments had been allocated to its current mix of underlying funds. |

| 2 | Class C shares were first offered on 6-14-11; Class I shares were first offered on 12-31-10; Class R2 shares were first offered on 3-1-12; Class R4 shares were first offered on 6-27-13; Class R6 shares were first offered on 9-1-11. Returns prior to these dates are those of Class A shares that have not been adjusted for class-specific expenses; otherwise, returns would vary. |

| 3 | For certain types of investors, as described in the fund's prospectus. |

| 4 | The contingent deferred sales charge is not applicable. |

ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND 7

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

The first line of each share class in the table on the following page is intended to provide information about the fund’s actual ongoing operating expenses, and is based on the fund’s actual return. It assumes an account value of $1,000.00 on March 1, 2020, with the same investment held until August 31, 2020.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at August 31, 2020, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

The second line of each share class in the table on the following page allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the class’s actual return). It assumes an account value of $1,000.00 on March 1, 2020, with the same investment held until August 31, 2020. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| 8 | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | ANNUAL REPORT | |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

SHAREHOLDER EXPENSE EXAMPLE CHART

| | | Account

value on

3-1-2020 | Ending

value on

8-31-2020 | Expenses

paid during

period ended

8-31-20201 | Annualized

expense

ratio2 |

| Class A | Actual expenses/actual returns | $1,000.00 | $1,034.80 | $3.43 | 0.67% |

| | Hypothetical example | 1,000.00 | 1,021.80 | 3.41 | 0.67% |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,031.10 | 6.99 | 1.37% |

| | Hypothetical example | 1,000.00 | 1,018.20 | 6.95 | 1.37% |

| Class I | Actual expenses/actual returns | 1,000.00 | 1,035.50 | 1.89 | 0.37% |

| | Hypothetical example | 1,000.00 | 1,023.30 | 1.88 | 0.37% |

| Class R2 | Actual expenses/actual returns | 1,000.00 | 1,034.10 | 3.83 | 0.75% |

| | Hypothetical example | 1,000.00 | 1,021.40 | 3.81 | 0.75% |

| Class R4 | Actual expenses/actual returns | 1,000.00 | 1,035.50 | 2.51 | 0.49% |

| | Hypothetical example | 1,000.00 | 1,022.70 | 2.49 | 0.49% |

| Class R6 | Actual expenses/actual returns | 1,000.00 | 1,036.20 | 1.28 | 0.25% |

| | Hypothetical example | 1,000.00 | 1,023.90 | 1.27 | 0.25% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| 2 | Ratios do not include fees and expenses indirectly incurred by the underlying funds and can vary based on mixed of underlying funds held by the fund. |

| | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 9 |

AS OF 8-31-20

| | | | | Shares | Value |

| Affiliated investment companies (A) 74.8% | | | $346,180,079 |

| (Cost $337,236,242) | | | | | |

| Absolute return strategies 35.3% | | | 163,177,706 |

| Absolute Return Currency, Class NAV, JHF II (First Quadrant) | | | | 2,171,854 | 23,151,965 |

| Alternative Risk Premia, Class NAV, JHIT (Unigestion) | | | | 3,199,338 | 26,554,507 |

| Credit Suisse Managed Futures Strategy Fund (B) | | | | 2,427,291 | 23,059,268 |

| Diversified Macro, Class NAV, JHIT (Graham) | | | | 3,910,520 | 37,189,046 |

| Multi-Asset Absolute Return, Class NAV, JHF II (NIMNAI) (C) | | | | 5,772,551 | 53,222,920 |

| Alternative investment approaches 32.4% | | | 149,922,776 |

| Seaport Long/Short, Class NAV, JHIT (Wellington) | | | | 4,927,628 | 60,117,066 |

| Short Duration Credit Opportunities, Class NAV, JHF II (Stone Harbor) | | | | 3,688,812 | 35,265,044 |

| Strategic Income Opportunities, Class NAV, JHF II (MIM US) (D) | | | | 4,962,754 | 54,540,666 |

| Alternative markets 7.1% | | | 33,079,597 |

| Infrastructure, Class NAV, JHIT (Wellington) | | | | 1,805,414 | 22,603,789 |

|

| Invesco DB Gold Fund (B) | | | | 181,211 | 10,475,808 |

| Unaffiliated investment companies 25.1% | | | $116,311,050 |

| (Cost $108,908,551) | | | | | |

| Absolute return strategies 11.8% | | | 54,474,802 |

| IQ Merger Arbitrage ETF (C) | | | | 550,783 | 17,801,307 |

| The Arbitrage Fund, Class I | | | | 2,688,673 | 36,673,495 |

| Alternative investment approaches 9.4% | | | 43,783,062 |

| JPMorgan Hedged Equity Fund | | | | 1,900,307 | 43,783,062 |

| Alternative markets 3.9% | | | 18,053,186 |

| Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF (E) | | | | 865,699 | 12,301,583 |

| Vanguard Real Estate ETF (E) | | | | 70,356 | 5,751,603 |

| | | Yield (%) | | Shares | Value |

| Short-term investments 1.2% | | | | | $5,286,668 |

| (Cost $5,280,309) | | | | | |

| Short-term funds 1.2% | | | | | 5,286,668 |

| John Hancock Collateral Trust (F) | 0.2611(G) | | 495,545 | 4,960,751 |

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 0.0399(G) | | 325,917 | 325,917 |

|

| Total investments (Cost $451,425,102) 101.1% | | | $467,777,797 |

| Other assets and liabilities, net (1.1%) | | | | (5,002,992) |

| Total net assets 100.0% | | | | | $462,774,805 |

| 10 | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. |

| Security Abbreviations and Legend |

| JHF II | John Hancock Funds II |

| JHIT | John Hancock Investment Trust |

| (A) | The underlying funds' subadvisor is shown parenthetically. |

| (B) | The fund owns 5% or more of the outstanding voting shares of the issuer and the security is considered an affiliate of the fund. For more information on this security refer to the Notes to financial statements. |

| (C) | Non-income producing. |

| (D) | The subadvisor is an affiliate of the advisor. |

| (E) | All or a portion of this security is on loan as of 8-31-20. |

| (F) | Investment is an affiliate of the fund, the advisor and/or subadvisor. This security represents the investment of cash collateral received for securities lending. |

| (G) | The rate shown is the annualized seven-day yield as of 8-31-20. |

At 8-31-20, the aggregate cost of investments for federal income tax purposes was $463,567,942. Net unrealized appreciation aggregated to $4,209,855, of which $14,051,698 related to gross unrealized appreciation and $9,841,843 related to gross unrealized depreciation.

| Subadvisors of Affiliated Underlying Funds | |

| First Quadrant, L.P. | (First Quadrant) |

| Graham Capital Management, L.P. | (Graham) |

| Manulife Investment Management (US) LLC | (MIM US) |

| Nordea Investment Management North America, Inc. | (NIMNAI) |

| Stone Harbor Investment Partners LP | (Stone Harbor) |

| Unigestion (UK) Limited | (Unigestion) |

| Wellington Management Company LLP | (Wellington) |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 11 |

STATEMENT OF ASSETS AND LIABILITIES 8-31-20

| Assets | |

| Unaffiliated investments, at value (Cost $109,234,468) including $4,820,712 of securities loaned | $116,636,967 |

| Affiliated investments, at value (Cost $342,190,634) | 351,140,830 |

| Total investments, at value (Cost $451,425,102) | 467,777,797 |

| Dividends and interest receivable | 172,405 |

| Receivable for fund shares sold | 533,321 |

| Receivable for investments sold | 143,513 |

| Receivable for securities lending income | 1,929 |

| Other assets | 44,706 |

| Total assets | 468,673,671 |

| Liabilities | |

| Due to custodian | 30,414 |

| Payable for investments purchased | 455,806 |

| Payable for fund shares repurchased | 298,169 |

| Payable upon return of securities loaned | 4,951,650 |

| Payable to affiliates | |

| Accounting and legal services fees | 28,348 |

| Transfer agent fees | 47,674 |

| Distribution and service fees | 198 |

| Trustees' fees | 256 |

| Other liabilities and accrued expenses | 86,351 |

| Total liabilities | 5,898,866 |

| Net assets | $462,774,805 |

| Net assets consist of | |

| Paid-in capital | $503,845,499 |

| Total distributable earnings (loss) | (41,070,694) |

| Net assets | $462,774,805 |

| |

| 12 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

STATEMENT OF ASSETS AND LIABILITIES (continued)

| Net asset value per share | |

| Based on net asset value and shares outstanding - the fund has an unlimited number of shares authorized with no par value | |

| Class A ($61,844,200 ÷ 4,244,887 shares)1 | $14.57 |

| Class C ($30,827,081 ÷ 2,114,847 shares)1 | $14.58 |

| Class I ($347,266,274 ÷ 23,796,707 shares) | $14.59 |

| Class R2 ($907,486 ÷ 62,384 shares) | $14.55 |

| Class R4 ($58,260 ÷ 3,990 shares) | $14.60 |

| Class R6 ($21,871,504 ÷ 1,497,740 shares) | $14.60 |

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 95%)2 | $15.34 |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| 2 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 13 |

STATEMENT OF OPERATIONS For the year ended 8-31-20

| Investment income | |

| Income distributions received from affiliated investments | $5,587,111 |

| Dividends | 1,071,832 |

| Interest | 56,033 |

| Securities lending | 25,924 |

| Total investment income | 6,740,900 |

| Expenses | |

| Investment management fees | 1,922,959 |

| Distribution and service fees | 574,003 |

| Accounting and legal services fees | 95,333 |

| Transfer agent fees | 626,389 |

| Trustees' fees | 8,999 |

| Custodian fees | 47,936 |

| State registration fees | 101,294 |

| Printing and postage | 62,510 |

| Professional fees | 57,345 |

| Other | 38,382 |

| Total expenses | 3,535,150 |

| Less expense reductions | (1,115,295) |

| Net expenses | 2,419,855 |

| Net investment income | 4,321,045 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Unaffiliated investments | 175,952 |

| Affiliated investments | (4,595,944) |

| Capital gain distributions received from unaffiliated investments | 780,190 |

| Capital gain distributions received from affiliated investments | 9,639,956 |

| | 6,000,154 |

| Change in net unrealized appreciation (depreciation) of | |

| Unaffiliated investments | 3,740,693 |

| Affiliated investments | (2,939,131) |

| | 801,562 |

| Net realized and unrealized gain | 6,801,716 |

| Increase in net assets from operations | $11,122,761 |

| 14 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

STATEMENTS OF CHANGES IN NET ASSETS

| | Year ended

8-31-20 | Year ended

8-31-19 |

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment income | $4,321,045 | $11,584,852 |

| Net realized gain (loss) | 6,000,154 | (8,139,442) |

| Change in net unrealized appreciation (depreciation) | 801,562 | 13,005,662 |

| Increase in net assets resulting from operations | 11,122,761 | 16,451,072 |

| Distributions to shareholders | | |

| From earnings | | |

| Class A | (2,347,118) | (1,639,841) |

| Class C | (1,030,673) | (598,120) |

| Class I | (15,281,356) | (9,760,461) |

| Class R2 | (44,843) | (43,758) |

| Class R4 | (1,208) | (4,113) |

| Class R6 | (800,607) | (649,346) |

| Total distributions | (19,505,805) | (12,695,639) |

| From fund share transactions | (96,498,367) | (119,232,261) |

| Total decrease | (104,881,411) | (115,476,828) |

| Net assets | | |

| Beginning of year | 567,656,216 | 683,133,044 |

| End of year | $462,774,805 | $567,656,216 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 15 |

| CLASS A SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.66 | $14.51 | $14.55 | $13.96 | $14.12 |

| Net investment income1,2 | 0.09 | 0.25 | 0.13 | 0.10 | 0.22 |

| Net realized and unrealized gain (loss) on investments | 0.31 | 0.17 | 0.01 | 0.60 | — 3 |

| Total from investment operations | 0.40 | 0.42 | 0.14 | 0.70 | 0.22 |

| Less distributions | | | | | |

| From net investment income | (0.27) | (0.17) | (0.11) | (0.08) | (0.21) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) |

| Total distributions | (0.49) | (0.27) | (0.18) | (0.11) | (0.38) |

| Net asset value, end of period | $14.57 | $14.66 | $14.51 | $14.55 | $13.96 |

| Total return (%)4,5 | 2.74 | 3.05 | 0.95 | 5.03 | 1.60 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $62 | $73 | $95 | $136 | $278 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions6 | 0.88 | 0.77 | 0.72 | 0.72 | 0.73 |

| Expenses including reductions6 | 0.66 | 0.64 | 0.59 | 0.59 | 0.59 |

| Net investment income2 | 0.63 | 1.73 | 0.86 | 0.71 | 1.56 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Less than $0.005 per share. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Does not reflect the effect of sales charges, if any. |

| 6 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 16 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS C SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.67 | $14.51 | $14.56 | $13.97 | $14.12 |

| Net investment income (loss)1,2 | (0.01) | 0.15 | 0.02 | — 3 | 0.12 |

| Net realized and unrealized gain (loss) on investments | 0.31 | 0.18 | 0.01 | 0.60 | 0.01 |

| Total from investment operations | 0.30 | 0.33 | 0.03 | 0.60 | 0.13 |

| Less distributions | | | | | |

| From net investment income | (0.17) | (0.07) | (0.01) | — | (0.11) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.01) | (0.17) |

| Total distributions | (0.39) | (0.17) | (0.08) | (0.01) | (0.28) |

| Net asset value, end of period | $14.58 | $14.67 | $14.51 | $14.56 | $13.97 |

| Total return (%)4,5 | 2.04 | 2.37 | 0.19 | 4.30 | 0.94 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $31 | $42 | $57 | $72 | $99 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions6 | 1.58 | 1.47 | 1.42 | 1.42 | 1.43 |

| Expenses including reductions6 | 1.36 | 1.34 | 1.29 | 1.29 | 1.29 |

| Net investment income (loss)2 | (0.06) | 1.02 | 0.17 | — 7 | 0.85 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Less than $0.005 per share. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Does not reflect the effect of sales charges, if any. |

| 6 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 7 | Less than 0.005%. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 17 |

| CLASS I SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.68 | $14.53 | $14.58 | $13.99 | $14.15 |

| Net investment income1,2 | 0.14 | 0.29 | 0.17 | 0.14 | 0.26 |

| Net realized and unrealized gain (loss) on investments | 0.30 | 0.18 | — 3 | 0.60 | — 3 |

| Total from investment operations | 0.44 | 0.47 | 0.17 | 0.74 | 0.26 |

| Less distributions | | | | | |

| From net investment income | (0.31) | (0.22) | (0.15) | (0.12) | (0.25) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) |

| Total distributions | (0.53) | (0.32) | (0.22) | (0.15) | (0.42) |

| Net asset value, end of period | $14.59 | $14.68 | $14.53 | $14.58 | $13.99 |

| Total return (%)4 | 3.04 | 3.39 | 1.18 | 5.34 | 1.93 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $347 | $423 | $510 | $495 | $433 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions5 | 0.58 | 0.49 | 0.42 | 0.40 | 0.42 |

| Expenses including reductions5 | 0.36 | 0.35 | 0.30 | 0.28 | 0.28 |

| Net investment income2 | 0.95 | 2.04 | 1.16 | 1.01 | 1.88 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Less than $0.005 per share. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 18 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS R2 SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.64 | $14.49 | $14.53 | $13.95 | $14.11 |

| Net investment income1,2 | 0.08 | 0.24 | 0.11 | 0.08 | 0.20 |

| Net realized and unrealized gain (loss) on investments | 0.31 | 0.17 | 0.01 | 0.60 | 0.01 |

| Total from investment operations | 0.39 | 0.41 | 0.12 | 0.68 | 0.21 |

| Less distributions | | | | | |

| From net investment income | (0.26) | (0.16) | (0.09) | (0.07) | (0.20) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) |

| Total distributions | (0.48) | (0.26) | (0.16) | (0.10) | (0.37) |

| Net asset value, end of period | $14.55 | $14.64 | $14.49 | $14.53 | $13.95 |

| Total return (%)3 | 2.65 | 2.95 | 0.85 | 4.87 | 1.51 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $1 | $2 | $3 | $4 | $7 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions4 | 0.96 | 0.87 | 0.83 | 0.82 | 0.81 |

| Expenses including reductions4 | 0.75 | 0.74 | 0.70 | 0.69 | 0.67 |

| Net investment income2 | 0.54 | 1.67 | 0.78 | 0.60 | 1.43 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 19 |

| CLASS R4 SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 |

| Net investment income1,2 | 0.07 | 0.27 | 0.15 | 0.12 | 0.14 |

| Net realized and unrealized gain (loss) on investments | 0.35 | 0.18 | 0.01 | 0.60 | 0.10 |

| Total from investment operations | 0.42 | 0.45 | 0.16 | 0.72 | 0.24 |

| Less distributions | | | | | |

| From net investment income | (0.29) | (0.20) | (0.13) | (0.10) | (0.23) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) |

| Total distributions | (0.51) | (0.30) | (0.20) | (0.13) | (0.40) |

| Net asset value, end of period | $14.60 | $14.69 | $14.54 | $14.58 | $13.99 |

| Total return (%)3 | 2.91 | 3.22 | 1.10 | 5.18 | 1.79 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $— 4 | $— 4 | $1 | $5 | $4 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions5 | 0.81 | 0.73 | 0.67 | 0.66 | 0.67 |

| Expenses including reductions5 | 0.50 | 0.50 | 0.44 | 0.44 | 0.43 |

| Net investment income2 | 0.45 | 1.76 | 1.05 | 0.85 | 1.00 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Less than $500,000. |

| 5 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| 20 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS R6 SHARES Period ended | 8-31-20 | 8-31-19 | 8-31-18 | 8-31-17 | 8-31-16 |

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $14.69 | $14.54 | $14.58 | $13.99 | $14.15 |

| Net investment income1,2 | 0.14 | 0.32 | 0.18 | 0.16 | 0.21 |

| Net realized and unrealized gain (loss) on investments | 0.32 | 0.16 | 0.02 | 0.60 | 0.07 |

| Total from investment operations | 0.46 | 0.48 | 0.20 | 0.76 | 0.28 |

| Less distributions | | | | | |

| From net investment income | (0.33) | (0.23) | (0.17) | (0.14) | (0.27) |

| From net realized gain | (0.22) | (0.10) | (0.07) | (0.03) | (0.17) |

| Total distributions | (0.55) | (0.33) | (0.24) | (0.17) | (0.44) |

| Net asset value, end of period | $14.60 | $14.69 | $14.54 | $14.58 | $13.99 |

| Total return (%)3 | 3.15 | 3.49 | 1.34 | 5.45 | 2.05 |

| Ratios and supplemental data | | | | | |

| Net assets, end of period (in millions) | $22 | $26 | $18 | $15 | $16 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions4 | 0.46 | 0.37 | 0.32 | 0.31 | 0.32 |

| Expenses including reductions4 | 0.25 | 0.24 | 0.20 | 0.18 | 0.17 |

| Net investment income2 | 1.01 | 2.23 | 1.26 | 1.11 | 1.52 |

| Portfolio turnover (%) | 37 | 39 | 18 | 10 | 17 |

| 1 | Based on average daily shares outstanding. |

| 2 | Net investment income is affected by the timing and frequency of the declaration of dividends by the underlying funds in which the fund invests. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Ratios do not include expenses indirectly incurred from underlying funds and can vary based on the mix of underlying funds held by the fund. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 21 |

Notes to financial statements

Note 1—Organization

John Hancock Alternative Asset Allocation Fund (the fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek long-term growth of capital.

The fund operates as a “fund of funds", investing in affiliated underlying funds of the Trust, other series of the Trust, other funds in John Hancock group of funds complex, non-John Hancock funds and certain other permitted investments.

The fund may offer multiple classes of shares. The shares currently outstanding are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R2 and Class R4 shares are available only to certain retirement and 529 plans. Class R6 shares are only available to certain retirement plans, institutions and other investors. Class C shares convert to Class A shares ten years after purchase (certain exclusions may apply). Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ.

The accounting policies of the John Hancock underlying funds in which the fund invests are outlined in the underlying funds’ shareholder reports, which include the underlying funds’ financial statements, available without charge by calling 800-344-1029 or visiting jhinvestments.com, on the Securities and Exchange Commission (SEC) website at sec.gov or at the SEC’s public reference room in Washington, D.C. The underlying funds are not covered by this report.

Note 2—Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the fund's Valuation Policies and Procedures.

In order to value the securities, the fund uses the following valuation techniques: Investments by the fund in underlying affiliated funds and other open end mutual funds, including John Hancock Collateral Trust (JHCT), are valued at their respective NAVs each business day. ETFs held by the fund are valued at the last sale price or official closing price on the exchange or principal market where the security trades. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price.

In certain instances, the Pricing Committee may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and trading occurred as normal on another exchange or market.

| 22 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | |

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

As of August 31, 2020, all investments are categorized as Level 1 under the hierarchy described above.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Income and capital gain distributions from underlying funds are recorded on ex-date. Dividend income is recorded on the ex-date, except for dividends of certain foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Return of capital distributions from underlying funds, if any, are treated as a reduction of cost.

Securities lending. The fund may lend its securities to earn additional income. The fund receives collateral from the borrower in an amount not less than the market value of the loaned securities. The fund will invest its cash collateral in JHCT, an affiliate of the fund, which has a floating NAV and is registered with the SEC as an investment company. JHCT invests in short-term money market investments. The fund will receive the benefit of any gains and bear any losses generated by JHCT with respect to the cash collateral.

The fund has the right to recall loaned securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies the fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of JHCT.

Although the risk of loss on securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The fund receives compensation for lending its securities by retaining a portion of the return on the investment of the collateral and

| | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 23 |

compensation from fees earned from borrowers of the securities. Securities lending income received by the fund is net of fees retained by the securities lending agent. Net income received from JHCT is a component of securities lending income as recorded on the Statement of operations.

Obligations to repay collateral received by the fund are shown on the Statement of assets and liabilities as Payable upon return of securities loaned and are secured by the loaned securities. As of August 31, 2020, the fund loaned securities valued at $4,820,712 and received $4,951,650 of cash collateral.

Overdraft. The fund may have the ability to borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund's custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law. Overdrafts at period end are presented under the caption Due to custodian in the Statement of assets and liabilities.

Line of credit. Effective June 25, 2020, the fund and other affiliated funds have entered into a syndicated line of credit agreement with Citibank, N.A. as the administrative agent that enables them to participate in a $1 billion unsecured committed line of credit. Excluding commitments designated for a certain fund and subject to the needs of all other affiliated funds, the fund can borrow up to an aggregate commitment amount of $850 million, subject to asset coverage and other limitations as specified in the agreement. Each participating fund paid an upfront fee in connection with this line of credit agreement, which is charged based on a combination of fixed and asset based allocations and amortized over 365 days. Prior to June 25, 2020, the fund and other affiliated funds had a similar agreement that enabled them to participate in a $750 million unsecured committed line of credit. A commitment fee payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund based on a combination of fixed and asset based allocations and is reflected in Other expenses on the Statement of operations. For the year ended August 31, 2020, the fund had no borrowings under the line of credit. Commitment fees for the year ended August 31, 2020 were $4,072.

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, for all classes, are charged daily at the class level based on the net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, as of August 31, 2020, the fund has a short-term capital loss carryforward of $12,159,629 and a long-term capital loss carryforward of $33,120,920 available to offset future net realized capital gains. These carryforwards do not expire.

As of August 31, 2020, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

| 24 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | |

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends annually. Capital gain distributions, if any, are typically distributed annually.

The tax character of distributions for the years ended August 31, 2020 and 2019 was as follows:

| | August 31, 2020 | August 31, 2019 |

| Ordinary income | $19,505,805 | $12,695,639 |

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of August 31, 2020, there were no distributable earnings on a tax basis.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP. Distributions in excess of tax basis earnings and profits, if any, are reported in the fund's financial statements as a return of capital. Short-term gains from underlying funds are treated as ordinary income for tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to partnerships and wash sale loss deferrals.

Note 3—Guarantees and indemnifications

Under the Trust's organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4—Fees and transactions with affiliates

John Hancock Investment Management LLC (the Advisor) serves as investment advisor for the fund. John Hancock Investment Management Distributors LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the fund. The Advisor and the Distributor are indirect, principally owned subsidiaries of Manulife Financial Corporation.

Management fee. The fund pays the Advisor a management fee for its services to the fund. Manulife Investment Management (US) LLC, a division of Manulife Asset Management (US) LLC, acts as the fund’s sole subadvisor. The fund is not responsible for payment of the subadvisory fees.

The management fee has two components: (1) a fee on assets invested in a fund of the Trust or John Hancock Funds III (JHF III); and (2) a fee on assets invested in investments other than a fund of the Trust or JHF III (Other assets).

Management fees are determined in accordance with the following schedule:

| | First $5.0 billion of net assets | Excess over $5.0 billion of net assets |

| Assets in a fund of the Trust or JHF III | 0.100% | 0.075% |

| Other assets | 0.550% | 0.525% |

| | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 25 |

The Advisor has contractually agreed to reduce its management fee and/or make payment to the fund in an amount equal to the amount by which “Other expenses” of the fund exceed 0.04% of the average net assets of the fund. “Other expenses” means all of the expenses of the fund, excluding: advisory fees, taxes, brokerage commissions, interest expense, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the fund’s business, class specific expenses, underlying fund expenses (acquired fund fees), and short dividend expense. The current expense limitation agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

The Advisor has contractually agreed to reduce its management fee by 0.05% of the fund’s average daily net assets up to $5 billion, and by 0.025% of the fund’s average daily net assets over $5 billion. The current expense limitation agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

The Advisor has voluntarily agreed to waive its management fee for the fund so that the aggregate advisory fee retained by the Advisor with respect to both the fund and its underlying investments (after payment of subadvisory fees) does not exceed 0.55% of the fund’s first $5 billion of average daily net assets and 0.525% of the fund’s average daily net assets in excess of $5 billion. The Advisor may terminate this voluntary waiver at any time upon notice to the Trust.

For the year ended August 31, 2020, the expense reductions described above amounted to the following:

| Class | Expense reduction |

| Class A | $144,362 |

| Class C | 78,670 |

| Class I | 841,626 |

| Class R2 | 2,997 |

| Class | Expense reduction |

| Class R4 | $216 |

| Class R6 | 47,315 |

| Total | $1,115,186 |

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the year ended August 31, 2020, were equivalent to a net annual effective rate of 0.16% of the fund's average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, compliance, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred, for the year ended August 31, 2020, amounted to an annual rate of 0.02% of the fund's average daily net assets.

Distribution and service plans. The fund has a distribution agreement with the Distributor. The fund has adopted distribution and service plans for certain classes as detailed below pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the fund. In addition, under a service plan for certain classes as detailed below, the fund pays for certain other services. The fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the fund's shares:

| Class | Rule 12b-1 Fee | Service fee |

| Class A | 0.30% | — |

| Class C | 1.00% | — |

| Class R2 | 0.25% | 0.25% |

| Class R4 | 0.25% | 0.10% |

| 26 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | |

The fund's Distributor has contractually agreed to waive 0.10% of Rule12b-1 fees for Class R4 shares. The current waiver agreement expires on December 31, 2020, unless renewed by mutual agreement of the fund and the Distributor based upon a determination that this is appropriate under the circumstances at the time. This contractual waiver amounted to $109 for Class R4 shares for the year ended August 31, 2020.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $54,949 for the year ended August 31, 2020. Of this amount, $8,961 was retained and used for printing prospectuses, advertising, sales literature and other purposes and $45,988 was paid as sales commissions to broker-dealers.

Class A and Class C shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% sales charge. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended August 31, 2020, CDSCs received by the Distributor amounted to $1,609 and $257 for Class A and Class C shares, respectively.

Transfer agent fees. The John Hancock group of funds has a complex-wide transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Advisor. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. It also includes out-of-pocket expenses, including payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to five categories of share classes: Retail Share and Institutional Share Classes of Non-Municipal Bond Funds, Class R6 Shares, Retirement Share Classes and Municipal Bond Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the year ended August 31, 2020 were as follows:

| Class | Distribution and service fees | Transfer agent fees |

| Class A | $200,756 | $84,456 |

| Class C | 365,796 | 46,164 |

| Class I | — | 492,631 |

| Class R2 | 7,070 | 190 |

| Class R4 | 381 | 14 |

| Class R6 | — | 2,934 |

| Total | $574,003 | $626,389 |

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. The costs of paying Trustee compensation and expenses are allocated to the fund based on its net assets relative to other funds within the John Hancock group of funds complex.

| | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 27 |

Note 5—Fund share transactions

Transactions in fund shares for the years ended August 31, 2020 and 2019 were as follows:

| | Year Ended 8-31-20 | Year Ended 8-31-19 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

| Sold | 532,714 | $7,649,230 | 795,055 | $11,305,156 |

| Distributions reinvested | 154,878 | 2,244,177 | 115,120 | 1,574,839 |

| Repurchased | (1,445,757) | (20,620,988) | (2,428,928) | (34,635,963) |

| Net decrease | (758,165) | $(10,727,581) | (1,518,753) | $(21,755,968) |

| Class C shares | | | | |

| Sold | 42,781 | $618,193 | 96,697 | $1,388,854 |

| Distributions reinvested | 68,875 | 1,002,820 | 42,160 | 579,700 |

| Repurchased | (888,201) | (12,690,671) | (1,146,343) | (16,394,140) |

| Net decrease | (776,545) | $(11,069,658) | (1,007,486) | $(14,425,586) |

| Class I shares | | | | |

| Sold | 6,847,511 | $97,633,578 | 9,148,547 | $130,782,292 |

| Distributions reinvested | 942,827 | 13,652,128 | 620,211 | 8,484,484 |

| Repurchased | (12,832,637) | (180,420,235) | (16,047,812) | (228,661,790) |

| Net decrease | (5,042,299) | $(69,134,529) | (6,279,054) | $(89,395,014) |

| Class R2 shares | | | | |

| Sold | 18,549 | $264,201 | 31,389 | $448,503 |

| Distributions reinvested | 2,864 | 41,474 | 2,947 | 40,280 |

| Repurchased | (118,578) | (1,709,278) | (54,897) | (777,693) |

| Net decrease | (97,165) | $(1,403,603) | (20,561) | $(288,910) |

| Class R4 shares | | | | |

| Sold | 6,520 | $94,845 | 6,916 | $98,951 |

| Distributions reinvested | 83 | 1,208 | 300 | 4,113 |

| Repurchased | (20,027) | (289,651) | (86,274) | (1,248,855) |

| Net decrease | (13,424) | $(193,598) | (79,058) | $(1,145,791) |

| Class R6 shares | | | | |

| Sold | 521,425 | $7,378,383 | 1,309,202 | $18,559,247 |

| Distributions reinvested | 55,291 | 800,607 | 47,502 | 649,346 |

| Repurchased | (842,680) | (12,148,388) | (801,314) | (11,429,585) |

| Net increase (decrease) | (265,964) | $(3,969,398) | 555,390 | $7,779,008 |

| Total net decrease | (6,953,562) | $(96,498,367) | (8,349,522) | $(119,232,261) |

Note 6—Purchase and sale of securities

Purchases and sales of securities, other than short-term investments, amounted to $190,209,024 and $285,595,633, respectively, for the year ended August 31, 2020.

| 28 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | |

Note 7—Investment in affiliated underlying funds

The fund invests primarily in affiliated underlying funds that are managed by the Advisor and its affiliates. The fund does not invest in the affiliated underlying funds for the purpose of exercising management or control; however, the fund's investment may represent a significant portion of each underlying funds’ net assets. At August 31, 2020, the fund held 5% or more of the net assets of the underlying funds shown below:

| Portfolio | Underlying fund's net assets |

| JHF Alternative Risk Premia Fund | 21.4% |

| JHF Diversified Macro Fund | 15.2% |

| JHF II Multi-Asset Absolute Return Fund | 11.4% |

| JHF Seaport Long/Short Fund | 8.3% |

| JHF II Absolute Return Currency Fund | 6.7% |

| JHF II Short Duration Credit Opportunities Fund | 5.2% |

| JHF Infrastructure Fund | 5.2% |

Information regarding the fund's fiscal year to date purchases and sales of the affiliated underlying funds as well as income and capital gains earned by the fund, if any, is as follows:

| | | | | | | | Dividends and distributions |

| Affiliate | Ending

share

amount | Beginning

value | Cost of

purchases | Proceeds

from shares

sold | Realized

gain

(loss) | Change in

unrealized

appreciation

(depreciation) | Income

distributions

received | Capital gain

distributions

received | Ending

value |

| Absolute Return Currency | 2,171,854 | $40,391,711 | $7,039,037 | $(27,879,140) | $32,401 | $3,567,956 | $714,019 | — | $23,151,965 |

| Alternative Risk Premia | 3,199,338 | — | 35,838,829 | (3,587,184) | (495,944) | (5,201,194) | 12,260 | — | 26,554,507 |

| Disciplined Alternative Yield | — | 66,558,006 | 7,831,656 | (69,333,617) | (2,983,177) | (2,072,868) | 604,346 | $7,227,310 | — |

| Diversified Macro | 3,910,520 | 45,326,846 | 5,401,892 | (9,592,077) | (748,960) | (3,198,655) | — | 1,592,220 | 37,189,046 |

| Infrastructure | 1,805,414 | 26,629,522 | 7,304,301 | (10,693,410) | 755,443 | (1,392,067) | 475,090 | 820,426 | 22,603,789 |

| John Hancock Collateral Trust* | 495,545 | 885,879 | 121,267,839 | (117,201,618) | 2,265 | 6,386 | 25,924 | — | 4,960,751 |

| Multi-Asset Absolute Return | 5,772,551 | 28,253,887 | 38,317,095 | (13,258,189) | (2,189,640) | 2,099,767 | — | — | 53,222,920 |

| Seaport Long/Short | 4,927,628 | 50,138,430 | 28,085,715 | (21,062,263) | 1,898,875 | 1,056,309 | 697,955 | — | 60,117,066 |

| Short Duration Credit Opportunities | 3,688,812 | 62,204,274 | 1,959,535 | (29,223,111) | (1,534,348) | 1,858,694 | 1,051,675 | — | 35,265,044 |

| Strategic Income Opportunities | 4,962,754 | 74,789,294 | 4,915,625 | (26,492,842) | (593,576) | 1,922,165 | 1,407,455 | — | 54,540,666 |

| | | | | | $(5,856,661) | $(1,353,507) | $4,988,724 | $9,639,956 | $317,605,754 |

| * | Refer to the Securities lending note within Note 2 for details regarding this investment. |

Note 8—Transactions in securities of affiliated issuers

Affiliated issuers, as defined by the 1940 Act, are those in which the fund's holdings of an issuer represent 5% or more of the outstanding voting securities of the issuer. A summary of the fund's transactions in the securities of these issuers during the year ended August 31, 2020, is set forth below:

| | ANNUAL REPORT | JOHN HANCOCK ALTERNATIVE ASSET ALLOCATION FUND | 29 |

| | | | | | | | Dividends and distributions |

| Affiliate | Ending

share

amount | Beginning

value | Cost of

purchases | Proceeds

from shares

sold | Realized

gain

(loss) | Change in

unrealized

appreciation

(depreciation) | Income

distributions

received | Capital gain

distributions

received | Ending

value |

| | | | | | | | | | |

| Credit Suisse Managed Futures Strategy Fund | 2,427,291 | $24,056,171 | $9,172,788 | $(7,610,079) | $(186,296) | $(2,373,316) | $428,413 | — | $23,059,268 |

| Invesco DB Gold Fund | 181,211 | 10,651,123 | 4,253,006 | (6,663,026) | 1,447,013 | 787,692 | 195,898 | — | 10,475,808 |

| | | | | | $1,260,717 | $(1,585,624) | $624,311 | — | $33,535,076 |

Note 9—Coronavirus (COVID-19) pandemic

The novel COVID-19 disease has resulted in significant disruptions to global business activity. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance.

| 30 | JOHN HANCOCK Alternative Asset Allocation Fund | ANNUAL REPORT | |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of John Hancock Alternative Asset Allocation Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s investments, of John Hancock Alternative Asset Allocation Fund (one of the funds constituting John Hancock Funds II, referred to hereafter as the "Fund") as of August 31, 2020, the related statement of operations for the year ended August 31, 2020, the statements of changes in net assets for each of the two years in the period ended August 31, 2020, including the related notes, and the financial highlights for each of the five years in the period ended August 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended August 31, 2020 and the financial highlights for each of the five years in the period ended August 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.